1. Introduction

The knowledge and organizational resources of the current competitive business environment have received substantial attention in the voyage of global competitiveness in the twenty-first century (

Egbu 2004;

Ramezan 2011), which created a new era in intangible resources management or intellectual capital (IC) that build a foundation for sustainable competitive advantages at the firm level (

Barney 1991;

Drucker 1993). Thus, IC is regarded as the bedrock of modern business since it supports organizational success and growth by optimally combining intellectual and physical resources to achieve greater productivity, firm performance, and value creation (

Drucker 1993;

Stewart 1997;

Sveiby 1997;

Zack 1999;

Tan et al. 2008). Surprisingly, the key reason for the IC attributing to improved firm performance (FP) is the creation of competitive advantages for a firm among peers (

Bontis 2001;

Tan et al. 2008) that propels the social and economic development of a nation, and therefore, it occupies the priority position in the organizational hierarchy for corporate value and improved FP (

Abeysekera and Guthrie 2005;

Stewart 1997). The literature describes the importance of IC on FP from two different schools of thought, i.e., cost concern and value creation (

Grassmann 2021;

Zhang et al. 2020).

The cost concern theory endorses that corporate investment causes cash outlay and reduces the FP. In contrast, the value creation perspective proposes that corporate investment enhances the FP by building competitive advantages and stakeholder relationships (

Grassmann 2021;

Zhang et al. 2020). A similar phenomenon is also observed in the IC literature where investment in IC increases FP (

Bayraktaroglu et al. 2019;

Bozbura 2004), but excess investment in IC results in cash outflows and lower FP (

Asif et al. 2020;

Xu et al. 2022). Therefore, the literature suggests that the linear relationship (i.e., positive or negative) between IC and FP may not be that visible in reality, as an increase in investment in IC is unlikely to increase the FP endlessly (

Asif et al. 2020;

Xu et al. 2022). The firms are faced with resource constraints and limits on the expertise of firms to effectively manage resources, beyond which pursuing IC could be burdensome. Thus, the entire scenario points towards a curvilinear relationship rather than a linear one. Further, the curvilinear relationship consists of two groups, viz., U-shaped (inverted U-shaped) relationship, based on the premise that an investment (spending) may increase (decrease) FP up to a threshold limit (

Grassmann 2021;

Sun et al. 2019). The extant literature explains the U-shaped relationship from the “too little of a good thing” effect perspective, where a firm needs to spend a minimal amount to increase the FP (

Grassmann 2021;

Sun et al. 2019). In contrast, the inverted U-shaped relationship can be explained through the “too much of a good thing” effect (

Grassmann 2021) and has been supported by the extant literature (

Asif et al. 2020;

Xu and Zhang 2021;

Xu et al. 2022). The scholarly work of

Pierce and Aguinis (

2013) describes the “too much of a good thing” effect in the field of management. They advocate that the positive relationship between dependent and independent variables is always not monotonic. After reaching the context-specific inflection point, this relationship transits from positive to negative and forms a curvilinear pattern. Hence, the positive relationship between IC and FP need not necessarily follow the monotonic path and can take the shape of curvilinearity due to the excessive investment in IC, resulting in a huge cash outflow, and may have an adverse effect on FP (

Asif et al. 2020;

Xu and Zhang 2021;

Xu et al. 2022).

In view of the previous literature (

Asif et al. 2020;

Xu and Zhang 2021;

Xu et al. 2022) examining the non-linear link between IC and financial performance or competitiveness, this study attempts to add to the existing literature in the following ways. First, this study examines the IC and FP relationship using cost concern and value creation perspectives. The research used resource-based theory (RBT) and stakeholder theory to conclude the relationship between IC and FP. Second, this study examines the prospect of interference of firm-specific aspects in IC and FP, which has not yet been investigated. Researchers strongly recommend that firm-level attributes, such as firm size, profitability, ownership structure, and many more, play important roles in shaping the IC (

Bozzolan et al. 2006;

Whiting and Woodcock 2011). However, the influence of ownership structure and the presence of BIG4 auditors exhibit a significant role in both IC and FP (

Bamiatzi et al. 2014;

Cerbioni and Parbonetti 2007;

Purkayastha et al. 2022). The ownership structure in the Indian environment is highly complex due to the dominance of business group firms (

Mohapatra and Mishra 2021;

Purkayastha et al. 2022). Although the group affiliation has certain benefits, like access to organizational assets and internal capital from the parent company that helps improve the FP, the same is coupled with disadvantages, such as principal–principal agency conflict, i.e., conflict of interest between major and minority shareholders. Most interestingly, the severity of principal–principal agency conflict due to group affiliation is more prevalent in emerging economies like China, India, South Korea, Thailand, and Russia (

Purkayastha et al. 2022;

Young et al. 2008).

Similarly, the role of auditors, especially BIG4 auditing firms, is more critical in the Indian scenario due to past corporate scandals (

Al-ahdal and Hashim 2022). Those corporate collapses trigger the importance of BIG4 auditors for better audit quality and governance (

Al-ahdal and Hashim 2022;

Dezoort et al. 2001;

Fan and Wong 2005). Hence, the group affiliation and presence of BIG4 auditors emerge as influential moderators due to their severity in the Indian context. Thus, this study expects that the relationship between IC and FP may not be similar in the presence or absence of group affiliation and BIG4 auditors. Third, the presence of BIG4 auditors in group-affiliated firms and their impact on the IC and FP relationship is still in a dilemma, as none of the previous research explored these dimensions in any context. However, in the Indian scenario, the large client base of the BIG 4 auditors due to economies of scale (

Johl et al. 2016), as well as the preference of affiliated firms for BIG4 auditors in emerging economies with an aim for better audit quality (

Ocak et al. 2021), create a base for further exploration in the Indian context. In addition to these, the innovative environment, internal resource sharing, functional stability in group-affiliated firms (

Bamiatzi et al. 2014;

Claessens et al. 2006;

Hsieh et al. 2010), and their approach toward BIG4 auditing firms (

Johl et al. 2016;

Ocak et al. 2021) may create a synergy that may boost both IC and FP. So, this study finds it worth examining to investigate the role of BIG4 auditors in group-affiliated firms for impacting the FP through IC. Therefore, it suggests a possible moderated moderation relationship in the Indian context.

In addition to the above characteristics of the Indian scenario for positioning the present research, the reporting practices of Indian companies further distinguish this research. The Indian Accounting Standards (Ind AS 1)

1 for preparing financial statements are not the same as the International Financial Reporting Standards (IFRS), as India adopted the converged version of IFRS after considering the operationalization of Indian firms. For example, IFRS permits the compilation of two distinct statements or a single statement of profit and loss and comprehensive income, whereas Ind AS 1 only allows the preparation of a single profit and loss statement. In a similar vein, IFRS principles permit organizations to categorize expenses according to their function or nature, whereas Ind AS 1 permits entities to recognize expenses in accordance with their nature only. Similarly, the Indian Accounting Standards (Ind AS 110) also state that the firm has to prepare a consolidated financial statement when it controls one or more subsidiaries or affiliated entities so that it may help the stakeholders understand the business operation of parent and affiliated companies. In addition to the abovementioned situation, IC reporting remains optional in India due to the lack of specific accounting standards. While Ind AS 38 does address intangible assets, its main purpose is to establish principles for the accounting treatment of intangible assets that are developed internally or externally. Despite the absence of a compulsory reporting requirement, prominent Indian corporations such as Reliance Industries, TCS, and ITC have adopted the practice of including their IC as an integral element in their annual reports. So, the above dynamics relating to IC and the unique Indian setting due to distinct accounting practices and complex ownership structure (

Mohapatra and Mishra 2021;

Purkayastha et al. 2022) motivate this study to investigate deeper to examine the identified research gaps.

After considering the sample firms from the National Stock Exchange (NSE) India and examining the linear and curvilinear relationship with group affiliation and BIG4 auditors as moderation and moderated moderation, this study contributes to the literature in the following ways. First, it reconciles the positive linear relationship between IC and FP with an inverted U-shaped curvilinear approach. It claims that the IC will enhance FP, but after a certain point, the additional investment in IC will gradually decrease the overall FP. Thus, our findings provide further recommendations to managers intending to use the IC to yield a better FP, especially in the Indian scenario. Second, this study strengthens the existing literature by advocating the role of group affiliation and BIG4 auditors in the Indian context in shaping the IC and FP relationship. Third, our research claims that the presence of BIG4 auditors in affiliated firms produces different results in IC and FP. So, the management of IC in affiliated firms where BIG4 auditors are present may be more critical for FP than non-BIG4-audited firms. So, this study could assist academia and researchers in conceptualizing and hypothesizing the IC and FP relationship and help them understand the importance of group affiliation and BIG4 auditors in emerging economies, subsequently opening up the possibility of doing comparable investigations in other developing countries. This study also concentrates on policy implications, arguing that policymakers need to perceive the IC as a strategic asset for long-term growth and FP. Similarly, our findings may assist policymakers in promoting or facilitating a knowledge-sharing culture, in which Indian enterprises support human capital, corporate stakeholder relationships, and structural viability for improved FP. Furthermore, this study’s findings can be used as a road map for corporations, academics, and policymakers to manage the IC effectively to improve FP.

The structure of this study is organized as follows. The

Section 2 outlines the institutional settings, while the

Section 3 examines the relevant literature and formulates the research hypothesis. The

Section 4 describes the data and methodology, the

Section 5 delivers the results and discussion, and the

Section 6 concludes this study.

6. Conclusions

The present study extends the IC and FP literature by examining linear and curvilinear relationships. Further, it considers the influential role of BIG4 auditors and business group affiliation in the Indian scenario and uses them as moderating factors to examine the IC and FP relationship. To the best of our knowledge, this is the first ever study in the Indian context exploring linear and curvilinear relationships between IC and FP with moderation and moderated moderation effects.

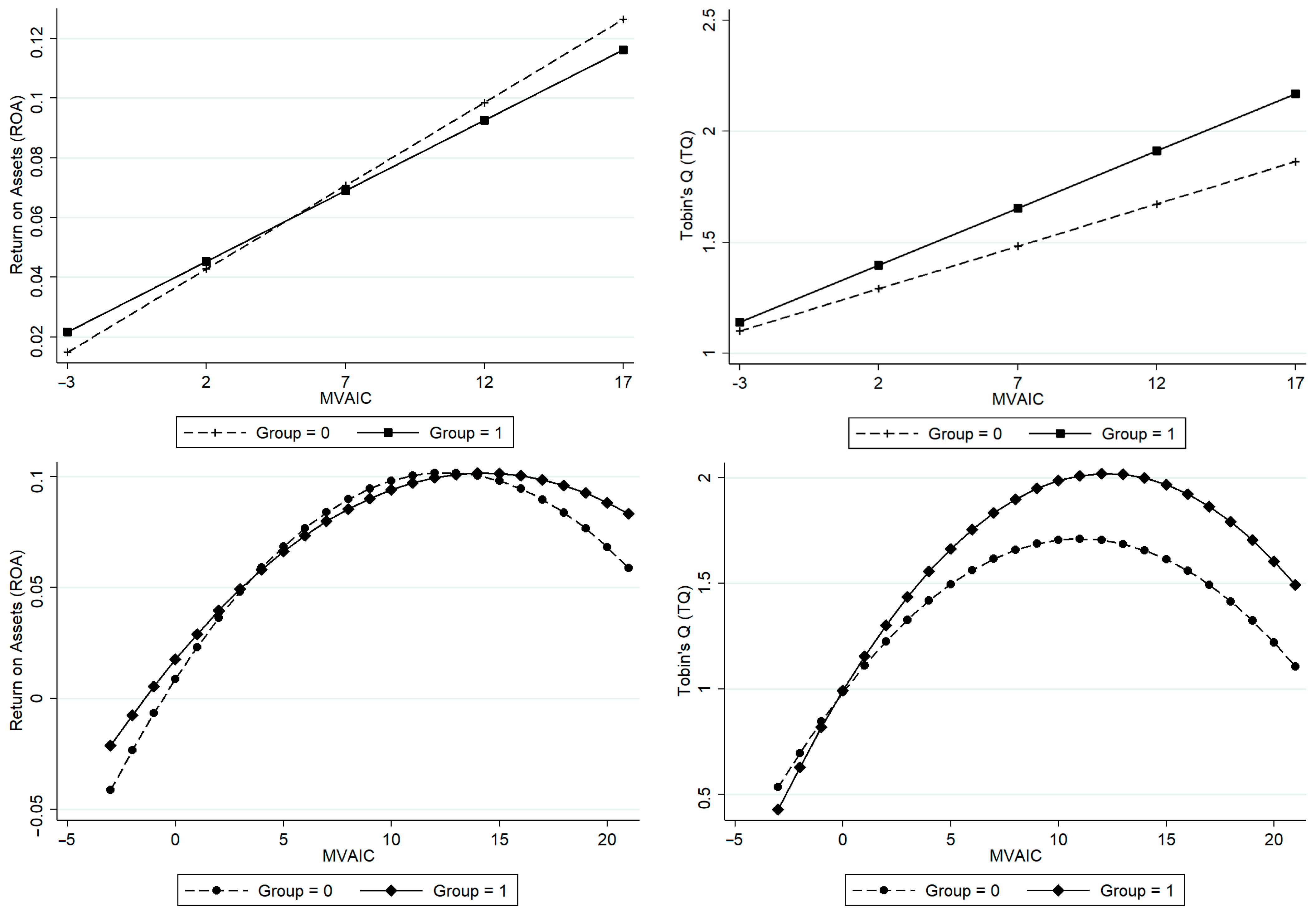

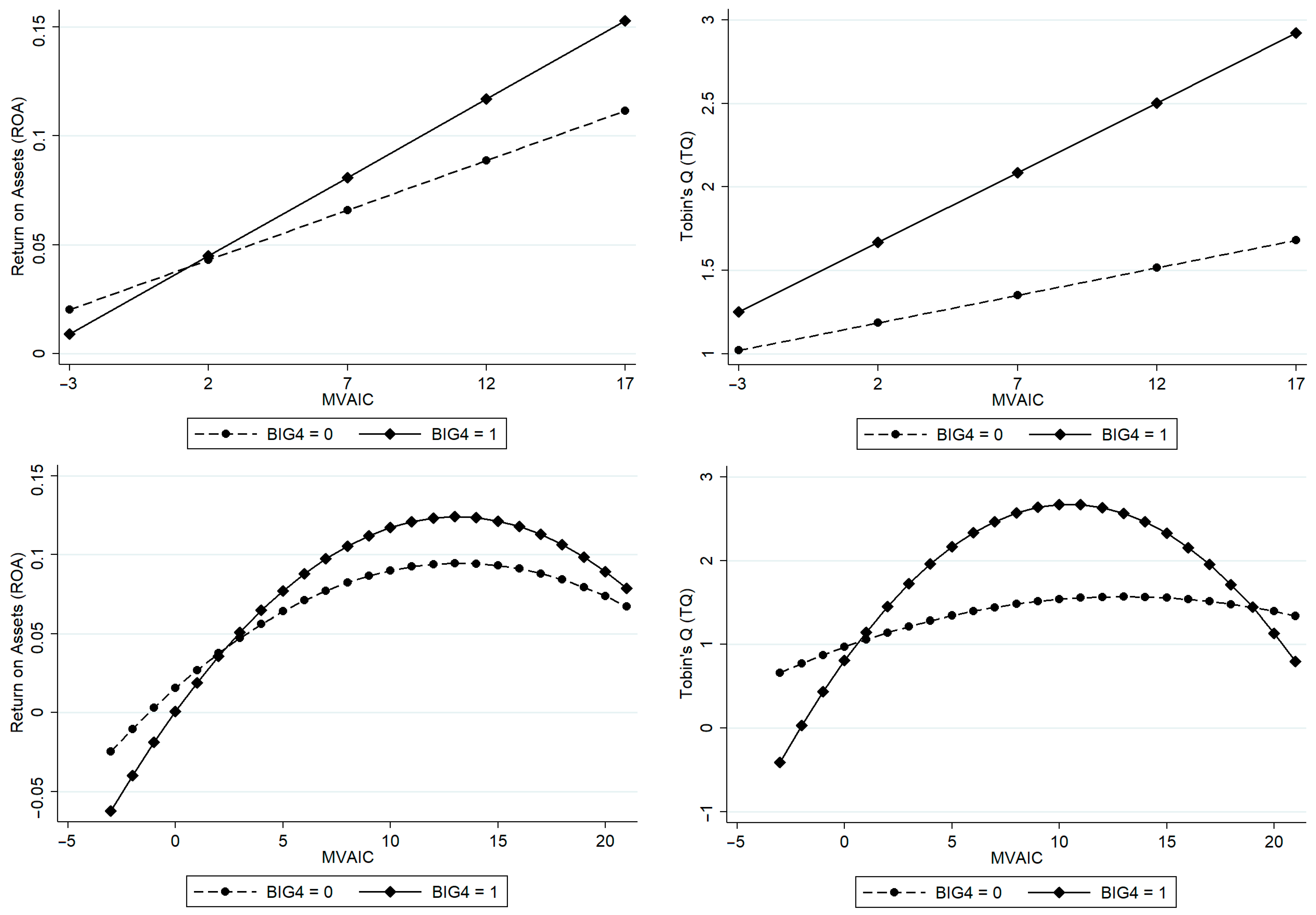

Our results claim that IC improves the performance of Indian firms and shows a strong moderation effect of BIG4 auditors in both financial and market performance. However, the moderating effect of group affiliation is negative and significant in financial performance, and it asserts that standalone firms enhance their financial performance by using IC compared to affiliated firms. On the contrary, IC improves the market performance of affiliated firms due to the benefits of competitive advantages. However, the particular scenario changes when affiliated firms appoint BIG4 auditors. Along with BIG4 auditors, IC improves the financial and market performance of group-affiliated firms in the Indian context.

Our curvilinear analysis reveals that IC has an inverted U-shaped relationship with FP, indicating that greater IC enhances FP up to a maximum threshold point, but after that, additional investment in IC reduces the FP. Our results validate the effect of “too much of a good thing” and support the earlier literature claiming that investment in IC enhances the FP, as the marginal return from IC investment is higher than the marginal cost in the initial scenario. However, after a certain point (i.e., inflection point), marginal returns gradually decline due to the inefficient management of IC resources, which causes an increment in marginal cost (

Xu and Zhang 2021;

Xu et al. 2022). Another explanation for this “too much of a good thing” effect aligns with the resource-based theory, which asserts that the IC and FP relationship depends on the efficient use of intangible resources. Based on this theoretical framework, the inverted U-shaped relationship between IC and FP indicates that IC’s efficiency initially positively impacts FP. However, beyond a certain threshold limit, the inefficiencies from IC investments undermine corporate performance due to the elevated associated costs (

Yao et al. 2019). Moreover, the findings claim that exceeding the IC investment beyond the inflection point can produce undesired outcomes due to economic disadvantages (

Poole and Van de Ven 1989;

Pierce and Aguinis 2013;

Poole and Van de Ven 1989;

Pierce and Aguinis 2013). Therefore, organizations need to be very careful in managing their IC while aiming for better FP. The moderation analysis also reveals that BIG4-audited firms establish an inverted U-shaped relationship with FP. On the other hand, group affiliation only positively moderates the curvilinear relationship between IC and financial performance. Thus, our results suggest that management and regulatory bodies need to scrutinize the management of internal resources in affiliated firms that drive FP through IC.

In a nutshell, this study has made some unique positioning in the IC and FP literature. When the entire business world focuses on intellectual capital, somewhere it ignores incorporating the firm-specific factors that influence the core business decisions. Considering this, this study first examined the relationship between IC and FP and revealed that undoubtedly IC enhances the FP, but there is some extremum point after that additional IC only increases the cost burden of the firm and resultantly reduces the FP. Interestingly, the positive relationship between IC and financial performance is not applicable for group-affiliated firms, indicating that standalone firms perform better using their IC. On the other hand, the role of BIG4 auditors in the Indian context is outstanding, as they help the corporations increase their FP by using the IC. So, the importance of BIG4 auditors in the Indian context is not limited to audit quality only. In addition to these, the business group firms also obtained advantages by appointing the BIG4 firms as their auditor. Earlier, we found that group-affiliated firms are not so effective in managing the IC to attain better performance. However, when they appoint the BIG4 auditors, the IC yields positive outcomes and enhances the FP. Further, this relationship is only significant in linear models, not curvilinear ones. Thus, we suggest that group-affiliated firms should optimize their IC resources and appoint the BIG4 auditing firms to generate superior firm performance.

This study has made the following contributions to the existing literature. First, our research examines both linear and curvilinear relationships between IC and firm performance, while most of the prior work only considered the linear approach (

Alipour 2012;

Bayraktaroglu et al. 2019;

Clarke et al. 2011;

Hejazi et al. 2016;

Mohapatra et al. 2019;

Vishnu and Gupta 2014). Our research strongly argues that investment in IC may not endlessly improve the FP, as the curvilinear relationship shows an inverted U-shaped curve. So, management and regulatory bodies may focus on a balanced point where investing in IC may enhance corporate performance to maximize the FP from their IC investment. Second, this study claims that BIG4 auditors and group affiliation moderate the relationship between IC and firm performance. Apart from these, the moderated moderation effect of both BIG4 auditors and group affiliation positively impacts FP. Therefore, management and policymakers may use those factors to optimize the investment in IC. Third, our results can be used as a guiding mechanism to manage the IC efficiently to yield better firm performance. This study may guide future research by helping to theorize and hypothesize the curvilinear relationship between IC and financial performance.

This study also presented policy recommendations for successfully harnessing intellectual capital (IC) to boost corporate performance. First, this study suggests that policymakers may promote the implementation of IC in the workplace and facilitate the development of a culture that values and exchanges knowledge regarding the significance of IC. Policymakers may consider implementing some guidelines for IC investment, given that our findings demonstrate that its benefits extend beyond knowledge-based sectors and effectively improve the FP of non-financial companies. Second, due to the inverted U-shaped relationship between IC and FP, regulatory bodies should refrain from mandating a minimum level of IC investment. Instead, they may advise companies to assess the efficiency of their intangible resources in order to determine the appropriate level of IC investment, which would improve their FP and prevent unnecessary investments in IC beyond a certain point or inflection point. Third, managers establish corporate policies that enable them to assess the marginal cost and marginal benefits of IC investments in order to optimize the utilization of IC resources and prevent excessive expenditures on intangible assets. Fourth, both management and regulatory bodies may acknowledge the importance of group affiliation and BIG4 auditors while framing the policies, as their presence significantly impacts the IC and FP relationship. In addition to these, the findings may imply that policymakers should promote a corporate environment in which Indian firms support human capital, corporate stakeholder connections, and structural viability in order to improve FP. Furthermore, policymakers should establish a forum for collaboration between academia and industry practitioners to promote the IC, allowing its benefits and impact on FP to be addressed and managed efficiently.

In addition to this study’s contribution to the existing body of knowledge, it has some limitations that can serve as avenues for future research. The present study measures the performance using fundamental financial performance variables and does not consider the financial risk while accessing the FP variables. However, future studies can consider the FP variables along with market risk, including systematic and idiosyncratic risk, to obtain better clarity on the impact of IC on FP and financial risk. This study finds that group-affiliated firms improve their performance with the help of IC when they appoint BIG4 auditors. Thus, future studies can explore this in more detail to identify the factors that drive these positive outcomes in the Indian context. Similarly, there is a scope for similar studies in other emerging economies, as we have limited the scope to the Indian context only. Since we have considered non-financial firms as our sample, future studies can be undertaken to compare financial and non-financial companies, which can provide an additional contribution.