The Impact of Financial Literacy on Retirement Planning with Serial Mediation of Financial Risk Tolerance and Saving Behavior: Evidence of Medium Entrepreneurs in Indonesia

Abstract

1. Introduction

2. Literature Review

2.1. Prospect Theory

2.2. Theory of Planned Behavior

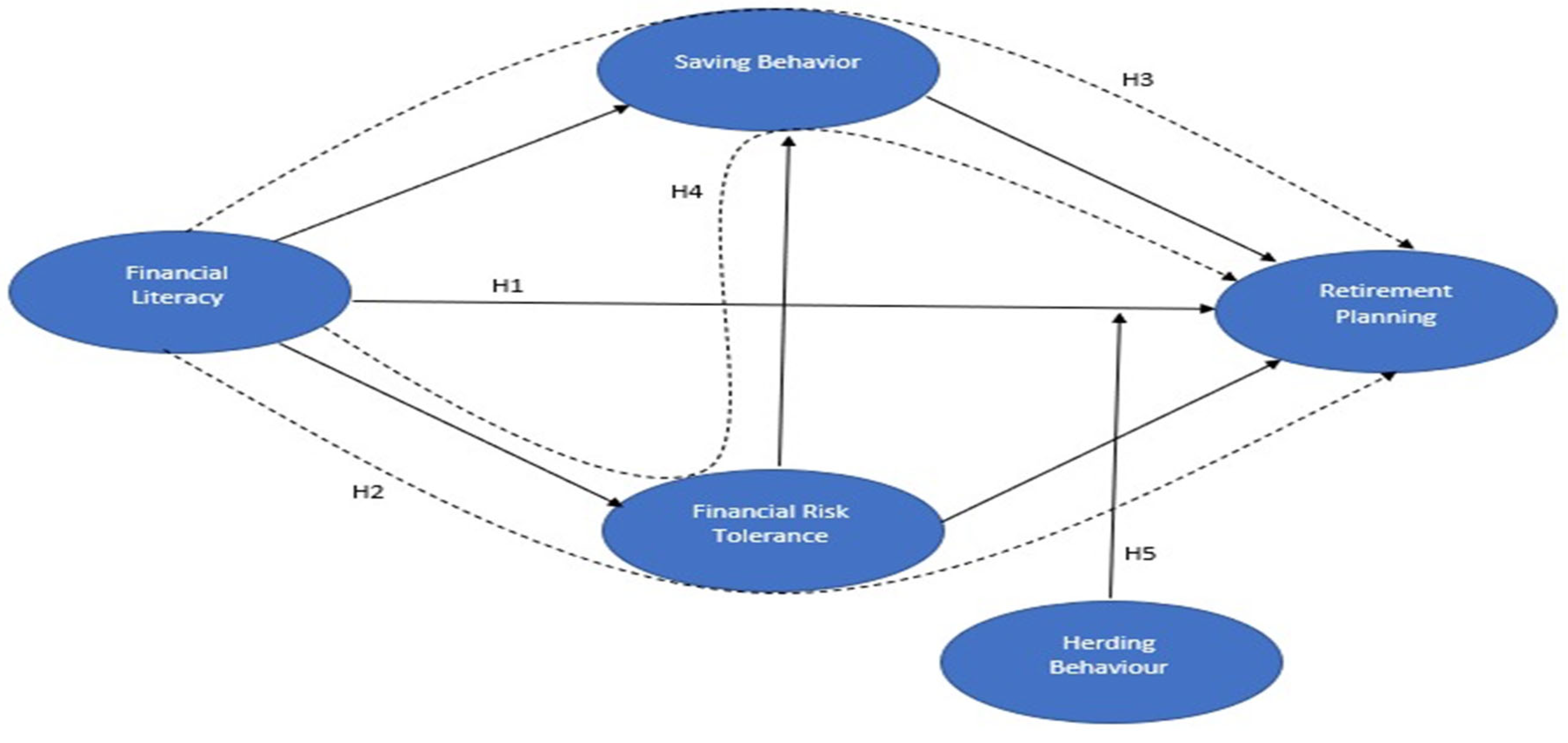

2.3. Relationship between Financial Literacy and Retirement Planning

2.4. Mediation Effect of Financial Risk Tolerance on the Relationship between Financial Literacy and Retirement Planning

2.5. Mediation Effect of Saving Behavior on the Relationship between Financial Literacy and Retirement Planning

2.6. Serial Mediation Effect of Financial Risk Tolerance and Saving Behavior on the Relationship between Financial Literacy and Retirement Planning

2.7. Moderating Role of Herding Behavior on the Relationship between Financial Literacy and Retirement Planning

3. Methodology

3.1. Sample and Data Collection

3.2. Measurement Items

4. Data Analysis and Results

4.1. Measurement Model

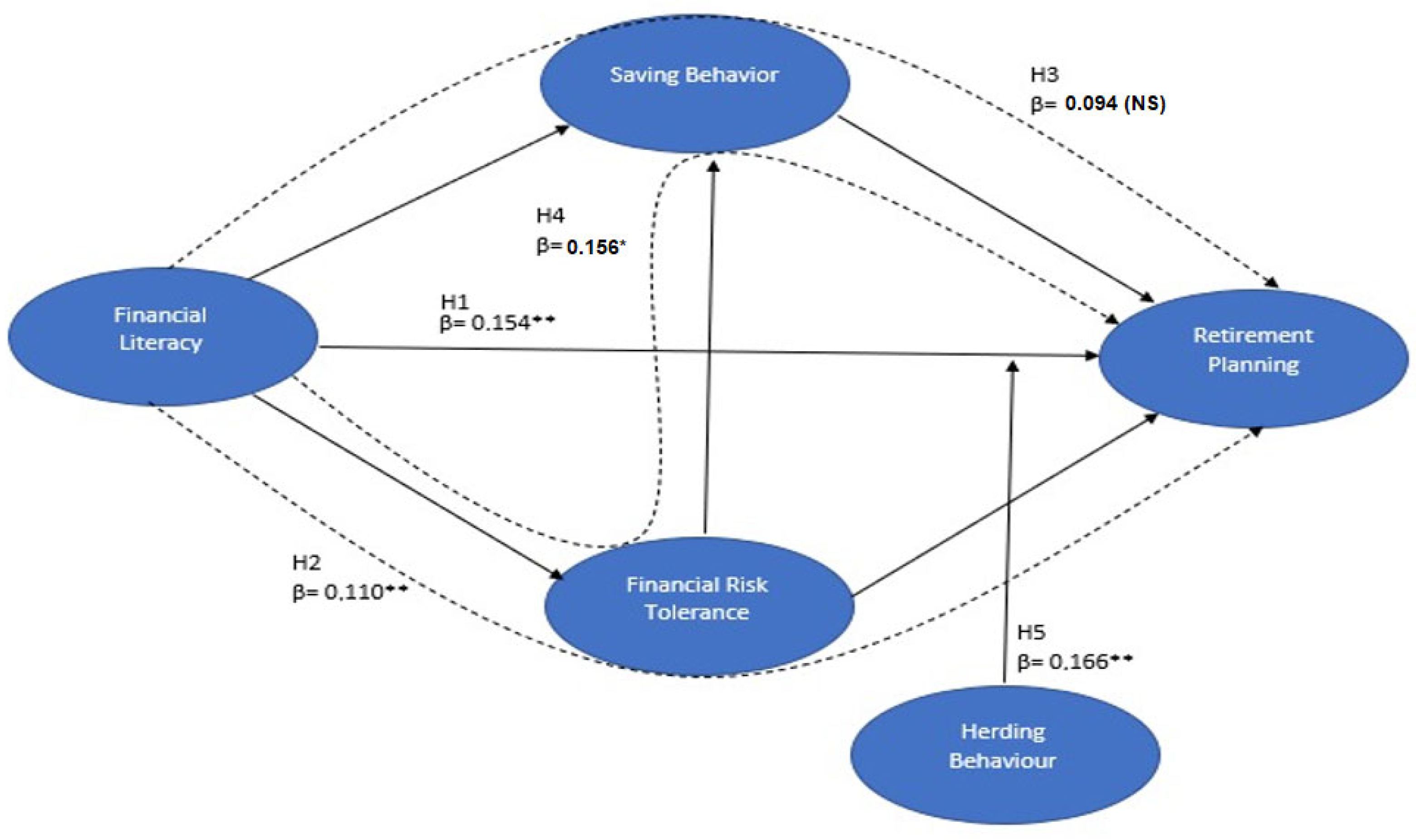

4.2. Hypothesis Testing

5. Discussion

6. Theoretical and Managerial Implications

7. Conclusions and limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abrahamse, Wokje, and Linda Steg. 2009. How So Socio-Demographic and Psychological Factors Relate to Households’ Direct and Indirect Use of Energy and Savings? Journal of Economic Psychology 30: 711–20. [Google Scholar] [CrossRef]

- Aeknarajindawat, Natnaporn. 2020. The combined effect of risk perception and risk tolerance on the investment decision making. Journal of Security & Sustainability Issues 9: 807–18. [Google Scholar]

- Agnew, Julie Richardson, Hazel Bateman, and Susan Thorp. 2012. Financial Literacy and Retirement Planning in Australian. UNSW Australian School of Business Research Paper 2012ACTL16. Amsterdam: Elsevier. [Google Scholar]

- Ajzen, Icek. 1991. The theory of planned behavior. Organizational Behavior and Human Decision Processes 50: 179–211. [Google Scholar] [CrossRef]

- Alkhawaja, Sara Osama, and Mohamed Albaity. 2020. Retirement saving behavior: Evidence from UAE. Journal of Islamic Marketing 13: 265–86. [Google Scholar] [CrossRef]

- Almenberg, Johan, and Jenny Säve-Söderbergh. 2011. Financial literacy and retirement planning in Sweden. Journal of Pension Economics & Finance 10: 585–98. [Google Scholar]

- Al-Tamimi, Hussein Al Hassan, and Al Anood Bin Kalli. 2009. Financial literacy and investment Decisions of UAE investors. Journal of Risk Finance 10: 500–16. [Google Scholar] [CrossRef]

- Altman, Morris. 2012. Implications of behavioural economics for financial literacy and public policy. The Journal of Socio-Economics 41: 677–90. [Google Scholar] [CrossRef]

- Aluodi, Emma, Amos Njuguna, and Bernard Omboi. 2017. Effect of Financial Literacy on Retirement Preparedness among Employees in the Insurance Sector in Kenya. Nairobi: United States International University Africa. [Google Scholar]

- Amirio, Dylan. 2015. RI’s Financial Literacy Remains among Lowest in Asia. Retrieved from The Jakarta Post Website. Available online: http://www.thejakartapost.com/news/2015/09/04/ri-s-financial-literacy-remains-among-lowest-asia.html (accessed on 4 September 2015).

- Anderson, Anders, Forst Baker, and David T. Robinson. 2017. Precautionary savings, retirement planning and misperceptions of financial literacy. Journal of Financial Economics 126: 383–98. [Google Scholar] [CrossRef]

- Ariadi, Gede, Surachman Sumiati, and Fathur Rohman. 2020. The effect of strategic external integration on financial performance with mediating role of manufacturing flexibility: Evidence from bottled drinking industry in Indonesia. Management Science Letters 10: 3495–506. [Google Scholar] [CrossRef]

- Ariadi, Gede, Surachman Sumiati, and F. Rohman. 2021. The effect of lean and agile supply chain strategy on financial performance with mediating of strategic supplier integration & strategic customer integration: Evidence from bottled drinking-water industry in Indonesia. Cogent Business & Management 8: 1930500. [Google Scholar] [CrossRef]

- Baskoro, Rahmat Aryo, and Rensi Aulia. 2019. The Effect of Financial Literacy and Financial Inclusion on Retirement Planning. International Journal of Business Economics 1: 49–58. [Google Scholar] [CrossRef]

- Beckmann, Elisabeth. 2013. Numeracy Advancing Education in Quantitative Literacy Financial Literacy and Household Savings in Romania Financial Literacy and Household Savings in Romania. Numeracy 6: 1–24. [Google Scholar] [CrossRef]

- Boisclair, David, Annamaria Lusardi, and Pierre Carl Michaud. 2017. Financial literacy and retirement planning in Canada. Journal of Pension Economics & Finance 16: 277–96. [Google Scholar]

- Bucher-Koenen, Tabea, and Annamaria Lusardi. 2011. Financial literacy and retirement planning in Germany. Journal of Pension Economics & Finance 10: 565–84. [Google Scholar]

- Chan, C. S. Ricard, Annaleena Parhankangas, Arvin Sahaym, and Pyayt Oo. 2020. Bellwether and the herd? Unpacking the u-shaped relationship between prior funding and subsequent contributions in reward-based crowdfunding. Journal of Business Venturing 35: 105934. [Google Scholar] [CrossRef]

- Chatterjee, Swarn, and Velma Zahirovic-Herbert. 2010. Retirement planning of younger baby-boomers: Who wants financial advice? Financial Decisions 22: 1–12. [Google Scholar]

- Chatterjee, Swarn, Fan Lu, Jacobs Ben, and Haas Robin. 2017. Risk Tolerance and Goals-based Savings Behavior of Households: The Role of Financial Literacy. Journal of Personal Finance 16: 66–77. [Google Scholar]

- Choi, Ki Hong, and Seong-Min Yoon. 2020. Investor Sentiment and Herding Behavior in the Korean Stock Market. International Journal of Financial Studies 8: 34. [Google Scholar] [CrossRef]

- Clauss, Thomas, Robert J. Breitenecker, Sascha Kraus, Alexander Brem, and Chris Richter. 2018. Directing the wisdom of the crowd: The importance of social interaction among founders and the crowd during crowdfunding campaigns. Economics of Innovation and New Technology 27: 709–29. [Google Scholar] [CrossRef]

- Crossan, Diana, David Feslier, and Roger Hurnard. 2011. Financial literacy and retirement planning in New Zealand. Journal of Pension Economics & Finance 10: 619–35. [Google Scholar]

- Disney, Richard, and John Gathergood. 2013. Financial literacy and consumer credit portfolios. Journal of Banking & Finance 37: 2246–54. [Google Scholar]

- Dohmen, Thomas, Armin Falk, David Huffman, Uwe Sunde, Jurgen Schupp, and Gert G. Wagner. 2011. Individual risk attitudes: Measurement, determinants, and behavioral consequences. Journal of the European Economic Association 9: 522–50. [Google Scholar] [CrossRef]

- Duckworth, Angela, Peterson Christopher, Michael D. Matthews, and Dennis R. Kelly. 2007. Grit: Perseverance and passion for long-term goals. Journal of Personality and Social Psychology 92: 1087–1101. [Google Scholar] [CrossRef] [PubMed]

- Faff, Robert, Daniel Mulino, and Daniel Chai. 2008. On the linkage between financial risk tolerance and risk aversion. Journal of Financial Research 31: 1–23. [Google Scholar] [CrossRef]

- Farrar, Sue, Jonathan Moizer, Jonathan Lean, and Mark Hyde. 2019. Gender, financial literacy, and preretirement planning in the UK. Journal of Women and Aging 31: 319–39. [Google Scholar] [CrossRef] [PubMed]

- Faught, Austin M., Olsen Lindsey Schubert, Chad Rusthoven, Edward Castillo, Richard Castillo, Jingjing Zhang, Thomas Guerrero, Moyed Miften, and Yevgeniy Vinogradskiy. 2018. Functional-guided radiotherapy using knowledge-based planning. Radiotherapy and Oncology 129: 494–8. [Google Scholar] [CrossRef]

- Fornell, Clae, and David F. Larcker. 1981. Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research 18: 39–50. [Google Scholar] [CrossRef]

- Giesler, Markus, and Ela Veresiu. 2014. Creating the responsible consumer: Moralistic governance regimes and consumer subjectivity. Journal of Consumer Research 41: 840–57. [Google Scholar] [CrossRef]

- Gold, Andrew H., Arvind Malhotra, and Albert H. Segars. 2001. Knowledge management: An organizational capabilities perspective. Journal of Management Information Systems 18: 185–214. [Google Scholar] [CrossRef]

- Grable, John. E. 2008. Risk tolerance. In Handbook of Consumer Finance Research. New York: Springer, pp. 3–19. [Google Scholar] [CrossRef]

- Graf, Stefan. 2017. Life-cycle funds: Much ado about nothing? The European Journal of Finance 23: 974–98. [Google Scholar] [CrossRef]

- Griffin, Barbara, Hesketh Beryl, and Loh Vanessa. 2012. The influence of subjective life expectancy on retirement transition and planning: A longitudinal study. Journal of Vocational Behavior 81: 129–37. [Google Scholar] [CrossRef]

- Gunnarsson, Jonas, and Richard Wahlund. 1997. Household financial strategies in Sweden: An exploratory study. Journal of Economic Psychology 18: 201–33. [Google Scholar] [CrossRef]

- Gustafsson, Carina, and Lisa Omark. 2015. Financial Literacy’s Effect on Financial Risk Tolerance—A Quantitative Study on Whether Financial Literacy Has an Increasing or Decreasing Impact on Financial Risk Tolerance. Umeå: Umeå School of Business and Economics, pp. 1–76. Available online: http://www.diva-portal.org/smash/get/diva2:826787/FULLTEXT01.pdf (accessed on 4 August 2022).

- Hallahan, Terrence A., Robert W. Faff, and Michael D. McKenzie. 2004. An empirical investigation of personal financial risk tolerance. Financial Services Review 13: 57–78. [Google Scholar]

- Hariharan, Govind, Kenneth S. Chapman, and Dale L. Domian. 2000. Risk tolerance and asset allocation for investors nearing retirement. Financial Services Review 9: 159–70. [Google Scholar] [CrossRef]

- Hassan, Kamal, Rohani Rahim, Fariza Ahmad, Tengku Nurn Azira Tengku Zainuddin, Rooshida Rahim Merican, and Siti Kholija Bahari. 2016. Retirement planning behaviour of working individuals and legal proposition for new pension system in Malaysia. Journal of Politics and Law 9: 43. [Google Scholar] [CrossRef]

- Hauff, Jeanette C., Anders Carlander, Tommy Gärling, and Gianni Nicolini. 2020. Retirement financial behaviour: How important is being financially literate? Journal of Consumer Policy 43: 543–64. [Google Scholar] [CrossRef]

- Hayat, Amir, and Muhammad Anwar. 2016. Impact of behavioral biases on investment decision; moderating role of financial literacy. Moderating Role of Financial Literacy. [Google Scholar] [CrossRef]

- Heenkenda, Shirantha. 2014. Determination of Financial Risk Tolerance among Different Household Sectors in Sri Lanka. Nagoya: Nagoya University, pp. 1–20. [Google Scholar]

- Henseler, Jorg, Christian M. Ringle, and Marko Sarstedt. 2015. A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science 43: 115–35. [Google Scholar] [CrossRef]

- Hermansson, Cecilia, and Sara Jonsson. 2021. The impact of financial literacy and financial interest on risk tolerance. Journal of Behavioral and Experimental Finance 29: 100450. [Google Scholar] [CrossRef]

- Hershey, Douglas A., Joy M. Jacobs-Lawson, and James T. Austin. 2013. Effective Financial Planning for Retirement. Oxford: Oxford University Press. [Google Scholar]

- Hilgert, Marianne A., Jeanne M. Hogarth, and Sondra G. Beverly. 2003. Household financial management: The connection between knowledge and behavior. Federal Reserve Bulletin 89: 309. [Google Scholar]

- Hills, John, and Francesca Bastagli. 2013. Wealth accumulation, ageing and house prices. In Wealth in the UK: Distribution, Accumulation, and Policy. Oxford: OUP Oxford, p. 63. [Google Scholar]

- Indonesia Financial Service Authority. 2020. Pension Fund Statistic 2020. Directorate of Statistic and Infromation Non Bank Financial Institutions Financial Service Authority. Available online: https://www.ojk.go.id/id/kanal/iknb/data-dan-statistik/dana-pensiun/Documents/Pages/Buku-Statistik-Dana-Pensiun-2020/BUKU STATISTIK DANA PENSIUN 2020.pdf (accessed on 4 August 2022).

- Jacobs-Lawson, Joy M., and Douglas A. Hershey. 2005. Influence of future time perspective, financial knowledge, and financial risk tolerance on retirement saving behaviors. Financial Services Review 14: 331–44. [Google Scholar]

- Jain, Ravindra, Prachi Jain, and Cherry Jain. 2015. Behavioral biases in the decision making of individual investors. IUP Journal of Management Research 14: 7–27. [Google Scholar]

- Joo, So-Hyun, and John E. Grable. 2005. Employee education and the likelihood of having a retirement savings program. Journal of Financial Counseling and Planning 16: 37–49. [Google Scholar]

- Kahneman, Daniel, and Avos Tversky. 1979. Prospect theory: An analysis of decision under risk. Econometric 2: 263–92. [Google Scholar] [CrossRef]

- Kalmi, Panu, and Olli Pekka Ruuskanen. 2018. Financial literacy and retirement planning in Finland. Journal of Pension Economics & Finance 17: 335–62. [Google Scholar] [CrossRef]

- Khan, Muhammad Nuruzzaman, David W. Rothwell, Katrina Cherney, and Tamara Sussman. 2017. Understanding the financial knowledge gap: A new dimension of inequality in later life. Journal of Gerontological Social Work 60: 487–503. [Google Scholar] [CrossRef] [PubMed]

- Kimball, Miles, and Matthew dan Shapiro. 2008. Labor Supply: Are the Income and Substitution Effects Both Large or Both Small? NBER Working Paper 14208. Available online: http://www.nber.org/papers/w14208.pdf (accessed on 4 August 2022).

- Kim, Myung Ja, and James F. Petrick. 2021. The Effect of herding behaviors on dual-route processing of communications aimed at tourism crowdfunding ventures. Journal of Travel Research 60: 947–64. [Google Scholar] [CrossRef]

- Koe, Joyce Hee-Nga, and Ken Kyid Yeoh. 2021. Factors Influencing Financial Planning for Marriage amongst Young Malaysian Couples. International Journal of Business and Society 22: 33–54. [Google Scholar]

- Kulathunga, K. M. M. C. B., Jianmu Ye, Saurabh Sharma, and P. R. Weerathunga. 2020. How does technological and financial literacy influence SME performance: Mediating role of ERM practices. Information 11: 297. [Google Scholar] [CrossRef]

- Kumari, Sharda, Bibhas Chandra, and Jamini Kanta Pattanayak. 2019. Personality traits and motivation of individual investors towards herding behaviour in Indian stock market. Kybernetes 49: 384–405. [Google Scholar] [CrossRef]

- Kusairi, Suhal, Nur Azura Sanusi, Suriyani Muhamad, Madihah Shukri, and Nadia Zamri. 2019. Financial households’efficacy, risk preference, and saving behaviour: Lessons from lower-income households in Malaysia. Economics & Sociology 12: 301–18. [Google Scholar]

- Larisa, Linda Evelina, Anastasia Njo, and Serli Wijaya. 2020. Female workers’ readiness for retirement planning: An evidence from Indonesia. Review of Behavioral Finance 13: 566–83. [Google Scholar] [CrossRef]

- Larson, Lindsay R., Jacqueline K. Eastman, and Dora E. Bock. 2016. A multi-method exploration of the relationship between knowledge and risk: The impact on millennials’ retirement investment decisions. Journal of Marketing Theory and Practice 24: 72–90. [Google Scholar] [CrossRef]

- Lim, Thien Sang, Rasid Mail, Mohd Rahimie Abd Karim, Zatul Karamah Ahmad Baharul Ulum, Junainah Jaidi, and Raman Noordin. 2018. A serial mediation model of financial knowledge on the intention to invest: The central role of risk perception and attitude. Journal of Behavioral and Experimental Finance 20: 74–79. [Google Scholar] [CrossRef]

- Lusardi, Annamaria, and Olivia S. Mitchell. 2007. Financial Literacy and Retirement Planning: New Evidence from the Rand American Life Panel. Michigan Retirement Research Center Research Paper No. WP 2007-157. Ann Arbor: Michigan Retirement Research Center. [Google Scholar]

- Lusardi, Annamaria, and Olivia S. Mitchell. 2011. Financial literacy and retirement planning in the United States. Journal of Pension Economics & Finance 10: 509–25. [Google Scholar]

- Lusardi, Annamaria, and Olivia S. Mitchell. 2014. The economic importance of financial literacy: Theory and evidence. Journal of Economic Literature 52: 5–44. [Google Scholar] [CrossRef]

- Lusardi, Annamaria, Michaud Pierre Carl, and Olivia S. Mitchell. 2017. Optimal financial knowledge and wealth ine-quali-ty. Journal of Political Economy 125: 431–77. [Google Scholar] [CrossRef]

- Mahdzan, Nurul Shahnaz, Mohd-Any Amrul Asraf, and Mun Kit Chan. 2017. The influence of financial literacy, risk aversion and expectations on retirement planning and portfolio allocation in Malaysia. Gadjah Mada International Journal of Business 19: 267–89. [Google Scholar] [CrossRef]

- Metawa, Noura, Hassan Moh Kabir, Metawa Saad, and Safa Moh Faisal. 2018. Impact of behavioral factors on investors’ financial de-cisions: Case of the Egyptian stock market. International Journal of Islamic and Middle Eastern Finance and Management 12. [Google Scholar]

- Mori, Neema. 2019. Determinants of individual savings among Tanzanians. Review of Behavioral Finance 11: 352–70. [Google Scholar]

- Nguyen, Thi Anh Nhu, Jiri Polách, and Iveta Vozňáková. 2019. The role of financial literacy in retirement investment choice. Equilibrium. Quarterly Journal of Economics and Economic Policy 14: 569–89. [Google Scholar] [CrossRef]

- Nguyen, Thi Anh Nhu, Zoltan Rózsa, Jaroslav Belás, and Ľudmila Belásová. 2017. The effects of perceived and actual financial knowledge on regular personal savings: Case of Vietnam. Journal of International Studies 10: 278–91. [Google Scholar] [CrossRef] [PubMed]

- Niu, Geng, Yang Zhou, and Hongwu Gan. 2020. Financial literacy and retirement preparation in China. Pacific Basin Finance Journal 59: 101262. [Google Scholar] [CrossRef]

- Noone, Jack, Fiona Alpass, and Christine Stephens. 2010. Do men and women differ in their retirement planning? Testing a theoretical model of gendered pathways to retirement preparation. Research on Aging 32: 715–38. [Google Scholar] [CrossRef]

- Parker, Adrew M., De Wandi Bruine, Bruin Joanne Yoong, and Robert Willis. 2012. Inappropriate confidence and retirement planning: Four studies with a national sample. Journal of Behavioral Decision Making 25: 382–9. [Google Scholar] [CrossRef] [PubMed]

- Rahman, Mahfuzur, Mohamed Albaity, and Che Ruhana Isa. 2019. Behavioural propensities and financial risk tolerance: The moderating effect of ethnicity. International Journal of Emerging Markets 15: 728–45. [Google Scholar] [CrossRef]

- Remund, David L. 2010. Financial literacy explicated: The case for a clearer definition in an increasingly complex economy. Journal of Consumer Affairs 44: 276–95. [Google Scholar] [CrossRef]

- Ricci, Ornella, and Massimo Caratelli. 2017. Financial literacy, trust and retirement planning. Journal of Pension Economics & Finance 16: 43–64. [Google Scholar]

- Riley, William B., Jr., and K. Victor Chow. 1992. Asset allocation and individual risk aversion. Financial Analysts Journal 48: 32–37. [Google Scholar] [CrossRef]

- Robb, Cliff A., and Ann S. Woodyard. 2011. Financial knowledge and best practice behavior. Journal of Financial Counseling and Planning 22: 36–46. [Google Scholar]

- Rutherford, Leann, and Sharon A. DeVaney. 2009. Utilizing the theory of planned behavior to understand convenience use of credit cards. Journal of Financial Counseling and Planning 20. [Google Scholar]

- Sabri, Mohamad Fazli, and Teo Tze Juen. 2014. The influence of financial literacy, saving behaviour, and financial management on retirement confidence among women working in the Malaysian public sector. Asian Social Science 10: 40. [Google Scholar]

- Sages, Ronald A., and John E. Grable. 2010. Financial Numeracy, Net Worth, and Financial Management Skills: Client Characteristics That Differ Based on Financial Risk Tolerance. Journal of Financial Service Professionals 64. [Google Scholar]

- Sekita, Shizuka. 2011. Financial literacy and retirement planning in Japan. Journal of Pension Economics and Finance 10: 637–56. [Google Scholar] [CrossRef]

- Statistics Center Bureau. 2021. Statistics Center Bureau Publication Catalog 2021. Available online: https://www.bps.go.id/publication/2021/12/29/565b2bec0c7b619528c3c79b/katalog-publikasi-bps-2021.html (accessed on 20 September 2021).

- Steen, Johan, Tom Loeys, Beatrijs Moerkerke, and Stijn Vansteelandt. 2017. Flexible Mediation Analysis with Multiple Mediators. American Journal of Epidemiology 186: 184–93. [Google Scholar] [CrossRef]

- Suh, Ellie. 2021. Can’t save or won’t save: Financial resilience and discretionary retirement saving among British adults in their thirties and forties. Ageing and Society, 1–28. [Google Scholar] [CrossRef]

- Sun, Yu, Lizhen Chen, Huaping Sun, and Farhad Taghizadeh-Hesary. 2020. Low-carbon financial risk factor correlation in the belt and road PPP project. Finance Research Letters 35: 101491. [Google Scholar] [CrossRef]

- . Tavor, Tchai, and Garyn-Tal Sharon. 2016. Risk tolerance and rationality in the case of retirement savings. Studies in Economics and Finance 33: 688–703. [Google Scholar] [CrossRef]

- Van Rooij, Maarten, Annamaria Lusardi, and Rob Alessie. 2011. Financial literacy and stock market participation. Journal of Financial Economics 101: 449–72. [Google Scholar] [CrossRef]

- Van Rooij, Maarten C. J., Annamaria Lusardi, and Rob J. M. Alessie. 2012. Financial literacy, retirement planning and household wealth. The Economic Journal 122: 449–78. [Google Scholar] [CrossRef]

- Ventura, Luigi, and Charles Yuji Horioka. 2020. The wealth decumulation behavior of the retired elderly in Italy: The importance of bequest motives and precautionary saving. Review of Economics of the Household 18: 575–97. [Google Scholar] [CrossRef]

- Wahyuni, Dessy Seri, Ketut Agustini, and Gede Ariadi. 2022. An AHP-Based Evaluation Method for Vocational Teacher’s Competency Standard. International Journal of Information and Education Technology 12: 157–64. [Google Scholar] [CrossRef]

- Wahyuni, Dessy Sri, Ketut Agustini, Gede Ariadi, I. Nengah Eka Mertayasa, and Nining Sugihartini. 2021. The impact of external knowledge on organization performance with indirect effect of instructional agility and process innovation effectiveness. Journal of Physics: Conference Series 1810: 12074. [Google Scholar] [CrossRef]

- Xiao, Jing Jian, and Jiayun Wu. 2008. Completing debt management plans in credit counseling: An application of the theory of planned behavior. Journal of Financial Counseling and Planning 19: 29–45. [Google Scholar]

- Yao, Rui, and Angela L. Curl. 2011. Do market returns influence risk tolerance? Evidence from panel data. Journal of Family and Economic Issues 32: 532–44. [Google Scholar] [CrossRef][Green Version]

- Yao, Rui, Michael S. Gutter, and Sherman D. Hanna. 2005. The financial risk tolerance of Blacks, Hispanics and Whites. Journal of Financial Counseling and Planning 16: 51–62. [Google Scholar]

- Yap, Stanley, Wei Ying Chong, Hon Wei Leow, and Nyen Vui Chok. 2017. The importance of financial literacy on the Malaysian household retirement planning. International Business Management 11: 1457–61. [Google Scholar]

- Yoong, Folk J., Beh See, and Diana Lea Baronovich. 2012. Financial literacy key to retirement planning in Malaysia. Journal Managment & Sustainability 2: 75–86. [Google Scholar]

- Yuh, Yoonkyung, and Sharon A. DeVaney. 1996. Determinants of couples’ defined contribution retirement funds. Journal of Financial Counseling and Planning 7: 31–38. [Google Scholar]

- Zazili, Ainol Sarin Ahmad, Mohammad Firdaus Bin Ghazali, Norlinda Tendot Binti Abu Bakar, Mastura Binti Ayob, and Irwani Hazlina Binti Abd Samad. 2017. Retirement planning: Young professionals in private sector. SHS Web of Conferences 36: 24. [Google Scholar] [CrossRef]

- Zocchi, Paola. 2013. Why do Italian households prefer adjustable rate mortgages? Journal of European Real Estate Research 6: 90–110. [Google Scholar] [CrossRef]

| Characteristics of Respondents | Totals | Percentage (%) | |

|---|---|---|---|

| Gender | Men Women | 296 92 | 76.78% 23.22% |

| Education Background | Diploma Bachelor Master Doctor Others | 31 284 34 3 39 | 7.98% 73.19% 8.76% 0.77% 10.05% |

| Business Tenure | <2 Years 2–5 Years 5–10 Years >10 Years | 14 68 135 171 | 3.61% 17.53% 34.79% 44.07% |

| Business Sectors | Food and beverages Consumer goods Farming product Others | 85 236 44 23 | 21.91% 60.82% 11.34% 5.93% |

| Annually Incomes Sales | <IDR 15 billion IDR 15 billion–IDR 30 billion >IDR 30 billion | 269 89 30 | 69.33% 22.94% 7.73% |

| TOTAL | 388 | 100% | |

| Constructs and Items | Factor Loadings | rho (ρA) | Composite Reliability | AVE |

|---|---|---|---|---|

| Financial Literacy (FL) FL1: I have the knowledge to calculate compound interest FL2: I have the knowledge to understand diversification risk of investment portfolios FL3: I have the knowledge to understand diversification risk of investment portfolio FL4: I have the knowledge to understand inflation level | 0.817 0.721 0.750 0.776 | 0.774 | 0.851 | 0.588 |

| Financial Risk Tolerance (FRT) FRT1: I am ready to bear the risk of every investment allocated FRT2: I dare to take a risk on every investment allocated FRT3: I put all my investments in fluctuating instruments FRT4: I allocate investment funds sourced from third party loans FRT5: I still consistently make investments even though there is a very significant decline in investment value | 0.794 0.721 0.734 0.714 0.775 | 0.786 | 0.850 | 0.533 |

| Saving Behavior (SB) SB1: I save when income is greater than consumption SB2: I make meaningful financial contributions to my voluntary retirement savings plan SB3: I save the rest of my income to mitigate inflation SB4: I keep substantial accumulated savings for retirement SB5: I make a conscious effort to save for retirement SB6: I am saving for an emergency reserve | 0.719 0.735 0.704 0.721 0.783 0.828 | 0.833 | 0.869 | 0.528 |

| Herding Behavior (HB) HB1: I plan my retirement finances because of the influence of other entrepreneurs who live prosperously HB2: I plan my retirement finances because of input from other entrepreneurs HB3: I plan my retirement finances based on input from social media information HB4: I plan my retirement finances because I follow the investment decisions of other entrepreneurs. HB5: I plan my retirement finances because other entrepreneurs have been involved in other retirement plans | 0.734 0.796 0.732 0.801 0.714 | 0.797 | 0.852 | 0.539 |

| Retirement Planning (RP) RP1: I visit financial planning sites to increase my knowledge about old age financial planning RP2: I identify plan income and expenses in old age RP3: I often coordinate related to retirement plans with financial planning consultants RP4: I have a special savings fund for old age needs RP5: I have an asset or property to rent/sell for old age needs RP6: I invest in the capital market for old age needs RP7: I have life insurance that can be claimed after a certain age | 0.723 0.702 0.707 0.725 0.808 0.776 0.791 | 0.867 | 0.896 | 0.552 |

| HB | FL | RP | SB | FRT | |

|---|---|---|---|---|---|

| HB | |||||

| FL | 0.473 | ||||

| RP | 0.818 | 0.735 | |||

| SB | 0.743 | 0.609 | 0.783 | ||

| FRT | 0.777 | 0.614 | 0.752 | 0.888 |

| Hypothesis | Relationship | Standard Coefficients | Test Result |

|---|---|---|---|

| Financial Literacy → Retirement Planning | 0.154 ** | Significant | |

| Financial Literacy → Financial Risk Tolerance → Retirement Planning | 0.110 ** | Significant | |

| Financial Literacy → Saving Behavior → Retirement Planning | 0.094 | Non-Significant | |

| Financial Literacy → Financial Risk Tolerance → Saving Behavior →Retirement Planning | 0.156 * | Significant | |

| Moderation of Herding Behavior on Financial Literacy → Retirement Planning | 0.166 ** | Significant |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Harahap, S.; Thoyib, A.; Sumiati, S.; Djazuli, A. The Impact of Financial Literacy on Retirement Planning with Serial Mediation of Financial Risk Tolerance and Saving Behavior: Evidence of Medium Entrepreneurs in Indonesia. Int. J. Financial Stud. 2022, 10, 66. https://doi.org/10.3390/ijfs10030066

Harahap S, Thoyib A, Sumiati S, Djazuli A. The Impact of Financial Literacy on Retirement Planning with Serial Mediation of Financial Risk Tolerance and Saving Behavior: Evidence of Medium Entrepreneurs in Indonesia. International Journal of Financial Studies. 2022; 10(3):66. https://doi.org/10.3390/ijfs10030066

Chicago/Turabian StyleHarahap, Subur, Armanu Thoyib, Sumiati Sumiati, and Atim Djazuli. 2022. "The Impact of Financial Literacy on Retirement Planning with Serial Mediation of Financial Risk Tolerance and Saving Behavior: Evidence of Medium Entrepreneurs in Indonesia" International Journal of Financial Studies 10, no. 3: 66. https://doi.org/10.3390/ijfs10030066

APA StyleHarahap, S., Thoyib, A., Sumiati, S., & Djazuli, A. (2022). The Impact of Financial Literacy on Retirement Planning with Serial Mediation of Financial Risk Tolerance and Saving Behavior: Evidence of Medium Entrepreneurs in Indonesia. International Journal of Financial Studies, 10(3), 66. https://doi.org/10.3390/ijfs10030066