Performance Analysis of Gold- and Fiat-Backed Cryptocurrencies: Risk-Based Choice for a Portfolio

Abstract

:1. Introduction

2. Literature Review

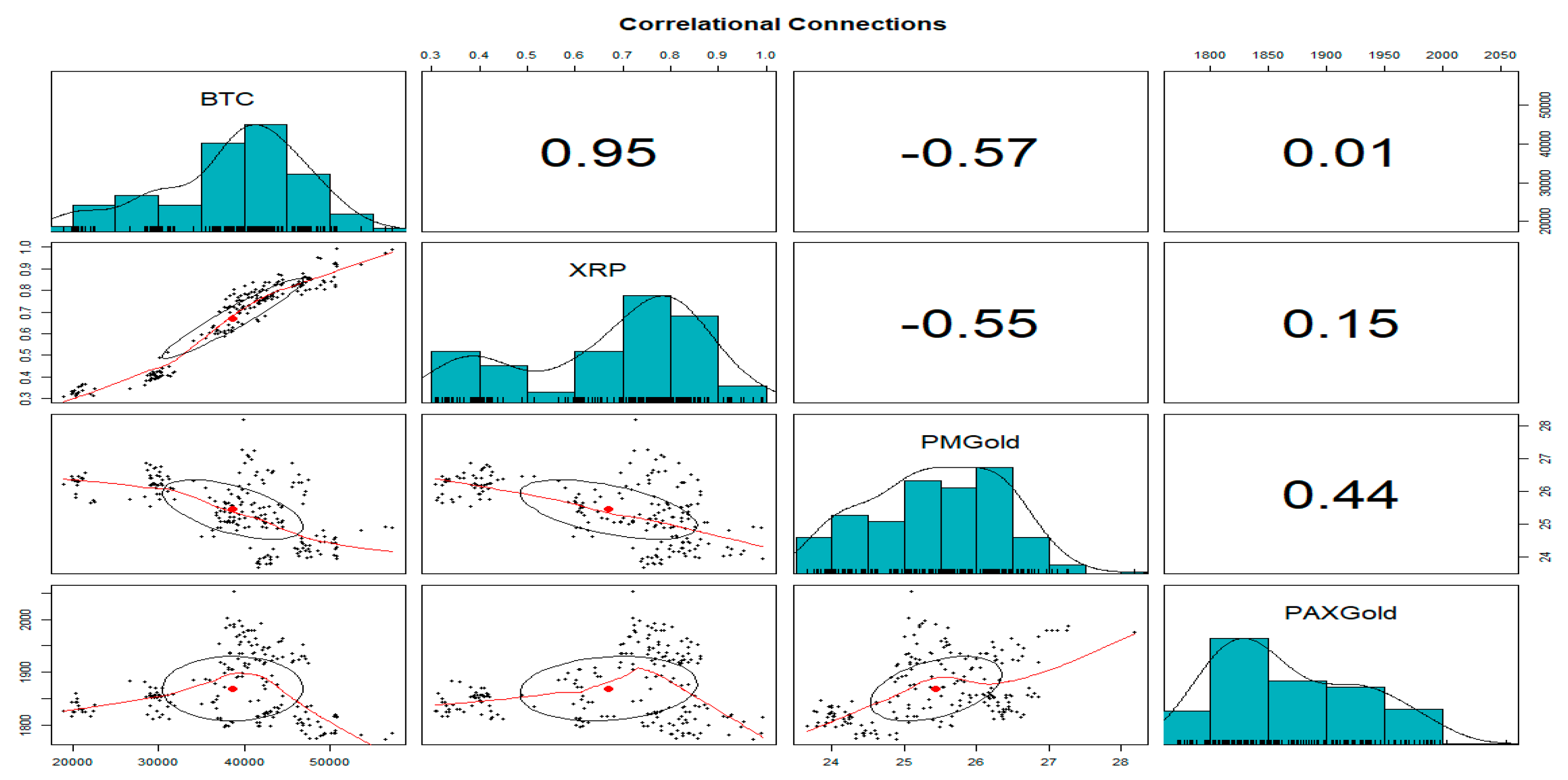

3. Data and Methodology

4. Results and Discussion

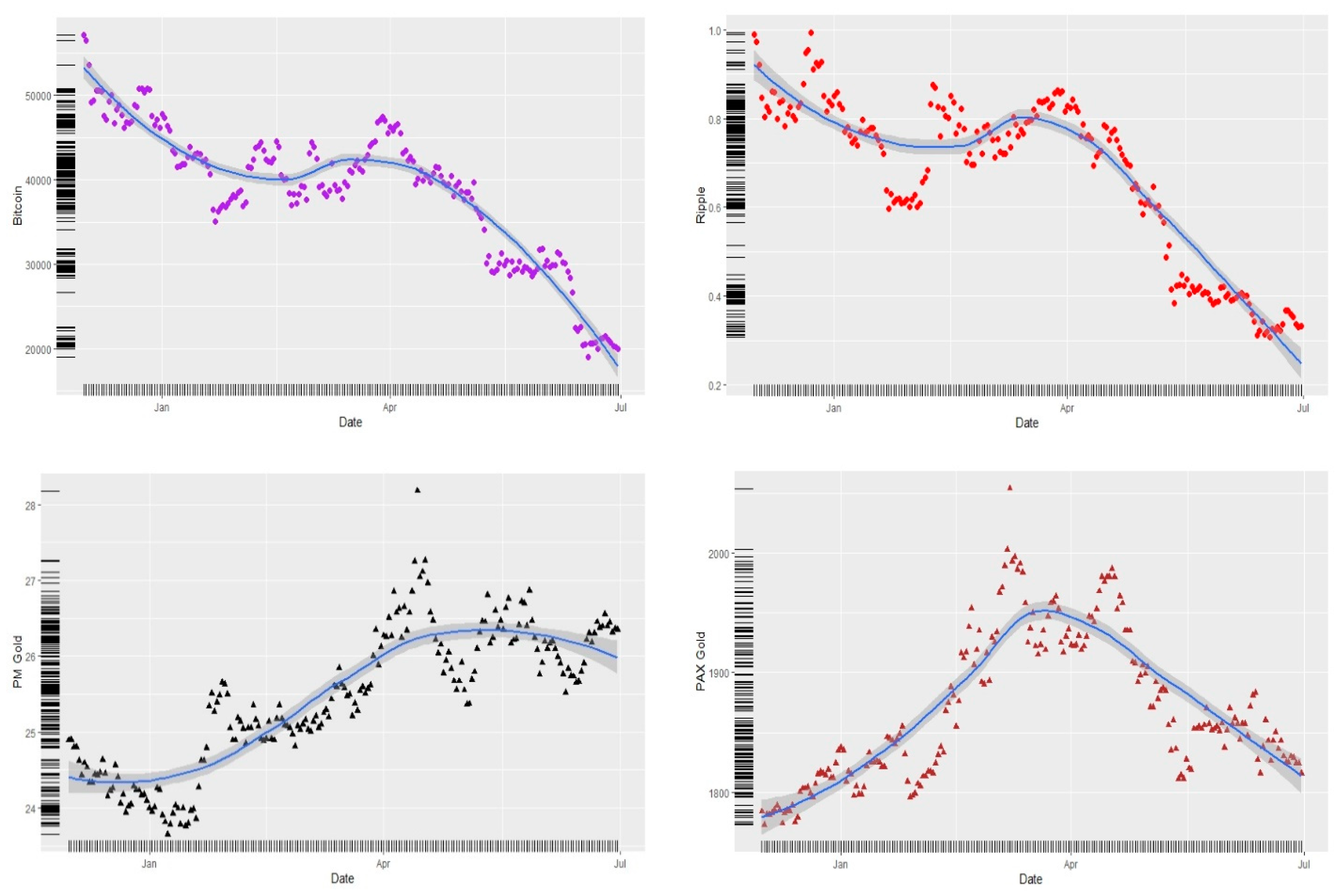

4.1. Results

4.2. Discussion

5. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

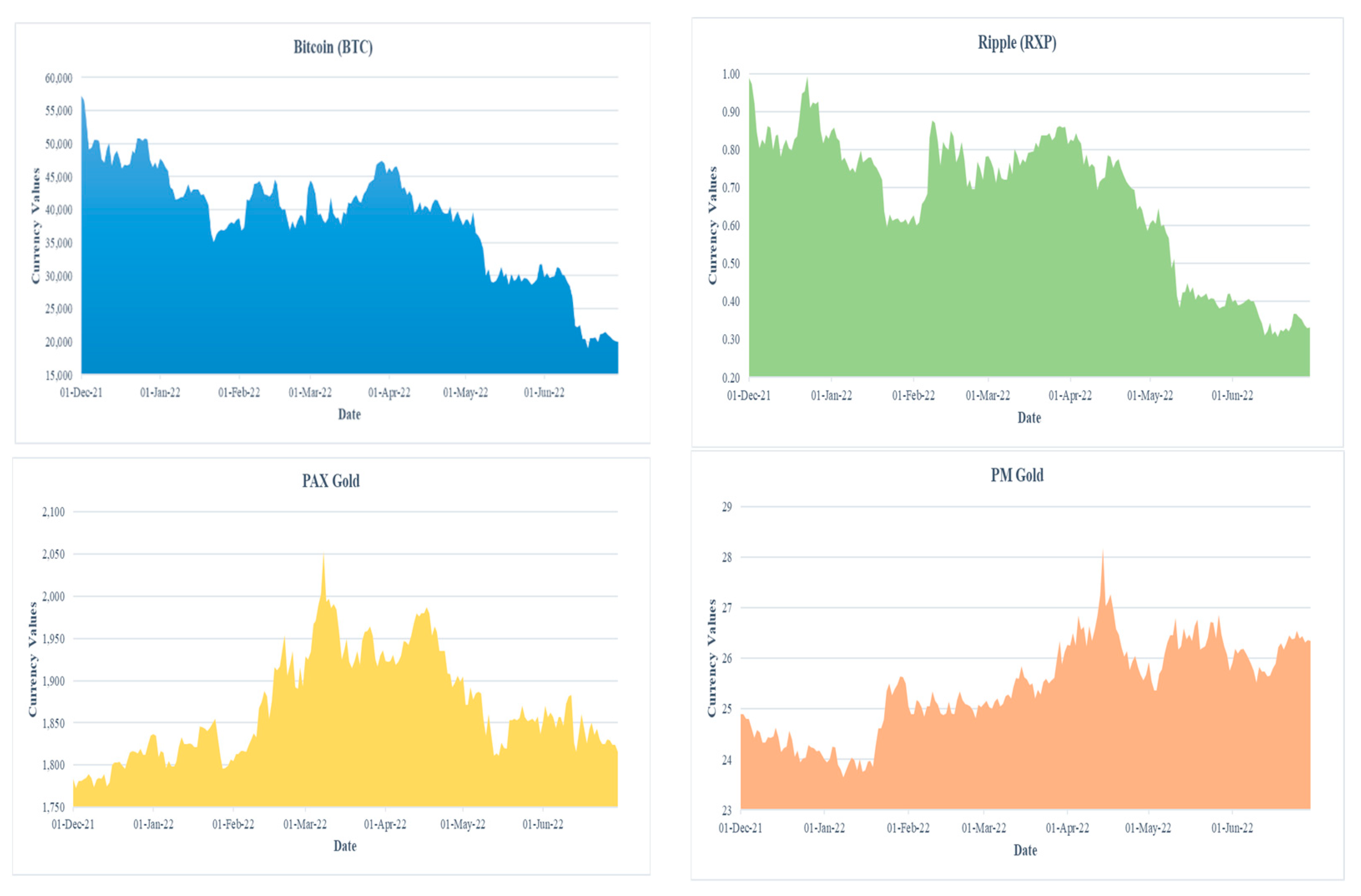

| 1 | The cryptocurrency market has been represented by Bitcoin with a hike during the last few years due to its popularity in developed markets. |

| 2 | Much of the research during the last two years, capturing the pandemic period, has explored how Bitcoin, Ripple, Ethereum, and other cryptocurrencies gained significant attention and became hedges or diversifiers. |

| 3 | The risk that an investment could lose value. |

| 4 | The debate surrounding safe havens, hedges, and diversifiers simultaneously consists of gold, oil, and cryptocurrencies in a portfolio (Bouri et al. 2017a). |

| 5 | Bitcoin is constantly criticized from two perspectives. First is its outrageous instability; it is the case that Bitcoin is exceptionally unpredictable (not a steady coin). Somewhat whimsical value variances are not entirely due to the built-in qualities of Bitcoin; practicality and volatile cost swings are, to a limited extent, brought about by legislature, banks, officials, and controllers running head first into reactions to Bitcoin and other coins. Second, Bitcoin has a supposed relationship with specific illegal exercises which can be firmly checked and discouraged by the establishment of appropriate regulations and laws. |

| 6 | Gold prices flared, and the pandemic has shaken the financial system; investors seek to invest in low-risk cryptocurrencies (Klein et al. 2018). |

| 7 | |

| 8 | In November 2001, the Bitcoin market declined and dropped to USD 18,000. In this scenario, investors are looking for safe asset classes for future investment (Karim et al. 2022). |

| 9 | This price fluctuation is influenced by reactions to news as the cryptocurrency market is susceptible and absorbs the impact rapidly. On the other hand, a sharp decline in the prices of cryptocurrencies was observed as bad news circulated (Urquhart and Zhang 2019). |

References

- Aharon, David Y., Ahmed S. Baig, and R. Jared DeLisle. 2022. The impact of government interventions on cross-listed securities: Evidence from the COVID-19 pandemic. Finance Research Letters 46: 102276. [Google Scholar] [CrossRef] [PubMed]

- Ahmed, Shaker, Klaus Grobys, and Niranjan Sapkota. 2020. Profitability of technical trading rules among cryptocurrencies with privacy function. Finance Research Letters 35: 101495. [Google Scholar] [CrossRef]

- Aloui, Chaker, Hela ben Hamida, and Larisa Yarovaya. 2021. Are Islamic gold-backed cryptocurrencies different? Finance Research Letters 39: 101615. [Google Scholar] [CrossRef]

- Anwer, Zaheer, Muhammad Abubakr Naeem, M. Kabir Hassan, and Sitara Karim. 2022. Asymmetric connectedness across Asia-Pacific currencies: Evidence from time-frequency domain analysis. Finance Research Letters 47: 102782. [Google Scholar] [CrossRef]

- Apergis, Nicholas. 2022. COVID-19 and cryptocurrency volatility: Evidence from asymmetric modelling. Finance Research Letters 47: 102659. [Google Scholar] [CrossRef] [PubMed]

- Appel, Dominik, and Michael Grabinski. 2011. The origin of financial crisis: A wrong definition of value. Portuguese Journal of Quantitative Methods 2: 33–51. [Google Scholar]

- Arfaoui, Nadia, and Imran Yousaf. 2022. Impact of covid-19 on volatility spillovers across international markets: Evidence from var asymmetric bekk garch model. Annals of Financial Economics 17: 1–25. [Google Scholar] [CrossRef]

- Aslanidis, Nektarios, Aurelio F. Bariviera, and Óscar G. López. 2022. The link between cryptocurrencies and Google Trends attention. Finance Research Letters 47: 102654. [Google Scholar] [CrossRef]

- Bouri, Elie, Chi Keung Marco Lau, Brian Lucey, and David Roubaud. 2019a. Trading volume and the predictability of return and volatility in the cryptocurrency market. Finance Research Letters 29: 340–46. [Google Scholar] [CrossRef]

- Bouri, Elie, Naji Jalkh, Peter Molnár, and David Roubaud. 2017a. Bitcoin for energy commodities before and after the December 2013 crash: Diversifier, hedge or safe haven? Applied Economics 49: 5063–73. [Google Scholar] [CrossRef]

- Bouri, Elie, Peter Molnár, Georges Azzi, David Roubaud, and Lars Ivar Hagfors. 2017b. On the hedge and safe haven properties of Bitcoin: Is it really more than a diversifier? Finance Research Letters 20: 192–98. [Google Scholar] [CrossRef]

- Bouri, Elie, Rangan Gupta, Aviral Kumar Tiwari, and David Roubaud. 2017c. Does Bitcoin hedge global uncertainty? Evidence from wavelet-based quantile-in-quantile regressions. Finance Research Letters 23: 87–95. [Google Scholar] [CrossRef]

- Bouri, Elie, Rangan Gupta, and David Roubaud. 2019b. Herding behaviour in cryptocurrencies. Finance Research Letters 29: 216–21. [Google Scholar] [CrossRef]

- Bouri, Elie, Syed Jawad Hussain Shahzad, David Roubaud, Ladislav Kristoufek, and Brian Lucey. 2020. Bitcoin, gold, and commodities as safe havens for stocks: New insight through wavelet analysis. Quarterly Review of Economics and Finance 77: 156–64. [Google Scholar] [CrossRef]

- Bredin, Don, Thomas Conlon, and Valerio Potì. 2015. Does gold glitter in the long-run? Gold as a hedge and safe haven across time and investment horizon. International Review of Financial Analysis 41: 320–28. [Google Scholar] [CrossRef]

- Brik, Hatem, Jihne El Ouakdi, and Zied Ftiti. 2022. Roles of Stable versus Nonstable Cryptocurrencies in Bitcoin Market Dynamics. Research in International Business and Finance 2022: 101720. [Google Scholar] [CrossRef]

- Bromberg-Martin, Ethan S., Yang-Yang Feng, Takaya Ogasawara, J. Kael White, Kaining Zhang, and Ilya E. Monosov. 2022. A neural mechanism for conserved value computations integrating information and rewards. bioRxiv. [Google Scholar] [CrossRef]

- Cao, Guangxi, and Wenhao Xie. 2022. Asymmetric dynamic spillover effect between cryptocurrency and China’s financial market: Evidence from TVP-VAR based connectedness approach. Finance Research Letters 49: 103070. [Google Scholar] [CrossRef]

- Chandio, Abbas Ali, Yuansheng Jiang, Waqar Akram, Sultan Adeel, Muhammad Irfan, and Inayatullah Jan. 2021. Addressing the effect of climate change in the framework of financial and technological development on cereal production in Pakistan. Journal of Cleaner Production 288: 125637. [Google Scholar] [CrossRef]

- Chen, Conghui, Lanlan Liu, and Ningru Zhao. 2020. Fear Sentiment, Uncertainty, and Bitcoin Price Dynamics: The Case of COVID-19. Emerging Markets Finance and Trade 56: 2298–309. [Google Scholar] [CrossRef]

- Chen, Huihui, Mubeen Abdur Rehman, Jia Luo, and Madad Ali. 2022. Dynamic influence of natural resources, financial integration and eco-innovation on ecological sustainability in EKC framework: Fresh insights from China. Resources Policy 79: 103043. [Google Scholar] [CrossRef]

- Ciaian, Pavel, Miroslava Rajcaniova, and d’Artis Kancs. 2018. Virtual relationships: Short- and long-run evidence from BitCoin and altcoin markets. Journal of International Financial Markets, Institutions and Money 52: 173–95. [Google Scholar] [CrossRef]

- Conlon, Thomas, and Richard McGee. 2020. Safe haven or risky hazard? Bitcoin during the Covid-19 bear market. Finance Research Letters 35: 101607. [Google Scholar] [CrossRef]

- Conlon, Thomas, Shaen Corbet, and Richard J. McGee. 2020. Are cryptocurrencies a safe haven for equity markets? An international perspective from the COVID-19 pandemic. Research in International Business and Finance 54: 101248. [Google Scholar] [CrossRef] [PubMed]

- Corbet, Shaen, Charles Larkin, and Brian Lucey. 2020a. The contagion effects of the COVID-19 pandemic: Evidence from gold and cryptocurrencies. Finance Research Letters 35: 101554. [Google Scholar] [CrossRef]

- Corbet, Shaen, Yang (Greg) Hou, Yang Hu, Charles Larkin, and Les Oxley. 2020b. Any port in a storm: Cryptocurrency safe-havens during the COVID-19 pandemic. Economics Letters 194: 109377. [Google Scholar] [CrossRef]

- Derrick, Allison. 2020. Cryptocurrencies and trade. The Economics of Cryptocurrencies 8: 65–73. [Google Scholar] [CrossRef]

- Díaz, Antonio, Carlos Esparcia, and Diego Huélamo. 2022. The Role of Stablecoins: Cryptocurrencies Sought Stability and Found Gold and Dollars. Mathematical and Statistical Methods for Actuarial Sciences and Finance. Cham: Springer International Publishing, pp. 209–15. [Google Scholar] [CrossRef]

- Dunbar, Kwamie, and Johnson Owusu-Amoako. 2022. Cryptocurrency returns under empirical asset pricing. International Review of Financial Analysis 82: 102216. [Google Scholar] [CrossRef]

- Enoksen, Fredrik A., Ch J. Landsnes, Katarina Lučivjanská, and Peter Molnár. 2020. Understanding risk of bubbles in cryptocurrencies. Journal of Economic Behavior and Organization 176: 129–44. [Google Scholar] [CrossRef]

- García-Medina, Andrés, and José B. Hernández C. 2020. Network Analysis of Multivariate Transfer Entropy of Cryptocurrencies in Times of Turbulence. Entropy 22: 760. [Google Scholar] [CrossRef] [PubMed]

- Ghorbel, Achraf, and Ahmed Jeribi. 2021. Contagion of COVID-19 pandemic between oil and financial assets: The evidence of multivariate Markov switching GARCH models. Journal of Investment Compliance 22: 151–69. [Google Scholar] [CrossRef]

- Gil-Alana, Luis Alberiko, Emmanuel Joel Aikins Abakah, and María Fátima Romero Rojo. 2020. Cryptocurrencies and stock market indices. Are they related? Research in International Business and Finance 51: 101063. [Google Scholar] [CrossRef]

- Grabinski, Michael, and Galiya Klinkova. 2019. Wrong Use of Averages Implies Wrong Results from Many Heuristic Models. Applied Mathematics 10: 605–18. [Google Scholar] [CrossRef]

- Grabinski, Michael, and Galiya Klinkova. 2020. Scrutinizing distributions proves that IQ is inherited and explains the fat tail. Applied Mathematics 11: 605–18. [Google Scholar] [CrossRef]

- Hasan, Mudassar, Muhammad Abubakr Naeem, Muhammad Arif, Syed Jawad Hussain Shahzad, and Xuan Vinh Vo. 2022. Liquidity connectedness in cryptocurrency market. Financial Innovation 8: 3. [Google Scholar] [CrossRef] [PubMed]

- Hu, Yang, Harold Glenn A. Valera, and Les Oxley. 2019. Market efficiency of the top market-cap cryptocurrencies: Further evidence from a panel framework. Finance Research Letters 31: 138–45. [Google Scholar] [CrossRef]

- Hung, Ngo Thai. 2022. Asymmetric connectedness among S&P 500, crude oil, gold and Bitcoin. Managerial Finance 48: 587–610. [Google Scholar] [CrossRef]

- Iqbal, Najaf, Zeeshan Fareed, Guangcai Wan, and Farrukh Shahzad. 2021. Asymmetric nexus between COVID-19 outbreak in the world and cryptocurrency market. International Review of Financial Analysis 73: 101613. [Google Scholar] [CrossRef]

- Irfan, Muhammad, Asif Razzaq, Arshian Sharif, and Xiaodong Yang. 2022a. Influence mechanism between green finance and green innovation: Exploring regional policy intervention effects in China. Technological Forecasting and Social Change 182: 121882. [Google Scholar] [CrossRef]

- Irfan, Muhammad, Mubeen Abdur Rehman, Xuemei Liu, and Asif Razzaq. 2022b. Interlinkages between mineral resources, financial markets, and sustainable energy sources: Evidence from minerals exporting countries. Resources Policy 79: 103088. [Google Scholar] [CrossRef]

- Jalan, Akanksha, Roman Matkovskyy, and Larisa Yarovaya. 2021. “Shiny” crypto assets: A systemic look at gold-backed cryptocurrencies during the COVID-19 pandemic. International Review of Financial Analysis 78: 101958. [Google Scholar] [CrossRef] [PubMed]

- Karim, Sitara, Brian M. Lucey, Muhammad Abubakr Naeem, and Samuel A. Vigne. 2022. The dark side of Bitcoin: Do Emerging Asian Islamic markets help subdue the ethical risk? Emerging Markets Review 31: 100921. [Google Scholar] [CrossRef]

- Katsiampa, Paraskevi, Larisa Yarovaya, and Damian Zięba. 2022. High-frequency connectedness between Bitcoin and other top-traded crypto assets during the COVID-19 crisis. Journal of International Financial Markets, Institutions and Money 79: 101578. [Google Scholar] [CrossRef]

- Khan, Irfan, Fujun Hou, Abdulrasheed Zakari, Muhammad Irfan, and Munir Ahmad. 2022. Links among energy intensity, non-linear financial development, and environmental sustainability: New evidence from Asia Pacific Economic Cooperation countries. Journal of Cleaner Production 330: 129747. [Google Scholar] [CrossRef]

- Klein, Tony, Hien Pham Thu, and Thomas Walther. 2018. Bitcoin is not the New Gold—A comparison of volatility, correlation, and portfolio performance. International Review of Financial Analysis 59: 105–16. [Google Scholar] [CrossRef]

- Kumar, Ashish, Najaf Iqbal, Subrata Kumar Mitra, Ladislav Kristoufek, and Elie Bouri. 2022. Connectedness among major cryptocurrencies in standard times and during the COVID-19 outbreak. Journal of International Financial Markets, Institutions and Money 77: 101523. [Google Scholar] [CrossRef]

- Kyriazis, Nikolaos A. 2019. A Survey on Efficiency and Profitable Trading Opportunities in Cryptocurrency Markets. Journal of Risk and Financial Management 12: 67. [Google Scholar] [CrossRef]

- Kyriazis, Nikolaos, Stephanos Papadamou, and Shaen Corbet. 2020. A systematic review of the bubble dynamics of cryptocurrency prices. Research in International Business and Finance 54: 101254. [Google Scholar] [CrossRef]

- Liu, Xiaoxi, Asif Razzaq, Mohsin Shahzad, and Muhammad Irfan. 2022. Technological changes, financial development and ecological consequences: A comparative study of developed and developing economies. Technological Forecasting and Social Change 184: 122004. [Google Scholar] [CrossRef]

- Mahdavi-Damghani, Babak, Robert Fraser, James Howell, and Jon Sveinbjorn Halldorsson. 2022. Cryptocurrency Sectorization through Clustering and Web-Scraping: Application to Systematic Trading. The Journal of Financial Data Science 4: 158–79. [Google Scholar] [CrossRef]

- Mnif, Emna, Anis Jarboui, and Khaireddine Mouakhar. 2020. How the cryptocurrency market has performed during COVID 19? A multifractal analysis. Finance Research Letters 36: 101647. [Google Scholar] [CrossRef]

- Mnif, Emna, Khaireddine Mouakhar, and Anis Jarboui. 2022. The co-movements of faith-based cryptocurrencies in periods of pandemics. Review of Financial Economics 40: 300–11. [Google Scholar] [CrossRef]

- Naeem, Muhammad Abubakr, Imen Mbarki, and Syed Jawad Hussain Shahzad. 2021. Predictive role of online investor sentiment for cryptocurrency market: Evidence from happiness and fears. International Review of Economics and Finance 73: 496–514. [Google Scholar] [CrossRef]

- Palamalai, Srinivasan, K. Krishna Kumar, and Bipasha Maity. 2021. Testing the random walk hypothesis for leading cryptocurrencies. Borsa Istanbul Review 21: 256–68. [Google Scholar] [CrossRef]

- Qian, Lihua, Jiqian Wang, Feng Ma, and Ziyang Li. 2022. Bitcoin volatility predictability–The role of jumps and regimes. Finance Research Letters 47: 102687. [Google Scholar] [CrossRef]

- Rehman, Mubeen Abdur, Zeeshan Fareed, and Farrukh Shahzad. 2022. When would the dark clouds of financial inclusion be over, and the environment becomes clean? The role of national governance. Environmental Science and Pollution Research 29: 27651–63. [Google Scholar] [CrossRef] [PubMed]

- Ren, Xiaohang, Rui Wang, Kun Duan, and Jinyu Chen. 2022. Dynamics of the sheltering role of Bitcoin against crude oil market crash with varying severity of the COVID-19: A comparison with gold. Research in International Business and Finance 62: 101672. [Google Scholar] [CrossRef]

- Shahzad, Syed Jawad Hussain, Elie Bouri, David Roubaud, Ladislav Kristoufek, and Brian Lucey. 2019. Is Bitcoin a better safe-haven investment than gold and commodities? International Review of Financial Analysis 63: 322–30. [Google Scholar] [CrossRef]

- Taheri, Siavash, Janelle Mann, and Austin McWhirter. 2021. The Nexus between Cryptocurrencies, Currencies and Commodities: A Primer. Cryptofinance, 191–206. [Google Scholar] [CrossRef]

- Tan, Shay Kee, Jennifer So Kuen Chan, and Kok Haur Ng. 2020. On the speculative nature of cryptocurrencies: A study on Garman and Klass volatility measure. Finance Research Letters 32: 101075. [Google Scholar] [CrossRef]

- Thompson, Earl A. 2007. The tulip mania: Fact or artifact? Public Choice 130: 99–114. Available online: https://www.jstor.org/stable/i27698036 (accessed on 4 August 2022). [CrossRef]

- Tien, Ho Thuy, and Ngo Thai Hung. 2022. Volatility spillover effects between oil and GCC stock markets: A wavelet-based asymmetric dynamic conditional correlation approach. International Journal of Islamic and Middle Eastern Finance and Management 15: 1127–49. [Google Scholar] [CrossRef]

- Tormählen, Maike, Galiya Klinkova, and Michael Grabinski. 2021. Statistical significance revisited. Mathematics 9: 958. [Google Scholar] [CrossRef]

- Trabelsi, Nader. 2019. Dynamic and frequency connectedness across Islamic stock indexes, bonds, crude oil and gold. International Journal of Islamic and Middle Eastern Finance and Management 12: 306–21. [Google Scholar] [CrossRef]

- Urquhart, Andrew, and Hanxiong Zhang. 2019. Is Bitcoin a hedge or safe haven for currencies? An intraday analysis. International Review of Financial Analysis 63: 49–57. [Google Scholar] [CrossRef]

- Vigliotti, Maria Grazia, and Haydn Jones. 2020. The Rise and Rise of Cryptocurrencies. The Executive Guide to Blockchain: Using Smart Contracts and Digital Currencies in your Business. 71–91. [Google Scholar] [CrossRef]

- Wang, Gang Jin, Xin yu Ma, and Hao yu Wu. 2020. Are stablecoins truly diversifiers, hedges, or safe havens against traditional cryptocurrencies as their name suggests? Research in International Business and Finance 54: 101225. [Google Scholar] [CrossRef]

- Wasiuzzaman, Shaista, Ayu Nadhirah Muhd Azwan, and Aina Nazurah Hj Nordin. 2022. Analysis of the performance of Islamic gold-backed cryptocurrencies during the bear market of 2020. Emerging Markets Review 2022: 100920. [Google Scholar] [CrossRef]

- Wasiuzzaman, Shaista, and Hajah Siti Wardah Haji Abdul Rahman. 2021. Performance of gold-backed cryptocurrencies during the COVID-19 crisis. Finance Research Letters 43: 101958. [Google Scholar] [CrossRef] [PubMed]

- Xie, Bofeng, Mubeen Abdur Rehman, Junyan Zhang, and Runze Yang. 2022. Does the financialization of natural resources lead toward sustainability? An application of advance panel Granger non-causality. Resources Policy 79: 102989. [Google Scholar] [CrossRef]

- Yousaf, Imran, and Larisa Yarovaya. 2022. Spillovers between the Islamic gold-backed cryptocurrencies and equity markets during the COVID-19: A sectorial analysis. Pacific Basin Finance Journal 71: 101705. [Google Scholar] [CrossRef]

- Zhang, Yun, Yun Liu, Yifei Zhang, and Xin Chen. 2022. Globalization blueprint and households’ fintech debt: Evidence from China’s One Belt One Road initiative. International Review of Economics and Finance 79: 38–55. [Google Scholar] [CrossRef]

| BTC | XRP | PM Gold | PAX Gold | |

|---|---|---|---|---|

| No. of Obs. | 212 | 212 | 212 | 212 |

| Mean | 38,677.580 | 0.670 | 25.438 | 1868.896 |

| SD | 8191.568 | 0.185 | 0.906 | 61.245 |

| Mean/SD | 4.722 | 3.615 | 28.072 | 30.515 |

| Min | 18,986.500 | 0.308 | 23.650 | 1773.000 |

| 1st Quantile | 20,111.300 | 0.321 | 23.780 | 1779.000 |

| Median | 40,039.050 | 0.748 | 25.505 | 1854.000 |

| 3rd Quantile | 50,801.000 | 0.954 | 27.110 | 1993.000 |

| Max | 57,210.300 | 0.994 | 28.180 | 2054.000 |

| Test of Normality | ||||

| Skewness | 0.003 | 0.585 | 0.382 | 0.004 |

| Kurtosis | 0.606 | 0.536 | 0.538 | 0.012 |

| Jarque-Bera | 8.490 | 0.690 | 1.160 | 12.590 |

| Probability | 0.014 | 0.709 | 0.561 | 0.002 |

| Test of Autocorrelation | ||||

| Statistics | 623.745 | 523.876 | 648.952 | 550.438 |

| p-value | 0.000 | 0.000 | 0.000 | 0.000 |

| Test of Heteroscedasticity | ||||

| Statistics | 30.49 | 27.1 | 4.88 | 1.31 |

| p-value | 0.000 | 0.000 | 0.027 | 0.253 |

| Variables | ADF | PP | KPSS | |||

|---|---|---|---|---|---|---|

| I(0) | I(I) | I(0) | I(I) | I(0) | I(I) | |

| BTC | −1.160 | −14.307 *** | −1.198 | −14.307 *** | 2.440 *** | 0.091 |

| XRP | −1.152 | −14.979 *** | −1.152 | −14.979 *** | 3.040 *** | 0.064 |

| PM Gold | −1.759 | −16.863 *** | −1.759 | −16.863 *** | 1.350 *** | 0.036 |

| PAX Gold | −2.006 | −15.738 *** | −2.006 | −15.738 *** | 4.010 *** | 0.033 |

| Cryptocurrency | N | Positive Returns | Negative Returns | Expected Runs | Z-Value | p-Value |

|---|---|---|---|---|---|---|

| BTC | 212 | 127 | 85 | 18 | −12.160 *** | 0.000 |

| XRP | 212 | 130 | 82 | 4 | −14.160 *** | 0.000 |

| PM Gold | 212 | 110 | 102 | 10 | −13.350 *** | 0.000 |

| PAX Gold | 212 | 90 | 122 | 11 | −13.190 *** | 0.000 |

| Chi-Square | Lags (p) | DF | p-Value |

|---|---|---|---|

| 13.714 *** | 1 | 1 | 0.000 |

| Variables | BTC | XRP | PM Gold | PAX Gold |

|---|---|---|---|---|

| β | 5.301 | 0.689 *** | −0.002 | 1868.037 *** |

| (0.862) | (0.000) | (0.532) | (0.000) | |

| AR1 | −0.142 *** | −0.328 *** | 0.053 | −0.270 *** |

| (0.003) | (0.000) | (0.506) | (0.000) | |

| MA1 | −0.949 *** | −0.965 *** | ||

| (0.000) | (0.000) | |||

| ARCH1 | −0.207 *** | −0.226 *** | −0.097 ** | −0.061 |

| (0.000) | (0.000) | (0.049) | (0.284) | |

| p-value | 0.000 | 0.000 | 0.000 | 0.000 |

| Wald Chi2 | 5640.260 | 32.080 | 3313.150 | 12.350 |

| Arch Effect | (1) | (0) | (1) | (0) |

| Variance Equation | ||||

| β | 33,033.750 *** | −0.451 *** | 10.618 *** | 572.360 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| µ | −0.751 *** | −0.877 *** | 0.118 *** | −0.669 *** |

| (0.000) | (0.000) | (0.547) | (0.000) | |

| α | 15.106 *** | −6.351 *** | −1.155 *** | 7.287 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| p-value | 0.000 | 0.000 | 0.000 | 0.000 |

| Wald Chi2 | 10,649.770 | 5032.930 | 317.340 | 393.490 |

| N | 212 | 212 | 212 | 212 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Irfan, M.; Rehman, M.A.; Nawazish, S.; Hao, Y. Performance Analysis of Gold- and Fiat-Backed Cryptocurrencies: Risk-Based Choice for a Portfolio. J. Risk Financial Manag. 2023, 16, 99. https://doi.org/10.3390/jrfm16020099

Irfan M, Rehman MA, Nawazish S, Hao Y. Performance Analysis of Gold- and Fiat-Backed Cryptocurrencies: Risk-Based Choice for a Portfolio. Journal of Risk and Financial Management. 2023; 16(2):99. https://doi.org/10.3390/jrfm16020099

Chicago/Turabian StyleIrfan, Muhammad, Mubeen Abdur Rehman, Sarah Nawazish, and Yu Hao. 2023. "Performance Analysis of Gold- and Fiat-Backed Cryptocurrencies: Risk-Based Choice for a Portfolio" Journal of Risk and Financial Management 16, no. 2: 99. https://doi.org/10.3390/jrfm16020099

APA StyleIrfan, M., Rehman, M. A., Nawazish, S., & Hao, Y. (2023). Performance Analysis of Gold- and Fiat-Backed Cryptocurrencies: Risk-Based Choice for a Portfolio. Journal of Risk and Financial Management, 16(2), 99. https://doi.org/10.3390/jrfm16020099