1. Introduction

Rare earth elements (REEs) include the lanthanide series of the periodic table from atomic number of 57 to 71 starting with lanthanum (La) to lutetium (Lu) and including scandium (Sc) and yttrium (Y). They are in short supply internationally with domination by China in production and trade. The criticality level of REEs has been ranked as high with the highest score of 29 based on the analysis of several reports and three criticality factors [

1]. This score reported in this document was calculated by summing the individual scores for each commodity in each of recent studies of materials criticality in the UK, EU, US, South Korea and Japan.

One of the members of the lanthanide series, promethium (Pm) is radioactive and exceedingly scarce. Pm is usually sourced through nuclear transformations. Rare earths are further divided into the light rare earth elements (LREE) and heavy rare earth elements (HREE) with the divide falling between the unpaired and paired electrons in the 4f shell [

2]. This divide is somewhat arbitrary and the common convention in industry considers that the LREE includes from lanthanum to europium and includes scandium. The HREEs include from gadolinium to lutetium and includes yttrium. The International Union of Pure and Applied Chemistry (IUPAC) definition includes gadolinium within LREE and based on that all of the HREE have paired electrons. There is some inconsistency in reporting REEs. Companies report lanthanum to neodymium as LREE and sometime include up to samarium but other times HREEs start from samarium. Sometimes precise classification of rare earth oxides are grouped as LREE La to Nd or Ce, Sm to Gd as medium REEs and Tb to Lu and Y as HREEs or yttric [

3].

Over the last 40 to 50 years there has been extensive speculation on peak oil,

i.e., the point at which oil production will start to decline. This “peak” concept is now discussed with respect to many elements in the periodic table where the demand is increasing rapidly but the supply is limited [

4,

5]. Phosphorus (P) and indium (In) fall into this category. In the case of phosphorus, intensive farming practices are required to feed a growing world population but limited phosphorus supply suggests a looming crisis [

5]. Indium is a key ingredient for displays in mobile phones and newer generation computers. While it is relatively abundant in the earth’s crust, there are few rich mineral deposits meaning that the lifetime of known, minable reserves may be as short as 10 years. The increasing demand for rare earth elements and limited reserves for some rare earths cause similar speculation for future availability. The CSIRO Minerals Down Under Flagship Cluster research used a model called “Geological Resources Supply Demand Model (GeRs-DeMo)” for several minerals (e.g., copper, gold, lithium) that predicts supply and demand of a selected commodity. A peak supply year can be estimated for a mineral commodity using the concept of “peak oil” [

6,

7]. This model may be applied in the future to predict the sustainability of mixed REEs rather than individual 17 elements that may be complex.

It is likely that wind energy and electric vehicles will be considered as part of the solution for a more sustainable future. Present technologies for electric vehicles and wind turbines rely heavily on dysprosium (Dy) and neodymium (Nd) for rare-earth magnets. Future large scale adoption of these technologies will increase the demand for these two elements [

8]. It is anticipated that recycling and recovery will assist to satisfy the demand for rare earth element but it is currently very low (

i.e., less than 1%) and will pose significant challenge in terms of collection, processing and their recovery due low concentration in the products [

9]. Environmental impact indicators relevant for rare earths were listed and some literature reported results were published [

10]. However, the reporting of comprehensive life cycle based assessment results of all relevant environmental impacts for specific rare earth product still non-existence.

There is limited comprehensive information in the open literature on the current status of REEs, partially because during the rise of industries that relies on REEs, China was the major source and the remainder of the world has not until recently actively sought to discover new reserves. The recycling aspects have also been described. This paper is considered as a review since a lot of information have been collected, collated, compiled and analysed. However, a small case-study on environmental impact has been used for demonstration rather than reporting the magnitude of results with certainty to indicate that this aspect is important consideration for rare earth industry.

The objective of this paper is to describe a review on the overview of REE mining, mineralogy, extraction processes, and selected environmental impacts.

3. Results and Discussion

3.1. Abundance

Typical abundances for rare earths in the earth’s crust are provided in

Table 1. Ce, at 60–70 ppm, has a similar abundance to Cu. Of course, the actual availability of these rare earths relates to their mineralogy, since having rich ore bodies means that these elements can be mined and processed more easily than if they are distributed evenly within the earth’s crust. Mining of poorer quality ore bodies leads to processing of large amounts of ore, increased energy consumption and CO

2 emissions. Two papers discussed this in the context of gold mining [

13,

14].

Table 1.

Abundance, resources, production and uses of the rare earths.

Table 1.

Abundance, resources, production and uses of the rare earths.

| Element | Crustal Abundance in ppm | Resources tonnes | Production tonnes/annum (Year’s of Reserve) | Uses, Source of Data and References |

|---|

| Lanthanum (La) | 32 | 22,600,000 | 12,500 (1,800) | Hybrid engines, metal alloys [15], catalysis, phosphors [16], Carbon Arc Lamps,

cigarette lighter flints [17] |

| Cerium (Ce) | 68 | 31,700,000 | 24,000 (1,300) | Catalysis particularly auto [18] petroleum refining, metal alloys [15], Phosphors [16], corrosion protection, Carbon Arc Lamps,

cigarette lighter flints [17,19] |

| Praseodymium (Pr) | 9.5 | 4,800,000 | 2,400 (2,000) | Magnets [15], Optical Fibres,

Carbon-Arc Lamps [17] |

| Neodymium (Nd) | 38 | 16.700,000 | 7,300 (2,300) | Catalysis particularly petroleum refining [15],

hard drives in laptops, headphones, hybrid engines,

Nd-Fe-B magnets [17] |

| Promethium | NA | NA | NA | Nuclear Battery, Pm [17] |

| Samarium (Sm) | 7.9 | 2,900,000 | 700 (4,100) | Sm-Co magnets , IR absorption in glass [17] |

| Europium (Eu) | 2.1 | 244,333 | 400 (610) | Red colour for TV and computer screens [15],

(5%Eu, 95%Y), green phosphor (2% Eu) [16] |

| Gadolinium (Gd) | 7.7 | 3,622,143 | 400 (9,100) | Magnets, nuclear magnetic resonance imaging, phosphors [17] |

| Terbium (Tb) | 1.1 | 566,104 | 10 (57,000) | Phosphors [16] particularly for fluorescent

lamps [17], magnets [15]. |

| Dysprosium (Dy) | 6 | 2,980,000 | 100 (29,800) | Magnets [15], hybrid engines [15,17],

can increase the coercivity Nd-Fe-B magnets. |

| Holmium (Hm) | 1.4 | NA | 10 | Glass colouring agent, lasers [15] |

| Erbium (Er) | 3.8 | 1,850,000 | 500 (3,700) | Red, green phosphors, amplifiers for optical fibres transmission, pink in glass melts, sunglasses [17]. |

| Thulium (Th) | 0.48 | 334,255 | 50 (6,700) | Medial X-ray units—X-ray sensitive phosphors [17] |

| Ytterbium (Yt) | 3.3 | 1,900,000 | 50 (38,000) | Lasers, steel alloys—grain refiner [15,17],

stress sensors [17] |

| Lutetium (Lu) | | 395,000 | NA | Catalysts in petroleum refining,

Ce-doped Lu-glass used in detectors for positron emission tomography—PET |

| Yttrium (Y) | 30 | 9,000,000 | 8,900 (1,011) | Red phosphors [16], fluorescent lamps, metals,

Y-Fe-garnets resonators [15], ceramics [19,20] |

| Scandium | 22 | NA | 400 kg primary production, 1600 kg/year from Russian stockpile | Aluminium-scandium alloys for aerospace industry [21], defence industry, high intensity discharge light |

| Copper | 60–70 | 1,615,000,000 | 17,000,000 | Electrical wiring, heat exchangers, piping and roof construction and increasingly consumer electronics [6,18] |

According to the Unites States Geological Survey (USGS), world resources are enough to meet foreseeable demand but world production falls short of meeting current demand [

2]. The production tonnage and resources for individual rare earths are presented in

Table 1. Copper, a commonly used metal, has been shown as a comparison in the last row of this table. The resources have been calculated using data on the percentage of rare earths found in various ore deposits [

2] and the known resources of rare earth containing ores [

15]. The only rare earth element estimated to have less than 1000 years resource is Eu at approximately 600 years. However growth in consumption of particularly the heavy rare earth elements has grown by many orders of magnitude in the past two decades, and another order of magnitude increase in demand is not out of the question since Eu is used in red phosphors (along with Y) for low energy consuming lighting suggesting that peak Eu might be as little as 10 to 30 years away. This further underlines the urgent case for recycling [

16]. Although this assessment is too simplistic since the life of particular resources will be influenced by the finding of new deposits, technological efficiency such as use of less specific material per product, extraction efficiency of low grade ore, and finally potentially the stream of recovered metal from recycling. However, it is useful to identify those materials based on these potential critical factors.

Australia potentially has a role in world supply, with relatively modest deposits of REEs (2 Mt REE and yttrium oxide as Economically Demonstrated Resources (EDR), of which 31% EDR is accessible). World resource is reported as 95 Mt [

22]. This Australian resource estimate excludes the tailings heap of Olympic Dam which can be a significant source of light REEs at a very low grade. The estimated demand for REEs was about 125,000 t in 2010 with 95% supply from China [

23]. The reported current supply from China is estimated to be 94% [

24]. The expected demand of rare earth oxide is about 200,000 t in 2014 [

11] although this figure does not discriminate between which rare earths will be in highest demand. The supply was 115,000 t in 2012 and 108,000 t in 2013. Another estimate predicted that in 2016 the forecast supply would 195,000 tonnes against a demand of 180,000 t. This may not happen in reality and may have uncertainty. Clearly, further information is required in a breakdown of consumption patterns for all of these elements.

3.2. Mineralogy

Rare earth containing minerals are usually dominated by either HREEs or LREEs. Minerals containing predominantly yttrium and the HREEs include gadolinite, xenotime, samarskite, euxenite, fergusonite, yttrotantalite, yttrotungstite, yttrialite. Minerals containing predominantly LREEs include bastnasite, monazite, allanite, loparite, ancylite, parasite, lanthanite, chevinite, cerite, stillwellite, britholite, fluocerite and cerianite. However, commercially operating mines around the world mainly extract bastnasite, monazite and xenotime ores.

The major mineral deposits in Australia principally contain monazite and some xenotime whereas the US and Chinese deposits principally contain bastnasite. China and Malaysia have xenotime deposits. Some of Australia’s deposits occur near Alice Springs (Arafura, Perth, Australia), Dubbo (Alkane, Perth, Australia; Jervois Mining, Melbourne, Australia), Laverton, WA (Lynas, Sydney, Australia), Nyngan and Young, NSW (Jervois Mining, Melbourne, Australia, Sc only), Southeast Kimberley (Navigator resources Ltd, Perth, Australia), Capital (near Canberra), Gifford Creek, WA (Artemis Resources Ltd, Sydney, Australia), Mount Gee SA (Marathon Resources Ltd, Adelaide, Australia), Olympic Dam SA (BHP Billiton, Perth, Australia), Brown’s Range WA & NT (Hastings Metals, Sydney, Australia & Northern Minerals, Perth, Australia), Mary Kathleen Queensland (BHP Billiton, Perth, Australia) and Greenvale Qld (Metallica Minerals Ltd, Brisbane, Australia). These deposits have a large variation in composition [

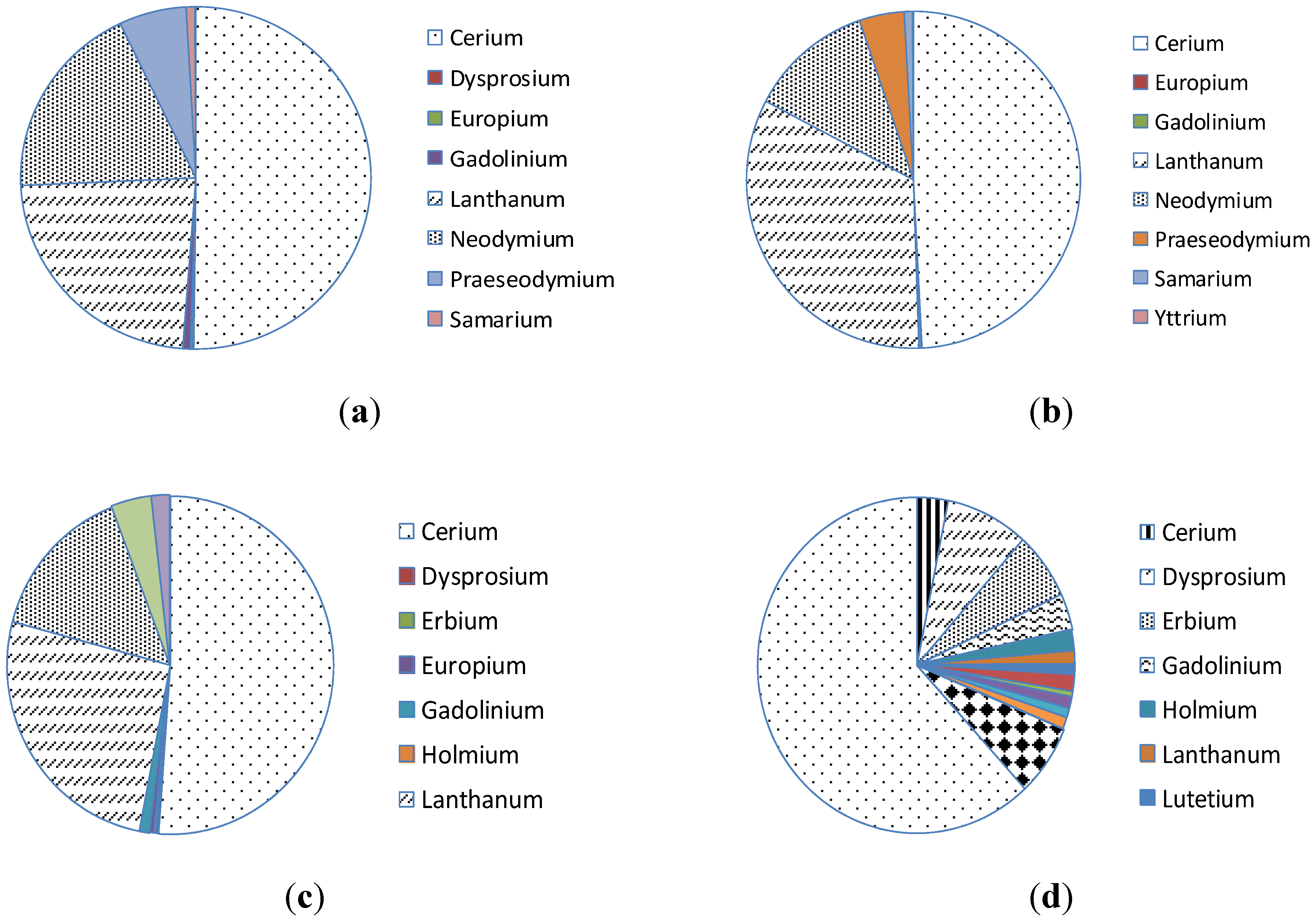

25]. Although the number of identified deposits in the world may be over 850, the actual operating mines are only handful. Prominent currently operating mines are Bayan Obo in China, Mountain Pass in the US and recently opened Mount Weld in Australia. Distribution of rare earth elements in various mines is shown in

Figure 1.

Figure 1.

Average distribution of rare earth elements in each deposit [

18]. (

a) Bayan Obo, China; (

b) Mountain pass, USA; (

c) Mount Weld, Australia; (

d) Lahat, Malyasia.

Figure 1.

Average distribution of rare earth elements in each deposit [

18]. (

a) Bayan Obo, China; (

b) Mountain pass, USA; (

c) Mount Weld, Australia; (

d) Lahat, Malyasia.

REEs are also often found associated with uranium/thorium mineralization and uranium ores often contain appreciable REE (and vice versa). This co-deposition with radio-nuclides can pose particular challenges in the processing of REE ores [

17,

22,

26]. Current issues surrounding Lynas Corporation’s REE plant in Malaysia relate to the perception that the plant will produce a radioactive waste. However, according to International Atomic Energy Agency, the radiation generated from the Malaysian plant would be the effect below harmful levels [

27].

Mining of rare earths is generally divided into three historic eras: (i) monazite-placer; (ii) Mountain Pass and (iii) Chinese eras [

26]. The advent of the Chinese era (mid 1980s) was marked by availability of rare earths at prices that undercut most other mining operations, resulting in closure of many mines outside of China. At this point, the Chinese have around 55% of all known rare earth deposits and control 95% of world supply through integrated mining, refining and supply chains.

All of these minerals are found in land based deposits, however, marine deposits have also been considered. It was reported that river run-off was considered the most dominant source of rare earth elements in the ocean [

28]. However, the work [

29] suggests that significant ocean rare earth sediments may arise from hydrothermal plumes from the East Pacific Rise and the Juan de Fuca Ridge. These deposits have similar to or greater levels of REE compared to the Chinese deposits and perhaps greater HREE content.

3.3. Mining Methods

Rare earth mining can be open pit, underground or leached in-situ. For a typical open pit mine, the approach is very similar to other mining operations which involve removal of overburden, mining, milling, crushing and grinding, separation or concentration. The product of the enriched concentrate after separation may contain around 30%–70% of rare earth bearing ore. The process requires higher amount of water and energy usage (e.g., compared with other common metals, i.e., 0.2 to 1 GJ energy/t REO, 0.3 to 1.8 ML water/t REO) as well as production of waste streams (i.e., with other metals due very low grade) such as tailings and wastewater.

If the deposit type is hard rock based then conventional open-cut or underground truck shovel mining system is used. On the other hand, if it is mineral sand based monazite type deposit then wet-dredging or dry mining method is used. If a wet mining operation, a floating dredge cuts the ore under the surface of a pond and pumps the ore slurry to a floating wet concentrator. Dry mining can be similar to conventional truck and shovel system.

3.4. Extraction and Concentration

The following description of rare earth processing is necessarily very general and represents a limited range of options that could be used in the industry. The actual process flowsheets are quite varied and tailored to the gangue and host ores such as monazite based or bastnasite based. There will be implications on impact as a result of these differences; however, this was assumed beyond the scope of this study. The extraction and processing has been described in detail [

30].

To extract rare earths, further processing/extraction and refining are required. The extraction may involve using acidic or alkaline routes depending on the mineralogy of the REE-containing phases and reactivity of gangue phases. Typically, the acidic route is the most common, dominating at least 90% of the extraction methods. Depending strongly on mineralogy, the extraction step often involves roasting of the rare earth ore at 400 °C–500 °C in concentrated sulphuric acid to remove fluoride and CO2, and to change the mineral phase to make it more water-soluble. The monazite ore processing would have different routes. The resulting ore paste is washed (usually using water) and filtered or decanted to remove fine solid impurities. The REEs are then further leached (sometimes in multiple steps) using extraction agents (hydrochloric acid) and precipitating agents (ammonium bicarbonate (NH4)HCO3 or NaOH precipitation). Further separation stages are required through, for example successive solvent extraction (e.g., (C16H35O3P) and HCl) and then followed by precipitation steps using ammonium bicarbonate (NH4)HCO3 or oxalic acid (C2H2O4). The precipitate is heated to form rare earth oxides (REO). LREEs may be extracted by molten salt electrolysis based on chlorides or oxides. Metallothermic reduction processes are used to extract the middle and heavy rare metals such as Sm, Eu, Tb and Dy in near vacuum conditions with inert gas at high temperatures (>1000 °C). The difficulty and complications associated with preparing commercial grade rare earth compounds and metals is more akin to fine chemical production than commodity manufacture. Additionally, valuable rare earth ores are often “incidental” and occur in association with valuable elements such as Nb, Ta, In and Ni. The flowsheets for production can therefore be further complicated with extraction steps for other valuable metals.

In an alkaline dissolution based production process, monazite concentrate is decomposed with sodium hydroxide to produce rare earth hydroxides. The rare earth hydroxides are then leached using hydrochloric acid and a mixed rare earth chloride solution is produced. The mixed solution is separated into light, medium and heavy rare earths using solvent extraction processes. Further solvent extraction stages are then required to separate these streams into solutions of individual rare earth chlorides. The separated rare earth chlorides are treated with oxalic acid to produce a rare earth hydrate, and these are then calcined in a furnace at 1000 °C to produce the final rare earth oxide products of greater than 99% purity.

In China, the rare earth elements are also recovered as a by-product of iron mining. The world’s largest light rare earth deposit is Bayon Obo located in Baotou, China, containing 48 million tonnes of rare earths reserves in the form of bastnasite ore [

22,

24]. Bastnasite ore concentrate is typically calcined to drive off CO

2 and fluorine. It is then hydrometallurgically treated by two stage digestion with hydrochloric acid, then treatment with sodium hydroxide, respectively, to produce rare earth hydroxides. The rare earth hydroxides are chlorinated and converted to rare earth chloride products. Separation of mixed rare earth oxides into the individual rare earths can partially be achieved by multiple recrystallisation as double salts, and ultimately by multi-stage solvent extraction. The mining and processing steps for refining of rare earths, therefore, tend to be energy, water and chemical intensive with significant environment risks affecting water discharges (radionuclides, mainly thorium and uranium; heavy metals; acids; fluorides), tailing management and air emissions (radio-nuclides, Th and U, heavy metals, HF, HCl, SO

2 and dust).

3.5. Commercial REE Mining in Australia

In Australia, the principal rare earth mineral exploited has been monazite, which typically has associated radioactivity due to thorium content (by substitution up to 30%). Until 1995, rare earth production in Australia was largely as a by-product of processing monazite contained in heavy mineral sands [

24]. The process involved concentrating monazite using wet processing followed by dry concentration techniques. Wet concentration separates the heavy minerals from gangue minerals. Dry concentration, such as magnetic, electrostatic and gravity separation steps are used to separate monazite from the other heavy minerals. The rare earth elements may be dissolved from monazite by high temperature leaching in concentrated sulphuric acid [

31].

In 2007, mining began at the Mount Weld deposit, Laverton, WA in Western Australia, which is the richest known deposit of rare earths in the world. This deposit’s mineralogy has been described as a secondary rare earth phosphate, but those phosphates (most likely monazite) are encapsulated in iron oxide minerals. Parts of the deposit have distinct xenotime mineralogy, with heavier rare earth components. The first crushed ore was fed to the concentration plant in 2011. Mount Weld is claimed to have the highest grade known deposit of rare earths in the world. This deposit consists of the Central Lanthanide Deposit (“CLD”) and Duncan Deposit. The mine has a conventional open-pit operation. About 773 kt ore has been mined at 15.4% REO grade or 116 kt contained REO. The stockpiled ore is sufficient to sustain steady state production for 6 years for Phase 1 capacity of concentration plant [

32].

The concentrator commissioned in 2011 is designed to process 121,000 tonnes of ore per year producing 33,000 tonnes of concentrate in the first phase using flotation technology. The second phase is expected to double this production. It is intended that the concentrates will be exported to the Lynas advanced materials plant (LAMP) built in Malaysia. As reported in June 2013, 15,000 t of dry bagged concentrate has been made ready for shipment to LAMP [

32].

The LAMP is located in the Gebeng Industrial Estate, in Pahang. Initial capacity in 2012 is designed at 11,000 tonnes of separated REOs per year, with expansion to 22,000 tonnes per year in 2013 [

33]. While the specific details of the flowsheet for processing concentrate are not available, they are likely to include steps of calcination, caustic conversion, acid leach and solvent extraction. Lynas reported some issues as identified relating to clogging and premature wearing of equipment that are affecting the ability to operate continuously at nameplate production capacity of LAMP. A series of work programs involving equipment changes and materials handling was implemented by Lynas in the late 2013 [

32]. Their immediate target is to optimise production at the Phase 1 capacity level of 11,000 tpa REO until market prices recover. In the June 2014 quarter, the company produced 1,882 tonnes of rare earth oxides (REO), up 73% over the previous quarter. The full year production to date in September 2014 was 3,965 tonnes [

33]. Lynas claimed in June 2014 [

32] in their corporate website that the production rate is on track to achieve the target.

The local residents had concerns over the operation of LAMP rare-earth processing plant particularly on the contamination of the coastal environment and the adverse health impact which could result from the mismanagement of radioactive waste streams. Recently, the Atomic Energy Licensing Board (AELB) of Malaysia agreed to issue a two-year full operating stage license to Lynas after it fulfilled all the conditions [

34]. The AELB assured residents that it was monitoring the operations of the Lynas plant and found radiation levels onsite and offsite to be within acceptable limits.

The reported mine production of rare-earth oxides in Australia, including yttrium oxide, was estimated to be 2,070 tonnes in 2011 and 4,000 tons in 2012 [

18]. However, the Australian production of REO and Y

2O

3 is reported as 2,070 kt [

1] in 2011 possibly due to a unit error. This should be 2,070 tonne, not in kilo-tonne. Unfortunately, there is a lot of anomaly in the reported production, resources, reserve and life of resources reported by various sources that is extremely difficult to verify particularly for REEs.

3.6. REE Mining in China

Between 2010 and 2012 the Chinese government put strict export quotas on their rare earth minerals and semi processed rare earth products [

2,

17,

35,

36]. The quotas reduced the output by nearly 60% compared to the 2008 total release of 34,156 tonnes [

2]. These quotas created a gap between demand and supply and large increases in the prices of the rare earths. In relation to a dispute under World Trade Organisation, the United States, European Union, Canada and Japan requested consultations with China with respect to China’s restrictions on the export of various forms of rare earths, tungsten and molybdenum in 2012. At the recent Dispute Settlement Body (DSB) meeting on 26 September 2014, China stated that it intended to implement the DSB’s recommendations and ruling in a manner that respects its WTO obligations. China added that it would need a reasonable period of time to do so [

37].

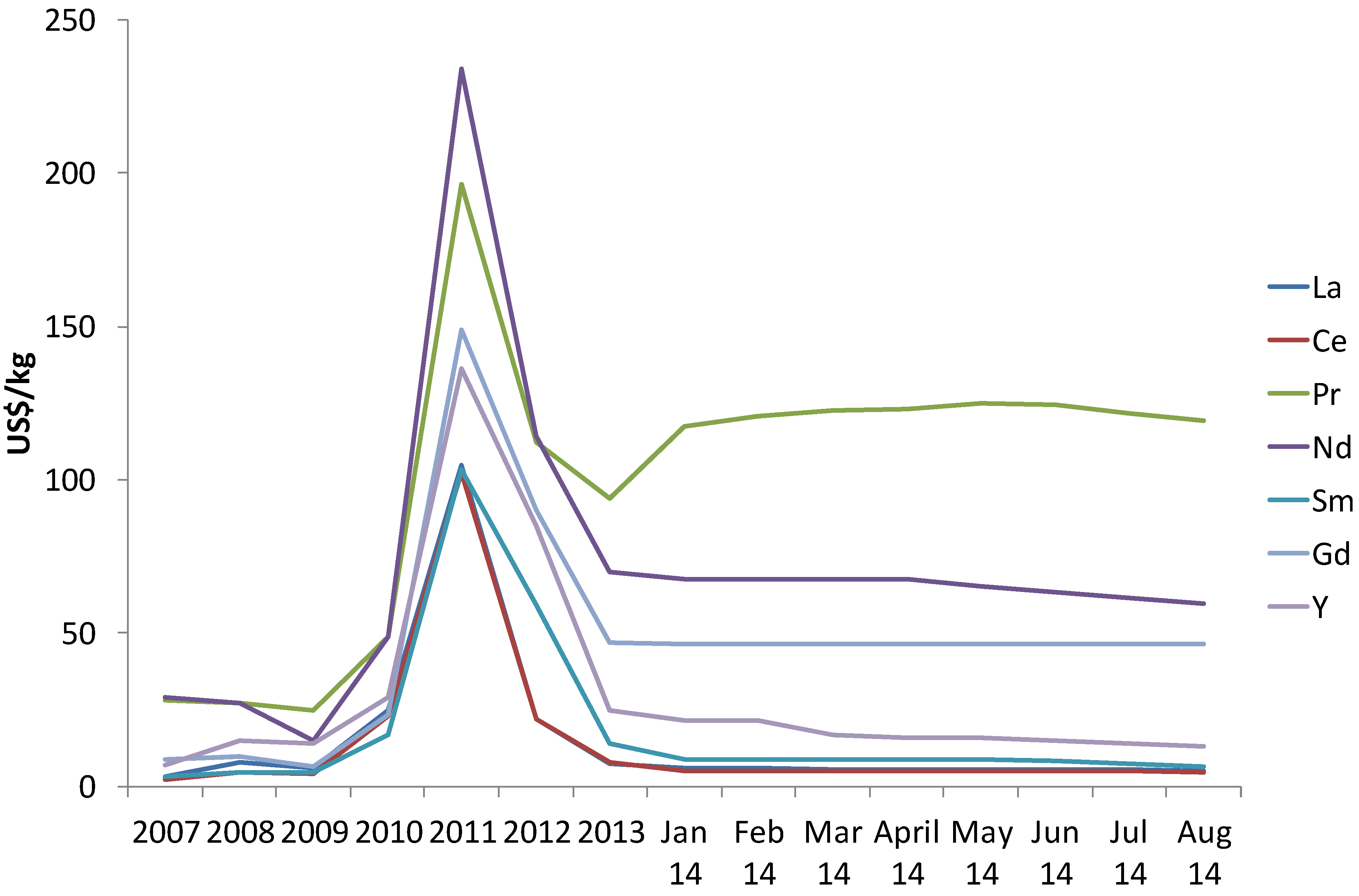

Because rare earths are not traded in a commodity market such as the London Metal Exchange, accurate records of prices are difficult to establish. However, from this source [

38] it is possible to establish that dramatic increases in prices up to 10 fold were observed over the decade. The prices of several oxides are presented in

Figure 2 and

Figure 3 that show the significant volatility of rare earth market. One example includes neodymium oxide which increased from just under $10/kg in 2001 to nearly $239/kg in 2011 but came down to $80/kg, which is about 3 times reduction from the peak. Other price increases include Europium, Dysprosium and Terbium oxide in the order of 300%–500% increase over the last 10 years [

39]. Recent trends in 2012 suggest that rare earth prices have decreased from their maxima in 2011 and are beginning to stabilise, albeit at significantly higher levels than prices even in 2010 for some with upward trend (Dy, Pr, Gd, Eu, Nd), no change (Tb) but reduction for other oxides (La, Ce, Sm). Announcements of new rare earth reserves in North Korea and Canada will also put downward pressure on prices.

The Chinese producers also have issues with environmental pollution resulting from poorly regulated mining operations, as well as reported smuggling of rare earths from the Southern provinces which have been estimated to account for 30% of total Chinese production [

19,

35].

Figure 2.

Price history in US dollars of the expensive rare earths [

40].

Figure 2.

Price history in US dollars of the expensive rare earths [

40].

Figure 3.

Price history in US dollars of the comparatively cheaper rare earths [

40].

Figure 3.

Price history in US dollars of the comparatively cheaper rare earths [

40].

3.7. RRE in Korea

A major impact on the rare earth market occurred with the announcement of rare earth deposits at Jongju in North Korea which are being developed by Pacific Century Rare Earth Mineral and the North Korea government. These reserves double the current estimates of rare earths reserves. Moreover, the rare earth deposits are relatively rich with 664.9 Mt at 9% TREO, 634 Mt between 5.7% and 9.0% and another couple of billion tonnes between 3.97% and 5.7% along with another 2.8 billion tonnes of lower grade ores. The total amount of lower grade REO is estimated to be around 216.2 Mt. Further exploratory drilling is expected to be undertaken this year and reported when the drilling is finished. However, veracity of this announcement is questioned by the sources of industry intelligence. Furthermore, there is a complication of making this project into reality due to political implications and international sanctions in the short to medium term.

3.8. RRE in Canada

Until the discovery of the Jongju deposit(s) the Canadian deposit at Nechalacho in the North-West Territories was one of the most exciting rare earth developments in recent years. This large deposit is rich in heavy rare earth elements consists of the following minerals: LREE in bastnaesite, synchisite, monazite and allanite and HREE in zircon, fergusonite and rare xenotime. The mine is fully owned by Avalon Rare Earth metals. Avalon also has a number of other sites in North America. The mine site treats the ores using hydrometallurgical approaches with acid leaching as the key processing step [

41]. The % of HREE to total RE varies from 6% to 30% from the top to bottom of the deposit. Total deposit is estimated to be 1.71 Mt of rare earth oxide. As with most REE mining thorium and uranium is associated with the deposit. Production is to begin in late 2016.

3.9. Uses

Some of the largest uses of rare earths are in catalysts (20%, largely Ce and La), rare earth magnets (21%, largely Nd, Sm and Dy), alloys (18%), powder production (12%) and phosphors (7%) [

42]. Catalyst applications are for both industrial and auto catalysts. Phosphors are important for a range of applications particularly for visual display in screens and low energy lighting [

26]. This is a likely growth area and will put pressure particularly on Eu and Tb reserves. Another area for expansion will be rare earth magnets (Nd, Pr, Sm and Dy) particularly for alternative energies. These will find widespread application in wind turbines, the auto industry (electric and hybrid cars) and defence industry (

i.e., missile guidance systems). Rare earth containing (Er) glasses are important for fibre optical amplifiers required in high speed optical communication networks [

26,

42]. Improving the efficiency of solar energy conversion is another area of probable expansion for rare earths [

42,

43,

44]. The rare earths Er, Yt and Ho show promise for up-conversion (converting low energy photons into higher energy photons by increasing the wavelength

i.e., infra red photons to visible) and Yb, Tm and Tb for down-conversion (converting high energy photons to lower energy) [

43,

44].

Some novel areas for rare earths include refrigeration using either laser cooling or the magnetocaloric effect [

42]. In laser cooling, vibrational energy is removed by emission of photons with a higher average energy than the absorbing photons in various materials that may include Y, Yb, La, Nd and Tm [

45,

46]. In the magnetocaloric effect, a material has its magnetic domains aligned under a strong magnetic field and when the field is removed the domains can unalign using phonons energy causing cooling. Room temperature magneto-caloric materials (e.g., Gd5(SixGe(1-x)) [

46] may offer an alternative to current vapour compression cycles used with current refrigerants [

47]. Some more mundane uses include flints for cigarette lighters (Ce), polishing agents (CeO

2), rechargeable batteries (La) and carbon arc lamps (La) [

26].

Growth in demand for these materials is certainly of concern in many countries which is best summarised in some US documents [

15,

26]. Rare earths underpin technologies that are seen as critical for clean energy economies, such as in photovoltaic devices, battery technologies for transport and wind energy, and phosphors for lighting. High speed optical fibre communication is another likely growth area. In fact a risk analysis undertaken by the U.S. Department of Energy nominates Dysprosium, Neodymium, Terbium, Europium and Yttrium as critical to advancement in a clean energy future [

48].

3.10. Recycling

Unlike other metal recycling industry, the recycling industry for rare earth is evolving with many of the activities still at development stages. The need for recycling is in part driven by rapid increase in demand and scarcity of materials combined with security of supply issues, a problem exacerbated by additional export restrictions imposed by the Chinese authority. The recycling option, however, offers several advantages including lower environmental impact, less dependency on Chinese export and the feed materials can be free from radioactive contaminants (e.g., Th and U).

Possible opportunities available for recovery of rare earths are typically from used magnets, batteries, lighting and spent catalysts. The materials could be sourced from post-production wastes and post-consumer disposed goods. Clearly, the latter option is expected to be more complex, requiring more extensive physical and chemical treatments and higher energy requirement.

Typical post-production wastes may, for example, include scraps produced during manufacturing of magnets (with expected wastage of 20%–30%) or sludge produced from shaping and grinding of magnet alloys [

49]. Typical recovery methods may include re-melting, reuse and re-blending of scraps or other selective extraction methods (e.g. using a molten salt agent (MgCl

2), Na

2SO

4 double-salt precipitation technique or oxalate secondary precipitation approach for recovery of Nd

2O

3 [

50]. There are already metal recyclers that have identified the value in magnet-manufacturing dross, with pilot programs using standard and simplified hydrometallurgical routes to recover Nd and Dy.

Recycling of rare earths from consumer goods at end-of-life is generally more challenging due to dispersed nature of the rare earth compounds which are intricately embedded into the products (e.g., neodymium magnets from hard disks and compressors, electronic displays). For effective recycling, it requires efficient and effective physical and chemical separation techniques. Physical separation methods may include mechanical dismantling of the components such as that proposed by Hitachi in which the neodymium magnets from hard disks and compressors motors/generators are selectively removed by a purpose designed automated machine, enabling significantly faster (8 times) separation than manual labour. Such a recycling approach is expected to meet 10% of Hitachi’s needs by 2013 [

51]. Other recovery approaches have been outlined for magnets from MRI (magnetic resonance imaging for medical application) [

49] and fluorescent lamps and tubes [

52]. A potential future strategy for industry is to collaborate on the design of RE magnet components to achieve some degree of dimensional standardisation and therefore reusability, and industrial design with easy recycling as an objective.

The chemical recovery methods for rare earth elements generally involve pyro-metallurgical and hydrometallurgical approaches [

53,

54]. Pyrometallurgical routes are commonly used for recovery of metals from electronic scraps. However, the rare earths are easily lost using this method as they tend to report to the slag phase due to the high affinity of the rare earth elements to oxygen. Hence hydrometallurgical approaches may be required to leach the rare earth elements from the slag. Rare earth elements (e.g., lanthanum, cerium, neodymium and praseodymium) and other valuable metals (Ni, Co) can be recovered from used Ni-MH batteries by leaching with sulphuric acid [

55]. While for spent catalysts, it is still not yet considered technically feasible and economically acceptable for the recycling of rare earth elements (mainly La and Ce) from FCC catalysts.

The losses of the consumer goods through exportation and uncontrolled disposal are thus making the recovery of resources difficult. One of the primary constraints is to have effective collection system and consumer cooperation in recycling of end-of-life devices. Although the R&D in this domain is gaining momentum but there is still a lack of fully developed commercial scale plants for rare earth recycling in part due to drawbacks on yields and cost. In addition, some of the devices containing rare earths are still new in the market place and it would take some time for the products to reach the end of their life (10–20 years for electric motors in vehicles and wind turbines) before they are available for recycling.

Another approach to address the rare earth supply issues is substitution with materials made from more common elements but this approach is still in its early stages. Possible opportunities for substitution under consideration are alternative turbine types for wind turbines; improving the reliability of traditional turbines with gears and alternative motor designs motors of hybrid and fully electric vehicles. However, it is conceived that substitution opportunities in applications related to energy efficient lighting systems containing rare earths (compact fluorescent lamp, LED, plasma display, LCD display); or catalysts in automotive and petroleum refining are still difficult and unlikely in the short term horizon without further research.

3.11. Dispersion and Issues with Recovery

As with all scarce elements one of the biggest issues is dispersion at the end-of-life for products into which these elements are incorporated. In the past most discarded product and waste from processing has ended up in landfill or dumped in the ocean. While there is discussion about mining waste dumps, material disposed of at sea is effectively lost,

i.e., dispersed into the environment. In the context of rare earths, most products where the more precious rare earths are used are not inherently dispersive and programs exist or are beginning in many countries for reclamation and driven by recent increases in the price of rare earths [

56,

57,

58].

Potential dispersive uses of rare earths include catalysts, magnets (Sm, Nd), missiles (Sm, Nd,) sunglasses (Er), MRI agents (Gd), lighting (Er, Eu, Tb) and cigarette lighters (Ce). Industrial catalysts generally go to landfill and can potentially be recovered from landfill sites in the future if they are not dispersed. In Europe there is a tendency to dispose of these catalysts into cement products as clinker, which is obviously a loss. While a large proportion of any automotive catalyst can, in principle, be recovered at end-of-life, degradation during the operational vehicle lifetime results in the formation of dust and dispersion of the dust onto roadways during exhaust gas flow. The dispersed material ends up in river systems as a result of storm water flow and effectively dispersed back into the environment. For automotive catalysts, this equates to the dispersive loss of the active metal catalyst (usually Pt is more important than that of CeO

2 which is also an active ingredient of the catalyst). Products including high field strength rare earth magnets are another potential source for dispersion. This is an interesting category as products with miniaturised electronics such as mobile phones tend not to be discarded but stored in Australian households [

59] and potentially available for rare earth recovery. However, the potential for mobile phones to be collected has also been documented [

60]. This behaviour is not unique to either electronic goods or Australian households but common across the OECD [

61].

On the other hand rare earth magnets used in missile guidance systems will be dispersed into the environment if the missile is deployed and used. Lighting products have traditionally been sent to landfill at end of life, but programs are now being considered for recovery of the rare earths in these products as discussed in the “Recycling” Section. Cigarette lighters (rare earth flints) are generally dispersed into the environment, either in landfill or storm water drains. Erbium used as fibre optic amplifiers for high speed communications might also end up being dispersed, in this case because the Er is used at dopant level [

62] making it expensive to recover.

The rare earths at greatest risk are those that have high volume, low reserves and significant dispersion. Essentially, rare earth elements are concentrated from very low grade in the ground and then dispersed into the various equipments in small quantities. Thus, unless recovered, there is greater chance of these materials lost with the disposal of the equipment.

3.12. Life Cycle Based Environmental Impact (Demonstration of One Data Set)

For life cycle based environmental impact assessment, one simple case study has been selected from the Ecoinvent database of SimaPro LCA software [

63,

64]. The mining and concentration of a bastnasite ore with a rare earth oxide concentration of 6% has been assumed in China [

65]. The boundary includes the mining, concentration of REE oxides and separation of products such cerium concentrate (60% cerium oxide), lanthanum oxide, neodymium oxide, praseodymium oxide, and samarium europium gadolinium (mixed medium heavy REE concentrate, 94% rare earth oxide). The global warming potential impact or greenhouse gas (GHG) footprint of rare earth production has been estimated and reported in kg CO

2-equivalent (kg CO

2-e) unit per kg of REO production.

The process included material and energy inputs, emissions and land use for the mining and concentration of a bastnasite ore with a rare earth oxide concentration of 6%. Input and outputs were reported from bastnasite ore composition mined in China. Infrastructure and land use was approximated with iron ore mining, assuming Chinese Bayan Obo mine which is largely started as an iron ore mine (Fe content is about 33%) but now produces over 95% of Chinese and 83% of global REE production. Some inputs of auxiliary materials were estimated according to stoichiometry. The estimation for energy consumption, wastes and emissions is indicative only. Production in China was considered for this study. This process may be applicable for other regions if a similar ore type is used.

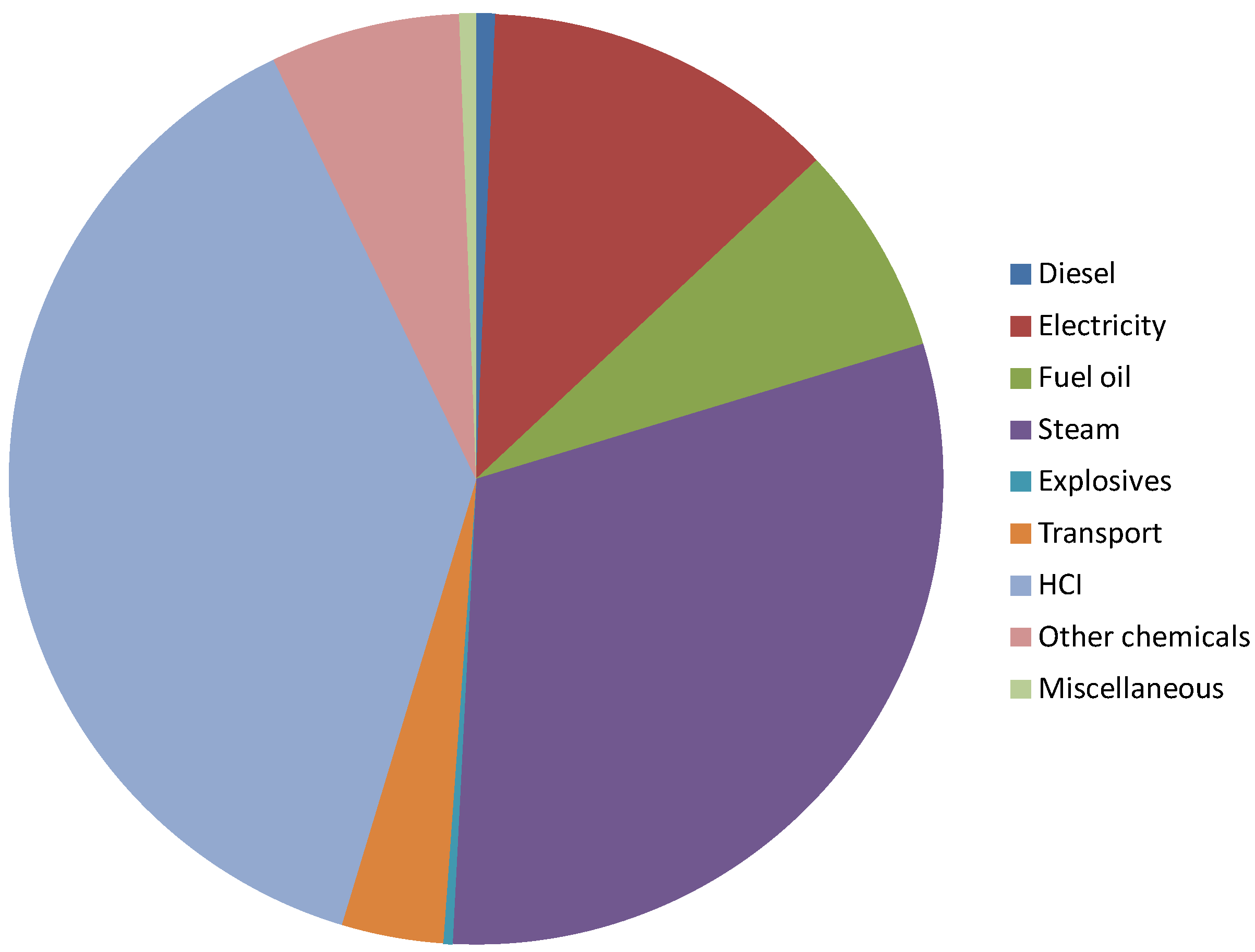

The assumed subsequent process produced products such cerium concentrate (60% cerium oxide), lanthanum oxide, neodymium oxide, praseodymium oxide, and samarium, europium, gadolinium (mixed medium heavy REE concentrate product with 94% rare earth oxide). This process included roasting and cracking of the REE concentrate with 98% sulphuric acid at 500°C in a rotary kiln. Solvent extraction (SX) was used for the separation of the different rare earth oxides where organic chemicals were used. The obtained rare earth oxide product has a purity of up to 99.9%. The revenue from each product was used to allocate environmental burden. The break-down of various energy and materials on the total greenhouse gas (GHG) emission from the production process of REE concentrate is shown in

Figure 4.

Figure 4.

Distribution of impact for producing mixed rare earth elements (REE) oxides (total 1.4 kg CO2-e/kg REE oxides).

Figure 4.

Distribution of impact for producing mixed rare earth elements (REE) oxides (total 1.4 kg CO2-e/kg REE oxides).

The major contributor to total GHG footprint of REE processing is hydrochloric acid (

ca. 38%), followed by steam use (32%) and electricity (12%). Overall 51% of GHG is due to use of energy in various forms (

i.e., diesel, steam, fuel oil and electricity). The remaining minor elements are from other chemicals and transport. To reduce GHG impact of REE processing, the focus should be on how to reduce the acid and energy consumption during processing. The reported GHG is an order of magnitude higher in a study published recently [

66]. There is always difference between reported results from an LCA due a variety of reasons that include the assumed boundary and allocation of impact. Ore grade is one of those main ones, which is assumed as 4% for their study. There will be differences on environmental impact if different ore type, deposit or mining methods are assumed. In this paper, although GHG impact has been selected, other impacts such as radio-activity will be important which has been considered beyond the scope of this present paper.

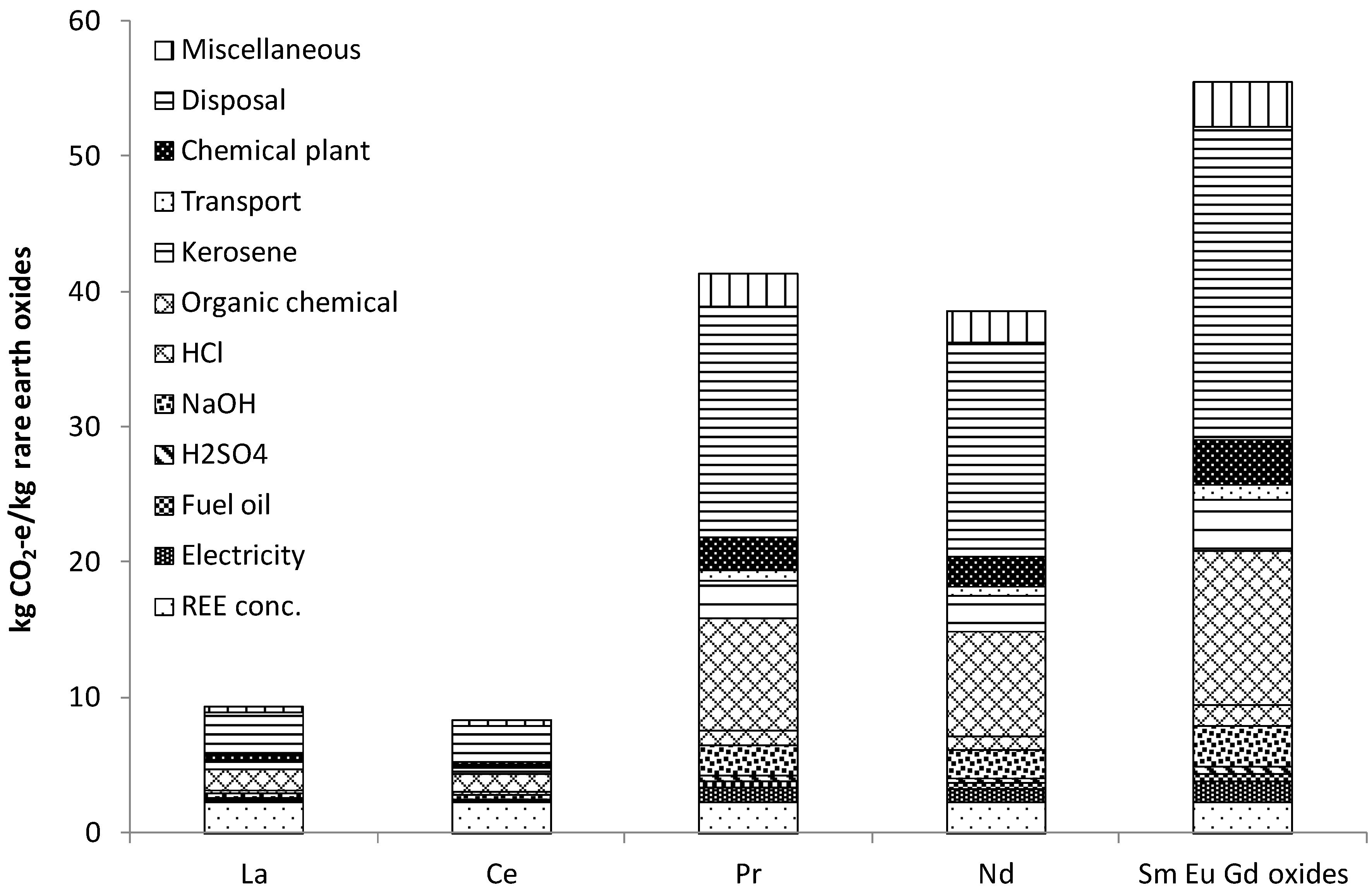

The GHG footprint of separated oxides of RE elements from the respective materials and energy contribution is shown in

Figure 5.

Figure 5.

Greenhouse gas footprint of selected rare earth products (note: disposal includes hazardous solvent incineration, 70% mixed REE is processed, 90% recovery to products, mine rehabilitation is under miscellaneous [

67].

Figure 5.

Greenhouse gas footprint of selected rare earth products (note: disposal includes hazardous solvent incineration, 70% mixed REE is processed, 90% recovery to products, mine rehabilitation is under miscellaneous [

67].

Disposal steps of solvents mixture with water and tailings and to hazardous waste incineration contributed significant amount of GHG emission for each separated RE oxide product. Use of organic chemical (during solvent extraction) had the next largest contribution on the total GHG footprint. Thus, the effort should focus on the reduction of the use of organic chemicals during rare earth purification and on the disposal issues.

Table 2 shows the few selected life cycle based environmental impact of selected rare earth elements production (Australian indicator set method was chosen for this impact analysis).

Table 2.

Environmental footprint of selected rare earth oxides production.

Table 2.

Environmental footprint of selected rare earth oxides production.

| REOs | Primary Energy MJ/kg | GHG kg CO2-e/kg | Water kL Water/kg | Toxicity *DALY/kg |

|---|

| La | 177 | 9.3 | 0.33 | 1.65 × 10 6 |

| Ce | 157 | 8.3 | 0.30 | 1.46 × 10 6 |

| Pr | 798 | 41.4 | 1.32 | 7.36 × 10 6 |

| Nd | 743 | 38.5 | 1.23 | 6.86 × 10 6 |

| Sm, Eu, Gd (mixed oxide) | 1,074 | 55.6 | 1.75 | 9.89 × 10 6 |

The environmental footprints depend on the ore grade and recovery of the particular REEs. For example, La and Ce is generally available in higher amounts in ore and concentrate and thus can be recovered more readily compared with other REEs. Thus their (La and Ce oxides) specific impact is relatively less compared with other elements. Since the energy footprint of REE oxides are similar to that of other metals, the footprints of REE metals would significantly be higher (with further processing stages) even with energy intensive metals such as aluminium (211 MJ/kg) and titanium (361 MJ/kg) [

68]. Their water footprints are much higher than that of the results for most metal studied in the past (

i.e., titanium water footprint is reported to be 110 kL/t metal [

69]).

The environmental impacts such as radioactivity potential, acidification, eutrophication, solid waste generation, water use, gross primary energy footprint, toxicity and any other impact of significance on regional and global basis should be taken into consideration. However, most of the REEs are expected to be used in energy reduction, energy efficiency and renewable energy technologies. Thus future LCA studies should include the boundary of the use phase and their impacts on overall emission reduction that requires further data and analysis that is beyond the scope of this current study.

4. Conclusions

The availability of rare earths is in transition from a temporary decline due mainly to quotas being imposed by the Chinese government on export to becoming more available with production increasing elsewhere in the world. The reduction in availability coupled with increasing demand led to increased prices for rare earths in 2012 and 2013, but prices have fallen from their peak values. The increasing demand for rare earths in a range of applications means that the rare earth market is likely to be demand-driven for some time to come. This is particularly the case for rare earths used in high field strength magnets. Price fluctuations are therefore likely to vary until such time as new rare earth deposits supply the market or formerly closed mines are reopened.

The rare earths at greatest risk are those that have high volume, low reserves and significant dispersion. Essentially, rare earth elements are concentrated from very low grade in the ground and then dispersed into various equipments in small quantities. Thus, unless recovered, there is greater chance of these materials lost with the disposal of the equipment. Recycling and recovery of rare earth poses challenge in terms use of energy to collection, reprocessing and reproducing products at specification that can replace primary metals.

The major contributor to total GHG footprint of REE processing is hydrochloric acid (ca. 38%), followed by steam use (32%) and electricity (12%). Overall, 51% of GHG is due to use of energy in various forms (i.e., diesel, steam, fuel oil and electricity). The remaining minor elements are from other chemicals and transport. To reduce GHG impact of REE processing, the focus should be on how to reduce the acid and energy consumption during processing.