1. Introduction

As a part of overall long-term business strategy, organizations are continually faced with the task of deciding between competing alternatives. A wide range of decision models exist to aid managers in evaluating and selecting the best alternative from a set of competing alternatives [

1,

2,

3]. The economic competitiveness of the global market coupled with increased stakeholder concerns for environmental and social performance objectives has intensified the importance placed on the role played by management decision making in the formulation of a firm’s core business strategy [

4,

5].

The scope of applications over which decision making is required is vast, covering multiple industry segments and numerous inter-firm and intra-firm value creating processes. Common to all these decision-making environments is the need to efficiently manage information and knowledge; it is essential that decision makers understand the paradigms and systems that facilitate the collection, processing and analysis of information and knowledge. This includes product–service (PPS) business models and their evaluation in decision-making support using key performance indicators [

6], as well as the emergence of decision-making schema within Industry 4.0 to improve decision making in such areas as operations scheduling [

7], sustainability [

8], value chain reliability [

9], and manufacturing and maintenance operations [

10]. For a more in-depth investigation of this literature the reader is directed to the review articles of Pirola et al. [

11], Xu et al. [

12], and Lu [

13].

When the decision under study requires the evaluation of profitability as a function of output, cost–volume–profit (CVP) analysis is an attractive decision tool to use, since it enables managers to make decisions under business conditions where costs, revenue, and volume are changing (see for example [

14,

15,

16]). For situations involving a single product, decision makers can use CVP to determine the sales volume needed to achieve a targeted profit when sales price, variable cost, or fixed cost change. When making decisions on establishing and/or revising a product line, CVP analysis can also be used to identify the most profitable combination of products to include within the product line.

The CVP model has been studied for several decades, and applications of the model still prevail in practice at companies such as the Nestle Company Limited [

17] and across a wide spectrum of organizations such as small businesses [

18] and universities [

19]. Despite the widespread application of the CVP, two gaps exist in the literature with respect to the CVP model. First, the stochastic inputs of the model are restricted to either normal or lognormal distributions, resulting in profitability being modeled as a normal or lognormal random variable. In our opinion, normal and lognormal random variables are assumed only for calculation simplicity. Second, when multiple stochastic inputs to the CVP model have been used, limiting assumptions have been used to simplify how the resulting probability distribution representing profitability is defined.

To bridge these gaps, we propose a more generalized modeling of the stochastic CVP model that allows a wider range of candidate probability distributions for defining the inputs of the model. The novel feature of our modeling methodology is the introduction of the Mellin Transform technique as a means to generalize the stochastic modeling of the CVP model. For a gateway into the methodology of Mellin Transforms the reader is referred to Bertrand et al. [

20] and Epstein [

21]. Due to the unique properties of the Mellin Transform, a much wider range of non-negative random variables can be used in the formulation and analysis of stochastic CVP models. In addition, model structures where more than one input parameter is defined stochastically can be captured, more accurately representing the true underlying form of the model’s profitability distribution when multiple stochastic parameters exist. The research herein bridges the aforementioned gaps of the stochastic CVP model and contributes to supporting an expanded scope of application for the model, as the model’s resulting profitability distribution (which would no longer have to be restricted to being normally or lognormally distributed) and multiple stochastic input parameters can be used. This extended scope of modeling flexibility enhances the attractiveness and application of the model in decision-making environments where uncertainty exists.

The remaining sections of this paper are organized as follows. In

Section 2 we review the literature on stochastic CVP models and identify limitations in the models. In

Section 3 we introduce the stochastic CVP model which uses the Mellin Transform methodology to overcome the limitations of the CVP models found in the literature, and conduct supporting numerical analyses in order to illustrate the developed models. In

Section 4 we present the summary, conclusions and directions for future research.

2. Literature Review

In reality, uncertainty and risk exist and can therefore potentially affect each input parameter of the CVP model. Hence, the deterministic CVP model defined in (1) is very limited in its practical application. Jaedicke and Robichek [

22] were the first to introduce stochastic parameters into the CVP model, thus broadening the appeal and application of the model and establishing the baseline for the literature on stochastic CVP models.

Jaedicke and Robichek [

22] were the first to integrate uncertainty into the CVP model by defining profitability as a random variable under two different model formats. In the first model, sales volume is represented as a normally distributed random variable, while selling price, unit cost and fixed cost remain deterministic; in the second model, all four model inputs are defined as independent normally distributed random variables. In model one, expected profit

T, which is a function of the combination of one normally distributed random variable (sales

Q) and three constants (selling price

P, variable cost

V and fixed cost

F), is normally distributed. In model two, the function defining expected profit T, which is defined by a function involving the difference of two normal random variables, (

V −

F), and the product of two normal random variables,

Q × (

P −

V), is assumed to be normally distributed. While the difference of two independent normally distributed random variables is well known in the literature to be normally distributed, the product of two independent normal random variables is not normally distributed and has a relatively complicated distribution form Craig [

23]. To simplify their model, Jaedicke and Robichek [

22] assume that the product of two independent normal random variables is normal. Under the normality assumption, the probability of gaining different levels of profits, including the probability of reaching the break-even level for competing production alternatives, can be easy calculated using the model. This study provides the foundation to the stochastic CVP model and its managerial application for selecting alternatives under conditions of uncertainty.

Ferrara et al. [

24] point out the limitations in the model of Jaedicke and Robichek [

22] and provide evidence from the literature that challenges the assumption made in Jaedicke and Robichek [

22] that the product of two independent normal variables (

Q and

P −

V) is also a normal variable. They argue the assumption that the product of two independent normally distributed random variables results in a normal distributed random variable holds only under certain conditions relating to the magnitude of the coefficients of variation of the random variables being multiplied. Using Monte Carlo simulation, they recommend that if the sum of the coefficients of variation for unit sales

Q times unit selling price P minus variable cost

V is less than or equal to 12 percent, the assumption that the product of two independent random variables,

Q × (

P −

V), is also normally distributed can be accepted at a 0.05 significance level.

Hilliard and Leitch [

25] argue that the use of independent normally distributed random variables in a stochastic CVP model formulation in Jaedicke and Robichek [

22] is too rigorous; the independent assumption is lack of practical support, since quantity, price, and variable cost are often correlated. Furthermore, under the normality assumption sales, prices, and variable costs can take on negative values when the standard deviation is large, which is problematic. Instead, they suggest that quantity and contribution margins are bivariate log-normal random variables and that dependent relationships obtain. Since the product of bivariate lognormal variables is known to be lognormal, Hilliard and Leitch [

25] overcome the limitation faced by Jaedicke and Robichek [

22]. However, the differencing of lognormal random variables continues to be a problem. To overcome this difficulty, Hilliard and Leitch [

25] assume that the contribution margin as a whole is a lognormal variable and the fixed variable is a constant.

Lau and Lau [

26] argue that the input variables in a stochastic CPV analysis could be right skewed or left skewed, which is determined by some crucial factors. They posit that a symmetry assumption is better than the right skewness assumption, in that symmetry assumption includes the possibility of both right and left skewness. This work lessens the contribution of Hilliard and Leitch [

25] to some extent.

Jarrett [

27] provides guidance for managers on how to use Bayesian Decision Theory to estimate the parameters of the CVP. According to Jarrett [

27], two options exist for parameter estimation: (i) use current information to guide all estimation, or (ii) postpone estimation until additional study on the parameters is completed. This paper also provides practical suggestions for managers to consider when selecting a given estimation option.

Kim [

28] presents two modified CVP models intended to help financial analysts avoid the problem of the difference of ex post and ex ante costs and prices in sensitivity analysis; some unexpected statistical and financial properties are displayed in this study.

Shih [

29] points out the deficiency of the traditional CVP model in failing to distinguish sales, demand and production. When production is larger than demand, the profit calculated from the tradition CVP model is overestimated, especially when the unsold products are perishable goods or the demand for the unsold products lasts only for a certain period of time. The tradition CVP model only includes the variable costs and fixed cost to produce the goods, not the costs to dispose of the leftovers. The traditional CVP model is limited in its applicability when the sales, demands, and productions are different. Shih [

29] modifies the tradition CVP model to consider random demand and determined production. The modified model enables managers to make optimal decisions under uncertainty.

Yunker [

30] extends the traditional CVP model by incorporating the downward-sloping demand curve and the U-shaped average cost curve, which is more realistic than Shih (1979). The extended model demonstrates that a firm confronting uncertainty will produce a smaller quantity than an equivalent firm under certainty, given a risk-averse manager, while if the manager is risk-neutral, equivalent firms under uncertainty and certainty will produce the same amount.

Cantrell and Ramsay [

31] study the statistical properties of the target quantity estimator. The point estimate of target quantity is found to be biased, possessing no moments, but consistent. The interval estimate of target quantity is provided by using the Maximum likelihood method for short-term and long-term analysis. This procedure minimizes the ambiguity in the stochastic CVP model.

Kim et al. [

32] incorporate the utility function of the decision maker into the CVP model. The authors argue that decisionmakers (managers) are trying their best to maximize their utility when they make decision on the investment in risky assets. Two main results are found. First, a change in fixed costs affects not only the manager’s decision on production, but also the decision on risky assets. The highly risk-averse manager tends to invest more (less) in risky assets and less (more) in risk-free assets with increasing fixed costs. Second, for managers displaying constant absolute risk aversion, the optimal combination of risky and risk-free assets is constant regardless of the changes in fixed costs. This study provides some insightful information on the managers’ investment behaviors.

Gonzalez [

33] extends the single product CVP model into multiproduct CVP analysis that is designed to be implemented at the enterprise level. The modified model requires the user to formulate a contribution rule that is consistent with the operating characteristics of the business environment as well as with the user’s assessment of the degree to which the different products must contribute to recovering costs so as to meet a targeted profitability level.

Lulaj and Iseni [

34] show that the amount of product produced has a positive effect on sales value in service companies and increases profit in the manufacturing business environment; there is also an important relationship between production and sales, and CVP analysis contributes to growth profitability and break-even in the business environment. Therefore, cost–volume–profit analysis should be utilized to make judgments because the risk threshold is reduced by conducting CVP analysis.

In the context of multiproduct CVP analysis applications, Enyi [

14] examines the efficacy of the Weighted Contribution Margin (WCM) with the Reversed Contribution Margin Ratio (RCMR). The WCM lacks analytical efficiency and generates suboptimal product mix because it ignores the inverse relationship between a product’s contribution margin ratio (CMR) and its break-even point (BEP). The RCMR, which considers CMR/BEP tradeoff effects in its measurement, is recommended in the study.

Abdullahi et al. [

18] examines the usage of CVP analysis as a decision-making tool in small businesses. They find that small businesses use CVP incorrectly, and it is suggested that small businesses be exposed to CVP analysis and other management accounting techniques in order to increase efficiency.

A review of the literature on stochastic CVP models identifies two key limitations of the model. First, the stochastic inputs of the model are restricted to either normal or lognormal distributions. Second, in applications involving multiple stochastic inputs to the CVP model, limiting assumptions restrict the model. In

Section 3, we present a generalized stochastic CVP model which uses Mellin transform methodology to overcome the limitations of the models found in the literature.

3. Model Development

3.1. CVP Model Definition and Assumptions

The basic CVP analysis involves the formulation of a total profit function for a single product (see Equation (1)). Total profit is defined as total revenue minus total cost,

where:

Z = Total Profit

Q = Sales (in units)

P = Selling price per unit

V = Variable cost per unit

F = Fixed cost.

The objective is to determine the level of sales where total revenue equals total cost. At this equilibrium, commonly referred to as the break-even point, the break-even quantity is defined as . When the sales volume is lower than a loss is incurred; when the sales volume is greater than a profit is generated.

When comparing across two competing alternatives, profit functions for each alternative can be defined and the quantity level where the decisionmaker is indifferent between the two alternatives can be determined. Given knowledge of this indifference point, the decisionmaker can then determine for a projected sales level which alternative is most profitable.

The traditional CVP model is based on the following set of assumptions:

- ○

Costs are only affected by a change in the sales level;

- ○

Costs (both variable and fixed) are linearly related to the sales level;

- ○

Revenues are linearly related to the sale level;

- ○

The inventory level is constant within a given time period;

- ○

All model parameters are deterministic.

3.2. Mathematical Transform Methods

In this section we provide the foundation of the Mellin transform which is used as the key methodology for our development of a generalized stochastic CVP model. Mathematical transform methods are frequently used in operation research when solving complex problems. Obtaining solutions by using transform methods is an indirect approach and can often avoid the complexity of using a direct solution procedure. Three transform methods that are commonly used to analyze continuous functions are the Fourier, Laplace, and Mellin transforms. These transforms are particularly useful in defining and analyzing the characteristic and moment generating functions of continuous random variables. All continuous transforms are based on the Fourier transform. The Fourier, Laplace, and Mellin transforms are interchangeable, with each having advantages in different applications.

The Fourier transform (see Equation (2)) is well-known for deriving the probability densities of sums and differences of random variables. If

is a function of

, then

is the Fourier transform of

.

and

form a unique transform pair, because

uniquely defines

and

uniquely defines

.

The Laplace transform is a derivative of the Fourier transform. If

is a function of

, then

is the Laplace transform of

(see Equation (3)).

and

form a unique transform pair. The Laplace transform finds its most widespread application in solving differential equations. Laplace transforms are widely used in operations management and engineering due to well-developed transform pair tables.

If

is a function of

, the Mellin transform of

is defined by

The Mellin transform may also be defined for , but for application purposes we focus only on the positive part. We note that and are unique transform pairs. The Mellin transform is a convenient technique for analyzing the products and quotients of continuous random variables.

Let

and

be positive-valued continuous random variables with probability density functions (pdf) of

and

, respectively. Let

, and let

be the probability density function of

. Define

and

as the Mellin transforms of

and

, respectively. The Mellin transform

of

is given by Schmidt and Davis [

35]:

See

Appendix A for the probability and cumulative probability density functions of the products of two random variables for the cases of the uniform, gamma and normal random variables.

If

, and

is the probability density function of

, then the Mellin transform

of

is given by Schmidt and Davis [

35]:

Similarly, if

, and

is the probability density function of

, then the Mellin transform

of

is given by Schmidt and Davis [

35]:

Schmidt and Davis [

35] present the Mellin transform pairs for the most widely used continuous random variables. Hence, the Mellin transforms of the products and quotients of two continuous random variables can be easily obtained, given the Mellin transforms of the two random variables. Since the Mellin transform and the original function are uniquely paired, if we know the Mellin transform of the products or quotients of two random variables, we will find the probability density function by inverting the Mellin transform function. However, the product of two Mellin transforms is rarely any format that we can find the inverse function of; hence it is a challenge to find the pdf of the products or quotients of two random variables. Nevertheless, like other continuous transforms, the Mellin transform can be used to compute the moments of random variables. From Equation (7), we can get

This unique format of Mellin transform simplifies the process to find the

nth moment of a continuous random variable. Replacing

with

in Equation (8) gives

, the nth moment of random variable x, which is defined as

The first and second moments allow the definition of the mean and variance of a random variable; the third and fourth moments can be used to determine the skewness and excess kurtosis of the random variable. When it is difficult to find the exact pdf of a random variable, the key attributes of the random variable and its distributional form can be estimated by studying the moments of the random variable.

3.3. Stochastic CVP Model

The stochastic CVP model has been studied for several decades. Applications of the model still prevail in practice, and the attractiveness and usefulness of the model can be advanced by further generalizing the model to bridge the following gaps. As identified in the review of the literature on the stochastic CVP model, the stochastic inputs of the model are restricted to either normal or lognormal distributions, resulting in profitability being modeled as either a normal or lognormal random variable. In our opinion, normal and lognormal random variables are assumed only for the sake of calculation simplicity. A more generalized distribution of profit in a stochastic CVP model that is not restricted to being normally or lognormally distributed can be obtained by using the Mellin Transform technique. The greater flexibility of selecting a wider range of different random variable types will enhance the application of the stochastic CVP model.

In this section, we apply Mellin Transform techniques in order to examine the stochastic CVP model when model inputs and profitability are not restricted to the normal and lognormal distributions. Two cases will be examined. In the first case, the model inputs to the stochastic CVP model will involve the product of two uniform random variables; in the second case, the model inputs will involve the product of two gamma random variables.

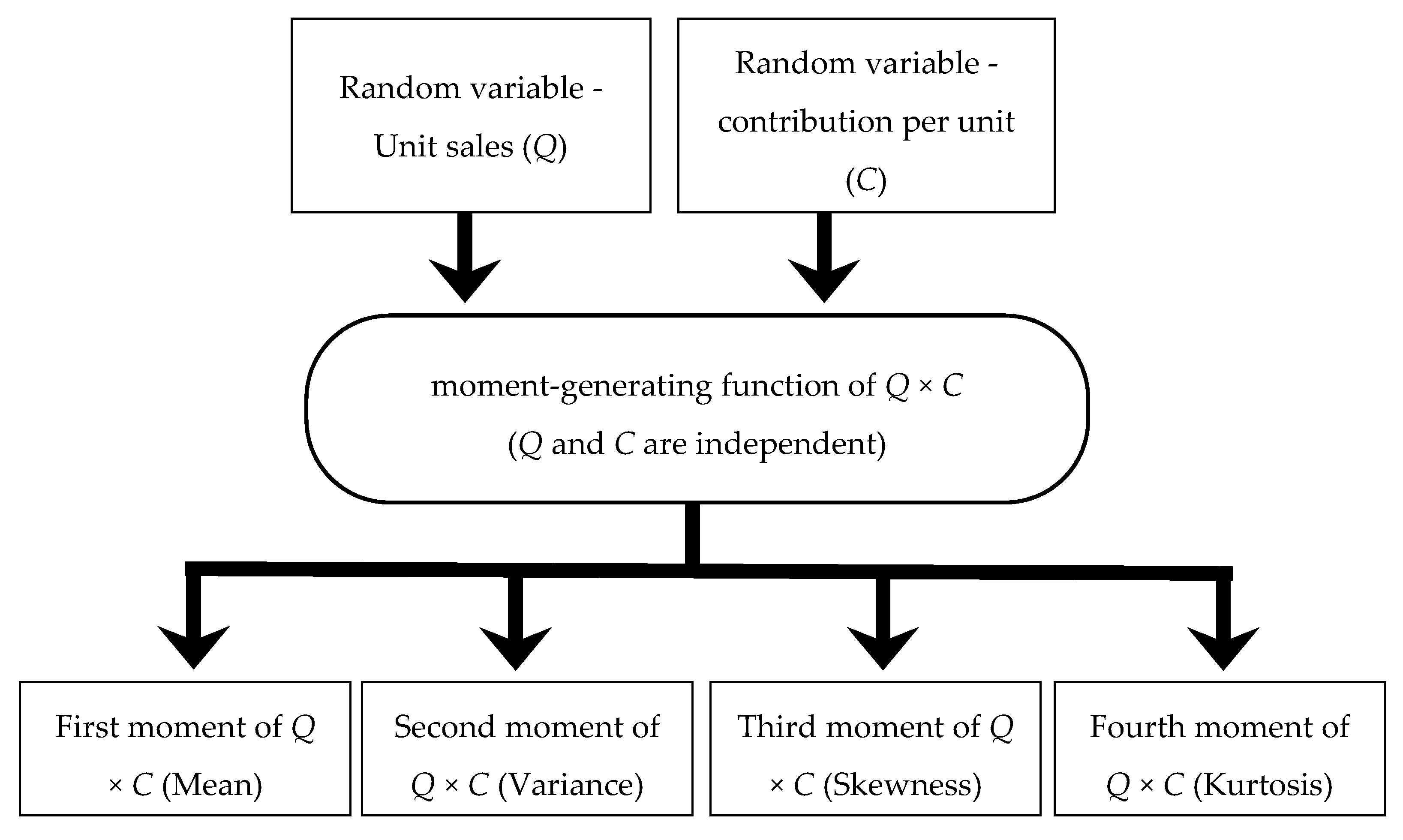

Figure 1 demonstrates the process used to derive the moments of the product of two independent random variables.

The stochastic CVP model takes the general form of

Defining the contribution per unit as

C =

P −

V yields

We note that in (11),

Q and

C are assumed to be independent random variables and

F is constant, thus defining the stochastic CVP model as the product of two independent random variables. Restating the contribution margin as

W =

Q ×

C, the stochastic CVP model is redefined as

where

Z = Profit

Q = Unit sales

P = Price/Unit

V = Variable Cost/Unit

F = Fixed cost

C = P − V = Contribution/Unit

W = Q × C = Contribution Margin

3.3.1. Case 1

Assuming that

Q and

C follow uniform distribution,

where

and

are the minimum values of random variables

Q and

C, and

and

are the maximum values of random variables

Q and

C. Per

Appendix A, the moment generating function of

is

Using, (13) and setting

, the first moment is

which simplifies to

Similarly, for

, the second moment is

which simplifies to

Setting

and

, the third and fourth moments are, respectively,

and

Using Equations (13)–(19), the mean, variance, skewness and excess kurtosis of are:

mean of

variance of

skewness,

of

excess kurtosis

of

We assume that fixed cost, F, is a constant number f. Using the above distribution characteristics of contribution margin, W, the distribution characteristics of total profit, Z, are:

mean of

variance of

skewness,

of

excess kurtosis

of

The cumulative distribution function (CDF) of the product of two uniform random variables (

Q and

C) where

,

,

, and

and when

ad <

bc is

When ad = bc or when ad > bc, the process illustrated by Equations (13)–(28) can be used to define the resultant CDF.

3.3.2. Case 2

Assume

Q and

C following Gamma distribution,

where

and

are shape parameters of random variable

Q and

C, and

and

are scale parameters of random variable

Q and

C. Per

Appendix A, the moment generating function of function of

is

Using (24), the first moment is

which simplifies to

Similarly, the second moment is

which simplifies to

The third moment,

simplifies to

The fourth moment,

simplifies to

Using Equations (29)–(37), the mean, variance, skewness and excess kurtosis of

are:

The variance of

is

The skewness,

of

is

The excess kurtosis,

of

is

We assume fixed cost, F, is a constant number f. With the above distribution characteristics of contribution margin, W, we can get the distribution characteristics of total profit, Z;

the mean of

is

variance of

is

skewness,

of

is

excess kurtosis

of

is

No closed form solution for the CDF of the product of two gamma random variables exists.

3.4. Numerical Illustration

The following theoretical numerical example illustrates the application of the stochastic CVP model for Cases 1 and 2. In each case, the mean and the variance of the unit sales are 5000 units and 300 units, respectively. The mean and the variance of the contribution per unit used in each case are USD 120 and USD 27, respectively. The specific parameters used in each case are presented in

Table 1.

The distribution characteristics of the product of

Q and

C are presented in

Table 2. The central and dispersion of the product of

Q and

C depends heavily on the distribution of

Q and

C.

As denoted in the literature, many researchers assume that the product of

Q and

C is normally distributed. As demonstrated in the skewness and excess kurtosis values found in

Table 2, the assumption of using a normal distribution is weakly supported, since a normal distribution would have a skewness of zero and an excess kurtosis of zero. Using the parameter set upon which the results of

Table 1 and

Table 2 are based, we employ the CDF as defined in Equation (28) to generate comparative probability calculations in

Table 3, further illustrating the inaccuracy of using the normal. Examining the fourth column, the percentage error associated with using the normal approximation ranges from an underestimation of approximately 31% to an overestimation of approximately 5%.

Based on the numerical illustration, the generalized CVP analysis overcomes the limitations of normal or lognormal assumption and improves the accuracy of profit estimation. When profitability is a primary goal of a firm, a more accurate profit estimation enables managers to make better decisions in dynamic marketplaces where costs, revenue and volume are changing.