Red Queen Effect in German Bank Industry: Implication of Banking Digitalization for Open Innovation Dynamics

Abstract

1. Introduction

2. Literature Review

3. Research Method

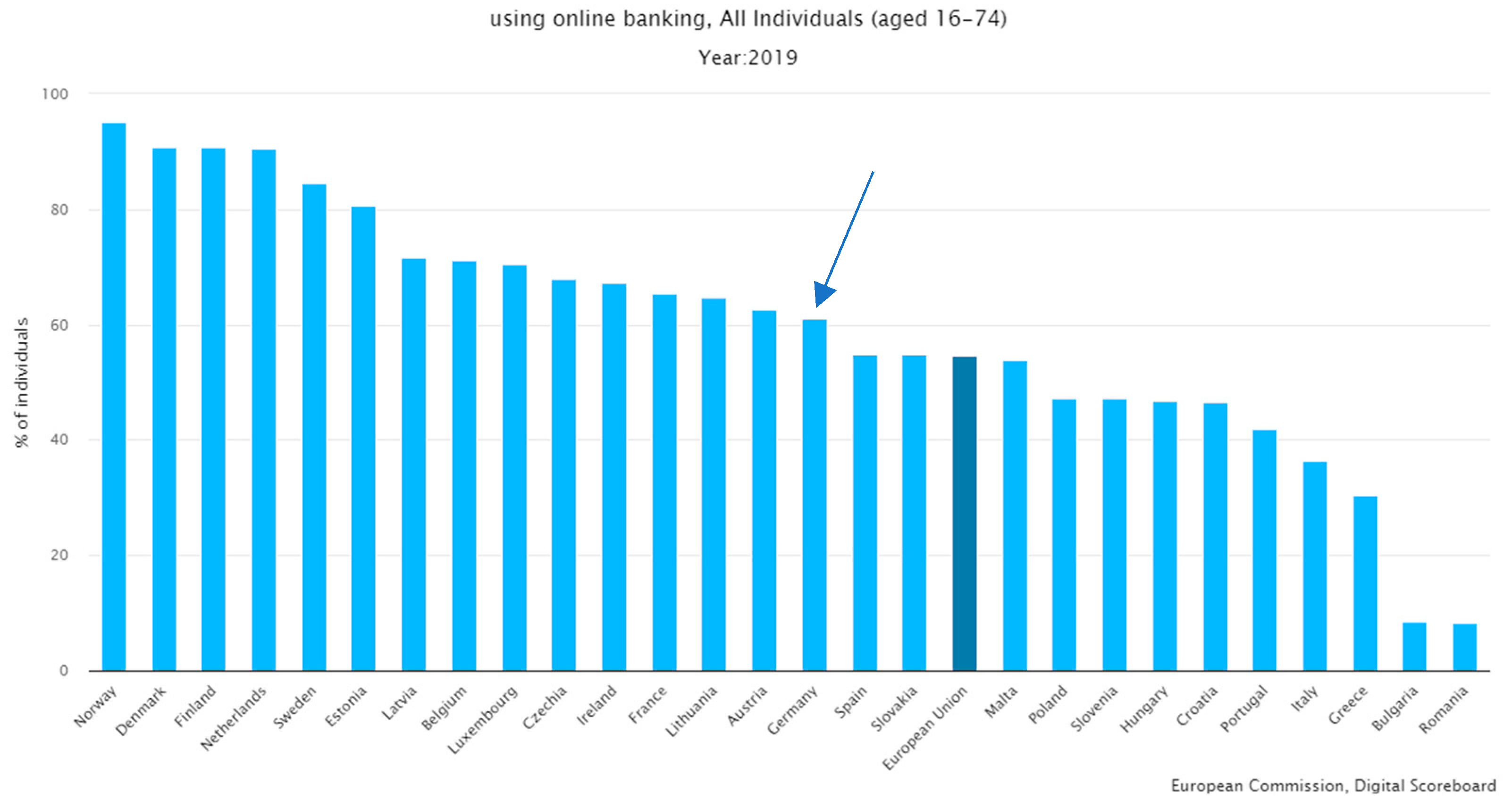

4. Analysis

4.1. Deutsche Bank AG (DB)

4.2. Corporate Division Overview

4.3. Value Chain of the Retail Banking Business

4.4. Product Mix

4.5. SWOT Analysis

4.5.1. Strength

4.5.2. Weakness

4.5.3. Opportunity

4.5.4. Threats

5. Retail Banking Sector

5.1. General External Environment and Influence

5.2. Competitor Analysis

5.3. European Banking Sector

6. Discussion: Red Queen Effect in the Banking Industry, and Open Innovation Dynamics

6.1. Discussion: Competitive Dynamics in Banking Digitalization and Red Queen Effect

6.2. Discussion: The Relation among Banking Digitalization, Red Queen Effect, and Open Innovation Dynamics

7. Conclusions

7.1. Findings of This Research

7.2. Practical and Theoretical Implications

7.3. Limitations and Future Research Topics

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Derfus, P.J.; Maggitti, P.G.; Grimm, C.M.; Smith, K.G. The Red Queen effect: Competitive actions and firm performance. Acad. Manag. J. 2008, 51, 61–80. [Google Scholar] [CrossRef]

- Argote, L. Organizational Learning: Creating, Retaining and Transferring Knowledge; Springer Science & Business Media: New York, NY, USA, 2012; pp. 321–331. [Google Scholar]

- Greve, H.R. Organizational Learning from Performance Feedback: A Behavioral Perspective on Innovation and Change; Cambridge University Press: Cambridge, UK, 2003. [Google Scholar]

- Pope, S. Deutsche Bank: The End of Ambition. Forbes. 7 January 2020. Available online: https://www.forbes.com/sites/stephenpope/2020/01/06/deutsche-bank-the-end-of-ambition/?sh=60e124ed16ca (accessed on 23 February 2021).

- JahanZaib Mehmood, F.G. Deutsche Bank Must Regain i-Bank Market Share in 2018 to Reassure Investors. 8 January 2018. Available online: https://www.spglobal.com/marketintelligence/en/news-insights/trending/dejke2nq3104fxttwyjq3w2 (accessed on 22 February 2021).

- Barnett, W.P.; Hansen, M.T. The red queen in organizational evolution. Strateg. Manag. J. 1996, 17, 139–157. [Google Scholar] [CrossRef]

- Ketchen, D.J., Jr.; Snow, C.C.; Hoover, V.L. Research on competitive dynamics: Recent accomplishments and future challenges. J. Manag. 2004, 30, 779–804. [Google Scholar] [CrossRef]

- Hitt, M.A.; Boyd, B.K.; Li, D. The state of strategic management research and a vision of the future. In Research Methodology in Strategy and Management; Emerald Group Publishing Limited: Bingley, UK, 2004. [Google Scholar]

- Criscuolo, C.; Haskel, J.; Martin, R. Import competition, productivity, and restructuring in UK manufacturing. Oxf. Rev. Econ. Pol. 2004, 20, 393–408. [Google Scholar] [CrossRef]

- Giachetti, C.; Lampel, J.; Pira, S.L. Red queen competitive imitation in the UK mobile phone industry. Acad. Manag. J. 2017, 60, 1882–1914. [Google Scholar] [CrossRef]

- Carroll, L. The Annotated Alice: ’Alice’s Adventures in Wonderland and Through the Looking-Glass, Illustrated by J. Tenniel, with an Introduction and Notes by M. Gardner; The New American Library: New York, NY, USA, 1960; p. 345. [Google Scholar]

- Baumol, W.J. Red-Queen games: Arms races, rule of law and market economies. J. Evol. Econ. 2004, 14, 237–247. [Google Scholar] [CrossRef]

- Dawkins, R.; Krebs, J.R. Arms races between and within species. Proceedings of the Royal Society of London. Ser. B Biol. Sci. 1979, 205, 489–511. [Google Scholar]

- Banker, R.; Cao, Z.; Menon, N.M.; Mudambi, R. The Red Queen in action: The longitudinal effects of capital investments in the mobile telecommunications sector. Ind. Corp. Chang. 2013, 22, 1195–1228. [Google Scholar] [CrossRef]

- McKendrick, D.G.; Barnett, W.P. The Organizational Evolution of Global Technological Competition; The Information Storage Industry Center: La Jolla, CA, USA, 2001. [Google Scholar]

- Barnett, W.P.; McKendrick, D.G. Why are some organizations more competitive than others? Evidence from a changing global market. Admin. Sci. Quart. 2004, 49, 535–571. [Google Scholar] [CrossRef]

- Barnett, W.P.; Pontikes, E.G. The Red Queen, success bias, and organizational inertia. Manag. Sci. 2008, 54, 1237–1251. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Graebner, M.E. Theory building from cases: Opportunities and challenges. Acad. Manag. J. 2007, 50, 25–32. [Google Scholar] [CrossRef]

- Gerring, J. What is a case study and what is it good for? Am. Polit. Sci. Rev. 2004, 341–354. Available online: https://www.jstor.org/stable/4145316?seq=1 (accessed on 8 March 2021). [CrossRef]

- Pettigrew, A.M. The character and significance of strategy process research. Strateg. Manag. J. 1992, 13, 5–16. [Google Scholar] [CrossRef]

- Eisenhardt, K.M. Building theories from case study research. Acad. Manag. Rev. 1989, 14, 532–550. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Methods, 4th ed.; Sage: Thousand Oaks, CA, USA, 2009. [Google Scholar]

- Stake, R.E. The Art of Case Study Research; Sage: Thousand Oaks, CA, USA, 1995. [Google Scholar]

- Siggelkow, N. Persuasion with case studies. Acad. Manag. J. 2007, 50, 20–24. [Google Scholar] [CrossRef]

- Easterby-Smith, M.; Lyles, M.A.; Peteraf, M.A. Dynamic capabilities: Current debates and future directions. Brit. J. Manag. 2009, 20, S1–S8. [Google Scholar] [CrossRef]

- Gaya, H.J.; Smith, E.E. Developing a qualitative single case study in the strategic management realm: An appropriate research design. Int. J. Bus. Manag. Econ. Res. 2016, 7, 529–538. [Google Scholar]

- Deutsche Bank. Deutsche Bank 1870–2010. Available online: http://www.bankgeschichte.de/en/docs/Chronik_D_Bank.pdf (accessed on 23 November 2019).

- Amadeo, K. Retail Banking, Its Types and Economic Impact. Available online: https://www.thebalance.com/what-is-retail-banking-3305885 (accessed on 24 November 2019).

- Desmangles, L.E. Global Retail Banking 2018: The Power of Personalization. (BCG, Editor). Available online: https://www.bcg.com/publications/2018/global-retail-banking-2018-power-personalization.aspx (accessed on 29 November 2019).

- Deutsche Bank. Online Banking. Available online: https://www.deutsche-bank.de/pk/digital-banking/online-banking/Leistungen-im-Ueberblick.html#parsys-headline_362805482-headlineparsys-accordion-accordionParsys-accordionentry_copy (accessed on 29 November 2019).

- Deutsche Bank. Deutsche Bank der Konzern im Überblick. Available online: https://www.db.com/newsroom_news/Finanzdaten_im_Ueberblick_und_Konzern-GuV_Q1_2019.pdf (accessed on 23 November 2019).

- Deutsche Bank. Geschäftsbericht DB Privat- und Firmenkundenbank AG: 2018 Deutlich Verbessertes Ergebnis vor Steuern und Fortschritte bei der Integration der Postbank. Available online: https://www.db.com/newsroom_news/2019/geschaeftsbericht-db-privat-und-firmenkundenbank-ag-2018-deutlich-verbessertes-ergebnis-vor-steuern-und-fortschr-de-11453.htm (accessed on 16 December 2019).

- Deutsche Bank. Deutsche Bank Erzielt Ersten Jahresgewinn nach Steuern seit 2014 und Erreicht Finanzziele für 2018. Available online: https://www.db.com/newsroom_news/2018/deutsche-bank-erzielt-ersten-jahresgewinn-nach-steuern-seit-2014-und-erreicht-finanzziele-fuer-2018-de-11787.htm (accessed on 23 November 2019).

- Deutsche Bank. Strategy. Available online: https://www.db.com/company/en/our-strategy.htm (accessed on 24 November 2019).

- Deutsche Bank. Annual Report 2018. Available online: https://www.db.com/ir/en/annual-reports.htm?fbclid=IwAR2RBOU1wmXPjgbzsBTWZPiJiSxYwwsjkhebOxgUnGqpQ8AnohLrtXQCeP4 (accessed on 18 December 2019).

- Flinders, K. Deutsche Bank to Set Up Innovation Division to Drive Digital Transformation. Retrieved 20 December 2019. Available online: https://www.computerweekly.com/news/252471964/Deutsche-Bank-to-set-up-innovation-division?fbclid=IwAR1ygfXIw7rXzaUaivIBTaaV7Nk_KCYVteLwhP-Phe-n2rTjAK23ZtZRmbI (accessed on 12 December 2019).

- McKinsey. Rewriting the Rules in Retail Banking. Available online: https://www.mckinsey.com/industries/financial-services/our-insights/rewriting-the-rules-in-retail-banking?fbclid=IwAR2NSmmJtd05d1-eZRkm96XXFtd85kqmll_KMql-CsZPo3cg8G_B8BZC8Rw (accessed on 18 December 2019).

- Deutsche Bank. Available online: https://www.deutsche-bank.de/pk.html (accessed on 20 December 2019).

- Fern Fort University. Deutsche Bank SWOT Analysis/Matrix. Available online: http://fernfortuniversity.com/term-papers/swot/1433/1120-deutsche-bank.php (accessed on 20 December 2019).

- Reed, E. Retail Banking vs. Commercial Banking. Available online: https://www.thestreet.com/markets/retail-banking-vs-commercial-banking-15109546 (accessed on 19 December 2019).

- Deutscher Bundestag. Bankensystem und Bankenaufsicht in Deutschland. Available online: https://www.bundestag.de/resource/blob/409624/7592c651aef84a826a8e2251d4d676ff/WD-4-094-09-pdf-data.pdf (accessed on 16 December 2019).

- Holtermann, F.; Atzler, E.; Kröner, A. Deutsche Onlinebanken Wachsen Rasant—2020 Soll der Durchbruch Gelingen. 8 December 2019. Available online: https://www.handelsblatt.com/finanzen/banken-versicherungen/finanzinstitute-deutsche-onlinebanken-wachsen-rasant-2020-soll-der-durchbruch-gelingen/25294504.html?ticket=ST-37050652-iXUmxqUQkDylmfFG4Fjh-ap1 (accessed on 20 December 2019).

- Duran, C. Tech Disruption in Retail Banking: German Banks Have Little Time for Digital Catch-Up. Available online: https://www.spglobal.com/en/research-insights/articles/tech-disruption-in-retail-banking-german-banks-have-little-time-for-digital-catch-up (accessed on 19 December 2019).

- Disselhoff, F. Warum Amazon Schon Längst Eine Bank Ist. Available online: https://financefwd.com/de/warum-amazon-schon-langst-eine-bank-ist/ (accessed on 12 December 2019).

- ING-DiBa. Impresum. 2019. Available online: https://www.ing.de/ueber-uns/unternehmen/impressum/ (accessed on 16 December 2019).

- Sparkase Frankfurt. Available online: https://www.frankfurter-sparkasse.de/de/home.html (accessed on 16 December 2019).

- Volksbanken Raiffeisenbanken. Available online: https://www.vr.de/privatkunden.html (accessed on 16 December 2019).

- ING-DiBa. Available online: https://www.ing.de/ (accessed on 16 December 2019).

- ING-DiBa. Unternehmen. Available online: https://www.ing.de/ueber-uns/unternehmen/ (accessed on 16 December 2019).

- ING-DiBa. Konzernlagebericht und Konzernabschluss 2018. Available online: https://www.ing.de/binaries/content/assets/pdf/ueber-uns/presse/publikationen/geschaftsbericht-2018-der-ing-holding-deutschland-gmbh.pdf (accessed on 16 December 2019).

- N26. Impressum. Available online: https://n26.com/de-de/impressum (accessed on 19 December 2019).

- Statista. Statistiken zur Commerzbank AG. Available online: https://de.statista.com/themen/210/commerzbank-ag/ (accessed on 16 December 2019).

- Deutsche Bank. Geschäftsbericht 2018. Available online: https://www.db.com/ir/de/download/DB_PFK_GB_2018_D.pdf (accessed on 16 December 2019).

- Finanzgruppe Deutscher Sparkassen- und Giroverband. Finanzbericht: Geschäftszahlen–Zahlen und Fakten 2018. Available online: https://www.dsgv.de/sparkassen-finanzgruppe/publikationen/finanzbericht.html (accessed on 16 December 2019).

- DNB ASA. Om oss. Available online: https://www.dnb.no/om-oss/om-dnb.html (accessed on 15 December 2019).

- Deutsche Bank Mobile-die Video-Anleitung zur Banking-App. Available online: https://www.youtube.com/watch?v=UfcfZukivuU (accessed on 16 December 2019).

- Statista. Revenues of DNB from 2008 to 2018 (in Million NOK). Available online: https://www.statista.com/statistics/1051663/revenues-of-dnb/ (accessed on 16 December 2019).

- Statista. Deutsche Bank-Kunden in Deutschland nach Alter im Vergleich mit der Bevölkerung im Jahr 2018. Available online: https://de.statista.com/statistik/daten/studie/479014/umfrage/umfrage-in-deutschland-zum-alter-der-deutsche-bank-kunden/?fbclid=IwAR0s_HeBHJ85VtLd1d7lcqvADOavL5IzHydFW4TerfIMnPZNzcorpJebek8 (accessed on 16 December 2019).

- Bankenverband. Online-Banking in Deutschland. Available online: https://bankenverband.de/media/files/2018_06_19_Charts_OLB-final.pdf (accessed on 19 December 2019).

- Sparkasse Dortmund. Girokonten-Übersicht. Available online: https://www.sparkasse-dortmund.de/de/home/privatkunden/girokonto/girokonten-uebersicht.html (accessed on 16 December 2019).

- Sparkasse Darmstadt. Girokonten im Überblick. Available online: https://www.sparkasse-darmstadt.de/de/home/privatkunden/girokonto.html (accessed on 16 December 2019).

- DNB ASA. Prisliste kort og Betaling. Available online: https://www.dnb.no/privat/priser/konto-kort-nettbank.html#bankkort%20(Visa) (accessed on 15 December 2019).

- NTB. DNB Har Brukt 2,5 Milliarder på Sluttpakker på fem år. Available online: https://e24.no/boers-ogfinans/i/J1d4GJ/dnb-har-brukt-25-milliarder-paa-sluttpakker-paa-fem-aar (accessed on 12 December 2019).

- Arnold, M. Five Ways Banks Are Responding to the Fintech Threat. Available online: https://www.ft.com/content/d0ab6b84-c183-11e8-84cd-9e601db069b8 (accessed on 19 December 2019).

- SSB. Befolkningen. Statistisk Sentralbyrå. Available online: https://www.ssb.no/befolkning/faktaside/befolkningen (accessed on 15 December 2019).

- Voll, B.I. DNB Stenger 59 Bank-Kontorer. Klar Tale. Available online: https://www.klartale.no/norge/dnb-stenger-59-bank-kontorer-1.695387 (accessed on 15 December 2019).

- Giske, M.E. DNB Blir Teknologibedrift Med Banklisens. DNB Nyheter. Available online: https://www.dnbnyheter.no/nyheter/dnb-blir-teknologibedrift-med-banklisens/ (accessed on 15 December 2019).

- Finans Norge. På bare tre år har tre av fire nordmenn tatt i bruk Vipps. 23 March 2018. Available online: https://www.finansnorge.no/aktuelt/sporreundersokelser/forbruker-ogfinanstrender/forbruker--og-finanstrender-2018/pa-bare-tre-ar-har-tre-av-firenordmenn-tatt-i-bruk-vipps/ (accessed on 14 December 2019).

- Deutsche Bank. Deutsche Bank Erwirbt fünf Prozent am FinTech Deposit Solutions; Exchange/Visiting ProgramsRoom B431-1, Lee Shau Kee Science and Technology Building Academic AffairsOffice, Tsinghua University: Beijing, China, 2019. [Google Scholar]

- Gujral, V.M. Rewriting the Rules in Retail Banking. McKinsey & Company. Available online: https://www.mckinsey.com/industries/financial-services/our-insights/rewriting-the-rules-in-retail-bank-ing?fbclid=IwAR2z05Jur (accessed on 15 December 2019).

- Meola, A. The Digital Trends Disrupting the Banking Industry in 2019. Business Insider. Available online: https://www.businessinsider.com/banking-industry-trends (accessed on 15 December 2019).

- Shevlin, R. Do Banks Still Need Branches? (The Answer Is No). Available online: https://www.forbes.com/sites/ronshevlin/2019/03/11/will-bank-branches-go-the-way-of-retail-stores/#248d401aa72d (accessed on 15 December 2019).

- Seibel, K. Die Deutsche Liebe zum Bargeld Verblasst–Wegen nur Einer Karte. Available online: https://www.welt.de/wirtschaft/article193063435/Zahlungsmittel-Karte-schlaegt-in-Deutschland-erstmals-Bargeld.html (accessed on 20 December 2019).

- Sterling, T.; Sims, T. Dutch Bank ING Thrives in Germany with Zero-Fee, Online-Only Accounts. Reuters. 11 August 2017. Available online: https://www.reuters.com/article/us-germany-banks-ing-idUSKBN1AR0FA. (accessed on 14 February 2021).

- Güttler, A.; Hackethal, A. How ING-DiBa conquered the German retail banking market. Electron. J. 2005. [Google Scholar] [CrossRef]

- DNB to Close 59 Branches in Norway as Online Banking Dominates (computerweekly.com). Available online: https://www.computerweekly.com/news/450280053/DNB-to-close-59-branches-in-Norway-as-online-banking-dominates (accessed on 15 February 2021).

- Wiggins, R.R.; Ruefli, T.W. Sustained Competitive Advantage: Temporal Dynamics and the Incidence and Persistence of Superior Economic Performance. Organ. Sci. 2002, 13, 81–105. [Google Scholar] [CrossRef]

- Barnett, W.P.; Sorenson, O. The Red Queen in organizational creation and development. Ind. Corp. Chang. 2002, 11, 289–325. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Park, K. Dynamics from open innovation to evolutionary change. J. Open Innov. Technol. Mark. Complex. 2016, 2, 7. [Google Scholar] [CrossRef]

- Al nawayseh, M.K. FinTech in COVID-19 and Beyond: What Factors Are Affecting Customers’ Choice of FinTech Applications? J. Open Innov. Technol. Mark. Complex. 2020, 6, 153. [Google Scholar] [CrossRef]

- Chesbrough, H.W. Open Innovation: The New Imperative for Creating and Profiting from Technology; Harvard Business Press: Brighton, MA, USA, 2003. [Google Scholar]

- Efma-Infosys Finacle. Innovation in Innovation in Retail Banking 2019. Available online: https://www.efma.com/assets/content/study/2019/efma_infosys_innovation_in_retail_banking_2019.pdf (accessed on 5 March 2021).

| Deutsche Bank [53] | Ing-DiBa [50] | Sparkasse [54] | DNB ASA | |

|---|---|---|---|---|

| Revenue in 2018 | 342 million € | 886 million € | 1.8 billion € | 50,368 million NOK equals to 5.03 million € [55]. |

| Online Systems | Website and App, very modern and comprehensive [56] | Website and App, very modern and goes smoothly [48] | Website and App, but it looks not as modern as the others | Excellent website (online Internet bank), mobile bank application, mobile savings application, and mobile application to use when a person sell/buy a used car that helps with a safe transaction. |

| Number of Customers | More than 20 million | 9,306,690 | About 50 million | 2.1 million personal customers [57]. |

| Number of online Customers | Half of their customers, but the structure of their customers can be a problem in archiving more since the people that are not using the mobile services yet are older and less willing to learn [33,58] | All | No official number, but a survey estimates 46% [59] | 1.5 million on their Internet bank. 935,000 on their mobile bank application [58]. |

| Account fee | Different monthly fees: −0 € for young people −8.99 € Basis −11.90 € BestKonto [56] | 0 € | Different monthly fees: −0 € for young people −2.95 € Online −1.95 € basis −7.95 € comfort, But additional fees for using offline services and different for each Bank [60,61] | The account and online services are for free. They charge customers a fee for debit cards. 0–18 years, and students can have one card per debit account for free. Other customers have to pay 295 NOK per year, which equals 30 € per year [62]. |

| Branches | 2064 | 0 | 17,530 | 57 [63] |

| Number of employees | 91,737 | 4790 | 301,600 | 8969 [63] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, S.; Kwon, Y.; Quoc, N.N.; Danon, C.; Mehler, M.; Elm, K.; Bauret, R.; Choi, S. Red Queen Effect in German Bank Industry: Implication of Banking Digitalization for Open Innovation Dynamics. J. Open Innov. Technol. Mark. Complex. 2021, 7, 90. https://doi.org/10.3390/joitmc7010090

Lee S, Kwon Y, Quoc NN, Danon C, Mehler M, Elm K, Bauret R, Choi S. Red Queen Effect in German Bank Industry: Implication of Banking Digitalization for Open Innovation Dynamics. Journal of Open Innovation: Technology, Market, and Complexity. 2021; 7(1):90. https://doi.org/10.3390/joitmc7010090

Chicago/Turabian StyleLee, Seungju, Yona Kwon, Nam Nguyen Quoc, Cynthia Danon, Maren Mehler, Karoline Elm, Raphael Bauret, and Seungho Choi. 2021. "Red Queen Effect in German Bank Industry: Implication of Banking Digitalization for Open Innovation Dynamics" Journal of Open Innovation: Technology, Market, and Complexity 7, no. 1: 90. https://doi.org/10.3390/joitmc7010090

APA StyleLee, S., Kwon, Y., Quoc, N. N., Danon, C., Mehler, M., Elm, K., Bauret, R., & Choi, S. (2021). Red Queen Effect in German Bank Industry: Implication of Banking Digitalization for Open Innovation Dynamics. Journal of Open Innovation: Technology, Market, and Complexity, 7(1), 90. https://doi.org/10.3390/joitmc7010090