Patent Openness Decisions and Investment Propensities of Frontier Enterprises in Asymmetric Competition

Abstract

1. Introduction

2. Literature Review

2.1. Patent Openness of Frontier and Laggard Enterprises

2.2. Green Patent Openness in Asymmetric Competition

2.3. Application of Evolutionary Game Theory to Industry Competition

3. Basic Model Construction and Hypothesis

3.1. Problem Description

3.2. Basic Assumptions Under Pure Market Operation

4. Decision Mechanism in the Pure Market Supply Chain

4.1. Model Construction

4.2. Evolutionary Game Stability Analysis

5. Numerical Simulation Analysis

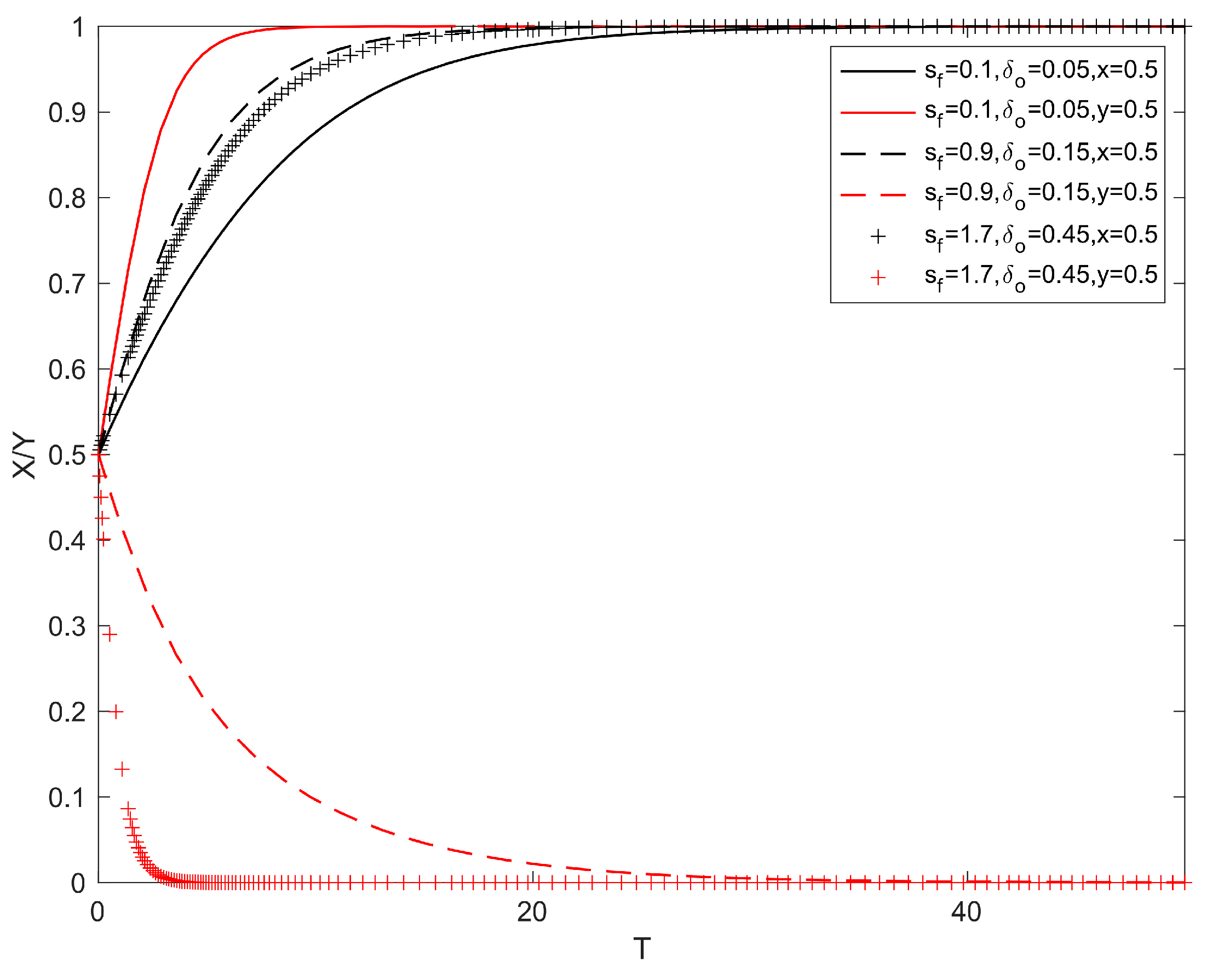

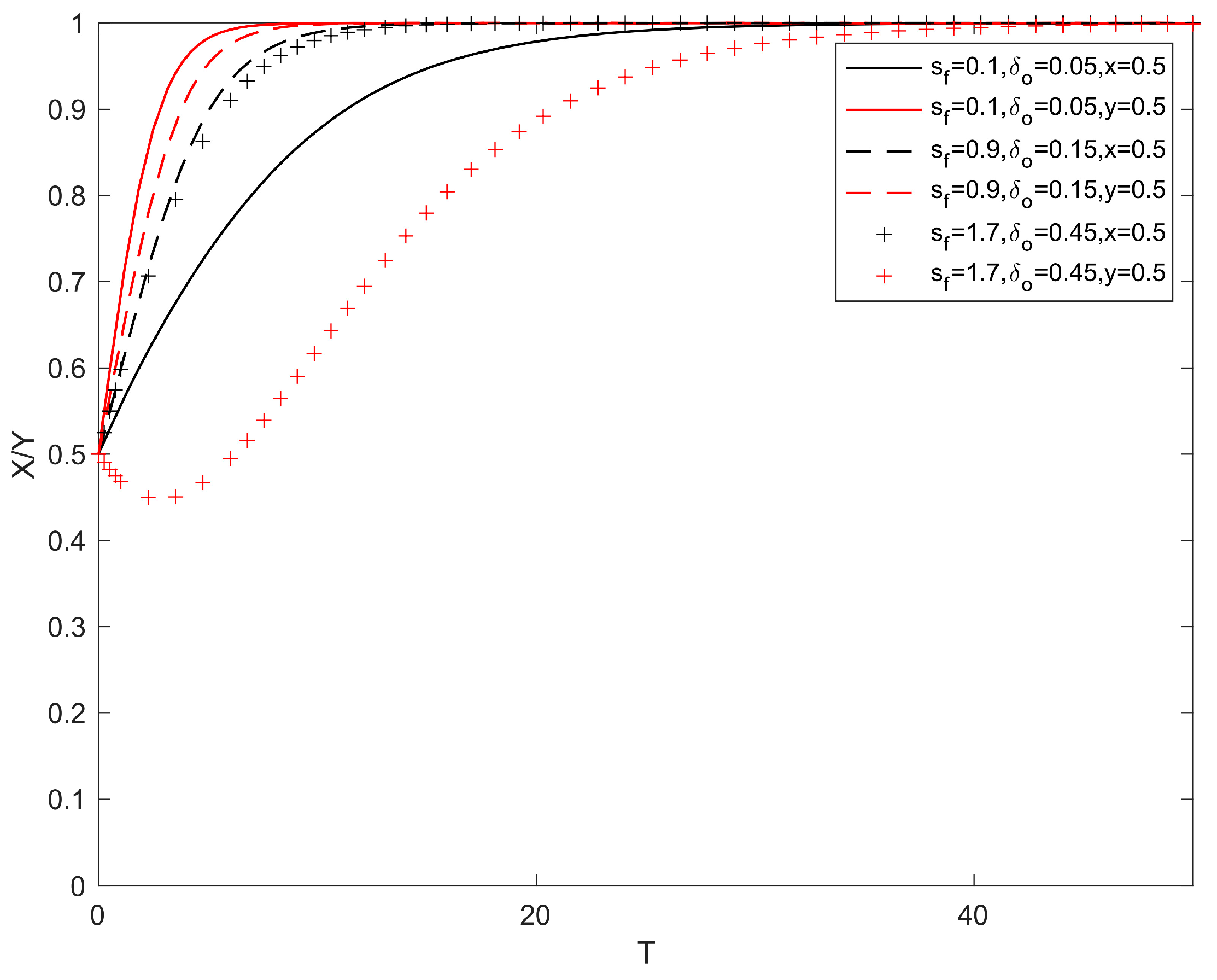

5.1. Impact of Changes in Initial Product Quality

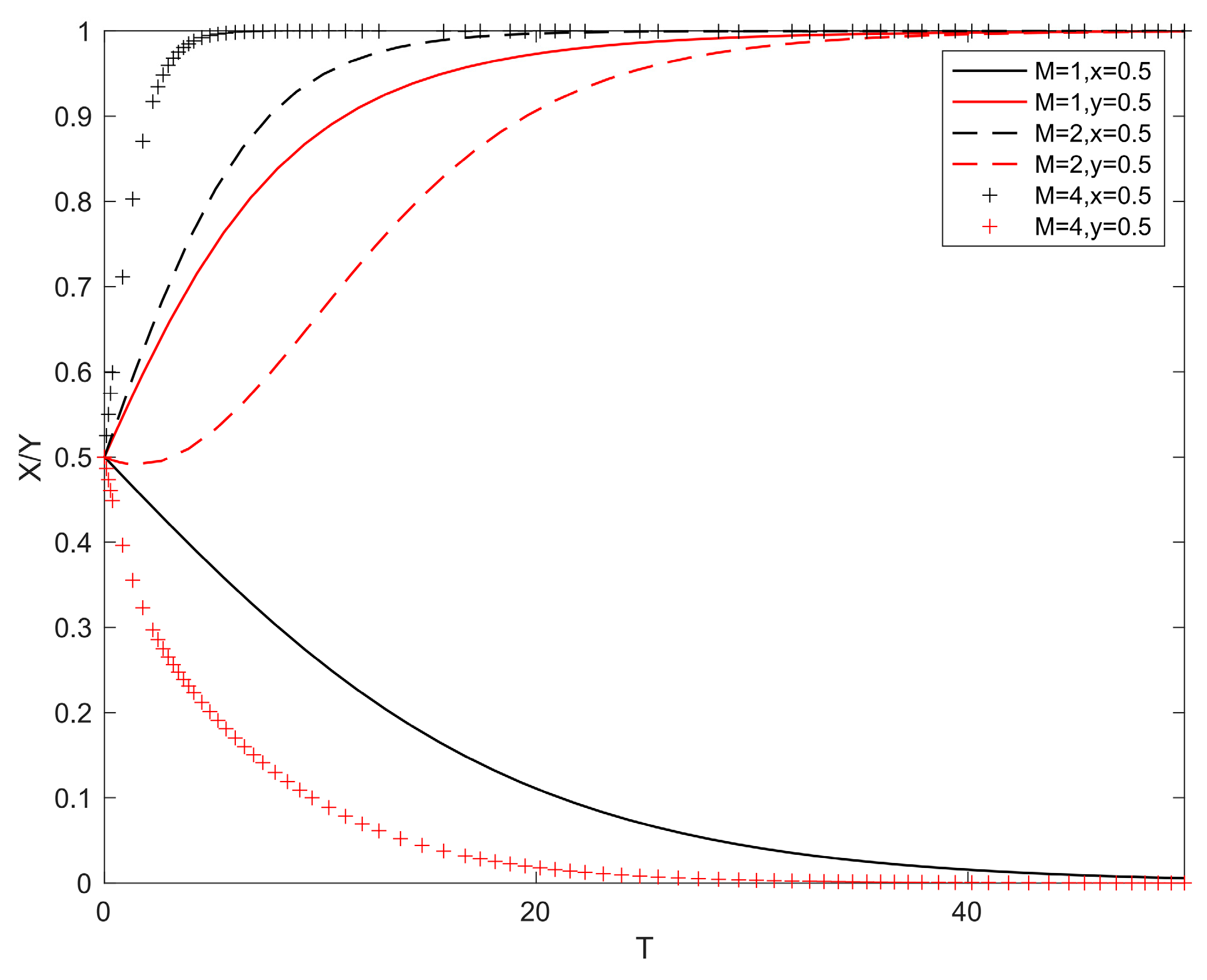

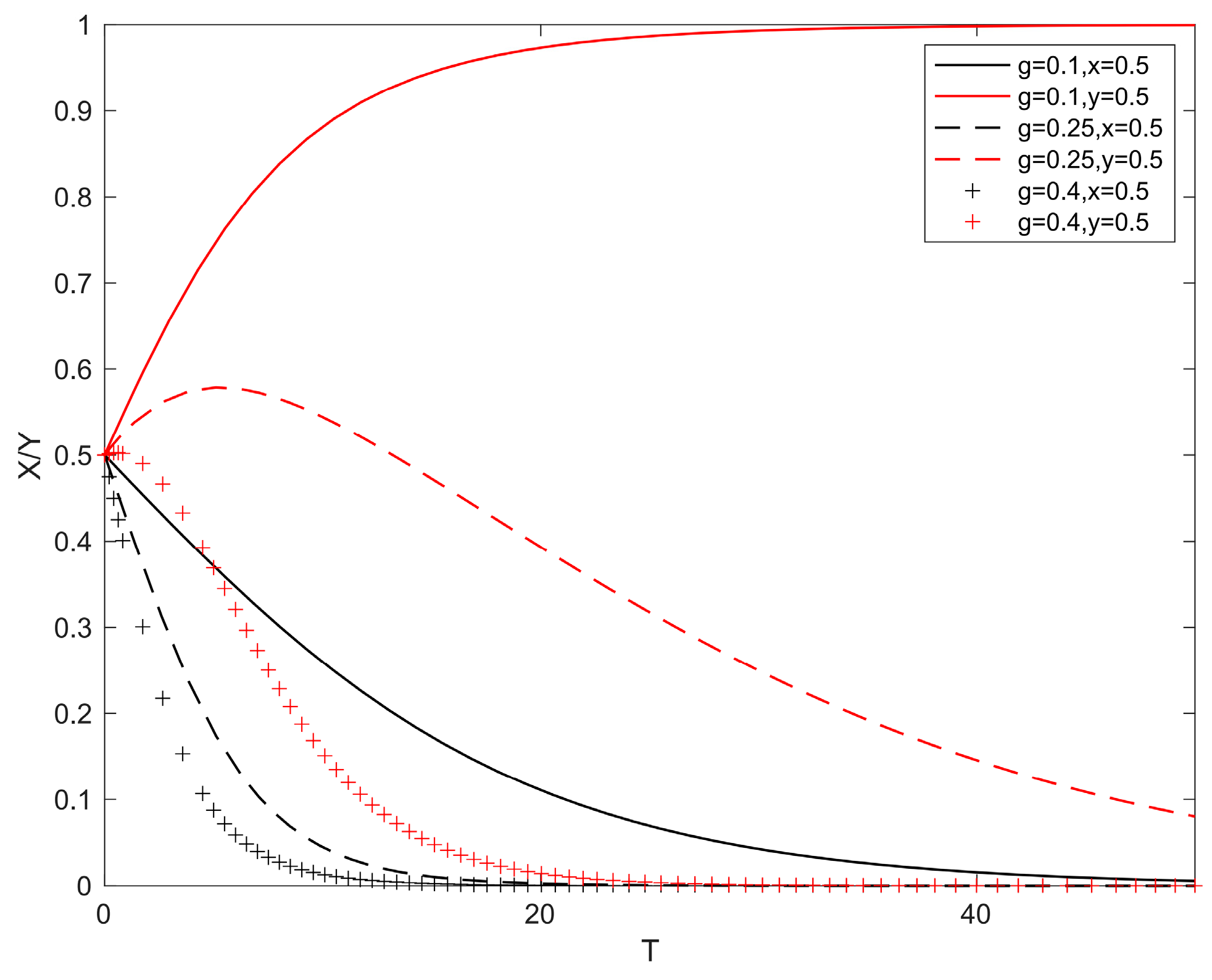

5.2. Impact of Changes in Market Share Due to Production Expansion

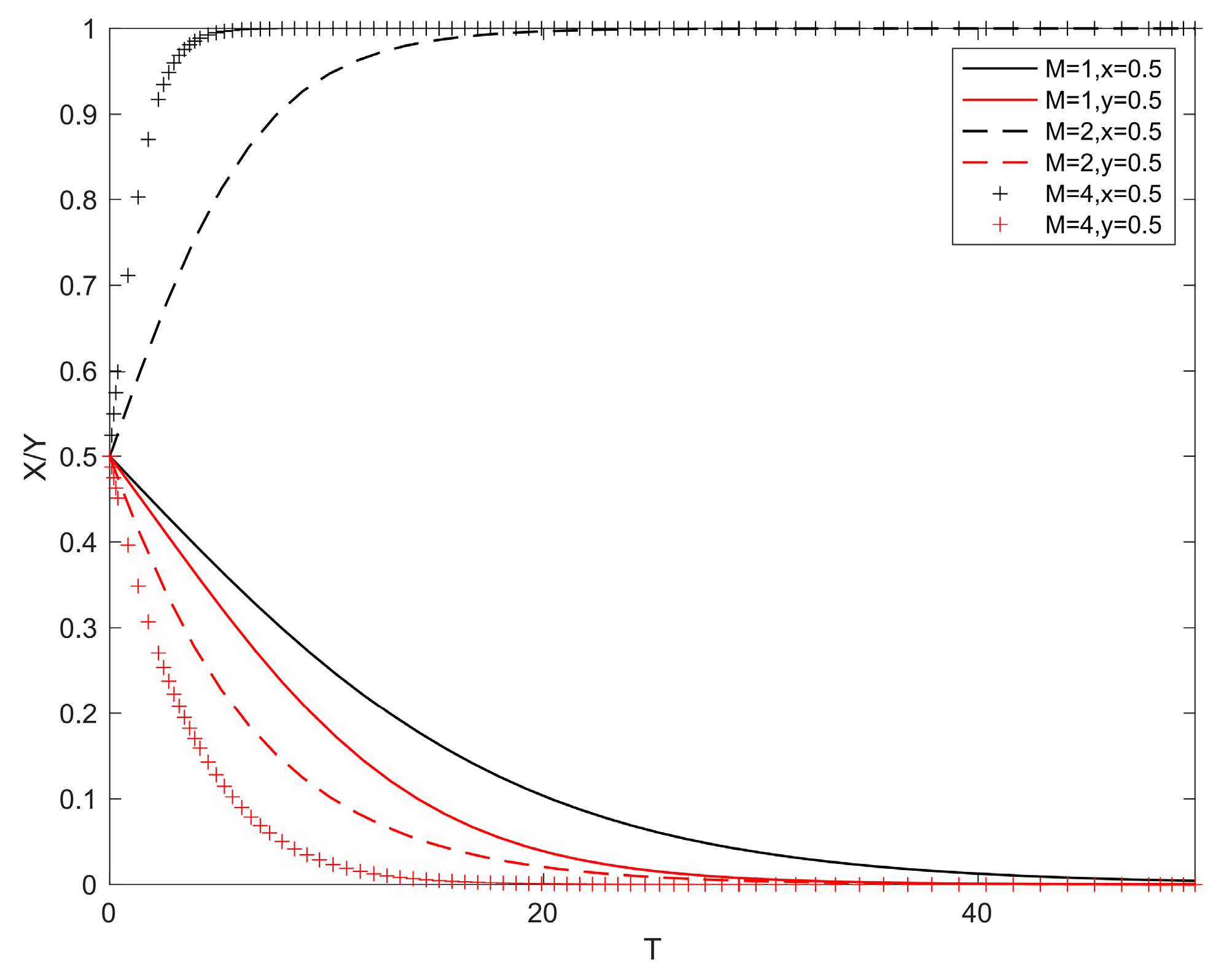

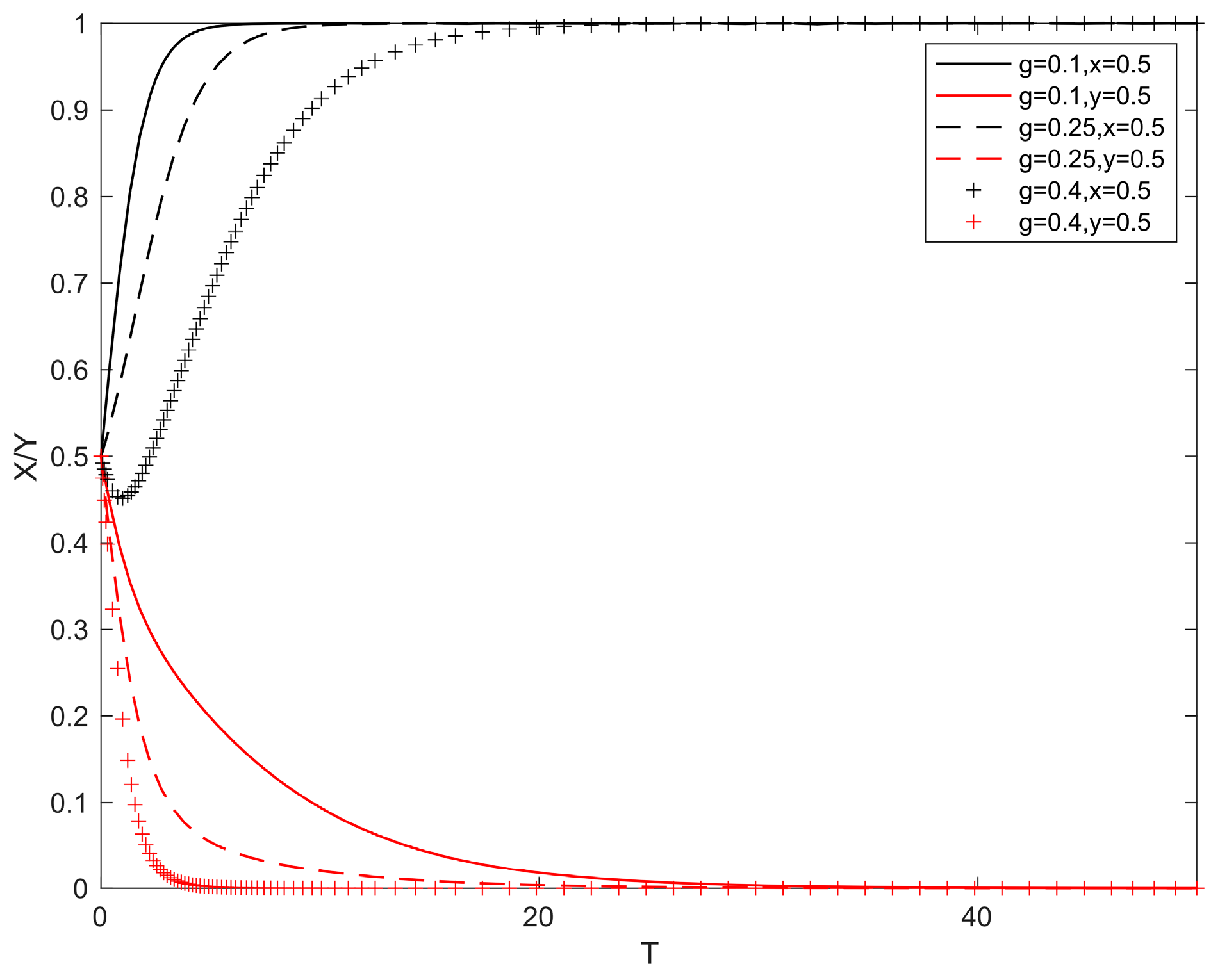

5.3. The Impact of Changes in Industry Production Costs

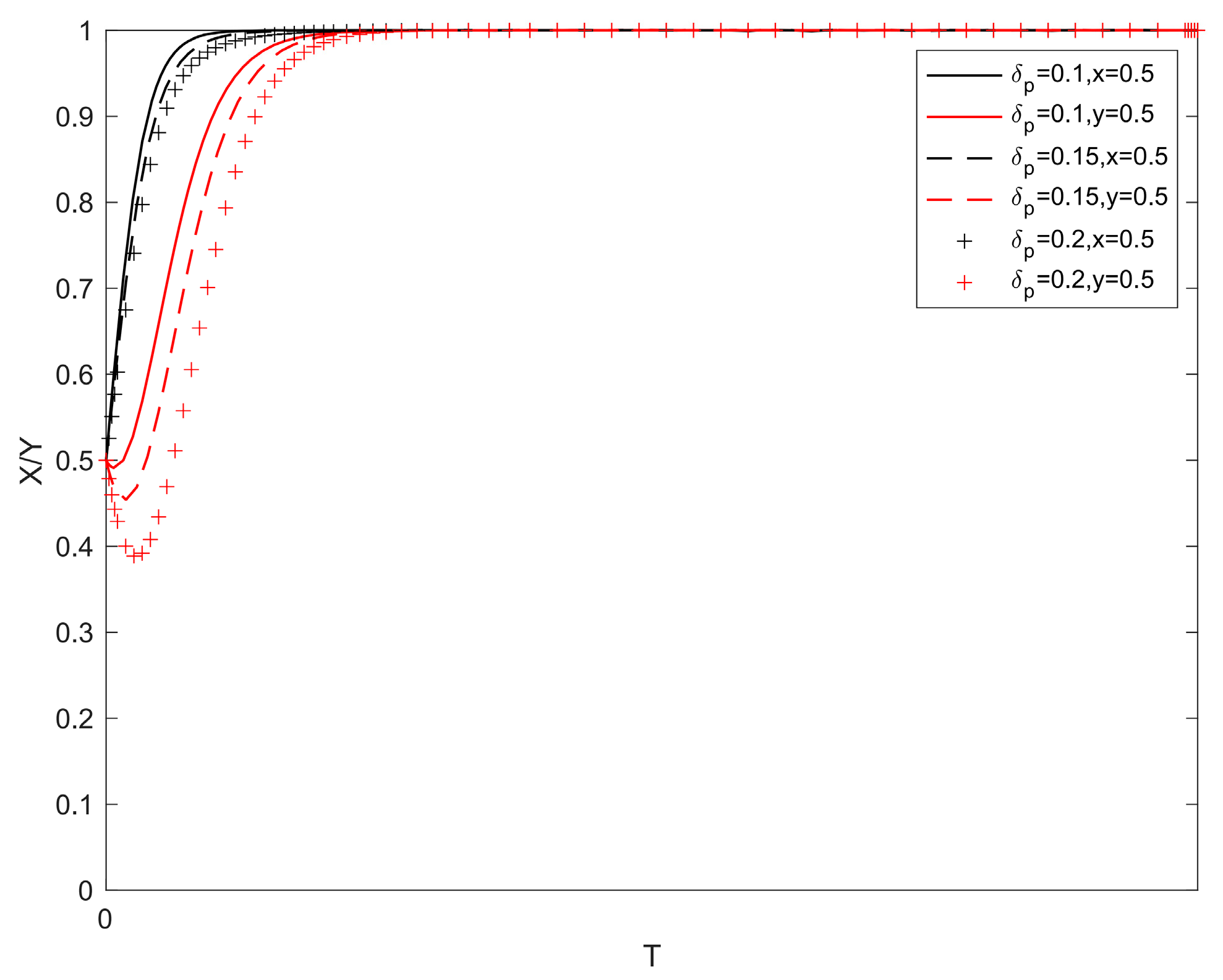

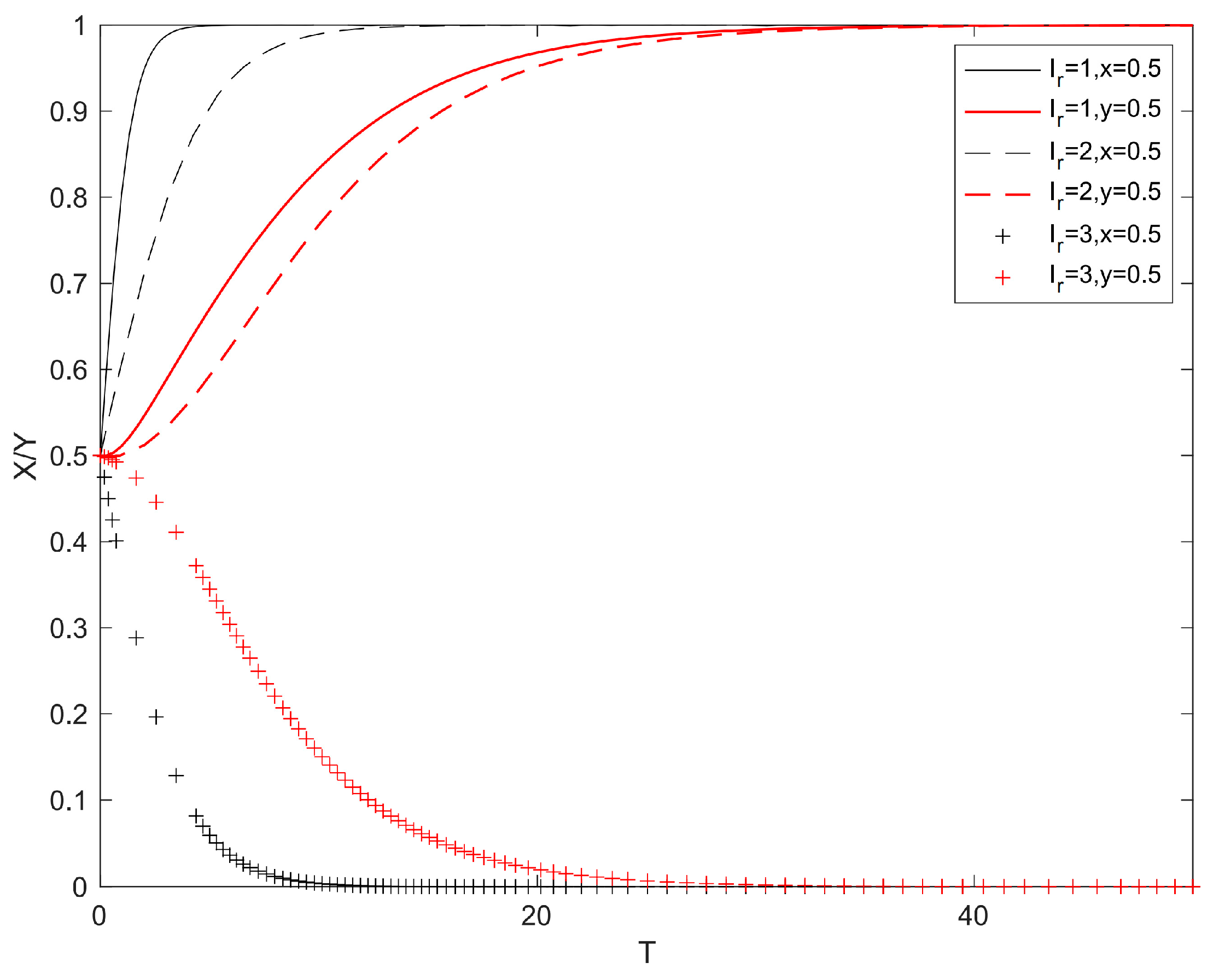

5.4. The Impact of Changes in Research and Development Costs

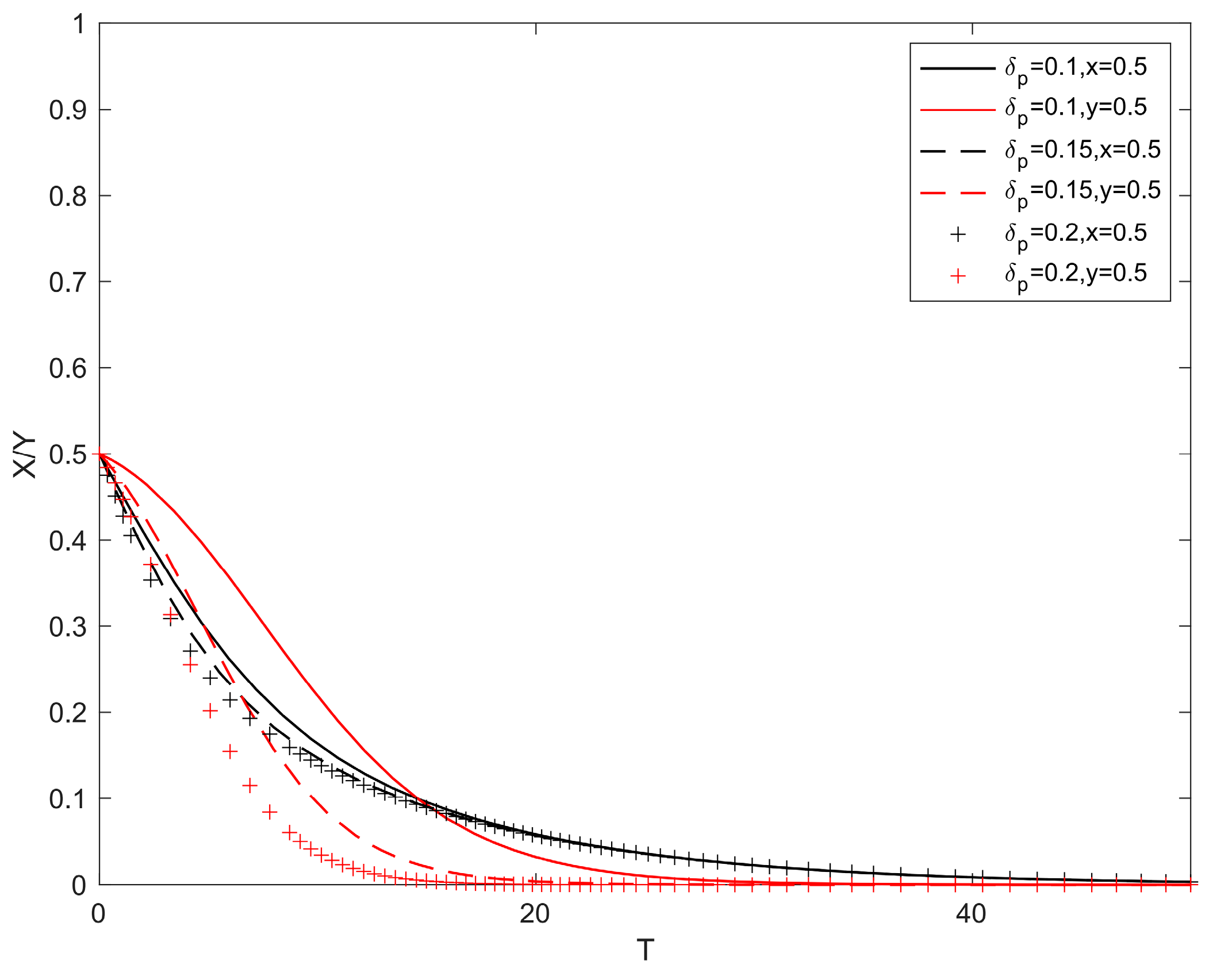

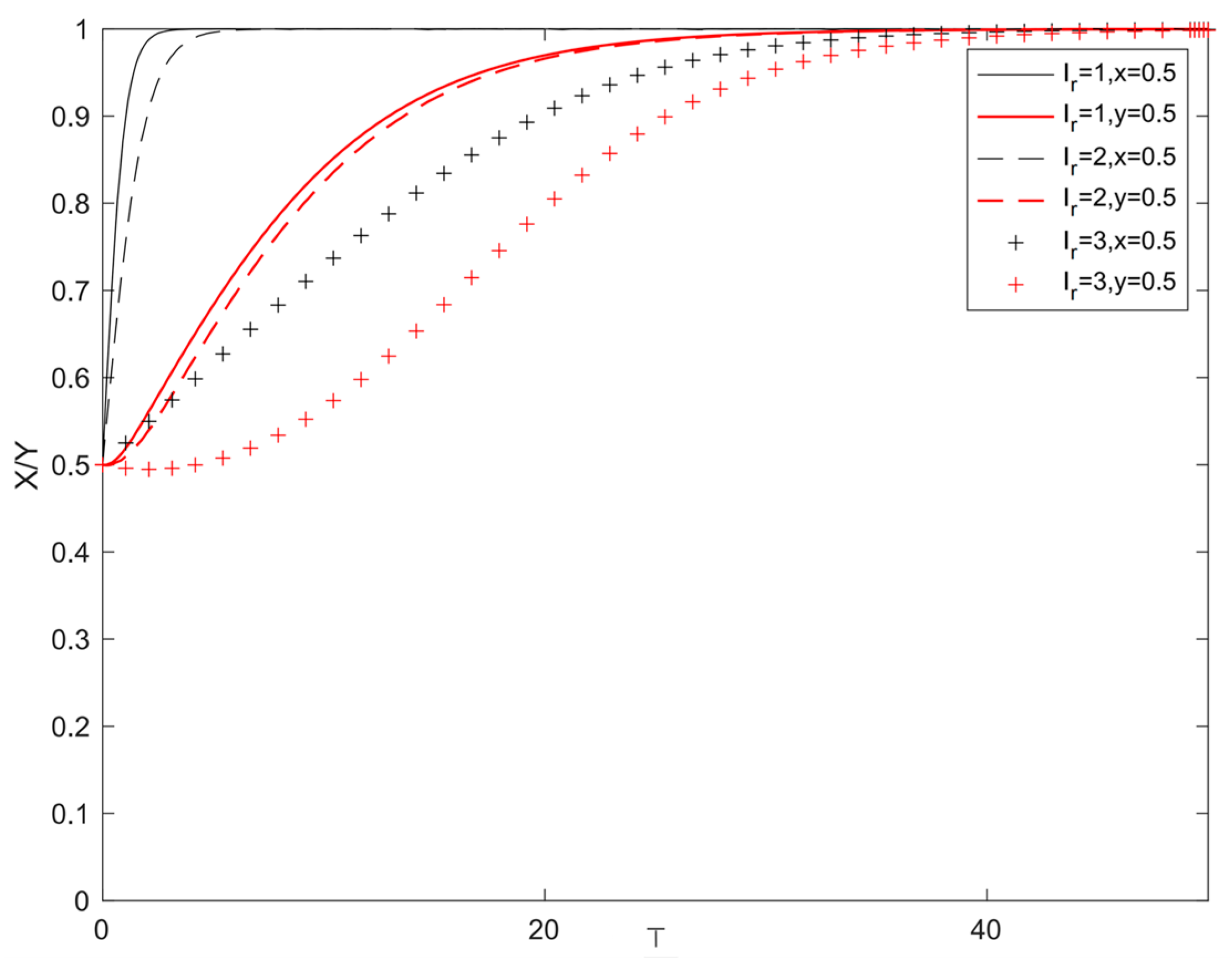

5.5. The Impact of Changes in Technological Advantage and Market Share

6. Conclusions and Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Andrews, D.; Criscuolo, C.; Gal, P.N. Frontier Firms, Technology Diffusion and Public Policy: Micro Evidence from OECD Countries; OECD Publishing: Paris, France, 2015. [Google Scholar]

- Berlingieri, G.; Calligaris, S.; Criscuolo, C.; Verlhac, R. Last but not least: Laggard firms, technology diffusion, and its structural and policy determinants. In OECD Science, Technology and Industry Policy Papers; No. 86; OECD Publishing: Paris, France, 2020. [Google Scholar] [CrossRef]

- Bogers, M.L. The Open Innovation Paradox: Knowledge Sharing and Protection in R&D Collaborations. Eur. J. Innov. Manag. 2010, 14, 93–117. [Google Scholar]

- Ji, Y.; Yu, X.; Sun, M.; Zhang, B. Exploring the Evolution and Determinants of Open Innovation: A Perspective from Patent Citations. Sustainability 2022, 14, 1618. [Google Scholar] [CrossRef]

- He, S.; Zhang, R.; Zhao, J. Research on the impact of Tesla’s technology patent opening on China’s new energy vehicle industry. BCP Bus. Manag. 2022, 23, 307–314. [Google Scholar] [CrossRef]

- Wang, J.; Peng, X. A Study of Patent Open Source Strategies Based on Open Innovation: The Case of Tesla. Open J. Soc. Sci. 2020, 8, 386–394. [Google Scholar] [CrossRef]

- Ullah, K.; Abbas, S.; Tariq, M.; Mahmood, N.; Kaechele, H. The symmetric and asymmetric impacts of green energy, eco-innovation, and urbanization in explaining low-carbon economy for Pakistan. Environ. Sci. Pollut. Res. 2023, 30, 33375–33395. [Google Scholar] [CrossRef] [PubMed]

- Haese, J.; Peukert, C. Open at the Core: Moving from Proprietary Technology to Building a Product on Open Source Software. SSRN 2024. [Google Scholar] [CrossRef]

- Chinese Government Website. China to Promote Efficient Operation of Patent Open License System. The State Council of the People’s Republic of China. Available online: http://english.www.gov.cn/news/202407/15/content_WS6694e148c6d0868f4e8e92f6.html (accessed on 15 July 2024).

- Lerner, J.; Tirole, J. Some simple economics of open-source. J. Ind. Econ. 2002, 50, 197–234. [Google Scholar] [CrossRef]

- Lee, K.; Park, I.; Yoon, B. An approach for r&d partner selection in alliances between large companies, and small and medium enterprises (smes): Application of bayesian network and patent analysis. Sustainability 2016, 8, 117. [Google Scholar] [CrossRef]

- Arora, A.; Huang, C.; Athreye, S. The paradox of openness revisited: Collaborative innovation and patenting by UK innovators. Res. Policy 2016, 45, 1352–1361. [Google Scholar] [CrossRef]

- Kim, B.; Kim, E.; Miller, D.J.; Mahoney, J.T. The impact of the timing of patents on innovation performance. Res. Policy 2016, 45, 914–928. [Google Scholar] [CrossRef]

- Vicente, D.C.D.A. The Impact of Tesla’s Patent Opening. Master’s Thesis, Roma Tre University, Rome, Italy, 2023. [Google Scholar]

- Kwon, D.; Lee, H.Y.; Cho, J.H.; Sohn, S.Y. Effect of an open patent pool strategy on technology innovation in terms of creating shared value. Technol. Forecast. Soc. Change 2023, 187, 122251. [Google Scholar] [CrossRef]

- Thompson, P.; Zang, W. The relationship between foreign direct investment and domestic entrepreneurship: The impact and scale of investments in China. Growth Change 2023, 54, 694–735. [Google Scholar] [CrossRef]

- Cappelli, R.; Czarnitzki, D.; Kraft, K. Sources of spillovers for imitation and innovation. Res. Policy 2014, 43, 115–120. [Google Scholar] [CrossRef]

- Mancusi, M.L. International spillovers and absorptive capacity: A cross-country cross-sector analysis based on patents and citations. J. Int. Econ. 2008, 76, 155–165. [Google Scholar] [CrossRef]

- Chen, W.; Filieri, R. Institutional forces, leapfrogging effects, and innovation status: Evidence from the adoption of a continuously evolving technology in small organizations. Technol. Forecast. Soc. Change 2024, 206, 123529. [Google Scholar] [CrossRef]

- Li, D.; Alkemade, F.; Frenken, K.; Heimeriks, G. Catching up in clean energy technologies: A patent analysis. J. Technol. Transf. 2023, 48, 693–715. [Google Scholar] [CrossRef]

- Fershtman, C.; Markovich, S. Patents, imitation and licensing in an asymmetric dynamic R&D race. Int. J. Ind. Organ. 2010, 28, 113–126. [Google Scholar]

- Moilanen, M.; Østbye, S.; Woll, K. Non-R&D SMEs: External knowledge, absorptive capacity and product innovation. Small Bus. Econ. 2014, 43, 447–462. [Google Scholar]

- Los, B.; Verspagen, B. R&D spillovers and productivity: Evidence from US manufacturing microdata. Empir. Econ. 2010, 25, 127–148. [Google Scholar]

- Wang, X.; Li, F.; Li, Y.; Hou, D.; Wang, L.; Qin, X. Does inter-regional investment by publicly listed companies promote local technological catch-up? A study of the mediation effects of patents in China. Technol. Anal. Strateg. Manag. 2024, 36, 279–292. [Google Scholar] [CrossRef]

- Wang, L.; Wang, Y.; Lou, Y.; Jin, J. Impact of different patent cooperation network models on innovation performance of technology-based SMEs. Technol. Anal. Strateg. Manag. 2020, 32, 724–738. [Google Scholar] [CrossRef]

- Chang, S.; Kim, H.; Song, J.; Lee, K. Dynamics of Imitation versus Innovation in Technological Leadership Change: Latecomers’ Catch-up Strategies in Diverse Technological Regimes. Res. Policy 2024, 53, 105056. [Google Scholar] [CrossRef]

- Liu, Y.; Wu, W.; Kim, Y. How do latecomer firms achieve catch-up through technology management: A comparative analysis. Humanit. Soc. Sci. Commun. 2023, 10, 561. [Google Scholar] [CrossRef]

- Khunakornbodintr, S.; Lv, P.; Hain, D.S. Windows of opportunity for unrelated diversification: A patent data analysis of the field of neurotechnology. Int. J. Emerg. Mark. 2024. Early Access. [Google Scholar] [CrossRef]

- Wang, J.; Du, Y. From leveraging to learning: Latecomer trade-offs between technology purchase and imitation. Technol. Anal. Strateg. Manag. 2023, 36, 3786–3798. [Google Scholar] [CrossRef]

- Cayton, S.E. The “Green Patent Paradox” and Fair Use: The Intellectual Property Solution to Fight Climate Change. Seattle J. Technol. Environ. Innov. Law 2020, 11, 214. [Google Scholar]

- Vakili, K. Collaborative promotion of technology standards and the impact on innovation, industry structure, and organizational capabilities: Evidence from modern patent pools. Organ. Sci. 2016, 27, 1504–1524. [Google Scholar] [CrossRef]

- Musk, E. All Our Patent Are Belong to You. Available online: https://www.tesla.com/blog/all-our-patent-are-belong-you (accessed on 12 June 2014).

- Bowman, J. The Eco-Patent Commons: Caring Through Sharing. WIPO Magazine, 3 June 2009. Available online: https://www.wipo.int/wipo_magazine/en/2009/03/article_0004.html (accessed on 20 July 2024).

- Hu, B.; Hu, M.; Yang, Y. Open or closed? Technology sharing, supplier investment, and competition. Manuf. Serv. Oper. Manag. 2017, 19, 132–149. [Google Scholar] [CrossRef]

- BBC. How Elon Musk Aims to Revolutionise Battery Technology. Justin Rowlatt. Available online: https://www.bbc.co.uk/news/business-53067009 (accessed on 17 June 2020).

- Liu, S. Competition and Valuation: A Case Study of Tesla Motors. IOP Conf. Ser. Earth Environ. Sci. 2021, 692, 022103. [Google Scholar] [CrossRef]

- BBC. Tesla Cuts Prices in Major Markets as Sales Fall. Mariko Oi. Available online: https://www.bbc.co.uk/news/articles/c1d4g8jz57yo (accessed on 22 April 2024).

- Friedman, D. Evolutionary games in economics. Econom. J. Econom. Soc. 1991, 59, 637–666. [Google Scholar] [CrossRef]

- Fudenberg, D.; Tirole, J. Game Theory; MIT Press: Cambridge, MA, USA, 1991. [Google Scholar]

- Liu, L.; Chen, G.; Niu, X. Game analysis of the knowledge sharing mechanism for the supply chain collaborative innovation. J. Ind. Eng. Manag. 2015, 8, 152–169. [Google Scholar] [CrossRef]

- Chen, W.; Hu, Z.H. Using evolutionary game theory to study governments and manufacturers’ behavioral strategies under various carbon taxes and subsidies. J. Clean. Prod. 2018, 201, 123–141. [Google Scholar] [CrossRef]

- Peng, X.; Wang, F.; Wang, J.; Qian, C. Research on food safety control based on evolutionary game method from the perspective of the food supply chain. Sustainability 2022, 14, 8122. [Google Scholar] [CrossRef]

- Jamali, M.B.; Rasti-Barzoki, M. A game theoretic approach for green and non-green product pricing in chain-to-chain competitive sustainable and regular dual-channel supply chains. J. Clean. Prod. 2018, 170, 1029–1043. [Google Scholar] [CrossRef]

- Xue, R.; Xiong, L. Two-stage evolutionary game model on complex networks for emergency logistics based on blockchain platform. Expert Syst. Appl. 2024, 256, 124925. [Google Scholar] [CrossRef]

- O’Donnell, N.; Shannon, D.; Sheehan, B. The impact of monetary policy interventions on banking sector stocks: An empirical investigation of the COVID-19 crisis. Financ. Innov. 2024, 10, 44. [Google Scholar] [CrossRef]

- Christl, M.; De Poli, S.; Figari, F.; Hufkens, T.; Leventi, C.; Papini, A.; Tumino, A. Monetary compensation schemes during the COVID-19 pandemic: Implications for household incomes, liquidity constraints and consumption across the EU. J. Econ. Inequal. 2023, 22, 411–431. [Google Scholar] [CrossRef]

- Wei, Y.; Li, D.; Wang, J.; Chu, Y. The Expansion of Central Bank Collateral and Green Innovation of Enterprises. Front. Bus. Econ. Manag. 2024, 15, 411–415. [Google Scholar] [CrossRef]

- Lv, J. The Expansion of Monetary Policy Collateral Promotes Green Innovation of Heavily Polluting Enterprises. Highlights Bus. Econ. Manag. 2024, 44, 323–330. [Google Scholar] [CrossRef]

- Liu, T.; Chen, X.; Yang, S. Economic policy uncertainty and enterprise investment decision: Evidence from China. Pac.-Basin Financ. J. 2022, 75, 101859. [Google Scholar] [CrossRef]

- Gao, W.; Wang, D. Will Increasing Government Subsidies Promote Open Innovation? A Simulation Analysis of China’s Wind Power Industry. Sustainability 2021, 13, 13497. [Google Scholar] [CrossRef]

- Feriansyah, F.; Nursechafia, N. Empirical Study of Interest Rate Pass-Through Before and After Subprime Mortgage Crisis: An International Evidence. In Proceedings of the 1st International Conference on Contemporary Risk Studies, Jakarta, Indonesia, 31 March–1 April 2022. [Google Scholar]

- Huang, Y.; Huang, X.; Yu, R. The effectiveness of nonfinancial interventions and monetary incentives on COVID-19 vaccination: A meta-analysis. Health Psychol. 2023, 42, 411–424. [Google Scholar] [CrossRef]

- Cortés, G.S.; Gao, G.P.; Silva, F.B.; Song, Z. Unconventional monetary policy and disaster risk: Evidence from the subprime and COVID–19 crises. J. Int. Money Financ. 2022, 122, 102543. [Google Scholar] [CrossRef]

- Guasoni, P.; Wang, G. Consumption and Investment with Interest Rate Risk. J. Math. Anal. Appl. 2018, 476, 215–239. [Google Scholar] [CrossRef]

- Cunningham, C.; Ederer, F.; Song, M. Killer Acquisitions. J. Political Econ. 2021, 129, 649–702. [Google Scholar] [CrossRef]

- Niu, S.; Wang, M. Partial acquisition and patent licensing in an asymmetric duopoly. Manch. Sch. 2022, 90, 92–105. [Google Scholar] [CrossRef]

- Zhang, S.; Li, J.; Jiang, B.; Guo, T. Government Intervention, Structural Transformation, and Carbon Emissions: Evidence from China. Int. J. Environ. Res. Public Health 2023, 20, 1343. [Google Scholar] [CrossRef]

- Jiang, Z.; Shi, J. Government intervention and technological innovation in the wind power industry in China: The role of industrial environmental turbulence. Appl. Energy 2023, 344, 121265. [Google Scholar] [CrossRef]

- Zhan, W.; Jiang, M.; Wang, X. Optimal Capacity Decision-Making of Omnichannel Catering Merchants Considering the Service Environment Based on Queuing Theory. Systems 2022, 10, 144. [Google Scholar] [CrossRef]

- Huang, X.; Zhan, W.; Li, C.; Ma, T.; Hong, T. Collaborative Decision-Making of the Supply Chain System Considering Green Innovation Capability. Kybernetes 2024. Early Access. [Google Scholar] [CrossRef]

- Zhan, W.; Liu, J.; Yuan, X.; Huang, X.; Jiang, M. The optimal decision of service provider considering extra waiting area value-added services–pooled or dedicated? RAIRO-Oper. Res. 2024, 58, 4307–4340. [Google Scholar]

| Frontier Enterprises | |||

|---|---|---|---|

| Laggard Enterprises | Investment in R&D | ||

| Investment in Production Expansion | |||

| Equilibrium Point | Eigenvalue 1 | Eigenvalue 2 |

|---|---|---|

| (0, 0) | ||

| (0, 1) | ||

| (1, 0) | ||

| (1, 1) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, C.; Yan, D.; Song, Z.; Shi, G.; Zhan, W.; Jiang, M. Patent Openness Decisions and Investment Propensities of Frontier Enterprises in Asymmetric Competition. Systems 2025, 13, 146. https://doi.org/10.3390/systems13030146

Liu C, Yan D, Song Z, Shi G, Zhan W, Jiang M. Patent Openness Decisions and Investment Propensities of Frontier Enterprises in Asymmetric Competition. Systems. 2025; 13(3):146. https://doi.org/10.3390/systems13030146

Chicago/Turabian StyleLiu, Chen, Daiqing Yan, Zihao Song, Gandang Shi, Wentao Zhan, and Minghui Jiang. 2025. "Patent Openness Decisions and Investment Propensities of Frontier Enterprises in Asymmetric Competition" Systems 13, no. 3: 146. https://doi.org/10.3390/systems13030146

APA StyleLiu, C., Yan, D., Song, Z., Shi, G., Zhan, W., & Jiang, M. (2025). Patent Openness Decisions and Investment Propensities of Frontier Enterprises in Asymmetric Competition. Systems, 13(3), 146. https://doi.org/10.3390/systems13030146