1. Introduction

Standard finance is a widely-studied model that dominates the field of finance. It is based on two distinct assumptions: rational markets and rational economic man. The rational markets hypothesis postulates that financial markets quickly and accurately incorporate all relevant information into asset prices. This theory suggests that investors find it difficult to consistently outperform the market, since prices reflect all available knowledge as well as the true intrinsic value of assets. The rational economic man refers to the theoretical representation of an individual who makes economic decisions logically, rationally evaluating costs and benefits, and maximizing utility or profit. According to this conception, rational economic man is supposed to be perfectly informed, able to process information objectively, and to make coherent choices according to his preferences.

In fact, different researchers like

Fama (

1991) and

Agrawal and Tandon (

1994) have proven that there are three main types of anomalies that contradict the efficient market hypothesis (Fundamental Anomalies, Technical Anomalies and Calendar Anomalies). Also, other researchers like

Katona (

1975) and

Thaler (

2000) criticize the bases of Homo economicus and assume that people are neither perfectly rational nor perfectly irrational. These studies have raised compelling arguments that challenge the dominant notions of standard finance, and highlight the role of cognitive biases and other psychological factors in influencing economic decisions. hence, the emergence of behavioral finance.

Behavioral finance, a branch of behavioral economics, is defined as the application of psychology to finance and become a very hot and interesting topic. It disputes the two concepts in standard finance mentioned above. According to

Pompian (

2012), behavioral finance can be broken down into two subtopics: Behavioral Finance Macro (BFMA) that examines the efficient market hypothesis, detects and describes their anomalies. And, Behavioral Finance Micro (BFMI) which focuses on individual investors and investigates their behaviors and biases.

Behavioral corporate finance, a subfield of BFMI, emphasizes that managers are not fully rational and states that several factors can influence their financial decisions, namely: heuristics, behavioral biases, personality traits, moods and emotions.

In this study, we were interested in behavioral biases, which are, according to

Chikh and Grandin (

2016), the discrepancy between the way we reason, and the way we should reason. We distinguish two types of biases: Cognitive biases and Emotional biases.

Research in behavioral corporate finance has developed strongly in recent years, thanks to the work of

Scott et al. (

1972),

Peel and Wilson (

1996),

Danielson and Scott (

2006),

Ang et al. (

2010),

Sammoudi and Hazami-Ammar (

2017),

Baker et al. (

2018) and several others. However, the specific study of managers is poorly documented, especially in comparison with the literature devoted to investors in financial markets (

Bessière 2007). This has been observed and studied in large companies, and it will be even worse for SMEs, which are the engines of growth and job creation.

Actually, Moroccan SMEs represent 93% of all companies in the country and contribute to 46% of job creation. So, they are so important for Moroccan economy, but they make only a small contribution to the overall value added, perform less well than large companies in terms of margins and returns, and are in first place in terms of insolvencies. In fact, Allianz Trade recorded 3830 insolvencies in the first quarter of 2023, up 28% on the same period of 2022. This is due to several internal and external factors, but mostly to the sub-optimal decisions, personality traits, behaviors and biases of the manager (

St-Pierre 2018). Thus, the main objective of our research is to answer the following question:

What is the impact of behavioral biases on the investment decisions of managers of Moroccan SMEs?

Despite the abundance of international research on this subject, the specific context of Moroccan SMEs remains relatively unexplored. Consequently, our study aims to fill this gap by shedding light on the complexities and consequences of behavioral biases in the context of Moroccan SMEs. We also aspire to contribute to academic understanding of the psychological and behavioral mechanisms underlying investment decision-making within these SMEs.

Through our empirical analysis and theoretical exploration, we aim to enrich existing knowledge and offer an in-depth understanding of the factors influencing financial decisions in this particular context.

Our research adopts a quantitative methodology, utilizing a questionnaire to gather data from managers of Moroccan SMEs across different industries and scales. The final sample comprises 133 valid questionnaires.

The article initiates with an extensive review of relevant literature and formulates hypotheses to test the association between behavioral biases and their impact on investment decisions. Following this, we identify the study’s sample and variables, conduct the analysis, interpret the results, and conclude by presenting our noteworthy observations.

2. Behavioral Biases and Investment Decisions: Literature Review and Hypotheses

2.1. SMEs Investment Decisions

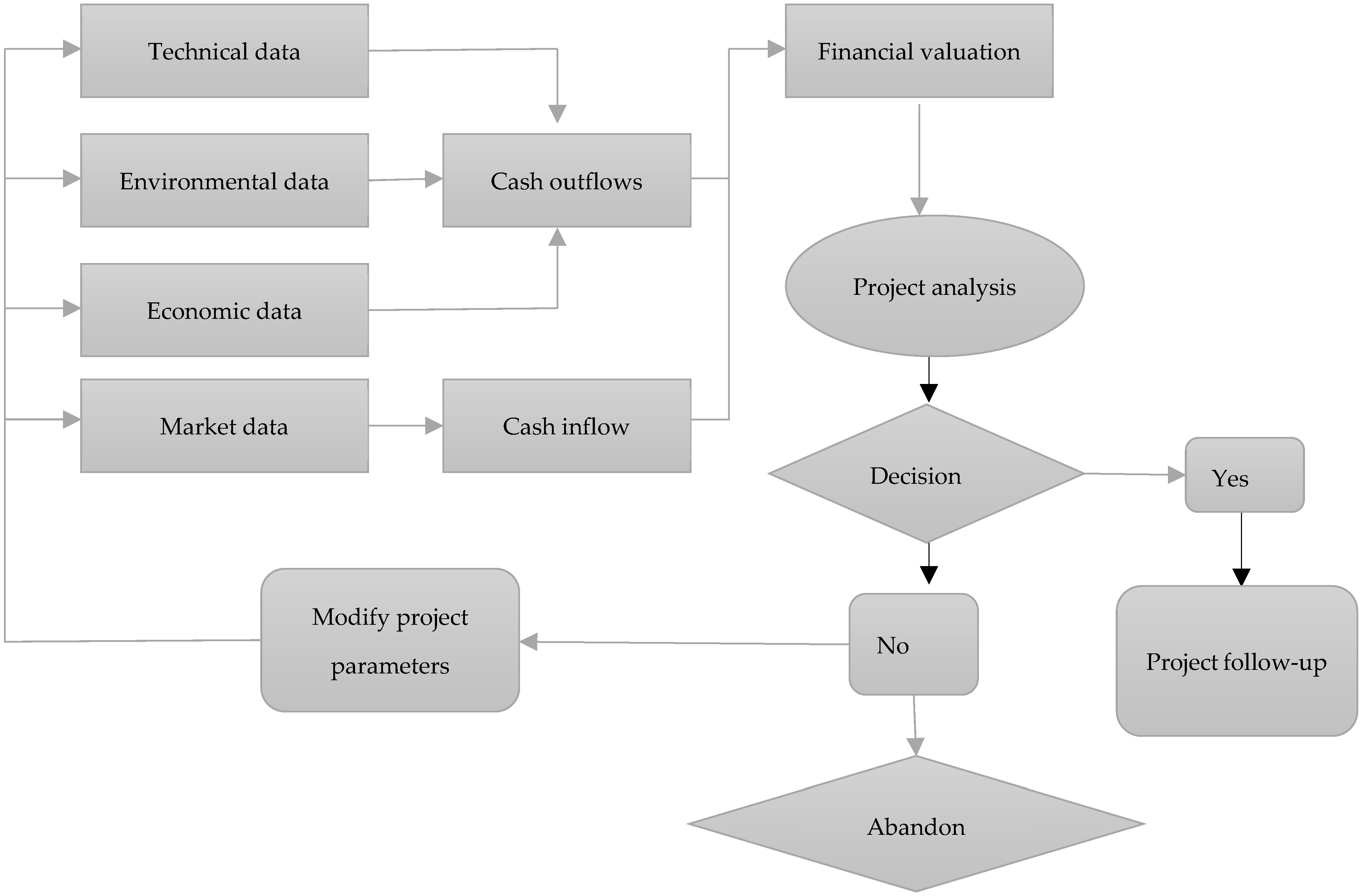

The

Figure 1 illustrates the financial evaluation process. Its importance lies in the fact that the company must take into account and plan for all the financial consequences of its decisions.

To carry out this evaluation, it is necessary to identify all the financial parameters linked to the project, which will enable us to determine the cash flows coming in (such as sales forecasts) and the cash flows going out (such as costs associated with preparation, equipment purchases, etc.). The data needed to calculate these cash flows come from a variety of sources and of different natures, such as technical, environmental, economic and market data. The data collected will be classified according to their nature (income or expenses) and analyzed using investment selection methods such as NPV (Net Present Value), IRR (Internal Rate of Return), ROI (Return on Investment), PI (Profitability Index), and Payback Period. All this enables the entrepreneur to make a decision about the viability of the project. The figure illustrates that the decision-maker can go back and make changes to make the project more financially viable for the company.

2.2. Manager’s Behavioral Biases and Investment Decisions

2.2.1. Overconfidence

Overconfidence bias refers to the propensity to overestimate one’s abilities, knowledge and ability to predict and control the future. It is essential to distinguish between overestimating the accuracy of our knowledge and believing that we are superior to the average in certain tasks, even in the absence of any means of comparison with that average (

Chikh and Grandin 2016).

Managerial overconfidence can be defined in two complementary ways. Firstly, it involves the overestimation of the information available to the manager, i.e., the belief that he or she has all the information needed to make accurate decisions, which is known as “miscalibration” (

Acker and Duck 2008). The manager believes he has all the relevant data, without taking into account the limits of his knowledge. Secondly, managerial overconfidence refers to the overestimation of the leader’s own skills, known as the “better-than-average effect”, as described by

Camerer and Lovallo (

1999). Overconfident leaders believe they are superior to the average in terms of skills and abilities, leading them to take excessive risks and minimize potential obstacles.

This overconfidence bias is commonly observed in business leaders, as it is often necessary to assume such roles (

Hiller and Hambrick 2005). Overconfident leaders overestimate their knowledge, minimize risks and exaggerate their ability to control events (

Malmendier et al. 2011).

Since the 2000s, researchers have been investigating the relationship between overconfidence and financial decisions. It has been consistently found that overconfident managers tend to overestimate the chances of success of their investment projects (

Sammoudi and Hazami-Ammar 2017).

In an efficient market, the presence of overconfidence, manifested in a misperception of investment opportunities, impacts investment decisions (

Malmendier and Tate 2005). Overconfidence has a positive effect on the frequency and premium of acquisitions, but a negative impact on shareholder wealth (

Smaoui Chabchoub 2010).

Based on these assumptions, we aim to examine the following hypothesis:

H1: Managers with overconfidence in Moroccan SMEs are inclined to make weightier investment decisions.

2.2.2. Optimism

According to

Pompian (

2006), excessive optimism refers to a positive, idealistic view of the future. When individuals project themselves into the future, they tend to overestimate the likelihood of positive experiences, while underestimating the risks of facing negative ones. This tendency was demonstrated in the life expectancy experiment conducted by

Puri and Robinson (

2007).

Excessive optimism manifests itself as a preference for favorable prospects (

Sammoudi and Hazami-Ammar 2017). The introduction of this bias to the corporate domain was carried out by

Heaton (

2002). His work demonstrated that “optimistic” managers tend to systematically overestimate the probability of good company performance, while underestimating the probability of poor performance. As a result, portfolio managers tend to overestimate their ability to outperform the market, and also have a biased view of their past performance.

Optimistic managers tend to perceive their company’s projects as more profitable than they really are. They believe that external investors underestimate the value of the company’s securities, such as bonds or shares. As a result, optimistic managers are more inclined to commit to investment projects because of their positive perception of the projects’ potential for success.

According to research by

Heaton (

2002) and

Malmendier and Tate (

2005), optimism plays a key role in managers’ investment decisions. When managers are optimistic, this means that they believe the market is undervaluing their company, leading them to assign a higher value to it (

Fairchild 2005). This optimistic outlook leads managers to overestimate future earnings and cash flows, prompting them to make potentially riskier investment decisions or to invest more in new projects.

We therefore formulate the following hypothesis:

H2: Optimistic managers in Moroccan SMEs are inclined to make weightier investment decisions.

2.2.3. Risk-Taking Behavior

Using prospect theory, we can identify three distinct categories of risk-taking behavior among leaders:

The risk-averse leader relies on established procedures, norms and standards, and looks to the actions of others for inspiration when making decisions. He prefers to align himself with past practices and decisions when evaluating available options.

Unconscious risk-takers undertake actions with a high probability of unfavorable outcomes, without fully recognizing the potential risks and threats involved. This behavior results from their reduced perception of risk and the associated level of threat.

The risk-taking executive, on the other hand, is influenced by the anticipation of gains or losses. After a failure, they are more inclined to choose the riskiest option to recoup their losses. Conversely, after a success, he gains confidence in his decision-making abilities, attributing success to his skills rather than luck. As a result, he may underestimate the role of luck in his past successes and continue to take risks to maintain his perceived success.

Risk-taking is a notion that expresses the willingness to commit oneself to actions whose outcome is uncertain, but which have the potential to pay off handsomely. This disposition is generally associated with typically entrepreneurial behavior (

Barringer and Bluedorn 1999).

More generally, risk-averse decision-makers tend to overestimate the probability of incurring losses from uncertain or unpredictable strategic choices. Conversely, those who are inclined to take risks take the opposite approach, overestimating the chances of making significant gains. In other words, risk aversion translates into a reluctance on the part of decision-makers to accept potential losses (

Kahneman and Lovallo 1993).

It has been established in the literature that productive investments present a high degree of irreversibility, making disinvestment virtually impossible or too costly in the event of results falling short of expectations. Consequently, it can be assumed that risk-averse decision-makers, who favor options with a low probability of loss over those offering high profitability, will adopt a less dynamic behavior in terms of productive investment than those who are more open to risk-taking. Thus, a direct link can be established between the degree of risk-taking of decision-makers and the level of productive investment by the company (

Sauner-Leroy 2004).

Our analysis of the theoretical and empirical literature has led us to conclude that risk-taking is closely linked to investment policy (

Coles et al. 2006;

Kose et al. 2005). We aim to examine the following hypothesis:

H3: Managers with a high propensity for risk-taking may be more open to bold investment decisions.

2.2.4. Mimicry

Economic agents have a propensity to follow similar decisions simultaneously, and to conform in a gregarious way. This behavior is often the result of voluntary or unconscious imitation of the models they seek to identify with, corresponding to a process of adaptation to group norms (

Grawitz 2004). Research by

Nofsinger and Sias (

1999) has shown that mimicry can occur within a group of investors where transactions are made in the same direction, reflecting a herd mentality. This translates into mutual imitation in their transactions.

According to

Corazzini and Greiner (

2007), the main sources of mimicry include revenue externalities, correlated effects and social preferences. Income externalities occur when the actions of each agent affect the income of other agents, prompting them to adopt herd behavior in order to maintain a certain equilibrium. Correlated effects refer to the fact that agents behave in a similar way due to common external constraints they encounter. Social preferences indicate that decision-makers, whether agents or managers, adopt the same strategic choices as their predecessors, ignoring available information and favoring that used by the former. This creates a mimetic cascade in which decisions are repeatedly reproduced.

Mimicry on the part of SME managers can lead them to adopt investment strategies that resemble those employed by successful counterparts. For example, if a manager observes that a competitor has achieved profitability through investments in a particular sector, he or she may be tempted to imitate these actions in order to reproduce similar results (

Belanes and Hachana 2010). This can lead to uninformed investment decisions. While these decisions can be successful, they can also end in failure.

Based on these observations, we can formulate the following hypothesis:

H4: Mimicry leads managers in Moroccan SMEs to undertake a significant number of investments.

2.2.5. Intuition

Intuition can be defined in two ways. Firstly, it represents the ability to grasp truth immediately, without recourse to reasoning. Secondly, it is the ability to foresee or guess. To have intuition is to have flair (

Kammoun and Benslimane 2011).

Intuition is therefore an unconscious mode of operation based on the accumulation of subconscious knowledge acquired over years of experience. It differs from, but is not necessarily opposed to, reason, and can be used simultaneously with a simplified analytical process. Intuition enables us to quickly grasp a situation or make decisions without the need for deliberate, rational thought. It can be seen as a form of “tacit knowledge” that results from accumulated experience and manifests itself spontaneously, almost instinctively (

Kammoun and Gherib 2008).

The majority of SME managers are extremely intuitive. In fact, they rely entirely on their intuition when making investment decisions, often with above-average degrees of reliance, depending on the problem at hand. The main reason they rely on their intuition is that they are faced with a high degree of uncertainty. A feeling of calm is an essential indicator of a good intuitive decision, while anxiety indicates just the opposite. Furthermore, anger is a major obstacle to the use of their intuitive abilities. Finally, most of those questioned confirmed that they often discuss the use of their intuition with others. This may in fact enhance their sixth sense, encouraging them to rely on their intuition as often as possible, to the point of declaring that they have put into practice at least one specific method or technique to make it more effective and developed. This reinforces the idea that the use of intuition is not a matter of chance, but rather the result of a real awareness on the part of managers, who see their intuitive faculties as a genuine decision-making tool.

Hence, we aim to verify the following hypothesis:

H5: Relying on intuition motivates managers in Moroccan SMEs to embark on a substantial number of investments.

3. Methodology

3.1. Population and Sample Size

The study’s target population consisted of all Moroccan SMEs, but given operational limitations, we created an observed population by excluding non-active companies. Thus, our research focuses mainly on small and medium-sized enterprises, i.e., a total of 295,038 Moroccan SMEs.

Since it was virtually impossible to conduct individual interviews with such a large number of companies, we opted for probability sampling to select a representative subset. The simple random sampling method was chosen, guaranteeing that every SME had an equal chance of being included in the sample, thus ensuring the fairness and representativeness of the process.

The sample size was calculated using an appropriate statistical formula, based on the simple random sampling method developed by

Krejcie and Morgan (

1970). This resulted in a sample of 383 Moroccan SMEs. Using a random selection process based on the available database, we were able to impartially select the 383 SMEs that would form part of our study. The questionnaires were addressed to the managers, those who make decisions in the company, since the research analyzes individual behavioral biases. This approach ensures that the study focuses on the relevant decision-makers within each SME.

Although we received responses from 142 companies, only 133 were considered usable for our analysis, giving a response rate of 34.72%. Despite this response rate, our sample remains representative and will enable us to obtain statistically significant results for our research.

3.2. Method of Analysis

In this study, we used structural equation methods (SEM) to analyze behavioral biases, variables that are difficult to observe directly. Using SEMs, we were able to measure and explore the underlying structure of these abstract concepts. To conduct our empirical verification, we used SmartPLS 4 software.

The evaluation and specification of the measurement model (Outer Model) played an essential role in ensuring the reliability and validity of the measurement instruments. We used specific thresholds, such as a Rhô coefficient ≥0.70 (

Hulland 1999) and an average variance extracted (AVE) ≥ 0.50 (

Hair et al. 2022), to assess the reliability of latent variables.

The convergent and discriminant validity of the variables was also examined by comparing the correlations between the concepts (

Hair et al. 2022). Convergent validity, which measures consistency between different measures of the same trait, can be assessed by examining the correlation between item scores and target concepts. In SmartPLS 4 software, a “Factor Loading” is considered reliable if its correlation with the construct exceeds 0.50 (

Hair et al. 2019;

Urbach and Ahlemann 2010). In addition, the statistical significance of factor contributions is determined by Student’s t-tests, with a significance level of 1.96%.

SmartPLS 4 software uses cross-loading analysis and average variance extracted (AVE) to estimate discriminant validity. There are two key rules to follow:

To test the robustness of the model, we opted for the bootstrap procedure, which is suitable for small sample sizes and non-normally distributed data (

Chou and Bentler 1995).

To evaluate the structural model (Inner Model), we used the squared multiple correlation coefficient (R2) to measure explained variation in latent concepts, and path coefficients to assess relationships between variables. A bootstrap procedure with 5000 iterations was used to determine the statistical significance of the coefficients. We focused on high R2 values and significant regression coefficients (R2 ≥ 0.67 for substantial variance) in the SmartPLS 4, which prioritizes maximizing explained variance over covariance (

Chin 1998).

3.3. Conceptualization and Operationalization of Research Variables

Our research focuses on five behavioral biases, abstract concepts that are difficult to observe directly. To measure these biases, we used a questionnaire, as their evaluation often relies on psychological tests (

Table 1,

Table 2,

Table 3,

Table 4 and

Table 5). Our research focuses on five behavioral biases, which are abstract concepts that are difficult to observe directly. To measure these biases, we used a questionnaire, as their evaluation often relies on psychological tests (

Table 1,

Table 2,

Table 3,

Table 4 and

Table 5). To measure the dependent variable INV, we used financial data collected from the SMEs managers.

3.3.1. Overconfidence

Overconfidence, characterized by an overestimation of personal abilities and an underestimation of the risks associated with decisions. To assess this, we used a 5-item scale developed by the savings research unit (PSE) of the French company Fern Hill and already employed by

Sammoudi and Hazami-Ammar (

2017) with Tunisian SMEs.

Table 1 lists the specific items related to the overconfidence bias.

3.3.2. Optimism

Optimism, which translates into an overly positive perception of future events, irrespective of personal capabilities. We used a 5-item scale based on the preferences expressed by managers. The items were also developed by the Savings Research Unit (PSE) of the French company Fern Hill.

Table 2 outlines the particular items associated with the optimism bias.

3.3.3. Risk-Taking Behavior

Risk-taking refers to the willingness to engage in actions that are both uncertain and have a high payoff. To measure it, we used five items, three of them come directly from the empirical work carried out by

Belanes and Hachana (

2010) in previous studies concerning risk aversion among SMEs managers. To complement the existing items, we also developed two new items specifically tailored to this study, drawing on relevant literature and aligning with our research objectives.

Table 3 enumerates the individual items pertaining to the Risk-taking bias.

3.3.4. Mimicry

Mimicry corresponds to the conscious or unconscious imitation of other people’s behaviors in order to identify with a specific social group. We used two items from previous research (

Belanes and Hachana 2010) and added two others based on empirical work.

Table 4 itemizes the specific items related to the mimicry bias.

3.3.5. Intuition

Intuition is an instinctive ability to evaluate and choose investment opportunities without resorting to in-depth rational analysis. It involves relying on instinct, impressions or immediate feelings to make financial decisions. To measure it, we used two items based on the preferences expressed by managers inspired from the literature (

Table 5).

3.3.6. Investment Decisions

Investment decisions encompass choices to acquire assets to secure future cash flows and maximize owners’ wealth. Given the lack of information on the market value of unlisted companies, we used an accounting measure based on the calculation of investment as a function of fixed assets and total assets.

This measure served as the dependent variable in the study (

Brigham and Houston 2015). Each company’s level of investment was calculated using a specific formula:

4. Assessment of Measurements Model (Outer Model)

In SmartPLS 4, the measurement model (external model) is assessed by examining the convergent and discriminant validity, as well as the internal reliability, of a block of indicators.

4.1. Convergent Validity Test

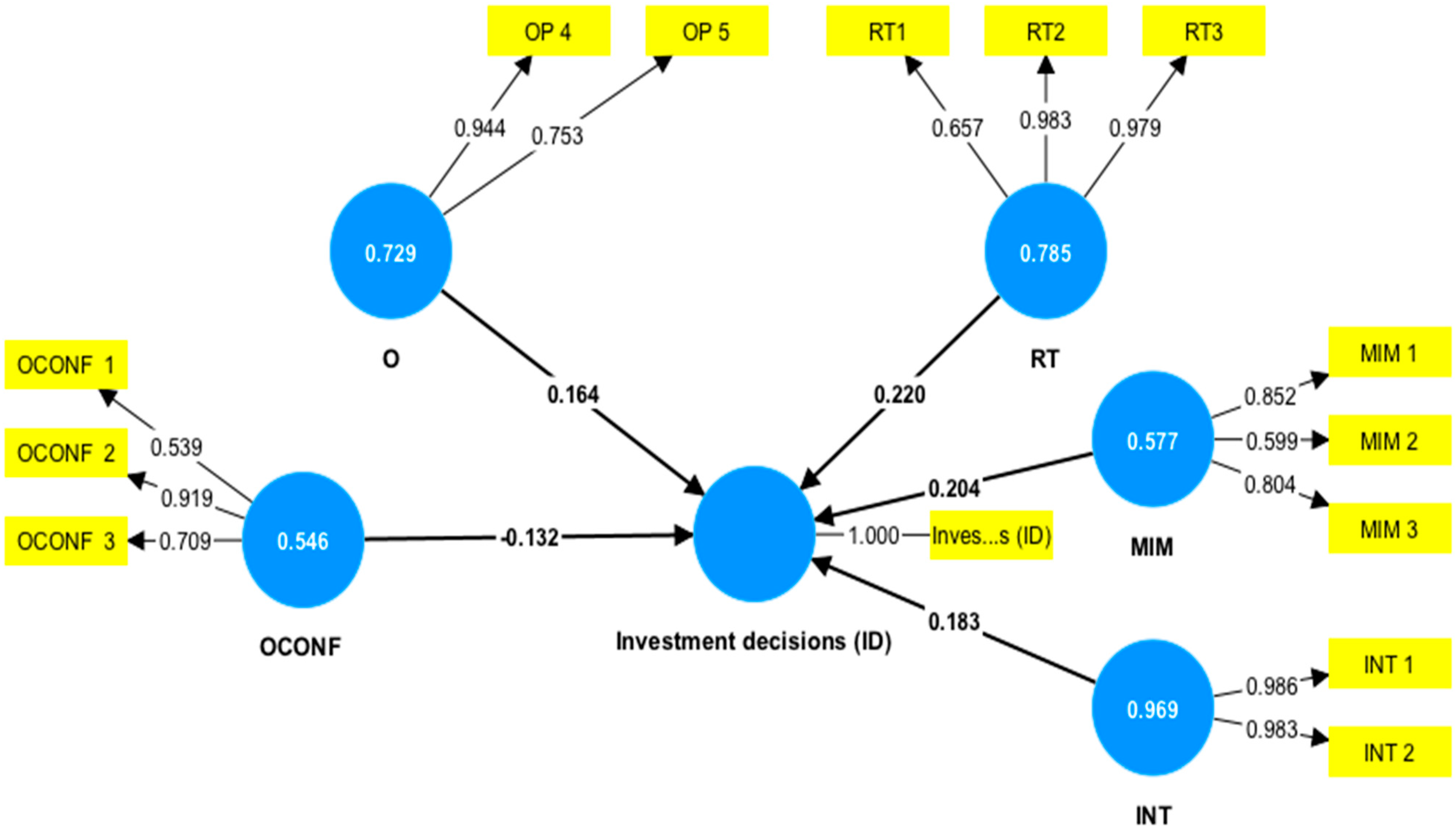

To determine the weights and loadings of each element in relation to the designated construct, we used SmartPLS 4. The results of this analysis are presented in the

Figure 2.

According to the graph, we note that items O1, O2 and O3 associated with optimism bias show low factor loadings, below 0.5. Similarly, items OCONF 4 and OCONF 5 associated with the overconfidence bias show very low factor loadings. As a result, we decided to remove them from the analysis to improve measurement quality.

Therefore, we obtain the following results, which are summarized in the

Figure 3 and the

Table 6.

The

Figure 3 shows the new loading values after re-evaluation of the measurement model. We can see that all remaining items show satisfactory Factor loading.

The results of the analysis reveal that the scales used to measure the Risk-taking (RA), Intuition (INT) and Optimism (O) variables achieved high levels of reliability (0.859, 0.968 and 0.626), indicating that the questions included in these scales are consistent and provide reliable measures of the respective concepts. In addition, these variables also showed high values of extracted variance (0.785, 0.969 and 0.729), meaning that the indicators explain a large part of the variance of the latent variables.

However, some variables showed slightly lower levels of reliability and extracted variance. This observation may be attributed to the complexity or specific nature of the concepts measured. Despite this, the results obtained remain acceptable, confirming that the scales used remain reliable and valid for assessing the Overconfidence (OCONF) and Mimicry (MIM) variables.

4.2. Discriminant Validity Test

The results of the cross-loading analysis and the Fornell and Larcker approach are presented in the following sections.

4.2.1. Cross Loading Analysis

The aim of this step is to ensure that items load mainly on their latent variable and show low loadings on other latent variables.

Table 7 illustrates the cross-loading analysis.

In our cross-loading analysis, we observe high factor loadings for items that are associated with their original latent variable, while these same items show low loadings on the other latent variables. These results suggest that the items adequately measure the latent variable to which they are assigned, and that they show low correlation with the other latent variables in the model. This reinforces the convergent and discriminant validity of the measures used in our research model.

4.2.2. The Fornell and Larcker Analysis

We observe that all the square roots of the mean variances extracted are greater than the respective correlations between the concepts (in rows and columns of

Table 8). This allows us to conclude that there is adequate discriminant validity, according to

Fornell and Larcker (

1981), between the variables in our research model. In other words, this analysis has enabled us to confirm that the concepts, being conceptually distinct, are indeed differentiated by their respective measures.

In conclusion, after a thorough examination of reliability and validity, we can confidently state that the instruments developed for this study present satisfactory measurement qualities after undergoing the purification process.

5. Analysis and Discussion

5.1. Impact of Behavioral Biases on the Investment Decisions of Managers of Moroccan SMEs

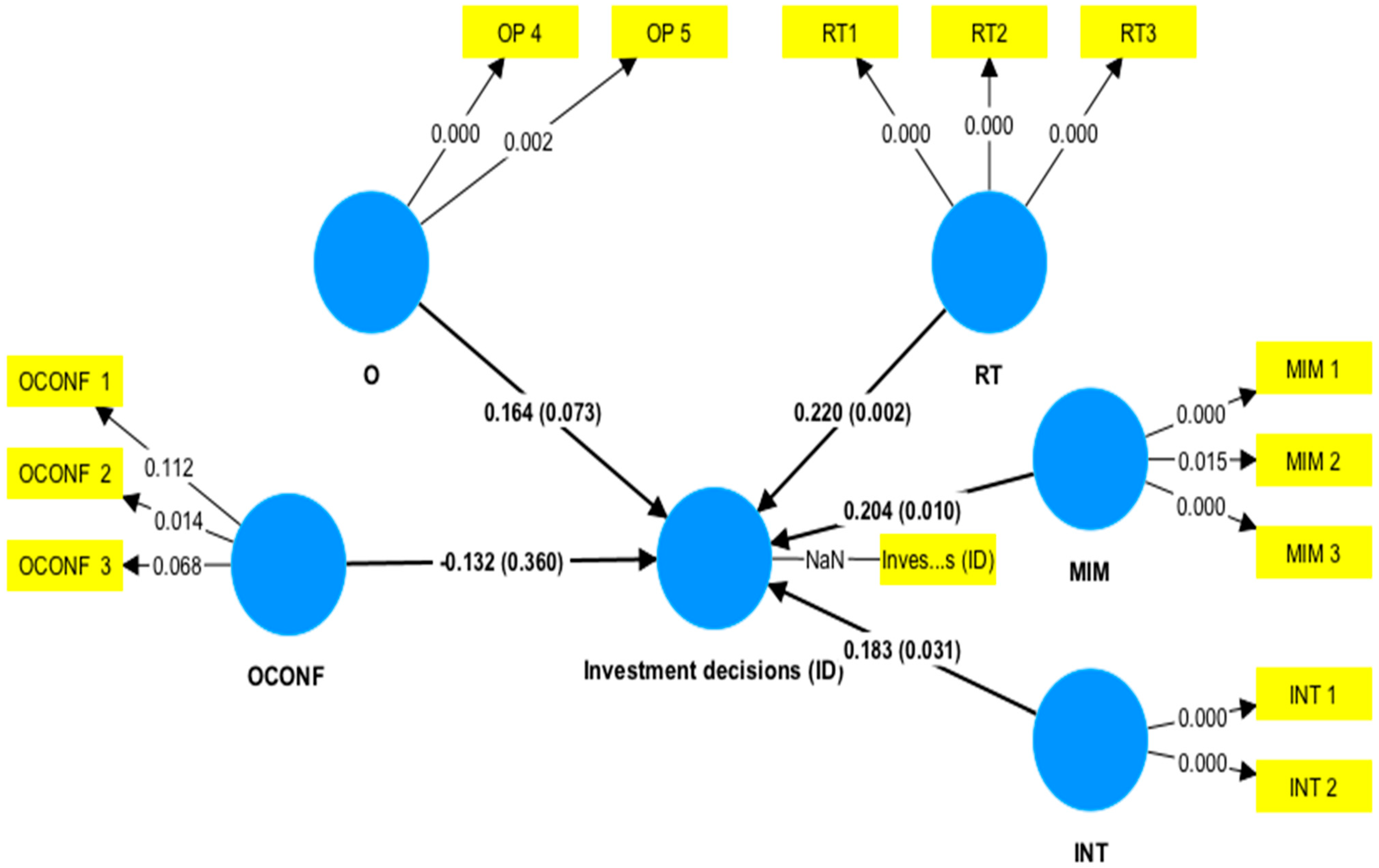

The effect of behavioral biases on the investment decisions of managers of Moroccan SMEs is represented in the

Table 9 and the

Figure 4.

In terms of variables coefficients, the first result is that the “overconfidence” construct, despite its importance, has a relatively weak direct effect with a causality coefficient of −0.132 on the investment decisions of Moroccan SMEs managers, and is statistically insignificant (p = 0.360 > 10%).

In contrast, the other four constructs—risk-taking, intuition, mimicry and optimism—have statistically significant direct effects on the “investment decisions” variable, with causality coefficients of 0.220, 0.183, 0.204 and 0.164 respectively.

Consequently, we can state that the four hypotheses H2, H3, H4 and H5 are statistically verified, while hypothesis H1 is rejected.

5.2. Interpretation of Results

In this article, we studied the impact of overconfidence, optimism, risk-taking, mimicry and intuition biases on the investment decisions of managers of Moroccan SMEs. All these variables are assumed to explain firm investment decision-making.

The data analyses highlighted the importance of these biases for a better understanding of investment decision-making in SMEs. Overall, the results of the PLS approach revealed significant coefficients for all items related to each behavioral bias, showing a positive or negative correlation with the investment ratio, with the exception of the overconfidence bias, which had no significant effect.

The results of our study demonstrated that optimistic managers tend to make investment decisions of greater weight, highlighting the positive correlation between optimism and investment choices. Indeed, managerial optimism is evident in the belief of managers that their company is undervalued by the market, leading them to perceive that their company’s value is higher than the market’s actual assessment. Consequently, optimistic managers tend to overestimate future earnings and cash flows, which prompts them to invest more in their company (

Fairchild 2005). These findings corroborate the results of previous studies conducted by

Heaton (

2002),

Malmendier and Tate (

2005), and

Sammoudi and Hazami-Ammar (

2017).

The results also indicate that managers’ risk-taking plays a crucial role in their investment decisions. Risk-taking managers prefer to take a bolder approach when it comes to deciding where to invest their financial resources. This preference for risk-taking is confirmed by the literature and the results of empirical research (

Sauner-Leroy 2004;

Coles et al. 2006;

Kose et al. 2005). Their propensity to take risks leads them to opt for more dynamic investment decisions, thereby increasing their exposure to market uncertainties and potential opportunities for financial gain. In practice, this means that these managers are inclined to invest in projects with higher levels of risk, while being aware that this could also lead to higher potential returns. They are prepared to take calculated risks to maximize their company’s potential for growth and expansion. This bold approach can be seen as a proactive strategy to seize investment opportunities likely to enhance the long-term viability of their business. As a result, managers with a high propensity for risk-taking may be more open to bold investment decisions, which can increase their ability to seize potentially more lucrative but riskier investment opportunities. However, this risk-taking may also expose them to greater financial losses in the event of unfavorable scenarios.

Mimicry has also been highlighted as a factor influencing investment decisions. Managers are likely to be influenced by the behaviors and decisions of other managers, which may lead them to adopt similar investment choices, thus inducing a positive impact of mimicry on investment decisions. This confirms the findings of

Belanes and Hachana (

2010). Managers’s mimicry can manifest itself in different ways. In order to foster the desire to belong to a specific social group, to feel more confident in their own investment decisions and to reinforce their sense of identity and professional competence, managers sometimes align themselves with the decisions of a group of successful managers (

Grawitz 2004). Social pressure and organizational culture can also reinforce the mimicry bias. In some cases, managers may feel pressured to follow the decisions of their peers, so as not to stand out negatively or be perceived as taking excessive risks (

Aytaç 2013).

Furthermore, the intuition of Moroccan SME managers was identified as a positive factor in the investment decision-making process, insofar as it enables them to capitalize on their experience and tacit knowledge to make quick and appropriate decisions, which can contribute to more timely and appropriate investment choices. These results are in line with those reported by

Kammoun and Gherib (

2008). However, it is important to use it in a balanced way, in conjunction with other analytical methods, to ensure informed decisions based on solid foundations. Unfortunately, Moroccan SMEs don’t seem to attach as much importance to investment analysis methods. In response to the question “To make an investment decision (renewal, expansion, new technologies, new products or markets...), I:”, we observe that 48% of managers follow market trends, 36% rely on intuition, while only 16% use financial analysis methods. This uneven distribution suggests that some Moroccan SMEs are not fully exploiting the potential of analytical methods to optimize their investment decisions.

However, the H1 hypothesis was rejected, indicating that there is no statistically significant link between overconfidence bias and the investment decisions of Moroccan SME managers. This may be explained by the fact that other factors are more influential in their investment choices, such as mimicry, intuition, risk-taking, or the information and analysis available at the time of decision-making, or by the fact that Moroccan SME managers, in general, do not display a significant level of overconfidence in their investment decisions.

In short, while managers subject to the biases of optimism, mimicry and intuition are inclined to take risks and seize bolder investment opportunities, those who are more risk-averse prefer a cautious approach to protect their company’s financial stability. These different behaviors reflect the diverse perspectives and preferences of managers in terms of financial management and decision-making, and help shape the growth and development trajectories of Moroccan SMEs.

6. Conclusions

The main objective of this research was to analyze the impact of managers’ overconfidence, optimism, risk-taking, mimicry and intuition biases on the investment decisions of Moroccan SMEs. The study was carried out using a questionnaire with 133 managers of Moroccan SMEs. The results highlighted that: (1) optimistic managers tend to make investment decisions of greater weight, (2) more risk-averse managers prefer to adopt a more cautious approach when deciding where to invest their financial resources, (3) mimicry was also identified as an influential factor in investment decisions. Managers are likely to be influenced by the behaviors and decisions of other managers, which may lead them to adopt similar investment choices, (4) the intuition of Moroccan SMEs managers was identified as a positive factor in the investment decision-making process, and (5) there was no statistically significant relationship between overconfidence bias and the investment decisions of Moroccan SMEs managers.

The results of our study are in line with previous research on the positive impact of optimism, risk-taking, mimicry and intuition on the investment decisions of SMEs managers.

The approach adopted in this study achieves its originality by targeting SMEs investment decisions in the Moroccan context, as well as by exploring, in a meticulous, specific and exhaustive manner, the biases of overconfidence, optimism, risk-taking, mimicry and intuition among the managers of these Moroccan companies, while combing through and studying each of these behavioral biases in relation to investment decisions.

This makes it possible to better understand the influence of each bias on the investment decisions made by managers, and to draw up a list of the behavioral factors that can help these Moroccan SMEs to flourish, and those that, on the other hand, lead to their decline.

This research enables the managers of Moroccan SMEs to acquire qualities leading to better decision-making:

- -

Behavioral biases are better elucidated: Good investment decision-making is made possible essentially by awareness of these biases in order to avoid them. This means being able to identify biases such as overconfidence, optimism, risk aversion, mimicry and intuition.

- -

Risk assessment is no longer superficial: in view of the motivational speeches made to entrepreneurs to give them a psychological boost, managers generally tend to miss out on a thorough and exhaustive assessment of the risks associated with each investment opportunity, so they need to attach greater importance to this assessment to reduce the rate of financial loss and establish greater financial stability for the company.

- -

Intuition is a double-edged sword: every manager has an intuition that guides him throughout the decision-making process, but it must be used alongside other, more objective methods of analysis. Hence the importance of using this asset in synergy with solid financial analytical studies, to avoid impulsive decisions and move towards more optimal ones.

- -

Market trends are no longer followed at face value: It’s a well-known fact that the human brain tends towards the similar and shuns the unknown, which explains some of the mimicry behavior of small business managers, except that each investment opportunity comes with its own context. It is therefore essential for managers to demonstrate a certain originality, and to analyze choices on a case-by-case basis, depending on the company’s situation and the various factors specific to it.

- -

Awareness of the importance of training: It is vital to make managers aware of the damage these behavioral biases can do to their decision-making. Training courses can be organized to help them face up to these challenges, manage their companies and ensure their financial stability.

By taking these parameters into account, the investment decision-making process can be upgraded, and the allocation of financial resources can be optimized to ensure the sustainability and development of Moroccan SMEs in a competitive economic environment.

Limitations of this research include:

- -

Sample size: Compared to the large number of Moroccan TPMEs, which is set at 295,038 active companies, a sample of 133 Moroccan TPME managers could be considered relatively small to generalize the results to the whole population. On the other hand, a larger sample size could reinforce the robustness of the findings.

- -

Measuring behavioral biases: The measurement of overconfidence, optimism, risk aversion, mimicry and intuition biases relies on response modalities that could be influenced by the researcher’s own perceptions, which may lead to a certain subjectivity in the results.

- -

Cross-sectional nature of the study: The results of the study are obtained without really taking into account the evolution and behavioral fluctuations of managers over time, since the data capture was carried out at a very specific point in time. The study is therefore cross-sectional rather than longitudinal in nature.

- -

Variables not taken into account: Investment decisions are influenced by several other external or internal parameters in addition to the behavioral biases studied, such as managerial experience, macroeconomic factors and company-specific financial constraints. These variables are therefore set aside in this study.

However, despite all the above, this research still achieves its objective and adds value to the understanding of the important impact of behavioral biases on the investment decision-making process of Moroccan SMEs managers.

Author Contributions

Conceptualization, K.B. and M.R.A.; methodology, K.B.; software, K.B.; validation, M.R.A.; formal analysis, K.B. and M.R.A.; investigation, K.B.; resources, K.B.; data curation, K.B.; writing—original draft preparation, K.B.; writing—review and editing, M.R.A.; visualization, K.B.; supervision M.R.A.; project administration, M.R.A.; funding acquisition, K.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data presented in this study were obtained from the Moroccan SMEs in our sample. They are available on request from the corresponding author. Data are not available to the public due to their confidentiality.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Acker, Daniella, and Nigel W. Duck. 2008. Cross-cultural Overconfidence and Biased Self-attribution. The Journal of Socio-Economics 37: 1815–24. [Google Scholar] [CrossRef]

- Agrawal, Anup, and Kishore Tandon. 1994. Anomalies or illusions? Evidence from stock markets in eighteen countries. Journal of International Money and Finance 13: 83–106. [Google Scholar]

- Ang, James S., Rebel A. Cole, and Dan Lawson. 2010. The Role of Owner in Capital Structure Decisions: An Analysis of Single-Owner Corporations. The Journal of Entrepreneurial Finance 14: 1–36. [Google Scholar]

- Aytaç, Beysül. 2013. Mimétisme institutionnel sur le marché financier émergent turc. La Revue des Sciences de Gestion 1: 81–90. [Google Scholar]

- Baker, H. Kent, Satish Kumar, and Harsh Pratap Singh. 2018. Behavioural biases among SME owners. International Journal of Management Practice 11: 259–83. [Google Scholar] [CrossRef]

- Barringer, Bruce R., and Allen C. Bluedorn. 1999. The Relationship between Corporate Entrepreneurship and Strategic Management. Strategic Management Journal 20: 421–44. [Google Scholar] [CrossRef]

- Belanes, Amel, and Rym Hachana. 2010. Biais Cognitifs et Prise de Risque Managériale: Validation Empirique dans le Contexte Tunisien. Management International 14: 105–19. [Google Scholar]

- Bessière, Véronique. 2007. Excès de confiance des dirigeants et décisions financières:une synthèse. Finance Contrôle Stratégie 10: 39–66. [Google Scholar]

- Brigham, Eugene F., and Joel F. Houston. 2015. Fundamentals of Financial Management. Boston, MA: Cengage Learning USA, pp. 339–402. [Google Scholar]

- Camerer, Colin, and Dan Lovallo. 1999. Overconfidence and Excess Entry: An Experimental Approach. The American Economic Review 89: 306–18. [Google Scholar] [CrossRef]

- Chikh, Sabrina, and Pascal Grandin. 2016. Finance Comportementale. Paris: Economica, pp. 107–30. [Google Scholar]

- Chin, Wynne W. 1998. The Partial Least Squares Approach to Structural Equation Modeling. In Modern Methods for Business Research, 1st ed. Edited by George Marcoulides. London: Psychology Press, pp. 295–336. [Google Scholar]

- Chou, Chih-Ping, and Peter Bentler. 1995. Estimates and Tests in Structural Equation Modeling. In Structural Equation Modeling: Concepts, Issues, and Applications, 1st ed. Edited by Rick H. Hoyle. Southend Oaks: Sage Publications, pp. 37–55. [Google Scholar]

- Coles, Jeffrey L., Naveen D. Daniel, and Lalitha Naveen. 2006. Managerial Incentives and Risk-Taking. Journal of Financial Economics 79: 431–68. [Google Scholar] [CrossRef]

- Corazzini, Luca, and Ben Greiner. 2007. Herding, social preferences and (non-) conformity. Economics Letters 97: 74–80. [Google Scholar] [CrossRef]

- Danielson, Morris, and Jonathan Scott. 2006. The Capital Budgeting Decisions of Small Businesses. Journal of Applied Finance 16. [Google Scholar]

- Fairchild, Richard. 2005. The Effect of Managerial Overconfidence, Asymmetric Information, and Moral Hazard on Capital Structure Decisions. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Fama, Eugene. 1991. Efficient Capital Markets: II. The Journal of Finance 46: 1575–617. [Google Scholar] [CrossRef]

- Fornell, Claes, and David Larcker. 1981. Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research 18: 39–50. [Google Scholar] [CrossRef]

- Grawitz, Madeleine. 2004. Lexique des Sciences Sociales. Paris: Dalloz. [Google Scholar]

- Gveroski, Miroslav, and Aneta Risteska Jankuloska. 2017. Determinants of Investment Decisions in Smes. Balkan and Near Eastern Journal of Social Sciences 3: 71–78. [Google Scholar]

- Hair, Joseph, G. Tomas M. Hult, Christian Ringle, and Marco Sarstedt. 2022. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 3rd ed. Southend Oaks: Sage Publications, pp. 109–36. [Google Scholar]

- Hair, Joseph, William Black, Barry Babin, and Rolph Anderson. 2019. Multivariate Data Analysis, 8th ed. Delhi: Cengage India, p. 151. [Google Scholar]

- Hasan, Maruf. 2013. Capital budgeting techniques used by small manufacturing companies. Journal of Service Science and Management 6: 38–45. [Google Scholar] [CrossRef]

- Heaton, John B. 2002. Managerial Optimism and Corporate Finance. Financial Management 31: 33–45. [Google Scholar] [CrossRef]

- Hiller, Nathan J., and Donald C. Hambrick. 2005. Conceptualizing Executive Hubris: The Role of (Hyper-) Core Self-Evaluations in Strategic Decision-Making. Strategic Management Journal 26: 297–319. [Google Scholar] [CrossRef]

- Hulland, John. 1999. Use of Partial Least Squares (PLS) in Strategic Management Research: A Review of Four Recent Studies. Strategic Management Journal 20: 195–204. [Google Scholar] [CrossRef]

- Kahneman, Daniel, and Dan Lovallo. 1993. Timid Choices and Bold Forecasts: A Cognitive Perspective on Risk Taking. Management Science 39: 17–31. [Google Scholar] [CrossRef]

- Kammoun, Mohja, and Jouhaina Ben Boubaker Gherib. 2008. L’intuition et la prise de décision stratégique dans les PME. XVIIème Conférence de AIMS VII: 1–26. [Google Scholar]

- Kammoun, Mohja, and Olfa Zeribi Benslimane. 2011. L’utilisation de l’intuition dans la prise de décision des dirigeants de PME: Proposition d’une échelle de mesure multidimensionnelle. In XXe Conference of AIMS. Nantes: Audencia School of Management. [Google Scholar]

- Katona, George. 1975. Psychological Economics. New York: Elsevier. [Google Scholar]

- Kose, John, Lubomir Litov, and Bernard Yeung. 2005. Corporate Governance and Managerial Risk Taking: Theory and Evidence. Washington, DC: Washington University. [Google Scholar]

- Krejcie, Robert, and Daryle Morgan. 1970. Determining sample size for research activities. Educational and Psychological Measurement 30: 607–10. [Google Scholar] [CrossRef]

- Lazaridis, Loannis. 2004. Capital budgeting practices: A survey in the firms in Cyprus. Journal of Small Business Management 42: 427–33. [Google Scholar] [CrossRef]

- Malmendier, Ulrike, and Geoffrey Tate. 2005. CEO Overconfidence and Corporate Investment. The Journal of Finance 60: 2661–700. [Google Scholar] [CrossRef]

- Malmendier, Ulrike, Geoffrey Tate, and Jon Yan. 2011. Overconfidence and Early-Life Experiences: The Effect of Managerial Traits on Corporate Financial Policies. The Journal of Finance 66: 1687–733. [Google Scholar]

- Nofsinger, John, and Richard Sias. 1999. Herding and Feedback Trading by Institutional and Individual Investors. The Journal of Finance 54: 2263–95. [Google Scholar] [CrossRef]

- Peel, Michael J., and Nicholas Wilson. 1996. Working capital and financial management practices in the small firm sector. International Small Business Journal 14: 52–68. [Google Scholar] [CrossRef]

- Pompian, Michael. 2006. Behavioral Finance and Wealth Management. Hoboken: Wiley Finance, pp. 9–13. [Google Scholar]

- Pompian, Michael M. 2012. Behavioral Finance and Investor Types: Managing Behavior to Make Better Investment Decisions. Hoboken: John Wiley & Sons. [Google Scholar]

- Puri, Manju, and David T. Robinson. 2007. Optimism and economic choice. Journal of Financial Economics 86: 71–99. [Google Scholar] [CrossRef]

- Sammoudi, Houda, and Sourour Hazami-Ammar. 2017. Biais comportementaux des dirigeants et structure du capital des PME Tunisiennes. Vie et Sciences de l’Entreprise 203: 63–96. [Google Scholar] [CrossRef]

- Sauner-Leroy, Jacques-bernard. 2004. Managers and Productive Investment Decisions: The Impact of Uncertainty and Risk Aversion. Journal of Small Business Management 42: 1–18. [Google Scholar] [CrossRef]

- Scott, D. F., Otha L. Gray, and Monroe Bird. 1972. Investing and financing behavior of small manufacturing firms. MSL Business Topics 20: 29–38. [Google Scholar]

- Smaoui Chabchoub, Aida. 2010. Excès de Confiance et Optimisme des Dirigeants: Cas des Firmes Initiatrices d’une Acquisition. Defended on 17-12-2010 at Montpellier 2 in Cotutelle with the University of Sfax (Tunisia). Available online: https://www.theses.fr/2010MON20205 (accessed on 7 August 2023).

- St-Pierre, Josee. 2018. La Gestion Financière des PME, 2nd ed. Québec: Presse de l’Université du Québec, pp. 25–44. [Google Scholar]

- Thaler, Richard. 2000. From Homo Economicus to Homo Sapiens. Journal of Economic Perspectives 14: 133–41. [Google Scholar] [CrossRef]

- Urbach, Nils, and Frederik Ahlemann. 2010. Structural Equation Modeling in Information Systems Research Using Partial Least Squares. Journal of Information Technology Theory and Application 11: 5–40. [Google Scholar]

- Zhao, Rui, and Xiaoyan Zhang. 2019. Analysis of Investment Decisions of SMEs. Paper presented at 2019 International Conference on Management, Education Technology and Economics (ICMETE 2019), Fuzhou, China, May 25–26; Amsterdam: Atlantis Press, Volume 82, pp. 427–30. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).