1. Introduction

With the growth of e-commerce and improvements in logistics, online purchases have emerged as a significant driver of consumer behavior. In 2023, China’s e-commerce transaction volume reached

$5.8 trillion, marking an 11% year-on-year growth. The growing popularity of online shopping has led to the widespread use of e-commerce platforms. The rapid growth of e-commerce has revolutionized global retail, offering manufacturers unprecedented access to vast consumer markets. In this context, a growing number of manufacturers sell their products online, leading to the gradual emergence of the e-commerce supply chain (ECSC). Concurrently, increasing environmental awareness and stringent carbon neutrality policies have driven manufacturers to adopt low-carbon production strategies, transforming into low-carbon manufacturers to meet consumer demand for sustainable products. The 2024 China Sustainable Consumption Report indicates that approximately 70–80% of consumers are prepared to spend an extra 10–30% on sustainable products, a proportion which has been steadily increasing compared to previous years. However, a critical challenge persists in e-commerce supply chains: information asymmetry between low-carbon manufacturers and consumers. Consumers often struggle to verify the authenticity of a product’s eco-friendly attributes, leading to skepticism and reduced market trust [

1]. Mark et al. conducted a survey of 1200 consumers, revealing that 54% of the respondents gave up purchasing low-carbon products because they were unable to verify the actual environmental protection performance of these products [

2]. To address this issue, blockchain technology has emerged as a promising solution. Its decentralized, tamper-proof, and transparent features enable end-to-end traceability of carbon footprints, allowing consumers to access verified information about a product’s sustainability [

3]. While blockchain adoption theoretically enhances trust, its economic viability for manufacturers remains contested due to high implementation costs and uncertain returns. For examples, Lenovo has effectively promoted information sharing between the firm and consumers and enhanced the transparency of the entire product lifecycle by adopting a “blockchain-supply chain integration” model [

4]; IKEA employs blockchain technology to monitor the production process of office desks, ensuring that all sourced materials originate from certified sustainable timber in Indonesian forests. Similarly, Haier has developed COSMOPlat, a user-centric industrial Internet platform powered by blockchain technology. This platform engages users directly, enabling them to participate in product manufacturing throughout the entire value chain, thereby strengthening consumer trust.

Within the ECSC, agency, reselling and dual mode are three common sales modes for cooperation between manufacturers and platforms [

5]. In the agency mode, the platform does not participate in the transaction. Instead, it charges a certain commission from the manufacturers who sell items directly to consumers through the platform. For example, the footwear brand Timberland chooses to sell products through its own online store on JD.com. In the reselling mode, the platform acquires products from the manufacturer and sells them to consumers. For instance, Christian Louboutin in beauty only engages with JD.com through reselling mode. In the dual mode, manufacturers utilize both the reselling and agency modes to distribute their products. Household appliance brand Midea is example of companies that sells through both self-operated store and their official flagship store on JD.com.

While prior researches explore sales modes in profit-driven contexts, few studies consider platforms with dual purpose that balances profit maximization with consumer surplus [

6]. Modern platforms like JD.com and Alibaba, increasingly prioritize corporate social responsibility (CSR), emphasizing consumer surplus alongside profitability. JD.com initiated a substantial subsidy initiative worth 10 billion yuan aimed at reducing the cost of its merchandise for consumers, aiming to enhance consumer welfare. Taobao’s “88VIP” program is a strategy aimed at enhancing consumer welfare by offering extra benefits to consumers. This approach has effectively drawn a loyal customer base for the company. These dual-purpose platforms introduce new complexities, as platform decisions must reconcile economic and social goals. Motivated by the phenomena above, the key research questions are progressively outlined below:

Q1: How should the low-carbon manufacturer jointly optimize blockchain adoption decisions and sales mode selection (agency/reselling/dual) under dual-purpose e-commerce platform?

Q2: How does a dual-purpose platform’s consumer surplus concern reshape manufacturers’ blockchain adoption and sales mode selection strategies?

Q3: What economic value does blockchain technology create for different supply chain members under alternative sales modes?

These questions are systematically addressed through six game-theoretic models (

Section 4), followed by integrated insights in

Section 5 and

Section 6. For the above purposes, this paper makes the following three contributions: First, simultaneously incorporate blockchain adoption and sales mode selection into the ECSC. This enables us to identify conditions where blockchain adoption amplifies or diminishes the advantages of specific sales modes; Second, introduce a dual-purpose platform (profit and consumer surplus) to study its influence on manufacturer strategies. This novel modeling approach allows us to quantify how platforms’ consumer surplus concern influences manufacturers’ operational decisions; Third, quantify the economic value of blockchain across sales modes to guide practical adoption, which provides actionable insights for managers to match blockchain investments with optimal sales mode selection strategies.

The rest of the paper is outlined below. Literature reviews are presented in

Section 2. The model description and assumption are illustrated in

Section 3.

Section 4 derives the equilibrium outcomes for six models.

Section 5 provides a comparative analysis of these equilibrium outcomes.

Section 6 conducts an integrated analysis of joint decision-making and the economic value of blockchain. Concluding remarks and managerial implications are discussed in

Section 7.

4. Model Solution and Analysis

As described above, the manufacturer faces a dual-dimensional strategic space: blockchain adoption (B) or non-adoption (N), coupled with three channel coordination mechanisms-agency (A), reselling (R), and dual modes (D). This combinatorial structure generates six distinct game-theoretic scenarios, formally defined as: Agency mode without blockchain (NA), reselling mode without blockchain (NR), dual mode without blockchain (ND), agency mode with blockchain (BA), reselling mode with blockchain (BR), and dual mode with blockchain (BD). Each of these six models will be solved using backward induction method.

4.1. Models Without Blockchain

Under non-blockchain adoption scenario, information asymmetry persists regarding product greenness level, leading consumers to form probabilistic assessments of environmental quality. In this case, we analyze three sales modes between the manufacturer and the platform. Based on these modes, each game structure is formalized through a sequential Stackelberg framework.

4.1.1. Agency Mode Without Blockchain (NA)

In model NA, the manufacturer determines retail price

and the commission rate of

is exogenous. At this time, the functions of eco-friendly product demand, consumer surplus, the utilities of manufacturer and platform are:

Using backward induction, the equilibrium strategies can be obtained under model NA.

Lemma 1. In the NA model, the retail price is:

By substituting (5) into Equations (1)–(4), we can get the demand for eco-friendly products, consumer surplus and utilities of supply chain members:

Corollary 1. In the NA model, in equilibrium:

A: (1) ;

(2) When , otherwise .

The increase in consumers’ information acquisition ability

raises both the retail price and demand, benefiting the manufacturer but reducing consumer surplus. The platform’s utility response to

depends on the commission rate

: Low

makes utility decrease with

due to insufficient compensation for price-driven demand shrinkage, while high

allows utility growth from higher revenue share. Unlike the NR/ND models (see

Section 5), the platform’s utility sensitivity to

in the agency mode critically hinges on

, highlighting the moderating role of commission structure in this channel.

B: When , otherwise .

If consumers’ green sensitivity is low, the platform benefits from concerning consumer surplus as price elasticity dominates. High reverses this effect: consumers tolerate less price reduction, making consumer-surplus-focused strategies unprofitable.

4.1.2. Reselling Mode Without Blockchain (NR)

In Model NR, the manufacturer determines the wholesale price

, and then the platform determines the retail price

. At this time, the functions of the demand for eco-friendly products, consumer surplus, the utilities of the manufacturer and the platform are:

Using backward induction, the equilibrium strategies can be obtained under model NR.

Lemma 2. In the NR model, the equilibrium strategies are:

By substituting (14) and (15) into Equations (10)–(13), we can get the demand for eco-friendly products, consumer surplus and utilities of the manufacturer and platform:

Corollary 2. In the NR model, in equilibrium:

A:

In the NR model, when consumers gain better access to eco-friendly product information ( increases), the manufacturer raises wholesale price, leading platform to increase retail price accordingly. Despite these price hikes, sales volume continues to grow because consumers demonstrate greater willingness to pay for verifiable eco-friendly attributes. While the manufacturer and the platform get higher utilities, consumers experience reduced net benefits. The increased expenditure outweighs the perceived value gain from enhanced product transparency, which leads to “diminished consumer surplus.”

B: (1) ;;;

(2) When , , , otherwise .

The platform’s concern on consumer welfare significantly influences pricing strategies. As increases, the platform strategically reduces retail price, compelling manufacturers to correspondingly lower wholesale price. This price reduction stimulates demand, but its effectiveness critically depends on consumers’ greenness sensitivity . In markets where consumers prioritize cost over sustainability (low ), aggressive pricing strategies can dramatically boost sales volume, potentially increasing profits for both platform and manufacturer despite lower margins. Conversely, in eco-conscious segments (high ), where consumers value eco-friendly attributes, price reductions yield diminishing returns. Here, the strategy may backfire-shrinking profit margins aren’t offset by sufficient demand growth, ultimately eroding value for all stakeholders while failing to meaningfully enhance consumer welfare. This dynamic creates a fundamental tension between price-based welfare policies and premium sustainability positioning.

4.1.3. Dual Mode Without Blockchain (ND)

In Model ND, the manufacturer markets eco-friendly products under reselling and the agency mode. Similar to Liu and Deng [

33,

34], we employ a utility function to derive the demand functions from these two modes, that is:

At this time, the functions of the demand for eco-friendly products, consumer surplus, the utilities of the manufacturer and the platform are:

Using backward induction, the equilibrium strategies can be obtained under model ND.

Lemma 3. In the ND model, the equilibrium strategies are:

By substituting (26), (27) and (28) into Equations (21)–(25), we can get the demand for eco-friendly products, consumer surplus and utilities of the manufacturer and the platform as follows:

where

.

Corollary 3. In the ND model, in equilibrium:

A: (1) ;

(2) When and , , otherwise When and , , otherwise ; When and , , otherwise

Retail prices rise in both agency and reselling modes as increases, but wholesale price only increase when the platform’s consumer surplus concern and channel competition are low. When < 0.5 and is small, higher boosts reselling mode demand; otherwise, demand contracts due to excessive price inflation. The Manufacturer benefits from only when commission rates and consumer green sensitivity are sufficiently high. The platform gains from when is high, but only if is moderate—excessive consumer surplus focus erodes price premiums.

B: (1) ;

(2) When , otherwise, When and otherwise .

Higher reduces wholesale price and reselling mode retail price, but increases total demand and consumer surplus. Manufacturer profit declines with unless is very low. Platform utility paradoxically increases with in low as the greenness sensitivity offsets margin erosion.

Table 3 summarizes the equilibrium results of the NA, NR, and ND models without blockchain technology.

4.2. Models with Blockchain

When the manufacturer adopts blockchain technology, consumers can fully obtain the greenness level of eco-friendly products, that is,.

4.2.1. Agency Mode with Blockchain (BA)

In model BA, the manufacturer retains full control over production and sales processes, including decisions on blockchain adoption. Consequently, the manufacturer bears the cost of blockchain adoption, while the platform operates solely as a distribution channel. The functions of the demand for eco-friendly products, consumer surplus, the utilities of the manufacturer and the platform are:

Using backward induction, the equilibrium strategies can be obtained under model BA.

Lemma 4. In the BA model, the equilibrium retail price is:

By substituting (38) into Equations (34)–(37), we can get the demand for eco-friendly products, consumer surplus and utilities of the manufacturer and the platform as follows:

where

.

Corollary 4. In the BA model, in equilibrium:

A: (1) ;;

(2) When ,, otherwise ; When , , otherwise ; When , , otherwise .

The blockchain adoption leads to higher retail price and reduced demand due to increased operational cost. Consumer surplus only diminishes when green sensitivity is low, as price-sensitive buyers are disproportionately affected. While manufacturer benefits from blockchain adoption in low markets, platform requires to exceed a critical threshold to realize utility gain.

B: When and , , otherwise .

The platform benefits from consumer surplus concern only when is sufficiently low, and is not high. Beyond these thresholds, harms utility without improving welfare. Therefore, when both and are low, increasing can simultaneously enhance platform utility and consumer surplus.

4.2.2. Reselling Mode with Blockchain (BR)

Under the BR model, the functions of the demand for eco-friendly products, consumer surplus, the utilities of the manufacturer and the platform are:

Using backward induction, the equilibrium strategies can be obtained under model BR.

Lemma 5. In the BR model, the equilibrium strategies are:

By substituting (47) and (48) into Equations (43)–(46), we can get the demand for eco-friendly products, consumer surplus and utilities of the manufacturer and the platform:

Corollary 5. In the BR model, in equilibrium:

A: (1) ;

(2) When , , otherwise

Rising unit operational cost of blockchain drives up both wholesale price and retail price, while depressing demand. Consumer surplus declines when is low, as price hikes outweigh authenticity assurance benefits. Both the manufacturer and the platform utilities uniformly decrease with , reflecting the reselling model’s sensitivity for unit operational cost of blockchain.

B: When , , otherwise ; When , , otherwise .

In the BR model, when is low, the retail price of eco-friendly products decreases as increases, while the market demand increases. When consumers’ greenness sensitivity is low, as increases, the consumer surplus, and the utilities of both the manufacturer and the platform decrease.

4.2.3. Dual Mode with Blockchain (BD)

In Model BD, the manufacturer sells eco-friendly products under both the reselling and agency modes. Similar to Liu and Zeng [

33,

34], we employ a utility function to derive the demand functions from these two modes, that is:

At this time, the functions of the demand for eco-friendly products, consumer surplus, the utilities of the manufacturer and the platform are:

Using backward induction, the equilibrium strategies can be obtained under model BD.

Lemma 6. In the BD model, the equilibrium strategies are:

By substituting (59), (60) and (61) into Equations (54)–(58), we can get the demand for eco-friendly products, consumer surplus and utilities of the manufacturer and the platform as follows:

where

,

,

,

,

.

Corollary 6. In the BD model, in equilibrium:

A: (1) ;

(2) When , , otherwise ; When and , , otherwise

where ;

With consumers having a high greenness sensitivity, they are more willing to pay a premium for products with verified eco-friendly attributes, the adoption of blockchain technology enhances the transparency and trustworthiness of the product’s greenness level, which can significantly increase consumer surplus. This is because consumers are more confident in the product’s eco-friendly claims, leading to a higher perceived value and willingness to pay. As a result, even though the retail prices increase due to the blockchain cost, the overall consumer surplus can still increase because the value gained from the verified greenness outweighs the price increase. For the manufacturer and the platform, when consumers have a high and , the utilities of both increase with .

B: (1) ;

(2) When , , otherwise .

When is low, both the retail price and the market demand under the reselling mode decrease as increases, while the consumer surplus increases.

Table 4 summarizes the equilibrium results of the BA, BR, and BD models with blockchain technology.

7. Conclusions and Managerial Insights

7.1. Main Findings

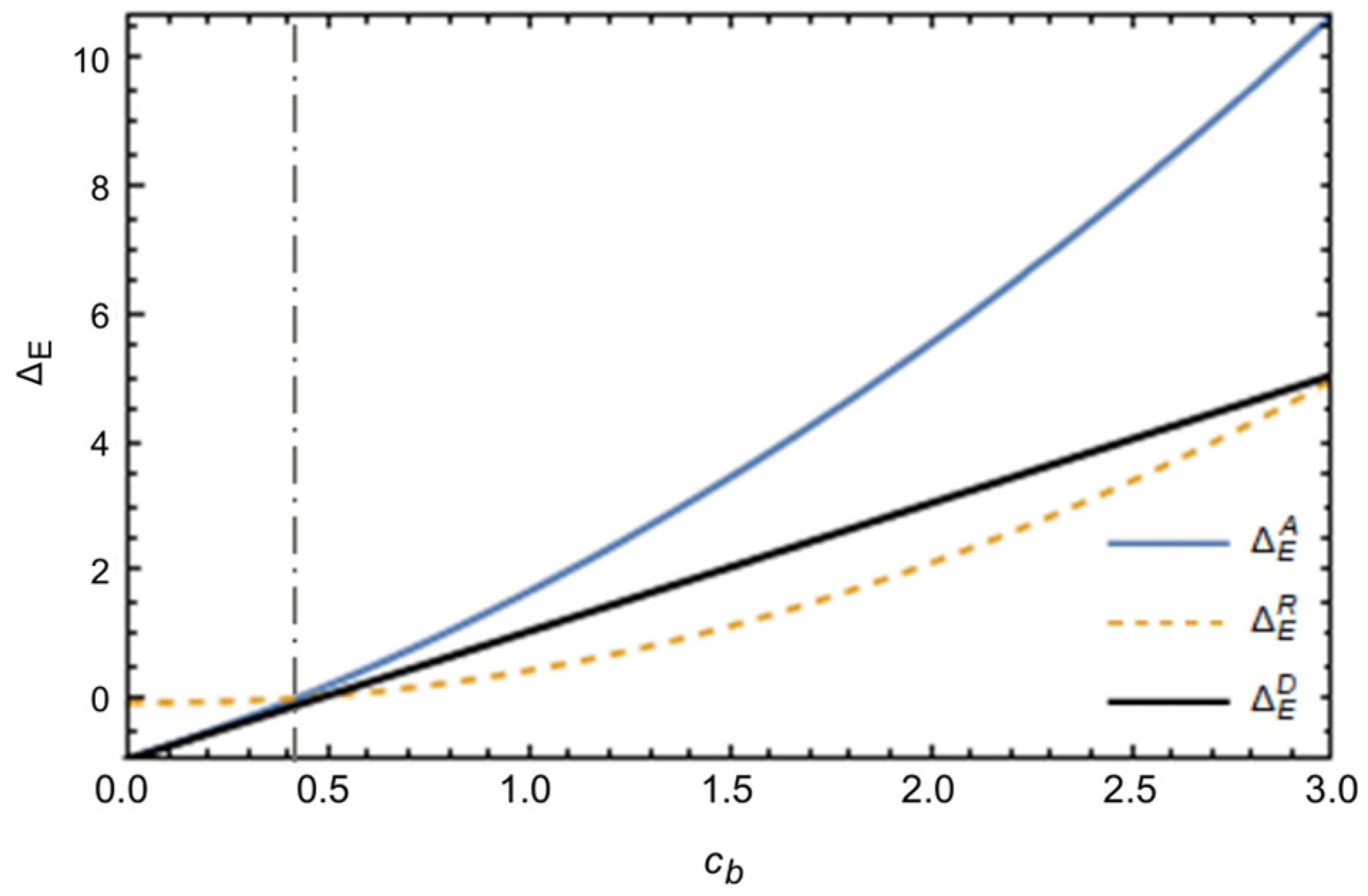

The study examines the strategic interplay between blockchain adoption and sales mode selection for a low-carbon manufacturer operating on a dual-purpose e-commerce platform that balances profit maximization with consumer surplus. Motivated by the challenges of information asymmetry in green product markets and the growing convergence of platform economies with low-carbon initiatives, we develop six game-theoretic models by combining three sales modes (agency, reselling, and dual modes) with two blockchain scenarios (adoption vs. non-adoption). Using backward induction, we derive equilibrium strategies for manufacturer and platform and analyze the impacts of key parameters. Building on these analyses, we further investigate the joint decision-making of blockchain adoption and sales mode selection, explore how the platform’s consumer surplus concern influences manufacturer decisions, and evaluate the economic value created by blockchain under alternative sales modes, ultimately leading to three key conclusions that address our core research questions.

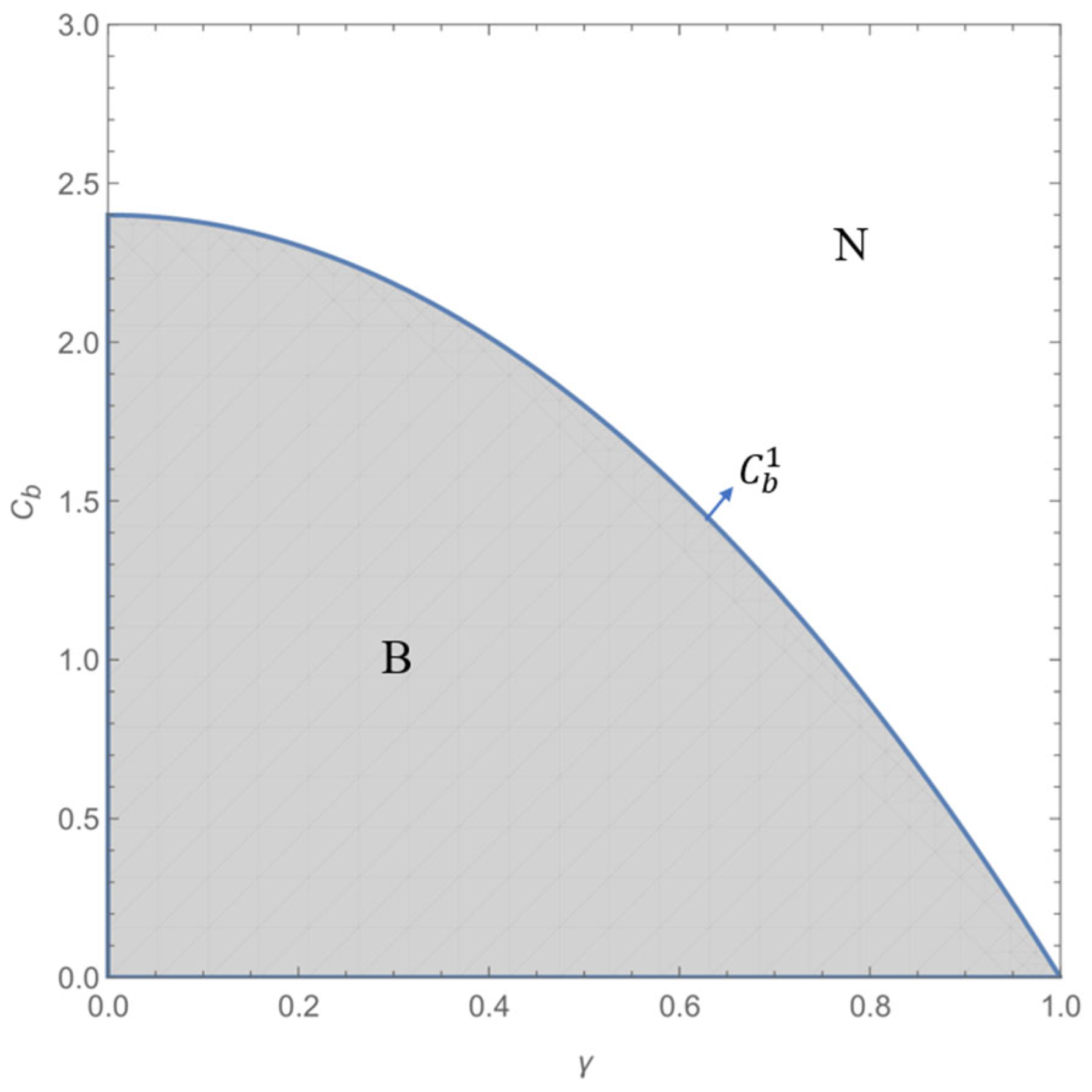

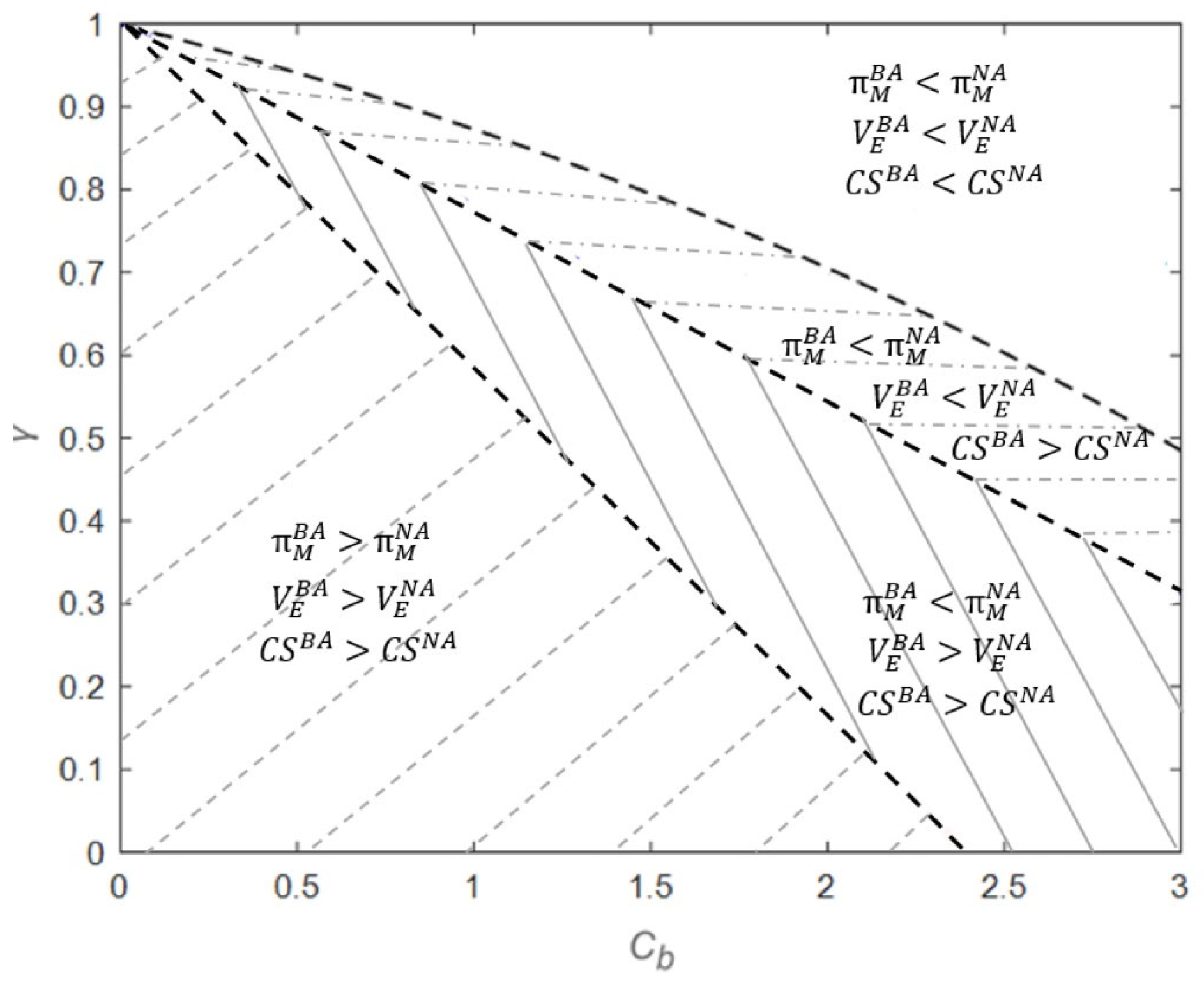

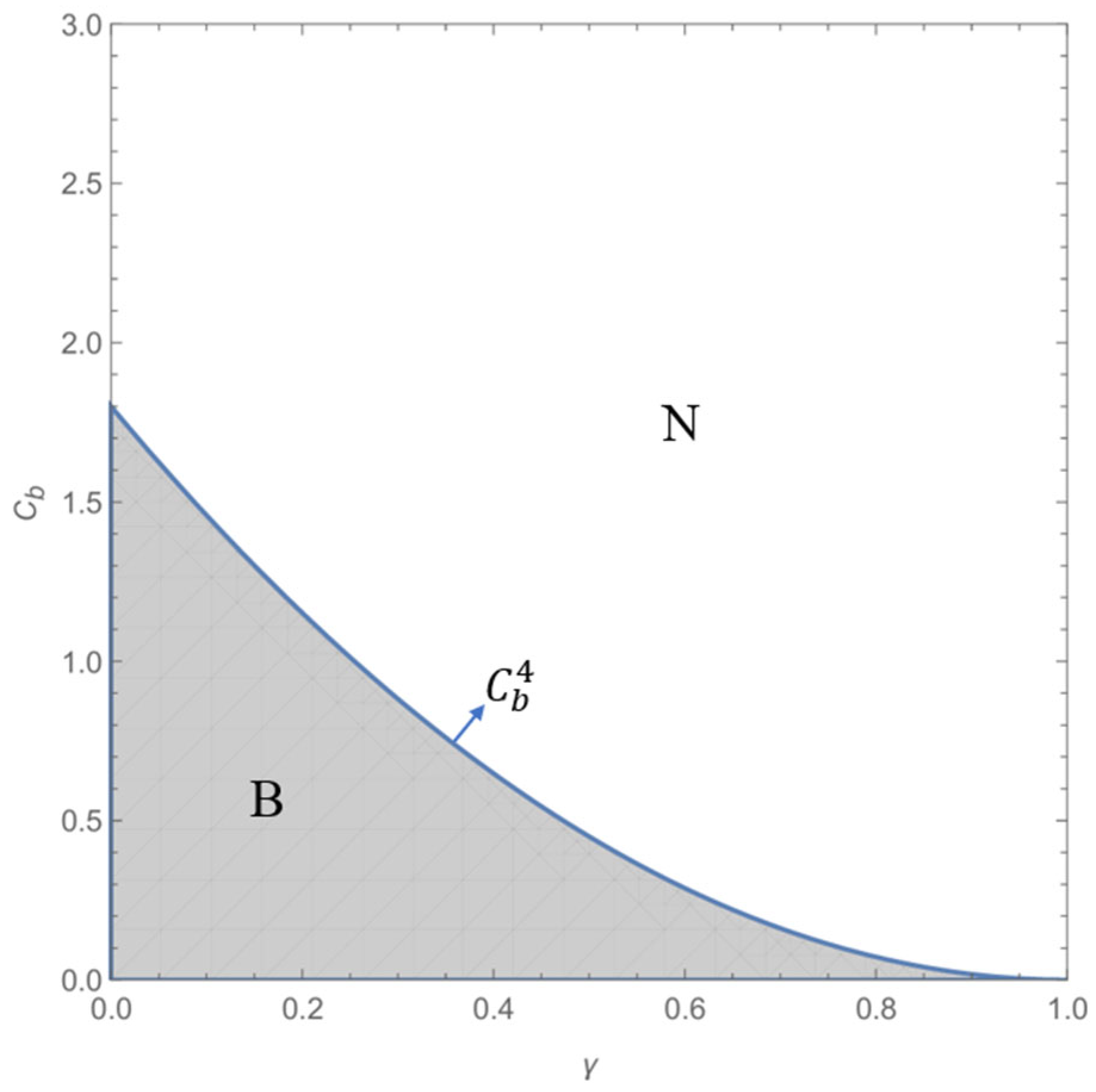

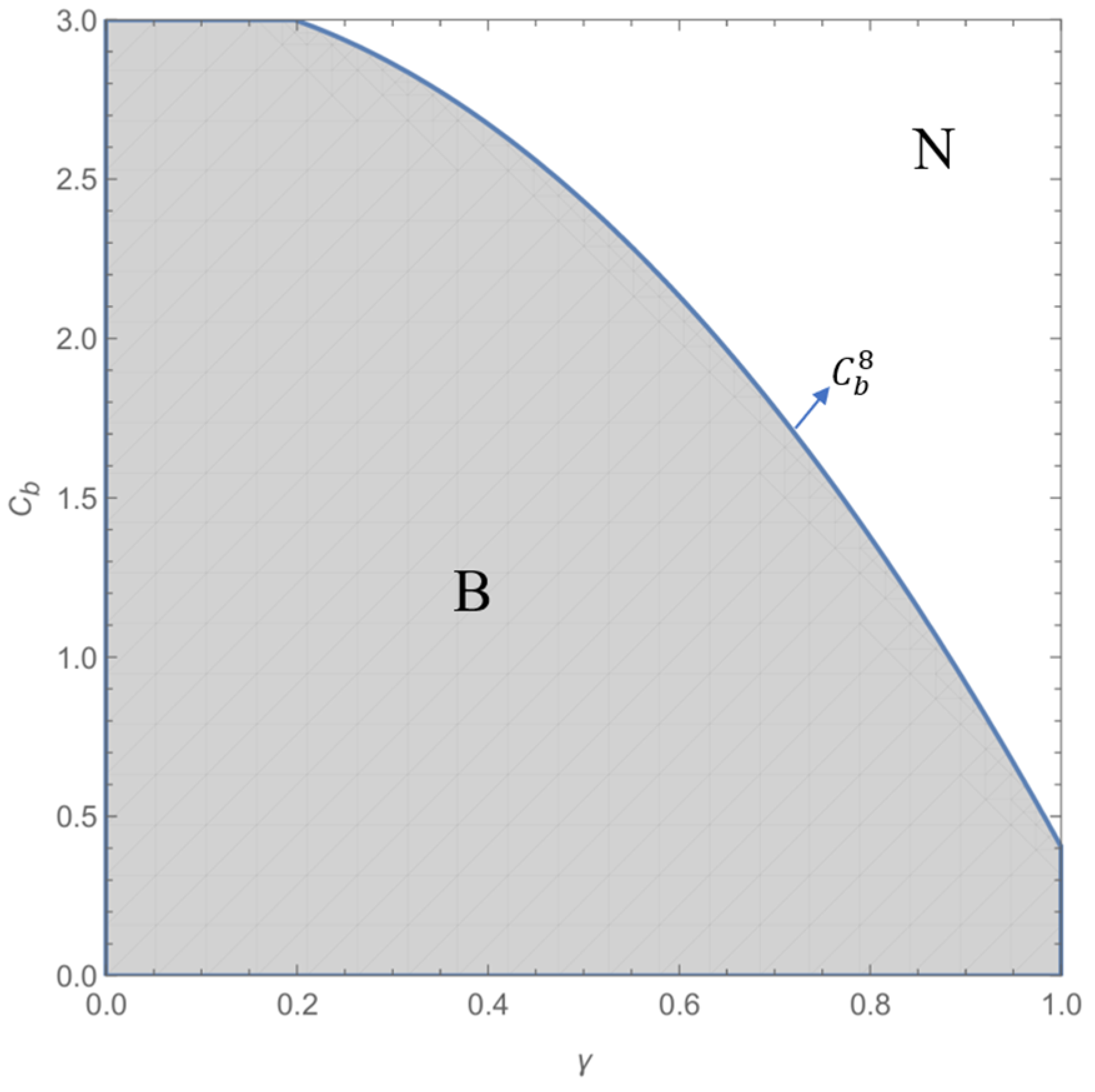

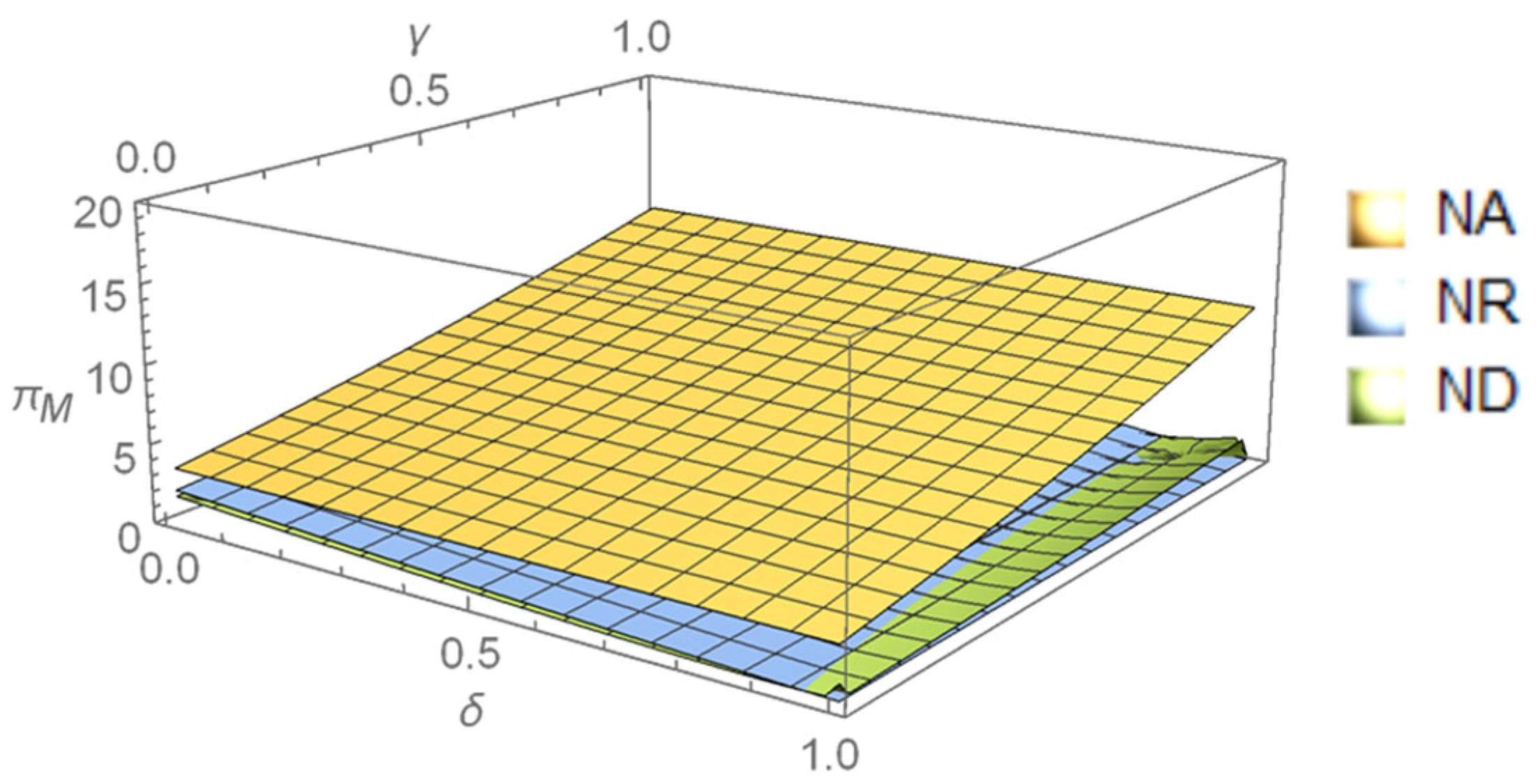

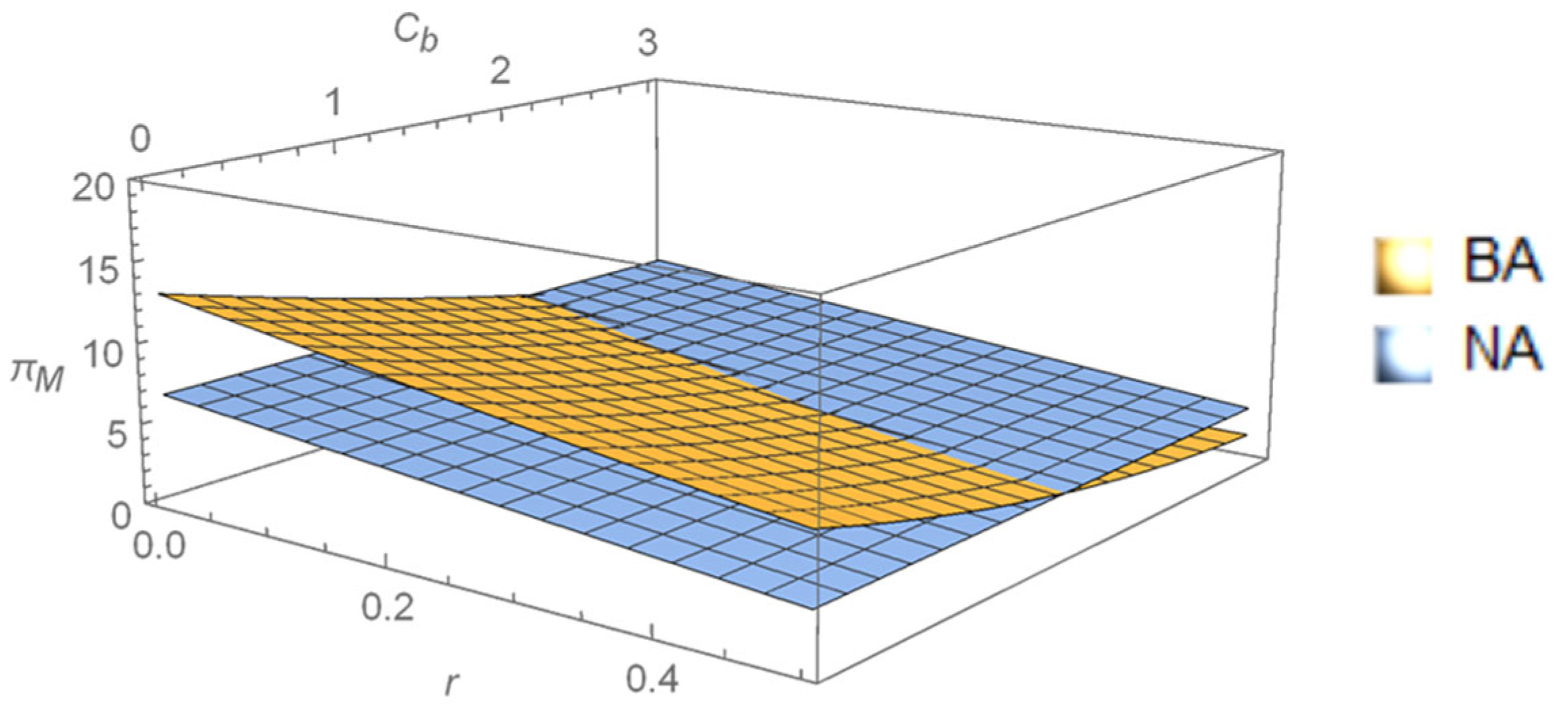

First, the agency mode remains the preferred choice in most scenarios, particularly when the platform’s degree of consumer surplus concern is at moderate levels, as it maximizes manufacturer profits, no matter with or without blockchain. Blockchain adoption requires meeting specific cost thresholds: under the agency mode, implementation is recommended only when unit operational cost of blockchain is below the critical value , enabling a triple win for manufacturer, platform, and consumers; while in the dual mode, adoption may be considered when unit operational cost of blockchain is below , though typically at the expense of reduced consumer surplus. Crucially, the dual mode only potentially surpasses the agency mode when platforms exhibit extreme concern on consumer surplus (either strong concern or complete neglect).

Second, the platform’s degree of consumer surplus concern primarily matters for manufacturer decisions only when blockchain is adopted, creating a “threshold effect” where extreme values override the default agency-mode preference. Blockchain amplifies the decision weight of . Without blockchain, has negligible impact on the manufacturer’s sales mode selection (agency mode remains consistently optimal). With blockchain, extreme values of can trigger the dual mode to become the new optimum, demonstrating how blockchain magnifies influence of on supply chain structure.

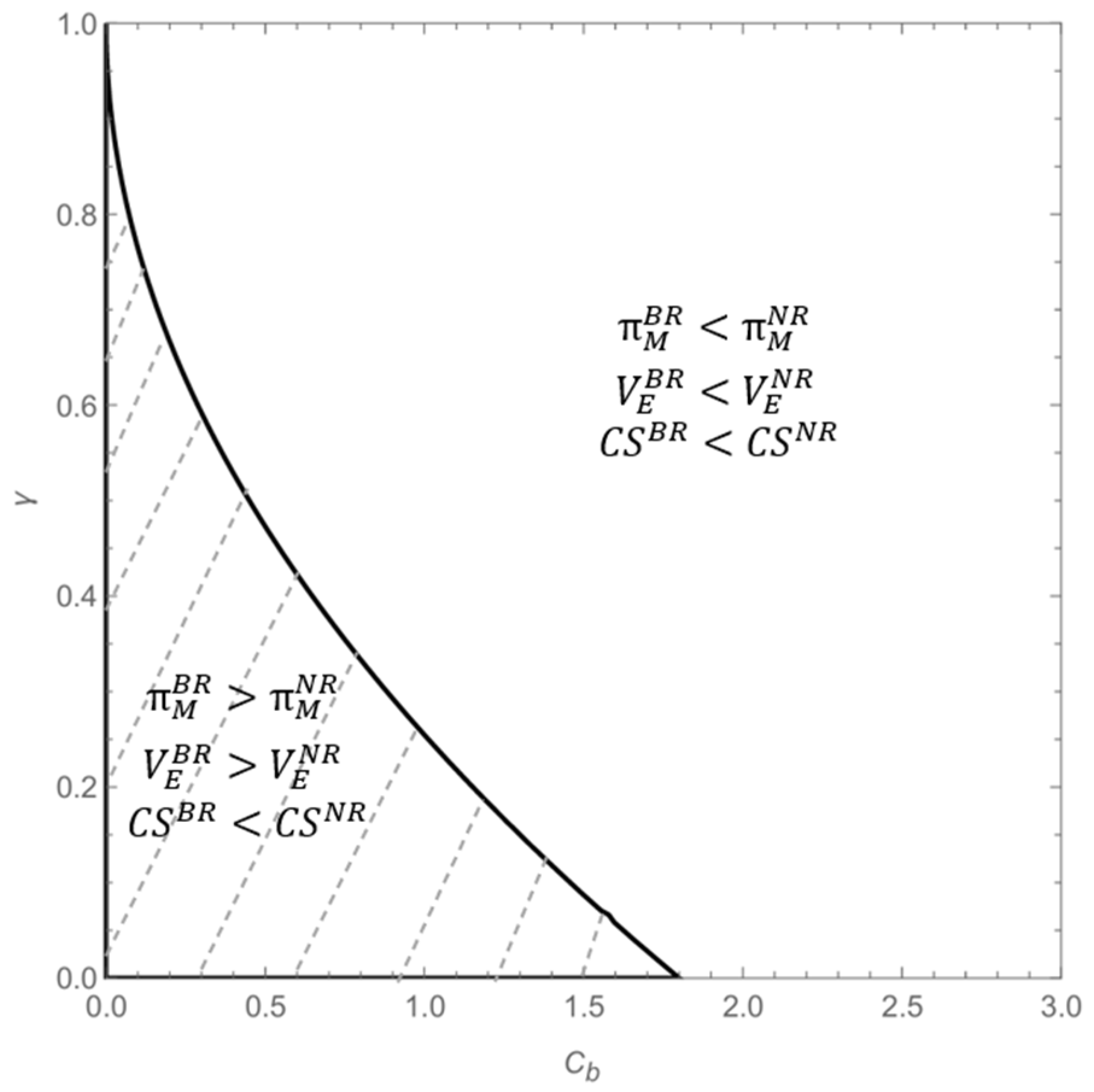

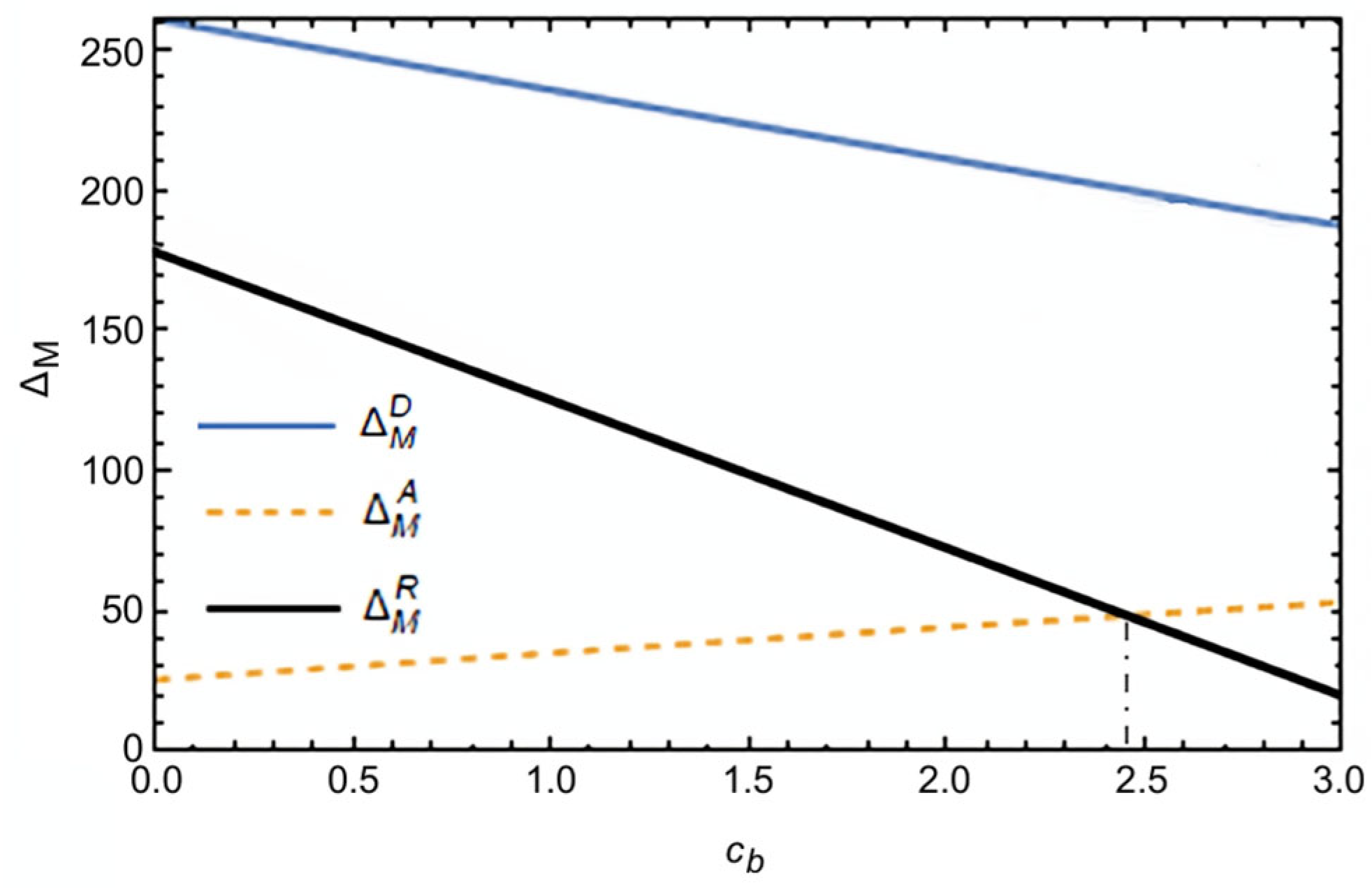

Third, the blockchain adoption generates the greatest economic value for manufacturers under the dual mode, with this advantage remaining consistent regardless of cost thresholds. For platforms, the optimal strategy depends on unit operational cost of blockchain: when cost is low, the reselling mode delivers maximum economic value, while higher cost makes the agency mode the preferred choice for platforms from the perspective of economic value of blockchain. This demonstrates how blockchain’s economic impact varies significantly across different sales modes and stakeholder perspectives.

7.2. Managerial Implications

Based on the findings, this study provides the following managerial implications for low-carbon manufacturers and e-commerce platforms:

First, for manufacturers, the agency mode is optimal in most scenarios, especially when the platform’s consumer surplus concern is moderate. It maximizes profits and simplifies blockchain integration. If adopting blockchain, manufacturers must evaluate its unit operational cost. Blockchain is viable only when the unit operational cost is below critical thresholds. The dual mode generates the highest economic value from blockchain, but it is preferred only when platform’s degree of consumer surplus concern is extremely high or low. Otherwise, the agency mode remains dominant.

Second, platforms must avoid excessive concern on consumer surplus, as extreme values disrupt profitability. A balanced degree of consumer surplus concern sustains win-win outcomes. Platforms with strong consumer welfare goals should incentivize blockchain adoption via cost-sharing mechanisms to align manufacturer incentives.

7.3. Limitagions and Future Research

While our study provides valuable insights into the strategic adoption of blockchain technology and sales mode selection, there are some limitations to our approach. First, we assume that the platform’s commission rate is exogenous, which may not fully capture the dynamic pricing strategies that platforms might employ in practice. Future research could endogenize this parameter to better reflect real-world scenarios. Second, our model assumes that consumer preferences and information acquisition abilities are homogeneous, which may not fully represent the heterogeneity observed in real markets. Incorporating heterogeneous consumer preferences and information acquisition abilities could provide a more nuanced understanding of the impact of blockchain adoption on supply chain decisions.