Does the Adoption of Industrial Internet Platforms Expand or Reduce Geographical Distance to Customers? Evidence from China’s New Energy Vehicle Industry

Abstract

1. Introduction

2. Theoretical Foundations and Hypotheses

2.1. Theoretical Perspectives Relevant to IIP Adoption

2.1.1. Resource- and Capacity-Based View

2.1.2. Open Innovation Theory

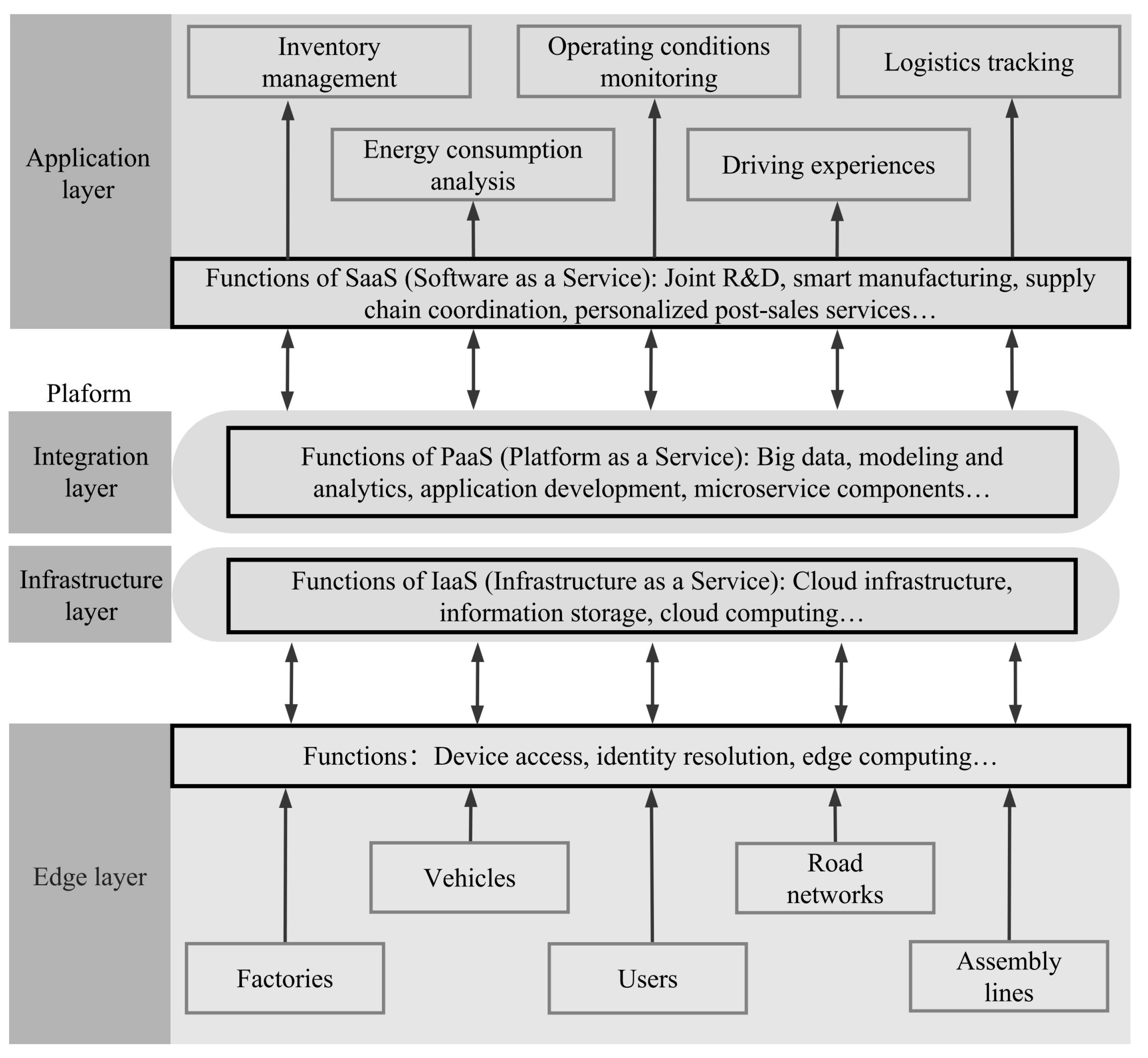

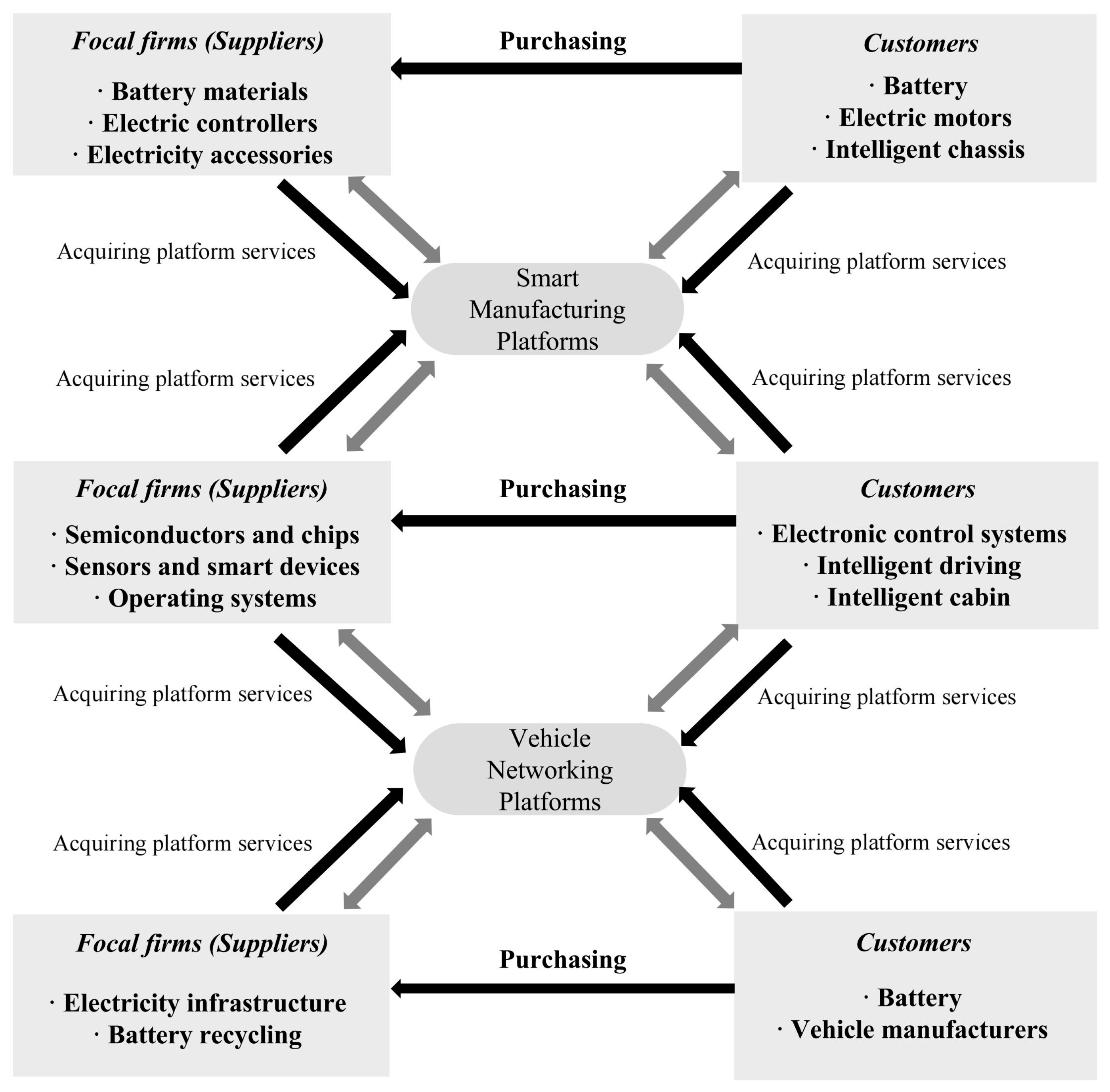

2.2. IIP System in the NEV Industry

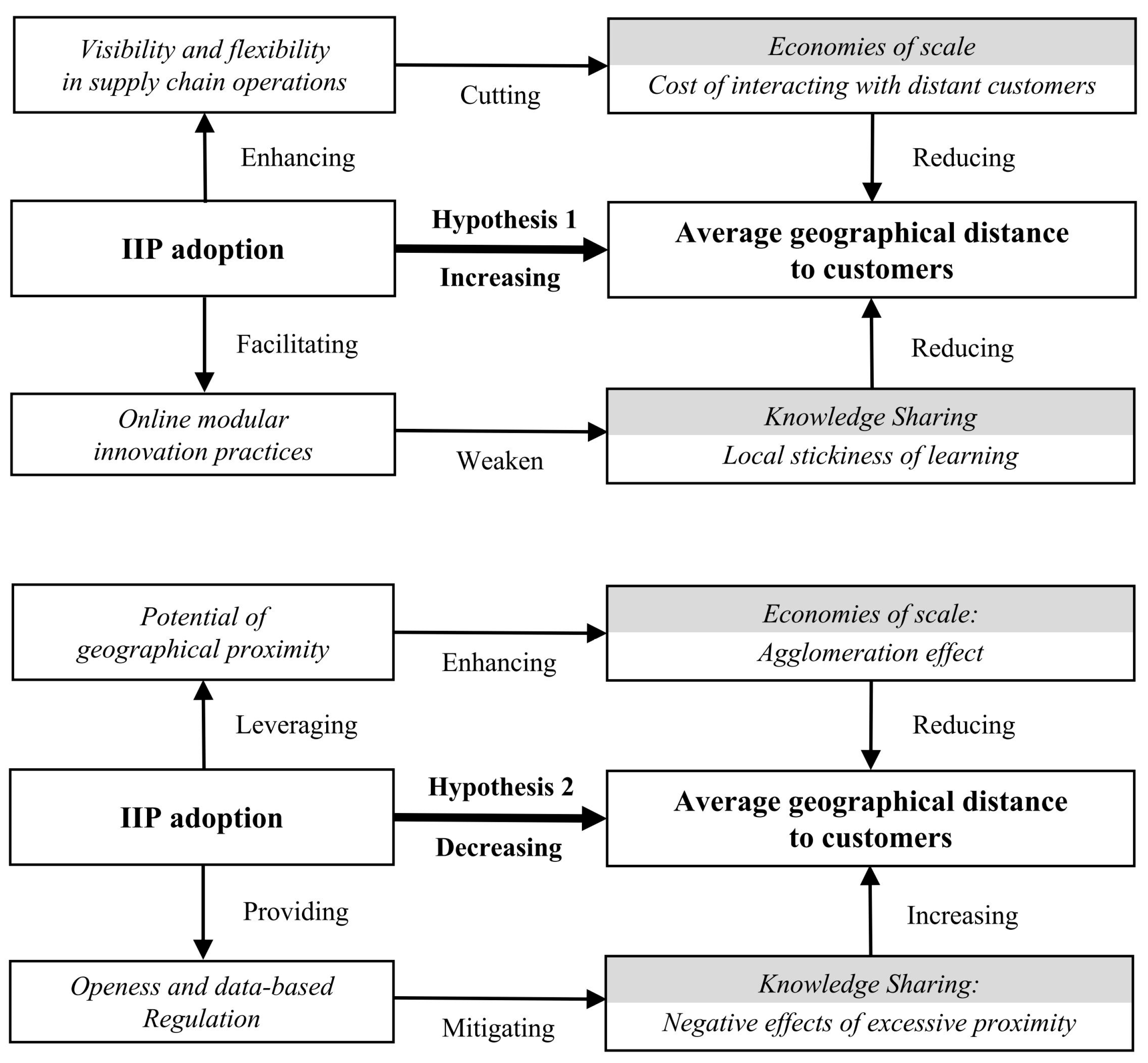

2.3. Impact of NEV Firms’ IIP Adoption on the Geographical Distance to Their Customers

2.3.1. IIP Adoption Increases Geographical Distance to Customers

2.3.2. IIP Adoption Reduces Geographical Distance to Customers

3. Methods and Data

3.1. Sample

3.2. Baseline Regression Model and Variables

3.2.1. Construction of Supply Chain Database

3.2.2. Baseline Regression Model

3.2.3. Explained Variable: Average Geographical Distance to Customers

3.2.4. Explanatory Variable: Frequency of IIP-Related Terms in Annual Reports

3.2.5. Control Variables

3.2.6. Variables for Heterogeneity Analysis

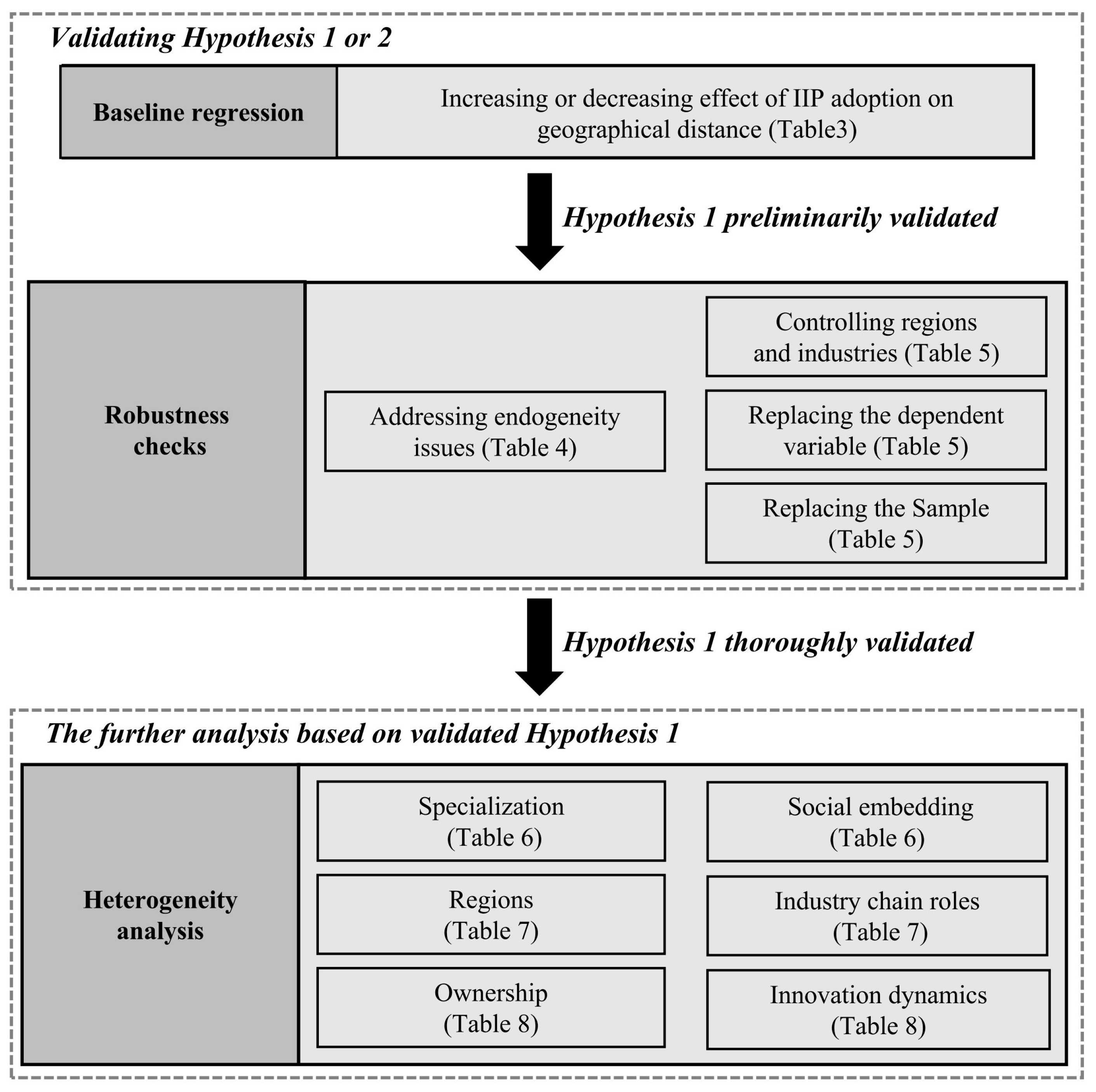

4. Results

4.1. Analysis of Baseline Results

4.2. Robustness Checks

4.2.1. Addressing Endogeneity Issues

4.2.2. Controlling Regions and Industries

4.2.3. Replacing the Dependent Variable

4.2.4. Replacing the Sample

4.3. Heterogeneity Analysis

4.3.1. Specialization

4.3.2. Social Embedding

4.3.3. Regions

4.3.4. Roles in the Industry Chain

4.3.5. Ownership

4.3.6. Innovation Dynamics

5. Conclusions and Discussion

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| IIPs | Industrial Internet Platforms |

| NEV | new energy vehicle |

| IoT | Internet of Things |

| MIIT | the Ministry of Industry and Information Technology of China |

| M | state-owned enterprise |

| ICT | information and communication technology |

| CSMAR | China Stock Market & Accounting Research Database |

| SMEs | small- and medium-sized enterprise |

Appendix A

| Layers | Guideline | Lexicon |

|---|---|---|

| Electrically powered drive systems | Vehicle manufacturability Production capacity Joint R&D of battery and powertrain Intelligent manufacturing Charging and switching facility operation Electricity grid management | Intelligent Data Analytics/Distributed Computing/Decentralized/Internet of Things/Edge Computing/Multi-Party Secure Computing/Converged Architecture/Mobile Computing/Data Visualization/Heterogeneous Data/Intelligent Terminals/Intelligent Information Systems/Cloud Platforms/Cloud Systems/Cloud Devices/Cloud Facilities/Cloud Terminals/Big Data Platforms/Big Data Devices/Big Data Information Systems/Industrial Internet/Digital Technology/5G Technology/Smart Manufacturing/Smart Power Grid/Smart Energy |

| Information interconnected ecosystems | Electrical and electronic architecture Semiconductors Smart cockpit Center console Smart chassis Internet infrastructure Internet-enabled service content User experiences regarding connected automobiles B2B data services | Artificial Intelligence/Intelligent Data Analytics/Machine Learning/Semantic Search/Face Recognition/Speech Recognition/Identity Verification/Intelligent Q&A/Distributed Computing/Decentralized/Internet of Things/Edge Computing/Multi-Party Secure Computing/Converged Architecture/Mobile Computing/Big Data/Data Mining/Augmented Reality/Mixed Reality/Virtual Reality/Intelligent Terminals/Intelligent Information Systems/Cloud Platforms/Cloud Systems/Cloud Equipment/Cloud Facilities/Cloud Terminal/Big Data Platform/Big Data Facility/Big Data Equipment/Big Data Information System/Artificial Intelligence Platform/Artificial Intelligence Infrastructure/Artificial Intelligence Equipment/Artificial Intelligence System/Mobile Internet/Industrial Internet/Digital Technology/Human–Computer Interaction/Intelligent Planning/Intelligent Optimization/Intelligent Environmental Protection/Smart Grid/Smart Transportation/Internet+ |

| Intelligent assisted driving | Complete vehicle manufacturing | Artificial Intelligence/Image Understanding/Supervised Learning/Deep Learning/Computer Vision/Unmanned Driving/Data Mining/Learning Algorithms/Autonomous Driving/Intelligent Terminal/Intelligent Information System/Cloud Platform/Cloud System/Cloud Devices/Cloud Facilities/Cloud Terminal/Big Data Platform/Big Data Facilities/Big Data Equipment/Big Data Information System/Artificial Intelligence Platform/Artificial Intelligence Infrastructure/Artificial Intelligence Equipment/Artificial Intelligence System/Mobile Internet/Digital Technology/Human–Computer Interaction/Intelligent Planning/Intelligent Optimization/Intelligent Transportation/Internet+ |

| 1 | In this paper, NEV is defined as a vehicle that relies entirely or mainly on new types of sources of energy, including pure electric vehicles (EV), plug-in hybrid electric vehicles (PHEV), and fuel cell vehicles (FCEV), which is in line with MIIT. |

| 2 | Qichacha (https://www.qcc.com/) is a commercial database focused on enterprises, drawing data from the national enterprise credit information public system and various public databases, including business registration information and other publicly available records. |

References

- Wollschlaeger, M.; Sauter, T.; Jasperneite, J. The future of industrial communication: Automation networks in the era of the internet of things and industry 4.0. IEEE Ind. Electron. Mag. 2017, 11, 17–27. [Google Scholar]

- Lu, Y.; Xu, X.; Wang, L. Smart manufacturing process and system automation–A critical review of the standards and envisioned scenarios. J. Manuf. Syst. 2020, 56, 312–325. [Google Scholar]

- Mayer, S.; Hodges, J.; Yu, D.; Kritzler, M.; Michahelles, F. An open semantic framework for the industrial internet of things. IEEE Intell. Syst. 2017, 32, 96–101. [Google Scholar] [CrossRef]

- Yang, C.; Shen, W.; Wang, X. The internet of things in manufacturing: Key issues and potential applications. IEEE Syst. Man Cybern. Mag. 2018, 4, 6–15. [Google Scholar] [CrossRef]

- Büyüközkan, G.; Göçer, F. Digital supply chain: Literature review and a proposed framework for future research. Comput. Ind. 2018, 97, 157–177. [Google Scholar]

- Yang, M.; Fu, M.; Zhang, Z. The adoption of digital technologies in supply chains: Drivers, process and impact. Technol. Forecast. Soc. Chang. 2021, 169, 120795. [Google Scholar]

- Jacobides, M.G.; Cennamo, C.; Gawer, A. Towards a theory of ecosystems. Strateg. Manag. J. 2018, 39, 2255–2276. [Google Scholar] [CrossRef]

- Li, Z.; Chen, J.; Li, Z.; Zhang, Y. Strengthen or weaken? How industrial internet platform affects the core competitiveness of manufacturing companies. Oper. Manag. Res. 2024, 17, 220–232. [Google Scholar]

- Roßmann, B.; Canzaniello, A.; von der Gracht, H.; Hartmann, E. The future and social impact of Big Data Analytics in Supply Chain Management: Results from a Delphi study. Technol. Forecast. Soc. Chang. 2018, 130, 135–149. [Google Scholar]

- Waller, M.A.; Fawcett, S.E. Data science, predictive analytics, and big data: A revolution that will transform supply chain design and management. J. Bus. Logist. 2013, 34, 77–84. [Google Scholar] [CrossRef]

- Gu, J.; Shi, X.; Wang, P.; Xu, X. Examining the impact of upstream and downstream relationship stability and concentration on firms’ financial performance. J. Bus. Res. 2022, 141, 229–242. [Google Scholar] [CrossRef]

- Guo, C.; Ke, Y.; Zhang, J. Digital transformation along the supply chain. Pac.-Basin Finance J. 2023, 80, 102088. [Google Scholar] [CrossRef]

- Arunachalam, D.; Kumar, N.; Kawalek, J.P. Understanding big data analytics capabilities in supply chain management: Unravelling the issues, challenges and implications for practice. Transp. Res. Part E Logist. Transp. Rev. 2018, 114, 416–436. [Google Scholar]

- Seethamraju, R. Enterprise systems and demand chain management: A cross-sectional field study. Inf. Technol. Manag. 2014, 15, 151–161. [Google Scholar] [CrossRef]

- Porter, M.E.; Heppelmann, J.E. How smart, connected products are transforming competition. Harv. Bus. Rev. 2014, 92, 64–88. [Google Scholar]

- Wei, S.; Sheng, S. Does geographic distance to customers improve or inhibit supplier innovation? A moderated inverted-U relationship. Ind. Mark. Manag. 2023, 108, 134–148. [Google Scholar] [CrossRef]

- Bode, C.; Wagner, S.M.; Petersen, K.J.; Ellram, L.M. Understanding responses to supply chain disruptions: Insights from information processing and resource dependence perspectives. Acad. Manag. J. 2011, 54, 833–856. [Google Scholar] [CrossRef]

- Baldwin, R.E. Global Supply Chains: Why They Emerged, Why They Matter, and Where They are Going; CEPR Discussion Paper; Fung Global Institute: Hong Kong, China, 2012. [Google Scholar]

- Letaifa, S.B.; Rabeau, Y. Too close to collaborate? How geographic proximity could impede entrepreneurship and innovation. J. Bus. Res. 2013, 66, 2071–2078. [Google Scholar] [CrossRef]

- Gao, J.; Huang, F. Major-customer geographic proximity and supplier trade credit: Empirical evidence from China. Appl. Econ. 2024, 56, 4289–4314. [Google Scholar]

- Goldfarb, A.; Tucker, C. Digital economics. J. Econ. Lit. 2019, 57, 3–43. [Google Scholar] [CrossRef]

- Strange, R.; Zucchella, A. Industry 4.0, global value chains and international business. Multinatl. Bus. Rev. 2017, 25, 174–184. [Google Scholar] [CrossRef]

- Bernard, A.B.; Moxnes, A.; Saito, Y.U. Production networks, geography, and firm performance. J. Political Econ. 2019, 127, 639–688. [Google Scholar] [CrossRef]

- Li, W.; Liu, H.; Long, Z.; Tang, X. Enterprise Digital Transformation and the Geographic Distribution of Supply Chain. Quant. Technol. Econ. 2023, 40, 90–110. [Google Scholar]

- Nambisan, S. Digital entrepreneurship: Toward a digital technology perspective of entrepreneurship. Entrep. Theory Pract. 2017, 41, 1029–1055. [Google Scholar] [CrossRef]

- Akerman, A.; Leuven, E.; Mogstad, M. Information frictions, internet, and the relationship between distance and trade. Am. Econ. J. Appl. Econ. 2022, 14, 133–163. [Google Scholar] [CrossRef]

- Attaran, M. Digital technology enablers and their implications for supply chain management. Supply Chain Forum Int. J. 2020, 21, 158–172. [Google Scholar] [CrossRef]

- Autio, E.; Nambisan, S.; Thomas, L.D.; Wright, M. Digital affordances, spatial affordances, and the genesis of entrepreneurial ecosystems. Strateg. Entrep. J. 2018, 12, 72–95. [Google Scholar] [CrossRef]

- Forman, C.; Goldfarb, A.; Greenstein, S. The Internet and local wages: A puzzle. Am. Econ. Rev. 2012, 102, 556–575. [Google Scholar]

- Ji, J.; Wang, Y. The impact of digital infrastructure on the geographical supply chain layout of firms—Evidence from Chinese microdata. China Econ. Rev. 2024, 87, 102249. [Google Scholar] [CrossRef]

- Lüthje, B. China’s industrial internet: Platform-based manufacturing and restructuring of value chains. In China’s New Development Strategies: Upgrading from Above and from Below in Global Value Chains; Gereffi, G., Bamber, P., Fernandez-Stark, K., Eds.; Springer: Singapore, 2022; pp. 33–59. [Google Scholar]

- Zhao, Z.; Wang, S.; Chen, X. Beyond locality in restructuring the spatial organization of China’s automobile industry clusters under modular production: A case study of FAW-Volkswagen. Acta Geogr. Sin. 2021, 76, 1848–1864. [Google Scholar]

- Martens, B.; Zhao, B. Data access and regime competition: A case study of car data sharing in China. Big Data Soc. 2021, 8, 20539517211046374. [Google Scholar] [CrossRef]

- Penrose, E.T. The Theory of the Growth of the Firm; Oxford University Press: Oxford, UK, 2009. [Google Scholar]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Shibin, K.; Dubey, R.; Gunasekaran, A.; Hazen, B.; Roubaud, D.; Gupta, S.; Foropon, C. Examining sustainable supply chain management of SMEs using resource based view and institutional theory. Ann. Oper. Res. 2020, 290, 301–326. [Google Scholar] [CrossRef]

- Trujillo-Gallego, M.; Sarache, W.; de Sousa Jabbour, A.B.L. Digital technologies and green human resource management: Capabilities for GSCM adoption and enhanced performance. Int. J. Prod. Econ. 2022, 249, 108531. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, R.; Xie, Q. Does digital transformation promote the volatility of firms’ innovation investment? Manag. Decis. Econ. 2023, 44, 4350–4362. [Google Scholar] [CrossRef]

- Chae, H.-C.; Koh, C.E.; Park, K.O. Information technology capability and firm performance: Role of industry. Inf. Manag. 2018, 55, 525–546. [Google Scholar] [CrossRef]

- Laursen, K.; Salter, A. Open for innovation: The role of openness in explaining innovation performance among UK manufacturing firms. Strateg. Manag. J. 2006, 27, 131–150. [Google Scholar] [CrossRef]

- Rochet, J.-C.; Tirole, J. Platform competition in two-sided markets. J. Eur. Econ. Assoc. 2003, 1, 990–1029. [Google Scholar] [CrossRef]

- Gawer, A.; Cusumano, M.A. Industry platforms and ecosystem innovation. J. Prod. Innov. Manag. 2014, 31, 417–433. [Google Scholar] [CrossRef]

- Jacobides, M.G.; Winter, S.G. The co-evolution of capabilities and transaction costs: Explaining the institutional structure of production. Strateg. Manag. J. 2005, 26, 395–413. [Google Scholar] [CrossRef]

- Economides, N. The economics of networks. Int. J. Ind. Organ. 1996, 14, 673–699. [Google Scholar]

- Kapoor, R.; Lee, J.M. Coordinating and competing in ecosystems: How organizational forms shape new technology investments. Strateg. Manag. J. 2013, 34, 274–296. [Google Scholar] [CrossRef]

- Gawer, A. Bridging differing perspectives on technological platforms: Toward an integrative framework. Res. Policy 2014, 43, 1239–1249. [Google Scholar]

- Baldwin, C.Y.; Woodard, C.J. The architecture of platforms: A unified view. In Platforms, Markets and Innovation; Gawer, A., Ed.; Edward Elgar Publishing Limited: Camberley, UK, 2009; pp. 19–44. [Google Scholar]

- Habib, T.; Kristiansen, J.N.; Rana, M.B.; Ritala, P. Revisiting the role of modular innovation in technological radicalness and architectural change of products: The case of Tesla X and Roomba. Technovation 2020, 98, 102163. [Google Scholar] [CrossRef]

- Muniz, S.T.G.; Belzowski, B.M. Platforms to enhance electric vehicles’ competitiveness. Int. J. Automot. Technol. Manag. 2017, 17, 151–168. [Google Scholar]

- Alliance for Industrial Internet. Industrial Internet Platform White Paper; Ministry of Industry and Information Technology: Beijing, China, 2017. [Google Scholar]

- Alliance for Industrial Internet. Application Guidelines for Industrial Internet Identity Resolution (Automotive Industry); Alliance of Industrial Internet: Beijing, China, 2021. [Google Scholar]

- Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ); China Academy of Information and Communication Technology. Industry 4.0 x Industrial Internet: Practices and Insights; Ministry of Industry and Information Technology: Beijing, China, 2020. [Google Scholar]

- Miao, X. Changing Lanes: China’s Road to New Energy Vehicles; People’s Post and Telecommunications Press: Beijing, China, 2023. [Google Scholar]

- Schmitt, A.; Van Biesebroeck, J. Proximity strategies in outsourcing relations: The role of geographical, cultural and relational proximity in the European automotive industry. J. Int. Bus. Stud. 2013, 44, 475–503. [Google Scholar]

- Jagani, S.; Marsillac, E.; Hong, P. The Electric Vehicle Supply Chain Ecosystem: Changing Roles of Automotive Suppliers. Sustainability 2024, 16, 1570. [Google Scholar] [CrossRef]

- Williamson, O.E. The economics of organization: The transaction cost approach. Am. J. Sociol. 1981, 87, 548–577. [Google Scholar]

- Anderson, J.E.; Van Wincoop, E. Trade costs. J. Econ. Lit. 2004, 42, 691–751. [Google Scholar]

- Wagner, S.M.; Bode, C. An empirical examination of supply chain performance along several dimensions of risk. J. Bus. Logist. 2008, 29, 307–325. [Google Scholar] [CrossRef]

- Hopkins, J.; Hawking, P. Big data analytics and IoT in logistics: A case study. Int. J. Logist. Manag. 2018, 29, 575–591. [Google Scholar] [CrossRef]

- Yerpude, S.; Singhal, T.K. Enhancing new product development effectiveness with internet of things origin real time data. J. Cases Inf. Technol. (JCIT) 2018, 20, 21–35. [Google Scholar] [CrossRef]

- Min, H. Artificial intelligence in supply chain management: Theory and applications. Int. J. Logist. Res. Appl. 2010, 13, 13–39. [Google Scholar] [CrossRef]

- Tiwari, S.; Wee, H.-M.; Daryanto, Y. Big data analytics in supply chain management between 2010 and 2016: Insights to industries. Comput. Ind. Eng. 2018, 115, 319–330. [Google Scholar] [CrossRef]

- Baldwin, C.; Clark, K. Design Rules: The Power of Modularity; MIT Press: Cambridge, MA, USA, 1999. [Google Scholar]

- Sturgeon, T.; Van Biesebroeck, J.; Gereffi, G. Value chains, networks and clusters: Reframing the global automotive industry. J. Econ. Geogr. 2008, 8, 297–321. [Google Scholar] [CrossRef]

- Wells, P.; Nieuwenhuis, P. Transition failure: Understanding continuity in the automotive industry. Technol. Forecast. Soc. Chang. 2012, 79, 1681–1692. [Google Scholar] [CrossRef]

- Frenken, K.; Boschma, R.A. A theoretical framework for evolutionary economic geography: Industrial dynamics and urban growth as a branching process. J. Econ. Geogr. 2007, 7, 635–649. [Google Scholar] [CrossRef]

- Yoo, Y.; Henfridsson, O.; Lyytinen, K. Research commentary—The new organizing logic of digital innovation: An agenda for information systems research. Inf. Syst. Res. 2010, 21, 724–735. [Google Scholar] [CrossRef]

- Tao, F.; Cheng, J.; Qi, Q.; Zhang, M.; Zhang, H.; Sui, F. Digital twin-driven product design, manufacturing and service with big data. Int. J. Adv. Manuf. Technol. 2018, 94, 3563–3576. [Google Scholar] [CrossRef]

- Cozmiuc, D.; Petrisor, I. Industrie 4.0 by siemens: Steps made next. J. Cases Inf. Technol. (JCIT) 2018, 20, 31–45. [Google Scholar] [CrossRef]

- Müller, J.M.; Buliga, O.; Voigt, K.-I. Fortune favors the prepared: How SMEs approach business model innovations in Industry 4.0. Technol. Forecast. Soc. Chang. 2018, 132, 2–17. [Google Scholar]

- Marshall, A. Principles of Economics; Springer: Berlin, Germany, 2013. [Google Scholar]

- Duranton, G.; Puga, D. Micro-Foundations of Urban Agglomeration Economies. In Handbook of Regional and Urban Economics; Henderson, J., Thisse, J.-F., Eds.; Elsevier: Amsterdam, The Netherlands, 2004; Volume 4, pp. 2063–2117. [Google Scholar]

- Gertler, M.S. Tacit knowledge and the economic geography of context, or the undefinable tacitness of being (there). J. Econ. Geogr. 2003, 3, 75–99. [Google Scholar] [CrossRef]

- Maskell, P.; Malmberg, A. Localised learning and industrial competitiveness. Camb. J. Econ. 1999, 23, 167–185. [Google Scholar]

- Tiwana, A.; Konsynski, B.; Bush, A. Platform evolution: Coevolution of platform architecture, governance, and environmental dynamics. Inf. Syst. Res. 2010, 21, 675–687. [Google Scholar]

- Asheim, B.; Coenen, L.; Vang, J. Face-to-face, buzz, and knowledge bases: Sociospatial implications for learning, innovation, and innovation policy. Environ. Plan C Gov. Policy 2007, 25, 655–670. [Google Scholar]

- Storper, M.; Venables, A.J. Buzz: Face-to-face contact and the urban economy. J. Econ. Geogr. 2004, 4, 351–370. [Google Scholar]

- Balland, P.-A.; Boschma, R.; Frenken, K. Proximity and innovation: From statics to dynamics. Reg. Stud. 2015, 49, 907–920. [Google Scholar] [CrossRef]

- Boschma, R. Proximity and innovation: A critical assessment. Reg. Stud. 2005, 39, 61–74. [Google Scholar] [CrossRef]

- Frank, A.G.; Dalenogare, L.S.; Ayala, N.F. Industry 4.0 technologies: Implementation patterns in manufacturing companies. Int. J. Prod. Econ. 2019, 210, 15–26. [Google Scholar]

- Gao, L.; Bai, X. A unified perspective on the factors influencing consumer acceptance of internet of things technology. Asia Pac. J. Mark. Logist. 2014, 26, 211–231. [Google Scholar]

- Xu, L.D.; Xu, E.L.; Li, L. Industry 4.0: State of the art and future trends. Int. J. Prod. Res. 2018, 56, 2941–2962. [Google Scholar] [CrossRef]

- Holmström, J.; Holweg, M.; Lawson, B.; Pil, F.K.; Wagner, S.M. The digitalization of operations and supply chain management: Theoretical and methodological implications. J. Oper. Manag. 2019, 65, 728–734. [Google Scholar] [CrossRef]

- Chang, Q.; Kong, C.; Jin, S. Exploring the Impact of Digital Transformation on Corporate Violations in China’s A-Share Market. Systems 2024, 12, 322. [Google Scholar] [CrossRef]

- Lu, Y.; Xu, C.; Zhu, B.; Sun, Y. Digitalization transformation and ESG performance: Evidence from China. Bus. Strategy Environ. 2024, 33, 352–368. [Google Scholar] [CrossRef]

- Jiang, S.; Yeung, A.C.; Han, Z.; Huo, B. The effect of customer and supplier concentrations on firm resilience during the COVID-19 pandemic: Resource dependence and power balancing. J. Oper. Manag. 2023, 69, 497–518. [Google Scholar] [CrossRef]

- Wang, Y.B.; Liu, B.; Chan, H.K.; Zhang, T.T. Who pays buyers for not disclosing supplier lists? Unlocking the relationship between supply chain transparency and trade credit. J. Bus. Res. 2023, 155, 113404. [Google Scholar] [CrossRef]

- PwC. Digital Vehicles Report; PwC: Bristol, UK, 2023. [Google Scholar]

- Wang, J.; Wang, X.; Sun, F.; Li, X. The Functional Mechanisms through Which Artificial Intelligence Influences the Innovation of Green Processes of Enterprises. Systems 2024, 12, 378. [Google Scholar] [CrossRef]

- Li, Y.; Liu, C.; Mao, W.; Xie, Y. Spatial characteristics and location selection of global data center expansion. Acta Geogr. Sin. 2023, 78, 1936–1954. [Google Scholar]

- Liu, Y.; Chi, G. Does digital transformation promote supply chain efficiency? Evidence from China. Manag. Decis. Econ. 2024, 45, 5562–5576. [Google Scholar] [CrossRef]

- Zhang, K.; Qian, Q. Characteristics and proximities mechanism of China’s new energy vehicle industry innovation network. Geogr. Res. 2021, 40, 2170–2187. [Google Scholar]

- Zhang, N.; Duan, H.; Guan, Y.; Mao, R.; Song, G.; Yang, J.; Shan, Y. The “Eastern Data and Western Computing” initiative in China contributes to its net-zero target. Engineering, 2024; in press. [Google Scholar]

- Song, J.; Wang, R.; Cavusgil, S.T. State ownership and market orientation in China’s public firms: An agency theory perspective. Int. Bus. Rev. 2015, 24, 690–699. [Google Scholar] [CrossRef]

- Johansson, A.C.; Feng, X. The state advances, the private sector retreats? Firm effects of China’s great stimulus programme. Camb. J. Econ. 2016, 40, 1635–1668. [Google Scholar] [CrossRef]

- Wang, D.; Shao, X. Research on the impact of digital transformation on the production efficiency of manufacturing enterprises: Institution-based analysis of the threshold effect. Int. Rev. Econ. Financ. 2024, 91, 883–897. [Google Scholar] [CrossRef]

- Jing, H.; Fan, Y.W. Digital Transformation, Supply Chain Integration and Supply Chain Performance: Evidence From Chinese Manufacturing Listed Firms. Sage Open 2024, 14, 21582440241281616. [Google Scholar] [CrossRef]

- Li, H.; Yang, Z.; Jin, C.; Wang, J. How an industrial internet platform empowers the digital transformation of SMEs: Theoretical mechanism and business model. J. Knowl. Manag. 2023, 27, 105–120. [Google Scholar] [CrossRef]

| Industry Chain Position | Industry Chain Segments | Representative Enterprises |

|---|---|---|

| Upstream of the upstream | Positive and negative electrode materials, battery separator, electrolyte, lithium equipment, permanent magnet | Gaoxuan Hi-Tech Co., Ltd. (Hefei City), Zhongwei New Material Co., Ltd. (Tongren City), Sinoma Technology Co., Ltd. (Nanjing City), Ningbo Sanshan Co., Ltd. (Ningbo City), North Huachuang Group Co., Ltd. (Beijing City). |

| Upstream | Driving electric motor, thermal management system, battery, in-vehicle terminal, electronic control system, automotive chip, in-vehicle display, basic software, center console, intelligent cockpit, automated driving solution | Ningde Times New Energy Co., Ltd. (Ningde City), BYD Company Limited (Shenzhen City), BOE Technology Group Co., Ltd. (Beijing City), Foxconn Industrial Internet Co., Ltd. (Shenzhen City), ZTE Corporation (Shenzhen City) |

| Midstream | Complete vehicle manufacturing | Shanghai Automotive Group Co., Ltd. (Shanghai City), Great Wall Motor Co., Ltd. (Baoding City), Chongqing Changan Automobile (Chongqing City), Zoomlion Heavy Industry Co., Ltd. (Changsha City), FAW Jiefang Group Co., Ltd. (Changchun City). |

| Downstream | Battery recycling, charging pile, vehicle networking system integration, charging station, mobile communication operation | Zhejiang Huayou Cobalt Industry Co., Ltd. (Jiaxing City), Jiangxi Ganfeng Lithium Group Co., Ltd. (Xinyu City), Grimmie Co., Ltd. (Shenzhen City), Shanghai Baoxin Software Co., Ltd. (Shanghai City), Shenzhen Kelu Electronic Co., Ltd. (Shenzhen City) |

| Variables | Observations | Mean | Sd | Min | Max | Descriptions of the Indicator |

|---|---|---|---|---|---|---|

| Dist | 1308 | 6.0161 | 1.6199 | −4.5957 | 7.8314 | Logarithm of the average geographical distance to customers |

| IIP | 1405 | −0.1481 | 2.2292 | −2.3026 | 5.8438 | Logarithmic frequency of IIP-related terms in annual reports |

| Staff | 1405 | 8.1593 | 1.7944 | 0.0000 | 13.2535 | Logarithm of the number of employees |

| Mobility | 1405 | 0.0642 | 0.0835 | −1.6945 | 1.1067 | Liquid assets as a percentage of total assets |

| Growth | 1405 | 124.1752 | 3722.5150 | −84.5942 | 139,544.7000 | Revenue growth rate |

| ROE | 1405 | 7.0496 | 22.1670 | −331.9110 | 62.4020 | Return on equity |

| RD | 1405 | 7.2174 | 6.9011 | −0.1300 | 57.2300 | Ratio of R&D investment to revenue |

| Dist_DC | 1405 | 0.8129 | 14.9255 | 0.1357 | 395.9695 | Logarithm of the average distance to data centers in the same province |

| Concent_Sup | 1255 | −0.8639 | 0.6724 | −2.8704 | 0.0000 | Herfindahl Index of purchases from suppliers |

| Concent_Cus | 1278 | −0.9124 | 0.7551 | −3.8883 | 0.0000 | Herfindahl Index of sales to customers |

| SZ | 1308 | 0.2831 | 0.2941 | 0.0000 | 1.0000 | Share of frequency of transactions with customers in the NEV chain |

| SE | 1308 | 0.1191 | 0.1910 | 0.0000 | 1.0000 | Share of volume of transactions with related customers |

| Variables | (1) | (2) |

|---|---|---|

| Dist | Dist | |

| IIP | 0.0841 *** | |

| (0.0309) | ||

| Staff | 0.0068 | 0.0056 |

| (0.0231) | (0.0239) | |

| Mobility | −0.1025 | −0.0844 |

| (0.2665) | (0.2626) | |

| Growth | −1.55 × 10−5 *** | −1.40 × 10−5 *** |

| (2.91 × 10−6) | (2.99 × 10−6) | |

| ROE | −0.0001 | −0.0002 |

| (0.0007) | (0.0007) | |

| RD | 0.0163 | 0.0158 |

| (0.0122) | (0.0123) | |

| Dist_DC | 0.0009 *** | 0.0009 *** |

| (0.0003) | (0.0003) | |

| Concent_Sup | −0.1201 | −0.1063 |

| (0.0830) | (0.0832) | |

| Concent_Cus | −0.1892 *** | −0.1909 *** |

| (0.0597) | (0.0593) | |

| Constant | 5.5732 *** | 5.5970 *** |

| (0.2370) | (0.2440) | |

| Year FE | YES | YES |

| Firm FE | YES | YES |

| Observations | 1157 | 1157 |

| Adjusted R2 | 0.5034 | 0.5071 |

| Variables | (1) | (2) |

|---|---|---|

| First Stage | Second Stage | |

| IIP | Dist | |

| Incre_DC | 0.0116 *** | |

| (0.0030) | ||

| IU | 2.64 × 10−8 *** | |

| (6.58 × 10−9) | ||

| IIP | 0.4287 ** | |

| (0.2051) | ||

| Staff | 0.0104 | 0.0009875 |

| (0.0408) | (0.0313) | |

| Mobility | −0.3471 | −0.0102 |

| (0.4902) | (0.3186) | |

| Growth | −1.41 × 10−5 ** | −7.88 × 10−6 |

| (6.68 × 10−6) | (7.07 × 10−6) | |

| ROE | 0.0009 | −0.0003 |

| (0.0013) | (0.0009) | |

| RD | 0.0040 | 0.0138 |

| (0.0147) | (0.0137) | |

| Dist_DC | −0.0007 | 0.0010 |

| (0.0012) | (0.0007) | |

| Concent_Sup | −0.1684 ** | −0.0493 |

| (0.0724) | (0.0810) | |

| Concent_Cus | 0.0044 | −0.1979 *** |

| (0.0635) | (0.0580) | |

| Year FE | YES | YES |

| Firm FE | YES | YES |

| Kleibergen–Paap rk LM statistic | 15.4051 *** | |

| Kleibergen–Paap rk Wald F statistic | 22.297 | |

| Stock–Yogo weak ID test value (10%) | 19.93 | |

| Hansen J statistic | 0.154 | |

| F statistic | 22.3019 *** | |

| Observations | 1157 | 1157 |

| Adjusted R2 | −0.2857 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| Controlling Regions and Industries | Replacing the Dependent Variable | Replacing the Sample | |

| Dist | Remote | Dist | |

| IIP | 0.0832 *** | 0.1393 * | 0.0441 ** |

| (0.0312) | (0.0718) | (0.0185) | |

| Staff | 0.0249 | 0.1698 ** | −0.0087 |

| (0.0285) | (0.0834) | (0.0252) | |

| Mobility | −0.1138 | −1.2677 | −0.6878 |

| (0.2750) | (0.7841) | (0.9524) | |

| Growth | −1.83 × 10−5 *** | −2.66 × 10−5 *** | −8.91 × 10−6 *** |

| (2.70 × 10−6) | (8.54 × 10−6) | (8.37 × 10−6) | |

| ROE | −0.0002 | −0.0019 | −0.0004 |

| (0.0007) | (0.0025) | (0.0010) | |

| RD | 0.0140 | 0.01782 | 0.0157 |

| (0.0134) | (0.03658) | (0.0282) | |

| Dist_DC | 0.0010 * | −0.0019 ** | −0.0168 |

| (0.0005) | (0.0009) | (0.1881) | |

| Concent_Sup | −0.0810 | −0.4805 *** | |

| (0.0840) | (0.1812) | ||

| Concent_Cus | −0.1841 *** | −0.2035 | |

| (0.0597) | (0.2948) | ||

| Constant | 5.4833 *** | −3.7364 *** | 6.3705 *** |

| (0.2747) | (0.7746) | (0.3868) | |

| Industry FE | YES | NO | NO |

| Province FE | YES | NO | NO |

| Year FE | YES | YES | YES |

| Firm FE | YES | YES | YES |

| Observations | 1139 | 1103 | 795 |

| Adjusted R2 | 0.5013 | 0.3118 | 0.4982 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| SZ | SE | |||

| High | Low | High | Low | |

| Dist | Dist | Dist | Dist | |

| IIP | 0.1139 *** | 0.0411 | 0.0700 *** | 0.0870 |

| (0.0407) | (0.0481) | (0.0256) | (0.0647) | |

| Staff | 0.0756 | −0.0066 | 0.0017 | 0.1678 |

| (0.0516) | (0.0288) | (0.0263) | (0.1048) | |

| Mobility | −0.0562 | 0.0711 | −0.3231 | −0.3621 |

| (0.6759) | (0.4380) | (0.2063) | (0.7449) | |

| Growth | −0.0004 | −3.63 × 10−5 *** | −8.30 × 10−6 *** | −0.0003 |

| (0.0008) | (4.99 × 10−6) | (2.83 × 10−6) | (0.0012) | |

| ROE | 0.0008 | 0.0006 | 0.0001 | 0.0015 |

| (0.0019) | (0.0009) | (0.0008) | (0.0015) | |

| RD | 0.0320 * | −0.0032 | 0.0311 * | −0.0036 |

| (0.0174) | (0.0195) | (0.0183) | (0.0236) | |

| Dist_DC | 0.00233 | 0.0003 | 0.0020 *** | −0.0006 |

| (0.0638) | (0.0006) | (0.0005) | (0.0006) | |

| Concent_Sup | −0.0382 | −0.1272 | −0.0779 | −0.1527 |

| (0.1214) | (0.1387) | (0.0669) | (0.1440) | |

| Concent_Cus | −0.3159 *** | −0.0906 | −0.1405 *** | −0.1904 * |

| (0.0961) | (0.0662) | (0.0531) | (0.1001) | |

| Constant | 5.0272 *** | 5.7102 *** | 5.4723 *** | 4.5989 *** |

| (0.4628) | (0.3092) | (0.3424) | (0.9132) | |

| Year FE | YES | YES | YES | YES |

| Firm FE | YES | YES | YES | YES |

| Observations | 596 | 523 | 627 | 504 |

| Adjusted R2 | 0.4638 | 0.5926 | 0.6221 | 0.4728 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Regions | Roles in the Industry Chain | |||

| Eastern | Non-Eastern | Complete Vehicle Manufacturers | Upstream/Downstream Enterprises | |

| Dist | Dist | Dist | Dist | |

| IIP | 0.1020 ** | 0.0462 | 0.0025 | 0.1068 *** |

| (0.0410) | (0.0395) | (0.0326) | (0.0382) | |

| Staff | 0.0248 | 0.0109 | −0.0140 | 0.0206 |

| (0.0298) | (0.0325) | (0.0410) | (0.0277) | |

| Mobility | 0.1915 | −0.9147 | 0.0158 | 0.0891 |

| (0.278) | (0.7155) | (0.2586) | (0.5712) | |

| Growth | −0.0003 | −1.05 × 10−5 *** | −1.63 × 10−5 *** | −0.0003 |

| (0.0009) | (5.96 × 10−6) | (3.61 × 10−6) | (0.0007) | |

| ROE | −0.0008 | 0.0011 | 0.0004 | −0.0005 |

| (0.0011) | (0.0009) | (0.0008) | (0.0010) | |

| RD | 0.0103 | 0.0301 | 0.0281 * | 0.0155 |

| (0.0165) | (0.0238) | (0.0149) | (0.0137) | |

| Dist_DC | −2.0716 | 0.0011 ** | 0.0008 | −2.9298 *** |

| (1.2563) | (0.0005) | (0.0005) | (0.7057) | |

| Concent_Sup | −0.1513 | 0.0575 | 0.0945 | −0.1210 |

| (0.1042) | (0.0728) | (0.0957) | (0.0950) | |

| Concent_Cus | −0.2335 *** | −0.133 | −0.0499 | −0.2435 *** |

| (0.0752) | (0.107) | (0.0797) | (0.0715) | |

| Constant | 5.8744 *** | 5.8752 *** | 6.1251 *** | 6.1255 *** |

| (0.4198) | (0.3404) | (0.4350) | (0.2983) | |

| Year FE | YES | YES | YES | YES |

| Firm FE | YES | YES | YES | YES |

| Observations | 839 | 318 | 204 | 953 |

| Adjusted R2 | 0.5012 | 0.5192 | 0.4544 | 0.5092 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Ownership | Innovation Dynamics | |||

| Non-SOE | SOE | GEM or STAR | Main Board | |

| Dist | Dist | Dist | Dist | |

| IIP | 0.0800 ** | 0.1058 ** | −0.0337 | 0.1163 *** |

| (0.0401) | (0.0501) | (0.0754) | (0.03164) | |

| Staff | 0.0314 | −0.2000 *** | −0.2587 | −0.06940 |

| (0.0264) | (0.0701) | (0.1754) | (0.1094) | |

| Mobility | −0.0133 | −2.1133 | −0.1396 | −0.2082 *** |

| (0.2251) | (1.5671) | (0.1182) | (0.07272) | |

| Growth | 0.0009 | −0.00000313 | 0.0715 | −0.01719 |

| (0.0007) | (0.0000122) | (0.0666) | (0.02826) | |

| ROE | −0.0007 | 0.0004 | −0.3566 | −0.1091 |

| (0.0011) | (0.0009) | (0.3351) | (0.6031) | |

| RD | 0.0086 | 0.0412 ** | 8.86 × 10−4 | −1.44 × 10−5 ** |

| (0.0147) | (0.0177) | (0.0012) | (5.658 × 10−6) | |

| Dist_DC | −2.3681 | 0.0013 ** | −0.0006 | 5.42 × 10−6 |

| (2.1041) | (0.0005) | (0.0023) | (0.0007) | |

| Concent_Sup | −0.0710 | −0.1117 | 0.0221 | 0.0093 |

| (0.0865) | (0.1357) | (0.0318) | (0.0127) | |

| Concent_Cus | −0.2709 *** | −0.0951 | 9.1929 | 0.0011 *** |

| (0.0843) | (0.0907) | (8.8985) | (0.0003) | |

| Constant | 5.9347 *** | 7.3544 *** | 2.8492 | 5.8410 *** |

| (0.5476) | (0.5750) | (2.3113) | (0.3044) | |

| Year FE | YES | YES | YES | YES |

| Firm FE | YES | YES | YES | YES |

| Observations | 716 | 439 | 309 | 848 |

| Adjusted R2 | 0.5224 | 0.5470 | 0.3422 | 0.5644 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lin, J.; Mao, W.; Lin, X. Does the Adoption of Industrial Internet Platforms Expand or Reduce Geographical Distance to Customers? Evidence from China’s New Energy Vehicle Industry. Systems 2025, 13, 357. https://doi.org/10.3390/systems13050357

Lin J, Mao W, Lin X. Does the Adoption of Industrial Internet Platforms Expand or Reduce Geographical Distance to Customers? Evidence from China’s New Energy Vehicle Industry. Systems. 2025; 13(5):357. https://doi.org/10.3390/systems13050357

Chicago/Turabian StyleLin, Jiange, Weisheng Mao, and Xuehan Lin. 2025. "Does the Adoption of Industrial Internet Platforms Expand or Reduce Geographical Distance to Customers? Evidence from China’s New Energy Vehicle Industry" Systems 13, no. 5: 357. https://doi.org/10.3390/systems13050357

APA StyleLin, J., Mao, W., & Lin, X. (2025). Does the Adoption of Industrial Internet Platforms Expand or Reduce Geographical Distance to Customers? Evidence from China’s New Energy Vehicle Industry. Systems, 13(5), 357. https://doi.org/10.3390/systems13050357