Abstract

The aim of this study was to explore how artificial intelligence (AI) impacts the quality of financial reporting, providing insights into new opportunities in this field for the Saudi context. This study employed the UTAUT theory to examine the adoption of AI technology in auditing practices. This study also utilized bibliometric analysis techniques through an academic literature review and content analyses of the documentary evidence. The implication of this study is that non-Big 4 audit firms should adopt AI-powered drones, which consequently enhance decision making, decrease audit fees, and enhance the quality of financial reports, and the efficiency and accuracy of audits. Furthermore, this paper recommends that non-Big 4 audit firms adopting AI should foster a culture of change to ensure quality audits and consistency, overcome resistance to the change, and support the integration of technologies such as AI-driven audit automation. Our study also indicated the importance of integrating AI with the IFRS, developing a new framework for AI in auditing practices, incorporating AI into auditing courses, and modernizing auditing using AI. These implications lead to financial reports of enhanced quality. The results indicated four clusters, with artificial intelligence being the most significant keyword occurrence. This study has limitations, such as the lack of consideration of cyber-attack risks on drones, which may reduce the reliability of financial reports. Based on the findings of this research, audit companies and regulatory agencies in Saudi Arabia, like the Saudi Capital Market Authority (CMA), may evaluate the integration of AI to improve the quality of financial reporting. Implementing AI is expected to enhance the quality of audits, automate reporting, and support regulatory compliance to foster confidence and transparency in the financial industry.

1. Introduction

According to the literature and, more specifically, within the area of accounting, artificial intelligence (AI) is gaining importance. According to Pomerol (1997), AI refers to the use of computers designed to act independently, with attributes such as the ability to reason, learn, and use available data to make decisions. AI comprises several technologies, including data mining, which can enhance financial reporting via accurate and reliable predictions (Yang, 2022). Moreover, AI improves internal organizational accounting processes and financial statements by optimizing documentation processes and approval (Li et al., 2020; Safonova & Alekseenko, 2022). AI in auditing involves tasks such as sample selection, decision making, and the evaluation of results, thereby augmenting efficiency and decreasing human mistake rates (Law & Shen, 2024). Using AI in procedural activities that require a significant time investment is most beneficial. In addition, AI enhances auditors’ capacity to rapidly identify risks and to perform various accounting operations (Askary et al., 2018). Adopting AI protocols and efficient technological data collection systems can be a major change from collecting data in traditional ways by enhancing the speed and accuracy of financial reporting and, ultimately, audit standards (Aguguom & Ebun, 2021; Albawwat & Frijat, 2021; Deniz & Jeffery, 2022).

The auditing profession is experiencing significant disruption caused by AI, particularly impacting non-Big 4 practices. In this context, we explored how AI-embedded drones can improve audit inspections, extending the study conducted by Shankar et al. (2024) on drone usage in manufacturing audits. This research also builds upon Vitali and Giuliani’s (2024) discussion about the transformations that emerging technologies, including AI, bring about in auditing, focusing on the consequences for non-Big 4 firms. Referring to Qasim and Kharbat’s (2020) work on the modernization of accounting curricula, we stress the significance of utilizing AI in the auditing learning process of future professionals. This paper also discusses the role of regulation in the proper use of AI, using the insights of Seidenstein et al. (2024) into disruptive technologies in audit and assurance. The discussion culminates by focusing on the integration of the International Financial Reporting Standards (IFRS) and AI in modernizing financial reporting, based on insights provided by Mosteanu and Faccia (2020) into the use of digital systems in financial management. The present study provides valuable findings regarding the nature of change that AI brings within the context of external auditing and financial reporting, focusing on non-Big 4 audit firms. Collecting and analyzing the findings of recent studies, as well as presenting new perspectives, this paper provides useful recommendations for practitioners, educators, and policymakers related to the intersection of AI and auditing and financial reporting. To structure our research endeavor, we incorporated the Unified Theory of Acceptance and Use of Technology (UTAUT), which aided in categorizing AI adoption in auditing. Our methodological approach used documentary data and included a broad literature review applying bibliometric analysis. This was employed to determine trends in the field to minimize the risk of insufficient examination of the role of AI in auditing practices.

1.1. Practical Significance of the Study

This study is important for assessing the impact of adopting AI on the quality of financial reports of Saudi-listed companies. Saudi Vision 2030 planning will privatize many public sectors, and this will, in turn, generate demand for auditing services, as stated by Alhazmi et al. (2024). This work is relevant as it sought to examine how drone technology managed by AI can be used in auditing to overcome the issues of auditing large geographical areas of Saudi Arabia during external audits to improve performance expectancy. For example, when auditing Hazm Al Jalamid Mine in Saudi Arabia, which is over a thousand kilometers away from Riyadh, and where a firm such as AlKharashi & Co., located in Riyadh and engaged by Maaden Company, is, physical on-site inspections using AI drones would be easier. That is why the use of such technologies not only improves audit processes but also significantly cuts audit fees and travel expenses. Additionally, the use of AI-aided auditing can advance Saudi Arabia’s ambition to achieve zero carbon emissions by 2060, contributing to the Green Saudi plan, and complementing intelligent city initiatives such as NEOM. These improvements would allow Saudi audit firms to work more effectively than before in support of the kingdom’s envisaged environmental and technological plans. Furthermore, Saudi Arabia is willing to bring the best and most brilliant technologies into their economy to motivate many investors worldwide. In addition, they host and organize many conferences and initiatives in the field of AI for entrepreneurs and students, such as hackathons. Their aim is to reach the latest technological advancements. As a result, this study is significant because it focuses on AI adoption and external auditors’ motivations to use it in auditing. Therefore, this study will help create new opportunities for Saudi Arabia’s economy and audit profession to use the best technologies to enhance the quality of financial reports.

1.2. Statement of the Study Issue

As trends in the application of artificial intelligence in the auditing industry significantly influence auditing efficiency and financial reporting accuracy, the auditing profession in Saudi Arabia faces major challenges in its adoption. Based on the projects of Saudi Vision 2030, the privatization aimed at the development of the Kingdom of Saudi Arabia’s economy is generating more demand for improved auditing solutions that can capture economic change. Saudi Arabia’s large geographic area presents challenges in auditing inspections, but AI-managed drones can provide efficient and cost-effective audits of distant locations like Hazm Al Jalamid Mine. This study illustrates the need for early, holistic instructional training of auditors on AI, which has never been more paramount than today. Most auditors lack the technical expertise to implement these tools in their operations and integrate them into audits, which is why there is a strong demand for incorporating AI expertise in training courses and curricula.

1.3. The Aims of This Study

This study aimed to explore how AI impacts the quality of financial reporting on the Saudi Stock Exchange. This study utilized bibliometric analysis techniques through an academic literature review and content analysis of the documentary evidence. In addition, this study employed the UTAUT theory to examine the adoption of AI technology in auditing practices, which was employed through the following factors. The use of AI-powered drones in auditing inspections may improve the performance of non-Big 4 external auditors in decision making. The utilization of AI in non-Big 4 audit companies demands a positive work culture, which, in turn, may increase audit quality and consistency. Moreover, the integration of AI in auditing education may become the most crucial factor in preparing auditors for a profession where AI is used to improve financial reporting. Sound guidance and an appropriate regulatory framework may allow auditors to take advantage of AI technology and thus improve the accuracy and reliability of financial reporting. The modernization of financial reporting depends on an appropriate combination of the IFRS and AI in auditing, which is imperative for meeting the requirements of current technological changes and regulations and, hence, may provide higher-quality financial statements.

2. Literature Review

2.1. The Quality of Financial Reports

Financial reporting has long been fundamental to corporate governance because ownership tends to be dispersed across various companies. Consequently, financial reporting achieved two main objectives in the past. It originally served to shield corporations, promoters, and managers from misconduct. Its goal was simple: to ensure that those who either provide or owe funds can be confident about the security of their investments. Since top-level management was not often directly involved in overseeing recording processes, mechanisms such as internal controls and external audits were essential to ensure the integrity of financial records. In the modern context, as elaborated in detail in the descriptive study conducted by Moridu (2023) regarding the West Java banking sector, the quality of financial statements forms the essential entity that dictates investment decisions. By adhering strictly to accounting regulations, businesses achieve two key outcomes: the accuracy of their financial data and confidence that their investments possess a reliable foundation.

Notably, this change in financial reporting, which resulted from integration with AI, has lifted the quality of financial reporting to greater heights (Zraqat, 2020). AI’s ability to handle large volumes of data has provided some aspects of analysis that are critical in finance to be much more effective in detecting trends and identifying errors and issues compared to other manual audit systems (Chen & Du, 2009). In primary research using a self-developed questionnaire and secondary research employing an exploratory review, Hasan (2021) identified that adding AI to auditing could enhance the reliability of financial reports, increase efficiency, and optimize auditors’ processes. Equally, Noordin et al. (2022) pointed out that utilizing AI could help cut down the audit duration but not necessarily the efficiency of the audit involved. As a result of AI sorting through massive datasets, auditors may now offer sharper insights and improved report trustworthiness much more rapidly than is possible in its absence. Through advanced analytical instruments, experienced detectives can identify errors sooner while gaining preliminary and crucial financial data without difficulty. Murodovich and Ziyadullaevna (2022) argued that accountants and auditors should adopt automation and assert that they require digital skills. They argued that implemented correctly, it could alleviate workloads and improve information processing, thereby increasing the quality of financial reports at multiple business tiers. Examining each sequentially, the narrative they formed highlights how AI could not only change how external auditors approach audits but also usher in new levels of reliability and accuracy in our fiscal-data delivery and the accuracy of financial reports—making a leap into new frontiers of finance. In the current application, as supported by a descriptive study by Moridu (2023) in the banking sector of West Java Province, the relevance of the quality of financial statements was found to be significantly linked to investment decisions.

AI integration into auditing may be central to enhancing the performance of external auditors and audit firm activities. Fedyk et al. (2022) found that AI increases audit quality and efficiency, and reduces costs, including those relating to resources, by reducing the workforce, more so among juniors. Their study, based on analysis of over 310,000 CVs and interviews with audit firm partners, also noted a 5% decrease in audit restatements and a 0.9% reduction in audit fees with a corresponding and substantial investment in AI. Moreover, Rawashdeh et al. (2023) emphasized that the effectiveness of AI in auditing relies on the quality of the audit, the alignment between the technology and the firm’s needs, and organizational readiness to implement AI in areas such as risk assessment. An online survey of 240 accountants and external auditors determined that possessing tech-savvy skills is essential for both managing risks and maximizing the application of AI. This is linked to the strength of a business’s risk management strategies and IT capabilities corresponding to their level of confidence in AI. Future research should expand the geographical focus, and the methodologies used, noting that their study focused on a single region.

2.2. The Adoption of AI

2.2.1. Definition and Capabilities of AI

Pomerol (1997) defined AI as the use of computers and machines to think, learn, and act like humans. By extending this, AI can perform logical reasoning and autonomous learning, understand big datasets, and make independent judgments. AI may, therefore, be used to undertake the regular tasks of auditors and improve their decision making, as identified by Duan et al. (2019). Successful implementation of AI, including voice and visual identification, data interpretation, semantic interpretation, and machine learning, requires technical expertise and financial resources (Chukwuani, 2020). AI refers to the development of systems that can autonomously process information and perform tasks traditionally requiring human intelligence.

2.2.2. Advancements and Applications of AI in Auditing

Research indicates that AI systems are increasingly capable of performing functions that mimic human cognitive abilities and surpass human performance in specific domains, such as data analysis and pattern recognition (Abràmoff et al., 2023). These advancements highlight AI’s capacity to approach complex problems with creativity and efficiency, leveraging vast amounts of knowledge available from digital sources. Beyond this, AI can execute the same tasks as humans, and it can be used in cognitive science, entrepreneurship, academia, and software development. Moreover, AI may be the best at problems composed of stages clearly defined in the process of arriving at a decision—a potential area for businesses to investigate for greater benefits (Taghizadeh et al., 2013). Along with the automation of recurrent tasks, AI could enable auditors to spend more time on the quality of their work and on the usage of advanced analytics for informed decision making (Greenman, 2017). According to this author, manual bookkeeping is in the process of being phased out with the rise of AI-powered automation. Finally, AI is also important in the automatic review of documents as it can identify and extract key terms without assistance, demonstrating its capacity for automated processing (Raphael, 2015).

2.2.3. Economic Impacts of AI on the Auditing Profession

There is also a vast body of literature on the economic effects of AI on the auditing profession. The significant aspects of structural change connected to the integration of AI in the labor market have remained an area of discussion among policy-making and academic institutions. Capital structure, particularly AI, is not viewed as an expense but rather as an investment—akin to a “sowing”—that fosters extraordinary development and innovation for companies. As mentioned earlier, AI has its advantages in the auditing process, including increasing the effectiveness of an auditors’ work. This can be accomplished not only by automating processes such as risk assessment and exhaustive testing of all data but also by improving the decision-making process in audits, as reported by Munoko et al. (2020) and Rozario and Thomas (2019). Some other benefits disclosed by Brennan et al. (2017) include eradicating prejudices and mistakes made by people, offering continuous audit assistance, recognizing data patterns, and cutting down auditing expenses. However, Wiggins et al. (2020) pointed out the necessity of understanding human capacities, choices, and skills in order to use developments like AI to relieve the mental load. In the world of financial reporting, AI serves as a cleverly designed data mining technique with the main goal of generating precise and trustworthy predictions (Nair & Mohandas, 2015). It is all about completing tasks quicker; for example, zipping through document approvals leads directly to sharper financial report preparation without tripping over complicated procedures along the way. By digging deep with clever algorithms, AI excels at finding patterns or exceptions by detecting data that do not quite fit with the remainder of the information analyzed. It is a game-changer for auditors as finding risks faster means that audits and accounts can be completed at lightning speed.

2.2.4. Improvements in the Quality of Financial Reports with AI

Many researchers have delved deeper to comprehend the dynamics in the new financial reporting regime brought about by AI. The first research survey described in this paper looked at the impact of AI on financial audit quality, focusing on its role in accumulating audit evidence by IT auditors in Jordan (Al-Sayyed et al., 2021). It determined that financial audit quality and effectiveness can be improved considerably with AI technology. In a related examination, Abu El-Enein and Ahmed (2020) explored how AI and contemporary IT improve the skill set and efficiency of external auditors. They examined 100 different surveys with one aim—to light up the path to better quality by pinpointing winning tactics. Auditors who bring AI and IT into their toolkits are stepping up their game, making audits not just quicker but also more precise. These innovations promise easier and less costly ways of confirming tasks are completed correctly. The advice from researchers is that auditors need to amplify their computer skills and embrace AI and other info-tech gadgets wholeheartedly.

Research papers widely discuss the significant impact AI is having on transforming the auditing field. These advances signal hope, however, trusting this technology is another story. Its hit-and-miss nature leaves many hesitant. Shankar et al. (2024) conducted a study to assess what factors advocate for or oppose the use of AI-powered drones in checking manufacturing processes. The top motivations cited behind embracing this innovation include its eco-friendly nature, better ways of carrying out tasks, and expanding knowledge.

However, the perceptions of risk that AI could pose and the unwillingness to shift from conventional procedures considerably slow down the rate of adoption. Studies have noted that commitment to adopting new concepts requires building trust in the initial stages and addressing concerns, driven by an organization’s passion for technology. The same study also pointed out some future directions, such as expanding the knowledge frontier in technology, especially blockchain and a virtual world called the “Metaverse”. There are also research limitations pointed out by Shankar et al. (2024), including the work’s unique non-experimental, qualitative focus, and the potential sample size of the study group. Seethamraju and Hecimovic (2023) investigated the advent of AI in the auditing domain and further analyzed how determinants from technology, organizations, and the environment influence it through semi-structured interviews. As they pointed out, while AI can enhance audit quality through value-added services, it also poses another challenge: a lack of transparency between users and AI systems. In order to obtain a better view into how AI is being implemented and deployed in the audit profession, they advocated for more thinking on AI’s impact on auditor skills and skepticism, and the influence of organizational size through case and survey research. This would make it possible for professional services to practice using AI and improve productivity and the quality of products. Additionally, more research should be conducted on AI’s effects on auditor skills and skepticism and the effect of organizational size using deep case studies and empirical surveying. Furthermore, regulators and standard-setters should develop appropriate standards and guidelines for the use of AI across various audit engagements.

2.2.5. AI’s Influence on Accounting Education and Curricula

According to Holmes and Douglass (2022), AI may present the opportunity to change accounting curricula and revolutionize the accounting industry, using survey findings from a professional questionnaire as a basis for their discussion. The findings assumed that AI is viewed with a positive attitude since the respondents believed that the technology would enhance work effectiveness by eliminating repetitive work and the errors that correspondingly arise. The study articulated that there is an evident need to change accounting education, and addressing the integration of specialized computer skills drives the curriculum. This suggests that large public auditing firms are more inclined to adopt AI technology compared to professionals and educators in smaller firms and academic institutions. This likely has far-reaching implications, at least for accounting coursework, in that it suggests that the whole approach to teaching is changing from traditional theoretical knowledge to practical skills in data management. This is compelling evidence regarding the necessity for the accounting industry to adapt, even proactively, to changing technology to keep the profession relevant in an AI world.

2.2.6. Strategic Implementation of AI in Auditing

Goto (2023), in his instructive research on predictive technology in business activities, specifically within the context of auditing and AI, explained how professionals can strategically implement service research and development (R&D) to overcome the obstacles associated with adopting AI. The research provided a key contribution to exploring how service R&D can, therefore, support predictive innovation, allowing professional services to adopt AI and use it to increase productivity and enhance product quality. Finally, the author gathered data from peer-reviewed public literature, professional association reports, and business articles between 2012 and 2020. Hence, the proposition that Big 4 audit firms have a key role in auditing the R&D of AI and its function globally is also applicable.

2.2.7. AI in Decision Making and Financial Reporting

There is a high probability that AI will indeed improve decision making and financial reporting in auditing. Existing bodies of literature by auditors and academics, as identified through a systematic review by C. A. Zhang et al. (2022), have explored the use of ML algorithms and XAI methods in auditing, particularly the LIME instance explanation. LIME provides interpretable tools at the instance level through simple approximations of complex models (Ribeiro et al., 2016; Molnar, 2021). Zhang and his team covered the period from 2005 to 2017, with 26,841 firm-year observations, explaining how LIME can be integrated into existing audit documentation and evidence standards to provide greater transparency in AI applications. They also explained issues related to the adoption of tabular data in supervised auditing learning for different auditing operations, providing directions for future work, such as validity or stability analysis of the proposed XAI for various scenarios, like fake billing. Broadening the work to other types of data and ML problems was also proposed. However, a major limitation of the study is that material misstatement was measured using a binary variable, which is unable to capture the dollar amount of accounts being adjusted. As a result of the lack of availability of original financial statements, the study may not be appropriate for real-world auditing situations where quantifying misstatements is important.

2.2.8. AI-Backed Protocol Analysis and IFRS Challenges

The article by Rodgers et al. (2023) pointed out that the automation of protocol analysis from the perspective of cognitive psychology, where inferences about the information processes of people on the basis of their verbal behavior while solving a problem, could very well be achieved. They intended to try a framework with think-aloud protocols (TaPs) and thematic analysis in qualitative accounting research to examine the effects of legal conflict and the absence of IFRS information for nations implementing these standards in developing states such as Iraq. They conducted 32 semi-structured, in-depth telephone interviews with different groups of stakeholders, ranging from standard-setting bodies, investors, academics, and researchers to external auditors. From this, it is clear that the absence of an AI framework, IFRS knowledge and conflict in legislation would have adverse effects on the implementation of standards. They brought attention to the potential benefits that AI-backed protocol analysis may offer in terms of design features and opportunities for further research, design, and action. Moreover, they discussed challenges and opportunities during the implementation and training of machine learning and deep learning applications—more precisely, natural language processing (NLP)—for the study of human innovation and creativity. This research uniquely applied a combined implementation framework of both concurrent and retrospective TaPs, which is more distinctive than the previous literature. This could mean that future research should be directed toward institutional environmental forces, which include AI technology that influences IFRS adoption within developing transitional settings and, further, the impact of the national settings on the quality of financial statements post-IFRS implementation.

2.3. Knowledge Gap

In conclusion, Shankar et al. (2024), in their literature review on AI enablers and inhibitors, noted a gap in understanding how universally applicable these technologies are, similar to other emerging innovations like blockchain and the Metaverse. Thus, one cannot help but begin to research adoption factors in other innovative technologies in similar contexts. Furthermore, according to Seethamraju and Hecimovic (2023), another important gap is the lack of analysis of regulatory responses and standards for governing AI in audit engagements, which implies the provision of standards with respect to the integration of AI technologies in audit practices. There is a need for guidance on the integration of AI technologies within auditing practices. Moreover, Fedyk et al. (2022) argued that big investment in AI results in efficiency and lowered costs; however, this does not capture the possible effects on smaller audit firms that would likely never afford similar investments in AI. Lastly, while the study has implications for improving the quality and efficiency of audits, further findings need to be ascertained in terms of ethical and governance-related matters raised by the use of AI. As a result, the integration of AI needs to be studied to determine how it might affect the competitive forces in this industry and how it might, in turn, change the economics of smaller firms. There is also a need to study how firms implement transparency, accountability, and fairness in an AI-augmented audit and, therefore, what impact it has on professional ethics and standards. Holmes and Douglass (2022) identified a knowledge gap regarding the practical inclusion of AI-focused curricula in accounting education and questioned their effectiveness in preparing students while also raising concerns about faculty readiness to teach such technology-driven subjects. A further knowledge gap identified by Goto (2023) is the requirement to understand how the current culture within auditing firms facilitates or obstructs the implementation of AI technologies, particularly in addressing employee resistance, trust in technology, and the effectiveness of existing training programs in preparing auditors for AI adoption. C. A. Zhang et al. (2022) added to the knowledge gaps by detecting the absence of a clear conceptualization and realization of how LIME and other forms of XAI would apply in modern audit practice environments other than tabular environments. Open questions also exist about the use of such technologies in other dynamic auditing scenarios beyond traditional financial audits. Finally, Rodgers et al. (2023) noted that little is known about how AI could be systematically deployed to facilitate the implementation of the IFRS under different national and regulatory conditions, especially bearing in mind institutional and environmental conditions in transitional nations.

2.4. Theoretical Framework and Research Questions

2.4.1. Unified Theory of Acceptance and Use of Technology (UTAUT)

User perceptions are critical in determining the extent to which auditors adopt AI technology in auditing. Based on these premises, the current study used UTAUT. This approach combines several technical theories (Venkatesh et al., 2003), such as the Technology Acceptance Model (TAM) (Davis, 1989), the Theory of Planned Behavior (Ajzen, 1991; Taylor & Todd, 1995), Innovation Diffusion Theory (Moore & Benbasat, 1991), and Social Cognitive Theory (Compeau & Higgins, 1995). UTAUT is constructed to explain technical and advanced organizational technologies. This approach ensures that the model has more explanatory power and can be adopted in various contexts (Venkatesh et al., 2003). Relevant empirical evidence shows that UTAUT outperforms individual theoretical explanations by accounting for as much as 70% of the variance in behavioral intentions.

Based on this model, researchers have identified four key variables, as shown in Table 1: performance expectancy (PE), effort expectancy (EE), social influence (SI), and facilitating conditions (FC), which are employed when measuring AI adoption by external auditors. According to these factors, the application of AI can affect the quality of financial reports.

Table 1.

Description of UTAUT factors.

AI Adoption and Performance Expectancy (PE)

Employee evaluation and job performance improvement depend on the acceptance of sophisticated technology, such as AI. The extent to which workers view their job performance positively is determined by how much they think that the utilization of this tool can help them improve their performance (Venkatesh et al., 2003; Thompson et al., 1991). For instance, examiners may be required to devote more attention to complex transactions rather than to repetitive routine tasks. In the case of external auditors, applying AI to inspect companies may be considered as a way to improve the quality of financial statements. It could also help, either directly or indirectly, to develop financial reporting. Additionally, the use of AI in the auditing process may result in improved auditor decision making, which in turn increases the speed and accuracy of maintaining the quality of financial statements.

AI Adoption and Effort Expectancy (EE)

Thompson et al. (1991) categorized complexity as the effort needed to understand and implement innovation. Therefore, Payne and Curtis (2008) determined that because auditors are not only supposed to decide on the adoption of the technology but also serve the role of supervisors concerning this technology, they may well feel that these issues about the adoption of technology are more conspicuous to them than the situation with IT specialists. In essence, this work defines innovation as the ability to employ AI in auditing processes to identify best practices, thus enhancing the quality of financial reports. For instance, ML can significantly improve process efficiency by saving time in data processing and auditing. Thus, understanding to what extent the application of AI technology is flexible to auditors’ needs could increase the ease of auditing, reduce the time and effort utilized, and, over time, enhance the quality of financial reports being produced.

AI Adoption and Social Influence (SI)

In Triandis’s (1980) terminology, collectivistic social factors are processes in which individuals endorse cultural rules and norms operating for their group in a specific context. SI refers to an individual’s perception of how important others view their use of a new technology (Venkatesh et al., 2003). For instance, if auditors receive support from their superiors and colleagues regarding AI use, they are more likely to continue using it. As a result, this continued use might boost the quality of financial reports.

AI Adoption and Facilitating Conditions (FC)

Thompson et al. (1991) proposed “facilitating conditions” as key in contextual organizational environments influencing the implementation and adoption of AI systems. FC is defined as “the degree to which a person believes that there is institutional and technological support for the operation of this system” (Venkatesh et al., 2003, p. 29). In the context of advancements in auditing technology and the quality of financial reports, this means audit firms must provide their auditors with the appropriate computer-assisted audit techniques (CAATs), resources, smart technologies, technical support, and knowledge for using these technologies throughout the auditing process, including inspections and contracting.

2.4.2. Research Questions

In light of this, the purpose of this study was to evaluate AI’s impact on the quality of audited financial reports for firms in Saudi Arabia. Such trends mean that the application of AI in auditing is gradually transformed. This change in perspective is attributed to the fact that in the current practice of auditing, the application of AI is regarded as a means for developing the existing process while maintaining compliance with the relevant standards of auditing. Starting with Schulenberg’s study (Schulenberg, 2007), he recommended that “cognitive auditing” shows how AI, in specific machine learning algorithms, may advance auditors’ ability to discover errors and variations. The objective of this technology progress is not to replace the current audit frameworks but to expand and improve their analytical tools. To give sufficient basis to this statement, Gentner et al. (2018) argued that AI can determine the presence of unpredictability and documentation data points quickly and with effectiveness, thus resulting in a greater quality of financial reporting due to a more comprehensive and meaningful analysis of data. Additionally, the trend of audit development, as coined by Ikechukwu and Nwakaego (2015), is also directed toward developing more effectual and accurate audits, which are made more possible through AI software. Therefore, AI and audit quality are best described as having a cooperative relationship when it comes to strengthening audit quality and standards rather than an opposing one. Moreover, Chassignol et al. (2018) provided details on how AI can contribute to fraud detection, another determinant of audit quality, since it can identify fraudulent behavior indicators. Lin and Hazelbaker (2019), more accurately predicted the role of AI in raising the standard of accounting duties, the overall productivity, and creating new professional employment prospects in audit businesses. Therefore, auditors’ use of AI is a proactive strategy to promote audit quality in alignment with the required regulation framework without endangering the need for needless auditor registration. The research questions pursued herein are as follows:

- From 2017 to 2024, what are the top publications, citations, countries, journals, papers, and authors associated with the use of AI in auditing and financial reporting?

- From 2017 to 2024, what are the documents and authors’ bibliographic coupling, and what are the keyword occurrences associated with the use of AI in auditing and financial reporting?

- How does the use of AI in auditing practices improve financial reporting?

The study answers these questions via five sub-questions, as follows.

In the auditing sector, AI is expected to change how audits are conducted (Duan et al., 2019). AI is helpful for external auditors in that it helps automate work to redirect efforts toward work that takes more time. Consequently, there can be an increase in the quality of prepared financial reports since AI eases their preparation. Greenman (2017) identified that AI enhances the quality of auditors’ financial reports through superior analysis and strategic foresight. Thus, the indicated elements present opportunities for non-Big 4 external auditors in the case of AI in auditing processes. For example, AI can be used to minimize time spent on repetitive activities such as verifying daily transactions, thereby improving overall organizational performance as more time is spent on production.

Nevertheless, there are fears that such innovations could only be necessary for giant audit companies, which include Big 4 firms but not non-Big 4 firms. Fedyk et al. (2022) claimed that big investment in AI results in efficiency and lowered costs; however, this does not capture the possible effects on smaller audit firms that would likely never afford similar funds in AI. Efforts should be made to ensure that technology does not put firms of small sizes at a disadvantage since the expectation of higher quality in the auditing industry applies to firms of all sizes. Lastly, for non-Big 4 audit firms, the purpose is to obtain higher performance from external auditors, and the strategies involve adopting new innovative technology in auditing. For instance, Shankar et al. (2024) conducted a study to identify how AI-fixed aerial vehicles can monitor manufacturing processes, showing that AI improves audit efficiency. As far as the author is concerned, the following sub-questions sought to determine the impact that embedding AI can have on improving the efficiency of external auditors in non-Big 4 firms.

- 3.1.

- How does using AI-powered drones in auditing inspections improve non-Big 4 external auditors’ performance in decision making?

Effort expectation is the perceived user-friendliness of AI to streamline and reduce the function of external auditors. According to Goto (2023), companies that create a culture that supports technology adoption, lowers resistance, and motivates user interaction with technological tools may be the only approach for effectively incorporating AI in audits. External auditors who welcome such changes are more likely to provide financial audits of superior quality with greater consistency, resulting in more accountable financial management.

- 3.2.

- How does the utilization of AI in non-Big 4 audit companies demand a positive work culture, which, in turn, increases audit quality and consistency?

Holmes and Douglass (2022) noted that there is a need to change the accounting curriculum to incorporate a computer skill component. Along a similar line, Qasim and Kharbat (2020) examined the role of new technologies such as blockchain, business data analytics, and artificial intelligence in accountancy education. Most experts support the integration of technology into the curriculum. As a result, the following sub-question looks at the importance of incorporating AI in auditing curricula to the best of the author’s knowledge.

- 3.3.

- How does the integration of AI in auditing education become the most crucial factor in preparing auditors for a profession where AI is used to improve financial reporting?

In essence, Seethamraju and Hecimovic’s (2023) contribution proves the importance of putting together the whole picture, which includes the regulatory standards and guidance, in using AI as part of audit processes. In doing so, external auditors and audit firms can adopt AI with confidence in its accuracy and, thereby, reliability. For example, the combination of government authorities in Saudi Arabia, such as the Saudi Organization for Chartered and Professional Accountants (SOCPA) and the Capital Market Authority CMA, should assist in creating a framework for using AI in auditing practices. This governance integration might ensure stability and flexibility of innovation for smart technology, which in turn would improve the financial reporting in Saudi Arabia. The next sub-question investigates how the audit profession and government authorities can collaborate to enhance the use of AI in auditing.

- 3.4.

- How can sound guidance and an appropriate regulatory framework allow auditors to take advantage of AI technology and thus improve the accuracy and reliability of financial reporting?

In the literature, it has been argued that guidelines need to be established to adhere to all international audit standards and requirements during the implementation of AI. Shankar et al. (2024) posited that, like other emerging technologies, the global dimension of AI enablers and inhibitors in auditing needs to be investigated to promote the sharing of knowledge and ensure the development of quality auditing and standards across the globe. Moreover, Rodgers et al. (2023) advocated embracing an interdisciplinary exploration of incorporating AI with accounting, auditing, and behavioral science. This is a prerequisite to building a system of global financial reporting that covers all challenges and allows institutions to conduct audits formally and in a timely manner, without rushing, to ensure that ethical principles are not compromised. According to Seidenstein et al. (2024), technological innovations have changed auditing methods, impacting auditing practices in the long term. Auditors from current and future generations may not be impacted as technologies continue to advance. Through their exchange, the panelists spoke credibly of the place of the International Auditing and Assurance Standards Board in the realization of this vision.

- 3.5.

- How does the modernization of financial reporting depend on an appropriate combination of IFRS and AI in auditing, which is imperative for meeting the requirements of current technological changes and regulations and, hence, providing higher-quality financial statements?

3. Methods

This research attempted to investigate the following question: “How does the use of AI in auditing practices improve financial reporting?” through two main sources: a systematic literature review utilizing bibliometric and content analysis. This allowed the researcher to assess the questions through these two main sources. First, a systematic literature review utilizing bibliometric analysis was conducted (e.g., Johri & Singh, 2024; Lamboglia et al., 2021). Within this approach, researchers apply computer programs to conduct a quantitative analysis of features from the literature, including frequencies of citations of the given papers, frequencies and intensiveness of publications, and interactions of authors, journals, and nations (e.g., Lamboglia et al., 2021; Abu Huson et al., 2024). The second element of this paper’s method comprised a content analysis (document sources), which investigated the questions of this study. These documents were taken from published online sources, such as audit firms’ transparency reports and audited government agencies. This type of data is secondary (Bogdan & Biklen, 1997; Salijeni et al., 2019). In addition, it is a suitable basis for a study, as highlighted by Bogdan and Biklen (1997). Similar to this study, many researchers have used documentary data in the field of audit and technology, such as Jacky and Sulaiman (2022), and Sun and Vasarhelyi (2018).

3.1. Data Collection Technique for Bibliometric Analysis

The keywords were detected from this research question, and four hypotheses were developed based on the most frequent words in this research field. For instance, terms such as “AI” or “artificial intelligence” were employed to explain how the process of auditing is automated, which may have increased efficiency and reduced human error, as noted by Law and Shen (2024). Additionally, the keywords “audit” or “auditing” were used to focus on ensuring the integrity of financial reports, which can be verified through electronic tools (Secinaro et al., 2022). Our study selected the Web of Science (WoS) Core Collection to access multiple databases, such as Scopus and Google Scholar. In addition, WoS has an excellent reputation for collecting data for bibliometric analysis (Bartolacci et al., 2020; D. Zhang et al., 2019). For journal analysis, the WoS was used due to the availability of various scientific articles based on the Science Citation Index Expanded and the Social Sciences Citation Index, which is popular among different researchers for providing accurate data (Bartolacci et al., 2020; D. Zhang et al., 2019). Through well-organized interfaces and many tools for controlling search operations, the WoS greatly improves research cooperation (Mongeon & Paul-Hus, 2016). The WoS is known as a scientific and technical literature database that provides access to the most important scientific and technological resources available (Boyack et al., 2005).

WoS’s articles were extracted from 2017 to 7 June 2024 and categorized according to the following: ramifications of economics, public administration, business, and management, in the same way as Abu Huson et al. (2024). In addition, this study adds the following categories: computer science, artificial intelligence, business finance, law, and education. This method was further enhanced by including additional relevant articles. Only articles published in English were selected for this study (e.g., Johri & Singh, 2024; Lamboglia et al., 2021; Rahman et al., 2024). As shown in Table 2, the final code was as follows: #1 AND #2 and Article (Document Types) and 2017 or 2018 or 2019 or 2020 or 2021 or 2022 or 2023 or 2024 (Publication Years) and Computer Science Artificial Intelligence or Business Finance or Management or Business or Economics or Law or Education Educational Research or Public Administration (Web of Science Categories) and English (Languages).

Table 2.

Data search conducted 7 June 2024.

3.2. Justifications for the Chosen Time Period

Based on the period of analysis by Abu Huson et al. (2024), the time span of 2017–2024 was selected, considering the advancement of AI and growing applications in auditing. This spectrum ensured that the research reflected the trends in artificial intelligence, blockchain, and information technology, as well as the transformation brought about by the auditing profession starting in 2017. It also included the most modern research, innovations, and contributions in the domains of the automation of auditing tasks and the enhancement of the quality of financial reports. Furthermore, this era could be more significant in determining the consequences of implementing artificial intelligence in Saudi Arabia since Vision 2030 emphasizes the adoption of technology in the financial and auditing sectors. Furthermore, this period encompasses both the period before and after the Saudi government’s interest in AI, as evidenced by the establishment of the Saudi Data and AI Authority (SDAIA) in 2019.

4. Findings

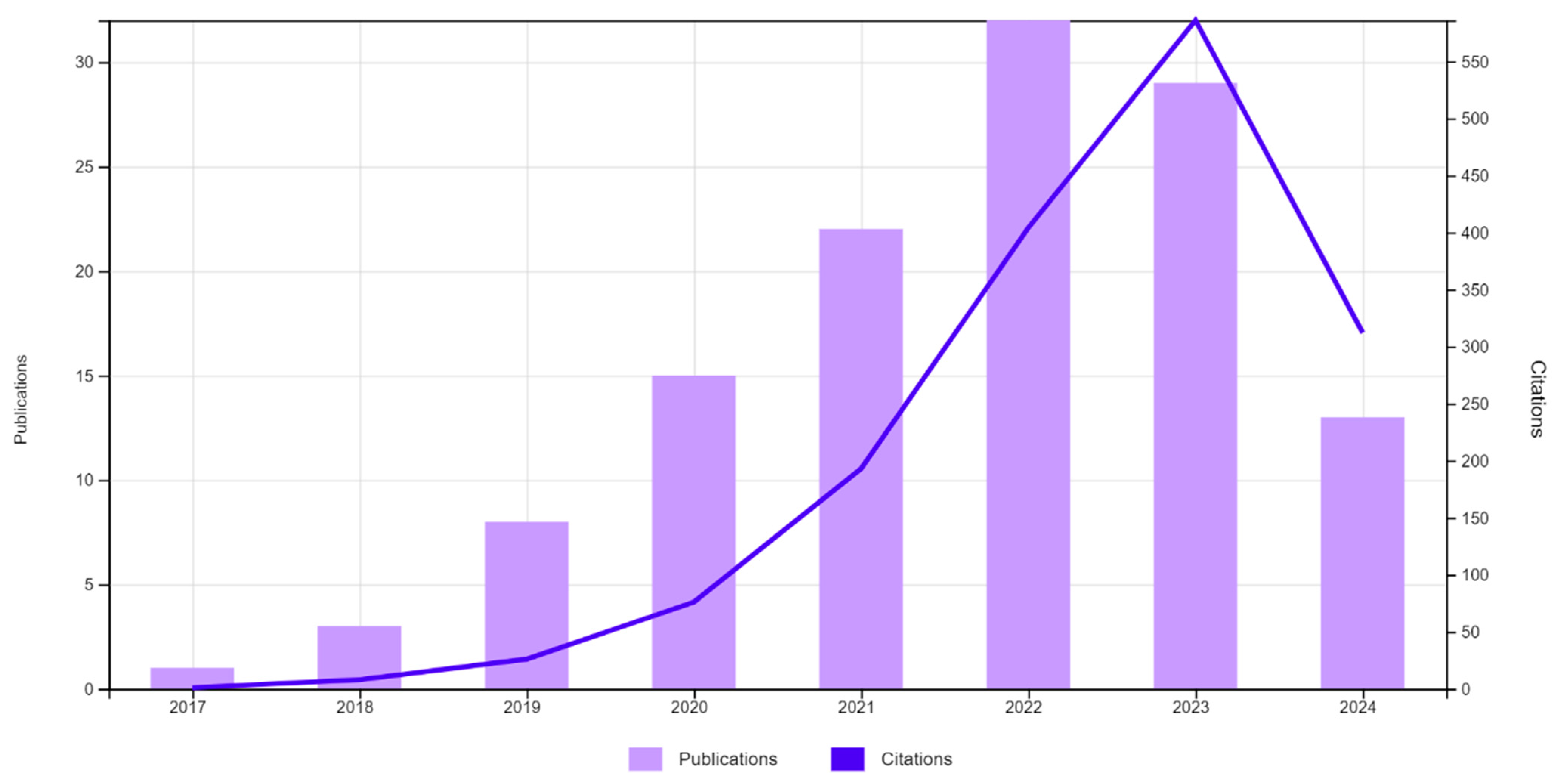

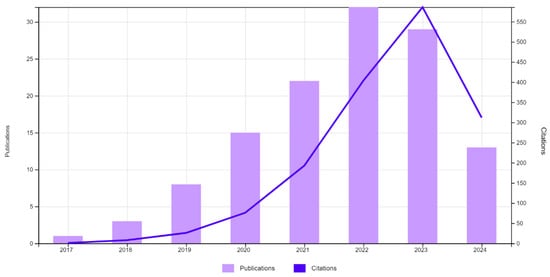

4.1. A Descriptive Analysis of the Studies

The data described in this section comprise information gathered on AI in auditing between 2017 and 7 June 2024. By number of articles sorted geographically, by number of articles and number of citations from 2017 to 2024, by journals that contributed most to the publications and number of citations, and by the ten most cited papers, one may find the most productive research for the timeframe (Merigo & Yang, 2017). Figure 1, Figure 2, Figure 3 and Figure 4 taken together offer a complex picture of the field, highlighting academic, geographical, and chronological aspects that frame AI’s involvement in auditing procedures all around. These domains were selected since they fit the goal of the study—that of evaluating the advancement, influence, and main players in the field of artificial intelligence in auditing. Previous studies underlined the need of knowing temporal patterns in technology adoption (Merigo & Yang, 2017) and the part that regional research clusters play in inspiring creativity (Van Eck & Waltman, 2017). Moreover, in bibliometric analyses to track significant contributions and developing trends in a given subject, determining leading journals and authors has been a standard strategy (Bartolacci et al., 2020; D. Zhang et al., 2019). This thorough investigation guarantees the study catches important insights on the transforming power of artificial intelligence in auditing and conforms with past research approaches. Figure 1 below shows the number of publications and citations of papers relating to AI in auditing between 2017 and 2024. As far as publications are concerned, from the data points, it is evident that more citations and publications have occurred in recent years, which indicates that the field is expanding. The data indicate the following number of publications per year: one in 2017, three in 2018, eight in 2019, fifteen in 2020, twenty-two in 2021, thirty-two in 2022, twenty-nine in 2023, and thirteen in 2024. There were intensive references to the cited material from the period before 2021, and the peak in 2023 demonstrates that the research from prior years had a significant impact on the field’s progression.

Figure 1.

Publications and citations from 2017 to 2024.

Figure 2.

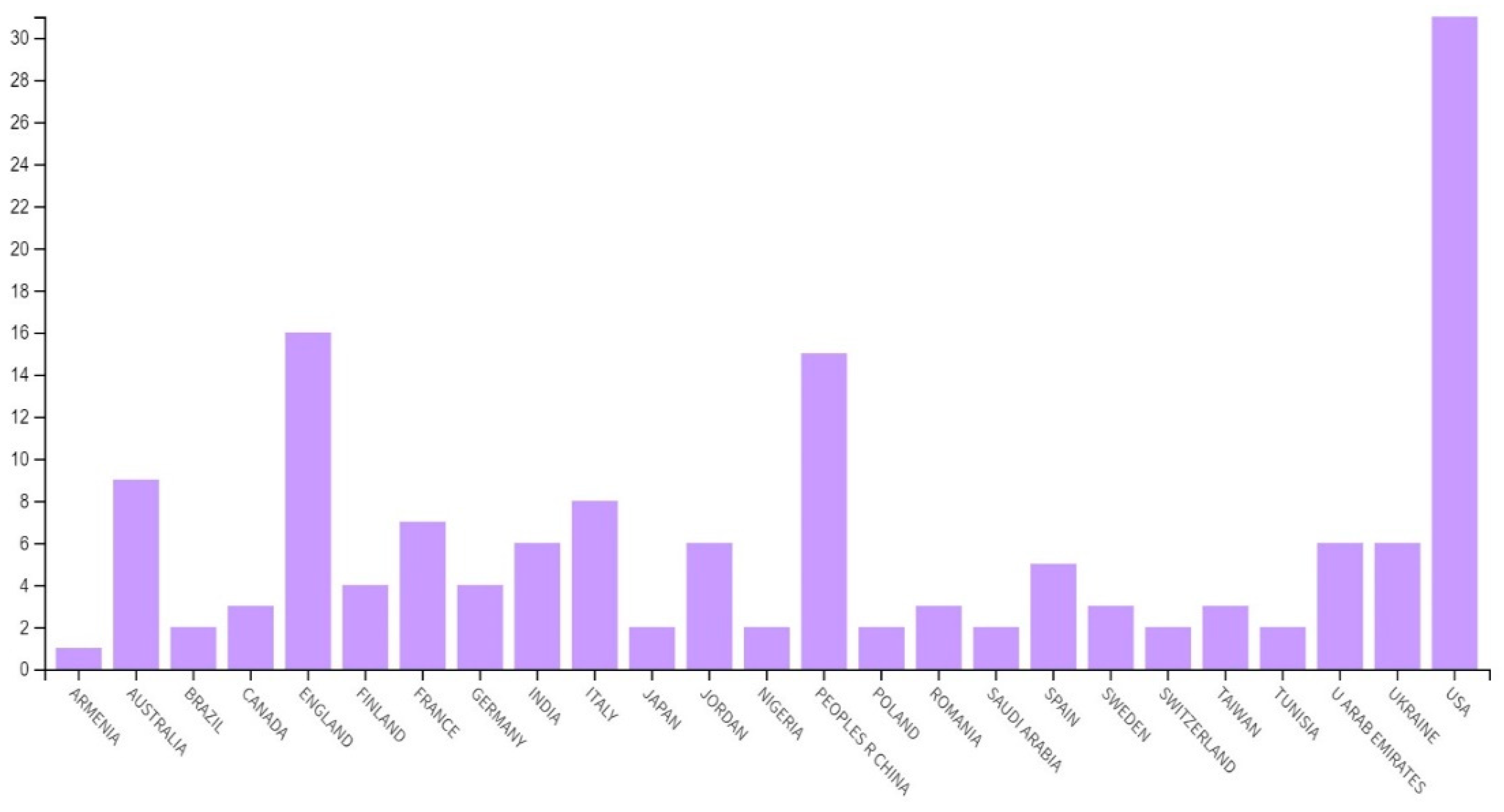

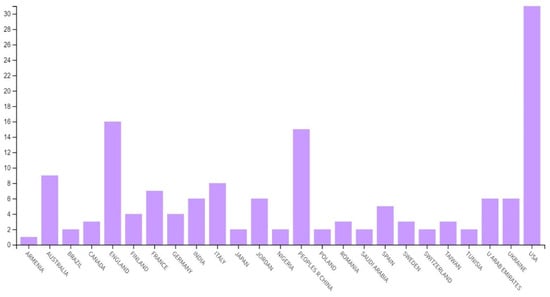

Distribution of publications by country and region.

Figure 3.

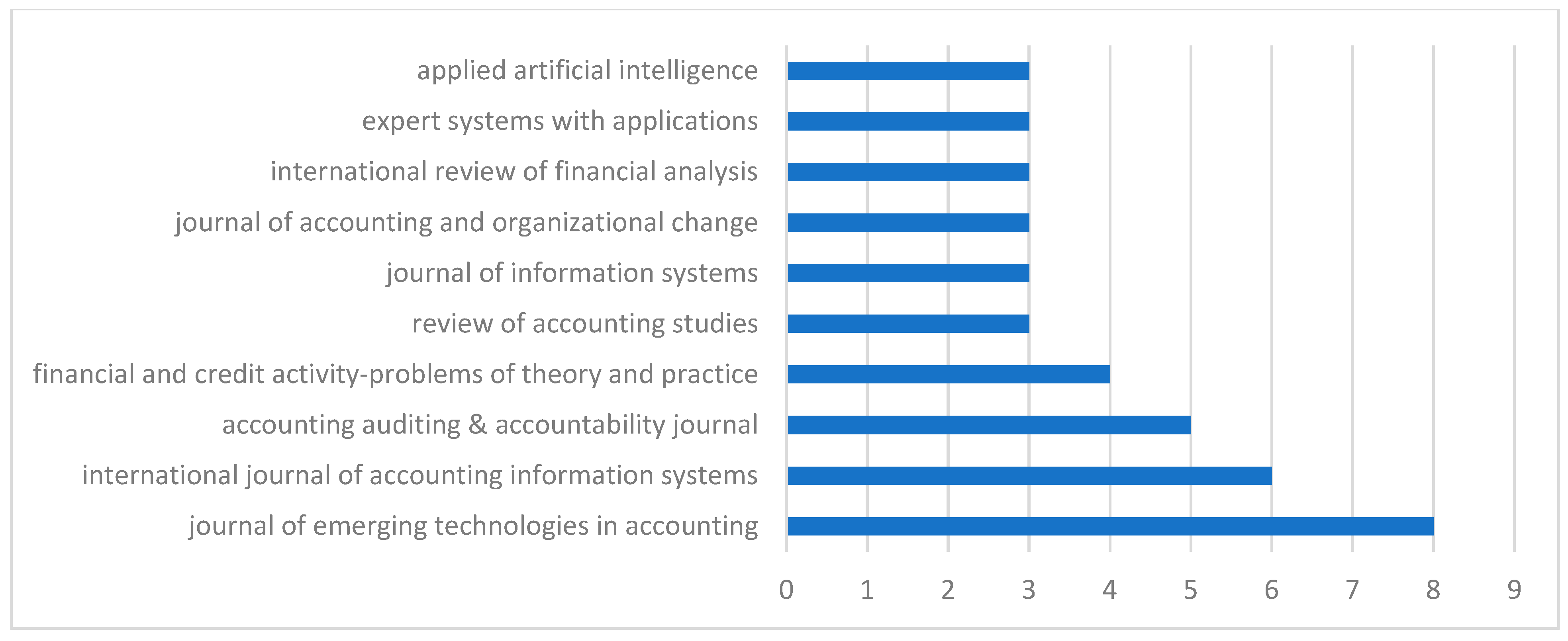

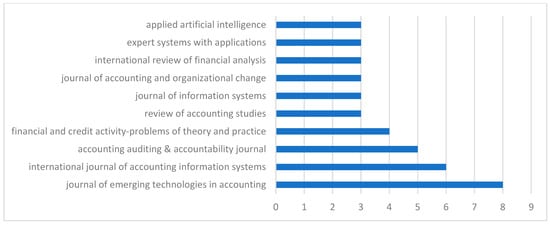

The top contributing journals.

Figure 4.

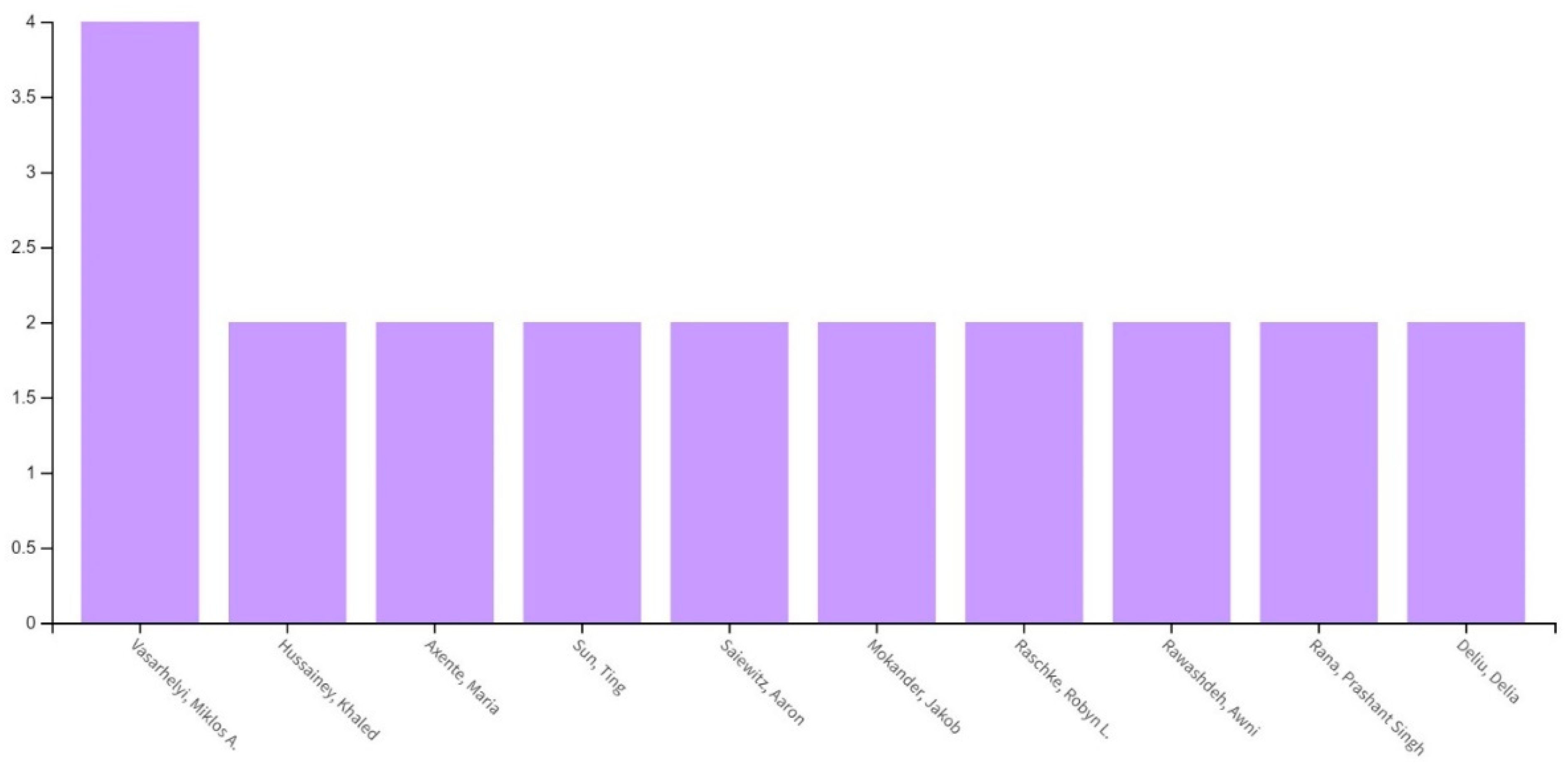

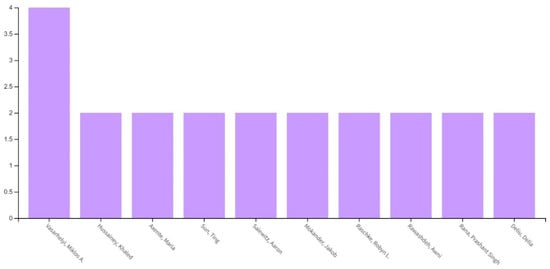

Top ten authors by number of publications.

As illustrated in Figure 2, the articles were classified into three categories. Furthermore, the distribution of articles related to AI in auditing is shown by countries and regions. Out of all of the countries, the US published 31 publications, England published 16, and China published 15, which confirms that AI research activity is high in these countries. Furthermore, additional items of exceptional worth come from Australia (nine), Italy (eight), France (seven), Jordan, Ukraine, the UAE (six), and Spain (five). Figure 3 shows the international contributions to AI studies, and the figures contributing to the studies hail from various countries, which implies that there is interest in the development of AI in auditing across the world.

In Figure 3 below, the journals with the highest impact have greatly contributed to the improvement of knowledge in the field of AI in auditing. Some of the top journals that publish research articles related to the field are the Journal of Emerging Technologies in Accounting, with nine publications, and the International Journal of Accounting Information Systems, with seven publications. Although there are only a few core journals in this field, they remain the most influential and significant in the established research.

Table 3 lists the top ten papers contributing to the field of AI in auditing, providing details such as the journal name, the paper’s author(s), year of publication, and the total number of citations. The most referenced paper was, “The Emergence of Artificial Intelligence: how automation is changing auditing.”. The paper titled “Shift to Automation in Auditing: Its Impact and Implications”, composed by Kokina and Davenport, has been cited 153 times. Kokina and Davenport (2017) addressed the topic of how artificial intelligence is affecting the auditing profession, particularly concerning how automation is changing some of the essential processes in auditing by improving the speed and precision of the work being carried out. Their research also explored the skepticism linked to AI and stressed the significance of subsequent analysis in seeking to eliminate such prejudices and, therefore, increase the openness to AI-based auditing systems.

Table 3.

Top ten papers in terms of citations.

Several papers have analyzed how AI and automation are changing the auditing profession, particularly robotic process animation (RPA) and the preservation of audit quality disrupted by COVID-19. After the first study, “Applying Robotic Process Automation (RPA) in Auditing”, Huang and Vasarhelyi’s (2019) study in the paper titled “A Framework” indicates that RPA decreases the audit’s volume of manual tasks and enhances efficiency so that auditors can concentrate on evaluation. In their study, “The Impact of COVID-19 on Auditing Quality”, Albitar et al. (2020) emphasized the urgent need for remote audit tools. However, they also highlighted concerns regarding audit quality and information validation. Tiberius and Hirth (2019), in “Impacts of Digitization on Auditing”, predicted that digitization would transform audits into fully digital processes and require auditors to develop digital competencies. Their predictions were based on findings from the “Delphi Study for Germany”. In addition, Qasim and Kharbat (2020), in their paper “Blockchain Technology, Business Data Analytics, and Artificial Intelligence: Use in the Accounting Profession and Ideas for Inclusion into the Accounting Curriculum”, emphasized that integrating blockchain and AI into accounting curricula is essential for preparing future accountants for technological advancements. In the paper titled “Digital Systems and New Challenges of Financial Management—FinTech, XBRL, Blockchain and Cryptocurrencies”, Mosteanu and Faccia (2020) stated that the implementation of digital systems is accompanied by new regulation risks. Therefore, governance frameworks must be updated. In the study titled “Mediating Effect of Use Perceptions on Technology Readiness and Adoption of Artificial Intelligence in Accounting”, conducted by Damerji and Salimi (2021), the authors proved that positive perceptions have a direct impact on AI adoption and reiterated the call for education and training to enhance technology readiness among employees. Finally, in the article “Intelligent Process Automation in Audit”, C. Zhang (2019) found that the automation of any audit reduces time consumption and results in a boost in audit accuracy.

In their research work “The Digital Transformation of External Audit and Its Impact on Corporate Governance”, Manita et al. (2020) identified the reality that digitalization augments audit firms’ governmental functions by providing a pertinent audit service, broadening service provision, and improving audit quality by following advanced data analysis, creating new audit profiles, and encouraging innovativeness, a development that highlights the need for proper governance and ethics owing to the emergence of complexities. It transforms the corporate environment by eradicating managerial discretion, thus enhancing firm governance. This means that improved audit standards are called for, as well as corresponding changes in the curricula offered in educational institutions. The research work of Munoko et al. (2020) titled “The Ethical Implications of Using Artificial Intelligence in Auditing” examined the gains and dilemmas arising from the use of AI in auditing. On the one hand, it focused on unveiling the strengths that AI can bring into the auditing field, including accuracy and efficiency; on the other hand, it outlined possible ethical problems with the rise of AI. Therefore, governance needs to face these changes in auditing.

Table 4 shows the authors who are most productive and have published many papers in the field of AI in auditing in the WoS database between 2017 and 2024. There were four publications written by Miklos A. Vasarhelyi, who has contributed significantly. Each of the following authors has published two papers: Khaled Hussainey, Maria Axente, Ting Sun, Aaron Saiewitz, Jakob Mokander, Robyn L. Raschke, Awni Rewashed, Prashant Singh Rana, and Delia Deliu. As is pointed out in Figure 4, Vasarhelyi has the highest author productivity in the field, and his works aim to unlock the possibilities offered by AI in auditing. For example, Vasarhelyi intervened on how best to sell auditing with RPA and the ethical dilemmas associated with deploying AI in audits. In addition, in Figure 4, there is a group of authors who have been contributing continuously to the development of AI in auditing practices and technologies; thanks to authors such as Hussainey, Axente, Sun, Saiewitz, Mokander, Raschke, Rawashdeh, Rana, and Deliu, AI is becoming diverse and has a wide range of research in this field.

Table 4.

Cluster 1 of keyword occurrence.

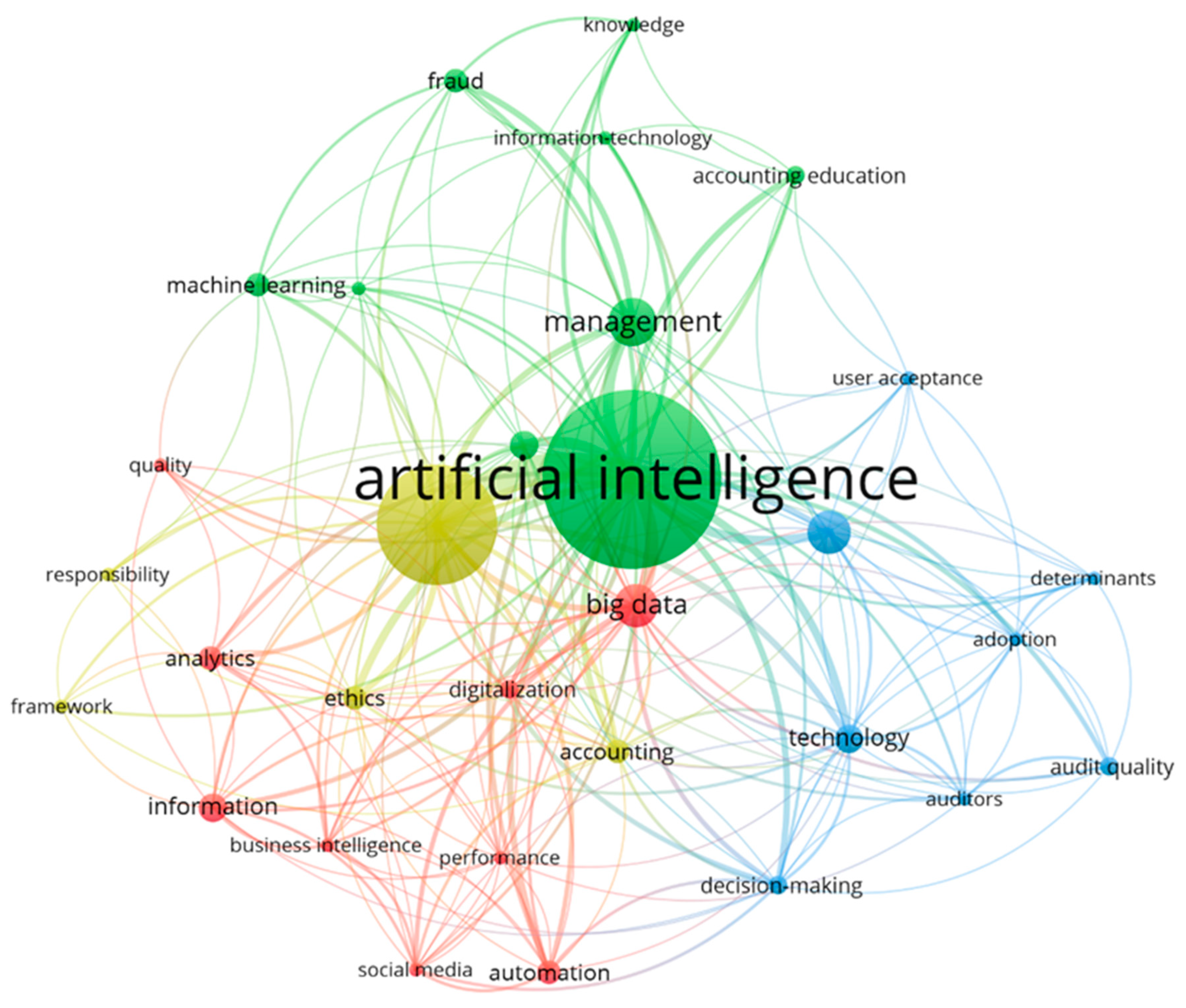

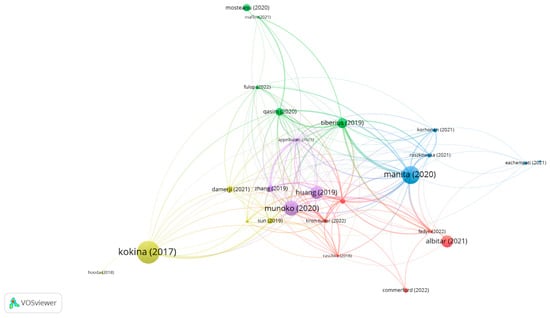

4.2. Co-Word Analysis

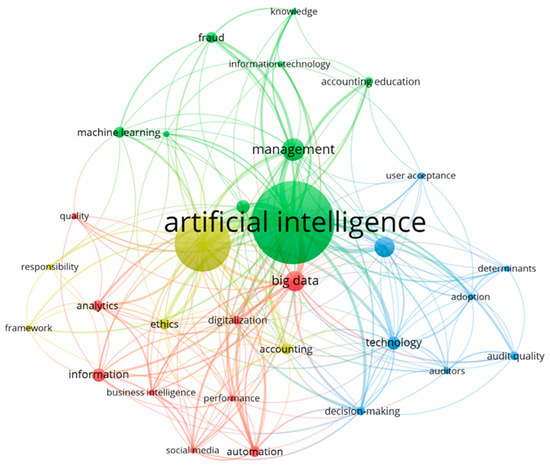

Using clustering, the VOSviewer program examines keyword co-occurrence to provide insightful analysis of the links and trends within certain study fields. The relevant software in VOSviewer contains a function called clustering, which sorts keywords according to their frequency, as described in Van Eck and Waltman’s (2017) work. The co-occurrence of keywords was identified from the titles, abstracts, and citation contexts using the text-mining feature of VOSviewer (Van Eck & Waltman, 2011). For Figure 5, the VOSviewer tool was employed in the co-occurrence analysis of the keywords to establish a network of keywords or clusters based on total links and the strength of the links connecting them. The structure of the network is such that the layers formed by the different clusters were assigned different colorations. These are collections of key terms that are associated with a particular domain. Management and fraud sit under the umbrella of the Green Cluster and include keywords such as artificial intelligence, information technology, knowledge, and accounting education. Big data, digitization, information, analytics, automation, social media ethics, and performance form the red cluster keywords. Keywords belonging to the blue cluster are technology, decision making, adoption, auditors, user acceptance, determinants, and audit quality. Keywords shown in the yellow cluster include audit quality, responsibility, and framework.

Figure 5.

Network visualization of keyword occurrence.

In this analysis, a screening of words was conducted. For example, impact, future, opportunities, etc., were eliminated due to their lesser importance and the infrequency of their application. The minimum keyword count was set to three, meaning that only keywords that appeared at least three times in the database were selected. This choice was made to capture the main keywords while excluding those that occur very rarely in a text. Though their occurrence is important, it was considered that they would not make a meaningful contribution to the analysis. To enhance the next level of analysis, the process of replacement was used in which words close in meaning were replaced with the most precise words. For instance, turning “AI” into “artificial intelligence” and the same for “artificial intelligence (AI)” and “artificial intelligence” while changing “audit” to “auditing” ensured that the clustering occurred within the correct context. Undertaking this approach assisted in the extraction of significant information and recognizing the links between the keywords, various relationships and connections, and hidden patterns in the research domain (Guleria & Kaur, 2021).

Table 4 highlights nine keywords along with their frequency and total link strength, showing how interconnected these concepts are in the research field. The terms include big data (nine mentions, link strength 51), digitalization (four mentions, link strength 21), information (six mentions, link strength 22), business intelligence (three mentions, link strength 21), social media (three mentions, link strength 23), analytics (five mentions, link strength 19), automation (five mentions, link strength 24), performance (three mentions, link strength 15), and quality (three mentions, link strength 9). These findings support previous research that underscores the transformative role of digital technologies in auditing. For instance, combining big data and business intelligence helps auditors process big datasets, hence making audit information more relevant and of better quality (Huang & Vasarhelyi, 2019; Tiberius & Hirth, 2019). The high degree of connection between digitalization and automation points to the significance of both concepts for improving efficiency and accuracy in audit works (Albitar et al., 2020; Manita et al., 2020). Furthermore, the existence of social media and analytics symbolizes the necessity for auditors to adopt a more diverse and data-driven approach to maintain audit quality in an ever-evolving digital landscape (Qasim & Kharbat, 2020; Damerji & Salimi, 2021). Thus, the categorization of performance and quality suggests that constant endeavors are being made to increase the efficiency and accuracy of auditing processes due to the employment of technology and the updating of methodologies by scholars (e.g., C. Zhang, 2019; Mosteanu & Faccia, 2020).

Table 5 lists nine keywords and illustrates their relevance to the research field of AI in auditing. The keywords include artificial intelligence (thirty-seven occurrences, link strength 117), management (ten occurrences, link strength 35), data analytics (six occurrences, link strength 25), machine learning (five occurrences, link strength 16), systems (three occurrences, link strength 12), information technology (three occurrences, link strength 13), fraud (five occurrences, link strength 17), accounting education (four occurrences, link strength 13), and knowledge (three occurrences, link strength 11). The nine keywords represent the growing significance of digital technologies in auditing and accounting. The importance of AI is demonstrated by its key role in improving decision making and operational efficiency in auditing (Huang & Vasarhelyi, 2019; Tiberius & Hirth, 2019). The importance of data analytics and machine learning demonstrates the need for auditors to adopt new analytical techniques to enhance audit quality and relevance (Albitar et al., 2020; Qasim & Kharbat, 2020). In contrast, words like management and systems reveal the structural transformation required for the adoption of these technologies to occur (Manita et al., 2020; Vitali & Giuliani, 2024). The other keywords recognized are information technology and accounting education and are associated with the need to revamp educational curricula in order to develop necessary skills for future accountants (Damerji & Salimi, 2021; Thottoli, 2024). The other two keywords were fraud and knowledge, indicating that despite any shortcomings noted in this paper, people continue to work on ways to enhance audit efficiency and credibility by applying technology and enhanced methodologies (C. Zhang, 2019; Mosteanu & Faccia, 2020).

Table 5.

Cluster 2 of keyword occurrence.

From the analysis of the journal articles, eight important keywords and their frequencies, along with the total link strength, are shown in Table 6. This identifies the importance attached to each concept and their relationships within the research area. These terms are technology (six occurrences, link strength 32), blockchain (nine occurrences, link strength 26), decision making (four occurrences, link strength 29), adoption (three occurrences, link strength 17), auditors (four occurrences, link strength 16), determinants (three occurrences, link strength 13), user acceptance (three occurrences, link strength 12), and audit quality (four occurrences, link strength 13). Likewise, Table 7 lists five items capturing the words identified to have high relevance, as follows: auditing, with twenty-five mentions and a link strength of 85; accounting, with five mentions and a link strength of 28; ethics, with five mentions and a link strength of 25; framework, with three mentions and a link strength of 9; responsibility, with three mentions and a link strength of 8. These keyword occurrences are in line with other studies that have drawn attention to the uses of digital technologies and frameworks for change in auditing and accounting processes. The emphasis on blockchain and technology attests to the constant advancement of these fields and their significance in making auditors’ work more secure and efficient, as numerous investigations into blockchains in auditing have demonstrated (Rawashdeh, 2024b; Sheikha et al., 2021). Decision making and adoption relate to changes in the practice of auditors, who use emerging technologies as tools to transform decision making and audit results and quality (Sachan & Liu, 2024; Manita et al., 2020). Auditing, accounting, and ethics remain the focus of further yearly attempts to uphold the profession’s ethical standards, especially when new technologies are being embraced (Albitar et al., 2020; Thottoli, 2024; Wang et al., 2024; Samiolo et al., 2024). Furthermore, the terms framework and responsibility imply that more profound and adequate regulation and governance must be established to ensure the appropriate application of these technologies (Munoko et al., 2020; Jackson & Allen, 2024; Kunz & Wirtz, 2024). Due to their relationship, these keywords show how technological development and the consideration of ethics impact the modern auditing profession.

Table 6.

Cluster 3 of keyword occurrence.

Table 7.

Cluster 4 of keyword occurrence.

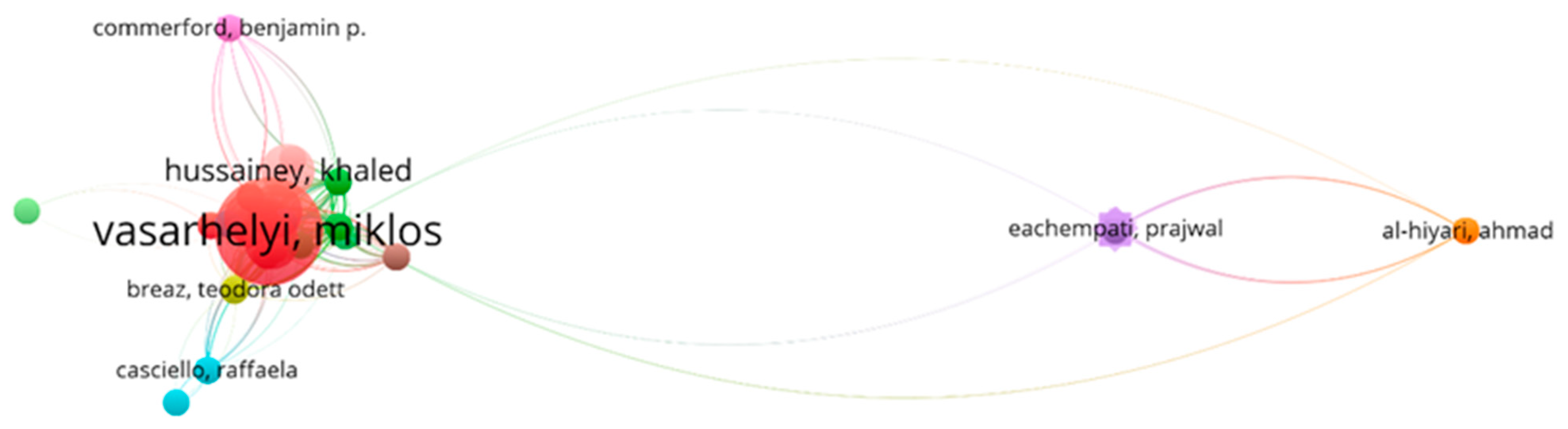

4.3. Bibliographic Coupling

To define the minimum threshold for author citations, a value of 17 was used in Figure 6, yielding 73 authors for this criterion. As stated, the bibliographic coupling network represents the relationship between these authors through the cultivation of co-citations. The person of most importance in this network is Miklos Vasarhelyi, which is evident from the node assigned to him, which represents the largest data value and expresses the overall productivity and contribution of this researcher in the given field. Other important authors are Khaled Hussainey, Pushkin Kachroo, and Benjamin P. Comerford, among others. They all have a clear connection and can represent co-authorships or co-citations with Vasarhelyi. The positions that form the network consist of clusters: the red area depicts Vasarhelyi’s cluster as it is densely connected. This defines a vast area of research composed of accounting, auditing, and financial reporting, which has a highly convoluted web. Although authors like Ahmad Al-Hiyari, Rajwal Eachempati, and Seema Bawa are not very central, they also have good connections within the network, implying that such authors may be active in areas that are still developing or specialized. In general, this network concentrates on the main authors, especially Vasarhelyi, and reveals a connection of research in the given field within both the experienced scholars and scopes for future research.

Figure 6.

Network visualization of the author’s network through bibliographic coupling.

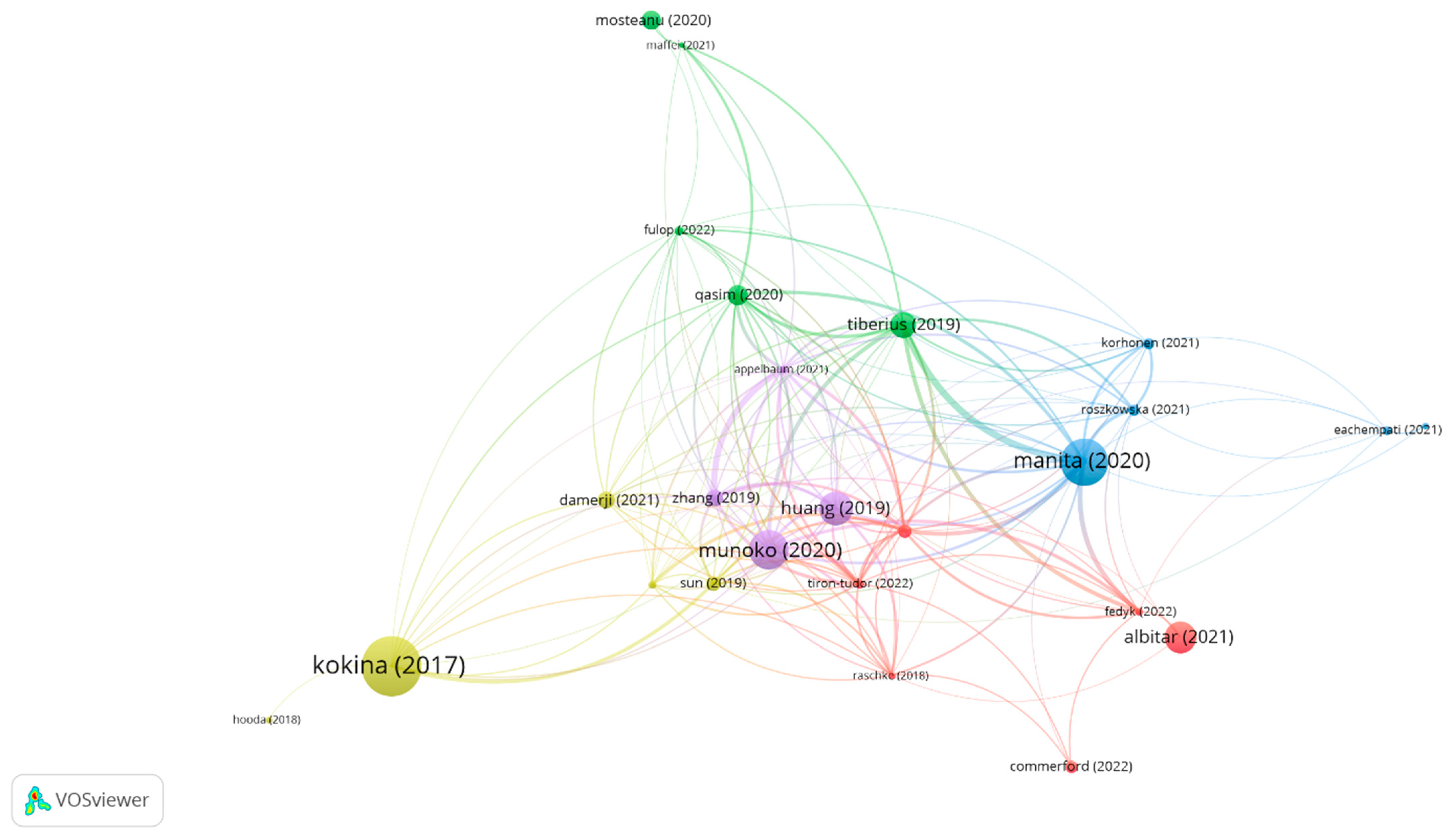

The bibliographic coupling is revealed in the form of network diagrams in Figure 7, selecting only those documents that have been cited more than 17 times; 25 documents were identified based on this criterion. Each circle corresponds to the document, and documents with higher citation values include Kokina and Davenport (2017), Manita et al. (2020), Munoko et al. (2020), Qasim and Kharbat (2020), and Albitar et al. (2020). Edges between nodes depict bibliographic coupling, and where the thickness and density of the line are high, the coupling is even more vital. Some references are circled into several clusters of yellow around Kokina and Davenport (2017), with other different clusters as documents that often use the same references as the cluster around Manita, Munoko, Qasim, and Albitar. This map shows the organization of research within the field by categorizing the essential documents and the relationships between them: thematic categories emphasize similarity in the stated research objectives due to cited references.

Figure 7.

Bibliographic coupling network diagram displaying documents with more than 17 citations. Notable references include Kokina and Davenport (2017), Manita et al. (2020), Munoko et al. (2020), Qasim and Kharbat (2020), Albitar et al. (2020), Appelbaum et al. (2021), Korhonen et al. (2021), Roszkowska (2021), Damerji and Salimi (2021), Tiron-Tudor and Deliu (2022), Raschke et al. (2018), Commerford et al. (2022), Fedyk et al. (2022), Eachempati et al. (2021), Hooda et al. (2020), Maffei et al. (2021), Tiberius and Hirth (2019), Huang and Vasarhelyi (2019), Sun (2019), C. Zhang (2019), Mosteanu and Faccia (2020).

Table 8 below identifies clusters gleaned from the document bibliographic coupling, which indicate five clusters of documents using the same references. The articles of Albitar et al. (2020), Commerford et al. (2022), Fedyk et al. (2022), Krieger et al. (2021), Raschke et al. (2018), and Tiron-Tudor and Deliu (2022) belonging to cluster I are mainly dedicated to increasing the applicability of technology in auditing tasks. First, Albitar et al. (2020) looked at the impact of the COVID-19 social distance policy on audit quality. They determined that support was necessary to enhance flexibility and collaboration between auditors and clients. Commerford et al. (2022) explored and demonstrated that although such auditors are willing to heed AI algorithm advice, they reduce proposed changes to management’s estimates when receiving the opposite information from AI compared to a human specialist. Fedyk et al. (2022) explored the effect of AI on audit quality and fees. The authors found that AI increases audit quality, coupled with a decrease in fees, however, it has an audit replacement effect when human auditors are ultimately replaced by AI systems. Krieger et al. (2021) explained how high-quality data analysis is implemented in auditing, and the authors recognized technological talent within audit teams. Raschke et al. (2018) noted the creation of opportunities for automated auditing processes by applying AI to reactivate audit inquiries. The last paper, by Tiron-Tudor and Deliu (2022), considered how algorithmic systems are embedded in audit work while also discussing the so-called human-in-the-loop approach to improve, on the one hand, the algorithms’ performance and, on the other, enhance the accountability of AI in auditing. In summary, the preceding literature demonstrates the possibility and potential of using advanced technology to improve audit quality and speed, as well as showing, in equal measure, the combination of people and technology for efficient auditing.

Table 8.

Clusters obtained from the documents’ bibliographic coupling.

Cluster 2 includes five papers by Tiberius and Hirth (2019), Qasim and Kharbat (2020), Mosteanu and Faccia (2020), Fülöp et al. (2022), and Maffei et al. (2021), and examines the various impacts on digital transformation in financial reporting. Regarding the challenges and prospects of digitization in auditing, Tiberius & Hirth (2019) showed that there will be an orientation toward continuous audits in the future and that new technologies will support rather than replace auditors. This is similar to Qasim and Kharbat’s (2020) discussion, who argued for a complete overhaul of accounting curricula that involves concepts in blockchain, business data analytics, and advanced technologies so that future accounting professionals are equipped for the dynamic profession. We can also refer to Mosteanu and Faccia (2020) on how developments, such as blockchain and XBRL, are transforming the management of finances due to decreased error rates, as well as fraud instances, increased outlook reliability, and reduction in costs. The paper by Fülöp et al. (2022) pointed out that digitization is not homogenous in companies, yet professionals depend heavily on digital tools, and their use depends on perceived risks connected to technological development. Finally, Maffei et al. (2021) discussed blockchain technology and accountants’ and auditors’ inability to rely on it completely, emphasizing the need for professional judgment and experience. In their study, they also noted that there are new risks emerging due to blockchain technology and that the profession should prepare for and transform to accommodate these changes. These five papers show that digitalization has a significant impact on the accounting and auditing professions, highlighting both opportunities and risks, and demonstrating that integrated and lifelong learning is, therefore, essential.

Cluster 3 looks at four papers from 2020 to 2021 that discuss the pros and cons of using technology in auditing. Drawing upon cutting-edge artificial intelligence, Eachempati et al. (2021) explored how accounting information influences the stock market. They discovered that by observing whether the language used is positive or negative, one could forecast market behavior. The study by Roszkowska (2021) outlined new fintech, such as blockchain. In their view, this could help stop financial fraud and increase the trustworthiness of financial reports. Korhonen et al. (2021) looked at automating management accounting. They found that some tasks they assumed would be best completed by computers are better undertaken by humans, highlighting the need to be careful about what is automated. Manita et al. (2020) studied how digital technology is changing external audits. They underscored how it ameliorates audits, enables audit firms to offer more services, and assists them in innovation. This results in improving how companies are run by keeping managers in check. These papers demonstrate how technology impacts auditing in those ways while emphasizing the fact that integration considerations can accompany the gains from technology.

The fourth cluster consists of Kokina and Davenport (2017), Damerji and Salimi (2021), Sun (2019), Zerbino et al. (2018), and Hooda et al. (2020), which are most relevant to the theoretical frameworks and methods used to implement new technologies in auditing. Kokina and Davenport (2017) sought to provide an attractive snapshot of the advanced technologies that have recently appeared in accounting, indicating the current possibilities and potential predispositions of the cognitive technologies used by large accounting companies. Damerji and Salimi (2021) examined the moderating effect of beliefs concerning the ease of use and usefulness between technology readiness and the adoption of AI among accounting students; the authors stressed the relevance of individual readiness as a key determinant of the readiness for new technologies. Sun (2019) provided an idea for implementing deep learning in auditing procedures, demonstrating how this facilitates the decision making of auditors using natural language search, speech, image, and data. To sum up, the use of process mining enables the audit methodology proposed by Zerbino et al. (2018). The outcomes of this methodology highlight the benefits of applying process-mining tools for audit analysis and conducting automated information system audits, as demonstrated in a case study involving a port community system. In their work titled “Ensemble machine learning for predicting fraudulent firms”, Hooda et al. (2020) provided auditors with a highly accurate decision-making model to help detect high-risk or potentially fraudulent firms before conducting fieldwork. Altogether, these papers offer sound theoretical and empirical coverage of the critical factors for implementing advanced technologies in auditing.

Cluster 5 includes Munoko et al. (2020), Huang and Vasarhelyi (2019), C. Zhang (2019), and Appelbaum et al. (2021), and focused on the ethical, regulatory, and real-life issues related to technology application in auditing. Munoko et al. (2020) offered a prospectus of ethical issues that may arise with the use of AI in auditing while discussing the advantages and disadvantages of its implementation. Summarizing the above works, Huang and Vasarhelyi (2019) conducted a study on robotic process automation (RPA) in auditing and recommended a framework for employing the technology within this context. They proposed an RPA audit program where some routine tasks are automated, freeing auditors to execute work that requires judgments to a higher degree. C. Zhang (2019) also discussed the use of RPA in audit engagements and how it can act as a change agent for enhancing how audits are conducted by integrating innovative technologies. Appelbaum et al. (2021) put forward a framework for auditor data literacy to highlight the necessity for technology and ADA in audit procedures. The imperative highlighted is the need to respond to market requirements and guarantee effective audits within a digitalized business environment. To summarize, these works reinforce the importance of paying attention to ethical concerns of integrating technologies in the auditing process, in addition to improving auditor knowledge and abilities to address emerging challenges.