A Clustering Approach to Identify the Organizational Life Cycle

Abstract

1. Introduction

2. Background and Related Studies

2.1. Clustering Methods

2.2. Principal Component Analysis (PCA)

2.3. Cluster Analysis (CA)

3. Materials and Methods

3.1. Data Collection

3.2. Statistical Analyses

- (1)

- Calculating variables

- (2)

- Principal component analysis

- (3)

- Cluster analysis

4. Results

4.1. Descriptive Statistic

4.2. PCA Analysis Results

4.3. Cluster Analysis Results

- Cluster 1: 57 (17.22%) of the firm-years belonged to this cluster. According to Table 7, the mean ± SD performance and SGlog10-DPR index were 0.06 ± 0.12 and −0.70 ± 0.25, respectively. Compared to the two other groups, the performance of Cluster 1 can be considered to be medium-upward. Concerning the SGlog10-DPR variable, this cluster had minimal amounts of SGlog10-DPR. According to Ebadi (2016), the firm’s SG and DPR usually move against each other: younger firms based on the OLC concept have more SG and less DPR, and the older ones are the opposite [1]. Compared to other clusters, this group with middle financial performance and minimal SGlog10-DPR ranges was almost in the early decline stage.

- Cluster 2: 113 (34.14%) of the firm-years belonged to Cluster 2. This class achieves maximal financial performance (mean ± SD = 0.15 ± 0.09) and medium-upward SGlog10-DPR amount (mean ± SD = −0.10 ± 0.09). Compared to the other clusters, the firm-years belonging to this cluster were in the maturity stage of OLC.

- Cluster 3: This cluster comprised 137 (41.39%) of the firm-years. According to Figure 1 and Table 7, its financial performance index was in the minimal range (mean ± SD = −0.08 ± 0.09), and its SGlog10-DPR index was in the medium range (mean ± SD = −0.12 ± 0.12). According to the low financial performance and medium SGlog10-DPR index of these firm-years compared to those of other clusters, the best-interpreted OLC situation for this cluster is the growth stage (Figure 1).

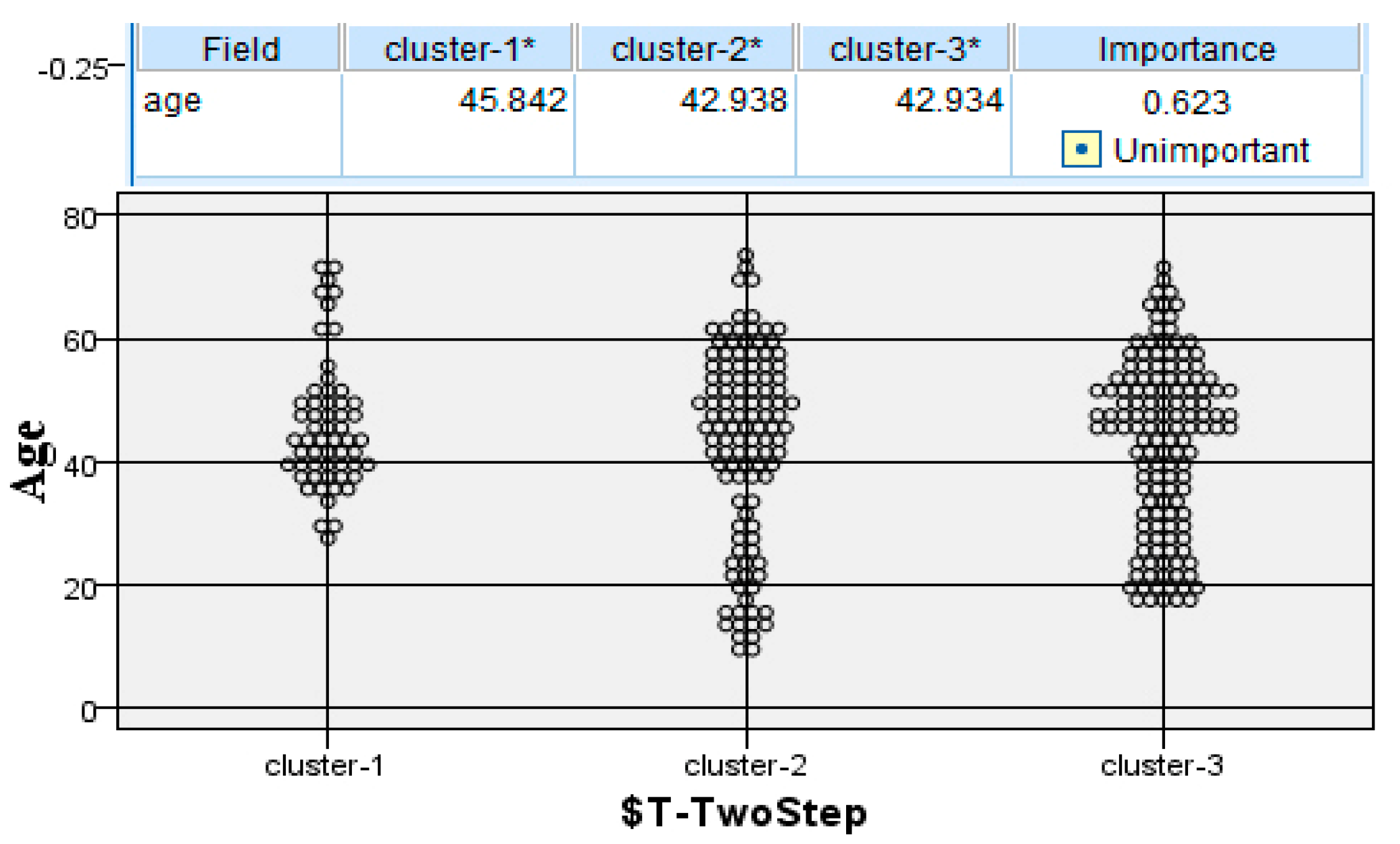

4.4. The Effect of Age on the OLC Situation

5. Discussion

5.1. Organizational Life Cycle of the Generic Industry in Iran

5.2. The Role of Open Innovation in Firms’ Survival

5.3. Declined Organizations: Causes and Solutions

6. Conclusions

7. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ebadi, T. The Effect of Corporate Life Cycle on the Accounting Conservatism. Scinzer J. Account. Manag. 2016, 2, 1–11. [Google Scholar]

- Dodge, H.R.; Robbins, J.E. An Empirical Investigation of the Organizational Life Cycle. J. Small Bus. Manag. 1992, 30, 27. [Google Scholar]

- Adizes, I. Corporate Lifecycles: How and Why Corporations Grow and Dies and What to Do About It; Prentice Hall: Paramus, NJ, USA, 1989. [Google Scholar]

- Anthony, J.H.; Ramesh, K. Association between Accounting Performance Measures and Stock Prices. A Test of the Life Cycle Hypothesis. J. Account. Econ. 1992, 15, 203–227. [Google Scholar] [CrossRef]

- Miller, D.; Friesen, P.H. A Longitudinal Study of the Corporate Life Cycle. Manage. Sci. 1984, 30, 1161–1183. [Google Scholar] [CrossRef]

- Stepanyan, G.G. Revisiting Firm Life Cycle Theory for New Directions in Finance. SSRN Electron. J. 2012. [Google Scholar] [CrossRef]

- Lester, D.L.; Parnell, J.A.; Carraher, S. Organizational Life Cycle: A Five-Stage Empirical Scale. Int. J. Organ. Anal. 2003, 11, 339–354. [Google Scholar] [CrossRef]

- Jirásek, M.; Bílek, J. The Organizational Life Cycle: Review and Future Agenda. Qual. Innov. Prosper./Kval. Inovácia Prosper. 2018, 22, 1–18. [Google Scholar] [CrossRef]

- Mosca, L.; Gianecchini, M.; Campagnolo, D. Organizational Life Cycle Models: A Design Perspective. J. Organ. Des. 2021, 10, 3–18. [Google Scholar] [CrossRef]

- Robert Phelps, R.A.; Bessant, J. Life cycles of growing organizations: A review with implications for knowledge and learning. Int. J. Manag. Rev. 2007, 9, 1–30. [Google Scholar] [CrossRef]

- Santanaa, M.; Vallea, R.; Galan, J.-L. Turnaround Strategies for Companies in Crisis: Watch out the Causes of Decline before Firing People. BRQ Bus. Res. Q. 2017, 20, 206–211. [Google Scholar] [CrossRef]

- Reinhardt, U.E. The Pharmaceutical Sector in Health Care. In Pharmaceutical Innovation: Incentives, Competition, and Cost-Benefit Analysis in International Perspective; Sloan, F., Hsieh, C., Eds.; Cambridge University Press: Cambridge, UK, 2007; pp. 25–53. [Google Scholar] [CrossRef]

- Shahangian, S.; Snyder, S.R.; Et, G.; Mekuria, B. A Qualitative Review of Strengths, Weaknesses, Opportunities and Threats of Clinical Pharmacy Services Provided by Tirunesh Beijing General Hospital Pharmaceutical Care & Health Systems. J. Pharm. Care Health Syst. 2019, 131, 418–431. [Google Scholar] [CrossRef]

- Kebriaeezadeh, A.; Koopaei, N.N.; Abdollahiasl, A.; Nikfar, S.; Mohamadi, N. Trend Analysis of the Pharmaceutical Market in Iran; 1997-2010; Policy Implications for Developing Countries. DARU J. Pharm. Sci. 2013, 21, 52. [Google Scholar] [CrossRef] [PubMed]

- Cheraghali, A.M. Trends in Iran Pharmaceutical Market. Iran. J. Pharm. Res. IJPR 2017, 16, 1–7. [Google Scholar] [CrossRef] [PubMed]

- Maldonado, C.; Beruvides, M.G.; Simonton, J. Influence of Intellectual Capital Intermediaries on Technical, 1st ed.; Maldonado, C., Ed.; Texas Tech University: Lubbock, TX, USA, 2008. [Google Scholar]

- Karacaer, S.; Gulec, O.F. Corporate Life Cycle Methods in Emerging Markets: Evidence from Turkey. Pressacademia 2017, 4, 224–236. [Google Scholar] [CrossRef]

- Aharony, J.; Falk, H.; Yehuda, N.; Technion, T.; Kemsley, D.; Thomas, J.; Ziv, A. Corporate Life Cycle and the Relative Value—Relevance of Cash Flow versus Accrual Financial Information. Available online: https://www.researchgate.net/publication/228170690_Corporate_Life_Cycle_and_the_Value_Relevance_of_Cash_Flow_versus_Accrual_Financial_Information (accessed on 23 June 2021).

- Bayaraa, B. Financial Performance Determinants of Organizations: The Case of Mongolian Companies. J. Compet. 2017, 9, 22–33. [Google Scholar] [CrossRef]

- Joudaki, H.; Rashidian, A.; Minaei-Bidgoli, B.; Mahmoodi, M.; Geraili, B.; Nasiri, M.; Arab, M. Improving Fraud and Abuse Detection in General Physician Claims: A Data Mining Study. Int. J. Health Policy Manag. 2016, 5, 165–172. [Google Scholar] [CrossRef]

- Swarndepp, S.J.; Pandya, S. An Overview of Partitioning Algorithms in Clustering Techniques. Int. J. Adv. Res. Comput. Eng. Technol. 2016, 5, 1943–1946. [Google Scholar]

- Rutherford, M.W.; Buller, P.F.; McMullen, P.R. Human Resource Management Problems over the Life Cycle of Small to Medium-Sized Firms. Hum. Resour. Manag. 2003, 42, 321–335. [Google Scholar] [CrossRef]

- Wang, Y.; Lee, H. A Clustering Method to Identify Representative Financial Ratios. Inf. Sci. 2008, 178, 1087–1097. [Google Scholar] [CrossRef]

- Momeni, M.; Mohseni, M.; Soofi, M. Clustering Stock Market Companies via K-Means Algorithm. Kuwait Chapter Arab. J. Bus. Manag. Rev. 2015, 4, 1–10. [Google Scholar] [CrossRef][Green Version]

- Jianfeng, L.; Yan, C. Application of Fuzzy Clustering Method in Classifying Steel Companies. In Proceedings of the Second International Conference on Innovative Computing, Informatio and Control (ICICIC 2007), Kumamoto, Japan, 5–7 September 2007; pp. 6–9. [Google Scholar] [CrossRef]

- Xu, X.; Liu, X.; Chen, Y. Applications of Axiomatic Fuzzy Set Clustering Method on Management Strategic Analysis. Eur. J. Oper. Res. 2009, 198, 297–304. [Google Scholar] [CrossRef]

- Chi-Hsien, K.; Nagasawa, S. Applying Machine Learning to Market Analysis: Knowing Your Luxury Consumer. J. Manag. Anal. 2019, 6, 404–419. [Google Scholar] [CrossRef]

- Granato, D.; Santos, J.S.; Escher, G.B.; Ferreira, B.L.; Maggio, R.M. Use of Principal Component Analysis (PCA) and Hierarchical Cluster Analysis (HCA) for Multivariate Association between Bioactive Compounds and Functional Properties in Foods: A Critical Perspective. Trends Food Sci. Technol. 2018, 72, 83–90. [Google Scholar] [CrossRef]

- Kettenring, J.R. The Practice of Cluster Analysis. J. Classif. 2006, 23, 3–30. [Google Scholar] [CrossRef]

- Gaitani, N.; Lehmann, C.; Santamouris, M.; Mihalakakou, G.; Patargias, P. Using Principal Component and Cluster Analysis in the Heating Evaluation of the School Building Sector. Appl. Energy 2010, 87, 2079–2086. [Google Scholar] [CrossRef]

- Ding, C.; He, X. K-Means Clustering via Principal Component Analysis. In Proceedings of the Twenty-First International Conference on Machine Learning, Banff, AB, Canada, 4–8 July 2004; pp. 225–232. [Google Scholar]

- IBM. IBM SPSS Modeler, 18.1.1; Modeler Modeling Nodes; IBM: New York, NY, USA, 2017; p. 422. Available online: https://ftp://public.dhe.ibm.com/software/analytics/spss/documentation/modeler/18.1.1/en/ModelerModelingNodes.pdf (accessed on 25 January 2018).

- Bulan, L.T.; Subramanian, N. Dividends and Dividend Policy; Citeseer: Boston, MA, USA, 2009. [Google Scholar]

- Wang, M.C. Value Relevance of Tobin’s Q and Corporate Governance for the Taiwanese Tourism Industry. J. Bus. Ethics 2015, 130, 223–230. [Google Scholar] [CrossRef]

- Daniswara, H.P.; Daryanto, W.M. Earning per Share (EPS), Price Book Value (PBV), Return on Asset (ROA), Return on Equity (ROE), and Indeks Harga Saham Gabungan (IHSG) Effect on Stock Return. South East Asia J. Contemp. Business Econ. Law 2019, 20, 11–27. [Google Scholar]

- Yousefi, N.; Mehralian, G.; Rasekh, H.R.; Tayeba, H. Pharmaceutical Innovation and Market Share: Evidence from a Generic Market. Int. J. Pharm. Healthc. Mark. 2016, 10, 376–389. [Google Scholar] [CrossRef]

- Mousavi, A.; Mohammadzadeh, M.; Zare, H. Developing a System Dynamic Model for Product Life Cycle Management of Generic Pharmaceutical Products; Its Relation with Open Innovation. J. Open Innov. Technol. Mark. Complex. 2022, 8, 14. [Google Scholar] [CrossRef]

- IFDA. Official Iranian Drug Statistics. Available online: https://www.fda.gov.ir/ (accessed on 20 March 2020).

- Securities and Exchange Organization. Available online: https://www.codal.ir/ (accessed on 20 March 2020).

- Benassi, M.; Garofalo, S.; Ambrosini, F.; Sant’Angelo, R.P.; Raggini, R.; De Paoli, G.; Ravani, C.; Giovagnoli, S.; Orsoni, M.; Piraccini, G. Using Two-Step Cluster Analysis and Latent Class Cluster Analysis to Classify the Cognitive Heterogeneity of Cross-Diagnostic Psychiatric Inpatients. Front. Psychol. 2020, 11, 1085. [Google Scholar] [CrossRef]

- Wendler, T.; Gröttrup, S. Data Mining with SPSS Modeler; Springer: Berlin, Germany, 2016. [Google Scholar] [CrossRef]

- Bierly, P.E.; Daly, P.S. E T & P Performance in Small Manufacturing Firms. Small 2007, 540, 493–517. [Google Scholar]

- Agarwal, R.; Sarkar, M.B.; Echambadi, R. The Conditioning Effect of Time on Firm Survival: An Industry Life Cycle Approach. Acad. Manag. J. 2016, 45, 971–994. [Google Scholar]

- Martin, R.; Sunley, P. Conceptualising Cluster Evolution: Beyond the Life-Cycle Model? Reg. Stud. J. 2011, 45, 1299–1318. [Google Scholar] [CrossRef]

- Mousavi, A.; Zare, H.; Asadian, A.; Mohammadzadeh, M. Factors Affecting the Product Life Cycle of Generic Medicines. Iran. J. Pharm. Res. 2022, 21, e127039. [Google Scholar]

- Sirmon, D.G.; Hitt, M.A.; Ireland, R.D.; Gilbert, B.A. Resource Orchestration to Create Competitive Advantage: Breadth, Depth, and Life Cycle Effects. J. Manag. 2011, 37, 1390–1412. [Google Scholar] [CrossRef]

- Steiner, A.; Morel, L.; Camargo, M. Well-suited organization to open innovation: Empirical evidence from an industrial deployment. J. Innov. Econ. Manag. 2014, 13, 93–113. [Google Scholar] [CrossRef]

- Guffarth, D.; Knappe, M. Patterns of Learning in Dynamic Technological System Lifecycles—What Automotive Managers Can Learn from the Aerospace Industry? J. Open Innov. Technol. Mark. Complex. 2018, 5, 1. [Google Scholar] [CrossRef]

- Tsinopoulos, C.; Sousa, C.M.P.; Yan, J. Process Innovation: Open Innovation and the Moderating Role of the Motivation to Achieve Legitimacy. J. Prod. Innov. Manag. 2018, 35, 27–48. [Google Scholar] [CrossRef]

- Yun, J.H.J.; Liu, Z. Micro- and Macro-Dynamics of Open Innovation with a Quadruple-Helix Model. Sustainability 2019, 11, 3301. [Google Scholar] [CrossRef]

- Rostoka, Z.; Locovs, J.; Gaile-Sarkane, E. Open Innovation of New Emerging Small Economies Based on University-Construction Industry Cooperation. J. Open Innov. Technol. Mark. Complex. 2019, 5, 10. [Google Scholar] [CrossRef]

- Kharazmi, O.A.; Nedaei, A.; Nejad, N.J. University-Industry Collaboration in the Iranian National System of Innovation: University Perspective Universities as Interactive Partners. In Proceedings of the Triple Helix International Conference 2013, London, UK, 8–10 July 2013. [Google Scholar]

- Perkmann, M.; Walsh, K. University Industry Relationships and Open Innovation: Towards a Research Agenda. Int. J. Manag. Rev. 2007, 9, 259–280. [Google Scholar] [CrossRef]

- Mytelka, L.K. Pathways and Policies to (Bio) Pharmaceutical Innovation Systems in Developing Countries. Ind. Innov. 2006, 13, 415–435. [Google Scholar] [CrossRef]

- Ankrah, S.; Al-Tabbaa, O. Universities—industry Collaboration: A Systematic Review. Scand. J. Manag. 2015, 31, 387–408. [Google Scholar] [CrossRef]

- Rico, M.; Puig, F. Successful Turnarounds in Bankrupt Firms? Assessing Retrenchment in the Most Severe Form of Crisis. BRQ Bus. Res. Q. 2021, 24, 114–128. [Google Scholar] [CrossRef]

- Fardazar, F.E.; Asiabar, A.S.; Safari, H.; Asgari, M.; Saber, A.; Azar, A.A.E.F. Policy Analysis of Iranian Pharmaceutical Sector; A Qualitative Study. Risk Manag. Healthc. Policy 2019, 12, 199–208. [Google Scholar] [CrossRef]

- Khayatzadeh-Mahani, A.; Fotaki, M.; Harvey, G. Priority Setting and Implementation in a Centralized Health System: A Case Study of Kerman Province in Iran. Health Policy Plan. 2013, 28, 480–494. [Google Scholar] [CrossRef]

- Monferrer, D.; Blesa, A.; Ripollés, M. Born Globals Trough Knowledge-Based Dynamic Capabilities and Network Market Orientation. BRQ Bus. Res. Q. 2015, 18, 18–36. [Google Scholar] [CrossRef]

- Mohammadzadeh, M.; Bakhtiari, N.; Safarey, R.; Ghari, T. Pharmaceutical Industry in Export Marketing: A Closer Look at Competitiveness. Int. J. Pharm. Healthc. Mark. 2019, 13, 331–345. [Google Scholar] [CrossRef]

- Flávio Morais, Z.S.; Ramalho, J.J. The Zero-Leverage Phenomenon in European Listed Firms: A Financing Decision or an Imposition of the Financial Market? BRQ Bus. Res. Q. 2021. [Google Scholar] [CrossRef]

- Rahmadia, R.; Hosen, M.N.; Muhari, S. Analysis of Factors That Impact Dividend Payout Ratio on Listed Companies at Jakarta Islamic Index. Int. J. Acad. Res. Account. Financ. Manag. Sci. 2016, 6, 87–97. [Google Scholar]

| OLC Stages | Special Characteristics | Firm Strategies |

|---|---|---|

| Introduction stage(existence) |

|

|

| Growth stage(survival) |

| |

| Maturity stage(success) |

|

|

| Decline stage(end of life) |

|

| Variable/Stage of PLC | Growth | Maturity | Decline |

|---|---|---|---|

| SG | High | Medium | Low |

| DPR | Low | Medium | High [4] |

| Financial performance | Low | High | Low [16] |

| Variable | N | Mean | St. Dev. | Minimum | Maximum | Range | Normal Form |

|---|---|---|---|---|---|---|---|

| SG | 331 | 0.55 | 0.21 | −0.49 | 1.91 | 2.40 | SG-log10 |

| DPR | 331 | 0.64 | 0.38 | 0.00 | 3.70 | 3.70 | DPR |

| Age | 331 | 43.56 | 13.71 | 9.00 | 73.00 | 64.00 | Age |

| Qtubin | 331 | 1.23 | 0.81 | 0.14 | 7.34 | 7.20 | Qtubin-log10 |

| ROA | 331 | 0.19 | 0.12 | 0.00 | 0.89 | 0.89 | ROA |

| ROE | 331 | 0.49 | 0.24 | 0.01 | 1.50 | 1.49 | ROE-log10 |

| NP | 331 | 0.25 | 0.17 | 0.01 | 2.00 | 1.99 | NP |

| Total Explained Variance | ||||||

|---|---|---|---|---|---|---|

| Initial Eigenvalues | Extraction Sums of Squared Loadings | |||||

| Component | Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % |

| 1 | 2.283 | 38.048 | 38.048 | 2.283 | 38.048 | 38.048 |

| 2 | 1.378 | 22.971 | 61.019 | 1.378 | 22.971 | 61.019 |

| 3 | 0.902 | 15.034 | 76.053 | |||

| 4 | 0.696 | 11.592 | 87.646 | |||

| 5 | 0.460 | 7.668 | 95.314 | |||

| 6 | 0.281 | 4.686 | 100.000 | |||

| Component | 1 | 2 |

|---|---|---|

| DPR | - | −0.820 |

| ROA | 0.829 | - |

| NP | 0.822 | - |

| SG_Log10 | - | 0.807 |

| Qtubin_Log10 | 0.547 | - |

| ROE_Log10 | 0.764 | - |

| Algorithm | Number of Inputs | Number of Clusters | Predicted Variables | Average Silhouette |

|---|---|---|---|---|

| Two-step | 2 (Performance, Log10SG-DPR) | 3 | 92.75% | 0.60 |

| Two-step | 2 (Performance, Log10SG-DPR) | 4 | 92.75% | 0.50 |

| Two-step | 2 (Performance, Log10SG-DPR) | 5 | 92.75% | 0.50 |

| Two-step | 2 (Performance, Log10SG-DPR) | 6 | 92.75% | 0.46 |

| Clusters | Index | Mean | Number | Std. Deviation | Minimum | Maximum |

|---|---|---|---|---|---|---|

| Cluster 1 | Financial performance | 0.06 | 57 | 0.12 | −0.46 | 0.28 |

| SGlog10-DPR | −0.7 | 57 | 0.25 | −1.54 | −0.33 | |

| Cluster 2 | Financial performance | 0.15 | 113 | 0.09 | 0.04 | 0.54 |

| SGlog10-DPR | −0.1 | 113 | 0.09 | −0.32 | 0.2 | |

| Cluster 3 | Financial performance | −0.08 | 137 | 0.09 | −0.53 | 0.04 |

| SGlog10-DPR | −0.12 | 137 | 0.12 | −0.51 | 0.11 | |

| Total | Financial performance | 0.03 | 331 | 0.14 | −0.53 | 0.54 |

| SGlog10-DPR | −0.22 | 331 | 0.27 | −1.54 | 0.2 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mousavi, A.; Mohammadzadeh, M.; Zare, H. A Clustering Approach to Identify the Organizational Life Cycle. J. Open Innov. Technol. Mark. Complex. 2022, 8, 108. https://doi.org/10.3390/joitmc8030108

Mousavi A, Mohammadzadeh M, Zare H. A Clustering Approach to Identify the Organizational Life Cycle. Journal of Open Innovation: Technology, Market, and Complexity. 2022; 8(3):108. https://doi.org/10.3390/joitmc8030108

Chicago/Turabian StyleMousavi, Atefeh, Mehdi Mohammadzadeh, and Hossein Zare. 2022. "A Clustering Approach to Identify the Organizational Life Cycle" Journal of Open Innovation: Technology, Market, and Complexity 8, no. 3: 108. https://doi.org/10.3390/joitmc8030108

APA StyleMousavi, A., Mohammadzadeh, M., & Zare, H. (2022). A Clustering Approach to Identify the Organizational Life Cycle. Journal of Open Innovation: Technology, Market, and Complexity, 8(3), 108. https://doi.org/10.3390/joitmc8030108