Restaurants’ Solvency in Portugal during COVID-19

Abstract

1. Introduction

2. Theoretical Background

2.1. The Restaurant Sector in Portugal

2.2. The Restaurant Sector in Portugal

2.3. The Restaurant Sector in Portugal

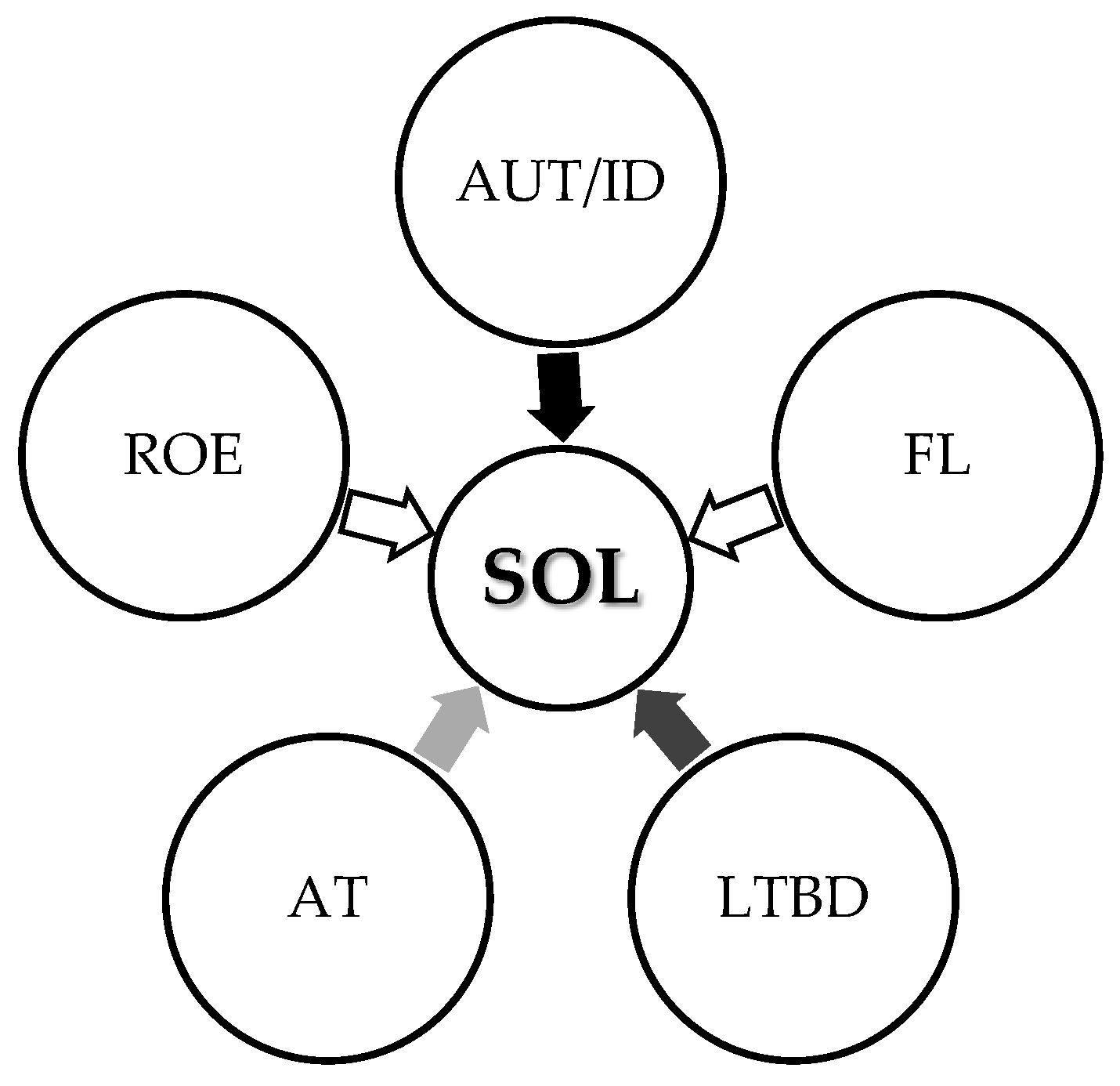

2.4. Determinants That Influence Solvency

3. Research Methodology

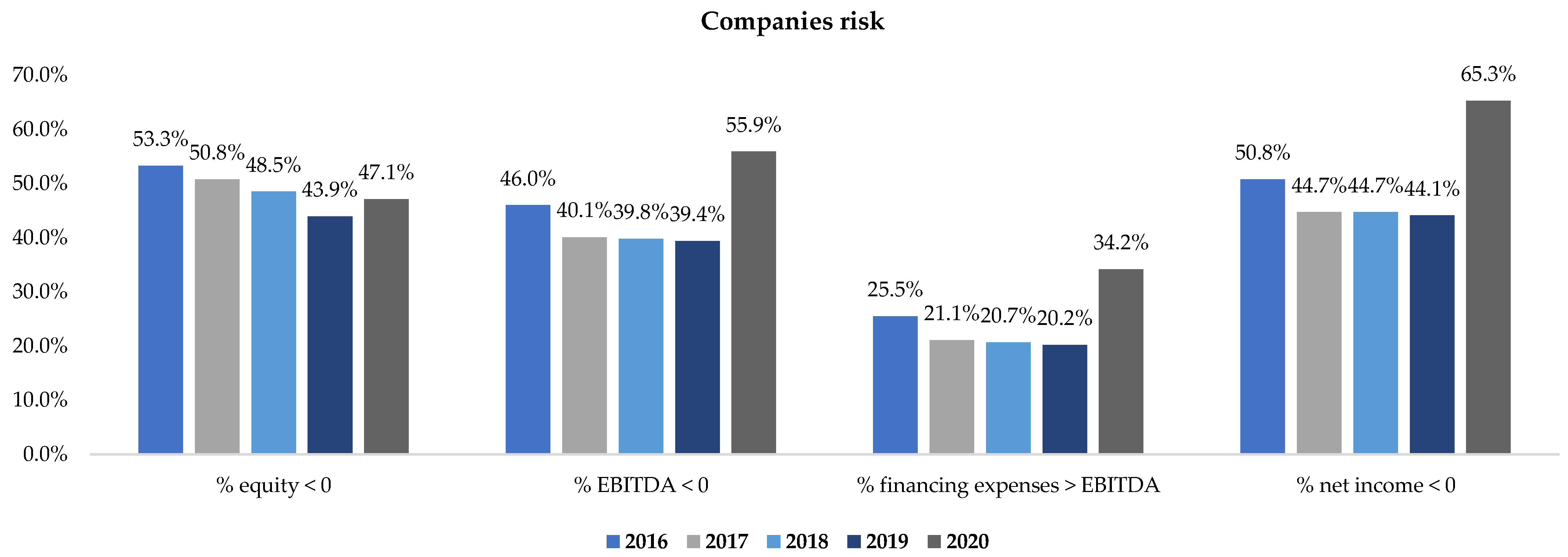

4. Findings

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- AHRESP. 2022. COVID-19 Impact: January 2022 Survey. Lisbon. Available online: https://ahresp.com/2022/02/inquerito-impacto-covid-janeiro-2022/ (accessed on 30 January 2023).

- Bank of Portugal. 2023. Dashboards of Sector 56—Food and Beverage Service Activities. Available online: https://www.bportugal.pt/QS/qsweb/Dashboards (accessed on 5 January 2023).

- Bao, Zhengyang, and Difang Huang. 2021. Shadow Banking in a Crisis: Evidence from Fintech during COVID-19. Journal of Financial and Quantitative Analysis 56: 2320–55. [Google Scholar] [CrossRef]

- Borde, Stephen. 1998. Risk Diversity Across Restaurants. Cornel Hotel and Restaurant Administration Quartely 39: 64–69. [Google Scholar] [CrossRef]

- Brîndescu-Olariu, Daniel. 2016. Assessment of the Bankruptcy Risk Based on the Solvency Ratio. Theoretical and Applied Economics XXIII: 257–66. Available online: www.levier.ro (accessed on 10 February 2023).

- Camilo, Angelo A. 2021. Strategic International Restaurant Development: From Concept to Production, 1st ed. Pennsylvania: IGI Global. [Google Scholar] [CrossRef]

- Chen, Muzi, Nan Li, Lifen Zheng, Difang Huang, and Boyao Wu. 2022. Dynamic Correlation of Market Connectivity, Risk Spillover and Abnormal Volatility in Stock Price. Physica A: Statistical Mechanics and Its Applications 587: 126506. [Google Scholar] [CrossRef]

- Correia, Cláudia, Rui Augusto Costa, Jorge Mota, and Zélia Breda. 2022. How Can Insolvency in Tourism Be Predicted? The Case of Local Accommodation. International Journal of Tourism Cities 8: 1127–40. [Google Scholar] [CrossRef]

- Crespí-Cladera, Rafel, Alfredo Martín-Oliver, and Bartolomé Pascual-Fuster. 2021. Financial Distress in the Hospitality Industry during the Covid-19 Disaster. Tourism Management 85: 104301. [Google Scholar] [CrossRef]

- Cultrera, Loredana, and Xavier Brédart. 2016. Bankruptcy Prediction: The Case of Belgian SMEs. Review of Accounting and Finance 15: 101–19. [Google Scholar] [CrossRef]

- Dhaoui, Elwardi. 2013. How to Strengthen the Financial Autonomy to Boost Investment in the Company? Paper presented at the First Annual Scientific Meeting in Applied Finance and Economics, Sfax, Tunisia, May 2. [Google Scholar]

- Díez, Federico J., Romain Duval, and Chiara Maggi. 2022. Supporting SMEs during COVID-19: The Case for Targeted Equity Injections. Economics Letters 219: 110717. [Google Scholar] [CrossRef]

- Dimitrić, Mira, Ivana Tomas Žiković, and Andrea Arbula Blecich. 2019. Profitability Determinants of Hotel Companies in Selected Mediterranean Countries. Economic Research-Ekonomska Istrazivanja 32: 1977–93. [Google Scholar] [CrossRef]

- Freitas, Rayane Stephanie Gomes, and Elke Stedefeldt. 2020. COVID-19 Pandemic Underlines the Need to Build Resilience in Commercial Restaurants’ Food Safety. Food Research International 136: 109472. [Google Scholar] [CrossRef]

- Galstian, Naira, Ana Monte, and Oksana Evseeva. 2017. The Level of Financial Literacy of Managers and Entrepreneurs—A Comparison Between Portugal And Russia. Paper presented at 25th International Scientific Conference on Economic and Social Development, Varazdin, Croatia, December 8–9; pp. 197–214. [Google Scholar]

- Gomes, Conceição, and Fernanda Oliveira. 2021. The Tourism Intermediaries’ Profitability in Portugal and Spain–Differences and Similarities. Journal of Hospitality and Tourism Insights 5: 1101–17. [Google Scholar] [CrossRef]

- Gomes, Conceição, Cátia Malheiros, Filipa Campos, and Luís Lima Santos. 2022. COVID-19’s Impact on the Restaurant Industry. Sustainability 14: 11544. [Google Scholar] [CrossRef]

- Gomes, Conceição, Luís Lima Santos, and Cátia Malheiros. 2021. An Empirical Analysis of Lisbon Hotel Room Rates Determinants. International Journal Procurement Management 14: 380–99. [Google Scholar]

- Horobet, Alexandra, Stefania Cristina Curea, Alexandra Smedoiu Popoviciu, Cosmin-Alin Botoroga, Lucian Belascu, and Dan Gabriel Dumitrescu. 2021. Solvency Risk and Corporate Performance: A Case Study on European Retailers. Journal of Risk and Financial Management 14: 536. [Google Scholar] [CrossRef]

- Israeli, Aviad A. 2007. Crisis-Management Practices in the Restaurant Industry. International Journal of Hospitality Management 26: 807–23. [Google Scholar] [CrossRef]

- Javed, Wajiha, Syed Hussain Baqar Abidi, and Jaffer bin Baqar. 2022. Seroprevalence and Characteristics of Coronavirus Disease (COVID-19) in Workers with Non-Specific Disease Symptoms. BMC Infectious Diseases 22: 481. [Google Scholar] [CrossRef] [PubMed]

- Katata, Cecília. 2022. Fatores Que Determinam a Falência Das PME Na Península Ibérica. Master’s thesis, Universidade do Minho, Braga, Portugal. [Google Scholar]

- Kim, Jaewook, Jewoo Kim, and Yiqi Wang. 2021. Uncertainty Risks and Strategic Reaction of Restaurant Firms amid COVID-19: Evidence from China. International Journal of Hospitality Management 92: 102752. [Google Scholar] [CrossRef] [PubMed]

- King, Gary, and Margaret E. Roberts. 2015. How Robust Standard Errors Expose Methodological Problems They Do Not Fix, and What to Do about It. Political Analysis 23: 159–79. [Google Scholar] [CrossRef]

- Kitsios, Fotis C., and Evangelos Grigoroudis. 2020. Evaluating Service Innovation and Business Performance in Tourism: A Multicriteria Decision Analysis Approach. Management Decision 58: 2429–53. [Google Scholar] [CrossRef]

- Lado-Sestayo, Rubén, Milagros Vivel-Búa, and Luis Otero-González. 2017. Determinants of TRevPAR: Hotel, Management and Tourist Destination. International Journal of Contemporary Hospitality Management 29: 3138–56. [Google Scholar] [CrossRef]

- Lima Santos, Luís, Conceição Gomes, and Inês Lisboa. 2021a. The Impact of Macroeconomic Factors on the Hotel Industry Through the Financial Leverage Trends. In Handbook of Research on Financial Management During Economic Downturn and Recovery. Edited by Nuno Teixeira and Inês Lisboa. Pennsylvania: IGI Global, pp. 94–111. [Google Scholar] [CrossRef]

- Lima Santos, Luís, Conceição Gomes, Cátia Malheiros, and Ana Lucas. 2021b. Impact Factors on Portuguese Hotels’ Liquidity. Journal of Risk and Financial Management 14: 144. [Google Scholar] [CrossRef]

- Lin, Li-Ying, Chang-Ching Tsai, and Jen-Yao Lee. 2022. A Study on the Trends of the Global Cruise Tourism Industry, Sustainable Development, and the Impacts of the COVID-19 Pandemic. Sustainability 14: 689. [Google Scholar] [CrossRef]

- Lu, Xun, and Halbert White. 2014. Robustness Checks and Robustness Tests in Applied Economics. Journal of Econometrics 178: 194–206. [Google Scholar] [CrossRef]

- Lucas, Ana, and Ana Ramires. 2022. Directions for management in small and medium hotels and restaurants companies. Geojournal of Tourism and Geosites 40: 210–17. [Google Scholar] [CrossRef]

- Lumley, Thomas, Paula Diehr, Scott Emerson, and Lu Chen. 2002. The Importance of The Normality Assumption in Large Public Health Data Sets. Annual Review Public Health 23: 151–69. [Google Scholar] [CrossRef]

- Madeira, Arlindo, Teresa Palrão, and Alexandra Sofia Mendes. 2021. The Impact of Pandemic Crisis on the Restaurant Business. Sustainability 13: 40. [Google Scholar] [CrossRef]

- Megaravalli, Amith Vikram, and Gabriele Sampagnaro. 2019. Predicting the Growth of High-Growth SMEs: Evidence from Family Business Firms. Journal of Family Business Management 9: 98–109. [Google Scholar] [CrossRef]

- Mohammed, Nor, Najwa Talib, Zuraidah Sanusi, Ancella Hemawan, and Nawal Kasim. 2019. Comparison of Liquidity, Solvency and Profitability Analyses. International Journal of Business and Management Science 9: 207–19. [Google Scholar]

- Moser, Francisco. 2002. Food and Beverage Management Handbook, 1st ed. Mem Martins: CETOP. [Google Scholar]

- Naruć, Wojciech. 2022. The Impact of the COVID-19 Pandemic on the Financial Situation of Hospitals in Europe. WSEAS Transactions on Business and Economics 20: 181–93. [Google Scholar] [CrossRef]

- Opstad, Leiv, Johannes Idsø, and Robin Valenta. 2022. The Dynamics of the Profitability and Growth of Restaurants; The Case of Norway. Economies 10: 53. [Google Scholar] [CrossRef]

- Pacheco, Luís, Mara Madaleno, Pedro Correia, and Isabel Maldonado. 2022. Probability of Corporate Bankruptcy: Application Io Portuguese Manufacturing Industry SMES. International Journal of Business and Society 23: 1169–89. [Google Scholar] [CrossRef]

- Parsa, H. G., Jeff C. Kreeger, Jean Pierre van der Rest, Lijjia Karen Xie, and Jackson Lamb. 2021. Why Restaurants Fail? Part V: Role of Economic Factors, Risk, Density, Location, Cuisine, Health Code Violations and GIS Factors. International Journal of Hospitality and Tourism Administration 22: 142–67. [Google Scholar] [CrossRef]

- Pestana, Maria, and João Gageiro. 2014. Análise de Dados Para Ciências Sociais, 6th ed. Lisboa: Edições Sílabo. [Google Scholar]

- Peterdy, Kyle. 2022. Debt to Asset Ratio. Vancouver: CFI Education Inc. Available online: https://corporatefinanceinstitute.com/resources/commercial-lending/debt-to-asset-ratio/ (accessed on 23 January 2023).

- Poon, Wai-Ching, and Kevin Lock-Teng Low. 2005. Are Travellers Satisfied with Malaysian Hotels? International Journal of Contemporary Hospitality Management 17: 217–27. [Google Scholar] [CrossRef]

- Rahman, Abdul Aziz A. Abdul. 2017. The Relationship between Solvency Ratios and Profitability Ratios: Analytical Study in Food Industrial Companies Listed in Amman Bursa. International Journal of Economics and Financial Issues 7: 86–93. [Google Scholar]

- Rizwankhurshid, Malik. 2013. Determinants of Financial Distress Evidence from KSE 100 Index. Business Review 8: 7–19. [Google Scholar]

- Russo, Rienna G., Shahmir H. Ali, Tamar Adjoian Mezzacca, Ashley Radee, Stella Chong, Julie Kranick, Felice Tsui, Victoria Foster, Simona C. Kwon, and Stella S. Yi. 2022. Assessing Changes in the Food Retail Environment during the COVID-19 Pandemic: Opportunities, Challenges, and Lessons Learned. BMC Public Health 22: 778. [Google Scholar] [CrossRef]

- Sholaeman, Bagus, Risal Rinofah, and Alfiatul Maulida. 2021. Liquidity, Solvability, and Profitability Ratio Analysis towards Financial Performance. Almana: Jurnal Manajemen Dan Bisnis 5: 337–43. [Google Scholar] [CrossRef]

- Siddiqi, Umar Iqbal, Naeem Akhtar, and Tahir Islam. 2022. Restaurant Hygiene Attributes and Consumers’ Fear of COVID-19: Does Psychological Distress Matter? Journal of Retailing and Consumer Services 67: 102972. [Google Scholar] [CrossRef]

- Singh, Karamjeet, and Firew Chekol Asress. 2010. Determining Working Capital Solvency Level and Its Effect on Profitability in Selected Indian Manufacturing Firms. Kelaniya: University of Kelaniya, pp. 1–14. [Google Scholar]

- Štefko, Róbert, Petra Vašaničová, Sylvia Jenčová, and Aneta Pachura. 2021. Management and Economic Sustainability of the Slovak Industrial Companies with Medium Energy Intensity. Energies 14: 267. [Google Scholar] [CrossRef]

- Su, Ruixin, Bojan Obrenovic, Jianguo Du, Danijela Godinic, and Akmal Khudaykulov. 2022. COVID-19 Pandemic Implications for Corporate Sustainability and Society: A Literature Review. International Journal of Environmental Research and Public Health 19: 1592. [Google Scholar] [CrossRef] [PubMed]

- Tibiletti, Veronica, Pier Luigi Marchini, and Federico Bertacchini. 2021. The Effects of COVID-19 on Financial Statements: Some Insights from Italy through an International Literature Review. Universal Journal of Accounting and Finance 9: 1033–48. [Google Scholar] [CrossRef]

- Touritaa, Íris, Conceição Gomesb, Cátia Malheirosc, and Luís Lima Santosd. 2019. Accounting for Dissimilarities in Hospitality Costs among Portuguese Regions. Paper presented at XI International Tourism Congress, Eskişehir, Turkey, October 16–19; pp. 189–201. [Google Scholar]

- Tsai, Henry, Steve Pan, and Jinsoo Lee. 2011. Recent Research in Hospitality Financial Management. International Journal of Contemporary Hospitality Management 23: 941–71. [Google Scholar] [CrossRef]

- Tse, Eliza. 1991. An Empirical Analysis of Organizational Structure and Financial Performance in the Restaurant Industry. International Journal of Hospitality Management 10: 59–72. [Google Scholar] [CrossRef]

- van Veldhoven, Ziboud, Paulien Aerts, Sanne Lies Ausloos, Jente Bernaerts, and Jan Vanthienen. 2021. The Impact of Online Delivery Services on the Financial Performance of Restaurants. Paper presented at the 2021 7th International Conference on Information Management, ICIM 2021, London, UK, March 27–29; pp. 13–17. [Google Scholar] [CrossRef]

- Vasiu, Diana Elena, and Iulian Gheorghe. 2014. Case Study Regarding Solvency Analysis, during2006–2012, of the Companies Having the Business Line in Industry and Construction, Listed and Traded on the Bucharest Stock Exchange. Procedia Economics and Finance 16: 258–69. [Google Scholar] [CrossRef]

- Vieira, Isa. 2020. O Desempenho Económico-Financeiro Dos Hotéis Face à Evolução Do Turismo Em Portugal. Master’s thesis, Polytechnic Institute of Leiria, Leiria, Portugal. [Google Scholar]

- Wang, Wenbao, Wenhe Lin, Zhenhua Bao, Xinyi Dai, and Qiaohua Lin. 2022. Study on the Influence of COVID-19 on the Growth of China’s Small and Medium-Sized Construction Enterprises. PLoS ONE 17: e0266315. [Google Scholar] [CrossRef]

- Wijaya, Dea Afifah, and Hery Harjono Muljo. 2022. The Effect Analysis of Solvency Ratio, Profitability Ratio and Inflation on Stock Return. Business Economic, Communication, and Social Sciences 4: 65–73. [Google Scholar] [CrossRef]

- Yang, Yun, and Yoon Koh. 2022. Is Restaurant Crowdfunding Immune to the COVID-19 Pandemic? International Journal of Contemporary Hospitality Management 34: 1353–73. [Google Scholar] [CrossRef]

- Yenni, Arifin, Eddy Gunawan, Leonard Pakpahan, and Halasan Siregar. 2021. The Impact of Solvency and Working Capital on Profitability. Journal of Industrial Engineering & Management Research 2: 15–38. [Google Scholar] [CrossRef]

- Yost, Elizabeth, Murat Kizildag, and Jorge Ridderstaat. 2021. Financial Recovery Strategies for Restaurants during COVID-19: Evidence from the US Restaurant Industry. Journal of Hospitality and Tourism Management 47: 408–12. [Google Scholar] [CrossRef]

- Youn, Hyewon, and Zheng Gu. 2009. U.S. Restaurant Firm Performance Check: An Examination of the Impact of the Recent Recession. Journal of Hospitality Financial Management 17: 35–53. [Google Scholar] [CrossRef]

- Zhou, Qingping, Long Wang, Li Juan, Shugong Zhou, and Lingli Li. 2021. The Study on Credit Risk Warning of Regional Listed Companies in China Based on Logistic Model. Discrete Dynamics in Nature and Society 2021: 6672146. [Google Scholar] [CrossRef]

| Source | Ratios | Formula |

|---|---|---|

| Dhaoui (2013) | Global financial autonomy | |

| Vasiu and Gheorghe (2014) | Solvency | |

| Horobet et al. (2021) | Asset turnover | |

| Lima Santos et al. (2021b) | Financial leverage | |

| Gomes et al. (2022) | Short-term bank debt | |

| Gomes et al. (2022) | Long-term bank debt | |

| Peterdy (2022) | Indebtedness |

| Source | Ratios | Formula |

|---|---|---|

| Lima Santos et al. (2021b) | ROE | |

| Sholaeman et al. (2021) | ROA | |

| Gomes and Oliveira (2021) | ROS |

| Variable | Formula | Mean | Std Deviation | Maximum | Minimum |

|---|---|---|---|---|---|

| ROE 2020 | −1.24 | 6.79 | 7.29 | −162.22 | |

| ROE 2019 | 0.15 | 2.58 | 30.77 | −5.36 | |

| ROA 2020 | −0.07 | 0.31 | 0.86 | −11.73 | |

| ROA 2019 | 0.1 | 0.26 | 1.76 | −4.12 | |

| ROS 2020 | −0.12 | 0.89 | 5.40 | −31.30 | |

| ROS 2019 | 0.06 | 0.25 | 5.03 | −4.54 | |

| NE 2020 | Number of employees | 9.38 | 16.05 | 434 | 0 |

| NE 2019 | 11.03 | 22.30 | 847 | 0 | |

| SOL 2020 | 2.71 | 8.53 | 162.58 | 0 | |

| SOL 2019 | 2.79 | 7.07 | 106.61 | 0 | |

| AUT 2020 | 0.43 | 0.28 | 1 | 0 | |

| AUT 2019 | 0.48 | 0.27 | 1 | 0 | |

| ID 2020 | 0.57 | 0.29 | 1 | 0 | |

| ID 2019 | 0.51 | 0.27 | 1 | 0 | |

| STBD 2020 | 0.1 | 0.22 | 1.02 | 0 | |

| STBD 2019 | 0.07 | 0.17 | 1 | 0 | |

| LTBD 2020 | 0.7 | 0.4 | 1 | 0 | |

| LTBD 2019 | 0.58 | 0.44 | 1 | 0 | |

| AT 2020 | 1.55 | 1.71 | 63.61 | 0 | |

| AT 2019 | 2.48 | 2.34 | 52.53 | 0 | |

| FL 2020 | 8.78 | 37.39 | 1067.53 | −168.87 | |

| FL 2019 | 4.98 | 16.42 | 384.45 | −26.2 |

| Region | Number | Percentage |

|---|---|---|

| Alentejo | 364 | 4.2% |

| Algarve | 975 | 11.2% |

| Center | 1216 | 14% |

| Lisbon Metropolitan Area | 3408 | 39.2% |

| North | 2208 | 25.4% |

| Autonomous Region of Madeira | 357 | 4.10% |

| Autonomous Region of Azores | 156 | 1.8% |

| Total | 8684 | 100% |

| Region | 2019 | 2020 |

|---|---|---|

| Alentejo | 4.20 | 3.72 |

| Algarve | 4.70 | 4.75 |

| Center | 2.24 | 2.40 |

| Lisbon Metropolitan Area | 2.79 | 2.65 |

| North | 2.19 | 2.16 |

| Autonomous Region of Madeira | 1.75 | 1.69 |

| Autonomous Region of Azores | 2.63 | 1.44 |

| Total | 2.79 | 2.71 |

| SOL 2020 | SOL 2019 | |

|---|---|---|

| SOL2019 | 0.637 ** | - |

| STBD | −0.092 ** | −0.087 ** |

| LTBD | −0.2 ** | −0.207 ** |

| ID | −0.48 ** | −0.51 ** |

| AUT | 0.48 ** | −0.51 ** |

| ROS | - | −0.049 ** |

| ROA | 0.037 ** | − |

| ROE | 0.056 ** | − |

| NE | −0.065 ** | −0.062 ** |

| AT | −0.078 ** | −0.091 ** |

| FL | −0.063 ** |

| Highest | Lowest |

|---|---|

| Alentejo Algarve | Autonomous Region of Madeira Autonomous Region of Azores North Center Lisbon Metropolitan Area |

| Highest | Median | Lowest |

|---|---|---|

| Alentejo Algarve | North Center Lisbon Metropolitan Area | Autonomous Region of Madeira Autonomous Region of Azores |

| Nonstandardized Coefficients | Collinearity Statistics | |||||

|---|---|---|---|---|---|---|

| b | Error | t | Sig | Tolerance | VIF | |

| (Constant) | 7.792 | 0.154 | 50.638 | 0.000 | - | - |

| ID | −9.155 | 0.226 | −40.524 | 0.000 | 0.759 | 1.318 |

| FL | 0.022 | 0.003 | 6.935 | <0.001 | 0.827 | 1.209 |

| LTBD | −0.890 | 0.119 | −7.507 | <0.001 | 0.887 | 1.127 |

| AT | −0.179 | 0.029 | −6.272 | <0.001 | 0.926 | 1.080 |

| ROA | −1.671 | 0.279 | −5.993 | <0.001 | 0.777 | 1.286 |

| Algarve | 0.580 | 0.155 | 3.734 | <0.001 | 0.973 | 1.027 |

| ROE | 0.062 | 0.021 | 2.984 | 0.003 | 0.780 | 1.282 |

| Alentejo | 0.526 | 0.253 | 2.077 | 0.038 | 0.991 | 1.009 |

| Nonstandardized Coefficients | Collinearity Statistics | |||||

|---|---|---|---|---|---|---|

| b | Error | t | Sig | Tolerance | VIF | |

| (Constant) | −0.268 | 0.211 | −1.266 | 0.206 | - | - |

| AUT | 8.844 | 0.259 | 34.136 | <0.001 | 0.849 | 1.178 |

| LTBD | −1.369 | 0.162 | −8.451 | <0.001 | 0.890 | 1.124 |

| AT | −0.355 | 0.049 | −7.234 | <0.001 | 0.932 | 1.073 |

| ROE | −0.027 | 0.011 | −2.317 | 0.021 | 0.579 | 1.728 |

| STBD | −1.018 | 0.348 | −2.925 | 0.003 | 0.979 | 1.021 |

| FL | 0.004 | 0.002 | 2.186 | 0.029 | 0.575 | 1.739 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gomes, C.; Campos, F.; Malheiros, C.; Lima Santos, L. Restaurants’ Solvency in Portugal during COVID-19. Int. J. Financial Stud. 2023, 11, 63. https://doi.org/10.3390/ijfs11020063

Gomes C, Campos F, Malheiros C, Lima Santos L. Restaurants’ Solvency in Portugal during COVID-19. International Journal of Financial Studies. 2023; 11(2):63. https://doi.org/10.3390/ijfs11020063

Chicago/Turabian StyleGomes, Conceição, Filipa Campos, Cátia Malheiros, and Luís Lima Santos. 2023. "Restaurants’ Solvency in Portugal during COVID-19" International Journal of Financial Studies 11, no. 2: 63. https://doi.org/10.3390/ijfs11020063

APA StyleGomes, C., Campos, F., Malheiros, C., & Lima Santos, L. (2023). Restaurants’ Solvency in Portugal during COVID-19. International Journal of Financial Studies, 11(2), 63. https://doi.org/10.3390/ijfs11020063