Corporate Venture Capital and Sustainability

Abstract

:1. Introduction

1.1. Open Innovation

1.2. The National Innovation System and Knowledge Transfer

1.3. Systemic Innovation and Business Ecosystems

2. Specific Context

2.1. On the Subject of Corporate Venture Capital

2.2. The Objectives of CVC

2.3. Corporate Venture Capitalists, Independent Venture Capitalists and Syndication

2.4. History, Evolution and Examples of CVC

3. Research Gap

3.1. Corporate Ambidexterity

3.2. Types of Companies and Adherence to CVC

3.3. Sustainability

4. Research Objectives

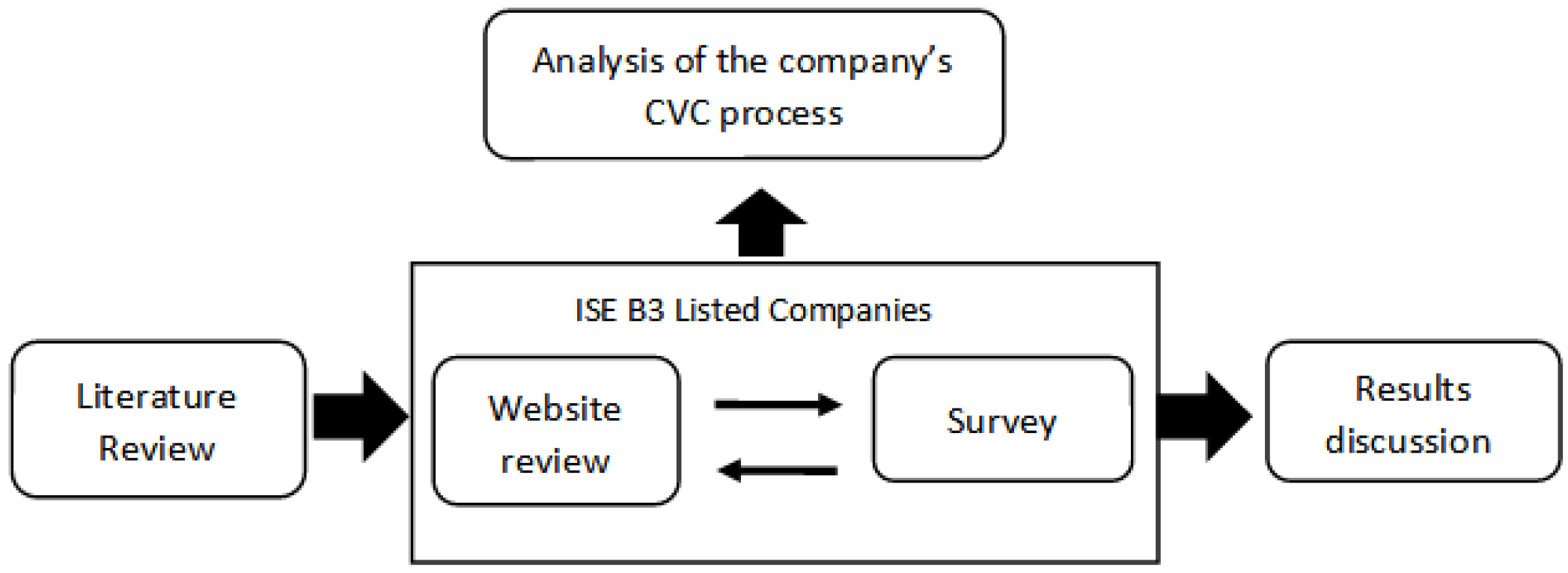

5. Research Structure

6. Material and Methods

6.1. Sample Definition

6.2. First Stage: Literature Review

- Database definition, so that scientific papers from main journals were considered, all of them rated by the Scopus, Science Direct and Web of Science databases.

- Keyword search: The terms “Corporate venture capital” and “Sustainability” were screened in title, abstract and keywords, encompassing the periods ranging from 2005 to 2021.

- Content analysis by identifying key concepts such as corporate venture capital and sustainability.

6.3. Second Stage: Company Website Review

6.4. Third Stage: Survey

6.5. Variable Definition

- The importance of financial goals and strategic goals: search and collection of information regarding financial and organisational goals according to their purpose.

- Investment value criterion: related to the investment decisions according to the company’s priorities.

- Decision-making autonomy: used as an indicator of independence of the CVC unit, according to (a) funding source, (b) investment goal, (c) staffing and (d) decision-making process.

- Financial commitment: determines the long-term commitment to the conduction of the investment. This is important, as it measures financial results and involves two main categories: (a) a clearly defined fund or free to access that contemplates a long-term time frame or (b) no clear definition of the fund, or even, no financial manners contemplating a long-term time frame.

- Success stories: used as a measure of performance, or success rate, to determine whether the companies have had any successful cases in their programme.

- Financial success: refers to the amount contributed to the programme.

7. Results Discussion

- –

- Generally, companies are more accustomed to M&A practices and private equity than CVC practices. Investing in early-stage companies is still unthinkable for many corporations.

- –

- Although a CVC aims at either financial or strategic goals, the second option appears with more significance. This is proven by the companies’ investment theses that are more prone to focus on the core activities of a business.

- –

- Only a few companies have demonstrated varied strategies in a single CVC programme which holds more than one investment fund. Most companies are focused on a single investment vehicle that best represents the main thesis of the company.

- –

- In a few cases, it is hard to determine whether the company actually owns a CVC programme, or if it is just an alternate corporate venturing practice that does not necessarily predict investing in startups.

- –

- At least 70% of ISE B3-listed companies own, to a certain level, a CVC programme.

- –

- Despite the extensive number of ISE B3-listed companies that started adopting CVC programmes in Brazil, their intensity is still low when compared with the average values of large companies not listed in the same index.

- –

- The number of companies that have chosen to externalise their research and development activities through CVC is growing.

8. Concluding Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

Appendix A

| Journal | Documents | Document Title | Topics | Cites (Scopus, July 2022) | Year |

|---|---|---|---|---|---|

| Journal of Business Venturing | 2 | Developing the selection and valuation capabilities through learning: The case of corporate venture capital | Analysis of 2110 cases of VenureXpert’s CVC investments measuring the impact of the intensity of experience of the development of activities. | 160 | 2009 |

| Towards understanding who makes corporate venture capital investments and why | Analysis of 477 established companies deciding to participate in CVC in technology and marketing issues. | 253 | 2011 | ||

| Strategic Entrepreneurship Journal | 2 | An empirical test of the relational view in the context of corporate venture capital | Analysis of a CVC investment relationship model based on knowledge sharing and through a process of income generation. | 44 | 2011 |

| The selection and nurturing effects of corporate investors on new venture innovativeness | Studied the influences of investors on new venture funding that affect the selection of opportunities. | 81 | 2016 | ||

| Technological Forecasting and Social Change | 2 | Exploring the impact of open innovation on national systems of innovation—A theoretical analysis | Studied the impact of open innovation based on national analytical approaches to improve its effectiveness. | 174 | 2011 |

| Fuzzy front end of systemic innovations: A conceptual framework based on a systematic literature review | Reviewed the fuzzy front-end stage of systemic innovation, ranging from mapping and strategic planning. | 76 | 2012 | ||

| Business Process Management Journal | 1 | To invest or to harvest? Corporate venture capital ambidexterity for exploiting/exploring innovation in technological business | Carried out on 18 CVC companies to determine ambidexterity; all companies dedicated to the technological area. | 17 | 2020 |

| Electricity Journal | 1 | Corporate venture capital programs of European electric utilities: Motives, trends, strategies and challenges$ | Conducted on 4 large European public companies seeking CVC programme methodologies. | 17 | 2017 |

| Entrepreneurship: Theory and Practice | 1 | Organizational Aspirations and External Venturing: The Contingency of Entrepreneurial Orientation | Developed the influence of capital-based entrepreneurial orientation. | 35 | 2020 |

| Industry and Innovation | 1 | Technological Diversification Through Corporate Venture Capital Investments: Creating Various Options to Strengthen Dynamic Capabilities | Research on the relationship between CSV and technological diversification of 5 high-tech industries. | 75 | 2015 |

| International Journal of Innovation Management | 1 | Reconciling competing institutional logics in corporate venture capital units | Studied 20 CVC units and developed an analysis of organisational structure. | 4 | 2020 |

| International Studies of Management and Organization | 1 | Social capital and knowledge relatedness as promoters of organizational performance: An explorative study of corporate venture capital activity | Study of the theory of social capital with the vision of the knowledge-based company. | 33 | 2010 |

| Jmm International Journal on Media Management | 1 | Strategic Media Venturing: Corporate Venture Capital Approaches of TIME Incumbents | A study of 68 companies dedicated to the area of telecommunications, electronics and information technology was carried out to review the differences and similarities of venture capital | 33 | 2017 |

| Journal of Business Research | 1 | When corporations get disruptive, the disruptive get corporate: Financing disruptive technologies through corporate venture capital | Developed the role of the CVC in the support of digital technologies to analyse financial strategies for new ventures. | 21 | 2020 |

| Journal of Cleaner Production | 1 | Why do they do it? Corporate venture capital investments in cleantech startups | Covered the study of 26 case studies of companies that invested in cleantech start-up companies | 17 | 2021 |

| Journal of Knowledge Management | 1 | Knowledge management behaviors in venture capital crossroads: a comparison between IVC and CVC ambidexterity | Researched the ambidextrous development of CVC on the 15 most active IVCs in the 2019 management, focusing on their organisation and financial objectives. | 24 | 2020 |

| Journal of Management | 1 | Ambidexterity and Survival in Corporate Venture Units | Conducted a study on why some units succeed or fail in 95 ambidextrous development VC units. | 413 | 2014 |

| Management Research Review | 1 | Bilateral inter-organizational learning in corporate venture capital activity: Governance characteristics, knowledge transfer, and performance | Analysed 232 VC investments to investigate the impact of governance characteristics and bilateral learning between organisations. | 46 | 2012 |

| Managerial and Decision Economics | 1 | Two’s company, three’s a crowd: The impact of corporate venture capital unit’s investment partners on the corporate investor’s innovation performance | Studied the relationship between the CVC venture capital unit and traditional venture capital VCs. | 0 | 2021 |

| Venture Capital | 1 | Corporate venture capital organizations in Germany | Analysed 20 German CVC organisations and compared with U.S. and European CVC firms | 50 | 2005 |

References

- Weill, P.; Woerner, S.L. Thriving in an Increasingly Digital Ecosystem. MIT Sloan Manag. Rev. 2015, 56, 27. [Google Scholar]

- Huarng, K.H.; Yu, T.H.K.; Lai, W. Innovation and diffusion of high-tech products, services, and systems. J. Bus. Res. 2015, 68, 2223–2226. [Google Scholar] [CrossRef]

- O’Reilly, C.A., III; Tushman, M.L. Ambidexterity as a dynamic capability: Resolving the innovator’s dilemma. Res. Organ. Behav. 2008, 28, 185–206. [Google Scholar] [CrossRef]

- Ireland, R.D.; Covin, J.G.; Kuratko, D.F. Conceptualizing Corporate Entrepreneurship Strategy. Entrep. Theory Pr. 2009, 33, 19–46. [Google Scholar] [CrossRef]

- Corbett, A.; Covin, J.G.; O’Connor, G.C.; Tucci, C.L. Corporate Entrepreneurship: State-of-the-Art Research and a Future Research Agenda. J. Prod. Innov. Manag. 2013, 30, 812–820. [Google Scholar] [CrossRef] [Green Version]

- Freeman, C. Continental, national and sub-national innovation systems—Complementarity and economic growth. Res. Policy 2002, 31, 191–211. [Google Scholar] [CrossRef]

- Chesbrough, H.W. Inovação Aberta: O Novo Imperativo Para Criar e Lucrar Com a Tecnologia; Harvard Business Press: Boston, MA, USA, 2003. [Google Scholar]

- Chesbrough, H.; Vanhaverbeke, W.; West, J. (Eds.) Open Innovation: Researching a New Paradigm; Oxford University Press: Oxford, UK, 2006. [Google Scholar]

- Vanhaverbeke, W.; Duysters, G.; Noorderhaven, N. External technology sourcing through alliances or acquisitions: An analysis of the application-specific integrated circuits industry. Organ. Sci. 2002, 13, 714–733. [Google Scholar] [CrossRef] [Green Version]

- Grand, S.; Von Krogh, G.; Leonard, D.; Dorothy, S.; Swap, W. Resource allocation beyond firm boundaries: A multi-level model for Open Source innovation. Long Range Plan. 2004, 37, 591–610. [Google Scholar] [CrossRef]

- Von Krogh, G.; Spaeth, S.; Lakhani, K.R. Community, joining, and specialisation in open source software innovation: A case study. Res. Policy 2003, 32, 1217–1241. [Google Scholar] [CrossRef]

- Pisano, G.P. The R&D boundaries of the firm: An empirical analysis. Adm. Sci. Q. 1990, 35, 153–176. [Google Scholar]

- Lundvall, B.-Å.; Intarakumnerd, P.; Vang-Lauridsen, J. Asia’s Innovation Systems in Transition; New Horizons in the Economics of Innovation Series; Edward Elgar Publishing: Cheltenham, UK; Northampton, MA, USA, 2006. [Google Scholar]

- De Jong, J.P.J. Policies for Open Innovation: Theory, Framework and Cases; EIM Business and Policy Research: Zoetermeer, The Netherlands, 2008. [Google Scholar]

- Nelson, R. (Ed.) National Innovation Systems: A Comparative Analysis; Oxford University Press: New York, NY, USA, 1993. [Google Scholar]

- Wang, Y.; Vanhaverbeke, W.; Roijakkers, N. Exploring the impact of open innovation on national systems of innovation—A theoretical analysis. Technol. Forecast. Soc. Chang. 2012, 79, 419–428. [Google Scholar] [CrossRef]

- OECD. Open Innovation in Global Network; OECD: Paris, France, 2005. [Google Scholar]

- Li, H.-L.; Tang, M.-J. Vertical integration and innovative performance: The effects of external knowledge sourcing modes. Technovation 2010, 30, 401–410. [Google Scholar] [CrossRef]

- Lane, P.J.; Lubatkin, M. Relative absorptive capacity and interorganizational learning. Strateg. Manag. J. 1998, 19, 461–477. [Google Scholar] [CrossRef]

- Grant, R. Toward a knowledge-based theory of the firm. Strateg. Manag. J. 1996, 17, 109–122. [Google Scholar] [CrossRef]

- Shepherd, D.; Zacharakis, A. Venture capitalists’ expertise: A call for research into decision aids and cognitive feedback. J. Bus. Ventur. 2002, 17, 1–20. [Google Scholar] [CrossRef]

- Weber, C.; Bauke, B.; Raibulet, V. An Empirical Test of the Relational View in the Context of Corporate Venture Capital. Strateg. Entrep. J. 2016, 10, 274–299. [Google Scholar] [CrossRef]

- Chesbrough, H.W.; Teece, D.J. Organizing for innovation: When is virtual virtuous? Harv. Bus. Rev. 2002, 80, 335–341. [Google Scholar]

- Boons, F.; Montalvo, C.; Quist, J.; Wagner, M. Sustainable innovation, business models and economic performance: An overview. J. Clean. Prod. 2013, 45, 1–8. [Google Scholar] [CrossRef]

- Boons, F.; Lüdeke-Freund, F. Business models for sustainable innovation: State-of-the-Art and steps towards a research agenda. J. Clean. Prod. 2013, 45, 9–19. [Google Scholar] [CrossRef]

- Moore, J.F. Predators and prey: A new ecology of competition. Harv. Bus. Rev. 1993, 71, 75–86. [Google Scholar]

- Li, Y.-R. The technological roadmap of Cisco’s business ecosystem. Technovation 2009, 29, 379–386. [Google Scholar] [CrossRef]

- Takey, S.M.; Carvalho, M.M. Fuzzy front end of systemic innovations: A conceptual framework based on a systematic literature review. Technol. Forecast. Soc. Chang. 2016, 111, 97–109. [Google Scholar] [CrossRef]

- Kapoor, R.; Lee, J.M. Coordinating and competing in ecosystems: How organizational forms shape new technology investments. Strateg. Manag. J. 2013, 34, 274–296. [Google Scholar] [CrossRef] [Green Version]

- Gompers, P.; Lerner, J. The Determinants of Corporate Venture Capital Success: Organizational Structure, Incentives and Complementarities; University of Chicago Press: Chicago, IL, USA, 1998. [Google Scholar]

- Dushnitsky, G. Corporate venture capital: Past evidence and future directions. In Oxford Handbook of Entrepreneurship; Casson, M., Yeung, B., Basu, A., Wadeson, N., Eds.; Oxford University Press: New York, NY, USA, 2006; pp. 387–431. [Google Scholar]

- Keil, T. External Corporate Venturing: Strategic Renewal in Rapidly Changing Industries; Greenwood Publishing Group: Westport, CT, USA, 2002. [Google Scholar]

- Maula, M.V.J. Corporate venture capital as a strategic tool for corporations. In Handbook of Venture Capital; Landström, H., Ed.; Edward Elgar Publishing Ltd.: Northampton, MA, USA, 2007; pp. 371–392. [Google Scholar]

- Allen, S.A.; Hevert, K.T. Venture capital investing by information technology companies: Did it pay? J. Bus. Ventur. 2007, 22, 262–282. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Maula, M.V.J.; Keil, T.; Zahra, S.A. Corporate Venture Capital and Recognition of Technological Discontinuities; Academy of Management Annual Meeting: Seattle, WA, USA, 2003. [Google Scholar]

- Lee, S.U.; Kang, J. Technological Diversification Through Corporate Venture Capital Investments: Creating Various Options to Strengthen Dynamic Capabilities. Ind. Innov. 2015, 22, 349–374. [Google Scholar] [CrossRef] [Green Version]

- Van de Vrande, V.; Vanhaverbeke, W. Como os investimentos anteriores de capital de risco corporativo moldam alianças tecnológicas: Uma abordagem de opções reais. Teoria e Prática empreendedora. Entrep. Theory Pr. 2013, 37, 1019–1043. [Google Scholar] [CrossRef]

- Dushnitsky, G.; Lenox, M.J. When do firms undertake R&D by investing in new ventures? Strateg. Manag. J. 2005, 26, 947–965. [Google Scholar]

- Battistini, B.; Hacklin, F.; Baschera, P. The state of corporate venturing: Insights from a global study. Res.-Technol. Manag. 2013, 56, 31–39. [Google Scholar] [CrossRef]

- Macmillan, I.C.; Roberts, E.; Livada, V.; Wang, A. Corporate Venture Capital (CVC) Seeking Innovation and Strategic Growth: Recent Patterns in CVC Mission, Structure, and Investment; National Institute of Standards and Technology: Gaithersburg, MD, USA, 2008. [Google Scholar]

- Weber, C.; Weber, B. Corporate Venture Capital Organizations in Germany: A Comparison between German, European and US CVCs. Ventur. Cap. 2005, 7, 51–74. [Google Scholar] [CrossRef]

- Birkinshaw, J.; Van Basten Batenburg, R.; Murray, G. Corporate Venturing: The State of the Art and the Prospects for the Future; Working Paper of the London Business School; London Business School: London, UK, 2002. [Google Scholar]

- Kelly, M.; Schaan, J.-L.; Joncas, H. Collaboration between technology entrepreneurs and large corporations: Key design and management issues. J. Small Bus. Strategy 2000, 11, 60–76. [Google Scholar]

- Keil, T. Building external corporate venturing capability. J. Manag. Stud. 2004, 41, 799. [Google Scholar] [CrossRef]

- Gompers, P.; Kovner, A.; Lerner, J.; Scharfstein, D. Specialization and Success: Evidence from Venture Capital; Working Paper; J. Econ. Manag. Strategy 2009, 18, 817–844. [Google Scholar] [CrossRef]

- Yang, Y.; Narayanan, V.; Zahra, S. Developing the selection and valuation capabilities through learning: The case of corporate venture capital. J. Bus. Ventur. 2009, 24, 261–273. [Google Scholar] [CrossRef]

- Wright, M.; Lockett, A. The structure and management of alliances: Syndication in the venture capital industry. J. Manag. Stud. 2003, 8, 2073–2090. [Google Scholar] [CrossRef]

- Lerner, J. The syndication of venture capital investments. Financ. Manag. 1994, 23, 16–27. [Google Scholar] [CrossRef]

- Manigart, S.; Lockett, A.; Meuleman, M.; Wright, M.; Landstrom, H.; Bruining, H.; Desbrieres, P.; Hommel, U. Why Do European Venture Capital Companies Syndicate? ERIM Report Series Reference No. ERS-2002-98-ORG; Erasmus University of Rotterdam Erasmus Research Institute of Management: Rotterdam, The Netherlands, 2002. [Google Scholar]

- Yoshikawa, T.; Phan, P.; Linton, J. The relationship between governance structure and risk management approaches in Japanese venture capital firms. J. Bus. Ventur. 2004, 19, 831–849. [Google Scholar] [CrossRef]

- Röhm, P.; Merz, M.; Kuckertz, A. Identifying corporate venture capital investors—A data-cleaning procedure. Financ. Res. Lett. 2020, 32, 101092. [Google Scholar] [CrossRef]

- Park, H.D.; Steensma, H.K. The Selection and Nurturing Effects of Corporate Investors on New Venture Innovativeness. Strateg. Entrep. J. 2013, 7, 311–330. [Google Scholar] [CrossRef]

- Rossi, M.; Festa, G.; Devalle, A.; Mueller, J. When corporations get disruptive, the disruptive get corporate: Financing disruptive technologies through corporate venture capital. J. Bus. Res. 2020, 118, 378–388. [Google Scholar] [CrossRef]

- Arping, S.; Falconieri, S. Strategic Versus Financial Investors: The Role of Strategic Objectives in Financial Contracting. Oxf. Econ. Pap. 2010, 62, 691–714. [Google Scholar] [CrossRef] [Green Version]

- Gompers, P.; Lerner, J. The Money of Invention: How Venture Capital Creates New Wealth; Harvard Business School Press: Boston, MA, USA, 2001. [Google Scholar]

- Briegl, M.; Hong, M.; Roos, A.; Schmieg, F.; Wu, X. Corporate Venturing Shifts Gear. How the Largest Companies Apply a Broad Set of Tools to Speed Innovation; The Boston Consulting Group: Boston, MA, USA, 2016. [Google Scholar]

- Rossi, M.; Festa, G.; Solima, L.; Popa, S. Financing knowledge-intensive enterprises: Evidence from CVCs in the US. J. Technol. Transf. 2016, 42, 338–353. [Google Scholar] [CrossRef]

- Levinthal, D.A.; March, J.G. The myopia of learning. Strateg. Manag. J. 1993, 14, 95–112. [Google Scholar] [CrossRef]

- Kessler, E.H.; Chakrabarti, A.K. Innovation speed: A conceptual model of context, antecedents and outcomes. Acad. Manag. Rev. 1996, 21, 1143–1191. [Google Scholar] [CrossRef]

- Kraatz, M.S.; Zajac, E.J. How organizational resources affect strategic change and performance in turbulent environments: Theory and evidence. Organ. Sci. 2001, 12, 632–657. [Google Scholar] [CrossRef]

- Staw, B.M.; Sandelands, L.E.; Dutton, J.E. Threat-rigidity effects in organizational behavior: A multilevel analysis. Adm. Sci. Q. 1981, 26, 501–524. [Google Scholar] [CrossRef]

- Fiegenbaum, A.; Hart, S.; Schendel, D. Strategic reference point theory. Strateg. Manag. J. 1996, 17, 219–235. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic Capabilities and Strategic Management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Raisch, S.; Birkinshaw, J.; Probst, G.; Tushman, M.L. Organizational Ambidexterity: Balancing Exploitation and Exploration for Sustained Performance. Organ. Sci. 2009, 20, 685–695. [Google Scholar] [CrossRef] [Green Version]

- Hill, S.A.; Birkinshaw, J. Ambidexterity and Survival in Corporate Venture Units. J. Manag. 2012, 40, 1899–1931. [Google Scholar] [CrossRef] [Green Version]

- Fontana, J.; Forer, G.; Chosson, C.-E. Future of Utilities. Who’s Got the Power? Utilities Unbundled. 15 December 2013. EY. Available online: www.ey.com/Publication/vwLUAssets/EY_-_Utilities_Unbundled_-_Issue_15/$File/EY-Utilities-Unbundled-Issue-15.pdf (accessed on 18 November 2015).

- Dong, J.Q.; Yang, C.H. Being central is a double-edged sword: Knowledge network centrality and new product development in U.S. pharmaceutical industry. Technol. Forecast. Soc. Chang. 2016, 113, 379–385. [Google Scholar] [CrossRef]

- Gilsing, V.; Nooteboom, B.; Vanhaverbeke, W.; Duysters, G.; Van den Oord, A. Network embeddedness and the exploration of novel technologies: Technological distance, betweenness centrality and density. Res. Policy 2008, 37, 1717–1731. [Google Scholar] [CrossRef]

- Atluri, V.; Rao, S.; Sahni, S. The Trillion-Dollar Opportunity for the Industrial Sector: How to Extract Full Value from Technology. Available online: https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/the-trillion-dollar-opportunity-for-the-industrial-sector (accessed on 8 June 2022).

- Paulraj, A. Motivações ambientais: Um esquema de classificação e seu impacto nas estratégias e práticas ambientais. Bus. Strategy Environ. 2009, 18, 453–468. [Google Scholar] [CrossRef]

- Bansal, P.; Roth, K. Why companies go green: A model of ecological responsiveness. Acad. Manag. J. 2000, 43, 717–736. [Google Scholar]

- Bento, N.; Gianfrate, G.; Thoni, M.H. Crowdfunding for sustainability ventures. J. Clean. Prod. 2019, 237, 117751. [Google Scholar] [CrossRef]

- Pernick, R.; Wilder, C. The Clean Tech Revolution: The Next Big Growth and Investment Opportunity; Harper Collins: New York, NY, USA, 2007. [Google Scholar]

- Cumming, D.; Henriques, I.; Sadorsky, P. ‘Cleantech’ venture capital around the world. Int. Rev. Financ. Anal. 2016, 44, 86–97. [Google Scholar] [CrossRef]

- Bürer, M.J.; Wüstenhagen, R. Which renewable energy policy is a venture capitalist’s best friend? Empirical evidence from a survey of international cleantech investors. Energy Policy 2009, 37, 4997–5006. [Google Scholar] [CrossRef] [Green Version]

- Hegeman, P.D.; Sørheim, R. Why do they do it? Corporate venture capital investments in cleantech startups. J. Clean. Prod. 2021, 294, 126315. [Google Scholar] [CrossRef]

- Cleantech Group. European Cleantech Fundraising 2013–2014—Revisited. Cleantech Group. 2015. Available online: http://info.cleantech.com/Georgieff-Fundraising-ResearchReport_European-Cleantech-Fundraising-2013-2014—Revisited-Submit.html (accessed on 20 April 2022).

- Livieratos, A.D.; Lepeniotis, P. Corporate venture capital programs of European electric utilities: Motives, trends, strategies and challenges. Electr. J. 2017, 30, 30–40. [Google Scholar] [CrossRef]

- Yang, Y. Bilateral inter-organizational learning in corporate venture capital activity: Governance characteristics, knowledge transfer, and performance. Manag. Res. Rev. 2012, 35, 352–378. [Google Scholar] [CrossRef]

- CIELO Investor Relations, Cielo. Available online: http://cielo.com.br/ (accessed on 9 November 2021).

- Americanas Investor Relations, Americanas. Available online: http://ri.americanas.com (accessed on 9 November 2021).

- Copel Investor Relations, Copel. Available online: http://copelvolt.com/ (accessed on 9 November 2021).

- CPFL Investor Relations, CPFL. Available online: http://cpfl.riweb.com.br/ (accessed on 9 November 2021).

- EDP Investor Relations, EDP. Available online: http://brasil.edp.com/ (accessed on 9 November 2021).

- AES Investor Relations, AES. Available online: http://ri.aesbrasil.com.br/ (accessed on 9 November 2021).

- Renner Investor Relations, Renner. Available online: http://lojasrenner.mzweb.com.br/ (accessed on 9 November 2021).

- Inovabra Investor Relations, Bradesco S/A. Available online: https://www.bradescori.com.br/o-bradesco/presenca-e-inovacao/inovabra/ (accessed on 16 November 2021).

- BRF Investor Relations, BRF. Available online: https://ri.brf-global.com/ (accessed on 9 November 2021).

- Ecorodovias Investor Relations, Ecorodovias. Available online: http://ri.ecorodovias.com.br/ (accessed on 9 November 2021).

- Santander Investor Relations, Santander. Available online: http://santanderx.com/ (accessed on 9 November 2021).

- Itau Unibanco Investor Relations, Itaú Unibanco. Available online: https://www.itau.com.br/relacoes-com-investidores/ (accessed on 11 November 2021).

- Boostlab Investor Relations, BTG Pactual. Available online: http://ri.btgpactual.com/ (accessed on 9 November 2021).

- Eletrobras Investor Relations, Eletrobras. Available online: http://ri.eletrobras.com/ (accessed on 9 November 2021).

- Light Investor Relations, Light. Available online: http://ri.light.com.br/ (accessed on 9 November 2021).

- Dexco Investor Relations, Dexco. Available online: https://www.dex.co/ri (accessed on 11 November 2021).

- WEG Investor Relations, WEG. Available online: https://ri.weg.net/ (accessed on 14 November 2021).

- Marfrig Investor Relations, Marfrig. Available online: https://ri.marfrig.com.br/ (accessed on 11 November 2021).

- Orsato, R.J.; Garcia, A.; Mendes, W.; Simonetti, R.; Monzoni, M. Sustainability indexes: Why join in? A study of the ‘Corporate Sustainability Index (ISE)’ in Brazil. J. Clean. Prod. 2015, 96, 161–170. [Google Scholar] [CrossRef]

- Ferrary, M. Managing the disruptive technologies life cycle by externalising the research: Social network and corporate venturing in the Silicon Valley. Int. J. Technol. Manag. 2003, 25, 165–180. [Google Scholar] [CrossRef]

- Basu, S.; Phelps, C.; Kotha, S. Towards understanding who makes corporate venture capital investments and why. J. Bus. Ventur. 2011, 26, 153–171. [Google Scholar] [CrossRef]

- Ahlfänger, M.; Kohut, M.; Leker, J. Reconciling Competing Institutional Logics in Corporate Venture Capital Units. Int. J. Innov. Manag. 2020, 24, 2040004. [Google Scholar] [CrossRef]

- Gaddy, B.E.; Sivaram, V.; Jones, T.B.; Wayman, L. Venture Capital and Cleantech: The wrong model for energy innovation. Energy Policy 2017, 102, 385–395. [Google Scholar] [CrossRef] [Green Version]

- Ghosh, S.; Nanda, R. Investimento de Capital de Risco no Setor de Energia Limpa; Harvard Business School Entrepreneurial Management Working Paper, n. 11-020; Harvard Business School: Cambridge, MA, USA, 2010. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Döll, L.M.; Ulloa, M.I.C.; Zammar, A.; Prado, G.F.d.; Piekarski, C.M. Corporate Venture Capital and Sustainability. J. Open Innov. Technol. Mark. Complex. 2022, 8, 132. https://doi.org/10.3390/joitmc8030132

Döll LM, Ulloa MIC, Zammar A, Prado GFd, Piekarski CM. Corporate Venture Capital and Sustainability. Journal of Open Innovation: Technology, Market, and Complexity. 2022; 8(3):132. https://doi.org/10.3390/joitmc8030132

Chicago/Turabian StyleDöll, Luciano Mathias, Micaela Ines Castillo Ulloa, Alexandre Zammar, Guilherme Francisco do Prado, and Cassiano Moro Piekarski. 2022. "Corporate Venture Capital and Sustainability" Journal of Open Innovation: Technology, Market, and Complexity 8, no. 3: 132. https://doi.org/10.3390/joitmc8030132

APA StyleDöll, L. M., Ulloa, M. I. C., Zammar, A., Prado, G. F. d., & Piekarski, C. M. (2022). Corporate Venture Capital and Sustainability. Journal of Open Innovation: Technology, Market, and Complexity, 8(3), 132. https://doi.org/10.3390/joitmc8030132