An Endogenous Approach to the Cyclicality of R&D Investment under Credit Constraints: Firms’ Cash Flow Matters!

Abstract

1. Introduction

2. Methods and Materials

2.1. The Determinants of Being Financially Constrained

2.1.1. Characteristics of Firms

2.1.2. Particularities of R&D Investment

2.1.3. Macroeconomic Conditions

2.2. Decisions on Doing R&D and on R&D Expenditures

2.3. Model Formulation

3. Results

3.1. Sample Data and Variables

3.2. Empirical Results

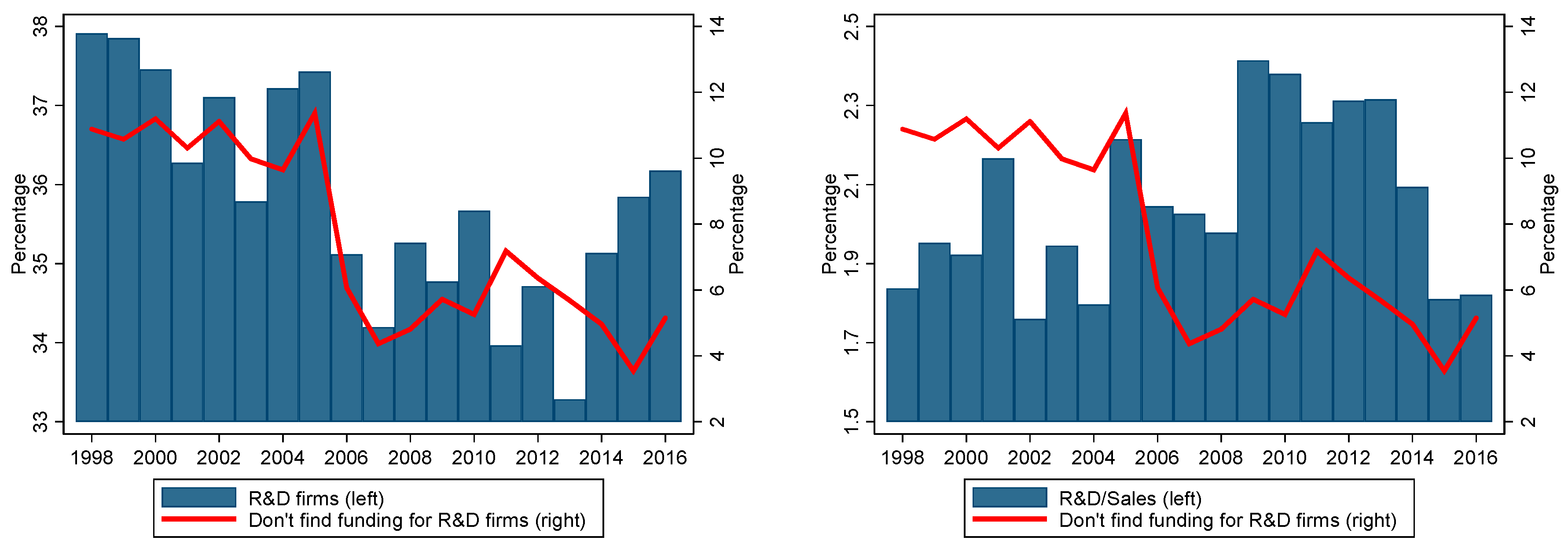

3.2.1. Descriptive Information

3.2.2. Results and Discussion of the Econometric Estimation

4. Discussion: Firms’ R&D Expenditures and Open Innovation in Externally Financial Constrained Situation

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Stiglitz, J.; Weiss, A. Credit Rationing in Markets with Imperfect Information. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Myers, S.; Majluf, N. Corporate Financing and Investment Decisions when Firms Have Information that Investors do not Have. J. Financ. Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef]

- Fazzari, S.; Hubbard, G.; Petersen, B. Financing Constraints and Corporate Investment. Brook. Pap. Econ. Act. 1988, 141–195. [Google Scholar] [CrossRef]

- Kaplan, S.N.; Zingales, L. Investment-Cash Flow Sensitivities Are not Valid Measures of Financing Constraints. Q. J. Econ. 2000, 115, 707–712. [Google Scholar] [CrossRef]

- Canepa, A.; Stoneman, P. Financial Constraints to Innovation in the UK: Evidence from CIS2 and CIS3. Oxf. Econ. Pap. 2008, 60, 711–730. [Google Scholar] [CrossRef]

- Hall, B.H. The Financing of Research and Development. Oxf. Rev. Econ. Policy 2002, 18, 35–51. [Google Scholar] [CrossRef]

- Hall, B.H. The Financing of Innovative Firms. Eib. Pap. 2009, 14, 8–28. [Google Scholar] [CrossRef]

- Piga, C.A.; Atzeni, G. R&D Investment, Credit Rationing and Sample Selection. Bull. Econ. Res. 2007, 59, 149–178. [Google Scholar]

- Savignac, F. Impact of Financial Constraints on Innovation: What Can Be Learned from a Direct Measure? Econ. Innov. New Tech. 2008, 17, 553–569. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Mohnen, P.; Palm, F.C.; van der Loeff, S.S. Financial Constraints and R&D Investment: Evidence from CIS. In Determinants of Innovative Behaviour: A Firm’s Internal Practices and Its External Environments; Kleinknecht, A., Ott, R., van Beers, C., Verburg, R., Eds.; Palgrave Macmillan: London, UK, 2008; pp. 217–242. [Google Scholar]

- Czarnitzki, D.; Hottenrott, H. R&D Investment and Financing Constraints of Small and Medium-Sized Firms. Small Bus. Econ. 2011, 36, 65–83. [Google Scholar]

- Beneito, P.; Rochina, M.E.; Sanchis, A. Ownership and the cyclicality of firms’ R&D investment. Int. Entrep. Manag. J. 2015, 11, 343–359. [Google Scholar]

- Bond, S.; Harhoff, D.; Van Reenen, J. Investment, R&D and Financial Constraints in Britain and Germany. Ann. Econ. Stat. 2005, 79/80, 435–463. [Google Scholar]

- Harris, R.; Trainor, M. Why Do Some Firms Undertake R&D Whereas Others Do Not? Discussion Papers; SERC (Spatial Economics Research Centre): London, UK, 2009. [Google Scholar]

- Mulkay, B.; Hall, B.H.; Mairesse, J. Investment and R&D in France and in the United States. In Investing Today for the World of Tomorrow; Bundesbank, D., Ed.; Springer: Berlin/Heidelberg, Germany, 2001. [Google Scholar]

- Bloom, N.; Griffith, R.; Van Reenen, J. Do R&D Tax Credits Work? Evidence from an International Panel of Countries 1979–97. J. Public Econ. 2002, 85, 1–31. [Google Scholar]

- Lach, S. Do R&D Subsidies Stimulate or Displace Private R&D? Evidence from Israel. J. Ind. Econ. 2002, 50, 369–390. [Google Scholar]

- Guellec, D.; Van Pottelsberghe de la Potterie, B. The Impact of Public R&D Expenditure on Business R&D. Econ. Innov. New Tech. 2003, 12, 225–243. [Google Scholar]

- Rafferty, M.C. Do Business Cycles Influence Long-Run Growth? The Effect of Aggregate Demand on Firm-Financed R&D Expenditures. East. Econ. J. 2003, 29, 607–618. [Google Scholar]

- Bloch, C. R&D Investment and Internal Finance: The Cash Flow Effect. Econ. Innov. New Tech. 2005, 14, 213–223. [Google Scholar]

- Bloom, N. Uncertainty and the Dynamics of R&D. Am. Econ. Rev. 2007, 97, 250–255. [Google Scholar]

- Aw, B.Y.; Roberts, M.J.; Xu, D.J. R&D Investments, Exporting, and the Evolution of Firm Productivity. Am. Econ. Rev. 2008, 98, 451–456. [Google Scholar]

- Aw, B.Y.; Roberts, M.J.; Xu, D.J. R&D Investment, Exporting and Productivity Dynamics. Am. Econ. Rev. 2011, 101, 1312–1344. [Google Scholar]

- Coad, A.; Rao, R. Firm Growth and R&D Expenditure. Econ. Innov. New Tech. 2010, 19, 127–145. [Google Scholar]

- Ouyang, M. On the Cyclicality of R&D. Rev. Econ. Stat. 2011, 93, 542–553. [Google Scholar]

- Becker, B. The Determinants of R&D Investment: A Survey of the Empirical Research. Economics Discussion Paper Series WP 2013-09; Loughborough University: Loughborough, UK, 2013. [Google Scholar]

- Fatas, A. Do Business-Cycles Cast Long Shadows? Short-Run Persistence and Economic Growth. J. Econ. Growth 2000, 5, 147–162. [Google Scholar] [CrossRef]

- Walde, K.; Woitek, U. R&D Expenditure in G7 countries and the Implications for Endogenous Fluctuations and Growth. Econ. Lett. 2004, 82, 91–97. [Google Scholar]

- Comin, D.; Gertler, M. Medium-Term Business Cycles. Am. Econ. Rev. 2006, 96, 523–551. [Google Scholar] [CrossRef]

- Barlevy, G. On the Cyclicality of Research and Development. Am. Econ. Rev. 2007, 97, 1134–1164. [Google Scholar] [CrossRef]

- Aghion, P.; Askenazy, P.; Berman, N.; Cette, G.; Eymard, L. Credit Constraints and the Cyclicality of R&D Investments: Evidence from France. J. Eur. Econ. Assoc. 2012, 10, 1001–1024. [Google Scholar]

- Lopez-Garcia, P.; Montero, J.M.; Morat-Benito, E. Business Cycles and Investment in Intangibles: Evidence from Spanish Firms; Working Paper; Bank of Spain: Madrid, Spain, 2012. [Google Scholar]

- Berger, A.; Udell, G. The Economics of Small Business Finance: The Roles of Private Equity and Debt Markets in the Financial Growth Cycle. J. Bank Financ. 1998, 22, 613–673. [Google Scholar] [CrossRef]

- Hubbard, R.G. Capital-Market Imperfections and Investment. J. Econ. Lit. 1998, 36, 193–225. [Google Scholar]

- Stein, J. Agency, Information and Corporate Investment. In Handbook of Economics and Finance; Constantinides, G., Harris, M., Stulz, R., Eds.; Elsevier North Holland: Amsterdam, The Netherlands, 2003. [Google Scholar]

- Máñez, J.A.; Rochina, M.E.; Sanchis, J.A.; Vicente, O. Financial constraints and R&D and Exporting Strategies for Spanish Manufacturing Firm. Ind. Corp Chang. 2014, 23, 1563–1594. [Google Scholar]

- Galia, F.; Legros, D. Complementarities between Obstacles to Innovation: Evidence from France. Res. Policy 2004, 33, 1185–1199. [Google Scholar] [CrossRef]

- Hyytinen, A.; Väänänen, L. Where Do Financial Constraints Originate From? An Empirical Analysis of Adverse Selection and Moral Hazard in Capital Markets. Small Bus. Econ. 2006, 27, 323–348. [Google Scholar] [CrossRef]

- Diamond, D. Reputation Acquisition in Debt Markets. J. Political Econ. 1989, 97, 828–862. [Google Scholar] [CrossRef]

- Pagano, P.; Schivardi, F. Firm Size Distribution and Growth. Scand. J. Econ. 2003, 105, 255–274. [Google Scholar] [CrossRef]

- Benfratello, L.; Schiantarelli, F.; Sembenelli, A. Banks and Innovation: Microeconometric Evidence on Italian Firms. J. Financ. Econ. 2008, 90, 197–217. [Google Scholar] [CrossRef]

- Schiantarelli, F.; Sembenelli, A. Form of Ownership and Financial Constraints: Panel Data Evidence from Flow of Funds and Investment Equations. Empirica 2000, 27, 175–192. [Google Scholar] [CrossRef]

- Beck, T.; Demirgüç-Kunt, A.; Maksimovic, V. The Determinants of Financing Obstacles. J. Int. Money Financ. 2006, 25, 932–952. [Google Scholar] [CrossRef]

- García-Vega, M.; Huergo, E. Determinants of International R&D Outsourcing: The Role of Trade. Rev. Dev. Econ. 2011, 15, 93–107. [Google Scholar]

- Brown, J.; Petersen, B. Cash Holdings and R&D Smoothing. J. Corp Financ. 2011, 17, 694–709. [Google Scholar]

- Brown, J.; Martinsson, G.; Petersen, B. Do Financing Constraints Matter for R&D? Eur. Econ. Rev. 2012, 56, 1512–1529. [Google Scholar]

- Arrow, K.J. Economics of Welfare and the Allocation of Resources for Invention. In The Rate and Direction of Inventive Activity; Nelson, R., Ed.; Princeton University Press: Princeton, NJ, USA, 1962; pp. 609–626. [Google Scholar]

- Hall, B.H.; Lerner, J. The Financing of R&D and Innovation. In Handbook of the Economics of Innovation; Hall, B.H., Rosenberg, N., Eds.; North-Holland: Amsterdam, The Netherlands, 2010. [Google Scholar]

- Hall, B.H. Investment and R&D at the Firm Level: Does the Source of Financing Matter? National Bureau of Economic Research, Working Paper n.º 4096. Available online: https://www.nber.org/papers/w4096 (accessed on 30 April 2020).

- Himmelberg, C.P.; Petersen, B.C. R&D and Internal Finance: A Study of Small Firms in High-Tech Industries. Rev. Econ. Stat. 1994, 76, 38–51. [Google Scholar]

- Chiao, C. Relationship between Debt, R&D and Physical Investment, Evidence from US Firm-Level Data. Appl. Financ. Econ. 2002, 12, 105–121. [Google Scholar]

- Mina, A.; Lahr, H.; Hughes, A. The Demand and Supply of External Finance for Innovative Firms. Ind. Corp. Chang. 2013, 22, 869–901. [Google Scholar] [CrossRef]

- Minsky, H.P. The Financial Instability Hypothesis; Working Paper 74. Available online: http://www.levyinstitute.org/pubs/wp74.pdf (accessed on 30 April 2020).

- Kaplan, S.N.; Zingales, L. Do Investment-Cash Flow Sensitivities Provide Useful Measures of Financing Constraints? Q. J. Econ. 1997, 112, 169–216. [Google Scholar] [CrossRef]

- Korajczyk, R.A.; Levy, A. Capital Structure Choice: Macroeconomic Conditions and Financial Constraints. J. Finan. Econ. 2003, 68, 75–109. [Google Scholar] [CrossRef]

- Levy, A.; Hennessy, C. Why Does Capital Structure Choice Vary with Macroeconomic Conditions? J. Monet. Econ. 2007, 54, 1545–1564. [Google Scholar] [CrossRef]

- Arqué-Castells, P.; Mohnen, P. Sunk Costs, Extensive R&D subsidies and Permanent Inducement Effects. J. Ind. Econ. 2015, 63, 458–494. [Google Scholar]

- Brown, J.; Fazzari, S.; Petersen, B. Financing Innovation and Growth: Cash Flow, External Equity and the 1990s R&D Boom. J. Finan. 2009, 64, 151–185. [Google Scholar]

- Durana, P.; Valaskova, K.; Vagner, L.; Zadnanova, S.; Podhorska, I.; Siekelova, A. Disclosure of Strategic Managers’ Factotum: Behavioral Incentives of Innovative Business. Int. J. Financ. Stud. 2020, 8, 17. [Google Scholar] [CrossRef]

- Melitz, M.J. The Impact of Trade on Aggregate Industry Productivity and Intra-Industry Reallocations. Econometrica 2003, 71, 1695–1725. [Google Scholar] [CrossRef]

- Girma, S.; Görg, H.; Hanley, A. R&D and Exporting: A Comparison of British and Irish Firms. Rev. World Econ. 2008, 144, 750–773. [Google Scholar]

- Bustos, P. Trade Liberalization, Exports, and Technology Upgrading: Evidence on the Impact of MERCOSUR on Argentinean Firms. Am. Econ. Rev. 2011, 101, 304–340. [Google Scholar] [CrossRef]

- González, X.; Jaumandreu, J.; Pazó, C. Barriers to Innovation and Subsidy Effectiveness. Rand J. Econ. 2005, 36, 930–950. [Google Scholar]

- Guariglia, A. Internal financial constraints, external financial constraints, and investment choice: Evidence from a panel of UK firms. J. Bank Financ. 2008, 32, 1795–1809. [Google Scholar] [CrossRef]

- Kliestik, T.; Misankova, M.; Valaskova, K.; Svabova, L. Bankruptcy prevention: New effort to reflect on legal and social changes. Sci. Eng. Ethics 2018, 24, 791–803. [Google Scholar] [CrossRef]

- Valaskova, K.; Kliestik, T.; Kovacova, M. Management of financial risks in Slovak enterprises using regression analysis. Oeconomia Copernic. 2018, 9, 105–121. [Google Scholar] [CrossRef]

- Rabe-Hesketh, S.; Skrondal, A.; Pickles, A. Generalized Multilevel Structural Equation Modeling. Psychometrika 2004, 69, 167–190. [Google Scholar] [CrossRef]

- Roodman, D. Fitting Fully Observed Recursive Mixed-Process Models with cmp. Stata J. 2011, 11, 159–206. [Google Scholar] [CrossRef]

- Frank, M.Z.; Goyal, V.K. Capital Structure Decisions: Which Factors are Reliably Important. Financ. Manag. 2009, 38, 1–37. [Google Scholar] [CrossRef]

- Ferreira, M.A.; Vilela, A.S. Why do firms hold cash? Evidence from EMU Countries. Eur. Financ. Manag. 2004, 10, 295–319. [Google Scholar] [CrossRef]

- Acharya, V.; Almeida, H.; Campello, M. Is cash negative debt? A hedging Perspective on Corporate Financial Policies! J. Financ. Intermed. 2007, 16, 515–554. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Park, K.; Jeong, E.; Zhao, X. The role of a business model in market growth: The difference between the converted industry and the emerging industry. Technol. Soc. Chang. 2019, 146, 534–562. [Google Scholar] [CrossRef]

- Van de Vrande, V.; de Jong, J.P.J.; Vanhaverbeke, W.; de Rochemont, M. Open innovation in SMEs: Trends, motives and management challenges. Technovation 2009, 29, 423–437. [Google Scholar] [CrossRef]

- Lee, S.; Park, G.; Yoon, B.; Park, J. Open innovation in SMEs—An intermediated network model. Res. Policy 2010, 39, 290–300. [Google Scholar] [CrossRef]

- Lichtenthaler, U. Outbound open innovation and its effect on firm performance: Examining environmental influences. RD Manag. 2009, 39, 317–330. [Google Scholar] [CrossRef]

- Yun, J.J.; Liu, Z. Micro- and Macro-Dynamics of Open Innovation with a Quadruple-Helix Model. Sustainability 2019, 11, 3301. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Park, K. Entrepreneurial cyclical dynamics of open innovation. J. Evol. Econ. 2018, 28, 1151–1174. [Google Scholar] [CrossRef]

| Total Sample | Subsample R&D | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Total | Have Problems to Find Finance | Difference Test a | Don’t Have Problems to Find Finance | ||||||

| Mean | Std. Dev. | Mean | Std. Dev. | Mean | Std. Dev. | Mean | Std. Dev. | ||

| Don’t find funding for R&D (% of firms) | 4.02 | 19.65 | 7.98 | 27.10 | |||||

| R&D (in thousands) | 813.47 | 7957.55 | 2114.71 | 12,722.98 | 1326.75 | 9917.24 | * | 2183.05 | 12,935.90 |

| Sales (in thousands) | 71,442.15 | 321,871.40 | 153,051.20 | 495,891.8 | 92,076.73 | 277,854.90 | *** | 158,339.50 | 510,099.20 |

| Age | 30.37 | 21.63 | 37.28 | 24.65 | 33.14 | 22.92 | *** | 37.64 | 24.76 |

| Group membership (% of firms) | 37.29 | 48.36 | 60.44 | 48.90 | 50.07 | 50.03 | *** | 61.34 | 48.70 |

| Owned by foreign capital (% of firms) | 16.70 | 37.30 | 29.01 | 45.38 | 20.50 | 40.40 | *** | 29.74 | 45.72 |

| Patents (% of firms) | 6.17 | 24.06 | 12.66 | 33.25 | 15.90 | 36.59 | *** | 12.37% | 32.93% |

| Debt with cost/Liabilities | 0.25 | 0.20 | 0.23 | 0.19 | 0.27 | 0.20 | *** | 0.23 | 0.19 |

| Cash Flow/Assets | 0.09 | 0.68 | 0.10 | 1.06 | 0.08 | 0.17 | 0.10 | 1.11 | |

| Public funding (% of firms) | 13.03 | 33.66 | 32.01 | 46.66 | 22.45 | 41.76 | *** | 32.84 | 46.97 |

| Debt Average Cost | 0.04 | 0.01 | 0.04 | 0.01 | 0.04 | 0.01 | *** | 0.04 | 0.01 |

| Investment in equipment/Assets | 0.03 | 0.05 | 0.03 | 0.04 | 0.03 | 0.05 | 0.03 | 0.04 | |

| GDP Deflator (+1) in % | 2.20 | 2.13 | 2.24 | 2.12 | 2.78 | 1.96 | *** | 2.19 | 2.12 |

| GDP Growth in % | 1.86 | 2.70 | 1.95 | 2.68 | 2.45 | 2.56 | *** | 1.90 | 2.68 |

| Debt Non-Financial Companies/GDP | 1.03 | 0.26 | 1.03 | 0.26 | 0.95 | 0.27 | *** | 1.03 | 0.26 |

| GDP Growth * (Cash Flow /Liabilities) | 0.002 | 0.02 | 0.003 | 0.04 | 0.003 | 0.01 | 0.002 | 0.04 | |

| Do R&D | Do not Find Funding for R&D | Log(R&D) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Coef. | Std. Error | Coef. | Std. Error | Coef. | Std. Error | ||||

| Don’t find funding for R&D | −2.148 | (0.073) | *** | ||||||

| Log(sales) | 0.385 | (0.008) | *** | −0.026 | (0.023) | 0.834 | (0.020) | *** | |

| Log(age) | 0.108 | (0.015) | *** | −0.025 | (0.028) | 0.096 | (0.025) | *** | |

| Group membership | 0.072 | (0.026) | *** | −0.064 | (0.045) | 0.208 | (0.041) | *** | |

| Owned by foreign capital | −0.202 | (0.029) | *** | −0.209 | (0.049) | *** | −0.357 | (0.042) | *** |

| Patents | −0.066 | (0.048) | |||||||

| Debt with cost/Liabilities(−1) | 0.040 | (0.051) | 0.246 | (0.102) | ** | 0.156 | (0.090) | * | |

| Cash Flow /Assets (−1) | −0.098 | (0.073) | −0.301 | (0.180) | * | −0.427 | (0.138) | *** | |

| Debt Average Cost (−1) | −1.944 | (0.818) | ** | 2.001 | (1.568) | −2.170 | (1.409) | ||

| Public subsidies (−1) | −0.461 | (0.039) | *** | ||||||

| Investment in equipment/Assets | −0.112 | (0.391) | |||||||

| Investment in equipment/Assets(−1) | 0.657 | (0.196) | *** | 0.557 | (0.354) | ||||

| Export activities | 0.540 | (0.027) | *** | 0.243 | (0.062) | *** | |||

| Standardized product | −0.129 | (0.023) | *** | −0.166 | (0.034) | *** | |||

| GDP Deflator (+1) | 1.393 | (0.675) | ** | 3.504 | (1.325) | *** | 1.918 | (1.106) | * |

| GDP Growth | −1.786 | (0.652) | *** | −2.728 | (1.303) | ** | −4.301 | (1.084) | *** |

| Debt Non-Financial Companies/GDP | −0.343 | (0.060) | *** | −0.398 | (0.109) | *** | −0.759 | (0.098) | *** |

| GDP Growth * (Cash Flow/Liabilities) | 3.297 | (2.108) | 8.275 | (4.998) | * | 12.669 | (4.023) | *** | |

| Sectorial dummiesincludedχ2(19) | 1372.35 | *** | 78.37 | *** | 911.01 | *** | |||

| Constant | −7.275 | (0.171) | *** | −1.002 | (0.557) | * | −2.510 | (0.470) | *** |

| ρ12 | −0.106 | (0.079) | |||||||

| ρ13 | 0.209 | (0.048) | *** | ||||||

| ρ23 | 0.749 | (0.020) | *** | ||||||

| Total obs. | 23,398 | ||||||||

| Log pseudolikelihood | −28,484.5 | ||||||||

| Do R&D | Do not Find Funding for R&D | Log(R&D) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Coef. | Std. Error | Coef. | Std. Error | Coef. | Std. Error | ||||

| Don’t find funding for R&D | −2.139 | (0.073) | *** | ||||||

| Log(sales) | 0.384 | (0.008) | *** | −0.026 | (0.023) | 0.834 | (0.020) | *** | |

| Log(age) | 0.115 | (0.015) | *** | −0.023 | (0.028) | 0.104 | (0.025) | *** | |

| Group membership | 0.074 | (0.026) | *** | −0.067 | (0.045) | 0.214 | (0.041) | *** | |

| Owned by foreign capital | −0.204 | (0.029) | *** | −0.210 | (0.050) | *** | −0.360 | (0.042) | *** |

| Patents | −0.064 | (0.048) | |||||||

| Debt with cost/Liabilities(−1) | 0.042 | (0.051) | 0.241 | (0.102) | ** | 0.180 | (0.090) | ** | |

| Cash Flow /Assets (−1) | 0.007 | (0.021) | −0.035 | (0.111) | 0.003 | (0.015) | |||

| Debt Average Cost (−1) | −2.811 | (0.863) | *** | 2.981 | (1.653) | * | −2.670 | (1.492) | * |

| Public subsidies (−1) | −0.463 | (0.039) | *** | ||||||

| Investment in equipment/Assets | −0.045 | (0.404) | |||||||

| Investment in equipment/Assets(−1) | 0.682 | (0.200) | *** | 0.689 | (0.365) | * | |||

| Export activities | 0.545 | (0.027) | *** | 0.246 | (0.062) | *** | |||

| Standardized product | −0.133 | (0.023) | *** | −0.169 | (0.034) | *** | |||

| 1998 | 0.287 | (0.063) | *** | 0.298 | (0.114) | *** | 0.600 | (0.102) | *** |

| 1999 | 0.287 | (0.059) | *** | 0.298 | (0.108) | *** | 0.540 | (0.095) | *** |

| 2000 | 0.174 | (0.060) | *** | 0.408 | (0.107) | *** | 0.484 | (0.096) | *** |

| 2001 | 0.135 | (0.061) | ** | 0.225 | (0.113) | ** | 0.461 | (0.099) | *** |

| 2002 | 0.153 | (0.058) | *** | 0.339 | (0.107) | *** | 0.390 | (0.094) | *** |

| 2003 | 0.054 | (0.061) | 0.322 | (0.111) | *** | 0.316 | (0.099) | *** | |

| 2004 | 0.096 | (0.060) | * | 0.319 | (0.109) | *** | 0.280 | (0.097) | *** |

| 2005 | 0.093 | (0.061) | 0.357 | (0.110) | *** | 0.237 | (0.099) | ** | |

| 2006 | 0.047 | (0.063) | 0.099 | (0.122) | 0.167 | (0.102) | * | ||

| 2008 | 0.037 | (0.057) | −0.050 | (0.117) | 0.027 | (0.094) | |||

| 2009 | 0.094 | (0.058) | * | 0.119 | (0.112) | 0.195 | (0.095) | ** | |

| 2010 | 0.108 | (0.058) | * | −0.012 | (0.118) | 0.129 | (0.094) | ||

| 2011 | −0.020 | (0.058) | 0.209 | (0.111) | * | 0.146 | (0.095) | ||

| 2012 | −0.026 | (0.059) | 0.061 | (0.120) | 0.149 | (0.097) | |||

| 2013 | −0.080 | (0.061) | 0.154 | (0.121) | 0.219 | (0.101) | ** | ||

| 2014 | −0.040 | (0.063) | −0.039 | (0.130) | 0.043 | (0.102) | |||

| 2015 | −0.088 | (0.064) | −0.034 | (0.135) | −0.046 | (0.104) | |||

| 2016 | −0.091 | (0.066) | 0.140 | (0.130) | 0.074 | (0.107) | |||

| χ2(18) | 95.20 | *** | 57.57 | *** | 102.44 | *** | |||

| Sectorial dummies includedχ2(19) | 1366.13 | *** | 79.34 | *** | 921.20 | *** | |||

| Constant | −7.680 | (0.159) | *** | −1.594 | (0.561) | *** | −3.611 | (0.471) | *** |

| ρ12 | −0.105 | (0.078) | |||||||

| ρ13 | 0.213 | (0.048) | *** | ||||||

| ρ23 | 0.748 | (0.020) | *** | ||||||

| Total obs. | 23,398 | ||||||||

| Log pseudolikelihood | −28,449.4 | ||||||||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Laborda, J.; Salas-Fumás, V.; Suárez, C. An Endogenous Approach to the Cyclicality of R&D Investment under Credit Constraints: Firms’ Cash Flow Matters! J. Open Innov. Technol. Mark. Complex. 2020, 6, 33. https://doi.org/10.3390/joitmc6020033

Laborda J, Salas-Fumás V, Suárez C. An Endogenous Approach to the Cyclicality of R&D Investment under Credit Constraints: Firms’ Cash Flow Matters! Journal of Open Innovation: Technology, Market, and Complexity. 2020; 6(2):33. https://doi.org/10.3390/joitmc6020033

Chicago/Turabian StyleLaborda, Juan, Vicente Salas-Fumás, and Cristina Suárez. 2020. "An Endogenous Approach to the Cyclicality of R&D Investment under Credit Constraints: Firms’ Cash Flow Matters!" Journal of Open Innovation: Technology, Market, and Complexity 6, no. 2: 33. https://doi.org/10.3390/joitmc6020033

APA StyleLaborda, J., Salas-Fumás, V., & Suárez, C. (2020). An Endogenous Approach to the Cyclicality of R&D Investment under Credit Constraints: Firms’ Cash Flow Matters! Journal of Open Innovation: Technology, Market, and Complexity, 6(2), 33. https://doi.org/10.3390/joitmc6020033