Mathematical Modeling for Financial Analysis of an Enterprise: Motivating of Not Open Innovation

Abstract

1. Introduction

2. Literature Foundations

3. Results

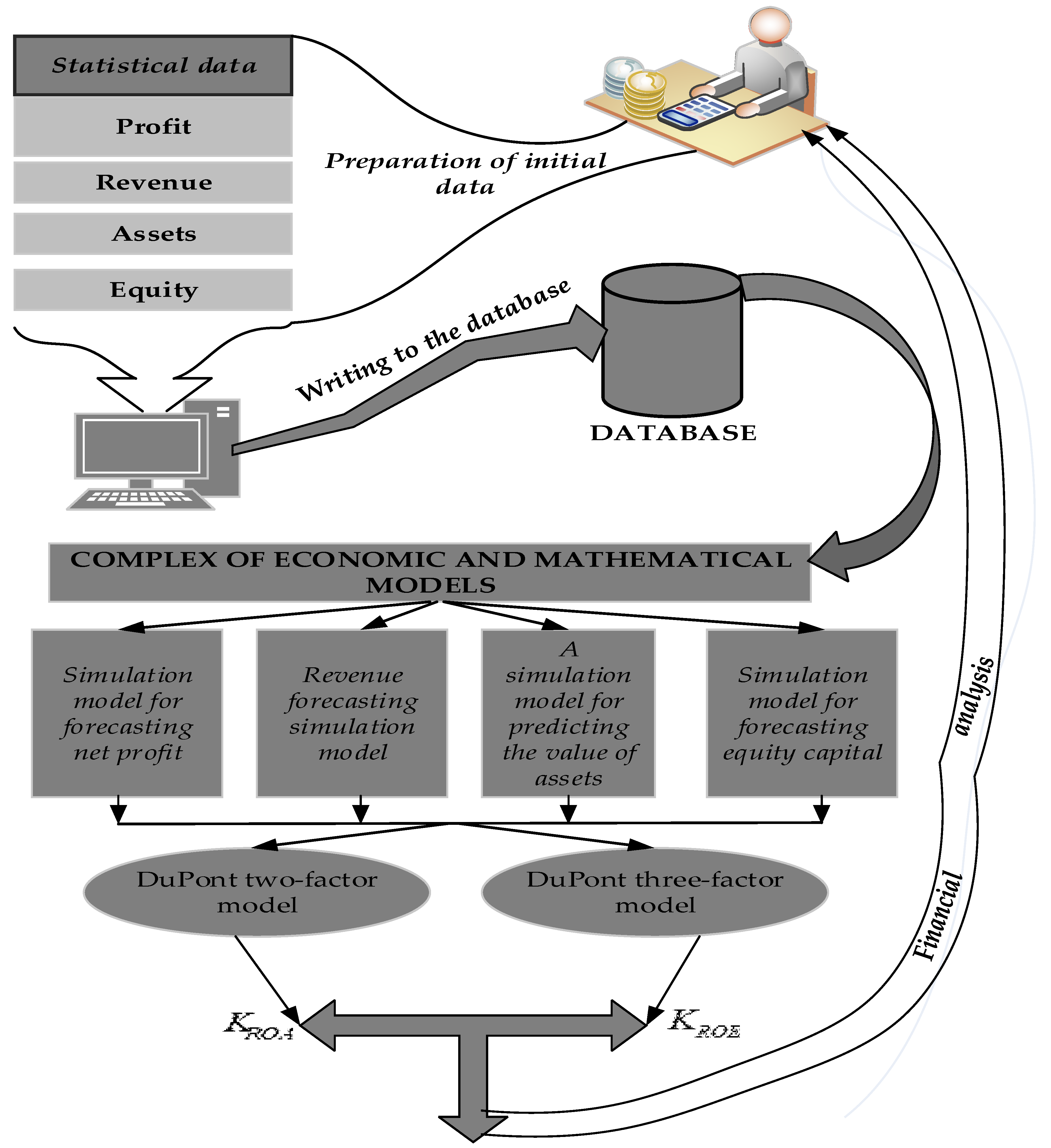

3.1. The Architecture of the Toolkit the Factorial Financial Analysis

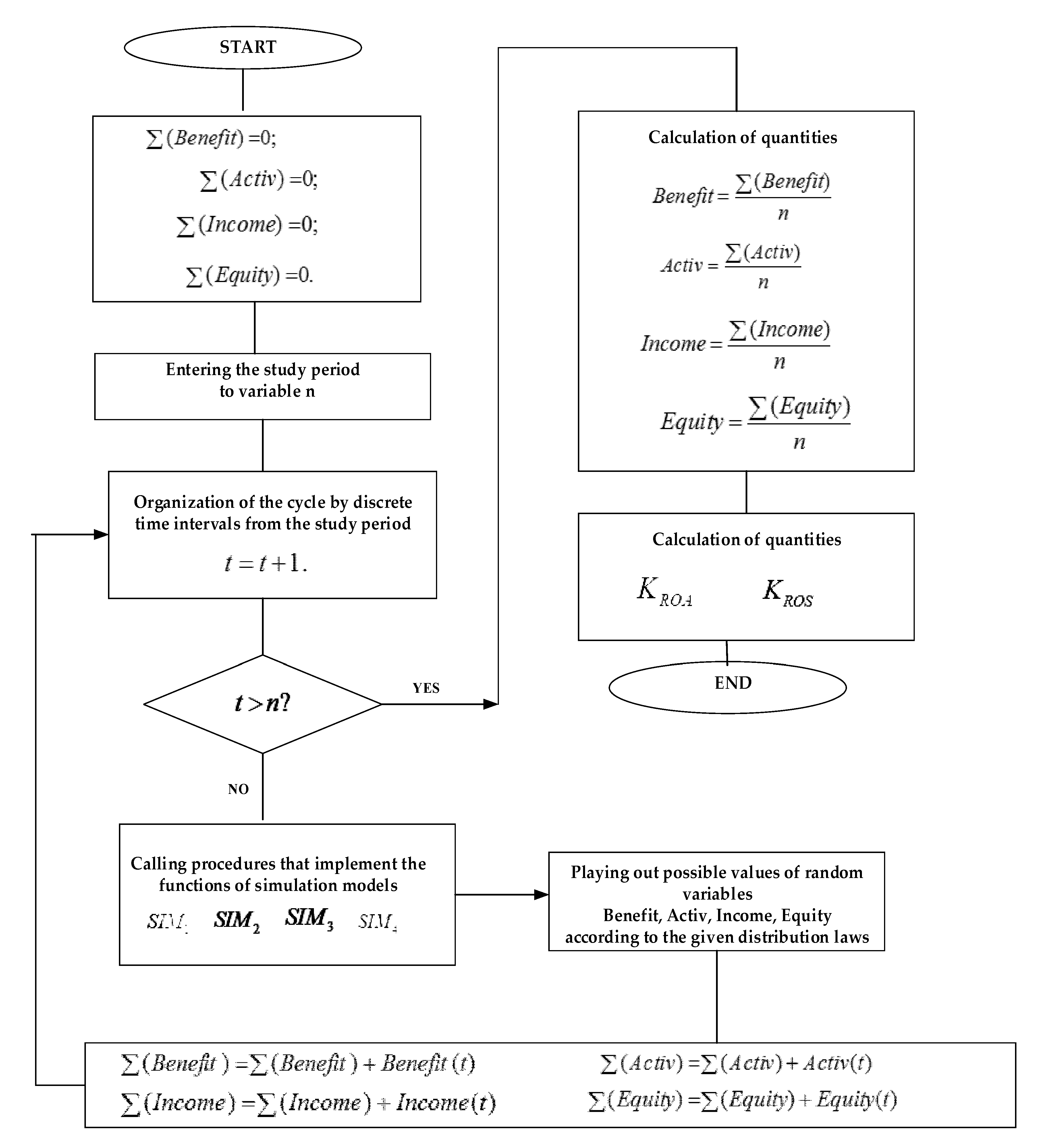

3.2. Complex of Economic and Mathematical Models of Factor Financial Analysis

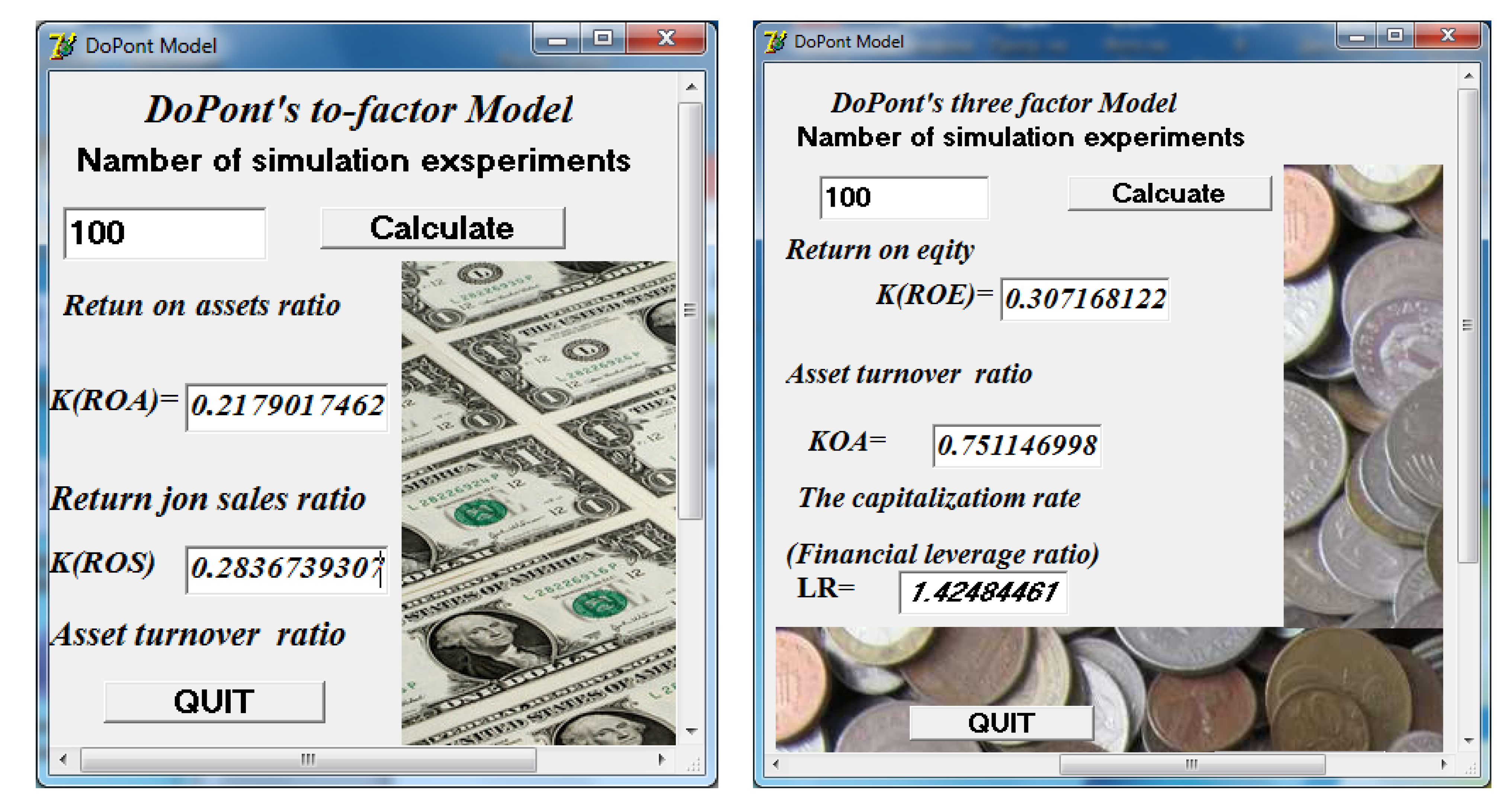

3.3. Computer Implementation of a Complex of Mathematical Models of Factor Financial Analysis

4. Discussion: Complexity of Economics, Mathematical Model, and Open Innovation

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Ali, H.F.; Charbaji, A. Applying factor analysis to financial ratios of international commercial airlines. Int. J. Commer. Manag. 1994, 4, 25–37. [Google Scholar] [CrossRef]

- Chen, Y.S.; Chen, L.-H.; Liaw, S.-Y. Using financial factors to investigate productivity: An empirical study in Taiwan. Ind. Manag. Data Syst. 2001, 101, 378–384. [Google Scholar] [CrossRef]

- Tan, P.M.; Koh, H.C.; Low, L.C. Stability of Financial Ratios: A Study of Listed Companies in Singapore. Asian Rev. Account. 1997, 5, 19–39. [Google Scholar] [CrossRef]

- Winand, M.; Zintz, T.; Scheerder, J. A financial management tool for sport federations. Sport Bus. Manag. Int. J. 2012, 2, 225–240. [Google Scholar] [CrossRef]

- Tamulevičienė, D.; Mackevičius, J. Methodology of complex analysis of tangible fixed assets. Entrep. Sustain. Issues 2019, 7, 1341–1352. [Google Scholar] [CrossRef]

- Timofeeva, N.Y. Forecasting the level of profitability of agricultural products of the Lipetsk region. Mod. Econ. Probl. Solut. 2017, 7, 129–135. [Google Scholar]

- Deminova, S.V.; Suchkova, N.A. Forecasting the profitability and sustainability of an organization’s activities using computer modeling. Bull. OrelGIET 2014, 4, 142. [Google Scholar]

- Alti, A.; Titman, S. A Dynamic Model of Characteristic-Based Return Predictability. SSRN Electron. J. 2017, 74, 6–3187. [Google Scholar] [CrossRef]

- Addoum, J.M.; Delikouras, S.; Korniotis, G.M.; Kumar, A. Income Hedging, Dynamic Style Preferences, and Return Predictability. J. Financ. 2019, 74, 2055–2106. [Google Scholar] [CrossRef]

- Bouchaud, J.; Krüger, P.; Landier, A.; Thesmar, D. Sticky Expectations and the Profitability Anomaly. J. Financ. 2018, 74, 639–674. [Google Scholar] [CrossRef]

- Weisbrod, E. Stockholders’ Unrealized Returns and the Market Reaction to Financial Disclosures. J. Financ. 2018, 74, 899–942. [Google Scholar] [CrossRef]

- Chiang, C.; Dai, W.; Fan, J.; Hong, H.; Tu, J. Robust Measures of Earnings Surprises. J. Financ. 2018, 74, 943–983. [Google Scholar] [CrossRef]

- Malloy, C.; Moskowitz, T.; Vissing-Jørgensen, A. Long-run stockholder consumption risk and asset returns. J. Financ. 2009, 64, 2427–2479. [Google Scholar] [CrossRef]

- Pastor, L.; Stambaugh, R.F. Predictive Systems: Living with Imperfect Predictors. SSRN Electron. J. 2008, 64, 4–1583. [Google Scholar] [CrossRef][Green Version]

- Livdan, D.; Sapriza, H.; Zhang, L. Financially Constrained Stock Returns. SSRN Electron. J. 2006, 64, 4–1827. [Google Scholar] [CrossRef][Green Version]

- Fama, E.; French, K. The corporate cost of capital and the return on corporate investment. J. Financ. 1999, 54, 1939–1967. [Google Scholar] [CrossRef]

- Harford, J. Corporate Cash Reserves And Acquisitions. SSRN Electron. J. 1997, 54, 6–1969. [Google Scholar] [CrossRef]

- Easterwood, J.C.; Nutt, S.R. Inefficiency in Analysts’ Earnings Forecasts: Systematic Misreaction or Systematic Optimism? J. Financ. 1999, 54, 1777–1797. [Google Scholar] [CrossRef]

- Jiang, F.; Ma, Y.; Wang, X. Multiple blockholders and earnings management. J. Corp. Financ. 2020, 64, 101689. [Google Scholar] [CrossRef]

- Sanchis, R.; Duran-Heras, A.; Poler, R. Optimising the Preparedness Capacity of Enterprise Resilience Using Mathematical Programming. Mathematics 2020, 8, 1596. [Google Scholar] [CrossRef]

- Cerna, S.; Guyeux, C.; Royer, G.; Chevallier, C.; Plumerel, G. Predicting Fire Brigades Operational Breakdowns: A Real Case Study. Mathematics 2020, 8, 1383. [Google Scholar] [CrossRef]

- Vasylieva, T.; Jurgilewicz, O.; Poliakh, S.; Tvaronavičienė, M.; Hydzik, P. Problems of measuring country’s financial security. J. Int. Stud. 2020, 13, 329–346. [Google Scholar] [CrossRef]

- Hilkevics, S.; Semakina, V. The classification and comparison of business ratios analysis methods. Insights Reg. Dev. 2019, 1, 48–57. [Google Scholar] [CrossRef]

- Shahi, T.B.; Shrestha, A.; Neupane, A.; Guo, W. Stock Price Forecasting with Deep Learning: A Comparative Study. Mathematics 2020, 8, 1441. [Google Scholar] [CrossRef]

- Espinoza-Audelo, L.F.; Olazabal-Lugo, M.; Blanco-Mesa, F.; León-Castro, E.; Alfaro-Garcia, V. Bonferroni Probabilistic Ordered Weighted Averaging Operators Applied to Agricultural Commodities’ Price Analysis. Mathematics 2020, 8, 1350. [Google Scholar] [CrossRef]

- Borodin, A.; Mityushina, I. Evaluating the effectiveness of companies using the DEA method. Nauk. Visnyk Natsionalnoho Hirnychoho Universytetu 2020, 6, 193–197. [Google Scholar] [CrossRef]

- Streltsova, E.; Yakovenko, I. Support of Dicision-Making in Interbudgetary Regulation on the Basis of Simulation Modeling. Smart Innov. Syst. Technol. 2019, 139, 165–172. [Google Scholar]

- Selvachandran, G.; Ngan, T.T.; Sharma, R. Similarity Measure of Lattice Ordered Multi-Fuzzy Soft Sets Based on Set Theoretic Approach and Its Application in Decision Making. Mathematics 2020, 8, 1255. [Google Scholar] [CrossRef]

- Lamothe-Fernández, P.; Alaminos, D.; Lamothe-López, P.; Fernández-Gámez, M.A. Deep Learning Methods for Modeling Bitcoin Price. Mathematics 2020, 8, 1245. [Google Scholar] [CrossRef]

- Szetela, B.; Mentel, G.; Mentel, U.; Bilan, Y. Directional Movement Distribution in the Bitcoin Markets. Eng. Econ. 2020, 31, 188–196. [Google Scholar] [CrossRef]

- Meng, Y.; Qasem, S.N.; Shokri, M.S. Dimension Reduction of Machine Learning-Based Forecasting Models Employing Principal Component Analysis. Mathematics 2020, 8, 1233. [Google Scholar] [CrossRef]

- Popkov, Y.S.; Popkov, A.Y.; Dubnov, Y.A.; Solomatine, D. Entropy-Randomized Forecasting of Stochastic Dynamic Regression Models. Mathematics 2020, 8, 1119. [Google Scholar] [CrossRef]

- Chiu, M.-C.; Chen, T.-C.T.; Hsu, K.-W. Modeling an Uncertain Productivity Learning Process Using an Interval Fuzzy Methodology. Mathematics 2020, 8, 998. [Google Scholar] [CrossRef]

- Jiang, P.; Hu, Y.-C.; Wang, W.; Jiang, H.; Wu, G. Interval Grey Prediction Models with Forecast Combination for Energy Demand Forecasting. Mathematics 2020, 8, 960. [Google Scholar] [CrossRef]

- Suganthi, L.; Samuel, A.A. Energy models for demand forecasting—A review. Renew. Sustain. Energy Rev. 2012, 16, 1223–1240. [Google Scholar] [CrossRef]

- Ediger, V.Ş.; Akar, S. ARIMA forecasting of primary energy demand by fuel in Turkey. Energy Policy 2007, 35, 1701–1708. [Google Scholar] [CrossRef]

- González, P.A.; Zamarreño, J.M. Prediction of hourly energy consumption in buildings based on a feedback artificial neural network. Energy Build. 2005, 37, 595–601. [Google Scholar] [CrossRef]

- Tutun, S.; Chou, C.-A.; Canıyılmaz, E. A new forecasting framework for volatile behavior in net electricity consumption: A case study in Turkey. Energy 2015, 93, 2406–2422. [Google Scholar] [CrossRef]

- Lauret, P.; Fock, E.; Randrianarivony, R.N.; Manicom-Ramsamy, J.-F. Bayesian neural network approach to short time load forecasting. Energy Convers. Manag. 2008, 49, 1156–1166. [Google Scholar] [CrossRef]

- Wang, C.-H.; Hsu, L.-C. Using genetic algorithms grey theory to forecast high technology industrial output. Appl. Math. Comput. 2008, 195, 256–263. [Google Scholar] [CrossRef]

- Cui, J.; Liu, S.-F.; Zeng, B.; Xie, N.-M. A novel grey forecasting model and its optimization. Appl. Math. Model. 2013, 37, 4399–4406. [Google Scholar] [CrossRef]

- Hu, Y.-C.; Tseng, F.-M. Functional-link net with fuzzy integral for bankruptcy prediction. Neurocomputing 2007, 70, 2959–2968. [Google Scholar] [CrossRef]

- Nieto, P.J.G.; Gonzalo, E.G.; Lasheras, F.S.; Sánchez, A.B. A Hybrid Predictive Approach for Chromium Layer Thickness in the Hard Chromium Plating Process Based on the Differential Evolution/Gradient Boosted Regression Tree Methodology. Mathematics 2020, 8, 959. [Google Scholar] [CrossRef]

- Zhou, Y.; Zhou, M.; Xia, Q.; Hong, W.-C. Zhou Construction of EMD-SVR-QGA Model for Electricity Consumption: Case of University Dormitory. Mathematics 2019, 7, 1188. [Google Scholar] [CrossRef]

- Shih, P.-C.; Chiu, C.-Y.; Chou, C.-H. Using Dynamic Adjusting NGHS-ANN for Predicting the Recidivism Rate of Commuted Prisoners. Mathematics 2019, 7, 1187. [Google Scholar] [CrossRef]

- Blackledge, J.; Kearney, D.; Lamphiere, M.; Rani, R.; Walsh, P. Econophysics and Fractional Calculus: Einstein’s Evolution Equation, the Fractal Market Hypothesis, Trend Analysis and Future Price Prediction. Mathematics 2019, 7, 1057. [Google Scholar] [CrossRef]

- Ermakov, S.; Leora, S. Monte Carlo Methods and the Koksma-Hlawka Inequality. Mathematics 2019, 7, 725. [Google Scholar] [CrossRef]

- Afanasyev, D.O.; Fedorova, E.A. On the impact of outlier filtering on the electricity price forecasting accuracy. Appl. Energy 2019, 236, 196–210. [Google Scholar] [CrossRef]

- Zelenkov, Y.; Fedorova, E.; Chekrizov, D. Two-step classification method based on genetic algorithm for bankruptcy forecasting. Expert Syst. Appl. 2017, 88, 393–401. [Google Scholar] [CrossRef]

- Prendes-Espinosa, P.; Solano-Fernández, I.; García-Tudela, P. EmDigital to Promote Digital Entrepreneurship: The Relation with Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 63. [Google Scholar] [CrossRef]

- Oudgou, M. Financial and Non-Financial Obstacles to Innovation: Empirical Evidence at the Firm Level in the MENA Region. J. Open Innov. Technol. Mark. Complex. 2021, 7, 28. [Google Scholar] [CrossRef]

- Jeong, H.; Shin, K.; Kim, E.; Kim, S. Does Open Innovation Enhance a Large Firm’s Financial Sustainability? A Case of the Korean Food Industry. J. Open Innov. Technol. Mark. Complex. 2020, 6, 101. [Google Scholar] [CrossRef]

- Jin, S.; Lee, K. The Government R&D Funding and Management Performance: The Mediating Effect of Technology Innovation. J. Open Innov. Technol. Mark. Complex. 2020, 6, 94. [Google Scholar] [CrossRef]

- Leitão, J.; Pereira, D.; De Brito, S. Inbound and Outbound Practices of Open Innovation and Eco-Innovation: Contrasting Bioeconomy and Non-Bioeconomy Firms. J. Open Innov. Technol. Mark. Complex. 2020, 6, 145. [Google Scholar] [CrossRef]

- Rashid, H.U.; Nurunnabi, M.; Rahman, M.; Masud, A.K. Exploring the Relationship between Customer Loyalty and Financial Performance of Banks: Customer Open Innovation Perspective. J. Open Innov. Technol. Mark. Complex. 2020, 6, 108. [Google Scholar] [CrossRef]

- Méndez-Suárez, M.; García-Fernández, F.; Gallardo, F. Artificial Intelligence Modelling Framework for Financial Automated Advising in the Copper Market. J. Open Innov. Technol. Mark. Complex. 2019, 5, 81. [Google Scholar] [CrossRef]

| R(Benefit) | Intervals | Ben1 | Ben2 | … | Benm |

| Relative frequency | P(Benefit1) | P(Benefit2) | … | P(Benefitm) | |

| R(Activ) | Intervals | Ac1 | Ac2 | … | Acm |

| Relative frequency | P(Activ1) | P(Activ2) | … | P(Activm) | |

| R(Income) | Intervals | In1 | In2 | … | Inm |

| Relative frequency | P(Income1) | P(Income2) | … | P(Incomem) | |

| R(Equity) | Intervals | Eq1 | Eq2 | … | Eqm |

| Relative frequency | P(Equity1) | P(Equity2) | … | P(Equitym) |

| Year | Net Profit | Equity Capital | Revenue | Assets |

|---|---|---|---|---|

| 2007 | 360,449,550 | 4,663,465,990 | 1,774,959,437 | 5,929,361,713 |

| 2008 | 173,021,630 | 4,773,520,598 | 2,507,009,504 | 6,181,534,689 |

| 2009 | 624,613,273 | 5,398,689,419 | 2,486,940,618 | 6,950,737,357 |

| 2010 | 364,478,382 | 6,187,890,234 | 2,879,390,324 | 7,828,107,263 |

| 2011 | 879,601,664 | 7,539,089,895 | 3,534,341,431 | 9,521,274,120 |

| 2012 | 556,387,169 | 7,883,295,478 | 3,659,150,757 | 10,035,900,474 |

| 2013 | 628,311,221 | 8,369,165,460 | 3,933,335,313 | 10,855,186,062 |

| 2014 | 188,980,016 | 9,089,213,120 | 3,990,280,172 | 12,249,735,124 |

| 2015 | 403,522,806 | 9,322,338,840 | 4,334,293,477 | 12,981,247,957 |

| 2016 | 411,424,597 | 10,414,000,247 | 3,934,488,441 | 13,852,945,759 |

| 2017 | 100,297,977 | 10,324,208,370 | 4,313,031,616 | 14,385,169,353 |

| Net Profit | Equity Capital | Revenue | Assets | ||||

|---|---|---|---|---|---|---|---|

| Real Data | The Generated Data | Real Data | The Generated Data | Real Data | The Generated Data | Real Data | The Generated Data |

| 360,449,550 | 320,542,670 | 4,663,465,990 | 3,992,167,381 | 1,774,959,437 | 893,211,621 | 5,929,361,713 | 3,884,564,529 |

| 173,021,630 | 184,011,450 | 4,773,520,598 | 5,124,125,870 | 2,507,009,504 | 998,115,412 | 6,181,534,689 | 5,223,876,561 |

| 624,613,273 | 529,824,282 | 5,398,689,419 | 4,284,363,882 | 2,486,940,618 | 1,754,671,523 | 6,950,737,357 | 4,881,563,761 |

| 364,478,382 | 392,253,671 | 6,187,890,234 | 7,003,001,420 | 2,879,390,324 | 2,111,431,912 | 7,828,107,263 | 7,337,817,825 |

| 879,601,664 | 77,510,432 | 7,539,089,895 | 7,176,401,567 | 3,534,341,431 | 2,992,317,849 | 9,521,274,120 | 8,991,113,610 |

| 556,387,169 | 235,272,098 | 7,883,295,478 | 6,376,832,653 | 3,659,150,757 | 2,932,581,438 | 10,035,900,474 | 6,345,145,356 |

| 628,311,221 | 439,221,383 | 8,369,165,460 | 6,654,216,571 | 3,933,335,313 | 2,299,928,727 | 10,855,186,062 | 11,167,567,481 |

| 188,980,016 | 211,471,057 | 9,089,213,120 | 8,872,925,411 | 3,990,280,172 | 3,000,181,357 | 12,249,735,124 | 19,949,783,765 |

| 403,522,806 | 296,319,714 | 9,322,338,840 | 6,221,546,721 | 4,334,293,477 | 3,873,169,847 | 12,981,247,957 | 13,825,001,345 |

| 411,424,597 | 383,517,329 | 10,414,000,247 | 9,837,110,164 | 3,934,488,441 | 3,111,258,325 | 13,852,945,759 | 19,457,656,731 |

| 100,297,977 | 111,224,315 | 10,324,208,370 | 8,656,435,651 | 4,313,031,616 | 4,313,031,616 | 14,385,169,353 | 21,376,574,674 |

| 1.4987 | 1.84 | 1.74 | 1.84 | 1.4235 | 1.84 | 0.461 | 1.84 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Borodin, A.; Mityushina, I.; Streltsova, E.; Kulikov, A.; Yakovenko, I.; Namitulina, A. Mathematical Modeling for Financial Analysis of an Enterprise: Motivating of Not Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 79. https://doi.org/10.3390/joitmc7010079

Borodin A, Mityushina I, Streltsova E, Kulikov A, Yakovenko I, Namitulina A. Mathematical Modeling for Financial Analysis of an Enterprise: Motivating of Not Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity. 2021; 7(1):79. https://doi.org/10.3390/joitmc7010079

Chicago/Turabian StyleBorodin, Alex, Irina Mityushina, Elena Streltsova, Andrey Kulikov, Irina Yakovenko, and Anzhela Namitulina. 2021. "Mathematical Modeling for Financial Analysis of an Enterprise: Motivating of Not Open Innovation" Journal of Open Innovation: Technology, Market, and Complexity 7, no. 1: 79. https://doi.org/10.3390/joitmc7010079

APA StyleBorodin, A., Mityushina, I., Streltsova, E., Kulikov, A., Yakovenko, I., & Namitulina, A. (2021). Mathematical Modeling for Financial Analysis of an Enterprise: Motivating of Not Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity, 7(1), 79. https://doi.org/10.3390/joitmc7010079