Examining the Factors Affecting the Adoption of Blockchain Technology in the Banking Sector: An Extended UTAUT Model

Abstract

:1. Introduction

1.1. Blockchain and Banking

1.2. Technology Adaption Model

2. Literature Review

3. Theoretical Ground

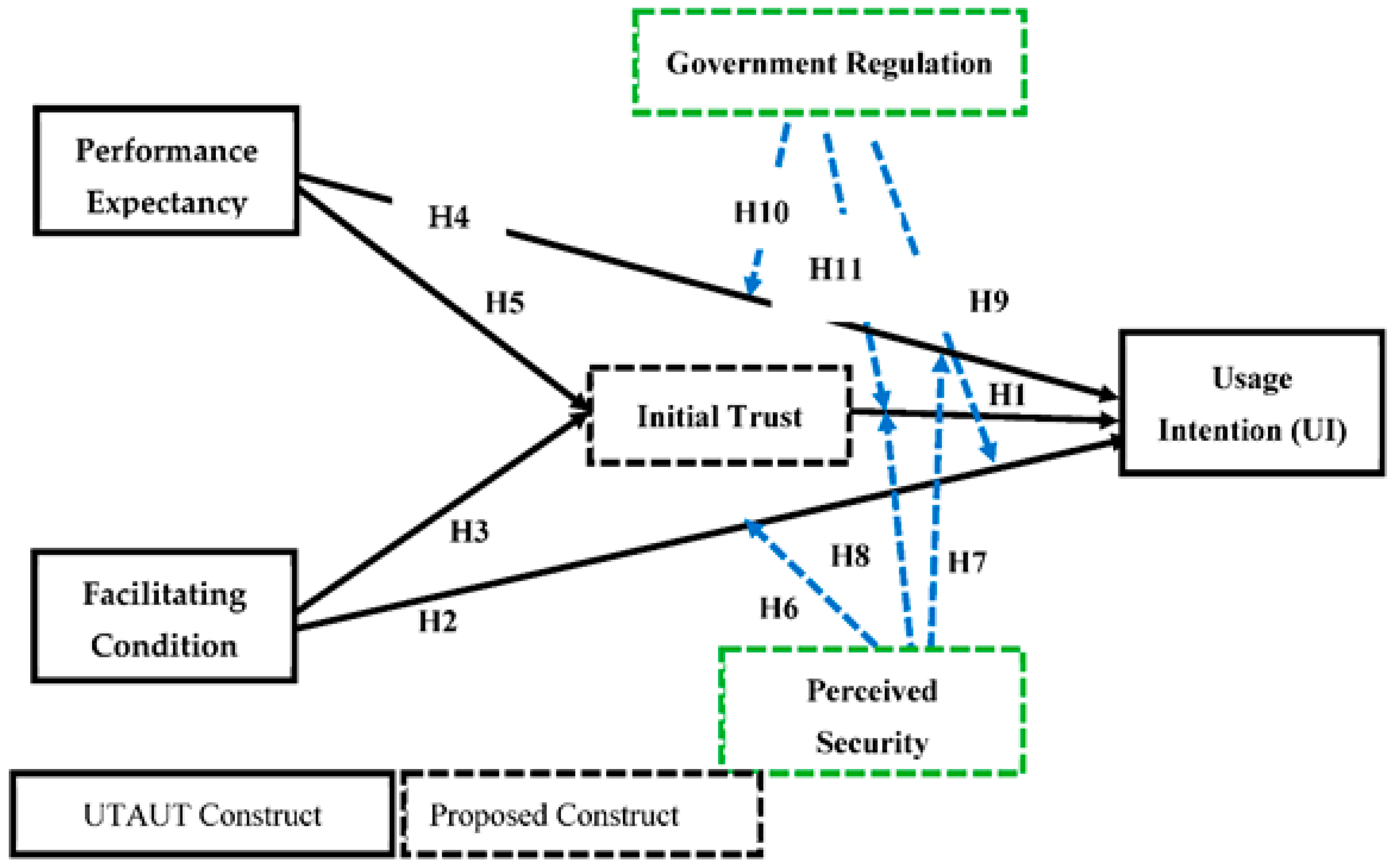

3.1. Hypothesis Development

- Usage Intention (UI)

- Initial Trust (ITR)

- Facilitating Conditions (FC)

- Performance Expectancy (PE)

3.1.1. Moderating Variables

- Perceived Risk (PR)

- Government Regulation (GR)

3.1.2. Mediating Variable

4. Research Methodology

4.1. Study Instrument

4.2. Participants

5. Results and Analysis

- The Nonresponse Bias Test

- The Common-Method Variance Test

5.1. Evaluation of Measurement Models

5.2. Model Assessment

5.2.1. Mediation Effect

5.2.2. Moderation Effect

6. Discussion

6.1. Study Implication

6.1.1. Theoretical Implications

6.1.2. Implications for Practice

7. Limitations and Future Research

8. Conclusions

Supplementary Materials

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | https://bfsi.economictimes.indiatimes.com/news/banking/how-indian-banks-are-leveraging-blockchain-technology/88027231 (assessed on 17 August 2022). |

References

- Ahmed, Rizwan Raheem, Dalia Štreimikienė, and Justas Štreimikis. 2022a. The extended UTAUT model and learning management system during COVID-19: Evidence from PLS-SEM and conditional process modeling. Journal of Business Economics and Management 23: 82–104. [Google Scholar] [CrossRef]

- Ahmed, Shamima, Muneer M. Alshater, Anis El Ammari, and Helmi Hammami. 2022b. Artificial intelligence and machine learning in finance: A bibliometric review. Research in International Business and Finance 61: 101646. [Google Scholar] [CrossRef]

- Ajzen, Icek. 1985. From intentions to actions: A theory of planned behavior. In Action Control. Berlin: Springer, pp. 11–39. [Google Scholar]

- Akhtar, Sadia, Muhammad Irfan, Shamsa Kanwal, and Abdul Hameed Pitafi. 2019. Analysing UTAUT with trust toward mobile banking adoption in China and Pakistan: Extending with the effect of power distance and uncertainty avoidance. International Journal of Financial Innovation in Banking 2: 183–207. [Google Scholar] [CrossRef]

- Aljaafreh, Ali. 2021. Why Students Use Social Networks for Education: Extension of Utaut2. Journal of Technology and Science Education 11: 53–66. [Google Scholar]

- Almisad, Budour, and Monirah Alsalim. 2020. Kuwaiti female university students’ acceptance of the integration of smartphones in their learning: An investigation guided by a modified version of the unified theory of acceptance and use of technology (UTAUT). International Journal of Technology Enhanced Learning 12: 1–19. [Google Scholar] [CrossRef]

- Alolah, Turki, Rodney A. Stewart, Kriengsak Panuwatwanich, and Sherif Mohamed. 2014. Determining the causal relationships among balanced scorecard perspectives on school safety performance: Case of Saudi Arabia. Accident Analysis & Prevention 68: 57–74. [Google Scholar]

- Armstrong, J. Scott, and Terry S. Overton. 1977. Estimating nonresponse bias in mail surveys. Journal of Marketing Research 14: 396–402. [Google Scholar] [CrossRef]

- Ayaz, A., and Mustafa Yanartaş. 2020. An analysis on the unified theory of acceptance and use of technology theory (UTAUT): Acceptance of electronic document management system (EDMS). Computers in Human Behavior Reports 2: 100032. [Google Scholar] [CrossRef]

- Bagozzi, Richard P., and Youjae Yi. 2012. Specification, evaluation, and interpretation of structural equation models. Journal of the Academy of Marketing Science 40: 8–34. [Google Scholar] [CrossRef]

- Bianchi, Emily C., and Joel Brockner. 2012. In the eyes of the beholder? The role of dispositional trust in judgments of procedural and interactional fairness. Organizational Behavior and Human Decision Processes 118: 46–59. [Google Scholar] [CrossRef]

- Boomsma, Anne, and Jeffrey J. Hoogland. 2001. The robustness of LISREL modeling revisited. Structural Equation Models: Present and Future. A Festschrift in Honor of Karl Jöreskog 2: 139–68. [Google Scholar]

- Bunea, Daniela, Polychronis Karakitsos, Niall Merriman, and Werner Studener. 2016. Profit distribution and loss coverage rules for central banks. ECB Occasional Paper 169: 1–56. [Google Scholar] [CrossRef]

- Burda, Daniel, and Frank Teuteberg. 2014. The role of trust and risk perceptions in cloud archiving—Results from an empirical study. The Journal of High Technology Management Research 25: 172–87. [Google Scholar] [CrossRef]

- Casey, Tristan, and Elisabeth Wilson-Evered. 2012. Predicting uptake of technology innovations in online family dispute resolution services: An application and extension of the UTAUT. Computers in Human Behavior 28: 2034–45. [Google Scholar] [CrossRef]

- Chang, Hsin Hsin, and Su Wen Chen. 2008. The impact of online store environment cues on purchase intention: Trust and perceived risk as a mediator. Online Information Review 32: 818–41. [Google Scholar] [CrossRef]

- Chang, Victor, Patricia Baudier, Hui Zhang, Qianwen Xu, Jingqi Zhang, and Mitra Arami. 2020. How Blockchain can impact financial services–The overview, challenges and recommendations from expert interviewees. Technological Forecasting and Social Change 158: 120166. [Google Scholar] [CrossRef] [PubMed]

- Chao, Cheng-Min. 2019. Factors determining the behavioral intention to use mobile learning: An application and extension of the UTAUT model. Frontiers in Psychology 10: 1652. [Google Scholar] [CrossRef]

- Chaouali, Walid, Imene Ben Yahia, and Nizar Souiden. 2016. The interplay of counter-conformity motivation, social influence, and trust in customers’ intention to adopt Internet banking services: The case of an emerging country. Journal of Retailing and Consumer Services 28: 209–18. [Google Scholar] [CrossRef]

- Cheng, Ritchie Jay. 2020. UTAUT implementation of cryptocurrency-based Islamic financing instrument. International Journal of Academic Research in Business and Social Sciences 10: 873–84. [Google Scholar] [CrossRef]

- Creswell, John W., and J. David Creswell. 2017. Research Design: Qualitative, Quantitative, and Mixed Methods Approaches. Thousand Oaks: Sage Publications. [Google Scholar]

- Cucari, Nicola, Valentina Lagasio, Giuseppe Lia, and Chiara Torrier. 2022. The impact of blockchain in banking processes: The Interbank Spunta case study. Technology Analysis & Strategic Management 34: 138–50. [Google Scholar]

- Davis, Fred D. 1987. User Acceptance of Information Systems: The Technology Acceptance Model (TAM). Ann Arbor: University of Michigan. [Google Scholar]

- Domingo, Marta Gómez, and Antoni Badia Garganté. 2016. Exploring the use of educational technology in primary education: Teachers’ perception of mobile technology learning impacts and applications’ use in the classroom. Computers in Human Behavior 56: 21–28. [Google Scholar] [CrossRef]

- Dwivedi, Yogesh K., Elvira Ismagilova, Prianka Sarker, Anand Jeyaraj, Yassine Jadil, and Laurie Hughes. 2021. A meta-analytic structural equation model for understanding social commerce adoption. Information Systems Frontiers 2021: 1–17. [Google Scholar] [CrossRef]

- Dwivedi, Yogesh K., Nripendra P. Rana, Anand Jeyaraj, Marc Clement, and Michael D. Williams. 2019. Re-examining the unified theory of acceptance and use of technology (UTAUT): Towards a revised theoretical model. Information Systems Frontiers 21: 719–34. [Google Scholar] [CrossRef]

- Falk, R. Frank, and Nancy B. Miller. 1992. A Primer for Soft Modeling. Akron: University of Akron Press. [Google Scholar]

- Fishbein, Martin, and Icek Ajzen. 1977. Belief, attitude, intention, and behavior: An introduction to theory and research. Philosophy and Rhetoric 10: 177–88. [Google Scholar]

- Fornell, Claes, and David F. Larcker. 1981. Structural Equation Models with Unobservable Variables and Measurement Error: Algebra and Statistics. Los Angeles: Sage Publications. [Google Scholar]

- Frame, W. Scott, Larry D. Wall, and Lawrence J. White. 2018. Technological Change and Financial Innovation in Banking: Some Implications for Fintech. Available online: https://ssrn.com/abstract=3261732 (accessed on 3 March 2022).

- Franch-Pardo, Ivan, Brian M. Napoletano, Fernando Rosete-Verges, and Lawal Billa. 2020. Spatial analysis and GIS in the study of COVID-19. A review. Science of the Total Environment 739: 140033. [Google Scholar] [CrossRef]

- Franque, Frank Bivar, Tiago Oliveira, and Carlos Tam. 2022. Continuance intention of mobile payment: TTF model with Trust in an African context. Information Systems Frontiers 2022: 1–19. [Google Scholar] [CrossRef]

- Ghazizadeh, Mahtab, Yiyun Peng, John D. Lee, and Linda Ng Boyle. 2012. Augmenting the technology acceptance model with trust: Commercial drivers’ attitudes towards monitoring and feedback. Proceedings of the Human Factors and Ergonomics Society Annual Meeting 56: 2286–90. [Google Scholar] [CrossRef]

- Giovannini, Cristiane Junqueira, Jorge Brantes Ferreira, Jorge Ferreira da Silva, and Daniel Brantes Ferreira. 2015. The effects of trust transference, mobile attributes and enjoyment on mobile trust. BAR-Brazilian Administration Review 12: 88–108. [Google Scholar] [CrossRef]

- Gupta, Abhishek, and Stuti Gupta. 2018. Blockchain technology: Application in Indian banking sector. Delhi Business Review 19: 75–84. [Google Scholar] [CrossRef]

- Gupta, Somya, Wafa Ghardallou, Dharen Kumar Pandey, and Ganesh P. Sahu. 2022. Artificial intelligence adoption in the insurance industry: Evidence using the technology–organization–environment framework. Research in International Business and Finance 5: 101757. [Google Scholar] [CrossRef]

- Haferkorn, Martin, and Josué Manuel Quintana Diaz. 2014. Seasonality and interconnectivity within cryptocurrencies-an analysis on the basis of bitcoin, litecoin and namecoin. International Workshop on Enterprise Applications and Services in the Finance Industry 217: 106–20. [Google Scholar]

- Hair, Joe F., Jr., Lucy M. Matthews, Ryan L. Matthews, and Marko Sarstedt. 2017. PLS-SEM or CB-SEM: Updated guidelines on which method to use. International Journal of Multivariate Data Analysis 1: 107–23. [Google Scholar] [CrossRef]

- Hair, Joseph F., David J. Ortinau, and Dana E. Harrison. 2010. Essentials of Marketing Research. New York: McGraw-Hill/Irwin, vol. 2. [Google Scholar]

- Hair, Joseph F., Jr., G. Tomas M. Hult, Christian M. Ringle, and Marko Sarstedt. 2016. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). Thousand Oaks: Sage Publications. [Google Scholar]

- Han, Jeonghye, and Daniela Conti. 2020. The use of UTAUT and post acceptance models to investigate the attitude towards a telepresence robot in an educational setting. Robotics 9: 34. [Google Scholar] [CrossRef]

- Harman, Harry H. 1976. Modern Factor Analysis. Chicago: University of Chicago Press. [Google Scholar]

- Harwood-Jones, Margaret. 2016. Blockchain and T2S: A Potential Disruptor. London: Standard Chartered Bank. [Google Scholar]

- Heidari, Hamed, Morteza Mousakhani, Mahmood Alborzi, Ali Divandari, and Reza Radfar. 2019. Explaining the Blockchain Acceptance Indices in Iran Financial Markets: A Fuzzy Delphi Study. Journal of Money and Economy 14: 335–65. [Google Scholar]

- Hew, Teck-Soon, and Sharifah Latifah Syed Abdul Kadir. 2016. Predicting instructional effectiveness of cloud-based virtual learning environment. Industrial Management & Data Systems 116: 1557–84. [Google Scholar]

- Hmoud, Bilal Ibrahim, and László Várallyai. 2020. Artificial intelligence in human resources information systems: Investigating its trust and adoption determinants. International Journal of Engineering and Management Sciences 5: 749–65. [Google Scholar] [CrossRef]

- Jena, R. K. 2022. Exploring Antecedents of Peoples’ Intentions to Use Smart Services in a Smart City Environment: An Extended UTAUT Model. Journal of Information Systems 36: 133–49. [Google Scholar] [CrossRef]

- Jevsikova, Tatjana, Gabrielė Stupurienė, Dovilė Stumbrienė, Anita Juškevičienė, and Valentina Dagienė. 2021. Acceptance of distance learning technologies by teachers: Determining factors and emergency state influence. Informatica 32: 517–42. [Google Scholar] [CrossRef]

- Karim, Sitara, Mustafa Raza Rabbani, and Hana Bawazir. 2022. Applications of blockchain technology in the finance and banking industry beyond digital currencies. In Blockchain Technology and Computational Excellence for Society 5.0. Hershey: IGI Global, pp. 216–38. [Google Scholar]

- Kawasmi, Zaina, Evans Akwasi Gyasi, and Deneise Dadd. 2020. Blockchain adoption model for the global banking industry. Journal of International Technology and Information Management 28: 112–54. [Google Scholar]

- Khalil, Mahmoona, Kausar Fiaz Khawaja, and Muddassar Sarfraz. 2021. The adoption of blockchain technology in the financial sector during the era of fourth industrial revolution: A moderated mediated model. Quality & Quantity 56: 2435–52. [Google Scholar]

- Kim, Kyung Kyu, and Bipin Prabhakar. 2004. Initial trust and the adoption of B2C e-commerce: The case of internet banking. ACM SIGMIS Database: The DATABASE for Advances in Information Systems 35: 50–64. [Google Scholar] [CrossRef]

- Kim, Sanghyun, and Gary Garrison. 2009. Investigating mobile wireless technology adoption: An extension of the technology acceptance model. Information Systems Frontiers 11: 323–33. [Google Scholar] [CrossRef]

- Kopp, Tobias, Marco Baumgartner, and Steffen Kinkel. 2022. How Linguistic Framing Affects Factory Workers’ Initial Trust in Collaborative Robots: The Interplay Between Anthropomorphism and Technological Replacement. International Journal of Human-Computer Studies 158: 102730. [Google Scholar] [CrossRef]

- Koufaris, Marios, and William Hampton-Sosa. 2004. The development of initial trust in an online company by new customers. Information & Management 41: 377–97. [Google Scholar]

- Kumari, Anitha, and N. Chitra Devi. 2022a. Blockchain technology acceptance by investment professionals: A decomposed TPB model. Journal of Financial Reporting and Accounting, ahead-of-print. [Google Scholar]

- Kumari, Anitha, and N. Chitra Devi. 2022b. Determinants of user’s behavioural intention to use blockchain technology in the digital banking services. International Journal of Electronic Finance 11: 159–74. [Google Scholar] [CrossRef]

- Kumari, Anitha, and N. Chitra Devi. 2022c. The Impact of FinTech and Blockchain Technologies on Banking and Financial Services. Technology Innovation Management Review. Available online: https://timreview.ca/article/1481 (accessed on 13 June 2022).

- Lai, Horng-Ji. 2020. Investigating older adults’ decisions to use mobile devices for learning, based on the unified theory of acceptance and use of technology. Interactive Learning Environments 28: 890–901. [Google Scholar] [CrossRef]

- Lin, Iuon-Chang, and Tzu-Chun Liao. 2017. A survey of blockchain security issues and challenges. International Journal of Network Security 19: 653–59. [Google Scholar]

- Luo, Xin, Han Li, Jie Zhang, and Jung P. Shim. 2010. Examining multi-dimensional trust and multi-faceted risk in initial acceptance of emerging technologies: An empirical study of mobile banking services. Decision Support Systems 49: 222–34. [Google Scholar] [CrossRef]

- MacDonald, Trent J., Darcy WE Allen, and Jason Potts. 2016. Blockchains and the boundaries of self-organized economies: Predictions for the future of banking. In Banking beyond Banks and Money. Berlin: Springer, pp. 279–96. [Google Scholar]

- Manchon, J.-B., Mercedes Bueno, and Jordan Navarro. 2022. How the initial level of trust in automated driving impacts drivers’ behaviour and early trust construction. Transportation Research Part F: Traffic Psychology and Behaviour 86: 281–95. [Google Scholar] [CrossRef]

- Martins, Carolina, Tiago Oliveira, and Aleš Popovič. 2014. Understanding the Internet banking adoption: A unified theory of acceptance and use of technology and perceived risk application. International Journal of Information Management 34: 1–13. [Google Scholar] [CrossRef]

- Masrek, Mohamad Noorman, Intan Salwani Mohamed, Norzaidi Mohd Daud, and Normah Omar. 2014. Technology trust and mobile banking satisfaction: A case of Malaysian consumers. Procedia-Social and Behavioral Sciences 129: 53–58. [Google Scholar] [CrossRef]

- Nazim, Nur Firas, Nabiha Mohd Razis, and Mohammad Firdaus Mohammad Hatta. 2021. Behavioural intention to adopt blockchain technology among bankers in islamic financial system: Perspectives in Malaysia. Romanian Journal of Information Technology and Automatic Control 31: 11–28. [Google Scholar] [CrossRef]

- Neirotti, Paolo, Elisabetta Raguseo, and Emilio Paolucci. 2018. How SMEs develop ICT-based capabilities in response to their environment: Past evidence and implications for the uptake of the new ICT paradigm. Journal of Enterprise Information Management 31: 10–37. [Google Scholar] [CrossRef]

- Nguyen, Quoc Khanh. 2016. Blockchain-a financial technology for future sustainable development. Paper presented at 2016 3rd International Conference on Green Technology and Sustainable Development (GTSD), Kaohsiung, Taiwan, November 24–25; pp. 51–54. [Google Scholar]

- Oliveira, Tiago, Matilde Alhinho, Paulo Rita, and Gurpreet Dhillon. 2017. Modelling and testing consumer trust dimensions in e-commerce. Computers in Human Behavior 71: 153–64. [Google Scholar] [CrossRef]

- Oliveira, Tiago, Miguel Faria, Manoj Abraham Thomas, and Aleš Popovič. 2014. Extending the understanding of mobile banking adoption: When UTAUT meets TTF and ITM. International Journal of Information Management 34: 689–703. [Google Scholar] [CrossRef]

- Osmani, Mohamad, Ramzi El-Haddadeh, Nitham Hindi, Marijn Janssen, and Vishanth Weerakkody. 2020. Blockchain for next generation services in banking and finance: Cost, benefit, risk and opportunity analysis. Journal of Enterprise Information Management 34: 884–99. [Google Scholar] [CrossRef]

- Patel, Ritesh, Milena Migliavacca, and M. Oriani. 2022. Blockchain in banking and finance: A bibliometric review. Research in International Business and Finance 62: 101718. [Google Scholar] [CrossRef]

- Patki, Aarti, and Vinod Sople. 2020. Indian banking sector: Blockchain implementation, challenges and way forward. Journal of Banking and Financial Technology 4: 65–73. [Google Scholar] [CrossRef]

- Podsakoff, Philip M., Scott B. MacKenzie, Jeong-Yeon Lee, and Nathan P. Podsakoff. 2003. Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology 88: 879. [Google Scholar] [CrossRef]

- Raza, Syed A., Wasim Qazi, Komal Akram Khan, and Javeria Salam. 2021. Social isolation and acceptance of the learning management system (LMS) in the time of COVID-19 pandemic: An expansion of the UTAUT model. Journal of Educational Computing Research 59: 183–208. [Google Scholar] [CrossRef]

- Saheb, Tahereh, and Faranak Hosseinpouli Mamaghani. 2021. Exploring the barriers and organizational values of blockchain adoption in the banking industry. The Journal of High Technology Management Research 32: 100417. [Google Scholar] [CrossRef]

- Saputra, Upayana Wiguna Eka, and Gede Sri Darma. 2022. The Intention to Use Blockchain in Indonesia Using Extended Approach Technology Acceptance Model (TAM). CommIT (Communication and Information Technology) Journal 16: 27–35. [Google Scholar] [CrossRef]

- Schreiber, James B., Amaury Nora, Frances K. Stage, Elizabeth A. Barlow, and Jamie King. 2006. Reporting structural equation modeling and confirmatory factor analysis results: A review. The Journal of Educational Research 99: 323–38. [Google Scholar] [CrossRef]

- Stone, Mervyn. 1974. Cross-validatory choice and assessment of statistical predictions. Journal of the Royal Statistical Society: Series B (Methodological) 36: 111–33. [Google Scholar]

- Taherdoost, Hamed. 2017. Appraising the smart card technology adoption; case of application in university environment. Procedia Engineering 181: 1049–57. [Google Scholar] [CrossRef]

- Taherdoost, Hamed. 2018. A review of technology acceptance and adoption models and theories. Procedia Manufacturing 22: 960–67. [Google Scholar] [CrossRef]

- Taherdoost, Hamed. 2022. A Critical Review of Blockchain Acceptance Models—Blockchain Technology Adoption Frameworks and Applications. Computers 11: 24. [Google Scholar] [CrossRef]

- Tallon, Paul P. 2010. A service science perspective on strategic choice, IT, and performance in US banking. Journal of Management Information Systems 26: 219–52. [Google Scholar] [CrossRef]

- Tamilmani, Kuttimani, Nripendra P. Rana, and Yogesh K. Dwivedi. 2021. Consumer acceptance and use of information technology: A meta-analytic evaluation of UTAUT2. Information Systems Frontiers 23: 987–1005. [Google Scholar] [CrossRef]

- Tamilmani, Kuttimani, Nripendra P. Rana, Naveena Prakasam, and Yogesh K. Dwivedi. 2019. The battle of Brain vs. Heart: A literature review and meta-analysis of “hedonic motivation” use in UTAUT2. International Journal of Information Management 46: 222–35. [Google Scholar] [CrossRef]

- Tapscott, Don, and Alex Tapscott. 2016. Blockchain Revolution: How the Technology behind Bitcoin is Changing Money, Business, and the World. New York: Penguin. [Google Scholar]

- Thusi, Philile, and Daniel K. Maduku. 2020. South African millennials’ acceptance and use of retail mobile banking apps: An integrated perspective. Computers in Human Behavior 111: 106405. [Google Scholar] [CrossRef]

- Tornatzky, Louis G., Mitchell Fleischer, and Alok K. Chakrabarti. 1990. Processes of Technological Innovation. Lanham: Lexington Books. [Google Scholar]

- Tsang, Kwok Kuen, Yuan Teng, Yi Lian, and Li Wang. 2021. School management culture, emotional labor, and teacher burnout in Mainland China. Sustainability 13: 9141. [Google Scholar] [CrossRef]

- Venkatesh, Viswanath. 2022. Adoption and use of AI tools: A research agenda grounded in UTAUT. Annals of Operations Research 308: 641–52. [Google Scholar] [CrossRef]

- Venkatesh, Viswanath, James Y. L. Thong, and Xin Xu. 2012. Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS Quarterly 36: 157–78. [Google Scholar] [CrossRef]

- Venkatesh, Viswanath, James Y. L. Thong, and Xin Xu. 2016. Unified theory of acceptance and use of technology: A synthesis and the road ahead. Journal of the Association for Information Systems 17: 328–76. [Google Scholar] [CrossRef]

- Venkatesh, Viswanath, Michael G. Morris, Gordon B. Davis, and Fred D. Davis. 2003. User acceptance of information technology: Toward a unified view. MIS Quarterly 27: 425–78. [Google Scholar] [CrossRef]

- Vidan, Gili, and Vili Lehdonvirta. 2019. Mine the gap: Bitcoin and the maintenance of trustlessness. New Media & Society 21: 42–59. [Google Scholar]

- von Solms, Basie, and Rossouw von Solms. 2018. Cybersecurity and information security–what goes where? Information & Computer Security 26: 2–9. [Google Scholar]

- Wijaya, Dennis, Ermi Girsang, Sri Lestari Ramadhani, Sri Wahyuni Nasution, and Ulina Karo Karo. 2022. Influence Of Organizing Functions, Direction Functions And Planning Functions On Nurse Performance At Hospital Royal Prima Medan. International Journal of Health and Pharmaceutical (IJHP) 2: 1–8. [Google Scholar] [CrossRef]

- Williams, Michael D., Nripendra P. Rana, and Yogesh K. Dwivedi. 2015. The unified theory of acceptance and use of technology (UTAUT): A literature review. Journal of Enterprise Information Management 28: 443–88. [Google Scholar] [CrossRef]

- Wolf, Erika J., Kelly M. Harrington, Shaunna L. Clark, and Mark W. Miller. 2013. Sample size requirements for structural equation models: An evaluation of power, bias, and solution propriety. Educational and Psychological Measurement 73: 913–34. [Google Scholar] [CrossRef] [PubMed]

- Xie, Heng, Alsius David, Md Rasel Al Mamun, Victor R. Prybutok, and Anna Sidorova. 2022. The formation of initial trust by potential passengers of self-driving taxis. Journal of Decision Systems 2022: 1–30. [Google Scholar] [CrossRef]

- Yang, Cheng-Chia, Cheng Liu, and Yi-Shun Wang. 2022. The acceptance and use of smartphones among older adults: Differences in UTAUT determinants before and after training. Library Hi Tech, ahead-of-print. [Google Scholar]

- Yusof, Hayati, M. F. M. B. Munir, Zulnurhaini Zolkaply, Chin Li Jing, Chooi Yu Hao, Ding Swee Ying, Lee Seang Zheng, Ling Yuh Seng, and Tan Kok Leong. 2018. Behavioral intention to adopt blockchain technology: Viewpoint of the banking institutions in Malaysia. International Journal of Advanced Scientific Research and Management 3: 274–79. [Google Scholar]

- Zahedi, Fatemeh, Jaeki Song, and Suprasith Jarupathirun. 2008. Web-based decision support. In Handbook on Decision Support Systems 1. Berlin: Springer, pp. 315–38. [Google Scholar]

- Zhou, Tao, Yaobin Lu, and Bin Wang. 2010. Integrating TTF and UTAUT to explain mobile banking user adoption. Computers in Human Behavior 26: 760–67. [Google Scholar] [CrossRef]

| Study | Model | Remarks |

|---|---|---|

| (Chang et al. 2020) | TPB | Financial services |

| (Kawasmi et al. 2020) | Modified TAM | Global banking |

| (Heidari et al. 2019) | Integration of TOE, DOI, and NIP models: | Financial markets |

| (Saheb and Mamaghani 2021) | Extending TOE factors | Banking |

| (Khalil et al. 2021) | A moderated mediated model | Financial sector |

| (Cheng 2020) | Basic UTAUT | Financial sector |

| (Yusof et al. 2018) | Basic UTAUT | Banking |

| (Kumari and Devi 2022a) | Decomposed theory of planned behavior (DTPB) model | Investment Banking |

| (Nazim et al. 2021) | Basic UTAUT and Technology-Organization-Environment (TOE) Framework | Banking |

| (Kumari and Devi 2022b) | Extended UTAUT model by financial literacy and perceived risk factors. | Digital banking |

| Construct | No of Items | Loading | Cronbach’ Alpha | AVE | CR |

|---|---|---|---|---|---|

| FC | 4 | 0.72–0.84 | 0.74 | 0.65 | 0.80 |

| PE | 3 | 0.66–0.81 | 0.71 | 0.62 | 0.77 |

| ITR | 4 | 0.71–0.77 | 0.73 | 0.64 | 0.79 |

| GR | 4 | 0.69–0.87 | 0.77 | 0.68 | 0.82 |

| PR | 3 | 0.72–0.87 | 0.76 | 0.66 | 0.79 |

| UI | 3 | 0.69–0.83 | 0.75 | 0.64 | 0.78 |

| Construct | Mean | SD | FC | PE | ITR | GR | PR | UI |

|---|---|---|---|---|---|---|---|---|

| FC | 3.44 | 0.05 | 0.80 | 0.82 | 0.79 | 0.89 | 0.82 | 0.81 |

| PE | 3.31 | 0.12 | 0.36 * | 0.79 | 0.74 | 0.79 | 0.83 | 0.80 |

| ITR | 3.21 | 0.09 | 0.33 * | 0.36 * | 0.80 | 0.79 | 0.78 | 0.74 |

| GR | 3.57 | 0.22 | 0.31 * | 0.32 * | 0.33 * | 0.82 | 0.86 | 0.87 |

| PR | 3.07 | 0.18 | 0.29 * | 0.25 * | 0.34 * | 0.42 * | 0.81 | 0.84 |

| UI | 3.15 | 0.26 | 0.32 * | 0.33 * | 0.39 * | 0.39 * | 0.37 * | 0.80 |

| Path | Indirect Effect | VAF | Mediation |

|---|---|---|---|

| PE→ITR→UI | 0.38 * | 0.92 | Full |

| FC→ITR→UI | 0.41 * | 0.93 | Full |

| Dependent Variable: Usage Intention (UI.) | Direct Effect | Direct + Interaction Effect |

|---|---|---|

| R2 | 0.71 | 0.69 |

| Adj. R2 | 0.71 | 0.68 |

| Performance Expectancy (PE) | 0.31 * | 0.29 * |

| Facilitating Condition (FC) | 0.41 * | 0.43 * |

| Trust (ITR) | 0.38 ** | 0.31 ** |

| Government Regulation (GR) | 0.29 ** | 0.33 ** |

| Perceived Risk (PR) | −0.19 * | −0.17 * |

| PE × GR | 0.22 * | |

| PE × PR | −0.24 ** | |

| PE × GR × PR | 0.01 | |

| FC × GR | 0.25 * | |

| FC × PR | 0.04 | |

| FC × GR × PR | 0.21 * | |

| ITR × GR | 0.37 * | |

| ITR × PR | 0.03 | |

| ITR × GR × PR | 0.11 |

| Hypothesis | Standard Beta (β) | T Statistics (t-Value) | Decision |

|---|---|---|---|

| H1 | 0.39 | 45.6 | S |

| H2 | 0.41 | −8.2 | S |

| H3 | 0.31 | 56.2 | S |

| H4 | 0.44 | 43.7 | S |

| H5 | 0.37 | 36.1 | S |

| H6 | −0.24 | 3.2 | S |

| H7 | 0.04 | −26.8 | NS |

| H8 | 0.03 | −4.3 | NS |

| H9 | 0.22 | 5.6 | S |

| H10 | 0.25 | 29.9 | S |

| H11 | 0.37 | 44.9 | S |

| H12 | 0.01 | 42.8 | NS |

| H13 | 0.21 | 6.2 | S |

| H14 | 0.03 | 24.9 | NS |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jena, R.K. Examining the Factors Affecting the Adoption of Blockchain Technology in the Banking Sector: An Extended UTAUT Model. Int. J. Financial Stud. 2022, 10, 90. https://doi.org/10.3390/ijfs10040090

Jena RK. Examining the Factors Affecting the Adoption of Blockchain Technology in the Banking Sector: An Extended UTAUT Model. International Journal of Financial Studies. 2022; 10(4):90. https://doi.org/10.3390/ijfs10040090

Chicago/Turabian StyleJena, Rabindra Kumar. 2022. "Examining the Factors Affecting the Adoption of Blockchain Technology in the Banking Sector: An Extended UTAUT Model" International Journal of Financial Studies 10, no. 4: 90. https://doi.org/10.3390/ijfs10040090

APA StyleJena, R. K. (2022). Examining the Factors Affecting the Adoption of Blockchain Technology in the Banking Sector: An Extended UTAUT Model. International Journal of Financial Studies, 10(4), 90. https://doi.org/10.3390/ijfs10040090