Abstract

This article provides a macro-foundation for why the specific value of 2% is a valid inflation target. The approach postulates that innovations generate transactional cost savings by comparison to barter. The optimal velocity of money is derived as a function of productivity growth and of long-term and short-term interest rates, with coefficients reflecting the leverage ratio of depository institutions and the degree of bias in technical progress in the transaction technology. The model is tested for the U.S. (for aggregates M1, M1RS, and M1S) over the period 1959–2007. Setting the inflation target rate equal to the growth rate of velocity leads to an inflation rate near 2% and is akin to pursuing the Friedman k-% rule. This rule provides flexibility to prevent deflation. A long-term Taylor-type rule is derived. A robustness test is also conducted by extending the sample period up to 2023, covering sustained episodes of unconventional U.S. monetary policy.

Keywords:

inflation target; velocity of narrow money; M1; M1RS; M1S; real GDP per capita growth; barter; financial leverage JEL:

E40

1. Introduction

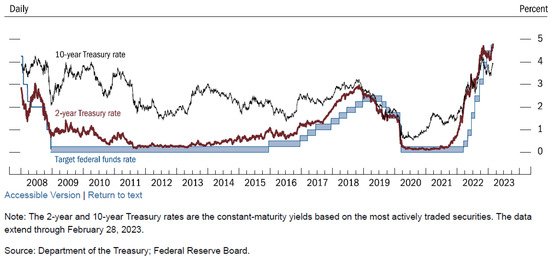

The U.S. Federal Reserve’s current rate policy in 2023 represents a significant departure from its “easy money” stance that was in effect dating back to the financial crisis of 2008. In March 2022, as inflation surged, the Fed shifted course and rapidly raised rates throughout the remainder of 2022 and into 2023. The Fed also reversed its previous policy of quantitative easing (QE), involving the purchase of Treasury and mortgage-backed securities to help boost capital market liquidity.

Federal Reserve Chair Jerome Powell has re-emphasized that the U.S. central bank’s decade-old 2% inflation target has in years past been a key factor in keeping inflation low and holding that target at that level should help in policymakers’ efforts to lower high price pressures. He stated on 7 March 2023: “We think it’s really important that we do stick to a 2% inflation target and not consider changing it”. The 2% inflation target “really anchors inflation” because “the modern belief is that people’s expectations about inflation actually have a real effect on inflation. If you expect inflation to go up 5% then it will,” he said.

It was in January 2012 that the U.S. Federal Open Market Committee (FOMC) adopted an explicit inflation targeting policy, which had been a long-time goal of past Fed chairman Ben Bernanke (Bernanke et al. 1999). The FOMC then issued an unusual press release stating that an inflation rate of 2% was “most consistent over the longer run with the Federal Reserve’s statutory mandate”. It further stated that “Communicating this inflation goal clearly to the public helps to keep longer-term inflation expectations firmly anchored, thereby fostering price stability and moderate long-term interest rates”.

Inflation targeting was first adopted as a primary policy instrument by the Reserve Bank of New Zealand in 1988. The U.K. and other G-7 central banks followed suit in the early 1990s. Since then, a consensus has emerged among central bankers and economists that a narrow inflation range of around 2% is optimal (see Table 1). The extant economic literature’s argument focuses on how a low positive inflation rate is ideal to avoid a deflationary trap (Coenen et al. 2003). However, an important question that has not been answered in the literature is what micro or macroeconomic fundamental parameters are behind the specific value of 2%, and by extension, why does a 2% value constitute the correct target?1

Table 1.

Inflation Targeting by G-7 Central Banks. Source: Reserve Bank of New Zealand.

To be clear upfront, I do not tackle the issue of the optimality of 2% as a target. Nevertheless, I am able in this article to tie that particular 2% value to fundamental macroeconomic parameters and give a rationale for why a target near 2% may make sense when pursuing the goal of price stability. The approach is founded on the transaction motive literature (Baumol 1952; Tobin 1956). I argue that money reduces transaction costs as compared to barter. I propose a new analytical framework in which a transaction cost savings function is expressed in terms of the loss of real GDP/capita that would occur if the economy reverted to barter. The fraction of real output saved is assumed to be a function of an index of technical progress and of the cost of substitutes of money, in particular credit cards, as those have been a major factor in speeding up the velocity of money (Geanakoplos and Dubey 2010). I argue that the transaction cost savings function must vary positively with the net return on assets for depository institutions.2

On the other hand, technical progress has also helped reduce the transaction costs associated with barter, “primitive” forms of money, and fiat money as well.3 For example, the creation of a fully electronic banking clearinghouse system such as ACH in 1994 has speeded up interbank settlements and the use of electronic and digital money has boomed with online shopping and banking due to the development of web browsers (1994).

I use real GDP per-capita as the variable representing technical progress. I distinguish between two main categories of progress: regime-biased and regime-neutral progress. Regime-biased technological progress enhances the relative efficiency of a given form of money by comparison to barter, which leads to ever greater savings from using that form of money. A regime-neutral technological innovation renders all forms of money and barter more efficient, and therefore the relative savings do not change.

I derive the optimal aggregate quantity of money per-capita (and velocity of money) by equating the marginal value of cost savings to the opportunity cost of holding money relative to barter. I find that the optimal velocity of money is declining with the net return on assets for depository institutions and thus is also a declining function of a parameter representing the long-term leverage of these institutions. Furthermore, the log of the velocity of money is a linear function of the log of real GDP/capita. If technical progress in transaction technology is slightly regime-biased towards the current form of money, the model implies that the velocity of money rises at a rate close to but less than long-run real GDP/capita growth (2.12% in the U.S. over the period 1959–2007).

I conduct empirical tests of these relations using Johansen’s (1988, 1991, 1995) VECM to estimate the long-run equilibrium for the U.S. velocity of narrow money over the period 1959–2007.4 Since the mid-1980s, and due to changes in the behavior and components of this aggregate, M1 is no longer considered the appropriate measure of narrow money. I test the model using alternate narrow money measures (M1RS and M1S) developed by Dutkowsky et al. (2006). Overall, the results lend strong support to the model. In all cases, I find that progress has indeed been new regime-biased and that the growth rate of velocity is estimated at a near 2% value (i.e., 1.85%).

Next, I find that targeting an inflation rate equal to the growth rate of the money velocity (again near 2%), based on specific macroeconomic parameters, is equivalent to a k-% money growth rule à la Friedman (1960). In other words, given that long-term inflation near 2% is targeted and that the velocity of money expands due to innovations, this policy rule is equivalent to a M1 growth target that matches growth in real GDP. I then show that this particular k-% rule is fully consistent with a derived Taylor (1993) type rule.

It is important to emphasize that the period 1959–2007 I chose to test this approach excludes the two major recent episodes of unconventional U.S. monetary policy.5 These are the Great Financial Crisis of 2008, which led to a drastic lowering of interest rates when the Fed used Quantitative Easing (QE) up until the end of 2014. At that time, the U.S. annual inflation rate dropped to levels below 1% (in 2014 and 2015), rarely seen since the 1950s and 1960s, and hovered around 2% until 2020, when the Fed implemented another round of QE policy in response to the COVID-19 crisis. Then, in 2022, the Fed reversed course and started raising rates very rapidly in response to a surge in inflation that had reached 7% annually in 2021 and 6.5% in 2022. It is safe to say that these two periods—2008–2014 and 2020–2023—correspond to a temporary shift of monetary policy away from its long-run inflation targeting in favor of emergency short-term measures in accordance with the Fed’s dual mandate to control inflation while striving to achieve maximum employment. However, I do conduct a robustness test of the model (in Appendix C) over the extended period 1959–2023. There, I discuss key features of these unconventional monetary policies and address how these emergency measures shocked interest rates and monetary aggregates (M1). These shocks do introduce distortions in the estimation of the long-run optimal quantity of money and its velocity. After adjusting for some of the effects of these policies, the robustness tests conducted over that extended period still provide validation for the model. That is, over the period 1959–2023, I am able to infer from estimates a range for the long-run inflation target tightly situated around 2%.6

The rest of this paper proceeds as follows: In Section 2, I develop the concept of the transaction cost savings function and justify its form in the context of the historical evolution of money. In Section 3, I determine the optimal velocity as well as the optimal quantity of narrow money. I introduce the VECM framework for the empirical tests in Section 4. Section 5 features the tests for various measures of narrow money (M1 and adjusted measures of M1) for the 1959–2007 period. Section 6 demonstrates that when the long-run inflation rate is targeted at near 2%, a version of Friedman’s (1960) k-% rule is implied. Section 7 shows the compatibility of the Friedman rule with a derived Taylor-type rule. Section 8 discusses Friedman’s (1969) deflationary monetary policy proposal in the context of the new rule derived in Section 7. Possible extensions are discussed in the concluding section.

2. The Evolution of Money and Transaction Cost Savings

Without a standard of exchange, transaction costs would rise steeply in the economy. A pure barter economy constrains trade and production. James Tobin (1992, p. 18) writes, “Does an economy arrive at the same real outcomes … as it would with the institution of money? Clearly not. Without money, confined to barter, the economy would produce a different menu of products, less of most things. People would spend more time searching for trades and less in actual production, consumption and leisure”.7 In The Age of Turbulence, Alan Greenspan (2007, p. 2) reflects that: “We’d always thought that if you wanted to cripple the U.S. economy, you’d take out the payment system… Businesses would resort to barter and IOUs; the level of economic activity across the country could drop like a rock”. As generally considered in the literature, the cost savings associated with using money relative to barter include:

- Economizing on resource costs due to the lack of double coincidence of wants. This occurs in a barter economy. Resources are wasted due to search costs and storage/spoilage costs (Tobin 1992).

- Economizing on the resource costs to produce commodity money Friedman (1951). In a barter economy, this cost is incurred repeatedly to sustain most of the stock of “mediums of exchanges” needed for transactions, as many of these barter goods are perishable. In a commodity (metallic) standard, production costs only occur for new money and constitute a deadweight loss for society in the sense that resources are transferred to a non-productive and non-consumable goods sector of the economy. In the transition from barter to commodity money (CM), the cost savings are getting smaller over time because the marginal cost of producing CM is rising. In a fiat money (FM) economy, the cost of producing money is essentially zero.

- Economizing on the costs generated by an inefficient banking clearinghouse system (Norman et al. 2006). In a commodity money system that maintains convertibility, clearing transactions with physical money settlements is costly. The fractional reserve system of the past and our current FM system have drastically reduced these costs.

- Avoiding recessionary deflations: deflations caused by secular money supply constraints have typically been associated with an economic slowdown (Friedman 1951; Bordo and Filardo 2005). Guerrero and Parker (2006), for example, find that a higher rate of deflation reduces the subsequent economic growth rate (even if it does not always lead to recession). Thus, there is reason to believe that deflation is bad for economic growth, even if it has become a relatively rare experience for most developed economies in the postwar era.

- Advances in transaction methods, such as credit cards and online shopping and banking, all of which boost the velocity of money.

Table 2 highlights some of the major innovations that transformed transaction technologies from 1959 to 2007. It seems clear that the stepwise evolution of exchange systems from barter to CM and from CM to FM has provided incremental cost savings. The key idea here is that the cost savings of using money and associated transactional innovations can be directly inputted in terms of avoiding loss of real GDP. Given a prevailing monetary system (CM or FM), going back to a lesser form of money or barter would lead to a permanent drop in real GDP.

Table 2.

Innovations Applicable to Transaction Technologies.

One simple illustration of this notion of incremental cost-savings inspired by Tobin’s quote above is to imagine a situation of barter as the baseline, with a search cost of 10 units of time (which could otherwise be used to increase GDP)—7 units to find the desired pair of traded goods and 3 units to travel for making payment (assuming delivery costs are the same in barter and fiat money economies). With fiat money produced at essentially 0 units of time, the search cost is reduced to 3 units of time (travel), with a cost-savings of 7 units. With online payment systems, the traveling cost is eliminated, resulting in an additional cost-saving of 3 units of time.

The notations for this paper are as follows:

are aggregate nominal balances carried from the beginning of period t (time t − 1) enabling the purchase of goods and services in period t. The variable is the real money holdings per-capita.8 Let me introduce the concept of the transaction cost savings function that constitutes the basic framework for conducting our analysis.

Definition 1

(Transactional Cost Savings of Using Money). Given a current level of real per capita output achieved by the economy, let denote the level of real GDP/capita (in a barter economy) that would prevail if the institution of money (but not credit) was abolished; i.e., the use of the (per-capita) stock of money were suddenly suspended in period t. I denote by the real cost savings of using and associated transactional innovations, where is the fraction of current real GDP/capita that would be lost if the economy reverted to barter.

The function captures the current state of the transaction technology.9 The larger the value of the greater the advances in the transaction technology as compared to barter, and the greater the savings are by comparison to barter. This definition is flexible enough to account for various monetary regimes such as CM and FM.

Definition 2

(Unit Costs Savings Function At). The per-unit-of-real-goods cost savings function is given by with .

The function accounts for three key features of a transaction technology. A transaction technology is characterized by: (1) the medium of exchange used in the economy, i.e., the monetary or barter regime; (2) the availability of substitutes for the medium(s) of exchange; and (3) the type of technological progress affecting one’s ability to transact for a given amount of real money per-capita. Feature (1) is addressed by using the size of real money per-capita in circulation. In that case, zero money holdings means that barter is in place. The function has decreasing marginal returns in the amount of real money per-capita, which is equivalent to assuming that the per-unit-of-money transaction (or average) cost savings function is decreasing with the amount of real money per-capita.

To model feature (2) above, the transaction cost savings function depends on the net cost of using money substitutes, in particular, credit card loans. The transaction cost savings of holding money (per unit of goods) must be decreasing with the availability of more credit instruments that closely substitute for money. In Appendix A, I analyze the interaction between the credit card market and the “bank” credit market. There, I show that there logically should be a positive relationship between the cost savings and the financial sector’s net asset returns, holding real money balances constant.

Hence, I model the log of the cost savings function, or percentage deviation of cost savings from trend, as varying positively with depository financial institutions’ net return on assets. In general, depository institutions borrow short-term and leverage-up to lend long-term.10 The net return on assets is proxied by , where is the long-term interest rate and is the short-term interest rate. In this context, when the weight > 1 is equal to (), it naturally represents the long-term leverage of depository institutions, i.e. the ratio of total assets over equity. For example, a value = 2 means that institutions borrow another 100% of their equity at short-term rates to double up the return on long-term loans. Thus, in the rest of the article, we naturally set = in the unit cost savings function At.

The third and last feature of a transaction cost savings function is accounted for by the variable , which represents an index of technical progress measured by real GDP/capita (as proxy for labor productivity). Hence, .11

Whether the cost savings function is increasing in real GDP/capita depends on the net effect of real GDP per-capita growth via income and the technical progress channels. This, in turn, depends on the sign of the parameter . I interpret the parameter as an indicator of the type of technical progress in transaction technology. I distinguish between regime-biased or regime-neutral innovations. Regime-biased technical progress reduces transaction costs associated with a specific monetary regime.

Biased progress can be of two subtypes: (1) New-regime biased : technological progress enhances the efficiency of the current monetary regime more than barter; (2) Old-regime biased : barter receives a greater efficiency boost than the current form of money, or alternatively, technological progress cannot prevent rising costs of producing money.12 Regime-neutral progress () allows all transactional systems (from barter to the current form of money) to benefit equally from a new technology. In other words, the efficiency gap is constant. This is obviously a knife-edge case. Table 2 introduces a rough classification of each innovation according to whether it is neutral or biased.13

3. The Optimal Quantity and Velocity of Money

In his classic paper, Friedman (1969) demonstrates that the socially optimal amount of money to hold is at the point where the marginal benefits of holding money equal its opportunity cost (nominal interest rate) plus the marginal cost of producing money. In a fiat money economy, the marginal cost of money production is zero. Friedman assumes that economic agents have a satiation point for holding money, which means that the marginal benefits become zero beyond a certain threshold. Consequently, the only way the marginal benefits of holding money can be equated with the marginal cost is by having monetary authorities set the short-term interest rate to zero.

Even though Friedman (1969) does enumerate the advantages of money over barter, he does not explicitly incorporate these benefits in his analysis. Presumably, these benefits do not have to be analyzed separately as they are already included in the pecuniary services of money. However, Friedman implicitly assumes that a full-blown monetary system is already institutionalized. The average household having zero money holdings does not imply that money is completely absent from the economy as a medium of exchange and that this household has to resort to barter. In fact, economic agents can recover money by selling goods or less liquid assets.

On the other hand, I quantify here the marginal costs and benefits of using money relative to barter. Money must fulfill the same basic transactional services as barter, in addition to removing the frictions caused by barter. Indeed, as discussed in the previous section, there are sizable transactional frictions associated with holding goods for barter rather than using money.14 The frictions associated with barter are possibly removable not by using a special tax scheme or setting the short-term interest to zero, but rather by achieving a sufficiently high level of technological progress.

Proposition 1.

Assume that there exists a representative unit basket of goods and a quantity of that basket satisfying trades in a barter economy. Assume that the consumption in autarky is related to the quantity of baskets bartered as follows ; where the velocity applies to a monetized economy at the point of collapse, i.e., experiencing a level of real output per-capita equal to . Further assume that the parameters of the transaction cost savings function satisfy . The optimal quantity of money per-capita and optimal velocity for an economy producing are given by:

Proof.

See Appendix B. □

There is a consensus in the literature that the velocity of money depends on income and interest rates (Taylor 1998). The optimal velocity of money given in Equation (2) is increasing in per-capita income due to technical progress and decreasing in the return differential . Recall that the spread shrinking is equivalent to the net return on assets dropping, which in turn leads to an expansion of credit cards in the economy (as shown in Appendix A). The optimal velocity decreasing with makes economic sense because the velocity of money should rise with the expansion of credit cards in the economy.

Intuitively, there are two effects acting on the velocity of money: (1) a substitution effect driven by the net returns to assets and its link to the supply of alternate instruments to money (credit-cards) and (2) a net income/technology effect for which the technological progress effect dominates the income effect and thus accelerates the velocity of money through advances in transaction technologies (e.g., digital monies).

The optimal quantity of real money balances given by Equation (1) is increasing in per-capita income and decreasing in the short-term interest rate, as one should expect, due to the opportunity cost of holding cash. On the other hand, the long-term interest rate is increasing. Again, this effect is due to the fact that by holding the amount of money per-capita constant, depository institutions are expanding the velocity of money by supplying more credit card loans. The novelty is the inclusion of two new key parameters in the optimum quantity of money equation. These are the degree of bias in technical progress and the leverage ratio of depository institutions . Adrian and Shin (2009), for example, make a strong case in favor of including leverage as a variable in monetary policy rules. Here, leverage is constant as the focus is on long-run equilibrium.

Equation (1) is consistent with the semi-log money demand function used by Bailey (1956) and Friedman (1969), in contrast with the double-log schedule preferred by Lucas (2000). Here, the per-capita real income elasticity of money demand is expected to be positive and close to zero, due to the fact that progress in transaction technology is new-regime biased. The optimum quantity of money is a function of the long-term and short-term interest rates, which is unusual in the literature but defended by Brunner and Meltzer (1989).

Contrary to several recent models replicating Friedman’s (1969) optimum quantity of money result, I do not assume satiation in this model in order to avoid the unrealistic prediction of infinite money holdings at zero interest rates.15 This is simply a standard feature of the semi-log schedule I use here: a finite level of cash is held at zero nominal interest. The (short-term) interest elasticity of money demand is , which is decreasing as the interest rate falls to zero. This simple result is in agreement with Mulligan and Sala-i-Martin’s (1996) findings. They used cross-sectional data on the asset holdings of U.S. households in 1989 and found that the interest elasticity is very low when interest rates are low.

They state on page 41: “Our prediction of low interest elasticity at low interest rates is crucial, for example, for the evaluation of the welfare costs of inflation. The consumer surplus approach applied by Bailey (1956), Lucas (1994), and others show that the welfare cost of inflation hinges fundamentally on the money demand elasticity at low interest rates”. Marty (1999) also criticizes Lucas’ choice on the basis that it artificially inflates welfare gains since the level of cash balances goes to infinity as the interest rate approaches zero.

My model is most related to the literature on innovation and money. Ireland (1994) argues that the effects of economic growth on the payment system can be substantial. In his model, the ratio M2/M1 rises steadily over time, and the demand for M1 becomes increasingly interest-elastic as the economy grows. The fact that M2/M1 rises is fully consistent with the idea that substitutes for narrow money enhance the velocity of narrow money. Ireland (1995) models the process of financial innovation as carrying a fixed cost. In order to innovate, the opportunity cost of holding cash balances has to be higher than a threshold level that might be greater than current interest rates. The model is based on Dotsey’s (1984) framework, in which financial innovations are endogenous and treated as investment projects. In a different vein, Jafarey and Masters (2003) study the impact of innovation on the velocity of money within the framework of a search/matching model. When the matching technology is improved, they show that the velocity of money is affected positively.

4. Data and Testing Framework

I test the long-term optimal velocity of money relations (2) for the U.S. on a quarterly basis over the period Jan. 1959–Oct. 2007.16 The variables used are real GDP per-capita calculated using real GDP (GDPC96; 2005 dollars, seasonally adjusted annual rate) from BEA and U.S. population monthly data (POP) from the Census Bureau that is matched with real GDP observations on a quarterly basis. Long-term interest rates are monthly rates based on the long-term bond series (LTGOVTBD) from the Fed’s BOG, which is the unweighted average yield on all outstanding bonds neither due nor callable in less than 10 years. The series ends in June 2000. I complete the long-term bond series by using the constant maturity (monthly) 10-year Treasury yield (GS10) from Q3 2000 to Q4 2007. For the short-term interest rate, I use the 3-month T-bill rate (TB3MS) over the same period. I use three alternate money stock measures related to M1. The first measure is M1 from the Fed’s BOG (M1SL), which is monthly and seasonally adjusted data. The other two measures, M1RS and M1S, are available on a seasonally adjusted basis. This data were obtained from Cynamon, Dutkowsky, and Jones’s website at http://www.sweepmeasures.com/ (accessed on 29 October 2009).17

Since the 1970s, depository institutions have been able to lower their reserve requirements on commercial demand deposits by sweeping deposits into other instruments, but initially the size of these operations was never great due to the lack of computer speed, given that the sweeps had to be returned at regular intervals. Since 1994, depository institutions have been able to lower their reserve requirements for retail deposits by using automated computer programs to move inventories of checkable deposits overnight into money market depository accounts (MMDAs) and money market mutual funds (MMMFs), which are not subject to reserve requirements.

These operations, known as sweep account programs, have led to a situation where M1 is underestimating actual narrow money. Anderson (2003) points out that sweep programs are initiated by banks, not by account depositors. Depositors optimize their cash holdings with the understanding that the whole balance is available from the bank at any point in time for transaction needs. Thus, it makes sense to include sweeps in a measure of narrow money.

Anderson (1997) and Dutkowsky and Cynamon (2003) estimated the magnitude of these sweep programs, and in particular, Dutkowsky et al. (2006) developed M1RS and M1S, the two new adjusted measures for M1. The new aggregate M1RS equals M1 + (swept funds from retail programs), which are funds with unrestricted transaction properties. M1S equals M1RS + (swept funds from commercial demand deposit sweep programs), which contains all sweeps.18

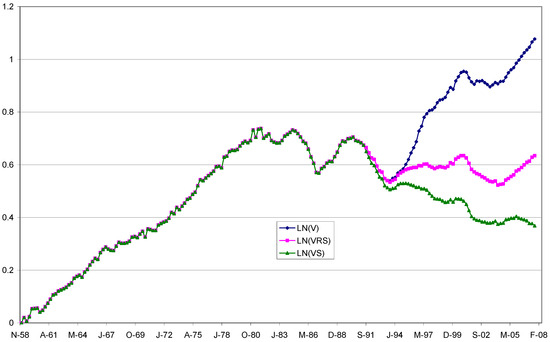

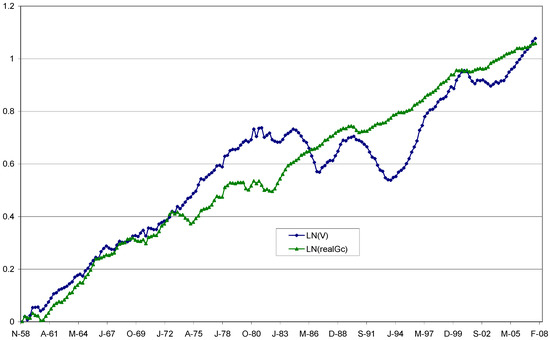

By definition, the actual velocity of money is . Figure 1 shows the velocities of all three measures of narrow money, and Figure 2 shows the velocity of M1 in relation to real GDP/capita growth. Visually, Figure 2 illustrates that there seems to be a strong connection between the log of M1 velocity and the log of real GDP per-capita growth over the period. On the other hand, from Figure 1, such a connection appears to break down with M1RS and M1S, as these money aggregates expanded rapidly after the early 1990s.

Figure 1.

Indexed Log of Narrow Money Velocity (M1, M1R1, M1S) 1959–2007.

Figure 2.

Indexed Log of M1 Velocity vs. Log Real GDP/capita 1959–2007.

I test the log of the velocity series for structural breaks, i.e., the presence of unit roots with at most two breaks (Clemente et al. 1998). I find that indeed two breaks are present in the log of velocity of M1RS and M1S. The break dates depend on whether the test is for additive outliers (AO) or innovational outliers (IO). The two break dates for M1RS are (Q2 1976; Q2 1994) for AO and (Q3 1971; Q3 1991) for IO. In the case of M1S, the break dates are (Q2 1976; Q2 1994) in the AO case and (Q3-1971; Q3 1991) in the IO case.

Interestingly, one of the two extreme break dates, Q3 1971, represents the end of the gold standard for the U.S. economy, and the other, Q2 1994, occurs one quarter after retail sweep programs began. I chose Q3 1971 as the earliest break date in the analysis for both M1RS and M1S. For M1RS, I chose the beginning of the retail sweep program, or Q1-1994. For M1S, I chose Q3 1991 for the second break, that is, when total sweeps started being recorded.

The long-run optimal velocity Equation (2) is the basis for the empirical tests conducted here. I test the following equilibrium relation:

My goal is to estimate the key coefficients , , , and . These coefficients are related to the optimal velocity Equation (2) as follows: ; > 0; < 0 and > 0.

I employ Johansen’s (1988, 1991, 1995) Vector Error Correction Model (VECM).19 The reason is that the variables may have a unit root and are possibly cointegrated. First, I confirm that all the variables are I(1).20 Johansen’s VECM estimates the full dynamic structure of the relationship between these variables while at the same time separating out the long-run from the short-run dynamics. In this paper, I am only interested in studying the long-run dynamics part of the VECM, which characterizes the long-run equilibrium for the optimal velocity given by Equation (3). The standard VECM set-up is given by. . Where the vector is (6 × 1), is a (6 × r) matrix representing the speed of adjustment, and is a (rx6) matrix representing the parameters of the cointegrating equations . For the sake of simplicity, I assume that the number of cointegrating relations r = 1, which I verify later.

The matrices are (6 × 6) and p is the number of lags in the short-term dynamics. I restrict the cointegrating equation to be stationary around constant means , which is a (rx1) vector. I also allow for a stochastic trend in levels by including a constant (6 × 1) vector in the short-run dynamics part of the VECM.

The (6 × 1) vector is associated with the dummy variable d5971, which accounts for a possible break in the time series of narrow money velocity due to the transition from the gold standard to a pure fiat money economy after the Nixon administration ended the dollar-gold peg. It also accounts for the reduction in the volatility of real GDP/capita post gold standard era. This dummy variable takes a value of 1 from Q1 1959 to Q3 1971 and 0 otherwise.

The variable SM1 is the ratio of sweeps divided by M1.21 This variable is used in the VECM only when the velocity of money is calculated using M1S or M1RS, for the purpose of accounting for structural breaks in these series. The SM1 variable spans January 1994 to October 2007 for M1RS and October 1991 to October 2007 for M1S. The (6 × 1) vector is associated with a seasonal dummy variable d7982, which accounts for the period covering the high inflation of 1979 and the 1982 recession under Volcker’s tenure. This dummy is only assumed to affect the short-term dynamics of the VECM. Following Johansen’s (1995) standard procedure, I normalize the coefficient on to 1, so that the matrix can be expressed as and , which renders the optimal velocity Equation (2) fully equivalent to Equation (3) above.

5. Test Results with M1 and Other Measures of Narrow Money

Table 3 presents the results for several versions of the cointegrating Equation (3) presented above. I test various lag structures as well. Each specific version presented in Table 3 minimizes either the AIC (Akaike criterion), the BIC (Bayesian information criterion), or the HQ (Hannan–Quinn information criterion) across possible lags from 1 to 4. All equations included in Table 3 have a cointegration rank of 1, i.e., only one cointegrating relation exists in each case.22 All coefficients for the long-run equilibrium are significant at least at the 99% level, except in a couple of instances. Overall, the basic model is supported for each measure of narrow money used here.

Table 3.

Cointegration Results for the Log of Velocity of M1, M1RS and M1S from Jan. 1959–Oct. 2007 on a Quarterly Basis.

For M1, the best result supporting the model is when the dummy variable d5971 is present in the model and the VECM lag = 2. In that case, the AIC, BIC, and Chi2 statistics are minimized. The estimate for the elasticity of real income per-capita is 0.85, and the estimate of the leverage coefficient is 14.91 (for RS) and −15.09 (for RL). These two coefficients are nearly equal in magnitude, as predicted by the theory.

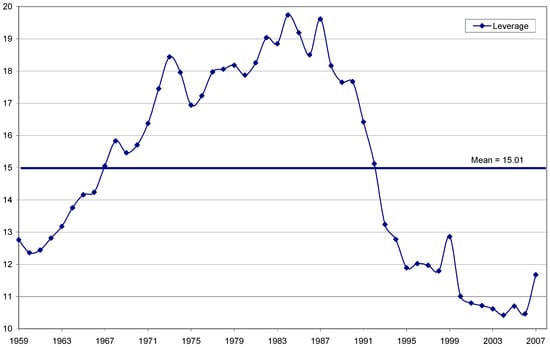

Interestingly, the value of these coefficients is close to the actual historical mean leverage of depository institutions, which is equal to 15.01. Figure 3 graphs the actual leverage for a broad sample of U.S. depository institutions over the period 1959–2007.23 Since the late 1980s, leverage has drastically dropped. This corresponds to the adoption of several rounds of Basel accords regarding capital adequacy ratios, starting in 1988.

Figure 3.

Asset/Equity (leverage) for Depository Institutions. 1956–2007. Source: Compustat. Outlier values above 100 removed.

Recall that the estimated parameter is the ratio of leverage over the parameter , and should theoretically equal . In this case, there is reason to believe that the coefficient on the long-term rate is more correct, as it does not suffer from the distortion created by the introduction of the NOW account in the early 1980s. The introduction of these accounts made the decision to hold cash less sensitive to short-term interest rates. Thus, I use and set = 15.01, i.e., I parameterize the leverage ratio using the mean for the sample of depository institutions. The coefficient can therefore be estimated at 0.99. This indicates that the elasticity of real money (1 − ) in the transaction cost savings function is very close to zero.24

The results with M1RS and M1S are not as strongly supportive, but they are still consistent with my findings for M1. In the case of M1RS, the best result in support of the theory is when the VECM lag = 4 and the dummy d5971 is used in conjunction with the variable SM1, i.e., retail sweeps divided by M1. In that case, the long-run relationship shows an elasticity of income equal to 0.84. The values for the leverage coefficient are respectively 12.64 (for RS) and −13.19 (for RL). The two coefficients are still close to each other in absolute value. Equally good with respect to the AIC criterion is the model that includes the dummy d7982. In that case, the coefficient is 11.43 (for RS), −12.82 (for RL), and 0.91 for the income elasticity. The best result for M1S, which minimizes the AIC criterion, is with a lag = 4 and including the d5971 dummy and the ratio of total sweeps over M1. In that case, the income elasticity is 0.89, and the two leverage coefficients are respectively 13.70 (for RS) and −13.90 (for RL).25

Taking the average of the four estimates for each measure of narrow money, my point estimate for the coefficient = 0.8725, so that = 0.12, and hence technical progress in the transaction technology is slightly new-regime biased. By the same token, I derive an average estimate for the constant A in the per-unit transaction cost savings function that equals 1.1. This is assuming that the depreciation (spoilage) rate in a barter economy has a value of around 0.45% per year, which is on the low side as compared to a rate of 1% per year estimated from grain agriculture in rural China (Park 2006), which is the only estimate I found in the literature. Under this assumption, the per-unit transaction cost savings function At is less than 1 over the sample period, as required by definition.

The reason I include the variable SM1 in the model is to account for the break in the two series after 1991 and 1994, respectively, when commercial demand deposits and retail sweep programs were instituted. Algebraically, it is easy to show that . That is, the log of the velocity of M1RS equals the log of the velocity of M1 minus SM1. The same identity holds when M1RS is replaced by M1S. In the case of M1RS with a lag = 4, the coefficient on the SM1 variable is not equal to 1, but rather −0.69. This means that the variable SM1 is having a distorting impact on other variables in the cointegration equation. An increase in the SM1 ratio correlates with lower income elasticity and lower leverage than would be generated by M1 alone.

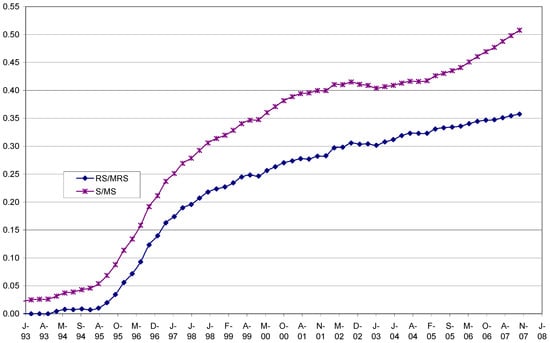

Even though computer software executes tasks faster and more efficiently, depository institutions still had to return swept funds back to the account they were swept from at set intervals due to regulations and customer cash needs. Thus, as institutions optimize to keep the sweeps as large as they can, the value of sweeps cannot outpace the value of deposits in the long-run, and thus sweeps must become a constant fraction of narrow money. Figure 4 visually shows that the ratio of retail sweeps to aggregate M1RS has been leveling off over time (1959–2007). As the ratio converges to a constant, sweep programs only have an intercept effect to lower the velocity of money. Sweep programs should then have no “perverse” effect on income elasticity but may still impact the leverage parameter at the margin. In Figure 4, however, total sweeps as a percentage of M1S do not exhibit that leveling-off pattern… yet!

Figure 4.

Retail and total sweeps, respectively, as % of M1RS and M1S 1994–2007.

I find that the velocity elasticity with respect to the short-term interest variable is smaller than the elasticity with respect to long-term interest for M1, M1RS, and M1S. Again, a possible explanation is that NOW accounts were instituted after 1981. These are checking-type accounts that pay interest, with some restrictions, however, as for-profit corporations are excluded from opening these accounts. As a result, the (short-term) opportunity cost of holding cash balances is lower than it was before.

As sweep programs distort the relationship between the required reserve ratio and demand deposits, it turns out that reverting to M1 as the measure of narrow money does actually help to uncover a stable long-run relationship between banks’ actual leverage ratios and the velocity of money, as all M1 funds were subject to the Fed statutory reserve requirements and to the capital adequacy ratio rules from the 1988 Basel and later accords.26

Because institutions were able to shelter some of their assets from regulatory requirements, they were effectively able to leverage themselves at a higher level than if all assets in M1RS or M1S were counted. This means that the leverage ratio associated with M1 should be closer to actual ratios, and the estimates associated with M1RS and M1S should be lower as compared to M1. Furthermore, the Basel accords were enforced over the entire asset base of financial institutions, whether they used sweeps or not. Given that assets are risk-weighted to compute the required leverage ratios, the minimum of 8% (equity/assets) will lead to an effective leverage ratio that is slightly higher than 12.5 (the inverse of 8%) but also lower than the historical average of 15.01, which is what I find for the leverage estimates using M1RS and M1S.

Putting these results in the context of the literature, many empirical studies have applied cointegration methods pioneered by Engle and Granger (1987) to study long-run U.S. money demand. Examples are Hetzel (1989), who finds a stable relation for M2. King et al. (1991) also find support for cointegration with M2 and the short-term interest rate. Baba et al. (1992) find support for a cointegrated money demand model with M1. In a comprehensive study, Carlson et al. (2000) document that a stable relationship between money, output, and opportunity costs prevailed in the U.S. until the late nineties. On the other hand, Miyao (1996) studies M2 from 1959 to 1993 and concludes that M2 is not a useful intermediate target for monetary policy in the 1990s.

A wave of articles examines the measures of narrow money. M1RS and M1S were developed by Dutkowsky et al. (2006). Dutkowsky et al. test the existence of a long-run demand relationship over 1959–2002 using M1, M1RS, and M1S. They do not include a measure of progress in their equation. They assume that the income elasticity of demand is unitary, which means that the velocity only depends on the rate of interest, a standard assumption in the literature. Not surprisingly, their best result is achieved when using M1S, which has the least amount of trending amongst the three alternate measures of narrow money. Ireland (2008) extends the work of Lucas (2000) and uses M1RS to measure the welfare cost of inflation. His conclusion weighs in favor of a semi-log formulation for the optimum quantity of money.

To sum-up, the extant literature tests money demand functions that depend on interest rates (short-term) and on GDP. These are generally derived from cash-in-advance or money in the utility function models, which are both subject to broad criticism (Hodrick et al. 1991; Sriram 1999). Empirically, the literature uses co-integrating methods such as the VAR methodology, of which the VECM method is a simple form that has been the workhorse methodology in the field for decades now (Sriram 1999). Based on the transactional gains of a monetary economy as compared to barter, I am able to express the long-run money demand (and velocity) as a function of the interest rate differential (which represents the banks’ net asset return that guides the supply of substitutes to money such as credit cards) as well as real GDP/capita, which measures the combined effect of income and technical progress in the long-run, with a dominance of the technological impact over the income effect on the velocity of money.

Like in many other studies, it is possible to find limitations to this approach, either based on the data or the econometric method used. For instance, I use narrow money M1 and not M2, because monetary policy and, in particular, inflation targeting will affect M1 most critically. As indicated in the empirical section, I also completed the missing data on long-term bond series by using the constant maturity (monthly) 10-year Treasury yield (GS10) from Q3 2000 to Q4 2007. On the methodological side, I use the standard VECM approach, but other approaches using VAR modeling could be used. These choices can be seen as limitations, but they were dictated by a parsimonious course of research. Regarding the choice of the period 1959–2007, in Appendix C, I undertake a review of the period 2008–2023 that contained periods of unconventional monetary policies and discuss why this period is excluded from my main sample given my focus on long-run equilibrium money demand and velocity relationships. At the same time, I provide some robustness tests of this study expanded to the whole period, which shows how these relationships are impacted due to those dramatic short-term inflections in monetary policy that disturbed the long-term equilibrium.

6. A Near-2% Inflation Target and a Constant Money Growth Rule

I examine here a particular rule that sets the long run inflation target at a value equal to the growth rate of money. Combining my derived optimal velocity of money rule with this particular target leads to long run inflation near 2%, and a Friedman’s (1960) k-% rule for monetary policy is implied.

Proposition 2.

In a steady-state, assume that the long-term inflation target is given by that is: the long-term rate of inflation is set equal to the growth rate of the money velocity. Further assume that money velocity is optimally defined by Equation (2) and that transactional innovations are new-regime biased on average (). Then, the long-term inflation target is near 2%, and a Friedman k-% money growth rule applies; that is .

Proof.

The QTM equation in terms of long-term growth rates is . Assuming simply entails that or that a ‘naïve’ Friedman k-% rule holds. As the short-term and long-term nominal interest rates are constant in the steady-state, the optimal velocity Equation (2) implies that . The long run real GDP/capita growth rate is estimated at 2.12% for the U.S. over the period 1959–2007. Using the point estimate from Section 5 above, we have 0.8725. Hence, I find that the long-term rate of inflation target has a value of 0.8725 × 2.12% = 1.85%, which is near 2%. □

Proposition 2 is fairly straightforward. First, it is easy to show that setting the long-term inflation rate equal to the rate of velocity growth is equivalent to a Friedman k-% money growth rule. Second, it turns out that given the optimal velocity of money expression (Equation (2)), the inflation target’s value is equal to 1.85%, near 2%.

It is also important to perform a sensitivity analysis of this result. Here we have two effects to contend with. (1) is the decreasing rate of long-run real GDP per capita growth since the 1980s, and (2) is the fact that we have 95% confidence bands around our point estimate. For instance, the long-run growth rate was 2.14% in 2005 and 2.09% in 2009. The 95% confidence band gives a range of values for the coefficient contained in [0.62, 1.13]. Using these values gives a range for the inflation target of [1.29%, 2.42%].

Here, while I do not claim to demonstrate the optimality of a 2% inflation target, I set forth an inflation target rule (based on a link to real GDP/capita growth) and link it to a Friedman k-% rule. It is also clear that it does not logically follow that a 2% inflation target rule necessarily results in a constant money growth rule because of the knife-edge nature of the parameterized target and the range of estimates.

A Friedman (1960) k-% rule is essentially stating that the money supply grows at the same pace as real GDP. This means that the monetary aggregate will not outpace the speed of economic growth and thus provide the economy with what it needs in terms of credit to sustain new economic opportunities and new business growth. Traditionally, in the analysis conducted at the time (1960s), velocity was assumed to be fairly constant, so the k-% rule leads to price stability (0% inflation) in that framework. There is no specific mention of what happens when the velocity of money grows. But logically, if the money supply grows at the rate of real GDP growth, the QTM equation implies an inflation rate that equals the rate of growth of velocity (near 2%).

Despite the desirable properties of a constant money growth rule, in principle, most central banks implement policy by setting short-term interest rates in practice. During most of the 1970s, The U.S. Federal Reserve targeted the federal funds rate. This choice reflected at least two considerations. First, the instability of money demand reduced the usefulness of money supply targets. Second, interest rate targets allowed the central bank to smooth out the effects of transitory shocks on financial markets. However, in October 1979, at a time when anti-inflationary measures were called for, the Federal Reserve switched its policy goal to targeting the quantity of reserves and achieving greater control over M1, mainly in response to deviations in M1 growth from the FOMCs objective. But by late 1982, it had become clear that financial innovations had weakened the historical link between M1 and the economic objectives of monetary policy. There was a return to interest-rate rules, followed by a combination of interest rules and long-term inflation targeting after 2012. In the recent context of long-term inflation targeting, what the result above shows is that when a strict money supply growth rule is ineffective, it is possible to substitute it with the inflation targeting rule described in Proposition 2 above.

Next, I explore the feasibility of a link between a long-term optimal money growth objective and interest rate targeting.

7. A Long-Term Taylor-Type Rule Compatible with a Money Growth Rule

The appeal of the Taylor Rule is that it is simple and specifies how the federal funds rate (effectively the Fed’s instrument) should be varied directly in response to inflation and to deviations of output and inflation from the Fed’s ultimate targets of full employment and price stability. Without adducing that the U.S. Federal Reserve was explicitly pursuing this policy, Poole (2006) shows a very high correlation between the predicted federal funds rate from following a Taylor rule vs. the actual federal funds rate during the Greenspan years (1987–2005).

It is my view here that a Taylor rule is effectively the central bank’s reaction function to optimal money holdings. In other words, assuming that the Fed can infer the optimal quantity of money function, it can impact it by acting on the interest rate. If the central bank’s long-term objective is price stability, it is crucial that it understands well the actual behavior of the long-term optimal quantity of money function. Here, I derive a Taylor-type rule using the optimal quantity of money Equation (1) rewritten as follows: . Where the constant . I assume that there is a long term optimal amount of real money balances that corresponds to an equilibrium value for both the short-term and long-term interest rates and and potential real GDP/capita . Therefore, the optimum is defined by . Assume monetary authorities set the long-term inflation target at . In other words, they are pursuing price stability by following a naïve k-% Friedman-type rule where nominal money growth is intended to match long-run real GDP growth.

Under Proposition 2 above, applying the inflation target is equivalent to minimizing the difference between the log of the supply of real money per-capita and the long-term optimal level, or setting . After some simple algebra, this is equivalent to setting , or a Taylor-type rule.

To recover values close to Taylor’s (1993) rule, I assume, along with Taylor (1998), that the long-term rate satisfies the Fisher effect, then = 2% (real interest) + (inflation target), where = 1.85%. Furthermore, I assume that the current long-term rate is = 2% (real interest) + πt, where πt stands for the expected inflation rate applicable to the current long-term nominal rate. In that case, I find that

Equation (4) is the main result of this section. Here, the rule states that the short-term interest rate should be raised when the inflation rate exceeds the target or when output exceeds the target level of GDP/capita. The coefficients of this Taylor-type rule have economic meanings, which is not typically the case in the literature. In this context, the key coefficient of Equation (4) is , that is, the ratio of the technological bias parameter divided by the leverage ratio of depository institutions. The naïve k-% rule in equilibrium implies that the short-term interest rate must be set to the natural rate , which in Taylor’s case is set at 2% real (assuming 2% inflation). Taylor’s (1993) coefficients on the inflation and the output gaps are both 0.5. In my case, the coefficients are 1 for the inflation gap and 0.8% for the log of the output gap.

Of course, the comparison is not apples to apples, as Taylor analyzes only a 5-year period, and I use a 50-year period. He uses the federal funds rate as the short-term rate, whereas I use the 3-month T-Bill. Moreover, he uses real GDP, not real GDP/capita, as I do here. The coefficient on the output gap is quite small in my case, which means a fairly insensitive response of policy to the business cycle.

Because these two policy rules are essentially equivalent, why would the Fed not directly implement a money growth rule? In hindsight, the breakdown of money growth rules after 1982 pointed to the fact that the transmission channel did not account for shifts in velocity and financial innovations. Possibly going the route of a Taylor rule may be easier if the parameters of the optimal velocity function are stable enough. It is important to emphasize, however, that the Taylor-type rule I derived assumes that the velocity of money is in its long-run equilibrium. This rule may be appropriate, for example, when the intent is to smooth interest rates and policy adjustments are gradual (Dueker 1999). It is not necessarily appropriate for sharp short-term policy responses to exogenous shocks, such as driving short-term rates to zero to avoid a recession, as in the case of the 2008 GFC or the 2020 Covid crisis.

While the literature appears divided on this issue, I am able to reconcile a ‘naïve’ k-% Friedman type of rule with a Taylor-type rule.27 Orphanides (2007) for example, states: “A policy rule quite as simple as Friedman’s k-% rule cannot be formulated with an interest rate instrument. As early as Wicksell’s (1936) monumental treatise on Interest and Prices, it was recognized that attempting to peg the short-term nominal interest rate at a fixed value does not constitute a stable policy rule. (Indeed, this was one reason why Friedman, 1968, and others expressed a preference for rules with money as the policy instrument.) Wicksell argued that the central bank should aim to maintain price stability, which in theory could be achieved if the interest rate were always equal to the economy’s natural rate of interest, r*”.

By contrast, I find that a k-% money growth rule and a Taylor-type rule are interchangeable.28 And thanks to Proposition 2, this long-term Taylor rule is also consistent with inflation targeting a near-2% rate. Nevertheless, caution must be exercised when applying this k-% rule in its interest-targeting form. Setting the real short-term interest to its long-term counterpart would constrain the real-term structure to be flat. This might be a problem, as this works against the segment of investors who are trying to hedge short-term risk and are willing to bid up short-term Treasury bonds and accept a lower real yield than that of long-term instruments. Faugere and Van Erlach (2009), for example, show that since the mid-1950s, real after-tax short-term one-year Treasury yields have embedded a negative time-varying risk premium in comparison to 30-year Treasury yields.

8. A Near-2% Target to Avoid “Bad” Deflations

Whether or not the policy shift to a Taylor-type rule was conducted with that purpose in mind, a Taylor rule has the advantage of being more flexible by contrast with the money supply growth objective, as it leads to a money supply that adjusts to short-term variations in the velocity of money and even to the case where velocity growth may stall in the long-term. Bordo and Filardo (2005), for example, state that “When inflation is low, the usefulness of monetary aggregates may be exceeded by that of short-term interest rates, especially if velocity is sufficiently unpredictable”.

Bordo and Filardo may be more concerned with short-term policy. On the other hand, avoiding long-term recessionary deflations matters too. Assuming that the pace of innovation in transaction technology slows down and velocity becomes constant (but not zero), then the Taylor type rule defined in Section 7 generates price stability, i.e., an actual inflation rate of 0%. This is because behind this Taylor rule is an inflation target rule that matches inflation to the growth rate of money velocity. Hence, with the help of this policy, actual inflation is mostly contained between 0% and 2%, which avoids falling into a deflationary trap.

On the other hand, velocity may temporarily accelerate faster than the 1.85% pace, as it did in the mid-1990s (M1 velocity). In that case, interest targeting leads to slightly greater inflation than desired. But this is a temporary situation because the pace of financial innovation must revert back to long-term productivity growth. As previously discussed, these results are also an artifact of Friedman’s (1960) k-% rule, as it is equivalent to the Taylor rule here.

A different but related literature has examined what inflation level is needed to avoid a recessionary deflation in the context of monetary policy hitting the zero nominal bound.

Coenen et al. (2003) build a model for a small open economy with staggered wages subject to stochastic shocks similar in magnitude to those experienced in the U.S. over the 1980s and 1990s. Once shocks to aggregate demand or supply push the economy into a sufficiently deep deflation, a zero-interest-rate policy may not be able to return the economy to its original equilibrium. With a series of shocks large enough to sustain deflationary expectations and to keep the real interest rate above its equilibrium level, aggregate demand is suppressed, further sending the economy into a deflationary spiral. They find that the consequences of the zero lower bound are negligible for target inflation rates as low as 2 percent but not lower. By contrast, my analysis clearly shows that interest targeting provides a long-term hedge against deflation, whether the zero bound is present or not, as it generates an inflation contained between 0 and 2% as long as the velocity of money does not decrease in the long run.

On the other hand, Friedman (1969) argues that a rate of deflation equal to the negative of the real interest rate might be desirable. Over the past 20 years, Friedman’s (1969) proposal has certainly been extensively studied by a plethora of macro models.29 While his prescription has clearly been rejected by major central banks as a guide for conducting long-term monetary policy, some low-level deflation may be acceptable and even desirable, as long as it is accompanied by productivity increases and no severe downward spiral in nominal wages and aggregate demand.

As the thesis of this paper argues, financial and technical innovations matter in determining the behavior of money velocity. While this is not a new idea, it seems that, practically speaking, this point has been ignored by policymakers. The implication of my analysis is that a slowdown in the velocity of money may accentuate the rate of deflation, turning it into a “bad” deflation as economic agents join the vicious cycle of money hoarding followed by an economic slowdown. I am not here pinpointing the particular threshold where this would happen. However, it appears that the potential downside associated with Friedman’s (1969) recommendation is great and that Friedman himself realized this by advocating for a k-% rule. Central bankers have also used their judgment wisely in staying away from it.

9. Conclusions and Extensions

In this paper, I provide a macroeconomic foundation for the behavior of the velocity of narrow money as well as for an inflation target near 2% in the U.S. The theoretical model is tested over the period 1959–2007, which bypasses the last two decades of unorthodox policies in the wake of the 2008 financial crisis and the 2020 Covid crisis. Nevertheless, a robustness test of the model is implemented for the period extended to 2023 and still confirms these findings after some adjustments made to correct for the impact of these UMPs.

Expanding on Baumol (1952) and Tobin (1956), I introduce a new approach to modeling the transaction cost savings relative to barter as a function of technical progress and of the net return on assets for the depository institutions. This implies that transaction cost savings are also a function of the depository institution leverage ratio, via the expansion of credit cards that substitute for other sources of consumer/business credit.30

Using the standard optimality of money holdings condition, I am able to derive the optimal velocity of narrow money, which increases with real GDP/capita and decreases with the net return on depository institution assets and leverage. It is in theory possible to arrive at the same reduced form for the optimal velocity of money as the one developed here via other frameworks. And therefore, I accept as debatable the proposition that it enhances our economic understanding of the monetary phenomenon to conceptualize an optimum velocity of money as being dictated by the convenience yield provided by money due to its transaction-facilitating properties relative to a barter economy.

Empirically, I use a VECM approach (Johansen 1988, 1991, 1995) and find that for various adjusted measures of narrow money, the long run velocity relation features parameter values consistent with the U.S. historical record over 1959–2007. The leverage parameter in the cointegrating equation (using M1) is a near-perfect match with estimates of the mean leverage ratio for U.S. depository institutions around a value of 15.

As Reynard (2006) remarks, “It is often suggested that an explanation for the upward trend in M1 velocity during the post-war period is that technical progress in credit cards and other advances would have allowed individuals to economize on money balances, justifying an income elasticity below unity”. Here, I do find support for that position. The income (real GDP/capita) elasticity of velocity is indeed less than unity because progress in transaction technology is, on average, biased towards new forms of money.

While not necessarily optimal, a particular value for the inflation target stands out in the analysis. Setting the long-term inflation target equal to the growth rate of money velocity entails that the optimal rate of inflation is a function of productivity growth and of the bias in progress parameter. My point estimate for this long-run inflation target is slightly below 2% at 1.85% for the U.S over 1959–2007. The estimated range based on confidence bands is [1.29%, 2.42%]. I show that this inflation target rule is consistent with a long-run money growth rule and a Taylor-type rule. I also conduct a robustness test over an extended period (1959–2023), which included some severe crises (GFC and COVID 19) and lengthy episodes of unconventional monetary policies. I find that these multiple QEs had a distorting effect on the estimates of leverage and other coefficient that impacts the target inflation rate. I develop a new measure of adjusted M1 that corrects for the impact of QEs by subtracting idle M1 (excess reserves that do not contribute to the expansion of credit) from M1. The robustness tests I conduct in Appendix C confirm the model over the extended sample period. I find that the long-run inflation target is contained in an estimated range of [2.02%; 2.31%].

It is worth pointing out that caution must be exercised not to infer the reverse causation that a 2% inflation target necessarily generates a constant money growth rule. If monetary authorities intend to pursue a goal of price (or rate) stability, the 1.85% target is clearly a knife-edge case, and slight deviations can propel the economy away from that goal. However, it is well understood by central bankers nowadays that even though policymakers may not be able to implement a precise target in practice, defining a credible and appropriate inflation target can help ensure that economic expectations are firmly anchored, which, for example, has strong implications for the stability of asset prices.31

Future research will examine the evolution of money and its impact on velocity as new technologies (AI) and new means of transaction continue to emerge. In particular, given the rising speed of networked computers, there is an increase of online barter as a method of commerce. Other possible extensions are to examine the inflationary implications of digital money. The impact of securitization is also an aspect that merits further investigation, as the dynamic link between bank profits and the gap between lending rate vs. deposit rate is not obvious, given that financial institutions can partially escape capital adequacy ratios by shipping risky (credit-card) loans off their balance sheets. Another issue is that while monetary policy is separated from public debt management and fiscal policy, it has been recognized that the monetary transmission mechanism may be affected by the impact of the structure of debt on market expectations. Circumstances that entail a risk of “fiscal dominance” (that is, high public debt ratios and heightened sovereign risk weakening the local banking system) can increase uncertainty about future interest rates. This might create expectations of time-inconsistent monetary policies, especially deviations from long-term inflation anchoring. These issues remain to be further investigated.

Funding

This research received no external funding.

Informed Consent Statement

No humans were involved in this study.

Data Availability Statement

Data available upon request.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A. The Credit Card Market and the “Banks” General Credit Market

Here, I conduct a comparative statistics analysis and show that as credit becomes more expensive, the demand for credit cards actually expands while the net return on depository institutions’ assets declines. The reason for the expansion of credit cards is that consumers and businesses view the “high” rates offered on credit cards as price ceilings. They believe they can control the effective interest they pay on the loan over the grace period by avoiding finance charges (Ausubel 1991). Thus, while other sources of credit are becoming more expensive, that is not necessarily the case for credit cards if customers are disciplined enough to avoid finance charges.

In particular, I show that the quantity supplied of credit card loans is related to depository institutions’ net return on assets. Notwithstanding, the link is not necessarily as obvious as one might imagine. For example, one might assume that the net return on credit card loans is about equal to that of other loans because of market efficiency, and thus the quantity supplied of credit card loans should rise with the net return on bank assets. However, this is not correct because borrowers substitute between credit instruments to select the “cheapest” one, which turns out to be credit cards, as borrowers have the option of using the grace period to avoid finance charges. This is the core of the analysis conducted below. Let me first start by covering some of the unique features of the credit card market.

First, it is well documented that during the 1980s and 1990s, credit card profits dramatically outpaced those of other types of bank loans. Ausubel (1997) reports that from 1983 to 1993, the return on assets (ROA) from credit card loans was roughly four times the banks’ overall ROA. Data from the Federal Reserve shows that the proportion of revolving loans as a percentage of the total (revolving plus non-revolving) has been rather stable, around 37% on average, since the early 1990s, with a slight upward trend peaking at about 41% in 1998–1999 and declining since then up until 2010.32 One possible reason why institutions have not expanded the share of credit card loans in their portfolios during that period is that the risk exposure is much greater for these unsecured loans, so that capital adequacy ratios put in place by the Basel accords after 1988 have limited how much of these loans could be placed on the banks’ balance sheets.33

Although it is unresolved at this point whether this is a permanent characteristic of the credit card market or not, Ausubel (1991, 1997) documents that credit card rates are relatively insensitive to changes in short-term rates (costs of funds). However, they appear to be slightly more sensitive to changes in long-term rates, at least since the interest rate ceilings on credit cards were removed in the early 1980s (Brown and Plache 2006). Stavins (1996) shows that the demand for credit cards is elastic, so the explanation of interest rate stickiness does not necessarily originate from the demand side, even though in some segments of the market, demand may be more inelastic. For example, the latter is true for customers with high balances, as they face high switching costs (Calem and Mester 1994). One explanation for the uniformity of “high” rates across the industry is adverse selection. Banks do not want to unilaterally lower their rates because, in doing so, they would attract a pool of higher-risk customers. On the other hand, the supposedly high interest rates that the industry charges are nowhere near the rate they expect to receive. In 1996, it was estimated that over half, and probably as much as 68%, of credit card users were considered “convenience users”. These customers use credit cards primarily as a transactional medium and pay off their balances in full each month. Around that same time, Visa estimated that almost 60 percent of total bankcard volume generated no interest. By contrast, revolvers carry a positive balance at the end of the month.

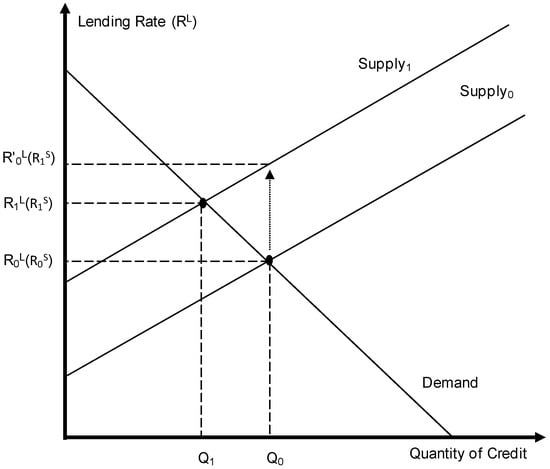

Below, I analyze the connection between a drop in the banks’ net asset returns and the equilibrium quantity of credit cards on the market. Assume that the Fed implements a restrictive policy and sets the short-term interest rate at . Figure A1 describes what happens in the depository institution’s loan market (excluding credit cards). The shift from the supply curve Supply0 to Supply1 takes place as depository institutions provide the same quantities of credit as before at the same maximized profit/net asset return, determined by long-run competition. Here, I assume that the net asset return for non-credit card loans uses the same leverage ratio as the total loan portfolio.

Figure A1.

“Bank” credit market (excluding credit cards)—restrictive monetary policy.

Focus on the initial equilibrium Q0. The new interest on loans on the new supply curve must be related to the old interest rate on loans in the following way , by the fact that , where represents the leverage parameter. As long as, the demand is elastic, Figure A1 shows that the new equilibrium rate on loans must satisfy and , so that .34 Thus, a contractionary monetary policy has the effect of decreasing the net asset return on (non-credit card) bank loans and reducing the quantity of these loans.

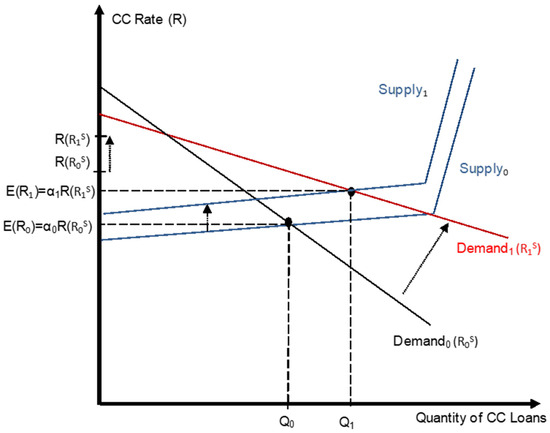

The second stage of the argument is to examine what happens in the credit card market. I hypothesize that the market supply and demand of credit cards are “effective” in the sense that they are driven by the weighted average return on these loans, holding the total number of users and the proportion of revolvers vs. convenient users constant. What is happening here is a substitution effect on the demand side. Because other sources of credit are becoming more expensive, the demand for credit card loans will increase as a substitute because borrowers believe they can control ex-ante the effective rate they pay. Even if customers have existing balances, they can transfer their balances to new credit cards and benefit from low introductory rates and a new grace period. Ausubel (1991) argues that credit card users often underestimate the amount they will borrow, as they are not careful enough to make payments on time or face unforeseen adverse economic situations. The demand from ex-post convenience users should go up, as some of these people will be able to implement the following arbitrage strategy: They can borrow money from the credit cards at a low effective rate (potentially 0%) and lend this capital at a higher short-term rate. In that case, some individual demands may even have a positive slope.

The demand for ex-post revolvers also increases as they end-up with a positive balance, even if they had set-out to have zero balances. Moreover, they can always take out a regular bank loan and pay back their credit card balance, as long as they remain creditworthy. All in all, this results in a displacement of the demand for credit cards. Figure A2 shows how the demand labeled according to the short-term rates () shifted, corresponding to an increased demand mostly driven by an increased proportion of convenience users. The proportion of customers who are “revolvers” is denoted by α. The rotation of the demand inward occurs, holding the number of credit card loans constant, after the proportion of revolvers drops from α0 to α1. On the other hand, a larger number of loans causes the demand Demand1 (R1S) to shift outward and end-up where shown in the graph.

Figure A2.

Credit card market—restrictive monetary policy.

Empirically, the maximum rates are insensitive to short-term rates, as discussed above. Assuming the stickiness of maximum rates would actually make my argument stronger. I chose to show on the graph an example where the maximum rate charged on credit cards does increase from R(R0S) to R(R1S). This case corresponds to a shift in an infinitely elastic (probably over a finite range) supply due to the higher cost of funds. This supply corresponds to the “best case” scenario for the banks, where all customers would be revolvers. However, that is not what happens in reality. The amount by which the maximum rate shifts is explained below.

The expected/average return on these loans is E(R0) = α0R(R0S) before the demand shift and E(R1) = α1R(R1S) after. The maximum rates R(R0S) and R(R1S) charged must satisfy λ1α0R(R0S) + (1 − λ1)R0S = λ1α1R(R1S) + (1 − λ1)R1S. In other words, given the leverage λ1, when the proportion of revolvers drops from α0 to α1, the maximum rate charged must rise so that the net asset return on credit card loans remains the same as the one determined by the long-run competitive equilibrium. The effective supply is actually shifting up, as shown in Figure A2. In that case, banks are not receiving a greater net asset return on credit card loans. In conclusion, a rise in short-term interest rates leads to a substitution of less traditional bank loans in favor of more credit card loans, at the same time as the net return on bank total assets is declining. A decrease in short-term interest rates leads to the reverse outcome.35

On the other hand, an increase in Treasury long-term rates first leads to an increase in bank lending rates because of the two markets competing for funds. Thus, the supply of bank loans shifts (credit cards and non-credit cards). However, because of abnormally large profits, banks bid-up short-term instruments used for leverage. Hence, the supply shift of non-credit card loans is such that the net asset return is again the maximum achievable under long-run competition (holding the quantity of non-credit-card loans constant). Similarly, as before, this leads to a decrease in the net asset return (movement along the demand curve) for non-credit card loans. Furthermore, the move upward in short-term and long-term rates impacts the maximum card rates. Thus, the credit card market is impacted in the same way as before. Finally, I have shown that in all cases, the equilibrium quantity of credit card loans varies on a one-to-one basis with the net returns on assets for depository institutions.36

Appendix B. Proof of Proposition 1

To set-up the result, it is first important to recognize that there is a relative opportunity cost to holding money as compared to holding goods for barter. Credit/lending technology is less efficient in a barter economy due to storage and spoilage costs. Given a rate of interest R promised in a monetary economy, if the monetary system suddenly collapses, the expected return in a barter economy becomes (1 + R)(1 − δ) − 1, where is the per-dollar storage and spoilage cost.37 Thus, the relative opportunity cost of holding an amount of money (or goods equivalent to the amount of money) for trade is therefore higher in a monetized economy than in a barter economy by the amount δ(1 + R).

Assuming that the opportunity cost of money is given by the short-term interest rate , the standard optimality condition determining the optimal money holdings is Net Marginal Benefits of Real Money Holdings − = 0. On the other hand, the services that money renders must at least be equal to the transaction services obtained by holding goods for barter, as money is an extension of barter. In other words, money services can be separated into two additive components: (1) the same basic transactional services that goods held for barter provide, plus (2) the reduction of transactional frictions caused by barter.38