Innovation Capabilities in the Banking Sector Post-COVID-19 Period: The Moderating Role of Corporate Governance in an Emerging Country

Abstract

:1. Introduction

2. Literature Review

2.1. Innovation Capabilities

2.2. Corporate Governance

2.3. Hypothesis Development

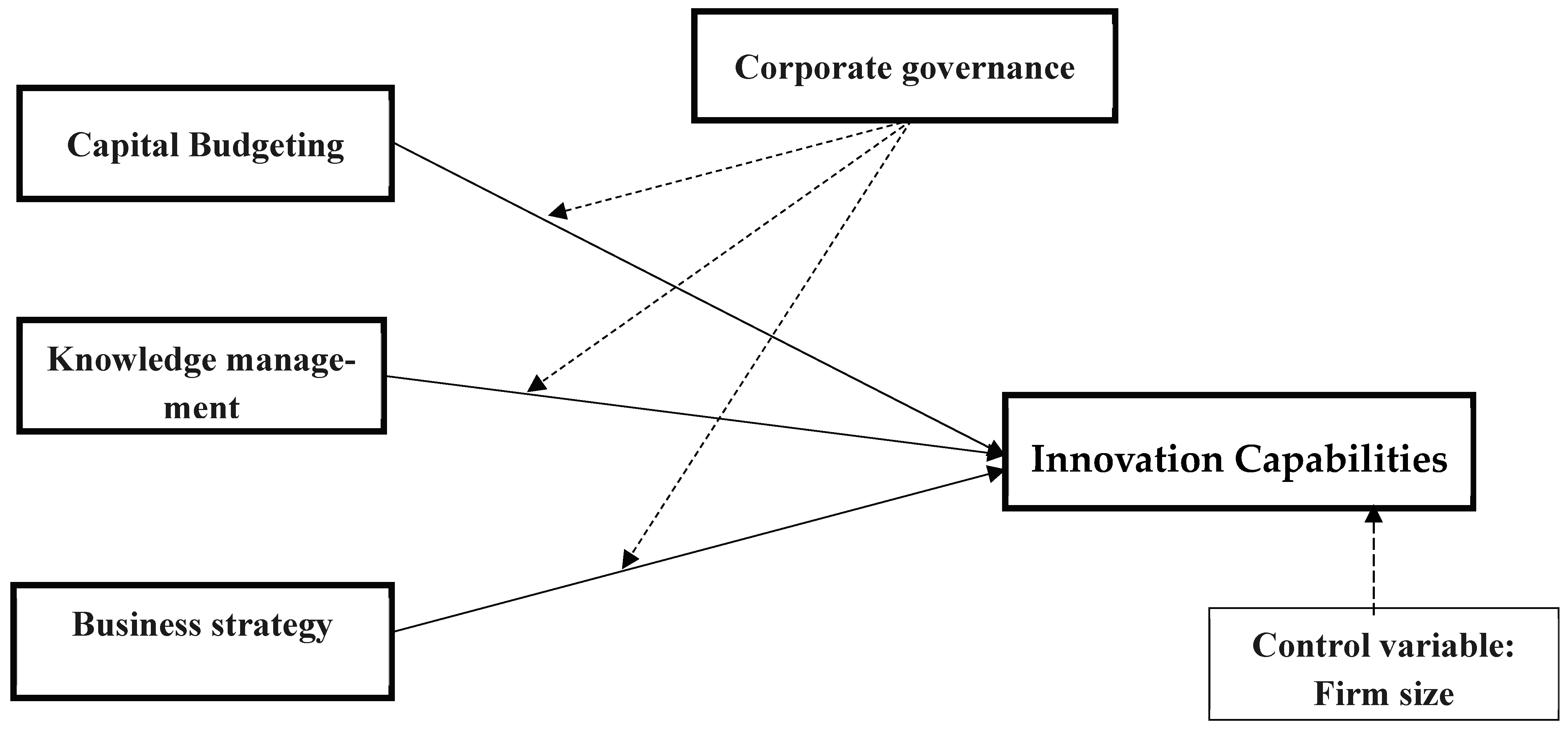

3. Methodology

3.1. Study Area

3.2. Measurement Scale

3.3. Sample and Data Collection

3.4. Data Analysis Method

4. Results

4.1. Measurement Model

4.2. Hypothesis Testing Result

5. Discussion

6. Theoretical and Practical Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Akhtaruzzaman, Sabri Boubaker, and Zaghum Umar. 2022. COVID–19 media coverage and ESG leader indices. Finance Research Letters 45: 102170. [Google Scholar] [CrossRef]

- Aldasoro, Iñaki, Jon Frost, Leonardo Gambacorta, and David Whyte. 2021. COVID-19 and Cyber Risk in the Financial Sector. No. 37. Basel: Bank for International Settlements. [Google Scholar]

- Alia, Muiz Abu, Islam Abdeljawad, Sara Emad Jallad, and Mamunur Rashid. 2022. Voluntary disclosure-cost of equity nexus and the moderating role of corporate governance: Evidence from an extremely politically unstable context. International Journal of Islamic and Middle Eastern Finance and Management. ahead-of-print. [Google Scholar] [CrossRef]

- Ali, Hafizi Muhamad, and Nor Hayati Ahmad. 2006. Knowledge management in Malaysian banks: A new paradigm. Journal of Knowledge Management Practice 7: 1–13. [Google Scholar]

- Andor, Gyorgy, Sunil Mohanty, and Tamas Toth. 2015. Capital budgeting practices: A survey of Central and Eastern European firms. Emerging Markets Review 23: 148–72. [Google Scholar] [CrossRef]

- Azmi, Misral, and Aldin Maksum. 2018. Knowledge Management, the Role of Strategic Partners, Good Corporate Governance and Their Impact on Organizational Performance. Prosiding CELSciTech 3: 20–26. [Google Scholar]

- Badri, Masood, Donald Davis, and Donna Davis. 2000. Operations strategy, environmental uncertainty and performance: A path analytic model of industries in developing countries. Omega 28: 155–73. [Google Scholar] [CrossRef]

- Barako, Dulacha, and Alistair Brown. 2008. Corporate social reporting and board representation: Evidence from the Kenyan banking sector. Journal of Management and Governance 12: 309–24. [Google Scholar] [CrossRef]

- Baron, Reuben, and David Kenny. 1986. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology 51: 1173. [Google Scholar] [CrossRef]

- Barua, Bipasha, and Suborna Barua. 2021. COVID-19 implications for banks: Evidence from an emerging economy. SN Business and Economics 1: 1–28. [Google Scholar] [CrossRef]

- Bascand, Geoff. 2020. Banking the Economy in Post-COVID Aotearoa. A Speech Delivered to Banking Industry Representatives in Wellington. Wellington: Reserve Bank of New Zealand, pp. 56–72. [Google Scholar]

- Bhaskaran, Suku. 2006. Incremental innovation and business performance: Small and medium-size food enterprises in a concentrated industry environment. Journal of Small Business Management 44: 64–80. [Google Scholar] [CrossRef]

- Bhatti, Waheed Akbar, and Arshad Zaheer. 2014. The role of intellectual capital in creating and adding value to organizational performance: A conceptual analysis. Electronic Journal of Knowledge Management 12: 185–92. [Google Scholar]

- Biancone, Paolo Pietro, Valerio Brescia, Federico Lanzalonga, and Gazi Mahabubul Alam. 2022. Using bibliometric analysis to map innovative business models for vertical farm entrepreneurs. British Food Journal 124: 2239–61. [Google Scholar] [CrossRef]

- Black, Benard, Inesa Love, and Andrel Rachinsky. 2006. Corporate governance indices and firms’ market values: Time series evidence from Russia. Emerging Markets Review 7: 361–73. [Google Scholar] [CrossRef]

- Boubaker, Sabri, Zhenya Liu, and Yaosong Zhan. 2022. Customer relationships, corporate social responsibility, and stock price reaction: Lessons from China during health crisis times. Finance Research Letters, ahead-of-print. [Google Scholar] [CrossRef]

- Cao, Zhangfan, Steven Xianglong Chen, and Edward Lee. 2022. Does business strategy influence interfirm financing? Evidence from trade credit. Journal of Business Research 141: 495–511. [Google Scholar] [CrossRef]

- Chen, Shimin. 1995. An empirical examination of capital budgeting techniques: Impact of investment types and firm characteristics. The Engineering Economist 40: 145–70. [Google Scholar] [CrossRef]

- Chi, Nguyen Thi Khanh. 2021a. Innovation capability: The impact of e-CRM and COVID-19 risk perception. Technology in Society 67: 101725. [Google Scholar] [CrossRef]

- Chi, Nguyen Thi Khanh. 2021b. Understanding the effects of eco-label, eco-brand, and social media on green consumption intention in ecotourism destinations. Journal of Cleaner Production 321: 128995. [Google Scholar] [CrossRef]

- Chi, Nguyen Thi Khanh. 2022. Environmentally responsible behaviour in outdoor recreation: The moderating impact of COVID-19 related risk perception. Journal of Tourism Futures, ahead-of-print. [Google Scholar] [CrossRef]

- Chi, Nguyen Thi Khanh, Le Thai Phong, and Kien Dinh Cao. 2021. The impact of organizational factors on E-CRM success implementation. VINE Journal of Information and Knowledge Management Systems, ahead-of-print. [Google Scholar]

- Chittenden, Francis, and Mohsen Derregia. 2015. Uncertainty, irreversibility and the use of ‘rules of thumb’in capital budgeting. The British Accounting Review 47: 225–36. [Google Scholar] [CrossRef]

- Ҫolak, Gonui, and Özde Öztekin. 2021. The impact of COVID-19 pandemic on bank lending around the world. Journal of Banking and Finance 133: 106207. [Google Scholar] [CrossRef]

- Deliu, Delia. 2020. The Intertwining between Corporate Governance and Knowledge Management in the Time of COVID-19–A Framework. Journal of Emerging Trends in Marketing and Management 1: 93–110. [Google Scholar]

- Demirgüç-Kunt, Asli, Alvaro Pedraza, and Claudia Ruiz-Ortega. 2021. Banking sector performance during the COVID-19 crisis. Journal of Banking and Finance 133: 106305. [Google Scholar] [CrossRef] [PubMed]

- Ermasova, Natalia, Tatyana Guzman, and Erica Ceka. 2021. Legacy effect of soviet budgeting system on public capital budgeting: Cases of Russia, Moldova, and Uzbekistan. International Journal of Public Administration 44: 1090–102. [Google Scholar] [CrossRef]

- Fornell, Claes, and David Larcker. 1981. Structural Equation Models with Unobservable Variables and Measurement Error: Algebra and Statistics. London: American Marketing Association. [Google Scholar]

- Gallego-Álvarez, Isabel, and Maria Consuelo Pucheta-Martínez. 2020. Corporate social responsibility reporting and corporate governance mechanisms: An international outlook from emerging countries. Business Strategy and Development 3: 77–97. [Google Scholar] [CrossRef]

- García-Sánchez, Isabel-Maria, and Emma García-Meca. 2018. Do talented managers invest more efficiently? The moderating role of corporate governance mechanisms. Corporate Governance: An International Review 26: 238–54. [Google Scholar] [CrossRef]

- Gerged, Ali meftah, Khaldoon Albitar, and Lara Al-Haddad. 2021. Corporate environmental disclosure and earnings management—The moderating role of corporate governance structures. International Journal of Finance and Economics, ahead-of-print. [Google Scholar] [CrossRef]

- Gitman, Lawrece. 2007. Principles of Managerial Finance, 11th ed. London: Pearson International. [Google Scholar]

- Goffetti, Giuia, Daniel Böckin, Henrikke Baumann, Tillman Anne-Marie, and Thomas Zobel. 2022. Towards sustainable business models with a novel life cycle assessment method. Business Strategy and the Environment, ahead-of-print. [Google Scholar] [CrossRef]

- Gulati, Ranjay, and Harbir Singh. 1998. The architecture of cooperation: Managing coordination costs and appropriation concerns in strategic alliances. Administrative Science Quarterly 54: 781–814. [Google Scholar] [CrossRef]

- Hair, Elizabeth, Tamara Halle, Elizabeth Terry-Humen, Bridget Lavelle, and Julia Calkins. 2006. Children’s school readiness in the ECLS-K: Predictions to academic, health, and social outcomes in first grade. Early Childhood Research Quarterly 21: 431–54. [Google Scholar] [CrossRef]

- Hajar, Ibnu. 2015. The effect of business strategy on innovation and firm performance in the small industrial sector. The International Journal of Engineering and Science 4: 1–9. [Google Scholar]

- Hamdan, Allam Mohammed, Amina Mohammed Buallay, and Bahaaeddin Ahmed Alareeni. 2017. The moderating role of corporate governance on the relationship between intellectual capital efficiency and firm’s performance: Evidence from Saudi Arabia. International Journal of Learning and Intellectual Capital 14: 295–318. [Google Scholar] [CrossRef]

- Hassan, Kabir, Mustafa Raza Rabbani, and Mahmood Asad Ali. 2020. Challenges for the Islamic Finance and banking in post COVID era and the role of Fintech. Journal of Economic Cooperation and Development 41: 93–116. [Google Scholar]

- Hatfield, Patricia, Philip Horvath, and Allen Webster. 1998. Financial criteria, capital budgeting techniques, risk analysis and manufacturing firm performance. Paper presented at the Annual Meeting of the Multinational Finance Society, Helsinki, Finland, June 24–27; pp. 24–27. [Google Scholar]

- IMF. 2020. The IMF’s Rapid Financing Instrument (RFI). April 9. Available online: https://www.imf.org/en/About/Factsheets/Sheets/2016/08/02/19/55/Rapid-Financing-Instrument (accessed on 10 April 2022).

- Jensen, Michael, and William Meckling. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Jia, Nan, Kenneth Huang, and Cyndi Man Zhang. 2019. Public governance, corporate governance, and firm innovation: An examination of state-owned enterprises. Academy of Management Journal 62: 220–47. [Google Scholar] [CrossRef]

- Kenny, David, and Charles Judd. 1984. Estimating the nonlinear and interactive effects of latent variables. Psychological Bulletin 96: 201. [Google Scholar] [CrossRef]

- Khatib, Saleh, and Abdul-Naer Ibrahim Nour. 2021. The impact of corporate governance on firm performance during the COVID-19 pandemic: Evidence from Malaysia. Journal of Asian Finance, Economics and Business 8: 943–52. [Google Scholar]

- Kwak, Wikil, Yong Shi, and Gang Kou. 2012. Bankruptcy prediction for Korean firms after the 1997 financial crisis: Using a multiple criteria linear programming data mining approach. Review of Quantitative Finance and Accounting 38: 441–53. [Google Scholar] [CrossRef]

- Latifah, Lyna, Doddy Setiawan, Anni Aryani, and Rahmawati Rahmawati. 2020. Business strategy—MSMEs’ performance relationship: Innovation and accounting information system as mediators. Journal of Small Business and Enterprise Development 28: 1–21. [Google Scholar] [CrossRef]

- Lazaridis, Ioannis. 2004. Capital budgeting practices: A survey in the firms in Cyprus. Journal of Small Business Management 42: 427–33. [Google Scholar] [CrossRef]

- Manual, Oslo. 2005. The measurement of scientific and technological activities. Proposed Guidelines for Collecting an Interpreting Technological Innovation Data 30: 162. [Google Scholar]

- Mazur, Mieszko, Man Dang, and Miguel Vega. 2021. COVID-19 and the march 2020 stock market crash. Evidence from S&P1500. Finance Research Letters 38: 101690. [Google Scholar] [PubMed]

- Mazzucato, Mariana, and George Dibb. 2020. Innovation policy and industrial strategy for post-Covid economic recovery. In UCL Institute for Innovation and Public Purpose, Policy Brief series (IIPP PB 10). London: UCL Institute for Innovation and Public Purpose. [Google Scholar]

- McNulty, James, Joel Harper, and Anita Pennathur. 2007. Financial intermediation and the rule of law in the transitional economies of Central and Eastern Europe. The Quarterly Review of Economics and Finance 47: 55–68. [Google Scholar] [CrossRef]

- Mendes-Da-Silva, Wesley, and Richard Saito. 2019. Stock Exchange Listing and Capital Budgeting Practices. In Individual Behaviors and Technologies for Financial Innovations. Cham: Springer, pp. 363–83. [Google Scholar]

- Migdadi, Mahmoud. 2020. Knowledge management, customer relationship management and innovation capabilities. Journal of Business and Industrial Marketing 36: 111–24. [Google Scholar] [CrossRef]

- Nahapiet, Janine, and Sumantra Ghoshal. 1998. Social capital, intellectual capital, and the organizational advantage. Academy of Management Review 23: 242–66. [Google Scholar] [CrossRef]

- Nasrallah, Nohade, and El Khoury. 2022. Is corporate governance a good predictor of SMEs financial performance? Evidence from developing countries (the case of Lebanon). Journal of Sustainable Finance and Investment 12: 13–43. [Google Scholar] [CrossRef]

- Ng, Peggy Mei Lan, Man Fung Lo, and Ellesmere Choy. 2015. Improving China’s Corporate Governance Within the Big Data era: Integration of Knowledge Management and Data Governance. Paper presented at the International Conference on Intellectual Capital and Knowledge Management and Organisational Learning, Academic Conferences International Limited, Bangkok, Thailand, November 5–6. [Google Scholar]

- Nguyen, Thanh Trung, Thanh Tung Nguyen, Viet Ngu Hoang, Clevo Wilson, and Shunsuke Managi. 2019. Energy transition, poverty and inequality in Vietnam. Energy Policy 132: 536–48. [Google Scholar] [CrossRef]

- Ormanidhi, Orges, and Omer Stringa. 2008. Porter’s model of generic competitive strategies. Business Economics 43: 55–64. [Google Scholar]

- Parnell, John. 2006. Generic strategies after two decades: A reconceptualization of competitive strategy. Management Decisio 32: 1–19. [Google Scholar] [CrossRef]

- Pereira, Carla Santos, Bruno Veloso, Natercia Durão, and Frenando Moreira. 2022. The influence of technological innovations on international business strategy before and during COVID-19 pandemic. Procedia Computer Science 196: 44–51. [Google Scholar] [CrossRef] [PubMed]

- PWC. 2020. Nen kinh tê hau Covid: Cac xu huong chinh nganh dich vu tai chinh. Available online: https://www.pwc.com/vn/vn/media/press-release/201009-pr-fs-report-vn.pdf (accessed on 3 May 2022).

- Rabbani, Mustafa Raza, Abu Bashar, Nishad Nawaz, Sitara Karim, Mahmood Asad Ali, Habeeb Ur Rahiman, and Md Shabbir Alam. 2021. Exploring the role of Islamic fintech in combating the aftershocks of COVID-19: The open social innovation of the Islamic financial system. Journal of Open Innovation: Technology, Market, and Complexity 7: 136. [Google Scholar] [CrossRef]

- Roper, Stephen, and Joanne Turner. 2020. R&D and innovation after COVID-19: What can we expect? A review of prior research and data trends after the great financial crisis. International Small Business Journal 38: 504–14. [Google Scholar]

- Rossi, Matteo. 2014. Capital budgeting in Europe: Confronting theory with practice. International Journal of Managerial and Financial Accounting 6: 341–56. [Google Scholar] [CrossRef]

- Singh, Rajesh, Suresh Garg, and S. G. Deshmukh. 2010. The competitiveness of SMEs in a globalized economy. Management Research Review 33: 54. [Google Scholar] [CrossRef]

- Swamidass, Paul, and William Newell. 1987. Manufacturing strategy, environmental uncertainty and performance: A path analytic model. Management Science 33: 509–24. [Google Scholar] [CrossRef]

- Tachizawa, Elcio, and Chee Yew Wong. 2015. The performance of green supply chain management governance mechanisms: A supply network and complexity perspective. Journal of Supply Chain Management 51: 18–32. [Google Scholar] [CrossRef]

- TTXVN. 2022. So hoa giup cac ngan hang giam dau mua COVID-19. Available online: https://ncov.vnanet.vn/tin-tuc/so-hoa-giup-cac-ngan-hang-giam-dau-mua-COVID-19/4c77558a-a51d-413d-80c8-8f2031594c7a (accessed on 2 February 2022).

- Vickery, Shawnee, Cornelia Droge, and Robett Markland. 1993. Production competence and business strategy: Do they affect business performance? Decision Sciences 24: 435–56. [Google Scholar] [CrossRef]

- Weiskirchner-Merten, Katrin. 2022. Capital budgeting and managerial empire building. Accounting and Business Research, ahead-of-print. [Google Scholar] [CrossRef]

- Wong, Christina, Chee Yew Wong, and Sakun Boon-Itt. 2013. The combined effects of internal and external supply chain integration on product innovation. International Journal of Production Economics 146: 566–74. [Google Scholar] [CrossRef]

- Zupic, Iva, and Tomaz Čater. 2015. Bibliometric methods in management and organization. Organizational Research Methods 18: 429–72. [Google Scholar] [CrossRef]

| Item Code | Item Description | Source | |

|---|---|---|---|

| Capital Budgeting | |||

| BUD1 | Discounted cash flow methods such as net present value and internal rate of return | Chen (1995) | |

| BUD2 | Payback period | ||

| BUD3 | Accounting rale of return | ||

| BUD4 | Non-financial techniques | ||

| Knowledge management | |||

| KM1 | Employees understand the importance of knowledge for business success post-COVID-19 period | Chi (2021a) | |

| KM2 | A high degree of participation in knowledge acquisition and transfer is expected post-COVID-19 period | ||

| KM3 | Our bank encourages employees to explore and experiment post-COVID-19 period | ||

| KM4 | Our bank focus on knowledge sharing as its benefits outweigh the costs post-COVID-19 period | ||

| Business strategy | |||

| STR1 | We are the technological leader in banking system | Vickery et al. (1993) | |

| STR2 | We place high emphasis on our R&D activities post-COVID-19 period | ||

| STR3 | We take technological risks post-COVID-19 period | ||

| STR4 | We constantly develop our services post-COVID-19 period | ||

| Corporate governance | |||

| GOV1 | Official plan for innovation adoption post-COVID-19 period | Black et al. (2006), Tachizawa and Wong (2015) | |

| GOV2 | Dedicated cross-functional team to execute innovation adoption post-COVID-19 period | ||

| GOV3 | Structure of departments to support interaction in the adoption of innovation post-COVID-19 period | ||

| GOV4 | Management actively participates in vision setting and strategy formulation for innovation post-COVID-19 period | ||

| Innovation capabilities | |||

| INC1 | Our banking system needs to have marketing innovation post-COVID-19 period | Chi (2021a) Migdadi (2020) | |

| INC2 | Our banking system to have process innovation post-COVID-19 period | ||

| INC3 | Our banking system needs services with outstanding quality post-COVID-19 period | ||

| INC 4 | Our banking system adopts innovation in management post-COVID-19 period | ||

| INC 5 | Our banking system needs to have new combinations of marketing, services, and information post-COVID-19 period | ||

| Constructs/Variables | Standard Loadings | Cronbach’s Alpha | Composite Reliability | AVE |

|---|---|---|---|---|

| Capital Budgeting | 0.845 | 0.55 | ||

| BUD1 | 0.777 | |||

| BUD2 | 0.798 | |||

| BUD3 | 0.690 | |||

| BUD4 | 0.783 | |||

| Knowledge management | 0.878 | 0.59 | ||

| KM1 | 0.820 | |||

| KM2 | 0.795 | |||

| KM3 | 0.763 | |||

| KM4 | 0.756 | |||

| Business strategy | 0.873 | 0.56 | ||

| STR1 | 0.716 | |||

| STR2 | 0.779 | |||

| STR3 | 0.726 | |||

| STR4 | 0.815 | |||

| Corporate governance | 0.866 | 0.60 | ||

| GOV1 | 0.850 | |||

| GOV2 | 0.744 | |||

| GOV3 | 0.713 | |||

| GOV4 | 0.826 | |||

| Innovation capabilities | 0.836 | 0.61 | ||

| INC1 | 0.877 | |||

| INC2 | 0.729 | |||

| INC3 | 0.776 | |||

| INC4 | 0.705 | |||

| INC5 | 0.712 |

| Constructs | BUD | KM | STR | GOV | INC |

|---|---|---|---|---|---|

| BUD | 0.742 | ||||

| KM | 0.630 | 0.768 | |||

| STRr | 0.507 | 0.598 | 0.748 | ||

| GOV | 0.668 | 0.573 | 0.634 | 0.775 | |

| INC | 0.541 | 0.657 | 0.660 | 0.563 | 0.781 |

| Relationship with Ecotourism Intention | First Stage Model 1 | Second Stage Model 2 | Hypothesis Testing Results | ||||

|---|---|---|---|---|---|---|---|

| β | Sig | t | β | Sig | t | ||

| Capital Budgeting | 0.077 | 0.064 | 1.848 | 0.082 | 0.075 | 1.974 | |

| Knowledge management | 0.196 | *** | 3.896 | 0.171 | ** | 3.398 | |

| Business strategy | 0.256 | *** | 4.967 | 0.214 | *** | 4.134 | |

| Corporate governance × Capital Budgeting | 0.103 | 0.115 | 1.644 | H1: Not accepted | |||

| Corporate governance x Knowledge management | 0.147 | * | 1.783 | H2: Accepted | |||

| Corporate governance × Business strategy | 0.138 | ** | 2.147 | H3: Accepted | |||

| F-value = 86.480 R-squared (R2) = 0.498, p = 0.000 | F-value = 62.948, R-squared (R2) = 0.597, p = 0.000 | ||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kien, C.D.; That, N.H. Innovation Capabilities in the Banking Sector Post-COVID-19 Period: The Moderating Role of Corporate Governance in an Emerging Country. Int. J. Financial Stud. 2022, 10, 42. https://doi.org/10.3390/ijfs10020042

Kien CD, That NH. Innovation Capabilities in the Banking Sector Post-COVID-19 Period: The Moderating Role of Corporate Governance in an Emerging Country. International Journal of Financial Studies. 2022; 10(2):42. https://doi.org/10.3390/ijfs10020042

Chicago/Turabian StyleKien, Cao Dinh, and Nguyen Huu That. 2022. "Innovation Capabilities in the Banking Sector Post-COVID-19 Period: The Moderating Role of Corporate Governance in an Emerging Country" International Journal of Financial Studies 10, no. 2: 42. https://doi.org/10.3390/ijfs10020042

APA StyleKien, C. D., & That, N. H. (2022). Innovation Capabilities in the Banking Sector Post-COVID-19 Period: The Moderating Role of Corporate Governance in an Emerging Country. International Journal of Financial Studies, 10(2), 42. https://doi.org/10.3390/ijfs10020042