Abstract

This study uses time series regression models and dynamic panel models of five-class housing to investigate the dynamics of the housing price-vacancy relationship in Hong Kong, offering insights distinct from previous cross-sectional analyses that take new housing completions as a supply proxy, without considering vacant homes as a source of housing supply. Two major contributions emerge: first, the results support the hypothesis that housing vacancies exert a negative impact on housing prices, holding other factors constant. Second, new builds supply is found to have a positive effect on housing prices, which is in line with many previous studies, but it contradicts the prediction. The results challenge the use of land supply or new housing completions as the proxy of housing supply and put forward a novel suggestion of including vacant homes in the housing price analysis. Advanced approaches to collecting housing vacancy data are also discussed. These findings have significant implications for policymakers, urban planners, and real estate investors, providing valuable insights for crafting targeted interventions and informing investment decisions. This is one of the first time series and dynamic panel analyses of housing vacancy’s effect on prices.

1. Introduction

In the study of housing markets, understanding the determinants of housing prices is of paramount importance for policymakers, investors, and researchers alike. Traditionally, many studies have approached this issue by considering housing demand and supply. However, housing supply is usually proxied by new builds, such as housing units constructed, building permits or land availability. This approach overlooks the existing supply from the inventory, that is the number of vacant housing units. In fact, developers’ decisions on new developments are shaped by the number of vacant homes in the market.

It is understandable that ignoring vacant homes is a practical solution to maintain estimation viability as data on vacancy are not commonly available. However, some previous studies using new builds as the supply variable have found an unexpectedly contradictory effect of supply, resulting in misinterpretations of the true drivers of housing price fluctuations.

To address these limitations, this study is a study utilising both the number of newly completed housing units and the number of vacant housing units as proxies for the two sources of housing supply to investigate the supply–demand dynamics of housing prices. By incorporating the number of vacant units as a determinant of housing prices, this study aims to analyse the impact of vacant homes on housing prices. Specifically, the study hypothesises that changes in the number of vacant units will affect the housing supply, thus exerting a significant influence on housing prices. We test the hypotheses by using both time series models and dynamic panel data models. Through this innovative approach, the study aims to provide a more comprehensive understanding of the determinants of housing prices and contribute to more robust policymaking and investment strategies in the housing sector.

It is well recognised that frequent housing vacancy data is often hardly available. Vacancy data is usually collected once every several years during the census, and the accuracy of the data is hard to ascertain. This may explain why vacancy rates are not commonly used in studies of housing price determinants. This study uses the Rating and Valuation Department’s annual data series of the number of vacancy units of five different housing classes in Hong Kong to examine the validity of the proposed hypothesis. Vacancy is defined as “the number of units not physically occupied at the time of the survey conducted at the end of the year” (RVD 2024). Premises under decoration and repair are also classified as vacant, as rehabilitation is commonly applied to maintain building quality (Yiu and Leung 2005). The data on vacancies after 2020 are estimated by a full survey of dwellings at the end of the year, and they are obtained from management offices, owners, occupiers, or by inspection. The data of vacancies before 2020 are estimated by a 3% random sample survey.

The Hong Kong housing market is characterised by high-density developments and an abundance of super high-rise apartment building blocks. With a population of 7.5 million people in 2023, living within 3 million housing units, the city’s urban landscape is dominated by towering residential structures that reach into the sky. This vertical living arrangement is a response to the limited land availability and the high demand for housing in one of the world’s most densely populated areas. This has led to a significant portion of the population residing in smaller units, often referred to as “nano flats”, which can be smaller than 200 square feet. Vacant homes are therefore critical, as even a small number of unoccupied units can significantly impact the overall housing supply and affordability.

Similar to New York and London, owning more than one home and foreign buyers of housing units (Fernandez et al. 2016; Bourne 2019) are very common in Hong Kong, as real estate investment is considered safe and thus one of the reasons why the government implemented stamp duty measures on non-first-time and non-local home buyers. Thus, housing prices can be strongly shaped by vacancies which reflect the demand of long-term and short-term renters. Vacancy can also signify city shrinkage or urban decline (Glaeser and Gyourko 2005; Couch and Cocks 2013; Suzuki and Asami 2020).

The preliminary findings suggest that changes in the number of vacant units impose a negative effect on changes in real housing prices, aligning with theoretical predictions. This underscores the importance of considering vacancy as a crucial determinant of housing prices, as vacancy encapsulates the outcome of the intricate interplay between the housing supply and demand dynamics. In the market downturn, owners of vacant units are more likely to reduce their asking prices when the vacant period is long, as found in many studies on time-on-the-market (İnaltekin et al. 2011).

The remainder of the paper is organised as follows: Section 2 presents a literature review on existing studies of the determinants of housing prices and vacancy rates. Section 3 outlines the research materials and methods used. Section 4 reports the results of the empirical tests. Section 5 discusses the findings and implications. Section 6 provides concluding remarks.

2. Literature Review

Wheaton (1990) developed the vacancy theory of homes based on a searching and matching process of home sellers (supply) and home buyers (demand). The theory implies that changes in supply and demand will result in changes of vacancy, which can have a negative and significant effect on house prices (Smith 1974). However, there have been very few studies investigating the impacts of vacancies on house prices, most of the previous studies focused on finding the natural vacancy rate (Gabriel and Nothaft 2001; Hagen and Hansen 2010), vacancy paradox (Hoekstra and Vakili-Zad 2011; McClure 2019) and causes of vacancies (Fritzsche and Vandrei 2018), etc. Previous studies on housing price determinants usually incorporated new builds housing supply variables, without considering vacant homes as another source of housing supply.

2.1. Supply-Side Determinants of Housing Prices

The broad and diverse nature of residential housing markets means that there are various demand and supply factors that interact to achieve an equilibrium and result in market housing prices (Xu and Tang 2014). Sirmans et al. (2006), however, found the existing literature failed to reach a common consensus on the effect of different determinants on housing prices through hedonic pricing models. It implies that the outcomes of the studies can vary greatly depending on the model specifications. This variation can challenge the robustness of the findings.

The results of housing supply determinants are particularly confusing. There have been studies finding that housing supply is positively associated with housing prices which contradicts the prediction of the Law of Supply. However, almost all of them considered new builds as housing supply proxies, without including vacant homes in the existing market. For example, both Ho and Ganesan (1998) and Glindro et al. (2011) took land supply for new builds as a proxy of the supply-side determinant, and Belke and Keil (2017) considered the number of newly constructed apartments and the total stock of existing apartments as the proxies of housing supply. Both found a positive and significant association between land or housing supply and housing prices, which contradicts their hypotheses. Glindro et al. (2011, p. 186), therefore concluded that “the coefficient of the land supply index is positive, which contradicts the theoretical prediction that increases in land supply have a dampening effect on house prices”. They tried to explain the contradictory results by contending that “higher house prices provide an incentive for developers to build up new residential property projects”. Similarly, Belke and Keil (2017, p. 14) analysed a panel dataset of nearly 100 German cities, with both supply and demand factors. They found that, among others, “the positive relation between construction activity and real estate prices could reflect a supply-side reaction of increasing construction in cities with strong demand”. Many other studies found no significant results of housing supply. For example, Taghizadeh-Hesary et al. (2019, p. 18) of ADBI analysed a time series dataset in 1999–2018 of macroeconomic variables and housing prices in Hong Kong. They took the total newly completed housing units as the proxy of supply and also found that, among others, “housing supply has never been statistically significant; housing supply is not responsible for or affected by, or does it respond to price changes”.

In contrast, there are studies that claim to find a negative association between housing supply and prices. Geng (2018), for instance, studied determinants of house prices of 20 advanced economies by a cross-country panel model and found a negative effect of housing supply on house prices. Yet, the proxy of supply is housing stock per capita. Similarly, Dröes and van de Minne (2017) also found a negative relationship between housing supply and prices by using the total number of housing units in Amsterdam as the proxy of supply. However, housing stock itself could not be interpreted as housing supply, and its first difference could represent net new builds, which again ignores the vacant homes in the market.

2.2. Demand-Side Determinants of Housing Prices

Studies on demand-side determinants of housing prices do have consistent results, categorised into population growth, economic growth, and monetary policy (Albsoul et al. 2024). Égert and Mihaljek (2007) studied the determinants of house prices in eight transition economies of Europe and 19 OECD countries and found that real interest rates, GDP per capita, population, etc., are demand-side price determinants. These demand-side price determinants are echoed through other studies that often consider population growth, economic growth, and monetary policy as proxies to study the demand-side impacts on house prices (Glindro et al. 2011; Xu and Tang 2014; Dröes and van de Minne 2017; Taghizadeh-Hesary et al. 2019; Yiu 2021).

2.3. Studies on Housing Vacancy

Theoretically, Wheaton (1990, p. 1290) developed one of the first housing vacancy models which “suggests that small changes in supply or demand, as they alter vacancy, can have very profound impacts on market prices.” Understanding the intricate relationship between housing prices and vacancy rates is crucial for policymakers, real estate investors, and analysts alike. However, as reviewed above, very few studies on house price determinants or dynamics would include vacancy as a variable, probably due to the unavailability of a time series of housing vacancies. For example, Hoekstra and Vakili-Zad (2011, p. 55) explained the Spain Paradox of rising house prices and high vacancies, but they could not collect enough data to quantify the argument as census data are only available once every ten years. Previous studies on housing vacancy often relied on cross-sectional data, such as in Lerbs and Teske (2016), which are hard to control all spatial differences and could not capture the temporal dynamics adequately. Furthermore, these cross-sectional studies are susceptible to endogeneity and omission biases, casting doubts on the reliability of their findings.

Molloy (2016) found a negative correlation between long-term vacancy and median house price change in the US. Zabel (2016, p. 368) investigated the role of vacancies on house prices in the US, using an error correction model. They found that “prices rise when vacancies fall but prices do not fall when there is excess supply and vacancies rise”. Yet, when there is excess supply and vacancies rise, most of his results are statistically insignificant with the sign changing, the findings are inconclusive. Thus, this study attempts to analyse the temporal effects of vacancy changes on housing price changes, ceteris paribus.

3. Methods and Materials

3.1. Data

The dataset for this study is collected from Rating and Valuation Department (RVD 2024), which provides yearly data on the number of vacant housing units and housing price indices for five distinct classes of housing units, categorised by their floor areas, in Hong Kong. Other demographic and macroeconomic data are collected from Census and Statistics Department (C&SD 2024). Both time series and dynamic panel analysis methods are employed to investigate the relationship between housing vacancies and prices over time, controlling for various housing sizes and other temporal factors.

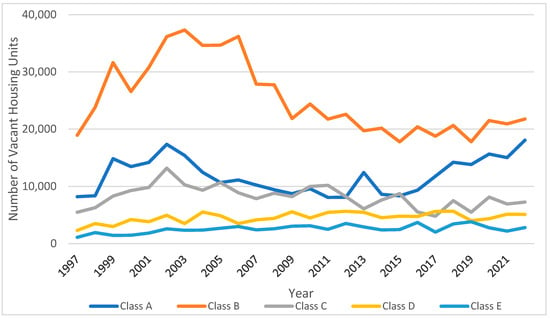

Housing data in Hong Kong are reported in five classes, based on the saleable floor area of housing units, viz. (a) Class A—less than 40 sq. m; (b) Class B—from 40 to 69.9 sq. m; (c) Class C—from 70 to 99.9 sq. m; (d) Class D—from 100 to 159.9 sq. m; and (e) Class E—from 160 sq. m and above. Figure 1 shows the vacancies of the five classes of housing in Hong Kong from 1997 to 2022. Classes A and B are the dominant sizes as they account for 80% (A: 32% and B: 48%) of total housing stock (1,256,772) in 2022. Classes C, D and E account for 12%, 6%, and 2%, respectively, (RVD 2024).

Figure 1.

Vacancies of the five housing classes in Hong Kong from 1997 to 2022. Source: RVD (2024). Legends: Classes of housing are categorised based on the saleable area of housing units, viz. (a) Class A—less than 40 sq. m; (b) Class B—from 40 to 69.9 sq. m; (c) Class C—from 70 to 99.9 sq. m; (d) Class D—from 100 to 159.9 sq. m; and (e) Class E—from 160 sq. m and above.

The vacancy of small-sized residential units (Class A) shows a recent increasing trend, while the vacancies of medium-sized residential units (Classes B and C) rose to the peak in around 2002–2003 and then fell afterward. The vacancies in large units have remained relatively steady. These trends are largely due to the changes in monetary policies and housing policies, especially the stamp duty measures and mortgage restrictions on the maximum loan-to-value ratio specific to different housing classes1. A dynamic panel data model method can help control these fixed effects of housing class. The housing vacancy rate of Hong Kong is relatively low compared to international standards. The lowest rate is 2.9% in 1988, and the average rate from 1985 to 2022 is only 4.5%, with a standard deviation of 0.95%. This is probably because of the high opportunity cost of vacant homes in Hong Kong.

Similarly, the yearly series of housing completions of each housing class is collected from the RVD (2024). Demand proxies, including population growth, real GDP economic growth, and interest rate, are common to all housing classes. Table 1 shows the descriptive statistics of the variables, and Table 2 shows the stationarities of the time series by the Augmented Dicky–Fuller (ADF) test and the Phillips–Perron (PP) test. They show that all the time series are stationary only in their first differences. The stationarities of the panel data are tested by the Levin, Lin and Chu test and the Im, Peasaran and Shin test. The vacancy data series, housing completions data series, and interest rate data series are stationary in the level terms, whereas all other series are stationary in their first differences.

Table 2.

Unit Root Tests of Variables, 1997–2022.

3.2. Research Design

A time series regression model and a dynamic panel data regression model (Equation (1)) taking population growth, economic growth, monetary policy and new builds housing supply variables as determinants (Albsoul et al. 2024) are conducted as the baseline models. Population growth, real GDP economic growth and interest rate (proxied by the 3-month Hong Kong Interbank Rate) are incorporated to estimate demand effects, whereas the number of housing completions is taken as the proxy of new builds housing supply. Corresponding models (Equations (2) and (3)) use or include the number of vacant housing units as an indicator of housing supply from the existing stock to test the vacancy hypothesis. Equation (2) is a simplified model with only the vacancy variable and the interest rate variable, which considers vacancy as the net demand for housing. Equation (3) includes all the variables. It considers vacancy as a proxy of housing supply from the existing stock which imposes an effect on housing prices different from that of new builds supply.

where , , , and are real house price indices, population, real gross domestic products, interest rates, number of housing units completed and number of vacant units (of class i in the dynamic panel data models or of the combined series in the time series models) at time t. control cross-class fixed effects in the dynamic panel data models, caters for the autoregressive effect of house price changes in a one-year lag. are coefficients to be estimated. is the error term.

In the time series models, the combined series of real house price index, housing vacancies and completions are directly provided by RVD (2024). The Autoregressive Moving Averages (ARMA) model is applied to analyse the time series variables, using the Broyden–Fletcher–Goldfarb–Shanno (BFGS) method to estimate the coefficients of the ARMA models. The BFGS algorithm is a numerical optimisation technique commonly used to maximise the likelihood function in Maximum Likelihood Estimation (MLE).

The dynamic panel data model is estimated using the Generalized Method of Moments (GMM), with lagged values of the dependent variable as instruments in the differenced equations. This approach is preferred over the Generalized Least Squares (GLS) method as Arellano and Bond (1991) demonstrated that fixed effects estimators by the GLS method for dynamic panel data are biased and inconsistent. They recommended using GMM estimators to obtain consistent estimates. The dynamic panel data models control class-specific fixed effects by a cross-section differencing transformation (Arellano and Bond 1991), which can control the differences in the impacts of policy changes in stamp duty and mortgage lending on different housing classes (Deng et al. 2024).

The models are estimated by using EViews which provides the Difference (Arellano-Bond 1-step) GMM weights for estimating the difference transformation. Furthermore, cross-section weights (PCSE) are applied to correct the standard errors and covariance matrix of the estimated coefficients to address heteroscedasticity issue.

4. Results

Utilising both time series and dynamic panel regression models, Models 1a and 1b in Table 3 show the results of the temporal impacts of demand and supply factors as well as the impacts of the changes of the number of vacant units on housing price changes, with housing size effects fixed in the panel analysis. In the baseline models, the results show a negative effect of population size change in both models, which contradicts theoretical prediction, probably because of the large-scale public housing schemes in Hong Kong that accommodate one-half of the households (Lui 2007). Also, a 1% increase in real GDP is found to have a positive (about 2% increase) and significant impact on housing prices in both models. The interest rate effect is negative, as expected. It is significant in the dynamic models, but not in the time series models. The new builds housing supply effect on housing prices is only statistically significant in the panel model 3b, but is positive, which contradicts the expected sign. This result is the same as in many previous studies, such as Glindro et al. (2011) and Taghizadeh-Hesary et al. (2019).

Table 3.

Results of the time series and dynamic panel regression models on the determinants of house price change.

Models 2a and 2b of Table 3 show a consistently negative and significant effect of vacant homes on housing prices, no matter in the time series model or the dynamic panel data model2. These findings suggest that housing vacancy is a price determinant, reflecting the housing supply effect of the number of vacant units from the existing housing stock. The dynamic panel analysis allows us to disentangle the temporal trends from housing size effects, providing a more accurate depiction of the housing vacancy-price relationship. The results highlight the importance of considering vacancies in understanding the complex dynamics of the real estate market.

Models 3a and 3b of Table 3 include all the housing demand and supply determinants, including both new builds supply and vacant homes supply. The effects of vacancies on housing prices are all in negative signs as expected, and the magnitude of the effect is quite similar in the two dynamic panel data models (Models 2b and 3b), indicating that the vacancy effect on prices is quite independent of the other factors. The new builds supply, on the contrary, shows a positive effect on housing prices, which contradicts the prediction.

As a diagnostic test, the Arellano and Bond’s (1991) first- and second-order serial correlation statistics confirm a negative and significant auto-correlation coefficient in the first order, and not in the second order correlation, as shown in the m-Statistics in the dynamic panel models’ results.

5. Discussion

The positive correlation between new builds housing supply and housing prices confirms Glindro et al.’s (2011) contention that new builds are a response to housing prices instead of the determinant of prices. This has been confirmed by numerous studies on housing supply elasticity (Mayer and Somerville 2000; Green et al. 2005).

Some previous studies exploited vacancy rate as the proxy (Smith 1974), but since the rate can be strongly affected by the denominator, i.e., the number of total stocks which is usually much larger than the number of vacant homes, it is not sensitive to vacancy changes. Instead, this study considers the impacts of the marginal variation of the number of vacant homes on housing price changes. It shows the sensitivity of housing prices on the change of vacancies.

It is not hard to agree that vacant homes should be considered as one source of housing supply from the existing stock, but the availability and accuracy of vacancy data can still be a concern for researchers. Traditional methods of collecting vacancy data, such as those conducted during the census once every five years, present challenges due to their infrequency and varying definitions across different cities. Fortunately, advancements in technology, particularly the digitalisation of utility meters, offer a promising solution to these challenges. By leveraging the data from digital electricity and water meters, cities can standardise the definition of vacant homes and collect meaningful vacancy data for housing price analysis.

In recent years, the digitalisation of utility meters, particularly electricity and water meters, has transformed the way utility consumption data is collected and analysed (Razavi et al. 2019; Newing et al. 2023). Digital meters provide real-time monitoring of energy and water usage in homes, offering a wealth of data that can be leveraged to identify vacant properties (Jacovine et al. 2022). The use of digital utility meters reduces the burden and cost associated with traditional vacancy surveys, as data collection can be automated and conducted remotely. The privacy issue can be addressed by using the same anonymity approach as in censuses. By leveraging real-time vacancy data, policymakers can develop more effective strategies to address housing market imbalances and promote housing affordability. Furthermore, the standardised nature of vacancy data collected through digital utility meters facilitates cross-city and cross-country comparisons, enabling researchers to identify trends and best practices in housing market regulation and policy implementation.

6. Conclusions

One of the major contributions of this study is identifying both the effects of new builds housing supply and vacant homes supply on housing prices. Traditionally, studies on price determinants usually took new builds as housing supply in regression models, overlooking the supply from the existing stock, i.e., the vacant homes. Worse still, the studies using new builds as the proxy of supply often found statistically insignificant results or even contradictory results. This study challenges the conventional approach by introducing housing vacancy as another main source of housing supply, i.e., supply from the existing housing stock. It can reflect more accurately the dynamics of housing supply. The empirical results show that the effect of new builds is positive, suggesting that developers’ decisions on the rate of development depend on the expected housing prices. Only vacant homes impose a negative effect on house prices. A higher vacancy signifies an increased number of housing units that are neither utilised for owner-occupation nor rented out. The underlying reasons for such vacancies can be diverse, including potential over-supply of building units in the market or an economic downturn leading to diminished accommodation demand for housing, or both. Conversely, a decrease in the vacancy may indicate a surge in net housing demand for accommodation, thereby exerting upward pressure on property prices.

By leveraging a dynamic panel data model analysis on a unique dataset from Hong Kong, this study advances our understanding of the housing vacancy–price relationship. The approach allows for a more accurate assessment of temporal trends, addressing the limitations of previous cross-sectional studies. The findings contribute to both academic research and practical applications in the real estate market, emphasising the importance of considering housing supply attributes from the stocks in housing market analyses.

The previous lack of use of the housing vacancy variable as a determinant of housing prices could have arguably occurred due to its data unavailability. In many cities, housing vacancy data is only surveyed once every census, and different cities define housing vacancy differently. Hence, the digitalisation of utility meters presents a transformative opportunity to modernise vacancy data collection for housing price analysis. Utilising data gathered from digital electricity and water meters, establishing a standardised definition for vacant properties, and collecting real-time vacancy information can help to address the constraints posed by conventional vacancy surveys.

By leveraging real-time vacancy data, policymakers can develop more effective strategies to address housing market imbalances and promote housing affordability. Furthermore, the standardised nature of vacancy data collected through digital utility meters facilitates both temporal and spatial (cross-city and cross-country) comparisons, enabling researchers to identify trends and best practices in housing market regulation and policy implementation.

Author Contributions

Conceptualisation, C.Y.Y.; methodology, C.Y.Y.; software, C.Y.Y.; validation, T.M. and C.Y.Y.; formal analysis, C.Y.Y.; investigation, T.M. and C.Y.Y.; resources, C.Y.Y.; data curation, T.M. and C.Y.Y.; writing—original draft preparation, C.Y.Y.; writing—review and editing, T.M. and C.Y.Y.; project administration, C.Y.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research received funding from the University of Auckland Faculty Research Development Fund (RDF 2024, Ref no: 3729664).

Informed Consent Statement

Not applicable.

Data Availability Statement

Acknowledgments

We acknowledge all the comments from the reviewers.

Conflicts of Interest

The authors declare no conflicts of interest.

Notes

| 1 | In November 2016, the government of Hong Kong raised stamp duties for all property transactions to 15% (after several modest measures in the previous few years), resulting in a shift of transactions to smaller-sized housing units. In 2017, the Hong Kong Monetary Authority also reduced the maximum loan-to-value ratio for residential property with a value exceeding HKD 10 million (USD 1.28 million) from 50% to 40%, further reducing transactions of larger-sized housing (Global Property Guide 2024). |

| 2 | Theoretically, there is a natural vacancy rate of less than 4%, so the vacancy effect is expected to be non-linear. However the small number of samples does not provide a statistically significant result if a non-linear effect of vacant homes is estimated. |

References

- Albsoul, Hadeel, Dat Tien Doan, Itohan Esther Aigwi, Nicola Naismith, and Amirhosein Ghaffarianhoseini. 2024. Examining critical factors affecting the housing price in New Zealand: A causal loop diagram model. Journal of Housing and the Built Environment 39: 639–61. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Stephen Bond. 1991. Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. The Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Belke, Ansgar, and Jonas Keil. 2017. Fundamental determinants of real estate prices: A panel study of German regions. International Advances in Economic Research 24: 25–45. [Google Scholar] [CrossRef]

- Bourne, Jonathan. 2019. Empty homes: Mapping the extent and value of low-use domestic property in England and Wales. Palgrave Communications 5: 9. [Google Scholar] [CrossRef]

- Couch, Chris, and Matthew Cocks. 2013. Housing Vacancy and the Shrinking City: Trends and Policies in the UK and the City of Liverpool. Housing Studies 28: 499–519. [Google Scholar] [CrossRef]

- C&SD. 2024. Statistics by Subject. Census and Statistics Department, HKSAR Government. Available online: https://www.censtatd.gov.hk/en/page_8000.html (accessed on 18 January 2024).

- Deng, Yongheng, Congyan Han, Teng Li, and Yonglin Wang. 2024. The effectiveness and consequences of the government’s interventions for Hong Kong’s residential housing markets. Real Estate Economics 52: 324–65. [Google Scholar] [CrossRef]

- Dröes, Martijn I., and Alex van de Minne. 2017. Do the Determinants of House Prices Change over Time? Evidence from 200 Years of Transactions Data, American Economic Association. Available online: https://www.aeaweb.org/conference/2017/preliminary/paper/7NHnQiSz (accessed on 20 January 2024).

- Égert, Balázs, and Dubravko Mihaljek. 2007. Determinants of House Prices in Central and Eastern Europe. BIS Working Papers no. 236. Available online: https://www.bis.org/publ/work236.pdf (accessed on 20 January 2024).

- Fernandez, Rodrigo, Annelore Hofman, and Manuel B. Aalbers. 2016. London and New York as a safe deposit box for the transnational wealth elite. Environment & Planning A 48: 2443–61. [Google Scholar]

- Fritzsche, Carolin, and Lars Vandrei. 2018. Causes of Vacancies in the Housing Market—A Literature Review. IFO Working Papers, 258. Available online: https://www.ifo.de/en/publications/2018/working-paper/causes-vacancies-housing-market-literature-review (accessed on 20 July 2024).

- Gabriel, Stuart A., and Frank Nothaft. 2001. Rental Housing Markets and the Natural Vacancy Rate. Journal of the American Real Estate and Urban Economics Association 16: 121–49. [Google Scholar] [CrossRef]

- Geng, Nan. 2018. Fundamental Drivers of House Prices in Advanced Economies. IMF Working Paper, WP/18/164. Washington: IMF. [Google Scholar]

- Glaeser, Edward, and Joseph Gyourko. 2005. Urban Decline and Durable Housing. Journal of Political Economy 113: 345–75. [Google Scholar] [CrossRef]

- Glindro, Eloisa T., Tientip Subhanij, Jessica Szeto, and Haibin Zhu. 2011. Determinants of house prices in nine Asia-Pacific economies. International Journal of Central Banking 26: 163–204. [Google Scholar] [CrossRef][Green Version]

- Global Property Guide. 2024. Hong Kong’s Housing Market Conditions Continue to Deteriorate. May 6. Available online: https://www.globalpropertyguide.com/asia/hong-kong/price-history (accessed on 20 January 2024).

- Green, Richard, Stephen Malpezzi, and Stephen Mayo. 2005. Metropolitan-specific estimates of the price elasticity of supply of housing, and their sources. The American Economic Review 95: 334–39. [Google Scholar] [CrossRef]

- Hagen, Daniel A., and Julia L. Hansen. 2010. Rental Housing and the Natural Vacancy Rate. Journal of Real Estate Research 32: 413–34. [Google Scholar] [CrossRef]

- Ho, Winky K. O., and Sivaguru Ganesan. 1998. On Land Supply and the Price of Residential Housing. Journal of Housing and the Built Environment 13: 439–52. [Google Scholar] [CrossRef]

- Hoekstra, Joris, and Cyrus Vakili-Zad. 2011. High vacancy rates and rising house prices: The Spanish paradox. Journal of Economic and Human Geography 102: 55–71. [Google Scholar] [CrossRef]

- İnaltekin, Hazer, Robert A. Jarrow, Mehmet Sağlam, and Yildiray Yıldırım. 2011. Housing prices and the optimal time-on-the-market decision. Finance Research Letters 8: 171–79. [Google Scholar] [CrossRef]

- Jacovine, Thiago Corrêa, Kaio Nogueira, Camila Nastari Fernandes, and Gabriel Marques da Silva. 2022. Evidence-Based Planning: A Multi-Criteria Index for Identifying Vacant Properties in Large Urban Centres. Urban Planning 7: 285–98. [Google Scholar] [CrossRef]

- Lerbs, Oliver, and Markus Teske. 2016. The House Price-Vacancy Curve. Discussion Paper No. 16-082. Centre for European Economic Research (ZEW). Available online: http://ftp.zew.de/pub/zew-docs/dp/dp16082.pdf (accessed on 18 January 2024).

- Lui, Hon-Kwong. 2007. The Redistributive Effect of Public Housing in Hong Kong. Urban Studies 44: 1937–52. [Google Scholar] [CrossRef]

- Mayer, Christopher J., and C. Tsuriel Somerville. 2000. Residential Construction: Using the Urban Growth Model to Estimate Housing Supply. Journal of Urban Economics 48: 85–109. [Google Scholar] [CrossRef]

- McClure, Kirk. 2019. The allocation of rental assistance resources: The paradox of high housing costs and high vacancy rates. International Journal of Housing Policy 19: 69–94. [Google Scholar] [CrossRef]

- Molloy, Raven. 2016. Long-term vacant housing in the United States. Regional Science and Urban Economics 59: 118–29. [Google Scholar] [CrossRef]

- Newing, Andy, Owen Hibbert, Jacob Van-Alwon, S. Ellaway, and Alan Smith. 2023. Smart water metering as a non-invasive tool to infer dwelling type and occupancy—Implications for the collection of neighbourhood-level housing and tourism statistics. Computers, Environment and Urban Systems 105: 102028. [Google Scholar] [CrossRef]

- Razavi, Rouzbeh, Amin Gharipour, Martin Fleury, and Ikpe Justice Akpan. 2019. Occupancy detection of residential buildings using smart meter data: A large-scale study. Energy and Buildings 183: 195–208. [Google Scholar] [CrossRef]

- RVD. 2024. Property Market Statistics, Publications. Rating and Valuation Department, HKSAR Government. Available online: https://www.rvd.gov.hk/en/publications/property_market_statistics.html (accessed on 18 January 2024).

- Sirmans, G. Stacy, Lynn MacDonald, David A. Macpherson, and Emily Norman Zietz. 2006. The Value of Housing Characteristics: A Meta Analysis. The Journal of Real Estate Finance and Economics 33: 215–40. [Google Scholar] [CrossRef]

- Smith, Lawrence B. 1974. A Note on the Price Adjustment Mechanism for Rental Housing. American Economic Review 63: 478–81. [Google Scholar]

- Suzuki, Masatomo, and Yasushi Asami. 2020. Shrinking housing market, long term vacancy and withdrawal from housing market. Asia-Pacific Journal of Regional Science 4: 619–38. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, Farhad, Naoyuki Yoshino, and Alvin Chiu. 2019. Internal and External Determinants of Housing Price Booms in Hong Kong, China. ADBI Working Paper Series, № 948. May. Available online: https://www.adb.org/sites/default/files/publication/503436/adbi-wp948.pdf (accessed on 20 January 2024).

- Wheaton, William C. 1990. Vacancy, Search, and Prices in a Housing Market Matching Model. Journal of Political Economy 98: 1270–92. [Google Scholar] [CrossRef]

- Xu, Lu, and Bo Tang. 2014. On the Determinants of UK House Prices. International Journal of Economic Research 5: 57–64. [Google Scholar]

- Yiu, Chung Yim. 2021. Why House Prices Increase in the COVID-19 Recession: A Five-Country Empirical Study on the Real Interest Rate Hypothesis. Urban Science 5: 77. [Google Scholar] [CrossRef]

- Yiu, Chung Yim, and Andrew Y. T. Leung. 2005. A cost-and-benefit evaluation of housing rehabilitation. Structural Survey 23: 138–51. [Google Scholar] [CrossRef]

- Zabel, Jeffrey. 2016. A Dynamic Model of the Housing Market: The Role of Vacancies. Journal of Real Estate Finance and Economics 53: 368–91. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).