Inclusive Internal Financing, Selective Internal Financing, or Hybrid Financing? A Competitive Low-Carbon Supply Chain Operational and Financing Strategies

Abstract

1. Introduction

2. Literature Review

2.1. LCSC

2.2. Competitive LCSC

2.3. LCSC Financing

2.4. Research Gaps

- (1)

- Existing studies on LCSC operations predominantly focus on well-funded supply chain decision-making. They overlook the critical impact of capital constraints and competitive behavior on supply chain resilience—particularly how financing interest rates and competition intensity under different financing modes affect LCSC operations and decisions.

- (2)

- In competitive LCSC research, scholars predominantly focus on chain-to-chain competition and same-tier competition (e.g., among manufacturers, retailers, or suppliers). While these studies provide valuable insights for our work, their conclusions do not align with our model outcomes. This divergence stems from our incorporation of carbon emission reduction investment levels as a key decision variable. Crucially, the existing research neglects LCSC operations where downstream retailers operate under capital constraints while engaging in competition.

- (3)

- Within LCSC financing research, scholars primarily focus on the impact of trade credit and bank credit on LCSC operational decisions and financing efficiency, comparing these two financing models while also concentrating on “one-to-one” LCSC structure. Nevertheless, existing literature gaps persist concerning how three distinct financing modes (IIF, SIF, and HF) influence LCSC operational decisions in competitive environments with capital-constrained retailers.

3. Problem Description and Benchmark Model

3.1. Problem Formulation and Model Assumptions

3.2. Benchmark Model

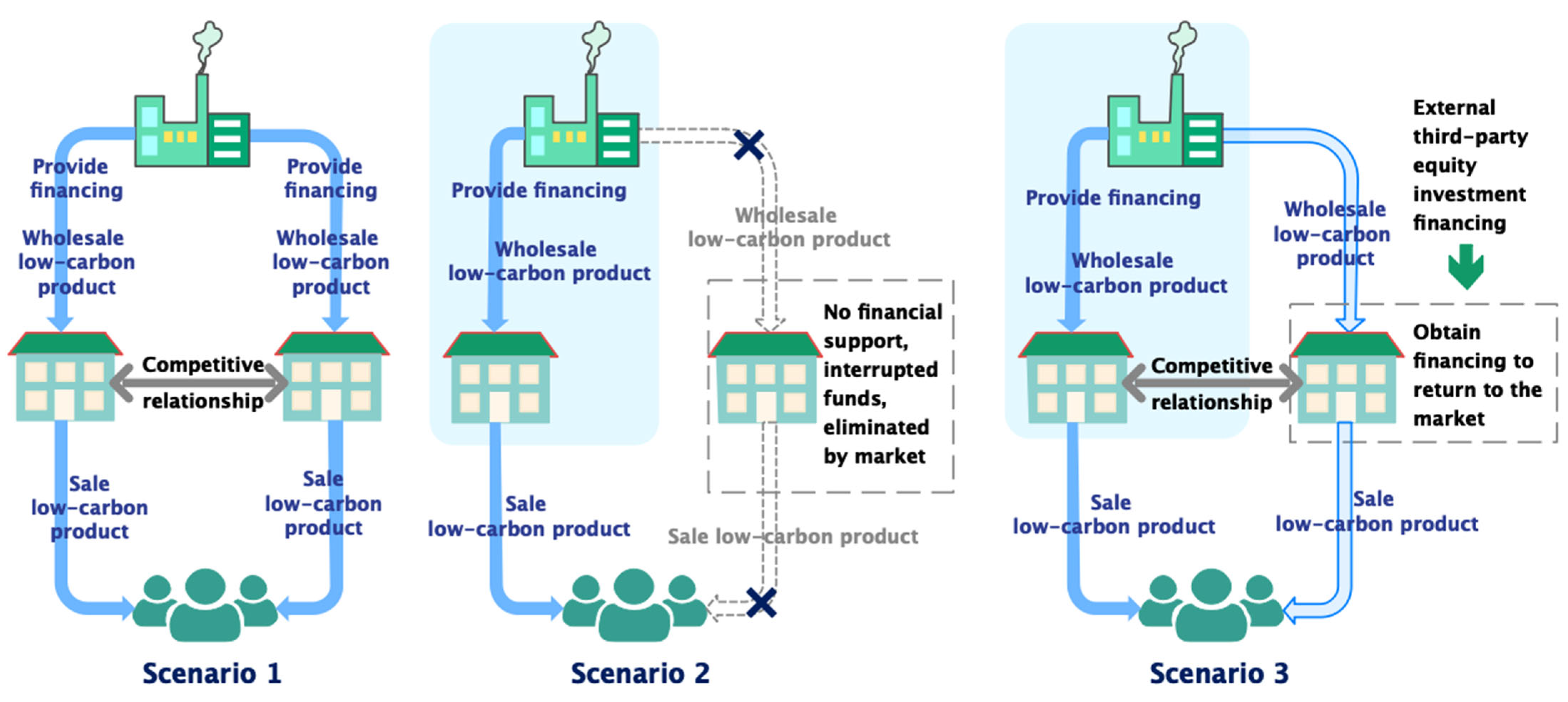

4. Pricing and Financing Decision Models for Competing Retailers Under Different Financing Scenarios

4.1. Scenario Where Manufacturer Provides Financing to Both Retailers Simultaneously (IIF)

4.2. Scenario Where Manufacturer Provides Financing to Single Retailer (SIF)

4.3. Scenarios Where Individual Retailer Returns to Market with Blended Financing (HF)

5. Numerical Simulation

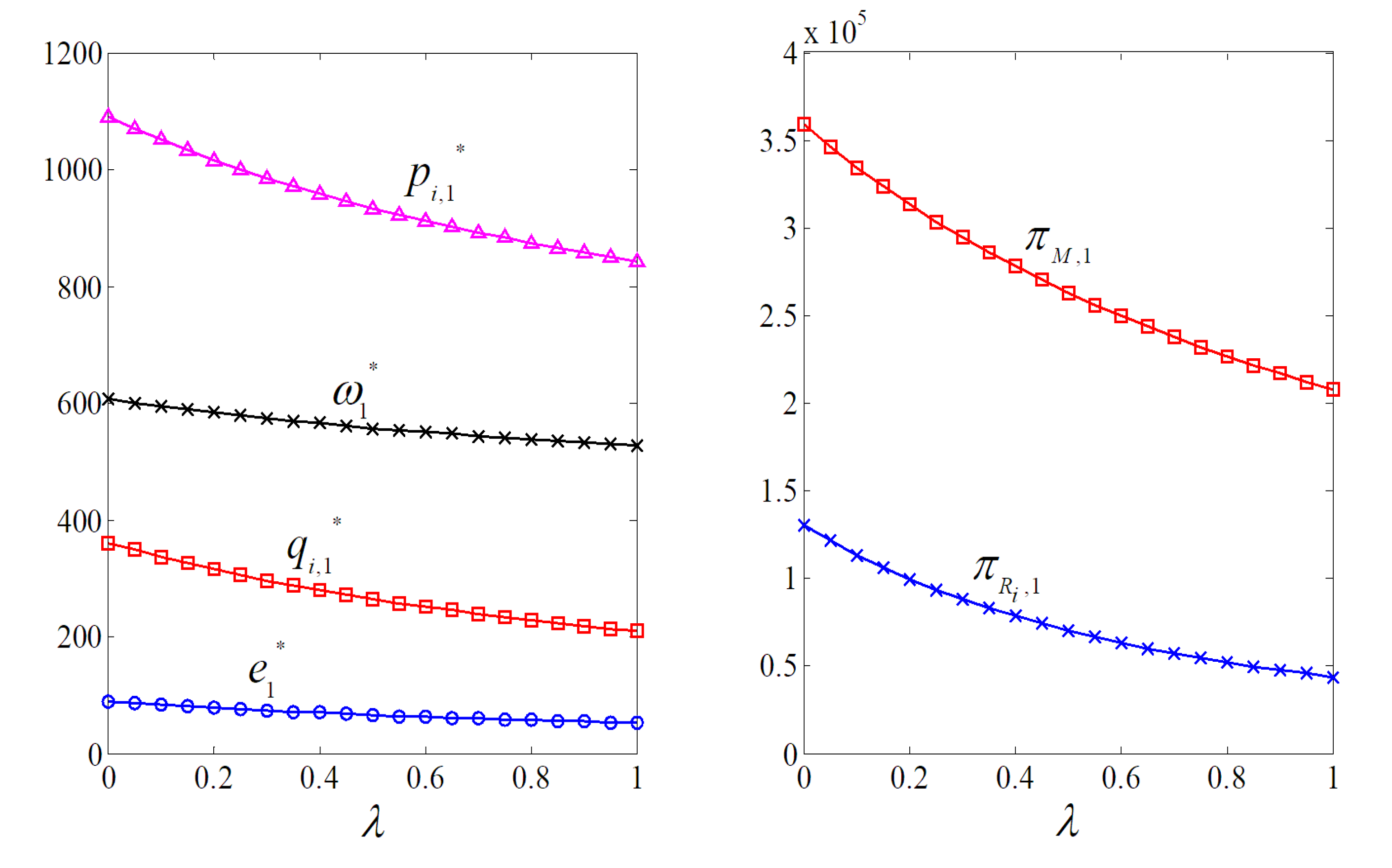

5.1. Manufacturer Provides Financing to Both Retailers Simultaneously

5.1.1. Analysis of Impact of Competition Intensity

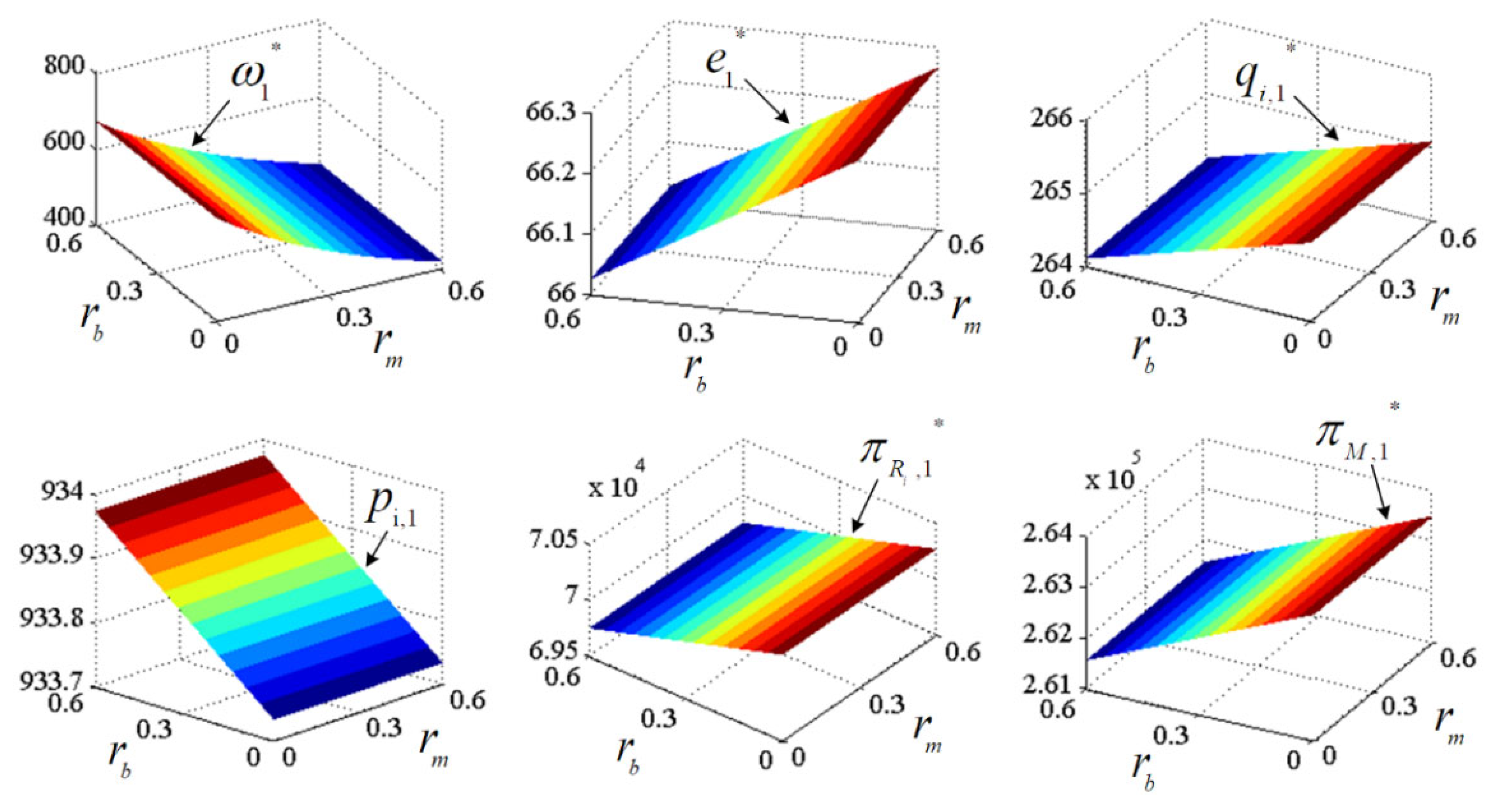

5.1.2. Analysis of Impact of and

5.2. Manufacturer Provides Financing to Single Retailer Only

5.2.1. The Manufacturer Provides Financing to a Single Retailer Without Forming an Alliance

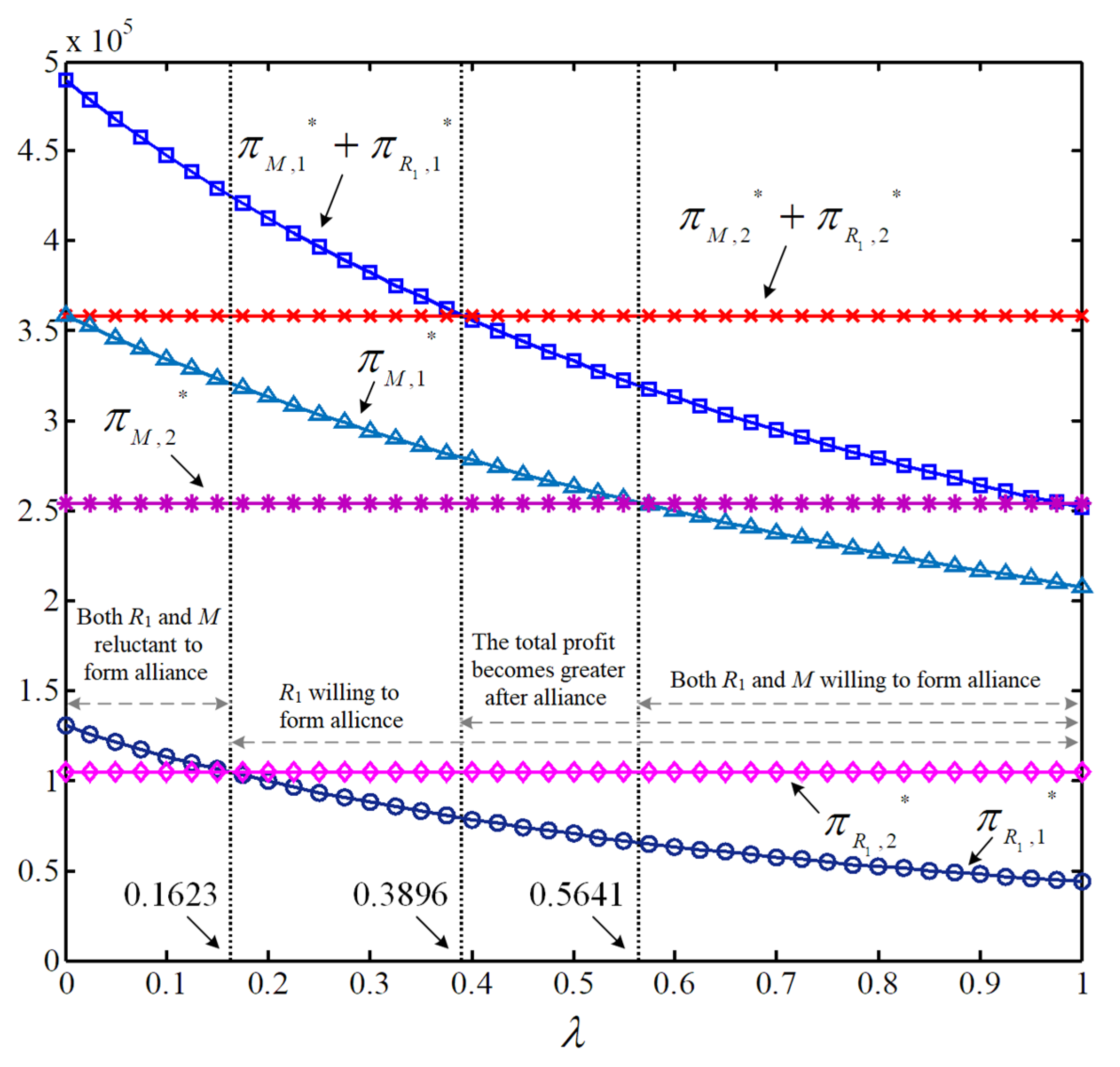

5.2.2. The Manufacturer Provides Financing to a Single Retailer and Forms an Alliance

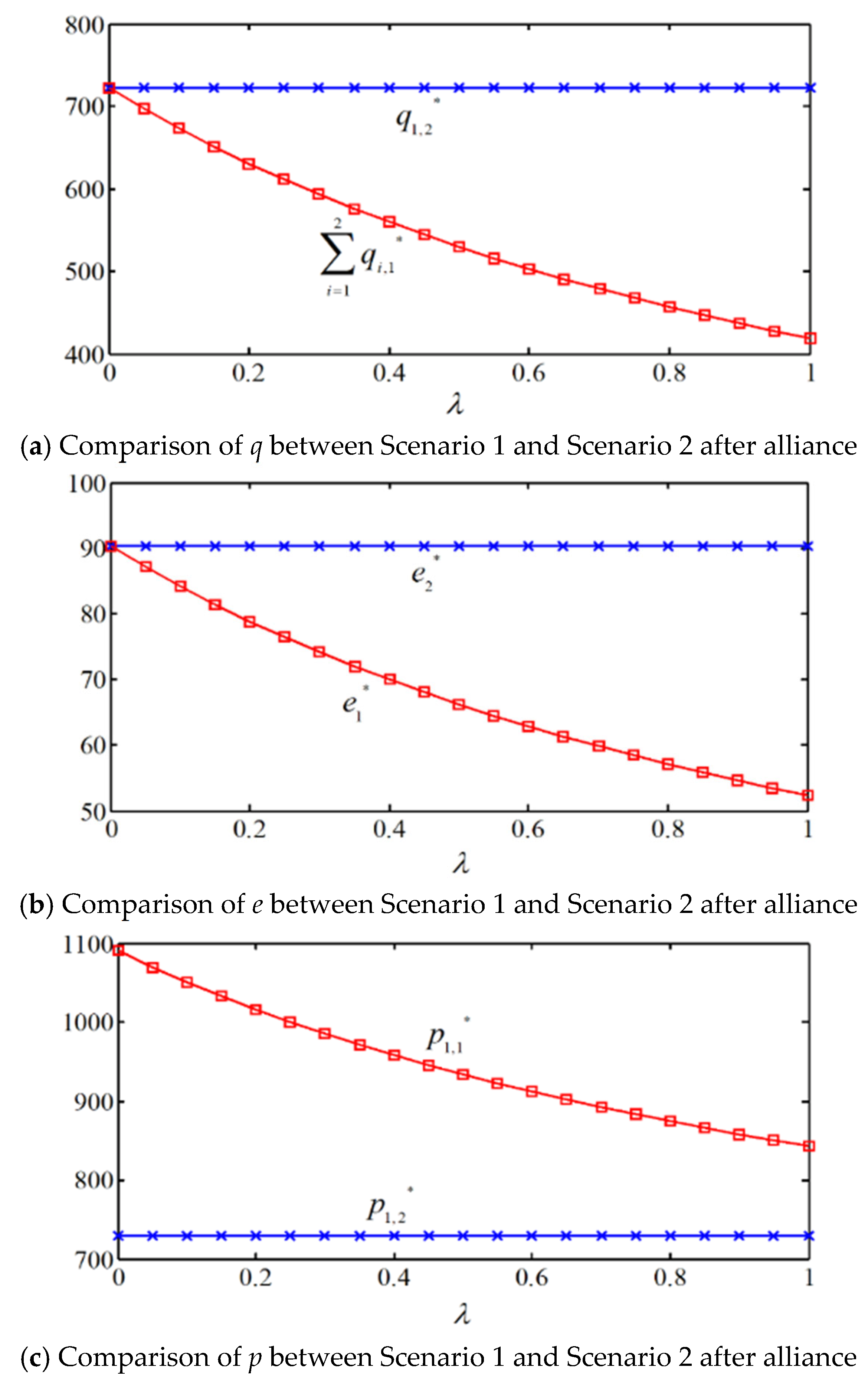

5.2.3. Comparison of q, e, and p Between Scenario 2 and Scenario 1 After Alliance Formation

5.2.4. Analysis of Alliance Willingness Between Manufacturer and Retailer

5.3. Single Retailer Re-Enters Market with HF

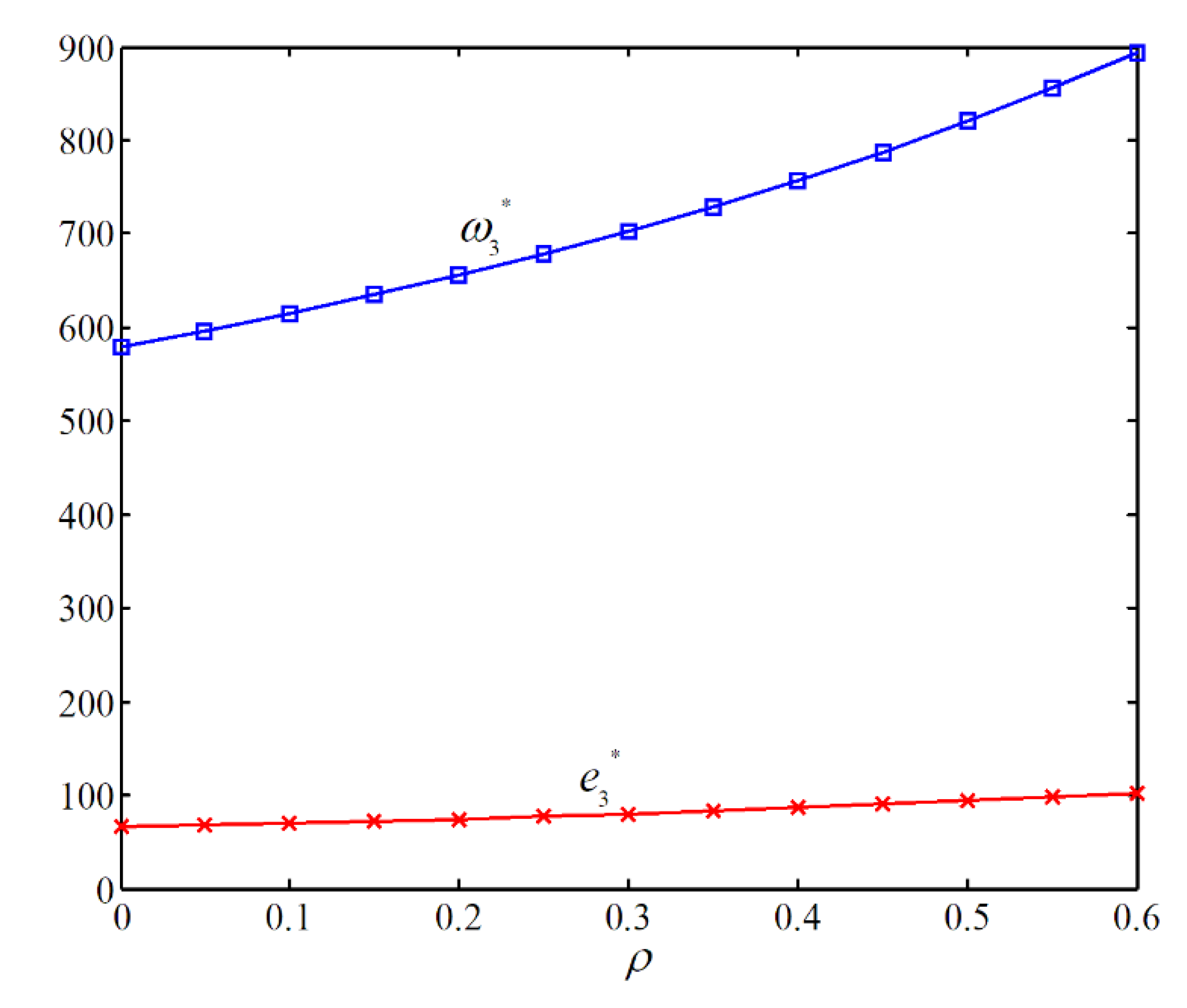

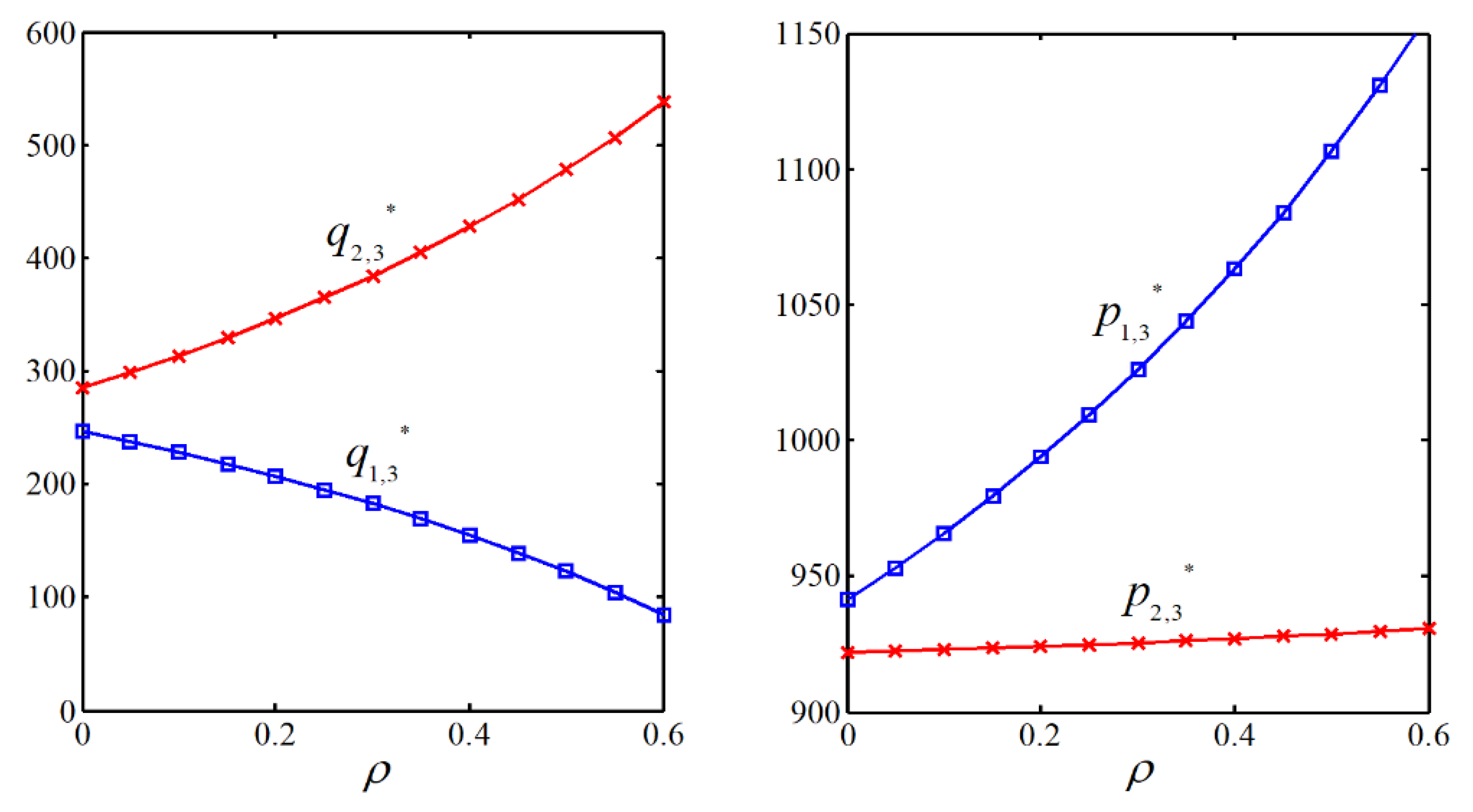

5.3.1. Impact Analysis of Equity Financing Ratio

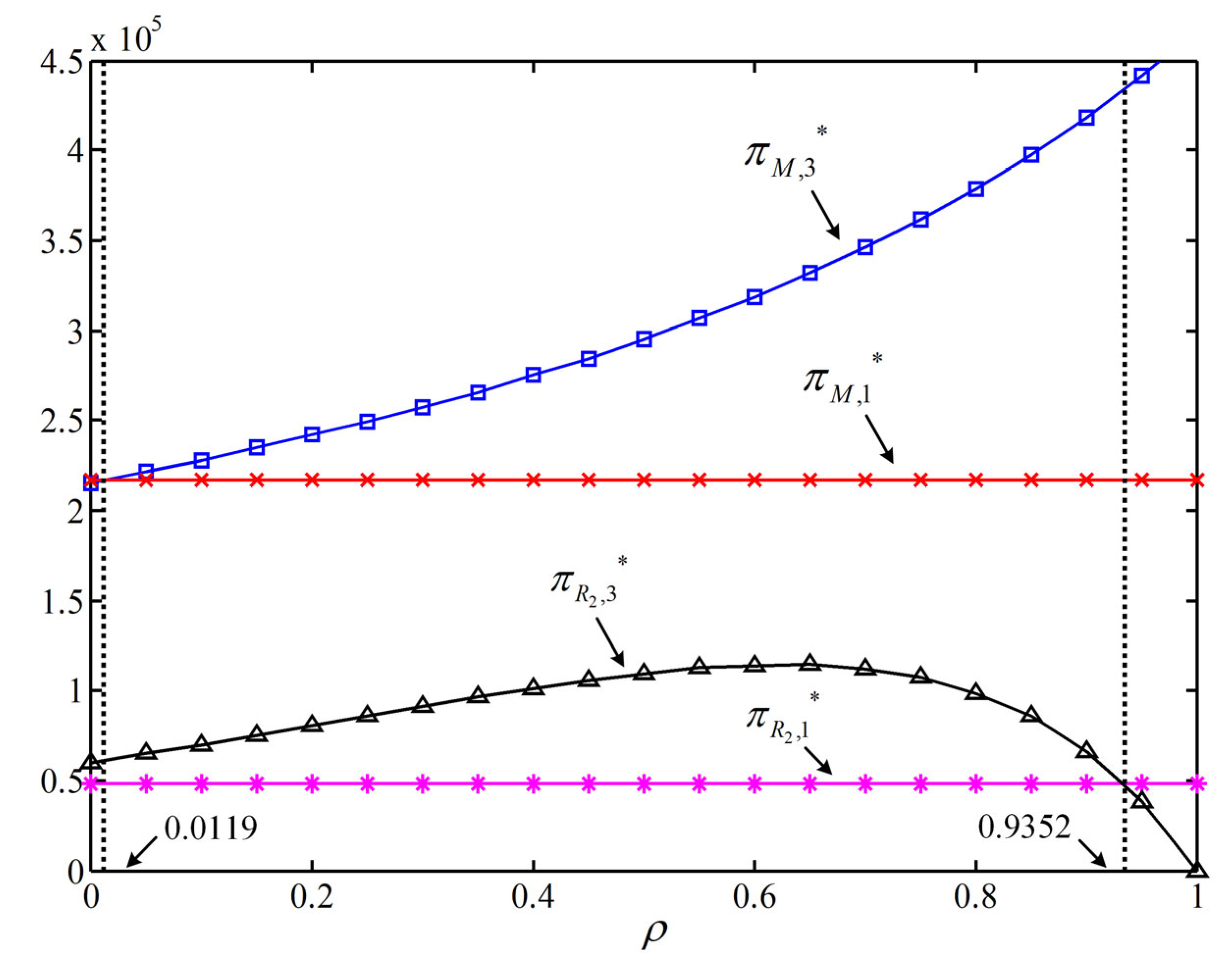

5.3.2. The Conditions Under Which the Manufacturer Allows Retailer to Return to the Market

6. Discussion and Management Recommendations

6.1. Results and Discussion

6.2. Managerial Recommendations

6.2.1. Government

6.2.2. LCSC System and Members

7. Conclusions

- (1)

- Regardless of the financing mode adopted, an escalation in competition intensity between two capital-constrained retailers consistently undermines product market order quantities, diminishes manufacturers’ carbon emission reduction efforts, and erodes the overall profitability of all LCSC members. This demonstrates that retailer competition fundamentally destabilizes the system’s sustainable development.

- (2)

- When competition intensity between the two retailers remains constant, distinct financing modes differentially influence LCSC equilibrium results. Under IIF, product wholesale prices inversely correlate with the financing interest rate while positively aligning with the bank credit interest rate. Carbon emission reduction investment levels, dual-retailer product orders, retail prices, and LCSC member profits remain unaffected by financing interest rates but exhibit sensitivity to bank credit interest rate fluctuations. Specifically, increased bank credit interest rates reduce manufacturers’ emission reduction investments, retailers’ order volumes, and overall participant profitability.

- (3)

- Under the SIF mode, non-supported retailers inevitably face market elimination due to funding shortages, regardless of the financial support alliance formed between manufacturers and a single retailer. Within wholesale-price-contract alliances, manufacturers’ product pricing and emission reduction investments and retailers’ order volumes and profits remain consistently inferior to those in IIF scenarios, thus deterring alliance adoption. Conversely, revenue-sharing-contract alliances’ feasibility critically depends on predetermined profit-sharing ratios and inter-retailer competition intensity—when post-alliance rivalry exceeds a defined threshold, measurable declines emerge in low-carbon product subscriptions, environmental investments, and market prices compared to IIF outcomes.

- (4)

- Under the hybrid financing mode, when a previously excluded retailer re-enters the market through external equity financing, if its equity financing ratio exceeds a critical threshold, it disrupts existing supply chain alliances and reignites competition. This increases the returning retailer’s profits while reducing alliance retailers’ earnings, incentivizing manufacturers to elevate financing ratios. Compared to SIF, market-re-entered retailers under HF diminish allied retailers’ competitiveness, with sufficiently high equity financing ratios enabling the returning retailers to displace alliance participants through market crowding effects.

- (5)

- Regarding the selection among the three financing modes, from a system-wide profitability perspective, IIF is preferable when financing interest rates are low due to reduced financing costs; regarding carbon emission reduction performance, SIF constitutes the dominant strategy; for retailers, the optimal choice depends critically on financing rates and competition intensity—IIF dominates under low competition intensity, while HF is preferred otherwise.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Wang, L.; Zhang, L.; Zhang, X. Optimal financing strategies for low-carbon supply chains: A Stackelberg game perspective. Manag. Decis. Econ. 2025, 46, 666–680. [Google Scholar] [CrossRef]

- Xia, T.; Wang, Y.; Lv, L.; Shen, L.; Cheng, T.C.E. Financing decisions of low-carbon supply chain under chain-to-chain competition. Int. J. Prod. Res. 2023, 61, 6153–6176. [Google Scholar] [CrossRef]

- Linklogis Technology Group. Linklogis Released the 2024 ESG Report: Serving the Sustainable Development Industry Chain with Assets of 37.1 Billion Yuan. 2024. Available online: https://mp.weixin.qq.com/s/jErqlQj-APbbHwB-GDKz7g (accessed on 5 June 2025).

- Chang, S.; Li, A.; Wang, X.; Wang, X. Joint optimization of e-commerce supply chain financing strategy and channel contract. Eur. J. Oper. Res. 2022, 303, 908–927. [Google Scholar] [CrossRef]

- Zhu, L.; Ou, Y. Enhance financing for small-and medium-sized suppliers with reverse factoring: A game theoretical analysis. Ann. Oper. Res. 2023, 331, 159–187. [Google Scholar] [CrossRef]

- Wang, X.; Chen, X. An empirical study on financing constraints of digital inclusive finance development on small and medium-sized technology-based enterprise. Kybernetes 2023, 52, 585–600. [Google Scholar] [CrossRef]

- Rao, P.; Kumar, S.; Chavan, M.; Lim, W.M. A systematic literature review on SME financing: Trends and future directions. J. Small Bus. Manag. 2023, 61, 1247–1277. [Google Scholar] [CrossRef]

- Zheng, Y.; Zhao, Y.; Meng, X. Market entrance and pricing strategies for a capital-constrained remanufacturing supply chain: Effects of equity and bank financing on circular economy. Int. J. Prod. Res. 2021, 59, 6601–6614. [Google Scholar] [CrossRef]

- Yang, H.; Zhuo, W.; Shao, L. Equilibrium evolution in a two-echelon supply chain with financially constrained retailers: The impact of equity financing. Int. J. Prod. Econ. 2017, 185, 139–149. [Google Scholar] [CrossRef]

- Jena, S.K.; Padhi, S.S.; Cheng, T.C.E. Optimal selection of supply chain financing programmes for a financially distressed manufacturer. Eur. J. Oper. Res. 2023, 306, 457–477. [Google Scholar] [CrossRef]

- Luo, Y.; Wei, Q.; Ling, Q.; Huo, B. Optimal decision in a green supply chain: Bank financing or supplier financing. J. Clean. Prod. 2020, 271, 122090. [Google Scholar] [CrossRef]

- Shi, J.; Liu, D.; Du, Q.; Cheng, T.C.E. The role of the procurement commitment contract in a low-carbon supply chain with a capital-constrained supplier. Int. J. Prod. Econ. 2023, 255, 108681. [Google Scholar] [CrossRef]

- Qin, J.; Fu, H.; Wang, Z.; Lyu, X. Financing decisions in capital-constrained supply chains considering uncertain emission reduction outputs and blockchain technology applications. Int. J. Prod. Res. 2025, 1–22. [Google Scholar] [CrossRef]

- Shang, Y.; Bai, C.; Sun, M. Bank or retailer? Manufacturer financing for carbon emission reduction using the carbon emission quota as a pledge. Int. J. Prod. Res. 2024, 1–21. [Google Scholar] [CrossRef]

- Gao, M.; Xia, L.; Xiao, Q.; Goh, M. Incentive strategies for low-carbon supply chains with information updating of customer preferences. J. Clean. Prod. 2023, 410, 137162. [Google Scholar] [CrossRef]

- Fan, X.; Zhang, Y.; Xue, J. Energy-efficient pathways in the digital revolution: Which factors influence agricultural product consumers’ adoption of low-carbon supply chains on e-commerce platforms? Systems 2024, 12, 563. [Google Scholar] [CrossRef]

- Zhou, F.; Chen, T.; Lim, M.K. Strategic low-carbon technology supervision in the closed-loop supply chain: An evolutionary game approach. J. Clean. Prod. 2024, 450, 141609. [Google Scholar] [CrossRef]

- Sharma, M.; Kaushal, D.; Joshi, S.; Luthra, S. Resilience through low-carbon supply chain integration in industry 4.0-led firms: A moderated-mediation effect of supplier environmental commitment. Bus. Strat. Environ. 2025, 34, 4679–4694. [Google Scholar] [CrossRef]

- Sun, L.; Cao, X.; Alharthi, M.; Zhang, J.; Taghizadeh-Hesary, F.; Mohsin, M. Carbon emission transfer strategies in supply chain with lag time of emission reduction technologies and low-carbon preference of consumers. J. Clean. Prod. 2020, 264, 121664. [Google Scholar] [CrossRef]

- He, P.; Wang, Z.; Shi, V.; Liao, Y. The direct and cross effects in a supply chain with consumers sensitive to both carbon emissions and delivery time. Eur. J. Oper. Res. 2021, 292, 172–183. [Google Scholar] [CrossRef]

- Hu, Z.; Wang, S. An Evolutionary game model between governments and manufacturers considering carbon taxes, subsidies, and consumers’ low-carbon preference. Dyn. Games Appl. 2022, 12, 513–551. [Google Scholar] [CrossRef]

- Wang, Q.; Zhao, D.; He, L. Contracting emission reduction for supply chains considering market low-carbon preference. J. Clean. Prod. 2016, 120, 72–84. [Google Scholar] [CrossRef]

- Zhang, Z.; Yu, L. Differential game analysis of recycling mode and power structure in a low-carbon closed-loop supply chain considering altruism and government’s compound subsidy. Ann. Oper. Res. 2024, 1–51. [Google Scholar] [CrossRef]

- Du, Q.; Yang, M.; Wang, Y.; Wang, X.; Dong, Y. Dynamic simulation for carbon emission reduction effects of the prefabricated building supply chain under environmental policies. Sustain. Cities Soc. 2024, 100, 105027. [Google Scholar] [CrossRef]

- Zhou, X.; Wei, X.; Lin, J.; Tian, X.; Lev, B.; Wang, S. Supply chain management under carbon taxes: A review and bibliometric analysis. Omega 2021, 98, 102295. [Google Scholar] [CrossRef]

- Fu, C.; Liu, Y.; Shan, M. Drivers of low-carbon practices in green supply chain management in construction industry: An empirical study in China. J. Clean. Prod. 2023, 428, 139497. [Google Scholar] [CrossRef]

- Hamidoğlu, A.; Weber, G.W. A novel Nash-based low-carbon implementation in agricultural supply chain management. J. Clean. Prod. 2024, 449, 141846. [Google Scholar] [CrossRef]

- Choi, T.M. Local sourcing and fashion quick response system: The impacts of carbon footprint tax. Transport. Res. E Log. 2013, 55, 43–54. [Google Scholar] [CrossRef]

- Cariou, P.; Parola, F.; Notteboom, T. Towards low carbon global supply chains: A multi-trade analysis of CO2 emission reductions in container shipping. Int. J. Prod. Econ. 2019, 208, 17–28. [Google Scholar] [CrossRef]

- Bian, J.; Zhao, X. Tax or Subsidy? An analysis of environmental policies in supply chains with retail competition. Eur. J. Oper. Res. 2020, 283, 901–914. [Google Scholar] [CrossRef]

- Tsay, A.A.; Agrawal, N. Channel dynamics under price and service competition. Manuf. Serv. Oper. Manag. 2000, 2, 372–391. [Google Scholar] [CrossRef]

- Yang, S.; Zhou, Y. Two-echelon supply chain models: Considering duopolistic retailers’ different competitive behaviors. Int. J. Prod. Econ. 2006, 103, 104–116. [Google Scholar] [CrossRef]

- Chen, X.; Luo, Z.; Wang, X. Impact of efficiency, investment, and competition on low carbon manufacturing. J. Clean. Prod. 2017, 143, 388–400. [Google Scholar] [CrossRef]

- Chod, J.; Lyandres, E.; Yang, S.A. Trade credit and supplier competition. J. Financ. Econ. 2019, 131, 484–505. [Google Scholar] [CrossRef]

- Zhang, C.; Xiao, G.; Xu, L. Manufacturers’ emission-reduction investments in competing supply chains with Prisoner’s Dilemma: The economic and environmental impacts of Retailer(s) capital Constraint(s). Transport. Res. E Log. 2024, 187, 103602. [Google Scholar] [CrossRef]

- Karray, S.; Martín-Herrán, G. The effects of decision timing for pricing and marketing efforts in a supply chain with competing manufacturers. Int. Trans. Oper. Res. 2024, 31, 568–615. [Google Scholar] [CrossRef]

- Li, F.; Yang, Y.; Zhang, W.; Li, J. A study on the co-opetition game between low-carbon supply chains under carbon cap-and-trade policy. Manag. Decis. Econ. 2025, 46, 2986–2999. [Google Scholar] [CrossRef]

- Li, R.; Yan, J.; Wang, X. Horizontal cooperation strategies for competing manufacturers in a capital constrained supply chain. Transport. Res. E Log. 2024, 181, 103369. [Google Scholar] [CrossRef]

- Ji, J.; Li, T.; Yang, L. Pricing and carbon reduction strategies for vertically differentiated firms under cap-and-trade regulation. Transport. Res. E Log. 2023, 171, 13064. [Google Scholar] [CrossRef]

- Feng, Q.; Lu, L.X. The strategic perils of low cost outsourcing. Manag. Sci. 2012, 58, 1196–1210. [Google Scholar] [CrossRef]

- Feng, Q.; Lu, L.X. The role of contract negotiation and industry structure in production outsourcing. Prod. Oper. Manag. 2013, 22, 1299–1319. [Google Scholar] [CrossRef]

- Wang, J.; Wan, Q.; Yu, M. Green supply chain network design considering chain-to-chain competition on price and carbon emission. Comput. Ind. Eng. 2020, 145, 106503. [Google Scholar] [CrossRef]

- Chen, D.; Tian, C.; Chen, Z.; Zhang, D. Competition among supply chains: The choice of financing strategy. Oper. Res. Int. J. 2022, 22, 977–1000. [Google Scholar] [CrossRef]

- Feng, Z.; Li, F.; Tan, C. Supplier development or supplier integration? Equilibrium analysis in competing electric vehicle supply chains with power battery recycling. Expert Syst. Appl. 2024, 238, 121519. [Google Scholar] [CrossRef]

- Chen, Z.; Dan, B.; Ma, S.; Tian, Y. Demand information sharing of fresh produce supply chain considering competing suppliers’ freshness-keeping effort. Int. Trans. Oper. Res. 2024, 31, 1206–1231. [Google Scholar] [CrossRef]

- Goyal, S.K. Economic order quantity under conditions of permissible delay in payments. J. Oper. Res. Soc. 1985, 36, 335–338. [Google Scholar] [CrossRef]

- Seifert, D.; Seifert, R.W.; Protopappa-Sieke, M. A review of trade credit literature: Opportunities for research in operations. Eur. J. Oper. Res. 2013, 231, 245–256. [Google Scholar] [CrossRef]

- Kouvelis, P.; Zhao, W. Financing the newsvendor: Supplier vs. bank, and the structure of optimal trade credit contracts. Oper. Res. 2012, 60, 566–580. [Google Scholar] [CrossRef]

- Lee, C.H.; Rhee, B.D. Trade credit for supply chain coordination. Eur. J. Oper. Res. 2011, 214, 136–146. [Google Scholar] [CrossRef]

- Kochhar, R.; Hitt, M. Linking corporate strategy to capital structure: Diversification strategy, type and source of financing. Strateg. Manag. J. 1998, 19, 601–610. [Google Scholar] [CrossRef]

- Xia, Q.; Zhi, B.; Wang, X. The role of cross-shareholding in the green supply chain: Green contribution, power structure and coordination. Int. J. Prod. Econ. 2021, 234, 108037. [Google Scholar] [CrossRef]

- Nigro, G.L.; Favara, G.; Abbate, L. Supply chain finance: The role of credit rating and retailer effort on optimal contracts. Int. J. Prod. Econ. 2021, 240, 108235. [Google Scholar] [CrossRef]

- Deng, S.; Gu, C.; Cai, G.; Li, H. Financing multiple heterogeneous suppliers in assembly systems: Buyer finance vs. bank Finance. Manuf. Serv. Oper. Manag. 2018, 20, 53–69. [Google Scholar] [CrossRef]

- Chen, X. A model of trade credit in a capital-constrained distribution channel. Int. J. Prod. Econ. 2015, 159, 347–357. [Google Scholar] [CrossRef]

- Xiao, S.; Sethi, S.P.; Liu, M.; Ma, S. Coordinating contracts for a financially constrained supply chain. Omega 2017, 72, 71–86. [Google Scholar] [CrossRef]

- Yan, N.; He, X.; Liu, Y. Financing the capital-constrained supply chain with loss aversion: Supplier finance vs. supplier investment. Omega 2019, 88, 162–178. [Google Scholar] [CrossRef]

- Liu, Y.; Gao, Q. Economic policy uncertainty and enterprise innovation in China: From the perspective of equity financing and financing structure. Econ. Anal. Policy 2024, 81, 17–33. [Google Scholar] [CrossRef]

- Buzacott, J.A.; Zhang, R.Q. Inventory management with asset-based financing. Manag. Sci. 2004, 50, 1274–1292. [Google Scholar] [CrossRef]

- Kouvelis, P.; Zhao, W. The newsvendor problem and price-only contract when bankruptcy costs exist. Prod. Oper. Manag. 2011, 20, 921–936. [Google Scholar] [CrossRef]

- Yan, N.; Sun, B. Coordinating loan strategies for supply chain financing with limited credit. OR Spectr. 2013, 35, 1039–1058. [Google Scholar] [CrossRef]

- Feng, Y.; Mu, Y.; Hu, B.; Kumar, A. Commodity options purchasing and credit financing under capital constraint. Int. J. Prod. Econ. 2014, 153, 230–237. [Google Scholar] [CrossRef]

- Chen, C.; Kieschnick, R. Bank credit and corporate working capital management. J. Corp. Financ. 2018, 48, 579–596. [Google Scholar] [CrossRef]

- Liao, Z.; Zhang, M. Carbon finance, green supply chain management, and firms’ environmental innovation: The moderating role of financing structure. Int. J. Prod. Res. 2024, 1–13. [Google Scholar] [CrossRef]

- Jain, R.; Reindorp, M.; Chockalingam, A. Buyer-backed purchase-order financing for sme supplier with uncertain yield. Eur. J. Oper. Res. 2023, 307, 758–772. [Google Scholar] [CrossRef]

- Lu, X.; Wu, Z. How taxes impact bank and trade financing for multinational firms. Eur. J. Oper. Res. 2020, 286, 218–232. [Google Scholar] [CrossRef]

- Zhen, X.; Shi, D.; Li, Y.; Zhang, C. Manufacturer’s financing strategy in a dual-channel supply chain: Third-party platform, bank, and retailer credit financing. Transport. Res. E Log. 2020, 133, 101820. [Google Scholar] [CrossRef]

- Jiang, L.; Cao, X.; Wang, Z.; Zhan, Y.; Zhang, J.; Chen, S. Promoting energy saving and emission reduction benefits in small and medium-sized enterprises supply chains through green finance-Evidence based on artificial intelligence intervention. Int. Rev. Financ. Anal. 2025, 102, 104112. [Google Scholar] [CrossRef]

- Wu, C.; Xu, C.; Zhao, Q.; Lin, S. Research on financing strategy of low-carbon supply chain based on cost-sharing contract. Environ. Sci. Pollut. Res. 2022, 29, 48358–48375. [Google Scholar] [CrossRef]

- Wang, Z.; Zhou, R.; Ma, Y.; Wang, Y. Carbon tax and low-carbon credit: Which policy is more beneficial to the capital-constrained manufacturer’s remanufacturing activities? Environ. Res. 2024, 246, 118079. [Google Scholar] [CrossRef]

- JD.com Announces Fourth Quarter and Full Year 2014 Results. Available online: https://ir.jd.com/static-files/1c0c4778-6ff2-4769-80ce-a95dac968a97 (accessed on 18 May 2025).

- The National Industry Finance Cooperation Platform Helps Enterprises Raise over One Trillion Yuan in Financing: Industry Finance Cooperation Empowers New Industrialization. Available online: https://paper.people.com.cn/zgjjzk/pc/content/202411/30/content_30046119.html (accessed on 2 June 2025).

- Cong, J.; Pang, T.; Peng, H. Optimal strategies for capital constrained low-carbon supply chains under yield uncertainty. J. Clean. Prod. 2020, 256, 120339. [Google Scholar] [CrossRef]

- Wu, D.D.; Yang, L.; Olson, D.L. Green supply chain management under capital constraint. Int. J. Prod. Econ. 2019, 215, 3–10. [Google Scholar] [CrossRef]

- Yang, H.; Miao, L.; Zhao, C. The credit strategy of a green supply chain based on capital constraints. J. Clean. Prod. 2019, 224, 930–939. [Google Scholar] [CrossRef]

| Literature | Carbon Reduction Behavior | Competition | Financing Mode | Research Method | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ELCB | CLCP | GLCP | OA | S-TC | C-TC | C-CC | IIF | SIF | HF | CC | GT | OM | |

| Xia et al. [2] | √ | √ | √ | √ | √ | √ | |||||||

| Zheng et al. [8], Yang et al. [9], Chen et al. [43], Liu and Gao [57] | √ | √ | √ | √ | √ | √ | |||||||

| Jena et al. [10], Feng et al. [61], Chen and Kieschnick [62], Kouvelis and Zhao [48] | √ | √ | √ | √ | |||||||||

| Luo et al. [11], Zhang et al. [35] | √ | √ | √ | √ | √ | √ | |||||||

| Shi et al. [12], Wu et al. [68], Liao and Zhang [63] | √ | √ | √ | √ | √ | √ | √ | ||||||

| Qin et al. [13] | √ | √ | √ | √ | √ | √ | √ | ||||||

| Shang et al. [14], Wang et al. [69] | √ | √ | √ | √ | √ | √ | |||||||

| Sun et al. [19], He et al. [20] | √ | √ | √ | ||||||||||

| Hu and Wang [21], Wang et al. [22], Hamidoğlu and Weber [27] | √ | √ | √ | √ | |||||||||

| Zhang and Yu [23], Du et al. [24], Zhou et al. [25] | √ | √ | √ | √ | √ | √ | |||||||

| Fu et al. [26], Choi [28], Cariou et al. [29], Lu and Wu [65] | √ | √ | √ | √ | √ | √ | |||||||

| Bian and Zhao [30], Tsay and Agrawal [31] | √ | √ | √ | √ | √ | √ | |||||||

| Yang and Zhou [32], Karray and Martín-Herrán [36] | √ | √ | √ | ||||||||||

| Chod et al. [34], Chen et al. [45] | √ | √ | √ | √ | |||||||||

| Ji et al. [39], Feng and Lu [40] | √ | √ | √ | ||||||||||

| Xia et al. [51], Nigro et al. [52], Deng et al. [53], Yan et al. [56] | √ | √ | √ | √ | √ | ||||||||

| Zhen et al. [66] | √ | √ | √ | √ | √ | √ | |||||||

| This paper | √ | √ | √ | √ | √ | √ | √ | √ | √ | ||||

| Symbol | Definition |

|---|---|

| Decision Variables | |

| Wholesale price of low-carbon products under scenario , with | |

| Carbon emission reduction investment level under scenario | |

| , | Order quantities of two retailers under scenario , , , |

| Model Parameters | |

| Market size | |

| Retail price of low-carbon products for retailer under scenario | |

| Unit production cost of low-carbon products | |

| Carbon emission reduction investment cost parameter | |

| Consumer low-carbon preference coefficient | |

| Competition intensity between retailers selling homogeneous products, | |

| Manufacturer’s financing interest rate, | |

| Bank credit interest rate, | |

| Equity financing proportion, | |

| Objective Functions | |

| Profits of retailers, manufacturer, and system under scenario where |

| Y = 1 | Y = 2 | Y = 3 | |

|---|---|---|---|

| - | |||

| - | |||

| - | |||

| Parameter | Value |

|---|---|

| 1000 | |

| 50 | |

| 6 | |

| 40 | |

| 5 | |

| 0.2 | |

| 0.1 |

| 0.00 | 1.5000 | 90.364 | 722.91 | 728.91 | 15.678 | 20.251 | 35.929 |

| 0.05 | 1.5750 | 90.336 | 722.69 | 728.99 | 15.668 | 20.238 | 35.907 |

| 0.10 | 1.6500 | 90.309 | 722.47 | 729.07 | 15.659 | 20.226 | 35.885 |

| 0.15 | 1.7250 | 90.282 | 722.25 | 729.15 | 15.650 | 20.214 | 35.864 |

| 0.20 | 1.8000 | 90.255 | 722.04 | 729.24 | 15.640 | 20.202 | 35.842 |

| 0.25 | 1.8750 | 90.227 | 721.82 | 729.32 | 15.631 | 20.190 | 35.820 |

| 0.30 | 1.9500 | 90.200 | 721.60 | 729.40 | 15.621 | 20.177 | 35.799 |

| 0.35 | 2.0250 | 90.173 | 721.38 | 729.48 | 15.612 | 20.165 | 35.777 |

| 0.40 | 2.1000 | 90.145 | 721.16 | 729.56 | 15.602 | 20.153 | 35.755 |

| 0.45 | 2.1750 | 90.118 | 720.95 | 729.65 | 15.593 | 20.141 | 35.734 |

| 0.50 | 2.2500 | 90.091 | 720.73 | 729.73 | 15.583 | 20.129 | 35.712 |

| 0.55 | 2.3250 | 90.064 | 720.51 | 729.81 | 15.574 | 20.116 | 35.690 |

| 0.60 | 2.4000 | 90.036 | 720.29 | 729.89 | 15.565 | 20.104 | 35.669 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, X.; Zhang, L.; Duan, C. Inclusive Internal Financing, Selective Internal Financing, or Hybrid Financing? A Competitive Low-Carbon Supply Chain Operational and Financing Strategies. Systems 2025, 13, 531. https://doi.org/10.3390/systems13070531

Zhang X, Zhang L, Duan C. Inclusive Internal Financing, Selective Internal Financing, or Hybrid Financing? A Competitive Low-Carbon Supply Chain Operational and Financing Strategies. Systems. 2025; 13(7):531. https://doi.org/10.3390/systems13070531

Chicago/Turabian StyleZhang, Xiaoli, Lin Zhang, and Caiquan Duan. 2025. "Inclusive Internal Financing, Selective Internal Financing, or Hybrid Financing? A Competitive Low-Carbon Supply Chain Operational and Financing Strategies" Systems 13, no. 7: 531. https://doi.org/10.3390/systems13070531

APA StyleZhang, X., Zhang, L., & Duan, C. (2025). Inclusive Internal Financing, Selective Internal Financing, or Hybrid Financing? A Competitive Low-Carbon Supply Chain Operational and Financing Strategies. Systems, 13(7), 531. https://doi.org/10.3390/systems13070531