1. Introduction

As recalled by

Calverley et al. (

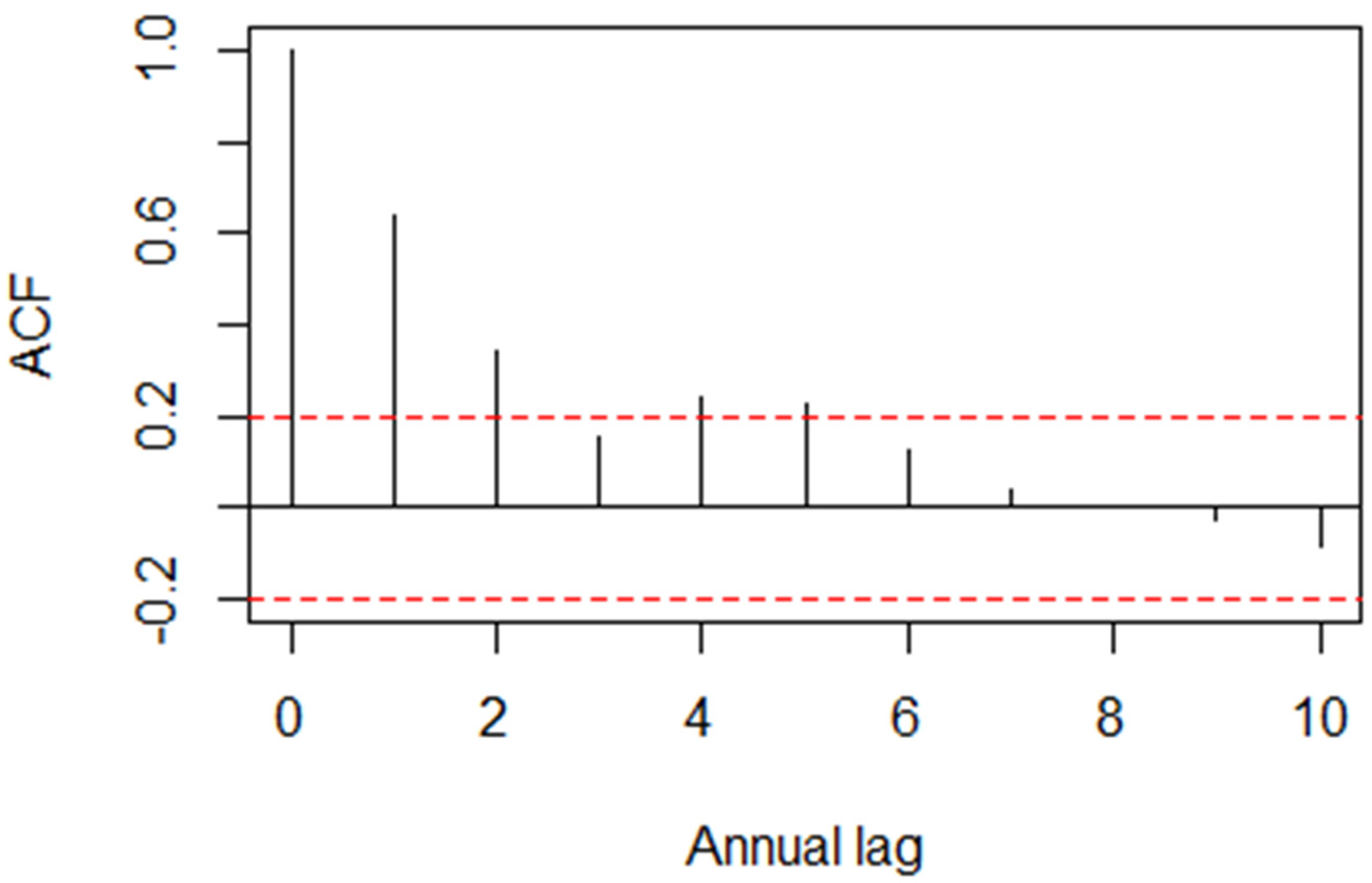

2007), there is convincing empirical evidence on variance clustering in many different markets, including equity, currency, and futures markets, especially when sampling is daily or weekly. Variance clustering implies that daily or weekly variance is not constant, so large price changes of either sign tend to follow previous large changes, whereas small price changes of either sign tend to follow previous small changes. A possible cause is that unexpected news tends to come up in clusters. Since the rates of squared or absolute return are serially correlated, variance tends to revert gradually to an appropriate mean value in the short term.

According to

Franses and van Dijk (

2004), when important stock indices are sampled daily or weekly, their rates of return are not normally distributed. Large negative rates of return are more frequent than large positive rates of return, with outliers being too frequent. Large rates of return tend to occur in clusters that are often triggered by large negative rates of return. As for industrial stocks, the statistical fit of their weekly rates of return is thoroughly examined by

Chiang and Li (

2015).

However, the annual rates of return have different statistical properties from the daily, weekly, or monthly rates of return. As checked once more by

Buzzacchi and Ghezzi (

2023), the monthly real rates of linear return on the S&P Composite Index are asymmetric and leptokurtic, whereas the annual real rates of linear return are normal. Indeed, three distinguished chartered financial analysts claim that if asset allocation and investment horizon are appropriate, “the normal distribution may reasonably be used as an approximate model of portfolio returns” (

Bronson et al. 2007, p. 54).

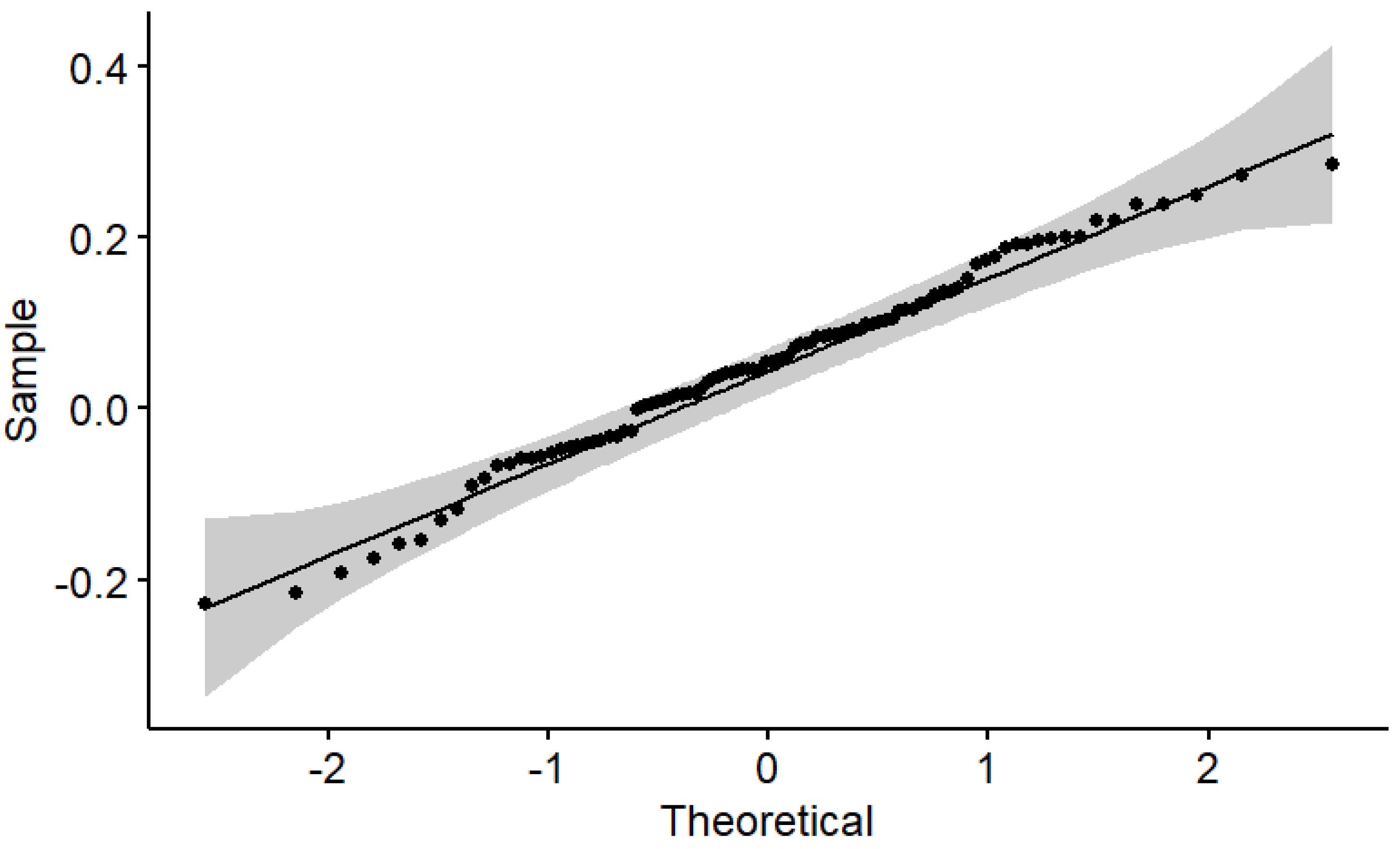

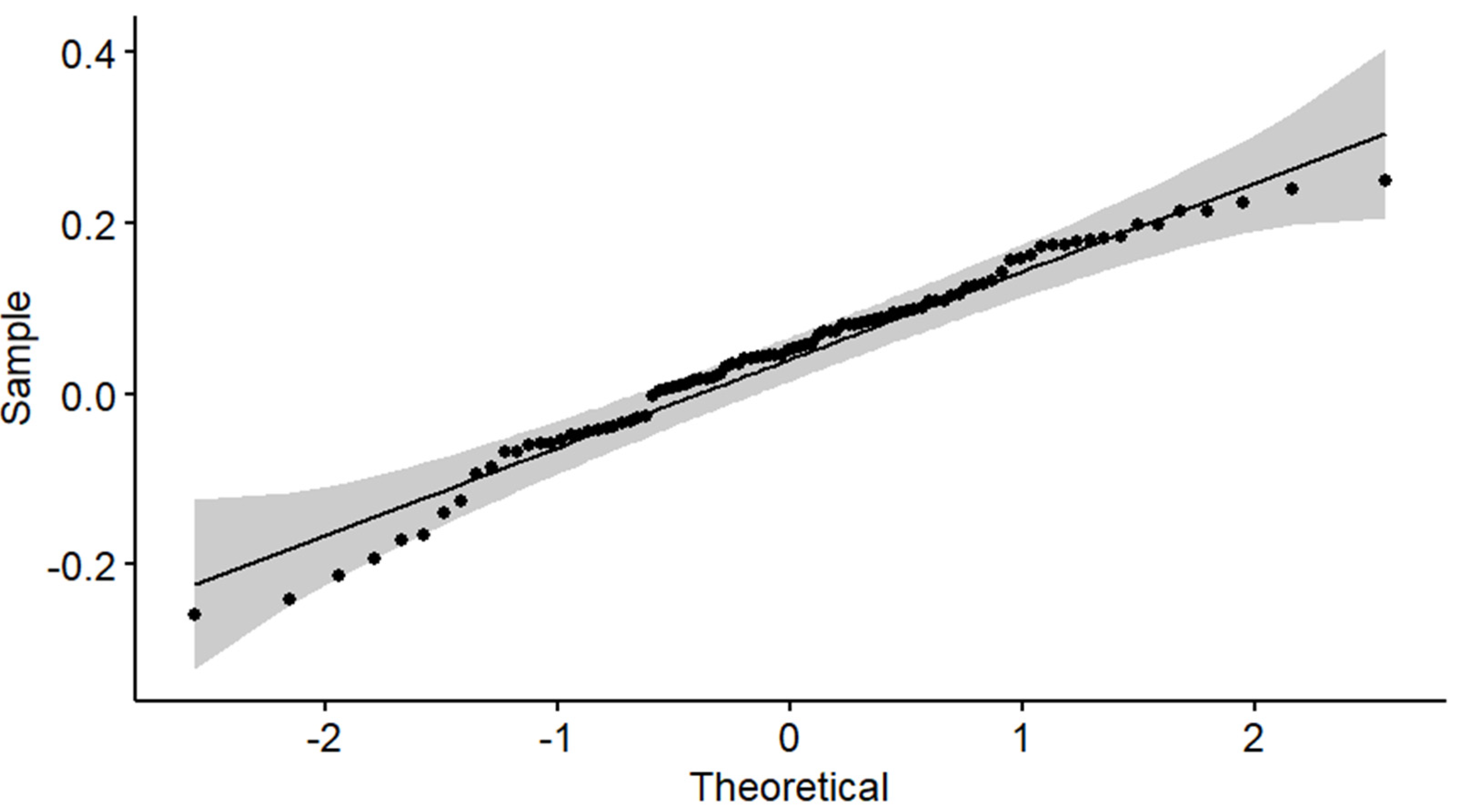

This study reconsiders asset allocations that properly include T-bills, T-bonds, and the S&P 500 stock index by using annual real rates of return downloaded by the home page of Professor Aswath Damodaran, New York University in spring 2024. At first, it carries out a preliminary statistical analysis, finding that such efficient asset allocations are normal and stationary in both mean and variance, while also being almost lognormal.

Next, it takes advantage of such statistical properties and explains once more how an efficient frontier based on the annual real rates of linear return turns into a complementary efficient frontier based on the annual real rates of logarithmic return. When it makes use of the above-mentioned annual real rates of return, appropriate efficient asset allocations in a linear space prove efficient in a logarithmic space as well. All efficient asset allocations are lognormal and made up of both stocks and bonds. It also shows that for each given feasible standard deviation, the resulting efficient asset allocation takes the highest possible arithmetic and geometric means.

Finally, it reconsiders the relationship between logarithmic and geometric means. Expanding on

Kirkwood (

1979), it recalls how to determine an asymmetric confidence interval for an annual geometric mean rate of return. Such a confidence interval comes in useful when calculating an expected long-run capital accumulation.

More generally, rational portfolio management is a systematic process that is composed of three stages, namely planning, executing, and monitoring. Each stage is made up of a few tasks. Feedback and feedforward loops are involved. All stages, tasks, and loops are outlined by

Damodaran (

2012) and thoroughly presented by

Maginn et al. (

2007). Selecting asset classes and target weights is the last task in the planning stage. When doing so, both individual and institutional investors may be assisted by financial advisors (

Farrell 1997;

Maginn et al. 2007). According to business practice, financial advisors should trade off the mean rate of return on a portfolio against the value at risk with an appropriate confidence level (

Bronson et al. 2007). This study bridges a gap in the scientific literature by enabling financial advisors to deal with the question more rigorously.

The plan of this study is as follows: the relevant scientific literature is reviewed in

Section 2, the dataset is described in

Section 3, a preliminary statistical analysis is carried out in

Section 4, theoretical and empirical findings are presented in

Section 5, and conclusions are drawn in

Section 6.

2. Literature Review

Asset allocation concerns the selection of all asset classes and their portfolio weights. It can be stated as a linear-quadratic optimization problem that has a quadratic objective function subject to linear equality and inequality constraints on portfolio weights. The late Dr. Harry Markowitz stated the mean-variance portfolio problem in 1952 (

Markowitz and Todd 2000). He devised the critical line algorithm in 1956, which efficiently determines an entire efficient frontier in a finite number of iterations (

Markowitz and Todd 2000). He was awarded the 1990 Nobel Prize in Economic Sciences. The milestones of his distinguished career are outlined by

Goetzmann (

2023).

The use of optimization, simulation, and sensitivity analysis in support of an asset allocation should be complemented with subjective judgment. All relevant procedures rest on the original mean-variance portfolio problem; they were reviewed by

Sharpe et al. (

2007). Since the original mean-variance portfolio problem deals with the rates of linear return of different asset classes or securities, only arithmetic means are available. Although the arithmetic mean rate of linear return on a portfolio can readily be calculated, it does not lend itself to the determination of an expected capital accumulation.

Let us consider an insightful though peculiar problem of portfolio management by way of an example. Four assumptions are needed: capital is invested only at inception, with coupons and dividends being reinvested; short selling is ruled out; rebalancing occurs once a year to restore the target portfolio weights; and the annual rates of logarithmic return on each portfolio are independent and normally distributed. Since short selling is assumed away, portfolio weights are non-negative. We have

so that each expected long-run accumulation depends on capital, time horizon, and a sample geometric mean. We also have

so that a joint use could be made of the annual rates of logarithmic return, as advocated by

Ghezzi (

2018).

Therefore, two efficient frontiers can be derived from the four above-mentioned assumptions. As is well known (

Markowitz 1991;

Rudolf 1994;

Sharpe et al. 2007 among others), the efficient frontier based on the annual rates of linear return is continuous, upward-sloping, strictly concave, and piecewise hyperbolic. Each hyperbolic piece is matched by dominant and dominated asset classes; the weights of the former are positive, whereas the weights of the latter are zero. Each hyperbolic piece starts from a corner portfolio and ends in another corner portfolio. In each corner portfolio, a dominant asset class may become dominated or vice versa, or both instances may occur. The asset class with the highest arithmetic mean is a corner portfolio.

As proved by

Buzzacchi and Ghezzi (

2020), if a sufficient condition is met, all efficient portfolios based on the annual rates of logarithmic return are also efficient portfolios based on the annual rates of linear return, with the opposite being not true. Moreover, the complementary efficient frontier based on the annual rates of logarithmic return is continuous, upward-sloping, and made up of pieces, each having two corner portfolios as bounds. The main outcomes of

Ghezzi (

2018) and

Buzzacchi and Ghezzi (

2020) are recapitulated in

Appendix A.

Both efficient frontiers are displayed in

Section 5 below, where reference is made to three major US asset classes, namely T-bills, T-bonds, and the S&P 500 stock index. Although the same asset classes are also used by

Buzzacchi and Ghezzi (

2020), historical periods and datasets are different. They check whether the annual rates of logarithmic return on specific portfolios are normally distributed. Such a null hypothesis is rejected for each asset class and some efficient asset allocations, whereas it is not rejected for other efficient asset allocations including all three asset classes.

The aim of this paper is to show that two null hypotheses cannot be rejected. According to the former, the annual rates of linear return on some asset allocations are normally distributed. According to the latter, the annual rates of logarithmic return on the same asset allocations are normally distributed. Let

r be an annual rate of linear return and

be the attendant annual rate of logarithmic return. Since the above-mentioned asset allocations include the S&P 500 stock index, T-bonds, and possibly T-bills, Taylor’s expansion truncated at the first order

may be a feasible approximation. Needless to say, whenever both null hypotheses are not rejected, statistical evidence is stronger for the annual rates of linear return.

Both efficient frontiers come in useful when selecting an asset allocation. As documented by

Sharpe et al. (

2007), asset allocation is the main driving factor of portfolio performance. As proved by

Sharpe (

1991), if commissions, fees, and personal taxes are assumed away, both market timing and security selection are zero-sum games. As explained by

Henriksson and Merton (

1981), effective market timing follows from macroforecasting skills, whereas effective security selection follows from microforecasting skills.

Financial advisors may assist both individual and institutional investors (

Farrell 1997;

Maginn et al. 2007). When selecting an asset allocation along with a client, financial advisors should check that investment objectives are consistent with risk tolerance. According to business practice, they should trade off the mean rate of return on a portfolio against the value at risk (

Bronson et al. 2007). As explained in the following, resorting to both efficient frontiers lays a more solid scientific foundation for business practice.

Unfortunately, the means and (co)variances of the annual real rates of linear return are hard to specify, whatever the asset classes (

Sexauer and Siegel 2024). According to

Black (

1993), means are harder to estimate than (co)variances. Moreover, efficient asset allocations are very sensitive to small changes in means and (co)variances and, hence, in estimation errors. As reported by

Luenberger (

2014) and

Sharpe et al. (

2007), among others, simulation studies have shown that errors in means have a much larger impact than errors in (co)variances. Owing to possible estimation errors, efficient asset allocations may have extreme weights so that important asset classes may be unrepresented. As explained by

Gibson and Sidoni (

2013), a heuristic remedy is to place lower and upper bounds on the weights of all asset classes so that a considerable part of an asset allocation is decided in advance. Although the resulting efficient asset allocations are suboptimal, they benefit from broad diversification because they include all asset classes. The imposition of additional constraints on stock portfolios is investigated in the pioneering work by

Frost and Savarino (

1988).

Abate et al. (

2022) reviewed the relevant literature and extended the analysis to the constrained diversification across the sectors of the MSCI All Country World Index.

3. Dataset

Data were downloaded in the spring of 2024 from the home page of Professor Aswath Damodaran, New York University. Data cover the historical period 1928–2023 and take the form of annual rates of return, both nominal and real. Three major US asset classes were selected: 3-month T-bills, 10-year T-bonds, and the S&P 500 stock index.

As explained by Professor Damodaran, the rates of return on the S&P 500 take dividends into account, the rates of return on 3-month T-bills are annual averages, and the yields to maturity on 10-year US T-bonds are provided by FRED, the database run by the Federal Reserve Bank of St. Louis. Professor Damodaran had turned yields to maturity into rates of return under the convenient assumption that 10-year T-bonds are issued at par. In total, 96 annual real rates of linear return as well as 96 annual real rates of logarithmic return were downloaded for each asset class along with 96 annual rates of inflation.

The sample statistics are reported in

Table 1 for linear rates and in

Table 2 for logarithmic rates.

Linear and logarithmic rates display the same percentage of negative rates by definition; such percentages are higher for T-bills and T-bonds, in spite of narrower ranges. As expected, the annual real rates of linear return on the S&P 500 have a very modest asymmetry and kurtosis excess. This is a clue that they are normally distributed.

The logarithmic rates on T-bills and the S&P 500 stock index tend to display more asymmetry and kurtosis excess than linear rates. In contrast, the logarithmic rates on T-bonds tend to display less asymmetry than linear rates, with kurtosis excess remaining unchanged.

The correlation matrix is reported in

Table 3 for both linear and logarithmic rates, which display very similar cross-correlations. The S&P 500 stock index is poorly correlated with both T-bills and T-bonds.

6. Conclusions

An efficient frontier is determined in this study by applying the critical line algorithm to almost a century of data on T-bills, T-bonds, and the S&P 500 stock index. The annual real rates of linear return on some intermediate efficient asset allocations are shown to be stationary in mean and variance and to benefit from aggregational normality, while also being almost lognormal. However, the possible occurrence of structural breaks is not examined.

Each intermediate efficient asset allocation includes an appropriate mix of stocks and bonds. The latter plays a twofold role: as remarked by

Graham et al. (

2006) and

Gibson and Sidoni (

2013), among others, bonds mitigate risk; moreover, since they reduce the range of possible outcomes, they also make the normal efficient asset allocations almost lognormal.

Upon assuming that the annual real rates of logarithmic return are independent and normally distributed, a complementary efficient frontier is also determined. Since some efficient asset allocations are almost lognormal, each given feasible standard deviation is matched by the highest possible arithmetic and geometric means. An asymmetric confidence interval for an annual geometric mean rate of return is eventually derived so that an expected long-run capital accumulation can be calculated more accurately.

According to business practice, financial advisors should trade off the annual mean rate of return on a portfolio against the annual value at risk with a 97.72% confidence level. This study bridges a gap in the scientific literature by enabling financial advisors to deal with the question more rigorously. When trading off reward against risk, financial advisors should make use of the above-mentioned annual geometric mean rate of return. Since emphasis is placed on the very long run, reference is made to a strategic asset allocation rather than to a tactical one.

The present treatment has two main limitations. On the one hand, it does not fix the main drawback of the mean-variance approach: the means and (co)variances of the annual rates of linear return are hard to specify. On the other hand, it deals with long-only asset allocations without admitting the statement of additional inequality constraints.