Empirical Analysis of the Global Supply and Demand of Entrepreneurial Finance: A Random Utility Theory Perspective

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Theoretical Analysis of the Global Entrepreneurial Finance Market Dynamics

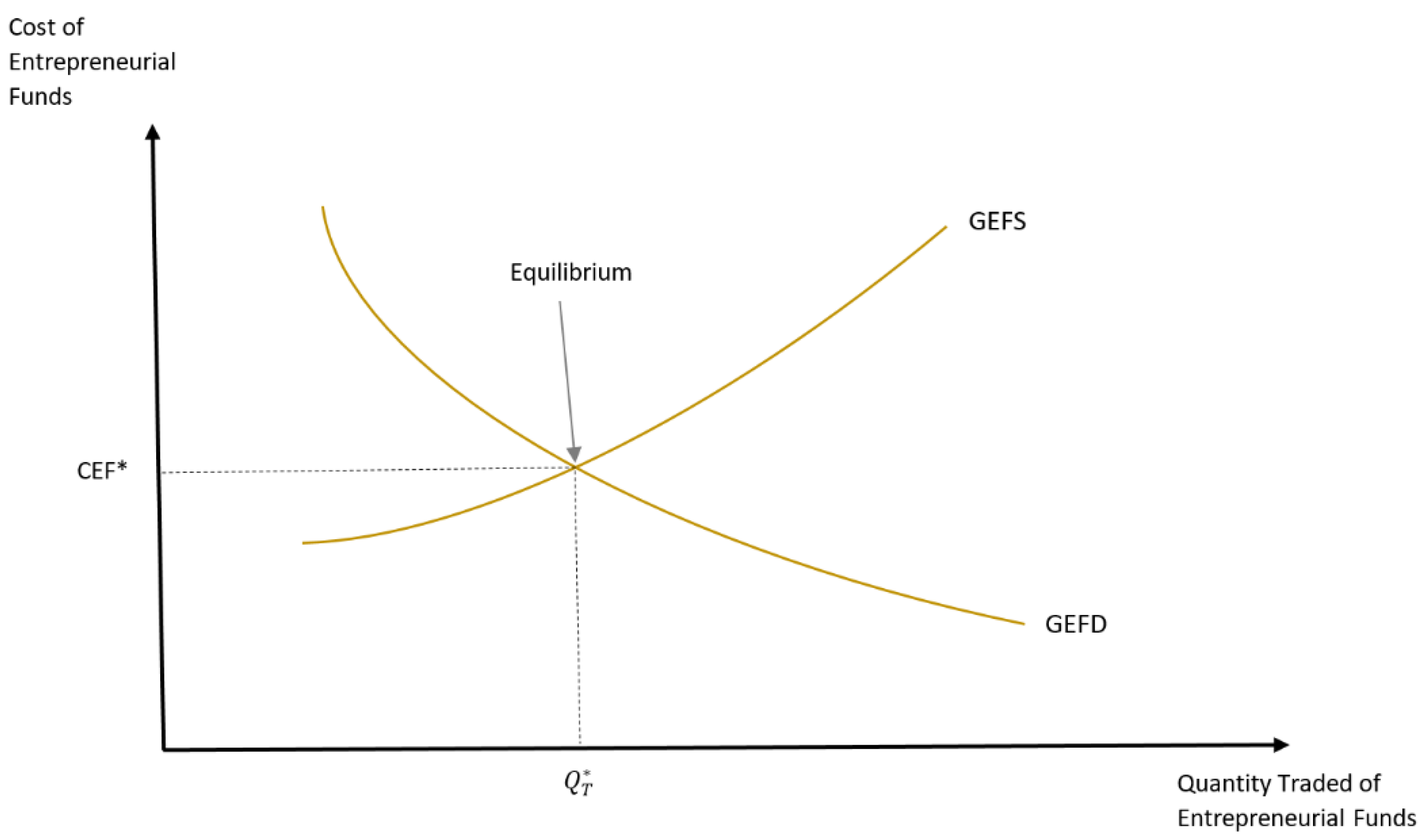

3.1.1. The Global Entrepreneurial Finance Market (GEFM)

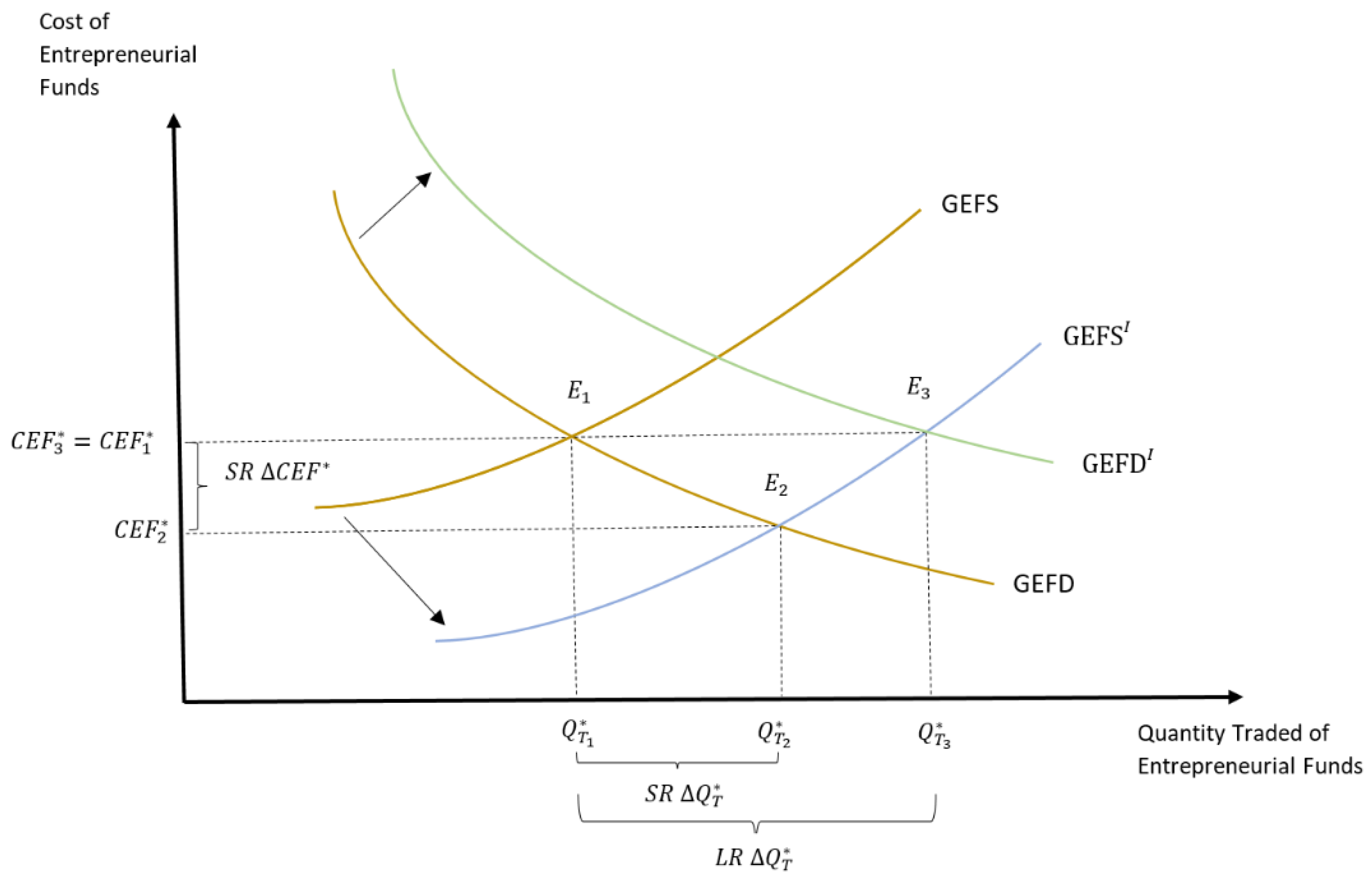

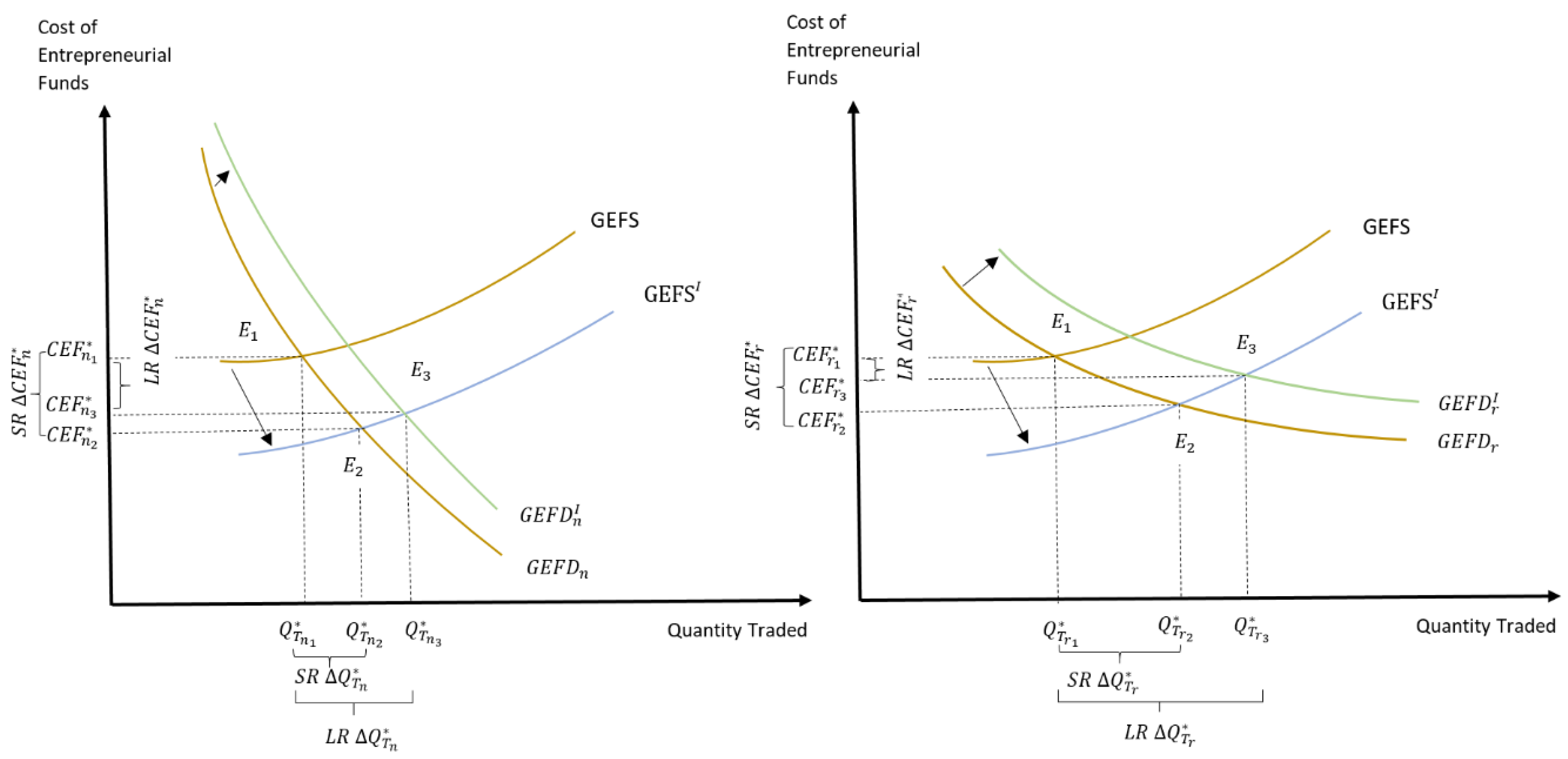

3.1.2. Public Sector and Private Sector Financial Injections and the GEFM

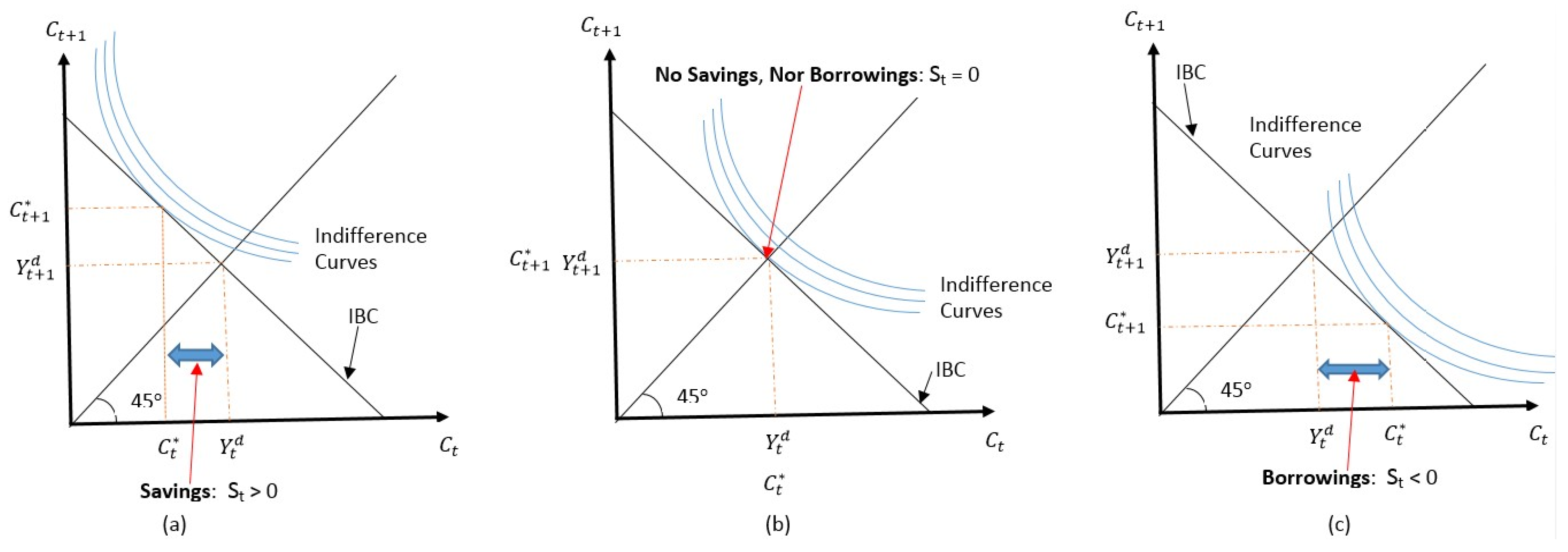

3.2. Random Utility Based Model of Individuals’ Behavioral Optimizations in the GEFM

3.3. The Description of the Data and Variables

4. Results

4.1. Descriptive Statistics of the Pooled Sample

4.2. Spatial Trends in the Global Entrepreneurial Finance Market (GEFM)

4.3. Tests for Empirical Model Validation

4.3.1. Test of Nominal Predictors Association with GEFM Outcome Indicators

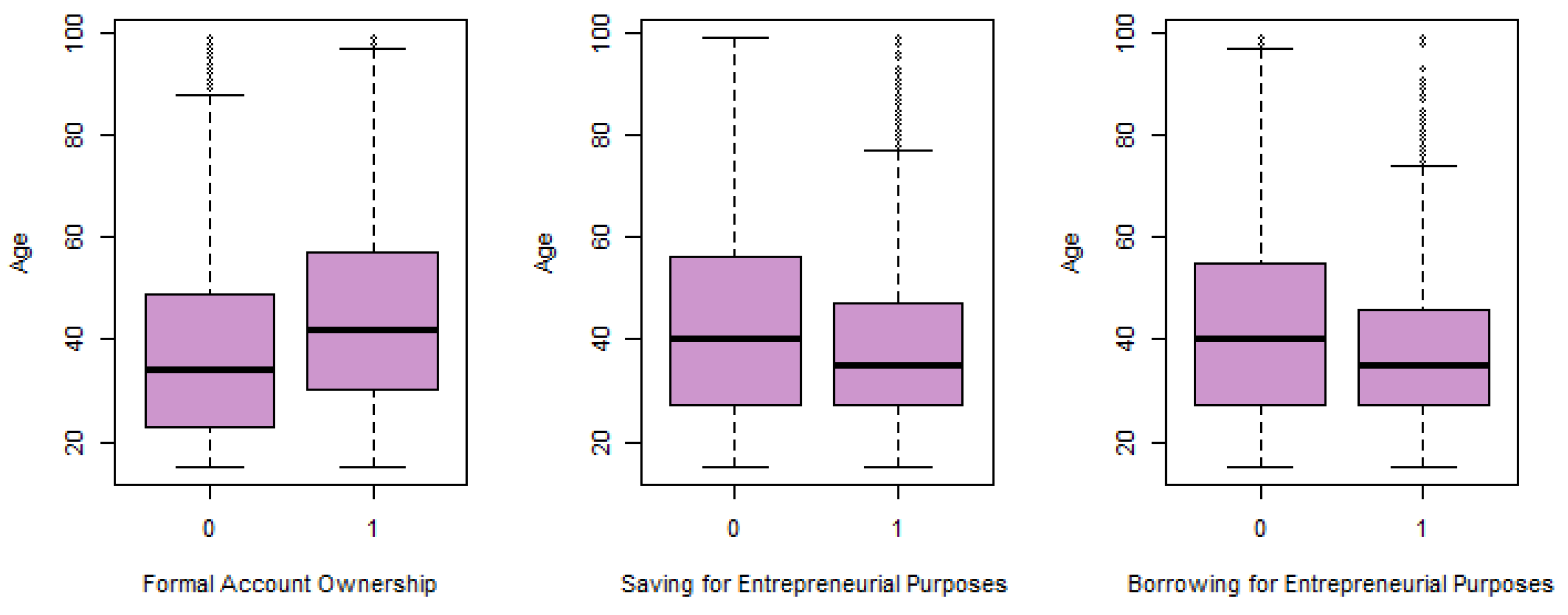

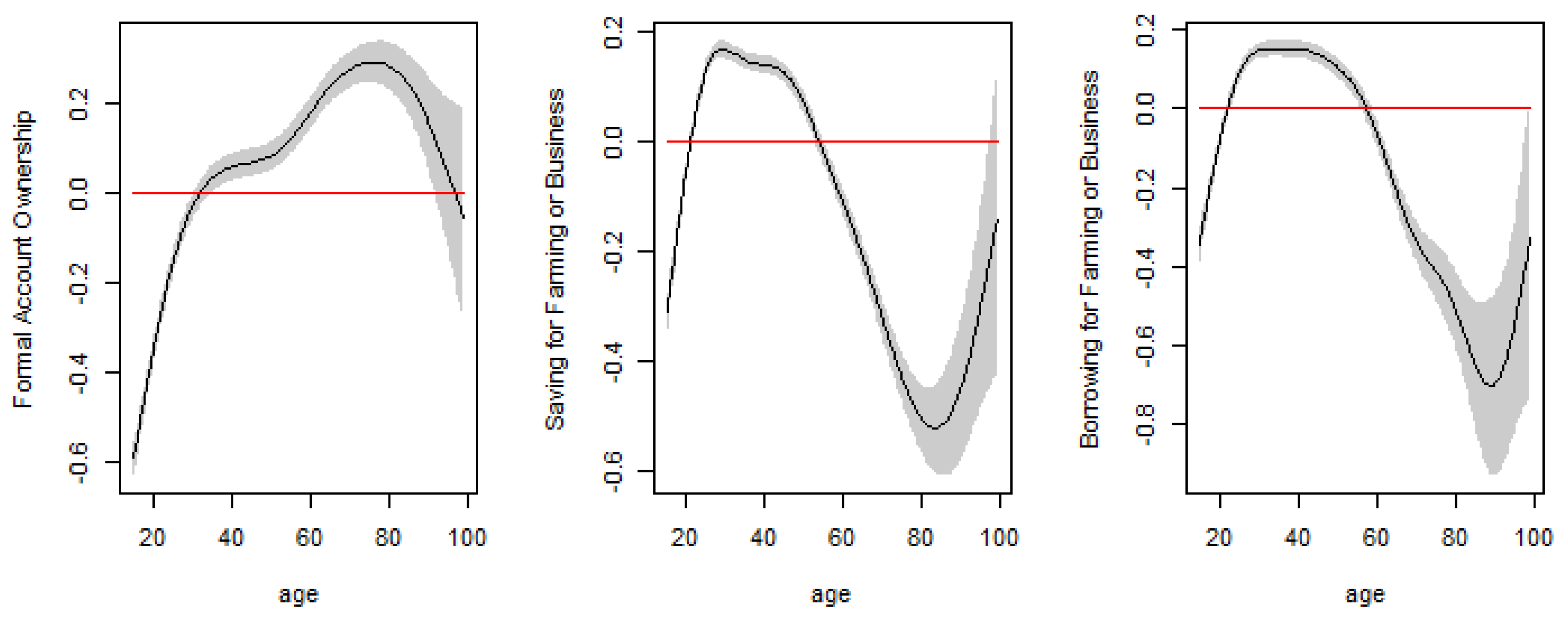

4.3.2. Test of “Age” Association with the Three GEFM Outcome Indicators

4.4. Conditional Probability Models’ Findings and Sensitivity Analysis

4.5. Marginal Effects Results of the GEFM Dynamics

4.5.1. Public Sector and Private Sector Financial Injections and the GEFM

4.5.2. The Impact of the Control Factors on the GEFM

5. Discussion

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Variable | Description |

|---|---|

| account_fin | = 1 if an individual has a formal account with a financial institution; and 0 otherwise. |

| SavFarmBusPurp12M | = 1 if an individual saved in the previous 12 months for Entrepreneurial (farming or business) purposes; and 0 otherwise. |

| BorwFarmBusPurpos12M | = 1 if an individual borrowed in the previous12 months for Entrepreneurial (farming or business) purposes; and 0 otherwise. |

| LoanFinInstHomAptLand | = 1 if an individual has a pending loan from a financial institution to purchase a home, an apartment or a land; and 0 otherwise. |

| GovTransf12m | = 1 if an individual reports any governmental support in the previous 12 months, for education, medication, unemployment, but non-inclusive of work related wages or salaries; and 0 otherwise. |

| WagPaiRec12m | = 1 if an individual reports any salary or wage payment in the previous 12 months, from an employer, but non-inclusive of payments from clients or customers for doing work; and 0 otherwise. |

| EmerFundAces | = 1 if an individual is able to come up with emergency funds, (defined as 5% of per-capita gross national income, within the next month); and 0 otherwise. |

| DebCard | = 1 if an individual has an automated tailor machine debit card; and 0 otherwise. |

| CredCard | = 1 if an individual has a credit card; and 0 otherwise. |

| InterntBasdPaymt | = 1 if an individual has made online payments in the previous 12 months, using a computer, mobile phone, or any other devices; and 0 otherwise. |

| educ | Education Level (1 if at most primary, 2 if secondary, and 3 if at least tertiary). |

| inc_q | Income quintile, based on pre-tax household income; inclusive of wages, salaries, remittances, and farming income. |

| female | = 1 if an individual of female gender; and 0 if male gender. |

| age | Individual’s Age measured in years. |

| year | Data collection period (one of 2014 or 2017). |

| economy2 | Country of residency (one of 153 nations-see Figure A1) |

| wgt | Country level final weight of each individual in the sample. |

| Quantitative Factors | Units | Pooled (2014 + 2017) Sample (N = 224,677) | |

|---|---|---|---|

| Mean | Standard Deviation | ||

| Sampling Weight (wgt) | - | 0.985 | 0.658 |

| AGE | (in years) | 41.83 | 17.53 |

| Qualitative Factors | levels | Absolute Frequency | Relative Frequency (%) |

| YEAR | 1: 2017 | 140,533 | 62.55 |

| 0: 2014 | 84,144 | 37.45 | |

| account_fin | 1: Yes | 142,085 | 63.24 |

| 0: No | 82,592 | 36.76 | |

| SavFarmBusPurp12M | 1: Yes | 33,486 | 14.90 |

| 0: No | 191,191 | 85.10 | |

| BorwFarmBusPurpos12M | 1: Yes | 15,708 | 6.99 |

| 0: No | 208,969 | 93.01 | |

| LoanFinInstHomAptLand | 1: Yes | 34,034 | 15.15 |

| 0: No | 190,643 | 84.85 | |

| GovTransf12M | 1: Yes | 33,392 | 14.86 |

| 0: No | 191,285 | 85.14 | |

| WagPaiRec12M | 1: Yes | 86,035 | 38.29 |

| 0: No | 138,642 | 61.71 | |

| EmerFundAcess | 1: Yes | 124,868 | 55.58 |

| 0: No | 99,809 | 44.42 | |

| DEBITCARD | 1: Yes | 108,526 | 48.30 |

| 0: No | 116,151 | 51.70 | |

| CREDITCARD | 1: Yes | 50,563 | 22.50 |

| 0: No | 174,114 | 77.50 | |

| InterntBasdPaymt | 1: Yes | 59,664 | 26.56 |

| 0: No | 165,013 | 73.44 | |

| FEMALE | 1: Yes | 107,144 | 47.69 |

| 0: No | 117,533 | 52.31 | |

| EDUCATION | 1: At most Primary | 68,413 | 30.45 |

| 2: Secondary | 114,096 | 50.78 | |

| 3: At least Tertiary | 42,168 | 18.77 | |

| INCOME QUINTILE | 1: Lowest 20% | 32,993 | 14.68 |

| 2: Second 20% | 37,786 | 16.82 | |

| 3: Middle 20% | 42,981 | 19.13 | |

| 4: Fourth 20% | 49,386 | 21.98 | |

| 5: Highest 20% | 61,531 | 27.39 | |

| Whole Sample (N = 224,677) | Categories | Chi2 Test | |||||

|---|---|---|---|---|---|---|---|

| Account_fin | SavFarmBusPurp12M | BorwFarmBusPurpos12M | |||||

| X-Stat | p-Value | X-Stat | p-Value | X-Stat | p-Value | ||

| GovTransf12M | 1: Yes | 8181.9 | 2.2 × 10−16 *** | 27.741 | 1.387 × 10−7 *** | 4.3873 | 0.03621 * |

| 0: No | |||||||

| WagPaiRec12M | 1: Yes | 24,083 | 2.2 × 10−16 *** | 260.26 | 2.2 × 10−16 *** | 49.056 | 2.487 × 10−12 *** |

| 0: No | |||||||

| EmerFundAcess | 1: Yes | 12,778 | 2.2 × 10−16 *** | 2790.9 | 2.2 × 10−16 *** | 103.33 | 2.2 × 10−16 *** |

| 0: No | |||||||

| DEBITCARD | 1: Yes | 117,140 | 2.2 × 10−16 *** | 295.36 | 2.2 × 10−16 *** | 232.48 | 2.2 × 10−16 *** |

| 0: No | |||||||

| CREDITCARD | 1: Yes | 33,094 | 2.2 × 10−16 *** | 325.35 | 2.2 × 10−16 *** | 8.895 | ** |

| 0: No | |||||||

| InterntBasdPaymt | 1: Yes | 32,506 | 2.2 × 10−16 *** | 987.05 | 2.2 × 10−16 *** | 26.123 | 3.203 × 10−07 *** |

| 0: No | |||||||

| FEMALE | 1: Yes | 1000.7 | 2.2 × 10−16 *** | 1848.2 | 2.2 × 10−16 *** | 532.16 | 2.2 × 10−16 *** |

| 0: No | |||||||

| EDUCATION | 1: At most Primary | 32,086 | 2.2 × 10−16 *** | 275.97 | 2.2 × 10−16 *** | 358.55 | 2.2 × 10−16 *** |

| 2: Secondary | |||||||

| 3: At least Tertiary | |||||||

| INCOMEQUINTILE | 1: Lowest 20% | 5074.9 | 2.2 × 10−16 *** | 2165.1 | 2.2 × 10−16 *** | 198.57 | 2.2 × 10−16 *** |

| 2: Second 20% | |||||||

| 3: Middle 20% | |||||||

| 4: Fourth 20% | |||||||

| 5: Highest 20% | |||||||

| YEAR | 2014 | 696.93 | 2.2 × 10−16 *** | 65.778 | × 10−16 *** | 38.647 | × 10−10 *** |

| 2017 | |||||||

| ECONOMY2 | 153 factor levels (country fixed effects) | 77,016 | 2.2 × 10−16 *** | 11,507 | 2.2 × 10−16 *** | 9423.5 | 2.2 × 10−16 *** |

| LoanFinInstHomAptLand | 1: Yes | 12,840 | 2.2 × 10−16 *** | 1000.3 | 2.2 × 10−16 *** | 3209.7 | 2.2 × 10−16 *** |

| 0: No | |||||||

| Age | ||

|---|---|---|

| Account_fin | Degree of freedom | 1 |

| F-statistic | 49.822 | |

| p-value | 1.688 × 10−12 *** | |

| SavFarmBusPurp12M | Degree of freedom | 1 |

| F-statistic | 4266.3 | |

| p-value | 2.2 × 10−16 *** | |

| BorwFarmBusPurpos12M | Degree of freedom | 1 |

| F-statistic | 2540.4 | |

| p-value | 2.2 × 10−16 *** | |

| Age | |||

|---|---|---|---|

| Account_fin | Group Mean Values | No | 37.42 |

| Yes | 44.38 | ||

| Difference in group means C. I. on the Difference in group means p-value | −6.04 (−6.189; −5.888) <2.2 × 10−16 *** | ||

| SavFarmBusPurp12M | Group Mean Values | No | 42.55 |

| Yes | 37.68 | ||

| Difference in group means C. I. on the Difference in group means p-value | 4.87 (4.701; 5.043) <2.2 × 10−16 *** | ||

| BorwFarmBusPurpos12M | Group Mean Values | No | 42.15 |

| Yes | 37.48 | ||

| Difference in group means C. I. on the Difference in group means p-value | 4.67 (4.446; 4.891) <2.2 × 10−16 *** | ||

| N = 224,677 | Fully-Parametric Specification | Semi-Parametric Specification | |||||

|---|---|---|---|---|---|---|---|

| Account_fin | SavFarmBus Purp12M | BorwFarmBusPurpos12M | Account_fin | SavFarmBus Purp12M | BorwFarmBusPurpos12M | ||

| (INTERCEPT) | −1.486 *** (0.091) | −2.621 *** (0.048) | −3.384 *** (0.074) | −0.558 *** (0.088) | −2.028 *** (0.044) | −2.619 *** (0.067) | |

| GovTransf12M | 1: Yes | 0.696 *** (0.014) | 0.103 *** (0.011) | 0.144 *** (0.013) | 0.692 *** (0.014) | 0.101 *** (0.011) | 0.143 *** (0.013) |

| WagPaiRec12M | 1: Yes | 0.403 *** (0.010) | −0.060 *** (0.008) | −0.114 ** (0.010) | 0.394 *** (0.010) | −0.071 *** (0.008) | −0.122 *** (0.010) |

| EmerFundAcess | 1: Yes | 0.223 *** (0.009) | 0.367 *** (0.008) | 0.131 *** (0.010) | 0.222 *** (0.009) | 0.366 *** (0.008) | 0.131 *** (0.010) |

| DEBITCARD | 1: Yes | 2.602 *** (0.016) | 0.199 *** (0.010) | 0.123 *** (0.012) | 2.596 *** (0.016) | 0.187 *** (0.010) | 0.115 *** (0.013) |

| CREDITCARD | 1: Yes | 0.705 *** (0.022) | 0.153 *** (0.011) | 0.203 *** (0.014) | 0.701 *** (0.023) | 0.155 *** (0.011) | 0.205 *** (0.014) |

| InterntBasdPaymt | 1: Yes | 0.313 *** (0.016) | 0.358 *** (0.010) | 0.218 *** (0.014) | 0.315 *** (0.016) | 0.355 *** (0.010) | 0.214 *** (0.014) |

| FEMALE | 1: Yes | 0.066 *** (0009) | 0.230 *** (0.007) | 0.185 *** (0.009) | 0.070 *** (0.009) | 0.234 *** (0.007) | 0.188 *** (0.009) |

| EDUCATION | 2: Secondary | 0.254 *** (0.010) | 0.007 (0.009) | −0.072 *** (0.012) | 0.249 *** (0.010) | 0.001 (0.009) | −0.077 *** (0.012) |

| 3: At least Tertiary | 0.506 *** (0.019) | 0.025 * (0.013) | −0.143 *** (0.017) | 0.478 *** (0.019) | 0.003 (0.013) | −0.159 *** (0.017) | |

| INCOME QUINTILE | 2: Second 20% | 0.052 *** (0.013) | 0.016 (0.012) | 0.011 (0.015) | 0.052 *** (0.013) | 0.016 (0.012) | 0.011 (0.015) |

| 3: Middle 20% | 0.125 *** (0.013) | 0.041 *** (0.012) | 0.008 (0.015) | 0.126 *** (0.013) | 0.041 *** (0.012) | 0.001 (0.015) | |

| 4: Fourth 20% | 0.162 *** (0.013) | 0.104 *** (0.012) | 0.004 (0.015) | 0.163 *** (0.014) | 0.104 *** (0.012) | 0.004 (0.015) | |

| 5: Highest 20% | 0.255 *** (0.014) | 0.174 *** (0.012) | 0.002 (0.015) | 0.258 *** (0.014) | 0.176 *** (0.012) | 0.018 (0.015) | |

| YEAR | 2017 | −0.051 *** (0.009) | −0.122 *** (0.008) | −0.090 *** (0.010) | −0.049 *** (0.010) | −0.120 *** (0.008) | −0.112 *** (0.010) |

| AGE | 0.034 *** (0.001) | −0.036 *** (0.001) | 0.044 *** (0.002) | <2 × 10−16 *** (edf = 7.03) | <2 × 10−16 *** (edf = 8.12) | <2 × 10−16 *** (edf = 8.69) | |

| AGE Square | −0.0003 *** (0.00001) | −0.0005 *** (0.00001) | −0.0005 *** (0.00002) | - | - | - | |

| LoanFinInstHomAptLand | 1: Yes | - | - | 0.631 *** (0.012) | - | - | 0.631 *** (0.012) |

| 0.203 * (0.194, 0.216) | 0.201 * (0.187, 0.211) | ||||||

| 0.193 * (0.178, 0.206) | 0.191 * (0.176, 0.206) | ||||||

| 0.514 * (0.504, 0.522) | 0.513 * (0.503, 0.521) | ||||||

| AIC | 363,667.3 | 363,063.5 | |||||

| BIC | 368,942 | 368,522.4 | |||||

| Variables | Account_fin | SavFarmBusPurp12M | BorwFarmBusPurpos12M | |

|---|---|---|---|---|

(s.e.) | (s.e.) | (s.e.) | ||

| GovTransf12M | 1: Yes | 0.077 *** (0.0018) | 0.020 *** (0.0022) | 0.014 *** (0.0014) |

| WagPaiRec12M | 1: Yes | 0.065 *** (0.0018) | −0.016 *** (0.0016) | −0.013 *** (0.0008) |

| EmerFundAcess | 1: Yes | 0.038 *** (0.0016) | 0.070 *** (0.0015) | 0.011 *** (0.0008) |

| DEBITCARD | 1: Yes | 0.451 *** (0.0044) | 0.038 *** (0.0019) | 0.008 *** (0.0011) |

| CREDITCARD | 1: Yes | 0.086 *** (0.0024) | 0.033 *** (0.0023) | 0.020 *** (0.0016) |

| InterntBasdPaymt | 1: Yes | 0.046 *** (0.0022) | 0.078 *** (0.0025) | 0.023 *** (0.0015) |

| FEMALE | 1: Yes | 0.008 *** (0.0014) | 0.046 *** (0.0014) | 0.016 *** (0.0008) |

| EDUCATION | 2: Secondary | 0.045 *** (0.0018) | 0.003 (0.0019) | −0.006 *** (0.0011) |

| 3: At least Tertiary | 0.068 *** (0.0021) | 0.006 * (0.0026) | −0.012 *** (0.0013) | |

| INCOME QUINTILE | 2: Second 20% | 0.009 *** (0.0021) | 0.006 * (0.0027) | 0.001 (0.0015) |

| 3: Middle 20% | 0.019 *** (0.0020) | 0.012 *** (0.0026) | 0.001 (0.0014) | |

| 4: Fourth 20% | 0.024 *** (0.0020) | 0.024 *** (0.0027) | 0.001 (0.0014) | |

| 5: Highest 20% | 0.041 *** (0.0020) | 0.039 *** (0.0027) | 0.001 (0.0014) | |

| YEAR | 2017 | −0.009 *** (0.0015) | −0.023 *** (0.0015) | −0.009 *** (0.0010) |

| AGE | 0.005 *** (0.0002) | 0.007 *** (0.0002) | 0.004 *** (0.0002) | |

| AGE Square | −0.00004 *** (0.000002) | −0.00009 *** (0.000003) | −0.00005 *** (0.000002) | |

| LoanFinInstHomAptLand | 1: Yes | - | - | 0.097 *** (0.0022) |

Appendix B

References

- Block, J.H.; Colombo, M.G.; Cumming, D.J.; Vismara, S. New players in entrepreneurial Finance and why they are there. Small Bus. Econ. 2018, 50, 239–250. [Google Scholar] [CrossRef] [Green Version]

- Klein, M.; Neitzert, F.; Hartmann-Wendels, T.; Kraus, S. Start-up Financing in the Digital Age–A Systematic Review and Comparison of New Forms of Financing. J. Entrep. Financ. 2020, 21, 46–98. [Google Scholar]

- Bellavitis, C.; Filatotchev, I.; Kamuriwo, D.S.; Vanacker, T. Entrepreneurial finance: New Frontiers of research and practice: Editorial for the special issue embracing entrepreneurial funding innovations. Ventur. Cap. 2017, 19, 16. [Google Scholar] [CrossRef] [Green Version]

- Bertoni, F.; Martí, J.; Reverte, C. The impact of government-supported participative loans on the growth of entrepreneurial ventures. Res. Policy 2019, 48, 371–384. [Google Scholar] [CrossRef]

- Cumming, D.; Groh, A.P. Entrepreneurial finance: Unifying themes and future directions. J. Corp. Finance 2018, 50, 538–555. [Google Scholar] [CrossRef]

- Nguyen, M.-H.; Pham, T.-H.; Ho, M.-T.; Nguyen, H.T.T.; Vuong, Q.-H. On the social and conceptual structure of the 50-year research landscape in entrepreneurial finance. SN Bus. Econ. 2020, 1, 29. [Google Scholar] [CrossRef]

- Salman, A.; Jamil, S. Entrepreneurial finance and its impact on e-business. Probl. Perspect. Manag. 2017, 15, 24–41. [Google Scholar] [CrossRef] [Green Version]

- Lindholm-Dahlstrand, Å.; Andersson, M.; Carlsson, B. Entrepreneuria experimentation: A Key function in systems of innovation. Small Bus. Econ. 2019, 3, 591–610. [Google Scholar] [CrossRef] [Green Version]

- Kohn, M. A loanable funds theory of unemployment and monetary disequilibrium. Am. Econ. Rev. 1981, 71, 859–879. [Google Scholar]

- Tsiang, S.C. Loanable Funds. In Money; Palgrave Macmillan: London, UK, 1989; pp. 190–194. [Google Scholar]

- Cavallo, E.; Eichengreen, B.; Panizza, U. Can Countries Rely on Foreign Saving for Investment and Economic Development? Rev. World Econ. 2018, 154, 277–306. [Google Scholar] [CrossRef] [Green Version]

- Niankara, I. Government and private sectors’ electronic transfer practices and financial inclusion in the economic community of the West African States. Int. J. Financ. Econ. 2020, 1–30. [Google Scholar] [CrossRef]

- Lambsdorff, J.G. Savings and investments—an old debate in times of trouble. J. Post Keynes. Econ. 2011, 33, 645–666. [Google Scholar] [CrossRef]

- Virick, M.; Basu, A.; Rogers, A. Antecedents of Entrepreneurial Intention among Laid-Off Individuals: A Cognitive Appraisal Approach. J. Small Bus. Manag. 2013, 53, 450–468. [Google Scholar] [CrossRef]

- Anjum, T.; Farrukh, M.; Heidler, P.; Díaz Tautiva, J.A. Entrepreneurial Intention: Creativity, Entrepreneurship, and University Support. J. Open Innov. Technol. Mark. Complex. 2021, 7, 13. [Google Scholar] [CrossRef]

- Agu, A.G.; Kalu, O.O.; Esi-Ubani, C.O.; Agu, P.C. Drivers of sustainable Entrepreneurial intentions among university students: An integrated model from a developing world context. Int. J. Sustain. High. Educ. 2021, 22, 659–680. [Google Scholar] [CrossRef]

- Soto-Simeone, A.; Kautonen, T. senior entrepreneurship following unemployment: A Social identity theory perspective. Rev. Manag. Sci. 2020, 15, 1683–1706. [Google Scholar] [CrossRef]

- Tenca, F.; Croce, A.; Ughetto, E. Business Angels Research in Entrepreneurial Finance: A Literature Review and a Research Agenda. J. Econ. Surv. 2018, 32, 1384–1413. [Google Scholar] [CrossRef]

- Mason, C.; Botelho, T.; Harrison, R. The changing nature of angel investing: Some research implications. Ventur. Cap. 2019, 21, 177–194. [Google Scholar] [CrossRef]

- Vincenzo, B.; Annalisa, C.; Elisa, U. Network dynamics in business angel group Investment decisions. J. Corp. Financ. 2020, 66, 101812. [Google Scholar]

- Cavallo, A.; Ghezzi, A.; Dell’Era, C.; Pellizzoni, E. Fostering digital entrepreneurship from startup to scaleup: The role of venture capital funds and angel groups. Technol. Forecast. Soc. Chang. 2019, 145, 24–35. [Google Scholar] [CrossRef]

- Lerner, J.; Nanda, R. Venture Capital’s Role in Financing Innovation: What We Know and How Much We Still Need to Learn. J. Econ. Perspect. 2020, 34, 237–261. [Google Scholar] [CrossRef]

- McCarthy, S.; Oliver, B.; Verreynne, M.-L. Bank financing and credit rationing of Australian SMEs. Aust. J. Manag. 2017, 42, 58–85. [Google Scholar] [CrossRef]

- Bedendo, M.; Siming, L. Bank financing and credit ratings. Appl. Econ. Lett. 2020, 27, 965–970. [Google Scholar] [CrossRef]

- Tykvová, T. Venture capital and private equity financing: An overview of recent literature and an agenda for future research. J. Bus. Econ. 2018, 88, 325–362. [Google Scholar] [CrossRef]

- Stulz, R.M. Public versus private equity. Oxf. Rev. Econ. Policy 2020, 36, 275–290. [Google Scholar] [CrossRef]

- Billah, M.S. Islamic Lease Financing (Al-Ijarah). In Islamic Financial Products; Palgrave Macmillan: Cham, Switzerland, 2019; pp. 227–241. [Google Scholar]

- Abdulkarim, U.F.; Mohammed, L.; Musa-Mubi, A. Lease Finance in Nigeria: Current Status, Challenges and Future Prospects. J. Account. Res. Organ. Econ. 2020, 3, 172–181. [Google Scholar] [CrossRef]

- Martínez-Sola, C.; García-Teruel, P.J.; Martínez-Solano, P. SMEs access to finance and the value of supplier financing. Span. J. Financ. Account./Rev. Esp. Financ. Contab. 2017, 46, 455–483. [Google Scholar] [CrossRef]

- Lin, Q.; Peng, Y.; Hu, Y. Supplier financing service decisions for a capital-constrained Supply chain: Trade credit vs. combined credit financing. J. Ind. Manag. Optim. 2020, 16, 1731–1752. [Google Scholar] [CrossRef]

- Munim, Z.H.; Shneor, R.; Adewumi, O.M.; Shakil, M.H. Determinants of crowdfunding Intention in a developing economy: Ex-ante evidence from Bangladesh. Int. J. Emerg. Mark. 2020, 16, 1105–1125. [Google Scholar] [CrossRef]

- De Crescenzo, V.; Botella-Carrubi, D.; García, M.R. Civic crowdfunding: A new Opportunity for local governments. J. Bus. Res. 2021, 123, 580–587. [Google Scholar] [CrossRef]

- Ackermann, E.; Bock, C.; Bürger, R. Democratising Entrepreneurial Finance: The Impact of Crowdfunding and Initial Coin Offerings (ICOs). In Contemporary Developments in Entrepreneurial Finance; Springer: Cham, Switzerland, 2020; pp. 277–308. [Google Scholar]

- Howell, S.T.; Niessner, M.; Yermack, D. Initial Coin Offerings: Financing Growth with Cryptocurrency Token Sales. Rev. Financial Stud. 2020, 33, 3925–3974. [Google Scholar] [CrossRef] [Green Version]

- Bellavitis, C.; Fisch, C.; Wiklund, J. A comprehensive review of the global development of initial coin offerings (ICOs) and their regulation. J. Bus. Ventur. Insights 2021, 15, e00213. [Google Scholar] [CrossRef]

- Efrat, K.; Gilboa, S.; Wald, A. The emergence of well-being in crowdfunding: A study of Entrepreneurs and backers of reward and donation campaigns. Int. J. Entrep. Behav. Res. 2020, 27, 397–415. [Google Scholar] [CrossRef]

- Nandru, P.; Chendragiri, M.; Velayutham, A. Examining the influence of financial inclusion on financial well-being of marginalized street vendors: An empirical evidence from India. Int. J. Soc. Econ. 2021, 48, 1139–1158. [Google Scholar] [CrossRef]

- Lee, L.F.; Porter, R.H. Switching regression models with imperfect sample separation Information–with an application on cartel stability. Econom. J. Econom. Soc. 1984, 52, 391–418. [Google Scholar] [CrossRef] [Green Version]

- Niankara, I.; Muqattash, R.; Niankara, A.; Traoret, R.I. COVID-19 Vaccine Development in a Quadruple Helix Innovation System: Uncovering the Preferences of the Fourth Helix in the UAE. J. Open Innov. Technol. Mark. Complex. 2020, 6, 25. [Google Scholar] [CrossRef]

- R Core Team. R: A Language and Environment for Statistical Computing; R Foundation for Statistical Computing: Vienna, Austria, 2015; Available online: https://www.R-project.org/ (accessed on 17 August 2019).

- Wojtys, M.; Marra, G.; Radice, R. Copula based generalized additive models for location, Scale and shape with non-random sample selection. Comput. Stat. Data Anal. 2018, 127, 14. [Google Scholar] [CrossRef]

- Fernihough, A. Mfx: Marginal Effects, Odds Ratios and Incidence Rate Ratios for GLMs. R Package Version, 1.2-2. 2019. Available online: https://cran.r-project.org/web/packages/mfx/mfx.pdf (accessed on 22 November 2020).

- Wood, M.; McKinley, W.; Engstrom, C.L. Endings and visions of new beginnings: The Effects of source of unemployment and duration of unemployment on entrepreneurial intent. Entrep. Res. J. 2013, 3, 171–206. [Google Scholar] [CrossRef] [Green Version]

- Ozaralli, N.; Rivenburgh, N.K. Entrepreneurial intention: Antecedents to entrepreneurial behavior in the U.S.A. and Turkey. J. Glob. Entrep. Res. 2016, 6, 32. [Google Scholar] [CrossRef] [Green Version]

- Eneji, R.I.; Nwbagbara, E.N.; Kati, G.K. Entrepreneurship Training for Mitigating Unemployment in Nigeria: How have the Tertiary Institutions Fared? J. Soc. Econ. Res. 2020, 7, 42–50. [Google Scholar] [CrossRef]

- World Bank. Global Outlook: Pandemic, Recession: The Global Economy in Crisis; World Bank Group: Washington, DC, USA, 2020; pp. 1–66. [Google Scholar] [CrossRef]

- Essel, E.O.; Min, W.; Essel, C.H.; Dumor, K. Unemployment Blues: Analysis of the Dual Mediating Effects of Knowledge and Perception on Entrepreneurial Intentions in the Environment. SAGE Open 2020, 10, 13. [Google Scholar] [CrossRef]

- Gonzalez, L.; Cernev, A.K.; de Araujo, M.H.; Diniz, E.H. Digital complementary currencies and public policies during the COVID-19 pandemic. Rev. Adm. Pública 2020, 54, 1146–1160. [Google Scholar] [CrossRef]

- Adegbite, O.O.; Machethe, C.L. Bridging the financial inclusion gender gap in smallholder agriculture in Nigeria: An untapped potential for sustainable development. World Dev. 2020, 127, 104755. [Google Scholar] [CrossRef]

- Elam, A.B.; Brush, C.G.; Greene, P.G.; Baumer, B.; Dean, M.; Heavlow, R. Global Entrepreneurship Monitor 2018/2019 Women’s Entrepreneurship Report. Babson College, Smith College, and the Global Entrepreneurship Research Association (GERA). 21 July 2020. Available online: https://www.gemconsortium.org/report/gem-20182019-womensentrepreneurship-report (accessed on 22 November 2020).

- Ramadani, V.; Hisrich, R.D.; Gërguri-Rashiti, S. Female entrepreneurs in transition Economies: Insights from Albania, Macedonia and Kosovo. World Rev. Entrep. Manag. Sustain. Dev. 2015, 11, 391–413. [Google Scholar] [CrossRef]

- Brush, C.; Edelman, L.F.; Manolova, T.; Welter, F. A gendered look at entrepreneurship ecosystems. Small Bus. Econ. 2018, 53, 393–408. [Google Scholar] [CrossRef]

- Hechavarria, D.; Bullough, A.; Brush, C.; Edelman, L. High growth women’s Entrepreneurship: Fueling social and economic development. J. Small Bus. Manag. 2019, 57, 5–13. [Google Scholar] [CrossRef] [Green Version]

- Bullough, A.; Guelich, U.; Manolova, T.S.; Schjoedt, L. Women’s entrepreneurship and culture: Gender role expectations and identities, societal culture, and the entrepreneurial environment. Small Bus. Econ. 2021, 1–12. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Niankara, I. Empirical Analysis of the Global Supply and Demand of Entrepreneurial Finance: A Random Utility Theory Perspective. J. Open Innov. Technol. Mark. Complex. 2022, 8, 26. https://doi.org/10.3390/joitmc8010026

Niankara I. Empirical Analysis of the Global Supply and Demand of Entrepreneurial Finance: A Random Utility Theory Perspective. Journal of Open Innovation: Technology, Market, and Complexity. 2022; 8(1):26. https://doi.org/10.3390/joitmc8010026

Chicago/Turabian StyleNiankara, Ibrahim. 2022. "Empirical Analysis of the Global Supply and Demand of Entrepreneurial Finance: A Random Utility Theory Perspective" Journal of Open Innovation: Technology, Market, and Complexity 8, no. 1: 26. https://doi.org/10.3390/joitmc8010026

APA StyleNiankara, I. (2022). Empirical Analysis of the Global Supply and Demand of Entrepreneurial Finance: A Random Utility Theory Perspective. Journal of Open Innovation: Technology, Market, and Complexity, 8(1), 26. https://doi.org/10.3390/joitmc8010026