Abstract

With the shift of the global innovation model from traditional closed-loop to open ecosystems, knowledge sharing and collaborative cooperation among firms have become key to obtaining sustainable competitive advantages. However, existing studies mostly focus on the static structure, and there is an insufficient exploration of the dynamic evolutionary mechanism and multi-party game strategies. In this paper, a two-dimensional analysis framework integrating the evolutionary game and the Lotka–Volterra model is constructed to explore the behavioral and strategic evolution of core enterprises, SMEs and the government in the innovation ecosystem. Through theoretical modeling and numerical simulation, the effects of different variables on system stability are revealed. It is found that a moderately balanced benefit allocation can stimulate two-way knowledge sharing, while an over- or under-allocation ratio will inhibit the synergy efficiency of the system; a moderate difference in the knowledge stock can promote knowledge complementarity, but an over-concentration will lead to the monopoly and closure of the system; and the government subsidy needs to accurately match the cost of the openness of the enterprises with the potential benefits to the society, so as to avoid the incentive from being unused. Accordingly, it is suggested to optimize the competition structure among enterprises through the dynamic benefit distribution mechanism, knowledge sharing platform construction and classification subsidy policy, promote the evolution of the innovation ecosystem to a balanced state of mutual benefit and symbiosis, and provide theoretical basis and practical inspiration for the governance of the open innovation ecosystem.

1. Introduction

Amidst an accelerating global market and technological integration, traditional innovation models have become increasingly inadequate in navigating complex, dynamic market environments [1]. As inter-firm boundaries progressively blur, this drives greater openness in knowledge sharing [2,3]. Consequently, innovation activities are evolving from isolated endeavors towards open collaboration [4]. Within this context, the open innovation ecosystem has emerged as a new paradigm. The open innovation ecosystem emphasizes the two-way flow of internal and external knowledge, shares innovation resources through open borders, “sharing is win-win” [5], and realizes co-development with partners to break through the limitations of the traditional organizational structure [6].

Further encouraging enterprises, users, universities, scientific research institutions and other subjects to collaborate under the framework of knowledge openness to promote the technological progress of enterprises and market adaptation [7,8] has gradually become a strategic choice for enterprises to obtain sustainable competitive advantages [9,10,11]. For example, Tesla has opened up its patents to promote the harmonization of technical standards and industry development in the new energy vehicle market [12].

Currently, the open innovation ecosystem is accelerating to become an important paradigm for industrial change, but its synergistic mechanism and governance system still face challenges [13]. For example, the benefit distribution mechanism of different subjects in the process of the value co-creation of innovation projects is still imperfect; insufficient openness, the high cost of sharing, and deepening contradictions between openness and sharing have become common problems in the innovation ecosystem [14].

Therefore, there is an urgent need to re-examine the evolution of open innovation ecosystems from a dynamic and interactive perspective and explore how multiple actors can form a stable cooperative and symbiotic relationship in the game. This paper innovatively integrates evolutionary game theory and the Lotka–Volterra model to construct a two-dimensional analytical framework: the former reveals the dynamic game process of knowledge opening and exclusive strategies among enterprises, and the latter simulates the interaction law of population size under the constraints of macro resources. Through theoretical modeling and numerical simulation, we systematically analyze the influence of different parameter combinations on the evolution path, refine the stability conditions of equilibrium strategies, and address the following three core research questions: first, how do heterogeneous firms realize the synergistic evolution of knowledge sharing behaviors through strategic adjustments in a dynamic competitive situation? Second, how do the key factors of subject decision-making and government subsidy policy affect the stability and efficiency of the system? Third, how does one promote the equilibrium leap from “isolation and stagnation” to the “mutual benefit and symbiosis” of heterogeneous subjects through institutional design?

The contribution of this paper is reflected in three aspects: First, it breaks through the traditional static analysis paradigm and reveals the dynamic coupling mechanism between the strategic interaction of multiple subjects and the evolution of the system, which makes up for the inadequacy of the existing research in the interpretation of the transmission path of micro-behavior to the macro-structure. Secondly, a synergistic regulatory framework of the “benefit distribution–knowledge difference–policy incentive” is proposed to provide a basis for balancing the efficiency and risk of openness. Thirdly, combined with the practice of enterprises in a real situation, policy suggestions such as categorized subsidies and dynamic benefit distribution are put forward to promote the transformation of open innovation ecosystems from a theoretical model to a governance tool. This not only expands the connotation of innovation ecosystem theory but also provides decision-making references for the government and enterprises to optimize the competitive relationship and build a sustainable synergistic mechanism.

2. Related Work

Existing studies have shown that the evolution of open innovation ecosystems is not only driven by technological complexity and relies on interdependence, social exchange and trust among enterprises but is also closely related to the game strategies and population dynamics among the participating subjects [15], which is specifically embodied in the behavioral differences and interaction logics among different subjects in the process of acquiring, transforming and sharing knowledge [16].

The game strategy determines the tendency of cooperation or competition between subjects, and the population dynamics reflects the change and evolution direction of the group structure, which together affect the stability and synergy of the ecosystem [17]. The open innovation ecosystem is essentially a dynamic ecosystem that evolves synergistically in competition and symbiosis [18].

2.1. Open Innovation Ecosystems

Regarding the theoretical framework, current research mainly focuses on platform strategy, enterprise connectivity, knowledge collaboration ability and other analytical frameworks for open innovation [19], showing a trend of transitioning from an individual enterprise perspective to an ecological network perspective and gradually forming a theoretical explanation system under a multi-dimensional perspective [20]. West and Gallagher [21], through their study of open-source software ecosystems, reveal the strategic logic of platform-led enterprises to reduce technical complexity and improve system adaptability through modular architecture, which provides an important perspective to understand how platforms can guide peripheral innovations through structural design. Liang Mei, Tao Zhang & Jin Chen [22] study the impact of inter-firm connectivity on open innovation in small and medium-sized enterprises (SMEs) from the perspective of innovation ecosystems. Radziwon, A. & Bogers, M [23] explored how small and medium-sized enterprises (SMEs) can achieve open innovation through cross-organizational collaboration in business ecosystems. Costa, J. & Matias, J.C.O. [24] explored how open innovation 4.0 can contribute to the establishment of sustainable innovation ecosystems, proposing a multilevel role of innovation ecosystems. Masucci, M., Brusoni, S. & Cennamo, C. [25] explore how firms can address technological bottlenecks in their business ecosystems through the strategic use of outward-looking open innovation (OOI). The study shows that SMEs face the challenge of relying on external partners to complement their internal innovation activities, while limited resources make it difficult for them to manage the OOI process.

2.2. Knowledge Sharing Behavior in Open Innovation Ecosystems

In the field of knowledge sharing, current research mainly interprets the behavior of “knowledge sharing” in terms of the coupling and interaction among “knowledge–institution–value” and emphasizes the key role of institutional design in promoting the synergy of knowledge and the balance of benefits. The key role of institutional design in promoting knowledge synergy and benefit balance is emphasized [26,27]. Bogers [28] systematically constructed a dual synergistic framework of knowledge flow–value appropriation and systematically explained the coupling mechanism of an intellectual property system and knowledge sharing incentives, revealing how firms can realize the balance between knowledge sharing and value capture through the design of the governance mechanism in open innovation ecosystems. Öberg, C. & Alexander, A.T. [29] explored inter-firm knowledge transfer links in open innovation ecosystems and analyzed the degree of openness of different inter-firm links and its impact on knowledge management in the context of the innovation management and general management literature. It is pointed out that the “openness” of open innovation is not a single dimension but a combination of the strength of inter-firm knowledge links, the quality of collaborative relationships and the degree of cultural fit and that firms need a trade-off between “more connections” and “more risk”. Ferreira, J.J. and Teixeira, A.A.C. [30] explore the role of open innovation and knowledge in promoting business ecosystems, emphasize the integration of innovation management and open innovation theory, and analyze how different companies can improve the overall performance of business ecosystems through open innovation networks and knowledge flows.

2.3. Evolutionary Games and the Lotka–Volterra Model

Evolutionary games, as an important branch of game theory, break through the assumption of complete rationality in traditional game theory. Wenbin Wang [31] pointed out that evolutionary game theory takes an evolutionary stable strategy (ESS) as the core, emphasizing limited rationality and the dynamic adaptation mechanism [32]. Subsequently, the theory has been continuously extended to asymmetric games, multi-subject games and other directions, enriching its analytical framework [33,34,35,36]. Guanbing Zhao [37] constructed an evolutionary game model of tacit knowledge sharing between upstream and downstream enterprises in the supply chain based on knowledge potential difference. It is found that a moderate knowledge potential difference can effectively promote tacit knowledge sharing, while too large or too small knowledge potential differences may inhibit sharing behavior.

Based on the evolutionary game theory, Qigang Yuan [14] systematically analyzes the evolutionary mechanism of an open sharing relationship in innovation ecology. The study reveals the profound influence of innovation resource value, sharing cost, irrational factors and default cost on the open sharing behavior of innovation ecology. Shen Zhang [38] constructs a three-party evolutionary game model including scientific data demanders, data providers and open sharing platforms and discusses in depth the interaction of interests of the three parties and the evolution of strategies. The study points out that the demanders’ willingness to pay is the key factor to promote the open sharing of scientific data, while the monitoring mechanism of the open sharing platform and the incentives and penalties for data providers significantly affect the positive sharing strategy of the providers.

The Lotka–Volterra model was originally proposed by ecologists to describe the competitive, predatory and symbiotic relationships among biological populations [39,40]. In terms of specific applications, in recent years, the model has been widely used in the fields of economics, management and social sciences to analyze the dynamic interactions and synergistic evolutionary mechanisms of multiple subjects [41,42]. Based on the Lotka–Volterra model, Wenqi Duan [43] constructed a dynamic evolution model of two-body startups and supporting resource organizations and three-body mature enterprises in the ecosystem of crowdsourcing space, which breaks through the traditional organizational boundaries and provides a quantitative basis for optimal resource allocation. Xu Yang [44] combined the Lotka–Volterra model with the DPSIR framework to construct a symbiotic system between the digital economy and real economy under the constraints of resource and environmental carrying capacity, which reveals the non-linear characteristics of “digital–physical” synergy. Qing Lu [45] also uses the evolutionary game and the Lotka–Volterra model to analyze the low-carbon transition of industrial gas emitters, which supports the dynamic optimization of the policy.

2.4. Review

In summary, existing research focuses on the analysis of the static structure of the system, often generalizing the ecosystem dynamics or focusing on a single interaction mode, ignoring the more complex systematic mechanism of the dynamic evolutionary process of mathematical modeling and game mechanism. This study innovatively integrates the evolutionary game and the Lotka–Volterra model to construct a two-dimensional analysis framework; the former reveals the dynamic game process between knowledge opening and exclusive strategies of the participating subjects, and the latter simulates the interaction law of the knowledge population between strategy selection and population size. This study verifies the validity of the model through parametric simulation. This cross-method integration not only breaks through the limitations of traditional case studies in dynamic modeling but also makes up for the shortcomings of a single mathematical model in the portrayal of the game subject’s behavior, which provides a theoretical basis and decision-making support for enterprises to build open innovation ecosystems.

3. Model

3.1. Research Hypotheses and Parameterization

With the intensification of innovation patterns and the convergence of uncertainties in innovation ecosystems, the innovation capacity of individual closed firms is increasingly being challenged. The choice of government, core enterprises and SMEs as the subjects of the game stems from the significant differences in their resource endowments, technological capabilities and economic logic.

In the study of innovation ecosystems, the division of core enterprises and SMEs is mainly based on the three dimensions of resource endowment, technological capability and the economic logic of knowledge sharing behavior. First, in terms of resource endowment and market position, core enterprises dominate the market by virtue of rich knowledge reserves and sufficient capital and significant market control, and their knowledge sharing behaviors aim to consolidate their competitive advantages by integrating external resources, while SMEs are constrained by their insufficient accumulation of knowledge and limited market share and need to realize capability leapfrogging through knowledge sharing. Secondly, in terms of technological capability and knowledge structure, core enterprises have strong knowledge integration and collaborative innovation capabilities, and their complex and specialized knowledge systems can generate higher direct information benefits, while SMEs rely on complementary external knowledge and enhance their technological capabilities through open learning, but their knowledge structure is relatively homogeneous. Finally, at the level of economic logic, core enterprises have higher costs of openness but have a dominant share of the benefits and need to weigh monopoly gains against synergy risks, while SMEs rely more on external support to fill the benefit gap due to the low weight of benefit sharing.

Core enterprises usually have more resources, technological advantages and market influence and tend to accelerate innovation by acquiring external resources through open innovation, while SMEs may face a shortage of resources and, at the same time, may realize reverse knowledge spillovers through the accumulation of knowledge and capacity, which may contribute to the ecosystem’s structural leap [46].

In addition, the government plays a balancing role in the openness strategy, and government subsidies can promote proactive patent openness and mitigate technological competition and asymmetry among firms [47]. The choice of each other’s behavior not only affects their respective development strategies but also reflects the competition and cooperation in the market, especially in the context of innovation transformation, SMEs tend to need to share knowledge to improve their innovation capabilities, while core enterprises realize the expansion of their market share through knowledge sharing.

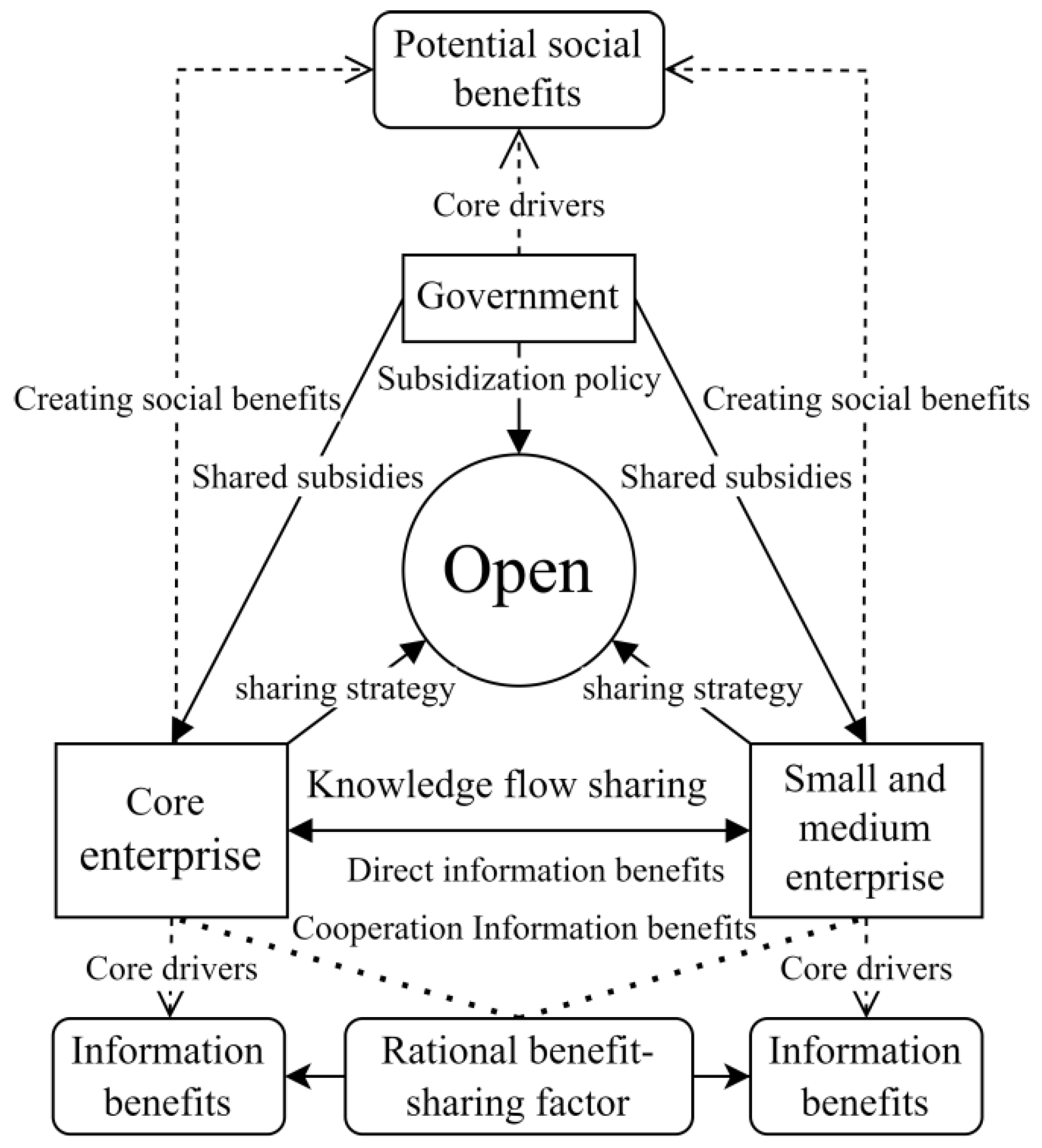

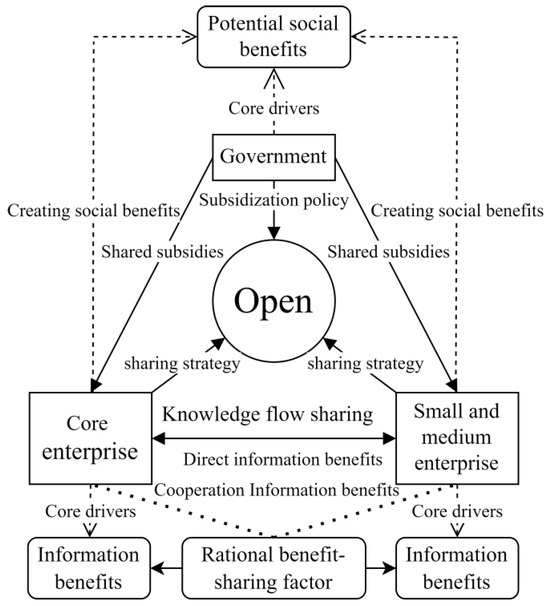

Therefore, the main players of the game are the government, the core group of enterprises and the group of SMEs. Each individual shows limited rationality and makes decisions based on limited information and continuously adjusts behavioral strategies based on the results of the decisions, regarding whether or not to open up to reach the equilibrium point in the evolutionary game. The game relationship between each subject is shown in Figure 1.

Figure 1.

Game relations between subjects.

H1.

Core enterprises adopt strategy set A = {share, do not share}, and SMEs adopt strategy set B = {share, do not share}. The Government’s Strategy Set G = {subsidize, do not subsidize}. The probability that the core enterprise chooses to “share” is , The probability of SMEs choosing “sharing” is . The probability of the government choosing “subsidize” is . It is worth noting that .

H2.

As knowledge sharing behavior leads to the opening of technological barriers, it generates information benefits, which are composed of three main components: direct information benefits, cooperative information benefits, and knowledge sharing costs [48]. Direct information benefits: self-efficacy, synergies, absorptive capacity, etc., have been proposed as key factors for open innovation [49].

H3 .

The knowledge structure within the firm is , and the self-efficacy is , then the information gain of core enterprise A in choosing to share knowledge is the gain that can be obtained from firm B in cross-organizational knowledge sharing, denoted by [50]. denotes the subject’s existing knowledge stock.

H4.

Collaborative information gain: The interaction of knowledge sharing and knowledge learning generates collaborative information gain. denotes the amount of non-overlapping knowledge between the two. denotes the knowledge absorption capacity of the subject and object organizations, which determines whether they can effectively identify, absorb and transform external heterogeneous knowledge, which in turn affects the effectiveness of boundary-crossing search for breakthrough innovations [51]. The revenue sharing coefficient of open creation is , and the revenue from cooperative information obtained by core enterprise A is . SME B receives a cooperative information benefit of . The potential gain to the government through knowledge sharing behavior is .

H5.

Environmental constraints: denotes the number or size of population i. denotes the environmental carrying capacity of a single population, is the first mover advantage when only one party chooses to share and the other chooses to be closed, and the open party obtains implicit potential benefits because of its good reputation, its influence on the industry standard and so on, whereas when the core enterprises and small and medium-sized enterprises all choose to share, this behavior will not obtain the first mover benefits for the subject. denotes the coefficient of government subsidy due to the openness of enterprises; the amount of the subsidy is determined according to the knowledge stock of open subject , and the amount of the subsidy is is synergistic capacity, which represents the amount of knowledge possessed by unit B that is available to unit A as a proportion of the total for unit B. Similarly, it represents the proportion of knowledge possessed by unit A that can be used by unit B to the total of A.

H6.

Behavioral cost: is the knowledge sharing cost coefficient. Knowledge sharing cost is divided into knowledge transfer cost and capability difference cost, which mainly originates from the cost arising from the leakage of knowledge due to the unidirectional export of knowledge by the subject and object organizations, as well as the loss of core competitiveness due to the export of knowledge related to core competitiveness.

From the Joseph [52] cost function, the cost of knowledge sharing is a curvilinear increasing function of the amount of knowledge sharing. The cost of understanding in knowledge sharing behavior is . is the cost of government strategy implementation, and denotes the loss of government credibility due to government inaction.

According to the model assumptions and parameter settings, the parameters of the tripartite evolutionary game model of the manufacturer, government and public and their definitions are shown in Table 1.

Table 1.

Description of model parameters and significance.

3.2. Model Building

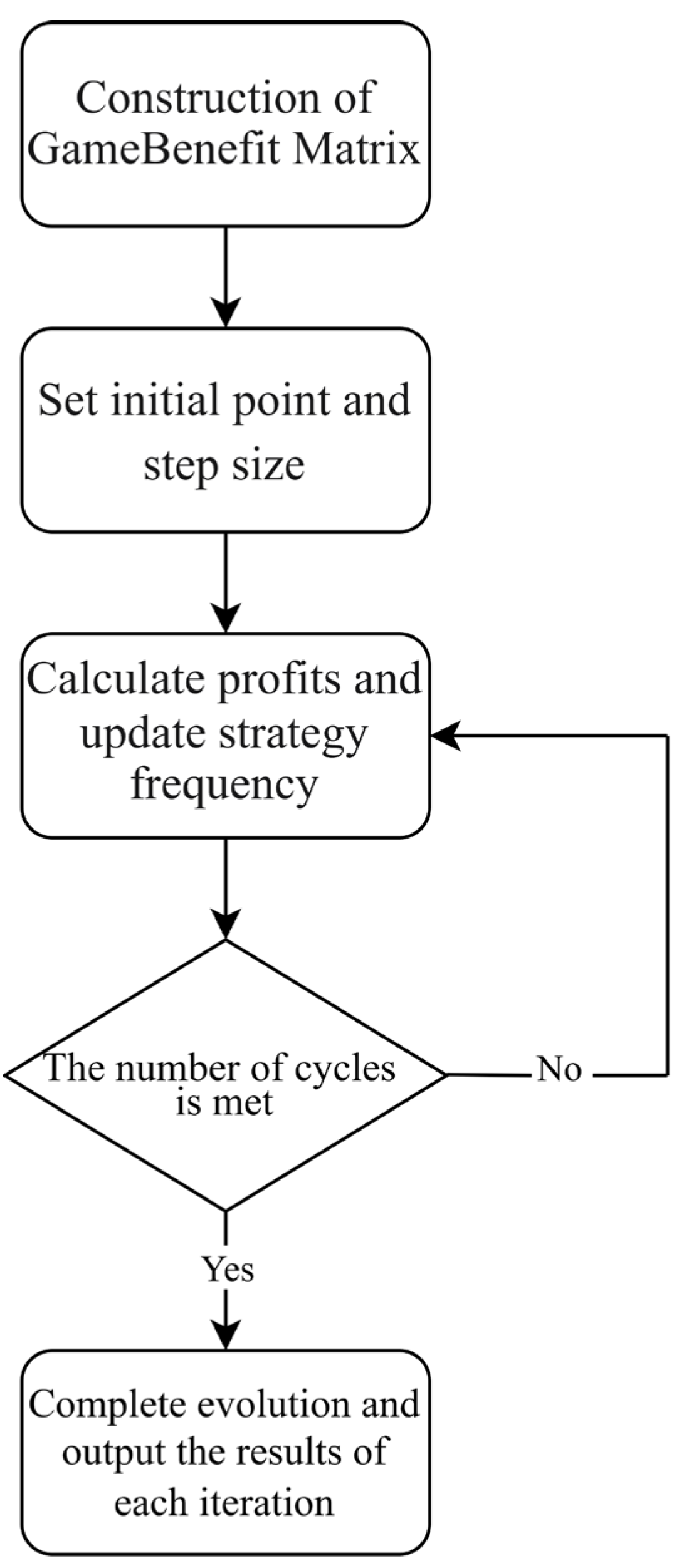

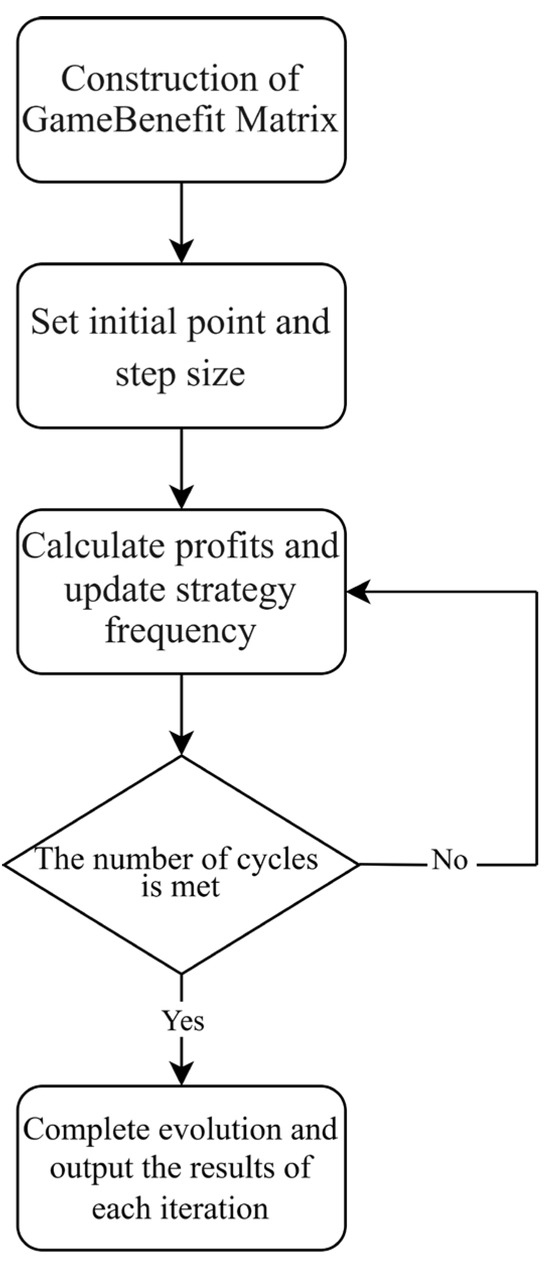

The usual evolutionary game process is shown in Figure 2, where the replication dynamic equation used to update the strategy frequency is . From the equation, the increase in the probability of choosing strategy x per unit time is the difference between the existing probability multiplied by the expected return of strategy x and the average expected return. The equation has good descriptive ability when the perspective of the study is put on several rational individuals. However, with the introduction of group latitude, the game players also need to consider the resource constraints in the macro-environment, and this implicit pressure from the macro-environment will also be reflected in the outcome of the game. Moreover, traditional sensitivity analysis only compares strategy adoption rates with game outcomes, failing to provide an intuitive representation of ecosystem-scale population dynamics. This leads to the introduction of the Lotka–Volterra competition model, which is widely used to describe the competition, predation, symbiosis and cooperation among species and is also commonly used in economics to portray the competitive trends in strategies, industries, markets and so on (see Formula (1)).

where r1 and r2 represent the natural population growth rate, N1 and N2 represent the population size, and represent the competition coefficient, and M1 and M2 represent the environmental carrying capacity. From the formula, the model utilizes () as the macroscopic external competition and natural resources on the natural growth of the population limits.

Figure 2.

Evolutionary game process diagram.

However, a limitation exists: the natural growth rate—an ecological concept—serves only as a macro-level proxy when applied to organizational entities, failing to capture firm-level dynamics.

Combining the two equations, i.e., replicating the dynamic equation combined with the Lotka–Volterra competitiveness model, describes the process of transforming the behavioral patterns among firms and, at the same time, can help to measure the impact of the resource situation on firms’ knowledge sharing behaviors in the macro-environment and realize the combination of the macro- and the micro-environments. The improved Lotka–Volterra competition equation is shown in Equation (2). In the following simulation, the improved Lotka–Volterra competition equation will be combined to reflect the effects of different strategies and parameter sensitivities on the final development of the innovation ecosystem as a whole.

4. The Construction of a Three-Party Evolutionary Game Model

4.1. Game Payoff Matrix Construction

According to the assumptions and parameter settings in the previous section, the benefits of the game for the three parties in the open innovation ecosystem are categorized into eight scenarios, and the benefit matrices are shown in Table 2 below.

Table 2.

Game payoff matrix for three parties in open innovation ecosystems.

When both core enterprises and SMEs choose to share, for core enterprise A, the firm receives government subsidies based on knowledge stock , direct information gains , and cooperative gains created by knowledge sharing behaviors and loses the corresponding costs due to sharing behaviors.

For SME B, the composition of cooperative benefits created by sharing behavior is . When one firm shares and the other does not, the firm that chooses to share incurs a cost of sharing, , and the one that chooses not to share suffers a reputational loss, H. In particular, when both firms do not share, core enterprise A maintains a lead . Whether or not the firm that chooses to share receives a subsidy depends on whether or not the government chooses subsidization. For the government, it receives full or partial direct benefits and potential benefits depending on whether it shares or not and pays administrative cost . It loses cost depending on whether it subsidizes or not. If neither core enterprises nor SMEs share and the government does not act aggressively to subsidize, the government suffers loss v from declining credibility.

4.2. Model Building for Solving

According to the three-party benefit matrix in Table 2, the expected benefit () of core enterprise A adopting the “share” strategy, the expected benefit () of adopting the “do not share” strategy, and the total expected benefit () are shown in Equation (3), Equation (4), and Equation (5), respectively:

Based on the tripartite benefit matrices in Table 2, SME B’s expected benefits for firms adopting the “share” strategy (), the expected benefits for firms adopting the “do not share” strategy (), and the total expected benefits for firms () are shown in Equations (6), (7) and (8), respectively:

Based on the tripartite payoff matrices in Table 2, the expected payoffs to firms with a “subsidized” strategy by government G (), the expected payoffs to the government with a “non-subsidized” strategy (), and the total expected payoffs to the firms () are shown in Equations (9), (10) and (11), respectively:

4.3. Analysis of Equilibrium Strategies in Evolutionary Game Models

Further to the overall analysis of the three-party system, it is obtained that there is no internal equilibrium point in the solved equations when the three-dimensional dynamical system of the evolutionary game F(x) = 0, F(y) = 0, F(z) = 0, and therefore, eight equilibrium points can be found, as shown in Table 3.

Table 3.

Equilibrium point stability analysis.

To determine evolutionarily stable strategies (ESSs), we assess the local equilibrium stability via Jacobian matrix eigenvalues: it is unstable if all eigenvalues are positive, a saddle point with mixed-sign eigenvalues, and asymptotically stable when all eigenvalues are negative. The stability of the equilibrium points of E1~E8 is analyzed as shown in Table 4.

Table 4.

Equilibrium point stability conditions.

Due to the large number of possible stabilization scenarios, six possible stabilization equilibria are selected for discussion on the basis of ensuring generality and typicality.

E1(1,1,1) becomes the stable equilibrium strategy point of the game when , i.e., when the potential benefits to the government are sufficient to cover the cost of government subsidies and management costs, and , i.e., when the benefits of sharing and cooperation, government subsidies, and potential reputational pressures on Firm B are greater than the costs of sharing. In this case, the possible benefits of each other are greater than the possible costs of sharing and subsidizing, which is also the most common approach, but it is worth noting that the satisfaction of this condition does not necessarily mean that it will converge to this stability; there may still be other stable points in the system, and the final evolution still needs to be analyzed in the context of the initial point and other circumstances. Under this structure, the three main actors in the system form a synergistic positive feedback mechanism: the core enterprises and SMEs have incentives to share knowledge and cooperate, the government is willing to intervene in the form of subsidies, and the behavior of the three parties provides mutual incentives, constituting a highly coupled, mutually beneficial and win–win dynamic relationship within the ecosystem. Compared to other equilibrium points, this state is the target state with the most evolutionary values because of the efficient allocation of innovation resources, the maximization of knowledge sharing and technology diffusion, the high degree of connectivity of the open cooperation network, and the strong overall system effectiveness.

E2(1,1,0) becomes the stable equilibrium strategy point of the game when ,, i.e., when the potential government subsidy benefits are greater than the operating costs for firms, and , i.e., when potential benefits R are lower than some of the regulatory and subsidy costs for the government. Interestingly, in this case, when the potential benefits are lower than the costs, the government will not choose to subsidize to save costs. However, as long as the possibility of a subsidy exists and the subsidy is attractive enough, even if the subsidy will not be implemented in the end, it can still provide a sufficiently effective incentive for firms to share and form a stable equilibrium strategy point in the system. This situation is representative in reality, especially in the case of limited government financial resources or a high threshold of subsidy implementation, where the signaling effect of the subsidy policy may be sufficient to drive the decision of knowledge sharing. From the perspective of system operation, this equilibrium point can reduce the burden of public expenditure to a certain extent and stimulate cooperation among enterprises, but there is a certain risk of instability: once enterprises lose confidence in the subsidy, knowledge sharing behavior may be quickly withdrawn. Therefore, although this state is stable, its maintenance depends on the credibility of policy signals and the effectiveness of subsidy expectation management.

E3(1,0,1) becomes the stable equilibrium strategy point of the game when , , , i.e., for core enterprises, the possible knowledge sharing cooperation benefits, monopoly advantage and reputation potential pressure are greater than the cost of sharing; SMEs’ knowledge sharing benefits, monopoly advantage, and reputation potential pressure are less than the cost of sharing; the government’s potential social benefits are greater than the cost of management and subsidy; and core enterprises share, SMEs do not, and the government subsidy becomes a stable equilibrium. Under this equilibrium structure, the system mainly relies on government incentives to promote the release of knowledge resources by core enterprises, but the synergistic effect of the system is limited by the fact that SMEs choose not to participate, and the cooperative structure is asymmetric. More importantly, SMEs have obvious “free-riding” behaviors in this structure: they do not participate in the sharing but indirectly benefit from the shared outputs of the core enterprises, such as knowledge spillovers and market connections. This structure places higher demands on governments, whose subsidies are concentrated on supporting a single type of enterprise, reducing the marginal output of social benefits and increasing the cost of fiscal expenditures.

E5(0,1,1) becomes the stable equilibrium strategy point of the game when , i.e., for core enterprises, the possible benefits of shared cooperation and monopoly advantage, as well as the potential pressure on reputation, are less than the cost of sharing, and for SMEs, the benefits of shared cooperation and monopoly advantage, as well as the potential pressure on reputation, are greater than the cost of sharing, and the potential social benefits to the government are greater than the costs of management and subsidies, and the core enterprises do not share, SMEs share, and the government subsidy becomes the A stable equilibrium strategy. In this case, the government subsidizes SMEs to share alone, and under this structure, the incentive to share comes mainly from the incentives between SMEs and the government, while the core enterprises choose to keep the technology closed because of their own better conditions, higher costs, and greater potential risks. In the short term, this combination of strategies can lead to a certain degree of cooperative output, with SMEs improving their sharing capabilities through government support and the government contributing to the partial activation of the system. However, it should be noted that this strategy has obvious limitations compared to enterprise-wide collaborative sharing. This type of subsidy requires a unilateral investment of resources to support SMEs’ sharing and cannot mobilize the technical and knowledge resources of core enterprises, which generates a much lower synergy and system value than in a global cooperative scenario. The lower marginal output efficiency of government expenditures leads to a lower cost-effectiveness ratio of financial incentives and makes it difficult for subsidies to generate the expected positive feedback in the system. Secondly, due to the absence of core enterprises, the structure of cooperative networks is incomplete, knowledge flow and sharing are limited to a part of the ecosystem, and although SMEs participate in sharing, it is difficult for them to obtain adequate technical support, and their sharing behavior is prone to the inefficiency of “isolated sharing”.

E7(0,0,1) becomes the stable equilibrium strategy point of the game when 0, i.e., when the benefits of cooperation between core enterprises and SMEs from sharing and reputational pressure are less than the cost of sharing, and when reputational loss to the government is greater than the possible cost of subsidization, core enterprises and SMEs will choose not to share and the government will choose to subsidize. In this state, core enterprises and SMEs choose to remain closed because the sum of the benefits of cooperation, government subsidies and reputational pressure from sharing is not enough to cover the marginal cost of sharing; however, the government, based on its public responsibility, reputation maintenance or medium- to long-term social returns, believes that the crisis of trust, policy failure or loss of institutional credibility caused by non-subsidization will bring more negative impacts and therefore chooses to continue to provide subsidy support. Therefore, the government chooses to continue to provide subsidized support. This structure reveals the characteristics of the government’s “unilateral push” subsidy game: the government invests resources to maintain the existence of the policy incentives despite the lack of response at the firm level and the failure to establish a genuine mechanism for sharing and cooperation. In reality, this state of affairs can be seen in the early stage of policy implementation or management, where the government chooses to invest first to stabilize the sharing expectations and maintain the credibility of the system. However, due to the lack of the actual participation of enterprises, it is difficult to stimulate knowledge synergies or form an effective closed loop of cooperation. From the perspective of resource allocation, E7 is an inefficient and unsustainable equilibrium structure. The government subsidy fails to produce the actual desired effect and only creates financial expenditure without realizing the output transformation, so the use of resources is inefficient; enterprises are generally closed due to a lack of confidence or insufficient incentives, and the system as a whole is in a state of “incentive idling”. If this state is maintained for a long time, the government is likely to weaken or even cancel the subsidy support after evaluating the cost and effect, and the system will probably slip further into the completely closed equilibrium of E8(0,0,0).

E8(0,0,0) becomes the stable equilibrium strategy point of the game when , i.e., when the cost to the government of subsidizing both firms is greater than the loss of reputation, the firms are likely to enter into a state of suspension, affecting their long-term development. In this case, the system relies heavily on the initial willingness to share, or an external fluctuation, to get out of this situation. This equilibrium point reflects a state of total failure of system incentives, where all actors adopt negative and conservative strategies, and the sharing and cooperation behaviors fall into a “zero-action” dilemma. From the perspective of evolutionary game, although this state may have stability under certain parameter combinations, it is the equilibrium with the lowest efficiency and weakest synergy value. At this time, the system as a whole is at a standstill: not only is the flow of knowledge resources made difficult and the mechanism of collaborative innovation made stagnant, but a shared degradation path may also be formed, which, in the long run, can seriously constrain the accumulation of the individual capacity of the enterprise and the technological evolution of the ecosystem as a whole. More importantly, under this equilibrium structure, the system is highly sensitive to the initial conditions. If the initial willingness to share is insufficient, the system will easily slip into the inefficient equilibrium, and it will be difficult to get out of it spontaneously, showing obvious path dependence. If the external perturbation is insufficient, the path dependence and negative lock-in mechanism will inhibit the generation of new technological paths, which is a structural challenge in the evolution of the innovation ecosystem [53].

5. Numerical Simulation of Evolutionary Game Models

5.1. Case Selection and Parameter Setting

The field of new energy vehicles in China, with a high patent sharing density of 32.7% and institutionalized knowledge collaboration mechanisms, has become a model for breaking down barriers to knowledge flow in the manufacturing industry. In 2024, the total output of new energy vehicles in the four provinces and one city of the Yangtze River Delta (Jiangsu, Zhejiang, Anhui, Jiangxi, and Shanghai) accounted for over 40% of the national total. Therefore, this study selects the four provinces and one city of the Yangtze River Delta New Energy Vehicle and Parts Industry Chain Quality Innovation Consortium as a case study. The project was jointly initiated by the market supervision departments of four provinces and one city in Jiangsu, Zhejiang, Anhui, Jiangxi, and Shanghai, successfully promoting a 40% reduction in the pilot period of the first 12 projects and accelerating knowledge transfer. Core enterprises such as Chery and Xinwangda lead the development of technology standards and share patent pools, triggering collaborative innovation in the industry chain through open core patents and reducing research and development costs. Small and medium-sized enterprises such as Zichen Technology and Lijin Technology rely on alliance resources to obtain technology spillovers, reduce supporting costs through standard mutual recognition, and share the industry education integration cultivation system to enhance technology absorption capacity. The selected case highly fits the research hypothesis in terms of the tripartite roles of “core enterprises–small and medium-sized enterprises–government”, knowledge sharing effects, and policy intervention mechanisms. It should be noted that the initial parameters are determined based on the development of the Jiangsu Zhejiang Anhui Jiangxi Shanghai New Energy Vehicle and Parts Industry Chain Quality Innovation Consortium, and the reference data from the “Jiangsu Province Power and Energy Storage Battery Industry Development Report (2025)”, “Three Year Action Plan for Integrated Development in the Yangtze River Delta Region (2024–2026)” and the relevant research literature are used to form the initial values of the control group [54,55], as shown in Table 5.

Table 5.

Initial values of evolutionary game parameters.

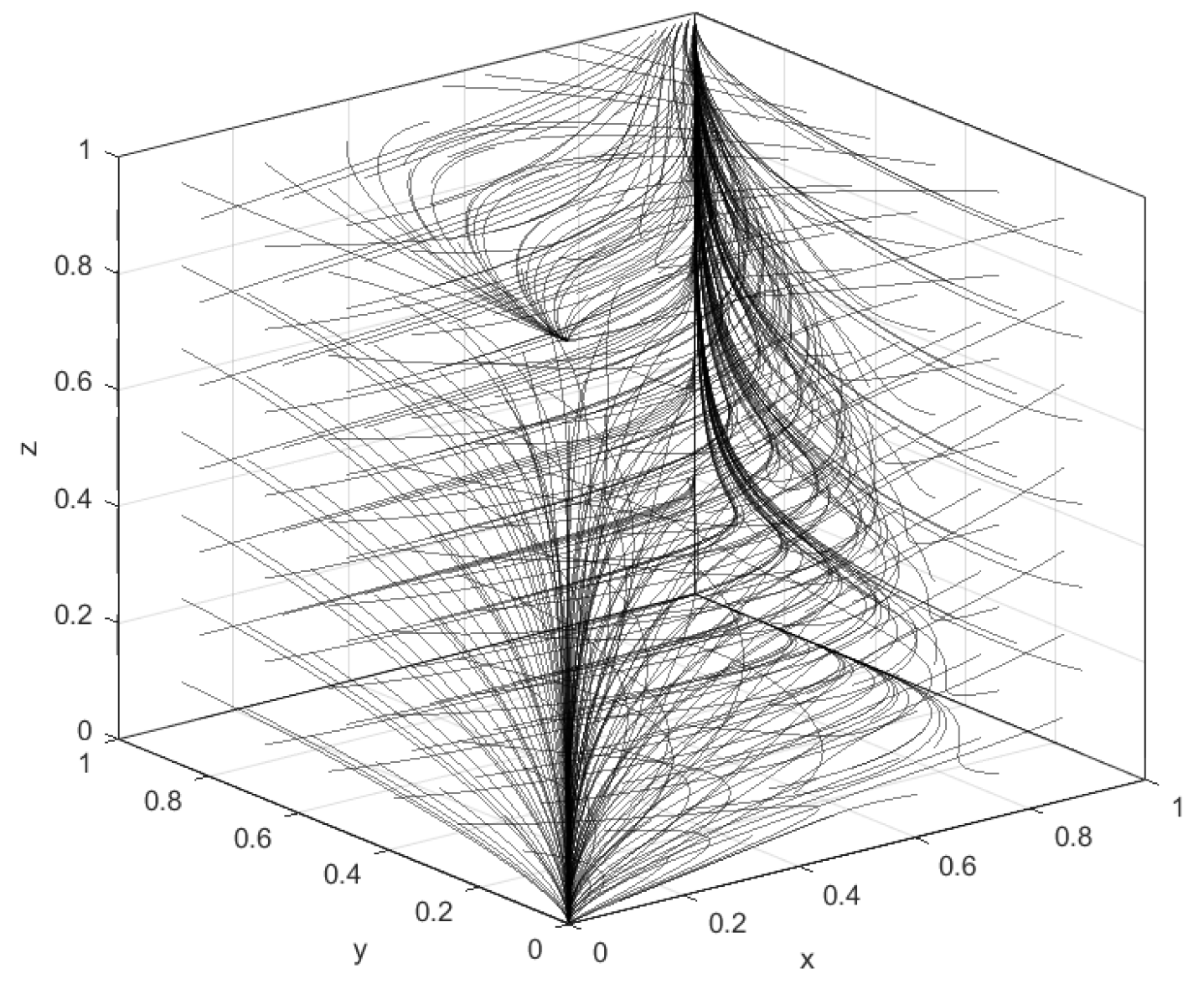

To validate theoretical stability results and investigate how initial willingness and key parameters (the benefit distribution ratio, knowledge stock, environmental capacity, and competition coefficient) influence evolutionary paths, we conduct sensitivity analysis using Matlab 2024a simulations.

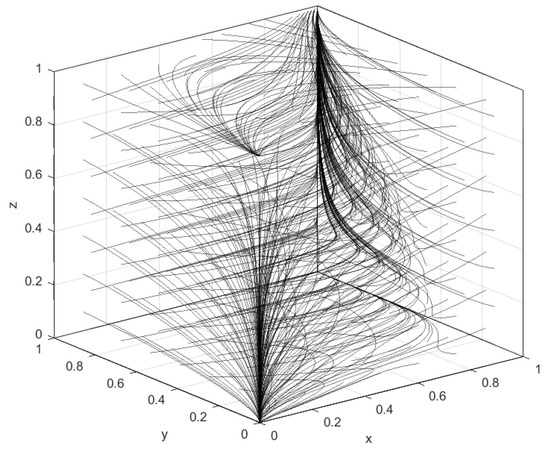

To make the evolving tripartite simulation system finally reach the ideal state, i.e., E1(1,1,1) becomes the system’s evolutionary stabilization strategy, it needs to satisfy the following two conditions: , . Considering the actual situation of knowledge sharing in real enterprise sharing behaviors and referring to the relevant studies, the initial values of the parameters of the model of the control group are set, as shown in Table 5, and satisfy the condition of E1(1,1,1) by the substitution test: the condition of ,, with E8(0,0,0) condition, . The simulation results of the evolution path of the control group are shown in Figure 3 below, from which it can be seen that all the different initial points in this system will finally evolve to E1(1,1,1) and point E8(0,0,0). At this point, the core enterprises and SMEs all choose to share and the government chooses to subsidize as a stabilizing strategy in this case, and at the same time, the core enterprises and SMEs all do not share and the government does not subsidize as another stabilizing strategy in this case. Two opposite stabilization scenarios emerge in the same environment.

Figure 3.

System evolutionary path scenarios.

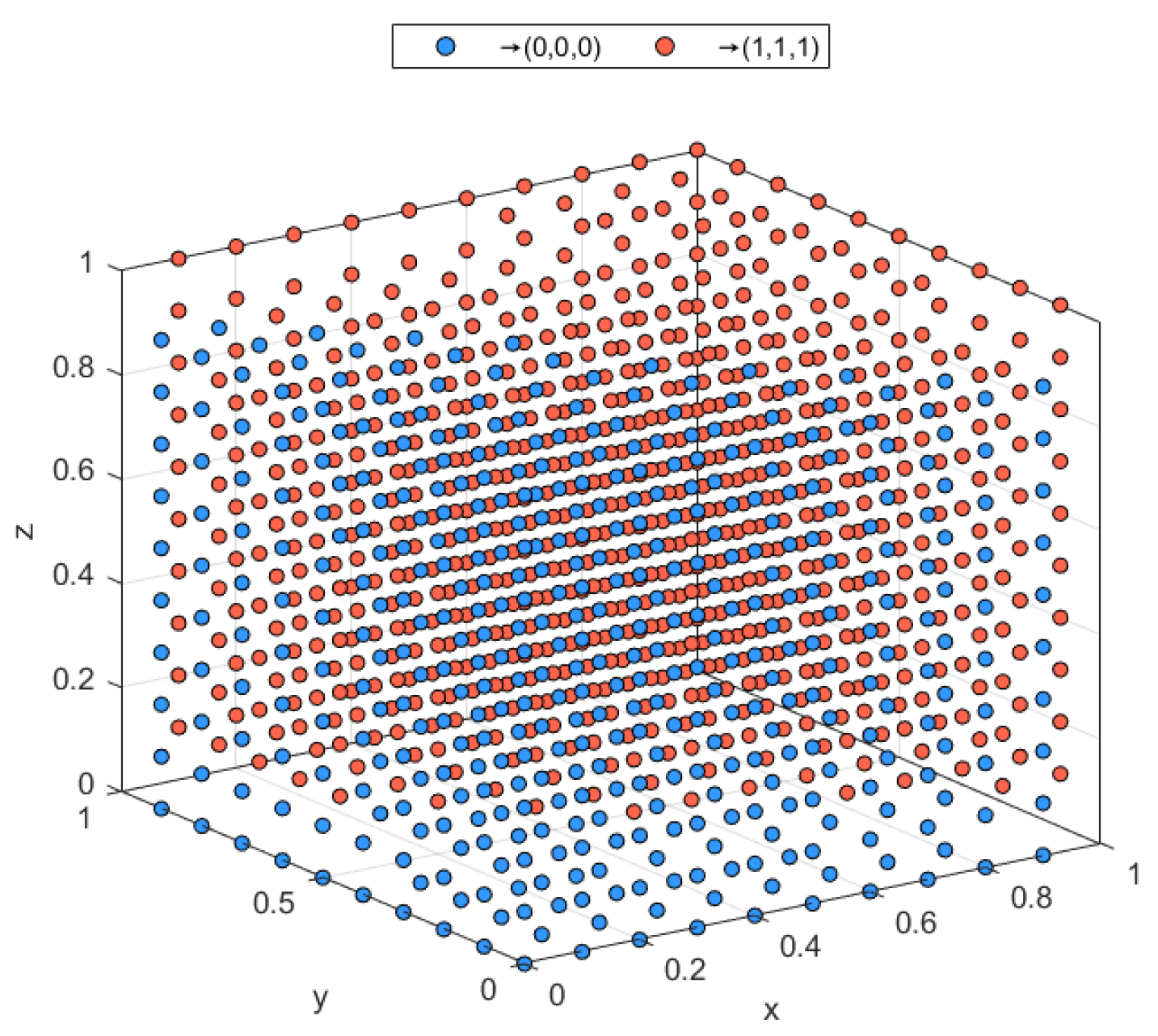

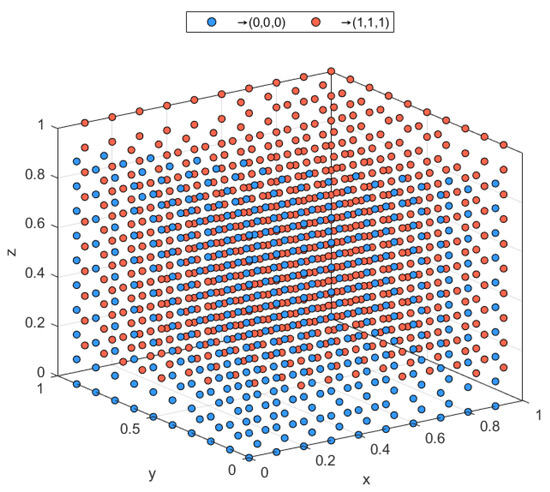

5.2. Initial Strategy Simulation Analysis

To systematically assess initial condition sensitivity, we discretize the strategy space (x,y,z) with 0.1-step nodes per dimension, generating 1331 initial points that uniformly sample the unit cube. This kind of full-space scanning method can help to explore the convergence trend of the system under different initial states and reveal the sensitivity of the evolution process to the initial conditions. As shown in the results of Figure 4, 53.4% of the points finally converge to (1,1,1). That is, all three parties, i.e., core enterprises, SMEs and government, choose sharing and subsidizing. This result suggests that with a higher initial willingness to share, the market information becomes more transparent, the level of trust between subjects increases, and the probability of the free-riding phenomenon is significantly reduced, which strengthens the government’s incentive to provide subsidies and pushes the system to enter a virtuous circle of collaborative sharing more quickly. This further confirms that the willingness to share at the initial stage of the system has a key influence on the final evolution path of the innovation ecosystem. Therefore, creating a sharing atmosphere that encourages sharing and mutual trust and cooperation is of great significance in enhancing the benefits of inter-organizational cooperation and constructing a stable synergy mechanism. To ensure simulation validity, initial strategy probabilities for all three agents are set to 0.5—a neutral starting point—revealing true evolutionary trends across parameter combinations.

Figure 4.

Convergence at the initial point.

5.3. Sensitivity Analysis

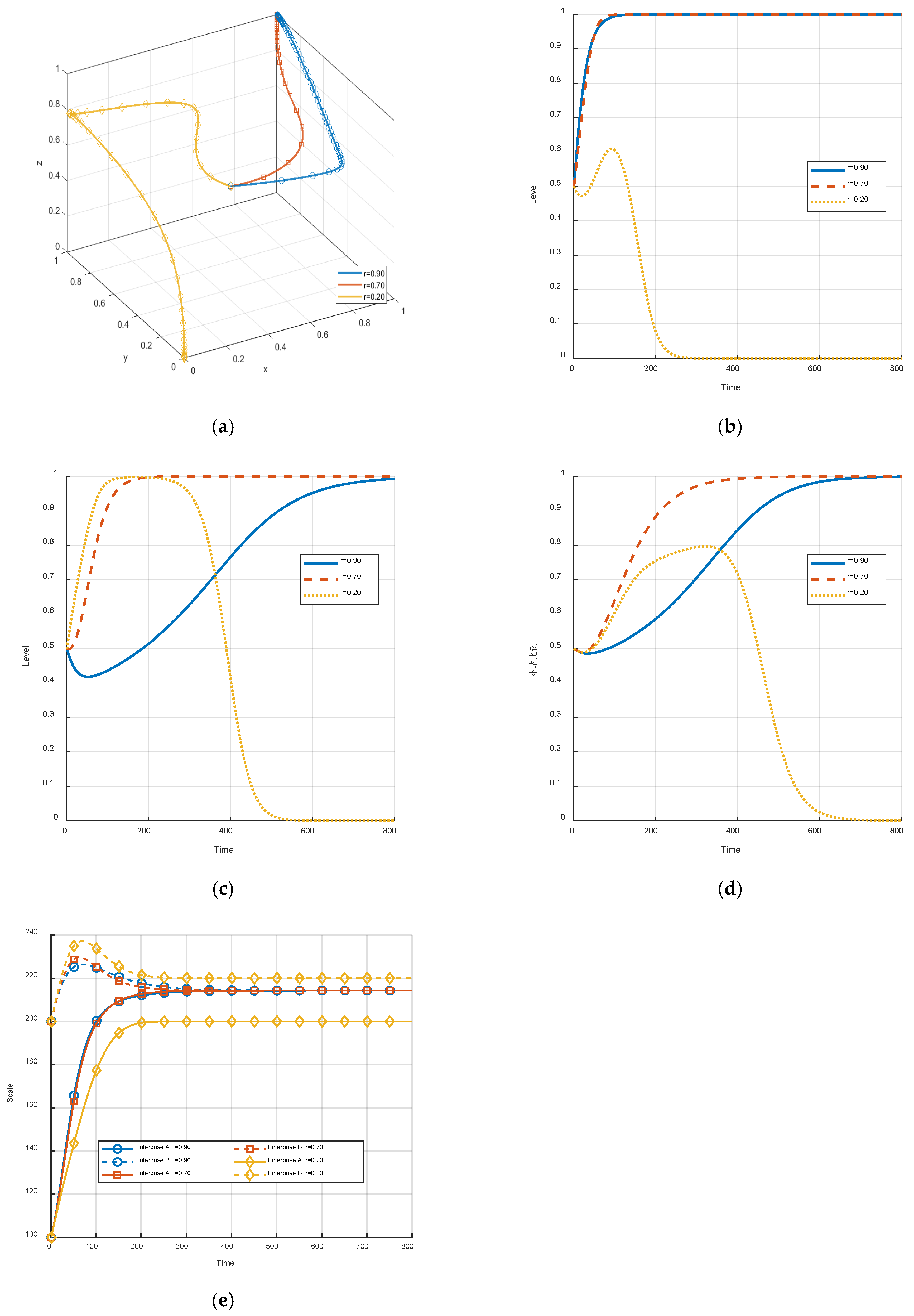

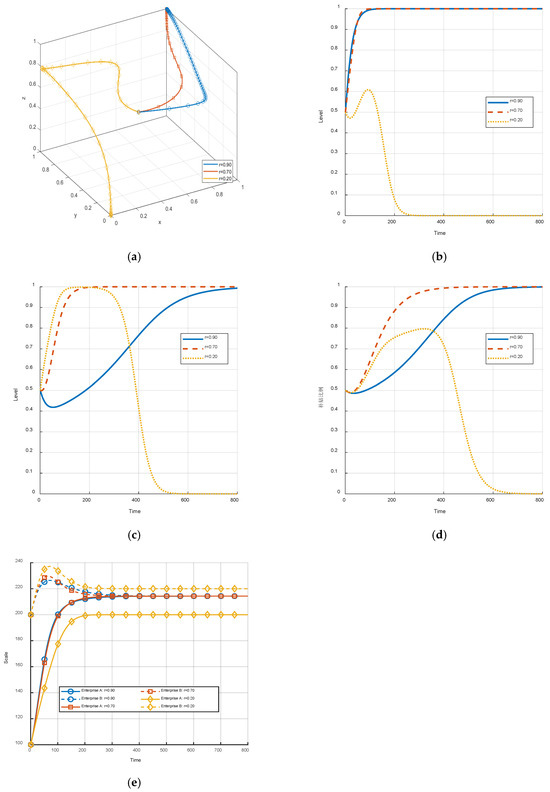

5.3.1. The Effect of Gain Sharing Coefficients on the Evolution of Knowledge Sharing Behavior

Figure 5 shows the effect of the revenue sharing coefficient on the sharing behavior of firms and the final number of firms’ development, while other parameters remain constant. The coordinated evolution and sustainable development of innovation ecosystems can be impeded by either too high or too low a share of benefits allocated to core enterprises. This is consistent with the research results of Lu Fangyuan et al. [56]. When the core enterprises take up too high a share of the benefits of cooperation, although they are more inclined to share in the short term, the over-concentrated distribution of benefits severely discourages SMEs from sharing, leading to a decline in the efficiency of government subsidies and ultimately inhibiting the long-term sharing benefits of the core enterprises, making it difficult for them to realize the effective transformation of resources and ecological linkages, and the system evolution falls into a structural imbalance. Conversely, excessively low benefit allocation ratios for core enterprises incentivize short-term SME sharing but induce core enterprise withdrawal due to unfavorable cost–return dynamics, eroding systemic cooperation foundations. It is difficult for SMEs to stimulate the potential value of cooperation individually, and the government also reduces subsidies due to the lack of stable returns, and the system as a whole eventually tends to decline in sharing or even collapse in cooperation. Therefore, setting up an appropriate and balanced benefit distribution mechanism is a key strategy to maintain the motivation of multiple actors in the system, enhance the efficiency of resource allocation, and promote the synergistic evolution of the innovation ecosystem. It is suggested that the system should be designed to ensure a dynamic and adjustable distribution of cooperation dividends between the advantaged and SMEs, stimulate the two-way sharing dynamics, and promote the benign development of the ecosystem through the government’s reasonable subsidy mechanism.

Figure 5.

The evolutionary trend of the impact of allocation coefficients on the sharing behavior of innovation ecosystems. (a) The evolutionary path of the impact of allocation coefficient r on sharing behavior. (b) The impact of allocation coefficient r on core enterprise A sharing. (c) The impact of allocation coefficient r on SME B sharing. (d) The effect of distribution coefficient r on government subsidies. (e) The impact of distribution coefficient r on the number of shared enterprises.

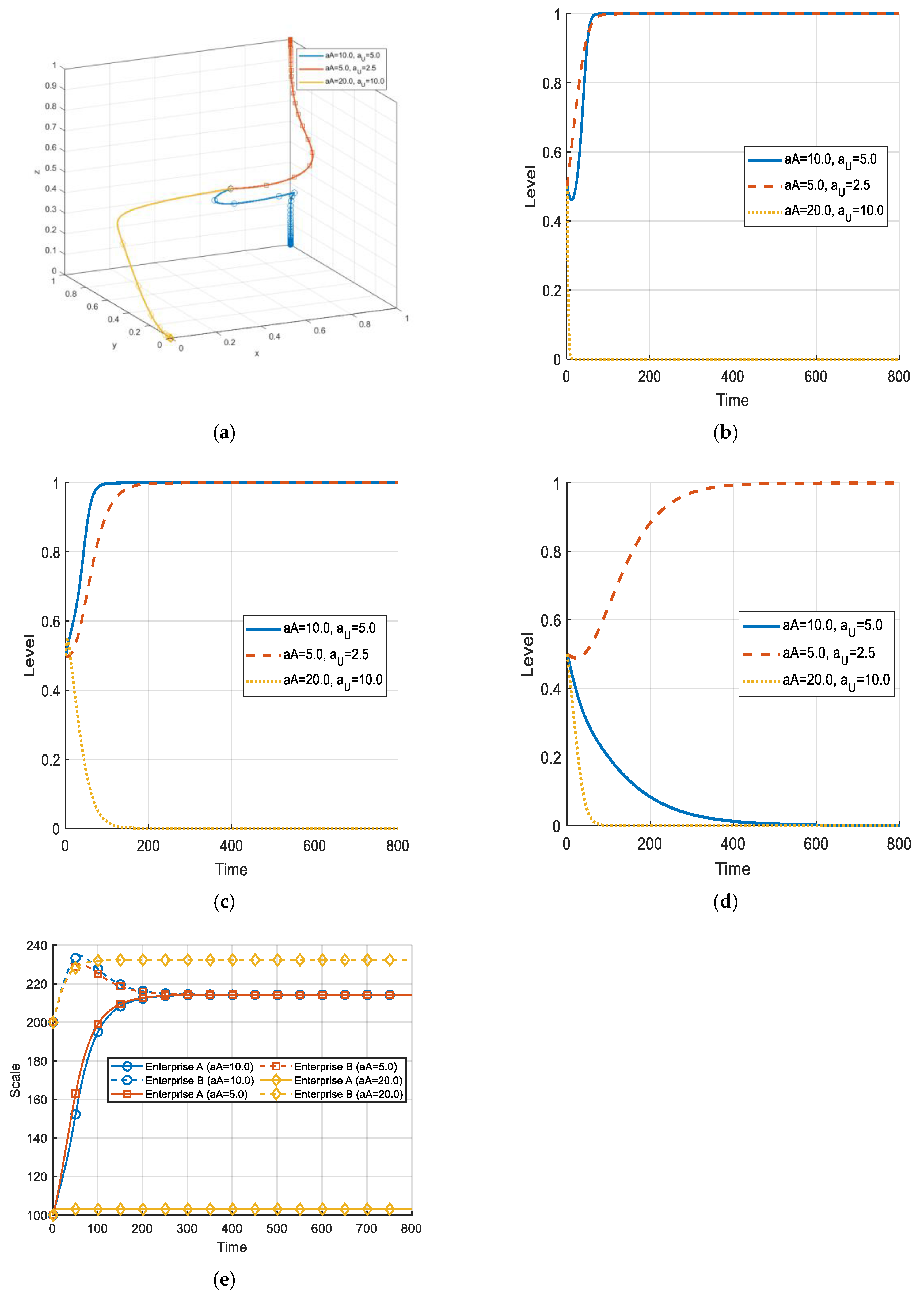

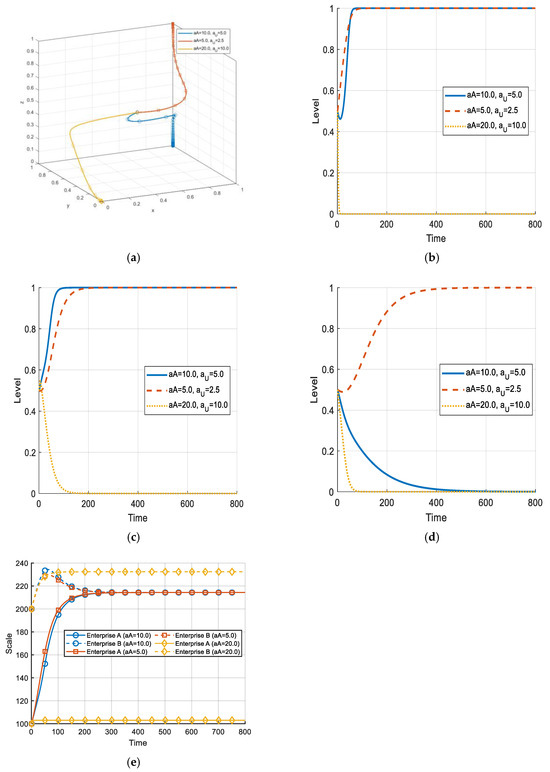

5.3.2. The Impact of Knowledge Inventory on the Evolution of Sharing Behavior

Figure 6 shows the effects of the knowledge stock of core enterprises and the amount of knowledge that does not overlap between firms on the sharing behavior of firms, while other parameters remain constant. It can be seen that the knowledge stock of core enterprises and the amount of knowledge that does not overlap with that of SMEs have a bi-directional effect on the sharing evolution of the innovation ecosystem. This aligns with findings by Öberg, C. et al., which posit that firms must strategically balance innovation volume and risk exposure. When the knowledge stock and differences are at a moderate level, sharing and cooperation can effectively stimulate knowledge complementarity and collaborative innovation, core enterprises have the ability to share, SMEs can benefit from it, government subsidies are more efficient, and the system as a whole tends to be in a benign state of tripartite collaboration and common sharing. However, when knowledge is highly concentrated and the differences between enterprises are too large, the system will face the risk of synergy breakdown. Core enterprises gradually withdraw from the system due to the high sharing cost and high risk of knowledge leakage, SMEs are willing to share but are difficult to effectively cooperate with, government incentives are ineffective, and the system eventually tends to be closed and inefficient. Therefore, the rational allocation of knowledge structure and degree of differentiation is the key to ensure the coordinated evolution of the system. Policymakers should avoid the monopolization of knowledge or excessive disparities and prevent cooperation from shrinking due to the “monopoly of the strong”. It is suggested that the establishment of a knowledge sharing platform, guiding core enterprises to share their boundaries, and enhancing the absorptive capacity of small and medium-sized enterprises can strengthen the basis of multi-party interactions, stimulate the endogenous dynamics of collaboration and sharing, and promote the sustainable development of the innovation ecosystem.

Figure 6.

The evolutionary trend map of the impact of knowledge stocks on sharing behavior in innovation ecosystems. (a) The evolutionary path of the impact of allocation coefficient r on sharing behavior. (b) The impact of knowledge inventory on A sharing in core enterprises. (c) The impact of knowledge stocks on B sharing in SMEs. (d) The impact of knowledge stocks on government G subsidies. (e) The effect of knowledge stocks on the number of firms choosing a sharing strategy.

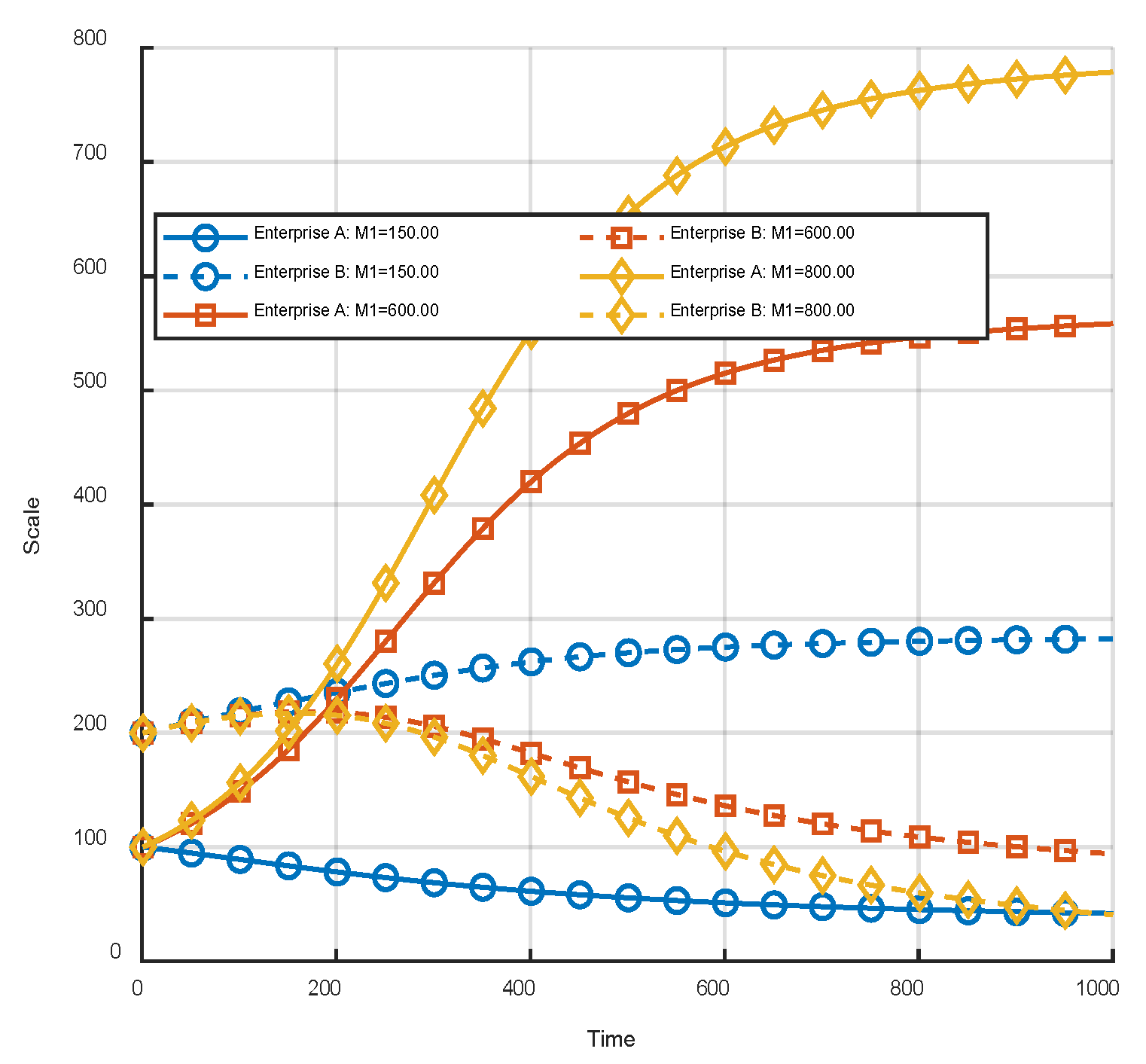

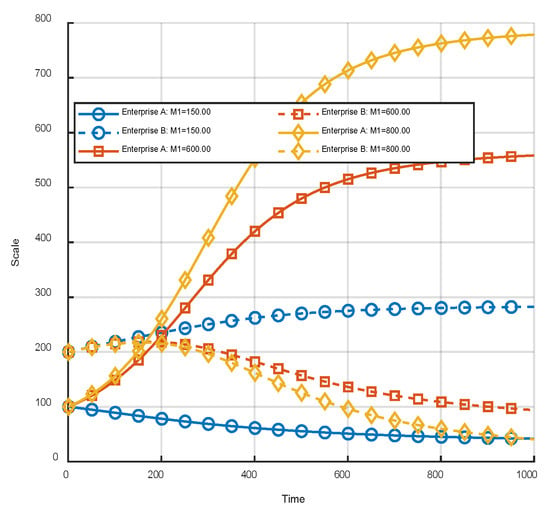

5.3.3. The Impact of Environmental Accommodation on the Evolution of Firms’ Sharing Behavior

It can be observed from Figure 7 that the final size of core enterprise A rises significantly as the environmental capacity of core enterprise A increases. Especially at , the number of core enterprises shows continuous growth and eventually stabilizes above 700, much higher than the stable size at . This suggests that the environmental capacity, as the upper limit of resources, plays a direct role in limiting the expansion capacity of core enterprises, and the larger the environmental space, the stronger their growth potential. In the case of lower , although the system may have strong willingness to share, the growth of core enterprises is inhibited due to the limited environmental carrying capacity. On the other hand, the evolutionary trend of SME B is characterized by mutual constraints with core enterprises. Especially in the case of , the number of SMEs grows rapidly in the early stage, but with the rapid expansion of core enterprises, their number declines significantly in the middle and late stages and eventually stabilizes at a low level. This indicates that high environmental capacity favoring core enterprises concentrates resources and market space toward them, constricting SME development opportunities and intensifying system competition—resulting in cumulative advantage dynamics. On the whole, environmental capacity not only affects the upper limit of the size of core enterprises but also indirectly determines the survival space of SMEs. A moderate level of capacity can help to maintain dynamic balance among enterprises and avoid the excessive tilting of resources, while extreme enlargement may lead to imbalance and structural risks within the system. Therefore, policy design should take into full consideration the impact of environmental capacity on different types of enterprises and, by regulating resource allocation and entry thresholds, guide the diversified coexistence of enterprises and promote the stable and coordinated development of the innovation ecosystem.

Figure 7.

Impact of core enterprises’ environmental capacity M1 on the number of firms choosing a sharing strategy.

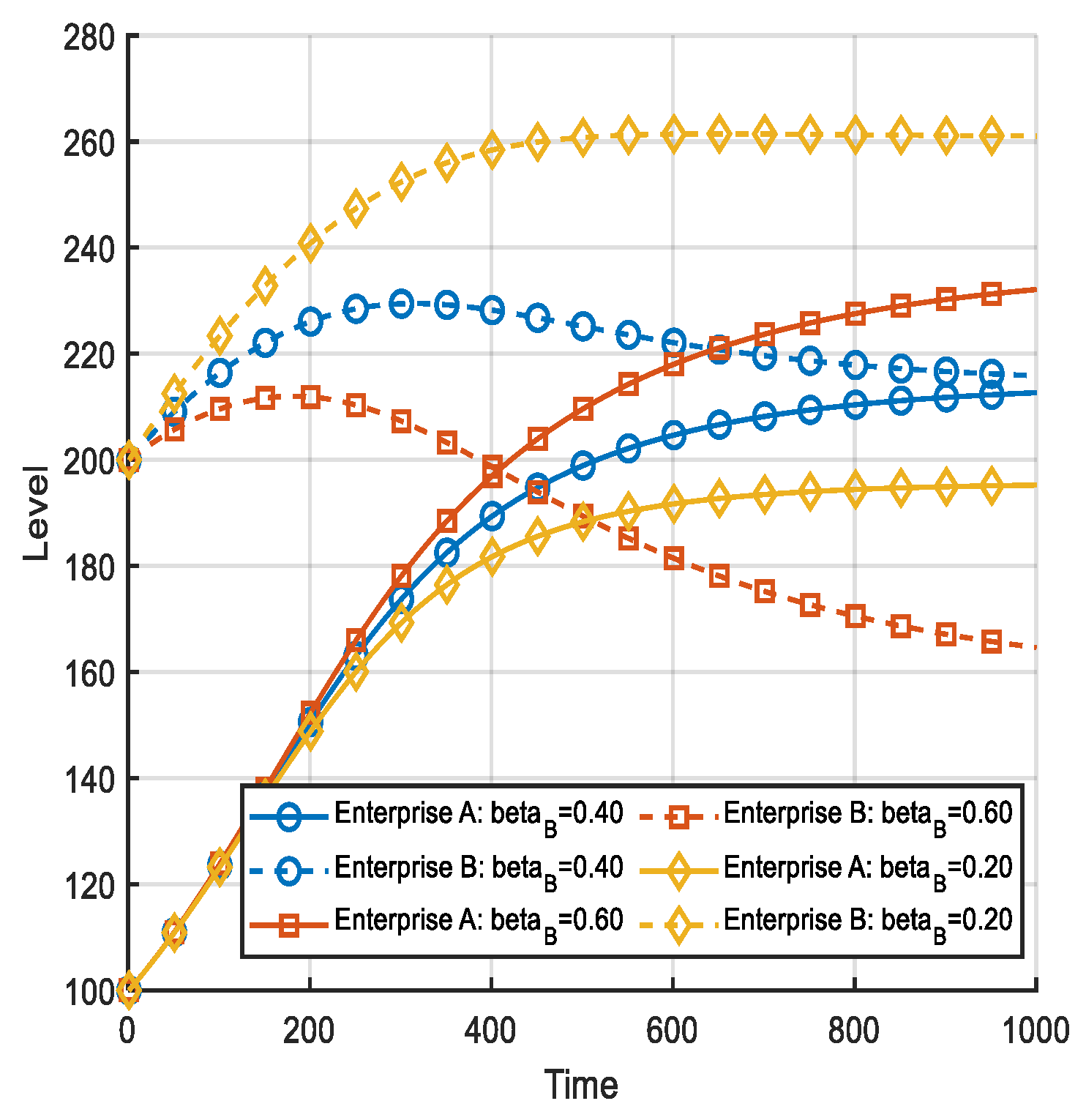

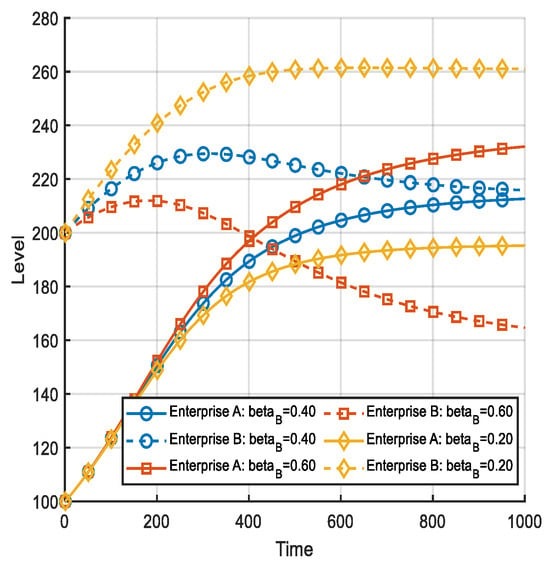

5.3.4. The Effect of the Competition Coefficient on the Evolution of Sharing Behavior of Firms

Figure 8 illustrates the trend in the number of core enterprises A and SMEs B under different competition coefficients. The coefficients here indicate the intensity of competition between core enterprises and SMEs in a limited resource environment, reflecting the competitive role of core enterprises against SMEs in resource competition and essentially describing the proportion of SMEs’ occupation of system resources. The increase in significantly limits the growth potential of core enterprises. When = 0.2, the number of core enterprises A grows steadily and eventually stabilizes at close to 240, indicating that SMEs exert less competitive pressure on them and core enterprises have more room for survival and expansion. However, as it rises to 0.6, the growth of core enterprises is significantly suppressed, and the number of core enterprises eventually drops to around 180. This suggests that under high competitive pressure, although core enterprises have stronger capabilities and knowledge accumulation, their development is limited due to the massive diversion of resources to SMEs, and the incentive effect of sharing behaviors decreases. At the same time, the number of SMEs shows a trend of negative correlation with : as the competition coefficient increases, the growth of its number is gradually weakened, or even a decline phenomenon occurs. This is because the larger is, the more resources SMEs take from the core enterprises, but at the system level, higher competitive pressure will destroy the synergistic allocation efficiency of resources. Although the number of SMEs rises rapidly in the early stage, the number of SMEs tends to saturate or even decline in the middle to late stage of the system due to the imbalance of the ecological structure and the weakening of the cooperative power and eventually stabilizes at a relatively low level. This suggests that excessive competition among SMEs does not lead to sustained growth but rather to a stage-by-stage “expansion effect”, and its long-term development is suppressed by the feedback of the system. Shared innovation ecosystems emphasize collaboration between multiple actors rather than zero-sum games, and if competition is not regulated, it will undermine the overall stability of the system and the effectiveness of knowledge diffusion. Therefore, it is crucial to maintain a moderate competition coefficient. On the one hand, policy must safeguard core enterprises’ resource conversion capabilities and technological dominance while preventing the competitive exclusion of SMEs. Policies can optimize the competition–collaboration structure of the system through the introduction of resource use quotas, knowledge sharing incentives, and competition intensity adjustment mechanisms to promote dynamic equilibrium among firms and the healthy evolution of the innovation ecosystem.

Figure 8.

Effect of competition coefficient on number of firms choosing sharing strategies.

6. Conclusions

In this paper, based on the evolutionary interactions of each participant in the open innovation ecosystem, we constructed a three-party evolutionary game and Lotka–Volterra two-dimensional analysis framework, focused on analyzing the dynamic game process of core enterprises, SMEs and the government in the innovation ecosystem regarding the behavior of knowledge sharing, and drew the following main conclusions through theoretical deduction and simulation experiments:

First, when expected benefits from cooperation, brand reputation, and government subsidies exceed knowledge sharing costs, core enterprises shift from a closed stance toward proactive sharing. This facilitates SME partnerships to leverage knowledge spillovers and first-mover advantages, strengthening their ecosystem dominance. Secondly, when SMEs expect that the synergistic benefits, learning enhancement effect and potential government support obtained through knowledge sharing are greater than the cost of sharing, they will accelerate the pace of sharing, change from “free-riders” to “collaborators”, strive for resource space and a voice in the ecosystem, enhance innovation capacity and realize ecological position leapfrogging. Thirdly, governments adopt subsidy strategies when systemic social benefits outweigh expenditure—guiding corporate sharing through incentives while avoiding overreliance on short-term penalties—thus enhancing long-term systemic efficiency. Finally, the evolution results show that the linkage of the three parties’ behaviors is closely related to the initial state of the system. When all agents exhibit high sharing willingness, the system converges stably to an all-sharing equilibrium of synergistic cooperation. Conversely, low initial sharing motivation leads to convergence toward an inefficient triple non-sharing equilibrium. Therefore, the initial incentive mechanism and information transparency play a decisive role in the evolutionary path of the system.

However, there are still several shortcomings in the study, which need to be further deepened and improved in the future. First, the model in this paper has some idealized assumptions in theoretical construction and parameter setting. The portrayal of multi-dimensional resource heterogeneity and dynamic environmental changes in the real innovation ecosystem is still relatively rough. Furthermore, the selection of model parameters relies primarily on the literature references and assumption settings, employing theoretically specified values that lack empirical validation. Second, this paper focuses on the tripartite subjects of core enterprises and SMEs and the government and does not fully consider the roles of other key innovation subjects, such as universities, research institutions, industry associations and open platforms. Future research can expand the scope of multiple subjects and construct a more complex and close-to-reality multi-level and multi-subject interaction model to enhance the adaptability and explanatory power of the theory. Based on the above shortcomings, future research can be carried out in the following directions: first, construct a multi-subject, multi-level open innovation ecosystem evolution model, combining the complex interactions between heterogeneous subjects and non-linear feedback mechanisms; second, deepen the multi-dimensional and multi-stage design of subjects, and explore the coupled evolution of the dynamic regulation mechanism and the response behaviors of the enterprises; and third, strengthen the empirical research and model validation, and enhance the application of the theoretical models, including their depth and breadth.

In summary, although this paper provides useful insights into the evolution mechanism of multi-subject knowledge sharing behavior in open innovation ecosystems, it still needs to be improved in terms of model complexity, subject diversity, policy dynamics, and empirical validation, so as to better serve the theoretical development and actual innovation governance and promote the healthy and sustainable evolution of open innovation ecosystems.

Author Contributions

Conceptualization, G.Z. and H.Z.; methodology, S.Y.; validation, S.Y.; data curation, G.Z. and S.Y.; writing—original draft preparation, G.Z. and S.Y., review and editing, H.Z.; supervision, H.Z. and S.Y.; project administration, H.Z. and Q.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Social Science Fund of China (22BJY135), a General Project in Applied Economics titled Research on Benefit Coordination Mechanism of Dual Closed-loop Supply Chain for New Energy Vehicle Power Batteries under Cascade Utilization, with the project start date on 30 September 2022. The project leader is Qiang Hou.

Data Availability Statement

The data that support the findings of this study are available upon request from the corresponding author.

Acknowledgments

The author sincerely thanks Qiang Hou for the funding support that made this research possible. Gratitude is also extended to the editors and reviewers for their careful review and valuable comments, which greatly improved the quality of this paper. Special thanks are given to Hua Zou for her insightful guidance and patient assistance throughout the research process.

Conflicts of Interest

Author Shuo Yang was employed by the company Economic Research Institute, Stat Grid Liaoning Electric Power Company Limited. The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

References

- Kiseleva, O.N.; Sysoeva, O.V.; Vasina, A.V.; Sysoev, V.V. Updating the Open Innovation Concept Based on Ecosystem Approach: Regional Aspects. J. Open Innov. Technol. Mark. Complex. 2022, 8, 103. [Google Scholar] [CrossRef]

- Fang, S.; Qin, Y. Social Identification in Open Innovation Projects: Role of Knowledge Collaboration and Resource Interdependence. Systems 2025, 13, 129. [Google Scholar] [CrossRef]

- Camilleri, M.A.; Troise, C.; Strazzullo, S.; Bresciani, S. Creating Shared Value through Open Innovation Approaches: Opportunities and Challenges for Corporate Sustainability. Bus. Strat. Environ. 2023, 32, 4485–4502. [Google Scholar] [CrossRef]

- Xie, X.; Han, Y.; Dai, M. Study on Symbiotic Relationships and Evolution Mechanisms of Population in Open Innovation Ecosystem. Keji Jinbu Yu Duice 2022, 39, 85–95. [Google Scholar]

- Oliver, A.L.; Rittblat, R. Facilitating Innovation for Complex Societal Challenges: Creating Communities and Innovation Ecosystems for SDG Goal of Forming Partnerships. Sustainability 2023, 15, 9666. [Google Scholar] [CrossRef]

- Traitler, H.; Watzke, H.J.; Saguy, I.S. Reinventing R&D in an Open Innovation Ecosystem. J. Food Sci. 2011, 76, R62–R68. [Google Scholar] [CrossRef]

- Lin, Y.; Zhang, H. Micro Mechanisms and Values of Open Innovation Ecosystem Evolution. Yanjiu Yu Fazhan Guanli 2020, 32, 133–143. [Google Scholar] [CrossRef]

- Mirghaderi, S.A.; Sheikh Aboumasoudi, A.; Amindoust, A. Developing an Open Innovation Model in the Startup Ecosystem Industries Based on the Attitude of Organizational Resilience and Blue Ocean Strategy. Comput. Ind. Eng. 2023, 181, 109301. [Google Scholar] [CrossRef]

- Borgh, M.; Cloodt, M.; Romme, A.G.L. Value Creation by Knowledge-based Ecosystems: Evidence from a Field Study. R&D Manag. 2012, 42, 150–169. [Google Scholar]

- Cricchio, J.; Barabuffi, S.; Crupi, A.; Di Minin, A. China’s New Knowledge Brokers: A Patent Citations Network Analysis of the Artificial Intelligence Open Innovation Ecosystem. J. Eng. Technol. Manag. 2025, 76, 101870. [Google Scholar] [CrossRef]

- McGahan, A.M.; Bogers, M.L.A.M.; Chesbrough, H.; Holgersson, M. Tackling Societal Challenges with Open Innovation. Calif. Manag. Rev. 2020, 63, 49–61. [Google Scholar] [CrossRef]

- Peng, X.; Wang, F.; Wang, J.; Qian, C. Research on Food Safety Control Based on Evolutionary Game Method from the Perspective of the Food Supply Chain. Sustainability 2022, 14, 8122. [Google Scholar] [CrossRef]

- Huang, M.; Li, L. Impact of Non-economic Benefit Distribution Model of Innovation Subject on Project Process Performance: Mediating Effect Based on Project Culture. Guanli Pinglun 2023, 35, 84–95. [Google Scholar] [CrossRef]

- Yuan, Q.; Wen, K. Evolutionary Game and Dynamic Simulation Study of Innovation Ecosystem Open Sharing Relationship. Hehai Daxue Xuebao (Zhexue Shehui Kexue Ban) 2022, 24, 100–108+112. [Google Scholar]

- Alam, M.A.; Rooney, D.; Taylor, M. From Ego-systems to Open Innovation Ecosystems: A Process Model of Inter-firm Openness. J. Prod. Innov. Manag. 2022, 39, 177–201. [Google Scholar] [CrossRef]

- Xie, X.; Wang, H.; Yu, S. Influence Mechanism of Open Innovation Ecosystem Network Structure on Value Co-creation. Guanli Kexue Xuebao 2024, 27, 133–158. [Google Scholar] [CrossRef]

- Xie, X.; Wang, H. How to Bridge the Gap between Innovation Niches and Exploratory and Exploitative Innovations in Open Innovation Ecosystems. J. Bus. Res. 2021, 124, 299–311. [Google Scholar] [CrossRef]

- Cao, Y.; Ren, S.; Du, M. Building a Globally Competitive Open Innovation Ecosystem. Kexue Xue Yanjiu 2024, 42, 1979–1987. [Google Scholar] [CrossRef]

- Oliveira-Duarte, L.; Reis, D.A.; Fleury, A.L.; Vasques, R.A.; Fonseca Filho, H.; Koria, M.; Baruque-Ramos, J. Innovation Ecosystem Framework Directed to Sustainable Development Goal #17 Partnerships Implementation. Sustain. Dev. 2021, 29, 1181–1195. [Google Scholar] [CrossRef]

- Randhawa, K.; West, J.; Skellern, K.; Josserand, E. Evolving a Value Chain to an Open Innovation Ecosystem: Cognitive Engagement of Stakeholders in Customizing Medical Implants. Calif. Manag. Rev. 2021, 63, 101–134. [Google Scholar] [CrossRef]

- West, J.; Gallagher, S. Challenges of Open Innovation: The Paradox of Firm Investment in Open-Source Software. R&D Manag. 2006, 36, 319–331. [Google Scholar] [CrossRef]

- Mei, L.; Zhang, T.; Chen, J. Exploring the Effects of Inter-firm Linkages on SMEs’ Open Innovation from an Ecosystem Perspective: An Empirical Study of Chinese Manufacturing SMEs. Technol. Forecast. Soc. Change 2019, 144, 118–128. [Google Scholar] [CrossRef]

- Radziwon, A.; Bogers, M. Open Innovation in SMEs: Exploring Inter-organizational Relationships in an Ecosystem. Technol. Forecast. Soc. Change 2018, 132, 80–93. [Google Scholar] [CrossRef]

- Costa, J.; Matias, J.C.O. Open Innovation 4.0 as an Enhancer of Sustainable Innovation Ecosystems. Sustainability 2020, 12, 8112. [Google Scholar] [CrossRef]

- Masucci, M.; Brusoni, S.; Cennamo, C. Removing Bottlenecks in Business Ecosystems: The Strategic Role of Outbound Open Innovation. Res. Policy 2020, 49, 103823. [Google Scholar] [CrossRef]

- Kim, S.L.; Cheong, M.; Srivastava, A.; Yoo, Y.; Yun, S. Knowledge Sharing and Creative Behavior: The Interaction Effects of Knowledge Sharing and Regulatory Focus on Creative Behavior. Hum. Perform. 2021, 34, 1–18. [Google Scholar] [CrossRef]

- Kmieciak, R. Trust, Knowledge Sharing, and Innovative Work Behavior: Empirical Evidence from Poland. Eur. J. Innov. Manag. 2020, 24, 1832–1859. [Google Scholar] [CrossRef]

- Bogers, M.; Zobel, A.K.; Afuah, A.; Almirall, E.; Brunswicker, S.; Dahlander, L.; Ter Wal, A.L.J. The Open Innovation Research Landscape: Established Perspectives and Emerging Themes across Different Levels of Analysis. Ind. Innov. 2017, 24, 8–40. [Google Scholar] [CrossRef]

- Öberg, C.; Alexander, A.T. The openness of open innovation in ecosystems—Integrating innovation and management literature on knowledge linkages. J. Innov. Knowl. 2018, 3, 1–10. [Google Scholar] [CrossRef]

- Ferreira, J.J.; Teixeira, A.A.C. Open Innovation and Knowledge for Fostering Business Ecosystems. J. Innov. Knowl. 2018, 4, 253–255. [Google Scholar] [CrossRef]

- Wang, W. Current Status and Prospects of Evolutionary Game Theory Research. Tongji Yu Juece 2009, 3, 158–161. [Google Scholar]

- Xiao, H.; Yu, F.; Tang, H.; Peng, D.; Zhou, J. Research on the evolutionary game of collaborative innovation among government, industry, academia, research, and finance in low-carbon and environmentally friendly technologies. Oper. Res. Manag. 2021, 30, 39–46. [Google Scholar]

- Yang, X.; Pan, L.; Song, A.; Ma, X.; Yang, J. Research on the Strategy of Knowledge Sharing among Logistics Enterprises under the Goal of Digital Transformation. Heliyon 2023, 9, e15191. [Google Scholar] [CrossRef]

- Wang, J.; Qin, Y.; Zhou, J. Incentive Policies for Prefabrication Implementation of Real Estate Enterprises: An Evolutionary Game Theory-Based Analysis. Energy Policy 2021, 156, 112434. [Google Scholar] [CrossRef]

- Shi, Y.; Wei, Z.; Shahbaz, M.; Zeng, Y. Exploring the Dynamics of Low-Carbon Technology Diffusion among Enterprises: An Evolutionary Game Model on a Two-Level Heterogeneous Social Network. Energy Econ. 2021, 101, 105399. [Google Scholar] [CrossRef]

- Xiao, H.; Peng, D.; Wang, H. Research on the International Transfer Game of Low Carbon Environmentally Friendly Technologies under Asymmetric Psychological Pressure. Oper. Manag. 2020, 29, 36–43. [Google Scholar]

- Zhao, G.; Zhang, J. Evolutionary Game Research on Tacit Knowledge Sharing Behavior between Upstream and Downstream Enterprises in the Supply Chain Based on Knowledge Gradient. Juece Zixun 2025, 2, 88–96. [Google Scholar]

- Zhang, S.; Zhao, M.; Cai, Y. Analysis of Behavior Strategies of Scientific Data Open Sharing Subjects Based on Three-Party Evolutionary Game. Keji Guanli Yanjiu 2024, 44, 202–210. [Google Scholar]

- Mohammed, W.W.; Aly, E.S.; Matouk, A.E.; Albosaily, S.; Elabbasy, E.M. An Analytical Study of the Dynamic Behavior of Lotka-Volterra Based Models of COVID-19. Results Phys. 2021, 26, 104432. [Google Scholar] [CrossRef]

- Wang, Z.A.; Xu, J. On the Lotka–Volterra Competition System with Dynamical Resources and Density-Dependent Diffusion. J. Math. Biol. 2021, 82, 7. [Google Scholar] [CrossRef]

- Chen, H.; Wang, J.; Miao, Y. Evolutionary Game Analysis on the Selection of Green and Low Carbon Innovation between Manufacturing Enterprises. Alex. Eng. J. 2021, 60, 2139–2147. [Google Scholar] [CrossRef]

- Xu, L.; Di, Z.; Chen, J.; Shi, J.; Yang, C. Evolutionary Game Analysis on Behavior Strategies of Multiple Stakeholders in Maritime Shore Power System. Ocean Coast. Manag. 2021, 202, 105508. [Google Scholar] [CrossRef]

- Duan, W.; Li, C.; Hui, S. Research on Symbiotic Model of Crowdsourcing Space Ecosystem Based on Lotka-Volterra Model. Shenji Yu Jingji Yanjiu 2021, 36, 107–116. [Google Scholar]

- Yang, X.; Lian, Z.; Su, Y. Research on Symbiotic Model of Digital Economy and Real Economy Based on Lotka-Volterra Model. Xuexi Yu Tansuo 2024, 8, 126–135. [Google Scholar]

- Lu, Q.; Fang, H. Promoting Low-Carbon Development in Yangtze River Delta Area in China through the Lens of Decarbonization of Industrial Gas Producers: A Case Study Based on Evolutionary Game and Lotka-Volterra Models. Technol. Forecast. Soc. Change 2024, 207, 123594. [Google Scholar] [CrossRef]

- Li, T.; Zhang, Z. Research on Reverse Knowledge Spillover of Non-Core Enterprises: System Dynamics Analysis Based on Open Innovation Perspective. Jishu Jingji Yu Guanli Yanjiu 2020, 4, 3–11. [Google Scholar]

- Liu, C.; Yan, D.; Song, Z.; Shi, G.; Zhan, W.; Jiang, M. Patent Openness Decisions and Investment Propensities of Frontier Enterprises in Asymmetric Competition. Systems 2025, 13, 146. [Google Scholar] [CrossRef]

- Shang, S.; Zhang, Z. Evolutionary Game Analysis of Knowledge Sharing in Virtual Enterprises. Zhongguo Ruan Kexue 2015, 3, 150–157. [Google Scholar]

- Bacon, E.; Williams, M.D.; Davies, G.H. Recipes for Success: Conditions for Knowledge Transfer across Open Innovation Ecosystems. Int. J. Inf. Manag. 2019, 49, 377–387. [Google Scholar] [CrossRef]

- Wang, H.; Han, Y. Evolutionary Game Research on Knowledge Sharing in Cooperative Information Retrieval and Search. Tushu Qingbao Gongzuo 2018, 19, 1–6. [Google Scholar]

- Wang, J.; Cao, N.; Wang, Y.; Wang, Y. The Impact of Knowledge Power on Enterprise Breakthrough Innovation: From the Perspective of Boundary-Spanning Dual Search. Sustainability 2022, 14, 10980. [Google Scholar] [CrossRef]

- Kissan, J.; Alex, T. Monitoring and Incentives in Sales Organizations: An Agency-Theoretic Perspective. Market. Sci. 1998, 17, 107. [Google Scholar]

- Qiao, Y.; Zhang, Y.; Li, Y.; Xiao, J.; Xue, Y. How Old Industrial Base Cities Build Open Innovation Ecosystems to Break Industrial Lock-In: A Case Study of Shiyan, Hubei. Zhongguo Ruan Kexue 2024, 3, 109–118. [Google Scholar]

- Shi, T.; Han, F.; Chen, L.; Shi, J.; Xiao, H. Study on value Co-creation and evolution game of low-carbon technological innovation ecosystem. J. Clean. Prod. 2023, 414, 137720. [Google Scholar] [CrossRef]

- Xiao, H.; Guo, P. Research on the Evolutionary Game Theory of Knowledge Sharing in Cross organizational Project Cooperation Considering Knowledge Potential Difference. Sci. Technol. Manag. 2023, 44, 132–151. [Google Scholar]

- Lu, F.; Chang, D. Stability analysis of industry university research cooperation innovation based on evolutionary game theory. Sci. Technol. Manag. Res. 2015, 35, 100–105+114. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).