Regional Variation in Pharmacist Perception of the Financial Impact of Medicare Part D

Abstract

:1. Introduction

2. Materials and Methods

- Financial Performance of Pharmacy since 2006

- Considerations regarding the sale of the pharmacy

- Providing Medication Therapy Management

- Concerns about Part D 2010 Updates

3. Results

3.1. Survey Responses

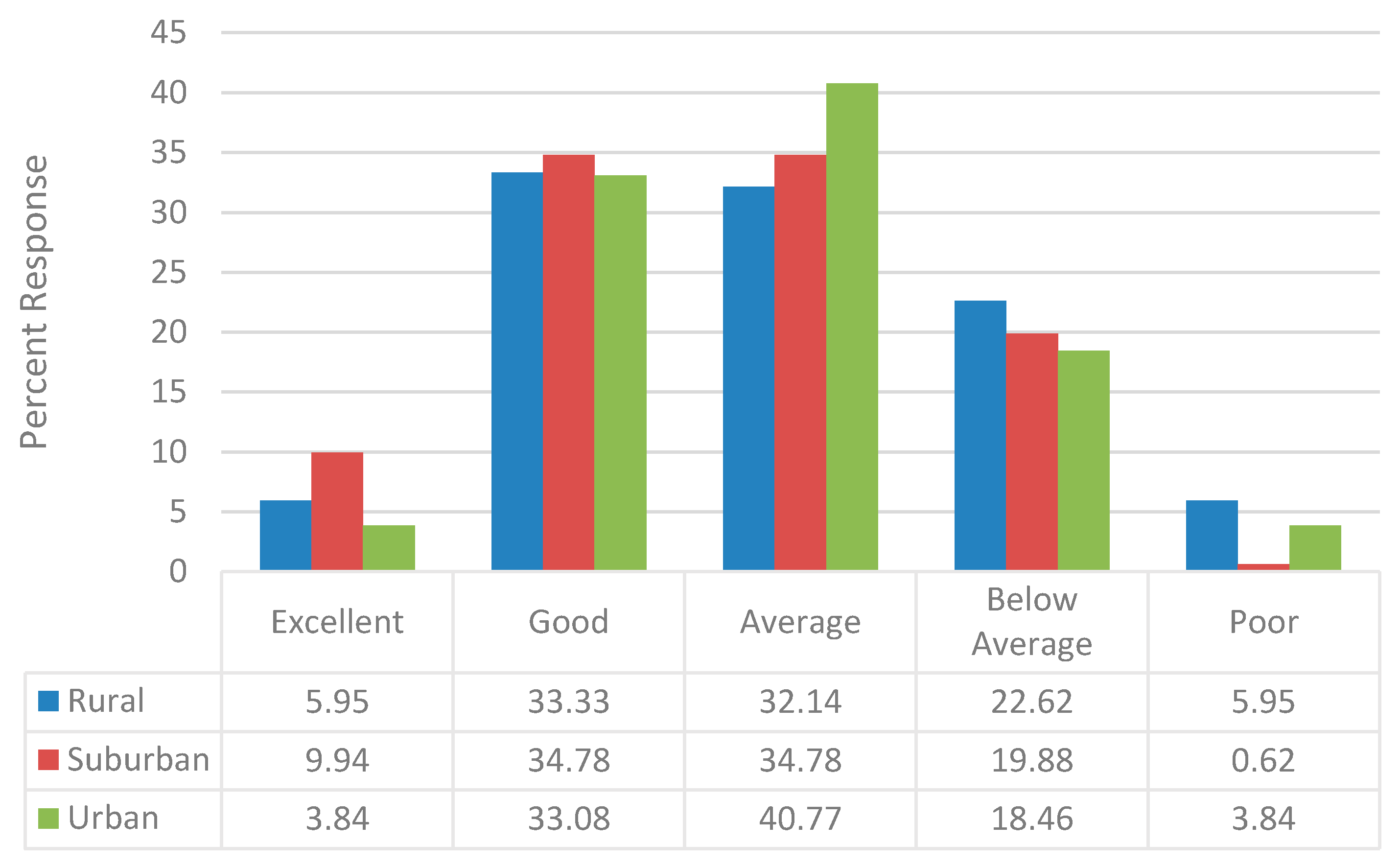

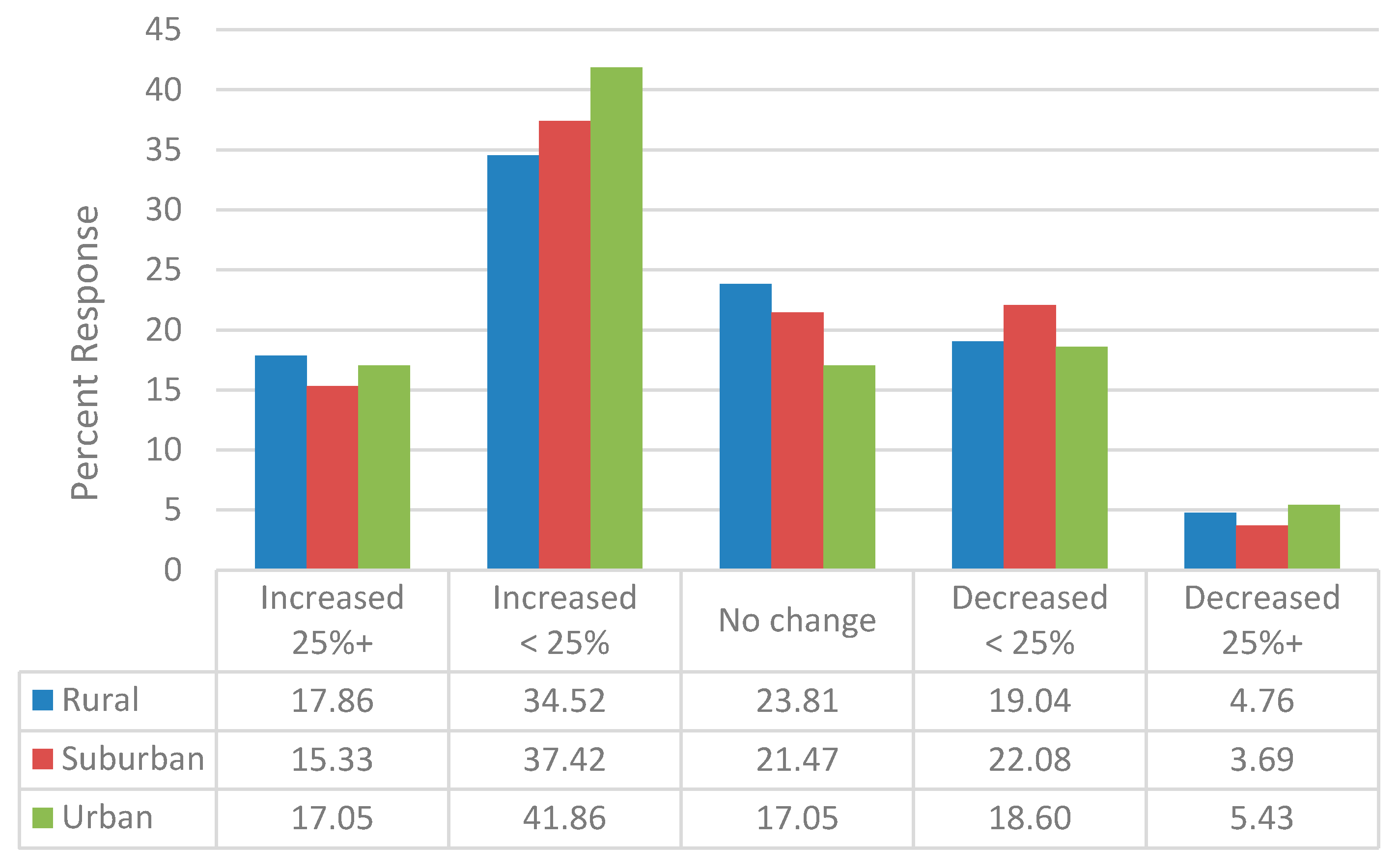

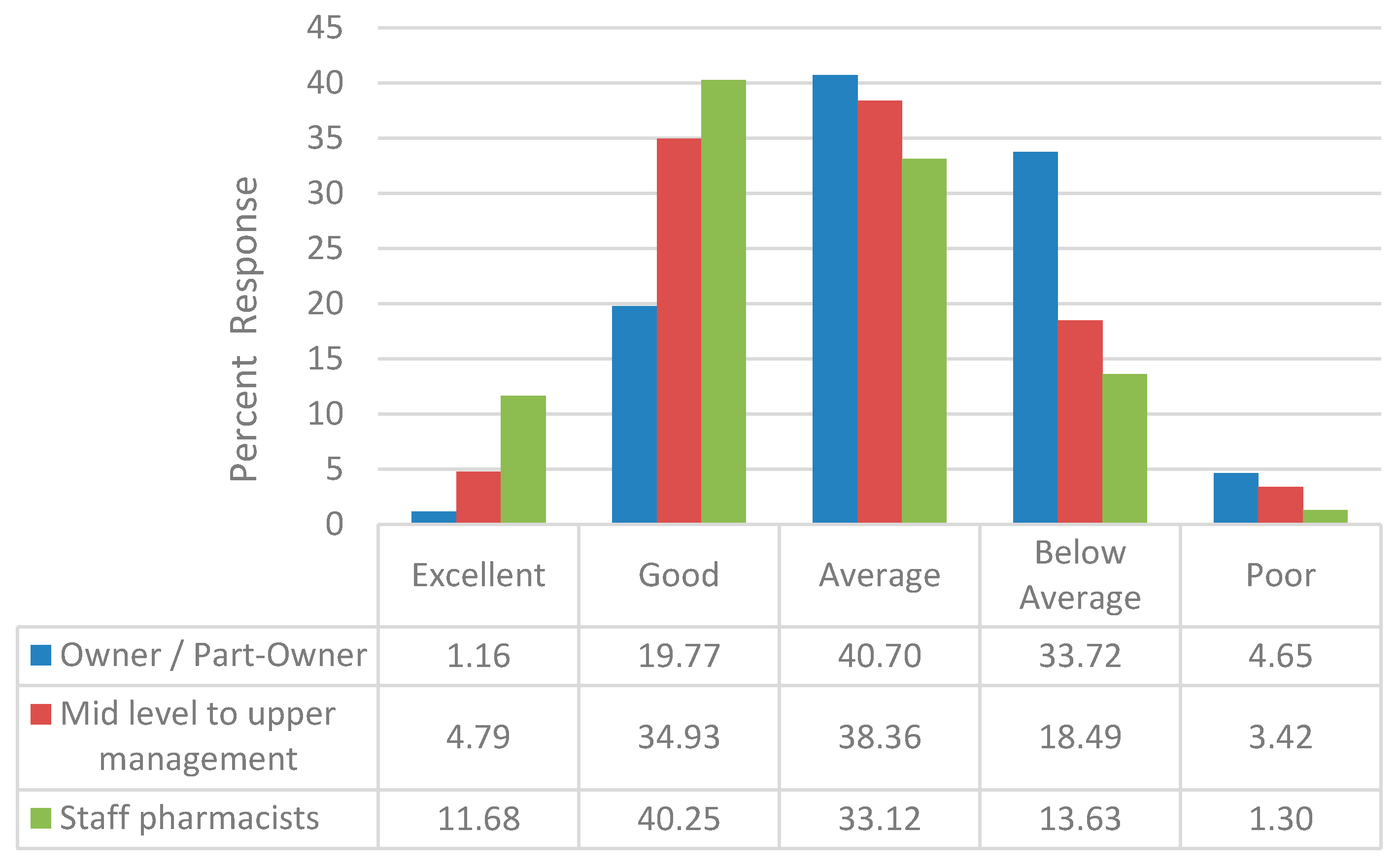

3.2. Financial Performance Since 2006

3.3. MTM Services

3.4. Part D 2010 Updates

4. Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Schneeweiss, S.; Patrick, A.R.; Pedan, A.; Varasteh, L.; Levin, R.; Liu, N.; Shrank, W.H. The effect of Medicare Part D coverage on drug use and associated cost sharing among seniors without prior drug benefits. Health Aff. 2009, 28, W305–W316. [Google Scholar] [CrossRef] [PubMed]

- Pitts, B.; Dominelli, A.; Khan, S. Physician patient communication concerning Part D in two Midwestern states. P&T 2007, 32, 544–551. [Google Scholar]

- IMS Health. Medicare Part D: The First Year; Plymouth Meeting; IMS: Danbury, CT, USA, 2007. [Google Scholar]

- Montgomery, L.; Lee, C. Success of drug plan challenges Democrats. Washington Post, 26 November 2006. [Google Scholar]

- Medicare Today. Senior Satisfaction Survey: 2007–2016. Available online: http://medicaretoday.org/resources/senior-satisfaction-survey/ (accessed on 6 October 2016).

- Epstein, A.J.; Rathmore, S.S.; Alexander, G.C.; Ketcham, J.D. Primary care physicians views of Medicare Part D. Am. J. Manag. Care 2008, 14, SP5–SP13. [Google Scholar] [PubMed]

- Khan, S.; Sylvester, R.; Scott, D.; Pitts, B. Physicians’ opinions about responsibility for patient out-of-pocket costs and formulary prescribing in two Midwestern states. J. Manag. Care Pharm. 2008, 14, 780–789. [Google Scholar] [CrossRef] [PubMed]

- Spooner, J.J. A bleak future for independent community pharmacy under Medicare Part D. J. Manag. Care Pharm. 2008, 14, 878–881. [Google Scholar] [CrossRef] [PubMed]

- Khan, S. Urban and Suburban Community Pharmacists’ Experiences with Part D—A Focus Group Study. J. Pharm. Technol. 2012, 28, 249–257. [Google Scholar] [CrossRef]

- Khan, S. What can pharmacists’ do about the Medicare Part D Donut hole and Reimbursement? A six-state survey. Aging Clin. Exp. Res. 2014, 27, 373–381. [Google Scholar] [CrossRef] [PubMed]

- Khan, S. Medicare Part D: Pharmacists and Formularies—Whose Job is it to Address Copays? Consult. Pharm. 2014, 29, 602–613. [Google Scholar] [CrossRef] [PubMed]

- Radford, A.; Slifkin, R.; Fraser, R.; Mason, M.; Mueller, K. The experience of rural independent pharmacies with Medicare part D: Reports from the field. J. Rural Health 2007, 23, 286–293. [Google Scholar] [CrossRef] [PubMed]

- Bono, J.D.; Crawford, S.Y. Impact of Medicare Part D on independent and chain community pharmacies in rural Illinois—A qualitative study. Res. Soc. Adm. Pharm. 2010, 6, 110–120. [Google Scholar] [CrossRef] [PubMed]

- Stern, C. CVS and Walgreens are Completely Dominating the US Drugstore Industry. Available online: http://finance.yahoo.com/news/cvs-walgreens-completely-dominating-us-211840229.html (accessed on 30 November 2016).

- NCPA-Pfizer Digest 2007; National Community Pharmacists Association: Alexandria, VA, USA, 2007.

- NCPA Digest 2011; National Community Pharmacists Association: Alexandria, VA, USA, 2011.

- Klepser, D.G.; Xu, L.; Ullrich, F.; Mueller, K.J. Trends in community pharmacy counts and closures before and after the implementation of Medicare part D. J. Rural Health 2011, 27, 168–175. [Google Scholar] [CrossRef] [PubMed]

- Retail Brand Reimbursement (Table 4). In The Prescription Drug Benefit Cost and Plan Design Survey Report; Takeda Pharmaceuticals North America: Osaka, Japan, 2003.

- Average dispensing fee by pharmacy channel (Table 25). In The 2014–2015 Prescription Drug Benefit Cost and Plan Design Report; Takeda Pharmaceuticals USA: Boston, MA, USA, 2014.

- Urick, B.Y.; Urmie, J.M.; Doucette, W.R.; McDonough, R.P. Assessing changes in third-party gross margin for a single community pharmacy. J. Am. Pharm. Assoc. 2014, 54, 27–34. [Google Scholar] [CrossRef] [PubMed]

- U.S. Government Printing Office. Public Law 108–173. The Medicare Prescription Drug, Improvement, and Modernization Act of 2003. Available online: https://www.gpo.gov/fdsys/pkg/PLAW-108publ173/html/PLAW-108publ173.htm (accessed on 4 October 2016).

- Winston, S.; Lin, Y.S. Impact on drug cost and use of Medicare part D of medication therapy management services delivered in 2007. J. Am. Pharm. Assoc. 2009, 49, 813–820. [Google Scholar] [CrossRef] [PubMed]

- MacIntosh, C.; Weiser, C.; Wassimi, A.; Reddick, J.; Scovis, N.; Guy, M.; Boesen, K. Attitudes toward and factors affecting implementation of medication therapy management services by community pharmacists. J. Am. Pharm. Assoc. 2009, 49, 26–30. [Google Scholar] [CrossRef] [PubMed]

- Cook, D.M.; Mburia-Mwalili, A. Medication therapy management favors large pharmacy chains and creates potential conflicts of interest. J. Manag. Care Pharm. 2009, 15, 495–500. [Google Scholar] [CrossRef] [PubMed]

- Fraher, E.P.; Slifkin, R.T.; Smith, L.; Randolph, R.; Rudolf, M.; Holmes, G.M. How might the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 affect the financial viability of rural pharmacies? An analysis of pre implementation prescription volume and payment sources in rural and urban areas. J. Rural Health 2005, 21, 114–121. [Google Scholar] [CrossRef] [PubMed]

- Hilsenrath, P.; Woelfel, J.; Shek, A.; Ordanza, K. Redefining the role of the pharmacist: Medication therapy management. J. Rural Health 2012, 28, 425–430. [Google Scholar] [CrossRef] [PubMed]

- Khan, S.; Snyder, H.W.; Rathke, A.M.; Scott, D.M.; Peterson, C.D. Is there a successful business case for telepharmacy? Telemed. J. Health 2008, 14, 235–244. [Google Scholar] [CrossRef] [PubMed]

- Nattinger, M.; Ullrich, F.; Mueller, K.J. Characteristics of Rural Communities with a Sole, Independently Owned Pharmacy. Rural Policy Brief. 2015, 6, 1–4. [Google Scholar]

- Scott, D.M. Assessment of pharmacists’ perception of patient care competence and need for training in rural and urban areas in North Dakota. J. Rural Health 2010, 26, 90–96. [Google Scholar] [CrossRef] [PubMed]

- Radford, A.; Lampman, M.; Richardson, I.; Rutledge, S. Profile of Sole Community Pharmacists’ Prescription Sales and Overall Financial Position; NC Rural Health Research & Policy Analysis Center: Chapel Hill, NC, USA, 2009. [Google Scholar]

- Creative Research Systems. Sample Size Calculator. Available online: https://www.surveysystem.com/sscalc.htm (accessed on 31 May 2018).

- Analytical Software. Statistix 10: Data Analysis Software for Researchers. Available online: https://www.statistix.com/ (accessed on 31 May 2018).

- Weigel, P.; Ullrich, F.; Mueller, K. Demographic and economic characteristics associated with sole county pharmacy closures, 2006–2010. Rural Policy Brief. 2013, 15, 1–4. [Google Scholar]

- Ullrich, F.; Mueller, K.J. Update: Independently owned pharmacy closures in rural America, 2003–2013. Rural Policy Brief. 2014, 7, 1–4. [Google Scholar]

- Radford, A.; Slifkin, R.; King, J.; Lampman, M.; Richardson, I.; Rutledge, S. The relationship between the financial status of sole community independent pharmacies and their broader involvement with other rural providers. J. Rural Health 2011, 27, 176–183. [Google Scholar] [CrossRef] [PubMed]

- Hoffman, E. Pharmacies & Drug Stores in the US, Industry Report; IBIS World: Los Angeles, CA, USA, 2016. [Google Scholar]

- PwC Health Research Institute. The Pharmacy of the Future: Hub of Personalized Health. Available online: http://pwchealth.com/cgi-local/hregister.cgi/reg/pwc-hri-pharmacy-of-the-future-united-states.pdf (accessed on 30 November 2016).

- Terlep, S.; Stevens, L. Amazon Buys Online Pharmacy PillPack for $1 Billion. Available online: https://www.wsj.com/articles/amazon-to-buy-online-pharmacy-pillpack-1530191443 (accessed on 3 July 2018).

- Kim, T. Walgreen, CVS and Rite-Aid Lose $11 Billion in Value after Amazon Buys Online Pharmacy PillPack. Available online: https://www.cnbc.com/2018/06/28/walgreens-cvs-shares-tank-after-amazon-buys-online-pharmacy-pillpack.html (accessed on 3 July 2018).

- National Community Pharmacists Association. Independent Pharmacy Today. Available online: http://www.ncpanet.org/home/independent-pharmacy-today (accessed on 7 June 2017).

- Brooks, J.M.; Doucette, W.R.; Wan, S.; Klepser, D.G. Retail pharmacy market structure and performance. Inquiry 2008, 45, 75–88. [Google Scholar] [CrossRef] [PubMed]

- Radford, A.; Mason, M.; Richardson, I.; Rutledge, S.; Poley, S.; Mueller, K.; Slifkin, R. Continuing effects of Medicare Part D on rural independent pharmacies who are the sole retail provider in their community. Res. Soc. Adm. Pharm. 2009, 5, 17–30. [Google Scholar] [CrossRef] [PubMed]

- National Community Pharmacists Association. NCPA Statement on CVS-Target Deal. Available online: http://www.ncpanet.org/newsroom/details/2015/06/15/ncpa-statement-on-cvs-target-deal (accessed on 7 June 2017).

- Todd, K.; Westfall, K.; Doucette, B.; Ullrich, F.; Mueller, K. Causes and consequences of rural pharmacy closures: A multi-case study. Rural Policy Brief. 2013, 11, 1–4. [Google Scholar]

- Law, A.V.; Okamoto, M.P.; Brock, K. Perceptions of Medicare Part D enrollees about pharmacists and their role as providers of medication therapy management. J. Am. Pharm. Assoc. 2008, 48, 648–653. [Google Scholar] [CrossRef] [PubMed]

- Henning-Smith, C.; Casey, M.; Moscovice, I. Does the Medicare Part D Decision-Making Experience Differ by Rural/Urban Location? J. Rural Health 2017, 33, 12–20. [Google Scholar] [CrossRef] [PubMed]

- Viswanathan, M.; Kahwati, L.C.; Golin, C.E.; Blalock, S.J.; Coker-Schwimmer, E.; Posey, R.; Lohr, K.N. Medication therapy management interventions in outpatient settings: A systematic review and meta-analysis. JAMA Intern. Med. 2015, 175, 76–87. [Google Scholar] [CrossRef] [PubMed]

- Cranor, C.W.; Bunting, B.A.; Christensen, D.B. The Asheville Project: Long-term clinical and economic outcomes of a community pharmacy diabetes care program. J. Am. Pharm. Assoc. 2003, 43, 173–184. [Google Scholar] [CrossRef]

- Bunting, B.A.; Smith, B.H.; Sutherland, S.E. The Asheville Project: Clinical and economic outcomes of a community-based long-term medication therapy management program for hypertension and dyslipidemia. J. Am. Pharm. Assoc. 2008, 48, 23–31. [Google Scholar] [CrossRef] [PubMed]

- Bunting, B.A.; Lee, G.; Knowles, G.; Lee, C.; Allen, P. The Hickory Project: Controlling healthcare costs and improving outcomes for diabetes using the Asheville project model. Am. Health Drug Benefits 2011, 4, 343–350. [Google Scholar] [PubMed]

- Gadkari, A.S.; Mott, D.A.; Kreling, D.H.; Bonnarens, J.K. Pharmacy characteristics associated with the provision of drug therapy services in nonmetropolitan community pharmacies. J. Rural Health 2009, 25, 290–295. [Google Scholar] [CrossRef] [PubMed]

- Nemlekar, P.; Shepherd, M.; Lawson, K.; Rush, S. Web-based survey to assess the perceptions of managed care organization representatives on use of copay subsidy coupons for prescription drugs. J. Manag. Care Pharm. 2013, 19, 602–608. [Google Scholar] [CrossRef] [PubMed]

- Midwest Pharmacy Workforce Consortium. Final Report of the 2014 National Sample Survey of the Pharmacist Workforce to Determine Contemporary Demographic Practice Characteristics and Quality of Work-Life. American Association of Colleges of Pharmacy. Available online: http://www.aacp.org/resources/research/pharmacyworkforcecenter/Documents/PWC-demographics.pdf (accessed on 1 November 2016).

| Total (n = 419) | Rural (n = 84) | Suburban (n = 163) | Urban (n = 131) | |

|---|---|---|---|---|

| Male | 60.5% | 53.6% | 60.7% | 64.6% |

| Age (>40 years) | 80.4% | 76.2% | 81.5% | 81.7% |

| Primary Region of Practice (via US Census Bureau designation) | ||||

| Northeast | 16.6% | 27.3% | 16.9% | 7.8% |

| Midwest | 31.9% | 35.1% | 29.2% | 35.9% |

| South | 39.5% | 28.6% | 40.9% | 44.5% |

| West | 11.9% | 9.1% | 13.0% | 11.7% * |

| Primary Type of Practice Site | ||||

| Independent (1 store to 3 stores) | 56.6% | 51.8% | 49.4% | 71.8% |

| Chain (≥4 stores) and Other § | 43.4% | 48.2% | 50.6% | 28.2% ** |

| Work Status (Full-Time) | 82.0% | 82.1% | 80.1% | 83.9% |

| Work Status (Part-Time 30 h or less) | 18.0% | 17.9% | 19.9% | 16.1% |

| Terminal Degree | ||||

| Doctor of Pharmacy | 26.9% | 29.3% | 25.5% | 26.7% |

| Bachelor of Science | 69.9% | 64.6% | 71.4% | 71.8% |

| Other | 3.2% | 6.1% | 3.1% | 1.5% |

| Primary Role as a Pharmacist | ||||

| Staff Pharmacist | 40.1% | 40.5% | 52.8% | 22.1% |

| Pharmacist-in-Charge/Pharmacy Manager/Part of Upper Level Pharmacy Management (District Manager)/Other | 37.9% | 40.5% | 34.4% | 41.2% |

| Community Pharmacy Part-Owner/Owner | 22.0% | 19.0% | 12.9% | 36.6% *** |

| Years of community pharmacy practice as a Registered Pharmacist | ||||

| 15 years or less | 25.6% | 36.9% | 24.4% | 19.2% |

| More than 15 years | 74.4% | 63.1% | 75.6% | 80.8% **** |

| Number of prescription dispensed in a typical day | ||||

| 0 to 300/weekday | 67.1% | 71.4% | 59.9% | 73.8% |

| >300/weekday | 32.9% | 28.6% | 40.1% | 26.2% |

| >50% of patients enrolled in Medicare Part D | 29.4% | 38.6% | 25.8% | 28.2% ***** |

| Percentage of prescriptions received electronically | ||||

| Zero | 1.1% | 0 | 0.6% | 2.3% |

| 1% to 25% | 32.3% | 27.4% | 29.4% | 38.9% |

| 26% to 50% | 44.4% | 51.2% | 45.4% | 38.9% |

| >50% | 22.2% | 21.4% | 24.5% | 19.8% |

| Factor | Odds Ratio | 95% CI | P value |

|---|---|---|---|

| Primary Practice Site * | 1.84 | 1.10 to 3.08 | 0.0211 |

| Primary Practice location ** | |||

| Rural | 0.75 | 0.40 to 1.42 | 0.3834 |

| Suburban | 0.86 | 0.50 to 1.49 | 0.5900 |

| Number of years in community practice | 0.64 | 0.38 to 1.07 | 0.0892 |

| Percentage of Part D patients | 0.88 | 0.53 to 1.46 | 0.6116 |

| Percentage of Prescriptions Received Electronically *** | |||

| 1% to 25% | 0.06 | 0.00 to 0.80 | 0.0329 |

| 26% to 50% | 0.10 | 0.01 to 1.33 | 0.0812 |

| >50% | 0.06 | 0.00 to 0.81 | 0.0343 |

| Primary Role **** | |||

| Pharmacist-in-charge, Pharmacy Manager, Part of Upper Level Management and Other | 0.65 | 0.39 to 1.09 | 0.1013 |

| Community Pharmacy Owner and Part-Owner | 0.38 | 0.18 to 0.79 | 0.0090 |

| Prescription Volume † | |||

| 100 to 300 per weekday | 2.08 | 0.78 to 5.54 | 0.1421 |

| 301 to 500 per weekday | 2.95 | 1.02 to 8.58 | 0.0465 |

| >500 per weekday | 3.30 | 1.08 to 10.02 | 0.0356 |

| All | Rural | Suburban | Urban | |

|---|---|---|---|---|

| Primary region of practice * | ||||

| Northeast | 13 (14.9%) | 5 (38.5%) | 5 (23.8%) | 1 (2.1%) |

| Mid-West | 26 (29.9%) | 3 (23.1%) | 8 (38.1%) | 14 (29.2%) |

| South | 42 (48.3%) | 4 (30.8%) | 7 (33.3%) | 29 (60.4%) |

| West | 6 (6.9%) | 1 (7.7%) | 1 (4.8%) | 4 (8.3%) |

| Percent of prescriptions received electronically ** | ||||

| None | 2 (2.2%) | 0 | 0 | 2 (4.2%) |

| 1% to 50% | 71 (79.8%) | 14 (87.5%) | 12 (57.1%) | 42 (87.5%) |

| >50% | 16 (18.0%) | 2 (12.5%) | 9 (42.9%) | 4 (8.3%) |

| Pharmacy’s financial performance since 2006 *** | ||||

| Excellent | 1 (1.2%) | 0 | 0 | 1 (2.1%) |

| Good | 17 (19.8%) | 2 (12.5%) | 3 (14.3%) | 12 (25.0%) |

| Average | 35 (40.7%) | 2 (12.5%) | 13 (61.9%) | 20 (41.7%) |

| Below average | 29 (33.7%) | 10 (62.5%) | 5 (23.8%) | 13 (27.1%) |

| Poor | 4 (4.7%) | 2 (12.5%) | 0 | 2 (4.2%) |

| Prescription volume dispensed (past 2 years prior to survey completion) **** | ||||

| Decreased | 30 (33.3%) | 8 (50.0%) | 4 (20.0%) | 15 (33.3%) |

| Increased | 39 (43.3%) | 7 (43.8%) | 7 (35.0%) | 20 (44.4%) |

| Remained the same | 21 (23.3%) | 1 (6.3%) | 9 (45.0%) | 10 (22.2%) |

| Provide MTM which is reimbursed by at least one Part D plan ***** | 55 (64.0%) | 6 (37.5%) | 13 (65.0%) | 34 (75.6%) |

| Number of prescription dispensed in a typical day of practice ****** | ||||

| 0 to 300/weekday | 63 (75.0%) | 8 (50.0%) | 16 (76.2%) | 39 (83.0%) |

| >300/weekday | 21 (25.0%) | 8 (50.0%) | 5 (24.8%) | 8 (17.0%) |

| Considerations regarding the sale of the pharmacy | ||||

| Respondent considering sale of the pharmacy | 38 (44.7%) | 5 (31.3%) | 8 (40.0%) | 24 (51.1%) |

| The decision to sell is influenced by the financial pressure exerted by Part D | 32 (94.1%) | 5 (100%) | 6 (75.0%) | 20 (83.3%) |

| Considering sale and have identified a potential buyer | 14 (36.8%) | 1 (20.0%) | 4 (50.0%) | 8 (33.3%) |

| Another community pharmacy located within 1 to 10 mile radius of the pharmacy considered for sale | 33 (86.8%) | 5 (100%) | 7 (87.5%) | 20 (83.3%) |

| Do You Provide MTM Reimbursed by at Least one Part D Plan at Your Primary Practice Site? | ||

|---|---|---|

| Yes | No | |

| All | 220 (57.3%) | 164 (42.7%) |

| Geographic location | ||

| Rural | 50 (59.5%) | 34 (40.5%) |

| Suburban | 88 (54.0%) | 75 (46%) |

| Urban | 79 (60.3%) | 52 (39.7%) |

| Age (≤40 years) | 57 (26.3%) | 17 (10.6%) |

| Age (>40 years) * | 160 (73.7%) | 143 (89.4%) |

| Years of community pharmacy practice ** | ||

| 15 years or less | 67 (31.0%) | 29 (18.2%) |

| More than 15 years | 149 (69.0%) | 130 (81.8%) |

| For the past 2 years, volume of prescription dispensed has *** | ||

| Increased | 98 (48.3%) | 53 (33.5%) |

| Remained the same | 62 (30.5%) | 55 (34.8%) |

| Decreased | 43 (21.2%) | 50 (31.6%) |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khan, S.; Spooner, J.J.; Spotts, H.E. Regional Variation in Pharmacist Perception of the Financial Impact of Medicare Part D. Pharmacy 2018, 6, 67. https://doi.org/10.3390/pharmacy6030067

Khan S, Spooner JJ, Spotts HE. Regional Variation in Pharmacist Perception of the Financial Impact of Medicare Part D. Pharmacy. 2018; 6(3):67. https://doi.org/10.3390/pharmacy6030067

Chicago/Turabian StyleKhan, Shamima, Joshua J. Spooner, and Harlan E. Spotts. 2018. "Regional Variation in Pharmacist Perception of the Financial Impact of Medicare Part D" Pharmacy 6, no. 3: 67. https://doi.org/10.3390/pharmacy6030067

APA StyleKhan, S., Spooner, J. J., & Spotts, H. E. (2018). Regional Variation in Pharmacist Perception of the Financial Impact of Medicare Part D. Pharmacy, 6(3), 67. https://doi.org/10.3390/pharmacy6030067