The Oil Price and Trade Nexus in the Gulf Co-Operation Council Countries

Abstract

1. Introduction

2. Literature Review

3. Methods

4. Results

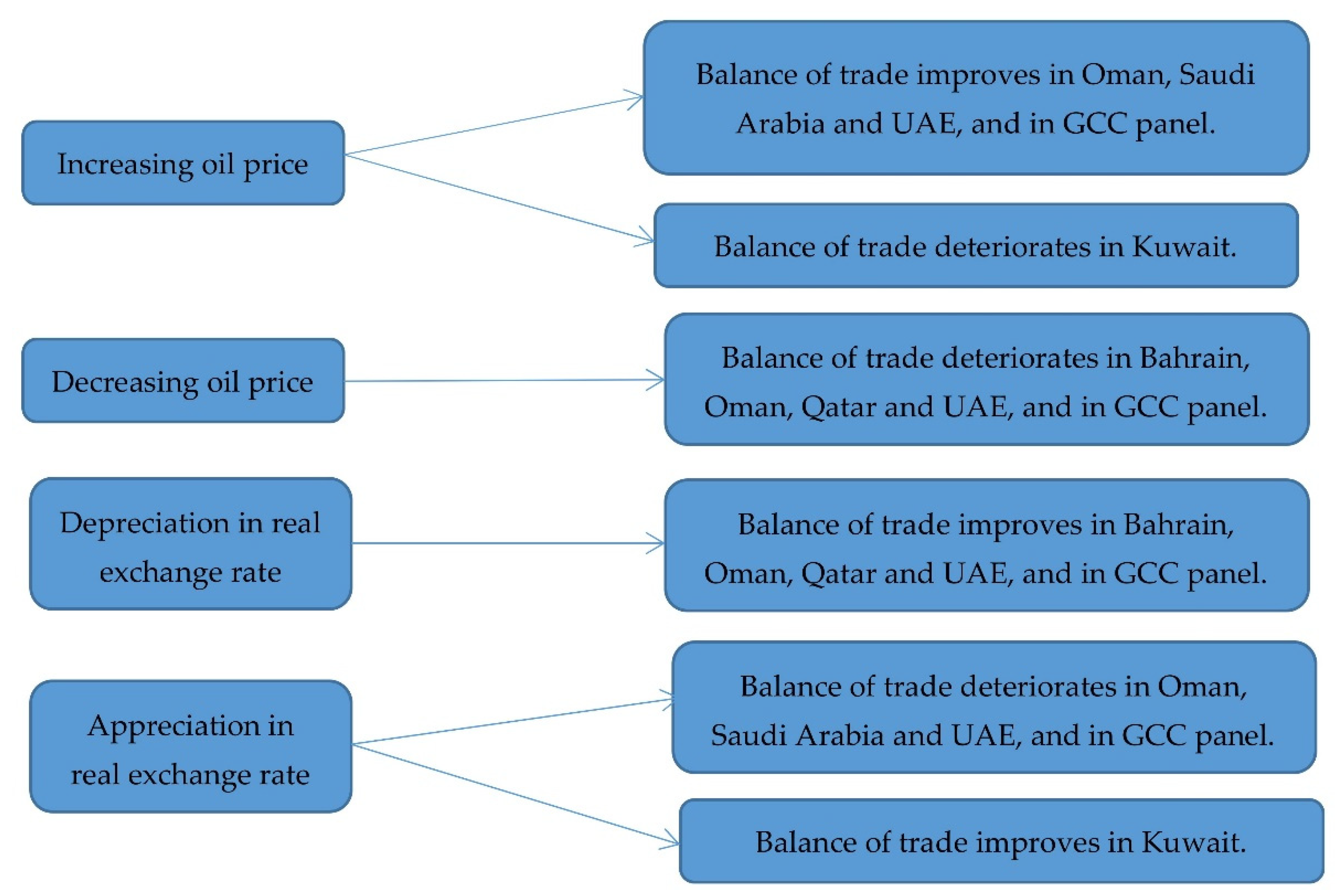

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Svensson, L. Oil prices, welfare, and the trade balance. Q. J. Econ. 1984, 99, 649–672. [Google Scholar] [CrossRef]

- Krugman, P. The Narrow Moving Band, the Dutch Disease, and the Competitive Consequences of Mrs. Thatcher: Notes on Trade in the Presence of Dynamic Scale Economies. J. Dev. Econ. 1987, 27, 41–55. [Google Scholar] [CrossRef]

- Timilsina, G.R. Oil Prices and the Global Economy: A General Equilibrium Analysis. Energy Econ. 2015, 49, 669–675. [Google Scholar] [CrossRef]

- Bodenstein, M.; Erceg, C.J.; Guerrieri, L. Oil shocks and external adjustment. J. Int. Econ. 2011, 83, 168–184. [Google Scholar] [CrossRef]

- Kilian, L.; Rebuccic, A.; Spatafora, N. Oil shocks and external balances. J. Int. Econ. 2009, 77, 181–194. [Google Scholar] [CrossRef]

- Le, T.-H.; Chang, Y. Oil price shocks and trade imbalances. Energy Econ. 2013, 36, 78–96. [Google Scholar] [CrossRef]

- Rafiq, S.; Sgroa, P.; Apergis, N. Asymmetric oil shocks and external balances of major oil exporting and importing countries. Energy Econ. 2016, 56, 42–50. [Google Scholar] [CrossRef]

- Korhonen, I.; Ledyaeva, S. Trade linkages and macroeconomic effects of the price of oil. Energy Econ. 2010, 32, 848–856. [Google Scholar] [CrossRef]

- Collier, P. The Bottom Billion: Why the Poorest Countries Are Falling behind and What Can Be Done about It; Oxford University Press: Oxford, UK, 2007. [Google Scholar]

- Huntington, H.G. Crude Oil-trade and Current Account Deficits. Energy Econ. 2015, 50, 70–79. [Google Scholar] [CrossRef]

- Jibril, H.; Chaudhuri, K.; Mohaddes, K. Asymmetric oil prices and trade imbalances: Does the source of the oil shock matter? Energy Policy 2020, 137, 111100. [Google Scholar] [CrossRef]

- Baek, J.; Kwon, K.D. Asymmetric effects of oil price changes on the balance of trade: Evidence from selected African countries. World Econ. 2019, 42, 3235–3252. [Google Scholar] [CrossRef]

- Baek, J.; Ikponmwosa, M.J.; Choi, Y.J. Crude oil prices and the balance of trade: Asymmetric evidence from selected OPEC member countries. J. Int. Trade Econ. Dev. 2019, 28, 533–547. [Google Scholar] [CrossRef]

- Ahad, M.; Anwer, Z. Asymmetrical relationship between oil price shocks and trade deficit: Evidence from Pakistan. J. Int. Trade Econ. Dev. 2020, 29, 163–180. [Google Scholar] [CrossRef]

- Akoum, I.; Graham, M.; Kivihaho, J.; Nikkinen, J.; Omran, M. Co-movement of oil and stock prices in the GCC region: A wavelet analysis. Q. Rev. Econ. Financ. 2012, 52, 385–394. [Google Scholar] [CrossRef]

- Arouri, M.E.H.; Lahiani, A.; Bellalah, M. Oil price shocks and stock market returns in oil-exporting countries: The case of GCC countries. Int. J. Econ. Financ. 2010, 2, 132–139. [Google Scholar] [CrossRef]

- Arouri, M.E.H.; Rault, C. Oil prices and stock markets in GCC countries: Empirical evidence from panel analysis. Int. J. Financ. Econ. 2011, 17, 242–253. [Google Scholar] [CrossRef]

- Arouri, M.E.H.; Lahiani, A.; Nguyen, D.K. Return and volatility transmission between world oil prices and stock markets of the GCC countries. Econ. Model. 2011, 28, 1815–1825. [Google Scholar] [CrossRef]

- Fayyad, A.; Daly, K. The impact of oil price shocks on stock market returns: Comparing GCC countries with the UK and USA. Emerg. Mark. Rev. 2011, 12, 61–78. [Google Scholar] [CrossRef]

- Louis, R.J.; Balli, F. Oil price and stock market synchronization in gulf cooperation council countries. Emerg. Mark. Financ. Trade 2014, 50, 22–51. [Google Scholar] [CrossRef]

- Mokni, K.; Youssef, M. Measuring persistence of dependence between crude oil prices and GCC stock markets: A copula approach. Q. Rev. Econ. Financ. 2019, 72, 14–33. [Google Scholar] [CrossRef]

- Nusair, S.A.; Al-Khasawneh, J.A. Oil price shocks and stock market returns of the GCC countries: Empirical evidence from quantile regression analysis. Econ. Change Restruct. 2018, 51, 339–372. [Google Scholar] [CrossRef]

- Siddiqui, A.; Mahmood, H.; Margaritis, D. Oil prices and Stock Markets during the 2014–16 Oil Price Slump: Asymmetries and Speed of Adjustment in GCC and Oil Importing Countries. Emerg. Mark. Financ. Trade 2019. [Google Scholar] [CrossRef]

- Nnachi, O.I. Improving the Forecast Accuracy of Oil-Stock Nexus in GCC Countries. Theor. Econ. Lett. 2018, 8, 3073–3091. [Google Scholar] [CrossRef][Green Version]

- Am, M.A.; Shanmugasundaram, G. Nexus between Crude Oil Price, Exchange Rate and Stock Market: Evidence from Oil Exporting and Importing Economies. Int. J. Humanit. Manag. Sci. 2017, 5, 41–43. [Google Scholar]

- Nusair, S.A. The effects of oil price shocks on the economies of the Gulf Co-operation Council countries: Nonlinear analysis. Energy Policy 2016, 91, 256–267. [Google Scholar] [CrossRef]

- Mahmood, H.; Zamil, A.M.A. Oil price and slumps effects on personal consumption in Saudi Arabia. Int. J. Energy Econ. Policy 2019, 9, 12–15. [Google Scholar] [CrossRef]

- Mahmood, H.; Alkhateeb, T.T.Y. Foreign Direct Investment, Domestic Investment and Oil Price Nexus in Saudi Arabia. Int. J. Energy Econ. Policy 2018, 8, 147–151. [Google Scholar]

- Metwally, M.M.; Perera, N. The effect of the downturn in oil prices on the relative efficiency of government expenditure in the GCC countries. Int. J. Energy Res. 1995, 19, 639–643. [Google Scholar] [CrossRef]

- El Mahmah, A.; Kandil, M. Fiscal sustainability challenges in the new normal of low oil prices: Empirical evidence from GCC countries. Int. J. Dev. Issues 2019, 18, 109–134. [Google Scholar] [CrossRef]

- Alkhateeb, T.T.Y.; Mahmood, H.; Sultan, Z.A.; Ahmad, N. Oil Price and Employment Nexus in Saudi Arabia. Int. J. Energy Econ. Policy 2017, 7, 277–281. [Google Scholar]

- Erdogan, S.; Cevik, E.I.; Gedikli, A. Relationship between oil price volatility and military expenditures in GCC countries. Environ. Sci. Pollut. Res. 2020, 27, 17072–17084. [Google Scholar] [CrossRef] [PubMed]

- Metwally, M.M. The effect of the downturn in oil prices on the external surpluses of the GCC countries. Int. J. Energy Res. 1993, 17, 173–182. [Google Scholar] [CrossRef]

- Haque, M.I. Oil price shocks and energy consumption in GCC countries: A system-GMM approach. Environ. Dev. Sustain. 2020. [Google Scholar] [CrossRef]

- Alkhateeb, T.T.Y.; Mahmood, H. Oil Price and Energy Depletion Nexus in GCC Countries: Asymmetry Analyses. Energies 2020, 13, 3058. [Google Scholar] [CrossRef]

- Gazdar, K.; Hassan, M.K.; Safa, M.F.; Grassa, R. Oil price volatility, Islamic financial development and economic growth in Gulf Cooperation Council (GCC) countries. Borsa Istanb. Rev. 2019, 19, 197–206. [Google Scholar] [CrossRef]

- Jouini, J. Linkage between international trade and economic growth in GCC countries: Empirical evidence from PMG estimation approach. J. Int. Trade Econ. Dev. 2015, 24, 341–372. [Google Scholar] [CrossRef]

- Aloui, C.; Hkiri, B.; Hammoudeh, S.; Shahbaz, M. A Multiple and Partial Wavelet Analysis of the Oil Price, Inflation, Exchange Rate, and Economic Growth Nexus in Saudi Arabia. Emerg. Mark. Financ. Trade 2018, 54, 935–956. [Google Scholar] [CrossRef]

- Nanovsky, S. The impact of oil prices on trade. Rev. Int. Econ. 2019, 27, 431–447. [Google Scholar] [CrossRef]

- Salisua, A.A.; Isaha, K.O.; Oyewoleb, O.J.; Akannic, L.O. Modelling oil price-inflation nexus: The role of asymmetries. Energy 2017, 125, 97–106. [Google Scholar] [CrossRef]

- Hatemi-J, A.; El-Khatib, J. The nexus of trade-weighted dollar rates and the oil prices: An asymmetric approach. J. Econ. Stud. 2020, 47, 1579–1589. [Google Scholar] [CrossRef]

- Al Rasasi, M. Oil prices and GCC exchange rates. Energy Sources Part B Econ. Plan. Policy 2017, 12, 344–350. [Google Scholar] [CrossRef]

- De, S.; Quayyum, S.; Schuettler, K.; Yousefi, S.R. Oil prices, growth, and remittance outflows from the Gulf Cooperation Council. Econ. Notes 2019, 48, e12144. [Google Scholar] [CrossRef]

- World Bank. World Development Indicators; The World Bank: Washington, DC, USA, 2019. [Google Scholar]

- Government of Saudi Arabia. Saudi Arabian Monetary Agency, Annual Statistics 2019; Saudi Arabian Monetary Agency: Riyadh, Saudi Arabia, 2019.

- Broock, W.A.; Scheinkman, J.A.; Dechert, W.D.; LeBaron, B. A Test for Independence Based on the Correlation Dimension. Econom. Rev. 1996, 15, 197–235. [Google Scholar] [CrossRef]

- Shin, Y.; Yu, B.; Greenwood-Nimmo, M. Modelling asymmetric cointegration and dynamic multiplier in an ARDL framework. In Festschrift in Honor of Peter Schmidt: Econometric Methods and Applications; Horrace, W.C., Sickles, R.C., Eds.; Springer Science and Business Media: New York, NY, USA, 2014; pp. 281–314. ISBN 1489980075. [Google Scholar]

- Ng, S.; Perron, P. Lag Length Selection and the Construction of Unit Root Tests with Good Size and Power. Econometrica 2001, 69, 1519–1554. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Structural analysis of vector error correction models with exogenous I(1) variables. J. Econom. 2001, 97, 293–343. [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for Unit Roots in Heterogeneous Panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Kao, C. Spurious regression and residual-based tests for cointegration in panel data. J. Econom. 1999, 90, 1–44. [Google Scholar] [CrossRef]

- Maddala, G.S.; Wu, S. A Comparative Study of Unit Root Tests with Panel Data and A New Simple Test. Oxf. Bull. Econ. Stat. 1999, 61, 631–652. [Google Scholar] [CrossRef]

- Johansen, S. Statistical Analysis of Cointegration Vectors. J. Econ. Control 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Pedroni, P. Panel Cointegration: Asymptotic and Finite Sample Properties of Pooled Time Series Tests with an Application to the PPP Hypothesis. Econom. Theory 2004, 20, 597–625. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R. Pooled mean group estimator of dynamic heterogeneous panels. J. Am. Stat. Assoc. 1999, 94, 621–634. [Google Scholar] [CrossRef]

- Pedroni, P. Fully modified OLS for heterogeneous cointegrated panels. Adv. Econom. 2001, 15, 93–130. [Google Scholar]

- Kao, C.; Chiang, M.H. On the estimation and inference of a co-integrated regression in panel data. Adv. Econom. 2000, 15, 179–222. [Google Scholar]

- Mahmood, H.; Alkhateeb, T.T.Y.; Ahmad, N. Impact of Devaluation on Service Sector Exports in Saudi Arabia: Non-Linear ARDL Approach. Econ. Ann. XXI 2017, 165, 36–40. [Google Scholar] [CrossRef]

- Kripfganz, S.; Schneider, D.C. Response Surface Regressions for Critical Value Bounds and Approximate p-Values in Equilibrium Correction Models; University of Exeter: Exeter, UK; Max Planck Institute for Demographic Research: Rostock, Germany, 2018; Available online: http://www.kripfganz.de/research/Kripfganz_Schneider_ec.html (accessed on 6 May 2020).

| Authors | Countries | Major Findings |

|---|---|---|

| The literature on testing the symmetrical relationship between oil prices and trade | ||

| Kilian et al. [5] | 26 oil-exporting and 12 oil-importing countries | Oil demand and supply shocks were majorly responsible for a change in the external balances of both oil exporting and importing economies. |

| Le and Chang [6] | Japan, Singapore, and Malaysia | Oil prices caused oil trade balances in all investigated countries. |

| Nanovsky [39] | 63 industrialized countries | Increasing oil prices restricted trade in nearby countries and vice versa. |

| The literature on testing the asymmetrical relationship between oil prices and trade | ||

| Rafiq et al. [7] | 28 oil-exporting and 40 oil-importing countries | The asymmetrical effect of oil prices was found in both oil-exporting and importing countries. |

| Baek et al. [13] | Organization of the Petroleum Exporting Countries (OPEC) members | The asymmetrical effect of oil prices on oil trade was found in some of the investigated countries. |

| Baek and Kwon [12] | African oil-exporter countries | The asymmetrical effect of oil prices on oil trade was found. |

| Jibril et al. [11] | 25 oil-exporting and 76 oil-importing countries | Increasing (decreasing) oil demand and supply shocks had negative (positive) effects in oil-exporting and vice versa in oil-importing countries. |

| Ahad and Anwer [14] | Pakistan | A positive and asymmetrical relationship was found between oil prices and the trade deficit. |

| The literature on oil prices-related studies in GCC countries | ||

| Metwally [33] | GCC countries | A positive relationship was found between oil exports and external surpluses. |

| Al Rasasi [42] | GCC countries | Increasing oil prices resulted in appreciation. |

| Metwally and Perera [29] | GCC countries | A negative relationship was found between oil prices and public spending. |

| El Mahmah and Kandil [30] | GCC countries | A positive relationship was corroborated between oil prices and fiscal primary balances. |

| Arouri et al. [16] | GCC countries | A nonlinear positive relationship was found between oil prices and SMI in 4 out of 6 GCC countries. |

| Arouri and Rault [17] | GCC countries | A positive relationship was found between oil prices and SMI in 5 out of 6 GCC countries. |

| Arouri et al. [18] | GCC countries | A positive relationship was found between oil prices and SMRs. |

| Fayyad and Daly [19] | UK, US, and GCC region | Oil prices improved the predictability of SMRs. |

| Louis and Balli [20] | GCC countries | A mild to a strong relationship was found between oil prices and SMI. |

| Akoum et al. [13] | GCC countries | A positive relationship was found between oil and SMRs. |

| Nusair and Al-Khasawneh [22] | GCC countries | A positive and asymmetrical relationship was found between oil prices and SMRs. |

| Siddiqui et al. [23] | GCC countries and the four largest Asian oil importers | A positive and asymmetrical relationship was found between oil prices and SMI in most of the GCC stock markets. |

| Mokni and Youssef [21] | GCC countries | A relationship between oil prices and SMRs became stronger after the 2014-oil price slump. |

| Nusair [26] | GCC countries | A positive and asymmetrical relationship was found between oil prices and economic growth. |

| Mahmood and Zamil [27] | Saudi Arabia | A positive relationship was found between oil prices and personal consumption. |

| De et al. [43] | GCC countries | A positive relationship was found between oil prices and remittances. |

| Alkhateeb and Mahmood [35] | Saudi Arabia | A positive and asymmetrical relationship was found between oil prices and energy depletion. |

| Erdogan et al. [32] | Bahrain, Kuwait, KSA, and Oman | A positive relationship was found between oil prices and military spending in Kuwait, KSA, and Oman. |

| Mahmood and Alkhateeb [28] | Saudi Arabia | A positive relationship was found between oil prices and foreign direct investment inflows. |

| Alkhateeb et al. [31] | Saudi Arabia | A positive relationship was found between oil prices and employment. |

| Country | Dimension | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| Variable | |||||

| Bahrain | BOTt | 0.0778 (0.0000) | 0.1228 (0.0000) | 0.1373 (0.0000) | 0.1358 (0.0000) |

| RERt | 0.1558 (0.0000) | 0.2558 (0.0000) | 0.3280 (0.0000) | 0.3710 (0.0000) | |

| OPt | 0.1306 (0.0000) | 0.2229 (0.0000) | 0.3066 (0.0000) | 0.3509 (0.0000) | |

| Kuwait | BOTt | 0.0797 (0.0000) | 0.1195 (0.0000) | 0.1247 (0.0000) | 0.1206 (0.0000) |

| RERt | 0.1799 (0.0000) | 0.3005 (0.0000) | 0.3841 (0.0000) | 0.4365 (0.0000) | |

| OPt | 0.1600 (0.0000) | 0.2787 (0.0000) | 0.3639 (0.0000) | 0.4122 (0.0000) | |

| Oman | BOTt | 0.0492 (0.0001) | 0.0683 (0.0007) | 0.0557 (0.0222) | 0.0423 (0.0913) |

| RERt | 0.1678 (0.0000) | 0.2819 (0.0000) | 0.3594 (0.0000) | 0.4074 (0.0000) | |

| Qatar | BOTt | 0.0904 (0.0000) | 0.1506 (0.0000) | 0.1659 (0.0000) | 0.2129 (0.0000) |

| RERt | 0.2131 (0.0000) | 0.3641 (0.0000) | 0.4683 (0.0000) | 0.5349 (0.0000) | |

| OPt | 0.1523 (0.0000) | 0.2732 (0.0000) | 0.3580 (0.0000) | 0.4029 (0.0000) | |

| Saudi Arabia | BOTt | 0.1191 (0.0000) | 0.1945 (0.0000) | 0.2386 (0.0000) | 0.2599 (0.0000) |

| RERt | 0.1765 (0.0000) | 0.3024 (0.0000) | 0.3902 (0.0000) | 0.4492 (0.0000) | |

| UAE | BOTt | 0.0590 (0.0000) | 0.1230 (0.0000) | 0.1389 (0.0000) | 0.1062 (0.0000) |

| RERt | 0.1914 (0.0000) | 0.3309 (0.0000) | 0.4215 (0.0000) | 0.4788 (0.0000) | |

| OPt | 0.1647 (0.0000) | 0.2647 (0.0000) | 0.3088 (0.0000) | 0.3322 (0.0000) |

| Test | Series | Level-Variables | Differenced-Variables | ||

|---|---|---|---|---|---|

| C | C&T | C | C&T | ||

| LLC | BOTit | −1.3748 | 0.1086 | −4.2998 *** | −2.6179 *** |

| POPit | −1.0957 | −0.8888 | −10.7994 *** | −9.7220 *** | |

| NOPit | 2.5129 | −1.1236 | −13.3411 *** | −12.0371 *** | |

| PRERit | 2.2623 | −1.4989 | −14.0542 *** | −12.1978 *** | |

| NRERit | −1.0902 | −0.9194 | −12.6662 *** | −10.9018 *** | |

| IPS | BOTit | −0.9548 | −0.1214 | −11.7930 *** | −10.6834 *** |

| POPit | 1.9755 | −0.3818 | −9.2387 *** | −7.9786 *** | |

| NOPit | 5.0301 | −0.4016 | −11.3402 *** | −10.1354 *** | |

| PRERit | 4.7012 | −0.1213 | −11.5483 *** | −10.7280 *** | |

| NRERit | −0.1329 | −0.7590 | −6.0569 *** | −5.3464 *** | |

| Pedroni’s Test | ||||

| Test | Statistic | p-Value | Statistic | p-Value |

| v-stat. | 1.6774 | 0.0467 | 1.3590 | 0.0871 |

| rho-stat. | −0.6750 | 0.2498 | −0.6135 | 0.2698 |

| PP-statistic | −2.0455 | 0.0204 | −1.8205 | 0.0343 |

| ADF-stat. | −2.3520 | 0.0093 | −2.0566 | 0.0199 |

| Group rho-stat istic | 0.5538 | 0.7101 | ||

| Group PP-stat istic | −2.7058 | 0.0034 | ||

| Group ADF-stat istic | −2.7118 | 0.0033 | ||

| Kao’s Test | ||||

| ADF-stat istic | −4.13449 | 0.0000 | ||

| Johansen-Fisher’s Test | ||||

| Co-Integrated Vectors | Trace Statistic | p-Value | Max-Eigen Statistic | p-Value |

| None | 110.60 | 0.0000 | 81.40 | 0.0000 |

| At-most 1 | 72.43 | 0.0000 | 53.51 | 0.0000 |

| At-most 2 | 32.60 | 0.0011 | 22.70 | 0.0304 |

| At-most 3 | 18.77 | 0.0943 | 18.40 | 0.1040 |

| At-most 4 | 13.11 | 0.3611 | 13.11 | 0.3611 |

| Variable | PMG | FMOLS | DOLS |

|---|---|---|---|

| POPit | 0.4302 (0.0019) | 0.2708 (0.0268) | 0.4910 (0.0003) |

| NOPit | 0.5213 (0.0008) | 0.4064 (0.0050) | 0.5862 (0.0000) |

| PRERit | 0.6474 (0.0432) | 0.9672 (0.0039) | 1.1531 (0.0001) |

| NRERit | 0.5242 (0.0113) | 0.4470 (0.0138) | 0.7228 (0.0009) |

| Country | Variable | Level | First Difference | ||||||

|---|---|---|---|---|---|---|---|---|---|

| MZa | MZt | MSB | MPT | MZa | MZt | MSB | MPT | ||

| Bahrain | BOTt | −11.011 | −2.277 | 0.207 | 8.618 | −18.337 ** | −3.028 ** | 0.165 ** | 4.971 ** |

| POPt | −3.255 | −1.232 | 0.378 | 27.052 | −17.799 ** | −2.957 ** | 0.166 ** | 5.276 ** | |

| NOPt | −9.679 | −2.144 | 0.229 | 9.808 | −18.386 ** | −3.020 ** | 0.164 ** | 5.031 ** | |

| PRERt | −10.460 | −2.282 | 0.218 | 8.734 | −18.282 ** | −3.018 ** | 0.165 ** | 5.017 ** | |

| NRERt | −3.109 | −1.247 | 0.401 | 29.312 | −15.337 * | −2.766 * | 0.180 * | 5.962 * | |

| Kuwait | BOTt | −12.634 | −2.513 | 0.199 | 7.213 | −22.915 ** | −3.378 ** | 0.147 ** | 4.021 ** |

| POPt | −9.096 | −2.128 | 0.234 | 10.035 | −23.289 ** | −3.395 ** | 0.146 ** | 4.020 ** | |

| NOPt | −7.067 | −1.782 | 0.252 | 13.027 | −23.474 ** | −3.409 ** | 0.145 ** | 3.981 ** | |

| PRERt | −1.863 | −0.680 | 0.365 | 31.445 | −23.392 ** | −3.397 ** | 0.145 ** | 4.035 ** | |

| NRERt | −2.793 | −1.172 | 0.419 | 32.305 | −20.083 ** | −3.129 ** | 0.156 ** | 4.782 ** | |

| Oman | BOTt | −11.241 | −2.358 | 0.210 | 8.171 | −22.323 ** | −3.339 ** | 0.150 ** | 4.093 ** |

| PRERt | −9.200 | −2.105 | 0.229 | 10.062 | −23.397 ** | −3.408 ** | 0.146 ** | 3.968 ** | |

| NRERt | −3.361 | −1.247 | 0.371 | 26.163 | −22.591 ** | −3.357 ** | 0.149 ** | 4.059 ** | |

| Qatar | BOTt | −5.482 | −1.603 | 0.292 | 16.455 | −22.587 ** | −3.485 ** | 0.142 ** | 4.125 ** |

| POPt | −7.382 | −1.891 | 0.256 | 12.393 | −24.643 *** | −3.483 *** | 0.141 *** | 3.857 ** | |

| NOPt | −6.006 | −1.659 | 0.276 | 15.068 | −20.589 ** | −3.190 ** | 0.155 ** | 4.534 ** | |

| PRERt | −4.427 | −1.381 | 0.312 | 19.664 | −21.457 ** | −3.254 ** | 0.152 ** | 4.374 ** | |

| NRERt | −0.222 | −0.164 | 0.738 | 109.74 | −20.987 ** | −3.214 ** | 0.153 ** | 4.554 ** | |

| Saudi Arabia | BOTt | −6.299 | −1.761 | 0.280 | 14.461 | −21.386 ** | −3.235 ** | 0.151 ** | 4.474 ** |

| PRERt | −8.053 | −1.990 | 0.247 | 11.364 | −23.477 ** | −3.418 ** | 0.146 ** | 3.933 ** | |

| NRERt | −4.573 | −1.466 | 0.321 | 19.584 | −22.350 ** | −3.350 ** | 0.148 ** | 4.088 ** | |

| UAE | BOTt | −7.662 | −1.948 | 0.254 | 11.910 | −20.462 ** | −3.191 ** | 0.156 ** | 4.499 ** |

| POPt | −3.003 | −1.211 | 0.403 | 29.941 | −18.434 ** | −2.985 ** | 0.162 ** | 5.502 ** | |

| NOPt | −3.905 | −1.347 | 0.345 | 22.469 | −17.984 ** | −2.963 ** | 0.165 ** | 5.270 ** | |

| PRERt | −5.408 | −1.633 | 0.302 | 16.797 | −14.829 * | −2.698 * | 0.182 * | 6.280 * | |

| NRERt | −7.001 | −1.831 | 0.262 | 13.042 | −17.033 * | −2.860 * | 0.168 * | 5.683 * | |

| Country | F-Statistics | Heteroscedasticity | Serial Correlation | Normality | Functional Form |

|---|---|---|---|---|---|

| Bahrain | 2.4736 | 0.9004 (0.5071) | 0.5493 (0.5833) | 3.0024 (0.2245) | 0.0187 (0.8920) |

| Kuwait | 3.9544 | 1.1080 (0.3744) | 0.3510 (0.7062) | 4.1245 (0.1247) | 2.0197 (0.1630) |

| Oman | 7.9131 | 0.5728 (0.8375) | 0.5220 (0.5981) | 0.7695 (0.6806) | 1.1303 (0.2952) |

| Qatar | 6.1550 | 0.9787 (0.5064) | 1.0986 (0.3704) | 0.2308 (0.8910) | 3.1689 (0.1027) |

| Saudi Arabia | 9.6230 | 1.3232 (0.2619) | 0.5704 (0.5703) | 0.5632 (0.7546) | 0.9348 (0.3399) |

| UAE | 8.1214 | 1.2704 (0.3606) | 2.8722 (0.1286) | 0.2739 (0.8720) | 0.1786 (0.6837) |

| Country | Bahrain | Kuwait | Oman | Qatar | Saudi Arabia | UAE |

|---|---|---|---|---|---|---|

| Long-run | ||||||

| POPt | −0.0624 (0.8549) | −0.9230 (0.0074) | 0.3434 (0.0051) | −1.3938 (0.1289) | 0.5747 (0.0395) | 0.7912 (0.0100) |

| NOPt | 0.3664 (0.0086) | 0.4702 (0.2321) | 0.5773 (0.0087) | 3.7977 (0.0284) | −0.1496 (0.7527) | 1.5126 (0.0020) |

| PRERt | 2.1413 (0.0075) | 0.4743 (0.6909) | 0.6655 (0.0599) | 8.3092 (0.0502) | −0.1829 (0.8843) | 5.6208 (0.0028) |

| NRERt | −0.1304 (0.8754) | −2.1083 (0.0039) | 0.2901 (0.0568) | −1.9911 (0.1193) | 1.2179 (0.0013) | 1.6121 (0.0112) |

| Intercept | 0.1071 (0.8859) | 0.1934 (0.5697) | 0.0473 (0.5933) | 9.2719 (0.0123) | 1.4760 (0.0009) | −0.3957 (0.7035) |

| Short-run | ||||||

| ΔBOTt−1 | 0.2031 (0.0604) | |||||

| ΔPOPt | −0.0289 (0.8552) | 0.5654 (0.0044) | 0.8298 (0.0001) | 0.9698 (0.0050) | 0.6236 (0.0004) | 0.6035 (0.0095) |

| ΔPOPt−1 | 0.7942 (0.0007) | −0.4241 (0.0402) | ||||

| ΔNOPt | 0.1696 (0.0579) | 0.2396 (0.2479) | 0.6419 (0.0000) | 1.3833 (0.0004) | 0.5098 (0.0428) | −0.0162 (0.9611) |

| ΔNOPt−1 | −0.2235 (0.0204) | |||||

| ΔPRERt | 0.9912 (0.0395) | 0.2417 (0.6911) | 0.4166 (0.0218) | 2.1082 (0.0100) | −0.0816 (0.8852) | −0.2216 (0.8478) |

| ΔPRERt−1 | −0.5441 (0.1416) | |||||

| ΔNRERt | −0.7438 (0.2263) | −1.0744 (0.0043) | 0.4848 (0.0546) | 0.8446 (0.1803) | 0.5435 (0.0122) | 1.2296 (0.0088) |

| ECTt−1 | −0.4629 (0.0188) | −0.5096 (0.0048) | −0.6260 (0.0000) | −0.3642 (0.0123) | −0.4463 (0.0000) | −0.7628 (0.0005) |

| Country | Major Finding | Suggested Policy | Expected Policy Outcome |

|---|---|---|---|

| Bahrain | Depreciation improves the trade balance. | To depreciate the local currency | Exports may increase and/or imports may decrease, and the trade balance may improve. |

| Kuwait | Appreciation improves the trade balance. | To appreciate the local currency | Exports may increase and/or imports may decrease, and the trade balance may improve. |

| Qatar | Depreciation improves the trade balance. | To depreciate the local currency | Exports may increase and/or imports may decrease, and the trade balance may improve. |

| Oman | Depreciation improves the trade balance. | To depreciate the local currency | Exports may increase and/or imports may decrease, and the trade balance may improve. |

| Appreciation deteriorates the trade balance. | To avoid appreciation policy | The trade balance would be protected from deterioration. | |

| Saudi Arabia | Appreciation deteriorates the trade balance. | To avoid appreciation policy | The trade balance would be protected from deterioration. |

| UAE | Depreciation improves the trade balance. | To depreciate the local currency | Exports may increase and/or imports may decrease, and the trade balances may improve. |

| Appreciation deteriorates the trade balance. | To avoid appreciation policy | The trade balance would be protected from deterioration. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alkhateeb, T.T.Y.; Mahmood, H. The Oil Price and Trade Nexus in the Gulf Co-Operation Council Countries. Resources 2020, 9, 139. https://doi.org/10.3390/resources9120139

Alkhateeb TTY, Mahmood H. The Oil Price and Trade Nexus in the Gulf Co-Operation Council Countries. Resources. 2020; 9(12):139. https://doi.org/10.3390/resources9120139

Chicago/Turabian StyleAlkhateeb, Tarek Tawfik Yousef, and Haider Mahmood. 2020. "The Oil Price and Trade Nexus in the Gulf Co-Operation Council Countries" Resources 9, no. 12: 139. https://doi.org/10.3390/resources9120139

APA StyleAlkhateeb, T. T. Y., & Mahmood, H. (2020). The Oil Price and Trade Nexus in the Gulf Co-Operation Council Countries. Resources, 9(12), 139. https://doi.org/10.3390/resources9120139