Effects of Financial Literacy and Financial Behavior on Financial Well-Being: Meta-Analytical Review of Experimental Studies

Abstract

1. Introduction

Research Questions

2. Theoretical Lens

2.1. Financial Literacy

2.2. Financial Behavior

2.3. Financial Well-Being

3. Methods

3.1. Study Design

3.2. Search Strategy

3.3. Classification and Selection

3.4. Construct Variable Coding

3.5. Outcome Measures

3.6. Interventions

3.7. Validity Assessment

3.8. Statistical Analyses

4. Results

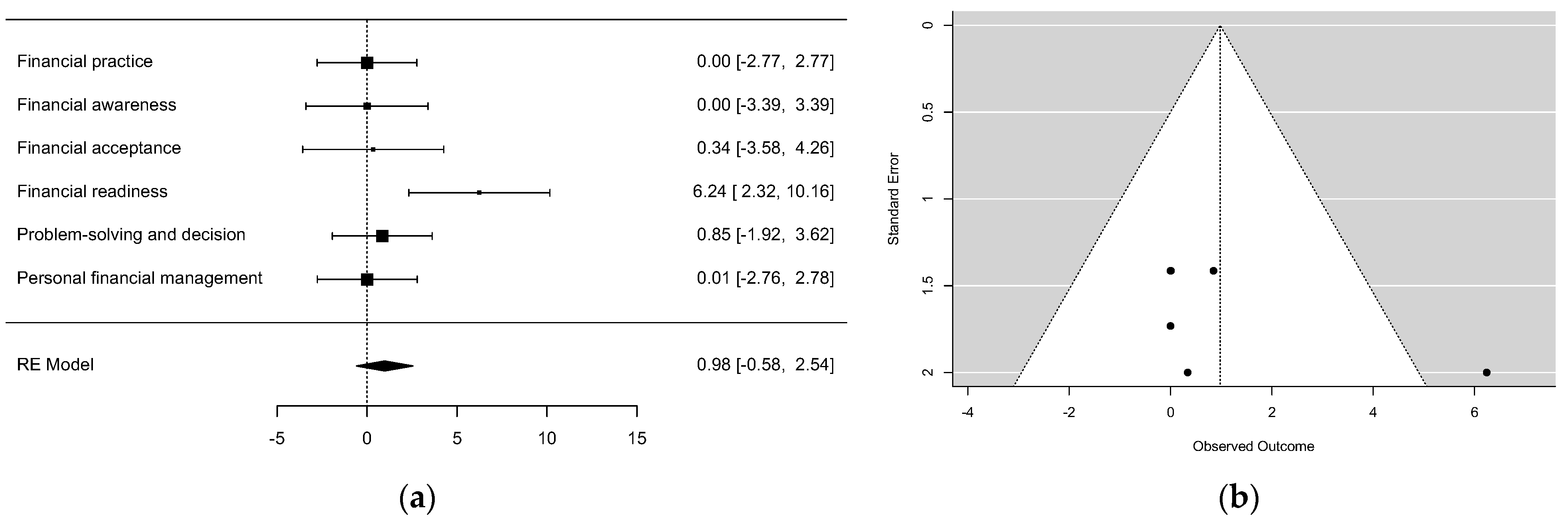

4.1. Summary Effects

4.2. Intervention Effects

4.3. Fixed-Effects Model

4.4. Risk of Bias Within Studies

5. Discussion

5.1. Discussion of Results

5.2. Theoretical and Practical Implications

5.3. Strengths, Limitations, and Future Research

6. Concluding Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aguirre, R. A. A., & Aguirre, A. A. A. (2024). Behavioral finance: Evolution from the classical theory and remarks. Journal of Economic Surveys, 38, 452–475. [Google Scholar] [CrossRef]

- Ahamed, F. T., Houqe, M. N., & van Zijl, T. (2023). Meta-analysis of the impact of financial constraints on firm performance. Accounting & Finance, 63, 1671–1707. [Google Scholar]

- Ahmad, M., & Shah, S. Z. A. (2020). Overconfidence heuristic-driven bias in investment decision-making and performance: Mediating effects of risk perception and moderating effects of financial literacy. Journal of Economic and Administrative Sciences, 38, 60–90. [Google Scholar] [CrossRef]

- Ahmad, M., & Wu, Q. (2022). Does herding behavior matter in investment management and perceived market efficiency? Evidence from an emerging market. Management Decision, 60, 2148–2173. [Google Scholar] [CrossRef]

- Anglim, J., Horwood, S., Smillie, L. D., Marrero, R. J., & Wood, J. K. (2020). Predicting psychological and subjective well-being from personality: A meta-analysis. Psychological Bulletin, 146, 279–323. [Google Scholar] [CrossRef] [PubMed]

- Anthony, R., & Sabri, M. F. (2019). The impact of a financial capability program on the financial well-being of medical practitioners. Management, 6, 344. [Google Scholar] [CrossRef]

- Bapat, D. (2020). Antecedents to responsible financial management behavior among young adults: Moderating role of financial risk tolerance. International Journal of Bank Marketing, 38, 1177–1194. [Google Scholar] [CrossRef]

- Barrafrem, K., Västfjäll, D., & Tinghög, G. (2020). Financial well-being, COVID-19, & the financial better-than-average-effect. Journal of Behavioral and Experimental Finance, 28, 100410. [Google Scholar]

- Bashir, I., & Qureshi, I. H. (2023). A systematic literature review on personal financial well-being: The link to key Sustainable Development Goals 2030. FIIB Business Review, 12, 31–48. [Google Scholar] [CrossRef]

- Brüggen, E. C., Hogreve, J., Holmlund, M., Kabadayi, S., & Löfgren, M. (2017). Financial well-being: A conceptualization and research agenda. Journal of Business Research, 79, 228–237. [Google Scholar] [CrossRef]

- Callis, Z., Gerrans, P., Walker, D. L., & Gignac, G. E. (2023). The association between intelligence and financial literacy: A conceptual and meta-analytic review. Intelligence, 100, 101781. [Google Scholar] [CrossRef]

- Carpena, F., Cole, S., Shapiro, J., & Zia, B. (2019). The ABCs of financial education: Experimental evidence on attitudes, behavior, & cognitive biases. Management Science, 65, 346–369. [Google Scholar]

- Carter, E. C., Schönbrodt, F. D., Gervais, W. M., & Hilgard, J. (2019). Correcting for bias in psychology: A comparison of meta-analytic methods. Advances in Methods and Practices in Psychological Science, 2, 115–144. [Google Scholar] [CrossRef]

- Chatterjee, D., Kumar, M., & Dayma, K. K. (2019). Income security, social comparisons and materialism: Determinants of subjective financial well-being among Indian adults. International Journal of Bank Marketing, 37, 1041–1061. [Google Scholar] [CrossRef]

- Cwynar, A. (2020). Financial literacy, behaviour and well-being of millennials in Poland compared to previous generations: The insights from three large-scale surveys. Review of Economic Perspectives, 20, 289–335. [Google Scholar] [CrossRef]

- D’Ambrosio, C., Jäntti, M., & Lepinteur, A. (2020). Money and happiness: Income, wealth and subjective well-being. Social Indicators Research, 148, 47–66. [Google Scholar] [CrossRef]

- Daovisan, H., & Chamaratana, T. (2020). Financing accumulation for start-up capital: Insights from a qualitative case study of women entrepreneurs in Lao PDR. Journal of Family Business Management, 10, 231–245. [Google Scholar] [CrossRef]

- Dare, S. E., van Dijk, W. W., van Dijk, E., van Dillen, L. F., Gallucci, M., & Simonse, O. (2023). How executive functioning and financial self-efficacy predict subjective financial well-being via positive financial behaviors. Journal of Family and Economic Issues, 44, 232–248. [Google Scholar] [CrossRef]

- De Almeida, F., Ferreira, M. B., Soro, J. C., & Silva, C. S. (2021). Attitudes toward money and control strategies of financial behavior: A comparison between overindebted and non-overindebted consumers. Frontiers in Psychology, 12, 566594. [Google Scholar] [CrossRef] [PubMed]

- Despard, M. (2023). Promoting staff financial well-being in human service organizations: The role of pay, benefits, & working conditions. Human Service Organizations: Management, Leadership & Governance, 47, 404–421. [Google Scholar]

- Diener, E., Scollon, C. N., & Lucas, R. E. (2003). The evolving concept of subjective well-being: The multifaceted nature of happiness. Advances in Cell Aging and Gerontology, 15, 187–219. [Google Scholar]

- Dinesh, T. K., Shetty, A., Dhyani, V. S., Shwetha, T. S., & Dsouza, K. J. (2022). Effectiveness of mindfulness-based interventions on well-being and work-related stress in the financial sector: A systematic review and meta-analysis protocol. Systematic Reviews, 11, 79. [Google Scholar] [CrossRef]

- Dittmar, H., Bond, R., Hurst, M., & Kasser, T. (2014). The relationship between materialism and personal well-being: A meta-analysis. Journal of Personality and Social Psychology, 107, 879. [Google Scholar] [CrossRef]

- Easterlin, R. A. (2001). Subjective well-being and economic analysis: A brief introduction. Journal of Economic Behavior and Organization, 45, 225–226. [Google Scholar] [CrossRef]

- Easterlin, R. A. (2004). The economics of happiness. Daedalus, 133, 26–33. [Google Scholar] [CrossRef]

- Falconier, M. K., Kim, J., & Lachowicz, M. J. (2023). Together–A couples’ program integrating relationship and financial education: A randomized controlled trial. Journal of Social and Personal Relationships, 40, 333–359. [Google Scholar] [CrossRef]

- Flather, M. D., Farkouh, M. E., Pogue, J. M., & Yusuf, S. (1997). Strengths and limitations of meta-analysis: Larger studies may be more reliable. Controlled Clinical Trials, 18, 568–579. [Google Scholar] [CrossRef] [PubMed]

- Frandsen, T. F., Nielsen, M. F. B., Lindhardt, C. L., & Eriksen, M. B. (2020). Using the full PICO model as a search tool for systematic reviews resulted in lower recall for some PICO elements. Journal of Clinical Epidemiology, 127, 69–75. [Google Scholar] [CrossRef] [PubMed]

- Fu, J. (2020). Ability or opportunity to act: What shapes financial well-being? World Development, 128, 104843. [Google Scholar] [CrossRef]

- García, M. O. (2021). The effect of financial literacy and gender on retirement planning among young adults. International Journal of Bank Marketing, 39, 1068–1090. [Google Scholar] [CrossRef]

- Glenn, N. M., Scott, L. A., Hokanson, T., Gustafson, K., Stoops, M. A., Day, B., & Nykiforuk, C. I. J. (2021). Community intervention strategies to reduce the impact of financial strain and promote financial well-being: A comprehensive rapid review. Global Health Promotion, 28, 42–50. [Google Scholar] [CrossRef] [PubMed]

- González-Castro, T. B., & Tovilla-Zárate, C. A. (2014). Meta-analysis: A tool for clinical and experimental research in psychiatry. Nordic Journal of Psychiatry, 68, 243–250. [Google Scholar] [CrossRef]

- Goyal, K., & Kumar, S. (2021). Financial literacy: A systematic review and bibliometric analysis. International Journal of Consumer Studies, 45, 80–105. [Google Scholar] [CrossRef]

- Hamilton, K. (2018). MAJOR—Meta-analysis. Available online: https://github.com/kylehamilton/MAJOR#major-meta-analysis-jamovi-r (accessed on 20 September 2024).

- Higgins, J. P. T., Thompson, S. G., Deeks, J. J., & Altman, D. G. (2003). Measuring inconsistency in meta-analyses. BMJ: British Medical Journal, 327, 557–560. [Google Scholar] [CrossRef]

- Hilgert, M. A., Hogarth, J. M., & Beverly, S. G. (2003). Household financial management: The connection between knowledge and behavior. Federal Reserve Bulletin, 89, 309. [Google Scholar]

- Hirshleifer, D. (2015). Behavioral finance. Annual Review of Financial Economics, 7, 133–159. [Google Scholar] [CrossRef]

- Holman, D., & Axtell, C. (2016). Can job redesign interventions influence a broad range of employee outcomes by changing multiple job characteristics? A quasi-experimental study. Journal of Occupational Health Psychology, 21, 284–295. [Google Scholar] [CrossRef] [PubMed]

- Hooper, P., Jutai, J. W., Strong, G., & Russell-Minda, E. (2008). Age-related macular degeneration and low-vision rehabilitation: A systematic review. Canadian Journal of Ophthalmology, 43, 180–187. [Google Scholar] [CrossRef] [PubMed]

- Huang, J., Sherraden, M. S., Sherraden, M., & Johnson, L. (2022). Experimental effects of child development accounts on financial capability of young mothers. Journal of Family and Economic Issues, 43, 36–50. [Google Scholar] [CrossRef]

- Huston, S. J. (2010). Measuring financial literacy. Journal of Consumer Affairs, 44, 296–316. [Google Scholar] [CrossRef]

- Hwang, H., & Park, H. I. (2023). The relationships of financial literacy with both financial behavior and financial well-being: Meta-analyses based on the selective literature review. Journal of Consumer Affairs, 57, 222–244. [Google Scholar] [CrossRef]

- Iannello, P., Sorgente, A., Lanz, M., & Antonietti, A. (2021). Financial well-being and its relationship with subjective and psychological well-being among emerging adults: Testing the moderating effect of individual differences. Journal of Happiness Studies, 22, 1385–1411. [Google Scholar] [CrossRef]

- Ingale, K. K., & Paluri, R. A. (2022). Financial literacy and financial behaviour: A bibliometric analysis. Review of Behavioral Finance, 14, 130–154. [Google Scholar] [CrossRef]

- Kaiser, T., & Menkhoff, L. (2020). Financial education in schools: A meta-analysis of experimental studies. Economics of Education Review, 78, 101930. [Google Scholar] [CrossRef]

- Kaiser, T., & Menkhoff, L. (2022). Active learning improves financial education: Experimental evidence from Uganda. Journal of Development Economics, 157, 102870. [Google Scholar] [CrossRef]

- Kaur, G., & Singh, M. (2024). Pathways to individual financial well-being: Conceptual framework and future research agenda. FIIB Business Review, 13, 27–41. [Google Scholar] [CrossRef]

- Kaur, G., Singh, M., & Singh, S. (2021). Mapping the literature on financial well-being: A systematic literature review and bibliometric analysis. International Social Science Journal, 71, 217–241. [Google Scholar] [CrossRef]

- Klontz, B. T., Zabek, F., Taylor, C., Bivens, A., Horwitz, E., Klontz, P. T., Tharp, D., & Lurtz, M. (2019). The sentimental savings study: Using financial psychology to increase personal savings. Journal of Financial Planning, 32, 44–55. [Google Scholar]

- Kumar, P., Pillai, R., Kumar, N., & Tabash, M. I. (2023). The interplay of skills, digital financial literacy, capability, & autonomy in financial decision making and well-being. Borsa Istanbul Review, 23, 169–183. [Google Scholar]

- Lipsey, M. W., & Wilson, D. B. (2001). The way in which intervention studies have “personality” and why it is important to meta-analysis. Evaluation & the Health Professions, 24, 236–254. [Google Scholar]

- Lone, U. M., & Bhat, S. A. (2024). Impact of financial literacy on financial well-being: A mediational role of financial self-efficacy. Journal of Financial Services Marketing, 29, 122–137. [Google Scholar] [CrossRef]

- Lontchi, C. B., Yang, B., & Shuaib, K. M. (2023). Effect of financial technology on SMEs performance in Cameroon amid COVID-19 recovery: The mediating effect of financial literacy. Sustainability, 15, 2171. [Google Scholar] [CrossRef]

- Lusardi, A., & Mitchell, O. S. (2011). Financial literacy around the world: An overview. Journal of Pension Economics & Finance, 10, 497–508. [Google Scholar]

- Lusardi, A., & Streeter, J. L. (2023). Financial literacy and financial well-being: Evidence from the US. Journal of Financial Literacy and Wellbeing, 1, 169–198. [Google Scholar] [CrossRef]

- Lyons, A. C., & Kass-Hanna, J. (2021). A methodological overview to defining and measuring “digital” financial literacy. Financial Planning Review, 4, e1113. [Google Scholar] [CrossRef]

- Mahendru, M. (2021). Financial well-being for a sustainable society: A road less travelled. Qualitative Research in Organizations and Management: An International Journal, 16, 572–593. [Google Scholar] [CrossRef]

- Mahendru, M., Sharma, G. D., & Hawkins, M. (2022). Toward a new conceptualization of financial well-being. Journal of Public Affairs, 22, e2505. [Google Scholar] [CrossRef]

- McGuire, J., Kaiser, C., & Bach-Mortensen, A. M. (2022). A systematic review and meta-analysis of the impact of cash transfers on subjective well-being and mental health in low-and middle-income countries. Nature Human Behaviour, 6, 359–370. [Google Scholar] [CrossRef]

- Miller, M., Reichelstein, J., Salas, C., & Zia, B. (2015). Can you help someone become financially capable? A meta-analysis of the literature. The World Bank Research Observer, 30, 220–246. [Google Scholar] [CrossRef]

- Mutlu, Ü., & Özer, G. (2022). The moderator effect of financial literacy on the relationship between locus of control and financial behavior. Kybernetes, 51, 1114–1126. [Google Scholar] [CrossRef]

- Nanda, A. P., & Banerjee, R. (2021). Consumer’s subjective financial well-being: A systematic review and research agenda. International Journal of Consumer Studies, 45, 750–776. [Google Scholar] [CrossRef]

- Ngamaba, K. H., Armitage, C., Panagioti, M., & Hodkinson, A. (2020). How closely related are financial satisfaction and subjective well-being? Systematic review and meta-analysis. Journal of Behavioral and Experimental Economics, 85, 101522. [Google Scholar] [CrossRef]

- Noctor, M., Stoney, S., & Stradling, R. (1992). Financial literacy: A discussion of concepts and competences of financial literacy and opportunities for its introduction into young people’s learning. National Foundation for Educational Research. [Google Scholar]

- Ouachani, S., Belhassine, O., & Kammoun, A. (2021). Measuring financial literacy: A literature review. Managerial Finance, 47, 266–281. [Google Scholar] [CrossRef]

- Page, M. J., McKenzie, J. E., Bossuyt, P. M., Boutron, I., Hoffmann, T. C., Mulrow, C. D., Shamseer, L., Tetzlaff, J. M., Akl, E. A., Brennan, S. E., Chou, R., Glanville, J., Grimshaw, J. M., Hróbjartsson, A., Lalu, M. M., Li, T., Loder, E. W., Mayo-Wilson, E., McDonald, S., … Moher, D. (2021). The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ, 372, n71. [Google Scholar] [CrossRef]

- Pak, T. -Y., Fan, L., & Chatterjee, S. (2024). Financial socialization and financial well-being in early adulthood: The mediating role of financial capability. Family Relations, 73, 1664–1685. [Google Scholar] [CrossRef]

- Pangestu, S., & Karnadi, E. B. (2020). The effects of financial literacy and materialism on the savings decision of generation Z Indonesians. Cogent Business & Management, 7, 1743618. [Google Scholar]

- Peng, C., She, P. -W., & Lin, M. -K. (2022). Financial literacy and portfolio diversity in China. Journal of Family and Economic Issues, 43, 452–465. [Google Scholar] [CrossRef]

- Porter, N. M., & Garman, E. T. (1992). Money as part of a measure of financial well-being. American Behavioral Scientist, 35, 820–826. [Google Scholar] [CrossRef]

- Postmus, J. L., Hetling, A., & Hoge, G. L. (2015). Evaluating a financial education curriculum as an intervention to improve financial behaviors and financial well-being of survivors of domestic violence: Results from a longitudinal randomized controlled study. Journal of Consumer Affairs, 49, 250–266. [Google Scholar] [CrossRef]

- Rahman, M., Isa, C. R., Masud, M. M., Sarker, M., & Chowdhury, N. T. (2021). The role of financial behaviour, financial literacy, and financial stress in explaining the financial well-being of B40 group in Malaysia. Future Business Journal, 7, 1–18. [Google Scholar] [CrossRef]

- Remund, D. L. (2010). Financial literacy explicated: The case for a clearer definition in an increasingly complex economy. Journal of Consumer Affairs, 44, 276–295. [Google Scholar] [CrossRef]

- Sabri, M. F., Anthony, M., Law, S. H., Rahim, H. A., Burhan, N. A. S., & Ithnin, M. (2024). Impact of financial behaviour on financial well-being: Evidence among young adults in Malaysia. Journal of Financial Services Marketing, 29, 788–807. [Google Scholar] [CrossRef]

- Sajid, M., Mushtaq, R., Murtaza, G., Yahiaoui, D., & Pereira, V. (2024). Financial literacy, confidence and well-being: The mediating role of financial behavior. Journal of Business Research, 182, 114791. [Google Scholar] [CrossRef]

- Sakuraya, A., Imamura, K., Watanabe, K., Asai, Y., Ando, E., Eguchi, H., Nishida, N., Kobayashi, Y., Arima, H., Iwanaga, M., Otsuka, Y., Sasaki, N., Inoue, A., Inoue, R., Tsuno, K., Hino, A., Shimazu, A., Tsutsumi, A., & Kawakami, N. (2020). What kind of intervention is effective for improving subjective well-being among workers? A systematic review and meta-analysis of randomized controlled trials. Frontiers in Psychology, 11, 528656. [Google Scholar] [CrossRef] [PubMed]

- Salditt, M., Eckes, T., & Nestler, S. (2024). A tutorial introduction to heterogeneous treatment effect estimation with meta-learners. Administration and Policy in Mental Health and Mental Health Services Research, 51, 650–673. [Google Scholar] [CrossRef] [PubMed]

- Santini, F. D. O., Ladeira, W. J., Mette, F. M. B., & Ponchio, M. C. (2019). The antecedents and consequences of financial literacy: A meta-analysis. International Journal of Bank Marketing, 37, 1462–1479. [Google Scholar] [CrossRef]

- Sayinzoga, A., Bulte, E. H., & Lensink, R. (2016). Financial literacy and financial behaviour: Experimental evidence from rural Rwanda. The Economic Journal, 126, 1571–1599. [Google Scholar] [CrossRef]

- Sánchez, A. C., Kamau, H. N., Grazioli, F., & Jones, S. K. (2022). Financial profitability of diversified farming systems: A global meta-analysis. Ecological Economics, 201, 107595. [Google Scholar] [CrossRef]

- Sharma, S., Arora, K., Chandrashekhar, Sinha, R. K., Akhtar, F., & Mehra, S. (2021). Evaluation of a training program for life skills education and financial literacy to community health workers in India: A quasi-experimental study. BMC Health Services Research, 21, 46. [Google Scholar] [CrossRef]

- She, L., Rasiah, R., Turner, J. J., Guptan, V., & Nia, H. S. (2022). Psychological beliefs and financial well-being among working adults: The mediating role of financial behaviour. International Journal of Social Economics, 49, 190–209. [Google Scholar] [CrossRef]

- Shefrin, H. M., & Thaler, R. H. (1988). The behavioral life-cycle hypothesis. Economic Inquiry, 26, 609–643. [Google Scholar] [CrossRef]

- Shim, S., Xiao, J. J., Barber, B. L., & Lyons, A. C. (2009). Pathways to life success: A conceptual model of financial well-being for young adults. Journal of Applied Developmental Psychology, 30, 708–723. [Google Scholar] [CrossRef]

- Slim, K., Nini, E., Forestier, D., Kwiatkowski, F., Panis, Y., & Chipponi, J. (2003). Methodological index for non-randomized studies (minors): Development and validation of a new instrument. ANZ Journal of Surgery, 73, 712–716. [Google Scholar] [CrossRef]

- Stanley, T. D. (2001). Wheat from chaff: Meta-analysis as quantitative literature review. Journal of Economic Perspectives, 15, 131–150. [Google Scholar] [CrossRef]

- Stanley, T. D., & Doucouliagos, H. (2015). Neither fixed nor random: Weighted least squares meta-analysis. Statistics in Medicine, 34, 2116–2127. [Google Scholar] [CrossRef] [PubMed]

- Statman, M. (2014). Behavioral finance: Finance with normal people. Borsa Istanbul Review, 14, 65–73. [Google Scholar] [CrossRef]

- Strömbäck, C., Skagerlund, K., Västfjäll, D., & Tinghög, G. (2020). Subjective self-control but not objective measures of executive functions predicts financial behavior and well-being. Journal of Behavioral and Experimental Finance, 27, 100339. [Google Scholar] [CrossRef]

- Tahir, M. S., Ahmed, A. D., & Richards, D. W. (2021). Financial literacy and financial well-being of Australian consumers: A moderated mediation model of impulsivity and financial capability. International Journal of Bank Marketing, 39, 1377–1394. [Google Scholar] [CrossRef]

- Thomas, A., & Gupta, V. (2021). Social capital theory, social exchange theory, social cognitive theory, financial literacy, & the role of knowledge sharing as a moderator in enhancing financial well-being: From bibliometric analysis to a conceptual framework model. Frontiers in Psychology, 12, 664638. [Google Scholar]

- Utkarsh, A. P., Ashta, A., Spiegelman, E., & Sutan, A. (2020). Catch them young: Impact of financial socialization, financial literacy and attitude towards money on financial well-being of young adults. International Journal of Consumer Studies, 44, 531–541. [Google Scholar] [CrossRef]

- Van Nguyen, H., Ha, G. H., Nguyen, D. N., Doan, A. H., & Phan, H. T. (2022). Understanding financial literacy and associated factors among adult population in a low-middle income country. Heliyon, 8, e09638. [Google Scholar] [CrossRef] [PubMed]

- Viechtbauer, W. (2010). Conducting meta-analyses in R with the metafor package. Journal of Statistical Software, 36, 1–48. [Google Scholar] [CrossRef]

- Vlaev, I., & Elliott, A. (2014). Financial well-being components. Social Indicators Research, 118, 1103–1123. [Google Scholar] [CrossRef]

- Vörös, Z., Szabó, Z., Kehl, D., Kovács, O. B., Papp, T., & Schepp, Z. (2021). The forms of financial literacy overconfidence and their role in financial well-being. International Journal of Consumer Studies, 45, 1292–1308. [Google Scholar] [CrossRef]

- Widyastuti, M., & Hermanto, Y. B. (2022). The effect of financial literacy and social media on micro capital through financial technology in the creative industry sector in East Java. Cogent Economics & Finance, 10, 2087647. [Google Scholar]

- Zaniyani, T. N., Taherinia, M., Dehkordi, D. J., & Givaki, E. (2022). The effectiveness of acceptance and commitment group financial therapy on financial literacy, personal financial management and mental accounting. International Journal of Finance & Managerial Accounting, 7, 227–239. [Google Scholar]

| Inclusion criteria: |

|

|

|

|

| Exclusion criteria: |

|

|

|

|

| Author(s) | Reporting (%) | EV (%) | IR (%) | CB (%) | Overall (%) |

|---|---|---|---|---|---|

| Anthony and Sabri (2019) | 86.849 | 64.590 | 80.000 | 20.367 | 65.609 |

| Carpena et al. (2019) | 89.147 | 58.870 | 70.000 | 30.000 | 50.128 |

| Falconier et al. (2023) | 90.130 | 60.469 | 80.000 | 10.000 | 64.503 |

| Holman and Axtell (2016) | 94.256 | 61.267 | 80.000 | 70.000 | 66.156 |

| Huang et al. (2022) | 85.294 | 57.259 | 90.000 | 40.000 | 73.031 |

| Klontz et al. (2019) | 77.104 | 60.269 | 60.000 | 20.000 | 50.046 |

| Sayinzoga et al. (2016) | 92.395 | 64.562 | 80.000 | 30.000 | 61.045 |

| Sharma et al. (2021) | 75.391 | 59.835 | 50.000 | 40.000 | 50.859 |

| Zaniyani et al. (2022) | 72.360 | 56.408 | 80.000 | 50.00 | 60.481 |

| Author(s) | Design | Intervention | Sample | T_Mean | T_SD | C_Mean | C_SD | Key Results |

|---|---|---|---|---|---|---|---|---|

| Anthony and Sabri (2019) | INT | T/C | 100 | 72.98 | 5.49 | 52.54 | 8.227 | Financial capability programs impact financial well-being. |

| Carpena et al. (2019) | INT | T/C | 1235 | 1.61 | 0.62 | 0.712 | 0.024 | Financial education associated with financial knowledge affects behavior change. |

| Falconier et al. (2023) | INT | T/C | 292 | 37.955 | 10.53 | 39.925 | 10.795 | Financial stress, shared financial responsibilities, and dyadic coping responses have a positive effect on well-being. |

| Holman and Axtell (2016) | QUE | T/C | 120 | 3.15 | 0.67 | 3.42 | 0.65 | Psychological well-being positively affects financial well-being. |

| Huang et al. (2022) | INT | T/C | 825 | 1.15 | 0.85 | 1.01 | 0.79 | Financial knowledge and access positively affect financial management. |

| Klontz et al. (2019) | RAE | T/C | 102 | 6.68 | 8.94 | 6.76 | 11.234 | Personal savings have a positive effect on financial well-being. |

| Sayinzoga et al. (2016) | EXD | T/C | 360 | 2.875 | 0.090 | 2.727 | 0.09 | Knowledge, perceptions, and practices positively affect financial literacy. |

| Sharma et al. (2021) | QUE | T/C | 171 | 16.2 | 3.3 | 9.9 | 4.2 | Financial literacy training is positively associated with financial knowledge and behavior. |

| Zaniyani et al. (2022) | QUE | T/C | 40 | 30.39 | 34.4 | 55.27 | 88.5 | Personal financial management and financial literacy positively affect mental financial well-being. |

| Variables | T_Effect | C_Mean | C_SD | T_Mean | T_SD | L_95%CI | U_95%CU | p-Value |

|---|---|---|---|---|---|---|---|---|

| Financial literacy | ||||||||

| Financial capability | 52.54 | 8.22 | 72.98 | 5.49 | 0.01 | |||

| Financial numeracy | 0.031 | 0.05 | −0.02 | 0.03 | 0.01 | |||

| Financial instrumental support | 0.23 | 2.04 | 1.84 | 2.54 | 1.87 | 0.18 | ||

| Financial skills | 1.05 | 4.13 | 1.53 | 4.18 | 1.46 | 0.10 | ||

| Financial education | 1.1 | 10.49 | 0.31 | 9.16 | 0.29 | 0.01 | ||

| Financial importance | 5.68 | 9.29 | 0.97 | 9.45 | 0.9 | 0.05 | ||

| Communication skills | 0.72 | 11.5 | 2.1 | 6.2 | 2 | −1.07 | −0.20 | 0.80 |

| Financial planning | 0.07 | 3.41 | 2.05 | 4.42 | 1.68 | 0.13 | 0.47 | 0.05 |

| Financial behavior | ||||||||

| Financial practice | 63.16 | 9.07 | 80.60 | 8 | 0.01 | |||

| Financial awareness | 0.05 | 0.02 | 0.10 | 0.02 | 0.01 | |||

| Financial acceptance | 2.78 | 1.86 | 3.74 | 1.66 | 0.01 | |||

| Financial readiness | 6.24 | 1.87 | 0.38 | 1.64 | 0.69 | 0.01 | ||

| Problem-solving and decision-making | 0.85 | 8 | 9 | 3 | −0.55 | 0.31 | 0.20 | |

| Personal financial management | 0.01 | 85.11 | 63.2 | 55.11 | 83.1 | 0.05 | ||

| Financial well-being | ||||||||

| Mental financial well-being | 0.05 | 0.02 | 0.03 | 0.10 | 0.02 | 0.01 | ||

| Coping financial well-being | 0.3 | 3.4 | 1.95 | 4.11 | 1.74 | 0.05 | ||

| Psychological well-being | 0.24 | 2.83 | 0.67 | 2.71 | 0.69 | 0.01 | ||

| Emotional financial well-being | 18.47 | 5.02 | 0.94 | 5.15 | 1.01 | 0.01 | ||

| Financial satisfaction | 7.62 | 5.39 | 2.28 | 5.11 | 2.43 | 0.07 | ||

| Cognitive financial well-being | 0.11 | 0.04 | 0.02 | 0.05 | 0.04 | 0.75 | ||

| Subjective happiness | 0.01 | −0.29 | 0.18 | −0.19 | 0.16 | 0.46 | ||

| Subjective financial well-being | 0.41 | 0.38 | 0.2 | −0.35 | 0.17 | 0.06 |

| Author(s) | Treatment | Control | d | 95% CI | |||||

|---|---|---|---|---|---|---|---|---|---|

| M | S.D. | N | M2 | s2 | N2 | Lower | Upper | ||

| Anthony and Sabri (2019) | 72.980 | 5.490 | 50 | 52.54 | 8.227 | 50 | −2.900 | −3.46 | −2.338 |

| Carpena et al. (2019) | 1.61 | 0.620 | 972 | 0.712 | 0.024 | 263 | −0.89 | −0.937 | −0.858 |

| Falconier et al. (2023) | 37.955 | 10.530 | 145 | 39.92 | 10.795 | 147 | 0.184 | −0.045 | 0.414 |

| Holman and Axtell (2016) | 3.150 | 0.670 | 96 | 3.42 | 0.650 | 62 | 0.405 | 0.083 | 0.728 |

| Huang et al. (2022) | 1.150 | 0.850 | 410 | 1.01 | 0.790 | 415 | −0.170 | −0.307 | −0.033 |

| Klontz et al. (2019) | 6.680 | 8.940 | 57 | 6.7 | 11.234 | 45 | 0.007 | −0.382 | 0.398 |

| Sharma et al. (2021) | 16.200 | 3.300 | 86 | 9.90 | 4.200 | 85 | −1.661 | −2.009 | −1.314 |

| Sayinzoga et al. (2016) | 2.875 | 0.090 | 174 | 2.73 | 0.090 | 167 | −1.636 | −1.881 | −1.390 |

| Zaniyani et al. (2022) | 30.390 | 34.400 | 20 | 55.27 | 88.500 | 20 | 0.363 | −0.261 | 0.988 |

| Variable | Treatment | Control | d | 95% CI | |||||

|---|---|---|---|---|---|---|---|---|---|

| M | S.D. | N | M2 | s2 | N2 | Lower | Upper | ||

| Financial literacy | |||||||||

| Financial capability | 72.980 | 5.490 | 50 | 52.540 | 8.220 | 50 | −2.901 | −3.463 | −2.340 |

| Financial numeracy | −0.021 | 0.028 | 972 | 0.031 | 0.050 | 263 | 1.533 | 1.384 | 1.682 |

| Financial instrumental support | 2.540 | 1.870 | 145 | 2.040 | 1.840 | 147 | −0.268 | −0.499 | −0.038 |

| Financial skills | 4.180 | 1.460 | 410 | 4.130 | 1.530 | 415 | −0.033 | −0.169 | 0.103 |

| Financial education | 9.160 | 0.290 | 410 | 10.490 | 0.310 | 415 | 4.425 | 4.172 | 4.679 |

| Financial importance | 9.450 | 0.900 | 410 | 9.290 | 0.970 | 415 | −0.170 | −0.307 | −0.034 |

| Communication skills | 6.200 | 2.000 | 86 | 11.500 | 2.100 | 85 | 2.573 | 2.168 | 2.978 |

| Financial planning | 4.420 | 1.680 | 145 | 3.410 | 2.050 | 147 | −0.537 | −0.770 | −0.303 |

| Financial behavior | |||||||||

| Financial practice | 80.600 | 8.000 | 50 | 63.160 | 9.070 | 50 | −2.023 | −2.505 | −1.541 |

| Financial awareness | 0.104 | 0.020 | 972 | 0.051 | 0.020 | 263 | −2.648 | −2.820 | −2.476 |

| Financial acceptance | 3.740 | 1.660 | 145 | 2.780 | 1.860 | 147 | −0.543 | −0.776 | −0.309 |

| Financial readiness | 1.640 | 0.690 | 410 | 1.870 | 0.380 | 415 | 0.413 | 0.275 | 0.551 |

| Problem-solving and decision-making | 0.000 | 3.000 | 86 | 8.000 | 9.000 | 85 | 1.190 | 0.864 | 1.515 |

| Personal financial management | 55.110 | 83.100 | 20 | 85.110 | 63.200 | 20 | 0.398 | −0.227 | 1.024 |

| Financial well-being | |||||||||

| Mental financial well-being | 0.095 | 0.024 | 972 | 0.024 | 0.028 | 263 | −0.071 | −0.074 | −0.67 |

| Coping financial well-being | 4.110 | 1.740 | 145 | 3.400 | 1.950 | 147 | −0.710 | −1.133 | −0.286 |

| Psychological well-being | 2.710 | 0.690 | 96 | 2.830 | 0.670 | 62 | 0.120 | −0.096 | 0.336 |

| Emotional financial well-being | 5.150 | 1.010 | 410 | 5.020 | 0.940 | 415 | −0.133 | −0.263 | 0.003 |

| Financial satisfaction | 5.110 | 2.430 | 410 | 5.390 | 2.280 | 415 | 0.280 | −0.041 | 0.601 |

| Cognitive financial well-being | 0.050 | 0.040 | 174 | 0.040 | 0.020 | 167 | −0.010 | −0.016 | −0.003 |

| Subjective happiness | −0.19 | 0.160 | 174 | −0.290 | 0.180 | 167 | −0.100 | −0.136 | −0.063 |

| Subjective financial well-being | −0.35 | 0.170 | 140 | 0.380 | 0.200 | 33 | 0.730 | 0.656 | 0.803 |

| Author(s) | i | ii | ii | iv | v | vi | vii | viii | ix | Total |

|---|---|---|---|---|---|---|---|---|---|---|

| Anthony and Sabri (2019) | 2 | 2 | 2 | 2 | 1 | 1 | 0 | 2 | 0 | 14 |

| Carpena et al. (2019) | 2 | 2 | 2 | 0 | 1 | 2 | 2 | 2 | 1 | 14 |

| Falconier et al. (2023) | 2 | 1 | 2 | 0 | 1 | 2 | 1 | 2 | 2 | 13 |

| Holman and Axtell (2016) | 1 | 2 | 2 | 2 | 2 | 1 | 2 | 2 | 2 | 16 |

| Huang et al. (2022) | 2 | 2 | 0 | 2 | 1 | 1 | 2 | 0 | 1 | 10 |

| Klontz et al. (2019) | 2 | 2 | 2 | 2 | 1 | 1 | 0 | 2 | 0 | 12 |

| Sharma et al. (2021) | 2 | 2 | 2 | 2 | 0 | 0 | 2 | 2 | 2 | 14 |

| Sayinzoga et al. (2016) | 2 | 1 | 2 | 2 | 1 | 2 | 2 | 2 | 0 | 14 |

| Zaniyani et al. (2022) | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 18 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Choowan, P.; Daovisan, H.; Suwanwong, C. Effects of Financial Literacy and Financial Behavior on Financial Well-Being: Meta-Analytical Review of Experimental Studies. Int. J. Financial Stud. 2025, 13, 1. https://doi.org/10.3390/ijfs13010001

Choowan P, Daovisan H, Suwanwong C. Effects of Financial Literacy and Financial Behavior on Financial Well-Being: Meta-Analytical Review of Experimental Studies. International Journal of Financial Studies. 2025; 13(1):1. https://doi.org/10.3390/ijfs13010001

Chicago/Turabian StyleChoowan, Phaktada, Hanvedes Daovisan, and Charin Suwanwong. 2025. "Effects of Financial Literacy and Financial Behavior on Financial Well-Being: Meta-Analytical Review of Experimental Studies" International Journal of Financial Studies 13, no. 1: 1. https://doi.org/10.3390/ijfs13010001

APA StyleChoowan, P., Daovisan, H., & Suwanwong, C. (2025). Effects of Financial Literacy and Financial Behavior on Financial Well-Being: Meta-Analytical Review of Experimental Studies. International Journal of Financial Studies, 13(1), 1. https://doi.org/10.3390/ijfs13010001