1. Introduction

Climate change has emerged as a major challenge globally. The 2021 Sixth Assessment Report by the Intergovernmental Panel on Climate Change (IPCC) indicated that global warming is projected to exceed 1.5 °C relative to pre-industrial benchmarks and that there will be a marked increase in the frequency and intensity of extreme weather events, along with a significant rise in risks to ecosystems and human societies. Against this global backdrop, the signatories to the Paris Accord committed to capping global warming at 2 °C or less. Over the past four decades, China’s swift industrial progress has been characterized by a development pattern marked by “high input, high energy consumption, and high emissions”. This has exacerbated the conflicts among energy consumption, environmental degradation, and economic development [

1]. As the world’s largest carbon emitter, China proposed the ‘double carbon’ goal in 2020, targeting a carbon peak in 2030 and carbon neutrality by 2060 [

2]. In this policy context, the green transformation and low-carbon development of enterprises, which are at the core of the micro-market, have become a pivotal force in building the green economy and achieving the ‘dual-carbon’ goals.

Corporate green transformation results from the synergistic interplay of multiple factors. Existing studies have explored the antecedents of corporate green transformation from internal and external perspectives. Regarding internal factors, scholars have mainly focused on corporate endogenous motivations and stakeholder impacts. For instance, high-green-focused investors exert pressure on corporations through external channels like ESG-related discussions, incentivizing green transformation [

3]. Supply chain finance promotes the green transformation of heavy polluters by optimizing resource allocation and enabling risk sharing [

4]. Green financial policies promote the green transformation by increasing investor confidence and maximizing resource allocation [

5,

6]. Green financial instruments can significantly speed up the green transformation of non-polluting companies through productive property distribution. Regarding external factors, the green transformation of firms is immediately influenced by macro-environmental factors, industrial structures, and corporate financing capabilities [

7]. Corporate ESG ratings play a significant role in promoting green technological innovation and low-carbon transformation in a number of ways, including easing financing restrictions, encouraging environmental protection investments, refining governance structures, and improving market reputation [

8,

9].

Data elements constitute a strategic productive force in the digital economy, integrating with conventional factors—labor, capital, technology, and land—to establish the operational foundation of modern economic systems [

10]. Due to their inherent traits, such as non-exclusiveness, growing marginal utility, and high shareability, data elements have a unique role and enormous potential in the new economy [

11]. Data elements have become a major driver of China’s economy thanks to the rapid advances of information technology. Their broad inclusion in various industries gives companies’ green transformation a new lease of life. In order to facilitate low-carbon transformations in production processes, the National Development and Reform Commission has further stressed the value of encouraging synergy between data elements and green industries. Additionally, current studies demonstrate that data elements are becoming more significant as a novel production factor and can increase green total factor productivity [

12] through technological diffusion and industrial synergy. Furthermore, data factors play a crucial role in environmental governance by driving green technological innovation and optimizing energy structures, thereby significantly reducing carbon emission intensity [

12]. Data elements, as a novel production factor, exert significant influence on an enterprise’s total factor productivity. This impact operates through dual mechanisms: direct enhancement of multidimensional capability architectures, and indirect mitigation of internal information asymmetries coupled with reduced supply chain concentration, ultimately elevating corporate innovation performance [

13]. Current research also highlights that data elements may contribute to green transformation via pathways such as green process innovation [

14].

To further advance the integration of data elements with the green economy, the Chinese government established the National Big Data Comprehensive Pilot Zone (NBDPZ). Among the eight locations designated for NBDPZ by the State Council are Guizhou, Beijing, Tianjin, Hebei, and the Pearl River Delta. The goals were to research the market-based allocation of data components, promote cross-industry data sharing, and promote green technological innovation. Most recent studies have generally assessed the NBDPZ’s impact on regional scientific and technological innovation capacity, urban green transformation, industrial economic growth, and carbon emissions [

15,

16,

17]. The NBDPZ plan substantially increases urban land-use reliability thanks to a triple-intake system incorporating technological innovation, mitigation of resource misallocation, and industrial agglomeration. Additionally, there is an inward-moving trend regarding the policy effect [

18]. Also, scholars have focused on how the efficiency of various pilot policies affects data-driven development capabilities, finding that data elements significantly drive regional scientific and technological innovation capacity [

19]. Existing studies further indicate that the NBDPZ has gradually become a critical policy instrument for driving green transformation of business and enterprises by constructing a continuous mechanism between ‘data factors’ and ‘green innovation’. Through progressive, staggered, double-difference modelling from the perspectives of carbon emission growth rate and productivity [

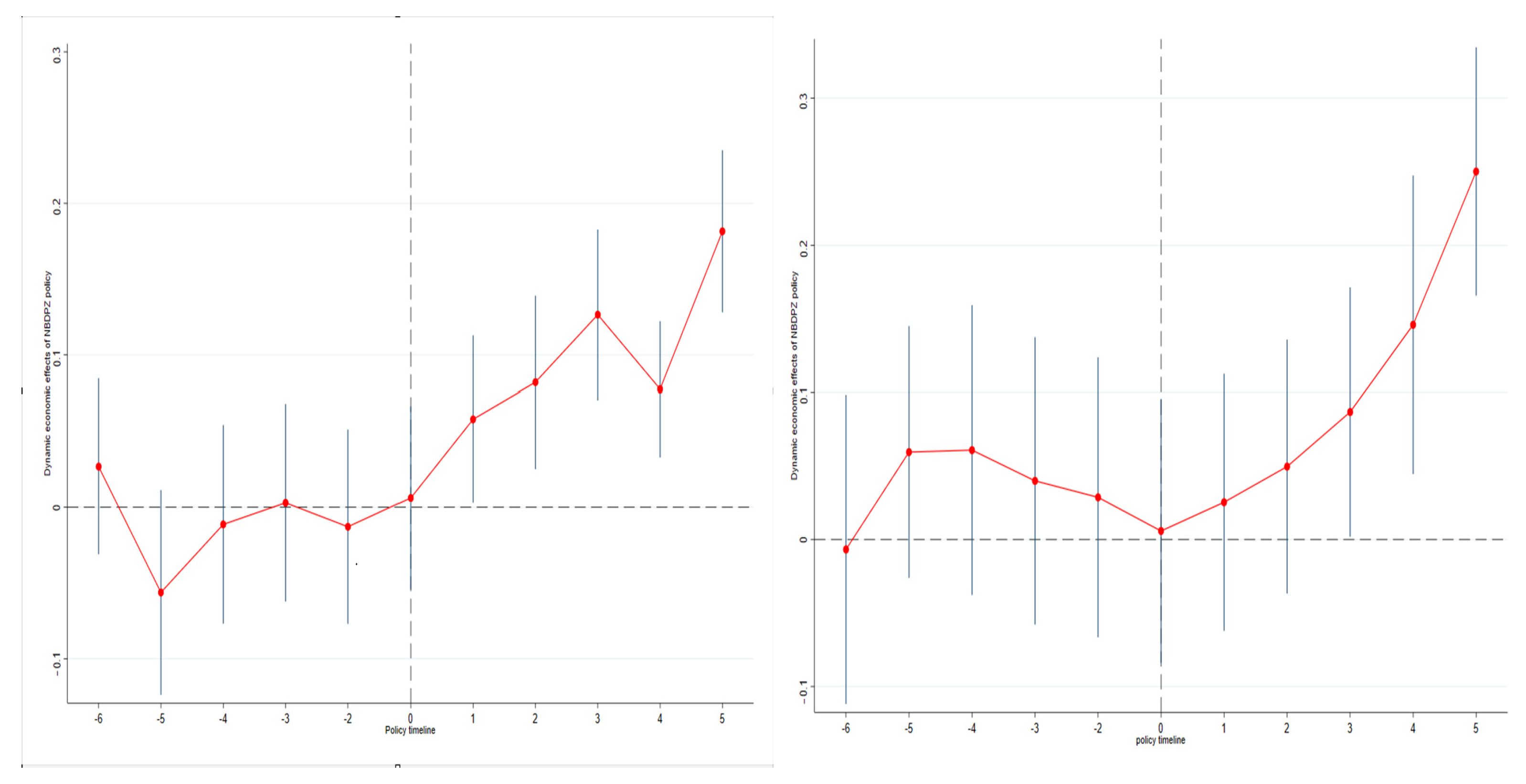

20], the NBDPZ policy effectively drives urban green transformation. The NBDPZ is a pioneer in the market-based reform of data factors, optimizing engineering resources via data trading businesses, assisting businesses in developing biological data software scenarios, and supporting regular industries in developing contemporary low-carbon models [

21,

22]. However, the literature does not adequately explore the casual relationship between data elements and corporate green transformation from the perspective of the NBDPZ policy.

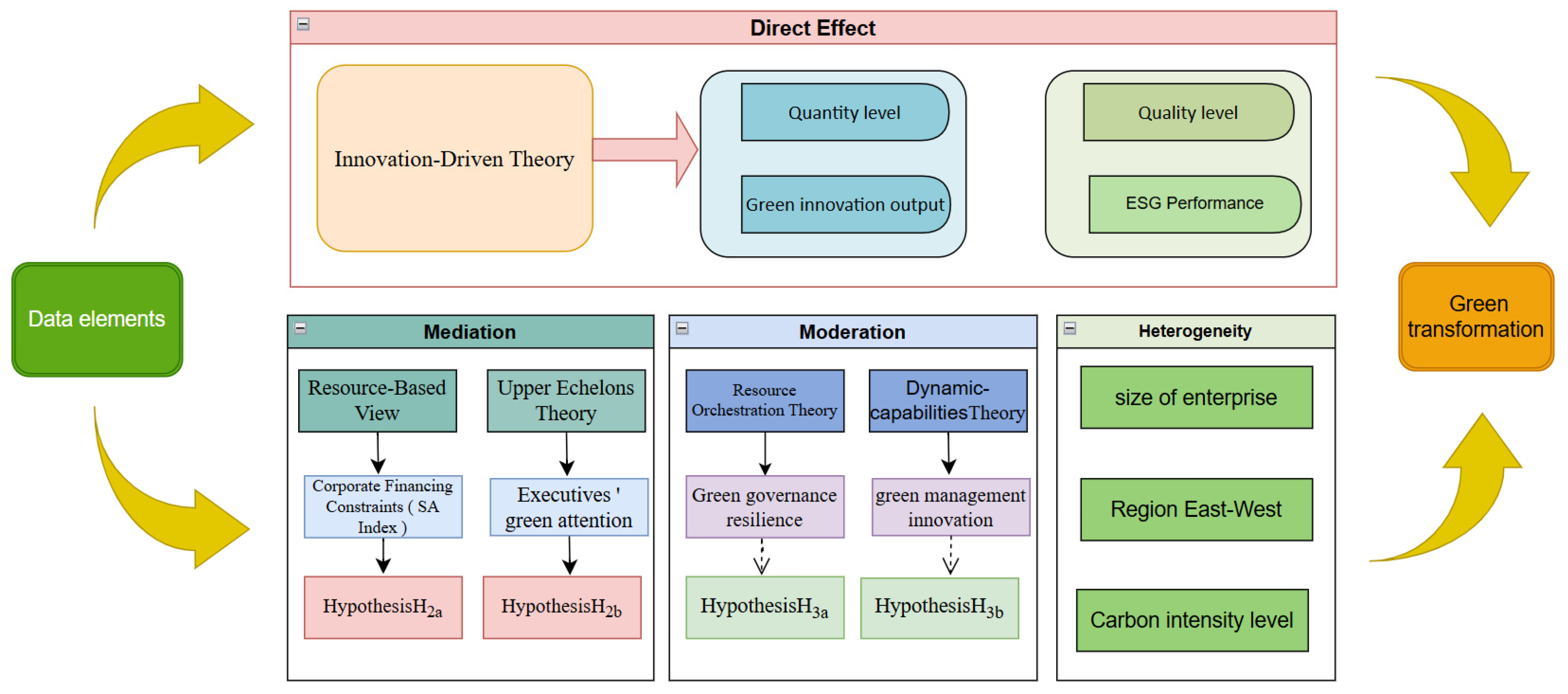

Compared with existing studies, the marginal contribution of our study mainly lies in the following factors. First, using the NBDPZ policy as a quasi-natural experiment and applying the staggered difference-in-differences method, we identify the causal impact of data elements on corporate green transformation according to innovation-driven theory, which enriches the literature about data elements’ consequences and the factors influencing corporate green transformation. Second, integrating resource-based theory and hierarchical echelon theory, we bring financing constraints and executive green attention into the theoretical framework and adopt the mediating effect model to analyze how these factors work in the transmission mechanism between data elements and corporate green transformation, shedding light on the previously understudied “black box” of corporate greening driven by data elements. Third, based on resource orchestration theory and dynamic capability theory, we introduce green governance resilience and green management innovation as moderating variables in the empirical design and examine their impact on the relationship between data elements and corporate green transformation from an organizational management perspective, clarifying the boundary conditions under which data elements can empower corporate green transformation.

6. Conclusions

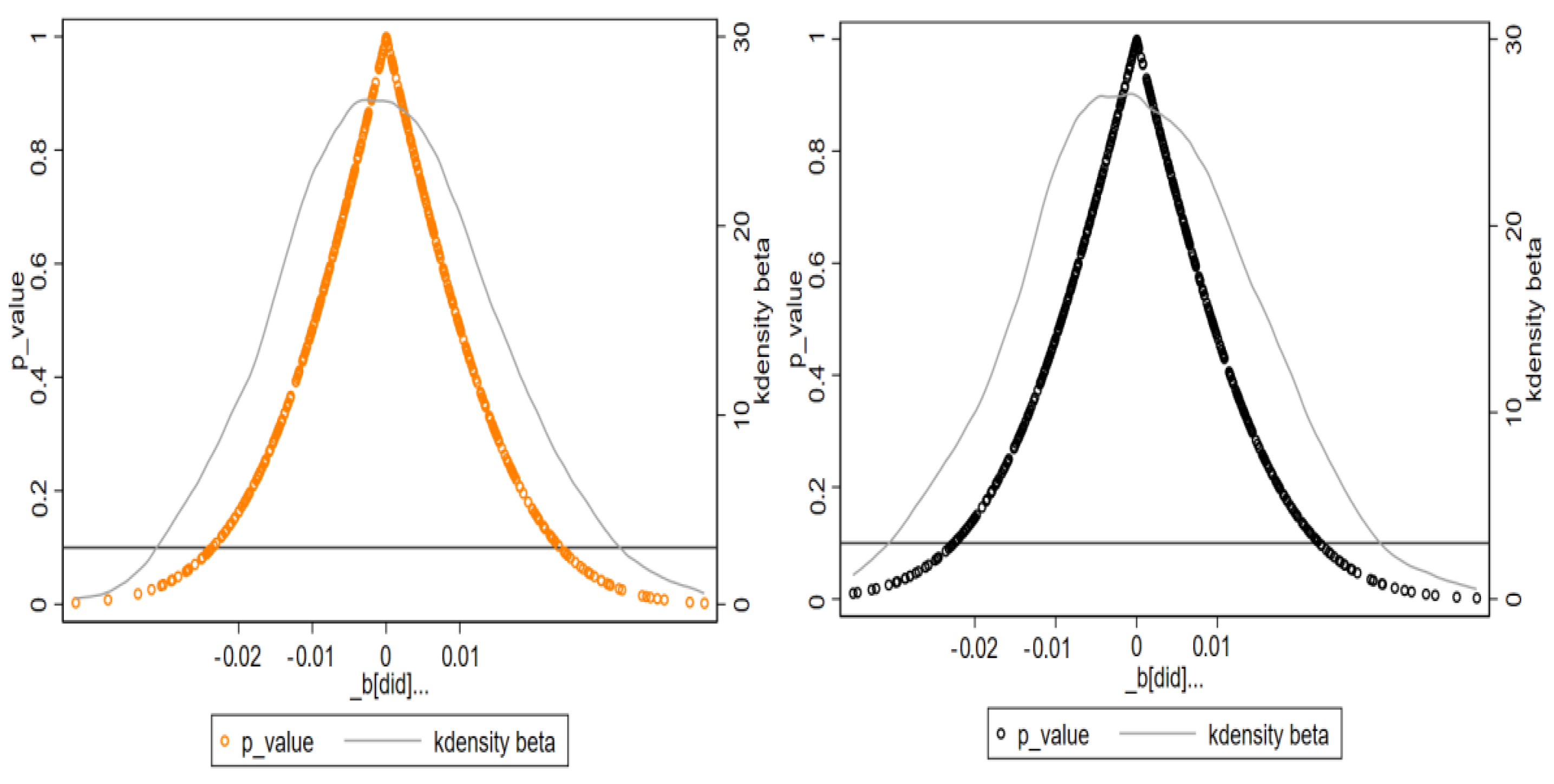

The National Big Data Comprehensive Pilot Zone is a key Chinese strategy for optimizing regional data element resource allocation and promoting corporate green transformation. This study used the staggered difference-in-differences method and data from listed companies from 2011 to 2022 to explore the casual impact of data elements on corporate green transformation and the mechanisms behind it. The findings are as follows: (a) Data elements significantly promote corporate green transformation, particularly in driving green innovation at the action level. These results were found to be robust in various robustness checks; (b) Data elements alleviate financing constraints and increase executive green attention, thereby facilitating corporate green transformation; (c) Green management innovation and governance resilience positive moderate the promoting effect of data elements on corporate green transformation; (d) A heterogeneity analysis showed that the positive impact of data elements on corporate green transformation is more obvious in large-scale, eastern regions and high-carbon emission intensity corporations.

This study has significant theoretical implications. First, from a theoretical standpoint, it extends the existing literature and systematically elucidates how data elements, as a novel type of production factor, enable the green transformation of corporate. This study enriches the literature on data elements and corporate green transformation within innovation-driven theory and provides a foundation for understanding the synergy between digital and green initiatives. Second, it combines the resource-based view and upper echelons theory to explore the mediating mechanism of data elements in corporate green transformation. By introducing the SA index and EGA as mediators, it clarifies how data elements affect this process and offers theoretical insights into their impact on corporate green transformation. Third, drawing on resource orchestration and dynamic capability theories, it examined how GGR and GMI moderate the effect of data elements on corporate green transformation. This provides an innovative viewpoint for examining corporate sustainability within the evolving digital economic landscape.

This study has several practical implications. Given the importance of corporate green transformation in terms of achieving the ‘dual-carbon’ goals and sustainable development, empowering corporations with data elements provides a feasible way forward. First, the baseline regression findings indicated that the NBDPZ policy is exerting a significant positive impact on corporations’ green transformation, with a particularly pronounced effect on GIO. We recommend that the government augment its financial support for the NBDPZ policy, steadily broaden the scope of policy pilots, and conduct regular evaluations of policy implementation efficacy. This involves setting up experimental zones in regions with a well-established digital economy base and considerable industrial development potential. Second, the implementation of differentiated regional strategies is imperative. Based on the results of the heterogeneity analysis, we suggest scaling up the NBDPZ policy primarily within eastern and central regions. By establishing a comprehensive data element platform with extensive coverage, the government can facilitate the efficient circulation and sharing of data elements among enterprises, which, in turn, would support their endeavors in green transformation. For corporations located in western regions, initial steps should involve strengthening training programs and promotional activities aimed at cultivating digital talent while also enhancing digital infrastructure to improve overall digital accessibility. Lastly, local governments may introduce relevant policies and regulations designed to incentivize enterprises with varying carbon intensities toward achieving green transformation goals. For enterprises characterized by high carbon emission intensity, setting emission reduction standards along with providing incentives for ESG performance and GIO initiatives could effectively guide them toward sustainable practices.

This study also had several limitations. First, there were certain limitations regarding the sample selection and research context. This study exclusively focused on Chinese A-share listed firms and did not include MSMEs. Moreover, the research unfolded within a particular national regulatory setting, which made it difficult to generalize the findings to other countries or economic systems with different institutional traits. As a result, the broader applicability of our results is restricted. Future research could contemplate including MSMEs in the sample and extending the investigation to diverse institutional contexts to evaluate the generalizability of the paper’s findings. Second, the mechanism analysis could be further expanded. Unexamined mediating or moderating variables, such as enterprise digital capabilities and regional innovation ecosystems, might influence the data elements and green transformation relationship. Third, our analysis relied solely on the NBDPZ policy for data-element shocks, neglecting other relevant policies like the ‘East Counts, West Counts’ project. Future research could explore how multiple policy shocks affect corporate green transformation. Fourth, although our study comprehensively utilized classical theories such as the RBV, UET, ROT, and DCT to analyze the influence mechanisms of data elements on corporate green transformation, it failed to introduce a new theoretical paradigm. Future research should strive to go beyond traditional theoretical boundaries to explore novel theoretical categories.