Quantifying Foreign Exchange Risk in the Selected Listed Sectors of the Johannesburg Stock Exchange: An SV-EVT Pairwise Copula Approach

Abstract

:1. Introduction

2. Literature Review

3. Materials and Econometric Models

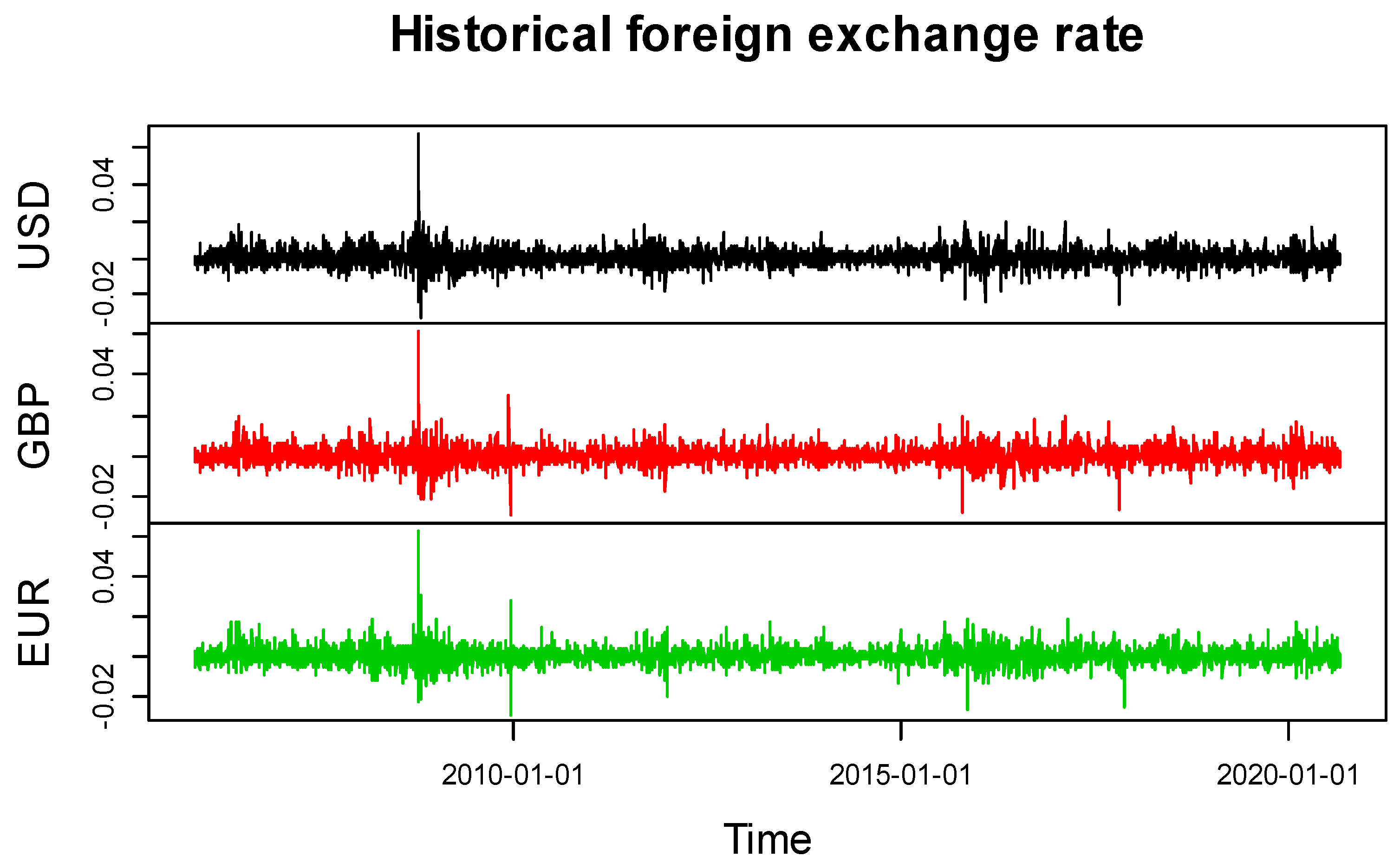

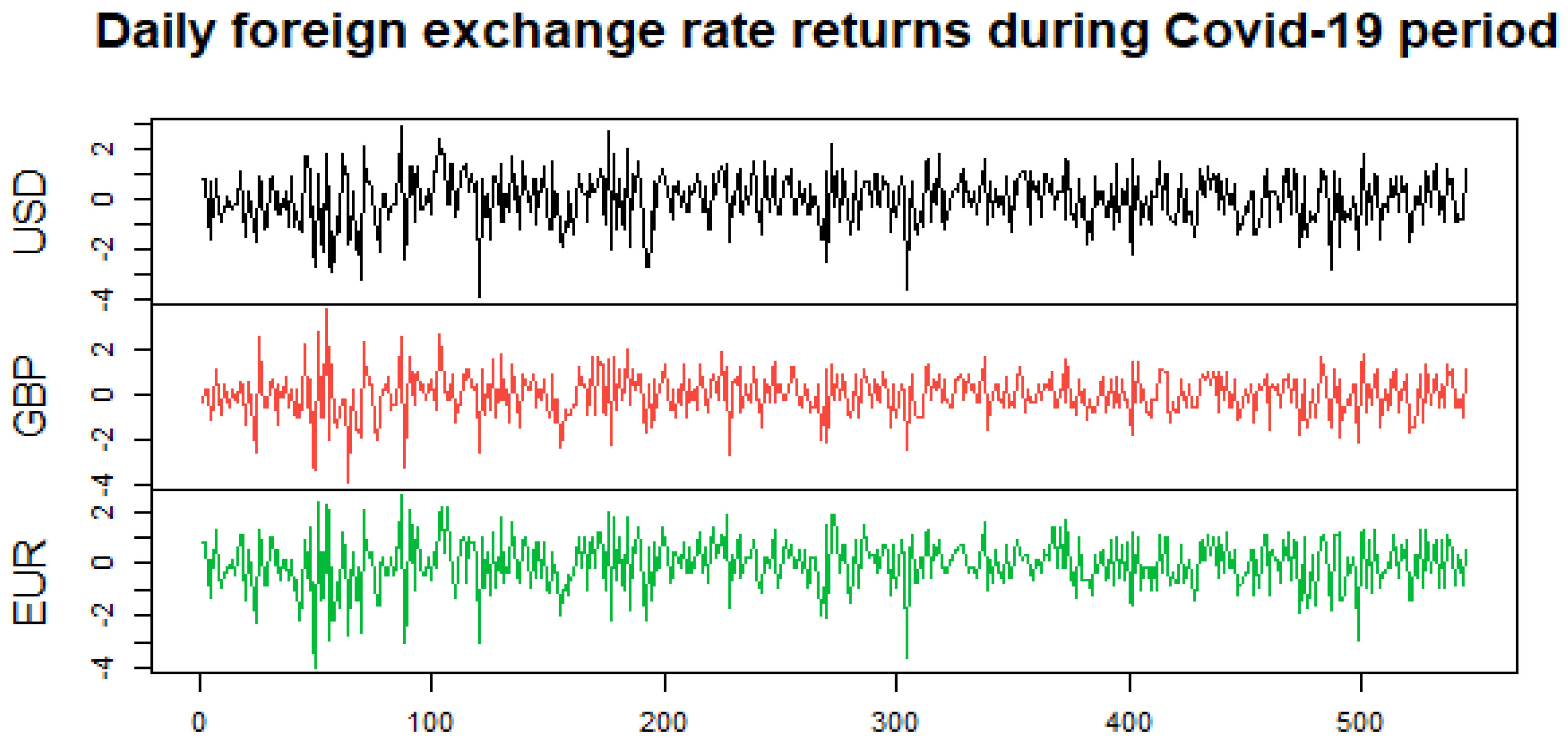

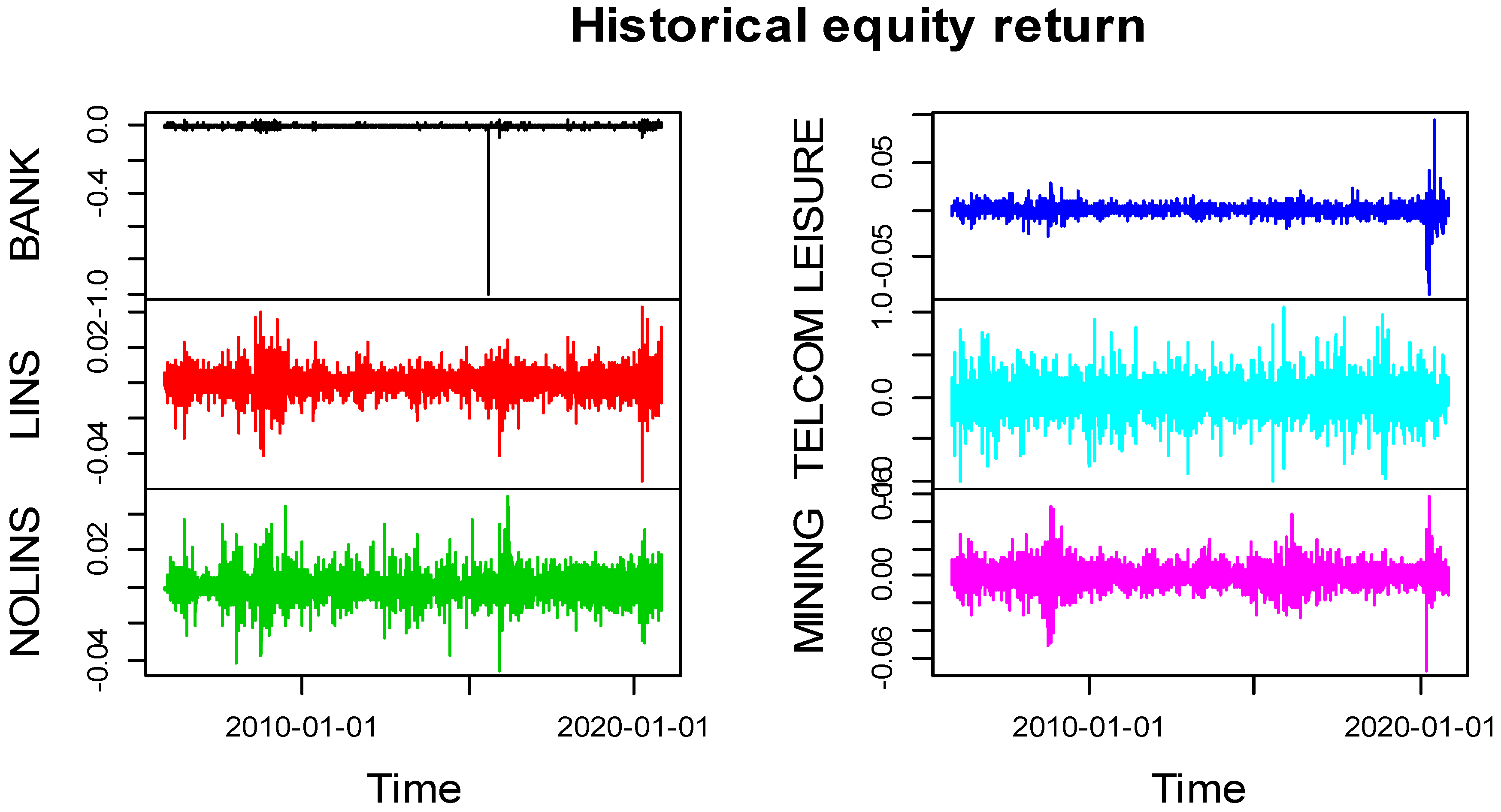

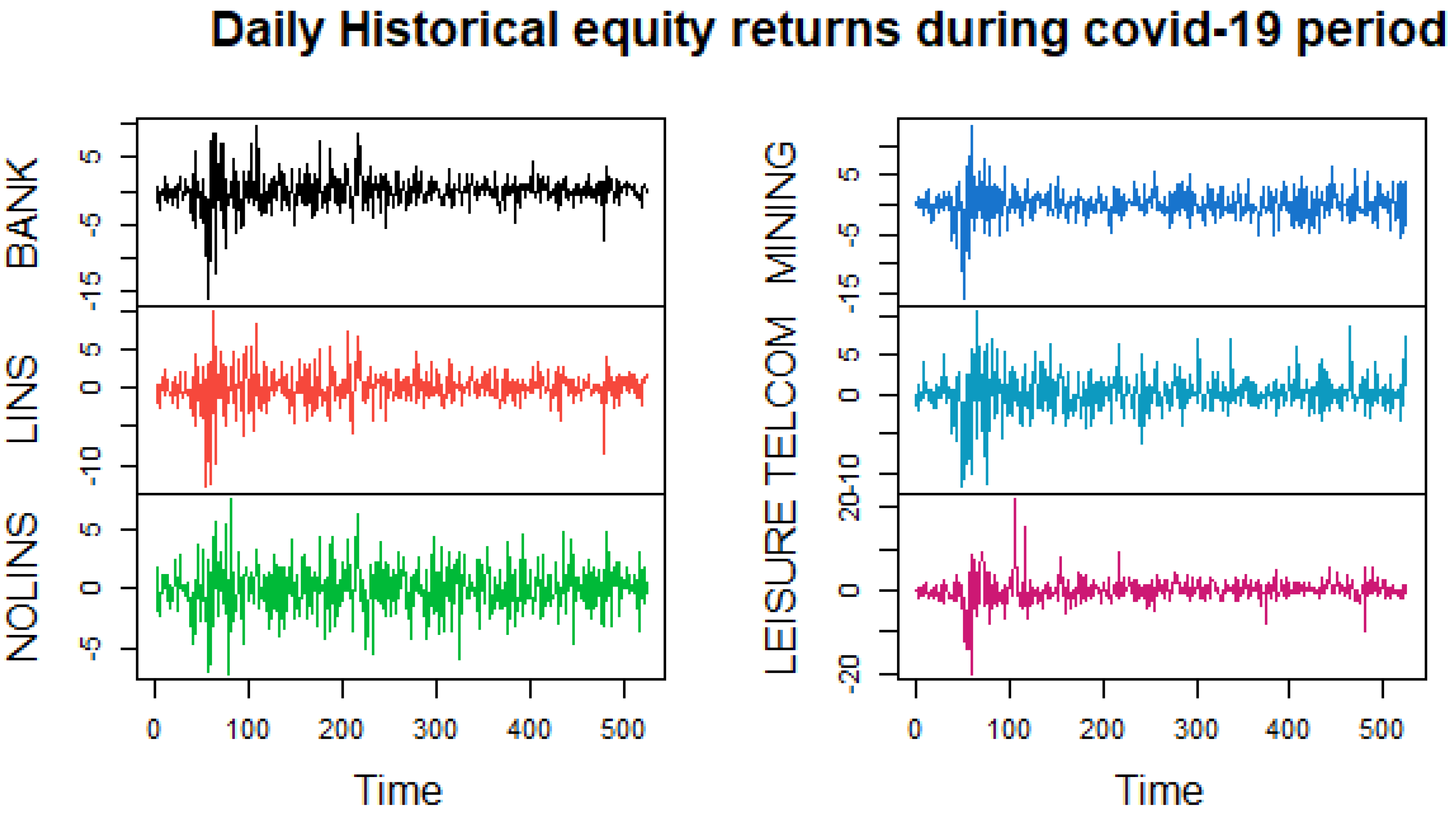

3.1. Sampling and Data Collection

3.2. Marginal Distribution Models

3.2.1. Stochastic Volatility Models

3.2.2. GARCH-Type Models

3.2.3. Generalised Pareto Distribution (GPD) Function

3.3. Dependence Structure Model and Risk Model

3.3.1. Pairwise Copula Approach

3.3.2. Value at Risk Model

3.3.3. Backtesting Test

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Tree | Serie 1 | Serie 2 | Conditioning Series | Pair-Copula | 1st Par | 2nd Par | Tau | Utd | ltd |

|---|---|---|---|---|---|---|---|---|---|

| Panel 1: equity market | |||||||||

| 1 | LINS | NOLINS | BB1 | 0.27 | 1.08 | 0.19 | 0.11 | 0.10 | |

| LINS | LEISURE | Student’s t | 0.38 | 5.25 | 0.25 | 0.14 | 0.14 | ||

| BANK | TELCOM | BB1_270 | −0.07 | −1.00 | −0.03 | - | - | ||

| LINS | BANK | Student’s t | 0.70 | 4.90 | 0.49 | 0.35 | 0.35 | ||

| MINING | LINS | Student’s t | 0.43 | 3.97 | 0.29 | 0.22 | 0.22 | ||

| 2 | LEISURE | NOLINS | LINS | Student’s t | 0.14 | 13.19 | 0.09 | 0.01 | 0.01 |

| BANK | LEISURE | LINS | Student’s t | 0.17 | 10.99 | 0.11 | 0.01 | 0.01 | |

| LINS | TELCOM | BANK | S-BB1 | 0.00 | 1.00 | 0.00 | 0.00 | 0.00 | |

| MINING | BANK | LINS | Student’s t | 0.10 | 5.88 | 0.06 | 0.05 | 0.05 | |

| 3 | BANK | NOLINS | LEISURE, LINS | Student’s t | 0.09 | 25.61 | 0.06 | 0.00 | 0.00 |

| MINING | LEISURE | BANK, LINS | Student’s t | 0.03 | 9.68 | 0.02 | 0.01 | 0.01 | |

| MINING | TELECOM | LINS, BANK | BB1_90 | −0.00 | −1.01 | −0.01 | - | - | |

| 4 | MINING | NOLINS | BANK, LEISURE, LINS | Student’s t | −0.01 | 20.62 | −0.01 | 0.00 | 0.00 |

| TELCOM | LEISURE | MINING, BANK, LINS | BB1_270 | −0.01 | −1.00 | −0.00 | - | - | |

| 5 | TELCOM | NOLINS | MINING, BANK, LEISURE, LINS | S-BB1 | 0.05 | 1.00 | 0.03 | 0.00 | 0.01 |

| Panel 2: foreign exchange market | |||||||||

| 1 | USD/ZAR | GBP/ZAR | Student’s t | 0.17 | 4.13 | 0.11 | 0.11 | 0.11 | |

| EUR/ZAR | USD/ZAR | Student’s t | −0.02 | 9.22 | −0.01 | 0.11 | 0.11 | ||

| 2 | EUR/ZAR | GBP/ZAR | USD/ZAR | Student’s t | 0.01 | 14.45 | 0.00 | 0.00 | 0.00 |

| Panel 3: mixture market | |||||||||

| 1 | LINS | NOLINS | S-BB1 | 0.97 | 1.08 | 0.38 | 0.52 | 0.10 | |

| LINS | LEISURE | S-BB1 | 1.05 | 1.14 | 0.42 | 0.56 | 0.16 | ||

| LINS | MINING | S-BB1 | 1.22 | 1.16 | 0.46 | 0.61 | 0.18 | ||

| BANK | LINS | S-BB1 | 1.60 | 1.45 | 0.62 | 0.74 | 0.39 | ||

| TELCOM | BANK | Frank | 0.26 | 0.00 | 0.03 | - | - | ||

| USD/ZAR | GBP | Joe | 1.84 | 0.00 | 0.32 | 0.54 | - | ||

| TELCOM | USD/ZAR | Joe | 1.56 | 0.00 | 0.24 | 0.44 | - | ||

| EUR/ZAR | TELCOM | Joe | 1.54 | 0.00 | 0.23 | 0.43 | - | ||

| 2 | LEISURE | NOLINS | LINS | BB1 | 0.02 | 1.16 | 0.15 | 0.19 | 0.00 |

| BANK | LEISURE | LINS | BB1 | 0.07 | 1.12 | 0.14 | 0.14 | 0.00 | |

| BANK | MINING | LINS | Student’s t | 0.13 | 6.91 | 0.08 | 0.04 | 0.04 | |

| TELCOM | LINS | BANK | Joe | 1.05 | 0.00 | 0.03 | 0.07 | - | |

| EUR/ZAR | BANK | TELCOM | S-BB1 | 0.32 | 1.01 | 0.15 | 0.12 | 0.02 | |

| TELCOM | GBP/ZAR | BANK | Joe | 1.17 | 0.00 | 0.09 | 0.19 | - | |

| EUR/ZAR | USD/ZAR | TELCOM | Joe | 1.23 | 0.00 | 0.12 | 0.25 | - | |

| 3 | BANK | NOLINS | LEISURE, LINS | BB1 | 0.06 | 1.05 | 0.08 | 0.07 | 0.00 |

| MINING | LEISURE | BANK, BANK | Student’s t | 0.07 | 10.14 | 0.04 | 0.01 | 0.01 | |

| TELCOM | MINING | BANK, LINS | Frank | 0.02 | 0.00 | 0.00 | - | - | |

| EUR/ZAR | LINS | TELCOM, BANK | Student’s t | 0.02 | 14.15 | 0.01 | 0.00 | 0.00 | |

| GBP/ZAR | BANK | EUR/ZAR, TELCOM | Joe | 1.19 | 0.00 | 0.10 | 0.21 | - | |

| EUR/ZAR | GBP/ZAR | TELCOM, USD/ZAR | Joe | 1.13 | 0.00 | 0.07 | 0.16 | - | |

| 4 | MINING | NOLINS | BANK, LEISURE, LINS | Joe | 1.05 | 0.00 | 0.03 | 0.07 | - |

| TELCOM | LEISURE | MINING, BANK, LINS | Joe | 1.11 | 0.00 | 0.06 | 0.13 | - | |

| EUR/ZAR | MINING | TELCOM, BANK, LINS | Student’s t | 0.01 | 12.06 | 0.01 | 0.00 | 0.00 | |

| GBP/ZAR | LINS | EUR/ZAR, TELCOM, BANK | S-Joe | 1.19 | 0.00 | 0.07 | 0.16 | - | |

| GBP/ZAR | BANK | USD/ZAR, EUR/ZAR, TELCOM | BB1 | 0.00 | 1.08 | 0.07 | 0.09 | 0.00 | |

| 5 | TELCOM | NOLINS | MINING, BANK, LEISURE, LINS | Joe | 1.16 | 0.00 | 0.08 | 0.18 | - |

| EUR/ZAR | LEISURE | TELCOM, MINING, BANK, LINS | Joe | 1.05 | 0.00 | 0.03 | 0.06 | - | |

| USD/ZAR | LEISURE | EUR/ZAR, TELCOM, BANK, LINS | Joe | 1.03 | 0.00 | 0.02 | 0.04 | - | |

| GBP/ZAR | LINS | USD/ZAR, EUR/ZAR, LEISURE, LINS | Student’s t | 0.01 | 13.59 | 0.00 | 0.00 | 0.00 | |

| 6 | EUR/ZAR | NOLINS | TELCOM, MINING, BANK, LEISURE, LINS | Gumbel | 1.03 | 0.00 | 0.03 | 0.04 | - |

| USD/ZAR | LEISURE | EUR/ZAR, TELCOM, MINING, BANK, LINS | Student’s t | 0.01 | 15.00 | 0.01 | 0.00 | 0.00 | |

| GBP/ZAR | MINING | USD/ZAR, EUR/ZAR, LEISURE, BANK, LINS | S-Joe | 1.01 | 0.00 | 0.01 | - | 0.02 | |

| 7 | USD/ZAR | NOLINS | EUR/ZAR, TELCOM, MINING, BANK, LEISURE, LINS | Joe | 1.03 | 0.00 | 0.02 | 0.04 | - |

| GBP/ZAR | LEISURE | USD/ZAR, EUR/ZAR, LEISURE, MINING, BANK, LINS | Joe | 1.05 | 0.00 | 0.03 | 0.06 | - | |

| 8 | GBP/ZAR | NOLINS | USD/ZAR, EUR/ZAR, TELCOM, MINING, BANK, LEISURE, LINS | Joe | 1.02 | 0.00 | 0.01 | 0.02 | - |

| Tree | Serie 1 | Serie 2 | Conditioning Series | Pair-Copula | 1st Par | 2nd Par | Tau | Utd | ltd |

|---|---|---|---|---|---|---|---|---|---|

| Panel 1: equity indices | |||||||||

| 1 | LINS | LEISURE | S-Gumbel | 1.32 | 0.00 | 0.24 | - | 0.31 | |

| LINS | TELCOM | C_270 | −0.06 | 0.00 | −0.03 | - | - | ||

| LINS | NOLINS | S-Gumbel | 1.22 | 0.00 | 0.18 | - | 0.24 | ||

| LINS | BANK | S-Gumbel | 1.93 | 0.00 | 0.48 | - | 0.57 | ||

| MINING | LINS | S-Gumbel | 1.39 | 0.00 | 0.28 | - | 0.36 | ||

| 2 | BANK | LEISURE | LINS | Gumbel | 1.13 | 0.00 | 0.11 | 0.15 | - |

| BANK | TELCOM | LINS | C_270 | −0.02 | 0.00 | −0.01 | - | - | |

| BANK | NOLINS | LINS | Frank | 0.71 | 0.00 | 0.08 | - | - | |

| MINING | BANK | BANK, LINS | Gumbel | 1.09 | 0.00 | 0.08 | 0.11 | - | |

| 3 | NOLINS | LEISURE | BANK, LINS | S-Gumbel | 1.07 | 0.00 | 0.06 | - | 0.09 |

| NOLINS | TELCOM | BANK, LINS | S-Clayton | 0.05 | 0.00 | 0.03 | 0.00 | - | |

| MINING | NOLINS | BANK, LINS | C_90 | −0.02 | 0.00 | −0.01 | - | - | |

| 4 | MINING | LEISURE | NOLINS, BANK, LINS | S-Gumbel | 1.03 | 0.00 | 0.03 | - | 0.04 |

| MINING | TELCOM | NOLINS, BANK, LINS | C_270 | −0.01 | 0.00 | −0.00 | - | - | |

| 5 | TELCOM | LEISURE | MINING, NOLINS, BANK, LINS | C_270 | −0.00 | 0.00 | −0.00 | - | - |

| Panel 2: exchange rates | |||||||||

| 1 | USD/ZAR | GBP/ZAR | Gumbel | 1.13 | 0.00 | 0.12 | 0.15 | - | |

| EUR/ZAR | USD/ZAR | G_90 | −1.03 | 0.00 | −0.02 | - | - | ||

| 2 | EUR/ZAR | GBP/ZAR | USD/ZAR | S-Gumbel | 1.02 | 0.00 | 0.02 | - | 0.03 |

| Panel 3: mixed system | |||||||||

| 1 | LINS | MINING | S_Gumbel | 1.49 | 0.00 | 0.33 | - | 0.41 | |

| LINS | NOLINS | S-Gumbel | 1.30 | 0.00 | 0.23 | - | 0.29 | ||

| LINS | USD/ZAR | S_Clayton | 0.60 | 0.00 | 0.23 | 0.32 | - | ||

| LINS | TELCOM | Frank | 0.34 | 0.00 | 0.04 | - | - | ||

| LINS | LEISURE | S-Gumbel | 1.14 | 0.00 | 0.29 | - | 0.37 | ||

| LINS | GBP/ZAR | S-Clayton | 0.59 | 0.00 | 0.23 | 0.31 | - | ||

| LINS | BANK | S-Gumbel | 2.11 | 0.00 | 0.52 | - | 0.61 | ||

| EUR/ZAR | LINS | S-Clayton | 0.60 | 0.00 | 0.23 | 0.31 | - | ||

| 2 | BANK | MINING | LINS | Gumbel | 1.20 | 0.00 | 0.17 | 0.22 | - |

| BANK | NOLINS | LINS | Gumbel | 1.20 | 0.00 | 0.17 | 0.22 | - | |

| BANK | USD/ZAR | LINS | S-Clayton | 0.19 | 0.00 | 0.09 | 0.03 | - | |

| BANK | TELCOM | LINS | Frank | 0.08 | 0.00 | 0.01 | - | - | |

| BANK | LEISURE | LINS | Gumbel | 1.25 | 0.00 | 0.20 | 0.26 | - | |

| BANK | GBP/ZAR | LINS | S-Gumbel | 0.24 | 0.00 | 0.11 | 0.05 | - | |

| EUR/ZAR | BANK | LINS | S-Clayton | 0.24 | 0.00 | 0.11 | 0.06 | ||

| 3 | GBP/ZAR | MINING | BANK, LINS | Gumbel | 1.07 | 0.00 | 0.06 | 0.09 | - |

| GBP/ZAR | NOLINS | BANK, LINS | S-Clayton | 0.19 | 0.00 | 0.09 | 0.02 | - | |

| GBP/ZAR | USD/ZAR | BANK, LINS | Gumbel | 1.28 | 0.00 | 0.22 | 0.28 | - | |

| GBP/ZAR | TELCOM | BANK, LINS | S-Clayton | 0.25 | 0.00 | 0.09 | 0.03 | - | |

| GBP/ZAR | LEISURE | BANK, LINS | S-Clayton | 0.20 | 0.00 | 0.09 | 0.03 | - | |

| EUR/ZAR | GBP/ZAR | BANK, LINS | Gumbel | 1.13 | 0.00 | 0.11 | 0.15 | - | |

| 4 | LEISURE | MINING | GBP/ZAR, BANK, LINS | Gumbel | 1.12 | 0.00 | 0.10 | 0.14 | - |

| LEISURE | NOLINS | GBP/ZAR, BANK, LINS | S-Clayton | 0.48 | 0.00 | 0.19 | 0.23 | - | |

| LEISURE | USD/ZAR | GBP/ZAR, BANK, LINS | Gumbel | 1.06 | 0.00 | 0.06 | 0.08 | ||

| LEISURE | TELCOM | GBP/ZAR, BANK, LINS | S-Gumbel | 0.31 | 0.00 | 0.13 | 0.11 | - | |

| EUR/ZAR | LEISURE | GBP/ZAR, BANK, LINS | Gumbel | 1.05 | 0.00 | 0.05 | 0.07 | - | |

| 5 | TELCOM | MINING | LEISURE, GBP/ZAR, BANK, LINS | S-Gumbel | 0.19 | 0.00 | 0.05 | 0.07 | - |

| TELCOM | NOLINS | LEISURE, GBP/ZAR, BANK,LINS | S-Gumbel | 0.26 | 0.00 | 0.11 | 0.07 | - | |

| TELCOM | USD/ZAR | LEISURE, GBP/ZAR, BANK,LINS | Gumbel | 1.08 | 0.00 | 0.08 | 0.10 | - | |

| EUR/ZAR | TELCOM | LEISURE, GBP/ZAR, BANK,LINS | S-Gumbel | 0.21 | 0.00 | 0.04 | 0.05 | - | |

| 6 | EUR/ZAR | MINING | TELCOM, LEISURE, GBP/ZAR, BANK, LINS | Gumbel | 1.04 | 0.00 | 0.04 | 0.05 | - |

| EUR/ZAR | NOLINS | TELCOM, LEISURE, GBP/ZAR, BANK, LINS | Gumbel | 1.04 | 0.00 | 0.04 | 0.06 | - | |

| EUR/ZAR | USD/ZAR | TELCOM, LEISURE, GBP/ZAR, BANK, LINS | Gumbel | 1.06 | 0.00 | 0.04 | 0.07 | - | |

| 7 | NOLINS | MINING | EUR/ZAR,TELCOM, LEISURE,GBP/ZAR,BANK, LINS | Gumbel | 1.04 | 0.00 | 0.04 | 0.06 | - |

| USD/ZAR | NOLINS | EUR/ZAR, TELCOM, LEISURE,GBP/ZAR,BANK, LINS | Gumbel | 1.03 | 0.00 | 0.03 | 0.04 | - | |

| 8 | GBP/ZAR | MINING | NOLINS, EUR/ZAR, TELCOM, LEISURE,GBP/ZAR,BANK, LINS | Gumbel | 1.04 | 0.00 | 0.04 | 0.05 | - |

| Tree | Serie 1 | Serie 2 | Conditioning Series | Pair-Copula | 1st Par | 2nd Par | Tau | Utd | ltd |

|---|---|---|---|---|---|---|---|---|---|

| Panel 1: equity indices | |||||||||

| 1 | LINS | LEISURE | S-Gumbel | 1.32 | 0.00 | 0.24 | - | 0.31 | |

| LINS | TELCOM | C_270 | −0.06 | 0.00 | −0.03 | - | - | ||

| LINS | NOLINS | S-Gumbel | 1.22 | 0.00 | 0.18 | - | 0.24 | ||

| LINS | BANK | S-Gumbel | 1.93 | 0.00 | 0.48 | - | 0.57 | ||

| MINING | LINS | S-Gumbel | 1.39 | 0.00 | 0.28 | - | 0.36 | ||

| 2 | BANK | LEISURE | LINS | Gumbel | 1.13 | 0.00 | 0.11 | 0.15 | |

| BANK | TELCOM | LINS | C_270 | −0.02 | 0.00 | −0.01 | - | - | |

| BANK | NOLINS | LINS | Frank | 0.71 | 0.00 | 0.08 | - | - | |

| MINING | BANK | BANK, LINS | Gumbel | 1.09 | 0.00 | 0.08 | 0.11 | - | |

| 3 | NOLINS | LEISURE | BANK, LINS | S-Gumbel | 1.07 | 0.00 | 0.06 | - | 0.09 |

| NOLINS | TELCOM | BANK, LINS | S-Clayton | 0.05 | 0.00 | 0.03 | 0.00 | - | |

| MINING | NOLINS | BANK, LINS | C_90 | −0.02 | 0.00 | −0.01 | - | - | |

| 4 | MINING | LEISURE | NOLINS, BANK, LINS | S-Gumbel | 1.03 | 0.00 | 0.03 | - | 0.04 |

| MINING | TELCOM | NOLINS, BANK, LINS | C_270 | −0.01 | 0.00 | −0.00 | - | - | |

| 5 | TELCOM | LEISURE | MINING, NOLINS, BANK, LINS | C_270 | −0.00 | 0.00 | −0.00 | - | - |

| Panel 2: exchange rates | |||||||||

| 1 | USD/ZAR | GBP/ZAR | Gumbel | 1.13 | 0.00 | 0.12 | 0.15 | - | |

| EUR/ZAR | USD/ZAR | G_90 | −1.03 | 0.00 | −0.02 | - | - | ||

| 2 | EUR/ZAR | GBP/ZAR | USD/ZAR | S-Gumbel | 1.02 | 0.00 | 0.02 | - | 0.03 |

| Panel 3: mixed system | |||||||||

| 1 | LINS | MINING | S_Gumbel | 1.49 | 0.00 | 0.33 | - | 0.41 | |

| LINS | NOLINS | S-Gumbel | 1.30 | 0.00 | 0.23 | - | 0.29 | ||

| LINS | USD/ZAR | S_Clayton | 0.60 | 0.00 | 0.23 | 0.32 | - | ||

| LINS | TELCOM | Frank | 0.34 | 0.00 | 0.04 | - | - | ||

| LINS | LEISURE | S-Gumbel | 1.14 | 0.00 | 0.29 | - | 0.37 | ||

| LINS | GBP/ZAR | S-Clayton | 0.59 | 0.00 | 0.23 | 0.31 | - | ||

| LINS | BANK | S-Gumbel | 2.11 | 0.00 | 0.52 | - | 0.61 | ||

| EUR/ZAR | LINS | S-Clayton | 0.60 | 0.00 | 0.23 | 0.31 | - | ||

| 2 | BANK | MINING | LINS | Gumbel | 1.20 | 0.00 | 0.17 | 0.22 | - |

| BANK | NOLINS | LINS | Gumbel | 1.20 | 0.00 | 0.17 | 0.22 | - | |

| BANK | USD/ZAR | LINS | S-Clayton | 0.19 | 0.00 | 0.09 | 0.03 | - | |

| BANK | TELCOM | LINS | Frank | 0.08 | 0.00 | 0.01 | - | - | |

| BANK | LEISURE | LINS | Gumbel | 1.25 | 0.00 | 0.20 | 0.26 | - | |

| BANK | GBP/ZAR | LINS | S-Gumbel | 0.24 | 0.00 | 0.11 | 0.05 | - | |

| EUR/ZAR | BANK | LINS | S-Clayton | 0.24 | 0.00 | 0.11 | 0.06 | ||

| 3 | GBP/ZAR | MINING | BANK, LINS | Gumbel | 1.07 | 0.00 | 0.06 | 0.09 | - |

| GBP/ZAR | NOLINS | BANK, LINS | S-Clayton | 0.19 | 0.00 | 0.09 | 0.02 | - | |

| GBP/ZAR | USD/ZAR | BANK, LINS | Gumbel | 1.28 | 0.00 | 0.22 | 0.28 | - | |

| GBP/ZAR | TELCOM | BANK, LINS | S-Clayton | 0.25 | 0.00 | 0.09 | 0.03 | - | |

| GBP/ZAR | LEISURE | BANK, LINS | S-Clayton | 0.20 | 0.00 | 0.09 | 0.03 | - | |

| EUR/ZAR | GBP/ZAR | BANK, LINS | Gumbel | 1.13 | 0.00 | 0.11 | 0.15 | - | |

| 4 | LEISURE | MINING | GBP/ZAR, BANK, LINS | Gumbel | 1.12 | 0.00 | 0.10 | 0.14 | - |

| LEISURE | NOLINS | GBP/ZAR, BANK, LINS | S-Clayton | 0.48 | 0.00 | 0.19 | 0.23 | - | |

| LEISURE | USD/ZAR | GBP/ZAR, BANK, LINS | Gumbel | 1.06 | 0.00 | 0.06 | 0.08 | ||

| LEISURE | TELCOM | GBP/ZAR, BANK, LINS | S-Gumbel | 0.31 | 0.00 | 0.13 | 0.11 | - | |

| EUR/ZAR | LEISURE | GBP/ZAR, BANK, LINS | Gumbel | 1.05 | 0.00 | 0.05 | 0.07 | - | |

| 5 | TELCOM | MINING | LEISURE, GBP/ZAR, BANK, LINS | S-Gumbel | 0.19 | 0.00 | 0.05 | 0.07 | - |

| TELCOM | NOLINS | LEISURE, GBP/ZAR, BANK,LINS | S-Gumbel | 0.26 | 0.00 | 0.11 | 0.07 | - | |

| TELCOM | USD/ZAR | LEISURE, GBP/ZAR, BANK,LINS | Gumbel | 1.08 | 0.00 | 0.08 | 0.10 | - | |

| EUR/ZAR | TELCOM | LEISURE, GBP/ZAR, BANK, LINS | S-Gumbel | 0.21 | 0.00 | 0.04 | 0.05 | - | |

| 6 | EUR/ZAR | MINING | TELCOM, LEISURE, GBP/ZAR, BANK, LINS | Gumbel | 1.04 | 0.00 | 0.04 | 0.05 | - |

| EUR/ZAR | NOLINS | TELCOM, LEISURE, GBP/ZAR, BANK, LINS | Gumbel | 1.04 | 0.00 | 0.04 | 0.06 | - | |

| EUR/ZAR | USD/ZAR | TELCOM, LEISURE, GBP/ZAR, BANK, LINS | Gumbel | 1.06 | 0.00 | 0.04 | 0.07 | - | |

| 7 | NOLINS | MINING | EUR/ZAR, TELCOM, LEISURE, GBP/ZAR, BANK, LINS | Gumbel | 1.04 | 0.00 | 0.04 | 0.06 | - |

| USD/ZAR | NOLINS | EUR/ZAR, TELCOM, LEISURE, GBP/ZAR, BANK, LINS | Gumbel | 1.03 | 0.00 | 0.03 | 0.04 | - | |

| 8 | GBP/ZAR | MINING | NOLINS, EUR/ZAR, TELCOM, LEISURE, GBP/ZAR, BANK, LINS | Gumbel | 1.04 | 0.00 | 0.04 | 0.05 | - |

Appendix B

References

- Abuzayed, Bana, Elie Bouri, Nedal Al-Fayoumi, and Naji Jalkh. 2021. Systemic risk spillover across global and country stock markets during the COVID-19 pandemic. Economic Analysis and Policy 71: 180–97. [Google Scholar]

- Adrian, Tobias, and Markus K. Brunnermeier. 2011. COVAR. Working Paper 17454. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Akhtaruzzaman, Md, Sabri Boubaker, and Ahmet Sensoy. 2021a. Financial contagion during COVID–19 crisis. Finance Research Letters 38: 101604. [Google Scholar]

- Akhtaruzzaman, Md, Sabri Boubaker, Brian M. Lucey, and Ahmet Sensoy. 2021b. Is gold a hedge or a safe-haven asset in the COVID–19 crisis? Economic Modelling 102: 105588. [Google Scholar]

- Akhtaruzzaman, Md, Sabri Boubaker, and Zaghum Umar. 2022. COVID-19 media coverage and ESG leader indices. Finance Research Letters 45: 102170. [Google Scholar] [PubMed]

- Al Janabi, Mazin A. M. 2006. Foreign-exchange trading risk management with value at risk: Case analysis of the Moroccan market. Journal of Risk Finance 7: 273–91. [Google Scholar]

- Bartram, Söhnke M., and G. Andrew Karolyi. 2006. The impact of the introduction of the Euro on foreign exchange rate risk exposures. Journal of Empirical Finance 13: 519–49. [Google Scholar]

- Bedford, Tim, and Roger M. Cooke. 2001. Probability density decomposition for conditionally de-pendent random variables modeled by vines. Annals of Mathematics and Artificial Intelligence 32: 245–68. [Google Scholar]

- Berkowitz, Jeremy, and James O’Brien. 2002. How accurate are value-at-risk models at commercial banks? The Journal of Finance 57: 1093–111. [Google Scholar]

- Boako, Gideon, and Paul Alagidede. 2017. Examining evidence of ‘shift-contagion’ in African stock markets: A CoVaR-copula approach. Review of Development Finance 7: 142–56. [Google Scholar]

- Boako, Gideon, and Paul Alagidede. 2018. Systemic Risks Spillovers and Interdependence among Stock Markets: International Evidence with Covar-Copulas. South African Journal of Economics 86: 82–112. [Google Scholar]

- Boubaker, Sabri, Zhenya Liu, and Yaosong Zhan. 2022. Customer relationships, corporate social responsibility, and stock price reaction: Lessons from China during health crisis times. Finance Research Letters 2022: 102699. [Google Scholar]

- Chen, Kuan-Heng, and Khaldoun Khashanah. 2016. Analysis of systemic risk: A vine copula-based ARMA-GARCH model. Engineering Letters 24: 268–73. [Google Scholar]

- Chiu, Ching-Wai Jeremy, Haroon Mumtaz, and Gabor Pinter. 2017. Forecasting with VAR models: Fat tails and stochastic volatility. International Journal of Forecasting 33: 1124–43. [Google Scholar]

- Clarke, Kevin A. 2007. A simple distribution-free test for non-nested model selection. Political Analysis 15: 347–63. [Google Scholar]

- Culp, Christopher L., Merton H. Miller, and Andrea M. P. Neves. 1998. Value at risk: Uses and abuses. Journal of Applied Corporate Finance 10: 26–38. [Google Scholar]

- Danielsson, Jon. 1994. Stochastic volatility in asset prices estimation with simulated maximum likelihood. Journal of Econometrics 64: 375–400. [Google Scholar]

- De Luca, Giovanni, Giorgia Rivieccio, and Stefania Corsaro. 2020. Value-at-Risk dynamics: A copula-VAR approach. European Journal of Finance 26: 223–37. [Google Scholar]

- Dowd, Kevin. 1999. A value at risk approach to risk-return analysis. The Journal of Portfolio Management 25: 60–67. [Google Scholar]

- Engle, Robert F., and Simone Manganelli. 2001. Value at Risk Models in Finance. No. 75. European Central Bank Working Paper. Frankfurt: European Central Bank. [Google Scholar]

- Eun, Cheol S., and Bruce G. Resnick. 1988. Exchange rate uncertainty, forward contracts, and international portfolio selection. The Journal of Finance 43: 197–215. [Google Scholar]

- Gencay, Ramazan, and Faruk Selçuk. 2004. Extreme value theory and Value-at-Risk: Relative performance in emerging markets. International Journal of Forecasting 20: 287–303. [Google Scholar]

- Guo, Yanhong, Ping Li, and Aihua Li. 2021. Tail risk contagion between international financial markets during COVID-19 pandemic. International Review of Financial Analysis 73: 101649. [Google Scholar]

- Horobeţ, Alexandra, and Livia Ilie. 2010. International investments with exchange rate risk: The case of central and eastern Europe currencies. Studies in Business & Economics 5: 185–200. [Google Scholar]

- Huang, Jen-Jsung, Kuo-Jung Lee, Hueimei Liang, and Wei-Fu Lin. 2009. Estimating value at risk of portfolio by conditional copula-GARCH method. Insurance: Mathematics and Economics 45: 315–24. [Google Scholar]

- Ibragimov, Rustam. 2009. Portfolio diversification and value at risk under thick-tailedness. Quantitative Finance 9: 565–80. [Google Scholar]

- Iyke, Bernard Njindan, and Sin-Yu Ho. 2021. Exchange rate exposure in the South African stock market before and during the COVID-19 pandemic. Finance Research Letters 43: 102000. [Google Scholar]

- Joe, Harry, Haijun Li, and Aristidis K. Nikoloulopoulos. 2010. Tail dependence functions and vine copulas. Journal of Multivariate Analysis 101: 252–70. [Google Scholar]

- Jorion, Philippe. 2007. Risk management for hedge funds with position information. The Journal of Portfolio Management 34: 127–34. [Google Scholar]

- Koliai, Lyes. 2016. Extreme risk modeling: An EVT–pair-copulas approach for financial stress tests. Journal of Banking and Finance 70: 1–22. [Google Scholar]

- Kupiec, Paul H. 1995. Techniques for verifying the accuracy of risk measurement models. Journal of Derivatives 3: 73–84. [Google Scholar]

- Le, Trung Hai, Hung Xuan Do, Duc Khuong Nguyen, and Ahmet Sensoy. 2021. COVID-19 pandemic and tail-dependency networks of financial assets. Finance Research Letters 38: 101800. [Google Scholar] [PubMed]

- May, Cyril, and Greg Farrell. 2018. Modelling exchange rate volatility dynamics: Empirical evidence from South Africa. Studies in Economics and Econometrics 42: 71–114. [Google Scholar]

- McNeil, Alexander J., and Rüdiger Frey. 2000. Estimation of tail-related risk measures for heteroscedastic financial time series: An extreme value approach. Journal of Empirical Finance 7: 271–300. [Google Scholar]

- Molele, Mashukudu Hartley, and Janine Mukuddem-Petersen. 2020. Emerging market currency risk exposure: Evidence from South Africa. The Journal of Risk Finance 21: 159–79. [Google Scholar]

- Muzindutsi, Paul-Francois, and Ferdinand Niyimbanira. 2012. The exchange rate risk in the Johannesburg stock market: An application of the arbitrage pricing model. Journal of Global Business and Technology 81: 60–70. [Google Scholar]

- Nikoloulopoulos, Aristidis K., Harry Joe, and Haijun Li. 2012. Vine copulas with asymmetric tail dependence and applications to financial return data. Computational Statistics and Data Analysis 56: 3659–73. [Google Scholar]

- Papaioannou, Michael G. 2006. Exchange Rate Risk Measurement and Management: Issues and Approaches for Firms. South-Eastern Europe Journal of Economics 4: 129–46. [Google Scholar]

- Racicot, François-Éric, and Raymond Théoret. 2010. Forecasting stochastic Volatility using the Kalman filter: An Application to Canadian Interest Rates and Price-Earnings Ratio. The IEB International Journal of Finance 1: 28–47. [Google Scholar]

- Rajesh, P. N. Rao. 2009. Selection of value-at-risk model and management of risk using information transmission. IUP Journal of Applied Finance 15: 31. [Google Scholar]

- Reboredo, Juan C., Miguel A. Rivera-Castro, and Andrea Ugolini. 2016. Downside and upside risk spillovers between exchange rates and stock prices. Journal of Banking and Finance 62: 76–96. [Google Scholar]

- Ross, Stephen A. 1977. The capital asset pricing model (CAPM), short-sale restrictions and related issues. The Journal of Finance 32: 177–83. [Google Scholar]

- Shahzad, Syed Jawad Hussain, Jose Arreola-Hernandez, Stelios Bekiros, Muhammad Shahbaz, and Ghulam Mujtaba Kayani. 2018. A systemic risk analysis of Islamic equity markets using vine copula and delta CoVaR modelling. Journal of International Financial Markets, Institutions and Money 56: 104–27. [Google Scholar]

- Su, Xianfang. 2020. Measuring extreme risk spillovers across international stock markets: A quantile variance decomposition analysis. North American Journal of Economics and Finance 51: 101098. [Google Scholar]

- Virdi, Navneet Kaur. 2011. A review of backtesting methods for evaluating value-at-risk. International Review of Business Research Papers 7: 14–24. [Google Scholar]

- Vuong, Quang H. 1989. Likelihood ratio tests for model selection and non-nested hypotheses. Econometrica: Journal of the Econometric Society, 307–33. [Google Scholar]

- Wang, Yi-Chiuan, Jyh-Lin Wu, and Yi-Hao Lai. 2013. A revisit to the dependence structure between the stock and foreign exchange markets: A dependence-switching copula approach. Journal of Banking and Finance 37: 1706–19. [Google Scholar]

- Yeboah, Michael, and Andras Takacs. 2019. Does Exchange Rate Matter in Profitability of Listed Companies in South Africa? An Empirical Approach. International Journal of Energy Economics and Policy 9: 171–78. [Google Scholar]

- Yu, Jun. 2002. Forecasting volatility in the New Zealand stock market. Applied Financial Economics 12: 193–202. [Google Scholar]

- Yu, Wenhua, Kun Yang, Yu Wei, and Likun Lei. 2018. Measuring Value-at-Risk and Expected Shortfall of crude oil portfolio using extreme value theory and vine copula. Physica A: Statistical Mechanics and Its Applications 490: 1423–33. [Google Scholar]

- Zhang, Bangzheng, Yu Wei, Jiang Yu, Xiaodong Lai, and Zhenfeng Peng. 2014. Forecasting VaR and ES of stock index portfolio: A Vine copula method. Physica A: Statistical Mechanics and Its Applications 416: 112–24. [Google Scholar]

- Živkov, Dejan, Jovan Njegić, and Jasmina Pavlović. 2016. Dynamic Correlation between Stock Returns and Exchange Rate and Its Dependence on the Conditional Volatilities—The Case of Several Eastern European Countries. Bulletin of Economic Research 68: 28–41. [Google Scholar]

| Shape | AIC | Log-Lik | BIC | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Exchange rate | USD/ZAR | 1.271 (0.073) *** | −0.046 (0.013) *** | 0.000 (0.000) | 0.055 (0.010) *** | 0.953 (0.008) *** | −0.044 (0.009) *** | −8.151 | 17,111.3 | −8.142 |

| GBP/ZAR | 1.200 (0.031) *** | −0.035 (0.013) ** | 0.000 (0.000) | 0.066 (0.002) *** | 0.935 (0.005) *** | −0.041 (0.011) *** | −8.259 | 17,338.3 | −8.250 | |

| EUR/ZAR | 1.152 (0.048) *** | −0.021 (0.013) | 0.000 (0.000) | 0.078 (0.024 | 0.923 (0.020) *** | −0.066 (0.017) *** | −8.329 | 17,485.8 | −8.320 | |

| Equity index | BANK | 2.902 (0.425) *** | 0.735 (0.027) *** | 0.024 (0.022) | 0.000 (0.087) | 0.726 (0.257) ** | 0.483 (0.133) *** | 0.849 | −1491.2 | 0.860 |

| LINS | 2.811 (0.197) *** | 0.739 (0.015) *** | 0.025 (0.006) *** | 0.000 (0.032) | 0.706 (0.071) *** | 0.553 (0.082) *** | 0.844 | −1481.8 | 0.854 | |

| NOLINS | 2.828 (0.171) *** | 0.727 (0.013) *** | 0.066 (0.007) *** | 0.000 (0.025) | 0.380 (0.066) *** | 0.704 (0.090) *** | 0.833 | −1462.2 | 0.843 | |

| LEISURE | 2.707 (0.207) *** | 0.732 (0.014) *** | 0.052 (0.026) * | 0.000 (0.054) | 0.495 (0.253) *** | 0.630 (0.051) *** | 0.840 | −1475.6 | 0.851 | |

| TELCOM | 3.559 (0.330) *** | 0.710 (0.024) *** | 0.068 (0.009) *** | 0.000 (0.052) | 0.470 (0.084) *** | 0.441 (0.091) *** | 0.925 | −1624.7 | 0.935 | |

| MINING | 2.998 (0.054) *** | 0.744 (0.010) *** | 0.015 (0.006) * | 0.000 (0.028) | 0.811 (0.084) *** | 0.348 (0.054) *** | 0.852 | −1497.0 | 0.863 |

| Parameter | Mean | SD | 95% Interval | Inefficiency | Parameter | Mean | SD | 95% Interval | Inefficiency |

|---|---|---|---|---|---|---|---|---|---|

| Forex market—USD/ZAR | Equity market—BANK | ||||||||

| −11.16 | 0.155 | −10.91 | 2295 | −10.152 | 0.162 | −9.890 | 5326 | ||

| 0.983 | 0.013 | 0.993 | 307 | 0.133 | 0.016 | 0.161 | 121 | ||

| 0.987 | 0.004 | 0.121 | 142 | 0.984 | 0.004 | 0.991 | 213 | ||

| 9.612 | 1.981 | 13.25 | 66 | 9.319 | 1.140 | 11.328 | 177 | ||

| 0.003 | 0.000 | 0.004 | 2295 | 0.006 | 0.000 | 0.007 | 5326 | ||

| 0.009 | 0.002 | 0.014 | 142 | 0.018 | 0.004 | 0.026 | 121 | ||

| Forex market—GBP/ZAR | Equity market—LIFE INSURANCE (LINS) | ||||||||

| −11.30 | 0.117 | −11.19 | 1037 | −10.341 | 0.16 | −10.074 | 2880 | ||

| 0.125 | 0.022 | 0.165 | 83 | 0.156 | 0.001 | 0.184 | 135 | ||

| 0.978 | 0.007 | 0.989 | 106 | 0.982 | 0.000 | 0.990 | 281 | ||

| 6.881 | 0.979 | 8.821 | 120 | 27.505 | 1.000 | 44.771 | 22 | ||

| 0.003 | 0.002 | 0.003 | 1037 | 0.005 | 0.000 | 0.006 | 2880 | ||

| 0.016 | 0.005 | 0.027 | 83 | 0.024 | 0.000 | 0.034 | 135 | ||

| Forex market—EUR/ZAR | Equity market—NON-LIFE INSURANCE (NOLINS) | ||||||||

| −11.47 | 0.107 | −11.30 | 1200 | −10.413 | 0.088 | −10.27 | 264 | ||

| 0.135 | 0.024 | 0.176 | 76 | 0.309 | 0.060 | 0.958 | 54 | ||

| 0.975 | 0.008 | 0.986 | 108 | 0.987 | 0.004 | 0.993 | 307 | ||

| 6.282 | 0.816 | 7.742 | 115 | 10.670 | 5.633 | 18.740 | 20 | ||

| 0.003 | 0.000 | 0.003 | 1200 | 0.005 | 0.000 | 0.006 | 264 | ||

| 0.018 | 0.007 | 0.031 | 76 | 0.099 | 0.039 | 0.180 | 42 | ||

| Equity market—LEISURE | Equity market—TELCOM | ||||||||

| −10.94 | 0.153 | −10.695 | 1508 | −3.65 | 0.040 | −3.58 | 1240 | ||

| 0.168 | 0.029 | 0.218 | 46 | 0.44 | 0.045 | 0.52 | 156 | ||

| 0.978 | 0.007 | 0.989 | 71 | 0.72 | 0.045 | 0.79 | 151 | ||

| 13.222 | 6.292 | 25.178 | 13 | 39.78 | 8.151 | 49.27 | 41 | ||

| 0.004 | 0.000 | 0.004 | 1508 | 0.16 | 0.003 | 0.17 | 1240 | ||

| 0.029 | 0.010 | 0.047 | 46 | 0.20 | 0.040 | 0.27 | 156 | ||

| Equity market—MINING | |||||||||

| −9.913 | 0.222 | −9.571 | 5461 | ||||||

| 0.099 | 0.010 | 0.116 | 211 | ||||||

| 0.991 | 0.002 | 0.995 | 622 | ||||||

| 34.847 | 8.482 | 48.373 | 46 | ||||||

| 0.007 | 0.000 | 0.008 | 5461 | ||||||

| 0.010 | 0.002 | 0.013 | 211 | ||||||

| Panel A: Before COVID-19 (January 2005 to December 2019) | ||||||||||

| Markets | Model | Log-Lik | AIC | BIC | Clarke Test | Vuong Test | ||||

| Wo/cor | AIC | BIC | Wo/cor | AIC | BIC | |||||

| Equity indices | R-vine | 2454.12 | −4848.23 | −4663.2 | 1816 | 1816 | 1816 | 3.87 *** | 3.87 *** | 3.87 *** |

| C-vine | 2256.61 | −4483.23 | −4390.71 | 1455 *** | 1483 *** | 1590 *** | −6.15 *** | −5.56 *** | −3.73 *** | |

| D-vine | 2451.09 | −4556.18 | −4714.32 | 1810 | 1803 | 1778 | 3.81 *** | 3.96 *** | 4.40 *** | |

| Exchange rates | R-vine | 150.88 | −289.77 | −252.76 | 2044 | 2044 | 2044 | 4.25 *** | 4.25 *** | 4.25 *** |

| C-vine | 87.79 | −169.57 | −151.07 | 1574 *** | 1600 *** | 1672 *** | −1.12 | −0.98 | −0.56 | |

| D-vine | 150.88 | −288.77 | −252.76 | 2038 | 2030 | 2005 *** | 4.30 *** | 4.14 *** | 3.66 *** | |

| Mixed System | R-vine | 3605.23 | −7108.46 | −6786.83 | 1500 | 1555 * | 1723 *** | −1.77 * | −0.25 | 4.31 *** |

| C-vine | 2997.24 | −5922.49 | −5695.46 | 927 *** | 939 *** | 970 *** | −20.07 *** | −19.69 *** | −18.55 *** | |

| D-vine | 3493.24 | −6896.49 | −6612.69 | 927 *** | 939 *** | 970 *** | −4.22 *** | −4.04 *** | −3.51 *** | |

| Panel B: COVID-19 Period (January 2020 to January 2022) | ||||||||||

| Equity indices | R-vine | 591.96 | −1123.92 | −996.07 | 246 | 234 * | 208 *** | −0.645 | −1.907 | −4.596 *** |

| C-vine | 595.79 | −1131.59 | −1003.74 | 240 | 229 | 205 *** | −0.610 | −1.642 | −3.842 *** | |

| D-vine | 594.31 | −1140.61 | −1038.34 | 270 | 257 | 231 *** | −0.338 | −1.291 | −3.321 *** | |

| Exchange rates | R-vine | 722.09 | −1432.18 | −1406.38 | 327 | 327 *** | 327 *** | 2.506 | 2.506 * | 2.506 * |

| C-vine | 704.61 | −1397.23 | −1371.42 | 327 | 327 *** | 327 *** | 2.506 | 2.506 * | 2.506 * | |

| D-vine | 599.93 | −1153.86 | −1055.85 | 327 | 327 *** | 327 *** | 2.506 | 2.506 * | 2.506 * | |

| Mixed System | R-vine | 1341 | −2538.01 | −2228.35 | 262 | 237 * | 208 *** | 1.630 | −0.279 | −4.348 *** |

| C-vine | 1340.46 | −2568.92 | −2328.08 | 274 | 262 | 246 | 1.882 | 1.351 | 0.220 | |

| D-vine | 1333.28 | −2522.56 | −2212.9 | 274 | 262 | 246 | 1.518 | −0.143 | −3.684 *** | |

| Panel A: Before COVID-19 (January 2005 to December 2019) | |||||||||||||||

| VaR Value | Unconditional Coverage Test | Conditional Coverage Test | |||||||||||||

| VaR (%) | VaR Exceedance | Kupiec Statistic | Christoffersen Statistic | ||||||||||||

| % | S-P | Normal | Std- t | S-P | Normal | Std- t | S-P | Normal | Std-t | Decision | S-P | Normal | Std-t | Decision | |

| Equity | |||||||||||||||

| BANK | 95 | 0.0167 | 0.0168 | 0.0167 | 93 | 90 | 93 | 0.057 | 0.116 | 0.057 | NO | 0.161 | 0.277 | 0.161 | NO |

| 97.5 | 0.0219 | 0.0220 | 0.0219 | 53 | 50 | 43 | 0.021 ** | 0.063 | 0.433 | NO | 0.055 | 0.152 | 0.72 | NO | |

| 99 | 0.0308 | 0.0310 | 0.0308 | 23 | 23 | 23 | 0.064 | 0.064 | 0.064 | NO | 0.126 | 0.126 | 0.126 | NO | |

| LINS | 95 | 0.0152 | 0.0152 | 0.0152 | 108 | 98 | 103 | 0.000 | 0.014 | 0.003 | YES | 0.001 | 0.047 | 0.001 | YES |

| 97.5 | 0.0195 | 0.0194 | 0.0195 | 62 | 56 | 51 | 0.000 ** | 0.006 ** | 0.044 | NO | 0.001 ** | 0.023 ** | 0.111 | NO | |

| 99 | 0.0262 | 0.0262 | 0.0262 | 33 | 31 | 19 | 0.000 ** | 0.000 ** | 0.353 | NO | 0.000 ** | 0.001 ** | 0.511 | NO | |

| NOLINS | 95 | 0.0142 | 0.0142 | 0.0142 | 76 | 75 | 82 | 0.977 | 0.883 | 0.504 | NO | 0.993 | 0.975 | 0.767 | NO |

| 97.5 | 0.0178 | 0.0179 | 0.0178 | 43 | 43 | 38 | 0.433 | 0.433 | 0.984 | NO | 0.211 | 0.211 | 0.998 | NO | |

| 99 | 0.0234 | 0.0233 | 0.0234 | 22 | 20 | 8 | 0.103 | 0.243 | 0.040 | NO | 0.192 | 0.388 | 0.117 | NO | |

| LEISURE | 95 | 0.0115 | 0.0115 | 0.0115 | 98 | 93 | 102 | 0.014 | 0.057 ** | 0.004 | YES | 0.043 | 0.156 ** | 0.012 | YES |

| 97.5 | 0.0152 | 0.0153 | 0.0152 | 57 | 48 | 48 | 0.004 ** | 0.119 | 0.119 | NO | 0.013 ** | 0.16 | 0.16 | NO | |

| 99 | 0.0215 | 0.0216 | 0.0215 | 33 | 31 | 24 | 0.000 ** | 0.000 ** | 0.038 | NO | 0.000 ** | 0.001 ** | 0.08 | NO | |

| TELCOM | 95 | 0.3304 | 0.3306 | 0.3304 | 13 | 43 | 44 | 0.000 | 0.000 | 0.000 | YES | 0.000 | 0.000 | 0.000 | YES |

| 97.5 | 0.4032 | 0.4030 | 0.4032 | 15 | 19 | 17 | 0.000 | 0.001 | 0.000 | YES | 0.000 | 0.000 | 0.000 | YES | |

| 99 | 0.5047 | 0.5045 | 0.5047 | 7 | 8 | 4 | 0.018 ** | 0.040 ** | 0.001 | YES | 0.058 ** | 0.117 ** | 0.003 | YES | |

| MINING | 95 | 0.0181 | 0.0182 | 0.0181 | 87 | 82 | 83 | 0.216 | 0.504 | 0.434 | NO | 0.036 ** | 0.323 | 0.279 | NO |

| 97.5 | 0.0229 | 0.0229 | 0.0229 | 52 | 47 | 47 | 0.031 | 0.160 | 0.16 | NO | 0.079 | 0.343 | 0.343 | NO | |

| 99 | 0.0298 | 0.0298 | 0.0298 | 27 | 24 | 19 | 0.006 ** | 0.038 | 0.353 | NO | 0.015 | 0.079 | 0.511 | NO | |

| Foreign exchange | |||||||||||||||

| USD | 95 | 0.0086 | 0.0087 | 0.0086 | 58 | 63 | 65 | 0.025 ** | 0.109 | 0.176 | NO | 0.008 ** | 0.255 | 0.179 | NO |

| 97.5 | 0.0108 | 0.0108 | 0.0108 | 35 | 34 | 31 | 0.603 | 0.491 | 0.227 | NO | 0.384 | 0.363 | 0.254 | NO | |

| 99 | 0.0141 | 0.0141 | 0.0141 | 20 | 18 | 18 | 0.243 | 0.491 | 0.082 | NO | 0.388 | 0.636 | 0.636 | NO | |

| GBP | 95 | 0.0085 | 0.0085 | 0.0085 | 61 | 65 | 68 | 0.064 | 0.176 | 0.324 | NO | 0.100 | 0.396 | 0.614 | NO |

| 97.5 | 0.0108 | 0.0107 | 0.0107 | 36 | 35 | 33 | 0.725 | 0.603 | 0.390 | NO | 0.393 | 0.384 | 0.333 | NO | |

| 99 | 0.0141 | 0.0142 | 0.0142 | 19 | 18 | 16 | 0.353 | 0.491 | 0.744 | NO | 0.511 | 0.636 | 0.833 | NO | |

| EUR | 95 | 0.0081 | 0.0081 | 0.0081 | 66 | 72 | 85 | 0.218 | 0.614 | 0.312 | NO | 0.892 | 0.834 | 0.561 | NO |

| 97.5 | 0.0101 | 0.0101 | 0.0101 | 39 | 41 | 35 | 0.886 | 0.641 | 0.603 | NO | 0.355 | 892 | 0.854 | NO | |

| 99 | 0.0131 | 0.0131 | 0.0131 | 17 | 18 | 13 | 0.658 | 0.491 | 0.491 | NO | 0.511 | 0.636 | 0.636 | NO | |

| Panel B: COVID-19 Period (January 2020 to January 2022) | |||||||||||||||

| VaR Value | Unconditional Coverage Test | Conditional Coverage Test | |||||||||||||

| VaR (%) | VaR Exceedance | Kupiec Statistic | Christoffersen Statistic | ||||||||||||

| % | S-P | Normal | Std- t | S-P | Normal | Std- t | S-P | Normal | Std-t | Decision | S-P | Normal | Std-t | Decision | |

| Equity | |||||||||||||||

| BANK | 95 | 5.22 | 5.203 | 0.016 | 10 | 9 | 8 | 0.09 | 0.046 | 0.021 | YES | 0.173 | 0.105 | 0.057 | NO |

| 97.5 | 7.00 | 6.990 | 0.021 | 4 | 5 | 4 | 0.106 | 0.236 | 0.106 | NO | 0.258 | 0.458 | 0.258 | NO | |

| 99 | 10.00 | 10.042 | 0.030 | 2 | 3 | 1 | 0.456 | 0.892 | 0.143 | NO | 0.748 | 0.963 | 0.341 | NO | |

| LINS | 95 | 0.015 | 4.866 | 0.015 | 7 | 7 | 9 | 0.009 | 0.009 | 0.046 | YES | 0.027 | 0.027 | 0.105 | YES |

| 97.5 | 0.019 | 6.566 | 0.019 | 3 | 6 | 6 | 0.038 | 0.434 | 0.434 | NO | 0.112 | 0.657 | 0.657 | NO | |

| 99 | 0.026 | 9.520 | 0.026 | 2 | 3 | 3 | 0.456 | 0.892 | 0.892 | NO | 0.748 | 0.963 | 0.963 | NO | |

| NOLINS | 95 | 4.017 | 3.993 | 0.014 | 12 | 13 | 13 | 0.263 | 0.399 | 0.399 | NO | 0.336 | 0.406 | 0.406 | NO |

| 97.5 | 4.846 | 4.826 | 0.017 | 6 | 9 | 8 | 0.434 | 0.753 | 0.753 | NO | 0.657 | 0.735 | 0.735 | NO | |

| 99 | 5.917 | 5.916 | 0.026 | 3 | 4 | 3 | 0.892 | 0.682 | 0.892 | NO | 0.963 | 0.875 | 0.963 | NO | |

| LEISURE | 95 | 5.150 | 5.212 | 0.011 | 5 | 5 | 5 | 0.001 | 0.001 | 0.001 | YES | 0.004 | 0.004 | 0.004 | YES |

| 97.5 | 7.089 | 7.188 | 0.015 | 3 | 3 | 3 | 0.038 | 0.038 | 0.038 | NO | 0.112 | 0.112 | 0.115 | NO | |

| 99 | 10.614 | 10.737 | 0.021 | 2 | 2 | 2 | 0.456 | 0.456 | 0.456 | NO | 0.748 | 0.748 | 0.748 | NO | |

| TELCOM | 95 | 4.678 | 4.624 | 0.330 | 4 | 6 | 10 | 0.000 | 0.003 | 0.09 | YES | 0.001 | 0.001 | 0.173 | YES |

| 97.5 | 6.369 | 6.343 | 0.403 | 2 | 3 | 3 | 0.010 | 0.038 | 0.038 | NO | 0.034 | 0.112 | 0.112 | NO | |

| 99 | 9.507 | 9.665 | 0.504 | 1 | 1 | 1 | 0.456 | 0.143 | 0.143 | NO | 0.748 | 0.341 | 0.341 | NO | |

| MINING | 95 | 4.792 | 4.833 | 0.018 | 16 | 15 | 20 | 0.959 | 0.757 | 0.349 | NO | 0.971 | 0.459 | 0.222 | NO |

| 97.5 | 6.142 | 6.213 | 0.022 | 8 | 8 | 6 | 0.972 | 0.972 | 0.434 | NO | 0.816 | 0.816 | 0.657 | NO | |

| 99 | 8.437 | 8.481 | 0.029 | 4 | 5 | 2 | 0.682 | 0.363 | 0.87 | NO | 0.875 | 0.611 | 0.969 | NO | |

| Foreign exchange | |||||||||||||||

| USD | 95 | 2.186 | 2.189 | 0.008 | 11 | 11 | 12 | 0.099 | 0.099 | NO | 0.178 | 0.178 | NO | ||

| 97.5 | 2.597 | 2.600 | 0.010 | 6 | 7 | 6 | 0.339 | 0.563 | NO | 0.569 | 0.731 | NO | |||

| 99 | 3.111 | 3.112 | 0.014 | 2 | 3 | 2 | 0.394 | 0.803 | NO | 0.688 | 0.944 | NO | |||

| GBP | 95 | 2.016 | 2.031 | 0.008 | 10 | 10 | 10 | 0.053 | 0.053 | NO | 0.113 | 0.113 | NO | ||

| 97.5 | 2.443 | 2.456 | 0.010 | 7 | 7 | 8 | 0.563 | 0.563 | NO | 0.731 | 0.731 | NO | |||

| 99 | 2.993 | 2.979 | 0.014 | 2 | 4 | 3 | 0.394 | 0.772 | NO | 0.688 | 0.915 | NO | |||

| EUR | 95 | 2.159 | 2.160 | 0.008 | 9 | 9 | 10 | 0.025 | 0.025 | YES | 0.065 | 0.065 | NO | ||

| 97.5 | 2.627 | 2.627 | 0.010 | 5 | 5 | 5 | 0.175 | 0.175 | NO | 0.371 | 0.371 | NO | |||

| 99 | 3.238 | 3.239 | 0.013 | 2 | 2 | 2 | 0.394 | 0.394 | NO | 0.688 | 0.688 | NO | |||

| Panel A: Before COVID-19 (January 2005 to December 2019) | |||||||||||||||

| VaR (%) | VaR Exceedance | Unconditional Coverage Test | Conditional Coverage Test | ||||||||||||

| R-vine | C-vine | D-vine | R-vine | C-vine | D-vine | R-vine | C-vine | D-vine | Decision | R-vine | C-vine | D-vine | Decision | ||

| Equity Indices | 99 | −1.795 | −1.782 | −1.718 | 15 | 17 | 24 | 0.000 | 0.000 | 0.043 * | YES | 0.000 | 0.002 | 0.110 * | YES |

| 95 | −1.272 | −1.258 | −1.215 | 154 | 166 | 183 | 0.079 | 0.423 | 0.060 | NO | 0.018 | 0.385 * | 0.622 | YES | |

| Exchange Rate | 99 | −1.786 | −1.794 | −1.702 | 16 | 13 | 19 | 0.000 | 1.524 | 0.002 * | YES | 0.001 | 8.262 | 0.009 | YES |

| 95 | −1.262 | −1.270 | −1.199 | 156 | 163 | 158 | 0.110 | 0.299 | 0.151 | NO | 0.089 | 0.344 | 0.324 | NO | |

| Panel B: COVID-19 period (January 2020 to January 2022) | |||||||||||||||

| Equity Indices | 99 | −5.723 | −4.530 | −5.898 | 18 | 25 | 20 | 0.000 | 0.000 | 0.000 | YES | 0.000 | 0.000 | 0.000 | YES |

| 95 | −4.503 | −3.233 | −4.515 | 28 | 51 | 39 | 0.545 | 0.000 | 0.007 | YES | 0.783 | 0.000 | 0.015 | YES | |

| Exchange Rate | 99 | −4.527 | −4.391 | −4.410 | 9 | 13 | 9 | 0.106 | 0.002 | 0.106 | NO | 0.229 | 0.007 | 0.229 | NO |

| 95 | −3.231 | −3.095 | −3.113 | 39 | 37 | 39 | 0.007 | 0.021 | 0.007 | YES | 0.024 | 0.003 | 0.024 | YES | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Eita, J.H.; Tchuinkam Djemo, C.R. Quantifying Foreign Exchange Risk in the Selected Listed Sectors of the Johannesburg Stock Exchange: An SV-EVT Pairwise Copula Approach. Int. J. Financial Stud. 2022, 10, 24. https://doi.org/10.3390/ijfs10020024

Eita JH, Tchuinkam Djemo CR. Quantifying Foreign Exchange Risk in the Selected Listed Sectors of the Johannesburg Stock Exchange: An SV-EVT Pairwise Copula Approach. International Journal of Financial Studies. 2022; 10(2):24. https://doi.org/10.3390/ijfs10020024

Chicago/Turabian StyleEita, Joel Hinaunye, and Charles Raoul Tchuinkam Djemo. 2022. "Quantifying Foreign Exchange Risk in the Selected Listed Sectors of the Johannesburg Stock Exchange: An SV-EVT Pairwise Copula Approach" International Journal of Financial Studies 10, no. 2: 24. https://doi.org/10.3390/ijfs10020024

APA StyleEita, J. H., & Tchuinkam Djemo, C. R. (2022). Quantifying Foreign Exchange Risk in the Selected Listed Sectors of the Johannesburg Stock Exchange: An SV-EVT Pairwise Copula Approach. International Journal of Financial Studies, 10(2), 24. https://doi.org/10.3390/ijfs10020024