Abstract

The performance of foreign investors relative to domestic investors has been a subject of mixed evidence. While foreign investors are often perceived to underperform due to an information disadvantage, they are also known for their aggressive trading and superior performance in initiated orders. We provide further clarity on this issue. Specifically, by analyzing over five million transactions on the Jakarta Stock Exchange, our findings reveal that foreign investors consistently outperform domestic investors in terms of both annualized returns and profit amounts. Further investigation attributes this outperformance to the higher sophistication of foreign investors, who demonstrate superior stock-picking abilities and effective growth investing strategies.

Keywords:

trading performance; trading activity; foreign investor; domestic investor; investor’s sophistication level; Indonesian stock market JEL Classification:

G14; G15

“There are many perceptions of the role of foreign speculators in emerging equity markets—many of which are negative”. “One of the major conclusions of our work is that the capital market integration process reduces the cost of capital but perhaps by less than we expected”.—Bekaert and Harvey 2000, pp. 565, 601

1. Introduction

In the 1980s and 1990s, many developing countries liberalized their equity market (Bekaert and Harvey 2000; Bekaert et al. 2003). This wave of liberalization led to significant deregulation in key sectors, such as the banking industry, and opened the doors for foreign investors to trade in local equity markets. The effects of these changes, however, have been mixed. On the one hand, such structural reforms promote financial market integration, which not only lowers the cost of capital for domestic firms but also fosters economic growth (Bekaert and Harvey 1997, 2000; Bekaert et al. 2001, 2003; 2005; Henry 2000). On the other hand, the involvement of foreign investors, who are often more sensitive to market fluctuations, leads to increased instability and speculation in local exchanges (Bekaert and Harvey 2000; Stiglitz 2004; Wang 2007). In essence, the anticipated benefits of foreign investor participation in local equity markets may not be as significant as initially hoped.

To gain a deeper understanding of the impacts of foreign investors on local equity markets, it is critical to examine the differences in trading performance between foreign and domestic investors. We posit that the negative consequences of foreign investor presence are likely to be more pronounced when their trading performance significantly surpasses that of domestic investors, as observed in the Taiwanese and Finnish markets (Feng and Seasholes 2005; Grinblatt and Keloharju 2000). However, previous studies have also documented instances where domestic investors outperform foreign investors, such as in the German, Korean, Chinese, and Indonesian markets (Hau 2001; Choe et al. 2005; Chan et al. 2007; Sakir and Zainul 2019; Hanafi 2020; Prasetiadi 2021).

In the Indonesian stock market, specifically, although foreign investors generally underperform compared to domestic investors in trading activities, there are instances where they outperform their counterparts. Two primary explanations account for this underperformance. The first is the information disadvantage hypothesis, as suggested by Dvorák (2005), which posits that foreign investors are less informed due to physical, linguistic, and cultural barriers that impede the flow of information. The second is the trading aggressiveness hypothesis, proposed by Agarwal et al. (2009), which argues that foreign investors are more impatient and tend to expedite the execution of their buy (sell) orders by placing relatively higher (lower) prices. Interestingly, Agarwal et al. (2009) highlight that foreign investors can outperform domestic investors, especially in initiated orders, suggesting a nuanced view of their trading behavior.

Motivated by the mixed findings on the performance of foreign investors relative to domestic investors in the Indonesian stock market, we analyze over five million past transactions on the Jakarta Stock Exchange (JSE), conducted by more than 20,000 unique accounts at the stock–brokerage–investor-type level. We find foreign investors consistently outperform domestic investors in terms of both annualized returns and profit amounts. In terms of contributions, our paper provides additional evidence for the ongoing debate on the impact of foreign investors in emerging equity markets. Previous studies have highlighted the positive outcomes of equity market liberalization, such as boosting annual economic growth (Bekaert et al. 2001, 2003, 2005; Bumann et al. 2013) and promoting financial market integration (Bekaert and Harvey 1997, 2000). While we agree with these points, it is also important to consider the potential downsides of deregulation, such as increased market volatility that could lead to greater market speculation (Grabel 1995; Stiglitz 2004; Wang 2007; Chauhan and Chaklader 2023; Phan et al. 2023). Our study contributes to the discussion of negative consequences by presenting evidence that foreign investors may exploit domestic investors in terms of trading profits.

Furthermore, our study provides additional insights into the mixed findings regarding foreign investors’ trading performance in the Indonesian stock market. Both Dvorák (2005) and Agarwal et al. (2009) report the inferior performance of foreign investors, attributing it to their information disadvantage and trading aggressiveness, respectively. While Agarwal et al. (2009) also note the superior performance of foreign investors in the case of initiated trades, we argue that the mixed findings are due to varying levels of sophistication among foreign investors.

The remainder of this paper is organized as follows: Section 2 describes the data and provides the institutional background. Section 3 documents our primary findings, which include the characterization of foreign investors’ participation levels in local stocks and the trading performance of foreign and domestic investors. Section 4 presents and discusses our supplementary findings related to the impact of foreign investors’ participation on stock returns and the determinants of foreign investors’ stock-picking behavior in the Indonesian stock market. Finally, Section 5 concludes.

2. Institutional Background and Data

We obtain data from the Indonesian stock market. Looking back, the history of foreign investors itself in the Indonesian stock market dates back to 1988–1989, when they were first allowed to participate in the local equity market. However, at that time, there was a restriction preventing foreigners from owning more than 49% of the shares of listed companies. This restriction was later lifted due to a series of deregulations, with the cap being removed in September 1997 for non-financial companies and approximately four months later for financial companies. Accordingly, foreign investors became significant participants in the Indonesian stock market immediately following deregulation (Aaron et al. 2020).

Specifically, during the period of 1998–1999, despite the Asian Financial Crisis, foreign investors contributed to roughly 30–40% of the trading value and 25–30% of the trading volume in the entire market. Although foreign investment declined over the next three years (2000–2002), it saw a resurgence in 2003. Additionally, the Jakarta Composite Index often mirrored changes in the net inflows of foreign investments. This observation is consistent with the findings of Bae et al. (2004), who suggest that foreign investors can destabilize the local stock market due to their substantial equity holdings and the potential to exit the market by selling their shares to domestic investors.

Our data are obtained through the Jakarta Automated Trading System (JATS), a computerized platform that employs a continuous auction trading mechanism. Initially introduced in 1995, the system underwent a major update in 2002 to facilitate remote trading. To account for any structural changes resulting from this update, we focus on transactions conducted in the subsequent year, specifically in 2003.

We examine a total of 5,861,619 transactions conducted during the sample period, which took place across three different boards: regular, negotiated, and cash. Although there are technical differences among these three boards, JATS records the same following information for each transaction, namely: (1) Unique trade identification number; (2) Specific date and time when the transaction occurred; (3) Stock’s ticker; (4) Stockbroker’s code for both the buyers and the sellers; (5) Specific investor’s type (foreign or domestic investor); (6) The matched price; (7) The matched volume; and (8) The transaction value.

Moreover, while the JATS records the origin of every investor participating in the Indonesian stock market, it does not capture the investor’s identification number. Consequently, the most granular level of analysis available in this setting is at the stock–brokerage–investor-type level. It is worth noting that while prior studies have utilized similar data, only Dvorák (2005) offers a comparable depth of analysis to our study. However, Dvorák’s study focuses solely on the top 30 most liquid stocks in the market, whereas our study aims to analyze all stocks traded by foreign investors, encompassing approximately 175 out of 332 local stocks.

3. Main Results

3.1. Characterization of Foreign Participation Level on Local Stocks

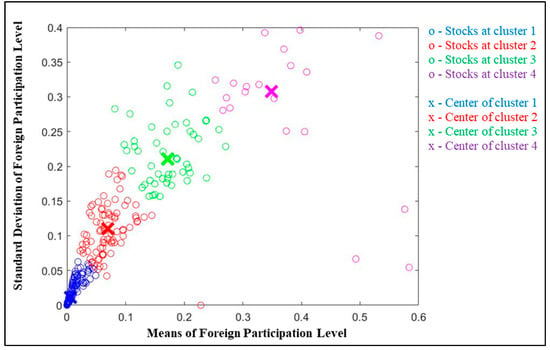

We first analyze the extent of foreign participation in local stocks. Specifically, the level of foreign participation is determined by dividing the trading value of stock i by foreign investors in month m by the total trading value of stock i by both foreign and local investors in month m. After calculating the monthly foreign participation levels for each stock throughout the sample period, the study then computes the overall means and standard deviations. Figure 1 below illustrates the characterization of foreign participation level in local stocks, which shows that, in general, as the level of foreign participation level on local stocks increases, the standard deviation also rises. This implies that certain local stocks are more attractive to foreign investors than others.

Figure 1.

Foreign Participation Level on Local Stocks.

To delve deeper, we conduct a clustering analysis using the K-means algorithm based on the level of foreign participation in each local stock. To determine the optimal number of clusters, we used the elbow method and noted that cluster 4 is the optimal one as it represents the point of inflection. Based on this clusterization, we present Table 1 below.

Table 1.

Foreign Investors’ Segmentation Strategy.

Table 1 shows that stocks with the lowest level of foreign participation are grouped in the first column (cluster 1), while those with the highest level of foreign participation are grouped in the fourth column (cluster 4). In cluster 4, specifically, the majority of foreign investments are concentrated in a small group of highly capitalized stocks, which have the highest value of trading frequency (19.6%), volume (38.0%), and value (38.4%) compared to the other clusters. This implies that foreign investors tend to trade specific stocks more frequently, in larger volumes, and with greater trading value than the remaining stocks in the sample. The cluster analysis shows that foreign investors have a tendency to trade in highly capitalized stocks. However, from Figure 1, cluster 4 is the most volatile and diverse compared to the other clusters as well, hinting at the sensitive behavior of foreign investors.

3.2. Trading Performance of Foreign and Domestic Investors

In this section, we calculate the trading performance of both foreign and domestic investors. We use the measurement initially proposed by Khwaja and Mian (2005), later refined by Imisiker et al. (2015), and subsequently adopted by Aaron et al. (2020), known as the Annualized Unbiased Rate of Return (AURR).

For each of the 22,941 unique stock–brokerage–investor types in the sample, we calculate the AURR using the following methodology. Initially, the net running profit is computed by aggregating individual profits. Each profit is derived by subtracting the investment from the revenue. The revenue (or investment) is determined by multiplying the specific price by the quantity involved in the transaction, where the transaction type is a sale (or purchase).

Second, we determine the time-weighted average capital required by averaging the net capital required over the sample period. The net capital required is calculated by subtracting the net running profit from the gross capital required. The gross capital required is derived by multiplying the absolute value of the share inventory by its current price. The share inventory is the cumulative total of net shares purchased, which is the difference between the quantities bought and sold. Following the methodology of Khwaja and Mian (2005), we assume that all remaining shares in the inventory are liquidated at the prevailing market price.

Finally, to obtain the AURR, we divide the net running profit with the time-weighted average capital required before annualizing it. A 10% AURR could be interpreted as the investor’s ability to earn USD 10 in a year for a USD 100 average capital investment during that year. One of the benefits of using this measurement is that, unlike Agarwal et al.’s (2009) methodology, the trading performance here accounts for the whole transaction in the JSE, regardless of the boards and type of transactions. In addition, unlike Dvorák’s (2005) methodology, this measurement only requires one transaction of buy and sale to be valid.

We examine whether there are differences in the trading performances of domestic and foreign investors. To provide a more comprehensive comparison, we analyze performance across different groups classified by various investment preferences. Additionally, we employ two metrics to measure investors’ trading performance: the annualized return (AURR), expressed as a percentage, and profit amounts (the numerator of AURR), expressed in monetary units.

Furthermore, Locke and Mann (2005) have established a positive relationship between an investor’s skills, such as trading discipline, and the future success of their investments. Similarly, Grinblatt and Keloharju (2001) highlighted that professional investor trades differently from retail or individual investor. These results suggest that varying levels of investor sophistication may lead to distinct trading strategies and performance outcomes. Building on these insights, we incorporate trading strategy as a key factor in explaining the differences in trading performance between local and foreign investors. To facilitate this analysis, the study categorizes the trading performance of each stock and investor group into quartiles. The lowest quartile (Q1) represents the performance of the least successful traders within an investor group, while the highest quartile (Q4) represents the performance of the most successful traders within the group. The results of this analysis are presented in Table 2 and Table 3 below.

Table 2.

Trading Performance of Foreign and Domestic Investors Based on Annualized Returns.

Table 3.

Trading Performance of Foreign and Domestic Investors Based on Monetary Units.

Specifically, Table 2 compares trading performance using annualized return as the metric. The performance differences between domestic and foreign investors are statistically significant in the first three quartiles, but not in the fourth quartile. On average, the annualized return rate (AURR) for foreign investors is 492% higher than that of local investors, nearly five times greater. The most substantial performance difference is observed in the third quartile, at 693%. Furthermore, foreign investors also outperform local investors in the stocks they trade most frequently, particularly in clusters 3 and 4.

Table 3 further compares trading performance using monetary units as the measurement, which serves as the numerator of AURR. Generally, the results align with those in Table 2, although the numbers in Table 3 are clearly influenced by stock prices. On average, the trading performance of foreign investors remains superior to that of local investors in clusters 3 and 4, with differences of IDR 1815.19 million and IDR 2736.48 million, respectively. It is noteworthy that for stocks heavily traded by foreign investors, there is no significant difference in trading performance between the top performers of the two groups in terms of annualized return. However, foreign investors demonstrate superior performance over the top performers and inferior performance over the worst performers among their counterparts. These results suggest that, regardless of the investor class, foreign investors tend to allocate the largest portion of their portfolios to the stocks they trade or favor the most, typically blue-chip stocks.

Overall, our findings reveal that foreign investors significantly outperform domestic investors in terms of both annualized returns and profit amounts. Furthermore, this conclusion holds across different investor classes, sorted by their annualized returns or profit amounts in quartiles. Nonetheless, when local stocks are categorized based on the activity level of foreign investors, we observe mixed findings similar to those reported by Agarwal et al. (2009). Specifically, for stocks predominantly traded by local investors, foreign investors consistently outperform their domestic counterparts across all investor classes. Conversely, for stocks heavily traded by foreign investors, there is no significant difference in trading performance between the top domestic and foreign investors in terms of annualized returns. However, when comparing profit amounts, the top (worst) performers among foreign investors exhibit superior (inferior) performance compared to their domestic counterparts.

4. Supplementary Results

4.1. Foreign Participation and Stock Return

Since we identified a significant difference in the trading performance of foreign and domestic investors on the JSE, the next step is to investigate the potential drivers behind this disparity. To this end, we examine whether foreign investors possess the sophistication to select winning stocks by employing the following regression specification, as outlined in Equation (1):

where StockReturn_Adji is the annual stock return adjusted by any relevant corporate actions (i.e., dividend paid, stock split) performed within the sample period. AVGForParti (SDForParti) is the overall means (standard deviation) of foreigners’ participation level at each stock (see Equation (1)). Lastly, LnMcapi is the natural logarithm of the stock’s market capitalization.

The regression analysis is designed to evaluate whether the level of foreign investor participation affects stock returns. The hypothesis posits that stocks with higher foreign participation should exhibit higher returns compared to those with lower participation. We seek to determine if foreign investments exert a price impact on the JSE. Notably, firm size, measured by the natural logarithm of market capitalization, is included to ensure that any observed price impacts are not solely driven by foreign investor preferences, as highlighted in the previous section.

Table 4 above presents the regression results of Equation 1. Specifically, columns (1) and (2) show that, when analyzed separately, both the average and standard deviation of foreign investment participation are positively related to stocks’ annualized returns, even after accounting for the size factor. However, column (3) indicates that when both variables are included together, the relationship between the standard deviation of foreign investment participation and stocks’ annualized returns becomes the dominant factor. Column (4) further demonstrates that these findings remain robust after incorporating industry-fixed effects. Consequently, we find that the volatility of foreign investment participation, reflecting the sensitive behavior of foreign investors, is a factor that can contribute to increased instability and speculation in the local market. In conjunction with the previous findings, our results suggest that heightened competition between local and foreign investors may diminish the influence exerted by either group (Zou et al. 2016).

Table 4.

Foreigners’ Participation and Stock Return.

4.2. Determinants of Foreigner’s Stock Picking Behavior

Given the positive correlation between the level of foreign investor participation and stock returns, it is essential to delve deeper into the firm-specific characteristics that influence the stock selection behavior of foreign investors. By doing so, we provide additional insights into the trading or investment strategies employed by foreign investors, such as whether they are more inclined toward value or growth investment strategies.

Previous research indicates that international diversification is beneficial for reducing portfolio risk and enhancing portfolio returns (Coeurdacier and Guibaud 2011). Consequently, the global visibility of a stock is a critical factor for foreign mutual fund managers when deciding to include a stock in their portfolios (Covrig et al. 2006). Additionally, these globally visible stocks are often characterized by high capitalization and liquidity (Bae et al. 2011; Zou et al. 2016). Furthermore, evidence suggests that country-specific information, such as political and economic uncertainty and regulatory changes, can also impact the stock selection behavior of foreign investors (Bekaert and Harvey 2000; Bekaert et al. 2003; Kim and Wei 2002; Santa-Clara and Valkanov 2003).

Given that our study focuses exclusively on a single country, it places greater emphasis on investigating firm-specific characteristics as potential determinants of foreign investors’ stock selection behavior. To achieve this, twenty-four financial ratios are computed from the firms’ financial statements and categorized into the following groups: (1) profitability, (2) liquidity, (3) solvency, (4) efficiency, and (5) valuation ratios. The dependent variable is a binary indicator, assigned a value of one for stocks selected by foreign investors and zero otherwise. Among the 299 listed stocks with complete data, 165 have been bought and sold at least once by foreign investors during the sample period, while the remaining 134 stocks have never been traded by them. Accordingly, we employ the regression model specified in Equation (2) to conduct the analysis.

Table 5 presents the results of stepwise logistic regression. Accordingly, from twenty-four financial ratios that are classified into five groups, only six ratios are included in the models, namely, Cash Flow Return on Assets (CFOA), Equity Ratio (EQUITY), Fixed Assets Turnover (FATO), Total Assets Turnover (TATO), Book Value per Share (BVS), and Market Value per Share (MVS). In general, these six variables represent the profitability, solvability, efficiency, and valuation ratios.

Table 5.

Determinants of Foreigners’ Stock Picking Behavior.

Column 1 of Table 5 reveals that the coefficients for CFOA and EQUITY are both positive and significant, indicating that foreign investors are more likely to select stocks from firms with higher profitability and lower leverage. When examining efficiency ratios, the coefficients for FATO and TATO are statistically significant but in opposite directions. Specifically, there is a positive relationship between fixed asset turnover and the likelihood of stock selection by foreign investors, whereas total asset turnover shows a negative relationship. These results suggest that foreign investors favor firms that generate more revenue from their fixed assets rather than from their current assets.

Similarly, in terms of valuation ratios, there is a positive relation between market value per share and the likelihood of stock selection by foreign investors, contrasted with a negative relationship for book value per share. This relation implies that foreign investors tend to prefer overvalued firms. These findings remain consistent even when the sample is randomly divided into a training dataset (70%), column 2, and a testing dataset (30%), column 3.

Table 5 infers that foreign investors in JSE are inclined toward a growth investing strategy rather than a value investing approach. Positively, foreign investors prioritize cash flow over earnings and place greater importance on the efficient use of a firm’s fixed assets rather than its total assets. Negatively, they avoid firms with high leverage, favoring those with a higher equity proportion over debt. Additionally, in terms of investment horizon, foreign investors appear to be less patient, opting to invest in overvalued stocks, which aligns with the findings of Agarwal et al. (2009). Collectively, these insights suggest that foreign investors may focus on medium-term investments and seek to capitalize on short-term momentum, particularly during the booming equity market of 2003 and 2004 (Aaron et al. 2020).

Taken together, these results suggest that, both the average level and the standard deviation of foreign participation positively influence stock returns when considered separately. However, when both variables are included in the model, the standard deviation’s effect is more pronounced. These findings suggest that the sensitive behavior of foreign investors may contribute to increased instability in the local market. Moreover, irrespective of investor class, foreign investors tend to allocate the largest portion of their portfolios to stocks they trade the most, typically local stocks that have higher profitability, efficiency to generate sales from fixed assets, have lower debt levels, and are perceived as overvalued.

5. Conclusions

The debate over whether foreign or domestic investors perform better in the domestic equity market, and the primary drivers behind this phenomenon, has persisted for a long time. Using transaction data from the Indonesian equity market, we provide evidence supporting the notion that foreign investors generally outperform domestic investors. It also highlights that the trading strategies employed by foreign investors may significantly contribute to their success.

Firstly, the study demonstrates that foreign investors are a significant component of the Indonesian equity market. Our first analysis indicates that certain stocks are more attractive to foreign investors, with a small number of highly capitalized stocks contributing the most to both trading volume and value.

Secondly, the study finds that foreign investors outperform domestic investors in the Indonesian equity market using the Annualized Unbiased Rate of Return (AURR) metric. Comparisons are made across different groups classified by various investment preferences (based on different clusters), with performance measured by both annualized return (AURR) and monetary units (the numerator of AURR). The results indicate that foreign investors outperform domestic investors, particularly in stocks that are most attractive to them.

Thirdly, the study employs several statistical tools to test whether certain common characteristics are shared by stocks frequently chosen by foreign investors. Using stepwise logistic regression, we find that foreign investors are more likely to select stocks with low leverage but higher profitability and efficiency. Interestingly, the logistic regression results show that foreign investors tend to pick stocks with high market value or low book value, suggesting a focus on short-term investment and capitalizing on short-term momentum during the booming equity market in 2003.

In conclusion, the study provides new evidence supporting the argument that foreign investors outperform domestic investors in the Indonesian equity market. It suggests that differences in investment sophistication levels may explain this phenomenon.

Future research could explore whether behavioral biases among different investors influence this observation. Additionally, applying machine learning approaches, such as principal component analysis for dimensionality reduction, might offer a better alternative to the stepwise methodology used in our study (Pukthuanthong et al. 2019; Kozak et al. 2020).

Author Contributions

Conceptualization, D.P.K. and A.A.; methodology, A.A. and S.W.; software, A.A.; validation, D.P.K., A.A. and S.W.; formal analysis, A.A. and S.W.; investigation, A.A. and S.W.; resources, D.P.K.; data curation, A.A.; writing—original draft preparation, A.A. and S.W.; writing—review and editing, A.A. and S.W.; visualization, A.A.; supervision, D.P.K.; project administration, D.P.K.; funding acquisition, D.P.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data is confidential and not publicly available.1

Conflicts of Interest

The authors declare no conflict of interest.

Note

| 1 | This study acknowledges that due to data unavailability and confidentiality issues, the scope of the analysis is only within a full year. However, the level of analysis of this study is very granular, and includes all the transactions conducted by all brokerage and investor types in every listed stock in the JSE. |

References

- Aaron, Aurelius, Deddy P. Koesrindartoto, and Ryuta Takashima. 2020. Micro-foundation investigation of price manipulation in Indonesian Capital Market. Emerging Markets Finance and Trade 56: 245–59. [Google Scholar] [CrossRef]

- Agarwal, Sumit, Sheri Faircloth, Chunlin Liu, and S. Ghon Rhee. 2009. Why do foreign investors underperform domestic investors in trading activities? Evidence from Indonesia. Journal of Financial Markets 12: 32–53. [Google Scholar] [CrossRef]

- Bae, Kee-Hong, Kalok Chan, and Angela Ng. 2004. Investibility and return volatility. Journal of Financial Economics 71: 239–63. [Google Scholar] [CrossRef]

- Bae, Sung C., Jae Hoon Min, and Sunbong Jung. 2011. Trading Behavior, Performance, and Stock Preference of Foreigners, Local Institutions, and Individual Investors: Evidence from the Korean Stock Market. Asia-Pacific Journal of Financial Studies 40: 199–239. [Google Scholar] [CrossRef]

- Bekaert, Geert, and Campbell R. Harvey. 1997. Emerging equity market volatility. Journal of Financial Economics 43: 29–77. [Google Scholar] [CrossRef]

- Bekaert, Geert, and Campbell R. Harvey. 2000. Foreign speculators and emerging equity markets. Journal of Finance 55: 565–614. [Google Scholar] [CrossRef]

- Bekaert, Geert, Campbell R. Harvey, and Christian Lundblad. 2001. Emerging equity markets and economic development. Journal of Development Economics 66: 465–504. [Google Scholar] [CrossRef]

- Bekaert, Geert, Campbell R. Harvey, and Christian Lundblad. 2003. Equity market liberalization in emerging markets. Journal of Financial Research 26: 275–99. [Google Scholar] [CrossRef]

- Bekaert, Geert, Campbell R. Harvey, and Christian Lundblad. 2005. Does financial liberalization spur growth? Journal of Financial Economics 77: 3–55. [Google Scholar] [CrossRef]

- Bumann, Silke, Niels Hermes, and Robert Lensink. 2013. Financial liberalization and economic growth: A meta-analysis. Journal of International Money and Finance 33: 255–81. [Google Scholar] [CrossRef]

- Chan, Kalok, Albert J. Menkveld, and Zhishu Yang. 2007. The Informativeness of Domestic and Foreign Investors’ Stock Trades: Evidence From the Perfectly Segmented Chinese Market. Journal of Financial Markets 10: 391–415. [Google Scholar] [CrossRef]

- Chauhan, Ajay Kumar, and Barnali Chaklader. 2023. Do Local Investors Exhibit Smart Value Investment? Empirical Evidence from India. Global Business Review 24: 833–44. [Google Scholar] [CrossRef]

- Choe, Hyuk, Bong-Chan Kho, and René M. Stulz. 2005. Do domestic investors have an edge? The trading experience of foreign investors in Korea. Review of Financial Studies 18: 795–829. [Google Scholar] [CrossRef]

- Coeurdacier, Nicolas, and Stéphane Guibaud. 2011. International portfolio diversification is better than you think. Journal of International Money and Finance 30: 289–308. [Google Scholar] [CrossRef]

- Covrig, Vicentiu, Sie Ting Lau, and Lilian Ng. 2006. Do domestic and foreign fund managers have similar preferences for stock characteristics? A cross-country analysis. Journal of International Business Studies 37: 407–29. [Google Scholar] [CrossRef]

- Dvořák, Tomáš. 2005. Do domestic investors have an information advantage? Evidence from Indonesia. Journal of Finance 60: 817–39. [Google Scholar] [CrossRef]

- Feng, Lei, and Mark S. Seasholes. 2005. Do investor sophistication and trading experience eliminate behavioral biases in financial markets? Review of Finance 9: 305–51. [Google Scholar] [CrossRef]

- Grabel, Ilene. 1995. Assessing the impact of financial liberalisation on stock market volatility in selected developing countries. Journal of Development Studies 31: 903–17. [Google Scholar] [CrossRef]

- Grinblatt, Mark, and Matti Keloharju. 2000. The investment behavior and performance of various investor types: A study of Finland’s unique data set. Journal of Financial Economics 55: 43–67. [Google Scholar] [CrossRef]

- Grinblatt, Mark, and Matti Keloharju. 2001. What makes investors trade? Journal of Finance 56: 589–616. [Google Scholar] [CrossRef]

- Hanafi, Mamduh M. 2020. Trading Performance of Foreign and Domestic Investors: Evidence from Indonesia during the Crisis and Recovery Periods. International Journal of Economics & Management 14: 203–18. [Google Scholar]

- Hau, Harald. 2001. Location matters: An examination of trading profits. Journal of Finance 56: 1959–83. [Google Scholar] [CrossRef]

- Henry, Peter Blair. 2000. Stock Market Liberalization, Economic Reform, and Emerging Market Equity Prices. Journal of Finance 55: 529–64. [Google Scholar] [CrossRef]

- Imisiker, Serkan, Rasim Özcan, and Bedri Kamil Onur Taş. 2015. Price manipulation by intermediaries. Emerging Markets Finance and Trade 51: 788–97. [Google Scholar] [CrossRef]

- Khwaja, Asim Ijaz, and Atif Mian. 2005. Unchecked intermediaries: Price manipulation in an emerging stock market. Journal of Financial Economics 78: 203–41. [Google Scholar] [CrossRef]

- Kim, Woochan, and Shang-Jin Wei. 2002. Foreign portfolio investors before and during a crisis. Journal of International Economics 56: 77–96. [Google Scholar] [CrossRef]

- Kozak, Serhiy, Stefan Nagel, and Shrihari Santosh. 2020. Shrinking the cross-section. Journal of Financial Economics 135: 271–92. [Google Scholar] [CrossRef]

- Locke, Peter R., and Steven C. Mann. 2005. Professional trader discipline and trade disposition. Journal of Financial Economics 76: 401–44. [Google Scholar] [CrossRef]

- Phan, Thi Nha Truc, Philippe Bertrand, Hong Hai Phan, and Xuan Vinh Vo. 2023. The role of investor behavior in emerging stock markets: Evidence from Vietnam. The Quarterly Review of Economics and Finance 87: 367–76. [Google Scholar] [CrossRef]

- Prasetiadi, Yoga. 2021. The Effect of Foreign Investment on Domestic Investment In Indonesia. Efficient: Indonesian Journal of Development Economics 4: 1278–89. [Google Scholar] [CrossRef]

- Pukthuanthong, Kuntara, Richard Roll, and Avanidhar Subrahmanyam. 2019. A Protocol for Factor Identification. Review of Financial Studies 32: 1573–607. [Google Scholar] [CrossRef]

- Sakir, A., and Zaida Rizqi Zainul. 2019. Are Foreign Investors Smarter than Domestic Investors? Empirical Evidence from Indonesia. Paper presented at 1st Aceh Global Conference (AGC 2018), Banda Aceh, Indonesia, October 17–18; pp. 389–95. [Google Scholar]

- Santa-Clara, Pedro, and Rossen Valkanov. 2003. The Presidential Puzzle: Political Cycles and the Stock Market. Journal of Finance 58: 1841–72. [Google Scholar] [CrossRef]

- Stiglitz, Joseph E. 2004. Capital-market Liberalization, Globalization, and the IMF. Oxford Review of Economic Policy 20: 57–71. [Google Scholar] [CrossRef]

- Wang, Jianxin. 2007. Foreign equity trading and emerging market volatility: Evidence from Indonesia and Thailand. Journal of Development Economics 84: 798–811. [Google Scholar] [CrossRef]

- Zou, Liping, Tiantian Tang, and Xiaoming Li. 2016. The stock preferences of domestic versus foreign investors: Evidence from Qualified Foreign Institutional Investors (QFIIs) in China. Journal of Multinational Financial Management 37–38: 12–28. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).