ICT Access and Entrepreneurship in the Open Innovation Dynamic Context: Evidence from OECD Countries

Abstract

1. Introduction

2. Review of the Literature

2.1. Entrepreneurship and Resource-Based Theory

2.2. Open Innovation Dynamic in Entrepreneurship

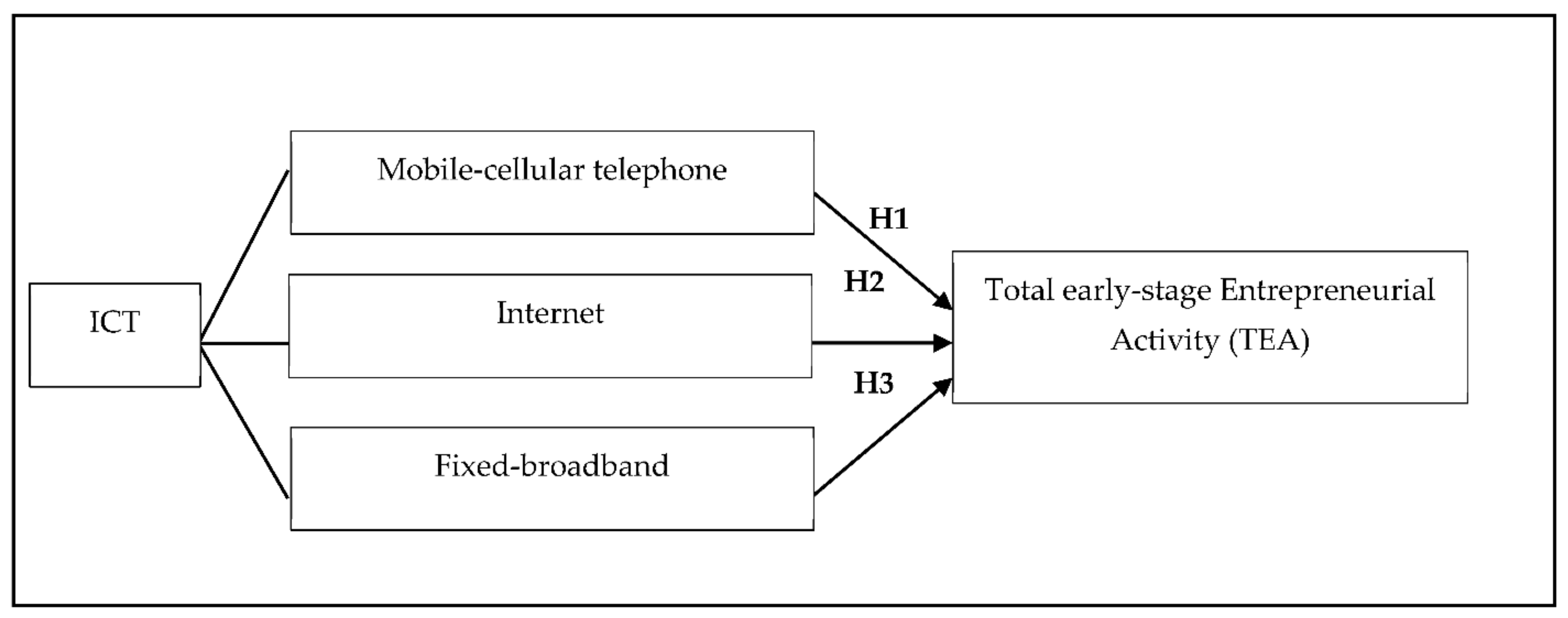

2.3. ICT Access and Entrepreneurship

3. Data and Methodology

3.1. Sample

3.2. Methods

4. Results

5. Discussion and Implications

5.1. Discussion of Results

5.2. Implications for Theory

5.3. Practical Implications

5.4. Political Implications

5.5. Limitations and Future Lines of Research

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Cunningham, P.M.; Cunningham, M.; Ekenberg, L. Factors Impacting on the Current Level of Open Innovation and ICT Entrepreneurship in Africa. Electron. J. Inf. Syst. Dev. Ctries. 2016, 73, 1–23. [Google Scholar] [CrossRef][Green Version]

- Mohsen, K.; Saeed, S.; Raza, A.; Omar, S.; Muffatto, M. Does using latest technologies impact new venture innovation? A contingency-based view of institutional environments. J. Small Bus. Manag. 2021, 59, 852–886. [Google Scholar] [CrossRef]

- Cunningham, P.M.; Cunningham, M.; Ekenberg, L. Baseline analysis of 3 innovation ecosystems in East Africa. In Proceedings of the 2014 14th International Conference on Advances in ICT for Emerging Regions (ICTer), Colombo, Sri Lanka, 10–13 December 2014; pp. 156–162. [Google Scholar]

- Parida, V.; Örtqvist, D. Interactive Effects of Network Capability, ICT Capability, and Financial Slack on Technology-Based Small Firm Innovation Performance. J. Small Bus. Manag. 2015, 53, 278–298. [Google Scholar] [CrossRef]

- González-Sánchez, V.M. ‘Information and Communication Technologies’ and Entrepreneurial Activity: Drivers of Economic Growth in Europe. Serv. Ind. J. 2013, 33, 683–693. [Google Scholar] [CrossRef]

- Sánchez, V.M.G. Education and ICT: Key factors to improve the development in the world. In International Political Economy; Nova Science Publishers: Hauppauge, NY, USA, 2011; pp. 171–190. [Google Scholar]

- BarNir, A. Starting technologically innovative ventures: Reasons, human capital and gender. Manag. Decis. 2012, 50, 399–419. [Google Scholar] [CrossRef]

- Battistella, C.; Biotto, G.; De Toni, A.F. From design driven innovation to meaning strategy. Manag. Decis. 2012, 50, 718–743. [Google Scholar] [CrossRef]

- Cegarra-Navarro, J.; Sánchez-Vidal, M.E.; Cegarra-Leiva, D. Balancing exploration and exploitation of knowledge through an unlearning context. Manag. Decis. 2011, 49, 1099–1119. [Google Scholar] [CrossRef]

- Goktan, A.; Miles, G. Innovation speed and radicalness: Are they inversely related? Manag. Decis. 2011, 49, 533–547. [Google Scholar] [CrossRef]

- Chaston, I.; Scott, G.J. Entrepreneurship and open innovation in an emerging economy. Manag. Decis. 2012, 50, 1161–1177. [Google Scholar] [CrossRef]

- Huarng, K.H.; Yu, T.H.-K. Entrepreneurship, process innovation and value creation by a non-profit SME. Manag. Decis. 2011, 49, 284–296. [Google Scholar] [CrossRef]

- Lopes, J.; Oliveira, M.; Silveira, P.; Farinha, L.; Oliveira, J. Business Dynamism and Innovation Capacity, an Entrepreneurship Worldwide Perspective. J. Open Innov. Technol. Mark. Complex. 2021, 7, 94. [Google Scholar] [CrossRef]

- Hopp, C.; Sonderegger, R. Understanding the Dynamics of Nascent Entrepreneurship—Prestart-Up Experience, Intentions and Entrepreneurial Success. J. Small Bus. Manag. 2015, 53, 1076–1096. [Google Scholar] [CrossRef]

- Aparicio, S.; Urbano, D.; Audretsch, D. Institutional factors, opportunity entrepreneurship and economic growth: Panel data evidence. Technol. Forecast. Soc. Change 2016, 102, 45–61. [Google Scholar] [CrossRef]

- Alderete, M.V. Mobile Broadband: A Key Enabling Technology for Entrepreneurship? J. Small Bus. Manag. 2017, 55, 254–269. [Google Scholar] [CrossRef]

- Siqueira, A.C.O.; Bruton, G.D. High-Technology Entrepreneurship in Emerging Economies: Firm Informality and Contextualisation of Resource-Based Theory. IEEE Trans. Eng. Manag. 2010, 57, 39–50. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Lopes, J.; Farinha, L.; Ferreira, J.J.; Silveira, P. Does regional VRIO model help policy-makers to assess the resources of a region? A stakeholder perception approach. Land Use Policy 2018, 79, 659–670. [Google Scholar] [CrossRef]

- Wernerfelt, B. A resource-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Farinha, L.; Lopes, J.; Sebastião, J.R.; Ferreira, J.J.; Oliveira, J.; Silveira, P. How do stakeholders evaluate smart specialisation policies defined for their regions? Compet. Rev. Int. Bus. J. 2021, 31, 594–624. [Google Scholar] [CrossRef]

- Sirmon, D.G.; Hitt, M.A.; Ireland, R.D. Managing Firm Resources in Dynamic Environments to Create Value: Looking Inside the Black Box. Acad. Manag. Rev. 2007, 32, 273–292. [Google Scholar] [CrossRef]

- Grant, R.M. The Resource-Based Theory of Competitive Advantage: Implications for Strategy Formulation. Calif. Manag. Rev. 1991, 33, 114–135. [Google Scholar] [CrossRef]

- Lopes, J.; Ferreira, J.J.; Farinha, L. Entrepreneurship and the resource-based view: What is the linkage? A bibliometric approach. Int. J. Entrep. Ventur. 2021, 13, 137. [Google Scholar] [CrossRef]

- Zhang, F.; Li, D. Regional ICT access and entrepreneurship: Evidence from China. Inf. Manag. 2018, 55, 188–198. [Google Scholar] [CrossRef]

- Dobrota, M.; Martic, M.; Bulajic, M.; Jeremic, V. Two-phased composite I-distance indicator approach for evaluation of countries’ information development. Telecommun. Policy 2015, 39, 406–420. [Google Scholar] [CrossRef]

- Baumol, W.J. Entrepreneurship: Productive, unproductive and destructive. J. Bus. Ventur. 1996, 11, 3–22. [Google Scholar] [CrossRef]

- Alvarez, S.A.; Busenitz, L.W. The entrepreneurship of resource-based theory. J. Manag. 2001, 27, 755–775. [Google Scholar] [CrossRef]

- Lee, C.; Lee, K.; Pennings, J.M. Internal capabilities, external networks and performance: A study on technology-based ventures. Strateg. Manag. J. 2001, 22, 615–640. [Google Scholar] [CrossRef]

- Rivard, S.; Raymond, L.; Verreault, D. Resource-based view and competitive strategy: An integrated model of the contribution of information technology to firm performance. J. Strateg. Inf. Syst. 2006, 15, 29–50. [Google Scholar] [CrossRef]

- Wade, M.; Hulland, J. The resource-based view and information systems research: Review, extension, and suggestions for future research. MIS Q. 2004, 28, 107–142. [Google Scholar] [CrossRef]

- Conner, K.R. A Historical Comparison of Resource-Based Theory and Five Schools of Thought within Industrial Organization Economics: Do We Have a New Theory of the Firm? J. Manag. 1991, 17, 121–154. [Google Scholar] [CrossRef]

- Barney, J.B. Strategic Factor Markets—Expectations, Luck and Business Strategy. Manag. Sci. 1986, 32, 1230–1241. [Google Scholar] [CrossRef]

- Dierickx, I.; Cool, K. Asset Stock Accumulation and Sustainability of Competitive Advantage. Manag. Sci. 1989, 35, 1504–1511. [Google Scholar] [CrossRef]

- Braganza, A.; Brooks, L.; Nepelski, D.; Ali, M.; Moro, R. Resource management in big data initiatives: Processes and dynamic capabilities. J. Bus. Res. 2017, 70, 328–337. [Google Scholar] [CrossRef]

- Mahoney, J.T.; Pandian, J.R. The resource-based view within the conversation of strategic management. Strateg. Manag. J. 1992, 13, 363–380. [Google Scholar] [CrossRef]

- Chang, S.J.; Hong, J. Economic Performance of Group-Affiliated Companies in Korea: Intragroup Resource Sharing and Internal Business Transactions. Acad. Manag. J. 2000, 43, 429–448. [Google Scholar] [CrossRef]

- Bruton, G.D.; Rubanik, Y. Resources of the firm, Russian high-technology startups and firm growth. J. Bus. Ventur. 2002, 17, 553–576. [Google Scholar] [CrossRef]

- Storey, D.J.; Tether, B.S. New technology-based firms in the European union: An introduction. Res. Policy 1998, 26, 933–946. [Google Scholar] [CrossRef]

- Powell, T.C.; DentMicallef, A. Information technology as competitive advantage: The role of human, business and technology resources. Strateg. Manag. J. 1997, 18, 375–405. [Google Scholar] [CrossRef]

- Morgan, N.A.; Vorhies, D.W.; Mason, C.H. Market orientation, marketing capabilities and firm performance. Strateg. Manag. J. 2009, 30, 909–920. [Google Scholar] [CrossRef]

- Newbert, S.L. Empirical research on the resource-based view of the firm: An assessment and suggestions for future research. Strateg. Manag. J. 2007, 28, 121–146. [Google Scholar] [CrossRef]

- Lopes, J.M.; Gomes, S.; Oliveira, J.; Oliveira, M. International Open Innovation Strategies of Firms in European Peripheral Regions. J. Open Innov. Technol. Mark. Complex. 2022, 8, 7. [Google Scholar] [CrossRef]

- Chesbrough, H. The logic of open innovation: Managing intellectual property. Calif. Manag. Rev. 2003, 45, 33–58. [Google Scholar] [CrossRef]

- West, J.; Gallagher, S. Challenges of open innovation: The paradox of firm investment in open-source software. RD Manag. 2006, 36, 319–331. [Google Scholar] [CrossRef]

- Yun, J.J.; Zhao, X.; Jung, K.; Yigitcanlar, T. The Culture for Open Innovation Dynamics. Sustainability 2020, 12, 5076. [Google Scholar] [CrossRef]

- Bianchi, M.; Campodall’Orto, S.; Frattini, F.; Vercesi, P. Enabling open innovation in small- and medium-sized enterprises: How to find alternative applications for your technologies. RD Manag. 2010, 40, 414–431. [Google Scholar] [CrossRef]

- Bogers, M.; Zobel, A.-K.; Afuah, A.; Almirall, E.; Brunswicker, S.; Dahlander, L.; Frederiksen, L.; Gawer, A.; Gruber, M.; Haefliger, S.; et al. The open innovation research landscape: Established perspectives and emerging themes across different levels of analysis. Ind. Innov. 2017, 24, 8–40. [Google Scholar] [CrossRef]

- Chesbrough, H.; Crowther, A.K. Beyond high tech: Early adopters of open innovation in other industries. RD Manag. 2006, 36, 229–236. [Google Scholar] [CrossRef]

- West, J.; Salter, A.; Vanhaverbeke, W.; Chesbrough, H. Open innovation: The next decade. Res. Policy 2014, 43, 805–811. [Google Scholar] [CrossRef]

- Gruber, M.; Henkel, J. New ventures based on open innovation—An empirical analysis of startup firms in embedded Linux. Int. J. Technol. Manag. 2006, 33, 356–372. [Google Scholar] [CrossRef]

- Caputo, A.; Pizzi, S.; Pellegrini, M.M.; Dabić, M. Digitalization and business models: Where are we going? A science map of the field. J. Bus. Res. 2021, 123, 489–501. [Google Scholar] [CrossRef]

- Beliaeva, T.; Ferasso, M.; Kraus, S.; Damke, E.J. Dynamics of digital entrepreneurship and the innovation ecosystem. Int. J. Entrep. Behav. Res. 2020, 26, 266–284. [Google Scholar] [CrossRef]

- Allen, D.W.E.; Berg, C.; Markey-Towler, B.; Novak, M.; Potts, J. Blockchain and the evolution of institutional technologies: Implications for innovation policy. Res. Policy 2020, 49, 103865. [Google Scholar] [CrossRef]

- Yun, J.J.; Park, K.; Kim, J.; Yang, J. Open Innovation Effort, Entrepreneurship Orientation and their Synergies onto Innovation Performance in SMEs of Korea. Sci. Technol. Soc. 2016, 21, 366–390. [Google Scholar] [CrossRef]

- Yun, J.-H.J.; Park, S.; Avvari, M.V. Development and Social Diffusion of Technological Innovation: Cases Based on Mobile Telecommunications in National Emergency Management. Sci. Technol. Soc. 2011, 16, 215–234. [Google Scholar] [CrossRef]

- Cuevas-Vargas, H.; Aguirre, J.; Parga-Montoya, N. Impact of ICT adoption on absorptive capacity and open innovation for greater firm performance. The mediating role of ACAP. J. Bus. Res. 2022, 140, 11–24. [Google Scholar] [CrossRef]

- Nestle, V.; Täube, F.A.; Heidenreich, S.; Bogers, M. Establishing open innovation culture in cluster initiatives: The role of trust and information asymmetry. Technol. Forecast. Soc. Change 2019, 146, 563–572. [Google Scholar] [CrossRef]

- Jimenez-Jimenez, D.; Martínez-Costa, M.; Sanchez Rodriguez, C. The mediating role of supply chain collaboration on the relationship between information technology and innovation. J. Knowl. Manag. 2019, 23, 548–567. [Google Scholar] [CrossRef]

- Howell, R.; van Beers, C.; Doorn, N. Value capture and value creation: The role of information technology in business models for frugal innovations in Africa. Technol. Forecast. Soc. Change 2018, 131, 227–239. [Google Scholar] [CrossRef]

- Skordoulis, M.; Ntanos, S.; Kyriakopoulos, G.L.; Arabatzis, G.; Galatsidas, S.; Chalikias, M. Environmental Innovation, Open Innovation Dynamics and Competitive Advantage of Medium and Large-Sized Firms. J. Open Innov. Technol. Mark. Complex. 2020, 6, 195. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Park, K. Entrepreneurial cyclical dynamics of open innovation. J. Evol. Econ. 2018, 28, 1151–1174. [Google Scholar] [CrossRef]

- Alshubiri, F.; Jamil, S.A.; Elheddad, M. The impact of ICT on financial development: Empirical evidence from the Gulf Cooperation Council countries. Int. J. Eng. Bus. Manag. 2019, 11, 1847979019870670. [Google Scholar] [CrossRef]

- Chen, J.-S.; Tsou, H.-T. Information technology adoption for service innovation practices and competitive advantage: The case of financial firms. Inf. Res. Int. Electron. J. 2007, 12, 472–477. [Google Scholar]

- Giudice, M.; Straub, D. Editor’s comments: IT and entrepreneurism: An on-again, off-again love affair or a marriage? MIS Q. 2011, 35, 3–8. [Google Scholar]

- Niles, S.; Hanson, S. A new era of accessibility. URISA J. 2003, 15, 35–41. [Google Scholar]

- Agarwal, R.; Animesh, A.; Prasad, K. Research Note—Social Interactions and the “Digital Divide”: Explaining Variations in Internet Use. Inf. Syst. Res. 2009, 20, 277–294. [Google Scholar] [CrossRef]

- Wang, Y.; Ahmed, P.K. The moderating effect of the business strategic orientation on eCommerce adoption: Evidence from UK family run SMEs. J. Strateg. Inf. Syst. 2009, 18, 16–30. [Google Scholar] [CrossRef]

- Chen, Y.; Wang, Y.; Nevo, S.; Benitez-Amado, J.; Kou, G. IT capabilities and product innovation performance: The roles of corporate entrepreneurship and competitive intensity. Inf. Manag. 2015, 52, 643–657. [Google Scholar] [CrossRef]

- Majeed, M.T.; Ayub, T. Information and Communication Technology (ICT) and Economic Growth Nexus: A Comparative Global Analysis. Pak. J. Commer. Soc. Sci. 2018, 12, 443–476. [Google Scholar]

- Ahmadi, M.; Osman, M.H.M. Exploitative dominant balanced ambidexterity solving the paradox of innovation strategies in SMEs. Int. J. Bus. Innov. Res. 2020, 21, 79–107. [Google Scholar] [CrossRef]

- El-Haddadeh, R. Digital Innovation Dynamics Influence on Organisational Adoption: The Case of Cloud Computing Services. Inf. Syst. Front. 2020, 22, 985–999. [Google Scholar] [CrossRef]

- Ishida, H. The effect of ICT development on economic growth and energy consumption in Japan. Telemat. Inform. 2015, 32, 79–88. [Google Scholar] [CrossRef]

- Xing, Z. The impacts of Information and Communications Technology (ICT) and E-commerce on bilateral trade flows. Int. Econ. Econ. Policy 2018, 15, 565–586. [Google Scholar] [CrossRef]

- Gomes, S.; Lopes, J.M.; Ferreira, L.; Oliveira, J. Science and Technology Parks: Opening the Pandora’s Box of Regional Development. J. Knowl. Econ. 2022, 1–24. [Google Scholar] [CrossRef]

- Ametowobla, D.; Baur, N.; Jungmann, R. Methods of Innovation Research: Qualitative, Quantitative and Mixed Methods Approaches; GESIS, Leibniz Institute for the Social Sciences: Mannheim, Germany, 2015; p. 160. [Google Scholar]

- Queirós, A.; Faria, D.; Almeida, F. Strengths and limitations of qualitative and quantitative research methods. Eur. J. Educ. Stud. 2017, 3, 369–387. [Google Scholar] [CrossRef]

- Nogueira, E.; Gomes, S.; Lopes, J.M. The Key to Sustainable Economic Development: A Triple Bottom Line Approach. Resources 2022, 11, 46. [Google Scholar] [CrossRef]

- GEM. Entrepreneurial Behaviour and Attitudes. Available online: https://www.gemconsortium.org/data/key-aps (accessed on 11 March 2022).

- Afawubo, K.; Noglo, Y.A. ICT and entrepreneurship: A comparative analysis of developing, emerging and developed countries. Technol. Forecast. Soc. Change 2022, 175, 121312. [Google Scholar] [CrossRef]

- Hassen, T. The entrepreneurship ecosystem in the ICT sector in Qatar: Local advantages and constraints. J. Small Bus. Enterp. Dev. 2020, 27, 177–195. [Google Scholar] [CrossRef]

- Tang, Y.K.; Konde, V. Differences in ICT use by entrepreneurial micro-firms: Evidence from Zambia. Inf. Technol. Dev. 2020, 26, 268–291. [Google Scholar] [CrossRef]

- Colovic, A.; Lamotte, O. Technological Environment and Technology Entrepreneurship: A Cross-Country Analysis. Creat. Innov. Manag. 2015, 24, 617–628. [Google Scholar] [CrossRef]

- World Bank. TCdata360. Available online: https://tcdata360.worldbank.org/ (accessed on 11 March 2022).

- Alderete, M.V. ICT incidence on the entrepreneurial activity at country level. Int. J. Entrep. Small Bus. 47 2014, 21, 183–201. [Google Scholar] [CrossRef]

- Irene, B.N.O. Technopreneurship: A Discursive Analysis of the Impact of Technology on the Success of Women Entrepreneurs in South Africa. In Digital Entrepreneurship in Sub-Saharan Africa: Challenges, Opportunities and Prospects; Taura, N.D., Bolat, E., Madichie, N.O., Eds.; Springer International Publishing: Cham, Switzerland, 2019; pp. 147–173. [Google Scholar]

- Yan, Y.; Guan, J. Entrepreneurial ecosystem, entrepreneurial rate and innovation: The moderating role of internet attention. Int. Entrep. Manag. J. 2019, 15, 625–650. [Google Scholar] [CrossRef]

- Jafari-Sadeghi, V.; Garcia-Perez, A.; Candelo, E.; Couturier, J. Exploring the impact of digital transformation on technology entrepreneurship and technological market expansion: The role of technology readiness, exploration and exploitation. J. Bus. Res. 2021, 124, 100–111. [Google Scholar] [CrossRef]

- Greene, W.H. Econometric Analysis, 8th ed.; Pearson-Prentice Hall: Hoboken, NJ, USA, 2020; p. 1241. [Google Scholar]

- Hall, A.R. Generalized Method of Moments. In A Companion to Theoretical Econometrics; Oxford University Press: Oxford, UK, 2007; pp. 230–255. [Google Scholar]

- Mileva, E. Using Arellano-Bond Dynamic Panel GMM Estimators in Stata; Fordham University: New York, NY, USA, 2007; Volume 64, pp. 1–10. [Google Scholar]

- Lahouel, B.; Gaies, B.; Ben Zaied, Y.; Jahmane, A. Accounting for endogeneity and the dynamics of corporate social—Corporate financial performance relationship. J. Clean. Prod. 2019, 230, 352–364. [Google Scholar] [CrossRef]

- Hayashi, F. Econometrics; Princeton University Press: Princeton, NJ, USA, 2011; pp. 1–683. [Google Scholar]

- Bogers, M.; Chesbrough, H.; Moedas, C. Open Innovation: Research, Practices and Policies. Calif. Manag. Rev. 2018, 60, 5–16. [Google Scholar] [CrossRef]

- Wulf, J.; Zelt, S.; Brenner, W. Fixed and Mobile Broadband Substitution in the OECD Countries—A Quantitative Analysis of Competitive Effects. In Proceedings of the 2013 46th Hawaii International Conference on System Sciences, Wailea, HI, USA, 7–10 January 2013; pp. 1454–1463. [Google Scholar]

- Mathew, V. Women entrepreneurship in Middle East: Understanding barriers and use of ICT for entrepreneurship development. Int. Entrep. Manag. J. 2010, 6, 163–181. [Google Scholar] [CrossRef]

- Leitão, J.; Baptista, R. Inward FDI and ICT: Are they a joint technological driver of entrepreneurship? Int. J. Technol. Transf. Commer. 2011, 10, 268–288. [Google Scholar] [CrossRef]

- Westerlund, M. Digitalization, internationalisation and scaling of online SMEs. Technol. Innov. Manag. Rev. 2020, 10, 48–57. [Google Scholar] [CrossRef]

- Menz, M.; Kunisch, S.; Birkinshaw, J.; Collis, D.J.; Foss, N.J.; Hoskisson, R.E.; Prescott, J.E. Corporate Strategy and the Theory of the Firm in the Digital Age. J. Manag. Stud. 2021, 58, 1695–1720. [Google Scholar] [CrossRef]

- Oliveira, J.; Azevedo, A.; Ferreira, J.J.; Gomes, S.; Lopes, J.M. An insight on B2B Firms in the Age of Digitalization and Paperless Processes. Sustainability 2021, 13, 11565. [Google Scholar] [CrossRef]

- Real, J.C.; Leal, A.; Roldán, J.L. Information technology as a determinant of organisational learning and technological distinctive competencies. Ind. Mark. Manag. 2006, 35, 505–521. [Google Scholar] [CrossRef]

- Bharadwaj, A.S. A resource-based perspective on information technology capability and firm performance: An empirical investigation. MIS Q. Manag. Inf. Syst. 2000, 24, 169–193. [Google Scholar] [CrossRef]

- Sambamurthy, V.; Zmud, R.W. Research Commentary: The Organizing Logic for an Enterprise’s IT Activities in the Digital Era—A Prognosis of Practice and a Call for Research. Inf. Syst. Res. 2000, 11, 105–114. [Google Scholar] [CrossRef]

- Capelleras, J.-L.; Mole, K.F.; Greene, F.J.; Storey, D.J. Do more heavily regulated economies have poorer performing new ventures? Evidence from Britain and Spain. J. Int. Bus. Stud. 2008, 39, 688–704. [Google Scholar] [CrossRef]

- Schillo, R.S.; Persaud, A.; Jin, M. Entrepreneurial readiness in the context of national systems of entrepreneurship. Small Bus. Econ. 2016, 46, 619–637. [Google Scholar] [CrossRef]

- Svahn, F.; Mathiassen, L.; Lindgren, R. Embracing digital innovation in incumbent firms: How Volvo Cars managed competing concerns. MIS Q. Manag. Inf. Syst. 2017, 41, 239–253. [Google Scholar] [CrossRef]

| Variables | Acronyms | Definition | Papers That Used the Variables |

|---|---|---|---|

| Dependent | |||

| Total early-stage Entrepreneurial Activity | TEA | Percentage of population aged 18–64 who are either nascent entrepreneurs or owner-manager of a new business | Afawubo and Noglo [80], Alderete [16], Hassen [81], Tang and Konde [82], Colovic and Lamotte [83] |

| Independent | |||

| Mobile-cellular telephone subscriptions per 100 inhabitants | MOBILE | During the past three months, cell phone subscriptions were used per 100 inhabitants. | Alderete [85], Irene [86], Yan and Guan [87], and Jafari-Sadeghi, Garcia-Perez, Candelo and Couturier [88] |

| Percentage of Individuals using the internet | INTERNET | During the past three months, the percentage of individuals using the internet. | |

| Fixed-broadband subscriptions per 100 inhabitants | FIXEDBROAD | Fixed-broadband subscriptions (fixed subscriptions to high-speed access to the public internet) per 100 inhabitants. |

| Tea | Mobile | Internet | Fixedbroad | |

|---|---|---|---|---|

| Mean | 8.99 | 104.61 | 66.30 | 21.57 |

| Median | 7.60 | 108.60 | 72.16 | 23.96 |

| Maximum | 36.70 | 172.12 | 99.01 | 46.33 |

| Minimum | 1.50 | 14.23 | 5.08 | 0.01 |

| Std. Dev. | 5.02 | 27.97 | 22.77 | 12.83 |

| Obs (n) | 400 | 400 | 400 | 400 |

| 1 | 2 | 3 | 4 | |

|---|---|---|---|---|

| 1. TEA | 1.0000 | |||

| 2. MOBILE | 0.3640 | 1.0000 | ||

| 3. INTERNET | 0.4768 | 0.4753 | 1.0000 | |

| 4. FIXEDBROAD | 0.4153 | 0.4285 | 0.4945 | 1.0000 |

| Variables | Coefficient | Standard Errors |

|---|---|---|

| TEA (−1) | 0.8960 | (0.0562) ** |

| MOBILE | 0.0903 | (0.0040) ** |

| INTERNET | 0.0363 | (0.0053) * |

| FIXEDBROAD | 0.0550 | (0.0047) * |

| AR (1) | 0.8126 | |

| p-value (AR1) | 0.0000 | |

| AR (2) | 0.2659 | |

| p-value (AR2) | 0.7987 | |

| p-value (Hansen Test) | 0.8678 | |

| Obs. | 400 | |

| Cross Sections Included | 34 | |

| Period Included | 17 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gomes, S.; Lopes, J.M. ICT Access and Entrepreneurship in the Open Innovation Dynamic Context: Evidence from OECD Countries. J. Open Innov. Technol. Mark. Complex. 2022, 8, 102. https://doi.org/10.3390/joitmc8020102

Gomes S, Lopes JM. ICT Access and Entrepreneurship in the Open Innovation Dynamic Context: Evidence from OECD Countries. Journal of Open Innovation: Technology, Market, and Complexity. 2022; 8(2):102. https://doi.org/10.3390/joitmc8020102

Chicago/Turabian StyleGomes, Sofia, and João M. Lopes. 2022. "ICT Access and Entrepreneurship in the Open Innovation Dynamic Context: Evidence from OECD Countries" Journal of Open Innovation: Technology, Market, and Complexity 8, no. 2: 102. https://doi.org/10.3390/joitmc8020102

APA StyleGomes, S., & Lopes, J. M. (2022). ICT Access and Entrepreneurship in the Open Innovation Dynamic Context: Evidence from OECD Countries. Journal of Open Innovation: Technology, Market, and Complexity, 8(2), 102. https://doi.org/10.3390/joitmc8020102