Abstract

The growing expenses, dependence on IT for business operations, and growing requirements regarding related party transaction (RPT) reporting impose the need for increased attention to this area. The paper’s objective is to examine the nature of RPTs, identified by auditors as a key audit matter (KAMs), challenges and solutions to problems related to risk management, and the detection of factors affecting audit quality. The research methodology is qualitative, with an analysis of the level of disclosure of KAMs reported by auditors from the Related Parties category, grouped by type of auditors, their opinion, year, country, and fields of activity. Data were collected from the Audit Analytics database and filtered by category KAM: Related parties, period 2013–2021. The selection resulted in 111 companies reporting 248 KAMs related to RPTs, from which most were reported in 2017–2019. Of these, nearly two-thirds were reported by auditors from the Big4 category. Most KAMs were reported by companies in the U.K., Germany, and France, and the industries with the most KAMs were finance, insurance, and real estate. In conclusion, there are factors that can affect audit quality due to the reporting of RPTs, but by identifying them, the audit process can be better managed, thus increasing its efficiency.

1. Introduction

The financial audit exercises its disclosure obligation by expressing an independent and professional opinion regarding the accuracy and reality of the financial statements prepared by the company’s management, and due to the fact that the auditor’s opinion is addressed to all those interested in the financial statements, the quality of the services provided by the financial auditor is quantified by the extent to which all the beneficiaries of the audit services trust this information. Identifying the factors that are affecting the audit quality and the use of related party transactions can guide managers in evaluating the resources required for financial audit engagements. In addition, by identifying critical factors related to audit quality, it is possible to better control and manage the audit process and thus increase audit effectiveness and efficiency. Although it may be impossible to eliminate or even influence some risks, economically significant risks are critical to the success or failure of business operations, and therefore, commercial enterprises generally allocate substantial resources to managing significant business opportunities and their inherent risks (Dang and Nguyen 2021). Multinational companies are under increasing pressure to adhere to regulations on related party transactions. For this reason, tax risk management plays a considerable role in strategy and decision-making for today’s companies (Rossing et al. 2017). The importance of related party transactions in auditing has grown rapidly and has brought together several factors that can affect the quality of the financial audit. The focus on related party transactions has been driven by the following aspects: increased spending, reliance on IT for business operations, and legislation or professional requirements related to this area. According to US GAAP Statement of Financial Accounting Standards 57 (FAS n.d.), related party transactions are transactions between a company and its subsidiaries, affiliates, principal owners, directors or their families, entities owned or controlled by the company’s directors or their families. The International Accounting Standards (IAS 24) definition of a related party is similar, namely IAS 24 (revised) considers that related parties can be a person, an entity, or an independent business”. Also, according to IAS 24, a related party transaction (RPT) is a “transfer of resources, services or obligations between related parties, regardless of whether a price is charged” (IASB). Another criterion for affiliation between companies is the effective control exercised by a natural or legal person over another legal person. An example of such affiliation is where two companies are managed by the same person. Bodu (2019) defines subsidiaries as legal entities controlled by or in a direct or indirect decision-making relationship with another legal entity. Control over subsidiaries is established by several legal–economic methods, namely when an entity (i) holds a majority of voting rights; (ii) has the right to appoint or dismiss a majority of the members of the administrative, management, supervisory bodies being at the same time partners/shareholders of the entity in question; (iii) is a partner/shareholder and controls alone a majority of voting rights on the basis of an agreement concluded with other partners; and (iv) has the power to exercise or effectively exercises a dominant or controlling influence. In addition, persons acting in concert are those entities that cooperate based on a tacit, oral, or written agreement to carry out a common policy, and therefore, these persons should be treated as a single controlling person. Related parties may decide to enter transactions that non-affiliates would not enter into, and these transactions may also be of different values than those entered into by non-affiliates. To discourage these practices, OECD has imposed international tax principles to member countries through which they have succeeded in achieving their proposed objectives, namely (i) to ensure a fair tax base to each tax jurisdiction involved in the transaction process and (ii) to avoid double taxation by minimizing conflict between tax administrations and promoting international trade and investments (OECD 2022).

The RPTs audit is a difficult field to audit; it was included in a top ten audit deficiencies in the case of fraud (Beasley et al. 2000), especially in the United States (Gordon et al. 2007). Previous research has analyzed whether the audit of related parties contributes to reducing the negative impact on minority shareholders and how the regulations contribute to their protection (El-Helaly 2018).

The independent auditor’s report underwent substantial changes in the last period. The communication of key audit matters (ISA 701) became mandatory in most countries only starting from 2017. The auditor has an additional objective, namely to determine the key matters in the audit and to communicate those that, in the auditor’s professional opinion, had the greatest importance in the audit of the financial statements of the current period, describing them in his report.

In the literature, we have identified numerous studies regarding the disclosure of KAMs, but the number of studies that have analyzed reporting on KAM topics is low. In this context, the paper’s goal is to identify the reports in which the financial auditors considered the related parties’ transactions on the financial statements of companies a key audit matter (KAM) and what the approach was in assessing this matter. Therefore, the paper’s objective is to examine the nature of RPTs, identified by auditors as a key audit matter (KAMs), challenges and solutions to problems related to risk management, and the detection of factors affecting audit quality. The research methodology is qualitative, with an analysis of the level of disclosure of KAMs reported by auditors from the Related Parties category, grouped by type of auditors, their opinion, year, country, and fields of activity. The sample consists of companies listed on European stock exchanges for 2013–2021 from 31 countries, and data were collected from the Audit Analytics database. The selection resulted in 111 companies reporting 248 KAMs related to RPTs, from which most were reported in 2017–2019. Of these, nearly two-thirds were reported by auditors from the Big4 category. Most KAMs were reported by companies in the U.K., Germany, and France, and the industries with the most KAMs were finance, insurance, and real estate.

The paper contributes to the literature by including a descriptive analysis of the RPTs’ impact on the audit by including it as a key audit matter in the auditors’ reports, an impact that leads to the need to use the expertise of other specialists.

The article continues with the literature review related to the reporting of related party transactions and their audit, the research methodology, the results, and the research conclusions and its limitations.

2. Literature Review

2.1. Related Parties’ Transaction Reporting

To understand more thoroughly the importance of related party transactions as well as their effect on the users of financial statements and not least on the jurisdictions in which they arise, we studied the importance they have in a global economy where coordination between countries offers countless opportunities to fairly achieve these desires compared to tax competition (Dang and Nguyen 2022). Thus, the natural trend must be to expand global trade on a multilateral and non-discriminatory basis (i.e., to achieve a consistent and sustainable level of economic growth in all countries participating in this trade). In the view of Sikka and Willmott (2010), transfer pricing is at the intersection of the debates on multinational accountability, social responsibility, and state legitimacy.

Related party transactions “can distort financial statements leading to greater information asymmetry and a general erosion of investor confidence in the firm” (Tong et al. 2014). In this context, more attention should be paid to the disclosure of such transactions in financial reports (Huang and Liu 2010).

A disclosure of related party transactions is necessary to allow users of financial statements to capture a complete picture of an entity’s position and results of operations (Epstein and Jermakowicz 2008). Multinational companies are under increasing pressure to adhere to transfer pricing regulations. For this reason, tax risk management plays a considerable role in transfer pricing strategy and decision making for today’s firms (Rossing et al. 2017).

According to Cheung et al. (2009) and Jian and Wong (2010), related party transactions are traditionally considered a tool of shareholder control to exercise expropriation on minority shareholders through several mechanisms (for example, loans with related parties, asset sales, and even business relationships). Despite the fact that recent literature has begun to distinguish between “good” and “bad” types of transactions, the relevant evidence is still quite mixed regarding related party transactions. Aharony et al. (2010) believe that related party sales are driven by exploitation while Habib et al. (2015) and Kohlbeck and Mayhew (2017) support the view of more efficient contracting in sales or purchases between related parties. Jorgensen and Morley (2017) consider that the impact of transactions with related parties may vary depending on the country, with different degrees of development of the capital market, the regulatory environment, characteristics of the firm’s ownership, etc. In this sense, the arguments of related party transactions based on transaction costs are probably more applicable to the Eastern European market than to markets in developed countries with mature stock markets. Wang et al. (2019) also try to identify a potential moderator, such as an industry similarity between group affiliates, that would cause related party transactions to be a “model of perfection”.

Related party transactions can be considered fraud mechanisms, but it is important for the audit profession to understand their nature and the differences between fair and fraudulent transactions (Henry et al. 2007). That is why it is necessary for the auditors to pay more attention to them and report them as KAM when they consider that they have a big impact on the financial statements.

2.2. Key Audit Matters Disclosure

The modification of the auditor’s report by including the key audit matters section has become an intensively researched topic at the international level, and researchers have debated issues generated by the disclosure of this information (Botes et al. 2020; Kitiwong and Sarapaivanich 2020; Hegazy and Kamareldawla 2021) as well as cultural influences in reporting (Kitiwong and Srijunpetch 2019). The determinants of KAM reporting (Al Lawati and Hussainey 2022) and the link between KAM and the level of materiality were also discussed (Iwanowicz and Iwanowicz 2019). The key aspects reported by auditors from several countries, such as China (Liu et al. 2022), South Africa (Ecim et al. 2023), and Romania (Corlaciu and Tiron-Tudor 2013; Căpăţână-Verdeş 2019; Grosu et al. 2020), were analyzed.

The users’ perception of the audit quality is given by the complexity of the auditor’s report. The number of key aspects reported by auditors can be different from one company to another; Özcan (2021) investigated the factors that influence this number. The results indicated that the non-Big4 auditors disclosed more key audit aspects than the Big4 auditors, and the number of KAMs increases depending on the complexity of the companies’ activities. In addition, Pinto and Morais (2018) investigated the factors influencing the number of KAMs in European countries based on a sample of the most significant companies in the UK, France, and the Netherlands that reported KAMs in 2016. The findings showed that the existence of many more business segments contributes to the disclosure of a more significant number of KAMs.

Contrary to expectations, the disclosure of a greater number of KAMs is associated with users’ perception of a lower audit quality (Sirois et al. 2018). From the research carried out by Rautiainen et al. (2021), it emerged that the number of KAMs did not significantly influence the quality of the audit and was not perceived as important by users. Hegazy and Kamareldawla (2021) investigated how external auditors comply with the requirements of ISA 701, and the results suggested that the current requirements of ISA 701 are not sufficiently explicit to assist auditors in identifying appropriate KAMs.

The literature contains numerous studies on the KAM disclosure, but there are few studies that have analyzed reporting on KAM topics. More than 50 topics covered by KAMs were identified in the literature (Wallis et al. 2022; Hategan et al. 2022), of which the most common were those related to impairment, revenue, and business combinations. Less frequent subjects were those related to information technology (IT), fraud risk, and related parties’ transactions. The previous study showed that the most reported KAM related to IT was in the field of finance, insurance, and real estate (Crucean and Hategan 2023); therefore, the company’s activity influences the subject of the revealed KAMs.

To achieve the proposed objective, the theoretical framework underlying the research is based on agency and stakeholder theories. Agency theory considers auditors independent and vigilant monitors of management and responsible for reporting to shareholders (Jensen and Meckling 1976). KAM reporting is an additional mechanism by which auditors report to shareholders information about management’s conduct, together with the audit opinion on the financial statements. The agency theory in combination with the stakeholder theory can be useful to explain the impact of KAM reporting on investors’ decisions, as they can reduce information asymmetries and conflicts of interest between companies and stakeholders (Suttipun 2021).

From the aspects presented, it appears that the literature on the reporting of transactions with related parties and their identification as a KAM is relevant, but the research is not very developed. Therefore, the research question is: Have the auditors identified related party transactions as key audit matters? What are the characteristics of the auditors and the respective companies?

3. Methodology

3.1. Data

The data were collected from the Audit Analytics database on 4 October 2022. The sample consisted of companies listed on European stock exchanges for 2013–2021 from 31 countries. The data were synthesized, systematized, and analyzed according to variables such as type of auditor, audit year, countries, and industries. During the analyzed period, we identified 248 KAMs for 111 distinct companies that referred to RPTs.

3.2. Method

The research methodology was quantitative with a descriptive analysis of the level of disclosure of KAMs reported by auditors from the Related Parties category. The descriptive study of KAMs will be grouped by auditor type and opinion, year, country, and areas of activity. In Audit Analytics database, the KAMs are grouped by topic; there are more than 60 topics included in this database (Hategan et al. 2022).

4. Results

4.1. Type and Opinion of the Auditor

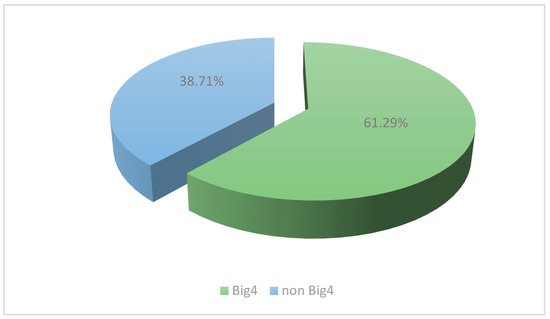

A key factor in reporting KAMs is the type of auditor issuing the audit report, particularly whether they are part of a Big4 or non-Big4 company. Following the synthesis of the analyzed data, the situation of auditors by type is shown in Figure 1.

Figure 1.

Type of auditor.

In Figure 1, auditors from Big4 companies had a significant percentage (61.29%) while auditors from non-Big4 companies had a lower percentage of KAMs (38.71%). In terms of the number of KAMs issued, Big4 reported 152 KAMs while non-Big4 auditors reported only 96 KAMs. In the reports that contained the 248 KAMs, the auditors issued only unreserved opinions.

Regarding the distribution of the four audit firms that are part of the Big4 group (Deloitte, Ernst & Young, KPMG, and PricewaterhouseCoopers), it can be seen from Table 1 that Ernst & Young LLP reported the most KAMs (69), followed by PricewaterhouseCoopers LLP with 35 KAMs. KPMG and Deloitte & Touche LLP complete the ranking, each issued 24 KAMs related to related party transactions.

Table 1.

Big4 auditor distribution.

Even though they recorded a much lower percentage than the first category of auditors, the contribution of non-Big4 auditors to KAM reporting on related party transactions is noteworthy. The results are detailed in Table 2 and Table 3.

Table 2.

Distribution of Non-Big4 auditors.

Table 3.

Distribution of non-big4 auditors by number of KAMs.

This category includes 24 auditors who reported a total of 96 KAMs, of which Shipleys LLP identified the most 19 KAMs; BDO and Welbeck Associates each identified 8 KAMs; Grant Thornton LLP, Hazlewoods LLP, and MHA MacIntyre Hudson each reported 5 KAMs; Baker Tilly CI Audit Limited, Crowe UK LLP, and UAB Audito sprendimai each reported 4 KAMs; SIA Potapovica an Andersone, Rodl & Partner GmbH, RMT Accountants & Business Advisors Ltd., MJ Abedin & Co., Mazars, and Baker Tilly 4Partners Auditores Independentes SS reported only 3 KAMs; RSM UK Audit LLP, Nexia Smith & Williamson Audit Limited, Lohr + Company GmbH, HW Fisher & Company, and ECOVIS reported only 2 KAMs; and Saffery Champness LLP, Moore Stephens LLP (UK), Elderton Audit UK, and Baker Tilly Berk NV only 1 KAM.

Regarding the opinion type, almost all the reports included an unqualified opinion, with the exception of a Greek company in the field of services that in two consecutive years (2017 and 2018) had an adverse opinion.

4.2. Audit Period

During the period analysed, the most KAMs were identified in 2018 (48 KAMs), 2017 (41 KAMs), and 2019 (36 KAMs). The detailed situation for each analyzed year is presented in Table 4.

Table 4.

Audit year.

On the other hand, the fewest KAMs were recorded in 2013 and 2015, which included a number of 9 and 10 KAMs respectively.

4.3. Geographical Distribution of the Companies

Another critical indicator in the data analysis was the geographical distribution of companies in the countries in which they registered their headquarters, which is shown in Table 5.

Table 5.

Geographical distribution of the companies.

Related party KAMs were reported for companies in 31 countries. The majority of IT-related KAMs were identified for UK companies (more than 42%); one reason for this is that this country also has the most significant number of companies in the sample analyzed.

A further 30 countries recorded a percentage of more than 2%, the most important being Germany and Isle of Man (4.47%), France (4.07%), Bermuda, Ireland (3.66%), Sweden (3.25%). A lower percentage is recorded for Guernsey, Netherlands (2.85%), Italy, Switzerland (2.44%), Belgium, Norway, Poland (2.03%), Germany (2.37%), and France (2.15%).

The Cayman Islands, Finland, Lithuania, and Luxembourg reported 1.63%: six companies reported KAMs below 1.22% and other companies in seven countries reported KAMs below 0%.

4.4. Fields of Activity

The structure of the sample by they area of activity correlated with the number of KAMs and audit reports issued is shown in Table 6.

Table 6.

Fields of activity.

Auditors reported the most KAMs regarding related parties for companies in finance, insurance, and real estate (33%). Other areas that had a significant share were mining, construction (21%), and the production sector, which cumulated 21% as well. The industries with the fewest KAMs reported by auditors were services (13% on two groups) and agriculture, forestry, and fishing, which reported only two KAMs.

5. Discussion

Starting from the research question of whether the auditors identified transactions with related parties as key audit issues, the results show that they identified 248 KAMs. From the point of view of the auditors’ characteristics, it was found that Big4 auditors included this KAM in the reports of two-thirds of the companies. It is known that at the international, but also European level, most companies are audited by Big4 auditors, and this result is in accordance with the general situation (Audit Analytics 2020).

From a recent study carried out at the level of European companies, it emerged that there is a connection between the number of KAMs and their topic with the audit fees (Cameran and Campa 2023). Therefore, the results of the study show that the KAM analysis on topics is important because it contributes to the identification of some factors that influence their disclosure. In addition, certain topics of KAMs that were disclosed may be related to the financial difficulties of the companies (Camacho-Miñano et al. 2023).

The results of this study meet the research objective: the analysis of the level of disclosure of KAMs regarding the RPTs. The results from the activity areas confirm the fact that, at financial institutions organized as financial groups, it was expected that the auditors would consider related party transactions a key important aspect. The results obtained are consistent with previous research that shows that the reporting of KAMs on different categories is an intensively researched topic (Hategan et al. 2022) and the fact that the category of related parties is an important topic along with other categories, such as IT (Sneller et al. 2017).

The results are different from previous studies because there are few studies that analyzed a single topic of KAM (Crucean and Hategan 2023), as there is more research that showed factors that influenced the reporting of KAMs by auditors (Pinto and Morais 2018; Özcan 2021).

6. Conclusions

Identifying the factors that are affecting the audit quality and the use of related party transactions can guide managers in evaluating the resources required for financial audit engagements. In addition, by identifying critical factors related to audit quality, it is possible to better control and manage the audit process and thus increase audit effectiveness and efficiency.

Although it may be impossible to eliminate or even influence some risks, economically significant risks are critical to the success or failure of business operations, and therefore, commercial enterprises generally allocate substantial resources to managing significant business opportunities and their inherent risks. Therefore, companies must invest more time and effort in dealing with the risk issues related to identifying these related party transactions and the reporting of them.

The objective of the paper was included in the topic related to audit quality, and the results of the research can support auditors to better control and manage the audit process and thus increase the effectiveness and efficiency of the audit mission. In addition, it has the role of highlighting and guiding managers in evaluating the resources needed for financial audit missions.

A first conclusion of our study concerns the reporting of key aspects that are revealed to us following the analysis as being predominant in the United Kingdom of Great Britain, where the independent auditor’s report has integrated the paragraph for the communication of key aspects since 2013.

In particular, we examined KAMs grouped by the type of auditors, their opinion, year, country, and fields of activity. We also wanted to draw attention to the key points that must be considered in the financial audit process regarding companies that carry out transactions with affiliate parties.

When communicated, these KAMs require attention for optimal formulation due to the significant risk aspects assessed by the auditor and due to their impact on the financial statements. Transactions with affiliate parties represent the accounting matters that not only require a longer period for analysis, but also a certain level of attention from the auditor and company management, with a significant impact on the financial statements. Auditors must have the ability to convey information so that users gain a clear perspective on the significant risks identified, the quality of internal controls, the risk management systems that the company has implemented, and the quality of its accounting policies. In addition, most users believe that a significant level of credibility of the audit report comes from the prestige and reputation of the audit firm.

The research results have theoretical and practical implications. On the one hand, at the academic level, it is a study that presents real situations from practice, and researchers can use the data in future studies. On the other hand, from the practical perspective, both of the auditing profession and from the point of view of users, the disclosure of KAMs on specific topics would encourage better communication and contribute to the reduction of information asymmetry.

The paper contributes to the literature on RPT reporting and auditing, with an analysis regarding the frequency of KAMs on the RPTs as an element of the external audit quality.

The limit of the paper consists in the fact that a single database was used and the items from the sample are published just in this database. Another limitation is the size of the sample and the research focusing only on European companies. Future research directions can be concretized in a quantitative analysis by building an econometric model that contains the dependent variable ‘key audit matter’, and the independent variables can be the most significant indicators obtained based on the analysis performed in this paper.

Author Contributions

Conceptualization, C.-D.H. and L.-V.P.; Methodology, C.-D.H. and L.-V.P.; Software, L.-V.P.; Investigation, L.-V.P.; Resources, L.-V.P.; Writing—original draft preparation, L.-V.P.; Writing—review and editing, C.-D.H.; Supervision, C.-D.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available upon request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Aharony, Joseph, Jiwei Wang, and Hongqi Yuan. 2010. Tunneling as an incentive for earnings management during the IPO process in China. Journal of Accounting and Public Policy 29: 1–26. [Google Scholar] [CrossRef]

- Al Lawati, Hidaya, and Khaled Hussainey. 2022. The Determinants and Impact of Key Audit Matters Disclosure in the Auditor’s Report. International Journal of Financial Studies 10: 107. [Google Scholar] [CrossRef]

- Audit Analytics. 2020. Monitoring the Audit Market in Europe. Available online: https://blog.auditanalytics.com/monitoring-the-audit-market-in-europe/ (accessed on 5 June 2023).

- Beasley, Mark, Joseph Carcello, Dana Hermanson, and Paul Lapides. 2000. Fraudulent financial reporting: Consideration of industry traits and corporate governance mechanisms. Accounting Horizons 14: 441–54. [Google Scholar] [CrossRef]

- Bodu, Sebastian. 2019. Piața de Capital. Legea nr. 24-2017 Privind Emitenții de Instrumente Financiare și Operașiuni de Piață–București. București: Rosetti. ISBN 978-606-025-007-4. [Google Scholar]

- Botes, Vida, Mary Low, and Aleena Sutton. 2020. Key audit matters and their implications for the audit environment. International Journal of Economics and Accounting 9: 374–96. [Google Scholar] [CrossRef]

- Camacho-Miñano, María-del-Mar, Nora Muñoz-Izquierdo, Morton Pincus, and Patricia Wellmeyer. 2023. Are key audit matter disclosures useful in assessing the financial distress level of a client firm? The British Accounting Review. [Google Scholar] [CrossRef]

- Cameran, Mara, and Domenico Campa. 2023. Key Audit Matters and Audit Outcomes: Evidence from the European Union. April 21. Available online: https://ssrn.com/abstract=4425465 (accessed on 5 June 2023).

- Căpăţână-Verdeş, Neli. 2019. Testing Compliance with IAS 24 fot Related Parties Listed on Bucharest Stock Exchange, in European Union Financial Regulation and Administrative Area: EUFIRE 2019; Edited by Mihaela Tofan, Irina Bilan and Elena Cigu. Iaşi: Editura Universităţii “Al. I. Cuza”, pp. 23–42. Available online: http://eufire.uaic.ro/wp-content/uploads/2019/08/EUFIRE_Conference_Proceeding2019.pdf (accessed on 10 November 2020).

- Cheung, Yan-Leung, Yuehua Qi, Raghavendra Rau, and Aris Stouraitis. 2009. Buy high, sell low: How listed firms price asset transfers in related party transactions. Journal of Banking & Finance 33: 914–24. [Google Scholar]

- Corlaciu, Alexandra, and Adriana Tiron-Tudor. 2013. Research on the Factors that Influence the Level of Related Party Disclosures as Required by ISA 24. Audit Financiar 11: 10–24. [Google Scholar]

- Crucean, Andreea Claudia, and Camelia-Daniela Hategan. 2023. Impact of Information Technology on Audit Quality: European Listed Companies’ Evidence. In Contemporary Studies of Risks in Emerging Technology, Part B. Bingley: Emerald Publishing Limited, pp. 327–39. [Google Scholar]

- Dang, Van Cuong, and Quang Khai Nguyen. 2021. Internal corporate governance and stock price crash risk: Evidence from Vietnam. Journal of Sustainable Finance & Investment, 1–18. [Google Scholar] [CrossRef]

- Dang, Van Cuong, and Quang Khai Nguyen. 2022. Audit committee characteristics and tax avoidance: Evidence from an emerging economy. Cogent Economics & Finance 10: 2023263. [Google Scholar]

- Ecim, Dusan, Warren Maroun, and Alain Duboisee de Ricquebourg. 2023. An analysis of key audit matter disclosures in South African audit reports from 2017 to 2020. South African Journal of Business Management 54: 3669. [Google Scholar] [CrossRef]

- El-Helaly, Moataz. 2018. Related-party transactions: A review of the regulation, governance and auditing literature. Managerial Auditing Journal 33: 779–806. [Google Scholar] [CrossRef]

- Epstein, Barry J., and Eva K. Jermakowicz. 2008. Chapter 23 Related-party disclosures. In Interpretation and Application of International Financial Reporting Standards. Hoboken: John Wiley & Sons Inc., pp. 852–63. [Google Scholar]

- Financial Accounting Standards Board. n.d. FAS 57 Related Parties’ Transactions. Available online: https://www.fasb.org/page/PageContent?pageId=/reference-library/superseded-standards/summary-of-statement-no-57.html&bcpath=tff (accessed on 31 March 2023).

- Gordon, Elisabeth A., Elain Henry, Timoty J. Louwers, and Brad J. Reed. 2007. Auditing related party transactions: A literature overview and research synthesis. Accounting Horizons 21: 81–102. [Google Scholar] [CrossRef]

- Grosu, Maria, Ioan-Bogdan Robu, and Costel Istrate. 2020. The Quality of Financial Audit Missions by Reporting the Key Audit Matters. Audit Financiar 18: 182–95. [Google Scholar] [CrossRef]

- Habib, Ahsan, Haiyan Jiang, and Donghua Zhou. 2015. Related-party transactions and audit fees: Evidence from China. Journal of International Accounting Research 14: 59–83. [Google Scholar] [CrossRef]

- Hategan, Camelia-Daniela, Ruxandra Ioana Pitorac, and Andreea Claudia Crucean. 2022. Impact of COVID-19 pandemic on auditors’ responsibility: Evidence from European listed companies on key audit matters. Managerial Auditing Journal 37: 886–907. [Google Scholar] [CrossRef]

- Hegazy, Mohamed Abdel Aziz, and Noha Mahmoud Kamareldawla. 2021. Key audit matters: Did IAASB unravel the knots of confusion in audit reports decisions? Managerial Auditing Journal 36: 1025–52. [Google Scholar] [CrossRef]

- Henry, Elain, Elisabeth A. Gordon, Brad Reed, and Thimoty J. Louwers. 2007. The Role of Related Party Transactions in Fraudulent Financial Reporting. Available online: https://ssrn.com/abstract=993532 (accessed on 5 June 2023).

- Huang, Derek-Teshun, and Zhien-Chia Liu. 2010. A study of the relationship between related party transactions and firm value in high technology firms in Taiwan and China. African Journal of Business Management 4: 1924. [Google Scholar]

- Iwanowicz, Tomasz, and Bartolomiej Iwanowicz. 2019. ISA 701 and Materiality Disclosure as Methods to Minimize the Audit Expectation Gap. Journal of Risk and Financial Management 12: 161. [Google Scholar] [CrossRef]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm. Managerial Behaviour, Agency Costs and Ownership Structure. Journal of Financial Economics 3: 305–60. [Google Scholar]

- Jian, Ming, and Tak J. Wong. 2010. Propping through related party transactions. Review of Accounting Studies 15: 70–105. [Google Scholar] [CrossRef]

- Jorgensen, Bjorn N., and Julia Morley. 2017. Discussion of “are related party transactions red flags?”. Contemporary Accounting Research 34: 929–39. [Google Scholar] [CrossRef]

- Kitiwong, Weerapong, and Naruanard Sarapaivanich. 2020. Consequences of the implementation of expanded audit reports with key audit matters (KAMs) on audit quality. Managerial Auditing Journal 35: 1095–119. [Google Scholar] [CrossRef]

- Kitiwong, Weerapong, and Sillapaporn Srijunpetch. 2019. Cultural influences on the disclosures of key audit matters. Journal of Accounting Profession 15: 45–63. [Google Scholar]

- Kohlbeck, Mark, and Brian W. Mayhew. 2017. Are related party transactions red flags? Contemporary Accounting Research 34: 900–28. [Google Scholar] [CrossRef]

- Liu, Hui, Jiaki Ning, Yue Zhang, and Junrui Zhang. 2022. Key audit matters and debt contracting: Evidence from China. Managerial Auditing Journal 37: 657–78. [Google Scholar] [CrossRef]

- OECD. 2022. Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations. Available online: https://www.oecd-ilibrary.org/taxation/oecd-transfer-pricing-guidelines-for-multinational-enterprises-and-tax-administrations-2022_0e655865-en (accessed on 31 March 2023).

- Özcan, Ahmet. 2021. What factors affect the disclosure of key audit matters? Evidence from manufacturing firms. International Journal of Management Economics and Business 17: 149–16. [Google Scholar] [CrossRef]

- Pinto, Ines, and Ana Isabel Morais. 2018. What matters in disclosures of key audit matters: Evidence from Europe. Journal of International Financial Management & Accounting 30: 145–62. [Google Scholar]

- Rautiainen, Antti, Jani Saastamoinen, and Kati Pajunen. 2021. Do key audit matters (KAMs) matter? Auditors’ perceptions of KAMs and audit quality in Finland. Managerial Auditing Journal 36: 386–404. [Google Scholar] [CrossRef]

- Rossing, Christian Plesner, Martine Cools, and Carsten Rohde. 2017. International transfer pricing in multinational enterprises. Journal of Accounting Education 39: 55–67. [Google Scholar] [CrossRef]

- Sikka, Prem, and Hugh Willmott. 2010. The dark side of transfer pricing: Its role in tax avoidance and wealth retentiveness. Critical Perspectives on Accounting 21: 342–56. [Google Scholar] [CrossRef]

- Sirois, Louis-Philippe, Jean Bédard, and Palash Bera. 2018. The informational value of key audit matters in the auditor’s report: Evidence from an eye-tracking study. Accounting Horizons 32: 141–62. [Google Scholar] [CrossRef]

- Sneller, Lineke, Ries Bode, and Arnoud Klerkx. 2017. Do IT matters matter? IT-related key audit matters in Dutch annual reports. International Journal of Disclosure and Governance 14: 139–51. [Google Scholar] [CrossRef]

- Suttipun, Muttanachai. 2021. Impact of key audit matters (KAMs) reporting on audit quality: Evidence from Thailand. Journal of Applied Accounting Research 22: 869–82. [Google Scholar] [CrossRef]

- Tong, Yan, Mingzhu Wang, and Feng Xu. 2014. Internal control, related party transactions and corporate value of enterprises directly controlled by Chinese central government. Journal of Chinese Management 1: 1–14. [Google Scholar] [CrossRef]

- Wallis, Mark, Matt Pinnuck, Amir Ghandar, and Zowie Pateman. 2022. Key Audit Matters. Insight 2022, Chartered Accountants Australia and New Zealand. Available online: https://www.charteredaccountantsanz.com/news-and-analysis/insights/research-and-insights/key-audit-matters-in-australia (accessed on 5 June 2023).

- Wang, Hong-Da, Chia-Ching Cho, and Chan-Jane Lin. 2019. Related party transactions, business relatedness, and firm performance. Journal of Business Research 101: 411–25. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).