Synergistic Evolution in the Digital Transformation of the Whole Rural E-Commerce Industry Chain: A Game Analysis Using Prospect Theory

Abstract

1. Introduction

2. Literature Review

2.1. Research Related to the Whole Rural E-Commerce Industrial Chain and Its Digital Transformation

2.2. Research Related to the Evolutionary Game of Industrial Chain Synergy

2.3. Application and Practice of Prospect Theory

2.4. Summary of the Literature

3. Model Construction

3.1. Scenario Description

3.2. Model Assumptions

3.3. Model Construction

3.4. Evolutionary Equilibrium Stability Analysis

4. Case Analysis and Numerical Simulation

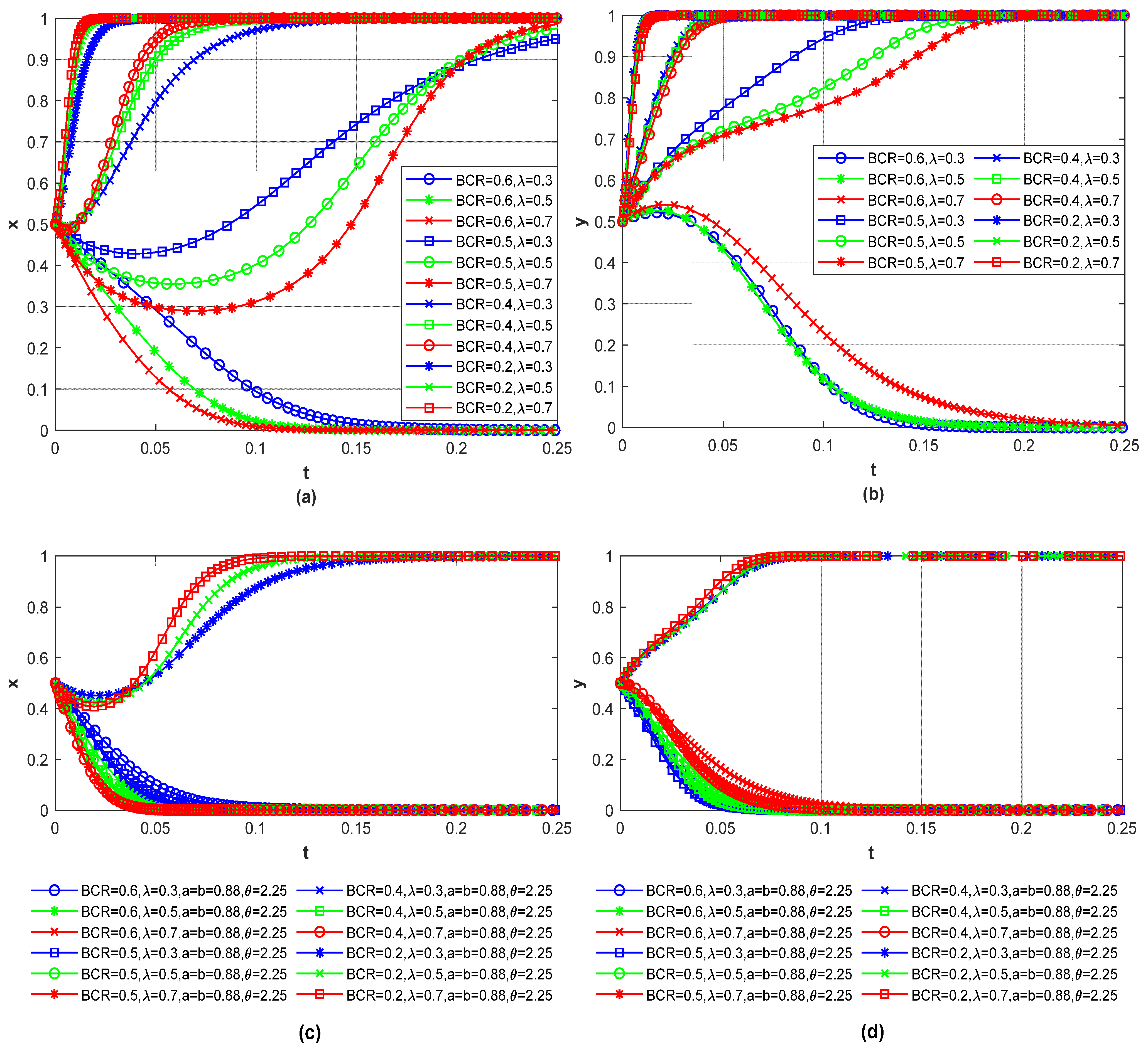

4.1. Sensitivity Analysis of Evolutionary Outcomes to Variations in the BCR

4.2. Sensitivity Analysis of Evolutionary Outcomes to Behavioral Characteristic Factors of Decision-Makers

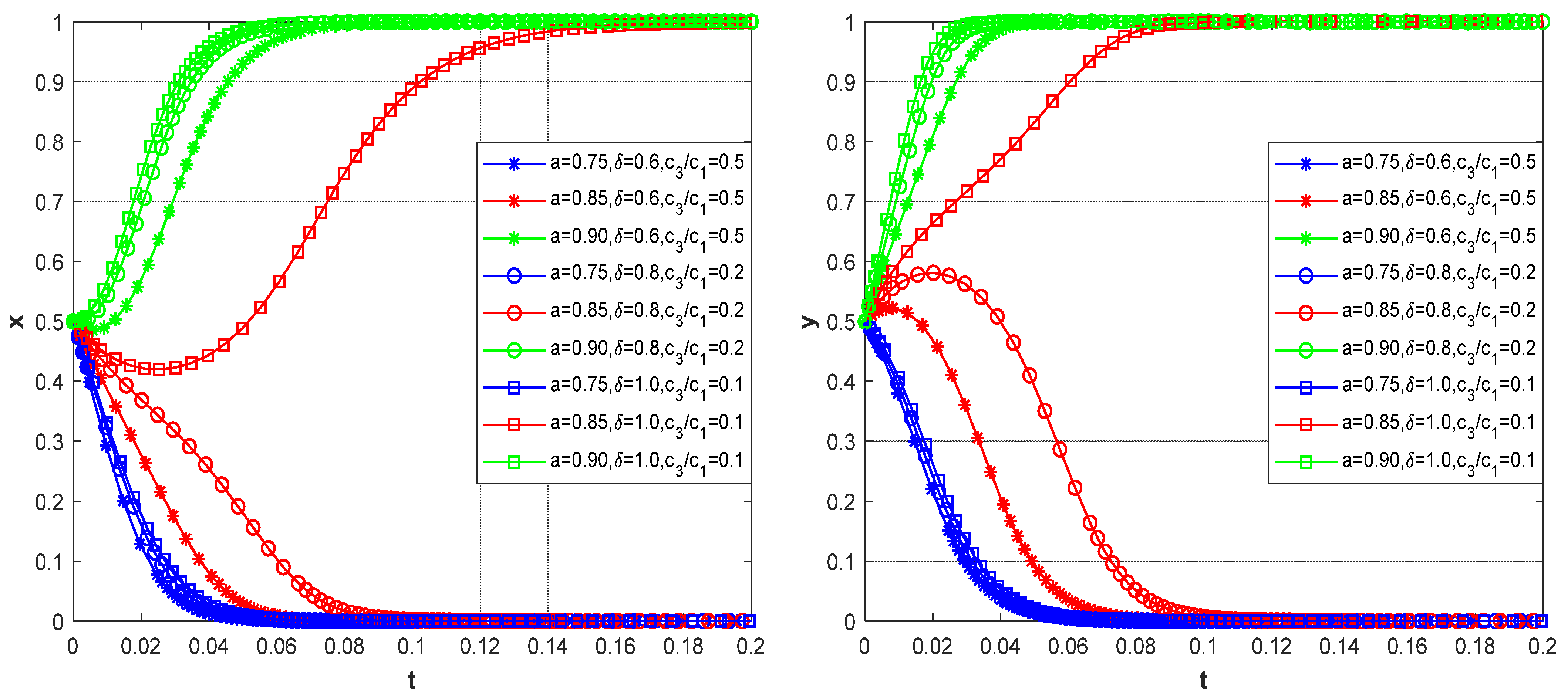

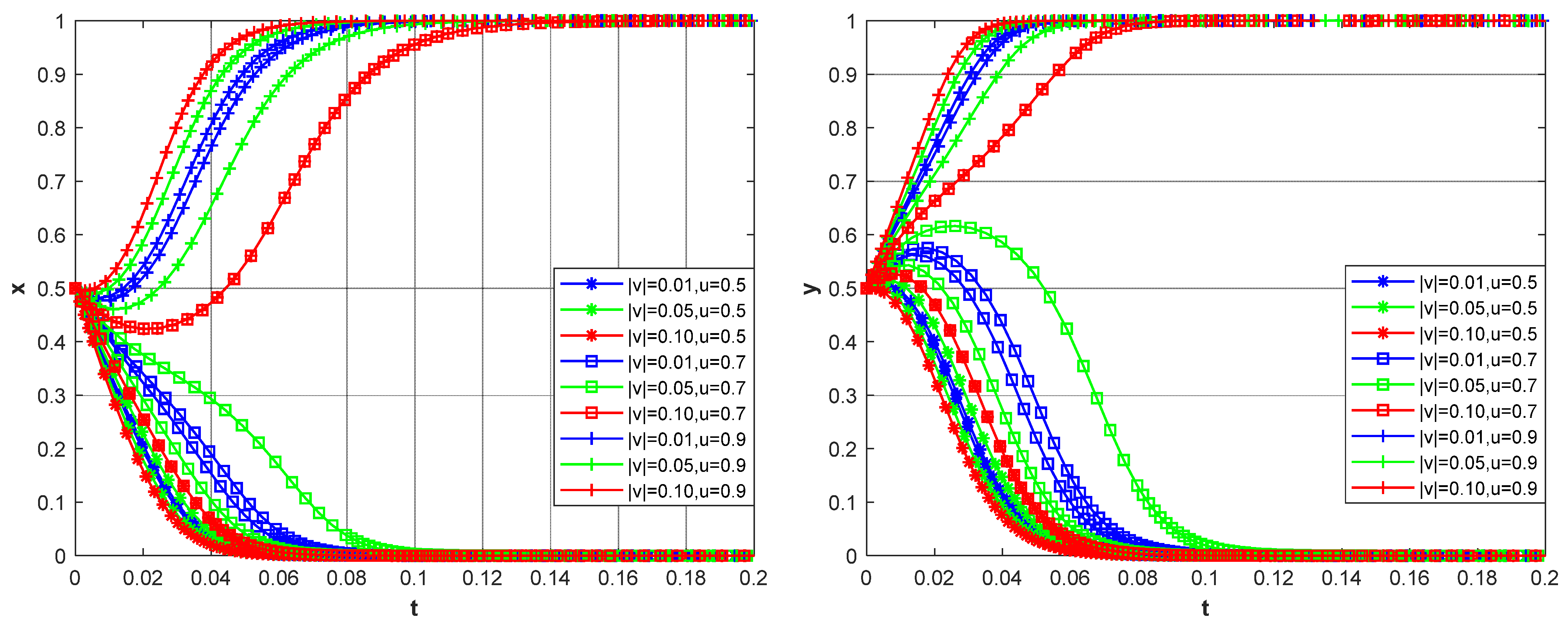

4.2.1. Sensitivity Analysis of Evolutionary Outcomes to the Interplay Among Risk Aversion Coefficients, Potential Risks, and Resource Absorption Capabilities

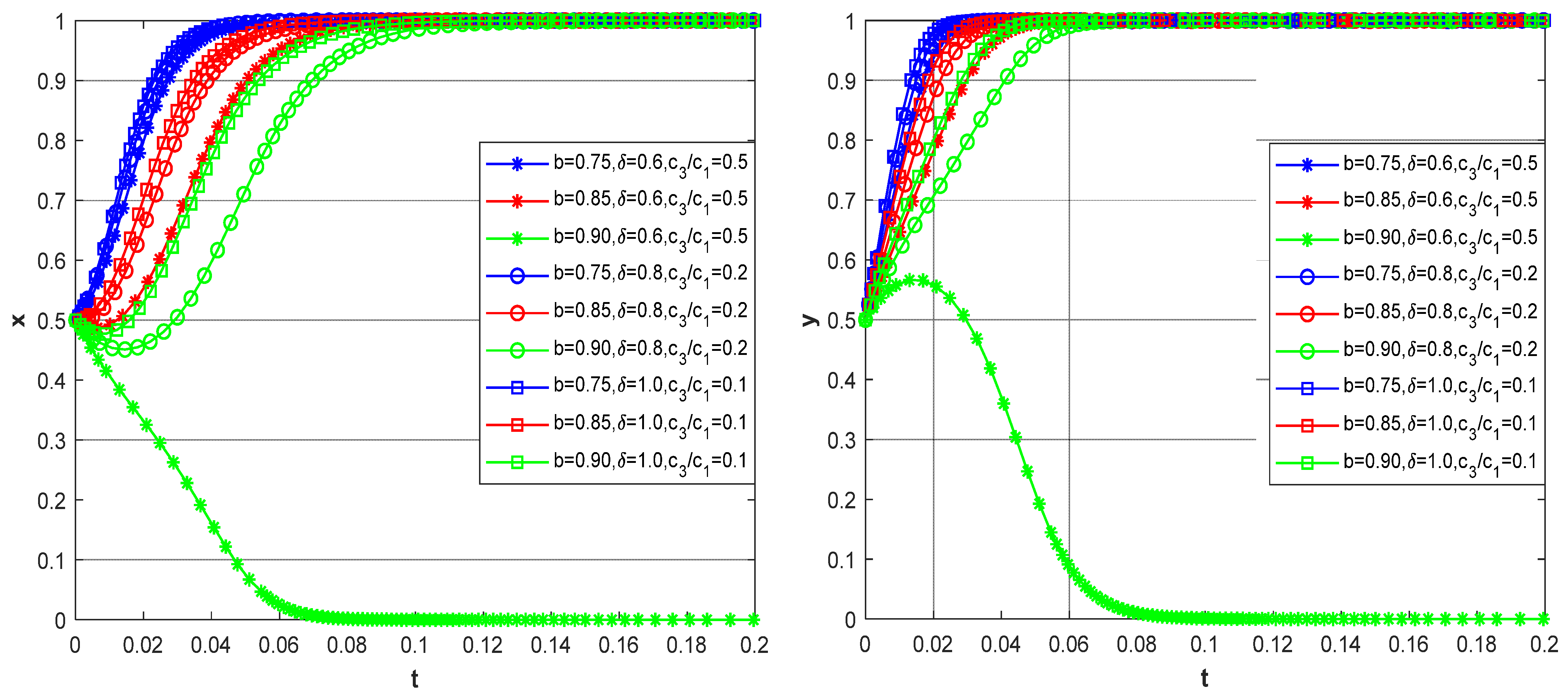

4.2.2. Sensitivity Analysis of Evolutionary Outcomes to the Interplay Among Risk Preference Coefficients, Potential Risks, and Resource Absorption Capabilities

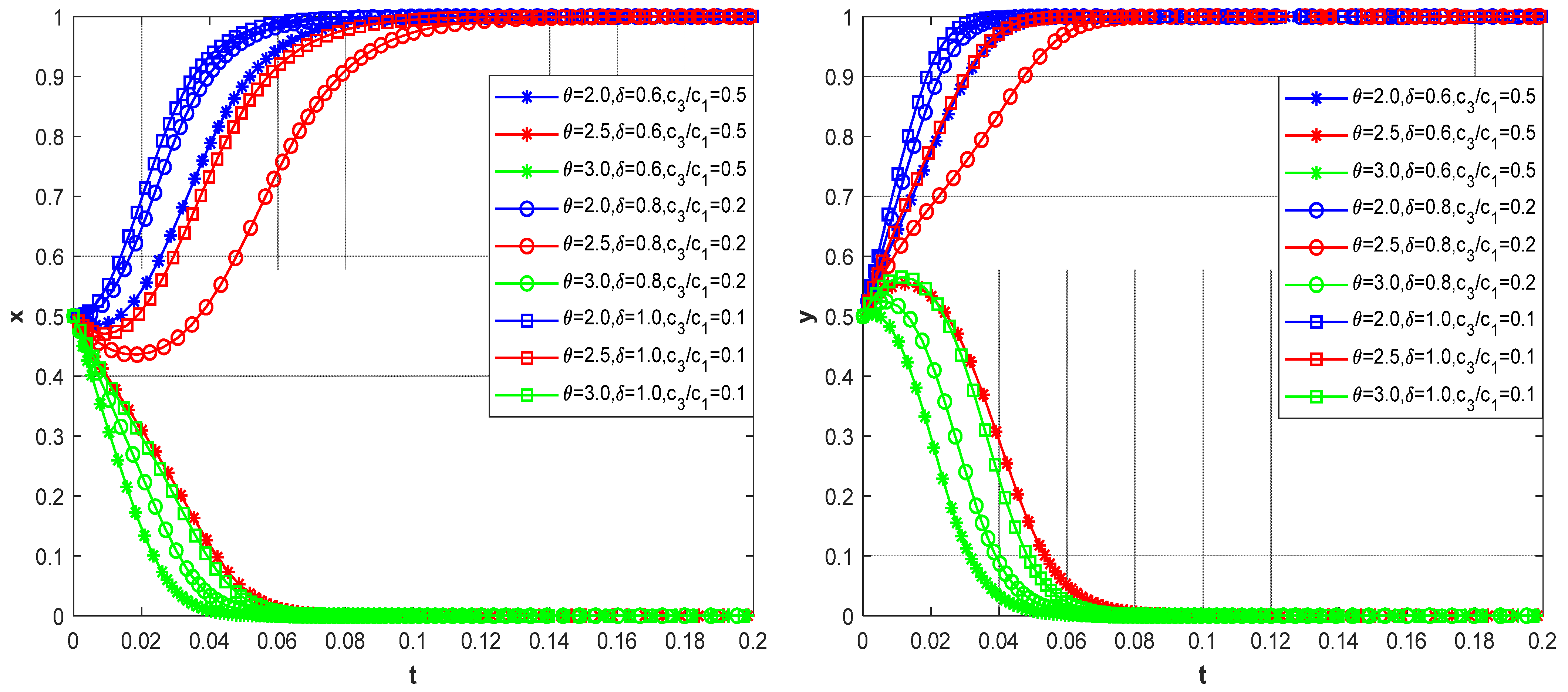

4.2.3. Sensitivity Analysis of Evolutionary Outcomes to the Interplay Among the Loss Sensitivity Factor, Potential Risks, and Resource Absorption Capabilities

4.3. Sensitivity Analysis of Evolutionary Outcomes to the Interplay Between Collaborative Innovation Capability and Environmental Uncertainty

4.4. Discussion

5. Conclusions and Implications

5.1. Conclusions

5.2. Research Implications

5.2.1. Theoretical Implications

5.2.2. Practical Implications

5.3. Research Limitations and Future Directions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Al-Omoush, K.S.; de Lucas, A.; del Val, M.T. The role of e-supply chain collaboration in collaborative innovation and value-co creation. J. Bus. Res. 2023, 158, 113647. [Google Scholar] [CrossRef]

- Yang, X.; Jiang, Y.; Chen, X.; Jia, F. ICT-empowered rural e-commerce development in China: An adaptive structuration perspective. Int. J. Technol. Manag. 2023, 95, 90–119. [Google Scholar] [CrossRef]

- Yang, X.; Zhang, Y.; Li, L. Can Digital Agriculture Realize the Sustainable Development of Rural E-commerce? In Innovation of Digital Economy: Cases from China; Springer: Berlin/Heidelberg, Germany, 2023; pp. 143–151. [Google Scholar]

- Prajapati, D.; Chan, F.T.; Daultani, Y.; Pratap, S. Sustainable vehicle routing of agro-food grains in the e-commerce industry. Int. J. Prod. Res. 2022, 60, 7319–7344. [Google Scholar] [CrossRef]

- Ning, S. A Study on the Factors that Restrict the Development of China’s Rural E-commerce and Countermeasures. Agro Food Ind. Hi-Tech 2017, 28, 3664–3667. [Google Scholar]

- Dai, D.N.; Stephens, P.; Si, Z. E-grocery as a new site of financialization? Financial drivers of the rise and fall of China’s E-grocery sector. Food Secur. 2024, 16, 471–485. [Google Scholar] [CrossRef]

- Hiam, S.; Gilles, T. Digitalization and Platforms in Agriculture: Organizations, Power Asymmetry, and Collective Action Solutions. 2020. ETLA Working Papers No 78. Available online: http://pub.etla.fi/ETLA-Working-Papers-78.pdf (accessed on 13 January 2025).

- Lin, J.; Li, H.; Lin, M.; Li, C. Rural e-commerce in China: Spatial dynamics of Taobao Villages development in Zhejiang Province. Growth Chang. 2022, 53, 1082–1101. [Google Scholar] [CrossRef]

- Chao, P.; Biao, M.; Zhang, C. Poverty alleviation through e-commerce: Village involvement and demonstration policies in rural China. J. Integr. Agric. 2021, 20, 998–1011. [Google Scholar]

- Liu, Y.; Zhou, M. Can rural e-commerce narrow the urban–rural income gap? Evidence from coverage of Taobao villages in China. China Agric. Econ. Rev. 2023, 15, 580–603. [Google Scholar] [CrossRef]

- Qin, Y.; Fang, Y. The effects of e-commerce on regional poverty reduction: Evidence from China’s rural e-commerce demonstration county program. China World Econ. 2022, 30, 161–186. [Google Scholar] [CrossRef]

- He, D.; Ceder, A.A.; Zhang, W.; Guan, W.; Qi, G. Optimization of a rural bus service integrated with e-commerce deliveries guided by a new sustainable policy in China. Transp. Res. Part E Logist. Transp. Rev. 2023, 172, 103069. [Google Scholar] [CrossRef]

- Liu, W. Route optimization for last-mile distribution of rural E-commerce logistics based on ant colony optimization. IEEE Access 2020, 8, 12179–12187. [Google Scholar] [CrossRef]

- Kahneman, D. Prospect theory: An analysis of decisions under risk. Econometrica 1979, 47, 278. [Google Scholar] [CrossRef]

- Tom, S.M.; Fox, C.R.; Trepel, C.; Poldrack, R.A. The neural basis of loss aversion in decision-making under risk. Science 2007, 315, 515–518. [Google Scholar] [CrossRef]

- Sawa, R.; Wu, J. Prospect dynamics and loss dominance. Games Econ. Behav. 2018, 112, 98–124. [Google Scholar] [CrossRef]

- Tversky, A.; Kahneman, D. Advances in prospect theory: Cumulative representation of uncertainty. J. Risk Uncertain. 1992, 5, 297–323. [Google Scholar] [CrossRef]

- Bain, J.S. Industrial Organization; John Willey & Sons: Hoboken, NJ, USA, 1968. [Google Scholar]

- Mullainathan, S.; Scharfstein, D. Do firm boundaries matter? Am. Econ. Rev. 2001, 91, 195–199. [Google Scholar] [CrossRef][Green Version]

- Prahalad, C.K.; Hamel, G. The core competence of the corporation. In Knowledge and Strategy; Routledge: London, UK, 2009; pp. 41–59. [Google Scholar]

- Mahoney, J.T.; Pandian, J.R. The resource-based view within the conversation of strategic management. Strateg. Manag. J. 1992, 13, 363–380. [Google Scholar] [CrossRef]

- Crandall, P.G.; O’Bryan, C.A.; Babu, D.; Jarvis, N.; Davis, M.L.; Buser, M.; Adam, B.; Marcy, J.; Ricke, S.C. Whole-chain traceability, is it possible to trace your hamburger to a particular steer, a US perspective. Meat Sci. 2013, 95, 137–144. [Google Scholar] [CrossRef]

- Liu, Y.; Yang, Z.; Zhu, C.; Zhang, B.; Li, H. The eco-agricultural industrial chain: The meaning, content and practices. Int. J. Environ. Res. Public Health 2023, 20, 3281. [Google Scholar] [CrossRef] [PubMed]

- Chen, W.; Feng, G.; Zhang, C.; Liu, P.; Ren, W.; Cao, N.; Ding, J. Development and application of big data platform for garlic industry chain. Comput. Mater. Contin. 2019, 58, 229. [Google Scholar] [CrossRef]

- Pfeiffer, J.; Gabriel, A.; Gandorfer, M. Understanding the public attitudinal acceptance of digital farming technologies: A nationwide survey in Germany. Agric. Hum. Values 2021, 38, 107–128. [Google Scholar] [CrossRef]

- Liu, K.; Wang, M. Exploration of Digital Countryside in the Context of Rural Revitalization Based on the Financial Industry and E-Commerce. Inf. Syst. Econ. 2023, 4, 12–25. [Google Scholar]

- Castro, R. SMEs must go online—E-commerce as an escape hatch for resilience and survivability. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 3043–3062. [Google Scholar] [CrossRef]

- Kwilinski, A. The relationship between sustainable development and digital transformation: Bibliometric analysis. Virtual Econ. 2023, 6, 56–69. [Google Scholar] [CrossRef] [PubMed]

- Mubarak, M.F.; Tiwari, S.; Petraite, M.; Mubarik, M.; Raja Mohd Rasi, R.Z. How Industry 4.0 technologies and open innovation can improve green innovation performance? Manag. Environ. Qual. Int. J. 2021, 32, 1007–1022. [Google Scholar] [CrossRef]

- Sirmon, D.G.; Hitt, M.A.; Ireland, R.D.; Gilbert, B.A. Resource orchestration to create competitive advantage: Breadth, depth, and life cycle effects. J. Manag. 2011, 37, 1390–1412. [Google Scholar] [CrossRef]

- Mazzei, M.J.; Noble, D. Big data dreams: A framework for corporate strategy. Bus. Horiz. 2017, 60, 405–414. [Google Scholar] [CrossRef]

- Abbasi, R.; Martinez, P.; Ahmad, R. The digitization of agricultural industry–a systematic literature review on agriculture 4.0. Smart Agric. Technol. 2022, 2, 100042. [Google Scholar] [CrossRef]

- Zhou, L.; Jiang, Z.; Geng, N.; Niu, Y.; Cui, F.; Liu, K.; Qi, N. Production and operations management for intelligent manufacturing: A systematic literature review. Int. J. Prod. Res. 2022, 60, 808–846. [Google Scholar] [CrossRef]

- Haken, H. An Introduction Nonequilibrium Phase Transitions and Self-Organization in Physics; Chemistry, and Biology; Springer: Berlin/Heidelberg, Germany, 1983; pp. 206–216. [Google Scholar]

- Teng, Y.; Mao, C.; Liu, G.; Wang, X. Analysis of stakeholder relationships in the industry chain of industrialized building in China. J. Clean. Prod. 2017, 152, 387–398. [Google Scholar] [CrossRef]

- Tianqi, Z. Paths for upgrade and transformation of E-commerce of China’s fresh agricultural products based on whole industry supply chain. Asian Agric. Res. 2017, 9, 1–4. [Google Scholar]

- Li, Y.; Li, N.; Li, Z. Evolution of carbon emissions in China’s digital economy: An empirical analysis from an entire industry chain perspective. J. Clean. Prod. 2023, 414, 137419. [Google Scholar] [CrossRef]

- Howieson, J.; Lawley, M. Implementing Whole of Chain Analysis for the Seafood Industry: A Toolbox Approach. In Australian and New Zealand Marketing Academy (ANZMAC) Annual Conference 2010 Proceedings, 2010; Department of Management, College of Business and Economics, University of Canterbury: Christchurch, New Zealand, 2010; pp. 1–8. [Google Scholar]

- Haizhong, A.; Huajiao, L. Theory and research advances in whole industrial chain of strategic mineral resources. Resour. Ind. 2022, 24, 8. [Google Scholar]

- Smith, J.M.; Price, G.R. The logic of animal conflict. Nature 1973, 246, 15–18. [Google Scholar] [CrossRef]

- Liu, J.; Teng, Y. Evolution game analysis on behavioral strategies of multiple stakeholders in construction waste resource industry chain. Environ. Sci. Pollut. Res. 2023, 30, 19030–19046. [Google Scholar] [CrossRef] [PubMed]

- Yu, N.; Zhao, C. Chain innovation mechanism of the manufacturing industry in the yangtze river delta of china based on evolutionary game. Sustainability 2021, 13, 9729. [Google Scholar] [CrossRef]

- Wang, L.; Zhang, Z.-X.; Wang, Y.-M. A prospect theory-based interval dynamic reference point method for emergency decision making. Expert Syst. Appl. 2015, 42, 9379–9388. [Google Scholar] [CrossRef]

- Abdellaoui, M.; Bleichrodt, H.; Kammoun, H. Do financial professionals behave according to prospect theory? An experimental study. Theory Decis. 2013, 74, 411–429. [Google Scholar] [CrossRef]

- Hasan, F.; Kayani, U.N.; Choudhury, T. Behavioral risk preferences and dividend changes: Exploring the linkages with prospect theory through empirical analysis. Glob. J. Flex. Syst. Manag. 2023, 24, 517–535. [Google Scholar] [CrossRef]

- Zheng, Q.; Liu, X.; Wang, W.; Wu, Q.; Deveci, M.; Pamucar, D. The integrated prospect theory with consensus model for risk analysis of human error factors in the clinical use of medical devices. Expert Syst. Appl. 2023, 217, 119507. [Google Scholar] [CrossRef]

- Liu, W.; Liu, C.; Ge, M. An order allocation model for the two-echelon logistics service supply chain based on cumulative prospect theory. J. Purch. Supply Manag. 2013, 19, 39–48. [Google Scholar] [CrossRef]

- Rezvani, M.S.; Amoozad Mahdiraji, H.; Abbasian, E.; Mehregan, M. Evaluation of Cooperation Strategy in Financial Services Supply Chain Based on Prospect Theory and Game Theory. Iran. J. Account. Audit. Financ. 2023, 7, 93–108. [Google Scholar]

- Nambisan, S.; Wright, M.; Feldman, M. The digital transformation of innovation and entrepreneurship: Progress, challenges and key themes. Res. Policy 2019, 48, 103773. [Google Scholar] [CrossRef]

- Cennamo, C. Competing in digital markets: A platform-based perspective. Acad. Manag. Perspect. 2021, 35, 265–291. [Google Scholar] [CrossRef]

- Shao, L.; Wu, X.; Zhang, F. Sourcing competition under cost uncertainty and information asymmetry. Prod. Oper. Manag. 2020, 29, 447–461. [Google Scholar] [CrossRef]

- Liu, J.; Yang, L. “Dual-Track” platform governance on content: A comparative study between China and United States. Policy Internet 2022, 14, 304–323. [Google Scholar] [CrossRef]

- Li, H.; Yang, Z.; Jin, C.; Wang, J. How an industrial internet platform empowers the digital transformation of SMEs: Theoretical mechanism and business model. J. Knowl. Manag. 2023, 27, 105–120. [Google Scholar] [CrossRef]

- Friedman, D. Evolutionary games in economics. Econom. J. Econom. Soc. 1991, 59, 637–666. [Google Scholar] [CrossRef]

- Weibull, J.W. Evolutionary Game Theory; MIT Press: Cambridge, MA, USA, 1997. [Google Scholar]

- Couture, V.; Faber, B.; Gu, Y.; Liu, L. E-Commerce Integration and Economic Development: Evidence from China; National Bureau of Economic Research: Cambridge, MA, USA, 2018; Volume 24383. [Google Scholar]

| Aspect | Existing Industrial Chains | Rural E-Commerce Industry Chain |

|---|---|---|

| Key characteristics | Stakeholder interaction and cooperation | Stakeholder interaction and cooperation |

| Challenges | Goal misalignment among participants | Higher environmental uncertainty (e.g., policy changes, rural system, rapid technological shifts) |

| Decision-making dynamics | Relatively stable risk attitudes | Relatively stable risk attitudes |

| Parameters | Description |

|---|---|

| Probability of platform enterprises choosing to “active participation” | |

| Probability of participating enterprises choosing to “active participation” | |

| Return risk aversion coefficient, | |

| Loss risk preference coefficient, | |

| Loss aversion factor, | |

| Objective probability of occurrence of event | |

| Level of digital empowerment | |

| Coefficient of return on co-innovation | |

| Co-innovation benefit-sharing ratio, | |

| Costs incurred by platform enterprises choosing “active participation” | |

| Loss of digital empowerment spillover risk for platform enterprises | |

| Costs incurred by participating enterprises choosing “active participation” | |

| Resource absorptive capacity coefficients of participating enterprises, |

| Platform Enterprises | Participating Enterprises | |

|---|---|---|

| Active Participation | Passive Participation | |

| Active Participation | ||

| Passive Participation | ||

| Scenario | Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Equilibrium | Stability | Stability | Stability | Stability | ||||||||

| ESS | ESS | ESS | ESS | |||||||||

| Saddle point | Unstable | Saddle point | Unstable | |||||||||

| Saddle point | Saddle point | Unstable | Unstable | |||||||||

| Unstable | Saddle point | Saddle point | ESS | |||||||||

| \ | \ | \ | \ | \ | \ | \ | \ | \ | 0 | Saddle point | ||

| BCR | |||||||

|---|---|---|---|---|---|---|---|

| 0.6 | 500 | 0.2 | 0.3 | 0.3 | 27 | 63 | 14 |

| 0.5 | 45 | 45 | 23 | ||||

| 0.7 | 63 | 27 | 32 | ||||

| 0.5 | 600 | 0.3 | 0.4 | 0.3 | 36 | 84 | 18 |

| 0.5 | 60 | 60 | 30 | ||||

| 0.7 | 84 | 36 | 42 | ||||

| 0.4 | 700 | 0.4 | 0.5 | 0.3 | 42 | 98 | 21 |

| 0.5 | 70 | 70 | 35 | ||||

| 0.7 | 98 | 42 | 49 | ||||

| 0.2 | 1000 | 0.6 | 0.8 | 0.3 | 48 | 112 | 24 |

| 0.5 | 80 | 80 | 40 | ||||

| 0.7 | 112 | 48 | 56 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Y.; Xu, J. Synergistic Evolution in the Digital Transformation of the Whole Rural E-Commerce Industry Chain: A Game Analysis Using Prospect Theory. Systems 2025, 13, 117. https://doi.org/10.3390/systems13020117

Wang Y, Xu J. Synergistic Evolution in the Digital Transformation of the Whole Rural E-Commerce Industry Chain: A Game Analysis Using Prospect Theory. Systems. 2025; 13(2):117. https://doi.org/10.3390/systems13020117

Chicago/Turabian StyleWang, Yanling, and Junqian Xu. 2025. "Synergistic Evolution in the Digital Transformation of the Whole Rural E-Commerce Industry Chain: A Game Analysis Using Prospect Theory" Systems 13, no. 2: 117. https://doi.org/10.3390/systems13020117

APA StyleWang, Y., & Xu, J. (2025). Synergistic Evolution in the Digital Transformation of the Whole Rural E-Commerce Industry Chain: A Game Analysis Using Prospect Theory. Systems, 13(2), 117. https://doi.org/10.3390/systems13020117