Abstract

The technological developments in the social economy have significant implications for social banks and are optimistically changing the way social retail banks conduct their business. Social banks can invest in social services for small- and medium-sized enterprises (SSMEs) either to acquire a strategic advantage or out of strategic necessity. With the assistance of a mathematical model, this study tries to identify SME service channels and assess potential impacts on social deposit banks’ performance. In the first stage, the proposed model estimates the predictive capacity of interpretive accounting variables (financial ratios) versus the interpreted accounting variable (future quarterly earnings before taxes (EBT)). Then, in the second stage, the SSME service channels were added to the earnings before tax model in terms of profitability measure, which informs corporate earnings before operating the business to account for the income tax attributed to it for the purpose of estimating their impact on the performance of social banks. According to our findings, the banks are investing in SME services just to validate their investments in SME services as a strategic necessity. SSMEs services do not provide any strategic advantage to any banks in terms of financial or accounting performance or efficiency since the banks are already efficient. Investing in SMEs is a tool for preserving their strategic positions. Therefore, the contribution of this study is focused on the fact that it highlights the impact of financing the social deposit banking industry on institutions, while most studies analyze the vice versa interaction.

1. Introduction

Social banking has existed since the 1950s and has typically been related to long-term investment. However, the concept is now more likely to refer to social media banking, peer-to-peer (P2P) lending, or the creation of online financial networks (Kitamura 2022; Stauropoulou et al. 2023). These sorts of financing are viewed as financial democratization and are frequently promoted as solutions to problems that the traditional banking system cannot or will not solve. In recent decades, the ongoing issue of social banking has piqued the interest of modern finance. To be more explicit, social banks operate to provide a beneficial social, environmental, or sustainability benefit (Kavouras et al. 2022; Vardopoulos 2019). The goal of social banking is to be carried out via social, ethical, or alternative banks, financial cooperatives, and credit unions (Weber 2005). Social banks’ products and services include the backing of social enterprises, renewable energy initiatives, and even communal housing (Kitamura 2022).

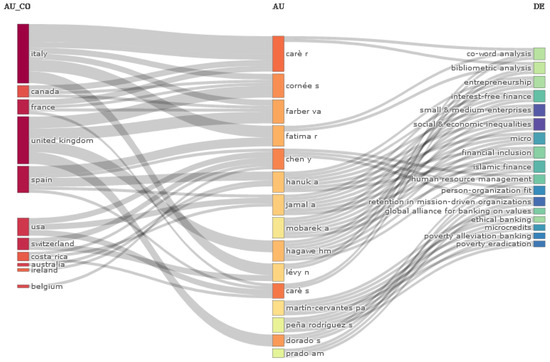

Moreover, the role of ethical banks has been enhanced in the last years as they are trying to address the capital issue facing SMEs by providing specialized loan options that make it simpler for company owners to get cash. For example, social banks in the US provide more than half of the country’s small business loans. In addition, ethical banks are growing all throughout Europe as well, offering SMEs that are founder-led, developing, and on a development trajectory of flexible financing with a personal touch. Thus, the present study’s research question focuses on the financial characteristics of social banks that work with small- and medium-sized businesses. The objective has been raised with the use of bibliometric analysis. Bibliometric analysis is the statistical evaluation of publications such as books, journals, or other works. The productivity and influence of authors or researchers are tracked using analyses. Additionally, bibliometric analysis is used to determine journal impact factors and to comprehend publishing linkages; bibliometrics data may also be visually represented. In order to run a bibliometric analysis, we have retrieved data from the database of Scopus and analyzed and visualized them with the use of the R statistical programming language. The Sankey diagram, which has been developed with the use of RStudio, illustrates the crucial concepts of sustainability in finance and the need of small and medium enterprises for sustainable and green funding from the social banking sector (Figure 1).

Figure 1.

Sankey diagram. Source: RStudio/Scopus.

Therefore, based on the background that has been presented above, and with the use of financial ratios, a representative sample of social banks’ future pretax profits may be predicted in the short term (on a quarterly basis) over the period 2002–2018. We obtain a social bank’s report and make evaluations on their financial status and outcomes based on the financial statements; we derive either immediately or through the calculation of various accounting variables, referred to as “financial analysis tools”. The ratio’s goal is to link a pair of numbers, a numerator, and a denominator, by delivering financial information about social financial activities to the analyst. According to Tsamis (1989), the quotient, stated either in absolute value or in percentage format, provides additional information that is distinct from and independent of the information content of the two accounting aggregates that were merged to construct the index. The study’s sample consists of 13 credit institutions, which account for 80% of the social economy. The selection of social banks was based on the size of the banks in terms of market share and profitability, as well as on medium- and small-sized social banks.

Moreover, the derived findings can take into consideration the total profit behavior, which is mostly reliant on bank size. The trimester was chosen as the timeframe for the survey since it is well acknowledged that exploring short-term capacity is more effective when time analysis is as brief as feasible. Finally, the research period was seventeen years, which is significant given the expansion of social enterprises and the growing growth of services for small- and medium-sized social enterprises, which have transformed the landscape of social banks. In addition, the time period comprises both the financial crisis and the reaction of the social economy. Based on the above, the contribution of the current research is focused on the complementary and one of the most important roles of social banking in the concept of sustainability. Unlike typical banks, its criteria and processes are designed to optimize sustainability rather than profit (Moustairas et al. 2022; Vardopoulos et al. 2021). Therefore, this research highlights that there are numerous essential components that allow financial entities to restrict their harmful influence solely to funding small and medium enterprises that follow all banking requirements.

The current research work is divided into five sections. Section 2 reviewed the current literature on the study topic of social banking and SMEs. Section 3 describes the materials and methods utilized to address the study issue, whereas Section 4 illustrates the findings. Section 5 is the last section, in which the results are discussed and areas for further research are recommended, while Section 6 concludes the paper.

2. Literature Review

The literature reports on the profitability of financial institutions are numerous and quite extensive. Indeed, according to Berger and Humphrey (1997), at least 116 studies referring to the determination of bank profitability were drawn up and published in the period 1992–1997. Although previous studies ignored the effects of the macroeconomic environment and did not provide a complete picture of the econometric methods used, the most recent studies examine in detail and clarify all the categories of factors that affect the profitability of credit institutions.

2.1. Factors Determine the Profitability of Banks

According to most studies, the profitability and efficiency of a bank are expressed as functions of a variety of endogenous and exogenous factors (Abidin et al. 2021; Endri et al. 2022; Gržeta et al. 2023; Shen et al. 2022). Endogenous factors refer to financial data from the balance sheets and the internal environment of the bank so they can alternatively be defined as microeconomic or financial determinants (Ngo et al. 2023). Conversely, exogenous factors are variables that are not directly related to bank management but reflect the economic and legal environment in which each credit institution operates and interacts (Ho et al. 2023; Kallel and Triki 2022; Yuen et al. 2022).

2.1.1. Endogenous Factors

Endogenous characteristics impacting the efficiency of banking organizations are typically studied in terms of five variables: capital sufficiency, liquidity risk, credit risk, institution size, and labor productivity. One of the topics that has received a lot of attention in the literature is the size of banks and whether there are economies of scale. According to Akhavein et al. (1997) and Smirlock (1985), there is a positive and statistically significant association between bank size and profitability. According to Demirguc-Kunt and Maksimovic (1998), the extent to which numerous financial, legal, and other issues impact bank profitability and efficiency is largely related to their size. Short (1979) emphasizes the strong link between credit-institution size and capital adequacy, observing that larger banks tend to concentrate less expensive capital, making them more lucrative. Furthermore, Altunbas et al. (2000) concluded in their study of German banks from 1989 to 1996 that larger banks, whether private or public, benefit from higher economies of scale.

As a consequence, Hondroyiannis et al. (1999) and Pasiouras (2008) show that the size of the banks, in terms of branches, has a positive and statistically significant relationship with both profitability and efficiency of banks for the years 1993–1995, when examined from a different perspective. Halkos and Salamouris (2004), Arpa et al. (2001), Berger et al. (1993), and Miller and Noulas (1996) reach the same conclusions, demonstrating a positive and significant relationship between profitability and credit-institution size while contradicting the findings of Christopoulos et al. (2002), Gibson (2005), and Kamberoglou et al. (2004). In the medium term, the study by Eichengreen and Gibson (2001), which examines the profitability of 25 Greek banks from 1993 to 1998, shows that the relationship between the size and profitability of the banks takes the shape of a bell, which means that profitability increases and then decreases as the size of the institution increases.

Another component of the banking business that has a significant impact on profitability is the risk connected with each banking operation. Both credit risk and liquidity risk can lead to economic collapse and the failure of credit institutions. Indeed, research by Molyneux and Thornton (1992), Athanassoglou et al. (2008), and Miller and Noulas (1996) show a negative and significant association between the two forms of risk and bank profitability. However, Bourke (1989) and Gibson (2005) study the opposite consequences, highlighting the favorable benefits of liquidity on the profitability of financial institutions. In order to explore the link between labor productivity and workers’ contribution to bank profitability, Halkos and Salamouris (2004) utilize the ratio of earnings before taxes to the number of employees.

Athanassoglou et al. (2008) utilize the same method to conclude that better staff quality and a reduction in the number of employees, both of which are absolutely necessary, contribute to an increase in labor productivity and, as a result, the creation of additional profit for banks. Furthermore, Eichengreen and Gibson (2001), using a panel data model, demonstrate that the influence of staff expenses is positive and important for the profitability and efficiency of credit institutions, most likely because banks with higher-paid personnel provide higher-quality services. Concerning capital sufficiency, Asimakopoulos et al. (2008) utilized equity to determine total assets and found that banks with high capital are better prepared to expand their company and manage potential unfavorable industry trends. Furthermore, high own funds serve as a tool for overseeing shareholder management, reducing moral hazard. However, the findings of the Kamberoglou et al. (2004) study underline that the larger the banks’ own money, the more their aversion to risk, and, therefore, their inefficiency.

2.1.2. Exogenous Factors

Exogenous variables that impact bank profitability are classified as (i) market features and (ii) macroeconomic environment parameters. Market variables that impact bank profitability are typically concentration, credit-market size, and ownership type of each unit. The concentration of banks, and their power in the financial sector, is a particularly important feature that influences the profitability of lending institutions and has captivated academics. Gibson (2005) employs the Herfindahl–Hirschman index to approximate this variable and indicates that there is a positive and significant association between bank concentration and profitability. The most efficient banks have a higher market share and use their influence to boost earnings. Berger (1995), who proposes the concepts of market power (MP) and relative market power (RMP), comes to the same result. Based on these assumptions, it shows clearly that administrative efficiency not only enhances profits but also leads to gains in market shares and, as a result, increases concentration.

From a different angle, Bourke (1989) and Molyneux and Thornton (1992) argue that increased concentration reflects banks’ growing divergence from the competitive market structure, resulting in monopoly profits and that there must be a statistically significant positive relationship between concentration and profitability. On the other hand, there are no clear signs that bank ownership has a particular impact on their concentration and profitability. According to Short (1979) and Barth et al. (2004), there is a negative association between state banking institutions and profitability; however, Bourke (1989) and Molyneux and Thornton (1992) found that the form of ownership had no effect on profitability. In his study, Revell (1989) contends that the impact of inflation on banks is determined by whether workers’ pay and operational expenditures rise faster than inflation.

How mature should a financial system be for inflation estimates to be accurate? This question is also used by Perry (1992) to demonstrate the favorable association between predicted inflation and profitability. Indeed, his study demonstrates that when inflation is known and expected, banks alter interest rates to increase income. Bikker and Hu (2001) investigate the impact of economic cycles on bank profitability in 26 different countries over a twenty-year period (1979–1999), examining the extent to which certain characteristics of banking institutions and their specific activities are influenced by the phases of the economic cycle. In more depth, they explore how the bank’s profitability, loan activity, and capacity to forecast future losses are tied to the economic cycle’s rising or negative phases. According to the study’s findings, the bank’s earnings follow the economic cycle’s patterns, resulting in capital buildup during blooming times. Bank lending operations follow the same pattern, with credit losses increasing during recessions and decreasing during booms. Demirgüç-Kunt and Huizinga (1998) and Arpa et al. (2001) reach similar results, emphasizing the positive association between inflation and bank profitability and efficiency (Global Impact Investing Network 2011).

2.2. Social Banking vs. Social Finance

Social or environmental requirements are included in the collection of investment indicators (Koellner et al. 2007), and ’social’ screening, coinvestment, and shareholder advocacy are included (O’Rourke 2003) in the investment procedure to assure greater and sustainable profit (Stauropoulou et al. 2023; Úbeda et al. 2022). The two main goals of RI are to ensure appealing economic returns by investing in securities that consider long-term sustainability concerns (Weber et al. 2011) and to direct capital toward projects that have a more extensive social, logical, or environmental fit, thereby encouraging sustainable business (Buttle 2007; Weber 2006). As a result of the use of environmental, social, and administrative variables, many SRI agents claim that this concept achieves more financial return than traditional investment (Sandberg et al. 2009). Social finance and impact investment take quite different approaches.

In contrast to many other responsible investment institutions, they instill social principles in government and company activities (Cadman 2011). In addition to financial profits, social banks spend money to provide social and environmental rewards (Monitor Institute 2009). Harji and Hebb (2009) define social finance as “the application of instruments, processes, and strategies where capital deliberately and intentionally seeks a valued value (ecosocial, social, and/or environmental) return.” According to Kaeufer, social banking is “addressing some of the most pressing issues of our time” (Kaeufer 2010). In order to clarify the scope of social finance and banking and provide a summary of its definition, Chertok et al. (2008) distinguished between the emphasis on financial returns and the emphasis on social returns. Conventional finance, in my opinion, can only function on one end of the spectrum. On the other hand, as previously noted, nonprofit investment or the social capital market exists (Meehan et al. 2004).

There is comparable uniformity in ethical or sustainable lending, which is an essential part of social banking. The first lenders encountered environmental issues in the 1990s as a result of the finding that the owner of a polluted property is responsible for decontamination, as stated in the US Comprehensive Environmental Response Compensation and Liability Act of 1980 (CERCLA). As a result of their cooperation with the management of a polluting firm, several banks were held liable (Bacow 1998). Similar incidents have occurred in Europe (Scholz et al. 1995). Later, debtors were subjected to sustainability criteria, which improved credit risk prediction (Weber et al. 2010). By incorporating these indicators into their credit risk management systems, traditional banks and financial institutions intend to increase credit risk prediction while minimizing social and environmental damage. Social banks, as opposed to SRI and the incorporation of sustainability risks into decision-making, make loans with the goal of providing social or environmental benefits (da Silva 2007; Edery 2006).

As a result, two main goals are intended: (1) a beneficial impact on society, the environment, and long-term development, and (2) a long-term financial return. The first pioneering social banks based on the aforementioned principles were created in the 1970s with the goal of highlighting financial ethics and utilizing money in a way that may positively benefit society and business (Milano 2011). These banks may have their origins in philosophy, such as the anthroposophist German GLS, or in social or ethical objectives, such as the Swiss Alternative Bank. Others, such as microfinance organizations, may be founded on development problems. There are other community-based organizations that encourage community integration or member integration, such as the Vancouver City Savings Credit Union (VanCity), a credit union founded in Vancouver, Canada.

3. Materials and Methods

In this study, we investigated the members of the Global Alliance for Banking on Values (GABV). GABV is a global membership group made up of the world’s premier sustainable banks. Its members work to address worldwide problems, provide alternatives to traditional financial institutions, and enhance people’s quality of life (Global Alliance for Banking on Values 2018). Table 1 presents the organization’s member banks.

Table 1.

Socials Banks in the sample, their type, their country, and region of origin.

In this study, we apply the linear pattern, specifically the multiple linear regression model. Earnings before tax (EBT) is a measure of profitability that informs about corporate earnings prior to the operation of the firm and accounts for the income tax owed to it. This metric is determined by deducting all expenditures, including interest and operational expenses, from the total income of the social bank while leaving out the amount of tax. Earnings before taxes (EBT) play a critical part in our study since they serve a dual purpose.

On the one hand, they serve as the research’s sole dependent variable in the form of future earnings (future earnings), while on the other, they serve as an independent variable known as historical profits (Et), with the following distinction: future earnings are defined as earnings before taxes at a later period, i.e., (t + 1); in our example, t = one trimester, derived from the model’s independent variables. Historical earnings, on the other hand, are defined as EBT time lag, or EBT before the dependent variable. It should be noted at this point that the bank’s accounting earnings were used as a dependent variable without considering the proportionate income tax because the tax burden (historically) is sometimes susceptible to fluctuations due to changes in tax regulations. This type of evolution is thought to have a detrimental impact on the findings reached. According to Fama and French (2000):

where,

: EBT third trimester;

: EBT nine months;

: EBT first semester.

One key factor that needs to be considered is the size of the debt liabilities undertaken by the banking institution. A measure that clearly shows a company’s total leverage, after deducting treasury bills and bonds, is the net debt index, which we have calculated as follows:

where,

: Net Liabilities for the second trimester;

: The short-term debt of the first semester;

: The short-term debt of the first trimester;

: The short-term debt of the first semester;

: The short-term debt of the first trimester;

: Available at first semester;

: Available at first trimester;

: Cash Equivalents of the first semester;

: Cash Equivalents of the first trimester.

It follows from the above that the net debt for one trimester, calculated by summing the averages of short- and long-term debt from this sum, is then deducted from the average of available and cash equivalents. The averages for balance-sheet items always refer to the current trimester and the immediately preceding one. The reason this methodology is used is that an approximate price is reached for the average level of bills during the quarter. Short-term debt is essentially defined as short-term liabilities, i.e., the liabilities of the social bank to be met within the current year. Long-term debt is also considered to be long-term debt, i.e., the debts undertaken by the social bank and repaid over the current financial year. Finally, available and cash equivalents in the specific case of bank balance sheets represent the financial value of the assets of the social banking institution as well as highly liquid assets with a known market value and maturity. The information on the net debt obtained from the calculation of the net debt ratio can be further enriched by adding to this financial instrument the equity of the social bank. In this way, the net debt is calculated not only by third parties but also by the shareholders who have invested their capital in the company. This information is given by the net capital, which in the third trimester of the year, according to Hanke and Reitsch (1992), following the custom formula below:

where,

: The net capital for the 3rd trimester;

: The net debt for the 3rd trimester;

: The equity of the nine-month period;

: The equity of the first semester.

The interest rate ratio, on the other hand, provides the analyst with an indication of whether the social bank has the ability to cover its interest expense based on the level of its accounting profits. The calculation formula, according to (Groppelli and Nikbakht 2006):

where,

: Four third trimester interest coverage indicator;

: Earnings before year taxes;

: Profits before tax for the period of nine months;

: Interest expense for the year;

: Interest expense for the period of nine months.

A generally accepted rule for interpreting the results for the above fraction is that if the ratio observed between the numerator and the denominator exceeds 2:1, then there is a very satisfactory coverage of interest costs. If it is between 1.5 and 2:1, this shows that there is moderate coverage. In addition, if it is between 1.0 and 1.5:1, there is relatively modest coverage of interest rate debt, and a ratio below 1 means that the level of interest coverage is insufficient to meet interest costs. Having defined the above-mentioned independent research variables (future quarterly profit before tax) as well as the selection of interpretive-independent variables (historical time loss profits, net debt, net funds, and interest coverage indicator), the following data were consolidated into a sample level, calculating the weighted average of the assets of the social banks. Thus, the weighted quarterly value of each variable has been calculated as:

where,

: The aggregate quarterly value of the variable, weighted ∈ assets;

: The total assets of each social bank of the sample on a quarterly basis;

: The total assets of all social banks ∈ the sample on a quarterly basis;

: The quarterly value of the variable for each social bank of the sample.

The descriptive test of the asset-weighted variables was done according to (Shapiro and Wilk 1965). According to this criterion, each variable under consideration that has a value greater than 0.50 displays regularity characteristics. As can be seen in the following Table 2, From the descriptive analysis, none of the variables examined show regularity, which is certainly expected since all the values of the variables are stochastic, and, therefore, the assumption of the linear model for the existence of fixed values cannot be valid.

Table 2.

Descriptive check of the Normality of variables.

Since the data are panel data, there is a need to clarify the fixed-effects estimation or random effects. The following results came from the realization of the Hausman test in Table 3 for the selected model. The Hausman test shows that our regression is for random effect and the provided statistics of the test, in comparison with their p value (p > Chi-square), are actually all higher than 10%. As a result, the adoption of a random-effects model is privileged;

Table 3.

Hausman test.

Moreover, the results of Estimating the Random Effects. The estimated results of the model can be found in Table 3.

Following the regularity check, Table 4 follows, which lists the findings of the survey from the formation of the multiple linear regression model which considers all the selected variables. As can be seen from the econometric model, the net debt variable has been excluded because of the colinearity that this variable displays with the net capital variable.

Table 4.

The results of estimation of the model.

As can be seen from the calculations, the formed linear regression equation has the following form:

where,

F.E = −244909.0 + 1.53246 × Et + 0.008 × Net Capital + 5.77 × DKT + ut

F.E: Future quarterly accounting profits;

Et: Quarterly time lag gains;

Net Capital: Net debt index;

DKT: Interest coverage indicator;

ut: regression residues.

The results of Table 4 show that all three interpretive variables show statistically significant predictive capacity at any of the acceptable confidence intervals, as shown by the t-statistic criterion, contributing to the predictability of future profits. The most significant predictive characteristics are reflected in the historical earnings (Et) variable with a fairly large difference from the second variable of the net equity. The lowest contribution to the predictive capacity of the model is observed for the interest coverage index. After analyzing the total calculations of the econometric model, we can see that the group of three selected interpretive variables in a multiple regression achieves a very high predictability (99%) since the model’s p-value is valued (0.0001). In addition to the existence of a statistically significant relationship, it is important to note that a very satisfactory percentage of interpretive capacity of the historical behavior of future profits is achieved since the adjusted determinant indicates that the model interprets the (79.26%) of the interpreted variable. It is also important to note that the Durbin–Watson index, which is used to control the autocorrelation of residues, leads to the conclusion that there is no autocorrelation in residues since the ‘d-test’ value is very close to an ideal value (2) and the p-value criterion, leads to the conclusion of accepting the zero residual correlation hypothesis.

4. Results

According to our findings, social banking is becoming an essential component of the financial system. According to Table 5, the European social banks have the highest overall profitability and net capital coverage. Our findings are consistent with those of Kaeufer (2010) and Weber and Remer (2011). Since 1997, social banking has been an increasingly important element of daily life in Europe. In the early 2000s, the major social banking services were internet-based social banking and cooperative social banks, and subsequently cooperative social schemes were added to the portfolio of digital social banking services. Mobile phone applications developed as a digital social banking method around 2011. All of these digital technologies provide SSMEs with various interfaces and possibilities. These technological advancements, as well as the introduction of SSMEs for social entrepreneurs, have changed the banking sector’s social dependency away from branches. As a result, the number of SME users of online and digital social banking services is growing. The number of social cooperative banking outlets where traditional banking is performed has been reduced or is not rising at the same rate as SSMEs services. With the advancement of SSMEs, online banking, call centers, and mobile applications have become an important element of all banking services, with the total number of clients utilizing digital banking services in Europe reaching 47 million in December 2018, an increase of 32% over 17% in the United States. Although average credits per sector and population increased gradually over time, the average population per social sector and average population per bank employee remained essentially constant or dropped over time. This implies that banks have established new social cooperative channels known as alternative social distribution channels to offer new social goods to fulfill the demands of other SSMEs’ customers. The European social banks appear to be changing their focus away from traditional industries and toward SME services relating to social businesses. In light of their respective American and Asian social banks’ lower rates of coverage, the European social banks are moving to invest more swiftly in SME social business services.

Table 5.

Determinants of the Social banks’ performance (2002–2018).

The findings show that the banks in the example adhere to the social finance and blended return principles identified by Bugg-Levine and Emerson (2011), Emerson (2003), Harji and Hebb (2009), Chertok et al. (2008), Kaeufer (2010), and Weber and Remer (2011). As their primary vision, the institutions adhere to the concept of having an effect on society. Most banks include social, environmental, or sustainability concerns as a primary issue in their core aim, distinguishing them from typical banks. They believe that their primary motivation has a good societal impact (Weber and Remer 2011). The social finance institutions in the case appear to fulfill the financial sustainability requirements as well. Every one of them satisfies the Bank for International Settlements’ (2005) guiding criterion of a four percent capital ratio. Furthermore, the banks show a significant increase in the number of lenders, investors, and representatives. In addition to income, their net earnings increased, as did their total assets and worth between 2007 and 2009. Several banks and financial institutions’ business successes suffered during those times of economic instability (Weber et al. 2011). This period appears to have benefited social banks. Customers may have elected to switch from traditional banks to social and ethical institutions, notably in Europe and the United States, where the 2008 economic crisis devastated the financial sector.

Another factor might be the more risk-averse operations of social and ethical banks, which rely on loans rather than explicit financial items such as futures or other varied choices that usually involve significant risk. These findings imply that pursuing the concept of impact finance as a primary company goal has a significant financial reward. Furthermore, even in the middle of financial difficulties, it might give a reasonable source of money. Nonetheless, despite these encouraging results, we must acknowledge that the social banking market is constrained by its scale. In our scenario, Vancity is the largest organization, with a balance sheet of USD 14 billion in 2010 (VanCity 2011). It is the country’s largest credit union. Nonetheless, this credit union is minor compared to other banks and financial organizations. In this way, the influence of these banks is most likely found in their role as an alternative, yet effective, banking model rather than in their real financial and social repercussions. In any event, as with sustainability problems, these financial unions might serve as pioneers (Weber 2005), laying the groundwork for social finance products and services to be integrated into traditional banking. However, if social banks are to have a long-term impact, they must pursue sustainable development and expand their clientele.

5. Discussion

The global financial crisis has had a tremendously detrimental impact on people’s lives. People have lost their jobs, houses, and money as a result of the crisis. One of the major causes of the crisis was that the financial system became too concentrated on its own interests and lost touch with the real sector and society at large (Pasiouras 2008). The importance of social banking and finance stems from the recognition that free-market forces do not always result in increased efficiency in the financial system, particularly when it comes to defending the interests of society’s most vulnerable members (Weber et al. 2011).

This is due to knowledge asymmetry operating against these portions, putting them at a significant disadvantage. Postcrisis, social banking has emerged as a major global subject. The necessity for banks to be relevant to society, in addition to pursuing their own commercial interests, has been reflected in a variety of legislative and regulatory measures enacted in several nations. The thinking process underlying these regulations was that changes in the financial realm might have serious spillover effects on the actual economy, therefore materially harming the lives of the public.

Thus, the stability and strength of the financial system is a public concern, which is reflected in these initiatives. It is important to emphasize that banks are an essential component of the social structure. They obtain resources such as labor, cash, support services, and so on from the community, which also serves as a consumer for the services provided by banks. Banks are so strongly dependent on society for their operations and it is reasonable to expect banks to reciprocate by ensuring that society’s interests are taken care of through social banking initiatives.

The present research uses a mathematical approach to identify SSME service channels and assess potential impacts on social deposit banks’ performance. As the results derived show that the social banking framework is growing in popularity, questions are raised about its potential for scale. The mechanisms for changing the social banking system are necessary for a new development of the social banking framework. In addition, the current research work assesses the potential impact of a change in the tax system from work to resources on the development of a social banking framework at various scales. Moreover, this paper illustrates the implications of a tax shift and its role as a powerful transformer of system change to assess its challenges and limitations.

In addition, the current research work argues that social or ethical banks, which demonstrate significant resilience in times of financial stress and operate under moderate risk are favorably related to economic development (Kaeufer 2010). Furthermore, because social banks use strict selectivity criteria in fund allocation and provide consistent transparency in the interest margins they offer, we believe these institutions can have a positive impact on domestic economic development, particularly in low-income countries (Harji and Hebb 2009). Small, local banking organizations that use soft, more intimate information and engagement can help the economy in low-income nations where access to financial vehicles is more limited. Additionally, the current study falls into some limitations, such as the small size of the dataset and the limited time duration of the study. Thus, one proposal for future research is to incorporate a larger data set in terms of the number of social banks and the time duration. This will help to update the findings of the research and to add to their robustness. Furthermore, our future research plans include several macroeconomic and financial indicators, such as interest rates and important bank profitability measures, which might reflect the existence of social banking and may turn out to be helpful to economic development.

6. Conclusions

Ethical or social banking is a type of value-driven banking that has both its own economic viability and a beneficial social and ecological effect at its core (Kitamura 2022; Stauropoulou et al. 2023). Despite its long and prosperous history, it is maybe now more relevant than ever in the wake of the most recent financial crisis. Most social banks emerged from this crisis not only uninjured but also significantly bigger and stronger than they were before. And unlike their traditional competitors, none of the social banks required public bailout money. This rapidly piques the interest of traditional banks as well as customers looking for responsible and secure ways to deposit their money. Traditional banks are starting to see the promise of a more socially conscious approach to banking.

Social banks may invest in SSMEs’ social services to gain a strategic advantage or out of a pressing need for such services. Thus, this study utilizes a mathematical model to discover SME service channels and evaluate possible effects on the performance of social deposit banks. In the initial step, the suggested model calculates the predictive power of interpreted accounting variables (future quarterly earnings before taxes (EBT)) vs. interpretive accounting variables (financial ratios). Moreover, in the second stage of our research, the SSME service channels were added to the earnings before tax model in terms of the profitability measure, which informs corporate earnings before operating the business to account for the income tax attributed to it with the aim of estimating their impact on the performance of social banks. Our research indicates that the banks are just investing in SME services to support their claims that such expenditures are tactically necessary (Fu et al. 2020; Kitamura 2022). SSMEs services do not give any banks a strategic edge in terms of financial or accounting performance or efficiency because banks are already efficient. Their ability to maintain their strategic positions can be improved by investing in SMEs.

The findings of the current research show that social or ethical banks that operate under moderate risk and show notable resilience in times of financial hardship are positively associated with economic development (Kaeufer 2010). In addition, social banks employ stringent selection criteria when allocating funds and consistently disclose the interest margins they offer. As a result, according to Harji and Hebb (2009), these institutions can positively affect domestic economic development, particularly in low-income nations. In low-income countries where access to financial instruments is more constrained, small, local banking firms can support the economy by using softer, more intimate information and interaction. In addition, the current study has a number of limitations such as the small dataset size and the brief study period. As a result, one suggestion for future study is to include a larger data set in terms of the quantity of social banks and the length of time. This will improve the research’s findings and strengthen their validity. Additionally, we will incorporate a number of macroeconomic and financial indicators in our future study plans, such as interest rates and significant bank profitability measurements, which may represent the existence of social banking and may prove beneficial to economic growth.

Author Contributions

Conceptualization, E.S. and K.S.; methodology, E.S., K.S. and A.G.; software, K.R.; validation, A.G., F.G. and K.S.; formal analysis, K.R.; investigation, E.S.; resources, E.S.; data curation, E.S.; writing—original draft preparation, E.S., K.S., A.G., K.R. and F.G.; writing—review and editing, E.S., K.S., A.G., K.R. and F.G.; visualization, K.S. and F.G.; supervision, K.S.; project administration, E.S., A.G. and K.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abidin, Z., R. M. Prabantarikso, R. A. Wardhani, and E. Endri. 2021. Analysis of Bank Efficiency Between Conventional Banks and Regional Development Banks in Indonesia. Journal of Asian Finance, Economics and Business 8: 741–50. [Google Scholar] [CrossRef]

- Akhavein, J., A. Berger, and D. Humphrey. 1997. The effects of megamergers on efficiency and prices: Evidence from a bank profit function. Review of Industrial Organization 12: 95139. [Google Scholar] [CrossRef]

- Altunbas, Y., M. Liu, P. Molyneux, and R. Seth. 2000. Efficiency and risk in Japanese banking. Journal of Banking & Finance 24: 1605–28. [Google Scholar]

- Arpa, M., I. Giulini, A. Ittner, and F. Pauer. 2001. The influence of macro-economic developments on Austrian banks: Implications for banking supervision. Bank for International Settlements Papers 1: 91–116. [Google Scholar]

- Asimakopoulos, Ioannis, Sophocles N. Brissimis, and Manthos D. Delis. 2008. The Efficiency of the Greek Banking System and its Determinants. Economic Bulletin, 7–27. [Google Scholar]

- Athanassoglou, P., S. Brissimis, and M. Delis. 2008. Bank-specific, industry-specific and macroeconomic determinants of bank profitability. Journal of International Financial Markets, Institutions and Money 18: 121–36. [Google Scholar] [CrossRef]

- Bacow, L. S. 1998. Risk Sharing Mechanisms for Brownfields Redevelopment. In Risk-Based Corrective Action and Brownfields Restoration. Edited by C. H. Benson, J. N. Meegoda, R. B. Gilbert and S. P. Clemence. Reston: American Society of Civil Engineers, pp. 178–95. [Google Scholar]

- Bank for International Settlements (BIS). 2005. International Convergence of Capital Measurement and Capital Standards (“Basel II”). Basel: Basel Committee on Banking Supervision. [Google Scholar]

- Barth, J., G. Caprio, and R. Levine. 2004. Bank regulation and supervision: What works best? Journal of Financial Intermediation 13: 205–24. [Google Scholar] [CrossRef]

- Berger, A. 1995. The Profit-Structure Relationship in Banking-Tests of Market-Power and Efficient- Structure Hypotheses. Journal of Money, Credit and Banking 27: 404–31. [Google Scholar] [CrossRef]

- Berger, A., and D. Humphrey. 1997. Efficiency of financial institutions: International survey and directions for future research. European Journal of Operational Research 98: 175–72. [Google Scholar] [CrossRef]

- Berger, A., W. Hunter, and S. Timme. 1993. The efficiency of financial institutions: A review and preview of research past, present, and future. Journal of Banking and Finance 17: 221–49. [Google Scholar] [CrossRef]

- Bikker, J., and H. Hu. 2001. Cyclical Patterns in Profits, Provisioning and Lending of Banks and Procyclicality of the New Basel Capital Requirements. Research Series Supervision nr 39; Amsterdam: Section Banking and Supervisory Strategy, Directorate Supervision, The Nederlandsche Bank PO Box 98. [Google Scholar]

- Bourke, P. 1989. Concentration and other determinants of bank profitability in Europe, North America and Australia. Journal of Banking and Finance 13: 65–79. [Google Scholar] [CrossRef]

- Bugg-Levine, A., and J. Emerson. 2011. Impact Investing—Transforming How We Make Money While Making a Difference. San Francisco: Jossey-Bass. [Google Scholar]

- Buttle, M. 2007. ‘I’m not in it for the money’: Constructing and mediating ethical reconnections in UK social banking. Geoforum 38: 1076–88. [Google Scholar] [CrossRef]

- Cadman, T. 2011. Evaluating the governance of responsible investment institutions: An environmental and social perspective. Journal of Sustainable Finance & Investment 1: 20–29. [Google Scholar] [CrossRef]

- Chertok, M., J. Hamaoui, and E. Jamison. 2008. The Funding Gap. Stanford Social Innovation Review 2008: 44–51. [Google Scholar]

- Christopoulos, D., S. Lolos, and E. Tsionas. 2002. Efficiency of the Greek banking system in view of the EMU: A heteroscedastic stochastic frontier approach. Journal of Policy Modelling 24: 813–29. [Google Scholar] [CrossRef]

- da Silva, A. F. C. 2007. Social Banking: The need of the hour. In Social Banking—Perspectives and Experiences. Edited by A. F. C. da Silva. Hyderabad: The Icfai Unioversity Press, pp. 3–9. [Google Scholar]

- Demirgüç-Kunt, Ash, and Harry Huizinga. 1998. Determinants of Commercial Bank Interest Margins and Profitability: Some International Evidence. The World Bank Economic Review 13: 379–408. [Google Scholar] [CrossRef]

- Demirguc-Kunt, Ash, and V. Maksimovic. 1998. Law, Finance and Firm Growth. Journal of Finance 53: 2107–37. [Google Scholar] [CrossRef]

- Edery, Y. 2006. A new model for supporting social enterprise through sustainable investment. Social Enterprise Journal 2: 82–100. [Google Scholar] [CrossRef]

- Eichengreen, B., and H. Gibson. 2001. Greek Banking at the Dawn of the New Millennium. CEPR Discussion Paper No. 2791. Available online: https://ssrn.com/abstract=269391 (accessed on 2 February 2023).

- Emerson, J. 2003. The Blended Value Proposition: Integrating social and financial returns. California Management Review 45: 35–51. [Google Scholar] [CrossRef]

- Endri, E., N. Fatmawatie, S. Sugianto, H. Humairoh, M. Annas, and A. Wiwaha. 2022. Determinants of efficiency of Indonesian Islamic rural banks. Decision Science Letters 11: 391–98. [Google Scholar] [CrossRef]

- Fama, E. F., and K. R. French. 2000. Forecasting Profitability and Earnings. The Journal of Business 73: 161–75. [Google Scholar] [CrossRef]

- Fu, Y., D. Wright, and G. Blazenko. 2020. Ethical Investing Has No Portfolio Performance Cost. Research in International Business and Finance 52: 101117. [Google Scholar] [CrossRef]

- Gibson, H. 2005. Greek Banking Profitability: Recent Developments. Bank of Greece, Economic Bulletin No 24. Available online: https://ssrn.com/abstract=4163855 (accessed on 3 March 2023).

- Global Alliance for Banking on Values. 2018. Available online: https://beneficialstate.org/wp-content/uploads/2019/05/2018-GABV-Research-Report-Final.pdf (accessed on 3 March 2023).

- Global Impact Investing Network. 2011. Global Impact Investing Network. Available online: http://www.thegiin.org (accessed on 7 April 2023).

- Groppelli, A. A., and Eshan Nikbakht. 2006. Finance. Hauppauge: Barrons Educational Series. [Google Scholar]

- Gržeta, I., S. Žiković, and I. Tomas Žiković. 2023. Size matters: Analyzing bank profitability and efficiency under the Basel III framework. Financial Innovation 9: 1–28. [Google Scholar] [CrossRef]

- Halkos, G., and D. Salamouris. 2004. Efficiency measurement of the Greek commercial banks with the use of financial ratios: A data envelopment analysis approach. Management Accounting Research 15: 201–24. [Google Scholar] [CrossRef]

- Hanke, J., and A. Reitsch. 1992. Bussiness Forecasting, 4th ed. New York: Simon & Schuster. [Google Scholar]

- Harji, K., and T. Hebb. 2009. The Quest for Blended Value Returns: Investor Perspectives on Social Finance in Canada. Ottawa: Carleton Centre for Community Innovation. [Google Scholar]

- Ho, T. H., D. T. Nguyen, T. B. Luu, T. D. Q. Le, and T. D. Ngo. 2023. Bank performance during the COVID-19 pandemic: Does income diversification help? Journal of Applied Economics 26: 2222964. [Google Scholar] [CrossRef]

- Hondroyiannis, G., S. Lolos, and E. Papapetrou. 1999. Assessing competitive conditions in the Greek banking system. Journal of International Financial Markets, Institutions and Money 9: 377–91. [Google Scholar] [CrossRef]

- Kaeufer, K. 2010. Banking as a Vehicle for Socio-Economic Development and Change: Case Studies of Socially Responsible and Green Banks. Cambridge: Presencing Institute. [Google Scholar]

- Kallel, H., and M. Triki. 2022. Foreign ownership, bank efficiency and stability: Whether the institutional quality of countries is important? International Journal of Finance & Economics. [Google Scholar] [CrossRef]

- Kamberoglou, Ν., Ε. Liapis, G. Simigiannis, and P. Tzamourani. 2004. Cost Efficiency of Greek Banking. Bank of Greece, Working Paper No. 9. Available online: https://ssrn.com/abstract=4162020 (accessed on 26 April 2023).

- Kavouras, S., I. Vardopoulos, R. Mitoula, A. A. Zorpas, and P. Kaldis. 2022. Occupational Health and Safety Scope Significance in Achieving Sustainability. Sustainability 14: 2424. [Google Scholar] [CrossRef]

- Kitamura, K. 2022. Ethical compatibility of socially responsible banking: Comparing the Japanese main bank system with the USA. Research in International Business and Finance 62: 101686. [Google Scholar] [CrossRef]

- Koellner, T., S. Suh, O. Weber, C. Moser, and R. W. Scholz. 2007. Environmental Impacts of Conventional and Sustainable Investment Funds Compared Using Input-Output LifeCycle Assessment. Journal of Industrial Ecology 11: 41–60. [Google Scholar] [CrossRef]

- Meehan, W. F. I., D. Kilmer, and M. O’Flanagan. 2004. Investing in Society. Stanford Social Innovation Review, Spring 2004: 34–43. [Google Scholar]

- Milano, R. 2011. Social banking: A brief history. In Social Banks and the Future of Sustainable Finance. Edited by O. Weber and S. Remer. New York: Routledge, pp. 15–47. [Google Scholar]

- Miller, S., and A. Noulas. 1996. The technical efficiency of large banks production. Journal of Banking and Finance 20: 495–509. [Google Scholar] [CrossRef]

- Molyneux, P., and J. Thornton. 1992. Determinants of European bank profitability: A note. Journal of Banking and Finance 16: 1173–78. [Google Scholar] [CrossRef]

- Monitor Institute. 2009. Investing for Social and Environmental Impact. Cambridge: Monitor Institute. [Google Scholar]

- Moustairas, I., I. Vardopoulos, S. Kavouras, L. Salvati, and A. A. Zorpas. 2022. Exploring factors that affect public acceptance of establishing an urban environmental education and recycling center. Sustainable Chemistry and Pharmacy 25: 100605. [Google Scholar] [CrossRef]

- Ngo, T., T. D. Le, D. T. Nguyen, and T. H. Ho. 2023. Determinants of bank performance: Revisiting the role of CEO’s personality traits using graphology. Bulletin of Monetary Economics and Banking 26: 52–87. [Google Scholar] [CrossRef]

- O’Rourke, A. 2003. The message and methods of ethical investment. Journal of Cleaner Production 11: 683–93. [Google Scholar] [CrossRef]

- Pasiouras, F. 2008. Estimating the technical and scale efficiency of Greek commercial banks: The impact of credit risk, off-balance sheet activities, and international operations. Research in International Business and Finance 22: 301–31. [Google Scholar] [CrossRef]

- Perry, P. 1992. Do banks gain or lose from inflation. Journal of Retail Banking 2: 25–30. [Google Scholar]

- Revell, J. 1989. The Future of Savings Banks: A Study of Spain and the Rest of Europe, Institute of European Finance, Research Monographs in Banking and Finance no. 8. Bangor: Institute of European Finance, University of Wales. [Google Scholar]

- Sandberg, Joakim, Carmen Juravle, Ted Martin Hedesström, and Ian Hamilton. 2009. The Heterogeneity of Socially Responsible Investment. Journal of Business Ethics 87: 519–33. [Google Scholar] [CrossRef]

- Scholz, R. W., O. Weber, J. Stünzi, W. Ohlenroth, and A. Reuter. 1995. Umweltrisiken systematisch erfassen. Kreditausfälle aufgrund ökologischer Risiken—Fazit erster empirischer Untersuchungen [The systematic measuring of environmental risk. Credit defaults caused by environmental risk—Results of a first Study]. Schweizer Bank 4: 4547. [Google Scholar]

- Shapiro, Samuel Sanford, and Martin B. Wilk. 1965. An Analysis of Variance Test for Normality (Complete Samples). Biometrika 52: 591–611. [Google Scholar] [CrossRef]

- Shen, Z., J. Li, M. Vardanyan, and B. Wang. 2022. Nonparametric shadow pricing of non-performing loans: A study of the Chinese banking sector. Annals of Operations Research, 1–25. [Google Scholar] [CrossRef]

- Short, B. 1979. The relation between commercial bank profit rates and banking concentration in Canada, Western Europe and Japan. Journal of Banking and Finance 3: 209219. [Google Scholar] [CrossRef]

- Smirlock, M. 1985. Evidence on the (Non) Relationship between Concentration and Profitability in Banking. Journal of Money, Credit and Banking 17: 69–83. [Google Scholar] [CrossRef]

- Stauropoulou, A., E. Sardianou, G. Malindretos, K. Evangelinos, and I. Nikolaou. 2023. The effects of economic, environmentally and socially related SDGs strategies of banking institutions on their customers’ behavior. World Development Sustainability 2: 100051. [Google Scholar] [CrossRef]

- Tsamis, A. 1989. Selection and Reliability of Financial Indicators. Athens: Interbooks. [Google Scholar]

- Úbeda, F., F. J. Forcadell, E. Aracil, and A. Mendez. 2022. How sustainable banking fosters the SDG 10 in weak institutional environments. Journal of Business Research 146: 277–87. [Google Scholar] [CrossRef]

- VanCity. 2011. Vancity 2010 Annual Report. Vancouver: Vancouver City Savings Credit Union. [Google Scholar]

- Vardopoulos, I. 2019. Critical sustainable development factors in the adaptive reuse of urban industrial buildings. A fuzzy DEMATEL approach. Sustainable Cities and Society 50: 101684. [Google Scholar] [CrossRef]

- Vardopoulos, I., E. Tsilika, E. Sarantakou, A. A. Zorpas, L. Salvati, and P. Tsartas. 2021. An Integrated SWOT-PESTLE-AHP Model Assessing Sustainability in Adaptive Reuse Projects. Applied Sciences 11: 7134. [Google Scholar] [CrossRef]

- Weber, O. 2005. Sustainability Benchmarking of European Banks and Financial Service Organizations. Corporate Social Responsibility and Environmental Management 12: 73–87. [Google Scholar] [CrossRef]

- Weber, O. 2006. Investment and environmental management: The interaction between environmentally responsible investment and environmental management practices. International Journal of Sustainable Development 9: 336–54. [Google Scholar] [CrossRef]

- Weber, O., and S. Remer. 2011. Social Banking—Introduction. In Social Banks and the Future of Sustainable Finance. Edited by O. Weber and S. Remer. New York: Routledge. [Google Scholar]

- Weber, O., M. Mansfeld, and E. Schirrmann. 2011. The Financial Performance of RI Funds After 2000. In Responsible Investment in Times of Turmoil. Edited by W. Vandekerckhove, J. Leys, K. Alm, B. Scholtens, S. Signori and H. Schaefer. Berlin/Heidelberg: Springer. [Google Scholar]

- Weber, O., R. W. Scholz, and G. Michalik. 2010. Incorporating sustainability criteria into credit risk management. Business Strategy and the Environment 19: 39–50. [Google Scholar] [CrossRef]

- Yuen, M. K., T. Ngo, T. D. Q. Le, and T. H. Ho. 2022. The environment, social and governance (ESG) activities and profitability under COVID-19: Evidence from the global banking sector. Journal of Economics and Development 24: 345–64. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).