Climate Risk, Green Transformation and Green Bond Issuance

Abstract

1. Introduction

2. Literature Review and Hypothesis Proposal

2.1. Climate Risk and Green Bond Issuance

2.2. The Mediating Effect of Green Transformation and Green Innovation

2.3. Moderating Effect of Ownership Concentration

2.4. The Moderating Effect of Managerial Overconfidence

3. Samples, Variables and Models

3.1. Samples

3.2. Variables

3.2.1. Explained Variable

3.2.2. Explanatory Variables

3.2.3. Mediating Variables

3.2.4. Moderator Variables

3.2.5. Control Variables

3.3. Model

3.3.1. Baseline Regression Model

3.3.2. Mediating Effect Model

3.3.3. Moderating Effect Model

4. Results

4.1. Descriptive Statistics

4.2. Results of Baseline Regression

4.3. Mediating Effects Results

4.4. Moderating Effect Results

4.5. Robustness Test

4.5.1. Replacing Explanatory Variable

4.5.2. Model Replacement

4.5.3. Changing the Time Interval of the Sample

4.5.4. Expanding the Sample Size

4.5.5. Adding Control Variable

4.5.6. PSM

4.5.7. Instrumental Variable Method

4.6. Heterogeneity Analysis

4.6.1. Enterprise Scale

4.6.2. Industry Type

4.6.3. Environmental Performance

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix B

References

- Giglio, S.; Kelly, B.; Stroebel, J. Climate Finance. Annu. Rev. Financ. Econ. 2021, 13, 15–36. [Google Scholar] [CrossRef]

- Stroebel, J.; Wurgler, J. What Do You Think about Climate Finance? J. Financ. Econ. 2021, 142, 487–498. [Google Scholar] [CrossRef]

- Hu, X.; Zhu, B. Do Climate Risks Matter for Intersectoral Systemic Risk Spillovers? Evidence from China. Financ. Res. Lett. 2025, 75, 106873. [Google Scholar] [CrossRef]

- Task Force on Climate-Related Financial Disclosures|TCFD). Available online: https://www.fsb-tcfd.org/ (accessed on 3 December 2024).

- Azhgaliyeva, D.; Kapsalyamova, Z. Policy Support in Promoting Green Bonds in Asia: Empirical Evidence. Clim. Policy 2023, 23, 430–445. [Google Scholar] [CrossRef]

- Fatica, S.; Panzica, R. Green Bonds as a Tool against Climate Change? Bus. Strateg. Environ. 2021, 30, 2688–2701. [Google Scholar] [CrossRef]

- Flammer, C. Corporate Green Bonds. J. Financ. Econ. 2021, 142, 499–516. [Google Scholar] [CrossRef]

- Wu, S.; Zhou, Y.; Tang, G. Green bonds: Green technology innovation, environmental performance and firm value. J. Xiamen Univ. (A Q. Stud. Arts Soc. Sci.) 2022, 72, 71–84. [Google Scholar]

- Chen, Z.; Huang, L.; Wu, N. The Positive Impact of Green Bond Issuance on Corporate ESG Performance: From the Perspective of Environmental Behavior. Appl. Econ. Lett. 2024, 31, 1247–1252. [Google Scholar] [CrossRef]

- Dutordoir, M.; Li, S.; Neto, J.Q.F. Issuer Motivations for Corporate Green Bond Offerings. Br. J. Manag. 2024, 35, 952–973. [Google Scholar] [CrossRef]

- Chen, J.; Yang, Y.; Liu, R.; Geng, Y.; Ren, X. Green Bond Issuance and Corporate ESG Performance: The Perspective of Internal Attention and External Supervision. Humanit. Soc. Sci. Commun. 2023, 10, 437. [Google Scholar] [CrossRef]

- Yu, Q.; Hui, E.C.-M.; Shen, J. The Real Impacts of Third-Party Certification on Green Bond Issuances: Evidence from the Chinese Green Bond Market. J. Corp. Financ. 2024, 89, 102694. [Google Scholar] [CrossRef]

- García, C.J.; Herrero, B.; Miralles-Quirós, J.L.; Del Mar Mirallles-Quirós, M. Exploring the Determinants of Corporate Green Bond Issuance and Its Environmental Implication: The Role of Corporate Board. Technol. Forecast. Soc. Change 2023, 189, 122379. [Google Scholar] [CrossRef]

- Cheng, L.T.W.; Sharma, P.; Broadstock, D.C. Interactive Effects of Brand Reputation and ESG on Green Bond Issues: A Sustainable Development Perspective. Bus. Strateg. Environ. 2023, 32, 570–586. [Google Scholar] [CrossRef]

- Wang, S.; Chen, S.; Ali, M.H.; Tseng, M. Nexus of Environmental, Social, and Governance Performance in China-listed Companies: Disclosure and Green Bond Issuance. Bus. Strateg. Environ. 2024, 33, 1647–1660. [Google Scholar] [CrossRef]

- Riley, J. Informational equilibrium. Econometrica 1979, 47, 331–359. [Google Scholar] [CrossRef]

- Spence, M. Job Market Signaling*. Q. J. Econ. 1973, 87, 355–374. [Google Scholar] [CrossRef]

- Tan, X.; Dong, H.; Liu, Y.; Su, X.; Li, Z. Green Bonds and Corporate Performance: A Potential Way to Achieve Green Recovery. Renew. Energy 2022, 200, 59–68. [Google Scholar] [CrossRef]

- Fama, E.; French, K. Common Risk-Factors in the Returns on Stocks and Bonds. J. Financ. Econ. 1993, 33, 3–56. [Google Scholar] [CrossRef]

- Tao, R. Will climate risk intensify corporate tax avoidance? Financ. Econ. 2024, 1, 91–102. [Google Scholar]

- Dyreng, S.D.; Hanlon, M.; Maydew, E.L. The Effects of Executives on Corporate Tax Avoidance. Account. Rev. 2010, 85, 1163–1189. [Google Scholar] [CrossRef]

- Pankratz, N. Climate Change, Firm Performance, and Investor Surprises. Manag. Sci. 2023, 69, 7352–7398. [Google Scholar] [CrossRef]

- Chava, S. Environmental Externalities and Cost of Capital. Manag. Sci. 2014, 60, 2223–2247. [Google Scholar] [CrossRef]

- Zerbib, O. The Effect of Pro-Environmental Preferences on Bond Prices: Evidence from Green Bonds. J. Bank. Financ. 2019, 98, 39–60. [Google Scholar] [CrossRef]

- Wu, Y.; Tian, Y.; Chen, Y.; Xu, Q. Spillover effect, mechanism and performance of green bond issuance. Manag. World 2022, 38, 176–193. [Google Scholar] [CrossRef]

- Ruan, Q.; Li, C.; Lv, D.; Wei, X. Going Green: Effect of Green Bond Issuance on Corporate Debt Financing Costs. N. Am. J. Econ. Financ. 2025, 75, 102299. [Google Scholar] [CrossRef]

- Xie, X.; Han, Y. How can local manufacturing enterprises achieve “gorgeous transformation” in green innovation?—Multiple case studies based on the basic view of attention. Manag. World 2022, 38, 76–106. [Google Scholar] [CrossRef]

- Research Group of Institute of Industrial Economics of Cass; Li, P. Research on China’s industrial green transformation. China Ind. Econ. 2011, 4, 5–14. [Google Scholar] [CrossRef]

- Zhou, K.; Wang, R.; Tao, Y.; Zheng, Y. Corporate green transformation and stock price crash risk. J. Manag. Sci. 2022, 35, 56–69. [Google Scholar]

- Shen, H.; Huang, Z.; Guo, X. Confession or justification: A study on the relationship between corporate environmental performance and environmental information disclosure. Nankai Bus. Rev. 2014, 17, 56–63, 73. [Google Scholar]

- Liu, S.; Ma, L. The impact of green finance on the green transformation of manufacturing enterprises. Resour. Sci. 2023, 45, 1992–2008. [Google Scholar] [CrossRef]

- Zhang, K.; Xiong, Z.; Huang, X. Green bonds, carbon reduction effect and high-quality economic development. J. Financ. Econ. 2023, 49, 64–78. [Google Scholar] [CrossRef]

- Li, Z.; Huang, C.; Ma, Y. Regional differences and dynamics of ecological environment measurement in the Yellow River Basin: An empirical analysis based on the theory of strong sustainable development. J. Henan Norm. Univ. (Philos. Soc. Sci. Ed.) 2024, 51, 39–45. [Google Scholar] [CrossRef]

- Ba, S.; Cong, Y.; Zhu, W. Green bond theory and Chinese market development. J. Hangzhou Norm. Univ. (Soc. Sci. Ed.) 2019, 41, 91–106. [Google Scholar]

- Jensen, M.C.; Meckling, W.H. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Munari, F.; Oriani, R.; Sobrero, M. The Effects of Owner Identity and External Governance Systems on R&D Investments: A Study of Western European Firms. Res. Policy 2010, 39, 1093–1104. [Google Scholar] [CrossRef]

- Xu, L.; Xin, Y.; Chen, G. Ownership concentration and equity balance and their impact on corporate performance. Econ. Res. J. 2006, 1, 90–100. [Google Scholar]

- Shleifer, A.; Vishny, R.W. Large Shareholders and Corporate Control. J. Polit. Econ. 1986, 94, 461–488. [Google Scholar] [CrossRef]

- He, Y.; Zhang, Y.; Mo, J. The impact of ownership concentration on corporate performance under different regional governance environments. J. Financ. Res. 2014, 12, 148–163. [Google Scholar]

- Zhao, H.; Chen, X.; Xia, H. An empirical study on corporate independent innovation input and gov-ernance structure characteristics. China Soft Sci. 2008, 7, 145–149. [Google Scholar]

- Xu, X.; Wang, Y. Ownership Structure and Corporate Governance in Chinese Stock Companies. China Econ. Rev. 1999, 10, 75–98. [Google Scholar] [CrossRef]

- Roll, R. The Hubris Hypothesis of Corporate Takeovers. J. Bus. 1986, 59, 197–216. [Google Scholar] [CrossRef]

- Pikulina, E.; Renneboog, L.; Tobler, P.N. Overconfidence and Investment: An Experimental Approach. J. Corp. Financ. 2017, 43, 175–192. [Google Scholar] [CrossRef]

- Ahmed, A.S.; Duellman, S. Managerial Overconfidence and Accounting Conservatism. J. Account. Res. 2013, 51, 1–30. [Google Scholar] [CrossRef]

- Landier, A.; Thesmar, D. Financial Contracting with Optimistic Entrepreneurs. Rev. Financ. Stud. 2009, 22, 117–150. [Google Scholar] [CrossRef]

- Park, J.H.; Noh, J.H. Relationship between Climate Change Risk and Cost of Capital. Glob. Bus. Financ. Rev. 2018, 23, 66–81. [Google Scholar] [CrossRef]

- Hong, H.; Li, F.W.; Xu, J. Climate Risks and Market Efficiency. J. Econom. 2019, 208, 265–281. [Google Scholar] [CrossRef]

- He, F.; Ren, X.; Wang, Y.; Lei, X. Climate Risk and Corporate Bond Credit Spreads. J. Int. Money Financ. 2025, 154, 103297. [Google Scholar] [CrossRef]

- Jiang, C.; Li, Y.; Zhang, X.; Zhao, Y. Climate Risk and Corporate Debt Decision. J. Int. Money Financ. 2025, 151, 103261. [Google Scholar] [CrossRef]

- Golosov, M.; Hassler, J.; Krusell, P.; Tsyvinski, A. Optimal Taxes on Fossil Fuel in General Equilibrium. Econometrica 2014, 82, 41–88. [Google Scholar]

- Zhu, W.; Li, S.; Su, H.; Yang, S. Identification of Systemic Financial Risks: The Role of Climate Risks. Financ. Res. Lett. 2025, 74, 106727. [Google Scholar] [CrossRef]

- Du, J.; Xu, X.; Yang, Y. Does climate risk affect the cost of equity capital? -- Empirical evidence from text analysis of Chinese listed companies’ annual reports. Chin. Rev. Financ. Stud. 2023, 15, 19–46+125. [Google Scholar]

- Xia, H.; Chen, X.; Wen, Y. Impact of transformation climate risk on carbon emission efficiency of energy enterprises from a policy perspective. China Soft Sci. 2024, S1, 118–124. [Google Scholar]

- Berkman, H.; Jona, J.; Soderstrom, N. Firm-Specific Climate Risk and Market Valuation. Account. Organ. Soc. 2024, 112, 101547. [Google Scholar] [CrossRef]

- Wang, C.-W.; Wu, Y.-C.; Hsieh, H.-Y.; Huang, P.-H.; Lin, M.-C. Does Green Bond Issuance Have an Impact on Climate Risk Concerns? Energy Econ. 2022, 111, 106066. [Google Scholar] [CrossRef]

- Loughran, T.; Mcdonald, B. When Is a Liability Not a Liability? Textual Analysis, Dictionaries, and 10-Ks. J. Financ. 2011, 66, 35–65. [Google Scholar] [CrossRef]

- Luo, Y.; Xiong, G.; Mardani, A. Environmental Information Disclosure and Corporate Innovation: The “Inverted U-Shaped” Regulating Effect of Media Attention. J. Bus. Res. 2022, 146, 453–463. [Google Scholar] [CrossRef]

- Xu, P.; Ye, P.; Jahanger, A.; Huang, S.; Zhao, F. Can Green Credit Policy Reduce Corporate Carbon Emission Intensity: Evidence from China’s Listed Firms. Corp. Soc. Resp. Env. Ma. 2023, 30, 2623–2638. [Google Scholar] [CrossRef]

- Xu, W.; Jiang, L. Research on micro-effects of green bond policy: From the perspective of corporate green Inno-vation. Wuhan Financ. Mon. 2023, 6, 22–30. [Google Scholar]

- Fan, B.; Sun, H. R&D investment, ownership concentration and company growth. J. Harbin Univ. Commer. (Soc. Sci. Ed.) 2023, 3, 35–46. [Google Scholar]

- Wu, S.; Qu, D.; Guo, Y.; Dong, J. Ownership concentration, management shareholding and enterprise green technology innovation. Financ. Res. 2023, 6, 80–89. [Google Scholar] [CrossRef]

- Zhang, F.; Jin, T.; Yang, C.; Zhang, W. Ownership concentration of listed companies and domestic green bond issuance scale. Rev. Invest. Stud. 2022, 41, 144–159. [Google Scholar]

- Wei, Z. Managerial overconfidence, Capital structure and firm performance. Ind. Tech. Econ. 2018, 37, 3–12. [Google Scholar]

- Pan, A.; Liu, W.; Wang, X. Managerial overconfidence, debt capacity and merger premium. Nankai Bus. Rev. 2018, 21, 35–45. [Google Scholar] [CrossRef]

- Wang, F.; Wang, Y.; Liu, S. Influence of media attention and managerial overconfidence on earnings management. Chin. J. Manag. 2022, 19, 832–840. [Google Scholar]

- Wen, Z.; Zhang, L.; Hou, J.; Liu, H. Mediating effect test program and its application. Acta Psychol. Sin. 2004, 5, 614–620. [Google Scholar]

- Baron, R.M.; Kenny, D.A. The Moderator–Mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

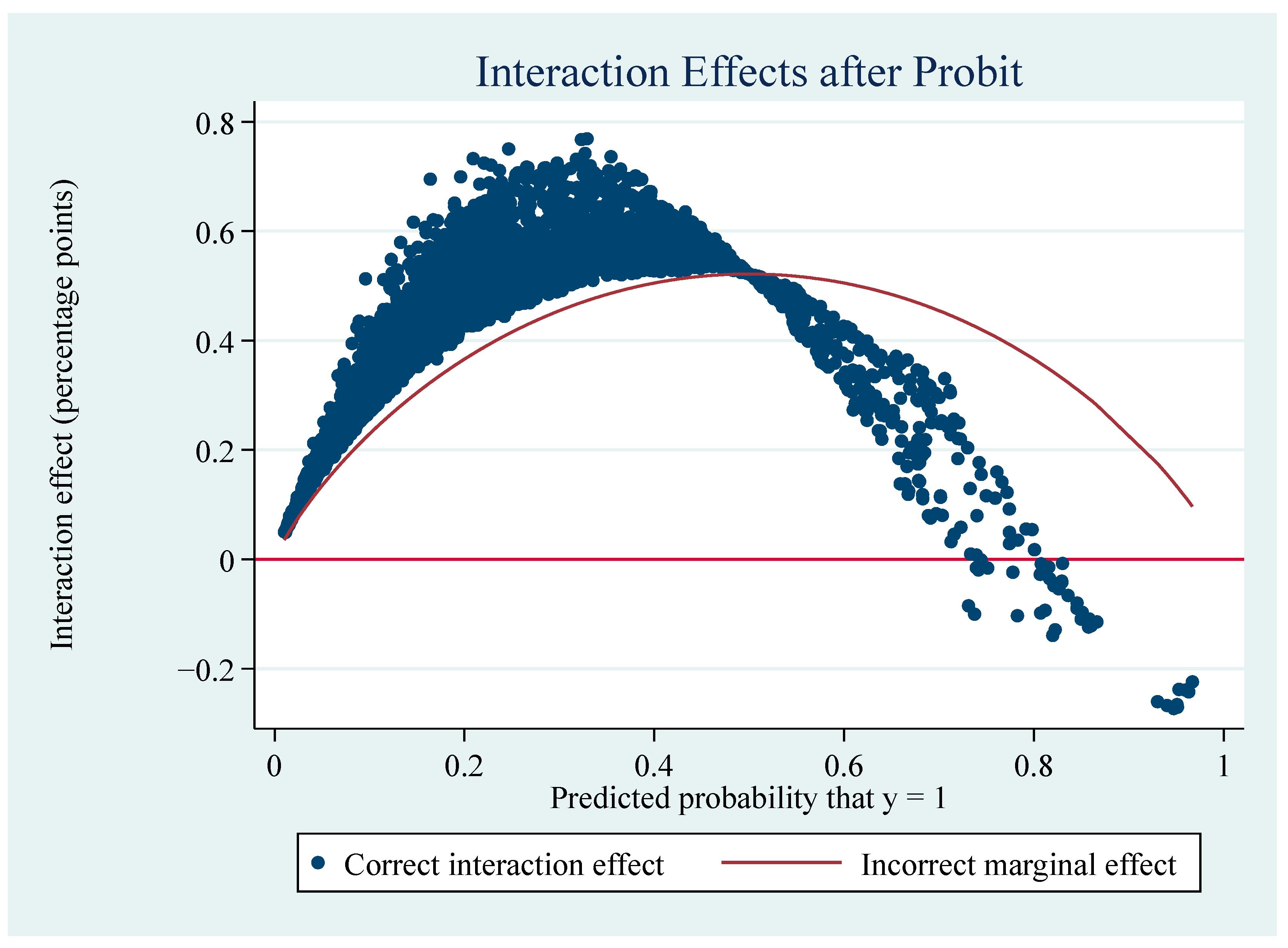

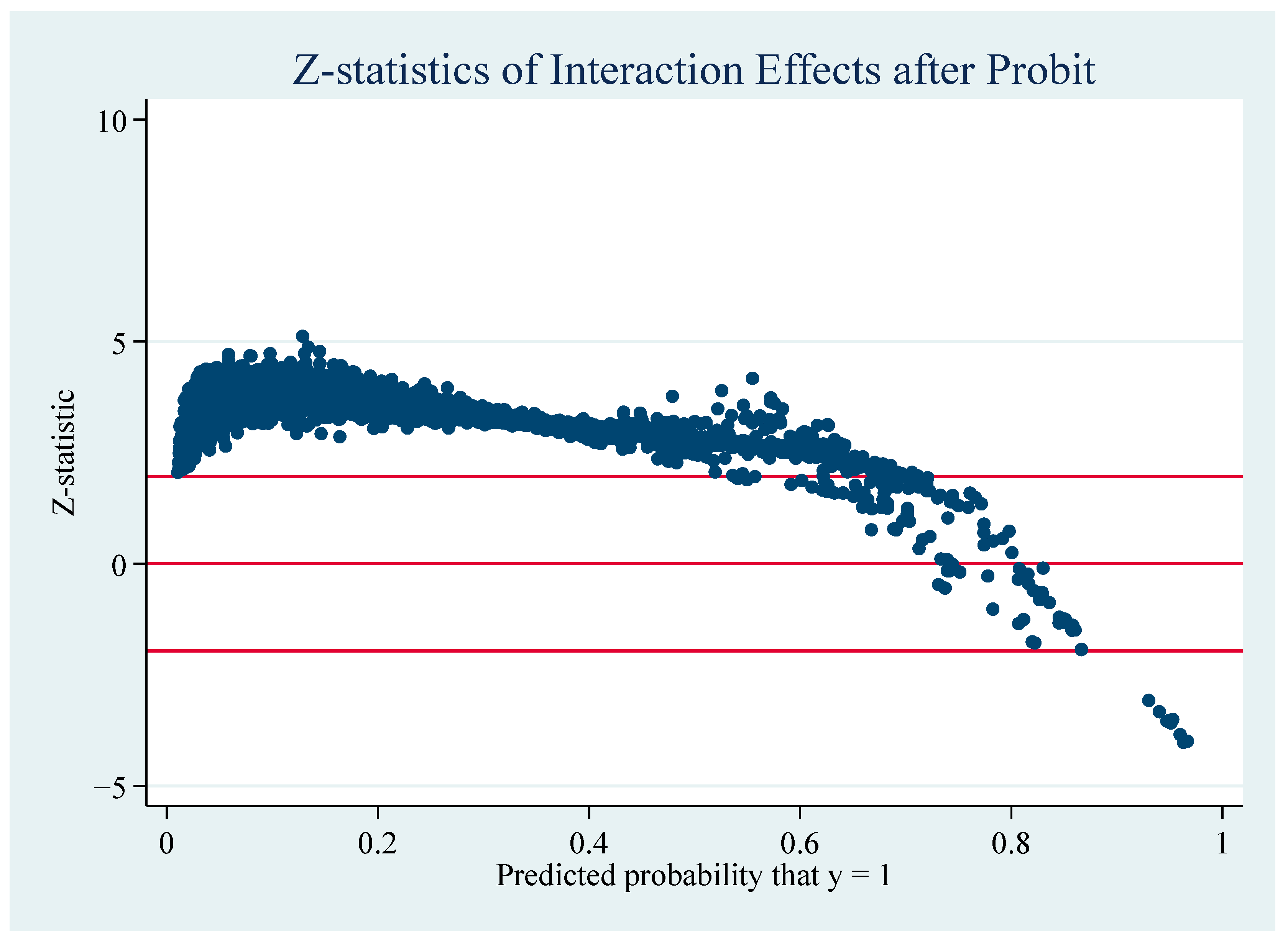

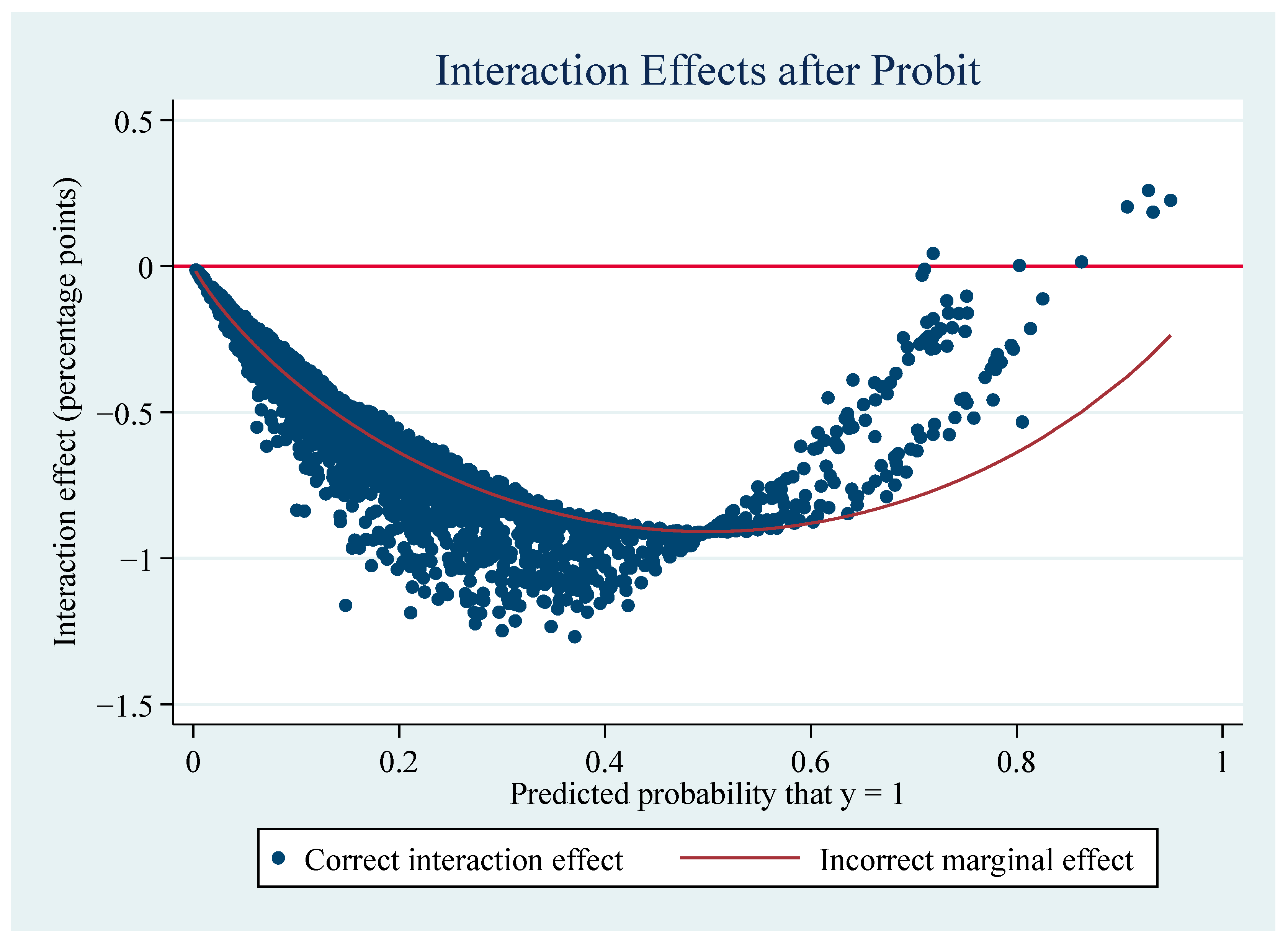

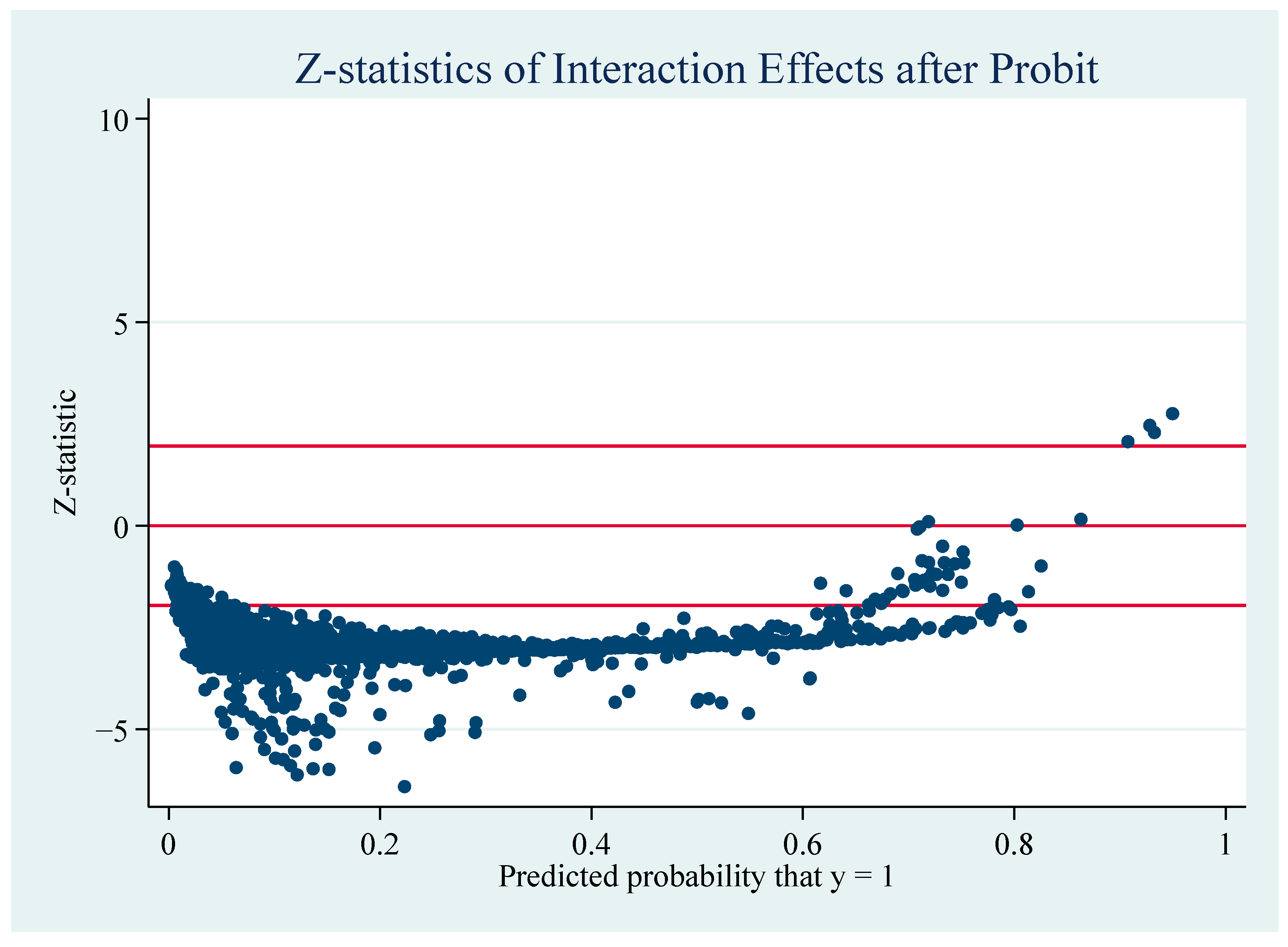

- Ai, C.; Norton, E.C. Interaction Terms in Logit and Probit Models. Econ. Lett. 2003, 80, 123–129. [Google Scholar] [CrossRef]

- Guo, K.; Ji, Q.; Zhang, D. A Dataset to Measure Global Climate Physical Risk. Data Brief 2024, 54, 110502. [Google Scholar] [CrossRef]

- Fisman, R.; Svensson, J. Are Corruption and Taxation Really Harmful to Growth? Firm Level Evidence. J. Dev. Econ. 2007, 83, 63–75. [Google Scholar] [CrossRef]

- Xu, J.; Liao, H.; Yang, J. Government subsidies and corporate emissions: An empirical study based on micro-enterprises. Ind. Econ. Res. 2022, 4, 30–45. [Google Scholar] [CrossRef]

- Larcker, D.F.; Rusticus, T.O. On the Use of Instrumental Variables in Accounting Research. J. Account. Econ. 2010, 49, 186–205. [Google Scholar] [CrossRef]

- Bellemare, M.F.; Masaki, T.; Pepinsky, T.B. Lagged Explanatory Variables and the Estimation of Causal Effect. J. Politics 2017, 79, 949–963. [Google Scholar] [CrossRef]

- Yuan, W. Endogeneity test method, procedure and Stata application of binary selection model. Stat. Decis. 2018, 34, 15–20. [Google Scholar] [CrossRef]

- Adams, C.A.; Hill, W.-Y.; Roberts, C.B. Corporate social reporting practices in western europe: Legitimating corporate behaviour? Br. Account. Rev. 1998, 30, 1–21. [Google Scholar] [CrossRef]

- Yin, M.; Sheng, L.; Li, W. Executive motivation, innovation input and firm performance: An empirical study based on endogenous perspective. Nankai Bus. Rev. 2018, 21, 109–117. [Google Scholar]

| Variable Type | Variable Name | Variable Code | Variable Definition |

|---|---|---|---|

| Explained variable | Probability of green bond issuance | Pr. (GB = 1) | If the company has issued green bonds between 2016 and 2023, then GB = 1 |

| Explanatory variable | Climate risk of corporate | CR | Using a text analysis approach |

| Mediating variable | Green transformation index | GTF | Using a text analysis approach |

| Mediating variable | Green innovation | GI | ln (green patent applications + 1) |

| Moderator variable | Ownership concentration | Top1 | The shareholding ratio of the largest shareholder |

| Moderator variable | Managerial overconfidence | OC | Scored from four aspects: gender, age, education and position |

| Control variable | Company size | SZ | ln (total assets) |

| Control variable | Ratio of fixed assets | FIX | Net fixed assets/Total assets |

| Control variable | Debt-to-assets ratio | DR | Total liabilities/Total assets |

| Control variable | Return on assets | ROA | Net profit/Total assets |

| Control variable | Total assets growth rate | AGR | (Current year total assets/Previous year total assets) − 1 |

| Control variable | Company market value | TQ | Firm’s market value/Total assets |

| Control variable | Years since company establishment | YE | ln (the current year—year of company establishment + 1) |

| Control variable | Board membership size | BD | ln (the total number of the board of directors) |

| Control variable | Institutional investor shareholding ratio | INSR | Institutional investors’ shareholdings/Total amount of equity |

| Variable | N | Mean | p50 | SD | Min | Max |

|---|---|---|---|---|---|---|

| CR | 7238 | 0.184 | 0.101 | 0.227 | 0.005 | 1.140 |

| SZ | 7238 | 22.53 | 22.36 | 1.520 | 19.31 | 26.90 |

| FIX | 7238 | 0.254 | 0.215 | 0.193 | 0.001 | 0.787 |

| DR | 7238 | 0.516 | 0.528 | 0.197 | 0.078 | 1.069 |

| ROA | 7238 | 0.046 | 0.042 | 0.051 | −0.181 | 0.197 |

| AGR | 7238 | 0.277 | 0.147 | 0.519 | −0.348 | 3.766 |

| TQ | 7238 | 1.579 | 1.317 | 0.788 | 0.877 | 5.727 |

| YE | 7238 | 2.635 | 2.708 | 0.468 | 1.099 | 3.434 |

| BD | 7238 | 2.190 | 2.197 | 0.219 | 1.609 | 2.708 |

| INSR | 7238 | 0.342 | 0.329 | 0.268 | 0 | 0.901 |

| VARIABLES | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| PR | PR | PR | PR | PR | PR | |

| CR | 1.345 *** | 1.207 *** | 1.361 *** | 1.057 *** | 1.041 *** | 1.311 *** |

| (0.0702) | (0.102) | (0.106) | (0.0762) | (0.111) | (0.115) | |

| SZ | 0.270 *** | 0.313 *** | 0.379 *** | |||

| (0.0190) | (0.0229) | (0.0237) | ||||

| FIX | 0.358 *** | −1.178 *** | −1.367 *** | |||

| (0.0986) | (0.144) | (0.147) | ||||

| DR | −0.182 | 0.216 | −0.0141 | |||

| (0.136) | (0.146) | (0.151) | ||||

| ROA | −0.262 | −0.529 | −1.061 * | |||

| (0.497) | (0.565) | (0.568) | ||||

| AGR | −0.0978 ** | −0.102 ** | −0.0945 ** | |||

| (0.0417) | (0.0469) | (0.0482) | ||||

| TQ | −0.0136 | 0.00924 | 0.0756 ** | |||

| (0.0317) | (0.0337) | (0.0368) | ||||

| YE | −0.187 *** | −0.344 *** | 0.00263 | |||

| (0.0427) | (0.0492) | (0.0570) | ||||

| BD | 0.348 *** | 0.394 *** | 0.168 | |||

| (0.0904) | (0.103) | (0.107) | ||||

| INSR | −0.190 ** | −0.220 ** | 0.0505 | |||

| (0.0906) | (0.101) | (0.111) | ||||

| Constant | −1.196 *** | −0.791 *** | −0.895 *** | −7.445 *** | −7.464 *** | −8.933 *** |

| (0.0229) | (0.214) | (0.273) | (0.427) | (0.538) | (0.577) | |

| Observations | 7238 | 6878 | 6878 | 7238 | 6878 | 6878 |

| Industry | No | Yes | Yes | No | Yes | Yes |

| Year | No | No | Yes | No | No | Yes |

| Delta-Method | ||||||

|---|---|---|---|---|---|---|

| VARIABLES | dy/dx | Std. Err. | z | p > |z| | [95% Conf. | Interval] |

| CR | 0.249895 | 0.0218237 | 11.45 | 0.000 | 0.207121 | 0.292669 |

| SZ | 0.072195 | 0.0042234 | 17.09 | 0.000 | 0.063917 | 0.080473 |

| FIX | −0.26064 | 0.0277839 | −9.38 | 0.000 | −0.3151 | −0.20618 |

| DR | −0.00269 | 0.0287454 | −0.09 | 0.925 | −0.05903 | 0.053646 |

| ROA | −0.20237 | 0.1083166 | −1.87 | 0.062 | −0.41467 | 0.009927 |

| AGR | −0.01803 | 0.0091802 | −1.96 | 0.050 | −0.03602 | −3.4 × 10−5 |

| TQ | 0.014417 | 0.0070087 | 2.06 | 0.040 | 0.00068 | 0.028154 |

| YE | 0.000502 | 0.0108729 | 0.05 | 0.963 | −0.02081 | 0.021813 |

| BD | 0.032112 | 0.0203563 | 1.58 | 0.115 | −0.00779 | 0.07201 |

| INSR | 0.009626 | 0.0211447 | 0.46 | 0.649 | −0.03182 | 0.051069 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| VARIABLES | PR | GTF | PR | PR | GI | PR |

| CR | 1.311 *** | 1.491 *** | 1.226 *** | 1.311 *** | 0.455 *** | 1.233 *** |

| (0.115) | (0.0564) | (0.121) | (0.115) | (0.0669) | (0.117) | |

| GTF | 0.0616 * | |||||

| (0.0316) | ||||||

| GI | 0.292 *** | |||||

| (0.0288) | ||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −8.933 *** | −0.814 *** | −8.793 *** | −8.933 *** | −3.862 *** | −7.848 *** |

| (0.577) | (0.212) | (0.577) | (0.577) | (0.278) | (0.590) | |

| Observations | 6878 | 7236 | 6878 | 6878 | 7236 | 6878 |

| R-squared | - | 0.608 | - | - | 0.289 | - |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| VARIABLES | PR | PR | PR | PR | PR | PR |

| CR | 0.432 *** | 0.356 ** | 0.539 *** | 2.520 *** | 2.848 *** | 3.395 *** |

| (0.177) | (0.202) | (0.208) | (0.482) | (0.526) | (0.540) | |

| Top1 | 0.163 | 0.0197 | −0.0591 | |||

| (0.150) | (0.168) | (0.173) | ||||

| CR × Top1 | 1.519 *** | 1.723 *** | 1.884 *** | |||

| (0.375) | (0.432) | (0.449) | ||||

| OC | 0.192 | 0.284 | 0.490 * | |||

| (0.238) | (0.258) | (0.265) | ||||

| CR × OC | −2.244 *** | −2.510 *** | −2.857 *** | |||

| (0.742) | (0.810) | (0.831) | ||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −7.690 *** | −7.630 *** | −9.121 *** | −8.314 *** | −8.906 *** | −10.25 *** |

| (0.452) | (0.586) | (0.598) | (0.607) | (0.737) | (0.779) | |

| Observations | 6713 | 6392 | 6392 | 4450 | 4201 | 4201 |

| Industry | No | Yes | Yes | No | Yes | Yes |

| Year | No | No | Yes | No | No | Yes |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| VARIABLES | PR | PR | PR | PR | PR | PR | PR |

| CR1 | 0.140 ** | ||||||

| (0.0622) | |||||||

| CR2 | 0.00594 *** | ||||||

| (0.00199) | |||||||

| CR | 2.219 *** | 1.204 *** | 1.136 *** | 1.146 *** | 1.336 *** | ||

| (0.215) | (0.133) | (0.171) | (0.0782) | (0.115) | |||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | |

| Controls2 | Yes | ||||||

| Constant | −10.07 *** | −8.982 *** | −16.21 *** | −11.66 *** | −13.19 *** | −9.723 *** | −9.865 *** |

| (0.847) | (0.565) | (1.051) | (0.862) | (1.109) | (0.472) | (0.712) | |

| Observations | 5087 | 6951 | 6878 | 5344 | 2900 | 29,034 | 6878 |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Variable | Unmatched | Mean | %Reduct | t-Test | V(T)/V(C) | |||

|---|---|---|---|---|---|---|---|---|

| Matched | Treated | Control | %Bias | |Bias| | t | p > |t| | ||

| SZ | U | 23.528 | 22.311 | 74 | 26.8 | 0 | 1.79 * | |

| M | 23.475 | 23.338 | 8.3 | 88.8 | 2.03 | 0.042 | 1.36 * | |

| FIX | U | 0.30731 | 0.24299 | 31.4 | 10.9 | 0 | 1.42 * | |

| M | 0.30398 | 0.29254 | 5.6 | 82.2 | 1.36 | 0.174 | 1.18 * | |

| DR | U | 0.55163 | 0.522 | 10.8 | 3.02 | 0.003 | 0.27 * | |

| M | 0.55087 | 0.55406 | −1.2 | 89.2 | −0.45 | 0.656 | 0.94 | |

| ROA | U | 0.04369 | 0.04551 | −1.9 | −0.51 | 0.613 | 0.13 * | |

| M | 0.04389 | 0.04228 | 1.7 | 11.5 | 0.87 | 0.387 | 0.95 | |

| AGR | U | 0.25966 | 1.2641 | −2.9 | −0.73 | 0.464 | 0.00 * | |

| M | 0.26264 | 0.27629 | 0 | 98.6 | −0.46 | 0.644 | 1.02 | |

| TQ | U | 1.3852 | 1.705 | −15 | −3.91 | 0 | 0.05 * | |

| M | 1.3907 | 1.4145 | −1.1 | 92.5 | −0.95 | 0.342 | 1.01 | |

| YE | U | 2.6647 | 2.6286 | 7.5 | 2.5 | 0.012 | 1.1 | |

| M | 2.6644 | 2.6267 | 7.9 | −4.3 | 1.9 | 0.057 | 0.93 | |

| BD | U | 2.2482 | 2.1775 | 31.7 | 10.37 | 0 | 0.99 | |

| M | 2.2437 | 2.2428 | 0.4 | 98.8 | 0.09 | 0.929 | 0.85 * | |

| INSR | U | 0.42906 | 0.32323 | 38.7 | 13.05 | 0 | 1.20 * | |

| M | 0.4262 | 0.41621 | 3.6 | 90.6 | 0.92 | 0.358 | 1.12 * | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| VARIABLES | PR | PR | PR | PR | PR | PR |

| CR | 1.091 *** | 0.969 *** | 1.112 *** | 0.889 *** | 0.852 *** | 1.104 *** |

| (0.0720) | (0.101) | (0.105) | (0.0766) | (0.110) | (0.114) | |

| Controls | No | No | No | Yes | Yes | Yes |

| Constant | −1.090 *** | −0.574 ** | −0.662 ** | −6.949 *** | −6.821 *** | −8.176 *** |

| (0.0235) | (0.234) | (0.289) | (0.428) | (0.536) | (0.570) | |

| Observations | 6541 | 6206 | 6206 | 6541 | 6206 | 6206 |

| Industry | No | Yes | Yes | No | Yes | Yes |

| Year | No | No | Yes | No | No | Yes |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| VARIABLES | CR | PR | CR | PR |

| IV1 | 0.8306 *** | |||

| (0.013) | ||||

| IV2 | 0.9802 *** | |||

| (0.005) | ||||

| CR’ | 1.2787 *** | 1.1086 *** | ||

| (0.133) | (0.085) | |||

| Controls | Yes | Yes | Yes | Yes |

| Constant | −0.2928 *** | −7.5412 *** | −0.0515 ** | −7.4904 *** |

| (0.047) | (0.446) | (0.022) | (0.452) | |

| Observations | 7057 | 7057 | 6392 | 6392 |

| Industry | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| AR | 89.06 *** | 169.45 *** | ||

| Wald | 90.06 *** | 169.87 *** | ||

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| VARIABLES | PR | PR | PR | PR | PR | PR |

| CR | 1.568 *** | 1.064 *** | 1.363 *** | 1.103 *** | 1.422 *** | 0.792 *** |

| (0.149) | (0.251) | (0.257) | (0.123) | (0.145) | (0.199) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −10.34 *** | −7.147 *** | −9.750 *** | −8.031 *** | −9.319 *** | −9.812 *** |

| (1.107) | (1.249) | (0.680) | (1.092) | (0.655) | (0.993) | |

| Observations | 3370 | 2986 | 4153 | 2643 | 4427 | 2181 |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Test of group coefficients difference | p = 0.046 | p = 0.004 | p = 0.000 | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Luo, X.; Lyu, C. Climate Risk, Green Transformation and Green Bond Issuance. Systems 2025, 13, 377. https://doi.org/10.3390/systems13050377

Luo X, Lyu C. Climate Risk, Green Transformation and Green Bond Issuance. Systems. 2025; 13(5):377. https://doi.org/10.3390/systems13050377

Chicago/Turabian StyleLuo, Xiaona, and Chan Lyu. 2025. "Climate Risk, Green Transformation and Green Bond Issuance" Systems 13, no. 5: 377. https://doi.org/10.3390/systems13050377

APA StyleLuo, X., & Lyu, C. (2025). Climate Risk, Green Transformation and Green Bond Issuance. Systems, 13(5), 377. https://doi.org/10.3390/systems13050377