The Importance of Exploration and Exploitation Innovation in Emerging Economies

Abstract

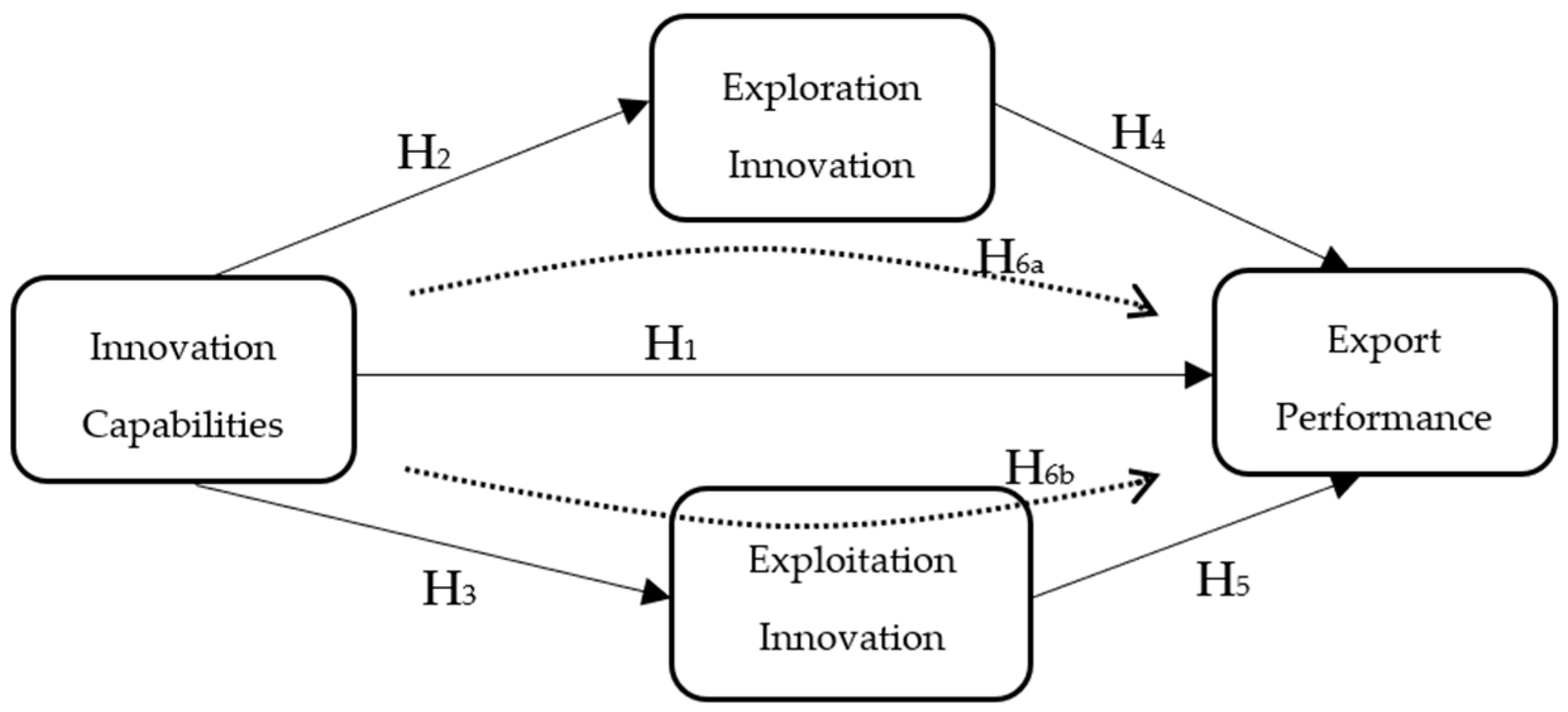

:1. Introduction

2. Literature Review

2.1. Innovation Capabilities

2.2. Exploration and Exploitation Innovations

3. Research Method

4. Results

- No mediation if 0 < VAF < 0.20;

- Partial mediation of 0.20 < VAF < 0.80;

- Full mediation if VAF > 0.80.

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Saunila, M. Performance measurement approach for innovation capability in SMEs. Int. J. Prod. Perform. Manag. 2016, 65, 162–176. [Google Scholar] [CrossRef]

- Zimmermann, R.; Ferreira, L.; Moreira, A.C. How supply chain strategies moderate the relationship between innovation capabilities and business performance. J. Purch. Supply Manag. 2020, 26, 100658. [Google Scholar] [CrossRef]

- Gatignon, H.; Tushman, M.L.; Smith, W.; Anderson, P. A structural approach to assessing innovation: Construct development of innovation locus, type, and characteristics. Manag. Sci. 2002, 48, 1103–1122. [Google Scholar] [CrossRef] [Green Version]

- Guan, J.; Ma, N. Innovative capability and export performance of Chinese firms. Technovation 2003, 23, 737–747. [Google Scholar] [CrossRef]

- Lawson, B.; Samson, D. Developing innovation capability in organisations: A dynamic capabilities approach. Int. J. Innov. Manag. 2001, 5, 377–400. [Google Scholar] [CrossRef]

- Ribau, C.P.; Moreira, A.C.; Raposo, M. SMEs innovation capabilities and export performance: An entrepreneurial orientation view. J. Bus. Econ. Manag. 2017, 18, 920–934. [Google Scholar] [CrossRef] [Green Version]

- Oura, M.M.; Zilber, S.N.; Lopes, E.L. Innovation capacity, international experience and export performance of SMEs in Brazil. Int. Bus. Rev. 2016, 25, 921–932. [Google Scholar] [CrossRef]

- Vicente, M.; Abrantes, J.L.; Teixeira, M.S. Measuring innovation capability in export firms: The INNOVSCALE. Int. Market. Rev. 2015, 32, 29–51. [Google Scholar] [CrossRef]

- Abernathy, W.; Clark, K. Innovation: Mapping the winds of creative destruction. Res. Policy 1985, 14, 3–22. [Google Scholar] [CrossRef]

- Reid, S.E.; De Brentani, U. The fuzzy front end of new product development for discontinuous innovations: A theoretical model. J. Prod. Innov. Manag. 2004, 21, 170–184. [Google Scholar] [CrossRef]

- Gil-Marques, M.; Moreno-Luzon, M. Driving human resources towards quality and innovation in a highly competitive environment. Int. J. Manpow. 2013, 34, 839–860. [Google Scholar] [CrossRef]

- Lennerts, S.; Schulze, A.; Tomczak, T. The asymmetric effects of exploitation and exploration on radical and incremental innovation performance: An uneven affair. Eur. Manag. J. 2020, 38, 121–134. [Google Scholar] [CrossRef]

- He, Z.; Wong, P. Exploration and exploitation: An empirical test of the ambidexterity hypothesis. Organ. Sci. 2004, 15, 481–494. [Google Scholar] [CrossRef]

- Arnold, T.; Fang, E.; Palmatier, R. The effects of customer acquisition and retention orientations on a firm’s radical and incremental innovation performance. J. Acad. Market. Sci. 2011, 39, 234–251. [Google Scholar] [CrossRef]

- Atuahene, K. Resolving the capability-rigidity. Paradox in the new product innovation. J. Market. 2005, 69, 61–83. [Google Scholar] [CrossRef]

- Camisón, C.; Boronat-Navarro, M.; Forés, B. The interplay between firms’ internal and external capabilities in exploration and exploitation. Manag. Decis. 2018, 56, 1559–1580. [Google Scholar] [CrossRef]

- Yalcinkaya, G.; Calantone, R.J.; Griffith, D.A. An examination of exploration and exploitation capabilities: Implications for product innovation and market performance. J. Int. Market. 2007, 15, 63–93. [Google Scholar] [CrossRef]

- Robbins, P.; O’Gorman, C.; Huff, A.; Moeslein, K. Multidexterity—A new metaphor for open innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 99. [Google Scholar] [CrossRef]

- Hoskisson, R.; Eden, L.; Lau, C.; Wright, M. Strategy in emerging economies. Acad. Manag. J. 2005, 43, 249–267. [Google Scholar]

- Wright, M.; Filatotchev, I.; Hoskisson, R.; Peng, M. Strategy research in emerging economies: Challenging the conventional wisdom. J. Manag. Stud. 2015, 42, 1–33. [Google Scholar] [CrossRef]

- Hermelo, F.; Vassolo, R. Institutional development and hypercompetition in emerging economies. Strateg. Manag. J. 2010, 31, 1457–1473. [Google Scholar] [CrossRef]

- Saccone, D. Economic growth in emerging economies: What, who and why. Appl. Econ. Lett. 2017, 24, 800–803. [Google Scholar] [CrossRef]

- Cavusgil, T.; Ghauri, P.; Liu, L.A. Doing Business in Emerging Markets; Sage: London, UK, 2021. [Google Scholar]

- Vujanović, N.; Radošević, S.; Stojčić, N.; Hisarciklilar, M.; Hashi, I. FDI spillover effects on innovation activities of knowledge using and knowledge creating firms: Evidence from an emerging economy. Technovation 2022, 118, 102512. [Google Scholar] [CrossRef]

- Koryak, O.; Lockett, A.; Hayton, J.; Nicolaou, N.; Mole, K. Disentangling the antecedents of ambidexterity: Exploration and exploitation. Res. Policy 2018, 47, 413–427. [Google Scholar] [CrossRef]

- Ribau, C.P.; Moreira, A.C.; Raposo, M. The role of exploitative and exploratory innovation in export performance: An analysis of plastics industry SMEs. Eur. J. Int. Manag. 2019, 13, 224–246. [Google Scholar] [CrossRef]

- Instituto para a Promoção das Pequenas e Médias Empresas. Perfil das Pequenas e Médias Empresas em Moçambique; Instituto para a Promoção das Pequenas e Médias Empresas: Maputo, Mozambique, 2016. [Google Scholar]

- Ministério de Indústria e Comércio. Pequenas e Médias Empresas em Moçambique. Situação e Desafios; Ministério de Indústria e Comércio: Maputo, Mozambique, 2016.

- Instituto Nacional de Estatística. Empresas em Moçambique: Resultados do Segundo Censo Nacional (2014–2015); Instituto Nacional de Estatística: Maputo Mozambique, 2017.

- Kaufmann, F. Política Centrada nas Micro, Pequenas e Médias Empresas: Situação, justificação e desafios; AHK: Maputo, Mozambique, 2016. [Google Scholar]

- Knight, G.A.; Kim, D. International business competence and the contemporary firm. J. Int. Bus. Stud. 2009, 40, 255–273. [Google Scholar] [CrossRef]

- Sen, F.K.; Egelhoff, W.G. Innovative capabilities of a firm and the use of technical alliances. IEEE Trans. Eng. Manag. 2000, 47, 174–183. [Google Scholar] [CrossRef]

- Wang, C.; Ahmed, P. The development and validation of the organisational innovativeness construct using confirmatory factor analysis. Eur. J. Innov. Manag. 2014, 7, 303–313. [Google Scholar] [CrossRef] [Green Version]

- Teece, D.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Hortinha, P.; Lages, C.; Lages, L.F. The trade-off between customer and technology orientations: Impact on innovation capabilities and export performance. J. Int. Market. 2011, 19, 36–58. [Google Scholar] [CrossRef] [Green Version]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef] [Green Version]

- Djoumessi, A.; Chen, S.L.; Cahoon, S. Deconstructing Lawson and Samson’s concept of innovation capability: A critical assessment and a refinement. Int. J. Innov. Manag. 2019, 23, 1950053. [Google Scholar] [CrossRef]

- Menguc, B.; Auh, S.; Yannopoulos, P. Customer and supplier involvement in design: The moderating role of incremental and radical innovation capability. J. Prod. Innov. Manag. 2014, 31, 313–328. [Google Scholar] [CrossRef]

- Lopes, J.; Oliveira, M.; Silveira, P.; Farinha, L.; Oliveira, J. Business dynamism and innovation capacity, an entrepreneurship worldwide perspective. J. Open Innov. Technol. Mark. Complex. 2021, 7, 94. [Google Scholar] [CrossRef]

- Zimmermann, R.; Moreira, A.C.; Ferreira, L. The effect of supply chain strategy on the relationship between innovation capabilities and business performance. A theoretical model. Int. J. Bus Perform. Supply Chain Model. 2020, 11, 291–307. [Google Scholar] [CrossRef]

- Yam, R.; Guan, J.C.; Pun, K.F.; Tang, E.P.Y. An audit of technological innovation capabilities in Chinese firms: Some empirical findings in Beijing, China. Res. Policy 2004, 33, 1123–1140. [Google Scholar] [CrossRef]

- Johnsson, M. Innovation enablers for innovation teams—A review. J. Innov. Manag. 2017, 5, 75–121. [Google Scholar] [CrossRef]

- Olsson, A.; Wadell, C.; Odenrick, P.; Bergendahl, M.N. An action learning method for increased innovation capability in organisations. Action Learn. Res. Pract. 2010, 7, 167–179. [Google Scholar] [CrossRef]

- Yi, J.; Wang, C.; Kafouros, M. The effects of innovative capabilities on exporting: Do institutional forces matter? Int. Bus. Rev. 2013, 22, 392–406. [Google Scholar] [CrossRef]

- Akman, G.; Yilmaz, C. Innovative capability, innovation strategy and market orientation: An empirical analysis in Turkish software industry. Int. J. Innov. Manag. 2008, 12, 69–111. [Google Scholar] [CrossRef]

- Hogan, S.J.; Soutar, G.N.; McColl-Kennedy, J.R.; Sweeney, J.C. Reconceptualizing professional service firm innovation capability: Scale development. Ind. Mark. Manag. 2011, 40, 1264–1273. [Google Scholar] [CrossRef] [Green Version]

- Bonaccorsi, A. On the relationship between firm size and export intensity. J. Int. Bus. Stud. 1992, 23, 605–635. [Google Scholar] [CrossRef]

- Zou, S.; Stan, S. The determinants of export performance: A review of the empirical literature between 1987 and 1997. Int. Market. Rev. 1998, 15, 333–356. [Google Scholar] [CrossRef] [Green Version]

- March, J. Exploration and exploitation in organizational learning. Organ. Sci. 2001, 2, 71–87. [Google Scholar] [CrossRef]

- Lubatkin, M.H.; Simsek, Z.; Ling, Y.; Veiga, J.F. Ambidexterity and performance in small-to medium-sized firms: The pivotal role of top management team behavioral integration. J. Manag. 2006, 32, 646–672. [Google Scholar] [CrossRef] [Green Version]

- Mueller, V.; Rosenbusch, N.; Bausch, A. Success patterns of exploratory and exploitative innovation: A meta-analysis of the influence of institutional factors. J. Manag. 2013, 39, 1606–1636. [Google Scholar] [CrossRef]

- Zhou, K.Z.; Wu, F. Technological capability, strategic flexibility, and production innovation. Strateg. Manag. J. 2010, 31, 547–561. [Google Scholar]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Junni, P.; Sarala, R.; Taras, V.; Tarba, S. Organizational ambidexterity and performance: A meta-analysis. Acad. Manag. Perspect. 2013, 27, 299–312. [Google Scholar] [CrossRef]

- Danneels, E. The dynamics of product innovation and firm competences. Strateg Manag. J. 2002, 23, 1095–1121. [Google Scholar] [CrossRef]

- Lisboa, A.; Skarmeas, D.; Lages, C. Export market exploitation and exploration and performance: Linear, moderated, complementary and non-linear effects. Int. Market. Rev. 2013, 30, 211–230. [Google Scholar] [CrossRef]

- Jensen, J.J.; Van den Bosch, F.A.; Volberda, H.W. Exploratory innovation, exploitative innovation, and ambidexterity: The impact of environmental and organizational antecedents. Schmalenach Bus. Rev. 2005, 57, 351–363. [Google Scholar] [CrossRef] [Green Version]

- Jantunen, A.; Puumalainen, K.; Saarenketo, S.; Kylaheiko, K. Entrepreneurial orientation, innovation capabilities and export performance. J. Int. Entrep. 2005, 3, 223–243. [Google Scholar] [CrossRef]

- Kuivalainen, O.; Sundqvist, S.; Servais, P. Firms’ degree of born-globalness, international entrepreneurial orientation and export performance. J. World Bus. 2007, 42, 253–267. [Google Scholar] [CrossRef]

- Aulakh, P.S.; Kotabe, M.; Teegen, H. Export strategies and performance of firms from emerging economies: Evidence from Brazil, Chile, and Mexico. Acad. Manag. J. 2002, 43, 342–361. [Google Scholar]

- Baloglu, S.; Mangaloglu, M. Tourism destination images of Turkey, Egypt, Greece, and Italy as perceived by US-based tour operators and travel agents. Tourism. Manag. 2001, 22, 1–9. [Google Scholar] [CrossRef]

- Silva, M.; Costa, R.; Moreira, A.C. The influence of travel agents and tour operators’ perspectives on a tourism destination. The case of Portuguese intermediaries on Brazil’s image. J. Hosp. Tour. Manag. 2018, 34, 93–104. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis: A Global Perspective; Pearson Prentice Hall Publishing: Upper Saddle River, NJ, USA, 2010. [Google Scholar]

- Hair, J.; Hult, G.T.M.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage: London, UK, 2016. [Google Scholar]

- Kline, R.B. Principles and Practice of Structural Equation Modeling; Guilford Press: New York, NY, USA, 2005. [Google Scholar]

- Reinartz, W.; Haenlein, M.; Henseler, J. An empirical comparison of the efficacy of covariance-based and variance-based SEM. Int. J. Res. Mark. 2009, 26, 332–344. [Google Scholar] [CrossRef] [Green Version]

- Henseler, J.; Chin, W.W. A comparison of approaches for the analysis of interaction effects between latent variables using partial least squares path modeling. Struct. Equ. Model. 2010, 17, 82–109. [Google Scholar] [CrossRef]

- Sarstedt, M.; Ringle, C.M.; Smith, D.; Reams, R.; Hair, J.F. Partial least squares structural equation modeling (PLS-SEM): A Useful tool for family business researchers. J. Fam. Bus. Strateg. 2014, 5, 105–115. [Google Scholar] [CrossRef]

- Nunnally, J. Psychometric Theory; McGraw-Hill: New York, NY, USA, 1978. [Google Scholar]

- Götz, O.; Liehr-Gobbers, K.; Krafft, M. Evaluation of structural equation models using the partial least squares (PLS) approach. In Handbook of Partial Least Squares: Concepts, Methods and Applications; Esposito Vinzi, V., Chin, W., Henseler, J., Wang, H., Eds.; Springer: Berlin/Heidelberg, Germany, 2010. [Google Scholar]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a silver bullet. J. Market. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Zhao, X.; Lynch, J.G.; Chen, Q. Reconsidering Baron and Kenny: Myths and truths about mediation analysis. J. Consum. Res. 2010, 37, 197–206. [Google Scholar] [CrossRef]

| Loadings | p-Values | p-Values | Loadings | p-Values | |

|---|---|---|---|---|---|

| LC1 ← Learning | 0.796 | 0.000 | OC1 ← Organizational | 0.872 | 0.000 |

| LC2 ← Learning | 0.774 | 0.000 | OC2 ← Organizational | 0.859 | 0.000 |

| LC3 ← Learning | 0.839 | 0.000 | OC4 ← Organizational | 0.818 | 0.000 |

| LC5 ← Learning | 0.846 | 0.000 | OC5 ← Organizational | 0.843 | 0.000 |

| MC1 ← Manufacturing | 0.823 | 0.000 | RDC1 ← R&D | 0.765 | 0.000 |

| MC2 ← Manufacturing | 0.865 | 0.000 | RDC2 ← R&D | 0.859 | 0.000 |

| MC3 ← Manufacturing | 0.917 | 0.000 | RDC4 ← R&D | 0.794 | 0.000 |

| MC4 ← Manufacturing | 0.873 | 0.000 | RDC5 ← R&D | 0.879 | 0.000 |

| MC5 ← Manufacturing | 0.840 | 0.000 | REC1 ← Res Explo | 0.923 | 0.000 |

| MKT2 ← Marketing | 0.865 | 0.000 | REC2 ← Res Explo | 0.858 | 0.000 |

| MKT3 ← Marketing | 0.853 | 0.000 | REC4 ← Res Explo | 0.794 | 0.000 |

| MKT4 ← Marketing | 0.897 | 0.000 | SC1 ← Strategy | 0.865 | 0.000 |

| MKT6 ← Marketing | 0.817 | 0.000 | SC2 ← Strategy | 0.951 | 0.000 |

| SC3 ← Strategy | 0.873 | 0.000 |

| Loadings | p-Values | Loadings | p-Values | ||

|---|---|---|---|---|---|

| EI1 ← Exploration | 0.814 | 0.000 | EoiI1 ← Exploitation | 0.825 | 0.000 |

| EI2 ← Exploration | 0.793 | 0.000 | EoiI2 ← Exploitation | 0.805 | 0.000 |

| EI3 ← Exploration | 0.640 | 0.000 | EoiI3 ← Exploitation | 0.880 | 0.000 |

| EI4 ← Exploration | 0.695 | 0.000 | EoiI4 ← Exploitation | 0.871 | 0.000 |

| EI5 ← Exploration | 0.806 | 0.000 | |||

| EP1 ← Export Perf | 0.887 | 0.000 | EP5 ← Export Perf | 0.867 | 0.000 |

| EP2 ← Export Perf | 0.860 | 0.000 | EP6 ← Export Perf | 0.915 | 0.000 |

| EP4 ← Export Perf | 0.863 | 0.000 | EP7 ← Export Perf | 0.845 | 0.000 |

| Path Coefficient | p-Values | |

|---|---|---|

| Learning ← Innov Cap | 0.902 | 0.000 |

| Manufacturing ← Innov Cap | 0.914 | 0.000 |

| Marketing ← Innov Cap | 0.842 | 0.000 |

| Organizational ← Innov Cap | 0.883 | 0.000 |

| R&D ← Innov Cap | 0.811 | 0.000 |

| Res Explo ← Innov Cap | 0.817 | 0.000 |

| Strategy ← Innov Cap | 0.560 | 0.000 |

| Variables | 1. | 2. | 3. | 4. | 5. | 6. | 7. | 8. | 9. | 10. |

|---|---|---|---|---|---|---|---|---|---|---|

| 1. Exploitation innovation | 0.846 | |||||||||

| 2. Exploration innovation | 0.702 | 0.753 | ||||||||

| 3. Export performance | 0.633 | 0.587 | 0.873 | |||||||

| 4. Learning capability | 0.558 | 0.491 | 0.497 | 0.814 | ||||||

| 5. Manufacturing capability | 0.475 | 0.511 | 0.351 | 0.796 | 0.864 | |||||

| 6. Marketing capability | 0.447 | 0.547 | 0.389 | 0.634 | 0.793 | 0.859 | ||||

| 7. Organizational capability | 0.523 | 0.603 | 0.549 | 0.732 | 0.808 | 0.823 | 0.848 | |||

| 8. R&D capability | 0.293 | 0.262 | 0.328 | 0.775 | 0.628 | 0.546 | 0.558 | 0.825 | ||

| 9. Resources exploitation capability | 0.506 | 0.455 | 0.414 | 0.751 | 0.676 | 0.585 | 0.618 | 0.736 | 0.860 | |

| 10. Strategic capability | 0.097 | 0.293 | 0.233 | 0.505 | 0.366 | 0.307 | 0.405 | 0.611 | 0.416 | 0.897 |

| Cronbach alpha | 0.867 | 0.808 | 0.938 | 0.832 | 0.915 | 0.881 | 0.870 | 0.847 | 0.822 | 0.879 |

| Rho_A | 0.871 | 0.821 | 0.941 | 0.844 | 0.919 | 0.889 | 0.875 | 0.863 | 0.828 | 0.917 |

| Composite Reliability | 0.910 | 0.866 | 0.951 | 0.887 | 0.937 | 0.918 | 0.911 | 0.895 | 0.895 | 0.925 |

| Average Variance Extracted (AVE) | 0.716 | 0.567 | 0.762 | 0.663 | 0.747 | 0.737 | 0.720 | 0.681 | 0.740 | 0.805 |

| Path | Original Sample | Standard Deviation | T Values | p-Values | Hypothesis Validation |

|---|---|---|---|---|---|

| Direct Effect | |||||

| Innovation capabilities → Export performance (H1) | 0.150 | 0.066 | 2.286 | 0.022 | Accepted |

| Innovation capability → Exploration innovation (H2) | 0.564 | 0.041 | 13.842 | 0.000 | Accepted |

| Innovation capability → Exploitation innovation (H3) | 0.526 | 0.046 | 11.372 | 0.000 | Accepted |

| Exploration innovation → Export performance (H4) | 0.224 | 0.105 | 2.217 | 0.033 | Accepted |

| Exploitation innovation → Export performance (H5) | 0.397 | 0.097 | 4.078 | 0.000 | Accepted |

| Specific Indirect Effect | |||||

| ICs → Exploitation innovation → Export performance (H6b) | 0.209 | 0.054 | 3.886 | 0.000 | Accepted |

| ICs → Exploration innovation → Export performance (H6a) | 0.126 | 0.057 | 2.199 | 0.028 | Accepted |

| Total Indirect Effect | |||||

| Innovation capabilities → Export performance | 0.335 | 0.040 | 8.374 | 0.000 | |

| Total Effect | |||||

| Innovation capabilities → Export performance | 0.500 | 0.037 | 6.823 | 0.000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Moreira, A.C.; Navaia, E.C.; Ribau, C. The Importance of Exploration and Exploitation Innovation in Emerging Economies. J. Open Innov. Technol. Mark. Complex. 2022, 8, 140. https://doi.org/10.3390/joitmc8030140

Moreira AC, Navaia EC, Ribau C. The Importance of Exploration and Exploitation Innovation in Emerging Economies. Journal of Open Innovation: Technology, Market, and Complexity. 2022; 8(3):140. https://doi.org/10.3390/joitmc8030140

Chicago/Turabian StyleMoreira, António Carrizo, Eurico Colarinho Navaia, and Cláudia Ribau. 2022. "The Importance of Exploration and Exploitation Innovation in Emerging Economies" Journal of Open Innovation: Technology, Market, and Complexity 8, no. 3: 140. https://doi.org/10.3390/joitmc8030140

APA StyleMoreira, A. C., Navaia, E. C., & Ribau, C. (2022). The Importance of Exploration and Exploitation Innovation in Emerging Economies. Journal of Open Innovation: Technology, Market, and Complexity, 8(3), 140. https://doi.org/10.3390/joitmc8030140