Data-Driven Sustainable Investment Strategies: Integrating ESG, Financial Data Science, and Time Series Analysis for Alpha Generation

Abstract

1. Introduction

1.1. Data-Driven Strategies, Environmental, Social, and Governance Integration, and Alpha Generation in Modern Investment Practices

1.2. Statistics and Trends in Environmental, Social, and Governance Investing

1.3. Enhancing Data Science Techniques

1.4. Research Objectives

1.5. Review of Existing Literature

1.5.1. Descriptive Statistics in Data Analysis

1.5.2. Impact of Environmental, Social, and Governance Performance on Firm Value

1.5.3. Financial Time Series Analysis

1.5.4. Predictive Analysis Using Social Media Sentiments

1.5.5. Data-Driven Investment Strategies

1.5.6. Environmental, Social, and Governance Factors in Investment Decisions

1.5.7. Bibliometric Review of Environmental, Social, and Governance Factors and Risk

1.5.8. Data-Driven Approaches in Stock Market Investment

1.5.9. Integration of Artificial Intelligence and Data Science in Finance

1.5.10. Environmental, Social, and Governance Strategies and Dividend Payout Policies

1.5.11. Environmental, Social, and Governance Risk and Firm Value

1.5.12. Factors Affecting Environmental, Social, and Governance Considerations and Their Investment Impact

1.5.13. Correlation between Environmental, Social, and Governance Ratings and Financial Variables

1.5.14. Analyses and Tests Using the Vector Autoregressive Model

1.5.15. Environmental, Social, and Governance Disclosure by Firms

2. Materials and Methods

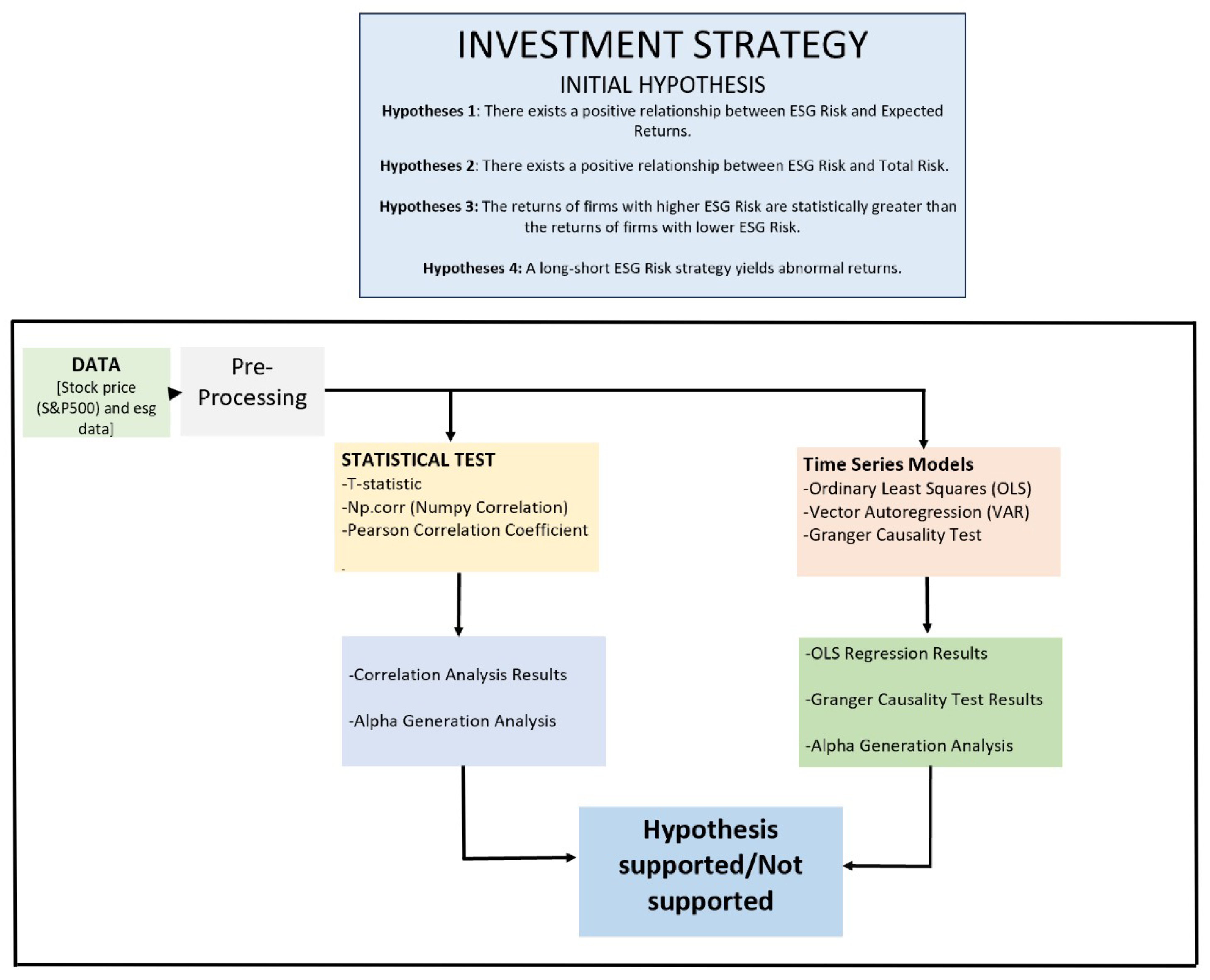

2.1. Developing an Investment Idea

- Research Question 1: We seek to understand the relationship between corporate governance, environmental, and social responsibility and stock returns/risk. Are these factors correlated with financial performance, and, if so, to what extent?

- Research Question 2: Assuming a relationship exists, can it be leveraged to achieve abnormal returns, i.e., returns that exceed what would be expected given the level of risk taken?

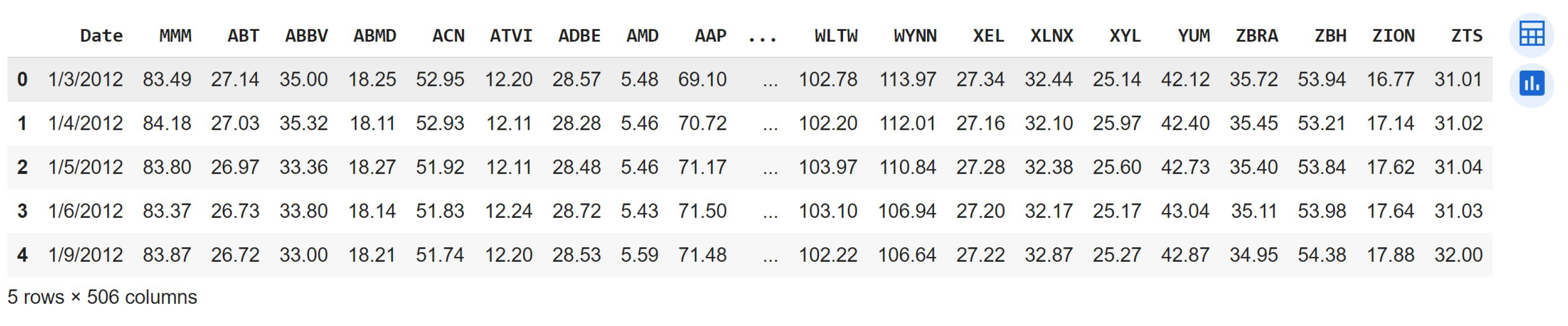

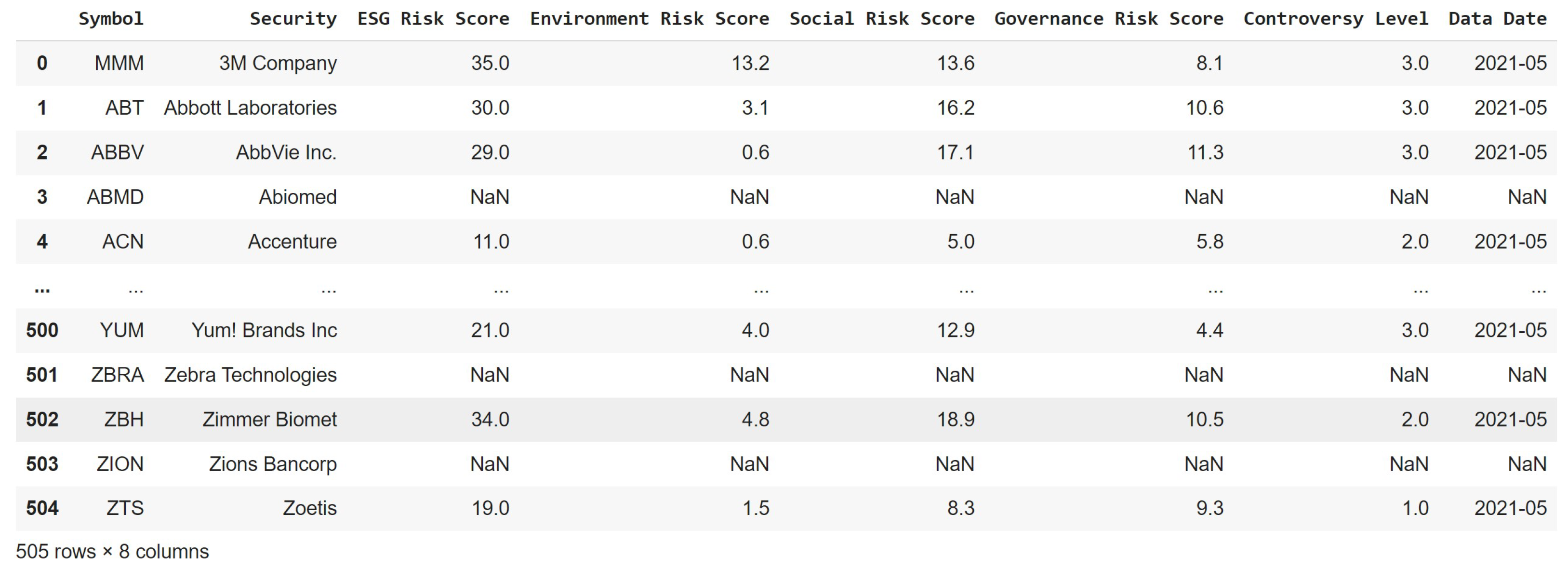

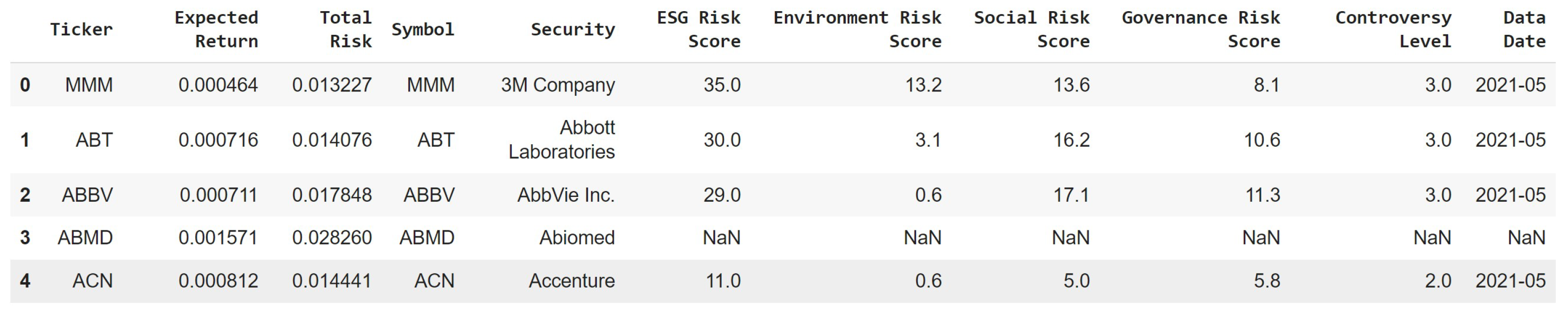

2.2. Sourcing Relevant Data: Data Collection and Pre-Processing

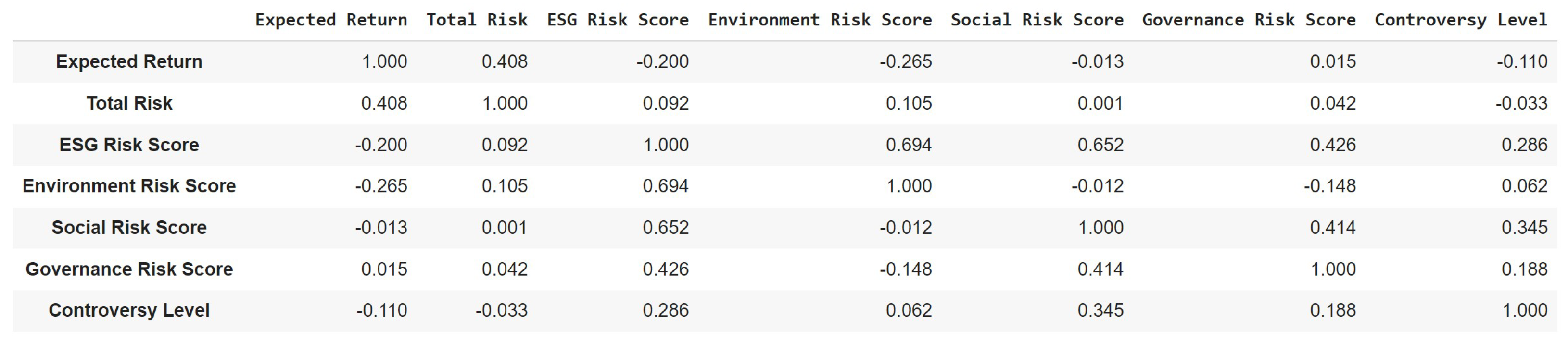

2.3. Statistical Techniques and Time Series Analysis

2.3.1. t-Stat Correlation

- -

- = t-statistic;

- -

- = correlation coefficient;

- -

- n = sample size.

- Dependent variable: expected returns of sustainable investment portfolios ();

- Independent variable: ESG Risk Score ().

- Dependent variable: total risk ();

- Independent variable: ESG Risk Score ().

- represents the t-statistic for the correlation coefficient ();

- is the correlation coefficient between ESG risk and expected returns;

- n is the sample size.

- represents the t-statistic for the correlation coefficient ();

- is the correlation coefficient between ESG risk and total risk;

- n is the sample size.

- -

- = t-statistic;

- -

- = expected return of the first quintile (Q1);

- -

- = estimated standard deviation of the difference in returns between Q1 and Q5;

- -

- n = sample size.

2.3.2. Correlation Analysis (Pearson Correlation Coefficient)

- -

- and are individual data points;

- -

- ∑ denotes the sum across all data points;

- -

- n is the sample size.

- is the Pearson correlation coefficient between ESG risk and expected returns;

- and represent the individual data points of ESG risk and expected returns, respectively;

- ∑ denotes the sum across all data points;

- n is the sample size.

- is the Pearson correlation coefficient between ESG risk and total risk;

- and represent the individual data points of ESG risk and total risk, respectively;

- ∑ denotes the sum across all data points;

- n is the sample size.

- is the Pearson correlation coefficient between the returns of the Q1 and Q5 ESG portfolios;

- and represent the individual data points of returns for the Q1 and Q5 portfolios, respectively;

- ∑ denotes the sum across all data points;

- n is the sample size.

- is the Pearson correlation coefficient between returns of the long–short ESG portfolio and market returns;

- and represent the individual data points of returns for the long–short ESG portfolio and market returns, respectively;

- ∑ denotes the sum across all data points;

- n is the sample size.

2.3.3. Ordinary Least Squares Regression Analysis

- -

- y is the dependent variable;

- -

- x is the independent variable;

- -

- is the intercept (constant term);

- -

- is the slope coefficient;

- -

- is the error term (residuals).

- is the dependent variable;

- is the independent variable;

- is the intercept (constant term);

- is the slope coefficient;

- is the error term (residuals).

- is the dependent variable;

- is the independent variable;

- is the intercept (constant term);

- is the slope coefficient;

- is the error term (residuals).

- Returns is the dependent variable;

- is the independent variable representing different ESG risk quintiles;

- is the intercept (constant term);

- is the slope coefficient;

- is the error term (residuals).

- Returns is the dependent variable;

- is the independent variable representing the long–short ESG portfolio;

- is the intercept (constant term);

- is the slope coefficient;

- is the error term (residuals).

2.3.4. Vector Autoregression

- is a vector of endogenous variables at time t;

- is a vector of intercept terms;

- are coefficient matrices for lag i (for );

- is a vector of error terms at time t.

2.3.5. Granger Causality Test (Vector Autoregression)

2.3.6. Quintile Analysis (Sorting Environmental, Social, and Governance Data into Quintiles)

2.3.7. Capital Asset Pricing Model for Alpha Estimation

- -

- = return on a quintile ESG portfolio i at time t;

- -

- = intercept term (abnormal return in this context);

- -

- = slope;

- -

- = return on the market portfolio;

- -

- = risk-free rate.

3. Results

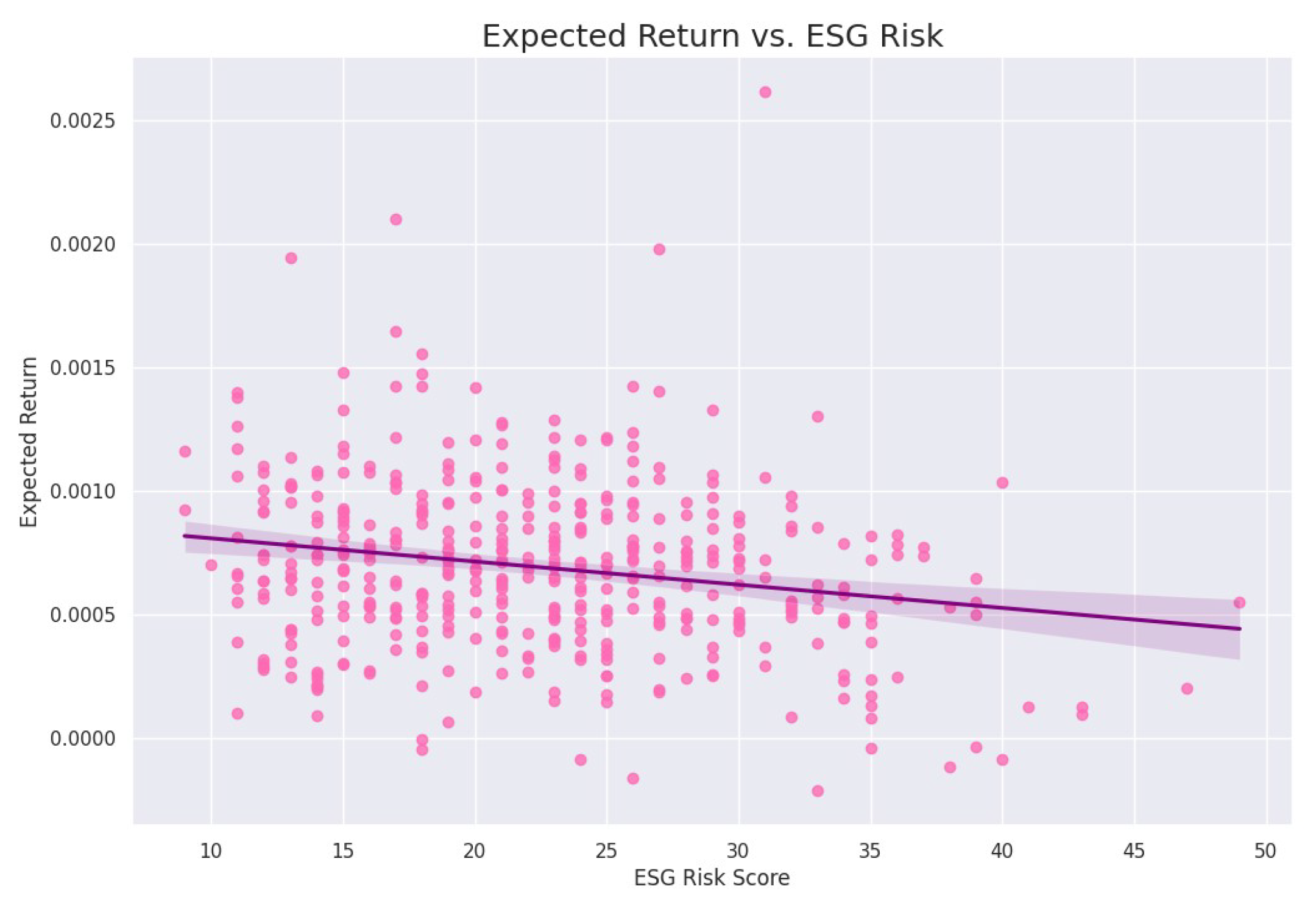

3.1. Testing Hypothesis 1: There Exists a Positive Relationship between Environmental, Social, and Governance Risk and Expected Returns

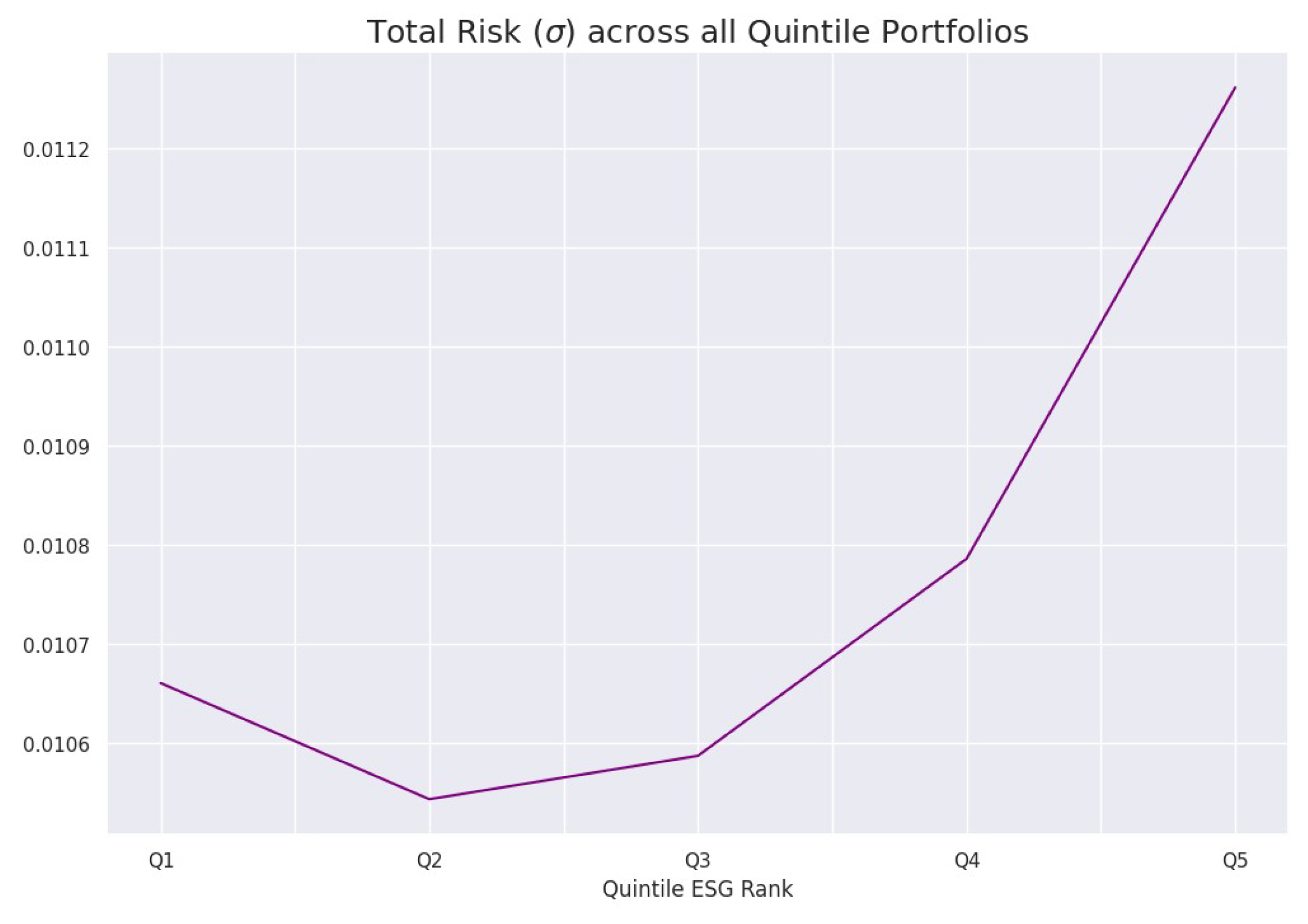

3.2. Testing Hypothesis 2: There Exists a Positive Relationship between Environmental, Social, and Governance Risk and Total Risk

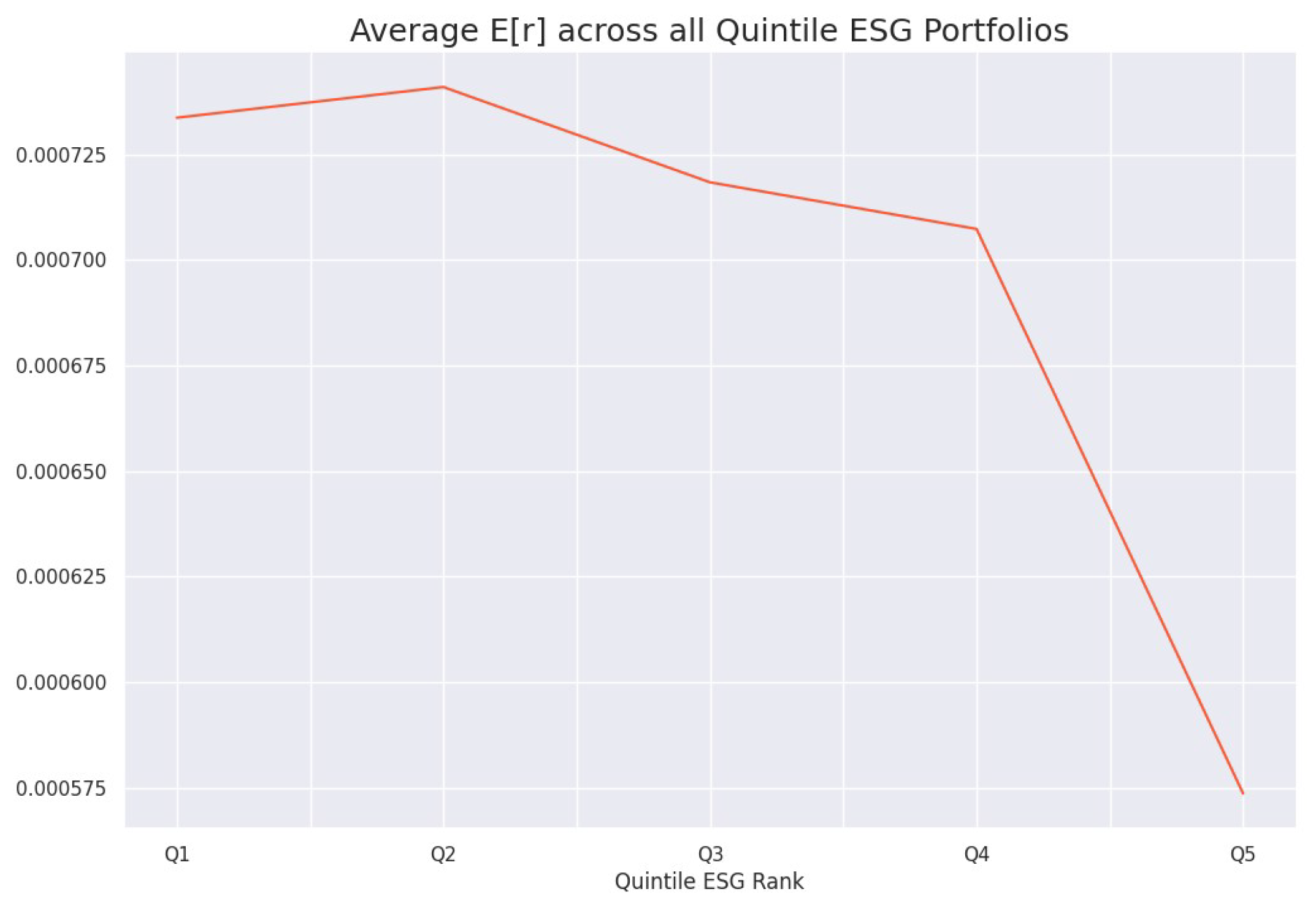

3.3. Testing Hypothesis 3 (Updated): Returns of Firms with Lower Environmental, Social, and Governance Risk Are Statistically Greater Than the Returns of Firms with Higher Environmental, Social, and Governance Risk

3.4. Testing Hypothesis 4: A Long–Short Environmental, Social, and Governance Risk Strategy Yields Abnormal Returns

4. Discussion

5. Conclusions

5.1. Summary of Key Findings

5.2. Investor-Focused Strategic Recommendations for Environmental, Social, and Governance Integration

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| ESG | Environmental, social, and governance |

| CAPM | Capital Asset Pricing Model |

| VAR | Vector Autoregression |

| OLS | Ordinary Least Squares Regression |

References

- Abdey, James S. 2023. Introduction to Mathematical Statistics. ST1215. This Guide Was Prepared for the University of London by: James S. Abdey, BA (Hons), MSc, PGCertHE, PhD, Department of Statistics, London School of Economics and Political Science. This Is One of a Series of Subject Guides Published by the University. Published by: University of London. © University of London 2023. Available online: https://www.lse.ac.uk/study-at-lse/uolip/Assets/documents/ST1215-Introduction-to-mathematical-statistics.pdf (accessed on 2 April 2024).

- Aich, Satyabrata, Ayusha Thakur, Deepanjan Nanda, Sushanta Tripathy, and Hee-Cheol Kim. 2021. Factors Affecting ESG towards Impact on Investment: A Structural Approach. Sustainability 13: 10868. [Google Scholar] [CrossRef]

- Akkaya, Murat. 2021. Vector Autoregressive Model and Analysis. In Handbook of Research on Emerging Theories, Models, and Applications of Financial Econometrics. Cham: Springer. [Google Scholar] [CrossRef]

- Asgarov, Ali. 2023. Predicting Financial Market Trends using Time Series Analysis and Natural Language Processing. arXiv arXiv:2309.00136. [Google Scholar] [CrossRef]

- Aydoğmuş, Mahmut, Güzhan Gülay, and Korkmaz Ergun. 2022. Impact of ESG performance on firm value and profitability. Borsa Istanbul Review 22 Suppl. 2: S119–S127. [Google Scholar] [CrossRef]

- Buckle, M., and E. Beccalli. 2011. Principles of Banking and Finance. FN1024, 2790024. Undergraduate Study in Economics, Management, Finance and the Social Sciences. This Guide Was Prepared for the University of London International Programmes by: M. Buckle, MSc, PhD, Senior Lecturer in Finance, European Business Management School, Department of Accounting, University of Wales, Swansea. E. Beccalli, Visiting Senior Fellow in Accounting, London School of Economics and Political Science. This Is One of a Series of Subject Guides Published by the University. Published by: University of London. © University of London 2011. Available online: https://www.coursehero.com/file/83165270/1-PBF-FN1024-VLE-full-version-2011pdf/ (accessed on 2 April 2024).

- Chakraborti, A., M. Patriarca, and M. S. Santhanam. 2007. Financial Time-series Analysis: A Brief Overview. In Econophysics of Markets and Business Networks. Edited by A. Chatterjee and B. K. Chakrabarti. Milano: Springer. [Google Scholar]

- Cleff, Thomas. 2019. Applied Statistics and Multivariate Data Analysis for Business and Economics: A Modern Approach Using SPSS, Stata, and Excel. Cham: Springer Nature. ISBN 9783030177676. [Google Scholar]

- Cohen, Gil. 2023. The impact of ESG risks on corporate value. Review of Quantitative Finance and Accounting 60: 1451–68. [Google Scholar] [CrossRef]

- De Giuli, Maria Elena, Daniele Grechi, and Alessandra Tanda. 2024. What do we know about ESG and risk? A systematic and bibliometric review. Corporate Social Responsibility and Environmental Management 31: 1096–108. [Google Scholar] [CrossRef]

- Dong, Yihang. 2023. Descriptive Statistics and Its Applications. Highlights in Science, Engineering and Technology 47: 16–23. [Google Scholar] [CrossRef]

- Ehlers, Torsten, Ulrike Elsenhuber, Anandakumar Jegarasasingam, and Eric Jondeau. 2022. Deconstructing ESG Scores: How to Invest with Your Own Criteria. BIS Working Papers No 1008, 15 March 2022. Available online: https://ssrn.com/abstract=4058612 (accessed on 2 April 2024).

- Farooq, Akeel, and Privanka Chawla. 2021. Review of Data Science and AI in Finance. Paper presented at International Conference on Computing Sciences (ICCS), Phagwara, India, December 4–5; pp. 216–22. [Google Scholar] [CrossRef]

- Gupta, Akshat, Utkarsh Sharma, and Sandeep Kumar Gupta. 2021. The Role of ESG in Sustainable Development: An Analysis Through the Lens of Machine Learning. Paper presented at 2021 IEEE International Humanitarian Technology Conference (IHTC), Virtual, December 2–4; pp. 1–5. [Google Scholar] [CrossRef]

- Horton, Cole, and Simon Jessop. 2022. Positive ESG Performance Improves Returns Globally, Research Shows. Reuters. Available online: https://www.reuters.com/business/sustainable-business/positive-esg-performance-improves-returns-globally-research-shows-2022-07-28/ (accessed on 2 April 2024).

- Lin, Woon Leong, Siong Hook Law, Jo Ann Ho, and Murali Sambasivan. 2019. The causality direction of the corporate social responsibility—Corporate financial performance Nexus: Application of Panel Vector Autoregression approach. The North American Journal of Economics and Finance 48: 401–18. [Google Scholar] [CrossRef]

- Narukulla, Sri Sai Hites. 2022. A Data-Driven approach to Stock Market Investment. IJRTI 7: 1439–41. Available online: https://www.ijrti.org/papers/IJRTI2206215.pdf (accessed on 7 March 2024).

- Niccolò, Nirino, Enrico Battisti, Armando Papa, and Nicola Miglietta. 2020. Shareholder value and dividend policy: The role of ESG strategies. Paper presented at 2020 IEEE International Conference on Technology Management, Operations and Decisions (ICTMOD), Marrakech, Morocco, November 24–27; pp. 1–5. [Google Scholar] [CrossRef]

- PwC. 2022. ESG-Focused Institutional Investment Seen Soaring 84% to USD 33.9 Trillion in 2026, Making Up 21.5% of Assets under Management: PwC Report. Available online: https://www.pwc.com/id/en/media-centre/press-release/2022/english/esg-focused-institutional-investment-seen-soaring-84-to-usd-33-9-trillion-in-2026-making-up-21-5-percent-of-assets-under-management-pwc-report.html (accessed on 2 April 2024).

- Qi, Xin-Zhou, Zhong Ning, and Meng Qin. 2022. Economic policy uncertainty, investor sentiment and financial stability—An empirical study based on the time varying parameter-vector autoregression model. Journal of Economic Interaction and Coordination 17: 779–99. [Google Scholar] [CrossRef] [PubMed]

- Singh, Harman. 2024. Machine Learning Algorithms for Trading: Predictive Modeling and Portfolio Optimization (Part 2- Research Project). Medium, January 11. [Google Scholar]

- Stiadi, Doni. 2023. Moderating Environmental, Social, and Governance (ESG) risk in the relationship between investment decisions and firm value. IOP Conference Series: Earth and Environmental Science 1177: 012007. [Google Scholar] [CrossRef]

- Ye, Xuan. 2021. A Data-Driven Study on Investment Strategies for P2P Lending Platforms. Paper presented at 2021 2nd International Conference on E-Commerce and Internet Technology (ECIT), Hangzhou, China, March 5–7; pp. 429–35. [Google Scholar] [CrossRef]

| Hypothesis | Correlation Analysis | OLS Regression | Granger Causality Test | Annualized Alpha | Hypothesis Outcome |

|---|---|---|---|---|---|

| H1 | Negative Correlation | Negative Coefficient (Non-Significant) | Fail to reject null hypothesis | Not Applicable | Hypothesis Not Supported |

| H2 | Positive Correlation (Weak) | Positive Coefficient (Significant) | Fail to reject null hypothesis | Not Applicable | Hypothesis Supported |

| H3 (Updated) | Significant Difference in Returns | Positive Coefficient (Significant) | Reject null hypothesis | Not Applicable | Hypothesis Supported |

| H4 | Weak Negative Correlation | Positive Coefficient (Significant) | Fail to reject null hypothesis | Positive Annualized Alpha (4.37%) | Hypothesis Supported |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sorathiya, A.; Saval, P.; Sorathiya, M. Data-Driven Sustainable Investment Strategies: Integrating ESG, Financial Data Science, and Time Series Analysis for Alpha Generation. Int. J. Financial Stud. 2024, 12, 36. https://doi.org/10.3390/ijfs12020036

Sorathiya A, Saval P, Sorathiya M. Data-Driven Sustainable Investment Strategies: Integrating ESG, Financial Data Science, and Time Series Analysis for Alpha Generation. International Journal of Financial Studies. 2024; 12(2):36. https://doi.org/10.3390/ijfs12020036

Chicago/Turabian StyleSorathiya, Afreen, Pradnya Saval, and Manha Sorathiya. 2024. "Data-Driven Sustainable Investment Strategies: Integrating ESG, Financial Data Science, and Time Series Analysis for Alpha Generation" International Journal of Financial Studies 12, no. 2: 36. https://doi.org/10.3390/ijfs12020036

APA StyleSorathiya, A., Saval, P., & Sorathiya, M. (2024). Data-Driven Sustainable Investment Strategies: Integrating ESG, Financial Data Science, and Time Series Analysis for Alpha Generation. International Journal of Financial Studies, 12(2), 36. https://doi.org/10.3390/ijfs12020036