Abstract

This study investigates the relationship between closing–opening prices of stocks in the US, UK, and European markets and the prices of stocks in the five Association of Southeast Asian Nations (ASEAN-5) markets, a group consisting of five founding members, namely, Indonesia, Malaysia, the Philippines, Singapore, and Thailand. In particular, this study examines the impact of US, UK, and European stock market movements on ASEAN-5 stock markets before and during the COVID-19 pandemic. An autoregressive distributed lag (ARDL) bounds testing approach was employed on two independent data sets, representing prices of stocks before and during the COVID-19 pandemic. The results reveal that among the ASEAN-5 markets, only the Philippines had a cointegration relationship with the US, UK, and European markets before the crisis. However, almost all ASEAN-5 markets moved in tandem with the US, UK, and European markets during COVID-19, except for Thailand. These empirical findings also indicate that the stock markets in the two regions tended to co-move during the COVID-19 pandemic, implying a contagion effect. Further, the causality results also provide substantial evidence of contagion between markets during the pandemic. These results imply that the stock markets in ASEAN-5 are susceptible at the opening bell to the behaviour of US, UK, and European stocks. Therefore, investors or traders in ASEAN-5 should participate in foreign markets (other than the US, UK, and Europe) that do not exhibit cointegration relationships to better mitigate and manage risk at the opening bell, especially during a global crisis.

1. Introduction

The novel coronavirus disease (COVID-19) is among the most catastrophic global crises of the 21st century (Alubo et al. 2020; Ashton 2020). Before COVID-19, another outbreak originating from China was severe acute respiratory syndrome (SARS) (El Zowalaty and Järhult 2020). The first reported SARS case was documented in Guangdong, China, and the disease was transmitted to individuals in 29 countries, resulting in a total of 774 cases with a 9.6% fatality rate (World Health Organization 2003). Chinese stocks became highly volatile during this period. This phenomenon spread throughout the East Asian region, slightly affecting countries such as Japan and severely affecting others including Hong Kong and Singapore (Siu and Wong 2004). The study by Chen et al. (2009) also demonstrated the impact of the SARS outbreak on Taiwan’s economy. The World Health Organization (WHO) categorised SARS as an epidemic, as it had only a limited impact on the global community, population, and region. In contrast, COVID-19 is classified as a pandemic as it spread across borders and affected various countries on a global scale (El Zowalaty and Järhult 2020).

COVID-19 cases have been reported in more than 220 countries worldwide (Worldmeter 2022), and COVID-19 has been declared a global virus outbreak. The mysterious virus originated in Wuhan, China, and was declared by WHO as a Public Health Emergency of International Concern (PHEIC) on 30 January 2020. The announcement was made after the first case was reported outside of China in Thailand on 13 January 2020 (World Health Organization 2020). While the number of cases gradually declined in China, most countries—including the United States (US), United Kingdom (UK), and European countries—became more severely affected. The number of confirmed cases exceeded 1 million by April 2020. As the total number of cases and the death rate increased, countries worldwide took unprecedented measures to contain the spread of the virus. Governments imposed movement restrictions on the population and prohibited certain economic activities. To a large extent, severely affected cities were in complete lockdown (de Bruin et al. 2020; Zhao et al. 2020). Unfortunately, the restricted movement negatively impacted the global economy, causing an economic shock leading to capital market crashes worldwide (Liu et al. 2020). Due to the lack of vaccines to combat the virus, stock markets plunged as most investors and traders were uncertain of the markets’ future direction (Kamaludin et al. 2021; Rouatbi et al. 2021).

At the peak of the outbreak in 2020, the values of major stock markets in the US, UK, Europe, and ASEAN-5 were wiped out by at least 30%. The drastic fall in stock markets stemmed from government-implemented lockdowns to contain the spread of COVID-19 worldwide. Nonetheless, the Malaysian stock market only saw a 25.1% reduction throughout the same period (see Table 1). Although the total number of cases and death tolls vary from country to country, a similar downside pattern is observable across almost all stock markets. Accordingly, the main issue was whether these markets were cointegrated before the outbreak and during the crisis or whether no such relationship existed.

Table 1.

Stock market performance during COVID-19 pandemic.

It is also recognised that countries such as the US, UK, as well as European and ASEAN-5 countries have a long history of economic relations intertwined with trade relations, investments, and capital inflows. According to the ASEAN Investment Report (ASEAN 2021), ASEAN-5 received the highest-ever inflows of FDI in 2019 and is the largest recipient among developing nations. As predicted, the US maintained its status as the top investor for 2019 (34.6%) in ASEAN-5 across all sectors. Various agreements were reached between countries where ASEAN-5 attempted to smoothen FDI inflows and provide more significant opportunities in attracting investments and enhancing the development of the global value chain in all economic regions. The growth of the relationship between regions and countries also means that each region and country are exposed to risk in the event of a crisis that leads to potential linkages and possible contagion between markets.

This study makes at least two significant contributions to the existing literature. Although many researchers have conducted studies on the impacts of financial crises (Huyghebaert and Wang 2010; Liu et al. 2020; Yang et al. 2003; Yildirim 2020), few have considered time zone differences. Most previous studies focus on close-to-close stock price relationships. This study offers a different perspective by focusing on the close-to-open stock price relationships among a group of stock markets.

Even though previous studies such as Yildirim (2020) and Kamaludin et al. (2021) examined the integration between major stock markets during the pandemic, the impact of major global markets’ closing prices on ASEAN-5 markets’ opening prices still needs to be explored. King and Wadhwani (1990) argued that the opening prices contain a significant volume of information. Traders at the ASEAN-5 markets may decide on their positions based on the events occurring in the US, UK, or Europe. Therefore, the non-overlapping trading hours between the US and Japan, for instance, provide a clean test of how information is transmitted from one market to another (Lin et al. 1994). The second significant contribution of this study is a better understanding of the stock markets’ reactions before and during the pandemic. These reactions are studied in the context of the relationship between ASEAN-5 with leading world stock markets, an area of research that still needs to be explored. Accordingly, there are two main research questions to consider: Do the closing prices of US, UK, and European stock markets significantly impact the opening prices of ASEAN-5 stock markets? Has the COVID-19 pandemic made a significant difference as a contagion channel between markets? With these contributions in mind, this study aims to investigate the impact of the US, UK, and European stock markets’ closing prices on the opening prices of ASEAN-5 stock markets before and during the COVID-19 pandemic.

This paper is divided into five parts. Section 1 provides introductory insights into the area of study. Section 2 presents the literature review on this area. Section 3 discusses the data collected and methods of data analysis used to examine the relationship between ASEAN-5 stock markets and the US, UK, and European stock markets in the long and short run. Section 4 outlines the empirical results, and Section 5 summarises the current study and findings.

2. Literature Review

Stulz (1981) and Solnik (1983) utilised the International Capital Asset Pricing Model (ICAPM) and stressed that it is impossible to determine whether asset markets are segmented internationally or not without any model. Stulz (1981) added that asset markets are perfectly integrated if two assets with perfectly correlated returns in a given currency belonging to different countries have identical expected returns in that particular currency. On the other hand, Solnik (1983) highlighted that a world market portfolio would only be optimal because investors hold different portfolios. King and Wadhwani (1990) claimed that any standard asset pricing model, such as ICAPM by Solnik (1983) and Stulz (1981), would allow stock markets from different countries to be correlated. They examined rational expectations on price equilibrium and the contagion model as investors have access to different sets of information to infer valuable information from price changes in other markets. However, their primary criticism of the ICAPM primarily related to the dismissal of a fundamental factor, namely, different time zones. Thus, they revised the ICAPM by including additional price changes and the differences in time zones.

Theory suggests that a lead–lag effect caused by asymmetric information can be transmitted slowly or quickly to investors. Lo and MacKinlay (1990), Mech (1993), and McQueen et al. (1996) agree that in financial theory, the lead–lag effect is a result of the unsynchronized trading hours due to time zone differences. Lo and MacKinlay (1990) also found that the behaviour of different sectors of the economy has varying sensitivity to macroeconomic shocks, market integration, investment concentration, and market shares due to the lead–lag relationship. The authors added that this relationship remains unexplained and should be investigated.

Grubel (1968) and Solnik (1974) found a lower correlation among national stock markets. However, Goldstein and Mussa (1993) found that international market linkages have increased over the past few decades, especially after stock markets were actively traded in major financial centres. Although each country has different economic structures, behaviours, sectors, exposure, market capitalisation, daily volume, and other factors, stock markets worldwide will move in tandem during crises, such as pandemics (Granger and Morgenstern 1963). Whether unexpected events in the US, UK, and Europe will cause panic in the opening prices of ASEAN-5 markets becomes pertinent in this regard.

Estimation of cross-market correlations between stable and crisis periods is one of the approaches used in the previous literature to study contagion, where a rise in correlation during a crisis compared to a stable period is interpreted as evidence of contagion (Samarakoon 2011; Akhtaruzzaman et al. 2021, 2022). In a study by King and Wadhwani (1990), the October 1987 stock market crash was described as a cause of contagion among global markets, where traders concluded that any risk triggered due to a mistake in one market could be transmitted to others. Meanwhile, a study found that Japanese traders were influenced by what had happened in the New York Stock Exchange before share buying and selling activities at the opening bell of the Nikkei 225 (Becker et al. 1990; Hamao et al. 1990). Moreover, Yildirim (2020) discovered the integration of the China stock market with Turkey and the US markets during COVID-19. Other findings by Kamaludin et al. (2021) also supported the strong integration between ASEAN-5 stock markets and the Dow Jones Index.

Several studies investigated the direct relationships among stock indexes worldwide (Blahun and Blahun 2020; Menon et al. 2009; Wong et al. 2004) given major critical events in certain countries (Huyghebaert and Wang 2010; Yang et al. 2003). For example, the US stock market crash in October 1987 affected European and Asia Pacific markets (Eun and Shim 1989). However, some researchers found no cointegration among markets in the US, UK, Japan, Hong Kong, Singapore, Australia (Malliaris and Urrutia 1992), South Korea, and Taiwan (Chan et al. 1992) before the October 1987 stock market crash. On the contrary, there is evidence of a causal relationship between the US and Canadian stock indexes (Ripley 1973). A cointegration relationship also existed between the US, UK, Germany, Switzerland, Netherlands, France, and Italy during the same period (Arshanapalli and Doukas 1993; Bessler and Yang 2003; Hassan and Naka 1996; Schollhammer and Sand 1985).

In general, previous findings conclude that the US and European economic and financial markets shared the same structure before the 1987 stock market crash in contrast to Asian markets. Based on this observation, it was concluded that the locality and structure of economies play an important role in studying the co-movement of world stock market indexes (Blahun and Blahun 2020; Menon et al. 2009). To illustrate this point, the stock markets in Thailand, Indonesia, Malaysia, Singapore, the Philippines, and other Asian countries severely contracted during the 1997/1998 Asian financial crisis. Nonetheless, the downtrend effects were not transmitted to the US or European countries (Jang and Sul 2002; King 2001; Sheng and Tu 2000). Another good example is the 2007/2008 global financial crisis, where only the European stock market suffered a significant impact from the shock that originated in the US, while Asian markets (excluding India, Japan, Hong Kong, Taiwan, South Korea, Thailand, Singapore, and the Philippines) experienced only indirect consequences (Junior and Franca 2012; Nobi et al. 2014; Rahman and Sidek 2011; Wang et al. 2013).

It is well acknowledged that the US stock market is the most influential globally and a top leader in market information and news that influences other stock markets (Bessler and Yang 2003; Eun and Shim 1989; Hassan and Naka 1996). For instance, Rijanto (2017) highlighted the relationship between global stock markets and ASEAN-5 and concluded that investors in ASEAN-5 experience differences in information transmission due to different time zone and trading hours. By utilising VECM, the empirical results showed that the US stock market consistently affected the stock markets of ASEAN-5 since the US capital market is a leader in information to other countries. Furthermore, even after the 2008 crisis, the US stock market still influences the ASEAN-5 stock markets, except Indonesia.

As stock markets are not open around the clock, King and Wadhwani (1990) developed several regimes of trading using regression models to address the price jump in all other markets following information from different markets. In the case of the US, UK, and Europe against ASEAN-5, this falls into the category of market 1 when it is closed (US, UK, Euro) and market 2 when it is open (ASEAN-5) since these markets are not trading at the same trading hours. The price jump that occurred when one market switched to another must be examined. Such jumps during the market opening are unique features of the imperfect revealing equilibrium model. The price jump in the opening price of ASEAN-5 stock markets implies the accumulated value of complete information on COVID-19 obtained from the US, UK, and European markets.

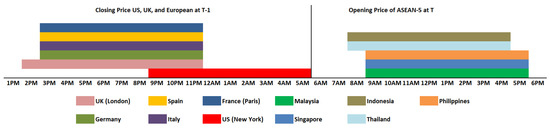

Contrary to the previous crises that only affected certain countries, the impact of COVID-19 at a global level is truly unprecedented (El Zowalaty and Järhult 2020). Therefore, it is crucial to investigate the movement of stock indexes to understand the impact of COVID-19 on the stock market (Chaudhary et al. 2020; Kamaludin et al. 2021; Liu et al. 2020; Luis and Gloria 2020; Yildirim 2020; Zhang et al. 2020) through risk transmission and possible contagion between markets (Akhtaruzzaman et al. 2021, 2022). Among the primary challenges of global traders during a crisis is that stock markets worldwide are not opened concurrently on a typical trading day due to time zone differences. In this regard, a global selloff from one market might be transmitted to another, triggering panic and fear for investors or traders from other markets in different time zones waiting for the opening bell in their respective domestic markets. Figure 1 shows the differences in time zones for selected stock markets, while Table 2 illustrates the trading hours in selected countries and stock markets.

Figure 1.

Time zone differences. Source: www.tradinghours.com (accessed on 3 February 2021).

Table 2.

Trading hours for stock indexes.

3. Methodology

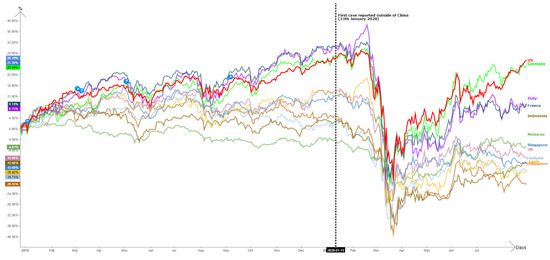

Following Sheng and Tu (2000)’s utilisation of daily data for cointegration analysis, the data used in the present study consist of stock indexes’ daily closing prices for the US Dow Jones Industrial Average (DJIA), the UK’s Financial Times Stock Exchange (FTSE100), Germany’s Deutscher Aktienindex (DAX), France’s Cotation Assistée en Continu (CAC), Italy’s Milano Indice di Borsa (MIB), and Spain’s Índice Bursátil Español (IBEX). The daily opening prices for ASEAN-5 stock indexes were also collected, consisting of data from Malaysia’s Kuala Lumpur Composite Index (KLCI), Singapore’s Singapore Exchange (SGX), Thailand’s Stock Exchange of Thailand (SETI), Indonesia’s Jakarta Stock Exchange (JKSE), and the Philippine Stock Exchange (PESi). Figure 2 shows the stock prices collected from 2 January 2019, to 31 July 2020, split into two sets to investigate the relationship variations before and during COVID-19, as follows:

Figure 2.

Movement of stock indexes from 2 January 2019 to 31 July 2020. Source: Bloomberg Trading Terminal.

- From 2 January 2019, to 10 January 2020 (before COVID-19 was reported outside China);

- From 13 January 2020, to 31 July 2020 (during and after COVID-19 spread outside China).

All variables representing stock indexes are presented in a natural logarithms (L). The opening prices of ASEAN-5 stock indexes for Malaysia, Singapore, Thailand, Indonesia, and the Philippines were recorded as LKLCI.O, LSGX.O, LSETI.O, LJKSE.O, and LPESi.O, respectively. The ‘.O’ represents the opening price. Variables representing stock closing prices of the US, UK, Germany, France, Italy, and Spain were recorded as LDJIA, LFTSE100, LDAX, LCAC, LMIB, and LIBEX, respectively.

The researchers commenced data analysis with descriptive statistics to obtain a general overview of each variable’s distributional assumption and characteristics. Next, the analysis involved a stationarity test in identifying the integration level of each variable. For this purpose, the researchers employed the augmented Dickey–Fuller (ADF) and Phillips–Perron (PP) unit root tests (Dickey and Fuller 1979; Phillips and Perron 1988). The long-run analysis utilised the autoregressive distributed lag (ARDL) model. Although the ARDL model does not require pre-testing for the unit root (Nkoro and Uko 2016), the ARDL is deemed invalid if any variables are integrated beyond I(1). As long as the series integrates within the I(0) and I(1) levels, the long-run cointegration analysis using the ARDL bounds test by Pesaran et al. (2001) may proceed. Compared to other cointegration methods, such as the Engle–Granger two-step procedure (Engle and Granger 1987) and the Johansen approach (Johansen 1988, 1991; Johansen and Juselius 1990) that required all variables to be integrated at the same level of the first difference or I(1), the additional advantage of ARDL is the ability to analyse the relationship among a group of variables with different or mixed levels of integration, provided that no variables are integrated beyond the I(1) level (Pesaran et al. 2001; Sari et al. 2008).

Furthermore, the ARDL method is also susceptible to small sample sizes. Moreover, within the ARDL framework, the long- and short-run coefficients can be estimated simultaneously with fewer endogeneity-related considerations as the method is free from residual correlation (Nkoro and Uko 2016). In addition, an error correction model (ECM) may be derived from ARDL for short-run adjustments without losing any long-run information. Theoretically, before further analysis, the selected ARDL models are evaluated in terms of model adequacy and robustness tests based on a series of diagnostic tests, including normality, autocorrelation, and heteroskedasticity. Ramsey’s regression equation specification error test (RESET) and stability tests based on cumulative sum (CUSUM) and CUSUM of square tests were other diagnostic tests conducted in this study. The final step was the bounds test for cointegration and ARDL regression estimation for long-run analysis and ECM-based ARDL estimation for short-run causality. The general model of the ARDL bounds testing approach is as follows:

where represents the ASEAN-5 stock indexes (LKLCI.O, LSGX.O, LSETI.O, LJKSE.O, or LPESi.O) and represents the US, UK, and European stock indexes (LDJIA, LFTSE100, LDAX, LCAC, LMIB, and LIBEX). The unknown parameters to be estimated are and , and , , and is the optimal lag length selected based on the lowest Akaike information criterion (AIC), and represents a white-noise error. The F-statistic was used for bounds testing for cointegration with two asymptotic F-bound critical values: the lower bound, I(0), and the upper bound, I(1). If the F-statistic value exceeds the upper bound critical value, there is cointegration between the regress and a group of regressors in the model. The result is inconclusive if the test statistic falls between the lower and upper bounds. On the contrary, there is insufficient evidence to reject the null hypothesis if the test statistic falls below the lower critical bound.

Hypothesis 1.

Cointegration.

The following is the research hypothesis associated with Equation (1) on the long-run cointegration relationship between ASEAN-5 stock markets with the US, UK, and Europe stock markets.

- (no cointegration)

- (cointegrated)

As to the long-run regression analysis, the general form of the conditional ARDL model is as follows:

Hypothesis 2.

Long-Run Impact.

The following is the research hypothesis associated with Equation (2) on the long-run impact of the US, UK, and European stock markets on ASEAN-5 stock markets.

- (no long-run impact)

- (long-run impact exists)

The causal relationship between the prices of variables was tested by employing the error correction model based on ARDL (ECM-ARDL), provided and are cointegrated in the previous cointegration test. The equation for the ECM-ARDL model is as follows:

where is an error correction term derived from the cointegration test that represents the performance of the dependent variable to the lagged deviation from the long-run equilibrium path (Sari et al. 2008; Ozturk and Acaravci 2010). denotes the coefficient of and represents the speed of adjustment towards long-run equilibrium. The symbol, is theoretically assumed to be negative and presumed to be statistically significant. Where the null hypothesis of no cointegration was not rejected, Equation (3) without the was estimated, and the short-run causality from to was tested using an F-test or Wald test.

Hypothesis 3.

Short-Run Causality.

The following associated research hypothesis from Equation (3) is the hypothesis testing on the short-run causality from the US, UK, and European stock markets on the ASEAN-5 stock markets.

- (no short-run causality)

- (short-run causality exists)

4. Empirical Results

The data analysis process begins with a general overview of the data characteristics using descriptive statistics. Table 3 summarises the descriptive statistics of 263 and 404 data points for observations before and during the COVID-19 pandemic. All variables in this study are expressed in a natural logarithm (L) for better approximation to normal distribution.

Table 3.

Summary of descriptive statistics.

Based on Table 3, the mean values, although not significantly different for all variables, are relatively minor during the pandemic compared to the pre-pandemic period, indicating that the opening and closing of stock prices are affected by the onset of the COVID-19 outbreak. The same conclusion can be made for the standard deviation (SD), where all stock prices experienced greater volatility during COVID-19 than before. The negative skewness values indicate that almost all variables are skewed to the left, exhibiting a lack of symmetric distribution. This negative skewness also indicates longer tails on the left side of the distribution. The LKLCI, LSETI, LPSEi, and LMIB recorded positive skewness, indicating longer tails on the right side of the distribution. The statistics also suggest that more than half of the variables are leptokurtic (exhibited heavy-tailed distribution), with a recorded kurtosis value (excess kurtosis) greater than 3. Meanwhile, the remaining variables featured light-tailed distribution (platykurtic) with kurtosis values smaller than 3. Further inspection using the normality test based on the Jarque–Bera test statistic showed that almost all variables were non-normally distributed, except for LSGX, LPSEi, and LMIB before the COVID-19 pandemic.

Table 4 summarises the unit root test results on the stationarity of variables series. Before the pandemic, all variables are stationary at the first difference, I(1), except for Singapore, the Philippines, and the UK stock markets, which are stationary at level I(0). The ADF and PP tests produced similar results, except for Spain, where the ADF test result was stationary at the first difference, while the PP test result was stationary at the level before the pandemic. These mixed levels of integration, I(0) and I(1), reaffirm the appropriate application of the ARDL model in analysing the cointegration relationship between ASEAN-5 and the US, UK, and European stock markets.

Table 4.

Unit root test results.

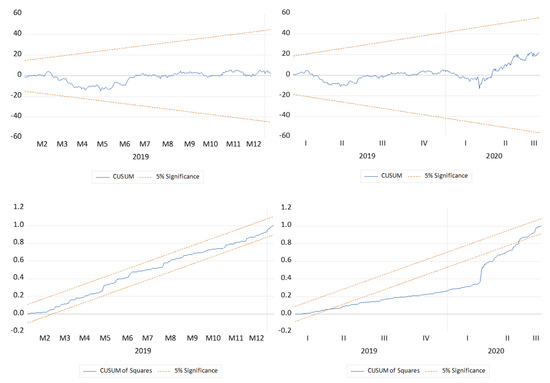

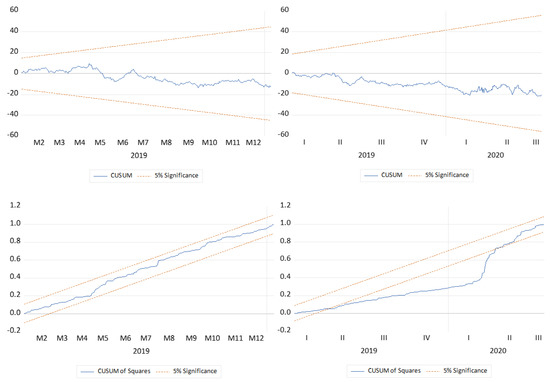

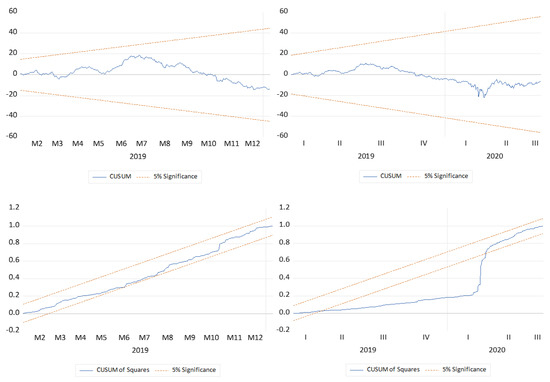

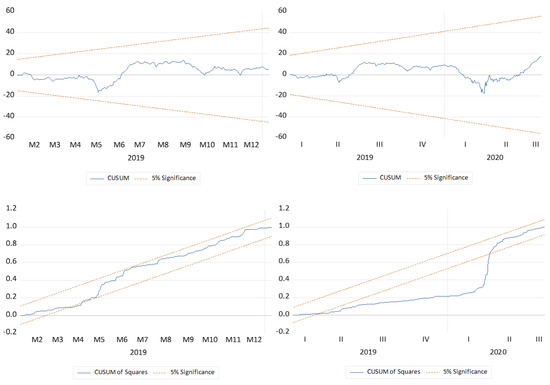

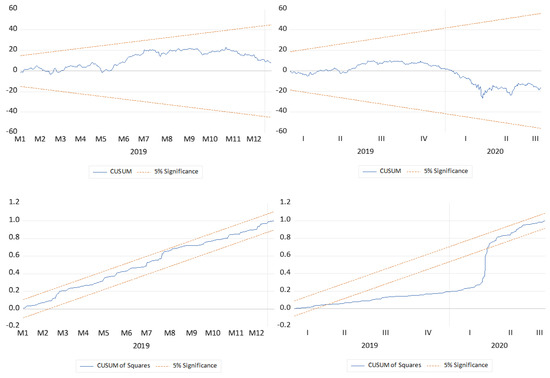

Table 5 and Figure 3, Figure 4, Figure 5, Figure 6 and Figure 7 present the model adequacy and robustness test results of the selected ARDL models, a series of diagnostic tests conducted on the residual series. The selected ARDL models were chosen based on the lowest AIC value. Nonetheless, most of the ARDL models were severely affected by COVID-19, as shown by the diagnostic test results on the autocorrelation and heteroskedasticity in the residual. ARDL models with autocorrelation or heteroskedasticity problems are typically re-estimated by applying the heteroskedasticity and the autocorrelation consistent (HAC) estimator. The results of the RESET test, however, confirm that the ARDL regression models are correctly specified. Moreover, the constancy of regression coefficients of the ARDL models is relatively stable, as shown by the CUSUM tests depicted in Figure 3, Figure 4, Figure 5, Figure 6 and Figure 7, regardless of the inconsistencies in the variances of CUSUM of squares tests. The cointegration results are shown in Table 6.

Table 5.

Diagnostic tests.

Figure 3.

Plots of CUSUM and CUSUMSQ for LKLCI.O model before (left panel) and during (right panel) COVID-19.

Figure 4.

Plots of CUSUM and CUSUMSQ for LSGX.O model before (left panel) and during (right panel) COVID-19.

Figure 5.

Plots of CUSUM and CUSUMSQ for LSETI.O model before (left panel) and during (right panel) COVID-19.

Figure 6.

Plots of CUSUM and CUSUMSQ for LJKSE.O model before (left panel) and during (right panel) COVID-19.

Figure 7.

Plots of CUSUM and CUSUMSQ for LPESi.O model before (left panel) and during (right panel) COVID-19.

Table 6.

ARDL bounds test results.

Before COVID-19, the bounds test failed to reject the null hypothesis of no cointegration (research hypothesis 1), except for LPSEi.O (Philippines). In other words, there is no indication of cointegration relationships between LKLCI.O (Malaysia), LSGX.O (Singapore), LSETI.O (Thailand), and LJKSE.O (Indonesia) and the LDJIA (US), LFTSE100 (UK), LDAX (Germany), LCAC (France), LMIB (Italy), and LIBEX (Spain). The Philippines market is the only exception, where evidence of a cointegration relationship was revealed through the bounds test. However, during and after the onset of COVID-19, almost all ASEAN-5 markets were cointegrated and moved in tandem with the US, UK, and European markets, except for Thailand. These results are partially in line with past empirical findings of a weak or no relationship between stock markets worldwide before the crisis, with significant relationships during the pandemic (Chan et al. 1992; Cho 2014; Eun and Shim 1989; Jang and Sul 2002; Junior and Franca 2012; King 2001; Malliaris and Urrutia 1992; Nobi et al. 2014; Sheng and Tu 2000; Akhtaruzzaman et al. 2021, 2022). The only difference is that past studies (except Akhtaruzzaman et al. 2021, 2022) focused on the economic or financial crisis and close-to-close price relationships, while the present study focuses on the recent COVID-19 pandemic and close-to-open price relationships. Further, Table 7 shows the associated long-run regression coefficients in the present study.

Table 7.

ARDL long-run coefficients.

Based on Table 7, related to research hypothesis 2, the LDJIA, LFTSE100, LDAX, and LCAC significantly influenced the LKLCI.O during COVID-19. However, similar evidence was not found for LMIB and LIBEX. The LSGX.O was significantly influenced by the LFTSE100 and LIBEX but not the LDJIA, LDAX, LCAC, and LMIB. Further, the LFTSE100 and LIBEX significantly influenced the LJKSE.O. However, evidence of the significant influence of the LDJIA, LDAX, LCAC, and LMIB on LJKSE.O was not found.

A comparison of all stock market indexes’ opening prices in ASEAN-5 markets indicates that only the LPSEi.O was cointegrated with the closing prices of the US, UK, and European markets before and during COVID-19 (see Table 6). Before the COVID-19 pandemic, the LFTSE100, LCAC, LMIB, and LIBEX significantly influenced the LPSEi.O, as shown in Table 6. Interestingly, only the LDJIA, LFTSE100, and LDAX were found to be significant during the pandemic.

The regression coefficients further suggest that Malaysia’s and the Philippines’ opening prices were exposed to changes in the US stock market during the COVID-19 pandemic. Every 1% change in LDJIA, the LKLCI.O and LPSEi.O responded negatively by 1.93% and 1.25%, respectively. In this regard, both countries’ stock markets display results similar to those experienced by Japanese traders during the October 1987 Black Monday stock market crash (Hamao et al. 1990; King and Wadhwani 1990). These findings suggest that investors and traders in Malaysia and the Philippines should further monitor all buying and selling activities and make trade decisions during the opening bell. However, the insignificant effect on the Singapore, Thailand, and Indonesia stock markets in the present study contradicted the findings in previous studies that claimed the US market was the most influential and top information provider that may directly influence other markets (Arshanapalli and Doukas 1993; Bessler and Yang 2003; Hassan and Naka 1996; Schollhammer and Sand 1985).

An interesting finding was observed in the UK stock market, in which the market’s closing prices significantly influenced the opening prices in all ASEAN-5 stock markets during COVID-19. The Philippines market is the most responsive to changes in the closing prices of the UK stock market. For every 1% change in the LFTSE100, the LPSEi.O responded positively by 1.76%, LKLCI.O by 1.48%, LJKSE.O by 1.09%, and LSGX.O by 0.68%. In addition, a 1% change in the LFTSE100 led to a 0.83% change in LPSEi.O before COVID-19. As the situation worsened and the number of COVID-19 cases increased in the UK, investors and traders monitored buying and selling activities more closely on the island than in the US. The empirical findings also demonstrate that the German stock market closing prices significantly influenced the opening prices of the Malaysian and Philippines stock markets during COVID-19. The magnitude of this relationship is such that for every 1% change in the LDAX, the LKLCI.O and LPSEi.O responded positively by 2.21% and 1.01%, respectively. Moreover, France’s stock market closing prices also significantly influenced the opening prices of Malaysia’s stock market during COVID-19, and the Philippines’ stock market before COVID-19, with every 1% change in the LCAC triggering a negative response by 1.95% and 1.06% in the LKLCI.O and LPSEi.O, respectively.

The closing prices of the Italy stock market only significantly influenced the opening prices of the Philippines stock market prior to COVID-19. On the other hand, the closing prices of the Spain stock market during COVID-19 significantly influenced the opening prices of the Singaporean and Indonesian stock markets. The estimated coefficients demonstrate that for every 1% change in the LMIB, the LPSEi.O changed by 0.70%, and for every 1% change in the LIBEX, the LSGX.O and LJKSE.O responded positively by 0.37% and 0.79%, respectively. Meanwhile, the LPSEi.O responded negatively to a 1% increase in LIBEX by 0.13%.

As to research hypothesis 3, further analysis of the causal impact of the US, UK, and European stock markets on ASEAN-5 stock markets using the causality test provides fascinating findings, as evident in Table 8. The results show that changes in the US, UK, and European stock markets during COVID-19 significantly caused changes in Malaysia’s stock market. In contrast, only the UK and Spain stock markets exhibited significant causal impacts on the Malaysia stock market prior to COVID-19. In other words, the behaviour of the Malaysian stock market depends on the behaviour of the US, UK, and European stock markets. The significance of the ECT coefficient from the bounds test re-confirms the existence of long-run cointegrations during COVID-19. The ECT value of −0.050 indicates that 5.0% of the deviation from the long-run equilibrium is corrected each day for about 20 days (1/θ).

Table 8.

Short-run causality test results.

Changes in the Singapore stock market were significantly caused by the movement of prices in the US, UK, and European stock markets before and during COVID-19. This finding is quite surprising considering other markets in ASEAN-5. An exception was detected in France (LCAC), where the stock market movement only affected Singapore during COVID-19 but not prior to it. This finding indicates that countries with more developed or advanced markets are more exposed to and dependent on the US, UK, and European stock market behaviour. During COVID-19, the ECT coefficient value recorded at −0.133 implies that the long-run equilibrium discrepancy is corrected at 13.3% daily for about 7.5 days. The Thailand stock market was less affected by changes in the UK and European stock markets prior to COVID-19 but more vulnerable during COVID-19. The results statistically showed that only changes in the US and Italy stock markets significantly triggered movements in the Thailand stock market prior to COVID-19. On the other hand, changes in the Thailand stock market were significantly caused by the behaviour of the US, UK, and almost all European stock markets except France and Spain. Due to the lack of evidence of long-run cointegration in the Thailand stock market before and during COVID-19, the ECT is irrelevant.

Statistically, the US, France, and Spain stock markets also significantly influenced the Indonesian stock market before and during COVID-19. Moreover, the Indonesian stock market is also significantly influenced by changes in the German stock market prior to COVID-19 and the UK during COVID-19. On the other hand, the Philippines stock market is significantly affected by changes in the UK, Germany, and Italy stock markets before and during COVID-19. Additionally, before COVID-19, changes in the Philippines stock market were significantly caused by movements in the France stock market. Meanwhile, during COVID-19, changes in the US stock market significantly caused movements in the Philippines. This finding implies that Indonesia and the Philippines’ stock markets are also affected by the behaviour of the US, UK, and European stock markets. In the case of the Indonesian market during COVID-19, the significant ECT coefficient value of 0.078 indicates that a 7.8% deviation for long-run equilibrium was corrected each day for about 12.8 days.

Meanwhile, across all ASEAN-5 stock markets, the Philippines is the only market where long-run cointegration had been established before and during COVID-19. The associated ECT coefficient values are −0.153 and −0.104 before and during COVID-19, respectively. These values indicate that prior to COVID-19, a 15.3% deviation from the long-run equilibrium was corrected each day for about 6.5 days. During COVID-19, a 10.4% deviation from the long-run equilibrium was corrected each day for about 9.6 days. The adjustment speed of the correction rate towards long-run equilibrium is longer during COVID-19 compared to the pre-pandemic period.

Table 9 shows the bivariate Granger causality test employed by the researchers for a robustness check of the empirical results regarding the long-run impacts and causal relationships. The additional causality analysis is between the US, UK, and European stock markets before and during the COVID-19 pandemic. None of the changes in the US, UK, and European stock markets (except France) caused changes in the stock markets between the three regions before the pandemic, even though these countries are located nearby and share a history of economic and trade relations. Even the US, the most prominent leader in stock market information, did not cause a change in the UK and European stock markets before the pandemic.

Table 9.

Bivariate short-run causality test results—US, UK, and Europe.

However, during the COVID-19 pandemic, the US stock market significantly influenced the UK and European stock markets. Meanwhile, the UK stock market changes significantly affected the Germany, France, Italy, and Spain stock markets. Further, changes in the French stock market led to changes in the US, UK, Germany, Italy, and Spain stock markets. Changes in the Italy stock market significantly caused stock market changes in the US, UK, and France. In addition, stock market changes in the UK, France, Germany, and Italy were significantly affected by the Spanish stock market. Among all the European stock markets, Germany is the only market statistically insignificant in causing changes in other stock markets, including the US and UK. These empirical results indicate the potential effect of the pandemic in creating contagion channels through financial markets. Financial market changes in the US, UK, and Europe are transmitted into ASEAN-5 markets due to similar patterns observed in the causal relationships between the ASEAN-5 stock markets with stock markets in the three regions.

In summary, the empirical findings based on cointegration and causality analyses provide strong evidence of the contagion between markets more significantly during the COVID-19 pandemic, in line with Akhtaruzzaman et al. (2021, 2022).

5. Conclusions

COVID-19 is a global pandemic with far-reaching effects in various countries. This study investigated the impact of the US, UK, and European stock markets’ closing prices on the opening prices of ASEAN-5 stock markets before and during COVID-19. This study is significant for fund managers and market participants in ASEAN-5 due to the differences in time zones and the lead–lag relationship between the leading stock markets. The data analysed using the ARDL bounds test and causality approach indicate that only the Philippines stock market’s opening prices cointegrated with the US, UK, and European stock markets before COVID-19. However, during COVID-19, all ASEAN-5 stock markets cointegrated with the US, UK, and European stock markets implying a contagion effect between markets, except Thailand. This statistical evidence of contagion suggests that any event in the US, UK, or Europe will affect the opening prices of stock market indexes in ASEAN-5 and practical considerations in making decisions for portfolio diversification strategies.

This study utilises the opening prices of ASEAN-5 stock markets, contrary to most previous studies that used the settlement or closing prices. King and Wadhwani (1990) and Hamao et al. (1990) agreed that the opening prices contain beneficial information, especially for countries with different time zones. The results indicate that investors and traders in Asian countries are vulnerable and exposed to the significant risk caused by the movement in the US, US, and European stock markets, especially in times of crisis. As the time zone differences cannot be changed, investors and traders should monitor the developments in the US, UK, and Europe or diversify their portfolio in foreign markets with minimal or no cointegration with the leading markets to mitigate and manage risks. In this regard, Granger and Morgenstern (1963) claimed that markets are not likely to be independent of major worldwide crises, such as a global economic or financial shock, pandemic (health) crisis, or war.

This study includes the effects of the COVID-19 pandemic since many stock indexes moved in tandem during the disaster. Future studies should consider the time factor limitations of this study to cover the relationship between the leading stock markets before, during, and after COVID-19 over an extended period. A post-crisis investigation based on the reaction of leading stock markets worldwide to vaccination against COVID-19 will provide valuable insights for future stock market transactions.

Author Contributions

Writing―original draft preparation, I.J.; model validation, I.J. and M.K.; resources, I.J., M.K. and J.L.; writing―review and editing, M.K., T.S.L. and J.L.; supervision, M.K. and T.S.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding, but the APC was funded by Universiti Malaysia Sabah.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available in this article.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Akhtaruzzaman, Md., Sabri Boubaker, and Ahmet Sensoy. 2021. Financial contagion during COVID-19 crisis. Finance Research Letters 38: 101604. [Google Scholar] [CrossRef] [PubMed]

- Akhtaruzzaman, Md., Sabri Boubaker, Duc Khuong Nguyen, and Molla Ramizur Rahman. 2022. Sytemic risk-sharing framework of cryptocurrencies in the COVID-19 crisis. Finance Research Letters 47: 102787. [Google Scholar] [CrossRef]

- Alubo, Ogoh, Sharon Ene Alubo, and Adah Sylvester Alubo. 2020. Corona virus containment and emerging challenges in Nigeria. Microbiology & Infectious Diseases 4: 1–8. [Google Scholar] [CrossRef]

- Arshanapalli, Bala, and John Doukas. 1993. International stock market linkages: Evidence from the pre- and post-October 1987 period. Journal of Banking and Finance 17: 193–208. [Google Scholar] [CrossRef]

- ASEAN. 2021. ASEAN Investment Report 2020–2021—Investing in Industry 4.0. Jakarta: ASEAN Secretariat. [Google Scholar]

- Ashton, John. 2020. COVID-19 and the ‘Spanish’ flu. Journal of the Royal Society of Medicine 113: 197–98. [Google Scholar] [CrossRef]

- Becker, Kent G., Joseph E. Finnerty, and Manoj Gupta. 1990. The intertemporal relation between the U.S. and Japanese stock markets. The Journal of Finance 45: 1297–306. [Google Scholar] [CrossRef]

- Bessler, David A., and Jian Yang. 2003. The structure of interdependence in international stock markets. Journal of International Money and Finance 22: 261–87. [Google Scholar] [CrossRef]

- Blahun, Ivan S., and Ivan I. Blahun. 2020. The relationship between world and local stock indices. Montenegrin Journal of Economics 16: 55–67. [Google Scholar] [CrossRef]

- Chan, Kam C., Benton E. Gup, and Ming-Shiun Pan. 1992. An empirical analysis of stock prices in major Asian markets and the United States. Financial Review 27: 289–307. [Google Scholar] [CrossRef]

- Chaudhary, Rashmi, Priti Bakhshi, and Hemendra Gupta. 2020. Volatility in international stock markets: An empirical study during COVID-19. Journal of Risk and Financial Management 13: 208. [Google Scholar] [CrossRef]

- Chen, Chun-Da, Chin-Chun Chen, Wan-Wei Tang, and Bor-Yi Huang. 2009. The positive and negative impacts of the SARS outbreak: A case of the Taiwan industries. The Journal of Developing Areas 43: 281–93. [Google Scholar] [CrossRef]

- Cho, Sungjun. 2014. What drives stochastic risk aversion? International Review of Financial Analysis 34: 44–63. [Google Scholar] [CrossRef]

- de Bruin, Yuri Bruinen, Anne-Sophie Lequarre, Josephine McCourt, Peter Clevestig, Filippo Pigazzani, Maryam Zare Jeddi, Claudio Colosio, and Margarida Goulart. 2020. Initial impacts of global risk mitigation measures taken during the combatting of the COVID-19 pandemic. Safety Science 128: 104773. [Google Scholar] [CrossRef]

- Dickey, David A., and Wayne A. Fuller. 1979. Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association 74: 427–31. [Google Scholar] [CrossRef]

- El Zowalaty, Mohamed E., and Josef D. Järhult. 2020. From SARS to COVID-19: A previously unknown SARS- related coronavirus (SARS-CoV-2) of pandemic potential infecting humans—Call for a One Health approach. One Health 9: 100124. [Google Scholar] [CrossRef]

- Engle, Robert F., and Clive W. J. Granger. 1987. Co-integration and error correction representation, estimation and testing. Econometrica 55: 251–76. [Google Scholar] [CrossRef]

- Eun, Cheol S., and Sangdal Shim. 1989. International Transmission of Stock Market Movements. The Journal of Financial and Quantitative Analysis 24: 241. [Google Scholar] [CrossRef]

- Goldstein, Morris, and Michael Mussa. 1993. The Integration of World Capital Markets. IMF Working Paper. Washington, DC: International Monetary Fund. [Google Scholar]

- Granger, Clive W. J., and Oskar Morgenstern. 1963. Spectral Analysis of New York Stock Market Prices. Kyklos 16: 1–27. [Google Scholar] [CrossRef]

- Grubel, Herbert G. 1968. International diversified portfolio: Welfare gains and capital flows. American Economic Review 58: 1299–314. [Google Scholar]

- Hamao, Yasushi, Ronald W. Masulis, and Victor Ng. 1990. Correlations in Price Changes and Volatility across International Stock Markets. Review of Financial Studies 3: 281–307. [Google Scholar] [CrossRef]

- Hassan, M. Kabir, and Atsuyuki Naka. 1996. Short-run and long-run dynamic linkages among international stock markets. International Review of Economics & Finance 5: 387–405. [Google Scholar] [CrossRef]

- Huyghebaert, Nancy, and Lihong Wang. 2010. The co-movement of stock markets in East Asia. Did the 1997–98 Asian financial crisis really strengthen stock market integration? China Economic Review 21: 98–112. [Google Scholar] [CrossRef]

- Jang, Hoyoon, and Wonsik Sul. 2002. The Asian financial crisis and the co-movement of Asian stock markets. Journal of Asian Economics 13: 94–104. [Google Scholar] [CrossRef]

- Johansen, Søren. 1988. Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control 12: 231–54. [Google Scholar] [CrossRef]

- Johansen, Søren. 1991. Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica 59: 1551–80. [Google Scholar] [CrossRef]

- Johansen, Søren, and Katarina Juselius. 1990. Maximum likelihood estimation and inference on cointegration—With applications to the demand for money. Oxford Bulletin of Economics and Statistics 52: 169–210. [Google Scholar] [CrossRef]

- Junior, Leonidas Sandoval, and Italo De Paula Franca. 2012. Correlation of financial markets in times of crisis. Physica A: Statistical Mechanics and Its Applications 391: 187–208. [Google Scholar] [CrossRef]

- Kamaludin, Kamilah, Sheela Sundarasen, and Izani Ibrahim. 2021. Covid-19, Dow Jones and equity market movement in ASEAN-5 countries: Evidence from wavelet analyses. Heliyon 7: e05851. [Google Scholar] [CrossRef]

- King, Mervyn A., and Sushil Wadhwani. 1990. Transmission of Volatility between Stock Markets. Review of Financial Studies 3: 5–33. [Google Scholar] [CrossRef]

- King, Michael R. 2001. Who triggered the Asian financial crisis? Review of International Political Economy 8: 438–66. [Google Scholar] [CrossRef]

- Lin, Wen-Ling, Robert F. Engle, and Takatoshi Ito. 1994. Do bulls and bears move across borders? International transmission of stock returns and volatility. The Review of Financial Studies 7: 507–38. [Google Scholar] [CrossRef]

- Liu, Haiyue, Aqsa Manzoor, Cangyu Wang, Lei Zhang, and Zaira Manzoor. 2020. The COVID-19 outbreak and affected countries stock markets response. International Journal of Environmental Research and Public Health 17: 2800. [Google Scholar] [CrossRef] [PubMed]

- Lo, Andrew W., and A. Craig MacKinlay. 1990. When are contrarian profits due to the stock market overreaction? The Review of Financial Studies 3: 175–205. [Google Scholar] [CrossRef]

- Luis, Gil-Alana, and Claudio-Quiroga Gloria. 2020. The COVID-19 Impact on the Asian Stock Markets. Asian Economics Letters 1: 1–4. [Google Scholar] [CrossRef]

- Malliaris, Anastasios G., and Jorge L. Urrutia. 1992. The International Crash of October 1987: Causality Tests. The Journal of Financial and Quantitative Analysis 27: 353–4. [Google Scholar] [CrossRef]

- McQueen, Grant, Michael Pinegar, and Steven Thorley. 1996. Delayed reaction to good news and the cross-autocorelation of portfolio returns. The Journal of Finance 51: 889–919. [Google Scholar] [CrossRef]

- Mech, Timothy S. 1993. Portfolio return autocorrelation. Journal of Financial Economics 34: 307–44. [Google Scholar] [CrossRef]

- Menon, N. Rajiv, M. V. Subha, and S. Sagaran. 2009. Cointegration of Indian stock markets with other leading stock markets. Studies in Economics and Finance 26: 87–94. [Google Scholar] [CrossRef]

- Nkoro, Emeka, and Aham Kelvin Uko. 2016. Autoregressive Distributed Lag ( ARDL ) cointegration technique: Application and interpretation. Journal of Statistical and Econometric Methods 5: 63–91. [Google Scholar]

- Nobi, Ashadun, Sungmin Lee, Doo Hwan Kim, and Jae Woo Lee. 2014. Correlation and network topologies in global and local stock indices. Physics Letters A 378: 2482–89. [Google Scholar] [CrossRef]

- Ozturk, Ilhan, and Ali Acaravci. 2010. The causal relationship between energy consumption and GDP in Albania, Bulgaria, Hungary, and Romania: Evidence from ARDL bound testing approach. Applied Energy 87: 1938–43. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Phillips, Peter C. B., and Pierre Perron. 1988. Testing for a unit root in time series regression. Biometrika 75: 335–46. [Google Scholar] [CrossRef]

- Rahman, Aisyah Abdul, and Noor Zahirah Mohd Sidek. 2011. Spill-over Effect of US Sub-Prime Crisis on ASEAN-5 Stock Markets. Business and Social Science Research Conference 7: 207–17. [Google Scholar]

- Rijanto, Arief. 2017. Lead-lag relationship: Did the financial crisis affect the interdependence of ASEAN-5 and the global stock market? International Journal of Economics and Management 11: 393–407. [Google Scholar]

- Ripley, Duncan M. 1973. Systematic Elements in the Linkage of National Stock Market Indices. The Review of Economics and Statistics 55: 356–61. [Google Scholar] [CrossRef]

- Rouatbi, Wael, Ender Demir, Renatas Kizys, and Adam Zaremba. 2021. Immunizing markets against the pandemic: COVID-19 vaccinations and stock volatility around the world. International Review of Financial Analysis 77: 101819. [Google Scholar] [CrossRef]

- Samarakoon, Lalith P. 2011. Stock market interdependence, contagion, and the U.S. financial crisis: The case of emerging and frontier markets. Journal of International Financial Markets, Institutions and Money 21: 724–42. [Google Scholar] [CrossRef]

- Sari, Ramazan, Bradley T. Ewing, and Ugur Soytas. 2008. The relationship between disaggregate energy consumption and industrial production in the United States. An ARDL approach. Energy Economics 30: 2302–13. [Google Scholar] [CrossRef]

- Schöllhammer, Hans, and Ole Sand. 1985. The interdependence among the stock markets of major European countries and the United States: An empirical investigation of interrelationships among national stock price movements. Management International Review 25: 17–26. [Google Scholar]

- Sheng, Hsiao-Ching, and Anthony H. Tu. 2000. A study of cointegration and variance decomposition among national equity indices before and during the period of the Asian financial crisis. Journal of Multinational Financial Management 10: 345–65. [Google Scholar] [CrossRef]

- Siu, Alan, and Y. C. Richard Wong. 2004. Economic impact of SARS: The case of Hong Kong. Asian Economic Papers 3: 62–83. [Google Scholar] [CrossRef]

- Solnik, B. H. 1974. Testing international pricing of risk: An empirical investigation of the world capital market structure. The Journal of Finance 29: 365–78. [Google Scholar] [CrossRef]

- Solnik, Bruno. 1983. International arbitrage pricing theory. The Journal of Finance 38: 449–57. [Google Scholar] [CrossRef]

- Stulz, René M. 1981. A model of international asset pricing. Journal of Financial Economics 9: 383–406. [Google Scholar] [CrossRef]

- Wang, Yudong, Chongfeng Wu, and Li Yang. 2013. Oil price shocks and stock market activities: Evidence from oil-importing and oil-exporting countries. Journal of Comparative Economics 41: 1220–39. [Google Scholar] [CrossRef]

- Wong, Wing-Keung, Jack Penm, Richard Deane Terrell, and Karen Yann Ching. 2004. The relationship between stock markets of major developed countries and Asian emerging markets. Journal of Applied Mathematics and Decision Sciences 8: 201–18. [Google Scholar] [CrossRef]

- World Health Organization. 2003. Summary of Probable SARS Cases with Onset of Illness from 1 November 2002 to 31 July 2003. Available online: https://www.who.int/publications/m/item/summary-of-probable-sars-cases-with-onset-of-illness-from-1-november-2002-to-31-july-2003 (accessed on 23 January 2021).

- World Health Organization. 2020. WHO Timeline—COVID-19. Available online: https://www.who.int/news/item/27-04-2020-who-timeline---covid-19 (accessed on 23 January 2021).

- Worldmeter. 2022. COVID Life: Coronavirus Statistics. Available online: https://www.worldometers.info/coronavirus/ (accessed on 13 June 2022).

- Yang, Jian, James W. Kolari, and Insik Min. 2003. Stock market integration and financial crises: The case of Asia. Applied Financial Economics 13: 477–86. [Google Scholar] [CrossRef]

- Yildirim, Ecenur Uğurlu. 2020. The impact of COVID-19 pandemic on the financial contagion among Turkey, US, and China stock markets. Journal of Business Research-Turk 12: 2764–73. [Google Scholar] [CrossRef]

- Zhang, Dayong, Min Hu, and Qiang Ji. 2020. Financial markets under the global pandemic of COVID-19. Finance Research Letters 36: 101528. [Google Scholar] [CrossRef]

- Zhao, Wenwu, Junze Zhang, Michael E. Meadows, Yanxu Liu, Ting Hua, and Bojie Fu. 2020. A systematic approach is needed to contain COVID-19 globally. Science Bulletin 65: 876–78. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).