Abstract

The purpose of this study is to look into the role of internal audit (IA) in reducing the effects of creative accounting (CA) on financial statement reliability in Jordanian Islamic Banks. The research study used the survey methodology to examine the role of internal audit (including independence and objectivity, verifiability, professional care, and neutrality) to reduce the effects of CA on the reliability of financial statements in Jordanian Islamic Banks. The population consists of all practicing auditors in Jordanian Islamic Banks, with a sample of 100 practicing auditors chosen from the total population of 143 auditors using a simple random selection approach. The questionnaire was distributed to the internal auditors working in these banks. Moreover, the primary data were analyzed using the partial least squares (3.3.3) software. The results showed that there was a role for IA (including independence objectivity, verifiability, professional care, and impartiality) in limiting the effects of CA on the reliability of financial statements in Jordanian Islamic Banks.

1. Introduction

The widespread corruption in society and the failure of businesses worldwide have heightened the necessity for accounting professionals to adhere to strict ethical rules, worrying that accounting fraud could undermine a bank’s operations (Hazaea et al. 2021). Internal auditing has emerged as a key factor in supporting effective controls and risk management in the aftermath of numerous previous accounting disasters. Furthermore, the IA contributes to risk management in a number of ways through its assurance and advisory duties (Jarah et al. 2022). Every bank should close the loophole by implementing a decent or high-quality internal auditing system that will oversee and monitor the bank’s policies and practices. Internal audit (IA) is also important since it ensures that the accounting system meets stakeholder needs for accurate financial information. The IA system was and is still thought to ensure the quality of financial statements, and it is envisaged that IA would act as a financial quality security compliance means. Therefore, the IA on the other hand has had little effect on the high percentage of fraudulent financial transactions (Ogoun and Atagboro 2020). Therefore, internal and external users’ decision-making may be significantly improved by the identification and assessment of risks of accounting mistakes and inaccuracies that go beyond the economic substance of the provided data (Drábková and Pech 2022).

Furthermore, while economic entities pay auditors to certify that their financial accounts reflect economic reality, the interests they safeguard are not those of the employing businesses. They must safeguard the interests of financial statement users, and in order to do so, they must be completely independent of the consumer who hires those (Albawwat et al. 2021). The presented information reflects the completeness of the processed data, or the consequence of the data is valuable and relevant (Jarah and Iskandar 2019). Thus, the function of audit in regulating creative accounting (CA) techniques should be defined by accountability and permanence; auditors should also exhibit independence, impartiality, fairness, competence, and credibility (Balaciu et al. 2012). Because of the detrimental effects on the financial statements’ reliability, the auditors should specify the rules and processes that the auditor must follow to remedy these activities (Ghamri 2020). Various CA techniques cause harm to account data users, and in order to make efficient investment and credit decisions, these users demand exact, true, objective, faithful, and credible accounting information (Bhasin 2016). As a result, data must accurately portray economic events that occurred during the accounting period. They also need to know how the economy is doing right now. When publicly available accounting data are subject to some CA practices, users’ capacity to make good and productive decisions is harmed (Al Momani and Obeidat 2013).

The goal of the audit quality is to give a fair assessment of the area under investigation, and the sampling procedure is critical to finding any irregularities and including the customer at every level of the IA. In the vocabulary used by the board of directors and top administrators, quality represents a bank’s distinctive performance (Almatarneh et al. 2022). Regardless of how unique each audit is, the audit technique is similar when it comes to performing audits, with the initial review auditor drafting an audit program and organizing the opening meeting. During the initial meeting, the auditor discusses the audit’s purpose and scope, as well as organizational challenges. Financial statements may be incorrect, and economic data may not reflect reality. Committed errors, the use of CA, or in the worst-case scenario, accounting fraud, could be the source of abnormalities in financial accounts (Klimczak 2013), where the audit committee has a role in diminishing CA acts when affected by accounting conservatism, according to this study by Wulandari and Machmuddah (2022). It also shows evidence that accounting conservatism influences CA. This study has important implications for corporate governance, accounting conservatism, and the audit committee’s role as a supervisor in limiting CA.

Furthermore, the importance of IA can be strengthened by the quality of the audit, the audit team’s competency, IA independence, and management support. The IA on the other hand is in charge of uncovering financial irregularities, specifically through the application of auditing standards (Betti et al. 2021). The IA’s function in identifying fraud is dependent on his practical abilities and professional training. Despite the importance of IA in fraud detection, most studies concentrate on the role of IA and its effectiveness, rather than the IA responsibility to detect fraud (Drogalas et al. 2017).

In light of current business conditions, many bank departments have turned to CA methods, utilizing a variety of accounting alternatives available, to beautify financial information in order to improve their financial situation, whether in terms of profitability or financial situation to achieve self-objectives. This has a negative impact on the integrity of financial statements when they are prepared. As a result, the study’s contribution is to determine the nature of these procedures and the amount to which internal auditors might use audit processes to weaken these methods in order to gain confidence in the financial statements contained in the financial statements.

In this study, we will add many topics about IA and its role in limiting the use of CA in banks. The researchers hope to develop new additional information to enrich the theoretical knowledge of the different influences on the role that IA will play in limiting CA activities that violate the spirit of good accounting practices. On a more practical level, the researchers hope that the findings will help bank departments by providing guidance regarding the dangers of CA and the significance of IA in limiting this accounting. The researchers also hope that the findings will help to clarify the idea of CA methods and be useful to decision-makers and policies.

2. Literature Review

The IA is a type of unbiased, independent verification and advice that adds value to a bank’s operations. It assists a bank in achieving its goals by examining and improving the effectiveness of risk management, control, and governance systems in a rigorous and disciplined manner (Stewart and Subramaniam 2010). Where the IA function in enhancing financial and accounting movement is to determine whether the activity conforms to current norms and requirements, operates in accordance with best practices in the field, and ensures effectiveness in meeting objectives (Betti et al. 2021). The IA also tries to limit the possibility that internal transactions and operations recorded in the entity’s main and accounting records would result in severe financial results distortions. In addition, the auditors’ primary purpose is to assess the efficiency of the IA, not just to uncover frauds and errors (Drogalas et al. 2017). In addition, the IA conducts examinations and assessments of all financial accounting components and operations, and to giving information and unbiased opinions to management on the creation of efficient and useful use of public resources and possessions (Munteanu et al. 2016).

In the same context, IA is viewed as a vital component in the implementation of accounting systems, which will aid in the reduction of the effects of CA (Ogoun and Atagboro 2020), where the IA gives financial data and financial statements more credibility, and can actively participate in decreasing the problem’s effects. Internal auditors are qualified to detect CA activities since they are expected to have a thorough understanding of the accounting and auditing professions (Saleh et al. 2021). Moreover, the internal auditors are assumed to be well-qualified to practice auditing and have a sufficient understanding of accounting principles and auditing standards, but if they do not follow their industry’s ethics, they will be unable to provide many advantages to the auditors, as well as reasonable solutions to the CA problem. Because there is evidence that the credit crisis has increased the risk of unethical conduct and fraud (Al Momani and Obeidat 2013).

Auditors play an important and beneficial function in financial reporting. Moreover, higher ethical standards signal fewer fraudulent actions, which have an influential and positive influence on financial accounts (Rakipi et al. 2021). Similarly, the CA plays a positive and influential role in financial statements, but it has been negatively correlated, which means that more additional managers involved may reduce the importance of financial statements, where government regulation and international measures play a positive and influential role if financial statements are elastic (Tassadaq and Malik 2015).

3. Independence and Objectivity

The independence and objectivity of auditors are crucial to the profession. The value and credibility of the auditors’ assurance services are founded on the core ideas of mental independence and an appearance of independence. Independence is defined as freedom from factors that weaken objectivity or the appearance of objectivity (Lois et al. 2021). Obstacles to objectivity must be removed at the individual auditor, engagement, functional, and regulatory levels. When performing audits, internal auditors must not rely on the judgment of others. Objectivity, on the other hand, is a neutral mental attitude that allows people to carry out tasks with confidence that their work output will be of good quality and that no substantial quality sacrifices will be made (Stewart and Subramaniam 2010).

The IA is a neutral, independent assurance and consulting activity that provides value and enhances the performance of a bank’s operations. It helps a company achieve its goals by reviewing and enhancing the effectiveness of risk management, control, and governance systems in a rigorous and disciplined manner. This term underlines the significance of independence and objectivity in the work of an IA (Goodwin and Yeo 2001). Concerns over IA independence and objectivity have sparked an interest in recent years. The importance of IA as a key corporate governance tool and internal consultation service is evolving and growing, which is driving this surge in research (Madawaki and Ahmi 2021). Internal auditors are in a unique position in this regard, as they provide both internal assurance services and management consulting services. This dual job has sparked considerable criticism since it has the potential to put the internal auditor in a conflicting position. Internal auditors’ ability to exercise true objectivity as employees of the organization has also been questioned (Stewart and Subramaniam 2010).

4. Verifiability

Due to the need to assess a greater variety of risks that the audit step was testing, auditors conducting those steps may have had a broader choice of audit technique possibilities. In general, identifying more specific hazards associated with a step should result in a larger amount of audit time being allocated in order to acquire the necessary proof (Agoglia et al. 2015). As a result, some low-verifiability actions may necessitate more audit time. Likewise, because a negative framing leads to more comprehensive risk processing, it should have a higher impact when audit processes are less verifiable. Auditors must ensure that important audit procedures are given adequate time in their audit plans. Some procedures are more difficult to verify because they present the preparer with a greater range of options for completing them. As a result, the auditor must take into account a broader variety of risks, as well as alternative financial statement values. In general, identifying more particular hazards related to the method should result in a larger amount of audit time being given so that the appropriate evidence may be obtained. Therefore, some low-verifiability operations may necessitate more auditor time (Maksymov et al. 2018).

5. Professional Care

In today’s business environment, internal auditors face a number of challenges and opportunities, including increasingly intricate and pervasive technology, a need for new skills, a rapidly changing regulatory structure, and a demand for expanding the scope of services, as well as increased competition and globalization (Endaya and Hanefah 2013). Internal auditors are developing innovative approaches to address difficulties, being more proactive, increasing their services, and otherwise altering the IA paradigm. Accounting scandals, business disasters, changes in corporate share ownership patterns, and regulatory reforms have all driven banks to improve their governance in recent years (Savčuk 2007). The IA serves as a check on the effectiveness and appropriateness of the bank’s other controls. Senior management appoints internal auditors, and internal auditors report to senior management. Naturally, major banks will have an IA department that reviews the operation of the entire bank operating units on a regular basis (Endaya and Hanefah 2016). The head of the IA department normally reports to the senior vice president of finance or the executive director, as well as the board of directors. Many boards now have audit committees that collaborate with the director of IA. Therefore, external auditors should examine if IA work has been appropriately planned, overseen, reviewed, and documented (Yee et al. 2008).

6. Neutrality

The primary perspectives of auditor professional skepticism have formed as neutrality and presumed doubt, and auditors should endeavor to be unbiased in informing their beliefs; there should be no prejudice in either the positive or negative direction. The auditor must seek and assess evidence to confirm management’s assertions while also ruling out other explanations (Quadackers et al. 2014). Thus, the auditor assumes no prejudice in management’s claims, which is known as neutrality. Presumptive doubt is an auditor’s mindset that assumes some amount of management dishonesty or bias unless evidence proves otherwise. Importantly, there is no agreement on which of these two types of skepticism is most appropriate for auditing (Nelson 2009). Neutrality is described as freedom from the effects of other people’s behaviors, as well as all other activities that can be influenced directly or indirectly. The audit profession’s independence is critical to its long-term viability.

Therefore, the auditors who are tasked with offering an objective and independent evaluation should not be swayed (Jakovljević 2021). At both the individual and collective levels, vulnerability to influence by audit banks and audit institutions can lead to a loss of audit independence and audit integrity. Those conducting audit engagements should maintain a high level of objectivity throughout their auditing careers, not only during the audit. Audit professionals’ neutrality, in this view, can be described as their willingness to remain immune to and independent of any internal or external influence based on character. It can be manifested in two ways: mental and physical political independence. The term “mind independence” refers to a state of mind in which an auditor is free of outside influences. It is, in reality, the auditor’s perspective on his impartiality (Usang Edet Usang and Salim 2018).

7. Creative Accounting (CA)

The CA refers to an accounting practice that follows accounting principles or standards in order to present the company to its stakeholders in the best possible light. As a result, the CA is the process of transforming financial accounting data from what they are to what the financial report preparer intends, either by following current standards or by ignoring some or all of them (Bhasin 2016). CA refers to accounting procedures that may or may not match the letter of accounting standard standards, but most certainly do not (Adámiková and Čorejová 2021). Two characteristics that may be present are excessive complication and the use of innovative ways to represent income, assets, and liabilities. The CA is a term that describes a systematic misrepresentation of a bank or organization’s true and fair income, liabilities, and assets (Yadav 2014), with many describing CA as an intentional kind used by the administration to beautify financial statements and show them without their true vision, to serve a specific category, by exploiting some gaps in international accounting standards (Al-Olimat and Al Shbail 2021). Every business’s main objective in CA is to enhance and expand its position in the market, whereas, over the years, financial statement fraud has also spread to nations in Central Europe (Durana et al. 2022).

CA stands for “undesirable practices” that include unethical aspects for attracting capital providers by presenting a dishonest and misleading state of affairs for a specific company. The majority of CA abstract delimitation is based on those two perspectives and the general tendency (Vladu and Matis 2010). CA refers to the manipulation of financial numbers or the transfer of data, and it was first popularized roughly two decades ago (Anggreni and Latrini 2021). They’re messing with numbers in order to make a good financial impression. The demand for the finest options is the positive side of earnings management, with the major goal being that the financial statement information reflects a true and fair image of the bank’s financial status (Ogoun and Atagboro 2020). The practice of CA is still common, leading to low-quality financial reporting, despite the fact that several approaches have been established by scholars and practitioners to identify any manipulation in financial reporting Abed et al. (2022b).

The CA is a type of accounting that follows or disregards accounting standards and principles. However, in order to portray the intended picture of the bank, it departs from the basic idea of such standards and values (Blazek 2021). CA is not illegal, but it is unethical because it fails to satisfy the fundamental goal of financial reporting, which is to present the bank in a fair and objective light (Adeosun et al. 2021). CA tactics include overstating assets, holding high stocks, decreasing expenses, manipulating depreciation methodologies, and presenting provisions as an asset. Changes in accounting regulations are reflected in CA procedures, which are modified to reduce financial data manipulation. On the other hand, changes in accounting standards usually bring new opportunities for accounting fraud (Remenarić et al. 2018). Ghamri (2020) defines CA as the ability of an accountant to create new accounting methods that aid in finding accounting solutions and achieving goals for the benefit of certain parties, even if they conflict with the interests of other parties and do not ultimately result in the benefit of all parties.

CA also has the ability to skew a company’s core financial performance, making it more difficult for an investor or financial assessor to evaluate and compare the company’s performance to that of other banks (Olojede and Erin 2021). As a result, CA as a misleading approach contrasts with the fundamental goal of accounting organizations, transforming standard establishing training into a repetitive feature on the one hand and on the other hand (Vladu and Matis 2010). The public has begun to question the role of auditors in uncovering these practices as the number of CA cases has increased. Theoretically, CA efforts are focused on exploiting gaps in accounting rules in order to prepare financial information reports without violating accounting standards. As a result, ethics is crucial in the audit profession because an auditor’s ethics will influence the audit quality requirements when analyzing financial accounts (Anggreni and Latrini 2021).

Therefore, Upon the illustration of the previous results and the gap in the studies, the researchers studied the results related to the role of internal audit to reduce the effects of CA on the reliability of financial statements in the Jordanian Islamic Banks, where the internal and external stakeholders can use financial statements to acquire a better understanding of a bank’s financial situation and operating performance. Their correctness and trustworthiness are critical for all stakeholders in a bank to make informed decisions.

Considering the above literature review, the following hypotheses have been formulated:

H1.

There is a statistically significant role of the IA combined (independence and objectivity, verifiability, professional care, and neutrality) in the reduced effects of CA on the reliability of financial statements in Jordanian Islamic Banks.

H1.1.

There is a statistically significant role of independence and objectivity in the reduced effects of CA on the reliability of financial statements in Jordanian Islamic Banks.

H1.2.

There is a statistically significant role of verifiability in the reduced effects of CA on the reliability of financial statements in Jordanian Islamic Banks.

H1.3.

There is a statistically significant role of professional care in the reduced effects of CA on the reliability of financial statements in Jordanian Islamic Banks.

H1.4.

There is a statistically significant role of neutrality in the reduced effects of CA on the reliability of financial statements in Jordanian Islamic Banks.

8. Methodology

8.1. Study Population

All Jordanian Islamic banks were included in the present research community. The researchers created a standardized table to determine the sample size for the study. The present study looked at the total number of auditors employed by Islamic banks, which came to 143 auditors. One hundred bank auditors who worked there were chosen at random using the quantitative research approach. As a result, 100 surveys in all were given to bank workers. Moreover, the data were analyzed using SEM and the Partial Least Squares (3.3.3) software.

8.2. Sampling Technique

In order to examine how internal auditing functions in reducing the impacts of CA on the accuracy of financial statements in Jordanian Islamic banks, internal auditors were chosen as the study’s target sample. It is expected that bank auditors will possess and be able to assess pertinent data and have expertise and understanding in the preparation of financial reports. Thus, the auditors who worked in Jordanian Islamic banks were the responders to this study. Consequently, the analysis at the individual level was chosen for this study’s evaluation of the relationship between internal auditing and inventive accounting. Internal audit’s significance may be increased through improving audit quality, the effectiveness of the audit team, internal audit independence, and management support. On the other hand, an internal audit is responsible for detecting financial irregularities that result from CA.

8.3. Data Collection Procedures

The questionnaire was employed as a data collection method in the study to represent the perspectives of the chosen sample. To meet the nature of the current investigation, a self-administered questionnaire was chosen as the survey instrument, as a regularly used approach for data collecting in the survey study. The researchers used the Five-scale Likert measures to design and improve the questionnaire and collect data in order to achieve the study objectives. The participants were informed of the research and given enough time to respond to all questions after receiving consent. To increase the response rate, respondents were requested to complete the questionnaire and provide their answers directly. The researchers collected 100 responses before the data gathering was finished.

8.4. Measures

Respondents were given a three-part questionnaire to fill out and administer themselves. The first component was designed to gather demographic information from respondents. This section has four items: gender, experience, qualification, and specialty. The second section, which includes twenty items, and the third section, which includes seven items, were used to assess auditors’ independence and objectivity, verifiability, professional care, and neutrality in order to mitigate the effects of CA on Jordanian Islamic Banks. The researchers used the Five-scale Likert measures to design and improve the questionnaire and collect data in order to achieve the study objectives ranging from 1, strongly disagree, to 5, strongly agree. As shown in the following Table 1.

Table 1.

Demographic information.

9. Analysis and Results

Measurement Model

The data were analyzed using SEM and partial least squares 3.3.3 (PLS 3.3.3) software to see if IA (independence and objectivity, verifiability, professional care, and neutrality) had a direct impact on the lessened effects of CA on the reliability of financial statements.

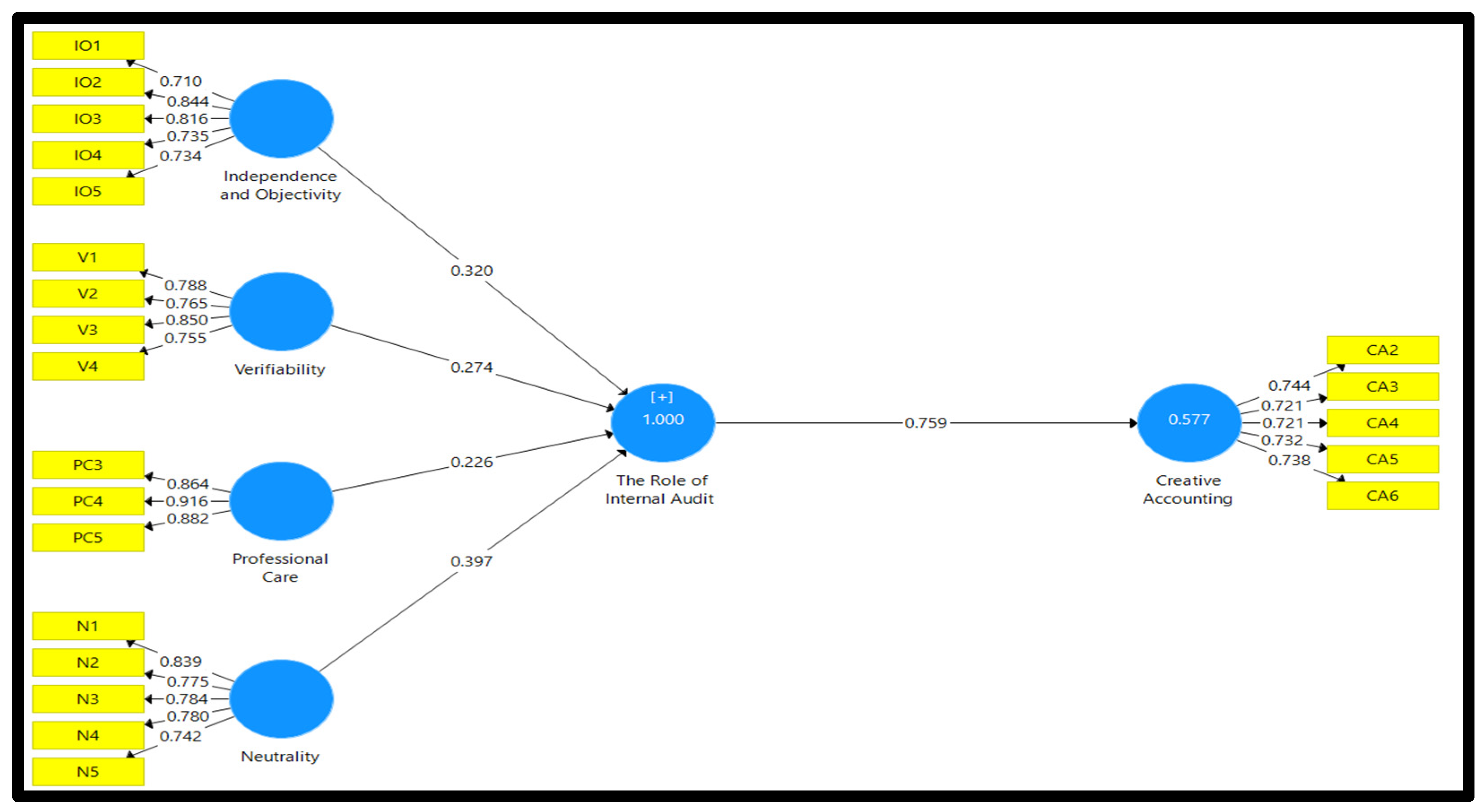

Firstly, the path loadings for the proposed model are presented in Figure 1.

Figure 1.

Factor analysis results.

Factor loadings greater than 0.70, were considered adequately significant in the suggested model (Hair et al. 2014). After that, delete the items (V5, PC1, PC2, CA1, and CA7) because they are not large enough 0.70. As a result, Table 2 shows the final path loading results for the proposed model after removing the 5 components (V5, PC1, PC2, CA1, and CA7).

Table 2.

The factor loading test of the model.

Secondly, the reliability (Cronbach’s alpha, composite reliability (CR), and validity (average variance extracted (AVE) tests for the proposed model are shown in Table 3.

Table 3.

The reliability and validity test of the model.

Table 3 shows that construct reliability can be accepted if Cronbach’s alpha value is greater than 0.70 (Hair et al. 2014). Furthermore, accept convergent validity if the CR is greater than 0.70 (Hair et al. 2014) and the AVE analyses are greater than 0.50. As a result, every item passes the reliability and validity tests.

Thirdly, the outcomes of the path quantity method for the proposed model use the R-squared value. See Table 4.

Table 4.

R-squared value.

The R-squared assessment for the variable IA (independence and objectivity, verifiability, professional care, and neutrality) on the reduced effects of CA on the financial statement’s reliability is 0.577, according to Table 4. As a result, if the R-squared value is greater than 0.25, the suggested model’s predictive validity is based on the orientation (Hair et al. 2014).

Assessment of discriminant validity using the Heterotrait-Monotrait ratio (HTMT):

The discriminant validity assessment has the goal to ensure that a reflective construct has the strongest relationships with its own indicators (e.g., in comparison with any other construct) in the PLS path model (Hair et al. 2014). This study evaluates discriminant validity over HTMT as less than (0.90). Consequently, the results of discriminant validity by HTMT are satisfied as presented in Table 5.

Table 5.

Results of discriminant validity by HTMT.

Finally, the outcomes of discriminant validity by consuming the Fornell-Larcker criterion are presented in Table 6.

Table 6.

Results of discriminant validity by Fornell-Larcker criterion.

Table 6 shows that exogenous constructs have a correlation of less than (0.85) (Hair et al. 2014). As a result, complete constructs’ discriminant validity is met.

10. Hypotheses Test

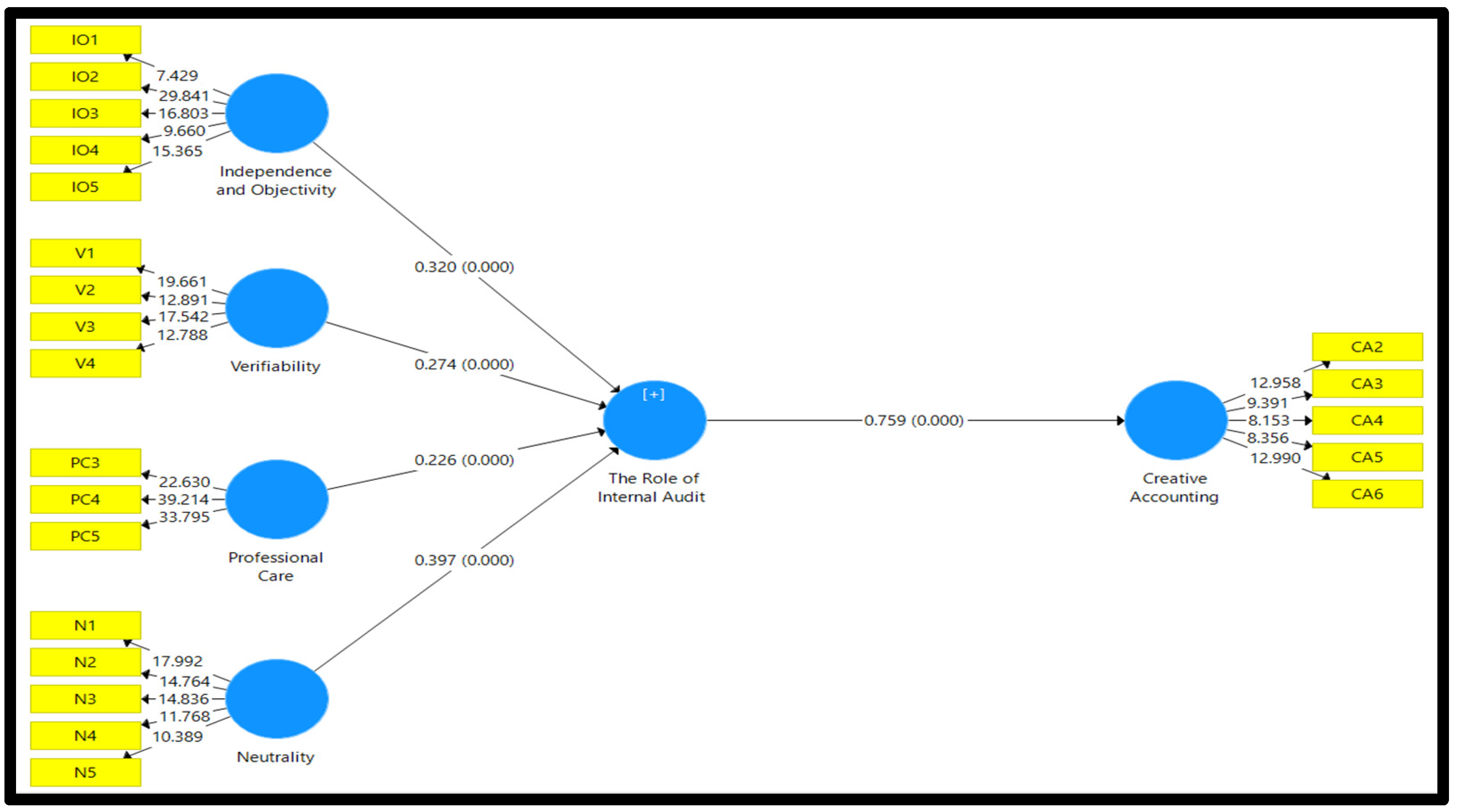

To find the T-Value, bootstrapping with Partial Least Squares 3.3.3 (PLS 3.3.3) software was used to evaluate all hypotheses. Figure 2 depicts the T-Value for the proposed model.

Figure 2.

Bootstrapping results.

The p-value test result to test the variable IA (independence and objectivity, verifiability, professional care, and neutrality) on the reduced effects of CA on the reliability of financial statements was shown in Figure 2 of the statistical analysis results in this section. Table 7 shows the results.

Table 7.

Test results for all hypotheses.

According to Table 7, the combined p-value of IA (independence and objectivity, verifiability, professional care, and neutrality) = 0.000 and minimized effects of CA on the financial statement’s credibility (Hair et al. 2014). As a result, it is significant at 0.05. Furthermore, according to Table 7, the value of beta (internal audit combined (independence and objectivity, verifiability, professional care, and neutrality) = 0.759), which states that changing one part of IA combined (independence and objectivity, verifiability, professional care, and neutrality) will result in (0.759) a change in reduced effects of CA on financial statement reliability. These findings support hypothesis (H1), which indicates that the IA function (independence and objectivity, verifiability, professional care, and neutrality) has a substantial role in reducing the effects of CA on financial statement dependability in Jordanian Islamic Banks.

Table 7 shows a p-valuefor independence and objectivity, as well as reduced effects of CA on financial statement reliability (Hair et al. 2014). As a result, it is significant at 0.05. In addition, according to Table 7, the value of beta (independence and objectivity) = 0.320, which means that changing one component of (independence and objectivity) will result in a change of (0.320) in the lessened effects of CA on financial statement dependability. These findings support hypothesis (H1.1), which indicates that independence and objectivity have a crucial impact on the reduced effects of CA on financial statement dependability in Jordanian Islamic Banks.

According to Table 7, the p-value for Verifiability = 0.000 and the lessened effects of CA on the financial statement’s reliability (Hair et al. 2014). As a result, it is significant at 0.05. In addition, according to Table 7, the value of beta (Verifiability = 0.274), states that changing one part of (Verifiability) will result in a change in the lessened effects of CA on financial statements’ dependability (0.274). These findings support hypothesis (H1.2), which argues that Verifiability has a crucial influence on the reduced effects of CA on financial statement dependability in Jordanian Islamic Banks.

Table 7 shows that the p-value among professional care = 0.000 and that CA has a lower effect on the financial statement’s reliability (Hair et al. 2014). As a result, it is significant at 0.05. In addition, according to Table 7, the value of beta (professional care = 0.226, which means that changing one part of (professional care) will result in a change in the lessened effects of CA on financial statement reliability (0.226). These findings support hypothesis (H1.3), which states that professional care plays a significant role in reducing the effects of CA on financial statement reliability in Jordanian Islamic Banks.

Finally, according to Table 7, the p-value for neutrality = 0.000 and the lessened consequences of CA on the financial statement’s reliability (Hair et al. 2014). As a result, it is significant at 0.05. Furthermore, according to Table 7, the value of beta (neutrality = 0.397, means that changing one part of (neutrality) will result in (0.397) a change in the reduced effects of CA on the financial statement’s reliability. These findings support hypothesis (H1.4), which argues that neutrality has a significant role in the reduced effects of CA on financial statement dependability in Jordanian Islamic Banks.

11. Discussion

Bhasin (2016) asserts that the purpose of CA is still to provide managers, companies, and accountants with an unfair edge. According to Munteanu et al. (2016) IA looks at whether the transactions and accounting procedures reported correctly represent the essence of the events that happened and if they are likely to be altered. The results of an IA mission must attest to the accuracy, completeness, and consistency with which financial accounting transactions from primary accounting records and financial statements are shown, as well as the integrity and coherence of the financial accounting system. Based on the factors of Ghamri (2020), there were no statistically powerful variations in the external auditors’ assessments of the impact of CA risk on auditing hazards (academic qualification, professional qualification, occupation, and experience). Based on these criteria, there were no statistically significant variations in the external auditors’ assessment of their obligation to uncover CA practices. According to Balaciu et al. (2012), the auditors in our sample discovered all the CA procedures in the study rather regularly, with the CA practices affecting financial assets having the lowest prevalence.

Auditor ethics has a considerable detrimental impact on auditors’ capacity to detect CA techniques, according to Anggreni and Latrini (2021), meaning that when an auditor detects CA practices in financial reports, the auditor selects to forgo ethics and ignore genuine findings. Meanwhile, audit tenure has a considerable positive impact on auditors’ capacity to detect CA practices in financial statements, meaning that the longer the audit tenure or audit engagement period, the better the auditor’s ability to detect CA practices in financial statements. Furthermore, according to Akpanuko and Umoren (2018), the CA is at the center of numerous accounting disputes. It denotes the modification of accounting statistics from what they do in accordance with economic reality to what managers want by exploiting or neglecting current regulations. Abed et al. (2022a) found that the audit committee significantly moderates the choice of CA in terms of financial reporting quality in the commercial banking industry. The findings of Moghadam et al. (2021) showed a positive and substantial association between intellectual capital and the readability of financial statements, indicating that as firms’ intellectual capital grows, so does the readability of their financial statements. The results of this study by Dalwai et al. (2021) show a decline in intellectual capital efficiency associated with improved annual report readability for financial sector firms, and corporate governance mechanisms like dispersed ownership and audit committee size also result in easily readable annual reports that support agency theory.

Drogalas et al. (2017)’s findings emphasize the importance of IA in detecting accounting fraud, as well as the need for organizations to invest in IA processes and training to improve corporate performance. In addition, the research emphasizes the need for IA and fraud detection for businesses in economically depressed areas. Abed et al. (2022b) provide study findings that demonstrate the relationship between the transparency and disclosure factors and the degree of influence for CA determinants. Shahid (2016) discovered a favorable association between agency issues and CA but found a negative relationship between CA and corporate governance, ethical value, and future orientation. CA has also been shown to have a significant negative impact on financial reporting accuracy and objectivity. According to the findings of Jarah and Almatarneh (2021), a correct knowledge of the organization leads to an increase in job quality. Additionally, the organization regulates and reinforces workers’ efforts on the company’s objective track. Al-Olimat and Al Shbail (2021) found that the quality of external audits and institutional governance principles have a statistically significant influence on reducing innovative accounting methods in Jordanian industrial businesses. The capacity of auditors to discover CA methods is influenced by their independence, integrity, objectivity, contingent fees, advertising rights, commission determination, and organizational shape, according to Al Momani and Obeidat (2013). The findings of Seifzadeh et al. (2021) show a significant and negative relationship between management entrenchment, real and accrual earnings management, comparability, and a positive and significant relationship between management narcissism, overconfidence, and board effort and financial statement comparability. According to Usman and Usman (2022), the audit committee mediates the link between the board’s gender diversity, ethnic diversity, reputation, nationality, risk, and CA of the businesses.

12. Implications

In this study, the role of internal auditing in reducing the effects of CA in Jordanian Islamic banks was highlighted. This study also contributed to the development of a new model that links internal auditing and CA using independence and objectivity, verifiability, professional care, and neutrality. Where this study added many topics related to internal auditing and its role in limiting the use of that accounting in Jordanian Islamic banks. The study also showed the role of internal audit in limiting this accounting in these banks at a time when the accounting output still suffers from a lack of confidence for the users of the financial statements.

13. Limitations and Future Research

Despite making some significant contributions, this study has certain drawbacks. As a result, admitting these limitations helps to the credibility of the current research findings. This study focuses on the variables stated in the conceptual design, with the goal of maintaining a balanced perspective in the diagnostic and interactive usage of the model in Jordanian Islamic banks, where the current study employed just 100 auditors to focus on internal auditors working in Islamic banks in Jordan. As a result, more bank responders may yield better findings. The current study concentrated on three aspects of internal audit. Other internal audit aspects, including audit committees, quality assurance, and improvement initiatives, can be employed. Furthermore, the current study recommends paying attention to activating the role of internal audit within banks because of its positive impact in adding value, improving operational effectiveness, and achieving goals, which contributes to limiting the use of any methods that would jeopardize the bank’s reputation. As a result, the current work might serve as a foundation for future research to improve field knowledge. As noted in earlier sections, the current study contradicted certain previous findings while being consistent with others. However, the shortcomings of the current study can be overcome in future research.

14. Conclusions

The purpose of this study was to look at the role of internal auditing in limiting the effects of CA on the credibility of Jordanian Islamic banks’ financial statements. According to the findings, the internal audit represented (including independence and objectivity, verifiability, professional care, and neutrality) plays a role in reducing the repercussions of CA in Jordanian Islamic banks. This study’s findings are consistent with recent research by, for example (Munteanu et al. 2016; Ghamri 2020; Balaciu et al. 2012; Anggreni and Latrini 2021; Drogalas et al. 2017; Shahid 2016; Al-Olimat and Al Shbail 2021). Because the IA’s primary goal is to ensure the financial statements are free of errors, as well as to detect fraud, and support the credibility of the audited annual financial statements by ensuring the integrity of disclosure and the comprehensiveness of these statements because the IA plays a significant and effective role in protecting the bank’s various risks. The internal auditor is also regarded as the most significant party in combating these risks by implementing corrective and protective actions. As a result, IA is critical in exposing CA methods and decreasing their risk, with auditors playing a key role in limiting their impact.

Author Contributions

Conceptualization, B.A.F.J. and M.A.A.J.; methodology and data collection and analysis; investigation and writing review and editing, M.A.A.A.-Z. and M.F.M.A.-J. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Data are available from the authors and can be produced upon request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abed, Ibtihal A., Nazimah Hussin, Hossam Haddad, Tareq Hammad Almubaydeen, and Mostafa A. Ali. 2022a. Creative Accounting Determination and Financial Reporting Quality: The Integration of Transparency and Disclosure. Journal of Open Innovation: Technology, Market, and Complexity 8: 38. [Google Scholar] [CrossRef]

- Abed, Ibtihal A., Nazimah Hussin, Hossam Haddad, Nidal Mahmoud Al-Ramahi, and Mostafa A. Ali. 2022b. The Moderating Impact of the Audit Committee on Creative Accounting Determination and Financial Reporting Quality in Iraqi Commercial Banks. Risks 10: 77. [Google Scholar] [CrossRef]

- Adámiková, Eva, and Tatiana Čorejová. 2021. Creative Accounting and the Possibility of Its Detection in the Evaluation of the Company by Expert. Journal of Risk and Financial Management 14: 327. [Google Scholar] [CrossRef]

- Adeosun, O. A., J. A. Adekanmbi, and W. A. Ogunleye. 2021. The Perception of Accounting Educators and Practitioners towards the Practices of Creative Accounting. EPRA International Journal of Research and Development 6: 28–35. [Google Scholar]

- Agoglia, Christopher P., Richard C. Hatfield, and Tamara A. Lambert. 2015. Audit team time reporting: An agency theory perspective. Accounting, Organizations and Society 44: 1–14. [Google Scholar] [CrossRef]

- Akpanuko, Essien Ekerette, and Ntiedo John Umoren. 2018. The influence of creative accounting on the credibility of accounting reports. Journal of Financial Reporting and Accounting 16: 292–310. [Google Scholar] [CrossRef]

- Al Momani, Mohammed Abdullah, and Mohammed Ibrahim Obeidat. 2013. The effect of auditors’ ethics on their detection of creative accounting practices: A field study. International Journal of Business and Management 8: 118–36. [Google Scholar] [CrossRef]

- ALbawwat, Ibrahim Emair, Mohammad Eid AL-Hajaia, and Yaser Saleh AL Frijat. 2021. The Relationship Between Internal Auditors’ Personality Traits, Internal Audit Effectiveness, and Financial Reporting Quality: Empirical Evidence from Jordan. The Journal of Asian Finance, Economics and Business 8: 797–808. [Google Scholar]

- Almatarneh, Zeyad, Baker Akram Falah Jarah, and Mufleh Amin AL Jarrah. 2022. The role of management accounting in the development of supply chain performance in logistics manufacturing companies. Uncertain Supply Chain Management 10: 13–18. [Google Scholar] [CrossRef]

- Al-Olimat, Nofan Hamed, and Mohannad Obeid Al Shbail. 2021. The mediating effect of external audit quality on the relationship between corporate governance and creative accounting. International Journal of Financial Research 12: 149–57. [Google Scholar] [CrossRef]

- Anggreni, Dewa Ayu Rai, and Made Yenni Latrini. 2021. Effect of auditor ethics and audit tenure on auditor ability to detect creative accounting practices. American Journal of Humanities and Social Sciences Research 5: 330–36. [Google Scholar]

- Balaciu, Diana Elisabeta, Victoria Bogdan, Ioana Teodora Meşter, and Dana Gherai. 2012. Empirical evidences of Romanian auditors’ behavior regarding creative accounting practices. Accounting and Management Information Systems 11: 213. [Google Scholar]

- Betti, Nathanaël, Gerrit Sarens, and Ingrid Poncin. 2021. Effects of digitalisation of organisations on internal audit activities and practices. Managerial Auditing Journal 36: 872–88. [Google Scholar] [CrossRef]

- Bhasin, Madan Lal. 2016. Survey of creative accounting practices: An empirical study. Wulfenia Journal KLAGENFURT 23: 143–62. [Google Scholar]

- Blazek, Roman. 2021. Creative accounting as a global tool for tax optimization. In SHS Web of Conferences. Les Ulis: EDP Sciences, vol. 92, p. 02007. [Google Scholar]

- Dalwai, Tamanna, Syeeda Shafiya Mohammadi, Gaitri Chugh, and Mahdi Salehi. 2021. Does intellectual capital and corporate governance have an impact on annual report readability? Evidence from an emerging market. International Journal of Emerging Markets. ahead-of-print. [Google Scholar] [CrossRef]

- Drábková, Zita, and Martin Pech. 2022. Comparison of Creative Accounting Risks in Small Enterprises: The Different Branches Perspective. E&M Economics and Management 25: 113–129. [Google Scholar] [CrossRef]

- Drogalas, George, Michail Pazarskis, Evgenia Anagnostopoulou, and Angeliki Papachristou. 2017. The effect of internal audit effectiveness, auditor responsibility and training in fraud detection. Accounting and Management Information Systems 16: 434–54. [Google Scholar] [CrossRef]

- Durana, Pavol, Roman Blazek, Veronika Machova, and Miroslav Krasnan. 2022. The use of Beneish M-scores to reveal creative accounting: Evidence from Slovakia. Equilibrium. Quarterly Journal of Economics and Economic Policy 17: 481–510. [Google Scholar] [CrossRef]

- Endaya, Khaled Ali, and Mustafa Mohd Hanefah. 2013. Internal audit effectiveness: An approach proposition to develop the theoretical framework. Research Journal of Finance and Accounting 4: 92–102. [Google Scholar]

- Endaya, Khaled Ali, and Mustafa Mohd Hanefah. 2016. Internal auditor characteristics, internal audit effectiveness, and moderating effect of senior management. Journal of Economic and Administrative Sciences 32: 160–76. [Google Scholar] [CrossRef]

- Ghamri, Wejdan Hassan M. 2020. The Relationship between Creative Accounting Risks and Auditing Risks from the Perspective of External Auditors in Saudi Arabia. Financial Risk and Management Reviews 6: 22–39. [Google Scholar] [CrossRef]

- Goodwin, Jenny, and Teck Yeow Yeo. 2001. Two factors affecting internal audit independence and objectivity: Evidence from Singapore. International Journal of Auditing 5: 107–25. [Google Scholar] [CrossRef]

- Hair, Joe F., Jr., Marko Sarstedt, Lucas Hopkins, and Volker G. Kuppelwieser. 2014. Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. European Business Review 26: 106–21. [Google Scholar] [CrossRef]

- Hazaea, Saddam A., Jinyu Zhu, Saleh FA Khatib, Ayman Hassan Bazhair, and Ahmed A. Elamer. 2021. Mapping of internal audit research in China: A systematic literature review and future research agenda. Cogent Business & Management 8: 1938351. [Google Scholar]

- Jakovljević, Nemanja. 2021. Political neutrality in the audit profession: Attitudes of respondents in the Republic of Serbia. BizInfo (Blace) Journal of Economics, Management and Informatics 12: 23–38. [Google Scholar] [CrossRef]

- Jarah, Baker Akram Falah, and Zeyad Almatarneh. 2021. The effect of the elements of accounting information system (AIS) on organizational culture (OC)-A field study. Academy of Strategic Management Journal 20: 1–10. [Google Scholar]

- Jarah, Baker Akram Falah, and Takiah Binti Mohd Iskandar. 2019. The Mediating Effect of Acceptance of Using AIS on the Relationship between the Accounting Information Systems and Financial Performance in Jordanian Companies. International Journal of Research and Innovation in Social Science (IJRISS) 3: 256–63. [Google Scholar]

- Jarah, Baker Akram Falah, Mufleh Amin Al Jarrah, and Murad Ali Ahmad Al-Zaqeba. 2022. The role of internal audit in improving supply chain management in shipping companies. Uncertain Supply Chain Management 10: 1023–28. [Google Scholar] [CrossRef]

- Klimczak, Krzysztof. 2013. Internal Audit as a Tool of Detecting Creative Accounting and Fraud in the Process of Effective Management in Organization. Bielsko-Biała: The University of Bielsko-Biala. [Google Scholar]

- Lois, Petros, George Drogalas, Michail Nerantzidis, Ifigenia Georgiou, and Eleni Gkampeta. 2021. Risk-based internal audit: Factors related to its implementation. Corporate Governance 21: 645–62. [Google Scholar] [CrossRef]

- Madawaki, Abdulkadir, and Aidi Ahmi. 2021. Internal audit functions, financial reporting quality and moderating effect of senior management support. Meditari Accountancy Research 30: 342–72. [Google Scholar] [CrossRef]

- Maksymov, Eldar M., Mark W. Nelson, and William R. Kinney Jr. 2018. Budgeting audit time: Effects of audit step frame and verifiability. Behavioral Research in Accounting 30: 59–73. [Google Scholar] [CrossRef]

- Moghadam, Hassan Mohammadzadeh, Mahdi Salehi, and Zohreh Hajiha. 2021. The relationship between intellectual capital and financial statements readability: The role of management characteristics. Journal of Facilities Management. ahead-of-print. [Google Scholar] [CrossRef]

- Munteanu, Victor, Lavinia Copcinschi, Carmen Luschi, and Anda Laceanu. 2016. Internal audit-determinanat factor in preventing and detecting fraud related activity to public entities financial accounting. Knowledge Horizons Economics 8: 14. [Google Scholar]

- Nelson, Mark W. 2009. A model and literature review of professional skepticism in auditing. Auditing 28: 1. [Google Scholar] [CrossRef]

- Ogoun, Stanley, and Emmanuel Atagboro. 2020. Internal Audit and Creative Accounting Practices in Ministries, Departments and Agencies (MDAs): An Empirical Analysis. Open Journal of Business and Management 8: 552. [Google Scholar] [CrossRef][Green Version]

- Olojede, Paul, and Olayinka Erin. 2021. Corporate governance mechanisms and creative accounting practices: The role of accounting regulation. International Journal of Disclosure and Governance 18: 207–22. [Google Scholar] [CrossRef]

- Quadackers, Luc, Tom Groot, and Arnold Wright. 2014. Auditors’ professional skepticism: Neutrality versus presumptive doubt. Contemporary Accounting Research 31: 639–57. [Google Scholar] [CrossRef]

- Rakipi, Romina, Federica De Santis, and Giuseppe D’Onza. 2021. Correlates of the internal audit function’s use of data analytics in the big data era: Global evidence. Journal of International Accounting, Auditing and Taxation 42: 100357. [Google Scholar] [CrossRef]

- Remenarić, Branka, Ivana Kenfelja, and Ivo Mijoč. 2018. Creative accounting-motives, techniques and possibilities of prevention. Ekonomski Vjesnik 31: 193–99. [Google Scholar]

- Saleh, Mousa Mohammad Abdullah, Omar Jawabreh, and Enas Fakhri Mohammad Abu-Eker. 2021. Factors of applying creative accounting and its impact on the quality of financial statements in Jordanian hotels, sustainable practices. Journal of Sustainable Finance & Investment. [Google Scholar] [CrossRef]

- Savčuk, Olga. 2007. Internal audit efficiency evaluation principles. Journal of Business Economics and Management 8: 275–84. [Google Scholar] [CrossRef]

- Seifzadeh, Maryam, Mahdi Salehi, Mohammadhamed Khanmohammadi, and Bizhan Abedini. 2021. The relationship between management attributes and accounting comparability. Journal of Facilities Management 20: 1–18. [Google Scholar] [CrossRef]

- Shahid, Maria. 2016. Influence of Creative Accounting on Reliability and Objectivity of Financial Reporting (Factors Responsible For Adoption of Creative Accounting Practices in Pakistan). Journal of Accounting and Finance in Emerging Economies 2: 75–82. [Google Scholar] [CrossRef]

- Stewart, Jenny, and Nava Subramaniam. 2010. Internal audit independence and objectivity: Emerging research opportunities. Managerial Auditing Journal 25: 328–60. [Google Scholar] [CrossRef]

- Tassadaq, Fizza, and Qaisar Ali Malik. 2015. Creative Accounting & Financial Reporting: Model Development & Empirical Testing. International Journal of Economics and Financial Issues 5: 544–51. [Google Scholar]

- Usang Edet Usang, Obal, and Basariah Salim. 2018. The Relationship between Institutional Environment, Internal Audit and Performance of Local Governments in Nigeria. International Journal of Accounting and Finance (IJAF) 7: 120–47. [Google Scholar]

- Usman, Abbas, and Hassan Shehu Usman. 2022. Mediating effect of audit committee on board dynamic and creative accounting in Nigerian firms. Gusau Journal of Accounting and Finance 3: 29. [Google Scholar]

- Vladu, Alina Beattrice, and Dumitru Matis. 2010. Corporate governance and creative accounting: Two concepts strongly connected? Some intersting insights highlighted by constructing the internal history of a literature. Annales Universitatis Apulensis: Series Oeconomica 12: 332. [Google Scholar] [CrossRef]

- Wulandari, Ayu, and Zaky Machmuddah. 2022. Peran komite audit dalam memoderasi konservatisme akuntansi terhadap creative accounting. Dinamika Akuntansi Keuangan Dan Perbankan 11: 53–60. [Google Scholar]

- Yadav, Brijesh. 2014. Creative accounting: An empirical study from professional prospective. International Journal of Management and Social Sciences Research 3: 38–53. [Google Scholar]

- Yee, Cassandra SL, Ahmad Sujan, Kieran James, and Jenny KS Leung. 2008. Perceptions of Singaporean internal audit customers regarding the role and effectiveness of internal audit. Asian Journal of Business and Accounting 1: 147–74. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).