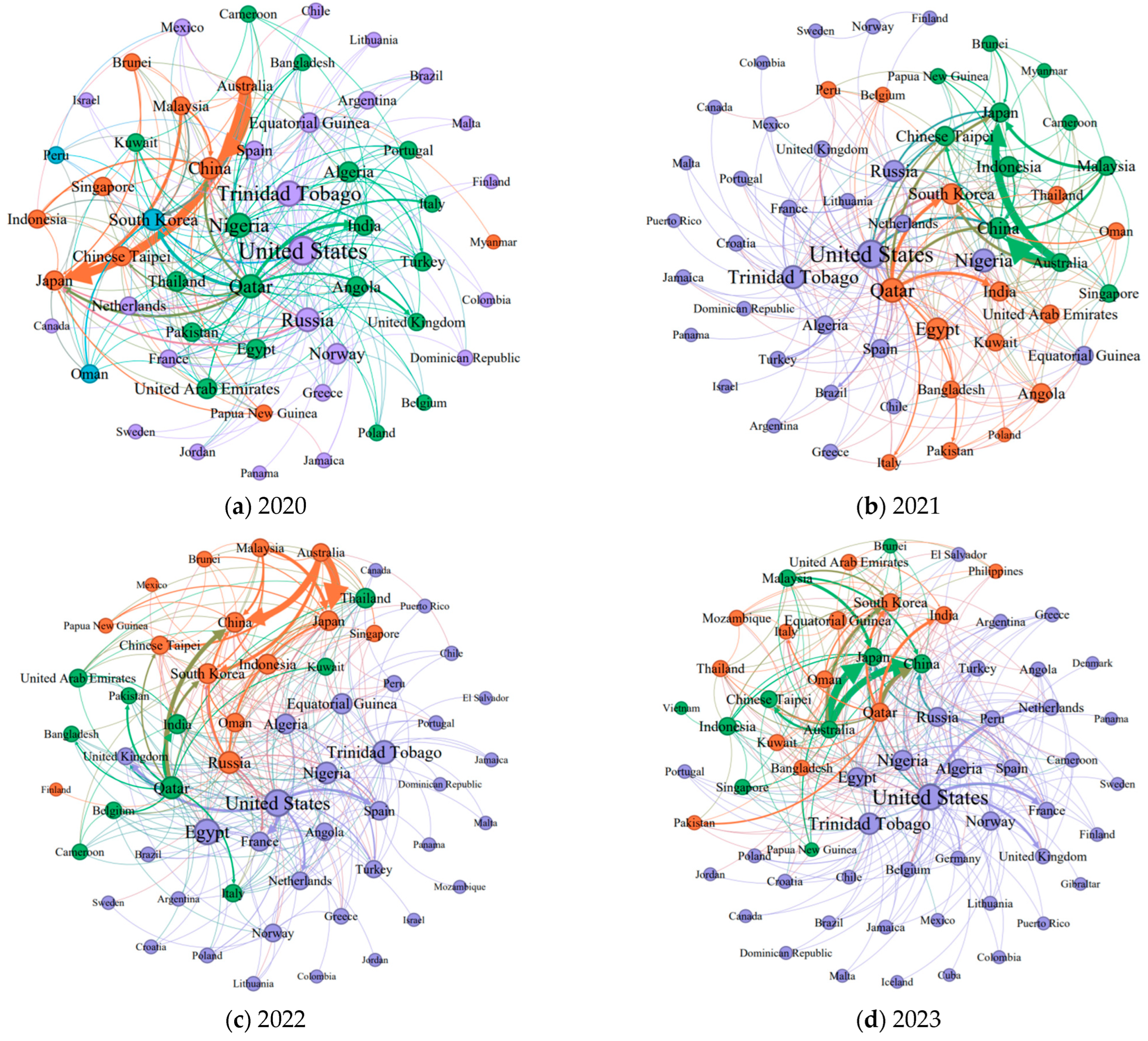

This section investigates the impact of the Russia–Ukraine conflict on the robustness of the global LNG trade network. It first identifies vulnerabilities in network robustness under varying attack budgets, then analyzes the dynamic changes in robustness throughout different phases of the conflict.

5.1. Impact of Attack Budgets on Network Robustness Amid the Russia–Ukraine Conflict

(1) Assessing Network Robustness Across Different Budget Scenarios

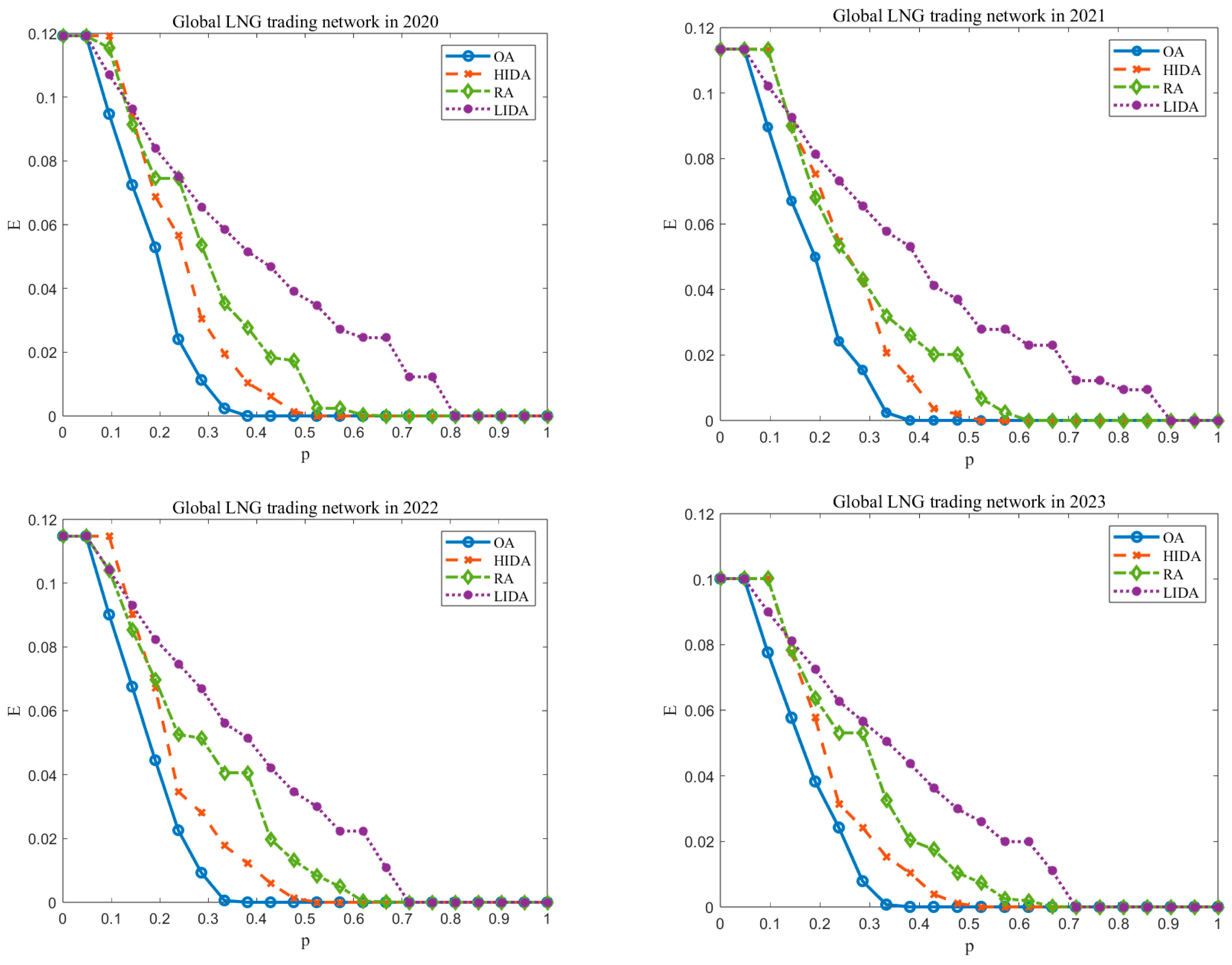

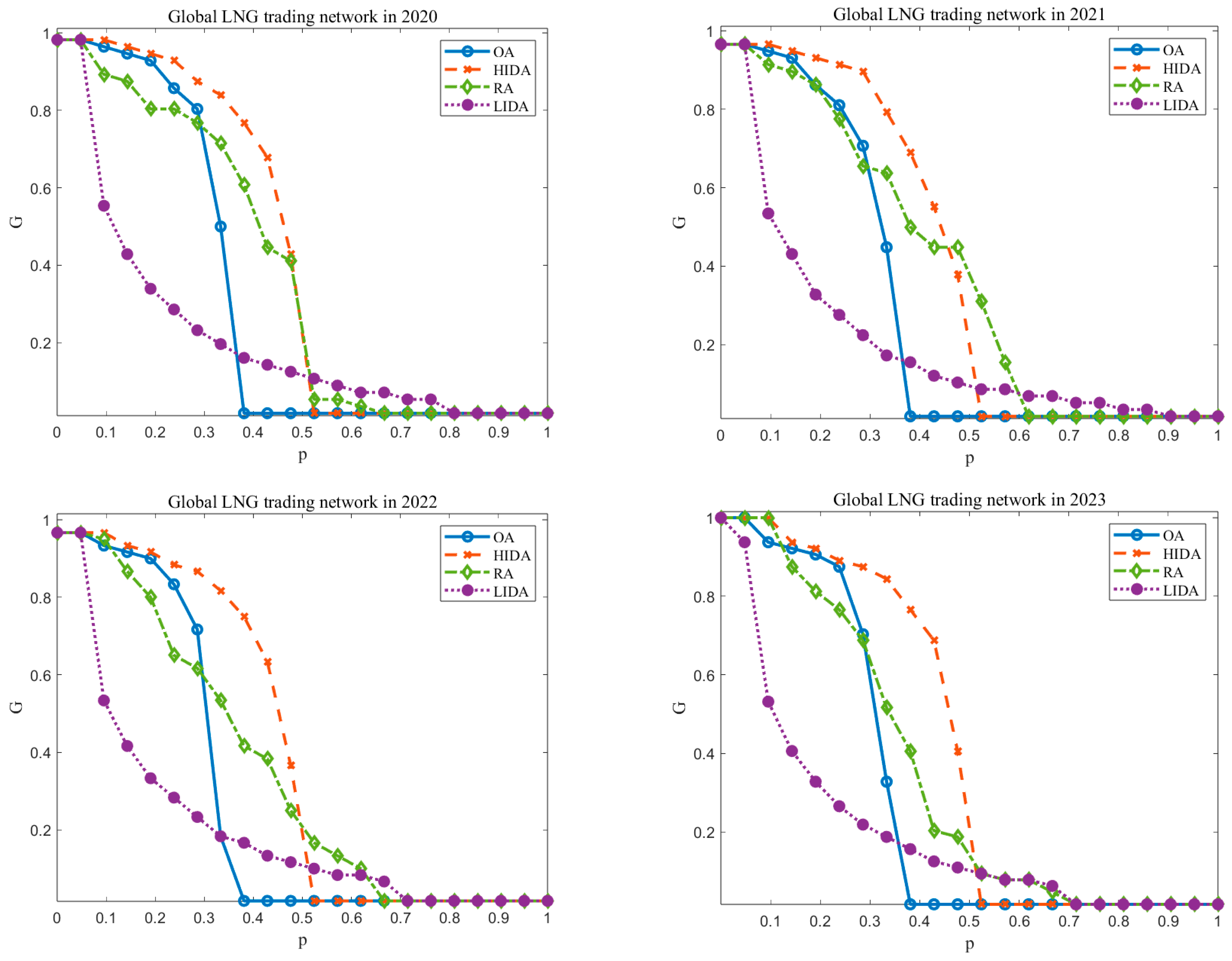

To assess the impact of the Russia–Ukraine conflict on the robustness of the global LNG trade network, this study employs simulated attack strategies to analyze changes in network robustness under varying attack budgets. The horizontal axis represents the attack budget coefficient, ranging within [0, 1], with the upper limit of the attack budget varying accordingly. The vertical axis shows both network efficiency and the size of the largest connected component, where lower values of these indicators reflect reduced network robustness.

Assuming an attack cost factor of 1 and determining node importance based on weighted degree centrality, we confirm that this approach effectively captures node connectivity. However, real-world LNG trade networks involve additional factors influencing node importance, which we further verify. First, a correlation analysis between weighted degree centrality and national economic strength reveals that countries with higher weighted degree centrality tend to have stronger economies, suggesting that centrality is a reasonable proxy for a country’s significance in LNG trade. Moreover, we examine the influence of energy strategy on node importance. A review of various national LNG trade policies indicates that countries with strategic energy roles typically exhibit higher weighted degree centrality. Hence, we conclude that using weighted degree centrality to indicate node significance is theoretically and empirically justifiable.

As shown in

Figure 3, for network efficiency, when

p < 0.05, there is no significant decline across all attack strategies, indicating that key nodes and pathways remain intact, thereby preserving overall network robustness. As

p increases to the range of 0.05 <

p < 0.35, the optimal attack (OA) strategy identifies and targets critical nodes and pathways at minimal cost, causing a sharp reduction in network efficiency. When

p approaches 0.35, network efficiency is nearly reduced to zero, highlighting the network’s heavy reliance on key nodes. At this stage, robustness deteriorates most rapidly under the OA strategy. Beyond

p > 0.35, the high-importance attack (HIDA) strategy also induces a steep decline in efficiency, gradually converging with the OA strategy’s impact. The random attack (RA) strategy follows while the low-importance attack (LIDA) strategy causes the slowest deterioration.

As shown in

Figure 4, regarding the largest connected component, when

p < 0.05, there is minimal reduction across all attack strategies, suggesting strong structural resilience. As

p increases to 0.05 <

p < 0.4, the LIDA strategy leads to the fastest initial decline in robustness, followed by the RA strategy. These strategies prioritize low-cost nodes, allowing more to be attacked within the budget. When

p > 0.4, the OA strategy induces the most severe degradation, and as

p approaches 0.4, the largest connected component nearly collapses. At this stage, the HIDA strategy also significantly reduces robustness, increasingly aligning with the OA strategy’s performance. Although the LIDA strategy causes rapid initial degradation, its impact plateaus as

p rises, ultimately reducing the largest connected component to zero.

Integrating the results from network efficiency and the largest connected component, we find that network robustness is highly sensitive to attack strategy, exhibiting clear phase transitions. Different strategies lead to varied decline rates: the OA strategy triggers the fastest breakdown, followed by the HIDA and RA strategies, while the LIDA strategy causes the slowest deterioration. This pattern reflects the scale-free nature of the network, where the OA strategy achieves maximal disruption at minimal cost, exerting the most substantial impact on robustness. Although the HIDA strategy also targets critical nodes, its less optimized selection sequence limits its effectiveness compared to the OA strategy. Meanwhile, the RA and LIDA strategies result in gradual robustness loss due to their random or non-targeted approaches.

(2) Analysis in the Context of the Russia–Ukraine Conflict

The global LNG trade network exhibits substantial robustness under low attack budgets (p < 0.05), where key nodes and pathways remain largely unaffected, and the overall network structure remains intact. This implies the existence of alternative trade routes within the network. Due to its structural resilience, resource reallocation capacity, and collaborative functioning of substitute nodes and paths, the network maintains basic trade flow efficiency, mitigating disruptions’ effects and ensuring continued operation.

Under moderate attack budgets (0.05 < p < 0.4), if the LIDA strategy is applied—targeting low-cost nodes—the largest connected component is rapidly disrupted, obstructing trade flows and leading to a sharp drop in robustness. When the OA strategy is employed, critical pathways, key countries, and essential routes are precisely targeted, resulting in concentrated and severe disruptions that quickly undermine network efficiency and connectivity. The HIDA and RA strategies also degrade the network, compounding the impact and broadening the scope of vulnerability. These findings reveal that the network is highly reliant on a few key nodes and routes, making it susceptible to deliberate, targeted disruptions. Moreover, targeting low-cost nodes exposes weaknesses in redundancy and decentralization, as insufficient alternative routes exist to buffer localized failures, thereby accelerating the decline in robustness.

When the attack budget is high (p > 0.4), the OA strategy continues to inflict severe disruptions, while other strategies produce substantial damage. The combined impact of these strategies further erodes the robustness of the global LNG trade network, significantly affecting core countries and strategic routes. As network efficiency and connectivity collapse, the network loses its capacity for self-repair and becomes unable to withstand sustained or compound attacks. Even peripheral countries and marginal routes are impacted, contributing to system-wide instability and accelerating network failure.

As the attack budget approaches its upper bound, the OA strategy reduces network efficiency and the largest connected component to near zero, indicating almost complete network collapse. Other strategies also contribute to this failure, exposing the extreme vulnerability of the network under intensive and coordinated attacks with limited resistance capacity.

In conclusion, the Russia–Ukraine conflict substantially compromises the robustness of the global LNG trade network. The network’s vulnerabilities—including reliance on low-cost configurations, concentration on critical nodes, and fragility under high-budget attacks—highlight its susceptibility to targeted disruptions and structural weaknesses in times of geopolitical crisis.

5.2. Impact of Conflict Phases on Network Robustness Amid the Russia–Ukraine Conflict

(1) Assessing Network Robustness Across Different Stages

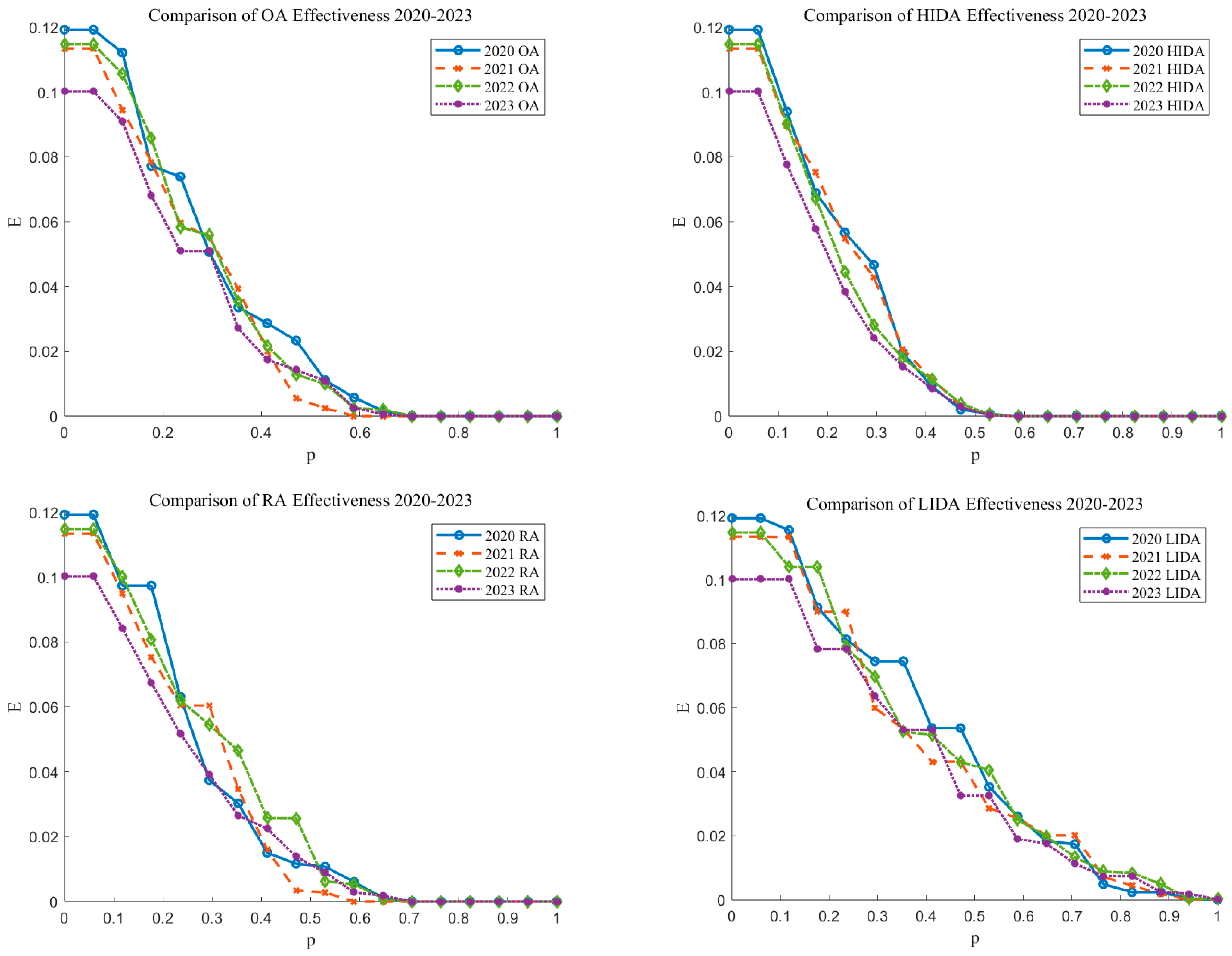

Following the method outlined in

Section 5.1, this section examines the robustness of the global LNG trade network from 2020 to 2023 under simulated attack scenarios. By comparing network performance across different years under consistent attack strategies, we aim to identify the long-term structural impacts of the Russia–Ukraine conflict on network robustness.

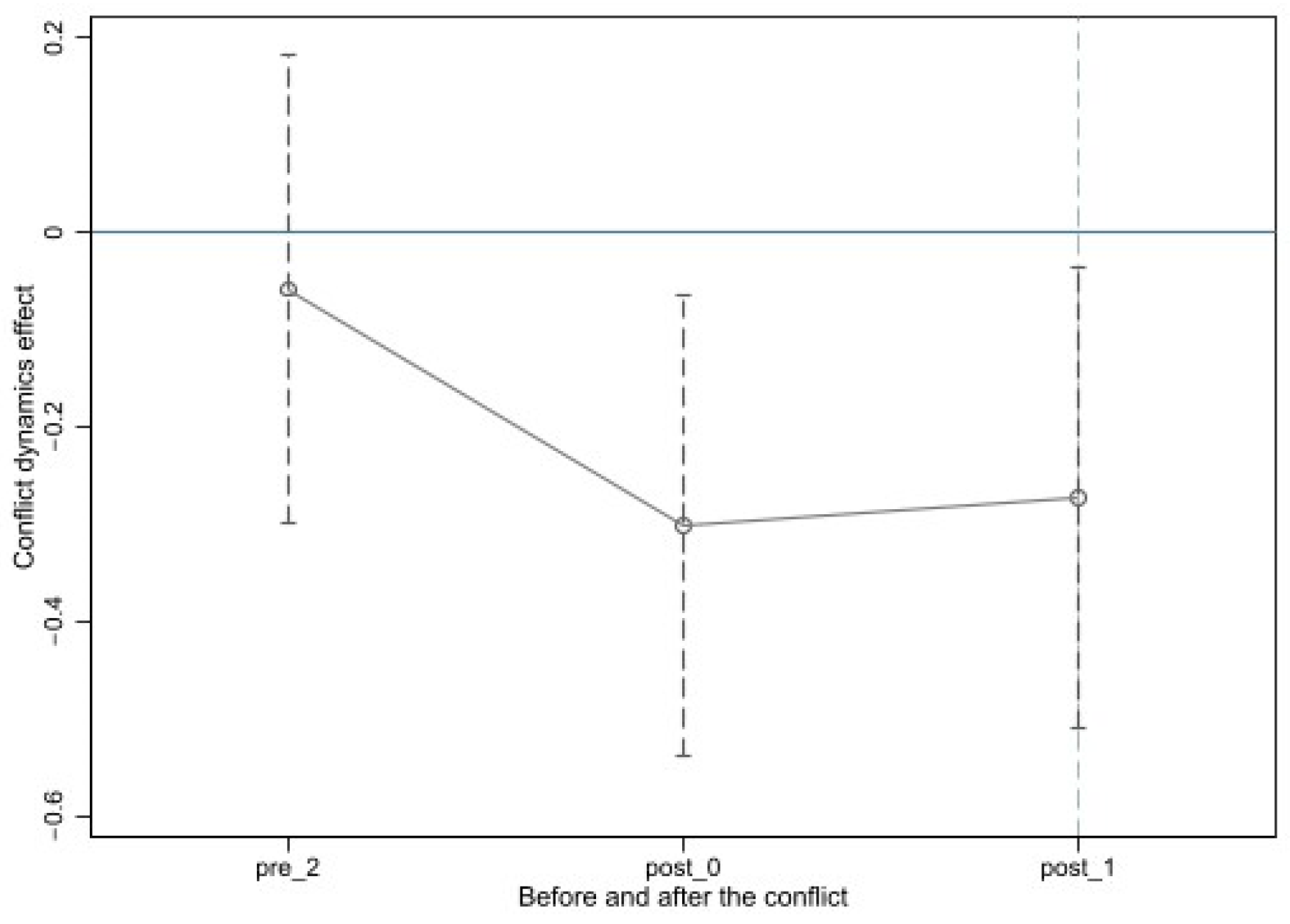

As shown in

Figure 5, the impact of the conflict on network robustness intensified progressively over time. Across all attack strategies, the network experienced the slowest decline in efficiency in 2020, indicating the highest level of robustness. This suggests that, under identical attack conditions, the network was more capable of maintaining functional performance and structural coherence. However, in 2021 and 2022, network robustness weakened, though it still retained a certain level of resilience. By 2023, the network showed the most rapid decline in efficiency and the lowest robustness, with stability and recovery capacity reduced to their weakest levels under attack.

(2) Analysis in the Context of the Russia–Ukraine Conflict

Before the Russia–Ukraine conflict (2020–2021), the global LNG trade network exhibited substantial robustness. Both network efficiency and the size of the largest connected component declined only moderately, even under various attack strategies. During this period, the global energy market remained relatively stable, geopolitical tensions had not yet escalated significantly, and LNG trade relationships among countries were generally robust. Most LNG-importing countries had not yet diversified away from Russian LNG, as demand patterns and supply chains remained relatively unchanged. Key trade routes remained intact, and multiple alternative pathways ensured continued trade flow. Despite increasing attack budget coefficients, the network maintained high connectivity and efficiency, demonstrating its capacity to absorb moderate disruptions without collapse.

With the outbreak of the conflict in 2022, the robustness of the global LNG trade network began to deteriorate significantly. Both network efficiency and the size of the largest connected component experienced accelerated declines, especially under high-importance attack (HIDA) and optimal attack (OA) strategies. The network’s vulnerabilities became increasingly evident. On the one hand, Russia’s capacity as a major LNG exporter was compromised, weakening its role in the global energy supply. On the other hand, geopolitical tensions prompted importing countries to reduce reliance on Russian LNG, seeking alternative sources and suppliers. This shift triggered a reconfiguration of trade routes, reshaping the network’s topology and redistributing key nodes and pathways. As a result, network connectivity and structural stability were significantly undermined.

As the conflict persisted into 2023, network robustness continued to erode. The network became increasingly vulnerable under all attack strategies, and, even at low attack budgets, connectivity and transmission efficiency declined sharply. Ongoing disruptions and rerouting efforts further weakened the network’s structural integrity. The volatility of the global energy market compounded these challenges, making connections between nodes more unstable and reducing the effectiveness of alternative pathways. Moreover, the network had not recovered from the initial disruptions, and its self-repair capability remained constrained by continuing geopolitical instability. These factors jointly contributed to the network’s heightened susceptibility to attack and sustained degradation of robustness.

In conclusion, the Russia–Ukraine conflict has had a profoundly negative impact on the robustness of the global LNG trade network. Before the conflict, the network demonstrated strong resilience and could withstand a range of attack scenarios. However, as the conflict escalated, robustness consistently declined, with critical nodes and pathways disrupted and the network structure undergoing fundamental changes. A comparative analysis of the different phases of the conflict reveals three primary mechanisms through which robustness was undermined: (1) the inability of Russia’s alternative suppliers to promptly compensate for lost supply, resulting in reduced network connectivity and structural imbalance; (2) the reconfiguration of trade routes, which distorted trade flow distribution and increased overall vulnerability; and (3) the rise in negative correlations within the network, leading to structural fragmentation and making key nodes more exposed to targeted attacks, thereby accelerating the decline in robustness.