Water Asset Transition through Treating Water as a New Asset Class for Paradigm Shift for Climate–Water Resilience

Abstract

:1. Introduction

1.1. Proposed Solution

- IF the GCF creates an enabling investment environment to identify, design, and implement public and privately funded transformational water security interventions as a new asset class;

- THEN GCF’s recipient countries can simultaneously mitigate and adapt to climate change through two low carbon climate-resilient development pathways in (i) water conservation; and (ii) preservation of water;

- BECAUSE an increasing share of investment in water security will be catalysed to deliver systemic change and maximise impact across the drivers of change in water security (Catalysing climate innovation and Mobilising finance at scale).

1.2. Definition

1.3. Financial Barriers and Solutions

- Under-valuing of water: Water is a public good and generally is under-valued and is not properly accounted for by the government and the investors that depend on or affect its availability in other sectors such as urban development, agriculture, and energy;

- Water services under-priced: Water services are often under-priced, resulting in low cost recovery for water investments;

- Capital-intensive: Water resources, irrigation, water supply, and wastewater infrastructures are generally capital-intensive, with high sunk costs and long pay-back periods;

- Difficulty of monetising benefits and co-benefits: Water management provides both public and private co-benefits, many of which cannot be easily monetised. This reduces potential revenue flows and the availability of creditworthiness;

- Context-specific projects: Water projects are often too small or too context-specific, raising transaction costs and making innovative financing models difficult to scale up;

- Poor business models: Business models often fail to support O&M efficiency, hampering the ability to sustain service at least cost over time in addition to integrity and transparency context.

- De-risking water security investments;

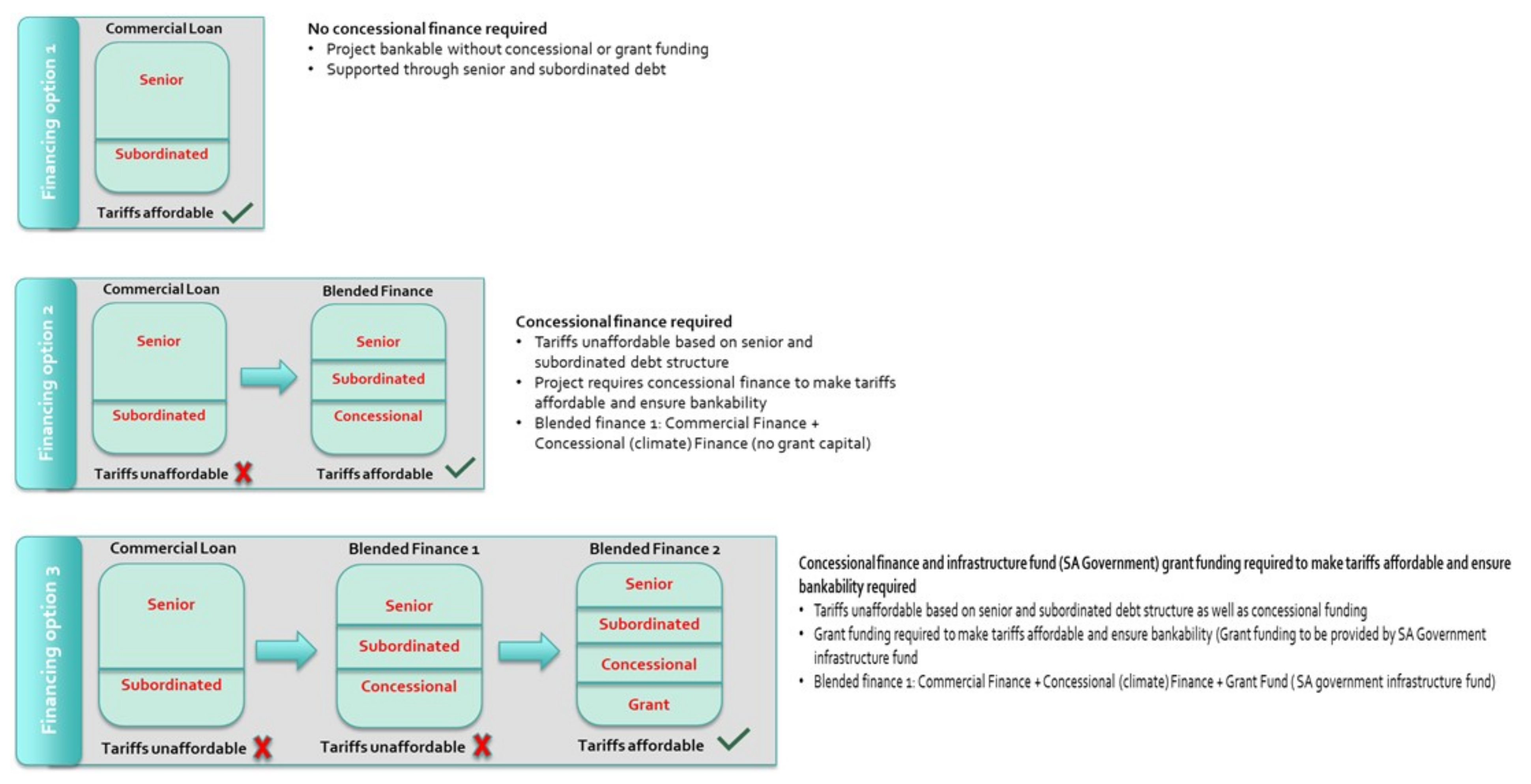

- Scaling up blended finance into water security interventions;

- Increasing collaboration with financial partners.

- Reclassify and redistribute the responsibilities among the players across infrastructure design, procurement, construction (capital expenditure) and the long-term operations and maintenance (O&M) of the asset;

- Access to water is a human right; however, affordable tariffs remain a challenge in revenue models, for which investors seek full-cost recoverable tariffs from water reuse and sanitation projects;

- Constraints on commercial loan grace and maturation periods, which require such loans to be carefully structured to better suit investments in long-term infrastructure assets such as water reuse and sanitation projects;

- Public finance restrictions, particularly those which limit the extent to which municipalities can commit to long-term financing.

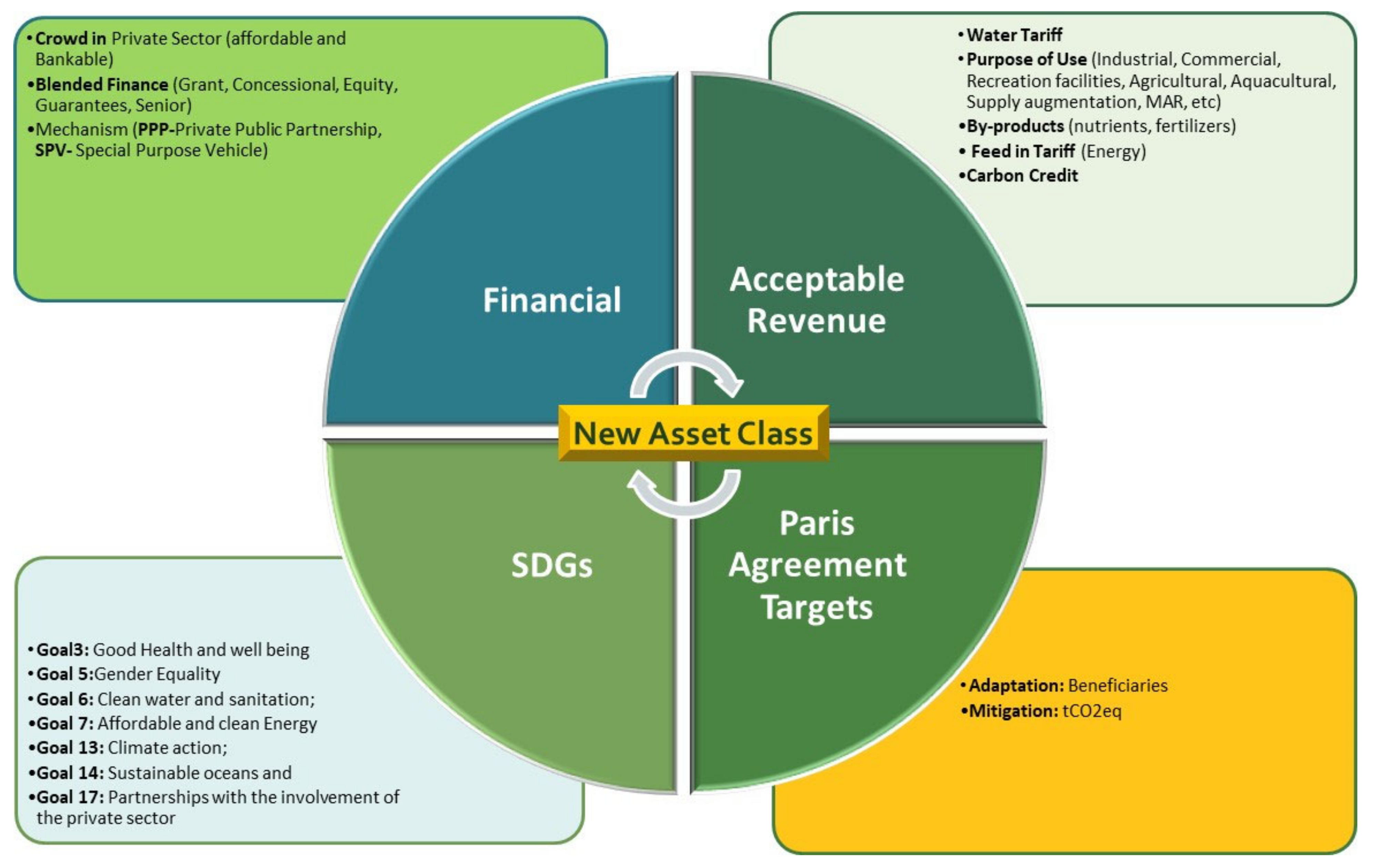

- Supporting countries to develop and adopt policies and legislation to create an enabling investment environment to identify, design, and implement public and privately funded transformational water security interventions as a new asset class;

- Finance the transition and de-risk private investment to address financial market barriers and ensure affordability and bankability to unlock water reuse investment;

- Supporting new financial models accompanied with acceptable revenue in line with Paris agreement targets and SDGs.

2. New Asset Class-Main Characteristics

- Financial;

- SDGs;

- Paris Agreement targets;

- Acceptable revenue in line with SDGs, ESG impacts and Paris Agreement.

- Cultural change: achieving water security involves creating a culture and environment that allows changes to take hold and work in practice;

- Collaboration: collaboration is essential for inspiring new ideas and applications, allowing for insights to develop, and spurring innovation. In addition to collaborating with external stakeholders, water sector actors can collaborate within their organisations, with other organisations, and with partners outside of the water sector at the scale (the water sector is the connector between many sectors, i.e., food, energy, ecosystems, etc.) [9];

- Technology: technology, when paired with the right culture, processes, and people, is a powerful enabler of innovation;

- Innovative regulatory frameworks: regulatory frameworks can be adequately designed to challenge various actors in the water sector to improve innovation for the benefit of customers, the environment, and broader society including inclusive governance arrangements. Regulatory frameworks can encourage innovation by developing market-based instruments to recover the full cost of providing water and related services and encourage research and development in innovative projects.

- Apply scientific evidence to support decision-making and develop a response to future needs;

- Investment programmes need to build the long-term capacity of local actors, rather than short-term delivery efficiency;

- Change how success is measured and make it culturally and locally specific and tailored;

- Embrace the central role of an IWRM approach to addressing water security challenges yet recognise that water is not the only actor (centre for SDGs);

- Innovative technical and social approaches need to bundle to create impact at a system scale;

- Technological adaptation and suite of innovations (technical, financial, business, institutional and social) to climate-related water security challenges in treating wastewater and re-using need to account for local context and access to markets and finance.

3. Conclusions and Key Messages

- Increase focus on adaptation that in turn supports a new asset class in sanitation and water reuse;

- Develop and apply a new financial model through credit enhancement that is accompanied by acceptable revenue streams that are in line with ESG impacts, Paris agreement targets and SDGs. This is essential for the recognition of wastewater and sanitation facilities as an asset class for private investment in developing countries;

- Building capacities of project owners in structuring bankable and affordable projects to encourage investors’ economic interest in water and sanitation projects and take it to the market;

- Provision of innovative financing solutions including the use of credit enhancement and blended finance mechanisms that lowers the cost of borrowing and improve investment grade levels;

- Creating partnerships and strengthening investor relationships among governments, financial institutions, and wider stakeholders to improve investors’ understanding and confidence;

- GCF’s role in financing the transition can make it happen through supporting countries to develop and adopt policies and legislation to create an enabling investment environment; financing the transition and de-risk private investment in addressing financial market barriers and ensuring affordability and bankability and supporting new financial models accompanied by acceptable revenue in line with Paris agreement targets and SDGs.

Author Contributions

Funding

Conflicts of Interest

References

- OECD. Financing a Water Secure Future. 2022. Available online: https://www.oecd-ilibrary.org/environment/financing-a-water-secure-future_a2ecb261-en (accessed on 12 July 2022).

- WEF. The World Is Facing 1 $15 Trillion Infrastructure Gap by 2040. Here’s How to Bridge It. 2019. Available online: https://www.weforum.org/agenda/2019/04/infrastructure-gap-heres-how-to-solve-it/ (accessed on 12 July 2022).

- WB. Ensure Access to Safe Water and Sanitation for All. 2021. Available online: https://twitter.com/WorldBankWater/status/1482212204296429569 (accessed on 12 July 2022).

- GCF. Water Security Sectoral Guide. Sectoral Guide Series; Green Climate Fund: Incheon, Republic of Korea, 2022. [Google Scholar]

- Kauffmann, C. Financing Water Quality Management. Int. J. Water Resour. Dev. 2011, 27, 83–99. [Google Scholar] [CrossRef]

- OECD. Global Material Resources Outlook to 2060. Economic Drivers and Environmental Consequences: Highlights. 2018. Available online: https://www.oecd.org/environment/waste/highlights-global-material-resources-outlook-to-2060.pdf. (accessed on 12 April 2022).

- Stanford Water in the West. Water Finance: The Imperative for Water Security and Economic Growth. 2018. Available online: https://waterinthewest.stanford.edu/sites/default/files/Water_Finance_Water_Security_Economic_Growth.pdf (accessed on 12 July 2022).

- Brears, R.C. Blue and Green Cities: The Role of Blue-Green Infrastructure in Managing Urban Water Resources; Palgrave Macmillan: London, UK, 2018. [Google Scholar]

- Aboelnaga, H.; Elmahdi, A. The World Is Off Track to Achieve SDG 6, Only 10 Years to Harvest! What Can MENA Region Do. 2019. Available online: https://smartwatermagazine.com/news/smart-water-magazine/world-track-achieve-sdg-6-only-10-years-harvest-what-can-mena-region-do (accessed on 11 May 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Elmahdi, A.; Wang, L. Water Asset Transition through Treating Water as a New Asset Class for Paradigm Shift for Climate–Water Resilience. Climate 2022, 10, 191. https://doi.org/10.3390/cli10120191

Elmahdi A, Wang L. Water Asset Transition through Treating Water as a New Asset Class for Paradigm Shift for Climate–Water Resilience. Climate. 2022; 10(12):191. https://doi.org/10.3390/cli10120191

Chicago/Turabian StyleElmahdi, Amgad, and Lixiang Wang. 2022. "Water Asset Transition through Treating Water as a New Asset Class for Paradigm Shift for Climate–Water Resilience" Climate 10, no. 12: 191. https://doi.org/10.3390/cli10120191

APA StyleElmahdi, A., & Wang, L. (2022). Water Asset Transition through Treating Water as a New Asset Class for Paradigm Shift for Climate–Water Resilience. Climate, 10(12), 191. https://doi.org/10.3390/cli10120191