Abstract

The rise of Industry 4.0 has led more manufacturers to embrace the concept of intelligent transformation. Understanding this relationship improves both transformation efficiency and the quality of innovation. This study, based on resource orchestration theory, empirically tests a sample of Chinese A-share listed manufacturing companies from 2007 to 2022. The key findings are as follows: (1) intelligent transformation significantly enhances the innovation quality of manufacturing firms, particularly in the eastern region, non-state-owned enterprises, and non-high-tech enterprises; (2) intelligent transformation, as a vital means of resource orchestration, optimizes resource allocation, thereby strengthening corporate financing, organizational resilience, and risk-taking capabilities, ultimately empowering the improvement in innovation quality; (3) the three sub-dimensions of intelligent transformation—intelligent sensing technology, intelligent production and manufacturing, and intelligent strategic layout—all significantly contribute to the enhancement of innovation quality in manufacturing firms. These conclusions provide new insights for manufacturing enterprises to utilize intelligent transformation for resource orchestration and offer valuable implications for the improvement in their innovation quality.

1. Introduction

In recent years, the convergence of technology and the oversupply of low-end products have become significant challenges for manufacturing firms. These challenges undermine the competitive advantage of such firms and hinder their progress in the global value chain. Consequently, the quality of innovations, recognized as a cornerstone for sustaining a long-term competitive advantage, has gained increased attention from both scholars and industry professionals [1,2]. However, improving innovation quality remains fraught with significant challenges. Some enterprises, driven by short-term gains and national policy subsidies, resort to “strategic innovation” practices. This strategy leads to a patent “bubble”, characterized by a focus on the quantity of innovations rather than their quality. As a result, the quality of innovations in China lags behind that of developed countries such as the United States, Germany, and the United Kingdom [3,4,5]. As the world’s second-largest economy and a leading manufacturing power, China’s innovation efforts and transformation processes are highly representative. Therefore, exploring how Chinese manufacturing enterprises improve their innovation quality provides valuable insights for the global manufacturing sector to overcome low-end lock-in and achieve high-end development. In this context, intelligent transformation has emerged as a key trend within the Industry 4.0 framework, with an increasing number of manufacturing firms accelerating their transformation efforts [6]. For example, companies such as Volkswagen and BMW have begun integrating intelligent manufacturing technologies to improve their overall innovation quality, effectively addressing the growing demand for personalized products. Intelligent transformation presents new opportunities to improve the innovation quality of manufacturing firms. However, intelligent transformation is a gradual process, with implementation outcomes varying widely across enterprises and industries. Therefore, the question of whether and how intelligent transformation can effectively improve innovation quality in manufacturing enterprises is a critical research priority.

Improving the quality of corporate innovation has become a central focus of academic research in recent years. Previous studies have examined the factors influencing innovation quality from various perspectives, including policy interventions [7], the adoption of independent board structures [8], and the use of mechanism design [9]. Innovation quality represents an extension of a firm’s knowledge base and serves as a key indicator of its technological innovation capabilities. Therefore, from a long-term perspective, research on innovation quality should shift its focus to the technological dimension [10]. Building on this, some scholars have explored innovation quality through the lens of digital technologies [11] and digital transformation [12]. However, the rise of the high-quality development paradigm and the deepening of supply-side structural reforms in the manufacturing sector have made traditional digital transformation inadequate in meeting the increasing demands for precision and flexible manufacturing. Excessive digital investment may crowd out innovation quality by increasing coordination costs and delaying resource allocation [13]. Intelligent transformation differs from digital transformation by empowering manufacturing enterprises through the integration of intelligent technologies. This approach not only overcomes the limitations of digital transformation in meeting the high-quality development needs of the manufacturing sector, but also strengthens core competitive advantages by orchestrating resources and optimizing manufacturing processes, significantly improving innovation quality [14,15]. Therefore, pursuing intelligent transformation is essential for enhancing innovation quality in manufacturing enterprises, significantly contributing to advancing the theoretical foundations and strategic frameworks of intelligent transformation in the industry.

Resource orchestration theory explains the efficient integration, bundling, and utilization of existing resources to develop unique capabilities, ensuring a sustained competitive advantage [16]. According to resource orchestration theory, intelligent transformation improves innovation quality in manufacturing enterprises by optimizing resource orchestration. Intelligent transformation improves the allocation efficiency of critical resources, such as information and capital, and unlocks their value creation potential. This process fosters essential capabilities, such as mitigating financial constraints, strengthening organizational resilience, and enhancing risk-taking capacity. As a result, intelligent transformation enhances innovation quality in manufacturing enterprises, injecting new momentum into the development of their core competitive advantages.

The above insights highlight several limitations in the existing research. First, although previous studies, such as that of Rammer et al. (2022) [17], have linked intelligent transformation to corporate innovation (e.g., finding that intelligent technology can significantly impact innovation in enterprises based on German data), these studies have not addressed the empowering effect of intelligent transformation on the quality of innovations. Furthermore, given that intelligent technology is relatively advanced in developed countries, it is unclear whether the conclusions of these studies are applicable to China. Second, due to data limitations, much of the existing research on intelligence remains at the theoretical analysis level and lacks sufficient empirical testing [18]. Additionally, most studies focus on the static intelligent resources of enterprises, largely neglecting the dynamic process of “resource orchestration, capability formation, and value creation”. Third, much of the existing research emphasizes the critical role of effective resource orchestration in building core competitiveness and achieving value creation in enterprises [19]. However, the “black box” mechanism by which intelligent transformation can effectively empower enterprises to enhance innovation quality through resource orchestration remains largely unexplored. This study addresses the following three issues, targeting the practical and theoretical bottlenecks discussed above:

Q1: Can intelligent transformation effectively enhance the innovation quality of manufacturing companies?

Q2: From the perspective of resource orchestration, what are the underlying mechanisms linking intelligent transformation to innovation quality?

Q3: How does intelligent transformation optimize resource allocation effectively in different contexts, and what impact does it have on innovation quality?

This study focuses on Chinese A-share listed manufacturing companies, analyzing the empowering effect of intelligent transformation on innovation quality and examining the mediating roles of financing constraints, organizational resilience, and risk-taking capacity. The findings were rigorously tested through heterogeneity analyses, robustness checks, and endogeneity assessments, with consistent conclusions across all evaluations. This study further disaggregates intelligent transformation into three sub-dimensions—intelligent sensing technology, intelligent production and manufacturing, and intelligent strategic layout—and investigates how each contributes to enhancing innovation quality in manufacturing enterprises.

Based on the above analysis, this study introduces several innovations: First, unlike previous studies that treat intelligence as a static resource, this study integrates the intelligent transformation of manufacturing enterprises into the dynamic framework of “resource orchestration–capability formation–value creation”, providing empirical evidence of its empowering effect on the innovation quality of manufacturing enterprises. Second, grounded in the theory of resource orchestration, this study reveals the “black box” mechanism of how intelligent transformation impacts innovation quality in manufacturing enterprises through the introduction of factors such as financing constraints, organizational resilience, and risk-bearing capacity, thus addressing the research gap in understanding the effect of intelligent transformation on innovation quality. Third, this study examines the contextual role of regional differences, property rights, and technology-intensive enterprise types in enhancing innovation quality through intelligent transformation. It also explores the impact of three sub-dimensions of intelligent transformation—intelligent sensing technology, intelligent production and manufacturing, and intelligent strategic layout—on innovation quality in manufacturing enterprises, effectively filling existing research gaps.

2. Literature Review

This study covers both mature topics, such as resource orchestration theory, and newly emerging topics, including intelligent transformation and the quality of innovation. Consequently, this literature review employs an integrative review method to creatively combine traditional and emerging theories. This method not only evaluates and integrates existing research findings but also identifies gaps in these areas to foster theoretical innovation and development [20]. The literature review aims to offer new perspectives on intelligent transformation and the quality of innovation, while also providing theoretical support for the further development of resource orchestration theory.

2.1. Intelligent Transformation

Intelligent transformation is a crucial driver of China’s transition from a manufacturing sector focused on scale to one centered on strength, playing a pivotal role in shaping its future position within the global industrial landscape [6]. It involves leveraging advanced intelligent technologies to optimize and upgrade R&D, production, and operational processes, aiming to improve efficiency, enhance product quality, accelerate market responsiveness, lower costs, and boost customer satisfaction [21,22].

Current academic discussions focus heavily on enterprise digital transformation, while research on intelligent transformation remains limited, leading to blurred distinctions between the two. Digital transformation mainly restructures and integrates resources to optimize processes and improve efficiency [23], whereas intelligent transformation extends this by embedding advanced technologies like artificial intelligence and big data, prioritizing innovation quality [24,25]. Unlike digital transformation’s focus on process optimization, intelligent transformation drives qualitative advancements in production and R&D, enhances organizational resilience, alleviates financing constraints, and boosts risk-taking capacity, significantly elevating innovation quality [26]. As the manufacturing sector shifts toward high-quality development, addressing challenges like low innovation quality through intelligent transformation is crucial to inject new momentum into the industry [1,21].

Intelligent transformation, as a key method for effective resource orchestration, has gained significant academic attention, with studies focusing on its impact on labor demand, organizational dynamics, and financial performance. It can substitute low-skilled labor while increasing demand for high-skilled workers [27,28], enhance inter-organizational collaboration and innovation quality through complementary advantages [25], and free up resources for their investment in intelligent technology R&D, thereby improving information processing and innovation capabilities [29]. These studies provide valuable insights to further explore the role of resource orchestration in intelligent transformation and its mechanism for enhancing firms’ innovation quality.

In summary, while the existing literature has yielded valuable results in the field of enterprise digital transformation, research on intelligent transformation remains underdeveloped. First, most studies focus on digital transformation, with relatively limited discussion on intelligent transformation, particularly lacking a clear distinction between the two. Although some studies have started to focus on intelligent transformation, they have yet to develop a comprehensive conceptual framework. Second, while most current research focuses on the impact of intelligent transformation on labor demand, teamwork, and financial aspects, the quality of firms’ innovation remains underexplored. Third, most existing studies treat intelligence as a static resource and overlook the underlying mechanisms through which intelligent transformation enhances innovation quality from a resource orchestration perspective. Therefore, they fail to uncover the “black box” mechanism from resource acquisition to capability formation to value creation.

2.2. Innovation Quality

Evolving from innovation and quality management theories, innovation quality is a key metric for assessing a firm’s innovation outcomes, reflecting stakeholder satisfaction [11,30]. It captures the creativity and breakthrough potential of technological achievements, encompassing a firm’s innovation capability, performance, efficiency, and value, thereby representing the overall quality of its innovation output [31]. Innovation quality is essential for strengthening a firm’s competitive advantage in innovation and boosting its value creation capacity.

Existing research on the antecedents of corporate innovation quality primarily focuses on internal and external organizational factors. From an internal perspective, scholars have systematically explored pathways for enhancing innovation quality through technological empowerment [29,32]. For instance, Wan et al. (2022) [32] indicated that blockchain applications enhance knowledge integration efficiency and deepen the innovation’s foundation, which are crucial for achieving high-value technological breakthroughs and improving innovation quality. The research by Vial(2019) [23] further confirmed that intelligent systems enhance decision-making accuracy in innovation processes, while specialized human capital ensures implementation fidelity, both of which are essential quality assurance mechanisms that further strengthen innovation quality [24,27]. From an external perspective, institutional arrangements, particularly intellectual property protections and fiscal incentives, systematically stimulate R&D investment and create sustainable ecosystems for cultivating high-quality innovations, ultimately driving higher innovation quality [2,26,33].

With the growing emphasis on innovation quality, its measurement has become a key focus of academic research, with methods broadly categorized as follows: (1) some scholars use the number of invention patent applications as a proxy for innovation quality in manufacturing firms [33,34]; (2) others contend that patent applications alone only partially reflect innovation capability and advocate for patent citations, which indicate a patent’s impact, as a more effective measure of innovation quality [35,36]; and (3) certain researchers assess innovation quality through the breadth of patent knowledge, arguing that more complex knowledge embedded in patents signifies higher innovation quality [37].

In summary, while existing studies have explored various factors affecting innovation quality, few have connected intelligent transformation to innovation quality or examined its transmission mechanism in the context of the intelligent era. This study aims to address the following gaps: first, it will systematically examine the impact of intelligent transformation on the innovation quality of manufacturing enterprises, moving beyond the traditional resource factor perspective; second, it will thoroughly analyze the internal transmission mechanism through which intelligent transformation affects innovation quality, moving beyond simple correlation analysis; and third, it will incorporate intelligent transformation as a key variable into the framework for studying innovation quality, enriching and advancing existing innovation quality theories.

2.3. Resource Orchestration Theory

Originating from the resource management and asset orchestration models, resource orchestration theory encompasses three interrelated processes: resource portfolio structuring, capability bundling, and leveraging capabilities to create value [16]. Resource portfolio structuring involves acquiring valuable resources and discarding obsolete ones to build a high-quality portfolio. Capability bundling integrates these resources through internalization and by learning to develop differentiated core capabilities. Leveraging capabilities aligns resources with market opportunities, transforming internal value into customer-facing outputs, creating unique value experiences, and securing a competitive advantage. These processes are interconnected and sequential, forming the core logic of resource orchestration theory [16,38]. Resource orchestration theory has been extensively applied in areas such as corporate innovation, capability formation, and digitalization. From a resource action perspective, high-quality innovation is intrinsically linked to effective resource orchestration, requiring firms to develop and utilize diverse resource portfolios and capabilities to achieve superior innovation outcomes [39]. Research indicates that the integration of data, platforms, and technological resources during intelligent transformation, alongside enhanced financing and organizational adaptive capabilities, significantly influences high-quality innovation in manufacturing firms. For example, Liu et al. (2016) [40] argued that deploying appropriate information technology capabilities to support supply chain integration can substantially improve innovation performance. However, no studies have yet explored the relationship between intelligent transformation and innovation quality in manufacturing firms or the “black box” of its mechanisms within this theoretical framework. Intelligent transformation can be viewed as a key pathway for enterprises to achieve value creation through resource orchestration. Resource building, as the starting point, reconfigures the enterprise’s resource base through the introduction of digital technologies, platforms, and data resources. The widespread application of industrial Internet platforms allows enterprises to efficiently acquire and integrate large amounts of data, creating a new type of digital resource pool that lays the foundation for subsequent innovation activities. In the resource bundling stage, intelligent transformation facilitates the deep integration of digital resources with existing enterprise resources, fostering key competencies in capital, organization, and risk management. Intelligent technology enables enterprises to optimize resource allocation and develop more flexible capital utilization, organizational adaptation, and risk control capabilities. Finally, in the resource utilization stage, supported by the above capabilities, enterprises can efficiently drive a leap in innovation quality.

Based on the above analysis, resource orchestration theory offers a solid theoretical foundation for understanding how enterprises can leverage intelligent transformation. First, the theoretical framework of “resource orchestration–capability formation–value creation” explains how and whether intelligent transformation influences the quality of innovations in manufacturing enterprises. Second, resource orchestration theory emphasizes the dynamic relationship between resources and capabilities as key drivers of corporate value creation, offering theoretical support for the multidimensional capability mechanisms generated by resource bundling through intelligent transformation. Third, resource orchestration theory emphasizes a contingent management approach in resource orchestration, providing a theoretical foundation for exploring contextual factors that influence the relationship between intelligent transformation and innovation quality in manufacturing firms across various levels, such as property rights, regions, and technological intensities.

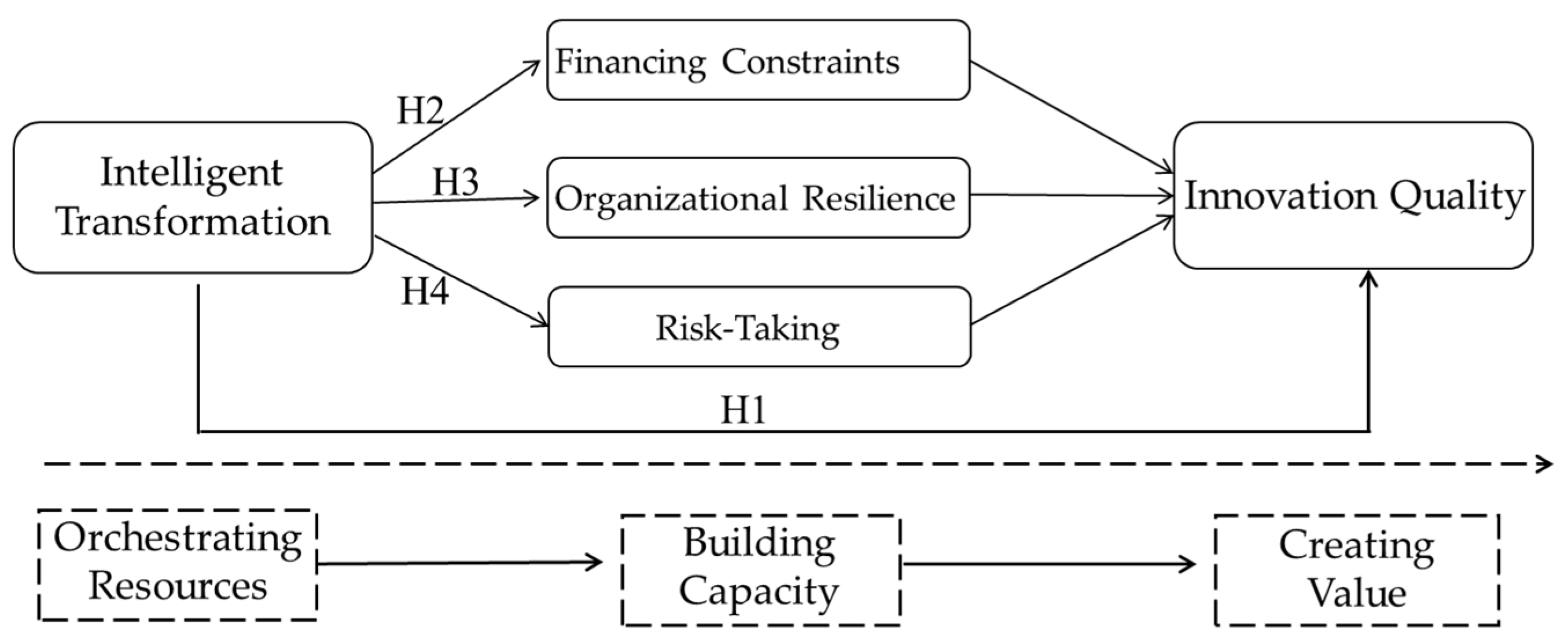

In summary, this study presents the following theoretical model (depicted in Figure 1) to explore how intelligent transformation impacts innovation quality in manufacturing firms. This model follows the core logic of resource orchestration—specifically, “resource orchestration–capability formation–value creation”. Building on this foundation, the model suggests that intelligent transformation, as an effective means of resource orchestration, enhances innovation quality in manufacturing firms by fostering and enhancing various capabilities, such as alleviating financing constraints, improving organizational resilience, and increasing risk-taking propensity. These relationships and mechanisms are further elaborated through the hypothesis development based on the theoretical framework.

Figure 1.

Theoretical model.

3. Hypothesis Development

3.1. The Impact of Intelligent Transformation on Innovation Quality in Manufacturing Enterprises

From the perspective of resource orchestration theory, intelligent transformation in manufacturing firms involves substituting physical capital for labor and optimizing innovation-related resources through structured portfolio management, capability bundling, and value leveraging. This process reconfigures resource combinations and orchestration methods at the financial, organizational, and risk-taking levels, fostering new resource portfolios and capabilities that enhance innovation quality [41]. For example, China’s Midea Group (Foshan, China), by implementing its “dual intelligence” strategy and developing the M.IoT industrial Internet platform, achieved full value chain intelligent transformation. This not only optimized resource allocation, resulting in a 53% reduction in the R&D cycle and a 74% decrease in product defect rates, but also fostered high-quality innovation, exemplified by the “Dongfeng” series of central air conditioners. This product, utilizing an intelligent temperature control algorithm for precise temperature regulation within ±0.1 °C, won the prestigious German Red Dot “Best of the Best” award. This strongly substantiates the effectiveness of intelligent transformation in enabling manufacturing firms to optimize resource orchestration, enhance innovation capabilities, and improve innovation quality.

Financially, intelligent transformation reflects resource portfolio structuring by introducing intelligent resource elements through investments in advanced systems and equipment while leveraging technologies like artificial intelligence to accelerate knowledge accumulation, reduce costs, and free up capital for innovation activities. The interplay between intelligent and traditional financial resources creates a complementary effect, sustaining innovation quality [21]. Organizationally, intelligent transformation bundles internal and external resources by restructuring coordination mechanisms, shifting from hierarchical control to collaborative action [42]. Supported by intelligent technologies, firms enhance information sharing, collaborative agility, and resource integration, developing capabilities that drive innovation quality [43,44]. From a risk-taking perspective, intelligent transformation leverages resources to enhance precision in identifying market trends and risks, enabling firms to undertake calculated risks and pursue high-return innovation strategies [45,46].

Through restructuring financial, organizational, and risk-related resources, intelligent transformation generates synergistic effects between new and existing resources. This iterative upgrading of resource portfolios, as described by resource orchestration theory, drives sustained improvements in innovation quality. Thus, we hypothesize the following:

H1:

Ceteris paribus, intelligent transformation has a significant positive impact on enhancing a firm’s innovation quality.

3.2. The Mediating Role of Financing Constraints

Financing capability is a critical factor influencing a firm’s innovation quality and a key mechanism through which intelligent transformation exerts its impact. Innovation activities require substantial capital, and internal fund shortages often necessitate external financing. However, market imperfections raise external financing costs, creating constraints that hinder both initial R&D investments and the continuity of innovation projects, particularly for capital-intensive and uncertain activities [47,48].

From the perspective of resource orchestration theory, intelligent transformation mitigates these constraints by structuring, bundling, and leveraging resources effectively. It reduces information asymmetry with financial institutions through intelligent systems that track and share real-time production and R&D data, providing a reliable basis for credit assessments [24,26]. Simultaneously, it bundles financial and operational resources by cutting daily operating costs and enhancing capital utilization through advanced equipment, generating economies of scale and a sustainable investment capacity [25]. Furthermore, policy support for intelligent manufacturing, such as subsidies, broadens financing channels, enabling firms to transition from quantity-driven to quality-focused innovation [49].

By alleviating financing constraints, intelligent transformation ensures stable funding for innovation activities, maintaining continuity and enhancing systematic improvements in innovation quality. Grounded in resource orchestration theory, we propose the following hypothesis:

H2:

Intelligent transformation drives the improvement in innovation quality in manufacturing firms by alleviating financing constraints.

3.3. The Mediating Role of Organizational Resilience

Based on resource orchestration theory, a firm’s competitive advantage arises from effectively managing its resource portfolio, with organizational resilience reflecting its ability to orchestrate resources to navigate adversity. In the VUCA era (Volatility, Uncertainty, Complexity, and Ambiguity), organizational resilience enables firms to resist and recover from external uncertainties and shocks [50]. Through intelligent transformation, which integrates R&D, production, operations, and management, firms utilize intelligent technologies for real-time monitoring, reducing risks, improving product quality, and ensuring innovation quality [41].

Intelligent transformation enhances resource integration, allocation, and reconfiguration, enabling firms to identify critical resources, establish risk monitoring systems, and adapt to environmental changes, thereby strengthening organizational resilience [51]. Resilient firms can adjust innovation strategies, optimize organizational structures, and pursue high-risk innovation projects during crises, minimizing losses and freeing resources for continuous innovation quality improvement [52,53]. Enhanced resilience also drives firms to explore new innovation paradigms, advancing innovation quality to higher levels.

From the perspective of resource orchestration theory, intelligent transformation strengthens organizational resilience by optimizing resource allocation and management, creating a robust internal driver for high-quality innovation. Thus, we propose the following hypothesis:

H3:

Intelligent transformation empowers the enhancement of innovation quality in manufacturing firms by strengthening their organizational resilience.

3.4. The Mediating Role of Risk-Taking Capacity

High-quality innovation requires long cycles, substantial investment, and effective risk management. Risk-taking capability, reflecting a firm’s willingness to pursue high returns despite uncertainty [54], is essential for orchestrating resources to support innovation projects. From the perspective of resource orchestration theory, intelligent transformation enhances this capability by structuring, bundling, and leveraging resources to optimize decision-making and resource allocation.

Intelligent transformation utilizes advanced technologies, such as artificial intelligence, to improve the identification and evaluation of high-return opportunities, reducing risks and enabling more rational decision-making [55]. By facilitating pre-emptive resource adjustments, it enhances agility and adaptability, encouraging firms to undertake high-risk, high-return innovation projects [56]. Additionally, it strengthens managerial cognitive capabilities, a key aspect of resource orchestration, improving decision-making and strategic execution under uncertainty [57,58].

With enhanced risk-taking capabilities, firms can dynamically allocate resources to high-potential innovation areas, ensuring smooth project progress and superior outcomes [33]. In uncertain environments, this capability allows firms to respond quickly to market changes, adjust strategies effectively, and avoid missteps [16]. Through resource orchestration, intelligent transformation ensures optimal resource allocation, driving continuous improvements in innovation quality and sustaining a competitive advantage.

Accordingly, we propose the following hypothesis:

H4:

Intelligent transformation promotes the improvement in innovation quality in manufacturing firms by enhancing their risk-taking capability.

4. Research Design

4.1. Sample Selection and Data Sources

We utilized data from Chinese A-share listed manufacturing companies spanning 2007 to 2022 as the initial research sample. The firm-level data were primarily obtained from the CSMAR database, while core variables were extracted through a textual analysis of the annual reports of A-share listed companies. The data were processed as follows: (1) samples with missing values for key research variables were excluded to prevent estimation bias due to incomplete data; (2) samples of ST and delisted companies were excluded, as ST firms exhibit extreme financial anomalies and delisted entities lack operational continuity, potentially compromising the generalizability of the findings; and (3) continuous variables were winsorized at the 1% and 99% levels to limit the impact of extreme values on parameter estimates. After processing, the final sample comprised 17,552 firm-year observations, which were analyzed in a regression using a two-way fixed-effects model. The data were cleaned and analyzed using Stata 17.0 to generate the statistical analysis findings.

4.2. Variable Definition

4.2.1. Explained Variable

Innovation quality (INQ). Currently, the academic community primarily employs methods such as the number of invention patent applications or their proportion, or the number of patent citations, to measure innovation quality. The former is more direct and convenient for data acquisition but fails to comprehensively reflect a firm’s overall innovation quality, while the latter, by indicating the influence of patents, provides a more effective measure of innovation quality [35]. To mitigate the limitations of focusing solely on patent quantity, we adopted the patent breadth research method of Akcigit et al. (2016) [37] and the knowledge breadth approach proposed by [9]. Patent knowledge breadth measures the complexity of knowledge embedded in a patent, with broader and more complex information indicating higher innovation quality. From an internal perspective, the complexity of patent knowledge directly shapes the patent’s quality composition as a knowledge-intensive innovation outcome. From an external perspective, increased complexity raises barriers to imitation and re-innovation, creating a scarcity effect for market substitutes and enhancing the patent holder’s monopoly power, thereby significantly influencing overall innovation quality. The use of the knowledge breadth method is both scientific and reasonable, and in subsequent robustness tests, overall innovation quality was employed as an alternative variable.

4.2.2. Core Explanatory Variables

Intelligent transformation (InTra). Currently, publicly listed companies in China generally do not provide detailed disclosures regarding their progress in intelligent transformation. Additionally, the academic community has not reached a consensus on the optimal methodology for measuring corporate intelligent transformation levels. As a result, constructing scientifically sound and justifiable indicators for intelligent transformation poses a significant challenge for this research. Existing studies have used industrial robot installations as proxies for corporate intelligent transformation levels [27]. However, while these approaches enrich the research on measuring intelligent transformation, they have notable limitations. For instance, indicators such as industrial robot installations fail to capture the breadth and strategic depth of intelligent transformation. Although industrial robots fall under automation technologies and represent a crucial aspect of intelligent transformation in production and manufacturing, their technical foundations differ significantly from next-generation information and communication technologies, such as artificial intelligence, big data, and cloud computing. This leads to a narrow conceptualization of intelligent transformation as automation-driven labor substitution, overlooking its core characteristics, such as data-driven operations, intelligent decision-making, and human–machine collaboration. Furthermore, industrial robots are primarily applied in specific stages of manufacturing, making them inadequate for reflecting firms’ intelligent transformation efforts in other areas of the value chain, such as research and design, marketing, and strategic deployment [59].

Unlike traditional research paradigms that rely on singular objective metrics, annual report textual analysis provides a more nuanced lens to capture the intrinsic characteristics of corporate strategic intent and transformation practices. As legally mandated disclosure documents, corporate annual reports—particularly the Management’s Discussion and Analysis (MD&A) section—not only serve as a core mechanism for management–investor communication [60] but also provide a platform for companies to systematically articulate strategic plans and outline their future trajectory. The frequent appearance of specific keywords within the annual reports of listed firms is not mere repetition; rather, it signals a strategic pivot toward intelligent technologies, foreshadowing increased resource allocation and intensified initiatives within this domain, thus providing deeper insights into corporate transformation. More crucially, the annual report disclosure system, governed by security regulations, exerts a dual governance effect. First, the statutory nature of annual report disclosure imposes a commitment on management, compelling them to translate strategic plans into concrete operational practices to uphold market reputation. Second, the public and transparent nature of information disclosure establishes a collaborative monitoring mechanism involving multiple stakeholders, reducing agency costs between strategic pronouncements and actual behavior. These institutional attributes and mechanisms ensure the predictive validity of annual report information on corporate intelligent transformation initiatives. Consequently, this research builds upon the methodology of Yu et al. (2020) [61] to gauge the extent of corporate intelligent transformation by analyzing the frequency of intelligence-related keywords in the MD&A section of annual reports. After consulting a team of experts in intelligent transformation, this study selected relevant keywords, such as “intelligence”, “digital intelligence”, and “intelligent manufacturing”, to construct a lexicon for textual analysis using “Jieba” in Python, also handling negation keywords. Based on this, intelligent transformation was quantified by taking the logarithm of one plus the total frequency of the intelligence-related keywords used by the manufacturing enterprises in the year.

4.2.3. Control Variables

Building on existing research [25,62], we included the following variables as control variables: Size, Lev, TobinQ, ListAge, Board, ROA, HHI, and Fixed. To enhance the accuracy of the model, we further controlled for firm-level individual effects (Firm) and time-specific year effects (Year) in the empirical analysis. The detailed definitions and measurements of these variables are presented in Table 1.

Table 1.

Variable definition.

4.3. Model Construction

To investigate the enabling effect of intelligent transformation on innovation quality in manufacturing firms, we established the following model:

In this model, the dependent variable INQ represents the innovation quality of the i-th manufacturing firm in year t. The explanatory variable InTra represents the level of intelligent transformation of the i-th manufacturing firm in year t. Controls represents the series of control factors mentioned previously; ΣFirm and ΣYear represent firm and year fixed effects, respectively; and ε is the random error term of the model. α0 is the constant term, and α1 and α2 are the regression coefficients. If the regression coefficient α1 > 0, it indicates that intelligent transformation and innovation quality are positively correlated, meaning that intelligent transformation improves the innovation quality level of the manufacturing firms; if the regression coefficient α1 < 0, it indicates that intelligent transformation weakens the innovation quality level of the manufacturing firms.

5. Empirical Results and Analysis

5.1. Descriptive Statistics and Correlation Analysis

Table 2 presents the descriptive statistics for the key variables. The mean innovation quality (INQ) is 0.402, with a minimum of 0 and a maximum of 0.943, indicating significant variation in the innovation quality levels across the firms, with a clear distinction overall. However, the innovation quality of Chinese listed manufacturing firms is generally moderate. The mean intelligent transformation (InTra) is 2.339, with a minimum of 0 and a maximum of 5.313, suggesting that many firms have yet to implement intelligent transformation, highlighting substantial market potential. Additionally, there are considerable differences in the transformation levels among the firms. The control variables were selected based on studies such as those of Li et al. (2024) [2], Wang and Yang (2024) [62], and Zhu et al. (2024) [63], aligning with the existing literature, which supports the feasibility and scientific soundness of the chosen variables.

Table 2.

Descriptive statistics.

Table 3 presents the results of the correlation analysis for the variables. Intelligent transformation and innovation quality exhibit a significant positive correlation of 0.061, suggesting that intelligent transformation has the potential to enhance the innovation quality of manufacturing firms. The correlation coefficients for the other control variables are predominantly below 0.2, indicating minimal concerns regarding multicollinearity in the model.

Table 3.

Pearson correlation coefficients of key variables.

5.2. Baseline Results

Table 4 presents the baseline regression results of the impact of intelligent transformation on innovation quality in manufacturing firms. Column (1) shows the model with industry and year fixed effects, excluding the control variables, where the coefficient for intelligent transformation (InTra) is 0.012. Column (2) includes only the control variables, while column (3) controls for both firm and year fixed effects and includes the control variables. In this model, the coefficient for InTra is 0.013, and the regression results for innovation quality (INQ) are significantly positive at the 1% level. Economically, ceteris paribus, a one-percentage-point increase in the level of intelligent transformation results in a 0.013 unit increase in innovation quality. These results confirm that intelligent transformation significantly improves the innovation quality of manufacturing firms, thus supporting Hypothesis H1.

Table 4.

Results of baseline analysis.

5.3. Robustness Check

While the baseline regression results indicate a significant positive effect of intelligent transformation on innovation quality, this study employs the following methods for robustness testing to address concerns regarding the influence of variable and sample selection on the model’s econometric stability:

(1) Substitution of the Core Explanatory Variable: Based on Pan et al. (2020) [64], we redefined intelligent transformation as a binary dummy variable, assigning a value of 1 if a company explicitly stated it had undergone transformation, and 0 otherwise. We also introduced an alternative indicator (InTra1), representing the ratio of the intelligent transformation-related word frequency to the total word count in the company’s annual report, multiplied by 100 to eliminate dimensionality effects. As shown in columns (1) and (2) of Table 5, the baseline regression results remain consistent after the substitution, further supporting our original hypotheses.

Table 5.

Robustness test—variable level.

(2) Substitution of the Dependent Variable: We used an alternative measure of innovation quality (INQ1) as the dependent variable, calculated as the natural logarithm of the sum of the citations received by a firm’s patent applications in the following year, plus one. As shown in column (3) of Table 5, the coefficient for intelligent transformation remains significantly positive, further reinforcing the robustness of our conclusions.

(3) Inclusion of Additional Control Variables: Building on the original micro-level controls and following Yang et al. (2023) [25], we added the growth rate of operating income (Growth), the proportion of independent directors (Indep), CEO duality (Dual), and the shareholding ratio of the largest shareholder (Top 1) to strengthen the robustness of our results. As shown in column (4) of Table 5, the regression results remain consistent with the baseline findings, further supporting our original hypotheses.

(4) Exclusion of Data from Specific Years: The 2015 Chinese stock market crisis, a significant financial “shock”, severely challenged enterprises’ intelligent transformation and innovation activities. Moreover, the “Made in China 2025” policy, issued in May of the same year, may have prompted strategic responses in firms’ annual reports. The 2020 global pandemic also impacted businesses across industries, forcing many to suspend operations. To ensure the accuracy and robustness of our analysis, we excluded data from 2015 and from 2020. As shown in columns (1) and (2) of Table 6, the baseline regression results remain consistent, further supporting the original hypotheses.

Table 6.

Robustness test—other levels.

(5) Inclusion of the Lagged Dependent Variable: Including lagged innovation quality as a control variable captured past influences, clarifying causality and addressing potential time lags. This also reduced omitted variable bias, enhancing the model’s accuracy. As shown in column (3) of Table 6, the inclusion of the lagged variable leaves the baseline regression results unchanged, reinforcing the original hypotheses.

(6) Mitigating Strategic Firm Behavior: While the intelligent transformation index reflects a firm’s transformation progress, it may be influenced by strategic disclosure, with firms potentially overstating their progress. To mitigate this, following Ang et al. (2024) [65], we (1) excluded samples from the ChiNext market, where firms are highly correlated with intelligent transformation; (2) removed samples with a zero transformation score; and (3) retained only firms listed on the Shenzhen Stock Exchange with an “Excellent” or “Good” information disclosure rating. As shown in columns (4)–(6) of Table 6, the coefficient of intelligent transformation remains significantly positive, confirming that intelligent transformation enhances innovation quality and supporting our original hypotheses.

5.4. Endogeneity Test

Given the potential for endogeneity issues, such as reverse causality, omitted variable bias, and sample selection problems, to affect the baseline regression results, this study employed the following approaches for endogeneity testing:

(1) Lagged Explanatory Variable Test: Given that intelligent transformation not only impacts current innovation quality but also drives future improvement, we followed the approach of Ang et al. (2024) [65]. We used lagged data on intelligent transformation to reduce bias from the correlation between the explanatory variable and the error term, while mitigating potential issues with control variables. As shown in column (1) of Table 7, the inclusion of the lagged variable did not alter the key findings, further confirming that intelligent transformation significantly enhances innovation quality in manufacturing enterprises, reinforcing the robustness of our results.

Table 7.

Endogeneity test.

(2) Controlling for Higher-Order Fixed Effects: To enhance model precision and the credibility of our results, we introduced higher-order fixed effects at the industry level, accounting for sector-specific dynamics. This approach mitigates endogeneity biases, strengthening the reliability of our estimates. As shown in column (2) of Table 7, the results align with the baseline regression, further supporting the original hypotheses.

(3) Two-Stage Least Squares (2SLS): The relationship between intelligent transformation and innovation quality may face endogeneity issues, particularly due to potential reverse causality. While intelligent transformation enhances innovation quality, firms with higher innovation quality may be more inclined to pursue further transformation to strengthen their competitive edge. To mitigate this issue, we employed the Two-Stage Least Squares (2SLS) method. Following Nunn and Qian (2014) [66], we used China’s 1984 postal and telecommunication data as an instrumental variable. Communication patterns shaped by technological and societal factors influence the firms’ digital technology adoption during the sample period, satisfying the relevance condition. As public infrastructure for communication services, postal and telecommunication networks do not directly affect firms’ internal structures, meeting the exogeneity condition. Based on this, we used the product of the number of Internet users and fixed-line telephone subscribers in 1984 as another instrument. We also included industry-level intelligent transformation, which influences firms’ transformation efforts while indirectly affecting innovation quality, satisfying both the relevance and exogeneity conditions. After rejecting the “under-identification” and “weak identification” null hypotheses, the results in columns (3)–(6) of Table 7 support the original hypotheses.

(4) Heckman Two-Stage Regression: Our study focuses on listed firms actively pursuing intelligent transformation, potentially introducing non-random sample selection bias. For instance, firms adopting intelligent transformation may also exhibit higher innovation quality, skewing the results. To mitigate this issue, we applied the Heckman two-stage method. First, a Probit model was constructed with “whether a firm undertakes intelligent transformation” as the dependent variable to calculate the Inverse Mills Ratio (IMR). In the second stage, the IMR was included as a control variable in the regression model. As shown in column (7) of Table 7, after incorporating the IMR, intelligent transformation remains significantly associated with improved innovation quality in manufacturing enterprises, consistent with the prior findings.

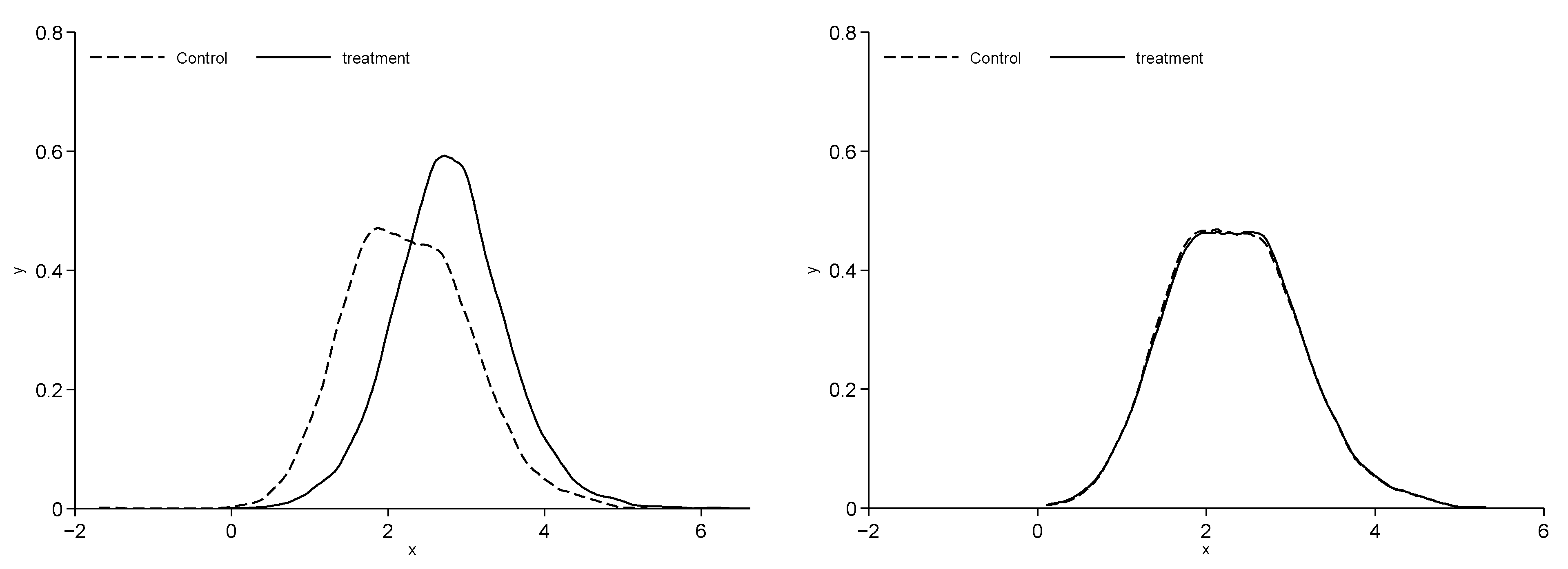

(5) Propensity Score Matching (PSM): We categorized the sample into treatment (InTra_dummy = 1) and control (InTra_dummy = 0) groups based on the firms’ engagement in intelligent transformation, using all the control variables as covariates. A Logit model was employed for estimation, followed by 1:1 nearest-neighbor matching without replacement. After matching, a balance test was conducted (see Figure 2), and a regression analysis was performed on the matched sample. The results in column (8) of Table 7 confirm the robustness of the main conclusions.

Figure 2.

PSM results.

5.5. Heterogeneity Test

The previous analysis assessed the impact of intelligent transformation on the innovation quality of manufacturing firms, validating the findings through robustness tests. However, this effect may vary with firm characteristics. Therefore, we further explored heterogeneity across regions, high-tech versus non-high-tech firms, and state-owned versus non-state-owned enterprises.

Columns (1) and (2) of Table 8 present regional sample tests. The regression coefficient of intelligent transformation on innovation quality is positive and statistically significant in the eastern region. In contrast, while the coefficient remains positive for the non-eastern region, it lacks statistical significance. From a supply-side perspective, the eastern region’s higher economic development and mature innovation environment attract talent, technology, and resources, fostering the adoption of advanced intelligent manufacturing technologies. On the demand side, larger firms in the east, facing more intense competition, have a stronger incentive to adopt intelligent transformation to reduce costs and enhance efficiency. In comparison, the non-eastern region, constrained by geographic and financial limitations, faces slower adoption and is still catching up.

Table 8.

Heterogeneity test.

Columns (3) and (4) of Table 8 present the sample tests for high-tech and non-high-tech enterprises. The manufacturing firms were divided into high-tech and non-high-tech groups. The results reveal that for non-high-tech enterprises, the coefficient of intelligent transformation is 0.016 and is statistically significant at the 1% level, whereas for high-tech firms, the coefficient is positive but not statistically significant. This difference is likely due to the advanced stage of intelligent technology adoption in high-tech enterprises, leaving limited room for further improvements in innovation quality. These firms thus experience diminishing returns and face potential technological bottlenecks. In contrast, non-high-tech enterprises, with a less developed technological foundation, can achieve substantial gains in production efficiency, resource optimization, and risk management through intelligent transformation, leading to a more significant enhancement in innovation quality.

Columns (5) and (6) of Table 8 present tests for state-owned and non-state-owned enterprises. The state-owned group is not statistically significant, while the non-state-owned group passes at the 1% level. State-owned enterprises, benefiting from their ownership structure, face less competitive pressure and are less inclined toward intelligent transformation. In contrast, non-state-owned enterprises, constrained by market forces, are driven by the need to innovate, enhance efficiency, reduce costs, and improve market responsiveness. Relatively disadvantaged in innovation resources and institutional support, non-state-owned enterprises can leverage intelligent transformation to optimize production, integrate resources, and adopt agile manufacturing, aligning with their developmental needs. As a result, they are more motivated to enhance innovation quality through intelligent transformation.

5.6. Mechanism Test

To further reveal the “black box” intelligent transformation mechanism that improves innovation quality, we developed the following econometric model [67]:

- (1)

- Financing Constraints

Intelligent transformation reduces information asymmetry between enterprises and financial institutions, offering a key avenue to alleviate financing constraints. Adopting the approach of Li et al. (2024) [14], we used the SA index to measure financing constraints. As shown in column (1) of Table 9, the coefficient of InTra is −0.003, statistically significant at the 1% level. This suggests that intelligent transformation, as a tool for resource orchestration, enables real-time access to upstream and downstream enterprise data through digital platforms. By enhancing information disclosure, it reduces internal and external asymmetry, enabling the efficient orchestration of supply chains, financial resources, and policy information. Through improved supply chain relationships, better information exchange with banks, and access to government subsidies, intelligent transformation alleviates financing constraints, strengthening internal financing and boosting overall innovation quality, completing the “resource orchestration–capability formation–value enhancement” cycle, as predicted by Hypothesis H2.

Table 9.

Mechanism analysis.

- (2)

- Organizational Resilience

Building on the methodology of Martin(2012) [68], we included total sales as a key indicator in the model to assess organizational resilience. The formula is as follows:

where Res denotes organizational resilience, Esale represents the previous year’s total sales of the enterprise, ΔEsale reflects the current year’s sales growth, Eall indicates the total sales of all enterprises in the prior year, and ΔEall shows sales growth across all enterprises. If Res is positive, organizational resilience is high; if negative, it is low. As shown in column (2) of Table 9, the estimated coefficient for InTra is 0.242 and is significant at the 1% level, suggesting that enhancing organizational resilience is a key mechanism through which intelligent transformation improves innovation quality. Intelligent transformation allows firms to dynamically coordinate resources, integrating technical, financial, and other assets, thereby bolstering resilience. In response to unexpected challenges, intelligent systems rapidly identify risks, trigger contingency plans, and deploy necessary resources. Additionally, by leveraging big data and AI, firms can continuously adjust strategies and resource allocation, optimizing decisions in real time. This strengthens a firm’s capacity to recover from setbacks, ensuring the sustained improvement in innovation quality, as anticipated in Hypothesis H3.

- (3)

- Risk Taking

Given the high volatility of the Chinese stock market, earning volatility is commonly used to assess the risk-taking propensity of enterprises. Following John et al. (2008) [69], we measured risk taking by calculating the rolling industry ROA based on a firm’s ROA volatility during the observation period. A higher value indicates greater volatility and larger risk-taking capacity. Additionally, following Faccio et al. (2011) [70], we standardized the measure by multiplying by 100, using the Risk indicator to quantify risk-taking ability. As shown in column (3) of Table 9, the coefficient of InTra is 0.001, significant at the 5% level, indicating that enhancing corporate risk-taking capability mediates the relationship between intelligent transformation and innovation quality improvement. Intelligent transformation, as a key resource orchestration mechanism, effectively coordinates resources such as finance and talent [24,26,27]. This model strengthens risk management, boosting risk taking and driving innovation quality enhancement, thus confirming Hypothesis H4.

6. Further Analysis

Enterprises undergoing intelligent transformation to enhance their innovation quality are engaged in a complex systemic process that involves the synergy of technology, operations, and strategy, rather than merely aggregating discrete elements. While existing research has explored the impact of intelligent transformation at an aggregate level [71], a comprehensive examination of its underlying nuances is still lacking. To address this, this study, grounded in the systemic nature of innovation quality enhancement and drawing on Vial’s perspective [23], seeks a deeper understanding of the intrinsic complexities of intelligent transformation. We recognize that its impact on innovation quality is neither linear nor isolated but permeates the entire process of enhancing technological capabilities, optimizing operational workflows, and reshaping strategic configurations. As a result, we construct a tripartite analytical framework encompassing “technology–operations–strategy”. Based on the earlier-developed intelligence keyword lexicon, we disaggregate intelligent transformation into three sub-dimensions: intelligent sensing technology (technology), intelligent production and manufacturing (operations), and intelligent strategic layout (strategy). This study aims to examine the differentiated mechanisms of the sub-dimensions of intelligence on the improvement in innovation quality in manufacturing enterprises, based on the empirical results in Table 10, to deeply and systematically understand the intrinsic association between the sub-dimensions of intelligent transformation and innovation quality. The results are presented in Table 10.

Table 10.

Further analysis.

Column (1) of Table 10 analyzes the impact of intelligent sensing technology on innovation quality in manufacturing enterprises. The results show that intelligent sensing technology has a significant positive effect on manufacturing firms’ innovation quality at the 1% significance level. Intelligent sensing technology provides enterprises with real-time insights into complex internal and external environments, enabling them to quickly capture innovation opportunities and execute activities with greater precision and efficiency, ultimately enhancing product innovation quality. For instance, Tesla significantly enhanced its innovation quality through the extensive use of intelligent sensing systems. Tesla vehicles, using the Dojo supercomputer and cloud-based AI algorithms, efficiently process vast amounts of data, quickly identifying user needs and latent pain points. For example, by analyzing driving data, Tesla identified pain points in windscreen wiper usage and iteratively upgraded its rain-sensing system, significantly improving automatic wiper accuracy. This data-driven approach accelerated the OTA (Over-The-Air) iteration of its autonomous driving system and significantly reduced accident rates. Conversely, many manufacturing enterprises are hindered in their innovation activities by a lack of keen perception and flexibility in responding to market changes, leading to “blind” innovation. Therefore, the widespread application of intelligent sensing technology in innovation decision-making would help manufacturing firms allocate resources more effectively, leading to a significant increase in innovation quality.

Column (2) of Table 10 examines the impact of intelligent production and manufacturing on innovation quality in manufacturing firms. The results show a statistically significant and positive impact of intelligent production and manufacturing on innovation quality at the 1% significance level. This is primarily due to intelligent production and manufacturing’s ability to leverage advanced technologies and information technology (IT) to optimize production processes, reduce human errors and defects, and directly enhance product innovation quality. Siemens’ Electronics Works Amberg (EWA) in Germany is a prime example of how intelligent production and manufacturing improves innovation quality. By deploying intelligent technologies such as digital twins and flexible production lines, EWA reduced product defect rates from 500 ppm to just 10 ppm. At the same time, product reliability increased to 99.9985%, and the new product development cycle was reduced by 30%. Furthermore, intelligent production and manufacturing enables flexible customization, allowing firms to better address user demands and market feedback. This optimizes product design and functionality, ensuring the high-quality application of innovative outputs. In contrast to traditional production paradigms, intelligent production and manufacturing transcends the trade-off between efficiency and quality, unlocking new opportunities for improving innovation quality in manufacturing enterprises.

Column (3) of Table 10 analyzes the impact of intelligent strategic layout on innovation quality in manufacturing firms. The findings reveal a significant positive effect of intelligent strategic layout on innovation quality, substantiated at the 1% significance level. Intelligent strategic layout integrates intelligent transformation into the overall strategic planning of manufacturing enterprises, proactively incorporating intelligent technologies for long-term development. This includes advancing intelligent manufacturing systems, intelligent service systems, and intelligent supply chain management, as well as upgrading production lines, thereby improving production efficiency and innovation quality. For example, China’s Midea Group, through its “Smart Home + Smart Manufacturing” dual-intelligence strategy, exemplifies how intelligent strategic layout enhances innovation quality. By establishing the M.IoT Industrial Internet platform, Midea reduced product defect rates by 74% and shortened the R&D cycle by 53%. Manufacturing enterprises must undertake well-considered, forward-looking strategic deployment to secure a competitive advantage in future competition and enhance their endogenous innovation quality. Conversely, a lack of long-term planning and a reactive approach to innovation may result in consistently low-quality products.

7. Discussion

Grounded in resource orchestration theory, this study conducted empirical tests using the annual data from Chinese A-share listed manufacturing companies to assess the impact of intelligent transformation on innovation quality. This section focuses on the conclusions of this study, as well as the implications and future directions for research.

Conclusions

First, drawing on resource orchestration theory, this study demonstrated that intelligent transformation significantly enhances innovation quality in manufacturing enterprises, and this conclusion holds after a series of robustness tests. In contrast to previous research on the impact of intelligent transformation on corporate innovation [17], this study specifically focuses on innovation quality within manufacturing firms, thereby significantly expanding the research by combining intelligent transformation and innovation quality. Resource orchestration theory suggests that the dynamic interplay between resources and capabilities is crucial for corporate value creation. However, previous research on intelligent transformation has mainly focused on a static view of resources [16,58], overlooking the dynamic process of “resource orchestration–capability formation–value creation”. This study empirically examined the orchestration process of key resources driven by intelligent transformation, addressing the gaps in existing research at both the theoretical and empirical levels. It expands the research boundary on the relationship between intelligent transformation and corporate innovation quality and provides both theoretical support and practical guidance for the high-quality development of manufacturing enterprises.

Second, this study uncovered the “black box” mechanism linking intelligent transformation and innovation quality in manufacturing firms. The mechanism analysis showed that intelligent transformation reduces financing constraints, strengthens organizational resilience, and improves risk taking, thereby driving innovation quality. While prior research has acknowledged the numerous advantages of intelligent transformation, such as alleviating financial constraints [71,72], and has recognized their significant implications for innovation quality enhancement [12], direct empirical evidence on how intelligent transformation influences innovation quality is lacking. The empirical research presented in this paper reveals that enterprise intelligent transformation, as a key means of resource orchestration, catalyzes continuous resource adjustments, enabling the effective integration and utilization of information, capital, organizational, and other resources. This strengthens the financing capacity, organizational resilience, and risk-bearing capacity within the enterprise, which dynamically empowers innovation quality enhancement in manufacturing firms and uncovers the “black box” between them.

Third, this study provided empirical evidence on the enhancement of innovation quality in manufacturing enterprises through intelligent transformation. Heterogeneity tests indicated that the effect was more pronounced in eastern regions, non-high-tech firms, and non-state-owned enterprises. Furthermore, the three sub-dimensions of intelligent transformation—intelligent sensing technology, intelligent production and manufacturing, and intelligent strategic layout—each contributed to the enhancement of innovation quality by reducing costs, improving data-driven decision-making, and integrating strategic initiatives. The practical contribution of this study lies in its extension of the application context of resource orchestration theory. It examined the economic consequences of intelligent transformation across different enterprises, industries, and regions and explored its impact on innovation quality. This facilitated more effective policy implementation and strengthened the role of intelligent technology in supporting innovation and development in manufacturing enterprises. Additionally, this study explored the empowering effects of the three sub-dimensions of intelligent transformation on innovation quality in manufacturing enterprises, addressing key research gaps in this field.

Based on these conclusions, this paper presents the following management recommendations:

First, manufacturing enterprises should actively embrace intelligent transformation as a strategic resource orchestration tool to systematically improve innovation quality and overall competitiveness. Based on the findings of this study, enterprises should do the following: (1) Strengthen financial safeguards and alleviate financing constraints. Manufacturing firms should deploy intelligent financial management systems, using AI algorithms to optimize capital allocation, refine cost control, and enable real-time cash flow alerts. (2) Optimize organizational structures and enhance organizational resilience. Manufacturing firms should promote flatter organizational structures and automate business processes. By strengthening cross-departmental collaboration, firms can enhance their ability to respond rapidly to market changes and absorb external shocks, thus boosting organizational resilience. (3) Improve risk management and enhance risk-bearing capacity. Manufacturing firms should build intelligent risk control platforms using big data, integrating multi-dimensional information on markets, customers, and competitors. Machine learning algorithms should be used to predict potential risks.

Second, manufacturing enterprises should deepen their strategic intelligent transformation across three synergistic dimensions—production manufacturing, sensing technology, and strategic deployment—to establish the following comprehensive innovation advantages: (1) Strengthen intelligent sensing to enable precise innovation. Enterprises should deploy sensors, RFID, and other sensing devices to build an enterprise-wide Internet of Things (IoT), enabling the real-time perception and an in-depth understanding of production factors, market demands, and user feedback. (2) Advance intelligent manufacturing to improve production efficiency. Enterprises should adopt advanced technologies such as industrial robots and intelligent equipment to build flexible, customized intelligent production models, achieving cost reduction, efficiency gains, and a qualitative improvement in product quality. (3) Strategically deploy intelligence to guide innovation direction. Senior management should formulate a clear intelligent transformation strategy and roadmap, establishing corresponding organizational structures and talent pools. This will provide forward-looking guidance and systematic support for innovation efforts.

Third, the enabling effect of intelligent transformation on innovation quality in manufacturing enterprises is context-dependent, requiring the formulation of policies tailored to regional, industry, and firm-specific conditions. For example, (1) promoting transformation with localized strategies. Enterprises in eastern regions should leverage their innovation advantages to lead in introducing cutting-edge intelligent technologies and restructuring industry value chains. Non-eastern enterprises, conversely, must increase investment to overcome locational disadvantages through technological leapfrogging. Governments should consider regional coordination and increase support for intelligent manufacturing in non-eastern regions to bridge the digital divide. (2) Guiding transformation with industry-specific policies. High-tech manufacturing enterprises should focus on product intelligence and re-engineering process flows to enhance innovative adaptability. Non-high-tech enterprises, on the other hand, should prioritize efficiency gains, cost reduction, and operational performance optimization. Industry regulators need to formulate differentiated guidance, clarifying key transformation priorities for each sector. (3) Optimizing transformation with firm-specific strategies. State-owned enterprises can leverage their resource advantages to lead in deploying intelligent infrastructure. Non-state-owned enterprises should base their approach on market demand, starting with production processes and implementing lean transformations. Governments should create a fair institutional environment for non-state-owned enterprises, removing systemic obstacles to their transformation.

Implication and Future Directions

This study broadened the scope and depth of existing research on intelligent transformation and innovation quality, enriched the application of resource orchestration theory, and provided valuable insights for innovation management in manufacturing enterprises. However, several limitations remain.

First, this study investigated the enabling effect of intelligent transformation on innovation quality using a sample of Chinese manufacturing enterprises. Future research could expand the scope to include international data, incorporating firms from various countries and regions, thus providing more universally applicable guidance for the global implementation of intelligent transformation.

Second, regarding the research methodology, this study measured the level of intelligent transformation in manufacturing enterprises using a dictionary-based approach applied to annual reports of listed companies. Future research could use cutting-edge machine learning methods and large language models (LLMs) to develop a more sophisticated set of intelligent transformation indicators. From a modeling perspective, this study primarily focused on a simple linear approach. Future studies could explore whether a non-linear relationship exists between intelligent transformation and innovation quality.

Third, this study focused on the discussion of mediating mechanisms and did not incorporate moderating variables to examine boundary conditions. Therefore, future research could explore potential moderating variables, such as industry competition levels or national industrial policies. This would more comprehensively reveal the complexity and context dependency of intelligent transformation’s enabling effect on corporate innovation quality.

Author Contributions

Conceptualization, X.L. and Y.D.; methodology, Q.Z.; formal analysis, X.L.; data curation, X.L.; writing—original draft preparation, X.L. and Q.Z.; writing—review and editing, Z.W.; All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by [The Pathways and Governance of Blockchain-Driven Supply Chain Finance Ecosystems in Empowering Corporate Development] grant number [No.: 24CGL037].

Data Availability Statement

The data presented in this study are openly available in CSMAR at https://data.csmar.com (accessed on 9 February 2025).

Conflicts of Interest

The authors declare no conflict of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| ST | Special Treatment |

| R&D | Research and Development |

References

- Zhao, A.; Wang, J.; Sun, Z.; Guan, H. Environmental taxes, technology innovation quality and firm performance in China—A test of effects based on the Porter hypothesis. Econ. Anal. Policy 2022, 74, 309–325. [Google Scholar] [CrossRef]

- Li, C.; Chen, H.; Xie, W.; Wang, P. Tax incentives for human capital accumulation and enterprise innovation quality: Evidence of a quasi-natural experiment in China. Financ. Res. Lett. 2024, 70, 106342. [Google Scholar] [CrossRef]

- Dang, J.; Motohashi, K. Patent statistics: A good indicator for innovation in China? Patent subsidy program impacts on patent quality. China Econ. Rev. 2015, 35, 137–155. [Google Scholar] [CrossRef]

- Fisch, C.; Sandner, P.; Regner, L. The value of Chinese patents: An empirical investigation of citation lags. China Econ. Rev. 2017, 45, 22–34. [Google Scholar] [CrossRef]

- Kang, Y.; Ma, X.; Xie, M.; Zhong, N. Innovation’s false spring: US export controls and Chinese patent quality. J. Int. Money Financ. 2025, 150, 103229. [Google Scholar] [CrossRef]

- Yu, Y.; Zhang, J.Z.; Cao, Y.; Kazancoglu, Y. Intelligent transformation of the manufacturing industry for Industry 4.0: Seizing financial benefits from supply chain relationship capital through enterprise green management. Technol. Forecast. Soc. Change 2021, 172, 120999. [Google Scholar] [CrossRef]

- Huergo, E.; Moreno, L. Subsidies or loans? Evaluating the impact of R&D support programmes. Res. Policy 2017, 46, 1198–1214. [Google Scholar]

- Balsmeier, B.; Fleming, L.; Manso, G. Independent boards and innovation. J. Financ. Econ. 2017, 123, 536–557. [Google Scholar] [CrossRef]

- Zhang, J.; Zheng, W. Has catch-up strategy of innovation inhibited the quality of China’s patents. Econ. Res. J. 2018, 53, 28–41. [Google Scholar]

- Zhuo, C.; Chen, J. Can digital transformation overcome the enterprise innovation dilemma: Effect, mechanism and effective boundary. Technol. Forecast. Soc. Change 2023, 190, 122378. [Google Scholar] [CrossRef]

- Chin, T.; Wang, W.; Yang, M.; Duan, Y.; Chen, Y. The moderating effect of managerial discretion on blockchain technology and the firms’ innovation quality: Evidence from Chinese manufacturing firms. Int. J. Prod. Econ. 2021, 240, 108219. [Google Scholar] [CrossRef]

- Nambisan, S.; Lyytinen, K.; Majchrzak, A.; Song, M. Digital innovation management. MIS Q. 2017, 41, 223–238. [Google Scholar] [CrossRef]

- Hajli, M.; Sims, J.M.; Ibragimov, V. Information technology (IT) productivity paradox in the 21st century. Int. J. Product. Perform. Manag. 2015, 64, 457–478. [Google Scholar] [CrossRef]

- Li, T. Does smart transformation in manufacturing promote enterprise value chain upgrades? Financ. Res. Lett. 2024, 69, 106124. [Google Scholar] [CrossRef]

- Zhang, L.; Zhang, X. Impact of digital government construction on the intelligent transformation of enterprises: Evidence from China. Technol. Forecast. Soc. Change 2025, 210, 123787. [Google Scholar] [CrossRef]

- Sirmon, D.G.; Hitt, M.A.; Ireland, R.D. Managing firm resources in dynamic environments to create value: Looking inside the black box. Acad. Manag. Rev. 2007, 32, 273–292. [Google Scholar] [CrossRef]

- Rammer, C.; Fernández, G.P.; Czarnitzki, D. Artificial intelligence and industrial innovation: Evidence from German firm-level data. Res. Policy 2022, 51, 104555. [Google Scholar] [CrossRef]

- Li, B.-H.; Hou, B.-C.; Yu, W.-T.; Lu, X.-B.; Yang, C.-W. Applications of artificial intelligence in intelligent manufacturing: A review. Front. Inf. Technol. Electron. Eng. 2017, 18, 86–96. [Google Scholar] [CrossRef]

- Zhou, N.; Zhang, S.; Chen, J.E.; Han, X. The role of information technologies (ITs) in firms’ resource orchestration process: A case analysis of China’s “Huangshan 168”. Int. J. Inf. Manag. 2017, 37, 713–715. [Google Scholar] [CrossRef]

- Snyder, H. Literature review as a research methodology: An overview and guidelines. J. Bus. Res. 2019, 104, 333–339. [Google Scholar] [CrossRef]

- Babina, T.; Fedyk, A.; He, A.; Hodson, J. Artificial intelligence, firm growth, and product innovation. J. Financ. Econ. 2024, 151, 103745. [Google Scholar] [CrossRef]

- Shen, Y.; Zhang, X. Intelligent manufacturing, green technological innovation and environmental pollution. J. Innov. Knowl. 2023, 8, 100384. [Google Scholar] [CrossRef]

- Vial, G. Understanding digital transformation: A review and a research agenda. J. Strateg. Inf. Syst. 2019, 28, 118–144. [Google Scholar] [CrossRef]

- Frank, A.G.; Dalenogare, L.S.; Ayala, N.F. Industry 4.0 technologies: Implementation patterns in manufacturing companies. Int. J. Prod. Econ. 2019, 210, 15–26. [Google Scholar] [CrossRef]