Abstract

During the past two decades, financial markets across the globe have experienced sporadic waves of crashes. Such waves raise concerns about the vulnerability of global financial markets and the transmission mechanisms of shocks beyond borders. The current study examines the co-movement of stock markets in BRICS (Brazil, Russia, India, China and South Africa) countries and the United States of America (US). It unfolds their exposure to contagion effects during the major financial crises, which have flared up since 2000. Daily close price indices of selected stock markets were used in this endeavour. These data spanned from 5 January 2000 to 10 March 2021. A wavelet decomposition on stock return series was performed on these data to determine the multihorizon nature of comovement (pure contagion or interdependence) and the dynamics of market integration. It emerges that before the 2006-US-housing-bubble and after the 2011/13-EU-sovereign-debt crises, some shocks caused pure contagion. Such transmission generated short-term shocks. Most of the earlier shocks, particularly the US subprime and the EU Sovereign Debt crises, were spread via interdependence. Trade linkages and economic integration improvements enhanced such interdependence. In addition, when analysing the episodes of market integration, it arises that, in general, the short- and long-term integration strengthened and deepened comovement among equity markets. From the portfolio diversification and risk management perspectives, these results indicate that the market in China provided lucrative grounds for short-run investors from the other countries covered in the current study. These results can be helpful for investors interested in portfolio diversification in the BRICS region. They might also help policymakers in the region mitigate the exposure to external shocks of markets.

Keywords:

financial crisis; comovement; contagion; integration; shock transmission; wavelet analysis JEL Classification:

C40; G01; G15; F15

1. Introduction

The propagation of foreign shocks and the vulnerability of global financial markets have been topics of great interest in international economic literature in recent years. Since the late 1990s, countries across the globe have experienced the recurring occurrence of financial crises and distresses, which unavoidably spilt over to other countries and regions. Examples are numerous. The 1997 East Asian crisis triggered by the devaluation of the Thai baht spread quickly across East Asia nations. The 1998 Russian financial crisis affected many former Soviet republics and several emerging markets (Kaminsky et al. 2003). The US subprime crisis in 2007 set off the 2008/09 Global Financial Crisis (GFC), which hit markets extensively across the globe, and further, the European sovereign debt crisis (ESDC) that occurred from September 2011 to March 2013. More recently, COVID-19 was declared a global pandemic on 11 March 2020 by the World Health Organization, which undoubtedly induced instantaneous distress in financial markets worldwide. For instance, the US volatility levels in mid-March 2020 exceed those last seen in the early 1930s, October 1987 and December 2008 (Baker et al. 2020; Alqaralleh and Canepa 2021). The recurring occurrence of financial turbulence in international financial markets offers an opening to examine the nature of the transmission mechanism beyond borders and whether such transmission is indeed a contagion.

In the financial literature, numerous papers have tried to identify the transmission channels of foreign shocks in periods of financial distress. Claessens et al. (2001) and Calvo and Reinhart (1996) stressed that the core issue in the empirical findings on financial contagion lies in the discrimination between the two channels, namely, fundamentals-based and pure or excessive contagion. The former indicates that shocks transmitted between markets have been caused by financial market integration and economic ties. It is labelled normal interdependence (Forbes and Rigobon 2002; Bae et al. 2003). In contrast, pure contagion refers to the transmission above what should be expected after adjusting for fundamental causes (Masson 1998; Bekaert et al. 2005). This form of contagion is generally related to investor behaviour. It leads to excessive comovement. Detecting the evidence of these two channels is the core of the discussion of the empirical findings.

Previous empirical analyses on contagion have mainly used various econometric approaches to detect contagion during periods of turbulence. Cross-market correlation coefficients, cointegration and probit models and GARCH frameworks count among these methods. The recent literature has focused on emerging markets. Aloui et al. (2011), Dimitriou et al. (2013) and Zhang et al. (2013) reported that the GFC and the ESDC had substantial effects on these markets, which include BRICS markets. Hammoudeh et al. (2016) documented that these two crises might have changed the behaviour of volatility and return in BRICS markets and, in turn, portfolio diversification gains and risk management. For example, Boubaker et al. (2016) showed considerable evidence of contagion among the US, developed and emerging markets after the 2008 subprime crisis. Khallouli and Sandretto (2012) revealed that the GFC spread to Middle East and North Africa (MENA) markets through mean and volatility contagion. In their part, Aloui et al. (2011) and Zhang et al. (2013) documented that the recent financial crisis has permanently altered the correlation structures of the US, European and the BRICS markets. Akhtaruzzaman et al. (2021) found contagion effects of the COVID-19 pandemic between China and the US financial and nonfinancial firms. Their findings show an increase in conditional correlation.

Forbes and Rigobon (2002) stressed that contagion tests based on correlation coefficients are still biased when heteroscedasticity is overlooked. In contrast, Corsetti et al. (2005) and Gallegati (2012) underlined that standard time-domain has a major drawback when discriminating fundamentals-based contagion from other transmissions, which fundamentals cannot explain. Studies by Bodart and Candelon (2009) and Orlov (2009) used the frequency-domain framework to test for contagion. They related low and high frequencies to interdependence and contagion, respectively. Candelon et al. (2008) stressed that such a distinction is crucial from a portfolio-diversification point of view.

Accordingly, the current work analysis addresses the empirical issue of distinguishing between interdependence and contagion, using the wavelet approach, a relatively novel approach in economics and finance. Given the increasing vulnerability of emerging countries to external shocks and their importance for international portfolio diversification, the current work attempts this approach in the BRICS (Brazil, Russia, India, China and South Africa) stock markets environment. BRICS are emerging economies that have caught much attention of the inspiration of the world. BRICS countries gained substantial momentum in the two last decades. The growth poles of these countries can sustain the emergence of a new global economy. With an enormously big pool of human and physical resources and a speedy-rising share in the growth of the global GDP, this block of heterogeneous economies has a substantial capability to take the place of the world’s number one engine of growth, i.e., the US. Collectively, BRIC countries account for around 40% of the world’s population and about 25% of the World’s GDP. Such figures are inclined to rise in the years to come. Most essentially, as per the Goldman Sachs (2003) report, it is widely alleged that, by the year 2030, China will overtake the US as the world-leading economy and that, by the year 2032, BRIC could grow as big as the G7. In addition, all five nations are rich in natural resources. This specificity has remained a core factor in this group’s rise. Further, the current work includes the US market since the latter is practically a proxy of the global market and the origin of the recent global financial crisis.

The wavelet analysis is a filtering technique that employs both time and frequency domains. By decomposing the return series into different time-scaled components, this method shows the variability and structure of the stochastic processes on a scale-by-scale basis. Such a specificity allows for distinguishing between interdependence and pure contagion, thus discriminating between short- and long-term investors. This information is helpful for policymakers, portfolio managers and investors for informed decision making. In addition, the wavelet coherence with rolling windows is used to capture the episodes of stock market integration in a multihorizon nature and further identify the lead–lag relationships between the changing comovement among markets.

Over the past decade, some studies have used the wavelet method to test for contagion in international stock market comovements in times of financial crisis. Ranta (2013) tested for contagion effects in four developed equity markets. Gallegati (2012), Dewandaru et al. (2016, 2017) and Alqaralleh and Canepa (2021) considered developed and emerging markets in their assessments. The main conclusion drawn by these authors is that wavelet analysis provides a valuable alternative to the existing conventional methodologies. The degree of comovement of stock returns varies across frequencies. Therefore, the risk of short and long-term investors is different.

The current study supplements the existing literature on two fronts. Firstly, the present work is the first empirical study to apply the wavelet analysis on the BRICS and the US stock markets to address the empirical issue on the evidence of pure contagion and interdependence. Its purposes are as follows: simultaneously investigate interdependence, contagion and episodes of market integration and further capture the transmission dynamics through lead–lag relationships analysis. Secondly, the current study unfolds the exposure of markets to contagion effects. Such an exercise is performed not only for the recent subprime or any specific crisis. It is also conducted for the earlier major crises and the COVID-19 volatility.

To this end, the current empirical analysis focuses on the following objectives: Firstly, detect the vulnerability of markets to contagion effects of major historical crises that flared up over the past two decades, knowing that the impact of each crisis may not be the same across markets. In this regard, this analysis uses data scattered within the span of January 2000–March 2021. Secondly, detect evidence of pure contagion or interdependence for each crisis and examine lead–lag relationships to capture the transmission dynamics. Thirdly, further analyse the evolution of short- and long-term integration. Indeed, well-integrated stock markets are likely to have high exposure to external shocks.

The current work reveals the following empirical findings. BRICS markets were exposed to major crises over the past two decades. So was the US market. The 2007/09 US subprime crisis, followed by the 2010/13 ESDC, showed substantial interdependence among all concerned markets. Clear signs of pure contagion are found, singly, around the 2014/15 Russian crisis and the Chinese stock market crash. In addition, both stronger short- and long-term integrations were found amongst the selected stock markets, given the relatively high openness of these markets to the global economy.

2. Literature Review

Two broad types of contagion emerged in the literature: fundamental-based contagion and pure contagion. Calvo and Reinhart (1996) posited that the difference between the two concepts is a core issue in the empirical findings. Masson (1998) mentioned three main transmission mechanisms through which a financial crisis can be transmitted from one country to another: monsoonal effects (or contagion from common causes), spillovers and pure contagion effects. Monsoonal effects are likely to occur when affected countries have similar economic fundamentals or face common external shocks (e.g., international interest rates or oil prices). Spillover effects arise from financial market interlinkages. The latter may be caused by trade ties or interdependence. These first two channels may be classified as fundamental causes and referred to as normal interdependence since the affected countries share certain macroeconomic fundamentals. This classification suggests that the financial shock spreads through channels or linkages that already existed between economies. A high degree of correlation between two markets after a crisis is just a prolongation of linkages anterior to the crisis (Masson 1998; Kaminsky and Reinhart 2000). For example, Collins and Biekpe (2003) found that, except for Egypt and South Africa, most African stock markets did not experience contagion after 1997. Instead, they experienced the effects of interdependence.

Pure contagion, often labelled as excessive comovement, refers to an episode in which shock in one country triggers a shock elsewhere due to causes unexplained by fundamentals. Pure contagion is related to humans’ behaviour. It is commonly due to causes induced by an announcement of sensitive news, such as herding, panic and loss of confidence in participants in the market. Pure contagion implies that cross-market comovement of two markets increase significantly after a shock, whereas their long-run trend does not change. Pure contagion could probably be quick and hence disappear in a short period.

Forbes and Rigobon (2001) distinguished three main channels of shock transmission related to human behaviour. These causes are liquidity and incentive problems, information asymmetries and imperfect information and reassessment of institutions’ rules in international finance. For example, a leveraged investor facing margin calls has to sell asset holdings. Because of the information asymmetries, a lemons problem arises. Thus, the holder can only sell the asset at a low-fire sale. Hence, the strategy will not be to trade an asset whose price has already dropped but additional assets in the portfolio. Yet, while doing so, the prices of these additional assets collapse. The initial shock propagates across markets and may cause a drastic outflow of funds. This liquidity problem arising from information asymmetries can lead to widespread upswings or declines in other markets. For example, the seminal work of King and Wadhwani (1990) evidenced contagion in developed markets of London, New York and Tokyo following the 1987 US stock market, using a cross-correlation technique. Calvo and Reinhart (1996) used the same framework. They reported a rise in the cross-market correlation between many emerging markets after the 1994 Mexican peso crisis.

Concerning BRICS markets, the literature over the last decade has investigated the comovement of the BRICS and developed markets in terms of contagion risk and volatility spillovers. This investigation has been motivated by the role the countries in the block play in the global economy and the potential gains they can provide to international investors, promoted by their high potential economic growth. Some empirical studies have shown that BRICS markets considerably reacted to the shocks generated by the GFC and the ESDC. The latter crises had substantial effects on the behaviour of emerging markets. For example, Dimitriou et al. (2013) explored BRICS stock markets using the DCC-FIAPARCH model. Their empirical results revealed signs of contagion effects in all markets in BRICS. These effects could be viewed as a shift in investors’ risk appetite consecutive to the US subprime crisis. Similar results were documented in the work of Zhang et al. (2013). These authors used the DCC-GARCH framework and found that the recent GFC has permanently altered the correlations among the US, European and the BRICS markets.

Pereira (2018) investigated the volatility of BRICS markets to the Lehman Brothers Bankruptcy and EU Sovereign debt crises using the VECM cointegration/Granger causality technique. His findings revealed contagion effects during both shocks. These crises have changed the structure of their long-term relationships, thus deteriorating the diversification benefits. This finding is in line with the conclusion reached by Ahmad et al. (2013) when using the DCC-GARCH model.

Other studies have stressed the importance of trade links and integration as parameters enhancing interdependence. Using the EGARCH model, Bhar and Nikolova (2009) found that macroeconomic factors played a more significant role than movements of global oil price in determining stock price dynamics in BRIC countries. Similarly, Bouri et al. (2018), using the Bayesian structural VAR framework, highlighted the role of both global and within-group stock market implied volatility in predicting individual implied volatility in BRICS countries.

Moreover, the evidence from empirical literature reveals that the economic structures of BRICS countries are heterogeneous in a sense, as the impact patterns of a shock are different for each market. For example, Syriopoulos et al. (2015) stressed that the US industrial and financial sectors exert substantial impacts on the returns of BRICS countries, except for China. In the same vein, the evidence by Lakshmi et al. (2015) revealed amplified linkages during the US subprime crisis and both short-run Granger causality and long-run relationships between BRICS-US. In the short run, however, variations in the Brazilian market are more responsive compared to the other four markets. For their part, Ji et al. (2018) found that, though the US VIX plays a prominent role in transmission to other BRICS VIXs, the impacts of the Chinese and Brazilian markets at a local level should not be neglected. Bonga-Bonga (2018) further found South Africa vulnerable to innovation emanating from China, India and Russia, contrary to innovations from South Africa to these countries.

Other studies have looked at how the interconnectedness of financial markets in BRICS could appeal to global investors. Using nonparametric cointegration, Zhong et al. (2014) found a long-term equilibrium between BRICS, UK and US stock markets. This equilibrium suggests that the investors in the US would not have diversification benefits in BRICS markets. This result is corroborated by Nashier’s (2015) findings which, obtained from the Johansen Cointegration test, validate the existence of long-run relationships between the BRICS and the US equity markets during the US subprime crisis. These relationships restrict any speculative activities among these markets. Lakshmi et al. (2015) found similar results. Recent work by Bouri et al. (2021) asserted that uncertainty of the COVID-19 pandemic has prompted herding among global financial market participants and that the herding effect is mainly strong for emerging markets, including BRICS. This result would probably narrow windows for international benefits diversification. Al-Mohamed et al. (2020) suggested that the opportunity of portfolio diversification among BRICS stock markets has diminished but has not been totally eradicated.

Thus far, from the aforementioned well-documented studies (including BRICS) on market comovement, it is difficult to identify whether the shock is transmitted via fundamental-based or pure contagion. These studies were inconclusive and therefore disputable. Yet, there is still a need to determine the shock transmission mechanisms. Econometric methods may encounter setbacks when testing for contagion. These setbacks are due to the difficulties of measurement mentioned earlier. Explicitly, standard time-domain methods may face issues in discriminating contagion from other types of shock transmission. They are unable to combine information from both frequency and time domains.

The wavelet approach emerges as a powerful mathematical filtering method that provides an appealing alternative for time-series and frequency-domain methods. This method decomposes the original signal into different frequency components, with a resolution matched to its scale. Over the last decade, some papers have used wavelet analysis to assess comovement among the BRICS, emerging and developed stock markets, following the GFC and ESDC. These studies (Benhmad 2013; Lehkonen and Heimonen 2014; Mensi et al. 2017) have concluded that China still provides diversification benefits for international investors.

In contrast, some recent studies explored, using wavelet analysis, cross-market linkages by distinguishing between pure contagion and interdependence. Alqaralleh and Canepa’s (2021) results from wavelet coherence on six major stock markets (Canada, Japan, China, Hong Kong, UK and the US) revealed interdependence before the start of the COVID-19 pandemic and pure contagion after the health crisis outbreak.

The results of Dewandaru et al. (2016, 2017) stressed the efficiency of the wavelet coherence to assess contagion and interdependence and additionally episodes of market integration. The results of Dewandaru et al. (2016) on the Asian-Pacific stock markets (Australia, Japan and Hong Kong) suggested that before the recent subprime crisis, shocks were mainly spread through excessive comovement (contagion), whereas the 2008/09 US subprime crisis evidenced fundamental-based contagion or interdependence. They also find a weak integration among the selected markets. On their side, Dewandaru et al. (2017) assessed regional spillovers of four emerging equity markets (Israel, The United Arab Emirates, Saudi Arabia and South Africa). Their results revealed that those shocks generated pure contagion before the US subprime crisis. They also showed that those shocks had generated interdependence for the subprime crisis. The dynamics of stock market integration results indicated a weak short-run integration.

Through time-varying estimation methods (wavelet coherence), these empirical findings have revealed the dynamicity of stock returns on a scale-by-scale basis and further delved into short- and long-term integration horizon degrees. This decomposition was used in the current work. It enabled discriminating excessive comovement (pure contagion) from fundamental-based linkage (interdependence), thereby assessing the risks of both short- and long-term investors. The market-integration dynamics was also captured.

3. Methodology and Data

3.1. Methodology

The wavelet transform can exhibit both time and frequency information. Such versatility makes the wavelet transform powerful in time series analysis. Wavelet transform can react to abrupt changes and nonstationary behaviour features inherent to most financial data. The wavelet analysis can be performed employing either the discrete wavelet transforms (DWT) or the continuous wavelet transform (CWT). The latter provides many advantages over the DWT. It offers the freedom in selecting the number of wavelets according to the length of the data, i.e., the number of scales generates itself following the data size. The CWT provides highly redundant information. As it operates on the original time series, the time turns into two variables, frequency and time. Aguiar-Conraria and Soares (2011) reported that the redundancy spotted in CWT eases the detection and interpretation of hidden information or patterns. These authors defined the wavelet squared coherence (WSC) of two time series as the ratio of their cross-spectra to the product of the spectrum of each series. Such ratio can be viewed as the local (both in time and frequency) correlation between these time series. The current study gives a brief description and a simplistic representation of these two concepts (see Grinsted et al. 2004, for detailed descriptions of the CWT and WSC).

A wavelet coherency analysis was performed using the continuous wavelet transform, as applied by Grinsted et al. (2004) and Aguiar-Conraria and Soares (2011). The continuous wavelet transform (CWT) of a time series x(t) for the wavelet ψ is a function of two variables given by the following convolution (Equation (1)).

where is the complex conjugate of the Morlet mother wavelet ψ, a complex sine-wave under Gaussian envelope, τ the translation parameter or time position controlling where the wavelet is localised and s the dilatation or scaling parameter regulating the width of the wavelet. |s|−0.5 indicates the normalisation factor that guarantees that transformation across scales and over time are still comparable and that the variance of ψ is equal to 1.

Numerous types of wavelets were used to decompose time series data in the previous studies. The choice of wavelet function depends on the type of application under investigation. The most popular of the complex-valued wavelets, the Morlet wavelet, is given by Equation (2).

In analogy with the terminology used in Fourier analysis, the wavelet power spectrum (WPS), sometimes called wavelet periodogram or scalogram, is described with Equation (3).

The WPS evaluates how much each time and scale contributed to the time series variance. The wavelet analysis provides tools that enable us to deal appropriately with the time-frequency dependencies between two time series. Therefore, the concepts of cross wavelet power, wavelet coherence and phase difference are helpful for the current work.

The cross-wavelet wavelet transform (XWT) is given by Equation (4).

where is the complex conjugate of Wy (τ,s).

The cross-wavelet power (XWP) is abridged in Equation (5).

The cross-wavelet power establishes the local covariance between pairs of time series and in the time-frequency space. It shows the areas with high common comovement between times series and , at a specific time-scale period.

The concept of wavelet coherence is used similarly in Fourier analysis. Given two time series xt and yt, their wavelet coherence is denoted by Equation (6).

where S is a smoothing operator in both scale (frequency range) and time.

The wavelet squared coherence (WSC), , was used to assess comovement levels between two time series. The WSC is analogous to the squared correlation coefficient in linear regression. Its value lies between 0 and 1, with a low (high) value suggesting a weak (strong) comovement. When the WSC values are plotted as a colour map, regions in which the two time series comove in time-frequency space can be detected. Such areas may not have necessarily high power. Yet, they reveal both time- and frequency-varying characteristics of the comovement. The level of significance of the calculated WSC was evaluated with Monte Carlo simulation techniques embedded in the AS toolbox used in the current work.

Lastly, the wavelet coherence phase differences, which reveal the details about the cycles (oscillations) between two time series, was used. The benefit of using a complex-valued analytic wavelet is that it contains information on both amplitude and phase. The phase difference provides information on negative and positive comovement and the lead–lag relationships between the two return series. The phase difference is the information that x leads over y. It is given by the (Equation (7)).

where I and R are the imaginary and real components of the smooth power spectrum.

A phase difference of zero indicates that the time series move together at a specified time-frequency. If

, the series move in phase with the time series leading . When

, is taking the leading role. A phase difference of π (or –π) indicates an antiphase relation. If , is leading. Time series is leading if .

The current study can explore the comovement level of stock market returns at different periods and frequencies. In the WSC colour map, the local correlation can be measured. The time series that is currently leading or lagging can be revealed using the direction of the pointing arrows. This direction further shows whether the comovement is negative or positive (phase or antiphase). The coloured map plots from WSC provide redundant information at different periods and frequencies. This redundancy is exploited in the current work to discover and interpret patterns or concealed information in the stock returns under investigation. These features can only be revealed through wavelet analysis.

3.2. Data

A wavelet analysis was applied to stock indices in five countries of the BRICS from Brazil (BOVESPA), Russia (RTS), India (SENSEX), China (SHANGHAI COMPOSITE), South Africa (JSE/ALL SHARE INDEX or ALSI) and the US (S&P 500). The data used in the current work were sourced from INET BFA and represent the most commonly used daily stock market closing price indices. They were sampled from 5 January 2000 to 10 March 2021. Such a data sample was sufficient to analyse the dynamic linkages among the related equity markets. It also revealed the effects of some recent major crises, such as the 2010/2012 European sovereign crisis and the 2007/2009 global financial crisis. In addition, incorporating the pandemic period in the data sample disclosed new insights into COVID-19 threats on stock markets. The pandemic has generated a massive spike in uncertainty in financial markets worldwide. For instance, the levels of volatility in the US stock markets exceed those last spotted in major financial crises, as mentioned earlier.

Thus, the time series x(t) and y(t) used in the current work were the returns of the said indices. These indices were computed as the difference between the logarithms of the stock prices (Equation (8)). They were processed on a pairwise basis.

where Returnt is the daily return at time t and Indext the daily closing price at time t and t − 1.

The descriptive statistics of the returns thus are presented in Table 1. The skewness is negative for all index returns through the current investigation period, suggesting that their peaks lean more to the right. Investors faced the risk of extreme losses. Compared to the US equity markets, all the BRICS equity markets offered investors higher mean returns. Moreover, the stock market of India evidenced the highest return average. Table 1 flags the stock market of Russia to be the most volatile, as indicated by the highest standard deviation, and the stock market in South Africa to be the least volatile. Based on Jarque–Bera statistics, all the returns are not normally distributed. Their distribution is negatively skewed and leptokurtic. It suggests that all stock returns exhibit the usual fact of volatility clustering.

Table 1.

Descriptive statistics of the stock market returns of the BRICS and the US.

Turning to the Pearson correlation matrix of the stock returns presented in Table 2, the linear dependence between equity markets in BRICS appears to be positive and noticeably low (<0.50). The highest is Russia–South Africa (0.4954), the lowest recorded is China–Brazil (0.1316). Compared to the US stock markets, BRICS still have a low correlation, except for Brazil–US (0.5996). China–US is the lowest correlation in the data used in the current work (0.0828). The overall results suggest that common factors do not affect the movement of all index returns in the data sample, indicating a sign of low integration between BRICS exchange participants as well as BRICS and the US.

Table 2.

Correlation matrix of the stock returns.

4. Empirical Results and Discussion

4.1. Evidence from the Continuous Wavelet Transform

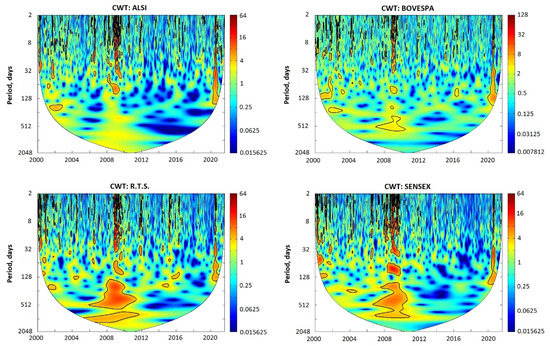

The continuous wavelet transform is the absolute square value, which computes the variance of the return series at each time and scale. It shows how volatility for the selected return series evolves in time-frequency space. The wavelet power spectrum (WPS) of each return series is displayed in Figure 1.

Figure 1.

The continuous wavelet power spectrum of the BRICS and US stock market returns. The thick black contour indicates a 5% significance level against red noise. The cone of influence where the edge effects might distort the picture is shown as a lighter shade. The power ranges from low (blue) to higher (red). The time in years and frequency in days are placed on the x- and y-axis, respectively.

The statistical significance of the wavelet power is evaluated against the null hypothesis of the stationary process with the background power spectrum. The thick black contour in regions indicating the 5% significance level against the red noise is estimated from Monte Carlo simulations using phase-randomized surrogate series. The power ranges from blue (low power) to red (high power). The curved black line limits the cone of influence (COI), which designates regions affected by edge effects. The area outside the COI shows no statistical significance.

The horizontal axis represents the time component (years) and covers study periods from 2000 to 2021. The vertical axis represents the frequency component. Frequency bands are based on daily units, ranging from 2- to 1024-day scales. These scales are further divided into two holding periods. The 2- to 256-day scale (high frequency) relates to the short term dynamics. The 256- to 1024-day scale (low frequency) relates to long-term dynamics.

The wavelet power spectra in Figure 1 display the evolution of variances of stock market indices within the sample period. It can be seen clearly that each market has experienced both short- and long-term volatility. From 2001 to 2002, all markets experienced short-run volatility as the variations can be observed near 256 days, with noticeable small high-power areas for the Indian market. These occurrences are linked with the synergy of the overlapping effects of two financial shocks. These shocks were the dot-com bubble and the al-Qaeda attack on the US. In the subsequent years, 2003–2004, slight variations were detected below 256 days in all markets, except for South Africa, with the Chinese market displaying high power. This outcome can be linked to the Madrid attack, which occurred in March 2004, when bombs exploded in the trains. Seemingly, markets were not affected by the shock.

Finally, the WPS show significant high variations in 2020 in all markets. They display high power areas below 256 days, with the market in China, however, unexpectedly demonstrating relatively small high-power areas below 64 days. This result can be linked to the COVID-19 outbreak, declared early in 2020, which had no national borders. Though the pandemic primarily happened in China, it seems that China has managed to contain the spread of the virus in time and thus mitigated the harsh impacts on its economy. As per Liu et al. (2020), China has won a precious opportunity for controlling and preventing the COVID-19 pandemic.

Alternatively, from 2006 to 2011, the wavelet power of all markets, except for South Africa, exhibited high-power areas and similar patterns in both short- and long-run terms, with Asian-BRIC markets showing broad high power at low-frequency bands. This finding indicates that BRICS markets were seriously hit by the global US-born subprime crisis and the European sovereign debt crisis, whereas the US market, unexpectedly, showed minimum exposure. Furthermore, the Chinese stock market crash in 2015/16 surprisingly affected only the Russian and the Chinese markets, respectively.

The Russian market displayed a small high power near 128 days, while the Chinese stock index had been exposed to both short- and long-term volatility shocks, as significant high variation is visible below 256-day and 512-day scales in 2016. The Shanghai stock market collapse coupled with a more typical slowdown of the Chinese economy may have significantly decreased investors’ confidence and deteriorated further structural problems.

High-power areas are detected at high-frequency bands, below 128 days, in most of the index-pairs. The short-term volatility shocks can be due to investors’ behaviour in periods of higher uncertainty, such as loss of confidence, herding and financial panic. The reviewing of expectations by investors will probably engender an overall reversal of funds causing capital flows. On its own, such a setback is a source of instability. A shock in one country is likely to generate fluctuations only within its borders but not at the group level. It is hinted that the Chinese market has absorbed nearly equally all the crises, while the US, followed by South Africa, had both minimum exposures to these major crises.

4.2. Exploring Comovement of Stock Markets

Following Dewandaru et al. (2017), a wavelet coherence model was applied in the current work. It has the gain that the targeted decomposition can be extended to obtain more time scales up to longer horizons. Such an approach was expected to bring more robustness to the comovement analysis. The presence of excessive or fundamental-based contagion is captured at different time scales instead of only one smooth time scale. More specifically, to assess stock market comovement and ascertain the shock transmission mechanisms (excessive or normal), return series are decomposed at most up to 1024 days (4 years). Wavelet coherence uses rolling-window in a multihorizon way. The thresholds of 2–256 day scales and 256–1024 day scales refer to pure or excessive contagion and interdependence (fundamental-based contagion), respectively, as reported in Dewandaru et al. (2016, 2017). In the current context, a financial year has roughly 256 days. Short-term investors are interested in financial instruments which can be held for less than one fiscal year, while long-term investors intend to keep assets for more than a year. The high-frequency range uncovers information concerning the short-term market linkages such as market panics, herding, informational asymmetries and liquidity problems. In contrast, lower-frequency bands may indicate fundamental links close to the real economy.

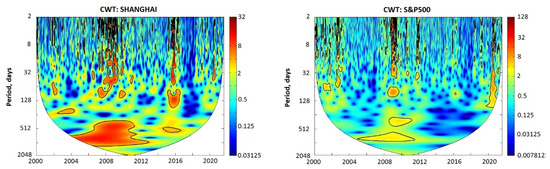

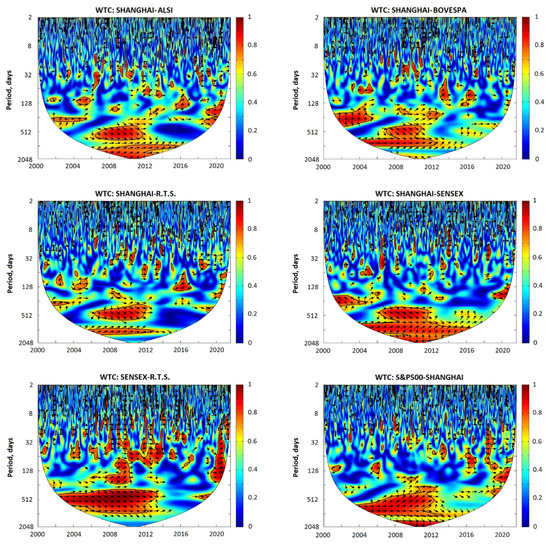

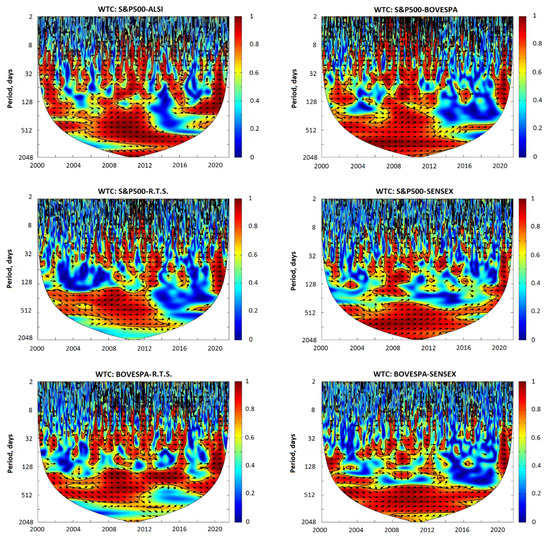

The wavelet-squared coherence plots are presented in Figure 2, Figure 3 and Figure 4. The wavelet phase difference represented by arrows ascertains the active connections of indices by detecting the lead–lag relationship via different investment horizons. Pointers display the direction of interdependence and cause–effect links. It has to be stressed that if a particular market leads another one, this relationship does not necessarily imply any causality between them. It merely means that the two markets are moving together, with one of them taking the lead over the other. The investigation of causality indices involved in the lead–lag relationship required examining several transmission mechanisms by the proxies of Granger causality in a multivariate framework, as indicated in well-documented theoretical and empirical studies.1

Figure 2.

Wavelet squared coherence of stock returns of China with other BRICS and the US and India and Russia. The comovement level is measured in the range of lower correlation (blue) to higher correlation (red), as shown in the colour bar. The thick black contour indicates a 5% significance level against red noise. The relative phase relationship is shown as pointing arrows. Down: the first series leading the second series by 90°; up: the second series leading the first series by 90°; right: in-phase; left: antiphase.

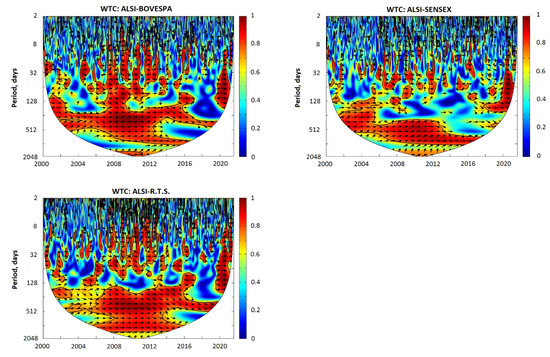

Figure 3.

Wavelet squared coherence of stock returns of the US and BRICS and Brazil with Russia and India. The comovement level is measured in the range of lower correlation (blue) to higher correlation (red), as shown in the colour bar. The thick black contour indicates a 5% significance level against red noise. The relative phase relationship is shown as pointing arrows. Down: the first series leading the second series by 90°; up: the second series leading the first series by 90°; right: in-phase; left: antiphase.

Figure 4.

Wavelet squared coherence of stock returns of South Africa with Brazil, India and Russia. The comovement level is measured in the range of lower correlation (blue) to higher correlation (red), as shown in the colour bar. The thick black contour indicates a 5% significance level against red noise. The relative phase relationship is shown as pointing arrows. Down: the first series leading the second series by 90°; up: the second series leading the first series by 90°; right: in-phase; left: antiphase.

4.2.1. Discovering Periods Related to Contagion

In this section, contagion and lead–lag relationships between BRICS and the US stock return are investigated using the plots of wavelet squared coherence (WSC). For contagion testing, the current study describes contagion as a momentarily (short-lived) increase in comovement immediately after a crisis. Such a description suggests the following. Contagion is any increasing comovement below 256 days. In the coherence plots, contagion is revealed by high coherence areas during some crisis periods. WSC plots (Figure 2, Figure 3 and Figure 4) are similar to those shown in Figure 1. The horizontal axis denotes time units in years, whereas the vertical axis represents the frequency in days. The warmer (red colour) regions illustrate that the two return series are highly dependent. In contrast, the cooler (blue colour) areas indicate that the two return series are less independent. The lead–lag relationship is detected through different investment horizons through arrows pointing in various directions. For example, to retrieve the relative phase relationship from the plot SHANGHAI-ALSI, the following holds in connection with the direction pointing arrows: Right: in-phase (positive association); left: antiphase (negative association); down: SHANGHAI leading ALSI by 90° and up: ALSI leading SHANGHAI by 90°.

A predominance of the blue colour in all index-pairs of the China stock market with the others (Figure 2, Figure 3 and Figure 4) emerges at first glance. Such a prevalence indicates that low-coherence areas dominate, thus implying a low comovement in China compared to other countries. This finding is consistent with the Pearson correlation results reported in Table 2. The latter result shows that China was the least correlated with the US and within BRICS countries. From 2001 to 2002, a transitory increase in high-coherence areas was perceptible near 256 days for the index-pairs of China–South Africa and China–Russia. The same holds for the pair US–China at 128 days. This finding is likely to reflect an excessive transmission channel since there is no sign of the increasing comovement over the longer time scale horizons. These periods can be linked to the effects of the al-Qaeda terrorist attack on the US in 2001. They could also be related to the dot-com bubble that originated from the accounting scandal in the US the following year. The pointing arrows show the leading role of South Africa and Russia over China, whereas China is leading the US.

From 2013 onwards, contagion was apparent in some index-pairs as the index-pairs showed transitory increases in comovement only at frequency bands below 256 days. High-coherence areas in 2014 were manifest for the index-pairs of China–Brazil and US–China at 128 days, while the index-pairs of China–Russia and India–Russia showed a short-live increase at 64 days. This result can be linked to the Russian financial crisis. The arrow’s direction shows the leading role of Brazil and Russia over China, whereas India–Russia and US–China move together. In 2016, high-coherence areas were noticeable for the index-pairs of US–Russia and India–Russia. The same holds for all index-pairs with China, except for China–India. This result can be associated with the global tumbling of stock markets triggered by the sudden collapse of the Shanghai composite in July 2015. The pointing arrows appear to indicate the leading role of other countries over China while India and Russia are in phase.

A temporary increase in comovement was also noticeable in 2018 for the index-pairs China–South Africa, China–Russia and US–China near 64 days. The same holds for frequency bands near 32 days for China–India. These periods can be linked to the stock market dive in the US, which created pessimism in stock markets across the globe. The dive was fuelled, among other factors, by Donald Trump’s administration trade war against China (e.g., the tariff on steel), the expectation of the hike of the interest rate by the Fed and the slowdown in global economic growth. These factors have brought in a tremendous amount of uncertainty into stock markets. From a causal perspective, all the selected stock markets are likely to take the lead over the China market. Finally, the evidence was remarkably found in 2019/20, where a common shock triggered by the COVID-19 outbreak caused nearly all index-pairs to react to short-term volatility shocks. The immediate increase in comovement appeared at a higher frequency, below 256 days.

The overall finding on contagion indicates that some shocks generated essentially distinct contagion effects before 2006 and after the EU sovereign debt crisis. Remarkably, the market crash in China engendered rising comovement of excessive nature. The COVID-19 pandemic caused an enormous spike in uncertainty in financial markets. This result can be attributed to the fact that, worldwide, countries had little experience with responding to COVID-19 spread. They did not have implementation plans and policies to shield their economies and equity markets. It is worth noting that contagion appeared mostly near the 128-days frequency ranges. This finding may infer that surprise news does not induce an abrupt stop of capital inflow owing to, among other factors, the slow adjustment of expectations of investors and fund managers, lack of complete information, substantial transaction costs and the increasing speculative sentiment of global investors about the economic policy uncertainty in the attempt to reduce the spread of COVID-19 (nationwide lockdowns).

Concerning the interdependence (or fundamental-based contagion), it is interpreted as an immediate increase in comovement that occurs both at higher- (below 256 days) and lower-frequency ranges (above 256 days). The trend shows that the 2007/12 crisis periods appeared to involve channels related to fundamental, as the immediate increase in the comovement temporarily is evident in the selected index-pairs both in short- and long-run frequency bands (Figure 2, Figure 3 and Figure 4). This market turbulence can be linked to the US subprime crisis and the sovereign debt in the EU. This outcome corroborates the finding from wavelet spectrum results that these recent financial crises have seriously hit BRICS markets. In addition, index-pairs in Figure 3 and Figure 4 that protruded in warmer colour have portrayed large high-coherence areas, with noticeable broad high power at longer time scales during the entire period of observations. This finding reveals fundamental-based contagion in reaction to structural shocks since the immediate rises of comovements happen at both high- and low-frequency ranges. From the transmission channel point of view, the direction of arrows shows the following, in general. Before the housing bubble in 2006, the US was leading, whereas Brazil was taking the lead over South Africa, India and Russia and had no clear direction for South Africa–Russia. In addition, the GFC and the ESDC disclose the leading role of BRICS over the US, while South Africa is taking the lead over Brazil, India and Russia. Brazil is leading India and Russia.

Furthermore, there is a high level of trade integration of BRICS with the rest of the world via bilateral free-trade agreements such as the WTO and G20, in which all five BRICS countries are members. Mensi et al. (2017) reported that BRIC markets appear to have more linkages with industrialized markets as they export, over time, more goods to these countries. For instance, the Brazilian market was severely affected by volatility from the US than the other markets in the BRICS. This outcome implies that the stock market of Brazil is exposed to trade contagion. All these relations may have amplified the vulnerability to fundamental-based contagion and probably justified the severe effects of the recent crises.

4.2.2. Market Integration

Modern financial theory suggests the following. When markets are completely integrated, investors in local and global markets receive a similar risk-adjusted expected return on identical financial instruments. To the degree that some macroeconomic variables, such as inflation and interest rates, are the same in two countries, their equity market performance should be alike. In this context, the performance of a local stock market would be explained by the covariance with other markets. Thus, strong market integration is likely to increase markets’ vulnerability to external shocks.

Prior studies have used the market integration approach to evaluate market comovement. Bekaert and Harvey (2002) described the increase in capital movements among financial markets by any rise in market integration. Johnson and Soenen (2003) argued that a high share of trade can positively affect the comovement of stock markets due to strong economic and financial integration. A recent study by Dewandaru et al. (2017) evaluated the stock market comovement as a proxy of the market integration degree. Wavelet coherence with rolling windows may reveal the episodes of market integration. Following Dewandaru et al. (2017), market integration is identified as the increase in comovement (at higher- or lower-frequency bands) that occurs gradually and tends to be more persistent.

When referring to the coherence maps in Figure 2, the following emerge. Across all the observations, the prevalence of the blue areas, at higher-frequency ranges, is patent for each return pair with China (including India–Russia). Such evidence indicates weak short-run integrations between markets. As for the short-term comovements (below 256 days), it is noticeable that high-coherence areas are temporary at some periods of crisis. Such a fact signals the presence of contagion. This finding indicates the presence of weak short-run integration among index-pairs of the Chinese and other selected markets. In addition, the low-frequency ranges portray, in general, a gradual increase in comovement from the years 2004 to 2013, at low-frequency ranges (above 256 days). High coherence became considerably large in 2007/12 due to structural shocks during this recent global crisis and the ESDC. Such evidence suggests strong long-run integration between China and other selected markets. From a causal perspective, the direction of the arrows shows the leading role of China stock market over the others, whereas India is leading Russia. However, there is no indication of any suspected fundamental channel in these index-pairs, as short-term shocks dominated from 2013 onwards.

Nevertheless, the coherence plots presented in Figure 3 and Figure 4 have uncovered a different piece of evidence for the remaining index-pairs, where the warmer colour prevails at both high- and low-frequency ranges, thus suggesting strong short- and long-term comovement. This finding shows evidence of strong short- and long-term integrations. In general, a gradual increase in comovement at high-frequency ranges (below 256 days) is evident in all index-pairs as they are protruded in red from the beginning to the end of the observations, particularly in the aftermath of the GFC and ESDC. This finding indicates the severity of the impact felt by these markets from these crises.

Similarly, a gradual and persistent increase in comovement was evident in all index-pairs from 2000 to 2019, at low-frequency ranges (above 256 days). This strong long-run integration turned weak from 2013 onwards. For instance, for the index-pairs US–South Africa and US–Brazil, the strong long-term integration started in 2001, with the US being the most influential market. They reached a high level of integration in the years 2007 to 2012. They turned weakly integrated from 2013 onwards, with the US lagging behind Brazil and South Africa. For the index-pairs US–India, Brazil–Russia and Brazil–India, the strong long-term integration started in 2002, with the leading role of the US over the other selected markets and decreased slightly in 2005 before they become relatively highly integrated in 2007 up to the end of the observations. The other markets are taking the lead over the US. For the index-pairs of South Africa–Brazil, South Africa–Russia and South Africa–India, a gradual rise in comovement appeared from 2000. This comovement decreased slightly in 2005, with a bidirectional relationship. It started increasing from 2011 onwards, with other markets taking the lead over South Africa. The increasing comovement in index-pairs with South Africa can be explained by the fact that South Africa joined BRICS in 2010 and increased its dependence with other countries, i.e., its vulnerability to external shocks since then.

For all index-pairs, there was interestingly a structural break around 512-day scales between 2016 and 2019. The index-pair of US–Russia showed a break from the year 2014 until the end of the observations. This result can be linked to the sudden decline in the financial market in China in 2016. The same relates to the US–China trade war in 2018 and the COVID-19 outbreak in China at the end of 2019. These turbulences originated from the two giant world economies. They may have troubled trade and hence disrupted financial linkages among countries involved in the associated index-pairs (shared macroeconomic risks).

4.2.3. Findings Summary

The following emerges from the overall findings on the comovement of the selected stock markets. As for the wavelet approach, the results of the current work reach the same conclusion documented in previous works that the comovement and diversification gains between international stock markets vary over time and across frequencies and accordingly, the risks of short- and long-term investors are different (Gallegati 2012; Dewandaru et al. 2016, 2017; Alqaralleh and Canepa 2021). As for the purposes of the current work, the following emerges. Markets in the BRICS and the US are vulnerable to the major crises which occurred during the past twenty years, with the GFC, ESDC and COVID-19 being much more virulent. Surprisingly, though COVID-19 was first reported in China, the Chinese market has shown minimal exposure to COVID-19 volatility. This result is validated by the conclusion of Abuzayed et al. (2021) that the Chinese stock market was the lowest marginal extreme risk that transmitted to, or received from, the global markets once the pandemic spread worldwide.

Results on contagion effects reveal excessive channels for some crises before the housing bubble in 2006 and the 2014/15 Russian financial crisis and Chinese stock market crash, respectively, noticeably in index-pairs with China. Furthermore, shocks volatility from the COVID-19 pandemic has resulted in contagion. This determination is in line with the findings of Alqaralleh and Canepa (2021), Bouri et al. (2021) and Yousaf et al. (2021). These authors suggested that this pandemic has generated contagion across international stock markets. They also pointed out that this pandemic is the first health crisis to induce devastating impacts similar to those spotted during the global financial crisis.

The observed pattern of interdependence was evident in nearly all index-pairs during the sample period. In particular, the recent global financial crisis and the EU sovereign debt crisis have had severe impacts on these markets. This finding was substantiated by empirical results by Zhong et al. (2014), Nashier (2015), Lakshmi et al. (2015) and Pereira (2018). These authors found long-run relationships between BRICS and the US stock markets during the recent financial crisis, restricting thus any speculative gains activities among the concerned equity markets. The weaknesses of these studies are that they used standard time-domain techniques. They also failed to identify fluctuations at short- and long-time horizons. The strengthening interdependence was further reflected in both strong short- and long-term integration in all index-pairs, except index-pairs with China. This finding implies that short-term investors from other concerned markets can diversify their portfolios in China. The results by Benhmad (2013), Lehkonen and Heimonen (2014) and Mensi et al. (2017) partly substantiate this finding that China provides the highest risk reduction for international investors during the GFC and ESDC. China’s restrictions on international-capital movements, such as limited control of shares for foreign investors in Chinese stock markets, may have played a role in restraining the crises to other markets. Such a situation can, in turn, result in less foreign investment, low levels of trading and a lack of liquidity opportunities across the borders. These eventualities are possible since BRICS markets are still relatively less developed compared to the size of their economy.

From the transmission channel point of view, in general, the direction of arrows displays another piece of evidence. The other markets appear to have the lead over the Chinese market when contagion is considered. The strong long-term interdependence discloses that, before the 2006 housing bubble, the US was the most influential market, given its leading role over the BRICS markets. Alternately, the GFC and ESDC reveal the leading role of the BRICS markets over the US, whereas, within the BRICS, South Africa followed by Brazil are likely to take more leads over India and Russia. Moreover, the negative shock triggered by the pandemic in March 2020 showed that markets are in phase and moving together.

5. Concluding Remarks

The current work attempted to measure the comovement among BRICS and the US stock markets by identifying the contagion effects attributable to major shocks generated worldwide from major historical crises. The novelty of the model used in this paper is that, unlike the modelling using the econometric procedures, it performed the wavelet analysis that transforms the stock return series into different timescale components. The wavelet coherence analysis provided the ability to distinguish between interdependence and pure contagion, thereby discriminating between short- and long-term investors. This distinction based on investor expectations is crucial from a risk-management point of view. It also assessed the phases of market integration. Indeed, deepening integration may amplify the vulnerability of markets to external shocks. It further analysed the lead–lag relationships.

The empirical results on daily returns data from January 2000 to March 2021 showed that the selected stock markets suffered from the major financial shocks that hit the global economy over the past twenty years. However, the impact was not the same across these markets as the comovement between the concerned markets varied significantly over time and across frequencies. Some crises before the 2006 housing bubble and the 2014/15 Russian financial crisis and the Chinese stock market crash, respectively, revealed excessive contagion. Furthermore, the COVID-19 pandemic health crisis displayed also excessive comovement in all markets and to a lesser extent in the Chinese market. The level of contagion is manifest near 128-days frequency ranges. This finding suggests that the reversal of funds is less probable to occur immediately when the crash arises and can be linked, among other causes, to a sluggish adjustment in absorbing bad news, extensive transaction costs and weak information linkage.

On the other hand, nearly all the associated historical periods of the related major crises have been channelled through interdependence in most index-pairs, with high short- and long-term volatility regimes prevailing in all index-pairs following the GFC and the ESDC. The severity of recent crises on BRICS and the vulnerability of this space to global shocks can be explained by the following. Their economies are in transition. Their financial integration with the global economy is high, their trade ties tighter and their economic integration within the region higher. The increasing interdependence was further illustrated in strong short- and long-term integration. There is a trivial chance that the block remains decoupled from the shock felt in the rest of the world. Such a chance narrows the window for international benefits diversification.

From a causal-relationship perspective, the following emerges. When contagion is taken into account, other markets have more influence over market in China. Yet, the COVID-19 pandemic health crisis displays no leading role. Alternatively, the GFC and the ESDC illustrated, in general, the leading role of the BRICS over the US though these recent crises emanated from western markets (the US and Europe). Furthermore, South Africa and Brazil were likely to lead India and Russia. It can be inferred that the two largest world economies (in terms of GDP), the US and China, were efficient and swift in absorbing the shocks that originated within their borders.

From a portfolio diversification and risk management point of view, the overall findings suggest that short-term investments of the BRICS and the US are best allocated in China during periods of turmoil because of a weak short-run integration, as highly disclosed in index-pairs with China. BRICS countries are a highly heterogeneous group with different structural fundamentals within their economies. It is not justifiable to consider the BRICS as a homogenous block when investigating stock market comovement.

A possible limitation of the current work is that the wavelet approach captures the overall structure of equity markets. For a more comprehensive contagion analysis, further research can expand the existing literature on BRICS stock market comovement by using wavelet coherence in conjunction with copula, from time- and frequency-varying features of stock returns and tail dependence. However, the main results of the current study convey significant policy implications. Capital mobility and better investment conditions within the BRICS region are needed to mitigate the speculative movements that enhance short-term fluctuations. Such prerequisites will decrease the transaction costs and allow a speedy adjustment in absorbing bad sensitive news. As they export goods to developed markets over time, the increasing interdependence of the BRICS countries with the world can hardly be avoided. Countries in this block need to expand their economies with more service and industrial sectors to alleviate their exposure to fundamental linkages. In addition, though regulators need stimulus packages to track down the spread of the COVID-19 pandemic to limit its impacts on portfolio optimisation, its effects are still in a primitive stage. Research on the latter concern may be conclusive if the COVID-19 pandemic remains active for a lengthy period.

Author Contributions

Conceptualization, M.B.; methodology, M.B.; software, M.B.; validation, M.B. and J.U.; formal analysis, M.B.; investigation, M.B.; resources, M.B.; data curation, M.B.; writing—original draft preparation, M.B.; writing—review and editing, M.B. and J.U.; visualization, M.B.; supervision, J.U. All authors have read and agreed to the published version of the manuscript.

Funding

This research was not funded.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data will be available upon request.

Acknowledgments

The assistance provided by Kambuyi Katuku for MATLAB programming is greatly appreciated. The authors would also like to thank the anonymous reviewers of this manuscript for making pertinent comments and remarks that helped improve its quality.

Conflicts of Interest

The authors declare no conflict of interest.

Note

| 1 | Multivariate framework is beyond the scope of the current work, as it focuses on the analysis of comovement in a bivariate framework. |

References

- Abuzayed, Bana, Elie Bouri, Nedal Al-Fayouni, and Naji Jalkh. 2021. Systemic risk spillover across global and country stock markets during the COVID-19 pandemic. Economic Analysis and Policy 71: 180–97. [Google Scholar] [CrossRef]

- Aguiar-Conraria, Luis, and Maria J. Soares. 2011. Business cycle synchronization and the Euro: A wavelet analysis. Journal of Macroeconomic 33: 477–89. [Google Scholar] [CrossRef]

- Ahmad, Wasim, Sanjay Sehgal, and Nagapudi R. Bhanumurthy. 2013. Eurozone crisis and BRIICKS stock markets: Contagion or market interdependence? Economic Modeling 33: 209–25. [Google Scholar] [CrossRef]

- Akhtaruzzaman, Md, Sabri Boubaker, and Ahmet Sensoy. 2021. Financial contagion during COVID–19 crises. Finance Research Letters 38: 101604. [Google Scholar] [CrossRef] [PubMed]

- Al-Mohamed, Somar, Audil Rashid, Walid Bakry, Ammar Jreisat, and Xuan V. Vo. 2020. The impact of BRICS formation on portfolio diversification: Empirical evidence from pre- and post-formation eras. Cogent Economics & Finance 8: 1747890. [Google Scholar] [CrossRef]

- Aloui, Riadh, Mohamed Safouane B. Aissa, and Duc K. Nguyen. 2011. Global financial crisis, extreme interdependences, and contagion effects: The role of economic structure. Journal of Banking and Finance 35: 130–41. [Google Scholar] [CrossRef]

- Alqaralleh, Huthaifa, and Alessandra Canepa. 2021. Evidence of stock market contagion during the COVID-19 pandemic: A Wavelet-Copula-GARCH approach. Journal of Risk and Financial Management 14: 329. [Google Scholar] [CrossRef]

- Bae, Kee-Hong, George Andrew Karolyi, and Rene M. Stulz. 2003. A new approach to measuring financial contagion. Review of Financial Studies 16: 716–63. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, Steven J. Davis, and Stephen J. Terry. 2020. COVID-Induced Economic Uncertainty. NBER Working Papers 26983. Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Bekaert, Geert, and Campbell Harvey. 2002. Research in emerging markets finance: Looking to the future. Emerging Markets Review 3: 429–48. [Google Scholar] [CrossRef]

- Bekaert, Geert, Campbell Harvey, and Angela Ng. 2005. Market integration and contagion. Journal of Business 78: 39–69. [Google Scholar] [CrossRef]

- Benhmad, François. 2013. Bull or bear markets: A wavelet dynamic correlation perspective. Economic Modeling 32: 576–91. [Google Scholar] [CrossRef]

- Bhar, Ramaprasad, and Bhar Nikolova. 2009. Return, volatility spillovers and dynamic correlation in the BRIC equity markets: An analysis using a bivariate EGARCH framework. Global Finance Journal 19: 203–18. [Google Scholar] [CrossRef]

- Bodart, Vincent, and Bertrand Candelon. 2009. Evidence of interdependence and contagion using a frequency domain framework. Emerging Markets Review 10: 140–50. [Google Scholar] [CrossRef]

- Bonga-Bonga, Lumengo. 2018. Uncovering equity market contagion among BRICS countries: An application of the multivariate GARCH model. The Quarterly Review of Economic and Finance 67: 36–44. [Google Scholar] [CrossRef]

- Boubaker, Sabri, Jamel Jouini, and Amine Lahiani. 2016. Financial contagion between the US and selected developed and emerging countries: The case of the subprime crisis. The Quarterly Review of Economics and Finance 61: 14–28. [Google Scholar] [CrossRef]

- Bouri, Elie, Riza Demirer, Rangan Gupt, and Jacobus Nel. 2021. COVID-19 pandemic and investor herding in international stock market. Risks 9: 168. [Google Scholar] [CrossRef]

- Bouri, Elie, Rangan Gupta, Seyedmehdi Hosseini, and Chi Keung M. Lau. 2018. Does global fear predict fear in BRICS stock markets? Evidence from Bayesian Structural VAR. Emerging Markets Review 34: 124–42. [Google Scholar] [CrossRef]

- Calvo, Sara Guerschanik, and Carmen M. Reinhart. 1996. Capital flows to Latin America: Is there evidence of contagion effects? In Private Capital Flows to Emerging Markets after the Mexican Crisis. Edited by Guillermo Calvo, Morris Goldstein and Eduard Hochreiter. Washington, DC: Institute for International Economics, pp. 151–71. [Google Scholar]

- Candelon, Bertrand, Jan Piplac, and Stefan Straetmans. 2008. On measuring synchronization of bulls and bears: The case of East Asia. Journal of Banking and Finance 32: 1022–35. [Google Scholar] [CrossRef]

- Claessens, Stijn, Rudiger Dornbusch, and Yung Chul Park. 2001. Contagion: Why Crises Spread and How This Can Be Stopped. In International Financial Contagion. Edited by Stijn Claessens and Kristin Forbes. Boston: Kluwer Academic Publishers, pp. 19–41. [Google Scholar]

- Collins, Dary, and Nicholas Biekpe. 2003. Contagion: A fear for African equity markets? Journal of Economics and Business 55: 285–97. [Google Scholar] [CrossRef]

- Corsetti, Giancarlo, Marcello Pericoli, and Massimo Sbracia. 2005. Some contagion, some interdependence: More pitfalls in tests of financial contagion. Journal of International Money and Finance 24: 1177–99. [Google Scholar] [CrossRef]

- Dewandaru, Ginanjar, Rumi Masih, and Mansur Masih. 2016. Contagion and interdependence across Asia-Pacific equity markets: An analysis based on multi-horizon discrete and continuous wavelet transformations. International Review of Economics and Finance 43: 363–77. [Google Scholar] [CrossRef]

- Dewandaru, Ginanjar, Rumi Masih, and Mansur Masih. 2017. Regional spillovers across transitioning emerging and frontier equity markets: A multi-time scale wavelet analysis. Economic Modelling 65: 30–40. [Google Scholar] [CrossRef]

- Dimitriou, Dimitrios, Dimitris Kenourgios, and Theodore Simos. 2013. Global financial crisis and emerging stock market contagion: A multivariate FIAPARCH-DCC approach. International Review of Financial Analysis 30: 46–56. [Google Scholar] [CrossRef]

- Forbes, Kristin J., and Roberto Rigobon. 2001. Measuring contagion: Conceptual and Empirical Issues. In International Financial Contagion. Edited by Stijn Claessens and Kristin Forbes. Boston: Kluwer Academic Publishers, pp. 43–66. [Google Scholar]

- Forbes, Kristin J., and Roberto Rigobon. 2002. No contagion, only interdependence: Measuring stock market co-movements. The Journal of Finance 57: 2223–61. [Google Scholar] [CrossRef]

- Gallegati, Marco. 2012. A wavelet-based approach to test for financial market contagion. Computational Statistics and Data Analysis 56: 3491–97. [Google Scholar] [CrossRef]

- Goldman Sachs. 2003. Dreaming with BRICS: The Path to 2050. Global Economics. 99. Available online: http://www.goldmansachs.com/ourthinking/topics/brics/brics-reports-pdfs/brics-dream.pdf (accessed on 15 April 2017).

- Grinsted, Aslak, Jhon C. Moore, and Svetlana Jevrejeva. 2004. Application of the cross wavelet transform and wavelet coherence to geophysical time series. Non-linear Processes in Geophysics 11: 561–66. [Google Scholar] [CrossRef]

- Hammoudeh, Shawkat, Sang H Kang, Walid Mensi, and Duc K. Nguyen. 2016. Dynamic global linkages of the BRICS stock markets with the united states and Europe under external crisis shocks: Implications for portfolio risk forecasting. The World Economy 39: 1703–27. [Google Scholar] [CrossRef]

- Ji, Qiang, Elie Bouri, and David Roubaud. 2018. Dynamic network of implied volatility transmission among the US equities, strategic commodities, and BRICS equities. International Review of Financial Analysis 57: 1–12. [Google Scholar] [CrossRef]

- Johnson, Robert, and Luc Soenen. 2003. Economic integration and stock market co movement in the Americas. Journal of Multinational Financial Management 13: 85–100. [Google Scholar] [CrossRef]

- Kaminsky, Graciela L., and Carmen M. Reinhart. 2000. On crises, contagion, and confusion. Journal of International Economics 51: 145–68. [Google Scholar] [CrossRef]

- Kaminsky, Graciela L., Carmen M. Reinhart, and Carlos A. Végh. 2003. The Unholy trinity of financial contagion. Journal of Economic Perspectives 17: 51–74. [Google Scholar] [CrossRef]

- Khallouli, Wajih, and Rene’ Sandretto. 2012. Testing for “contagion” of the subprime crisis on the Middle East and North African stock markets: A Markov Switching EGARCH approach. Journal of Economic Integration 27: 134–66. [Google Scholar] [CrossRef][Green Version]

- King, Mervyn A., and Sushil Wadhwani. 1990. Transmission of volatility between stock markets. Review of Financial Studies 3: 5–33. [Google Scholar] [CrossRef]

- Lakshmi, P., S. Visalakshmi, and Shanmugam Kavitha. 2015. Intensity of shock transmission amid US-BRICS markets. International Journal of Emerging Markets 10: 311–28. [Google Scholar] [CrossRef]

- Lehkonen, Heiki, and Kari Heimonen. 2014. Timescale-dependent stock market co movement: BRICs vs. developed markets. Journal of Empirical Finance 28: 90–103. [Google Scholar] [CrossRef]

- Liu, Wei, Xiao-Guang Yue, and Paul B. Tchounwou. 2020. Response to the COVID-19 epidemic: The Chinese experience and implications for other countries. International Journal of Environmental Research and Public Health 17: 2304. [Google Scholar] [CrossRef]

- Masson, Paul R. 1998. Contagion: Macroeconomic models with multiple equilibria. Journal of International Money and Finance 18: 587–602. [Google Scholar] [CrossRef]

- Mensi, Walid, Syed Jawad H. Shahzad, Shawkat Hammoudeh, Rami Zeitun, and Mobeen U. Rehman. 2017. Diversification potential of Asian frontier, BRIC emerging and major developed stock markets: A wavelet-based value at risk approach. Emerging Markets Review 32: 130–47. [Google Scholar] [CrossRef]

- Nashier, Tripti. 2015. Financial Integration between BRICS and developed markets. International Journal of Business and Management Investors 4: 65–71. [Google Scholar]

- Orlov, Alexei G. 2009. Co-spectral analysis of exchange rate co-movements during Asian financial crisis. Journal of International Financial Markets Institutions & Money 19: 742–58. [Google Scholar]

- Pereira, Dirceu. 2018. Financial contagion in the BRICS stock markets: An empirical analysis of the Lehman Brothers collapse and the European sovereign debt crisis. Journal of Economics and Financial Analysis 2: 1–44. [Google Scholar]

- Ranta, Mikko. 2013. Contagion among major world markets: A wavelet approach. International Journal of Managerial Finance 9: 133–50. [Google Scholar] [CrossRef]

- Syriopoulos, Theodore, Beljid Makram, and Adel Boubaker. 2015. Stock market volatility spillovers and portfolio hedging: BRICS and financial crisis. International Review of Financial Analysis 39: 7–18. [Google Scholar] [CrossRef]

- Yousaf, Imran, Elie Bouri, Shoaib Ali, and Nehme Azoury. 2021. Gold against Asian Stock Markets during the COVID-19 outbreak. Journal of Risk Financial Management 14: 186. [Google Scholar] [CrossRef]

- Zhang, Bing, Li Xindan, and Honghai Yu. 2013. Has recent financial crisis changed permanently the correlations between BRICS and developed stock markets? North American Journal of Economics and Finance 26: 725–38. [Google Scholar] [CrossRef]

- Zhong, Ming, Tsangyao Chang, and Han-Wen Tzeng. 2014. International equity diversification between the United States and BRICS countries. Romanian Journal of Economic Forecasting 17: 123–38. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).