Predictive Scenarios of the Russian Oil Industry; with a Discussion on Macro and Micro Dynamics of Open Innovation in the COVID 19 Pandemic

Abstract

1. Introduction

2. Materials and Methods

2.1. Determining Supply and Demand Indicators in the World Oil Market Affecting the Development of the Russian Oil Industry

- (i)

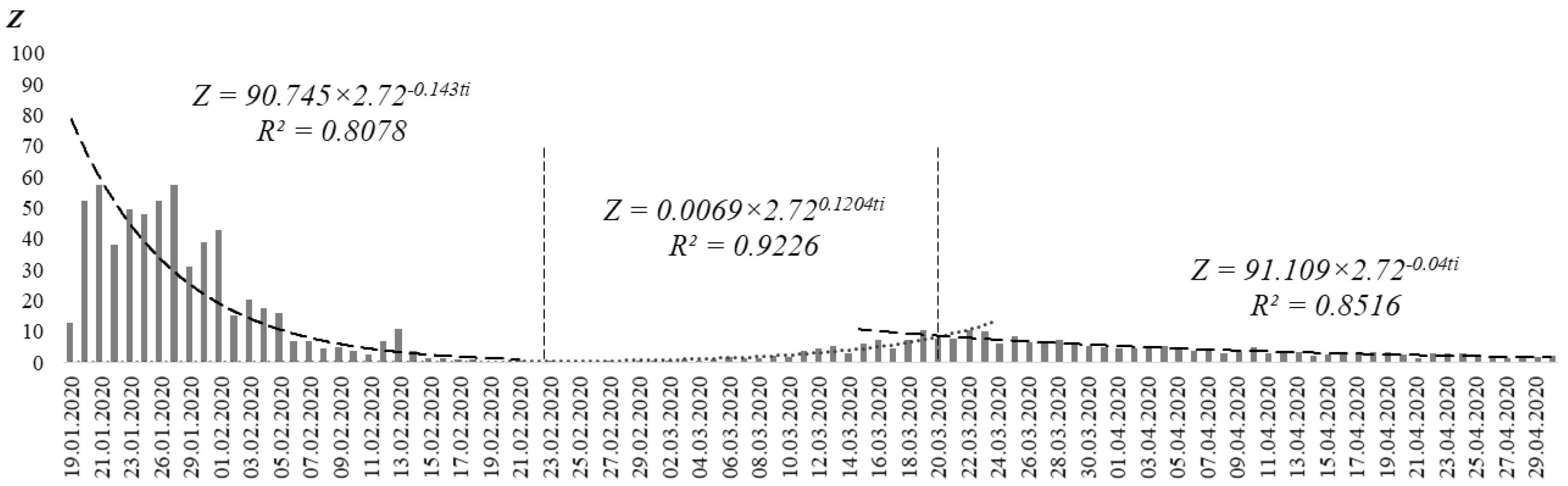

- rate of increase in the number of infected people in the world at a given time ti

- (ii)

- duration of the pandemic (duration is understood as the period of time from the moment of mass infection in China - 22.01.2020 to the analyzed point of time ti)

- (iii)

- number of people falling ill in the world at a time ti

- (iv)

- the number of countries in the world where COVID-19 infections have been recorded at a given time ti

- (v)

- number of countries in the world where quarantine has been implemented at a given time ti

- (vi)

- number of countries with prevalence > 0.001% of the population at the time of infection ti

- (vii)

- number of countries with prevalence > 0.01% of the population at the time of infection ti

- (viii)

- number of countries with prevalence > 0.1% of the population at the time of infection ti

- (ix)

- the number and rate of increase in the number of infected in the world’s main oil consumers (USA, China, India, Japan) [66]

- (x)

- the duration of the pandemic in these countries at a given time ti, in days

2.2. Predictive Scenarios of Russian Oil Industry Development

3. Results

3.1. Modeling the State of the Russian Oil Industry under the Influence of Supply and Demand Factors Amidst COVID-19 Pandemic

3.2. Predicting Supply and Demand in the Global Oil Market and Modeling Its Impact on the Russian Oil Industry

4. Discussions: Macro and Micro Dynamics of Open Innovation in the Covid 19 Pandemic

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- United States Energy Information Administration. STEO Archives. Available online: https://www.eia.gov/outlooks/steo/outlook.php#issues2012 (accessed on 12 May 2020).

- Federal State Statistics Service. Official Statistics. Available online: https://www.gks.ru/ (accessed on 15 May 2020).

- Maanimo. Online Oil Quotes in the World Today: Price, Dynamics, Chart. Available online: https://maanimo.com/oils (accessed on 13 May 2020).

- Semin, A.N.; Ponkratov, V.V.; Sokolov, A.A.; Lenkova, O.V.; Pozdnyaev, A.S. Investigating the Competitiveness of the Russian Oilfield Services Market. Ind. Eng. Manag. Syst. 2019, 18, 563–576. [Google Scholar] [CrossRef]

- International Energy Agency. Data and Statistics. Available online: https://www.iea.org/data-and-statistics/data-tables?country=WORLD&year=2017&energy=Oil (accessed on 13 May 2020).

- Ali, S.H.; Ali, A.H. Crude Oil Price Prediction Based on Soft Computing Model: Case Study of Iraq. J. Southwest Jiaotong Univ. 2019, 54, 54. [Google Scholar] [CrossRef]

- United States Energy Information Administration. Forecast Highlights. Available online: https://www.eia.gov/outlooks/steo/ (accessed on 18 May 2020).

- CNBC. 5 Charts that Explain the Saudi Arabia-Russia Oil Price War so far. Available online: https://www.cnbc.com/2020/04/01/5-charts-that-explain-the-saudi-arabia-russia-oil-price-war-so-far.html (accessed on 13 May 2020).

- International Energy Agency. Choice Rev. Online 2009, 47, 47. [CrossRef]

- Financial Times. US Oil Price Below Zero for First Time in History. Available online: https://www.ft.com/content/a5292644-958d-4065-92e8-ace55d766654 (accessed on 12 May 2020).

- Guardian. Oil Prices Fall Again Despite Opec+ Deal to Cut Production. Available online: https://www.theguardian.com/business/2020/apr/10/opec-russia-reduce-oil-production-prop-up-prices (accessed on 13 May 2020).

- Cook, S.A.; Russia Is Losing the Oil War—And the Middle East. Foreign Policy. Available online: https://foreignpolicy.com/2020/04/09/russia-saudi-arabia-oil-price-war-middle-east/ (accessed on 15 May 2020).

- Zagitova, L.R. Statistical Analysis of Dynamics of Decrease in Oil Production after Well Interventions. Conf. Ser. Mater. Sci. Eng. 2020, 860. [Google Scholar] [CrossRef]

- Quinn, C. Saudi Arabia and Russia Reach Deal to Cut Oil Production. Available online: https://foreignpolicy.com/2020/04/10/saudi-arabia-russia-deal-cut-oil-production/ (accessed on 13 May 2020).

- Blas, J.; El Wardany, S.; Smith, G. Saudi Arabia and Russia End Their Oil-Price War with Output Cut Agreement. Available online: https://www.worldoil.com/news/2020/4/9/saudi-arabia-and-russia-end-their-oil-price-war-with-output-cut-agreement (accessed on 12 May 2020).

- St24 Invest. Bloomberg: Russia Will Face a Major Crisis If it Does Not Adapt to the Changed Situation. Available online: https://st24invest.com/article/12359 (accessed on 16 May 2020).

- Humbatova, S.I.; Hajiyev, N.G.-O. Oil Factor in Economic Development. Energies 2019, 12, 1573. [Google Scholar] [CrossRef]

- Cheng, D.; Shi, X.; Yu, J.; Zhang, D.; Shi, X. How Does the Chinese Economy React to Uncertainty in International Crude Oil Prices? Int. Rev. Econ. Financ. 2019, 64, 147–164. [Google Scholar] [CrossRef]

- Nasir, M.A.; Naidoo, L.; Shahbaz, M.; Amoo, N. Implications of Oil Prices Shocks for the Major Emerging Economies: A Comparative Analysis of BRICS. Energy Econ. 2018, 76, 76–88. [Google Scholar] [CrossRef]

- Gogolin, F.; Kearney, F.; Lucey, B.M.; Peat, M.; Vigne, S.A. Uncovering Long Term Relationships between Oil Prices and the Economy: A Time-Varying Cointegration Analysis. Energy Econ. 2018, 76, 584–593. [Google Scholar] [CrossRef]

- Thorbecke, W. How Oil Prices Affect East and Southeast Asian Economies: Evidence from Financial Markets and Implications for Energy Security. Energy Policy 2019, 128, 628–638. [Google Scholar] [CrossRef]

- Baghestani, H.; Chazi, A.; Khallaf, A. A Directional Analysis of Oil Prices and Real Exchange Rates in BRIC Countries. Res. Int. Bus. Financ. 2019, 50, 450–456. [Google Scholar] [CrossRef]

- Lv, X.; Lien, D.; Chen, Q.; Yu, C. Does Exchange Rate Management Affect the Causality between Exchange Rates and Oil Prices? Evidence from Oil-Exporting Countries. Energy Econ. 2018, 76, 325–343. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Trabelsi, N.; Alqahtani, F.; Bachmeier, L. Modelling Systemic Risk and Dependence Structure between the Prices of Crude Oil and Exchange Rates in BRICS Economies: Evidence Using Quantile Coherency and NGCoVaR Approaches. Energy Econ. 2019, 81, 1011–1028. [Google Scholar] [CrossRef]

- Liu, S.; Fang, W.; Gao, X.; An, F.; Jiang, M.; Li, Y.; Siyao, L.; Wei, F. Long-Term Memory Dynamics of Crude Oil Price Spread in Non-Dollar Countries under the Influence of Exchange Rates. Energy 2019, 182, 753–764. [Google Scholar] [CrossRef]

- Vasiljeva, M.V.; Ponkratov, V.V.; Kharlamova, E.Y.; Kuznetsov, N.V.; Maramygin, M.S.; Volkova, M.V. Problems and Prospects of Development of the Oil Exchange Market in the Russian Federation. Int. J. Energy Econ. Policy 2019, 9, 77–86. [Google Scholar] [CrossRef][Green Version]

- Nusair, S.A. Oil Price and Inflation Dynamics in the Gulf Cooperation Council countries. Energy 2019, 181, 997–1011. [Google Scholar] [CrossRef]

- Hammoudeh, S.; Reboredo, J.C. Oil Price Dynamics and Market-Based Inflation Expectations. Energy Econ. 2018, 75, 484–491. [Google Scholar] [CrossRef]

- Lòpez-Villavicencio, A.; Pourroy, M. Inflation Target and (A) Symmetries in the Oil Price Pass-Through to Inflation. Energy Econ. 2019, 80, 860–875. [Google Scholar] [CrossRef]

- Choi, S.; Furceri, D.; Loungani, P.; Mishra, S.; Poplawski-Ribeiro, M. Oil Prices and Inflation Dynamics: Evidence from Advanced and Developing Economies. J. Int. Money Financ. 2018, 82, 71–96. [Google Scholar] [CrossRef]

- Ordóñez, J.; Monfort, M.; Cuestas, J.C.; Monfort, J.O.; Bellido, M.M. Oil Prices, Unemployment and the Financial Crisis in Oil-Importing Countries: The Case of Spain. Energy 2019, 181, 625–634. [Google Scholar] [CrossRef]

- Kocaaslan, O.K. Oil Price Uncertainty and Unemployment. Energy Econ. 2019, 81, 577–583. [Google Scholar] [CrossRef]

- Cuestas, J.C.; Ordóñez, J. Oil Prices and Unemployment in the UK before and after the Crisis: A Bayesian VAR Approach. A Note. Phys. A Stat. Mech. Appl. 2018, 510, 200–207. [Google Scholar] [CrossRef]

- Cuestas, J.C.; Gil-Alana, L.A. Oil Price Shocks and Unemployment in Central and Eastern Europe. Econ. Syst. 2018, 42, 164–173. [Google Scholar] [CrossRef]

- Bento, F.; Garotti, L. Resilience beyond Formal Structures: A Network Perspective towards the Challenges of an Aging Workforce in the Oil and Gas Industry. J. Open Innov. Technol. Mark. Complex. 2019, 5, 15. [Google Scholar] [CrossRef]

- Corff, A.G.-L. Did Oil Prices Trigger an Innovation Burst in Biofuels? Energy Econ. 2018, 75, 547–559. [Google Scholar] [CrossRef]

- Pyka, A. Dedicated Innovation Systems to Support the Transformation Towards Sustainability: Creating Income Opportunities and Employment in the Knowledge-Based Digital Bioeconomy. J. Open Innov. Technol. Mark. Complex. 2017, 3, 27. [Google Scholar] [CrossRef]

- Li, J.; Zhu, S.; Wu, Q. Monthly Crude Oil Spot Price Forecasting Using Variational Mode Decomposition. Energy Econ. 2019, 83, 240–253. [Google Scholar] [CrossRef]

- Cheng, S.; Cao, Y. On the Relation between Global Food and Crude Oil Prices: An Empirical Investigation in a Nonlinear Framework. Energy Econ. 2019, 81, 422–432. [Google Scholar] [CrossRef]

- Huang, S.; An, H.; Wen, S.; An, F. Revisiting Driving Factors of Oil Price Shocks Across Time Scales. Energy 2017, 139, 617–629. [Google Scholar] [CrossRef]

- Kapustin, N.O.; Grushevenko, D.A. A Long-Term Outlook on Russian Oil Industry Facing Internal and External Challenges. Oil Gas Sci. Technol.—Rev. IFP Energ. Nouv. 2019, 74, 72. [Google Scholar] [CrossRef]

- Plenkina, V.; Andronova, I.; Deberdieva, E.; Lenkova, O.V.; Osinovskaya, I. Specifics of Strategic Managerial Decisions-Making in Russian Oil Companies. Entrep. Sustain. Issues 2018, 5, 858–874. [Google Scholar] [CrossRef]

- Orazalin, N.; Mahmood, M. Economic, Environmental, and Social Performance Indicators of Sustainability Reporting: Evidence from the Russian Oil and Gas Industry. Energy Policy 2018, 121, 70–79. [Google Scholar] [CrossRef]

- Bradshaw, M.; Van De Graaf, T.; Connolly, R. Preparing for the New Oil Order? Saudi Arabia and Russia. Energy Strat. Rev. 2019, 26, 100374. [Google Scholar] [CrossRef]

- Sadik-Zada, E.R. Addressing the Growth and Employment Effects of the Extractive Industries: White and Black Box Illustrations from Kazakhstan. Post-Communist Econ. 2020, 1–33. [Google Scholar] [CrossRef]

- Sadik-Zada, E.R.; Loewenstein, W.; Hasanli, Y. Production Linkages and Dynamic Fiscal Employment Effects of the Extractive Industries: Input-Output and Nonlinear ARDL Analyses of Azerbaijani Economy. Miner. Econ. 2019. [Google Scholar] [CrossRef]

- Zadeh, L. Fuzzy sets. Inf. Control. 1965, 8, 338–353. [Google Scholar] [CrossRef]

- Balashova, S.; Serletis, A. Oil Prices Shocks and the Russian Economy. J. Econ. Asymmetries 2020, 21, e00148. [Google Scholar] [CrossRef]

- Akinsola, M.O.; Odhiambo, N.M. Asymmetric Effect of Oil Price on Economic Growth: Panel Analysis of Low-Income Oil-Importing Countries. Energy Rep. 2020, 6, 1057–1066. [Google Scholar] [CrossRef]

- Hailemariam, A.; Smyth, R.; Zhang, X. Oil Prices and Economic Policy Uncertainty: Evidence from a Nonparametric Panel Data Model. Energy Econ. 2019, 83, 40–51. [Google Scholar] [CrossRef]

- Olovsson, C. Oil Prices in a General Equilibrium Model with Precautionary Demand for Oil. Rev. Econ. Dyn. 2019, 32, 1–17. [Google Scholar] [CrossRef]

- Chai, J.; Wang, Y.; Wang, S.; Wang, Y. A Decomposition–Integration Model with Dynamic Fuzzy Reconstruction for Crude Oil Price Prediction and the Implications for Sustainable Development. J. Clean. Prod. 2019, 229, 775–786. [Google Scholar] [CrossRef]

- Imanov, G.; Hasanli, Y.; Murtuzaeva, M. Fuzzy Analysis of Macroeconomic Stability. In Proceedings of the 13th International Conference on Theory and Application of Fuzzy Systems and Soft Computing, Warsaw, Poland, 27–28 August 2018; Volume 896, pp. 223–229. [Google Scholar]

- Sadik-Zada, E.R.; Loewenstein, W. Drivers of CO2-Emissions in Fossil Fuel Abundant Settings: (Pooled) Mean Group and Nonparametric Panel Analyses. Energies 2020, 13, 3956. [Google Scholar] [CrossRef]

- Sadik-Zada, E.R. Distributional Bargaining and the Speed of Structural Change in the Petroleum Exporting Labor Surplus Economies. Eur. J. Dev. Res. 2019, 32, 51–98. [Google Scholar] [CrossRef]

- Rautava, J. The Role of Oil Prices and the Real Exchange Rate in Russia’s Economy; Bank of Finland, Institute for Economies in Transition (BOFIT): Helsinki, Finland, 2002. [Google Scholar]

- Bouoiyour, J.; Selmi, R.; Tiwari, A.K.; Shahbaz, M. The Nexus between Oil Price and Russia’s Real Exchange Rate: Better Paths via Unconditional vs Conditional Analysis. Energy Econ. 2015, 51, 54–66. [Google Scholar] [CrossRef]

- Syzdykova, A.; Tanriöven, C.; Nahipbekova, S.; Kuralbayev, A. The Effects of Changes in Oil Prices on the Russian Economy. Espacios 2019, 40, 15. [Google Scholar]

- Liu, D.; Meng, L.; Wang, Y. Oil Price Shocks and Chinese Economy Revisited: New Evidence from SVAR Model with Sign Restrictions. Int. Rev. Econ. Financ. 2020, 69, 20–32. [Google Scholar] [CrossRef]

- Chen, H.; Liao, H.; Tang, B.; Wei, Y.-M. Impacts of OPEC’s Political Risk on the International Crude Oil Prices: An Empirical Analysis Based on the SVAR Models. Energy Econ. 2016, 57, 42–49. [Google Scholar] [CrossRef]

- Zylla, E.; Hartman, L.; State COVID-19 Data Dashboards. State Health and Value Strategies. Available online: https://www.shvs.org/state-covid-19-data-dashboards/ (accessed on 13 May 2020).

- Chen, Z.-L.; Zhang, Q.; Lu, Y.; Guo, Z.-M.; Zhang, X.; Zhang, W.-J.; Guo, C.; Liao, C.-H.; Li, Q.-L.; Han, X.-H.; et al. Distribution of the COVID-19 Epidemic and Correlation with Population Emigration from Wuhan, China. Chin. Med. J. 2020, 133, 1044–1050. [Google Scholar] [CrossRef] [PubMed]

- World Bank Group. Understanding the Coronavirus (COVID-19) Pandemic through Data. Available online: http://datatopics.worldbank.org/universal-health-coverage/coronavirus/ (accessed on 13 May 2020).

- Van Harn, E.-J.; van der Veen, M.; COVID-19 Economic Dashboard. RaboResearch—Economic Research. Available online: https://economics.rabobank.com/publications/2020/april/covid-19-economic-dashboard/ (accessed on 10 May 2020).

- Saba, A.I.; Elsheikh, A.H. Forecasting the Prevalence of COVID-19 Outbreak in Egypt Using Nonlinear Autoregressive Artificial Neural Networks. Process. Saf. Environ. Prot. 2020, 141, 1–8. [Google Scholar] [CrossRef]

- Take-profit.org. Country Rating on Oil Extraction and Export. Available online: https://take-profit.org/statistics/crude-oil-production/ (accessed on 13 May 2020).

- Petersen, T. V, W, U or L: What could the Economic Recovery from Coronavirus Look Like? Global Economic Dynamics Project. Available online: https://ged-project.de/globalization/v-w-u-or-l-what-could-the-economic-recovery-from-coronavirus-look-like/ (accessed on 13 May 2020).

- Times of India. U, V, W or L? The Alphabet Soup of Economic Recovery Scenarios. Available online: https://timesofindia.indiatimes.com/business/international-business/u-v-w-or-l-the-alphabet-soup-of-economic-recovery-scenarios/articleshow/75679548.cms (accessed on 13 May 2020).

- Beta Shares. The V, U, or L Shape: Investing Ideas for Recession Recovery Scenarios (Webinar Recap). Available online: https://www.betashares.com.au/insights/the-v-u-or-l-shape-investing-ideas-for-recession-recovery-scenarios-webinar-recap/ (accessed on 13 May 2020).

- Dzyadko, T.; Fadeeva, A.; Polyakova, V.; OPEC+ Countries Signed an Agreement to Record Oil Extraction Reduction. RBC. Available online: https://www.rbc.ru/business/12/04/2020/5e9357129a79473d1267e1d6 (accessed on 20 May 2020).

- Fadeeva, A.; Dzyadko, T.; The Largest Oil Producers have Agreed to Reduce the Extraction by 15%. Is This Deal Beneficial to the Russian budget? RBC. Available online: https://www.rbc.ru/business/11/04/2020/5e8f197d9a79472db6950881 (accessed on 20 May 2020).

- Dubravitskaya, O. Record Fall: OPEC Estimated Oil Demand Prospects. Gazeta.Ru. Available online: https://www.gazeta.ru/business/2020/04/16/13051201.shtml (accessed on 13 May 2020).

- United States Energy Information Administration. Global Liquid Fuels. Available online: https://www.eia.gov/outlooks/steo/report/global_oil.php (accessed on 10 May 2020).

- Knoema. Global Markets Moved by China Coronavirus Outbreak. Available online: https://knoema.com/lwdhxyc/global-markets-moved-by-china-coronavirus-outbreak# (accessed on 12 May 2020).

- Organisation for Economic Co-operation and Development. Tackling Coronavirus (COVID-19) Contributing to a Global Effort. Available online: http://www.oecd.org/coronavirus/en/ (accessed on 11 May 2020).

- Global Health Security Index. NTI, Johns Hopkins Center for Health Security, The Economist Intelligence Unit. Available online: https://www.ghsindex.org/wp-content/uploads/2019/10/2019-Global-Health-Security-Index.pdf (accessed on 13 May 2020).

- Malysheva, M. Organization, the Main Directions and Objectives of Economic Analysis Environmental Performance. J. Contemp. Econ. Issues 2013, 4. [Google Scholar] [CrossRef]

- Golovina, T.; Uvarova, E. Control System of the Riskoustoychivost of the Industrial Enterprises on the Basis of Diagnostics of Weak Signals of the Crisis Situation. J. Contemp. Econ. Issues 2014, 2. [Google Scholar] [CrossRef]

- Chikunov, S.; Ponkratov, V.V.; Sokolov, A.A.; Pozdnyaev, A.; Osinovskaya, I.V.; Ivleva, M. Financial Risks of Russian Oil Companies in Conditions of Volatility of Global Oil Prices. Int. J. Energy Econ. Policy 2019, 9, 18–29. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Park, K. Entrepreneurial Cyclical Dynamics of Open Innovation. J. Evol. Econ. 2018, 28, 1151–1174. [Google Scholar] [CrossRef]

- Yun, J.J.; Liu, Z. Micro- and Macro-Dynamics of Open Innovation with a Quadruple-Helix Model. Sustainability 2019, 11, 3301. [Google Scholar] [CrossRef]

- Yun, J.J.; Zhao, X.; Jung, K.; Yigitcanlar, T. The Culture for Open Innovation Dynamics. Sustainability 2020, 12, 5076. [Google Scholar] [CrossRef]

- Chiaroni, D.; Chiesa, V.; Frattini, F. The Open Innovation Journey: How Firms Dynamically Implement the Emerging Innovation Management Paradigm. Technovation 2011, 31, 34–43. [Google Scholar] [CrossRef]

- Laursen, K.; Salter, A. The Paradox of Openness: Appropriability, External Search and Collaboration. Res. Policy 2014, 43, 867–878. [Google Scholar] [CrossRef]

| P | X1 | X2 | X3 | X4 | X5 | X6 | X7 | X8 | X9 | X10 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| P | 1 | ||||||||||

| X1 | −0.81 * | 1 | |||||||||

| X2 | −0.74 * | 0.76 * | 1 | ||||||||

| X3 | −0.76 * | −0.04 | −0.11 | 1 | |||||||

| X4 | −0.50 * | −0.19 | −0.12 | 0.61 * | 1 | ||||||

| X5 | −0.71 * | −0.13 | −0.14 | −0.09 | −0.12 | 1 | |||||

| X6 | −0.70 * | −0.18 | −0.09 | −0.10 | −0.13 | 0.75 * | 1 | ||||

| X7 | −0.20 | −0.11 | −0.20 | −0.08 | −0.14 | −0.10 | −0.12 | 1 | |||

| X8 | −0.17 | −0.19 | −0.11 | −0.12 | −0.16 | −0.16 | −0.15 | 0.48 * | 1 | ||

| X9 | −0.79 * | −0.20 | −0.11 | −0.16 | −0.17 | −0.20 | −0.12 | −0.16 | −0.13 | 1 | |

| X10 | −0.75 * | −0.19 | −0.20 | −0.08 | −0.20 | −0.11 | −0.07 | −0.11 | −0.17 | 0.86 * | 1 |

| Indicator | Predicted Values | ||

|---|---|---|---|

| Q2 2020 | Q4 2020 | 2021 | |

| Z | 0.1924 | 0.0001 | 0 |

| X1 | 27.5 | 21.8 | 17.5 |

| X3 | 15.1 | 10.9 | 10.3 |

| X5 | 5.3 | 5.1 | 5.5 |

| X9 | 3.9 | 1.9 | 2.4 |

| YTP (Z) | 0.71 | 0.73 | 0.73 |

| YTP (X1) | 0.62 | 0.78 | 0.9 |

| YTP (X3) | 0.52 | 0.59 | 0.61 |

| YTP (X5) | 0.44 | 0.44 | 0.43 |

| YTP (X9) | 0.34 | 0.19 | 0.23 |

| YTP | 0.66 | 0.42 | 0.57 |

| p1 | 1 | 1 | 1 |

| p2 | 0 | 0 | 0 |

| p3 | 0 | 0 | 0 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ponkratov, V.; Kuznetsov, N.; Bashkirova, N.; Volkova, M.; Alimova, M.; Ivleva, M.; Vatutina, L.; Elyakova, I. Predictive Scenarios of the Russian Oil Industry; with a Discussion on Macro and Micro Dynamics of Open Innovation in the COVID 19 Pandemic. J. Open Innov. Technol. Mark. Complex. 2020, 6, 85. https://doi.org/10.3390/joitmc6030085

Ponkratov V, Kuznetsov N, Bashkirova N, Volkova M, Alimova M, Ivleva M, Vatutina L, Elyakova I. Predictive Scenarios of the Russian Oil Industry; with a Discussion on Macro and Micro Dynamics of Open Innovation in the COVID 19 Pandemic. Journal of Open Innovation: Technology, Market, and Complexity. 2020; 6(3):85. https://doi.org/10.3390/joitmc6030085

Chicago/Turabian StylePonkratov, Vadim, Nikolay Kuznetsov, Nadezhda Bashkirova, Maria Volkova, Maria Alimova, Marina Ivleva, Larisa Vatutina, and Izabella Elyakova. 2020. "Predictive Scenarios of the Russian Oil Industry; with a Discussion on Macro and Micro Dynamics of Open Innovation in the COVID 19 Pandemic" Journal of Open Innovation: Technology, Market, and Complexity 6, no. 3: 85. https://doi.org/10.3390/joitmc6030085

APA StylePonkratov, V., Kuznetsov, N., Bashkirova, N., Volkova, M., Alimova, M., Ivleva, M., Vatutina, L., & Elyakova, I. (2020). Predictive Scenarios of the Russian Oil Industry; with a Discussion on Macro and Micro Dynamics of Open Innovation in the COVID 19 Pandemic. Journal of Open Innovation: Technology, Market, and Complexity, 6(3), 85. https://doi.org/10.3390/joitmc6030085