Abstract

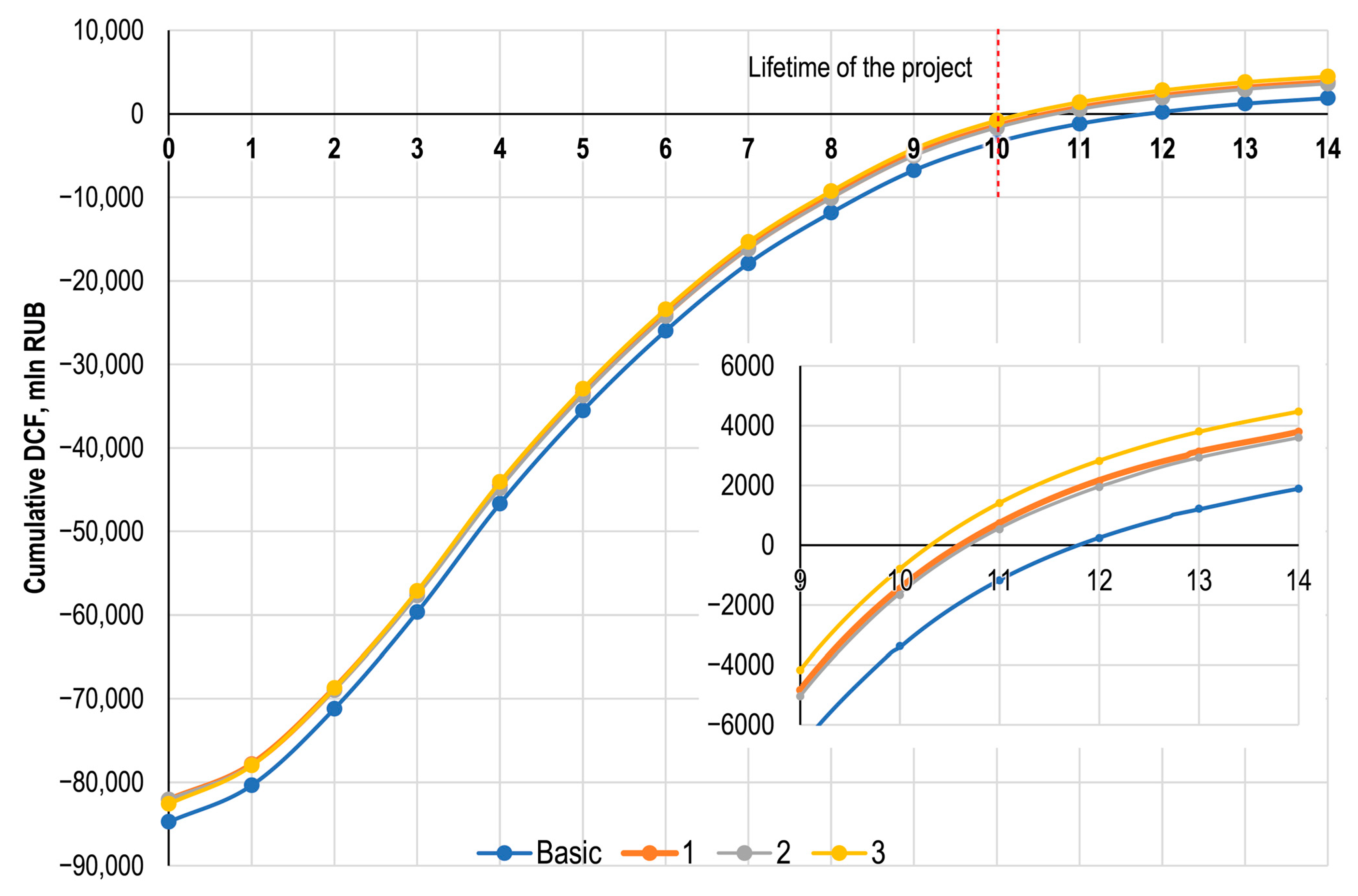

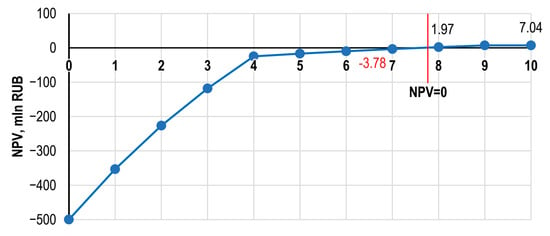

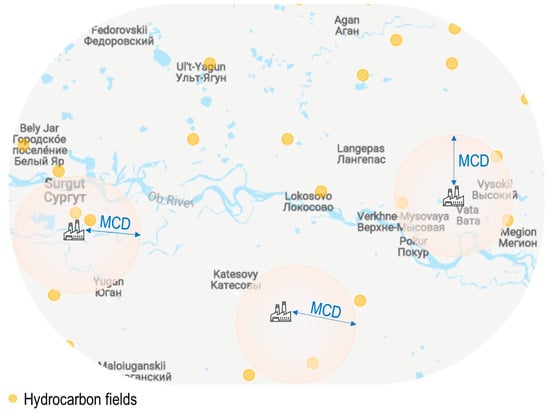

Drilling-waste management is of great importance in the oil and gas industry due to the substantial volume of multi-component waste generated during the production process. Improper waste handling can pose serious environmental risks, including soil and water contamination and the release of harmful chemicals. Failure to properly manage waste can result in large fines and legal consequences, as well as damage to corporate reputation. Proper drilling-waste management is essential to mitigate these risks and ensure the sustainable and responsible operation of oil and gas projects. It involves the use of advanced technologies and best practices to treat and utilize drilling waste in an environmentally safe and cost-effective manner. This article describes a feasibility study of four drilling-waste management options in the context of the Khanty-Mansi Autonomous Okrug of Russia. For ten years of the project life, the NPV under the base scenario is equal to RUB −3374.3 million, under the first scenario is equal to RUB −1466.7 million, under the second scenario is equal to RUB −1666.8 million and under the third scenario is equal to RUB −792.4 million. When considering projects, regardless of oil production, the project under the third scenario pays off in 7.8 years and the NPV is RUB 7.04 million. The MCD and MCV parameters were calculated to be 106 km and 2290 tons, respectively. Furthermore, the study estimates the ecological damage prevented and the environmental effect of each option. Quantitative risk assessments, conducted through sensitivity analysis, reveal that the fourth option, involving the conversion of drilling waste into construction materials, emerges as the most economically feasible. The study also evaluates the interaction between business and government and analyzes the current situation in the sphere of drilling-waste management, concluding with concise recommendations for both companies and official bodies.

1. Introduction

As industrial production and urbanization are growing, so is the consumption of mineral resources, which leads to growth in the volume of man-made waste and gives rise to environmental problems [1,2]. In the global energy mix, hydrocarbons are continuing to play a dominant role among other energy sources [3,4]. Within the oil and gas industry, the drilling of wells stands out as the primary source of waste generation [5]. Therefore, the establishment of effective waste-management systems that transform waste into valuable resources and materials is an important step towards fostering a circular economy [6]. Nevertheless, the adoption of such waste-management practices in developing countries remains improbable due to limited funding, inadequate government incentives, technological shortcomings, and regulatory deficiencies [7,8].

Considering the millions of tons of drill cuttings produced when drilling exploration and production wells in the oil and gas sector, substantial environmental damage is done, disrupting the equilibrium of entire ecosystems [9]. This is due to the fact that drilling waste consists of both safe and toxic components, the latter being harmful to nature and human health [10,11,12].

Waste includes drilling mud, buffer fluid, and drill cuttings [13]. The drilling mud is selected based on the geological conditions of the producing formation and the physical and chemical properties of the hydrocarbons [14]. Drilling muds are classified into aqueous (highly colloidal clay or polymer muds), oil (diesel fuel or crude oil), pneumatic (compressed dry air, natural gas, aerosol, or foamed gas) and synthetic (vegetable esters, olefins, linear paraffins, simple esters, or acetals) [15,16,17,18]. The buffer fluid is similar in composition to the drilling mud and is intended for cleaning the wellbore before plugging it [19]. Drill cuttings consist of drilled rock and saturating fluids.

The composition of the drilling mud includes a large number of reagents ensuring specific properties (density maintenance, rheological, thermal, and other properties): moisture and viscosity reducers, clay dispersion inhibitors, thermostabilizing agents, Ca2+ and Mg2+ binding ions, lubricants, emulsifiers, defoamers, pH regulators, H2S absorbers, fillers, etc. [15]. While some additives may not be inherently toxic, their interaction with formation minerals can yield poisonous substances, exemplified by the formation of harmful components when barite interacts with carbonates and chlorides. In addition to barium salts, heavy metals present in bentonite clays, such as lead, copper, zinc, nickel, cadmium, cobalt, antimony, tin, bismuth, and mercury [15], as well as silver, tungsten, iron, gold, and manganese [20], contribute to the toxicity of drilling muds.

According to [21], the toxicity of used drill cuttings is influenced by the concentration of polymers, heavy metal salts, and other additives. Notably, polyacrylamide (PAA), identified as the most hazardous polymer, exhibits carcinogenic properties due to the presence of unpolymerized acrylamide [22]. The accumulation and disposal processes can adversely affect the biosphere, water resources, soil, and flora, and may inhibit the sustainable development of promising regions of Russia [23,24,25]. Therefore, it is necessary to continue searching for more sustainable and cost-effective alternatives for drilling-waste processing [26].

Using a hydrocarbon field in the Khanty-Mansi Autonomous Okrug of Russia as a case study, the goal of this research is to identify flexible approaches to drill cutting utilization, assess their economic and environmental efficiency, and evaluate the effectiveness of employing drilling waste as a source for producing construction materials.

To achieve this goal, it is necessary to address a number of objectives:

- Analyze the socio-economic indicators of the Khanty-Mansi Autonomous Okrug and identify the prerequisites for processing drilling waste into construction materials.

- Determine the research methodology and gather initial data necessary for calculations.

- Identify and compare the advantages and disadvantages of the options under analysis.

- Formulate recommendations and suggestions for the development of effective drilling-waste utilization programs.

2. Literature Review

2.1. Current Situation

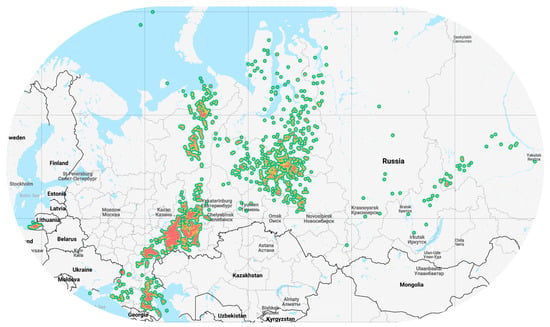

As of 2022, there are more than 1900 oil and gas fields in Russia (Figure 1) [27]. The Khanty-Mansi Autonomous Okrug and Samara Region host the largest number of fields, each with more than 250, while the Yamalo-Nenets Autonomous Okrug and the Republic of Bashkortostan feature over 150 fields each.

Figure 1.

Russian oil and gas fields. Adapted from [27].

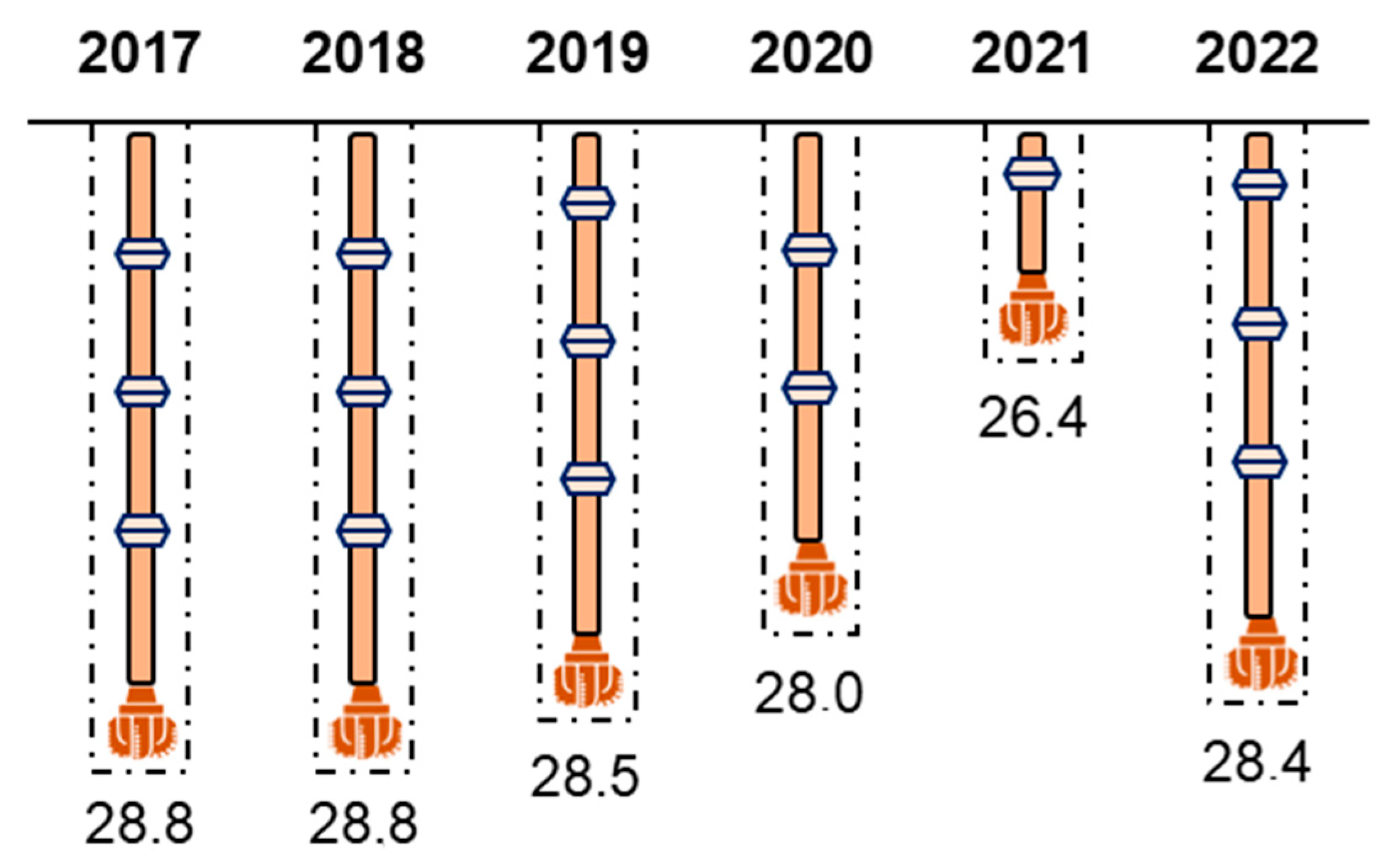

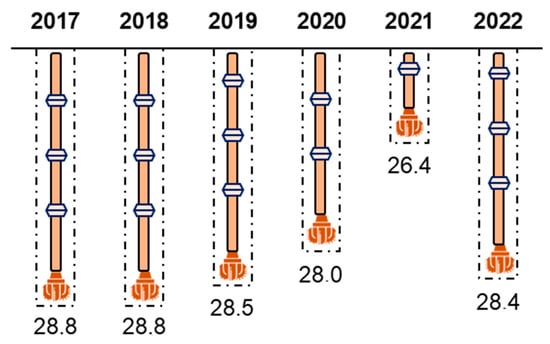

A substantial portion of these fields remains undeveloped, existing solely on company balance sheets, while those under development continue to undergo exploration [28,29]. In 2022, geological exploration witnessed an increase from 2021, resulting in a boost of 816 million tons in oil reserves (categories A + B1 + C1) and 828 billion m3 in natural gas reserves [30]. The major growth in oil reserves was accounted for by the Romashkinskoye and Novo-Yelkhovskoye fields in the Republic of Tatarstan (totaling 271 million tons) and the Petelinskoye and Priobskoye fields in the Khanty-Mansi Autonomous Okrug (totaling 40 million tons). Natural gas reserves saw a surge primarily in the Tambeyskoye and Pestsovoye fields in the Yamalo-Nenets Autonomous Okrug (411 billion m3) and the Chayandinskoye field in Yakutia (70 billion m3). As of the end of 2022, 34 new fields were discovered, with 6 being large, and the remainder classified as small or very small in terms of reserves. Consequently, exploration drilling and development drilling have maintained high levels, with development drilling reaching 28.4 million meters in 2022, an 8.8% increase from 2021 (Figure 2). Exploration drilling penetration for 2022 reached 1.06 million meters, a 26% increase from the previous year. According to Rosnedra forecasts, further growth in parametric drilling is anticipated in 2023, and, depending on sanctions, three drilling market development scenarios—basic, optimistic, and negative—are suggested. The Ministry of Energy assumed [31] that the drilling volumes in 2023 would grow as sophisticated technologies for enhanced oil recovery (EOR) were becoming unavailable. Thus, the volume of drilling waste will also either increase or remain at the same level. The Ministry of Energy states [31] that the first quarter of 2023 has already witnessed the drilling of 6.8 million meters in the development drilling sector alone, a 3.3% increase from the planned volume. According to the BCS Global Markets, the record for development drilling in Russia may be surpassed in 2023 [32].

Figure 2.

Drilling volumes by year, million m. Adapted from [31,32].

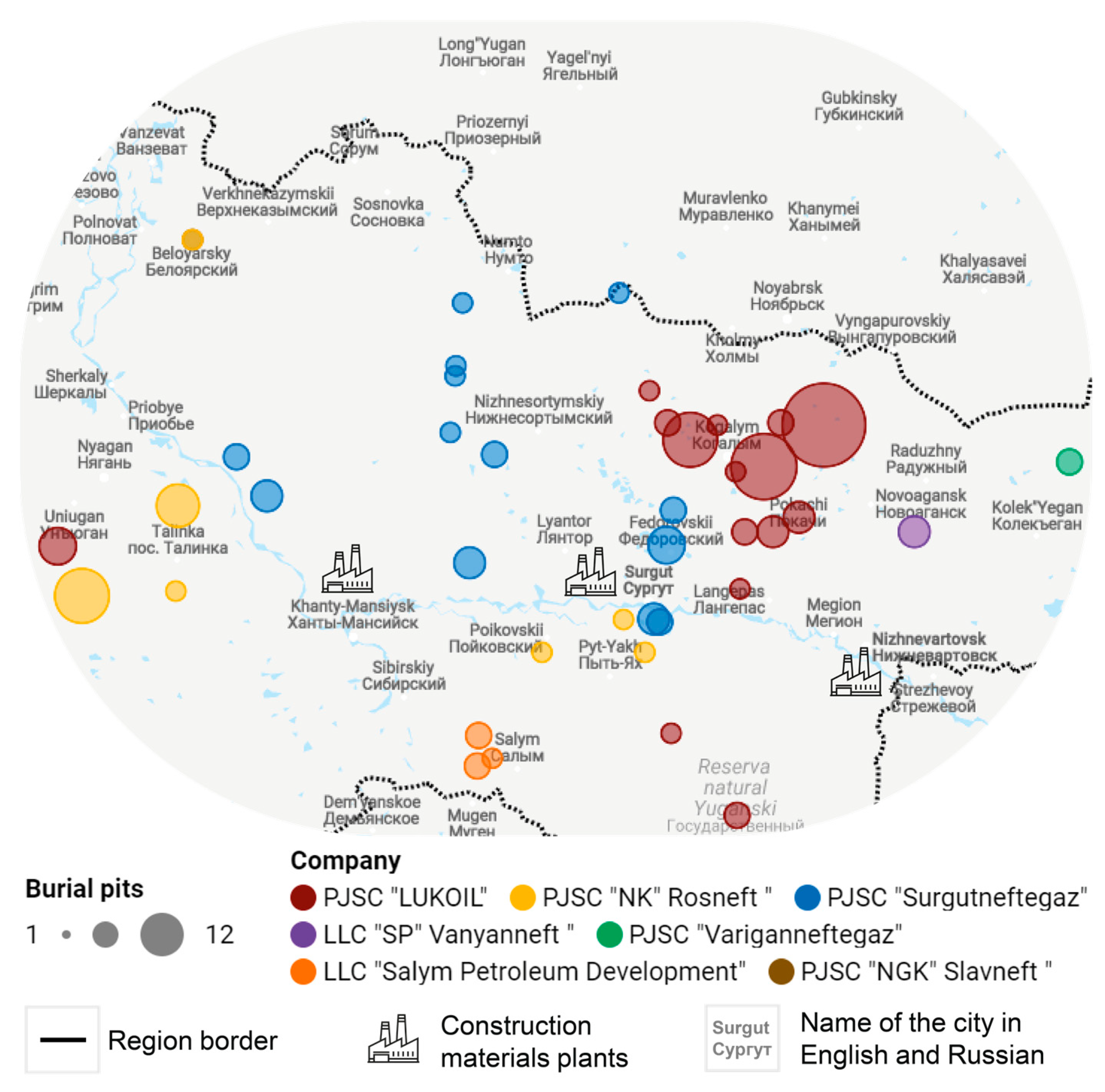

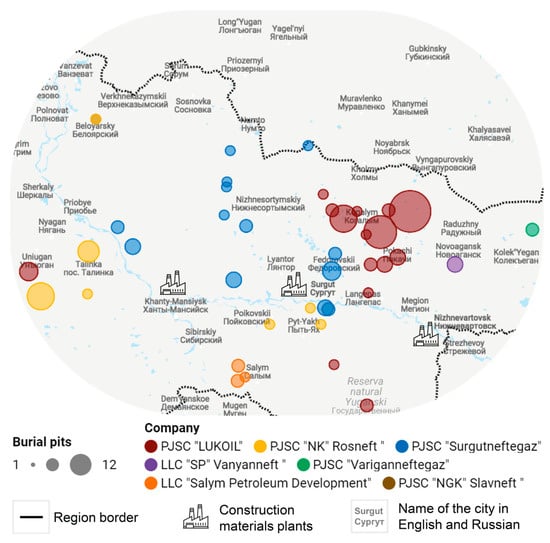

Waste from hydrocarbon exploration and production operations mainly accumulates within major oil and gas production regions, including the Khanty-Mansiysk Autonomous Okrug (4.728 million tons), Yamalo-Nenets Autonomous Okrug (1.16 million tons), Republic of Tatarstan (0.728 million tons), and Republic of Bashkiria (0.322 million tons) [33]. According to the national register of waste-disposal facilities [34], the Khanty-Mansi Autonomous Okrug hosted the largest number of landfills and pits in 2022. Surgutneftegaz alone accounted for 111 facilities, with Lukoil managing another 74. Rosneft and Gazprom had 35 and 34 facilities, respectively (Figure 3).

Figure 3.

Drilling-waste disposal sites on the territory of the Khanty-Mansiysk Autonomous Okrug. Adapted from [34].

2.2. Drilling-Waste Disposal Options

Given that drilling waste is a complex mixture, potentially including a wide array of chemicals, including heavy metals and their salts [35], improper handling can result in catastrophic environmental damage. Moreover, the utilization of drilling waste is often a resource-intensive and time-consuming process, particularly in regions with inadequate transport infrastructure where waste logistics costs can amount to as much as USD 230 per ton [36]. Additionally, in smaller-scale drilling operations, such as exploratory wells, the processes involved in cutting processing can prove economically inefficient [37]. Consequently, simpler and more cost-effective methods, such as disposal in pits and landfills, are commonly employed [38].

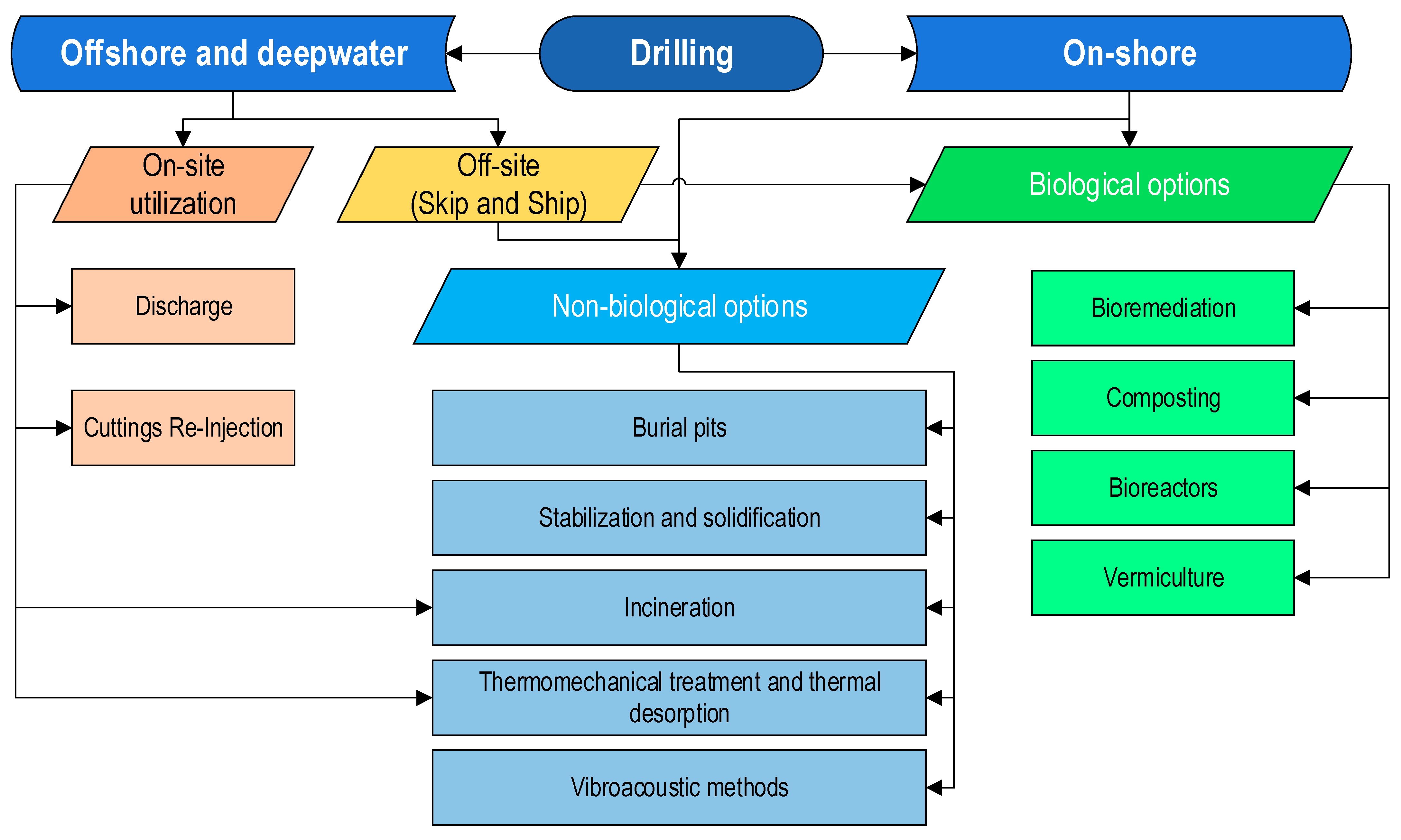

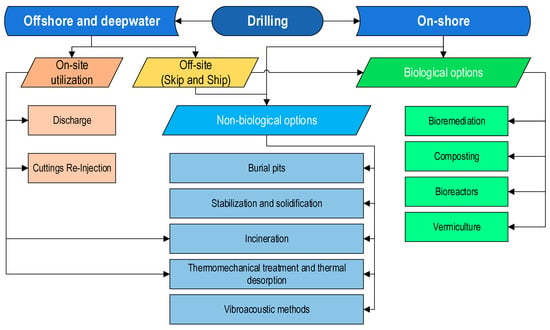

However, several oil and gas companies worldwide opt for alternative technologies that, despite their high costs and the need to use innovations, exhibit a less adverse environmental impact [39,40,41]. In general, drilling-waste management options can be classified into various categories (Figure 4).

Figure 4.

Drilling-waste management options. Adapted from [42,43,44,45,46,47,48,49,50].

Each method has its own advantages, disadvantages, and limitations. For example, offshore disposal is only possible for water-based drilling, while oil-based drilling requires re-injection or other treatment methods [51]. Biological methods are the least costly but require large areas and time investment [52]. Incineration and thermal methods are recommended for waste with high hydrocarbon content [53]. Regardless of the chosen method, considerations must include environmental risks, capital and operating costs, safety aspects, and adherence to regulatory guidelines. Table 1 describes the advantages, disadvantages, and limitations in more detail.

Table 1.

Advantages, disadvantages and limitations of drilling-waste disposal methods.

2.3. Extension of the Life Cycle of Waste

In the current environmental context, with increasing strain on the environment, there is a growing imperative to utilize production wastes [61]. Why not find a use for the mixture of rock, drilling mud, and formation fluids that have already been brought to the surface instead of dumping them? The answer to this question can be found in several economic and environmental considerations, as presented in Table 2.

Table 2.

Incentives to recycle and utilize drilling waste.

In addition to these incentives, it is necessary to revise the existing legislation in the sphere of industrial waste management in Russia. In May 2023, the Russian Government issued Resolution No. 881 titled “On Approval of the Rules of Calculation and Collection of Charges for Negative Environmental Impact” [62], effective from September of the same year until 2029. This resolution marks the first important step towards regulating waste-disposal activities and introduces new rules for calculating and charging fees for negative environmental impact (NEI). Notably, high fees for failure to use waste in the natural resources sector (drilling waste falls into this category) within the established deadline serve as a compelling incentive for companies to reconsider their policies and proactively address waste utilization and disposal.

Despite these incentives, companies holding licenses for hydrocarbon exploration and production predominantly employ recycled drilling waste as an admixture for embankments and field roads [63]. Excess drilling waste remains directly at well drilling sites [55]. To avoid excessive waste accumulation, it is necessary to extend the life cycle of drilling waste. The most environmentally friendly, resource-efficient, and rational approach involves utilizing waste in the production of construction materials and products [64,65,66,67]. This method not only frees up territories designated for storing drill cuttings but also yields ecological and economic benefits from drilling pit elimination, simultaneously enhancing the environmental safety of mining and industrial territories. Utilization of third-class hazardous waste can yield construction products classified as fourth-class hazardous, underscoring the potential for environmentally responsible practices. Nevertheless, it is essential to ensure that materials and products derived from drilling waste adhere to established national or international regulations, such as GOST and ISO standards [68,69].

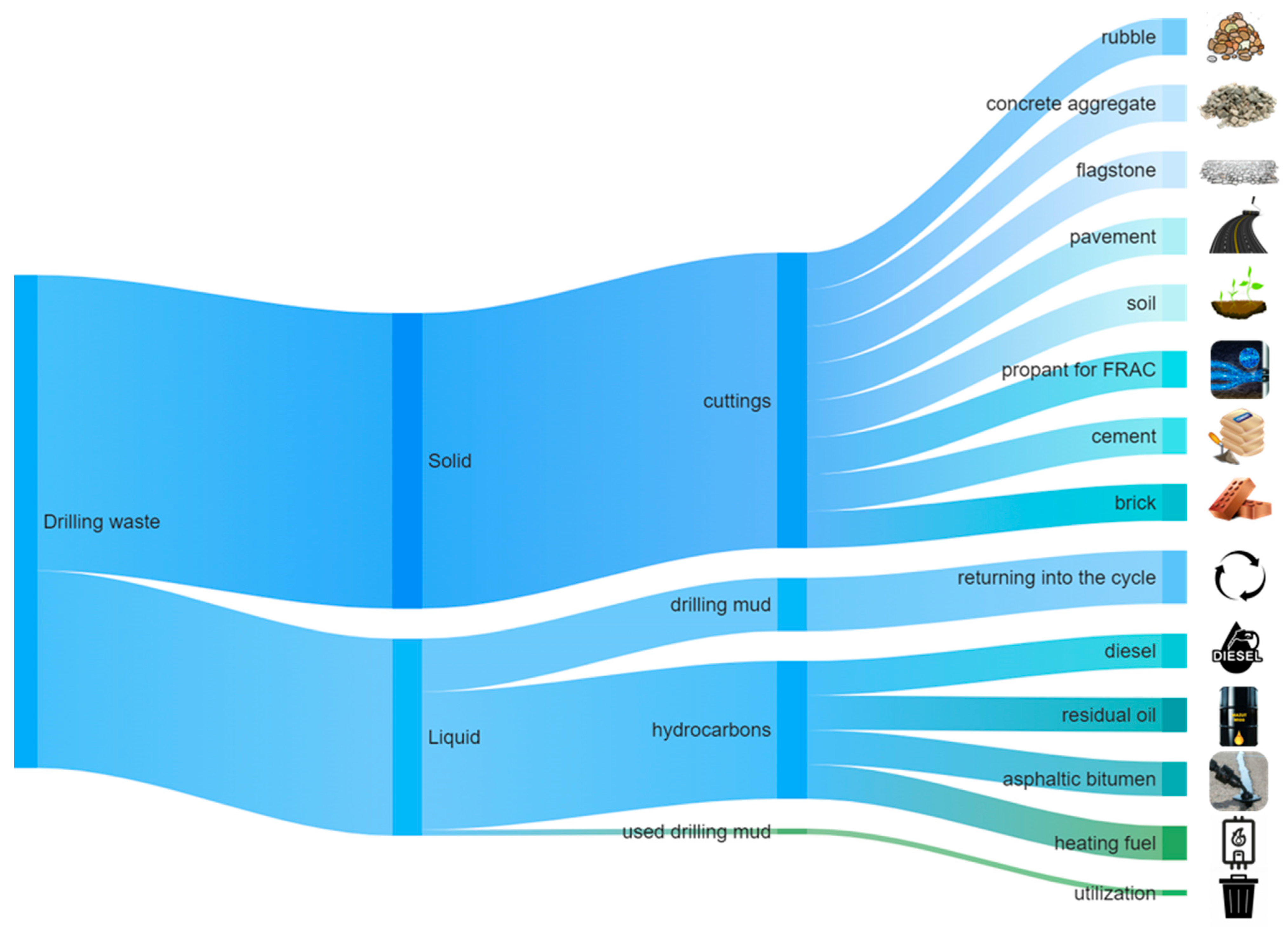

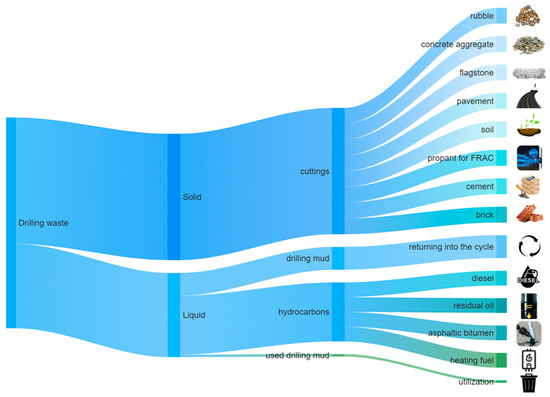

Currently, drilling-waste processing technologies enable the extraction of solid components for the production of construction and useful materials, including granular aggregate for concrete, soil for roads and drilling-site filling, ceramics, bricks, paving tiles, expanded clay, cinder blocks, boron stone, soil mixtures, and plant biostimulants, as well as materials used as proppants in hydraulic fracturing [70,71]. The liquid part yields purified drilling mud, some fuels, and road bitumen [72,73] (Figure 5).

Figure 5.

Useful products from drilling waste. Adapted from [70,71,72,73].

The level of technology for processing drill cuttings is different in each country. In Russia, the main direction of drilling-waste processing on industrial scales is focused on the production of soil mixes. Nevertheless, there are numerous patent developments for the production of other products listed above: service companies are gradually setting up small-scale production facilities for recycling waste into building materials (bricks, cement, aggregates for concrete). Unfortunately, in the current conditions, technological barriers created by the difficult geopolitical situation can cause difficulties in the implementation of high-tech projects. In this case, however, there is an impetus to develop our own technologies [74].

Thus, the challenge in processing drill cuttings to produce construction materials lies in the high added value of the resulting products, primarily comprising the costs of waste transportation and processing [75]. Therefore, it is important to identify the conditions under which the use of drill cuttings as a raw material is justified.

2.4. Study Object and Market Analysis

The Khanty-Mansiysk Autonomous Okrug, ranking 9th in territorial area among Russian regions at 534.8 thousand km2 [76], is primarily characterized by extensive forest lands covering 53.65%, followed by surface waters, including swamps at 43.17%, and lands intended for agricultural use at 1.18%. The region’s low population density is a result of its unique territorial features. Nevertheless, according to Rosstat data, the population of the Khanty-Mansi Autonomous Okrug continues to grow.

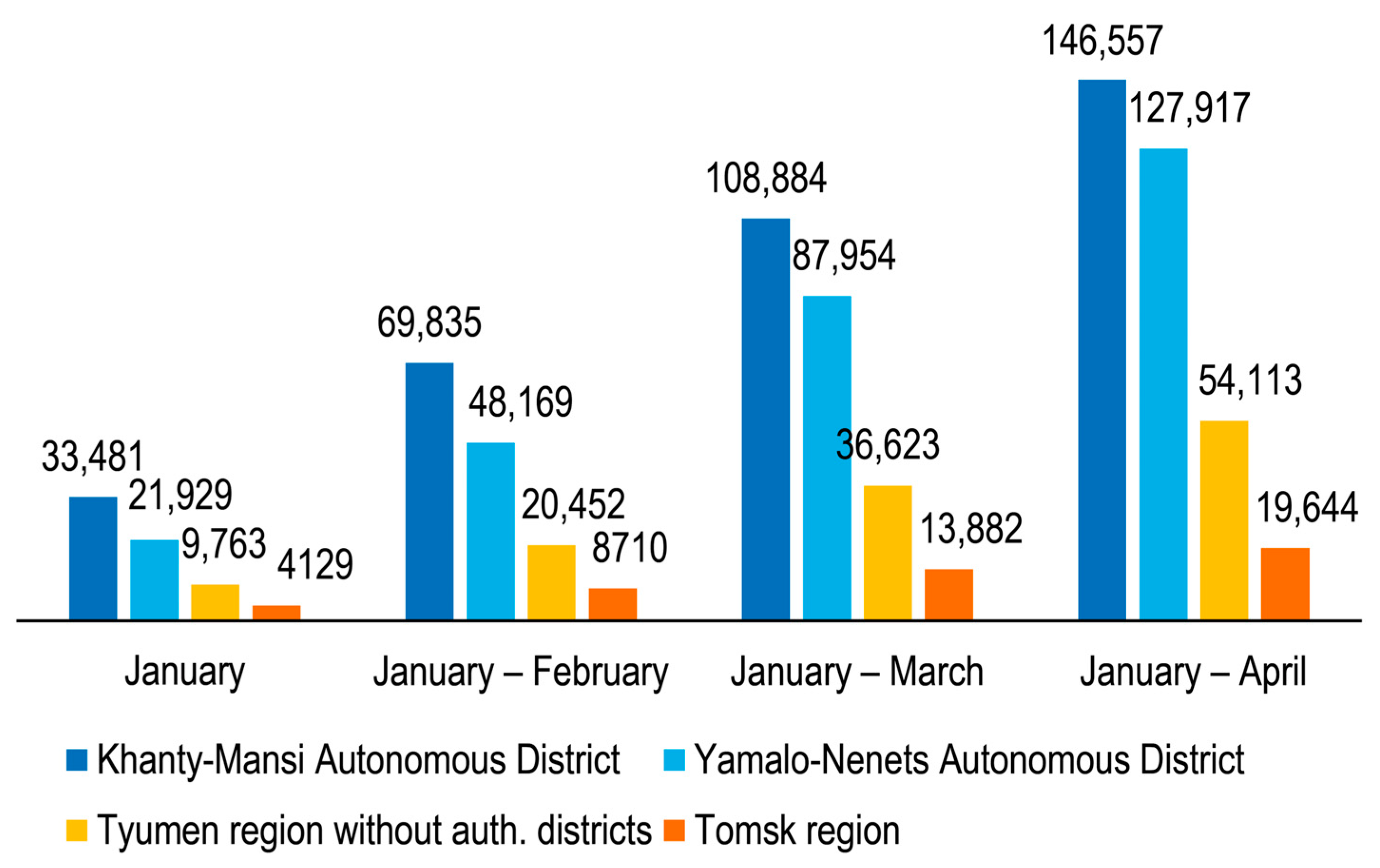

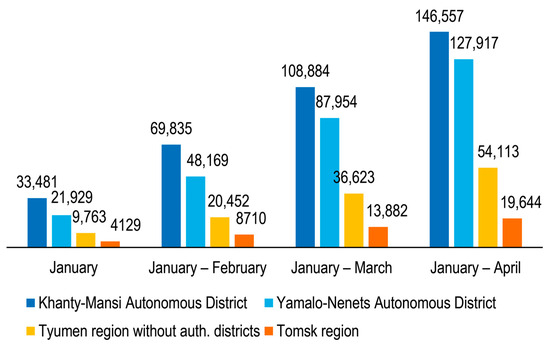

As highlighted earlier, the volume of mining and exploration operations is increasing, leading to a rise in construction activities. In the first quarter of 2023 alone, expenditures on construction reached RUB 146.557 million (Figure 6).

Figure 6.

Construction volumes, million RUB. Adapted from Rosstat.

This growth in construction works extends beyond the Khanty-Mansi Autonomous Okrug, also impacting neighboring regions.

As of the end of 2021, the share of investments in buildings and structures (except for residential) and land improvement was the largest (37%). By types of economic activity, as can be expected, the first place was occupied by mining (83%), with construction at 4%. A total of 0.2% is accounted for by water supply, wastewater disposal, waste collection and disposal, and activities to eliminate pollution.

By 2030, the target socio-economic indicators aim to increase the area occupied by residential buildings and the density of highways and hard-surface roads. The key target indicators for the development of the construction industry are outlined in Table 3.

Table 3.

Key target indicators for the development of the construction industry.

The Strategy for Socio-Economic Development of the Khanty-Mansi Autonomous Okrug emphasizes that the socio-economic benefits from raw material extraction and construction material production will primarily be realized through tax deductions at all administrative levels of the region, ultimately improving the socio-economic living conditions of the population [77].

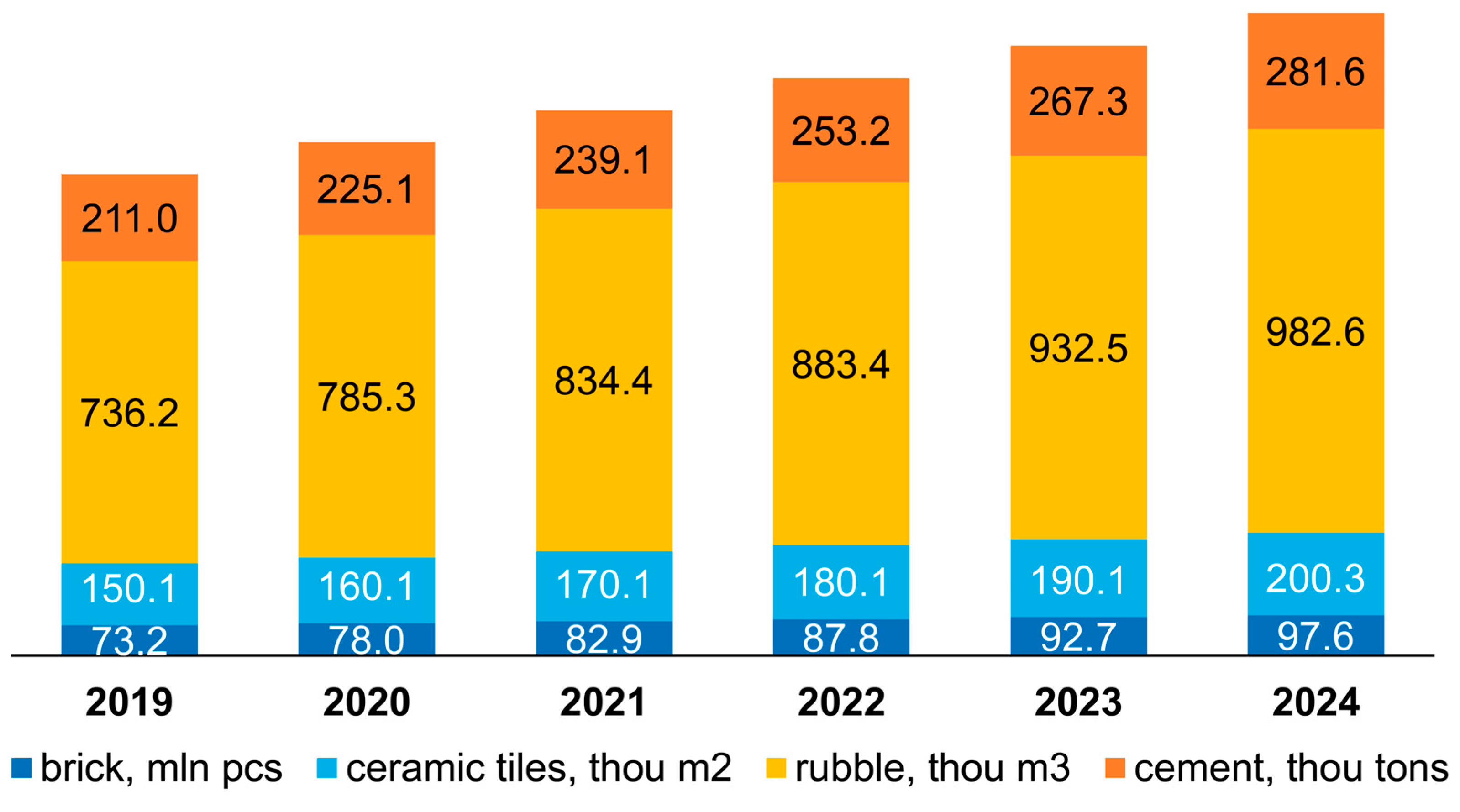

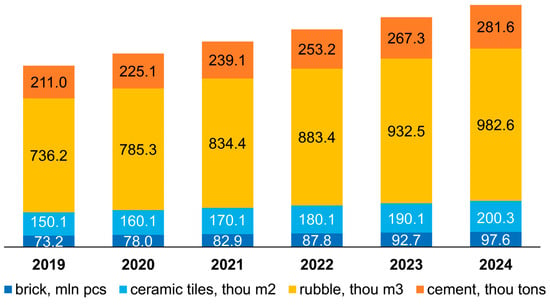

As of 2016, the region relies solely on sand production for its construction material needs, with 1575 deposits of commonly occurring minerals, including sand for planning works, construction sand, sand and gravel mixtures, building stone, clay rocks, brick clays, etc. However, the construction sector’s demand for materials, including crushed stone, gravel, Portland cement, building bricks, cement, and ceramic tiles, is in 100% deficit. A patent and literature review indicates that these materials can be produced from drill cuttings. Analysts forecast a growing demand for these materials (Figure 7) [78].

Figure 7.

Construction materials imported from other Russian regions.

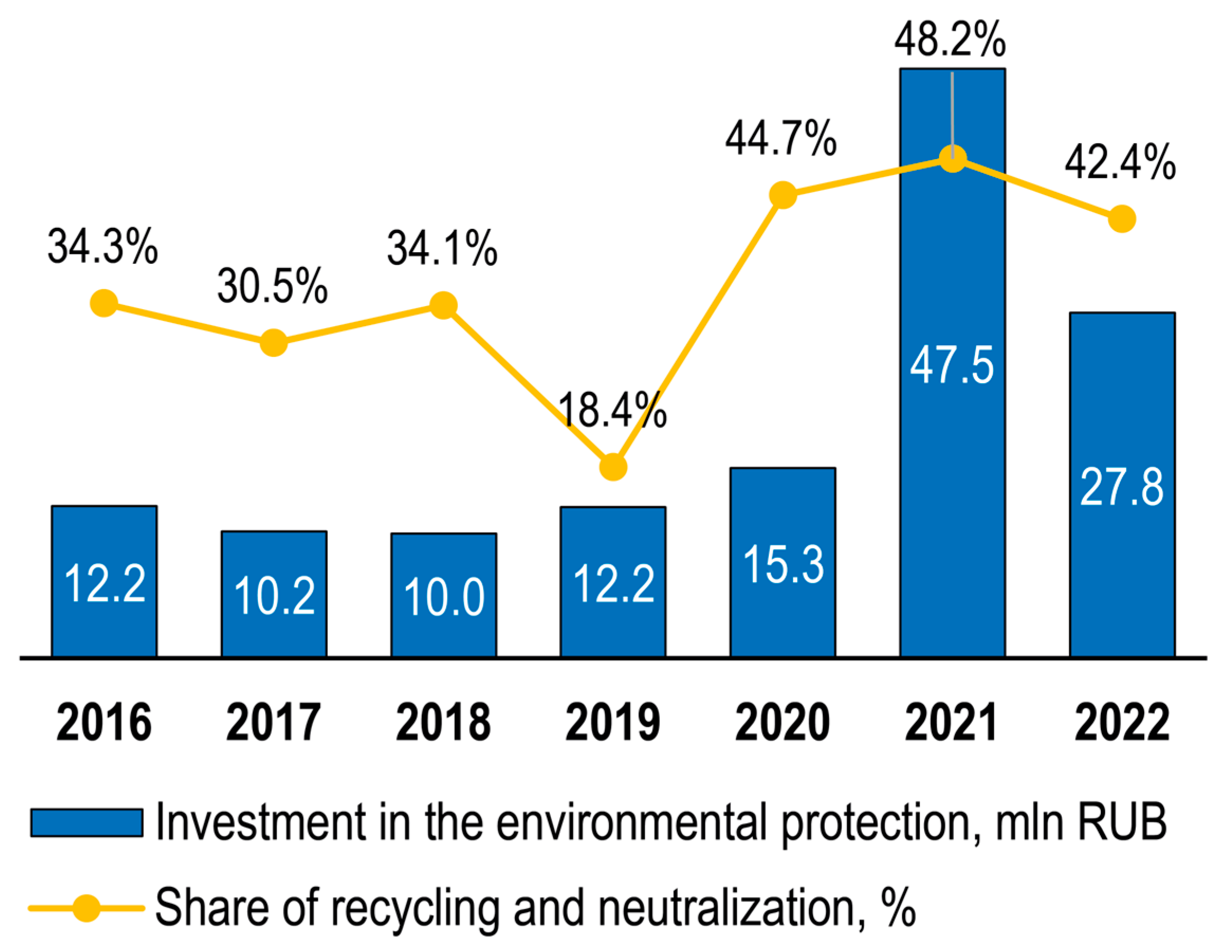

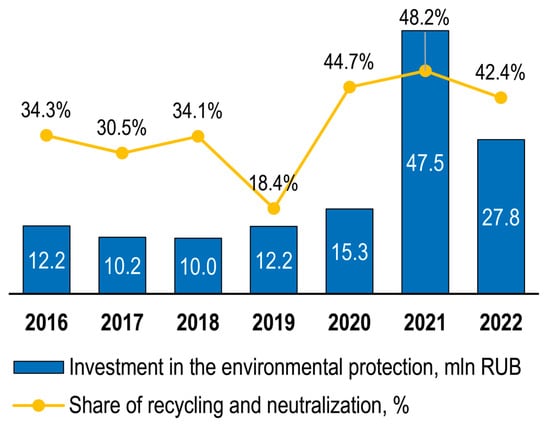

Investments in fixed capital to safeguard the environment from pollution caused by production and consumption waste have experienced a significant surge in the region from 2019 to 2022. This growth is attributed to the tightening of policies on industrial waste management (Figure 8).

Figure 8.

Investments in environmental measures against pollution caused by production and consumption waste.

The Khanty-Mansi Autonomous Okrug Natural Supervision Authority identifies the following key environmental problems associated with raw material extraction in the region [79]:

- Air pollution from emissions and associated petroleum gas utilization;

- Waste disposal and utilization problems;

- Land and water pollution, including pipeline accidents and improper waste disposal;

- Habitat destruction and negative effects on fauna and flora.

Despite these challenges, the resource base of the Khanty-Mansiysk Autonomous Okrug, particularly untapped mineral reserves and the potential resources represented by accumulated drilling waste, provide significant opportunities for the development of the construction materials sector. The northwest of the region, namely the Berezovsky, Sovetsky, Oktyabrsky, and Beloyarsky districts, possess the highest levels of untapped but in-demand reserves [78].

However, several factors in these areas act as constraints to regional development, especially hindering the growth of the construction materials sector:

- Infrastructure limitations. Eastern districts, such as Surgut, Nizhnevartovsk, Nefteyugansk, and Khanty-Mansiysk, are the key consumers of construction materials, accounting for 86 to 90% of the total consumption in the region. These districts have better transport accessibility compared to regions with less developed construction materials sectors. Furthermore, remote territories from urbanized centers leads to possible obstacles with the energy supply [80];

- Low labor potential, which, as noted above, is the result of low population density;

- High investments and operating costs compared to the existing production capacities in the southern regions of the Urals and the Siberian Federal District.

Considering the gathered information, utilizing drilling waste as a resource for the production of construction materials in the Khanty-Mansiysk Autonomous Okrug emerges as a promising and relevant area of research. This makes it necessary to analyze the technological readiness of the industry for processing drilling waste, identifying the necessity to establish local production of building materials capable of competing in terms of cost and quality with imported goods.

3. Materials and Methods

3.1. Utilization Options

In the Khanty-Mansiysk Autonomous Okrug, drilling-mud disposal in oil and gas production is carried out in compliance with environmental and technical requirements. The most popular drilling-waste management schemes currently include:

- The generated waste is transferred to waste recycling service companies for ownership and use. In the region, there are over 20 service companies that collect, transport, store, and recycle drilling waste [81].

- Waste is disposed of at the drilling site in burial pits. Based on the analysis conducted above, it appears that the number of burial pits is high. This is due to various circumstances, such as economic, technical, technological, and environmental factors, which make it more rational for companies to dispose of waste by constructing burial pits.

Gradually, companies are introducing methods aimed at expanding the life cycle of drilling waste through recycling into building materials and soils [82,83] due to stricter environmental standards and control over industrial waste management, as well as growing public concern.

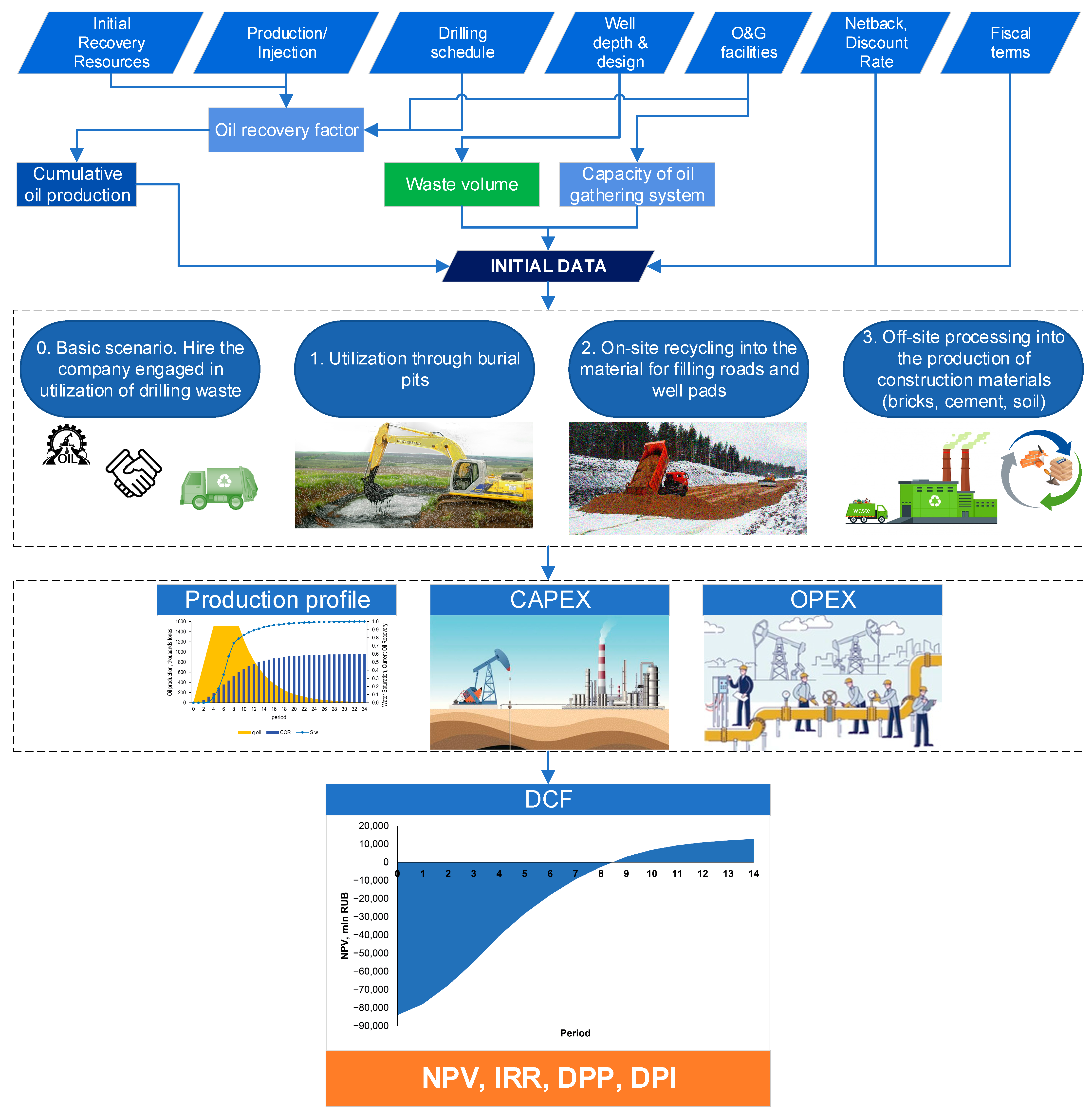

Therefore, to assess the viability of implementing drilling-waste management systems in hydrocarbon field development, a comprehensive analysis of four field development options is essential, each featuring distinct drilling-waste utilization options or scenarios (Table 4). The analysis of these four scenarios will help answer the question of whether waste recycling can really provide economic benefits to the company, and what it will hinge on, or whether it is better to apply traditional recycling options.

Table 4.

Options for analysis.

Analyzing the entire project lifecycle, from license acquisition and exploration to the final stage and field liquidation, would be impractical due to the complexity of assessing and calculating the impact of each utilization method. Therefore, it is more pragmatic to focus on the project phase with the highest drilling-waste generation, aligning with its processing and subsequent realization (depending on the scenario). Consequently, the project’s duration corresponds to the production drilling duration.

The field is developed by conventional waterflooding using a system of reservoir pressure maintenance. Accordingly, the drilling project involves both production and injection wells.

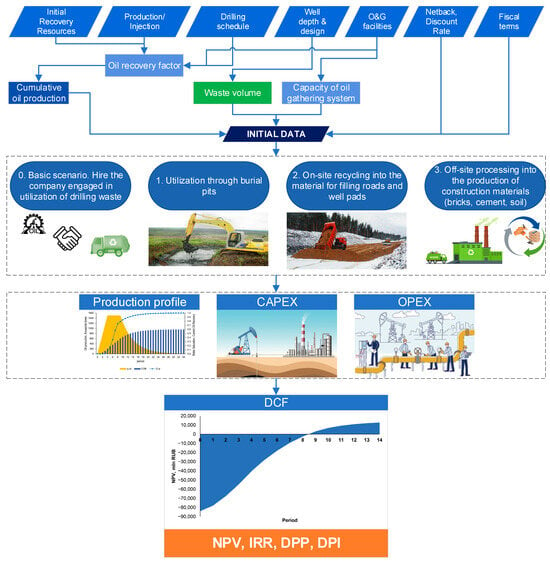

The calculation model is shown in Figure 9.

Figure 9.

Model design.

The following subsection will describe the basic notations and formulas used in developing the model for each scenario.

3.2. Initial Data and Descriptions

3.2.1. Determination of Production Profile and Number of Wells

1. When developing hydrocarbon field development models, the rules of project preparation are followed [84]. We will start by building the oil production profile:

where qoil(t) is oil production by years, thousand tons; k is the relative value of annual withdrawal during the period of constant maximum production; IRRes is initial recovery resources, million tons; t is the current year; tin is the period of incremental production, years; tmax is the period of maximum production, years; and β is the production decline rate.

The required parameters for the production curve can be determined from the statistical data [85] presented in Table 5.

Table 5.

Field development parameters based on IRRes.

2. Next, we will find the number of wells that will be able to provide withdrawal during the period of maximum oil production [86]:

where npw is the number of producing wells; kres is the well reserve coefficient; kexpl is the well operation coefficient; and q is the average flow rate of one well, tons per day.

3. The number of injection wells depends on the development grid and can be determined by Equation (3) [86]:

where niw is the number of injection wells and θ is the ratio of injection wells to production wells.

4. Current oil recovery factor [86]:

where η(t) is the current oil recovery factor and is cumulative production for the current period, million tons.

5. The watercut of the field can be modeled by the empirical relationship [87]:

where Sw(t) is field watercut; η0 is the water-free oil recovery factor (0–0.1); ηavg is the oil recovery factor at the second stage (0.1–0.5); ηmax is the maximum oil recovery factor (0.5–0.7); and a and b are watercut curve parameters.

6. Water production by years, taking into account previous formulas:

where qw(t) is water production by years, thousand tons.

7. Displacement agent (water) injection volumes:

where qinj(t) is water injection by years, thousand tons.

8. Well commissioning depends on maximum peak production and the average well flow rate. The first stage of development involves drilling at least 90% of the main well stock, with the remaining 10% to be drilled in the second stage [86].

9. The volume of drilling waste for each year is found using Equation (8):

where W(t) is the amount of drilling waste per year, thousand tons.; and Miw and Mpw are the volumes of drilling waste per production and injection well, respectively, thousand tons.

3.2.2. Macro Parameters and Fiscal Terms

1. Since the income part of the project is the received oil inflow (for the third option) and the cash inflow from the sale of construction materials, it is necessary to determine the value of crude oil sales on the domestic market:

where NetBack is the domestic sales price, RUB per ton; Coil is the Urals price, USD per barrel; Kbarr is the barrel coefficient equal to 7.2; Dcust is the custom duty, USD per ton; Cother is other costs, including those related to transportation to the commercial oil metering station and transshipment of crude oil, USD per ton; and P is the RUB/USD exchange rate, RUB/USD.

The exchange rate and oil price can be significantly affected by the geopolitical situation, which in turn can have a dramatic impact on the effectiveness of the project overall [88]. Therefore, it is essential to consider external changes and incorporate the corresponding risk values into the project model.

2. The discount rate is required to determine the time value of cash flows [89]. For oil and gas projects, the discount rate is determined using the WACC (Weighted Average Cost of Capital) or CAPM (Capital Assets Pricing Model) models [90]. Oil and gas companies often have internal documents and charters that justify the choice of a discount rate. In general, the discount rate consists of a risk-free (base) rate and a premium for the risk component (country risk, industry risk, risk associated with poor corporate governance, risk associated with the illiquidity of the issuer’s shares, etc.) [91].

3. In the production of hydrocarbons, the largest percentage of operating costs is in tax deductions [92]. Mineral extraction tax is determined in accordance with Article 342 of the Tax Code of the Russian Federation:

where MET is the mineral extraction tax, million RUB; Boil is the prime rate of mineral extraction tax on crude oil, RUB 919 per ton; and DM is the coefficient characterizing oil production peculiarities:

where KMET is RUB 559 per ton; K1, K2, and K3 are equal to 1; K4 is RUB 428 per ton; and Kdepl is the reserve depletion rate:

where Kdepl is the depletion coefficient.

3.2.3. Capital and Operating Expenditures

Depending on the choice of scenario, the structure of capital and operating costs will differ. The list of capital and operating costs that are relevant for each scenario is presented in Table 6, and the costs that will be different are presented in Table 7.

Table 6.

Costs relevant for each scenario.

Table 7.

List of additional expenditures.

3.2.4. Mathematical Representation of the Model—Estimation of Economic Efficiency

1. Capital expenditures for drilling wells can be summarized as follows:

where CAPEX is capital expenditures of the project, million RUB; Cdrill is the cost of drilling 1 m of a well, thousand RUB per meter; Ctreat is the cost of cutting utilization included in drilling costs, thousand RUB per meter; Cf is the value of field production facilities, million RUB; Hpw and Hiw are the depths of the production and injection well, respectively, m; Croads and Cpads are the costs of construction of haul roads and well pads, respectively, million RUB; α is the coefficient of reduction in the cost of bulk facilities due to the use of recycled drill cuttings; Consite is the cost of installations for mud processing on site, million RUB; and Coffsite is the cost of production expansion at the construction materials plant, million RUB.

2. Operating costs

where Current is current costs, million RUB; Tr is transportation costs, million RUB; D is amortization, million RUB; Ins is insurance costs, million RUB; Land is payment for land use; million RUB; NEI is payment for negative environmental impact, million RUB.; Treat is costs of construction and reclamation of pits, million RUB.; Tronsite is transportation costs for moving drill cuttings from the field to accumulation sites, million RUB; Troffsite is transportation costs to the factory, million RUB; and R is costs of processing cuttings into construction materials, million RUB.

The cost of transportation from the field to the plant can be calculated based on the cost of truck rental and diesel fuel:

where rentauto is the cost of truck rental, thousand RUB per day; qdf is diesel consumption, liters per 100 km; cdf is the cost of diesel fuel, RUB per liter; ntrail is the number of trips per day; s is the distance from the field to the plant, km; and nauto is the required number of trucks, calculated as:

where g is the load capacity of one truck, tons.

In Russia, according to the Federal Classification of Wastes, drilling wastes belong to hazard categories 3, 4, or 5 [33]. Each hazard category corresponds to a waste-disposal rate in the territory of the company’s business activities (Table 8).

Table 8.

Rates for waste disposal depending on the category of hazard.

Payment for negative environmental impact is charged on the amount of drill cuttings remaining at the end of the year:

where Rate is the waste-disposal rate, RUB per ton; coef1, coef2, and coef3 are coefficients determined by the Resolution of the Russian Federation [99]; Wstart of the year is the amount of drilling waste at the beginning of the year, thousand tons; and Wend of the year is the amount of drilling waste at the end of the year, thousand tons.

3. Revenues from domestic sales of crude oil and sales of construction materials

where Revenue is the revenue from product sales, million RUB; β is the degree of drill cutting processing; wbrick, wcement, and wsoil are the shares of mud being processed into bricks, cement, and road soil, respectively; cbrick, ccement, and csoil are the market values of bricks, cement, and road soil, thousand RUB per ton.

4. Balance profit, taxable profit, and net profit are calculated as follows:

where Profitbalance is balance profit, million RUB and VAT is value added tax, million RUB.

where Profittaxable is taxable profit, million RUB and Taxproperty is property tax, million RUB.

where Profitnet is net profit, million RUB and Taxprofit is profit tax, million RUB.

5. Cash flow, discount factor, and economic performance indicators are calculated as follows:

where CF is the cash flow, million RUB.

where Kdisc is the discount factor and r is the discount rate; i is the period number.

where NPV is net present value, million RUB; t is the period number; and n is project duration, years.

If NPV is positive, it means that the project will make a profit, and the higher the NPV value, the more lucrative the project is.

where IRR is the internal rate of return, %.

A project is accepted if IRR > r. If IRR = r, then the project is able to recover the invested capital and provide the necessary income on this capital. If IRR < r, then the project is unprofitable.

where DPP is the discounted payback period of investments, years.

where DPI is the discounted profitability index.

The project is accepted if DPI > 1. Otherwise, the project is unprofitable, and at DPI = 1, the net discounted income is zero.

In addition to the highlighted indicators, it is possible to assess the cash flows from the implemented methods of utilization and to estimate the environmental effect:

where Ecoleffect is the environmental effect measured by the difference between the prevented damage and the cost of drilling-waste utilization operations, million RUB; OPEXEcol is operating costs of measures associated with the utilization of lignite waste, million RUB; and Dam is prevented damage, million RUB, which is determined according to the methodology [104]:

where Wi is the amount of waste of one hazard class, thousand tons; T is the tax charged for each ton of disposed waste causing damage to soils as an object of environmental protection (54,000 RUB per ton for waste hazard class III and 13,000 RUB per ton for waste hazard class IV); Kland is the coefficient taking into account land category (from 1 to 2); and Ktopsoil is the coefficient taking into account the thickness of fertile soil (from 1 to 8).

4. Results

Calculations were made for an oil field with initial recoverable oil reserves of 30 million tons. The well stock required to achieve the projected oil recovery rate is 246 production wells and 82 injection wells. Technological indicators are detailed in Table 9.

Table 9.

Technological indicators.

It takes four years to reach peak production, which lasts for five years. Wells are commissioned during years of increasing production, constituting 90% of the total well stock. During peak production, the remaining 10% is commissioned. The cumulative waste generated amounts to 757.7 thousand tons.

Capital investments in drilling, infrastructure facilities, and additional production facilities by options are presented in Table 10.

Table 10.

Capital expenditures, million RUB.

In all the scenarios under consideration, approximately 92–93% of costs are accounted for by well drilling. Investment in waste-management facilities solely constitutes 3.13% for the baseline scenario, 0% for the first scenario, 0.33% for the second scenario, and 0.61% for the third scenario.

The operating costs for the first ten years of the project are summarized in Table 11.

Table 11.

Operating expenditures, million RUB.

Operational costs are highest for the third scenario, primarily due to transportation costs and waste-treatment expenses at the plant. Conversely, scenario 1 has the lowest operational costs, where utilization through the construction and reclamation of mud pits is the prevailing and cost-effective waste-management practice [105].

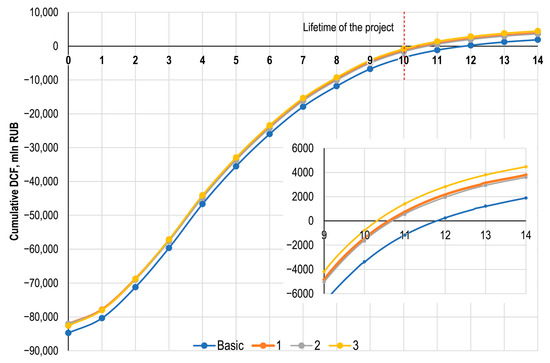

According to the payback schedule (Figure 10), the third scenario pays off faster than the others, yet none of the projects turns a profit within the 10-year timeframe. The reason is that the capital costs for drilling are too high and will not be recouped within 10 years despite the oil inflow.

Figure 10.

Project payback schedule for four scenarios.

Economic efficiency indicators for a period of 10 years are presented in Table 12.

Table 12.

Economic efficiency indicators.

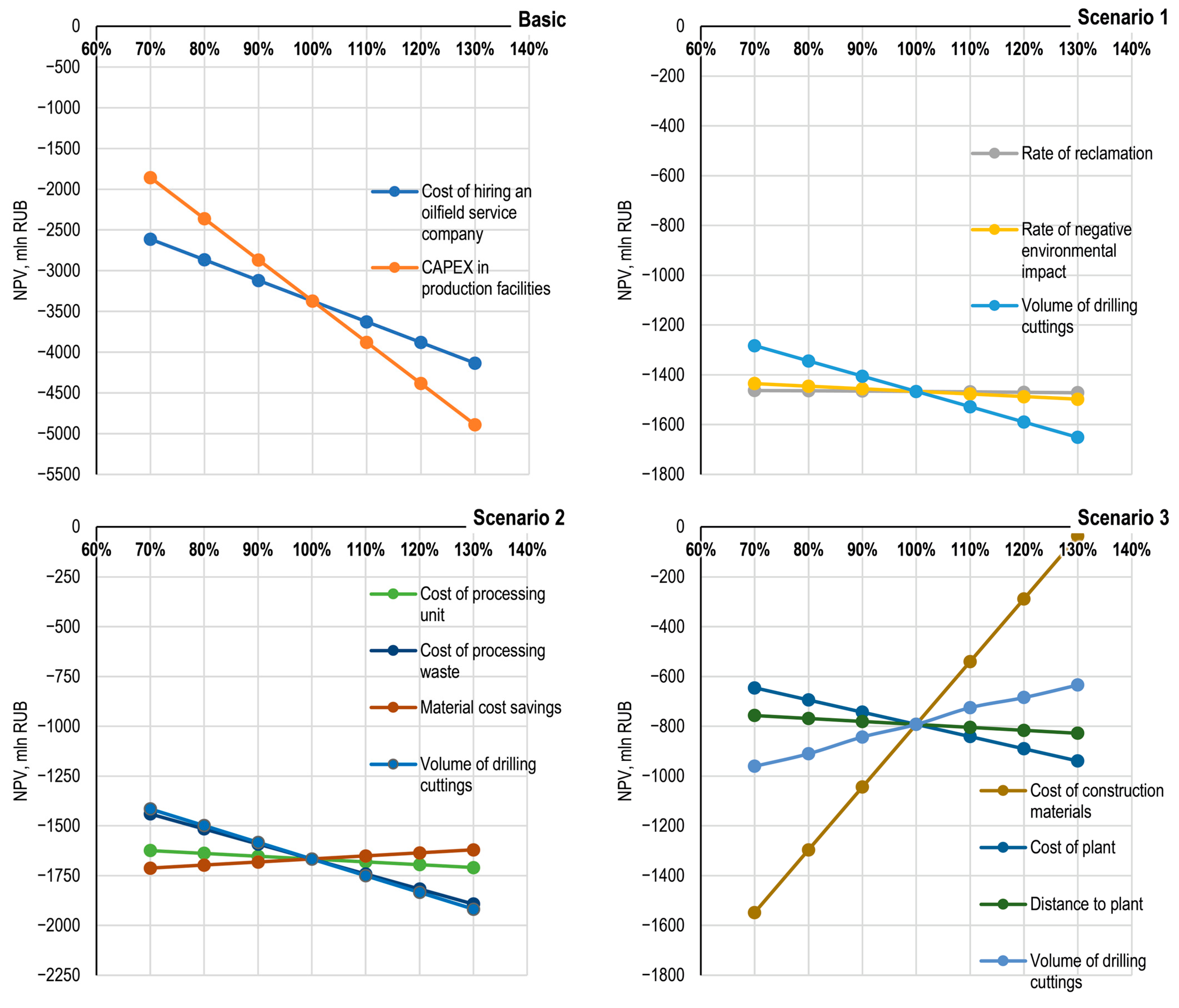

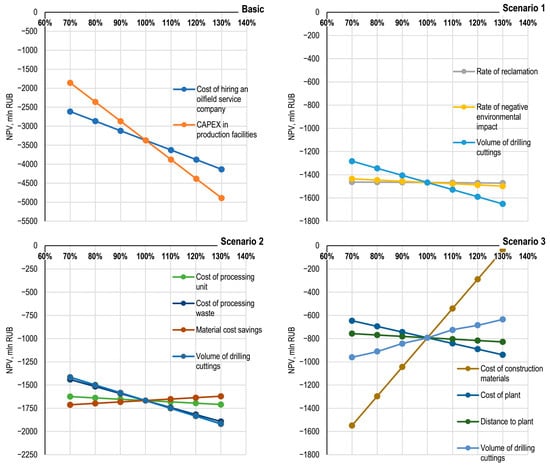

From the table, it is evident that the project in the third scenario holds the most promise under the given conditions. Naturally, the model inherently encompasses numerous variations, and the data used in calculations may fluctuate within a broad range. Consequently, it is imperative to assess the risk component, which can be quantitatively evaluated through sensitivity analysis (Figure 11). This approach enables the identification of parameters significantly influencing project performance [106].

Figure 11.

Sensitivity analysis.

For the baseline scenario, the impact of hiring a company is less pronounced than the investment in field facilities. As drill cutting volume increases, project efficiency diminishes for the baseline, first, and second scenarios. In contrast, the efficiency for the third scenario increases.

Environmental damage avoided under these conditions totals 14,677.1 million RUB. The environmental efficiency for each project is as follows:

- Baseline scenario—RUB 18,714.7 million;

- 1st scenario—RUB 17,378.3 million;

- 2nd scenario—RUB 16,954.7 million;

- 3rd scenario—RUB 14,677.1 million.

The lower the index, the higher the value of operating costs associated with cutting utilization.

At this stage of the study, it can be inferred that despite the fact that the projects under analysis do not pay back in ten years, there exist prerequisites for efficiency growth through the introduction of programs to recycle drill cuttings into construction materials.

5. Discussion

It is deemed impractical to solely rely on tax rate increments and penalties as incentives for companies, as there is a considerable risk of “artificial underestimation” of waste hazard categories or the transfer of waste usage rights to service companies (which is discussed in the new Resolution [62]). Recognizing this, the formula for waste-disposal charges has undergone modifications, introducing incentive coefficients (KOD, KPO, and KIND) determined by the Federal Law “On Environmental Protection”. To prevent an increase in illegal actions by waste-management companies, possibly leading to tax evasion, it is crucial not only to penalize or reduce fees for waste disposal but also to consider rewarding or subsidizing their beneficial use. This approach would motivate companies to adhere to proper waste-treatment methods and actively engage in producing end products.

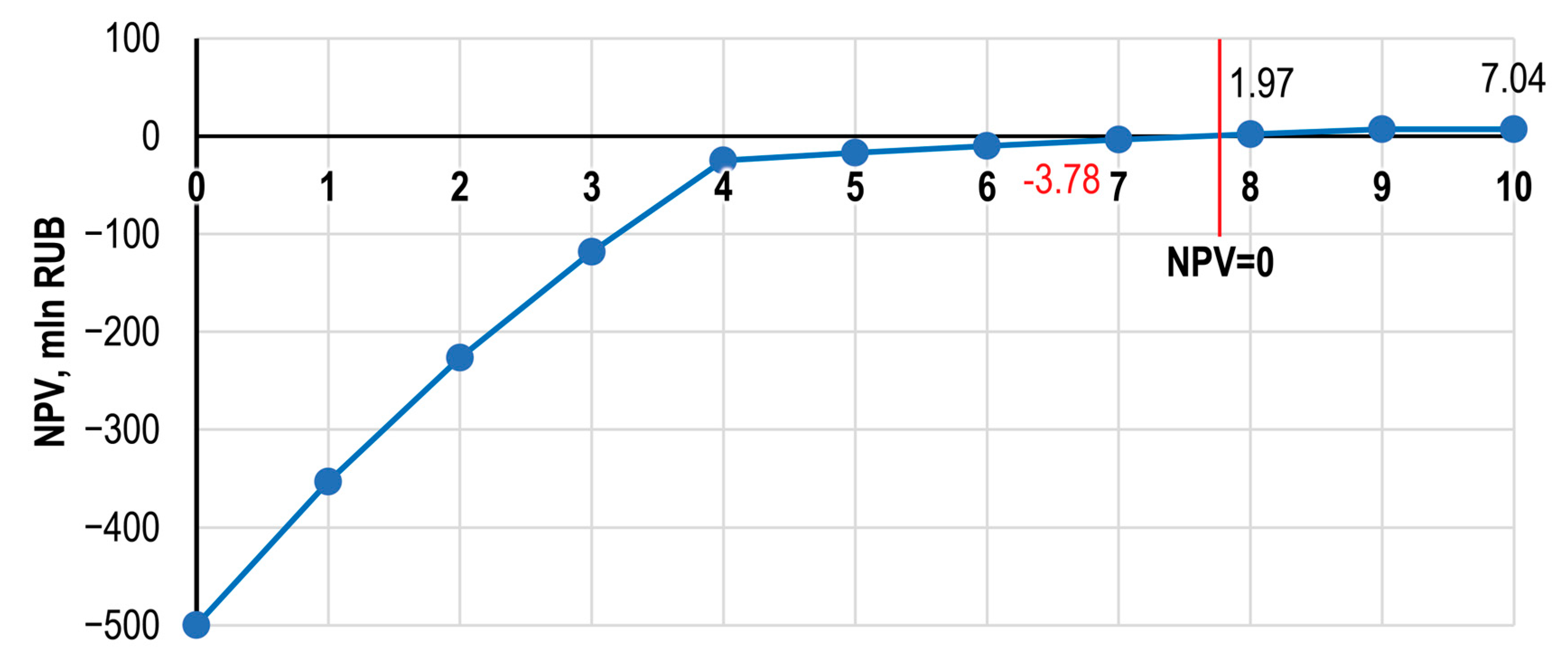

Thus, it is worthwhile to focus on the project following the 3rd scenario, isolating cash flows related to drilling-waste utilization processes (Figure 12). Project costs encompass capital expenditures for plant construction and operational expenses for waste transportation and processing at the plant. The revenue side includes the sale of construction materials at market prices.

Figure 12.

Payback schedule according to the 3rd scenario, without taking into account the development of the field.

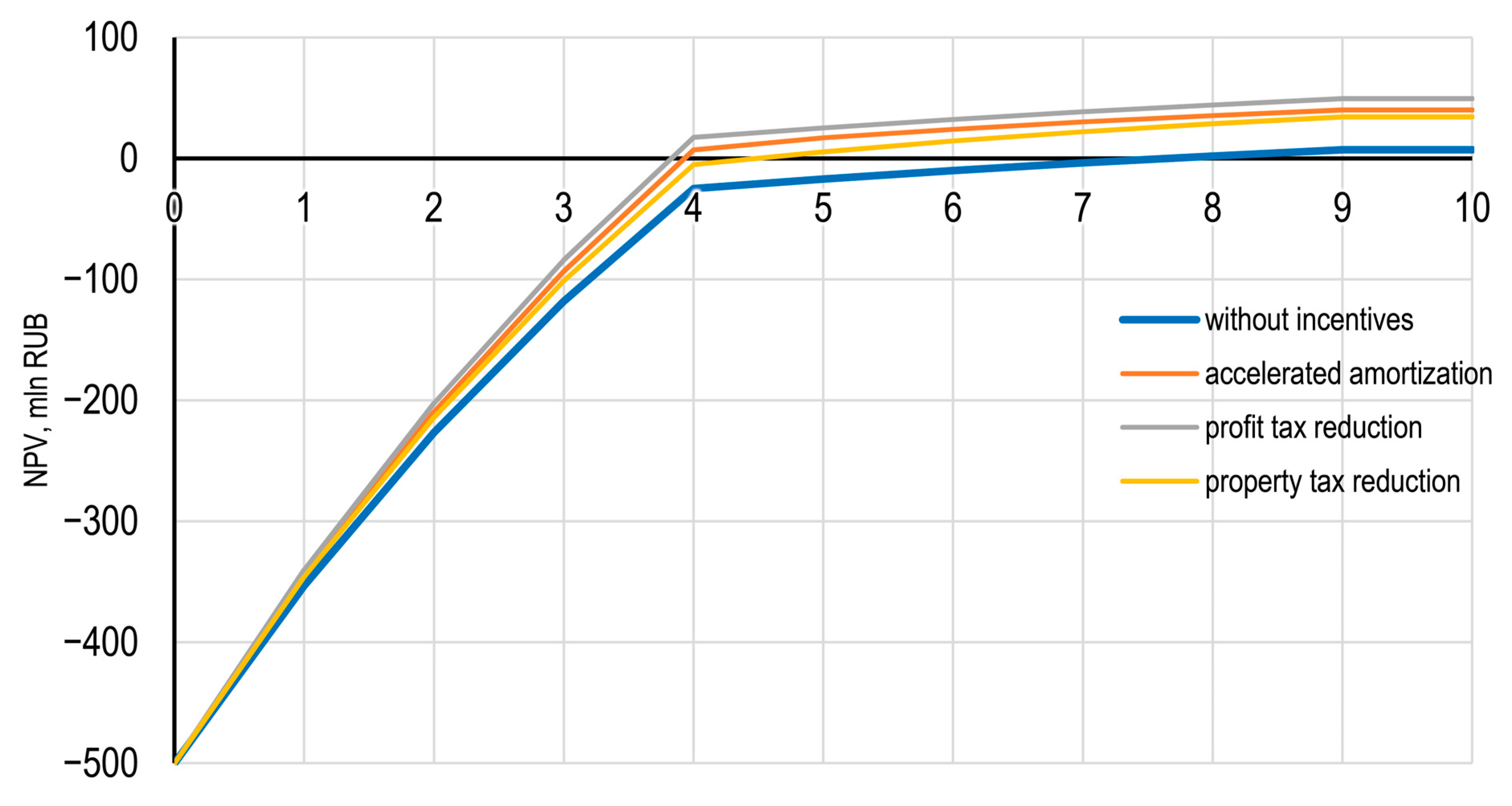

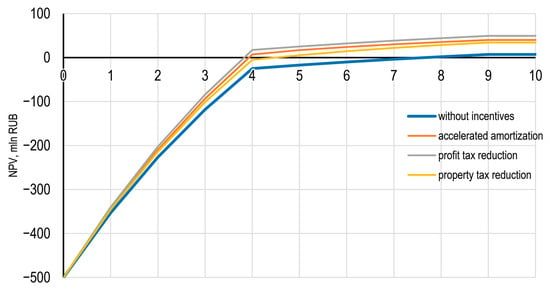

As can be seen from the graph, the project achieves payback in eight years. Collaboration between businesses and government [107] can improve project efficiency through incentives such as benefits for the use of best available technologies (BAT) [108] or special investment contracts (SPIC) [109]. For instance, benefits under special investment contracts may manifest as reduced profit or property taxes. If the project’s technological indicators align with the best available technology, benefits such as accelerated depreciation on fixed assets, with a maximum coefficient of 2, can be obtained. The assessment of these incentives is illustrated in Figure 13.

Figure 13.

Comparison of payback periods depending on incentives.

Reducing the profit tax from 20% to 10% enables the project to pay off in less than 4 years, yielding an NPV of RUB 49.3 million (7 times higher than without incentives). Due to accelerated depreciation, the project takes slightly longer to pay off, resulting in an NPV of RUB 39.9 million. Reducing the profit tax rate allows the project to pay off in 4.6 years with a final NPV of RUB 34.1 million.

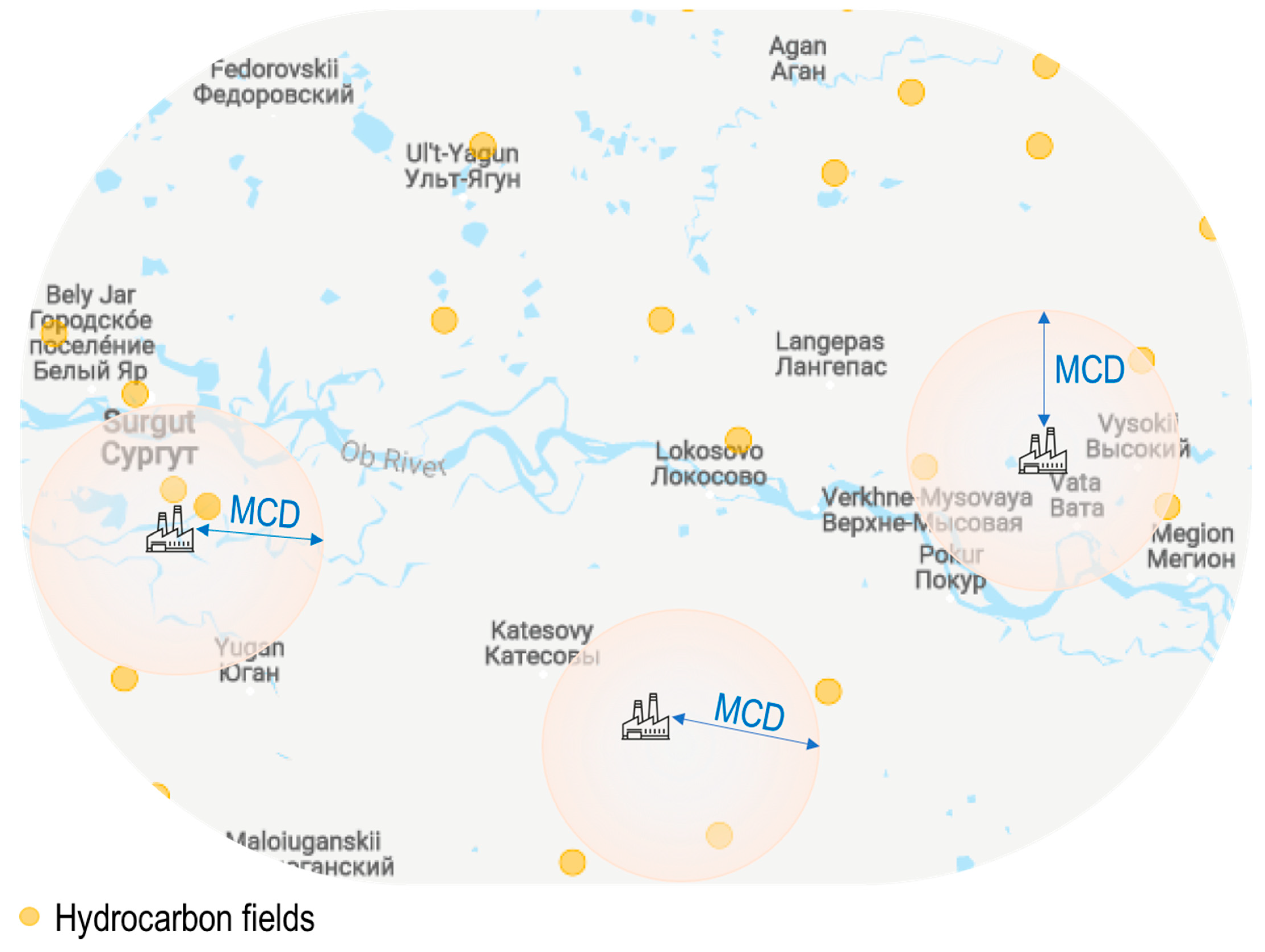

Nevertheless, it is important to estimate parameters such as the minimum commercial volume of drill cuttings (MCV), which is the volume of cuttings at which the NPV of the project will be equal to 0, as well as the minimum commercial distance from the field to the plant (MCD) (Figure 14).

Figure 14.

The minimum commercial distance from the field to the plant.

Since oil and gas fields vary in terms of reserves and there may be both large and small fields in the same area, the volumes of drill cuttings will therefore vary greatly. As we have explained above, the efficiency of a waste-to-construction project directly depends on the volume of waste. In the model, we use drill cuttings from one field, the MCD from the field to the plant is 106 km, and the MCV of drill cuttings is 2290 tons from one well on average. Considering that if the cuttings from one field are insufficient, but there are other fields within the minimum commercial distance, constructing the plant remains economically justified. However, the construction of new infrastructure in less developed areas with harsh climatic conditions may complicate and increase the cost of the project. It is essential to incorporate into the model the dependency of investment value on the distance to more populated areas in the region. This challenge can be fulfilled by applying the geoinformation system and modelling the functional relationship between the coordinates of the processing site and two parameters: MCD and MCV [110].

The transportation of mud over long distances from the field poses a serious logistical challenge. In the resource-intensive project of hydrocarbon field development, the need for substantial logistical support is particularly crucial in the initial stages. Hence, transporting drill cuttings outside the field territory allows the utilization of leased trucks for waste transportation, catering to the material requirements of field construction and resulting in savings through well-considered logistics.

Additional questions arise about waste management in the fields of Western Siberia. The swampy terrain, permafrost soils, and the frequent use of trucks may lead to problems such as erosion and soil degradation [111,112]. Maintenance of well pads and in-field embankment roads becomes necessary. Therefore, utilizing drill cuttings as a resource for repairing well pads and roads emerges as an effective solution, warranting further investigation.

6. Conclusions

As urbanization expands and the demand for hydrocarbons persists, the generation of drilling waste intensifies, imposing a growing burden on the environment. To mitigate the anthropogenic impact on the environment, a resource-efficient approach to production waste management is crucial. In this study, a feasibility assessment of four scenarios for drilling-waste utilization in the field was conducted, accompanied by an evaluation of the environmental impact. A model for assessing and calculating alternatives for drilling-waste management was developed.

The following conclusions and suggestions emerge from the research carried out:

- Considering the model and given conditions, the most economically effective approach was the fourth scenario, which involves the processing of waste into construction materials with subsequent market sales. The minimum commercial distance and volume of waste were calculated for this option, facilitating the design of the plant’s location and required capacity. Additionally, if waste from a single deposit proves insufficient, combining production facilities from nearby waste sources can expedite the plant’s investment recovery.

- The third scenario also has a potential for realization, as oil and gas field development is a resource-intensive project. The construction of field development facilities requires a large list of both construction materials and energy resources, making it viable to convert drilling waste into materials for road and well pad repairs, fuel, or hydraulic fracturing materials.

- In addition to the economic aspect, the prevented damage and the environmental effect of the implemented measures have been assessed.

- Collaborative efforts between companies and the state can result in tax benefits, reduced rates, subsidies, and other incentives. Based on the research findings, brief proposals for the development of drilling-waste management activities for both companies and the state can be given:

- First of all, when designing oil and gas projects, waste-disposal facilities or sites for their treatment and processing should be included in the construction.

- Possible alternatives for waste utilization should be analyzed based on minimum commercial waste volumes.

- When constructing field development facilities, drilling-waste recycling products should be used.

- It is advisable to issue more regulations covering the use of waste and recycled products and ensure stricter supervision over the licensed activity and use of waste processing and disposal technologies.

Future studies are planned to delve deeper into the possibilities of using drilling waste on site and to analyze the combined use of other waste sources, such as municipal solid waste and food industry waste, along with drilling waste.

Author Contributions

Conceptualization, A.C. and A.L.; methodology, A.C.; software, A.L.; validation, A.C.; formal analysis, A.C.; investigation, A.L.; resources, A.L.; data curation, A.C.; writing—original draft preparation, A.C. and A.L.; writing—review and editing, A.C.; visualization, A.L.; supervision, A.C.; project administration, A.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data are contained withing the manuscript.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Sozina, I.; Danilov, A. Microbiological Remediation of Oil-Contaminated Soils. J. Min. Inst. 2023, 260, 297–312. [Google Scholar] [CrossRef]

- Semenova, T.; Martínez Santoyo, J.Y. Economic Strategy for Developing the Oil Industry in Mexico by Incorporating Environmental Factors. Sustainability 2023, 16, 36. [Google Scholar] [CrossRef]

- Nevskaya, M.A.; Raikhlin, S.M.; Vinogradova, V.V.; Belyaev, V.V.; Khaikin, M.M. A Study of Factors Affecting National Energy Efficiency. Energies 2023, 16, 5170. [Google Scholar] [CrossRef]

- Tsvetkov, P.; Samuseva, P. Heterogeneity of the Impact of Energy Production and Consumption on National Greenhouse Gas Emissions. J. Clean. Prod. 2023, 434, 139638. [Google Scholar] [CrossRef]

- Caenn, R.; Darley, H.C.H.; Gray, G.R. Drilling and Drilling Fluids Waste Management. In Composition and Properties of Drilling and Completion Fluids; Elsevier: Amsterdam, The Netherlands, 2017; pp. 597–636. [Google Scholar]

- Marinina, O.; Kirsanova, N.; Nevskaya, M. Circular Economy Models in Industry: Developing a Conceptual Framework. Energies 2022, 15, 9376. [Google Scholar] [CrossRef]

- Wiesmeth, H.; Starodubets, N.V. The Management of Municipal Solid Waste in Compliance with Circular Economy Criteria: The Case of Russia. Econ. Reg. 2020, 16, 725–738. [Google Scholar] [CrossRef]

- Stroykov, G.; Vasilev, Y.N.; Zhukov, O.V. Basic Principles (Indicators) for Assessing the Technical and Economic Potential of Developing Arctic Offshore Oil and Gas Fields. J. Mar. Sci. Eng. 2021, 9, 1400. [Google Scholar] [CrossRef]

- Seyedmohammadi, J. The Effects of Drilling Fluids and Environment Protection from Pollutants Using Some Models. Model. Earth Syst. Environ. 2017, 3, 23. [Google Scholar] [CrossRef]

- Costa, L.C.; Carvalho, C.F.; Soares, A.S.F.; Souza, A.C.P.; Bastos, E.F.T.; Guimarães, E.C.B.T.; Santos, J.C.; Carvalho, T.; Calderari, V.H.; Marinho, L.S.; et al. Physical and Chemical Characterization of Drill Cuttings: A Review. Mar. Pollut. Bull. 2023, 194, 115342. [Google Scholar] [CrossRef] [PubMed]

- Kornev, A.V.; Spitsyn, A.A.; Korshunov, G.I.; Bazhenova, V.A. Preventing Dust Explosions in Coal Mines: Methods and Current Trends. Min. Informational Anal. Bull. 2023, 3, 133–149. [Google Scholar] [CrossRef]

- Eremeeva, A.M.; Ilyushin, Y.V. Automation of the Control System for Drying Grain Crops of the Technological Process for Obtaining Biodiesel Fuels. Sci. Rep. 2023, 13, 14956. [Google Scholar] [CrossRef]

- Njuguna, J.; Siddique, S.; Bakah Kwroffie, L.; Piromrat, S.; Addae-Afoakwa, K.; Ekeh-Adegbotolu, U.; Oluyemi, G.; Yates, K.; Kumar Mishra, A.; Moller, L. The Fate of Waste Drilling Fluids from Oil and Gas Industry Activities in the Exploration and Production Operations. Waste Manag. 2022, 139, 362–380. [Google Scholar] [CrossRef]

- Leusheva, E.; Alikhanov, N.; Brovkina, N. Study on the Rheological Properties of Barite-Free Drilling Mud with High Density. J. Min. Inst. 2022, 258, 976–985. [Google Scholar] [CrossRef]

- Ukeles, S.D.; Grinbaum, B. Drilling Fluids. In Kirk-Othmer Encyclopedia of Chemical Technology; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2004. [Google Scholar]

- Breuer, E.; Stevenson, A.G.; Howe, J.A.; Carroll, J.; Shimmield, G.B. Drill Cutting Accumulations in the Northern and Central North Sea: A Review of Environmental Interactions and Chemical Fate. Mar. Pollut. Bull. 2004, 48, 12–25. [Google Scholar] [CrossRef] [PubMed]

- Schaanning, M.T.; Trannum, H.C.; Øxnevad, S.; Carroll, J.; Bakke, T. Effects of Drill Cuttings on Biogeochemical Fluxes and Macrobenthos of Marine Sediments. J. Exp. Mar. Biol. Ecol. 2008, 361, 49–57. [Google Scholar] [CrossRef]

- Baba Hamed, S.; Belhadri, M. Rheological Properties of Biopolymers Drilling Fluids. J. Pet. Sci. Eng. 2009, 67, 84–90. [Google Scholar] [CrossRef]

- Tabatabaee Moradi, S.S.; Nikolaev, N.; Nikolaeva, T. Development of Spacer Fluids and Cement Slurries Compositions for Lining of Wells at High Temperatures. J. Min. Inst. 2020, 242, 174–178. [Google Scholar] [CrossRef]

- Reimers, N.F. Nature Use; Mysl’: Moscow, Russia, 1990; ISBN 5-244-00450-6. (In Russian) [Google Scholar]

- Matytsyn, V. The Concept of Environmental Protection Measures When Drilling Wells. Buren. I Neft 2006, 9, 36–38. (In Russian) [Google Scholar]

- Al Sandouk-Lincke, N.A.; Schwarzbauer, J.; Antic, V.; Antic, M.; Caase, J.; Grünelt, S.; Reßing, K.; Littke, R. Off-Line-Pyrolysis–Gas Chromatography–Mass Spectrometry Analyses of Drilling Fluids and Drill Cuttings—Identification of Potential Environmental Marker Substances. Org. Geochem. 2015, 88, 17–28. [Google Scholar] [CrossRef]

- Tsvetkov, P.; Andreichyk, A.; Kosarev, O. The Impact of Economic Development of Primary and Secondary Industries on National CO2 Emissions: The Case of Russian Regions. J. Environ. Manag. 2024, 351, 119881. [Google Scholar] [CrossRef]

- Golovina, E.; Khloponina, V.; Tsiglianu, P.; Zhu, R. Organizational, Economic and Regulatory Aspects of Groundwater Resources Extraction by Individuals (Case of the Russian Federation). Resources 2023, 12, 89. [Google Scholar] [CrossRef]

- Samylovskaya, E.; Makhovikov, A.; Lutonin, A.; Medvedev, D.; Kudryavtseva, R.-E. Digital Technologies in Arctic Oil and Gas Resources Extraction: Global Trends and Russian Experience. Resources 2022, 11, 29. [Google Scholar] [CrossRef]

- Morero, B.; Paladino, G.L.; Montagna, A.F.; Cafaro, D.C. Integrated Waste Management: Adding Value to Oil and Gas Industry Residues Through Co-Processing. Waste Biomass Valorizat. 2023, 14, 1391–1412. [Google Scholar] [CrossRef]

- Independent Oil and Gas Portal. Available online: https://oilgasinform.ru/ (accessed on 10 June 2023).

- Tsiglianu, P.; Romasheva, N.; Nenko, A. Conceptual Management Framework for Oil and Gas Engineering Project Implementation. Resources 2023, 12, 64. [Google Scholar] [CrossRef]

- Zakirova, G.; Pshenin, V.; Tashbulatov, R.; Rozanova, L. Modern Bitumen Oil Mixture Models in Ashalchinsky Field with Low-Viscosity Solvent at Various Temperatures and Solvent Concentrations. Energies 2022, 16, 395. [Google Scholar] [CrossRef]

- Rosnedra Summed up the Results of Exploration in Russia and 2022 and Outlined the Prospects for Hard to Recover Reserves. Available online: https://neftegaz.ru/news/Geological-exploration/782788-rosnedra-podveli-itogi-grr-v-rossii-i-2022-g-i-oboznachili-perspektivy-triz/ (accessed on 11 June 2023). (In Russian).

- Russian Oil Companies Have Increased the Commissioning of New Wells. Available online: https://www.vedomosti.ru/business/articles/2023/05/04/973682-rossiiskie-neftyaniki-uvelichili-vvodi-novih-skvazhin (accessed on 12 October 2023). (In Russian).

- Drilling Activity in the Russian Oil Sector Remains at a Record Level. Available online: https://neftegaz.ru/news/drill/788717-burovaya-aktivnost-v-neftyanom-sektore-rossii-ostaetsya-na-rekordnom-urovne/ (accessed on 12 October 2023). (In Russian).

- Bulatov, V.; Igenbaeva, N.; Nanishvili, O. Oil and Gas Complex Waste Products as Technological Indicator of Geoecological Condition of Russia Regions. Bull. Sci. Pract. 2021, 7, 46–55. [Google Scholar] [CrossRef]

- State Register of Waste Disposal Facilities. Available online: https://rpn.gov.ru/opendata/7703381225-groro?sphrase_id=1164166 (accessed on 13 June 2023).

- Yang, J.; Sun, J.; Wang, R.; Qu, Y. Treatment of Drilling Fluid Waste during Oil and Gas Drilling: A Review. Environ. Sci. Pollut. Res. 2023, 30, 19662–19682. [Google Scholar] [CrossRef]

- Krapivsky, E.I. Oil Sludge: Destruction, Disposal, Decontamination; Infra-Inzheneriya: Moscow, Russia, 2021; ISBN 978-5-9729-0578-2. (In Russian) [Google Scholar]

- Cherepovitsyn, A.; Lebedev, A. Drill Cuttings Disposal Efficiency in Offshore Oil Drilling. J. Mar. Sci. Eng. 2023, 11, 317. [Google Scholar] [CrossRef]

- Ball, A.S.; Stewart, R.J.; Schliephake, K. A Review of the Current Options for the Treatment and Safe Disposal of Drill Cuttings. Waste Manag. Res. J. A Sustain. Circ. Econ. 2012, 30, 457–473. [Google Scholar] [CrossRef]

- Darajah, M.H.; Karundeng, I.; Setiati, R.; Wastu, A.R.R. Drilling Waste Management Using Zero Discharge Technology with Drill Cutting Re-Injection (DCRI) Method for Environmental Preservation. IOP Conf. Ser. Earth Environ. Sci. 2021, 802, 012046. [Google Scholar] [CrossRef]

- Kirkness, A.; Garrick, D. Treatment of Nonaqueous-Fluid-Contaminated Drill Cuttings—Raising Environmental and Safety Standards. In Proceedings of the IADC/SPE Drilling Conference, Orlando, FL, USA, 4–6 March 2008. [Google Scholar]

- Allen, B.; Day, D.; Armstrong, S.; Page, P.; Murdoch, K.; Beardsley, R. The Development and Trial Use of Oil Exploration Drill-Cutting Waste as an Aggregate Replacement in Cold-Mix Asphalt. In Proceedings of the E&P Environmental and Safety Conference, Galveston, TX, USA, 5–7 March 2007; pp. 293–298. [Google Scholar]

- Durgut, İ.; Rye, H.; Reed, M.; Smit, M.G.D.; Ditlevsen, M.K. Dynamic Modeling of Environmental Risk Associated with Drilling Discharges to Marine Sediments. Mar. Pollut. Bull. 2015, 99, 240–249. [Google Scholar] [CrossRef] [PubMed]

- Saasen, A.; Paulsen, J.E.; Holthe, K. Environmental Priorities of Re-Injection and Land Based Handling of Drilled Cuttings and Affiliated Fluids. In Proceedings of the SPE International Conference on Health, Safety and Environment in Oil and Gas Exploration and Production, Stavanger, Norway, 26–28 June 2000. [Google Scholar]

- Bakke, T.; Klungsøyr, J.; Sanni, S. Environmental Impacts of Produced Water and Drilling Waste Discharges from the Norwegian Offshore Petroleum Industry. Mar. Environ. Res. 2013, 92, 154–169. [Google Scholar] [CrossRef] [PubMed]

- Ling, L.H.; Lye, K.H.; Shern, L.S. Environmentally Sustainable and Cost Effective Offshore Disposal of Drilling Wastes: A Review of Current Practice in Malaysia. In Proceedings of the SPE Asia Pacific Health, Safety, Security, Environment and Social Responsibility Conference, Kuala Lumpur, Malaysia, 4–6 April 2017. [Google Scholar]

- Singh, R.; Budarayavalasa, S. Solidification and Stabilization of Hazardous Wastes Using Geopolymers as Sustainable Binders. J. Mater. Cycles Waste Manag. 2021, 23, 1699–1725. [Google Scholar] [CrossRef]

- Rezaei Somee, M.; Shavandi, M.; Dastgheib, S.M.M.; Amoozegar, M.A. Bioremediation of Oil-Based Drill Cuttings by a Halophilic Consortium Isolated from Oil-Contaminated Saline Soil. 3 Biotech. 2018, 8, 229. [Google Scholar] [CrossRef] [PubMed]

- Arun, J.; Gopinath, K.P.; SundarRajan, P.S.; Felix, V.; JoselynMonica, M.; Malolan, R. A Conceptual Review on Microalgae Biorefinery through Thermochemical and Biological Pathways: Bio-Circular Approach on Carbon Capture and Wastewater Treatment. Bioresour. Technol. Rep. 2020, 11, 100477. [Google Scholar] [CrossRef]

- Kazamias, G.; Zorpas, A.A. Drill Cuttings Waste Management from Oil and Gas Exploitation Industries through End-of-Waste Criteria in the Framework of Circular Economy Strategy. J. Clean. Prod. 2021, 322, 129098. [Google Scholar] [CrossRef]

- Vagapova, E.A.; Ivanov, S.L.; Ivanova, P.V.; Khudyakova, I.N. Hydraulic Miner with Dewatering of Peat in Travelling Magnetic Field. Min. Informational Anal. Bull. 2023, 2023, 21–36. [Google Scholar] [CrossRef]

- Sadiq, R.; Husain, T.; Veitch, B.; Bose, N. Marine Water Quality Assessment of Synthetic-Based Drilling Waste Discharges. Int. J. Environ. Stud. 2003, 60, 313–323. [Google Scholar] [CrossRef]

- Rosa, A.P.; Triguis, J.A. Bioremediation Process on Brazil Shoreline. Environ. Sci. Pollut. Res. Int. 2007, 14, 470–476. [Google Scholar] [CrossRef]

- Carignan, M.-P.; Lake, C.B.; Menzies, T. Assessment of Two Thermally Treated Drill Mud Wastes for Landfill Containment Applications. Waste Manag. Res. J. A Sustain. Circ. Econ. 2007, 25, 394–401. [Google Scholar] [CrossRef]

- OSPAR Discharges, Spills and Emissions from Offshore Oil and Gas Installations in 2009. Including Assessment of Data Reported in 2008 and 2009. Available online: https://oap.ospar.org/en/versions/1884-en-1-0-0-2009-2019/ (accessed on 23 April 2023).

- Ismail, A.R.; Alias, A.H.; Sulaiman, W.R.W.; Jaafar, M.Z.; Ismail, I. Drilling Fluid Waste Management in Drilling for Oil and Gas Wells. Chem. Eng. Trans. 2017, 56, 1351–1356. [Google Scholar] [CrossRef]

- Leonard, S.A.; Stegemann, J.A. Stabilization/Solidification of Petroleum Drill Cuttings: Leaching Studies. J. Hazard. Mater. 2010, 174, 484–491. [Google Scholar] [CrossRef] [PubMed]

- Huang, X.; Peng, X.; Guo, W.; Han, Y.; Zhang, L.; Hou, J.; Yong, Y. Study on Barium Transformation and Environmental Risk during Oil-Based Drill Cuttings Incineration. Res. Environ. Sci. 2023, 36, 1006–1019. [Google Scholar] [CrossRef]

- Zhang, X.; Li, K.; Yao, A. Thermal Desorption Process Simulation and Effect Prediction of Oil-Based Cuttings. ACS Omega 2022, 7, 21675–21683. [Google Scholar] [CrossRef]

- Phillips, L.; Morris, A.; Innes, G.; Clark, A.; Hinden, P.-M. Drilling Waste Management—Solutions That Optimise Drilling, Reduce Well Cost and Improve Environmental Performance. In Proceedings of the Abu Dhabi International Petroleum Exhibition & Conference, Abu Dhabi, United Arab Emirates, 12–15 November 2018. [Google Scholar]

- Fedorov, G.B.; Dudchenko, O.L.; Kurenkov, D.S. Development of Vibroacoustic Module for Fine Filtration of Drilling Muds. J. Min. Inst. 2018, 234, 647–651. [Google Scholar] [CrossRef]

- Weigend Rodríguez, R.; Pomponi, F.; Webster, K.; D’Amico, B. The Future of the Circular Economy and the Circular Economy of the Future. Built Environ. Proj. Asset Manag. 2020, 10, 529–546. [Google Scholar] [CrossRef]

- Resolution of the Government of the Russian Federation of May 31, 2023 No. 881 “On Approval of the Rules for Calculating and Charging Fees for Negative Environmental Impact and on Invalidation of Certain Acts of the Government of the Russian Federation and a Separate Provision of the Act of the Government of the Russian Federation”. Available online: https://www.garant.ru/products/ipo/prime/doc/406865936/ (accessed on 12 October 2023). (In Russian).

- Pichugin, E.A. The Technology of Disposal of Drilling Sludge with the Production of Environmentally Friendly Road-Building Material. Molod. Uchyonyj. Young Sci. 2013, 9, 124–126. (In Russian) [Google Scholar]

- Foroutan, M.; Hassan, M.M.; Desrosiers, N.; Rupnow, T. Evaluation of the Reuse and Recycling of Drill Cuttings in Concrete Applications. Constr. Build. Mater. 2018, 164, 400–409. [Google Scholar] [CrossRef]

- Vlasov, A.S.; Pugin, K.G.; Surkov, A.A. Geoecological Assessment of the Technology for Using Drilling Waste in the Composition of Asphalt-Concrete. Neft. Khozyaystvo Oil Ind. 2020, 2020, 139–142. [Google Scholar] [CrossRef]

- Smyshlyaeva, K.I.; Rudko, V.A.; Kuzmin, K.A.; Povarov, V.G. Asphaltene Genesis Influence on the Low-Sulfur Residual Marine Fuel Sedimentation Stability. Fuel 2022, 328, 125291. [Google Scholar] [CrossRef]

- Khodadadi, M.; Moradi, L.; Dabir, B.; Moghadas Nejad, F.; Khodaii, A. Reuse of Drill Cuttings in Hot Mix Asphalt Mixture: A Study on the Environmental and Structure Performance. Constr. Build. Mater. 2020, 256, 119453. [Google Scholar] [CrossRef]

- Telichenko, V.I.; Oreshkin, D.V. Material Science Aspects of Geo-Ecological and Environmental Safety in Construction. Ecol. Urban. Areas 2015, 2, 31–33. [Google Scholar]

- Oreshkin, D.V. Environmental Problems of Comprehensive Exploitation of Mineral Resources When Large-Scale Utilization of Man-Made Mineral Resources and Waste in the Production of Building Materials. Stroit. Mater. 2017, 8, 55–63. [Google Scholar]

- Disposal of Environmentally Hazardous Drilling Waste. Available online: https://hozuyut.ru/otxody/utilizaciya-ekologicheski-opasnyx-burovyx-otxodov-2.html (accessed on 19 June 2023). (In Russian).

- Tretyak, A.A.; Yatsenko, E.A.; Doronin, S.V.; Borisov, K.A.; Kuznetsova, A.V. Predictive Modeling of Hydraulic Fracturing by Aluminosilicate Proppants Made Based on Drill Cuttings. Bull. Tomsk Polytech. Univ. Geo Assets Eng. 2023, 334, 165–172. [Google Scholar] [CrossRef]

- Samuels, D. Recover and SCS Team on Sustainable Drilling Waste to Fuel Solution. Available online: https://www.scsengineers.com/recover-and-scs-team-on-sustainable-drilling-waste-to-fuel-solution/ (accessed on 19 November 2023).

- Pereira, L.B.; Sad, C.M.S.; da Silva, M.; Corona, R.R.B.; dos Santos, F.D.; Gonçalves, G.R.; Castro, E.V.R.; Filgueiras, P.R.; Lacerda, V. Oil Recovery from Water-Based Drilling Fluid Waste. Fuel 2019, 237, 335–343. [Google Scholar] [CrossRef]

- Dmitrieva, D.; Solovyova, V. Russian Arctic Mineral Resources Sustainable Development in the Context of Energy Transition, ESG Agenda and Geopolitical Tensions. Energies 2023, 16, 5145. [Google Scholar] [CrossRef]

- De Almeida, P.C.; Araújo, O.D.Q.F.; de Medeiros, J.L. Managing Offshore Drill Cuttings Waste for Improved Sustainability. J. Clean. Prod. 2017, 165, 143–156. [Google Scholar] [CrossRef]

- Volkov, I.N.; Gokhberg, L.M.; Drobysheva, M.A.; Zubarevich, N.V.; Klimanov, V.V.; Kuznetsova, O.V.; Kukushkin, A.M.; Petrenko, A.V.; Skatershchikova, E.E.; Khoreva, L.A. (Eds.) Regions of Russia. Socio-Economic Indicators. 2022: P32 Statistical Collection; Rosstat: Moscow, Russia, 2022. (In Russian) [Google Scholar]

- The Strategy of Socio-Economic Development of the Khanty-Mansiysk Autonomous Okrug—Yugra until 2020 and for the Period 2030. Part 7. Construction Complex. Available online: https://depeconom.admhmao.ru/upload/iblock/077/stroitelnyy.pdf (accessed on 21 June 2023). (In Russian).

- Analysis of the Construction Materials Market in Khanty-Mansiysk Autonomous Okrug—Yugra | Regional Analytical Center. Available online: https://racugra.ru/wp-content/uploads/2019/04/StrojMaterialy.pdf (accessed on 21 June 2023). (In Russian).

- Problems of Drilling Waste Disposal in Khanty-Mansiysk Autonomous Okrug—Yugra. Available online: https://prirodnadzor.admhmao.ru/doklady-i-otchyety/otchety-o-deyatelnosti-prirodnadzora/teksty-vystupleniy-i-prezentatsii/arkhiv/2012-2015/133061/problemy-utilizatsii-otkhodov-bureniya-v-khanty-mansiyskom-avtonomnom-okruge-yugre/ (accessed on 21 June 2023). (In Russian).

- Lebedev, V.; Deev, A. Heat Storage as a Way to Increase Energy Efficiency and Flexibility of NPP in Isolated Power System. Appl. Sci. 2023, 13, 13130. [Google Scholar] [CrossRef]

- Razmanova, S.; Andrukhova, O. Oilfield Service Companies as Part of Economy Digitalization: Assessment of the Prospects for Innovative Development. J. Min. Inst. 2020, 244, 482–492. [Google Scholar] [CrossRef]

- Rosneft Applied an Innovative Method of Drilling Waste Utilisation in Yugra. Available online: https://www.rosneft.ru/press/news/item/187683/ (accessed on 20 September 2023). (In Russian).

- A Drilling Sludge Processing Line Has Been Built at the Vankor Field. Available online: https://lenta.ru/news/2023/09/26/shlam/ (accessed on 16 October 2023). (In Russian).

- Shandrygin, A.N. Evaluation of Recoverable Hydrocarbon Reserves. Do We Need to Reinvent the Wheel? Actual Probl. Oil Gas 2019, 4, 10. [Google Scholar] [CrossRef]

- Eder, I.; Filimonova, I.; Mishenin, A.; Mochalov, R. Forecast of Oil Production in Eastern Siberia and On the Far East: Methodologi-Cal Aspects, Practical Realization, The Sanctions Impacting. Buren. I Neft 2014, 12, 10–15. [Google Scholar]

- Ampilov, Y.P.; Gert, A.A. Economic Geology; Geoinformmark: Moscow, Russia, 2006; ISBN 5-98877-010-X. (In Russian) [Google Scholar]

- Zheltov, Y.P. Development of Oil Fields; Nedra: Moscow, Russia, 1986. (In Russian) [Google Scholar]

- Shapovalova, D.; Galimullin, E.; Grushevenko, E. Russian Arctic Offshore Petroleum Governance: The Effects of Western Sanctions and Outlook for Northern Development. Energy Policy 2020, 146, 111753. [Google Scholar] [CrossRef]

- Marin, E.A.; Ponomarenko, T.V.; Vasilenko, N.V.; Galevskiy, S.G. Economic Evaluation of Projects for Development of Raw Hydrocarbons Fields in the Conditions of the Northern Production Areas Using Binary and Reverting Discounting. Sev. I Rynok Form. Ekon. Porad. 2022, 25, 144–157. [Google Scholar] [CrossRef]

- Cochrane, J.H. Presidential Address: Discount Rates. J. Financ. 2011, 66, 1047–1108. [Google Scholar] [CrossRef]

- Ponomarenko, T.; Marin, E.; Galevskiy, S. Economic Evaluation of Oil and Gas Projects: Justification of Engineering Solutions in the Implementation of Field Development Projects. Energies 2022, 15, 3103. [Google Scholar] [CrossRef]

- Mishustin, M.V. Factors of Growth of Tax Revenues: A Macroeconomic Approach. Econ. Policy 2016, 11, 8–27. [Google Scholar] [CrossRef]

- Kuzmenkov, S.G.; Korolev, M.I.; Novikov, M.V.; Palyanitsina, A.N.; Nanishvili, O.A.; Isaev, V.I. Efficiency of Enhanced Oil Recovery’s and Oil Production Stimulation’s Methods at the Oil Fields of Khanty-Mansi Autonomous Okrug—Yugra. Georesursy 2023, 25, 129–139. [Google Scholar] [CrossRef]

- Sardanashvili, O.N.; Bogatkina, Y.G. Technical and Economic Assessment of the Development of the Sredne-Nazym Oil Field Using Various Tax Mechanisms. Neftegaz. Ru 2023, 7. (In Russian) [Google Scholar]

- Bogatkina, Y.G.; Lyndin, V.N.; Eremin, N.A. Information and Economical Approach for Evaluating Oil and Gas Investment Projects. News Tula State Univ. Sci. Earth 2020, 3, 335–346. [Google Scholar] [CrossRef]

- Ryabova, E.V.; Feruleva, N.V.; Zamotaeva, O.A. Assessing the Investment Attractiveness of Oil Field Development Projects under the Tax Maneuver: The Evidence from West Siberia. Financ. J. 2022, 14, 86–101. [Google Scholar] [CrossRef]

- Duryagin, V.; Nguyen Van, T.; Onegov, N.; Shamsutdinova, G. Investigation of the Selectivity of the Water Shutoff Technology. Energies 2022, 16, 366. [Google Scholar] [CrossRef]

- Bogdanova, O.; Okmynskaia, V. Experience in the Implementation of Drilling Waste Utilization Technology on the Example of a Large Oil and Gas Region of Russia. J. Ecol. Eng. 2022, 23, 132–139. [Google Scholar] [CrossRef] [PubMed]

- Decree of the Government of the Russian Federation, No. 913 of September 13, 2016 “On the Rates of Payment for Negative Environmental Impact and Additional Coefficients”. Available online: http://ivo.garant.ru/#/document/71489914/paragraph/1:2 (accessed on 19 June 2023). (In Russian).

- The Project of Reclamation of Lands Violated in Connection with The Arrange-Ment of Drilling Mud Barns and Lands Violated in Connection with The Arrange-Ment of Exploration Wells of JSC “Samotlorneftegaz”. Available online: https://clck.ru/36LL5v (accessed on 3 November 2023). (In Russian).

- Processing Of Drilling Waste in Offline Mode with the Use of a Filter Press In-Stallation. Available online: https://www.ecoindustry.ru/i/ent/903/presentation_14531229335228.pdf (accessed on 3 November 2023). (In Russian).

- Arrangement of the Cluster Site, No. 81 of the Srednebotuobinsky Oil and Gas Condensate Field. Available online: https://botuobuia.sakha.gov.ru/uploads/905/f09527c89184cfcb887e470b01007a4b58170f67.pdf (accessed on 3 November 2023). (In Russian)

- Anofriev, S.S. Construction of a Drilling Sludge Disposal Plant at the Samotlorskoye Field; South Ural State University: Nizhnevartovsk, Russia, 2020. (In Russian) [Google Scholar]

- Methodology for Calculating the Amount of Damage Caused to Soils as an Object of Environmental Protection. Available online: https://docs.cntd.ru/document/902227668?marker=6500IL (accessed on 8 November 2023). (In Russian).

- Siddique, S.; Novak, A.; Guliyev, E.; Yates, K.; Leung, P.S.; Njuguna, J. Oil-Based Mud Waste as a Filler Material in LDPE Composites: Evaluation of Mechanical Properties. Polymers 2022, 14, 1455. [Google Scholar] [CrossRef] [PubMed]

- Stroykov, G.A.; Babyr, N.V.; Ilin, I.V.; Marchenko, R.S. System of Comprehensive Assessment of Project Risks in the Energy Industry. Int. J. Eng. 2021, 34, 1778–1784. [Google Scholar] [CrossRef]

- Yudin, S.S.; Cherepovitsyn, A.E. Partnership between Government and Business to Ensure the Economic Sustainability of Complex Industrial Oil and Gas Systems in the Arctic. Sev. I Rynok Form. Ekon. Porad. 2022, 25, 7–18. [Google Scholar] [CrossRef]

- Malyshkov, G.B.; Nikolaichuk, L.A.; Sinkov, L.S. Legislative Regulation of Waste Management System Development in Russian Federation. Int. J. Eng. Res. Technol. 2019, 12, 631–635. [Google Scholar]

- Belov, V. Special Investment Contracts and Russian-German Economic Cooperation. Part Two. Contemp. Eur. 2020, 1, 146–157. [Google Scholar] [CrossRef]

- Bykowa, E.; Skachkova, M.; Raguzin, I.; Dyachkova, I.; Boltov, M. Automation of Negative Infrastructural Externalities Assessment Methods to Determine the Cost of Land Resources Based on the Development of a “Thin Client” Model. Sustainability 2022, 14, 9383. [Google Scholar] [CrossRef]

- Syasko, V.; Shikhov, A. Soil Deformation Model Analysis in the Processing of the Geotechnical Monitoring Results. E3S Web Conf. 2021, 266, 03014. [Google Scholar] [CrossRef]

- Syas’ko, V.; Shikhov, A. Assessing the State of Structural Foundations in Permafrost Regions by Means of Acoustic Testing. Appl. Sci. 2022, 12, 2364. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).