Abstract

In the context of fintech’s transformative impact on banking, many commercial banks blindly adopt emerging technologies, resulting in systemic inefficiencies. To address this, we propose a complex systems-based competitiveness evaluation framework guiding strategic fintech adjustments. First, the Delphi method identifies five fintech subsystems: big data, artificial intelligence, cloud computing, the Internet of Things, and blockchain. Next, an ANP model captures nonlinear dependencies and feedback loops among these subsystems, overcoming the limitations of linear hierarchical methods. Empirical validation using 16 listed Chinese banks demonstrates the model’s systemic coherence and practical utility. This study contributes to systems science by integrating complex adaptive systems (CAS) theory into competitiveness evaluation, shifting from firm-centric governance to ecosystem dynamics. It also offers banks a tool for adaptive strategy iteration in evolving fintech ecosystems.

1. Introduction

Since the inception of the modern financial system, global commercial banks have evolved and matured through a series of reforms [1,2]. However, the advent of financial technology (fintech) has reconfigured banking into a complex adaptive system where technology, data flows, and stakeholder interactions co-evolve [3]. Despite heavy investments in fintech [4,5], commercial banks struggle with systemic inefficiencies due to the lack of a scientifically grounded evaluation framework. Consequently, it is both urgent and imperative to construct a suite of fintech-centered competitiveness evaluation systems.

Although academic research into the competitiveness of commercial banks has yielded many valuable results, the predominant focus has been on internal corporate governance aspects, including financial accounting, risk management, and related fields [6,7], neglecting the proper assessment of competitiveness in the realm of fintech. Conventional wisdom suggests that robust financial strength is synonymous with competitiveness in commercial banks [8], prompting some scholars to devise competitiveness evaluation frameworks focusing on size [9], profitability [10], and stability [11], including the adoption of the CAMEL rating system proposed by U.S. financial regulators [12]. While some scholars acknowledge the significant role of information and communication technology in shaping the competitiveness of commercial banks, they continue to assert that financial factors exert a more substantial influence than ICT [13,14], thereby neglecting further investigation into it.

However, in the fintech era, evaluating the competitiveness of commercial banks solely from an internal corporate governance standpoint has become insufficient [15,16]. To bridge this gap, we propose a systems-based competitiveness evaluation framework, integrating Delphi and ANP methods to model fintech’s ecosystem dynamics. This study advances systems science through two contributions: operationalizing CAS principles in fintech banking and demonstrating ANP’s efficacy in capturing feedback-driven dependencies. Practically, it empowers banks to strategically navigate fintech’s complexity while aiding regulators in ecosystem-level oversight.

The research is structured as follows, based on the foregoing: First, the theoretical background and literature review section explicates the foundational theories and synthesizes pertinent studies, thereby setting the stage for subsequent indicator selection. Second, the section on research objectives, methods, and data delineates the paper’s core issues, articulates the research methodologies, and details the sample data. Next, the results and discussion section presents and discusses the construction and validation of the evaluation system. Finally, the conclusion section encapsulates the primary findings, advances recommendations for diverse stakeholders, and delineates the study’s limitations.

2. Theoretical Background and Literature Review

2.1. Theoretical Background

Complex Adaptive Systems (CAS) theory provides an interdisciplinary framework for investigating the mechanisms through which complex systems attain ordered states. Originally proposed by Holland [17], a pioneer in genetic algorithms, the theory has since gained prominence across disciplines. Central to the theory is the principle of “Complexity Made Simple” which posits that agents, situated within defined environments, possess adaptive capacities and can dynamically modify their internal states in response to evolving external conditions and governing rules. Through iterative learning and adaptation, agents engage in interactions with other components of the system, facilitating both individual and systemic co-evolution toward higher-order organization. Owing to its robust explanatory capacity for complex social phenomena, CAS theory has found wide-ranging applications in disciplines such as economics, biology, ecology, and environmental science. The theory characterizes the ongoing interaction between agents and their environment as “adaptation”. The system’s evolutionary trajectory—including the emergence, differentiation, aggregation, and development of novel agents, as well as increasing structural hierarchy and complexity—unfolds progressively through the process of adaptation. Moreover, macro-level system transformations can frequently be traced to the behavioral patterns of individual agents.

According to CAS theory, the enhancement of commercial banks’ competitiveness through fintech represents a systemic transition, wherein adaptive agents engage in interactive learning, co-evolution, and emergent innovation within a dynamically evolving technological ecosystem. Diverse subfields within fintech collectively underpin the intrinsic complexity of the system by capitalizing on their unique functionalities. These technologies operate in synergy within the daily functions of commercial banks, not only augmenting operational efficiency but also perpetually reinforcing adaptive feedback loops within the system. As interactions and iterative optimizations across these subfields intensify, commercial banks’ adaptive learning processes accelerate, culminating in a progressive accumulation of incremental advancements that eventually precipitate qualitative breakthroughs. This evolutionary trajectory cultivates a sustainable, ecosystem-wide competitive edge in fintech.

When the fintech ecosystem of commercial banks is regarded as a CAS, its core characteristics closely correspond to the complexity of social systems proposed by Buckley [18]. Accordingly, this study is grounded in three core assumptions of CAS theory: agent adaptability, nonlinearity, and emergence. First, agent adaptability manifests in commercial banks’ capacity to sustain competitive viability in the fintech era through strategic recalibrations and continuous business feedback [19]. Second, the nonlinearity denotes that as commercial banks incorporate emerging scientific and technological advancements into their operations, the resultant impact on competitiveness transcends a mere linear aggregation. Conversely, diverse subfields of fintech—such as big data, artificial intelligence, and cloud computing—synergistically interact within banking operations, amplifying value creation and precipitating a sharp escalation in competitiveness [20]. Finally, the emergence materializes as commercial banks embed themselves within the fintech ecosystem, catalyzing a transformative leap in their competitive standing [21].

The application of CAS theory to fintech systems in commercial banks helps bridge the current theoretical gap in explaining the complexity and adaptive dynamics of technological integration within the banking sector. Incorporating CAS allows researchers to elucidate the mechanisms underlying complex technology adoption in banks, while also introducing novel paradigms for interpreting dynamic competition, ecosystem evolution, and risk governance in fintech. By conceptualizing technology-driven banking transformation as an evolutionary process of adaptive systems—rather than a series of discrete technological upgrades—this approach offers both scholars and practitioners a more nuanced and prospective theoretical framework for analyzing fintech competitiveness.

2.2. Literature Review

Current research concerning the application of emerging scientific technologies in commercial banks predominantly focuses on big data, artificial intelligence, and cloud computing.

Big data facilitates the interpretation of information and the conversion of insights into tangible benefits, seamlessly integrating into the data-intensive financial environments of commercial banks [22,23]. Key applications include the following: (a) analyzing customers’ historical transaction records to assess credit status and repayment capabilities accurately. This effectively addresses issues of asymmetric information and improves the scientific basis for decision-making in traditional banking, thereby enhancing risk management capabilities [24,25]; (b) analyzing customers’ consumption habits and lifestyles allows banks to offer personalized product and service recommendations, facilitating the precise allocation of marketing resources [26,27,28]; (c) examining internal operational data, such as transaction processing times and service requests, helps swiftly identify bottlenecks and areas for improvement, significantly enhancing service quality [29,30].

Artificial intelligence is progressively alleviating the limitations of traditional commercial banking, such as outdated processes and escalating labor costs, by spearheading intelligent transformation within the financial services sector [31]. Key applications include the following: (a) delivering personalized investment advice and wealth management services to optimize customer portfolios and enhance returns. This effectively counters the high costs of traditional advisory services and addresses the widespread lack of financial literacy among investors [32,33,34]; (b) providing round-the-clock intelligent consultation services to manage common queries and transactions, thereby enhancing customer engagement and operational efficiency [35,36]; (c) employing intelligent system recognition alongside manual verification to mitigate fraud and improve customer service, thus standardizing operational protocols [37,38]; (d) integrating Artificial intelligence into claims processing minimizes manual data entry errors, thereby enhancing both efficiency and quality [39].

Cloud computing, characterized by its formidable computational power and dynamic scalability, is transforming traditional banking operations and services, providing commercial banks with a critical competitive advantage in a fiercely competitive market [40]. Key applications include the following: (a) delivering flexible and scalable data storage solutions that enable banks to integrate and manage data more efficiently, thereby mitigating the constraints of traditional storage models [41,42]; (b) offering IT infrastructure services that streamline business processes, bolster system stability and reliability, and reduce maintenance costs and hardware expenditures [43]; (c) despite the advanced maturity of cloud computing technologies, risks such as data breaches and transmission attacks persist, particularly due to the sensitive nature of the information processed, including customer identities and financial data [44,45].

Furthermore, with the rapid advancement of emerging scientific technologies, both IoT and blockchain are increasingly being integrated into commercial banking applications. However, scholarly attention on the application of these technologies within commercial banks remains limited.

The Internet of Things (IoT) enhances the interconnectivity of diverse devices, prompting commercial banks to strategically establish specialized service platforms to overcome business bottlenecks and reduce operational costs [46]. IoT capabilities, including gravity sensing and contour scanning, enable real-time monitoring and control of mobile assets, such as cars and ships, thus preventing issues like the duplicative pledging of collateral [47,48]. The exponential growth of IoT ecosystems is driving transformational changes in payment methodologies, where photon payment mechanisms now provide quantifiably enhanced security protocols and operational efficiencies compared to legacy systems [49,50]. Additionally, IoT technology facilitates real-time status monitoring and predictive maintenance of fixed assets, such as ATMs, significantly lowering the costs associated with manual inspections [51,52].

Blockchain technology, a pivotal force in the global technological revolution, is attracting considerable interest from commercial banks due to its decentralization and immutability, which promise to enhance operational performance [53]. Utilizing blockchain to authenticate transactions and track goods movement within the supply chain improves trade financing efficiency and transparency, reduces costs, and expedites turnover, thereby maximizing digital credit financing efficiency [54,55]. Additionally, blockchain delivers more transparent, faster, and cost-effective solutions for cross-border payments, ensuring efficient remittance processing and broadening the service spectrum [56,57]. Furthermore, integrating blockchain with bill discounting services addresses the challenges of incomplete information and opacity in traditional operations, effectively meeting the evolving needs of commercial banks [58,59].

In summary, the five fundamental subfields of fintech—big data, artificial intelligence, cloud computing, the Internet of Things, and blockchain—have been extensively integrated into the daily operations of commercial banks, playing a pivotal role in strengthening their competitiveness in fintech. However, existing research predominantly examines the isolated effects of individual subfields on commercial banks, contributing only marginally to a holistic enhancement of their fintech capabilities. Furthermore, the synergistic interactions among these fintech subfields and their collective impact on the overall competitiveness of commercial banks remain underexplored. Therefore, this study undertakes a comprehensive analysis of the synergistic effects among various fintech subfields in shaping the competitiveness of commercial banks. This study aims to construct a rigorous, systematic, and practical evaluation framework for fintech competitiveness, offering valuable insights and strategic guidance for commercial banks to refine their approaches in alignment with their fintech development objectives.

3. Research Objective, Methodology and Data

3.1. Research Objective

This study endeavors to devise a comprehensive and easily deployable fintech competitiveness evaluation system to accurately evaluate the development status of commercial banks in the realm of fintech, concurrently offering guidance for their future fintech strategy formulation. To accomplish this objective, the research will systematically address the following specific inquiries:

- Which indicators ought to be selected, and how should they be measured to appropriately assess the fintech competitiveness of commercial banks?

- What are the interrelationships among the various evaluation indicators of fintech competitiveness within commercial banks?

- How can scientific methodologies be employed to ascertain the weights of each fintech competitiveness evaluation indicator for commercial banks?

3.2. Research Methodology

To guarantee the successful attainment of the research objectives, we integrate the Delphi method and the Analytic Network Process (ANP) model. This methodological integration effectively bridges the gap between expert judgment and quantitative modeling in addressing research challenges. The integration of the Delphi method and ANP fosters a mechanism of “complementary enhancement”. The Delphi method initially conducts multiple iterative rounds with fintech experts to identify key determinants and preliminarily delineate their intrinsic interrelationships, thereby generating consensus-refined inputs for ANP. Based on this, ANP applies mathematical modeling to reveal latent dependencies within the research framework while ensuring logical coherence. This process converts expert judgments into quantifiable weights, facilitating a more rigorous and systematic analytical framework. Specifically, the Delphi method is utilized to construct a fintech-oriented framework for evaluating the competitiveness of commercial banks, and the ANP model is employed to convert qualitative judgments into quantitative data, thereby facilitating the scientific computation of comprehensive weights for each indicator.

3.2.1. Delphi Method

The Delphi method, also known as the expert survey method, enables experts to provide opinions anonymously, setting it apart from conventional brainstorming and thus ensuring the independence of their viewpoints [60]. As a well-established methodology for eliciting expert opinions, the Delphi method has seen extensive application in a variety of complex contexts, especially in evaluating the completeness of indicator systems [61]. The Delphi method operates on the premise that “collective intelligence” surpasses individual judgment, assuming that the chosen experts possess adequate knowledge, experience, and analytical expertise in the relevant domain to provide meaningful insights. Nevertheless, subjective biases inherent in expert scoring remain a challenge.

Following an exhaustive review of the relevant literature, this study initially outlined the dimensions and criteria for evaluating the competitiveness of commercial banks in fintech, which was subsequently refined via the Delphi method to ensure the completeness and scientific validity of the evaluation model. Considering the effectiveness of the Delphi method largely hinges on the expert’s familiarity with the core objectives [62], it is crucial to carefully select a panel of experts possessing extensive research experience in both commercial banking and fintech.

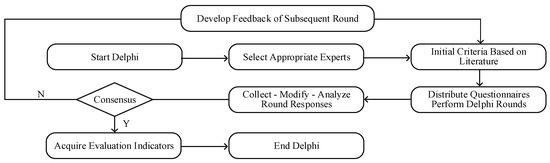

Additionally, this study established a platform that allowed experts to express a broad spectrum of opinions through surveys, thereby facilitating the collection of comprehensive information relevant to the research topic. The Delphi method involves an iterative process of gathering expert opinions until a consensus is reached regarding the evaluation framework [63], as illustrated in Figure 1.

Figure 1.

Delphi analysis process.

Given the exploratory nature of this study and the constraints of previous research, we assert that the design of evaluation dimensions and observational indicators must conform to the following principles:

- Relevance. The fintech competitiveness evaluation system established in this study diverges from the competitiveness evaluation systems developed by previous scholars, as it highlights the application capabilities of these banks within the realm of fintech. Thus, the indicator system should be systematically designed to align with the theme of commercial banks’ application capabilities in the fintech domain;

- Accessibility. A multitude of indicators exist to measure the fintech competitiveness of commercial banks; however, in practice, many of these indicators present challenges in data collection, and some may even be impossible to obtain. Thus, to ensure that the final evaluation system can be broadly disseminated within the banking sector, indicators should be designed to be easily searchable and collectible, thereby enhancing the operability of the research process;

- Coordination. The strength of a commercial bank’s fintech competitiveness results from the collective impact of various technology applications. Therefore, the constructed evaluation system should aim to encompass all relevant factors to form a complete system while ensuring good coordination among the subsystems within this system, thus maintaining the balance of indicators at all levels of the evaluation system.

To ensure the validity and robustness of the proposed evaluation framework, we developed a five-point Likert scale, as detailed in Appendix A, to facilitate expert assessment. To mitigate potential subjectivity in expert scoring, we implemented the following measures. First, we carefully selected experts with extensive practical experience and diverse professional backgrounds across fintech, commercial banking, and financial regulation (see Table 1), thereby ensuring the professionalism and diversity of scoring perspectives. Second, throughout the survey process, we strictly adhered to principles of independent scoring and anonymous response collection, thereby effectively mitigating herd effects and authority biases. Finally, we calculated the mean scores from the collected assessments to balance differing expert perspectives, thereby further enhancing the objectivity and representativeness of the evaluations. During the research process, these experts were segmented into two groups, each consisting of five members. The first round of the Delphi survey was conducted by one group of five experts, while the second round saw the alternate group verify the results of the first round and introduce new perspectives and insights [64].

Table 1.

Composition of the expert panel.

Following the first round, the indicators were adjusted based on the experts’ feedback, and the survey results were anonymously relayed to the subsequent round of experts, ensuring that the second group could re-evaluate their responses without external influence. Additionally, the experts were empowered to add, delete, or modify the indicators based on their individual research or business experience. Throughout this process, the research team utilized email to disseminate and collect the questionnaires.

3.2.2. ANP Method

The Analytic Network Process (ANP) method, unlike traditional weighting techniques, does not necessitate strict independence among indicators. It effectively captures interactions across hierarchical levels and demonstrates superior adaptability to interdependent hierarchical structures. Owing to its augmented practicality, the ANP method is extensively employed by academics in tackling intricate decision-making challenges [65]. The ANP method operates on the assumption that the constructed network model accurately represents the dependencies among various factors within the actual system, encompassing feedback loops and external influences. Nevertheless, given the intricacy of the network structure, managing multi-level dependencies and feedback loops becomes imperative. Throughout this process, SuperDecisions software 2.10, a computer-aided decision-making tool designed to support the ANP method, plays a crucial role in facilitating the seamless computation of complex models.

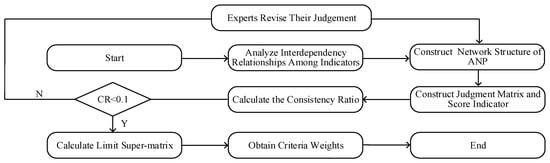

In this study, the indicators within the fintech competitiveness evaluation framework demonstrate significant complexity and interconnectivity. Based on CAS theory, analyzing the interactions among these indicators helps to reveal the nonlinear characteristics of dynamic evolution and the adaptive feedback pathways within the fintech competitiveness system of commercial banks. Accordingly, we employed the analytic network process (ANP) as the principal method for weighting the fintech competitiveness indicators of commercial banks. The ANP method facilitates interactions among indicators across various levels and adjacent layers, effectively mitigating redundant calculations of indicator weights in the presence of interdependencies [66]. Upon finalizing the evaluation framework, the ANP method, recognized as one of the most effective tools for determining weights, is utilized in this study to calculate the corresponding weights for each evaluation indicator. This facilitates the subsequent application and empirical validation of the model using actual operational data from sampled commercial banks. According to Saaty [67], the specific process of the ANP method is illustrated in Figure 2.

Figure 2.

ANP analysis process.

3.3. Research Data

In this study, due to the unavailability of 2024 operational data for many commercial banks, we selected 16 commercial banks that had been successfully listed on the Shanghai and Shenzhen stock exchanges by the end of 2023 as our research sample. These 16 banks were chosen primarily because their relevant data are readily accessible, and they are ranked among the top global commercial banks by “The Banker” magazine, making them highly representative.

The sample of state-owned commercial banks comprises: the Industrial and Commercial Bank of China (ICBC), China Construction Bank (CCB), Agricultural Bank of China (ABC), Bank of China (BOC), Postal Savings Bank of China (PSBC), and Bank of Communications (BOCOM). The sample of joint-stock commercial banks consists of: China Merchants Bank (CMB), Industrial Bank Co., Ltd. (CIB), PingAn Bank Co., Ltd. (PAB), Shanghai Pudong Development Bank Co., Ltd. (SPDB), China Minsheng Banking Corp., Ltd. (CMBC), China CITIC Bank Co., Ltd. (CITIC), and China Everbright Bank Co., Ltd. (CEB). The sample of city commercial banks includes: Bank of Ningbo Co., Ltd. (BON), Bank of Jiangsu Co., Ltd. (BOJ), and Bank of Beijing Co., Ltd. (BOB).

The data and information employed in the subsequent evaluation process were sourced from the Wind database and Zero One Think Tank.

4. Results and Discussion

4.1. Delphi Analysis Results

Drawing on the literature review in Section 2, the research team initially categorized the evaluation dimensions of commercial banks’ fintech competitiveness into five key domains: big data applications, artificial intelligence applications, cloud computing applications, Internet of Things applications, and blockchain applications. These dimensions primarily serve to evaluate the impact of these technologies on enhancing operational efficiency by driving innovation in financial products and services within commercial banks. By leveraging relevant literature from each technological subfield, we selected 16 indicators as the evaluation criteria for the fintech competitiveness of commercial banks, including ‘Risk Management Capability’, ‘Precision Marketing Capability’, ‘Operational Efficiency Optimization Capability’, ‘Robo-advisor Services’, ‘Chatbots Efficiency’, ‘Intelligent Identification Efficiency’, ‘Intelligent Claims Processing Services’, ‘Information Data Integration Capability’, ‘Business Process Optimization Capability’, ‘Data Security Protection Capability’, ‘Movable Property Pledge Financing Capability’, ‘Payment Function Optimization Capability’, ‘Machine Fault Detection Capability’, ‘Digital Credit Financing Services’, ‘Digital Payment Settlement Services’, and ‘Digital Bill Discounting Services’.

Following two rounds of the Delphi process, the research team iteratively collected and synthesized the opinions of the 10 experts, achieving a 100% response rate. Ultimately, the experts expressed no objections to the initially constructed evaluation dimensions but recommended adjustments to the specific evaluation indicators under each dimension. The 16 fintech competitiveness evaluation indicators initially identified from the literature review increased to 18 after the final round. The indicators ‘Intelligent Claims Service’ and ‘Business Process Optimization Capability’ were removed, while ‘Regulatory and Compliance Assistance Capability’, ‘Business Cost Reduction Capability’, ‘Insurance Business Innovation Capability’, and ‘Asset Custody and Clearing Business’ were added. Importantly, experts refined the phrasing of specific indicators and reached a consensus that these 18 indicators provide a comprehensive evaluation of fintech adoption in commercial banks.

Meanwhile, to ensure that the final results accurately reflect the experts’ consensus, it is crucial to calculate the coefficient of variation (CV) for each indicator [68], as shown in Equation (1). Thus, we calculated the mean and standard deviation (favoring lower values) for each indicator to determine the CV value, as presented in Table 2.

where S is the standard deviation, and is the mean.

Table 2.

Delphi analysis results.

As shown in Table 2, each indicator meets the stipulated standard with a CV below 0.2, indicating a high level of consensus among the experts regarding the validity of these 18 indicators. The indicators ‘Precision Marketing Capability’ and ‘Movable Property Pledge Financing Capability’ exhibit the lowest coefficient of variation, at zero, indicating a unanimous agreement among the experts on these indicators’ validity. The standard deviation for the remaining 16 indicators is approximately 0.5, demonstrating that most ratings are closely aligned with the mean (), reflecting a basic consensus among the experts.

Through a comprehensive literature review and an iterative Delphi process, we systematically identified five key evaluation dimensions: big data applications, artificial intelligence applications, cloud computing applications, Internet of Things applications, and blockchain applications. These dimensions are designated as A, B, C, D, and E for analytical clarity. A total of 18 specific observational indicators, along with their corresponding measurement methods, are systematically outlined in Table 3.

Table 3.

Evaluation framework for the fintech competitiveness of commercial banks.

4.2. ANP Analysis Results

Based on CAS theory, the five-dimensional evaluation framework developed in this study—encompassing Big Data, Artificial Intelligence, Cloud Computing, the Internet of Things, and Blockchain—can be conceptualized as an intelligent ecosystem possessing active adaptive capabilities. Within this system, technological components function as heterogeneous agents, establishing dynamic linkage mechanisms through nonlinear interactions and co-evolution, thus satisfying the three core assumptions of CAS theory: agent adaptability, system nonlinearity, and emergence. Consequently, the indicators within the evaluation framework are not mutually independent but instead display varying degrees of mutual influence and interdependence. In light of this, it is critical to examine the influence pathways and dependency relationships among the observed indicators before constructing the ANP network structure model [69]. To this end, we systematically synthesize and organize the interaction relationships among indicators by integrating insights from existing literature with the operational realities of commercial banks, as detailed below:

First, a significant interrelationship exists among ‘Risk Management Capability’ (A1), ‘Data Security Protection Capability’ (C3), and ‘Insurance Business Innovation Capability’ (D2). When commercial banks employ big data technology to mitigate loan default risks, the improvement of their risk management capabilities relies not only on precise data analysis but also on a strong correlation with their data security protection capabilities. Should banks frequently encounter security risks during data transmission, it will directly impact their effective utilization of data, consequently diminishing the success rate of risk management [45]. Concurrently, robust data security protection capabilities can significantly enhance customer trust in the bank, thereby fostering a more stable environment for the innovation of the bank’s insurance business. When customers perceive a heightened sense of security with the bank, they are more inclined to engage with new insurance products, particularly in innovative offerings such as UBI (Usage-Based Insurance) [70]. Thus, the advancement of insurance business innovation capabilities can generate new revenue streams for banks while also enhancing risk management capabilities, thus establishing a virtuous cycle.

Second, there exists a notable interconnection among ‘Precision Marketing Capability’ (A2), ‘Robo-advisors Services’ (B1), and ‘Chatbots Efficiency’ (B2). The enhancement of precision marketing capability can markedly elevate marketing success rates, indicating that banks become increasingly adept at identifying customer needs and optimizing product recommendations, thereby attracting a greater number of customers to utilize Robo-advisors [37]. When precision marketing effectively attracts new customers, the customer base for Robo-advisors services expands correspondingly, thereby fostering the growth of asset management and investment services. Concurrently, the enhancement of Chatbots efficiency plays an essential role in this process. By efficiently substituting human effort, intelligent customer service can rapidly respond to customer needs, elevate service quality, and minimize customer waiting times. This not only elevates customer satisfaction but also delivers real-time data feedback for precision marketing, enabling banks to more effectively adjust their marketing strategies to align with market demands [71].

Next, a significant interrelationship exists among ‘Operational Efficiency Optimization Capability’ (A3), ‘Information Data Integration Capability’ (C1), and ‘Business Cost Reduction Capability’ (C2). An enhancement in operational efficiency optimization capability typically indicates that commercial banks can process transactions more swiftly, which is contingent upon the effective integration of customer information. Information data integration capability significantly enhances data accessibility and accuracy through cloud computing technology, thereby enabling banks to swiftly obtain the requisite information and consequently expedite transaction processing speeds [72]. Furthermore, as transaction processing times decrease, banks can execute a greater number of transactions within the same timeframe, thereby augmenting overall operational efficiency. This enhancement in efficiency not only elevates customer satisfaction but also diminishes operational costs, thereby contributing to the strengthening of business cost reduction capability. When banks effectively manage IT expenditures and optimize resource allocation, this, in turn, creates opportunities for further technological investments, facilitating the ongoing integration of information and optimization of business processes [73].

Furthermore, a complementary and synergistic relationship exists between ‘Movable Property Pledge Financing Capability’ (D1) and ‘Digital Credit Financing Services’ (E1). The enhancement of movable property pledge financing capability can attract a greater number of corporate clients, particularly those possessing physical assets yet lacking credit histories. These enterprises may prefer to utilize movable asset pledge financing to secure liquidity; the successful implementation of this process not only generates new client sources for banks but also augments their expertise in the domain of movable asset pledges. Concurrently, the expansion of digital credit financing services can provide small and micro enterprises with more flexible financing options, particularly concerning credit assessment and approval processes. By integrating these two financing models, banks can offer more comprehensive financial solutions tailored to diverse types of enterprises, thereby enhancing customer satisfaction and fostering loyalty [74].

Finally, ‘Payment Function Optimization Capability’ (D3) serves to enhance ‘Digital Payment Clearing Business’ (E2). With the introduction of photon payment methods, banks can significantly enhance the speed and efficiency of payment processing. This optimized payment capability not only enhances the customer experience but also attracts a greater number of clients to participate in payment transactions. More efficient payment functions establish a robust foundation for digital payment-clearing operations, particularly in cross-border transactions, where they can markedly reduce transaction times and costs. Additionally, cross-border currency settlements employing blockchain technology can more effectively meet the demands of international clients for rapid and reliable payments, owing to their inherent transparency and security [75].

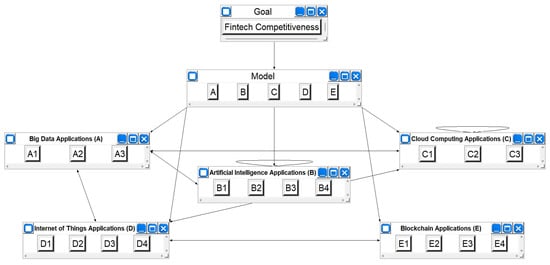

Based on the dependency relationships among the aforementioned indicators, we constructed the ANP network structure for the fintech competitiveness of commercial banks using SuperDecisions (SD) software, as illustrated in Figure 3. The overall goal (G), representing the fintech competitiveness of commercial banks, serves as the control layer. The network layer consists of five element groups: Big Data Applications (A), Artificial Intelligence Applications (B), Cloud Computing Applications (C), Internet of Things Applications (D), and Blockchain Applications (E), each containing specific observational indicators. Influences or dependencies among indicators within an element group are depicted by curved arrows, while influences or dependencies between element groups are depicted by straight arrows. The arrows indicate the direction of influence.

Figure 3.

ANP network structure in the SD software.

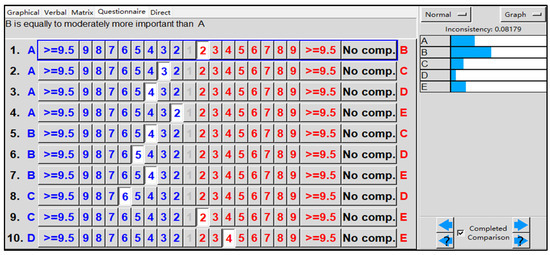

After the ANP network structure model was constructed, the experts used Saaty’s 9-point scale method to perform pairwise comparison scoring of the relative importance of each indicator. To reduce subjectivity, we averaged the collected indicator scores and, based on the results, constructed the corresponding judgment matrix in SD software. For instance, the judgment matrix constructed between the evaluation dimensions in the competitiveness evaluation system of commercial banks’ fintech is shown in Figure 4. The construction of judgment matrices for each observation indicator and certain indicators with influence relationships follows the same method as described above, and will not be elaborated further here.

Figure 4.

Example of a judgment matrix.

Once all judgment matrices are constructed, it is crucial to note that each matrix is derived from pairwise comparisons of each group of elements. Ensuring consistency across the entire indicator system can be challenging, which may impact the subsequent calculation of eigenvectors and eigenvalues. Therefore, consistency testing for each judgment matrix is essential to ensure that the resulting errors are maintained within an acceptable range.

Specifically, the test verifies whether C·I ≤ 0.1 holds; if this condition is met, it indicates that the errors are within an acceptable range. Otherwise, the matrix must be adjusted using the Random Consistency Index (R·I) [67], with reference standards for R·I provided in Table 4.

Table 4.

Reference standard of the random consistency index.

During the matrix adjustment process, the consistency ratio (C·R), calculated as C·R = (C·I)/(R·I), is used as a reference. A C·R value less than 0.1 is considered acceptable. The consistency ratios of the adjusted judgment matrices are presented in Table 5.

Table 5.

The consistency test results of each judgment matrix.

According to Table 5, the consistency ratios (C·R) of all judgment matrices are below the 0.1 threshold, indicating satisfactory consistency and confirming that the matrices are acceptable. After all matrices pass the consistency check, the unweighted super-matrix can be derived. However, the unweighted super-matrix only reflects the mutual influence between indicators and does not consider their weights. To address this, we normalized each column to generate the weighted super-matrix. We then perform multiple exponentiation operations on the weighted super-matrix with itself to compute the limit matrix. The elements in each column of the limit matrix no longer exhibit significant changes, indicating that the system has reached a stable state. The comprehensive weights of the indicators can be determined at this point, as shown in Table 6.

Table 6.

Calculation results of indicator weights.

As presented in Table 6, the five dimensions of the evaluation of fintech competitiveness are ranked according to their respective weights as follows: Artificial Intelligence Applications (B), Big Data Applications (A), Cloud Computing Applications (C), Blockchain Applications (E), and Internet of Things Applications (D). This suggests that the implementation of artificial intelligence and big data technologies exerts a more pronounced influence on the fintech competitiveness of commercial banks in comparison to the other three technological applications.

Specifically, within the realm of big data applications, the weight assigned to Precision Marketing Capability (A2) is the highest; in the context of artificial intelligence applications, the weight attributed to Robo-advisors Services (B1) is the most substantial; in cloud computing applications, the weight concerning Data Security Protection Capability (C3) is the most significant; in Internet of Things applications, the weight associated with Movable Property Pledge Financing Capability (D1) is the largest; and in blockchain applications, the weight pertaining to Digital Credit Financing Services (E1) is the highest.

Subsequently, given the varied units of measurement for each indicator, a direct uniform calculation of indicator values was deemed unfeasible [76]. Consequently, we performed dimensionless normalization on the collected sample data to eliminate the impact of unit disparities on the evaluation results. Ultimately, the calculation results derived using the weighted summation method are presented in Table 7.

Table 7.

Comprehensive fintech competitiveness ranking.

According to the evaluation results, ICBC, CMB, and CCB demonstrate no weaknesses in any technology application fields, ultimately ranking in the top three in overall fintech competitiveness among commercial banks. Among state-owned banks, although BOC and ABC did not perform as exceptionally as the top three banks, they still showed strong performance in several technology application fields, ranking fourth and fifth, respectively. BOCOM and PSBC ranked relatively lower, primarily due to insufficient scores in the application of artificial intelligence and big data technologies. While maintaining its leading position in blockchain applications among joint-stock commercial banks, CMB has remarkably risen to surpass a significant number of state-owned banks, securing the second-highest ranking in the sector. CIB, due to its average performance across all five technology application fields, ultimately ranked 15th, the lowest among joint-stock commercial banks. Despite their investments in various technology application fields, the three city commercial banks still exhibit unsatisfactory overall rankings. Furthermore, the findings of this study are largely consistent with the 2023 ranking of commercial banks conducted by the China Banking Regulatory Commission (CBRC) using the CAMELS rating method. This consistency indicates that a bank’s financial strength is a crucial factor influencing its fintech competitiveness. This also indirectly validates the rationality of the evaluation framework constructed in this study.

4.3. Discussion

This study substantiates that the fintech competitiveness of commercial banks is influenced by the degree of application of five key technologies: big data, artificial intelligence, cloud computing, the Internet of Things, and blockchain. Among these technologies, artificial intelligence exerts the most substantial impact on the fintech competitiveness of commercial banks, corroborating academic perspectives on Artificial intelligence’s pivotal role in enhancing banking operations [39,77,78]. Big data and cloud computing are ranked second and third in terms of their impact, collectively enhancing data risk management and operational efficiency in commercial banks, aligning with the research findings of Berisha et al. [79]. As Panarello et al. [80] noted, the integration of the Internet of Things and blockchain technologies into the daily operations of commercial banks is occurring progressively, thereby significantly augmenting their competitiveness within the financial market. Furthermore, this paper opposes the findings of Jungo et al. [8] since, in the era of fintech, focusing solely on the financial strength of commercial banks while ignoring the impact of various technologies can lead to the imbalanced development of commercial banks.

The rankings of commercial banks in specific technological applications do not always correspond to their overall standings, highlighting the diverse strategic approaches they adopt in fintech deployment. Firstly, despite their longstanding dominance in China’s banking sector, state-owned banks have not secured a decisive advantage over their commercial counterparts, as corroborated by earlier research by Berger et al. [81]. This situation stems from the fact that, although ICBC, CCB, ABC, and BOC each made substantial investments in fintech in 2023—totaling 27.246 billion yuan, 25.024 billion yuan, 24.850 billion yuan, and 22.397 billion yuan, respectively—and launched major platforms, including large-scale AI model infrastructures, the “CCB Cloud” platform, digital infrastructure bases, and multi-center infrastructure networks, thereby achieving high scores in fintech competitiveness assessments, their overall performance was nonetheless hindered by the weaker performance of other state-owned banks. BOCOM and PSBC invested only 12.027 billion yuan and 11.278 billion yuan, respectively, in fintech—less than half of ICBC’s investment—which led to both banks being surpassed by several joint-stock commercial banks in the overall fintech competitiveness rankings. Consequently, the overall standing of state-owned banks largely depends on the strong performance of these four major institutions: ICBC, CCB, ABC, and BOC.

Secondly, fintech competitiveness among joint-stock commercial banks is highly polarized due to disparities in financial strength, a phenomenon widely recognized in academic research [5,42]. For example, in 2023, CMB launched the “Three-Year Digital Transformation Plan”, explicitly targeting enhancements in customer experience, operational efficiency, and risk management capabilities through digitalization, with the ultimate aim of establishing an internationally competitive digital bank. Capitalizing on its robust financial resources, CMB established 12 fintech subsidiaries and filed 6830 patent applications, thereby securing the top position in fintech competitiveness rankings among joint-stock commercial banks. By contrast, CIB pursued a gradual digitalization strategy, limiting its fintech expenditure to less than 1.2% of its net profit, which restricted the breadth of its fintech offerings and ultimately relegated it to the lowest position among joint-stock commercial banks. Notably, PAB independently developed two major technology platforms—the “Nebula IoT Platform” and the “Open Banking API System”. By the end of 2023, PAB had formed strategic alliances with 34 fintech companies and integrated AI-driven wealth management tools, enabling it to capture over 19% of the market share among customers under the age of 35 and to secure the second position among joint-stock commercial banks.

Thirdly, as noted by Lee et al. [2], the growth of Chinese city commercial banks remains hindered by both temporal and structural constraints. Owing to their limited financial strength, these banks have been compelled to prioritize risk management over other initiatives, resulting in core banking system upgrades lagging behind those of their domestic peers by approximately five to seven years. The three city commercial banks analyzed in this study ranked relatively low overall, primarily because of limited fintech investment and delayed adoption, with their fintech infrastructure largely remaining in the early stages of development.

Finally, differences in organizational culture and regulatory frameworks among various types of commercial banks may also influence the findings of this study. In terms of organizational culture, state-owned commercial banks undertake national technological strategic objectives and are typically able to respond to national policies promptly, driving fintech development from the top down. Joint-stock commercial banks place greater emphasis on flexibility and rapid responses to customer needs. However, due to the pressure for short-term returns on technology investments, they may often overlook long-term technological accumulation. City commercial banks focus on local markets but have relatively weak independent research and development capabilities, making their fintech products more susceptible to homogenization. From a regulatory perspective, state-owned commercial banks, as systemically important banks, must meet stricter capital adequacy requirements while also enjoying priority access to national fintech pilot programs. Joint-stock commercial banks are allowed to explore innovation under controllable risk conditions. Compared to city commercial banks, they have a broader business scope and more diverse fintech application scenarios. In contrast, city commercial banks, due to their geographically constrained business scope, often face limitations in the large-scale application of fintech.

5. Conclusions, Contributions, and Future Work

The findings of this study indicated that the application of artificial intelligence and big data technologies is crucial to the competitiveness of commercial banks in the fintech sector, followed by cloud computing, blockchain, and IoT technologies. Meanwhile, the varying timelines of fintech adoption and the differing financial capacities of commercial banks have led to disparities in their competitiveness within the fintech sector. Therefore, given that fintech is revolutionizing the entire financial industry, commercial banks should prioritize fintech and strategically enhance their positioning in this rapidly evolving field. Management should encourage employees to broaden their thinking and cultivate a scientific mindset toward fintech innovation while also keeping abreast of current trends, continually enhancing their financial expertise, and systematically refocusing their fintech innovation strategies at various stages of development. This strategy facilitates swift decision-making in the dynamic financial market and enables commercial banks to distinguish themselves in intense market competition through fintech innovation. Additionally, commercial banks should not pursue fintech innovation blindly but rather should tailor their innovations in financial products and services to align with their specific developmental conditions.

Specifically, for state-owned commercial banks, top-ranked institutions such as ICBC, CCB, BOC, and ABC should sustain their competitive advantage in the fintech sector while also investing in relatively underdeveloped technological areas. For instance, in the realm of blockchain technology, targeted efforts should be directed toward overcoming bottlenecks in digital credit financing, thereby fostering holistic fintech development. Banks that rank relatively lower, such as BOCOM and PSBC, should focus their efforts on the fields of artificial intelligence and big data application to improve their standings in the overall fintech competitiveness evaluation system. For example, they should focus on precision marketing and intelligent investment advisory services to generate financial capital for sustained fintech advancement. For joint-stock commercial banks, those with strong fintech competitiveness (e.g., CMB) deserve recognition, but they should also remain humble and enhance their adoption of weaker technologies, such as cloud computing. Banks like CIB, which have underperformed in the fintech sector, should not abandon their efforts but, instead, focus on technological areas within their capabilities and strive to catch up. For instance, within the domain of artificial intelligence, they can attract high-value clientele through intelligent investment advisory and advanced customer service solutions, thereby laying the groundwork for future expansion into additional technological domains. For city commercial banks, despite their many limitations, they should choose one technology application from either artificial intelligence or big data to focus on, to avoid falling behind in the wave of fintech development.

Furthermore, financial regulatory authorities can leverage the evaluation framework established in this study to systematically assess the extent of fintech adoption among domestic commercial banks. This structured evaluation equips regulators with deeper insights into the evolving fintech landscape and the strategic development needs of commercial banks, facilitating the formulation of robust regulatory frameworks that foster the long-term stability and sustainable growth of the financial industry.

This research developed a competitiveness evaluation system for commercial banks from the innovative perspective of fintech, addressing the limitations of prior research that focused solely on corporate governance. For the first time, this research provided a comprehensive evaluation of the development status of commercial banks in the fintech sector from five technological dimensions: big data, artificial intelligence, cloud computing, the Internet of Things, and blockchain. It confirmed the scientific validity of the evaluation system using pertinent operational data from sampled commercial banks. This study not only enriches the theoretical framework for evaluating the competitiveness of commercial banks but also offers essential references for various types of commercial banks to tailor their fintech development strategies.

Moreover, due to the high degree of interconnectedness within the global financial system, banking systems in other countries—particularly those in Asia—exhibit significant similarities to China’s financial framework. In these countries, state-owned commercial banks, similar to their Chinese counterparts, generally possess the inherent advantage of strong capital bases, whereas joint-stock commercial banks exhibit marked differences in profitability owing to divergent development strategies. Accordingly, commercial banks in different countries may draw on the findings of this study to better assess their fintech competitiveness. Meanwhile, given substantial cross-country differences in financial regulatory policies, fintech development, and banking sector structures, it is recommended that flexible adjustment mechanisms—such as dynamic indicator weighting—be incorporated into the evaluation framework to accommodate region-specific requirements related to data security, technological compliance, and associated concerns. Furthermore, countries may supplement the framework with additional evaluation metrics tailored to their strategic priorities, thereby enhancing its adaptability and forward-looking relevance amid globalization, digital transformation, and sustainable development. Through such extensions, the evaluation framework proposed in this study is expected to better meet the assessment and decision-making needs of diverse regulatory environments and differentiated strategic goals across banking institutions, thereby substantially enhancing its empirical research value as well as the breadth and depth of its policy applications.

This study is not without its limitations, which provide opportunities for further development. First, although significantly refined from the original AHP method, the Delphi -ANP approach still does not completely eliminate the influence of subjective factors in the evaluation outcomes. During the research process, expert scores were averaged to enhance the relative objectivity of the results. Second, owing to data availability constraints, this study only selected 16 representative commercial banks for model validation, which somewhat diminishes the persuasiveness of the validation process. Third, as emerging scientific technologies increasingly integrate into the operations of commercial banks, future research should expand the evaluation dimensions to incorporate the latest technological advancements, ensuring that the evaluation system remains contemporary.

Author Contributions

X.W.: model construction, data collection, analysis, and interpretation of the results; W.H.: conceptualization and supervision; N.G.: discussion of the findings, and proposal of recommendations. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the Social Science Planning Fund of Xi’an City (18J201), and Soft Science Research Project of Xi’an Municipal Science and Technology Bureau (201805071RK2SF5(3)).

Data Availability Statement

Data available upon request from the corresponding author.

Acknowledgments

The authors of this paper sincerely express their gratitude to the expert panel in the field of fintech for participating in this research survey.

Conflicts of Interest

The authors of this paper declare that there are no competing financial, professional, or personal interests from other parties.

Appendix A

- Questionnaire Survey

- Dear Expert,

We are researchers from the “Model and Countermeasures for Promoting the Development of the Hard Technology Industry in Xi’an through fintech” project. We are conducting research on evaluating the fintech competitiveness of commercial banks and have identified you as an expert in this field. We have preliminarily constructed an evaluation framework and defined the indicators listed in the table at the end of this survey. Please rate each indicator on a scale of 1–5 based on its relevance, accessibility, and coordination. Additionally, please feel free to add any evaluation dimensions or indicators and provide corresponding ratings. We may repeat this process if necessary. All responses will be kept anonymous and confidential. We sincerely appreciate your assistance.

- Evaluation Section

- Please evaluate the relevance, accessibility, and coordination of each of the following indicators by scoring them on a scale of 1 to 5 (1 = very poorly aligned; 5 = very well aligned).

- Evaluation Dimensions 1: Big Data Application

- Observation Indicator 1.1: Risk Management Capability

- Relevance_________ Accessibility_________ Coordination_________

- Observation Indicator 1.2: Precision Marketing Capability

- Relevance_________ Accessibility _________ Coordination_________

- Observation Indicator 1.3: Operational Efficiency Optimization Capability

- Relevance_________ Accessibility _________ Coordination_________

- Evaluation Dimensions 2: Artificial Intelligence Application

- Observation Indicator 2.1: Robo-advisors Services

- Relevance_________ Accessibility _________ Coordination_________

- Observation Indicator 2.2: Chatbots Efficiency

- Relevance_________ Accessibility _________ Coordination_________

- Observation Indicator 2.3: Intelligent Identification Efficiency

- Relevance_________ Accessibility _________ Coordination_________

- Observation Indicator 2.4: Intelligent Claims Processing Services

- Relevance_________ Accessibility _________ Coordination_________

- Evaluation Dimensions 3: Cloud Computing Application

- Observation Indicator 3.1: Information Data Integration Capability

- Relevance_________ Accessibility _________ Coordination_________

- Observation Indicator 3.2: Business Process Optimization Capability

- Relevance_________ Accessibility _________ Coordination_________

- Observation Indicator 3.3: Data Security Protection Capability

- Relevance_________ Accessibility _________ Coordination_________

- Evaluation Dimensions 4: Internet of Things Application

- Observation Indicator 4.1: Movable Property Pledge Financing Capability

- Relevance_________ Accessibility _________ Coordination_________

- Observation Indicator 4.2: Payment Function Optimization Capability

- Relevance_________ Accessibility _________ Coordination_________

- Observation Indicator 4.3: Machine Fault Detection Capability

- Relevance_________ Accessibility _________ Coordination_________

- Evaluation Dimensions 5: Blockchain Application

- Observation Indicator 5.1: Digital Credit Financing Services

- Relevance_________ Accessibility _________ Coordination_________

- Observation Indicator 5.2: Digital Payment Settlement Services

- Relevance_________ Accessibility _________ Coordination_________

- Observation Indicator 5.3: Digital Bill Discounting Services

- Relevance_________ Accessibility _________ Coordination_________

- Open-ended Suggestions Section

- Please provide suggestions for modifications or additions to the evaluation dimensions or observation indicators in the indicator system. __________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

References

- Gonenc, H.; Jansen, F.; Tinoco, M.H.; Vulanovic, M. The impact of credit reforms on bank loans and firm leverage around the world. Eur. Financ. Manag. 2024, 30, 2449–2502. [Google Scholar] [CrossRef]

- Lee, C.C.; Ni, W.; Zhang, X. FinTech development and commercial bank efficiency in China. Glob. Financ. J. 2023, 57, 100850. [Google Scholar] [CrossRef]

- Lóska, G.; Uotila, J. Digital transformation in corporate banking: Toward a blended service model. Calif. Manag. Rev. 2024, 66, 93–115. [Google Scholar] [CrossRef]

- Magdy, M.; Raouf, E.; Al-wakeel, N. The Integration of Fintech and Banks: A Balancing Act Between Risk and Opportunity. Int. J. 2023, 10, 2467–2479. [Google Scholar] [CrossRef]

- Song, X.; Yu, H.; He, Z. Heterogeneous impact of fintech on the profitability of commercial banks: Competition and spillover effects. J. Risk Financ. Manag. 2023, 16, 471. [Google Scholar] [CrossRef]

- Nurwulandari, A.; Hasanudin, H.; Subiyanto, B.; Pratiwi, Y.C. Risk Based bank rating and financial performance of Indonesian commercial banks with GCG as intervening variable. Cogent Econ. Financ. 2022, 10, 2127486. [Google Scholar] [CrossRef]

- Rehman, Z.U.; Muhammad, N.; Sarwar, B.; Raz, M.A. Impact of risk management strategies on the credit risk faced by commercial banks of Balochistan. Financ. Innov. 2019, 5, 44. [Google Scholar] [CrossRef]

- Jungo, J.; Madaleno, M.; Botelho, A. The effect of financial inclusion and competitiveness on financial stability: Why financial regulation matters in developing countries? J. Risk Financ. Manag. 2022, 15, 122. [Google Scholar] [CrossRef]

- Arbolino, R.; Boffardi, R.; Kounetas, K.; Marani, U.; Napolitano, O. Are There Conditions That Can Predict When an M&A Works? Case Ital. List. Banks Econ. 2024, 12, 58. [Google Scholar]

- Dinu, V.; Bunea, M. The impact of competition and risk exposure on profitability of the Romanian banking system during the COVID-19 pandemic. J. Compet. 2022, 14, 5–22. [Google Scholar] [CrossRef]

- Mateev, M.; Moudud-Ul-Huq, S.; Sahyouni, A.; Tariq, M.U. Capital regulation, competition and risk-taking: Policy implications for banking sector stability in the MENA region. Res. Int. Bus. Financ. 2022, 60, 101579. [Google Scholar] [CrossRef]

- Barr, R.S.; Killgo, K.A.; Siems, T.F.; Zimmel, S. Evaluating the productive efficiency and performance of US commercial banks. Manag. Financ. 2002, 28, 3–25. [Google Scholar] [CrossRef]

- Chhaidar, A.; Abdelhedi, M.; Abdelkafi, I. The effect of financial technology investment level on European banks’ profitability. J. Knowl. Econ. 2023, 14, 2959–2981. [Google Scholar] [CrossRef]

- Haldar, A.; Sethi, N. Environmental effects of Information and Communication Technology-Exploring the roles of renewable energy, innovation, trade and financial development. Renew. Sustain. Energy Rev. 2022, 153, 111754. [Google Scholar] [CrossRef]

- Najaf, K.; Chin, A.; Fook, A.L.W.; Dhiaf, M.M.; Asiaei, K. Fintech and corporate governance: At times of financial crisis. Electron. Commer. Res. 2024, 24, 605–628. [Google Scholar] [CrossRef]

- Menicucci, E.; Paolucci, G. ESG dimensions and bank performance: An empirical investigation in Italy. Corp. Gov. Int. J. Bus. Soc. 2023, 23, 563–586. [Google Scholar] [CrossRef]

- Holland, J.H. Hidden Order: How Adaptation Builds Complexity; Basic Books: New York, NY, USA, 2011. [Google Scholar]

- Buckley, W. Society as a complex adaptive system. In Systems Research for Behavioral Science; Routledge: Abingdon, UK, 2017; pp. 490–513. [Google Scholar]

- Rabbani, M.R. The competitive structure and strategic positioning of commercial banks in Saudi Arabia. Int. J. Emerg. Technol. 2020, 11, 43–46. [Google Scholar]

- Alqahtani, M.M.M.; Singh, H.; Haddadi, E.A.A.; Al-Shibli, F.S.R.; Al-balushi, H.A.A. Impact of Internet of Things, Cloud Computing, Artificial Intelligence, Digital Capabilities, Digital Innovation, IT Flexibility on Firm Performance in Saudi Arabia Islamic Bank. Adv. Soc. Sci. Res. J. 2024, 11, 71–91. [Google Scholar] [CrossRef]

- Moran, N. Bank versus FinTech: Can Traditional Banks Protect Market Share from FinTech Start-Ups in the Area of Corporate Payment Services? Ph.D. thesis, National College of Ireland, Dublin, Ireland, 2020. [Google Scholar]

- Kumar, S.; Sharma, D.; Rao, S.; Lim, W.M.; Mangla, S.K. Past, present, and future of sustainable finance: Insights from big data analytics through machine learning of scholarly research. Ann. Oper. Res. 2022, 345, 1061–1104. [Google Scholar] [CrossRef]

- Hasan, M.M.; Popp, J.; Oláh, J. Current landscape and influence of big data on finance. J. Big Data 2020, 7, 21. [Google Scholar] [CrossRef]

- Du, G.; Liu, Z.; Lu, H. Application of innovative risk early warning mode under big data technology in Internet credit financial risk assessment. J. Comput. Appl. Math. 2021, 386, 113260. [Google Scholar] [CrossRef]

- Moradi, S.; Mokhatab Rafiei, F. A dynamic credit risk assessment model with data mining techniques: Evidence from Iranian banks. Financ. Innov. 2019, 5, 15. [Google Scholar] [CrossRef]

- Hernández-Nieves, E.; Hernández, G.; Gil-González, A.B.; Rodríguez-González, S.; Corchado, J.M. Fog computing architecture for personalized recommendation of banking products. Expert. Syst. Appl. 2020, 140, 112900. [Google Scholar] [CrossRef]

- Lehrer, C.; Wieneke, A.; Vom Brocke, J.A.N.; Jung, R.; Seidel, S. How big data analytics enables service innovation: Materiality, affordance, and the individualization of service. J. Manag. Inf. Syst. 2018, 35, 424–460. [Google Scholar] [CrossRef]

- Kshetri, N. Big data’s role in expanding access to financial services in China. Int. J. Inf. Manag. 2016, 36, 297–308. [Google Scholar] [CrossRef]

- Mikalef, P.; Krogstie, J.; Pappas, I.O.; Pavlou, P. Exploring the relationship between big data analytics capability and competitive performance: The mediating roles of dynamic and operational capabilities. Inf. Manag. 2020, 57, 103169. [Google Scholar] [CrossRef]

- Battisti, E.; Shams, S.R.; Sakka, G.; Miglietta, N. Big data and risk management in business processes: Implications for corporate real estate. Bus. Process Manag. J. 2020, 26, 1141–1155. [Google Scholar] [CrossRef]

- Broby, D. Financial technology and the future of banking. Financ. Innov. 2021, 7, 47. [Google Scholar] [CrossRef]

- Hentzen, J.K.; Hoffmann, A.; Dolan, R.; Pala, E. Artificial intelligence in customer-facing financial services: A systematic literature review and agenda for future research. Int. J. Bank Mark. 2022, 40, 1299–1336. [Google Scholar] [CrossRef]

- Shihembetsa, E. Use of Artificial Intelligence Algorithms to Enhance Fraud Detection in the Banking Industry. Ph.D. thesis, University of Nairobi, Nairobi, Kenya, 2021. [Google Scholar]

- Königstorfer, F.; Thalmann, S. Applications of Artificial Intelligence in commercial banks—A research agenda for behavioral finance. J. Behav. Exp. Financ. 2020, 27, 100352. [Google Scholar] [CrossRef]

- Sheth, J.N.; Jain, V.; Roy, G.; Chakraborty, A. AI-driven banking services: The next frontier for a personalised experience in the emerging market. Int. J. Bank Mark. 2022, 40, 1248–1271. [Google Scholar] [CrossRef]

- Ris, K.; Stankovic, Z.; Avramovic, Z. Implications of implementation of artificial intelligence in the banking business with correlation to the human factor. J. Comput. Commun. 2020, 8, 130. [Google Scholar] [CrossRef]

- Rahman, M.; Ming, T.H.; Baigh, T.A.; Sarker, M. Adoption of artificial intelligence in banking services: An empirical analysis. Int. J. Emerg. Mark. 2023, 18, 4270–4300. [Google Scholar] [CrossRef]

- Riikkinen, M.; Saarijärvi, H.; Sarlin, P.; Lähteenmäki, I. Using artificial intelligence to create value in insurance. Int. J. Bank Mark. 2018, 36, 1145–1168. [Google Scholar] [CrossRef]

- Boustani, N.M. Artificial intelligence impact on banks clients and employees in an Asian developing country. J. Asia Bus. Stud. 2022, 16, 267–278. [Google Scholar] [CrossRef]

- Hon, W.K.; Millard, C. Banking in the cloud: Part 1—Banks’ use of cloud services. Comput. Law Secur. Rev. 2018, 34, 4–24. [Google Scholar] [CrossRef]

- Habib, G.; Sharma, S.; Ibrahim, S.; Ahmad, I.; Qureshi, S.; Ishfaq, M. Blockchain technology: Benefits, challenges, applications, and integration of blockchain technology with cloud computing. Future Internet 2022, 14, 341. [Google Scholar] [CrossRef]

- Chen, X.; You, X.; Chang, V. FinTech and commercial banks’ performance in China: A leap forward or survival of the fittest? Technol. Forecast. Soc. Change 2021, 166, 120645. [Google Scholar] [CrossRef]

- Calderon-Monge, E.; Ribeiro-Soriano, D. The role of digitalization in business and management: A systematic literature review. Rev. Manag. Sci. 2024, 18, 449–491. [Google Scholar] [CrossRef]

- Golightly, L.; Chang, V.; Xu, Q.A.; Gao, X.; Liu, B.S. Adoption of cloud computing as innovation in the organization. Int. J. Eng. Bus. Manag. 2022, 14, 18479790221093992. [Google Scholar] [CrossRef]

- Subramanian, N.; Jeyaraj, A. Recent security challenges in cloud computing. Comput. Electr. Eng. 2018, 71, 28–42. [Google Scholar] [CrossRef]

- Bhat, J.R.; AlQahtani, S.A.; Nekovee, M. FinTech enablers, use cases, and role of future internet of things. J. King Saud. Univ. Comput. Inf. Sci. 2023, 35, 87–101. [Google Scholar] [CrossRef]

- Olugbade, S.; Ojo, S.; Imoize, A.L.; Isabona, J.; Alaba, M.O. A review of artificial intelligence and machine learning for incident detectors in road transport systems. Math. Comput. Appl. 2022, 27, 77. [Google Scholar] [CrossRef]

- Guo, L.; Chen, J.; Li, S.; Li, Y.; Lu, J. A blockchain and IoT-based lightweight framework for enabling information transparency in supply chain finance. Digit. Commun. Netw. 2022, 8, 576–587. [Google Scholar] [CrossRef]

- Singh, P.R.; Singh, V.K.; Yadav, R.; Chaurasia, S.N. 6G networks for artificial intelligence-enabled smart cities applications: A scoping review. Telemat. Inform. Rep. 2023, 9, 100044. [Google Scholar] [CrossRef]

- Shamshad, S.; Riaz, F.; Riaz, R.; Rizvi, S.S.; Abdulla, S. An enhanced architecture to resolve public-key cryptographic issues in the internet of things (IoT), employing quantum computing supremacy. Sensors 2022, 22, 8151. [Google Scholar] [CrossRef]

- Biju, A.K.V.N.; Thomas, A.S.; Thasneem, J. Examining the research taxonomy of artificial intelligence, deep learning & machine learning in the financial sphere—A bibliometric analysis. Qual. Quant. 2024, 58, 849–878. [Google Scholar]

- Omolara, A.E.; Alabdulatif, A.; Abiodun, O.I.; Alawida, M.; Alabdulatif, A.; Arshad, H. The internet of things security: A survey encompassing unexplored areas and new insights. Comput. Secur. 2022, 112, 102494. [Google Scholar] [CrossRef]

- Tseng, F.M.; Liang, C.W.; Nguyen, N.B. Blockchain technology adoption and business performance in large enterprises: A comparison of the United States and China. Technol. Soc. 2023, 73, 102230. [Google Scholar] [CrossRef]

- Peng, H.; Luxin, W. Digital economy and business investment efficiency: Inhibiting or facilitating? Res. Int. Bus. Financ. 2022, 63, 101797. [Google Scholar]

- Hald, K.S.; Kinra, A. How the blockchain enables and constrains supply chain performance. Int. J. Phys. Distrib. Logist. Manag. 2019, 49, 376–397. [Google Scholar] [CrossRef]

- Alhassan, U. E-government and the impact of remittances on new business creation in developing countries. Econ. Change Restruct. 2023, 56, 181–214. [Google Scholar] [CrossRef]

- Guermond, V. Remittance-scapes: The contested geographies of remittance management. Prog. Hum. Geogr. 2022, 46, 372–397. [Google Scholar] [CrossRef]

- Song, H.; Han, S.; Yu, K. Blockchain-enabled supply chain operations and financing: The perspective of expectancy theory. Int. J. Oper. Prod. Manag. 2023, 43, 1943–1975. [Google Scholar] [CrossRef]

- Dashottar, S.; Srivastava, V. Corporate banking—Risk management, regulatory and reporting framework in India: A Blockchain application-based approach. J. Bank. Regul. 2021, 22, 39–51. [Google Scholar] [CrossRef]

- Beiderbeck, D.; Frevel, N.; von der Gracht, H.A.; Schmidt, S.L.; Schweitzer, V.M. Preparing, conducting, and analyzing Delphi surveys: Cross-disciplinary practices, new directions, and advancements. MethodsX 2021, 8, 101401. [Google Scholar] [CrossRef]

- Barrios, M.; Guilera, G.; Nuño, L.; Gómez-Benito, J. Consensus in the delphi method: What makes a decision change? Technol. Forecast. Soc. Change 2021, 163, 120484. [Google Scholar] [CrossRef]

- da Silveira Junior, L.A.B.; Vasconcellos, E.; Guedes, L.V.; Guedes, L.F.A.; Costa, R.M. Technology roadmapping: A methodological proposition to refine Delphi results. Technol. Forecast. Soc. Change 2018, 126, 194–206. [Google Scholar] [CrossRef]

- Humphrey-Murto, S.; De Wit, M. The Delphi method—More research please. J. Clin. Epidemiol. 2019, 106, 136–139. [Google Scholar] [CrossRef]

- Quirke, F.A.; Battin, M.R.; Bernard, C.; Biesty, L.; Bloomfield, F.H.; Daly, M.; Devane, D. Multi-Round versus Real-Time Delphi survey approach for achieving consensus in the COHESION core outcome set: A randomised trial. Trials 2023, 24, 461. [Google Scholar] [CrossRef]

- Sánchez-Garrido, A.J.; Navarro, I.J.; García, J.; Yepes, V. An adaptive ANP & ELECTRE IS-based MCDM model using quantitative variables. Mathematics 2022, 10, 2009. [Google Scholar] [CrossRef]

- Taherdoost, H.; Madanchian, M. Analytic Network Process (ANP) method: A comprehensive review of applications, advantages, and limitations. J. Data Sci. Intell. Syst. 2023, 1, 12–18. [Google Scholar] [CrossRef]

- Saaty, T.L. The analytic hierarchy and analytic network processes for the measurement of intangible criteria and for decision-making. In Multiple Criteria Decision Analysis: State of the Art Surveys; Springer: Berlin/Heidelberg, Germany, 2016; pp. 363–419. [Google Scholar]

- Sohst, R.R.; Acostamadiedo, E.; Tjaden, J. Reducing uncertainty in Delphi surveys. Demogr. Res. 2023, 49, 983–1020. [Google Scholar] [CrossRef]

- Kadoić, N. Characteristics of the analytic network process, a multi-criteria decision-making method. Croat. Oper. Res. Rev. 2018, 9, 235–244. [Google Scholar] [CrossRef]

- Balaji, K. IoT in Financial Services Innovations in Banking and Insurance. In Managing Customer-Centric Strategies in the Digital Landscape; IGI Global: Hershey, PA, USA, 2025; pp. 75–104. [Google Scholar]

- Belanche, D.; Casaló, L.V.; Flavián, C. Artificial Intelligence in FinTech: Understanding robo-advisors adoption among customers. Ind. Manag. Data Syst. 2019, 119, 1411–1430. [Google Scholar] [CrossRef]

- Zhu, Y.; Jin, S. How does the digital transformation of banks improve efficiency and environmental, social, and governance performance? Systems 2023, 11, 328. [Google Scholar] [CrossRef]

- Musara, M.; Fatoki, O. Has technological innovations resulted in increased efficiency and cost savings for banks’ customers? Afr. J. Bus. Manag. 2010, 4, 1813. [Google Scholar]

- Love, I.; Martinez Pería, M.S.; Singh, S. Collateral registries for movable assets: Does their introduction spur firms’ access to bank financing? J. Financ. Serv. Res. 2016, 49, 1–37. [Google Scholar] [CrossRef]

- Krishnakumar, A. Quantum Computing and Blockchain in Business: Exploring the Applications, Challenges, and Collision of Quantum Computing and Blockchain; Packt Publishing Ltd.: Birmingham, UK, 2020. [Google Scholar]

- Hall, B.D. The Problem with ‘Dimensionless Quantities’. In Proceedings of the 10th International Conference on Model-Driven Engineering and Software Development (MODELSWARD 2022), Online, 6–8 February 2022; pp. 116–125. [Google Scholar]

- Rahmani, F.M.; Zohuri, B. The transformative impact of AI on financial institutions, with a focus on banking. J. Eng. Appl. Sci. Technol. 2023, 5, 1–6, SRC/JEAST-279. [Google Scholar]

- Jomon Jose, M.; Aithal, P.S. An analytical study of applications of artificial intelligence on banking practices. Int. J. Manag. Technol. Soc. Sci. (IJMTS) 2023, 8, 133–144. [Google Scholar]

- Berisha, B.; Mëziu, E.; Shabani, I. Big data analytics in Cloud computing: An overview. J. Cloud Comput. 2022, 11, 24. [Google Scholar] [CrossRef] [PubMed]

- Panarello, A.; Tapas, N.; Merlino, G.; Longo, F.; Puliafito, A. Blockchain and iot integration: A systematic survey. Sensors 2018, 18, 2575. [Google Scholar] [CrossRef] [PubMed]

- Berger, A.N.; Hasan, I.; Zhou, M. Bank ownership and efficiency in China: What will happen in the world’s largest nation? J. Bank. Financ. 2009, 33, 113–130. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).