1. Introduction

Big data has been considered “the next frontier for innovation, competition and productivity” (

Manyika et al. 2011, p. 1), and its usage is expected to become a crucial factor for organizations concerning business forecasting and strategic decision-making in the near future (

Appelbaum et al. 2017;

Goasduff 2021;

Ram and Zhang 2022). Therefore, organizations pay more attention to big data analytics (BDA) to keep up with business changes. The importance of BDA is to boost organization operations and decision making via information technology and quantitative analysis. Through BDA, organizations (e.g., banks) can improve their capabilities in understanding the market and finding business opportunities.

The value of BDA application has been widely accepted among academic scholars. Many organizations have also put considerable efforts and investments into related infrastructures, technologies, talents, and business practices, aiming to keep their competitive advantages in the market (

Ciampi et al. 2020,

2021). Thus, it is pivotal to look at how BDA magnifies business operations and facilitates marketing activities in the service context (

Leung et al. 2019;

Ram and Zhang 2022). Despite the importance of BDA, most prior studies focused on the manufacturing sector (

Wamba et al. 2017) and technology-oriented organizations (

Meire et al. 2017;

Troisi et al. 2020) rather than the service sector. Furthermore, it remains unclear how to effectively acquire BDA for a firm and transform it to a data-driven organization that is capable of turning big data into actionable insight (

Behl et al. 2022). Hence, it is necessary to explore what underlying factors construct big data analytics capabilities (BDAC) and the impacts of BDAC on business performance in the financial services context, the banking sector in particular. BDAC could be interpreted as a firm’s abilities to transform big data into meaningful knowledge and insight via related tangible and intangible resources (

Mikalef et al. 2019).

According to

Sivarajah et al. (

2020), SMEs and large organizations could gain competitive advantages through BDA by analysing data from multiple channels, including social media, online businesses, and informational portals. However, there is insufficient research examining the effects of BDA in the context of financial services. Specifically, studies focusing on the effects of BDAC on business performance in the banking sector are still underdeveloped. Meanwhile, the Malaysian banking sector must face new challenges along with large scale crises that may reoccur (e.g., the 1997 Asian financial crisis and the 2008 global financial crisis). In such turbulent market environments, the Malaysian banking sector must continuously update itself and embrace digital transformation for competitive advantages. The adoption of BDA is proliferating, but many organizations are still struggling to produce quality insights (

Ransbotham et al. 2016). Thus, there is a necessity for furthering research examining the factors of BDAC or adopting analytics in organizations. (

Aziz 2018;

Kim and Lui 2015;

Wang and Wang 2020). Research on BDAC in financial services organizations is considered to be fragmented in scope and limited in methodologies. Therefore, it is crucial to further understand the adoption of industry 4.0 to gain optimal outcomes for the banking sector in Malaysia. Banks need to keep abreast with the current and latest situation from many angles, including multiple economic perspectives in decision making, and integrating BDAC could facilitate this.

Based on the stated research problems and gaps, there are two research questions to address, as follows:

Q1: What are the enablers needed to build BDAC in the financial services industry, particularly banks?

Q2: How does BDAC impact business performance?

By addressing the research questions above, this research makes a contribution to the extant literature in twofold. Firstly, it clarifies how to effectively transform a firm into a data-driven organization in the context of Malaysia’s banking sector. In another word, what core resources are necessary to develop BDAC, which could facilitate banks’ transformation to data-driven organization in the current fast-changing market? Secondly, this study empirically demonstrates the direct impacts of BDAC on marketing performance and operational performance among financial firms in Malaysia, which justifies the importance and necessity of developing BDAC, thus encourages banks to make investments in big-data-related infrastructure, technology, and talent and make strategic decisions based on BDA-centric knowledge/insight in the financial sector.

2. Literature Review

2.1. Big Data Analytics Capabilities

The financial sector is a data-intensive industry concerning data generation and utilization. The advancement of technology allows for the connections of different physical elements, services, and spaces and facilitates real-time approximation and the generation of a large volume of data. Big data analytics (BDA) is critical for any commercial organization with the belief that data collection, analysis processes, technology deployment and talent resources are needed to capitalize on its values and increase its business performance in the current emerging data economy. The recent technologies have empowered customers to seek out and compare an endless array of products and services from around the globe (

Kiron et al. 2014;

Srinivasan and Kurey 2014). Thus, it is vital to understand the adoption of BDA to gain the optimal outcomes for the banking sector.

BDA has become a significant trend in today’s businesses and has emerged as a new frontier for academic and practical research. The application of big data is developing into a management revolution that affects commercial organizations’ strategies, processes, and systems (

George et al. 2016). BDA plays a crucial role in business operation and extends commercial organizations’ capabilities in developing international markets (

Doh et al. 2016;

Watson et al. 2018). BDA involves discovering meaningful data patterns using pattern-recognition techniques, statistics, machine learning, artificial intelligence, and data mining (

Abbott 2014). By scrutinizing big data, service organizations can develop actionable insights and new knowledge to establish competitive advantages in the market.In particular, BDA has become a significant differentiator between high-performance and low-performance firms as it allows companies to have a long-term vision, decreases customer acquisition costs by 47 percent, and raises firm revenue by about eight percent (

Liu 2014).

Due to the increasing digitalization of business in every aspect, BDA is crucial for organizations to gain competitive advantages and enhance their performances (

Akter et al. 2016). Big data has been defined primarily with five Vs: volume, variety, velocity, veracity, and value, and its application could deliver sustainable values to customers and improve firm performance (

Wamba et al. 2017). The application of BDA involves assisting firms in making strategic decisions on sourcing, supply chain network design, and product design and development. This involves many service organizations, including finance, telecommunications, internet service, mobile apps, and tourism (

Wang et al. 2015,

2016). Current information technological innovations (e.g., smartphones, digital devices, scanning devices, cloud computing, and Internet of Things) improve business productivity and generate a variety of extensive data, which helps service firms build analytics capabilities.

Organizations in the service industry must enhance and improve their big data analytics capabilities (BDAC) to sustain their competitiveness amid the current economic situation and intense market competition (

McDermott and Prajogo 2012), as BDAC is a dynamic and continuous process of “data-insights-behaviors-value” (

Zheng and Zhou 2019). Drawing from prior studies, this research argues that big data analytics capabilities are composed of tangible resources, human skills, and intangible resources (

Gupta and George 2016;

Jeble et al. 2018;

Mikalef et al. 2019). Specifically, tangible resources refer to data, technology, and some other basic resources; human skills contain managerial skills and technical skills; and intangible resources include data-driven culture and organizational learning. The seven resources/skills are the main components of BDAC, and BDAC is extremely important for a firm’s survival and success (

Su et al. 2022). Nevertheless, there is still a lack of academic studies and empirical evidence about BDA and its usage among companies (

Wang et al. 2015). As a result, adopting BDA and developing BDAC are relatively slow in the service sector, and the whole sector generally has no clear direction or guidance for digital development (

Stylos et al. 2021). Involving messy, massive, and real-time unstructured data can cause significant risks to companies. Thus,

Tan et al. (

2015) state that BDA is crucial in assisting a company in designing its operations strategy and making wiser decisions in enhancing capabilities.

2.2. Firm Performance

Firm performance refers to “the degree to which a focal firm has superior performance relative to its competition” (

Rai et al. 2006, p. 229). Several studies, such as

Gunasekaran et al. (

2017),

Sivarajah et al. (

2020), and

Su et al. (

2022), suggest that big data analytics capabilities (BDAC) positively impact a firm’s performance and precisely its organizational position in the market. BDAC also facilitates a firm’s achievement of distinctive consequences, and improves the robustness of its performance (

Wamba et al. 2017;

Watson et al. 2018). To fully measure the differences regarding firm performance among financial organizations, particularly banks in Malaysia, this study considers two distinct components of firm performance, namely market performance and operational performance. Market performance refers to the actual outcomes of a firm, such as market share, and operational performance is defined as the strategic dimensions in which companies choose to compete, such as profits and return on assets (

Liu et al. 2020;

Richard et al. 2009;

Upadhyay and Baber 2013).

2.3. Conceptual Framework and Hypotheses

The study draws on the resource-based view (RBV) and contingent resource-based view (CRBV) to explain the effects of significant big data analytics capabilities (BDAC) on performance (please refer to

Figure 1). At the same time, dominant quality logic will be referred to discuss the role of BDAC in terms of quality.

Barney’s (

1991) RBV supports the consideration of knowledge as a competitive asset.

Barney (

1991) argued that a firm’s competitive advantages derive from its valuable and irreplaceable resources and capabilities. In addition, the RBV has been identified as a functional theory for explaining big data’s impacts through knowledge generation in marketing as it explains how a firm integrates tangible and intangible resources and human skills to gain a unique competitiveness in the market (

Erevelles et al. 2015). The data revolution is changing market dynamics and behaviours. Whilst the contingent resource-based view (CRBV) relates to firms possessing resources and capabilities to achieve a competitive advantage, it depends on specific conditions and addresses the static nature of RBV (

Aragón-Correa and Sharma 2003;

Brandon-Jones et al. 2014). Adopting a dynamic and evolutionary view, this research argues that BDAC facilitates commercial organizations in repositioning themselves amid constantly changing business environments.

In such business environment, companies must continuously reconfigure their resources and capabilities for competitive advantages (

Mikalef et al. 2019). Furthermore, they must respond to both external and internal changes in a quick and effective way, which entails them to identity opportunities and challenges for continuity and growth in its marketplace (

Kiron et al. 2014). Prior studies, with empirical evidence, suggested that companies are able to produce meaningful insights from big data, and these data-generated insights could help them in identifying threats and opportunities (

Erevelles et al. 2015).

RBV is consistent with IS success theory (

DeLone and McLean 2003) as both focus on the competencies of internal management systems to influence firm performance.

Wixom and Todd (

2005) and

Nelson et al. (

2005) presented the quality dominant logic in technology usage theory by putting forward two fundamental dimensions of information systems. In addition,

Sivarajah et al. (

2020) highlighted that organizations need to rethink and reconfigure their operations to be customer-centric based on data analytics in the current technology advancement. In this research, we propose that companies need to combine tangible, human, and intangible resource to develop BDAC. With a competent BDAC, organizations can have a smoother process for coordinating, integrating, learning, and reconfiguring. As a result, they can have a better performance in the market (

Wamba et al. 2017). Therefore based on the conceptual framework (refer to

Figure 1) the following hypotheses are proposed.

Hypothesis H1. BDAC positively influences a firm’s marketing performance in the banking sector of Malaysia.

Hypothesis H2. BDAC positively influences a firm’s operational performance in the banking sector of Malaysia.

3. Methodology

The population of this study was banks that had adopted big data analytics (BDA) in Malaysia. Low-level to top-level managers were targeted as survey respondents because they were arguably more familiar with their banks’ marketing and operational performance. Furthermore, they knew the latest technology deployment for survival in the marketplace.

This study designed a self-administered questionnaire that closely matched the reality of the banking sector. The measurement items were adopted/adapted from relevant studies and further refined via a pre-test with five bank managers and three academic scholars before the finalization of the questionnaire for data collection. From 1 October 2021 to 31 December 2021, 162 valid responses were collected (the response rate was 81%).

This study used a filter question: does your firm use BDA? This ensured that only banks that adopted BDA were chosen for analysis. The instrument was developed based on an extensive review of the existing literature. Some measurement items were modified to be more suitable for the study. All of the items used to measure the constructs corresponded to their theoretical definitions. We adopted/adapted measurement items from previous studies to tailor them to the context of the banking sector. The questionnaire included three sections. The first section contained twenty-five items measuring BDAC (including seven dimensions) from

Mikalef et al. (

2019) and

Jeble et al. (

2018) The second section included four descriptive questions for banks (e.g., business type and category). The third section contained four items measuring market performance from

Gupta et al. (

2018) and four items measuring operational performance from

Wamba et al. (

2017) and

Gupta et al. (

2018). The descriptive questions were placed between predictive and criterion variables, which aimed to minimize common method bias (

Podsakoff et al. 2012). For measurement scales, a 7-point Likert scale was used for predictive variables (i.e., BDAC) and a 5-point Likert scale was used for criterion variables (i.e., marketing performance and operational performance). The rationale for the arrangement was to reduce the effect of common method bias (

Podsakoff et al. 2012).

3.1. Data Analysis

This research adopted partial least squares structural equation modelling (PLS-SEM) and specifically software package SmartPLS 3.3.3 for data analysis. There are two main approaches in structural equation modelling (SEM), namely the co-variance-based approach (CB-SEM) and the variance-based approach (PLS-SEM). The former one aims to reproduce a theoretical co-variance matrix, and the latter one aims to maximize the variance of endogenous variables.

Hair et al. (

2021) summarized five important criteria, such as research goal and measurement model specification, when choosing CB-SEM or PLS-SEM. Given that this research had formative and reflective variables, PLS-SEM was applied rather than CB-SEM (

Nair et al. 2018). Meanwhile, both G*Power and the “10 times rule” were used to check sample size requirements. The results indicated that the 162 samples satisfied the minimum size requirement for using PLS-SEM. To assess the hypothesis, the measurement and structural measurement models of the research needed to be confirmed. This study followed the data-analysis procedure suggested by

Hair et al. (

2019), and the detailed steps are reported as follows:

3.2. Measurement Model Assessment

Regarding the assessment of the measurement model, the internal reliability, convergent validity, and discriminant validity had to be confirmed. Given the existence of reflective and formative variables in the research framework, different assessment criteria were applied (

Hair et al. 2021). To establish the reliability and convergent validity of the first-order reflective variables (seven dimensions of BDAC, marketing performance, and operational performance), factor loadings, composite reliability (CR), and average variance extracted (AVE) values needed to surpass the cut-off threshold values at 0.7, 0.7, and 0.5 respectively. As shown in

Table 1, the reliability and convergent validity of all of the first-order reflective variables were confirmed.

Regarding the discriminant validity of the first-order reflective variables (including the seven dimensions of BDAC), this research applied Heterotrait–Monotrait of correlations (HTMT) for assessment (

Henseler et al. 2014). To confirm discriminant validity, HTMT should be no more than 0.90 (

Gold et al. 2001). According to

Table 2, all the HTMT scores were less than the cut-off threshold. Therefore, the discriminant validity of the research was confirmed.

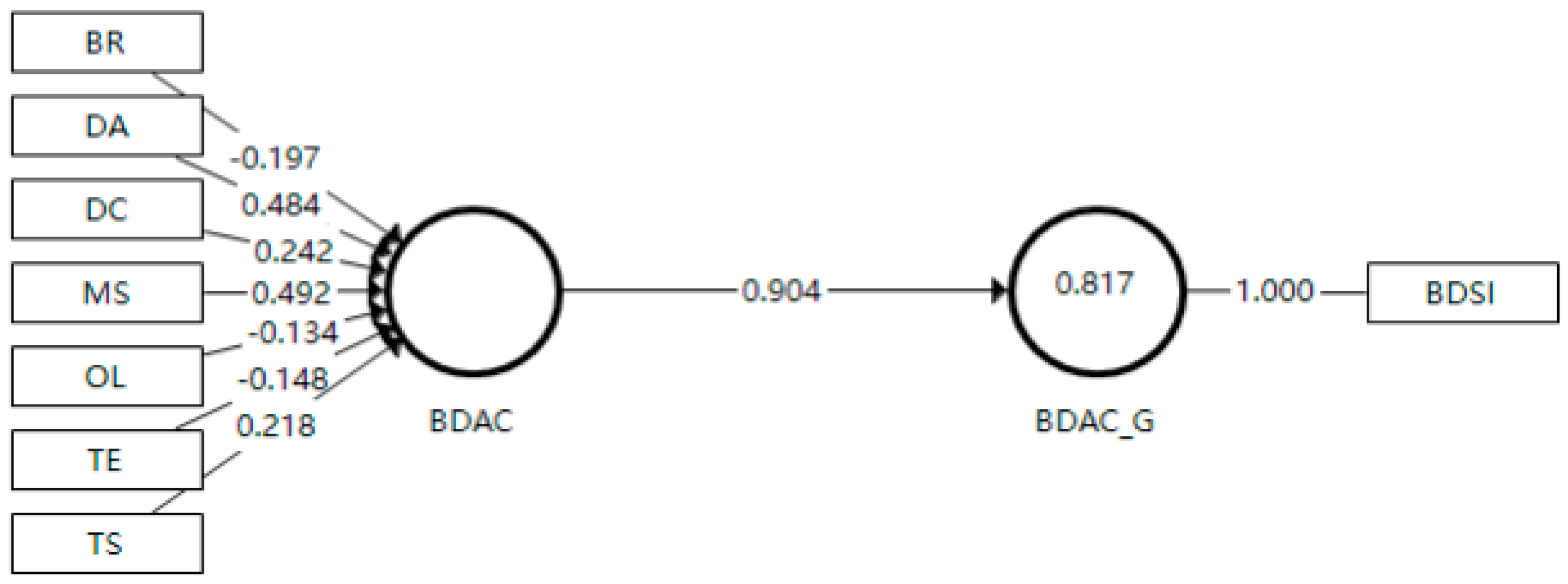

Apart from the first-order reflective variables, BDAC is a reflective-formative 2nd order composite construct. The assessment procedure of formative measurement, involving three steps, is different from the one of reflective measurement above. Firstly, the convergent validity is examined by performing redundancy analysis (

Chin 1998). As shown in

Figure 2, the path coefficient between the formative BDAC and the same construct being measured reflectively by a global single item was 0.904, which was much higher than the cut-off threshold at 0.70. Therefore, the convergent validity of the formative construct was confirmed (

Hair et al. 2021).

Then, collinearity issues among indicators (dimensions) have to be ruled out by checking the variance inflation factor (VIF). BDAC is a 2nd-order formative construct, so its dimensions are not inter-changeable. Significantly, high correlations among dimensions are not expected as high collinearity can lead to incorrect estimations of weights (

Hair et al. 2019). As shown in

Table 1, all VIF scores of BDAC’s dimensions were lower than 5. Thus, BDAC, as a formative composite construct, does not have a potential collinearity problem (

Hair et al. 2021).

Thirdly, the significance and relevance of formative indicators (dimensions) had to be confirmed via a bootstrapping technique for estimating the outer weight significance of BDAC’s dimensions (

Hair et al. 2021). The outer weight of each dimension indicates its relative importance to forming BDAC. Whether an outer weight is significant can be assessed by confidence interval bias corrected with significance at 0.95 (

Gannon et al. 2021). According to

Table 1, the outer weights of BR_BDAC, TE_BDAC, TS_BDAC, MS_BDAC, and DC_BDAC were not significant, and DA_BDAC and OL_BDAC were significant. The results suggest that the latter two dimensions were relatively more important than the first five dimension in forming BDAC. Meanwhile, as shown in

Table 3, the outer loadings were all higher than the cut-off threshold of 0.5, which confirms the absolute importance of the seven dimensions in forming the construct (

Hair et al. 2021). Therefore, all the dimensions were kept, regardless of outer weights.

3.3. Structural Model Assessment

After confirmation of the measurement model of the research, the structural model was assessed via t-value,

p-value, confidence intervals, coefficient of determination (R2), effect size (f2), and predictive relevance (Q2) (

Hair et al. 2021). By conducting a bootstrapping procedure with 5000 resamples, it was found that H1 and H2 were supported at 95% confidence intervals (see

Table 4). To be specific, BDAC positively influences marketing performance (β = 0.630, t = 11.463,

p = 0.000, LL = 0.515, CL = 0.703) and BDAC also positively influences operational performance (β = 0.547, t = 9.239,

p = 0.000, LL = 0.411, CL = 0.619) in the banking sector of Malaysia.

The model’s predictive accuracy was examined via the coefficient of determination (R2). As shown in

Table 5, the R2 values of marketing and operational performance were 0.400 and 0.299, respectively, which indicated that BDAC had a substantial level of predictive accuracy (

Cohen 1998). To assess the relative impact of a predicting variable on an endogenous variable, the effect size (f

2) is examined. The f

2 scores of BDAC on marketing and operational performance were 0.666 and 0.426, indicating a substantial effect size (

Cohen 1998). Concerning the predictive validity of the path model, Stone and Geisser’ Q

2 was checked via a blindfolding technique. It was found that the Q

2 scores were greater than 0, indicating that BDAC had a predictive relevance on marketing and operational performance (

Hair et al. 2021).

4. Discussion and Implications

A thorough understanding of extensive data analytics capabilities (BDAC) facilitates financial organizations (e.g., banks) to make better strategic decisions concerning new market exploration and product/service innovation. This study provides evidence of the outcomes of big data analytics (BDA) in the banking sector. Thus, this study derived the research model that statistically validates the gap in the related literature. Therefore, it makes significant contributions to filling up the identified research gaps and provides practical implications to managers in the banking sector.

This study finds that the dimensions of data and organizational learning dominate extensive BDAC in the banking sector. Furthermore, the analysis shows that about 40% of marketing performance and 30% of operational performance is explained by BDAC, respectively, among financial services organizations in the proposed model. The data analysis evidence shows that data and organizational learning help to enhance the quality of sales of new and current products and improve decision-maker engagement strategies.

Ransbotham et al. (

2016) stated that organizations could enhance their competitive advantage through BDA. Concerning the marketing of financial organizations (e.g., banks), big data provides insights into what is accessible to data through multiple internal and external sources in facilitating high-value analyses.

Organizational learning can be achieved through knowledge assimilation and applying the new knowledge from big data. For example, financial organizations can decide to understand the most effective data at each stage of a sales cycle, how to improve investments in customer relationship management (CRM) systems, and how to effectively adjust strategies for increasing conversion rates, prospect engagement, revenue, and customer lifetime value. Furthermore, banks can analyse and predict various phenomena, such as customer purchase behaviour and forecasting stock prices, market trends, market share, competitor moves, and profitability (

Pappas et al. 2018). The application of BDA throughout financial products’ life cycles facilitates extending customers’ value and prompting value-generating behaviours. By setting customer value as an underlying goal, financial services firms can improve their profitability by targeting the right customers, maintaining good customer relationships, enhancing the share of wallet, and reducing the cost of customer acquisition/retention.

The BDAC in the organization must determine the extent to which analytics will help improve a customer’s experience, reducing the dissonance in a customer’s mind about competing for brand choices in financial services that build customer loyalty. Financial services organizations should integrate the data from external and internal sources to facilitate high-value analyses. Financial services organizations need to optimize the analytics requirements to map out the scope of use across various customer and marketing processes. Significant BDAC may offer a unique advantage over competitors that could improve the existing marketing and operational performance by providing valuable insights.

From the organizational perspective of big data analytics, the banks may treat big data as an asset in decision making. Financial organizations should start with segmentation to build a comprehensive view of existing customers, as all targeting decisions are based on insights derived from segmentation. For example, a large bank can build a strategic segmentation model to capture its customers’ changing financial outlooks and design a new value proposition and prospect marketing program. Banks should use lead management techniques to score potential customers and focus acquisition efforts on those with high values. They can leverage knowledge from electronic networks through data from other organizations, customers, and workers to improve their business performance (

Aziz and Omar 2013).

BDA is related to demand generation, and it not only increases conversion rates but also reduces direct marketing costs. Banks that issue credit cards can route their inbound calls to the authorized agent or outsource a call centre to create a customized experience for each caller, which assists in conversion rates and revenue through increased call-centre productivity. Bank marketers should reduce the costs of mailing and outbound marketing campaigns through acquisition modelling that will produce the likelihood of response in attracting potential customers and increasing long-term customer profitability simultaneously. For example, a bank could monitor and inspect customer feedback from various sources, such as call centre comments, user-generated content (e.g., social media), and firm-generated content (e.g., bank website) to improve their products and services.

5. Conclusions

With ever-changing and expanding customer expectations and high competition in the financial services sector, financial services organizations should not ignore the untapped amount of big data they have (e.g., users of ATMs, account holders, mobile banking users, social media users) whereby banks should leverage the existing and new data sets to maximize customer understanding and gain a competitive advantage. Big data analytics drives the pattern analysis for prediction, supports automatization of organizational processes, creates opportunities, and generates value for the organization through exploiting various capabilities in developing knowledge (

Gupta and George 2016).

This study extends the literature from its conceptualization by emphasizing the lack of theoretically grounded evidence of the prominent data analytics roles in business performance, particularly in a financial services organization. The results will enable practitioners and academics from various areas, such as business and marketing e-commerce-related research, to further develop a shared understanding of big data analytics roles that will benefit the service industry. Thus, the study’s findings advance the business and management literature on technology assimilation in organizations based on the resource-based view and the dynamic capability view on the Malaysian banks as the foundation for services organizations. Therefore, the research focus and the findings from these Malaysian financial organizations may bring new insights to advance related theories.

6. Limitations and Future Research

Like any other research, this study has some limitations, even though it does provide a foundation for further investigation on BDAC in the services sector. First, the current research is limited to the financial services organizations based in Malaysia. There may be considerable differences across industries and countries. Thus, generalizing the findings of the research should be carried out with care. Future research should further validate this study’s findings empirically in different sectors and countries. Furthermore, future studies are advised to make comparisons for similarities and differences, which could further improve our understanding of BDAC’s role on firm performance. Second, this research collected data from bank managers through a self-administered questionnaire, and the collected data only reflects respondents’ perceptions. Future studies should also consider objective data, such as financial statements, to examine the effects of BDAC on firm performance. Thirdly, the dimensions of BDAC identified by this study are neither exhaustive nor complete, and other elements should be considered. Therefore, more in-depth research is needed.

Author Contributions

Conceptualization, N.A.A. and F.L.; methodology, N.A.A. and F.L.; software, F.L.; validation, N.A.A., F.L. and W.M.H.W.H.; formal analysis, F.L.; investigation, N.A.A. and F.L.; resources, N.A.A. and F.L.; data curation, N.A.A.; writing—original draft preparation, F.L.; writing—review and editing, W.M.H.W.H.; visualization, F.L.; supervision, N.A.A.; project administration, N.A.A.; funding acquisition, N.A.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by [RHB-UKM Endowment] grant number [RHB-UKM-2020-002] And The APC was funded by [RHB-UKM Endowment]. Information regarding the funder and the funding number should be provided. Please check the accuracy of funding data and any other information carefully.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abbott, Dean. 2014. Applied Predictive Analytics: Principles and Techniques for the Professional Data Analyst. Hoboken: John Wiley & Sons. [Google Scholar]

- Akter, Shahriar, Samuel Fosso Wamba, Angappa Gunasekaran, Rameshwar Dubey, and Stephen J. Childe. 2016. How to improve firm performance using big data analytics capability and business strategy alignment? International Journal of Production Economics 182: 113–31. [Google Scholar] [CrossRef]

- Appelbaum, Deniz, Alexander Kogan, Miklos Vasarhelyi, and Zhaokai Yan. 2017. Impact of business analytics and enterprise systems on managerial accounting. International Journal of Accounting Information Systems 25: 29–44. [Google Scholar] [CrossRef]

- Aragón-Correa, J. Alberto, and Sanjay Sharma. 2003. A contingent resource-based view of proactive corporate environmental strategy. Academy of Management Review 28: 71–88. [Google Scholar] [CrossRef]

- Aziz, Norzalita Abd. 2018. The Influence of Coproduction Factors & Corporate Image Toward Attitudinal Loyalty: Islamic Financial Banking Services Delivery in Malaysia. Journal of Islamic Marketing 9: 421–38. [Google Scholar]

- Aziz, Norzalita Abd, and Nor Asiah Omar. 2013. Exploring the effect of Internet Marketing Orientation, Learning Orientation and Market Orientation on Innovativeness and Performance. Journal of Business Economic & Management 14: S257–78. [Google Scholar]

- Barney, Jay. 1991. Firm Resources and Sustained Competitive Advantage. Journal of Management 17: 99–120. [Google Scholar] [CrossRef]

- Behl, Abhishe, Jighyasu Gaur, Vijay Pereira, Rambalak Yadav, and Benjamin Laker. 2022. Role of big data analytics capabilities to improve sustainable competitive advantage of MSME service firms during COVID-19—A multi-theoretical approach. Journal of Business Research 148: 378–89. [Google Scholar] [CrossRef]

- Brandon-Jones, Emma, Brian Squire, Chad W. Autry, and Kenneth J. Petersen. 2014. A contingent resource-based perspective of supply chain resilience and robustness. Journal of Supply Chain Management 50: 55–73. [Google Scholar] [CrossRef]

- Chin, Wynne W. 1998. Issues and Opinion on Structural Equation Modeling. MIS Quarterly 22: 7–16. [Google Scholar]

- Ciampi, Francesco, Giacomo Marzi, Stefano Demi, and Monica Faraoni. 2020. The big data-business strategy interconnection: A grand challenge for knowledge management. A review and future perspectives. Journal of Knowledge Management 24: 1157–76. [Google Scholar] [CrossRef]

- Ciampi, Francesco, Stefano Demi, Alessandro Magrini, Giacomo Marzi, and Armando Papa. 2021. Exploring the impact of big data analytics capabilities on business model innovation: The mediating role of entrepreneurial orientation. Journal of Business Research 123: 1–13. [Google Scholar] [CrossRef]

- Cohen, Jacob. 1988. Statistical Power Analysis for the Behavioral Sciences, 2nd ed. New York: Lawrence Erlbaum Associates. [Google Scholar]

- DeLone, William H., and Ephraim R. McLean. 2003. The DeLone and McLean model of information systems success: A ten-year update. Journal of Management Information Systems 19: 9–30. [Google Scholar]

- Doh, Jonathan P., Fred Luthans, and John Slocum. 2016. The world of global business 1965–2015: Perspectives on the 50th anniversary issue of the Journal of World Business: Introduction to the special issue. Journal of World Business 50: 1–5. [Google Scholar] [CrossRef]

- Erevelles, Sunil, Nobuyuki Fukawa, and Linda Swayne. 2015. Big data consumer analytics and the transformation of marketing. Journal of Business Research 69: 897–904. [Google Scholar] [CrossRef]

- Gannon, Martin, S. Mostafa Rasoolimanesh, and Babak Taheri. 2021. Assessing the mediating role of residents’ perceptions toward tourism development. Journal of Travel Research 60: 149–71. [Google Scholar] [CrossRef]

- George, Gerard, Ernst C. Osinga, Dovev Lavie, and Brent A. Scott. 2016. Big data and data science methods for management research. Academy of Management Journal 59: 1493–507. [Google Scholar] [CrossRef]

- Goasduff, L. 2021. Gartner Says 70% of Organizations Will Shift Their Focus from Big to Small and Wide Data by 2025. Gartner. Available online: https://aibots.my/officialBlog/gartner-says-70-of-organizations-will-shift-their-focus-from-big-to-small-and-wide-data-by-2025/ (accessed on 15 December 2021).

- Gold, Andrew H., Arvind Malhotra, and Albert H. Segars. 2001. Knowledge management: An organizational capabilities perspective. Journal of Management Information Systems 18: 185–214. [Google Scholar] [CrossRef]

- Gunasekaran, Angappa, Thanos Papadopoulos, Rameshwar Dubey, Samuel Fosso Wamba, Stephen J. Childe, Benjamin Hazen, and Shahriar Akter. 2017. Big data and predictive analytics for supply chain and organisational performance. Journal of Business Research 70: 308–17. [Google Scholar] [CrossRef]

- Gupta, Manjul, and Joey F. George. 2016. Toward the development of a big data analytics capability. Information and Management 53: 1049–64. [Google Scholar] [CrossRef]

- Gupta, Shivam, Xiaoyan Qian, Bharat Bhushan, and Zongwei Luo. 2018. Role of cloud ERP and big data on firm performance: A dynamic capability view theory perspective. Management Decision 57: 1857–82. [Google Scholar] [CrossRef]

- Hair, Joseph F., G. Tomas M. Hult, Christian M. Ringle, and Marko Sarstedt. 2021. A Primer on Partial Least Squares Structural Equation Modeling. Thousand Oaks: Sage. [Google Scholar]

- Hair, Joseph F., Jeffrey J. Risher, Marko Sarstedt, and Christian M. Ringle. 2019. When to use and how to report the results of PLS-SEM. European Business Review 31: 2–24. [Google Scholar] [CrossRef]

- Henseler, Jörg, Theo K. Dijkstra, Marko Sarstedt, Christian M. Ringle, Adamantios Diamantopoulos, Detmar W. Straub, David J. Ketchen, Jr., Joseph F. Hair, G. Tomas M. Hult, and Roger J. Calantone. 2014. Common beliefs and reality about PLS: Comments on Rönkkö and Evermann 2015. Organizational Research Methods 17: 182–209. [Google Scholar] [CrossRef]

- Jeble, Shirish, Rameshwar Dubey, Stephen J. Childe, Thanos Papadopoulos, David Roubaud, and Anand Prakash. 2018. Impact of big data and predictive analytics capability on supply chain sustainability. International Journal of Logistics Management 29: 513–38. [Google Scholar] [CrossRef]

- Kim, Youngok, and Steven S. Lui. 2015. The impacts of external network and business group on innovation: Do the types of innovation matter? Journal of Business Research 68: 1964–73. [Google Scholar] [CrossRef]

- Kiron, David, Pamela Kirk Prentice, and Renee Bocher Ferguson. 2014. The analytics mandate. MIT Sloan Management Review 55: 1–25. [Google Scholar]

- Leung, Ka Ho, Chiung Chug Luk, King Lun Choy, Hoi Yan Lam, and Ka Man Lee. 2019. A B2B flexible pricing decision support system for managing the request for quotation process under ecommerce business environment. International Journal of Production Research 57: 6528–51. [Google Scholar] [CrossRef]

- Liu, Huiming, Su Wu, Chongwen Zhong, and Ying Liu. 2020. The sustainable effect of operational performance on financial benefits: Evidence from chinese quality awards winners. Sustainability 12: 1966. [Google Scholar] [CrossRef]

- Liu, Ying. 2014. Big data and predictive business analytics. The Journal of Business Forecasting 33: 40–42. [Google Scholar]

- Manyika, James, Michael Chui, Brad Brown, Jacques Bughin, Richard Dobbs, Roxburgh Charles, and Angela Hung Byers. 2011. Big Data: The Next Frontier for Innovation, Competition, and Productivity. McKinsey Global Institute. Available online: https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/big-data-the-next-frontier-for-innovation (accessed on 15 December 2021).

- McDermott, Christopher M., and Daniel Prajogo. 2012. Service innovation and performance in SMEs. International Journal of Operations & Production Management 32: 216–37. [Google Scholar]

- Meire, Matthiijs, Michel Ballings, and Dirk Van den Poel. 2017. The added value of social media data in B2B customer acquisition systems: A real-life experiment. Decision Support Systems 104: 26–37. [Google Scholar] [CrossRef]

- Mikalef, Patrick, Maria Boura, George Lekakos, and John Krogstie. 2019. Big data analytics capabilities and innovation: The mediating role of dynamic capabilities and moderating effect of the environment. British Journal of Management 30: 272–98. [Google Scholar] [CrossRef]

- Nair, Smitha R., Mehmet Demirbag, Kamel Mellahi, and Kishore Gopalakrishna Pillai. 2018. Do parent units benefit from reverse knowledge transfer? British Journal of Management 29: 428–44. [Google Scholar] [CrossRef]

- Nelson, Ryan R., Petter A. Todd, and Barbara H. Wixom. 2005. Antecedents of information and system quality: An empirical examination within the context of data warehousing. Journal of Management Information Systems 21: 199–235. [Google Scholar] [CrossRef]

- Pappas, Ilias O., Patrick Mikalef, Michail Giannakos, John Krogstie, and George Lekakos. 2018. Big data and business analytics ecosystems: Paving the way towards digital transformation and sustainable societies. Information Systems and e-Business Management 16: 479–91. [Google Scholar] [CrossRef]

- Podsakoff, Philip M., Scott B. MacKenzie, and Nathan P. Podsakoff. 2012. Sources of method bias in social science research and recommendations on how to control it. Annual Review of Psychology 63: 539–69. [Google Scholar] [CrossRef]

- Rai, Arun, Ravi Patnayakuni, and Nainika Seth. 2006. Firm Performance Impacts of Digitally Enabled Supply Chain Integration Capabilities. Managerial MIS Quarterly 30: 226–46. [Google Scholar] [CrossRef]

- Ram, Jiwat, and Zeyang Zhang. 2022. Examining the needs to adopt big data analytic in B2B organizations: Development of proposition ad model needs. Journal of Business & Industrial Marketing 37: 790–809. [Google Scholar]

- Ransbotham, Sam, David Kiron, and Pamela Kirk Prentice. 2016. Beyond the hype: The hard work behind analytics success. MIT Sloan Management Review 57: 1–19. [Google Scholar]

- Richard, Pierre J., Timothy M. Devinney, George S. Yip, and Gerry Johnson. 2009. Measuring organizational performance: Towards methodological best practice. Journal of Management 35: 718–804. [Google Scholar] [CrossRef]

- Sivarajah, Uthayasankar, Zahitr Irani, Suraksha Gupta, and Kamaran Mahroof. 2020. Role of big data and social media analytics for business to business sustainability: A participatory web context. Industrial Marketing Management 86: 163–79. [Google Scholar] [CrossRef]

- Srinivasan, Ashwin, and Bryan Kurey. 2014. Creating a culture of quality. Harvard Business Review 92: 23–25. [Google Scholar]

- Stylos, Nikolaos, Jeremy Zwiegelaar, and Dimitrios Buhalis. 2021. Big data empowered agility for dynamic, volatile, and time-sensitive service industries: The case of tourism sector. International Journal of Contemporary Hospitality Management 33: 1015–36. [Google Scholar] [CrossRef]

- Su, Xiaofeng, Weipeng Zeng, Manhua Zheng, Xiaoli Jiang, Wenhe Lin, and Anxin Xu. 2022. Big data analytics capabilities and organizational performance: The mediating effect of dual innovations. European Journal of Innovation Management 25: 1142–60. [Google Scholar] [CrossRef]

- Tan, Kim Hua, YuanZhu Zhan, Guojun Ji, Fei Ye, and Chingter Chang. 2015. Harvesting big data to enhance supply chain innovation capabilities: An analytic infrastructure based on deduction graph. International Journal of Production Economics 165: 223–33. [Google Scholar] [CrossRef]

- Troisi, Orlando, Gennaro Maione, Mara Grimaldi, and Francesca Loia. 2020. Growth hacking: Insights on data-driven decision-making from three firms. Industrial Marketing Management 90: 538–57. [Google Scholar] [CrossRef]

- Upadhyay, Yogesh, and Ruturaj Baber. 2013. Market orientation and organizational performance in tourism and travel industry. Journal of Business and Management 10: 17–27. [Google Scholar]

- Wamba, Samuel Fosso, Angappa Gunasekaran, Shahriar Akter, Steven Ji-fan Ren, Rameshawar Dubey, and Stephen J. Childe. 2017. Big data analytics and firm performance: Effects of dynamic capabilities. Journal of Business Research 70: 356–65. [Google Scholar] [CrossRef]

- Wang, Gang, Angappa Gunasekaran, Eric W. T. Ngai, and Thanos Papadopoulos. 2016. Big Data analytics in logistics and supply chain management: Certain investigations for research and applications. International Journal of Production Economics 176: 98–110. [Google Scholar] [CrossRef]

- Wang, William Yu Chung, and Yichuan Wang. 2020. Analytics in the era of big data: The digital transformations, management revolution, and value creation. Industrial Marketing Management 86: 12–15. [Google Scholar] [CrossRef]

- Wang, Yula, Stein W. Wallace, Bin Shen, and Tsan Ming Choi. 2015. Service supply chain management: A review of operational models. European Journal of Operational Research 247: 685–98. [Google Scholar] [CrossRef]

- Watson, George F., IV, Scott Weaven, Helen Perkins, Deepak Sardana, and Robert W. Palmatier. 2018. International market entry strategies: Relational, digital, and hybrid approaches. Journal of International Marketing 26: 30–60. [Google Scholar] [CrossRef]

- Wixom, Barbara H., and Pater A. Todd. 2005. A theoretical integration of user satisfaction and technology acceptance. Information Systems Research 16: 85–102. [Google Scholar] [CrossRef]

- Zheng, L., and H. Zhou. 2019. Firm’s big data capability: A literature review and prospects. Science and Technology Progress and Policy 36: 153–60. [Google Scholar]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).