Bridging CEO Educational Background and Green Innovation: The Moderating Roles of Green Finance and Market Competition

Abstract

1. Introduction

2. Literature Review

2.1. Theoretical Advances

2.2. Antecedent Variables of Green Innovation

2.3. The Governance Effects of STEM CEOs

3. Theoretical Analysis and Hypothesis Development

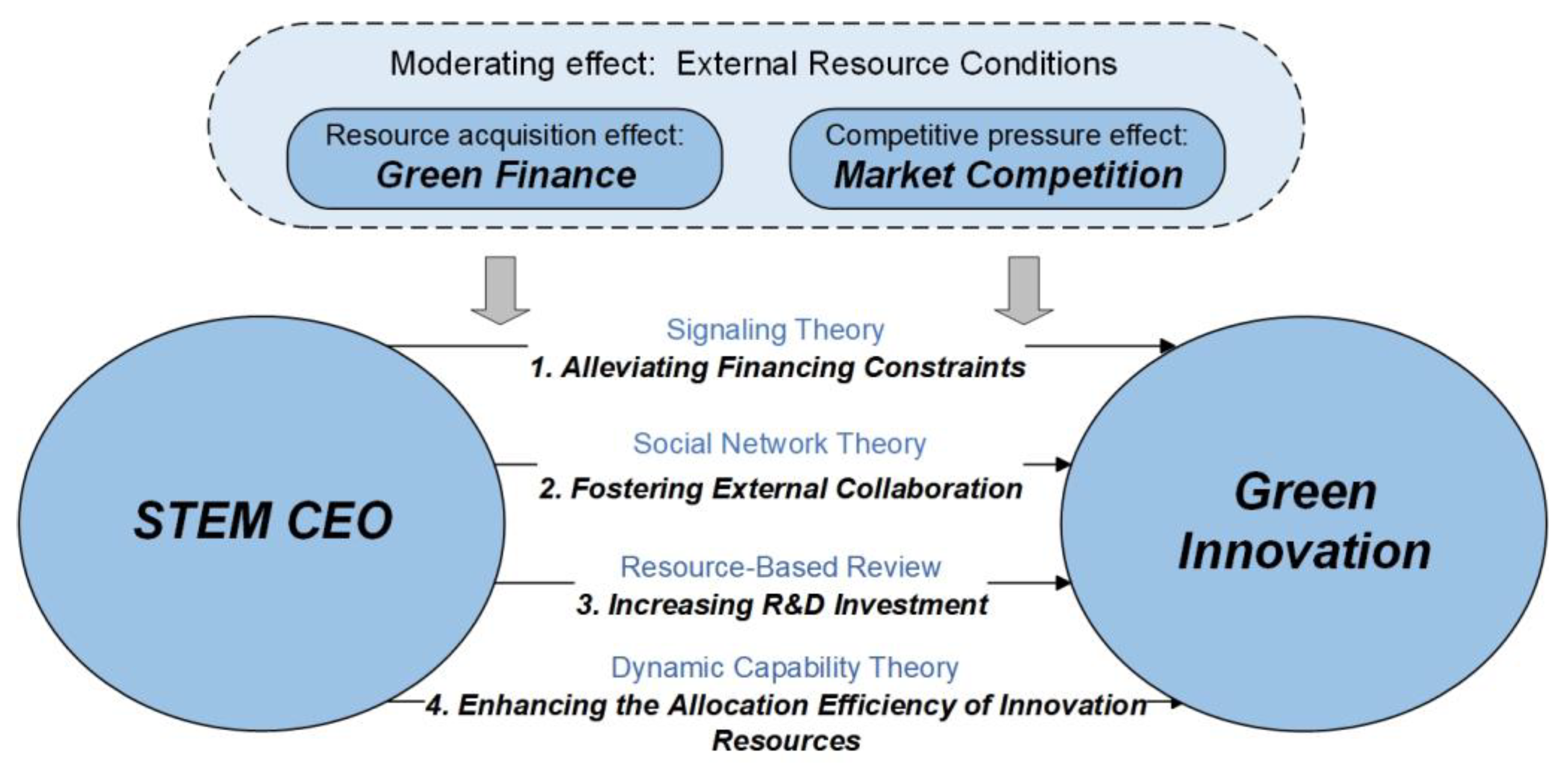

3.1. STEM CEOs and Green Innovation

3.2. Potential Channels of STEM CEOs and Corporate Green Innovation

3.3. The Moderating Effect of the External Environment

3.4. Theoretical Framework Explanation

4. Research Design

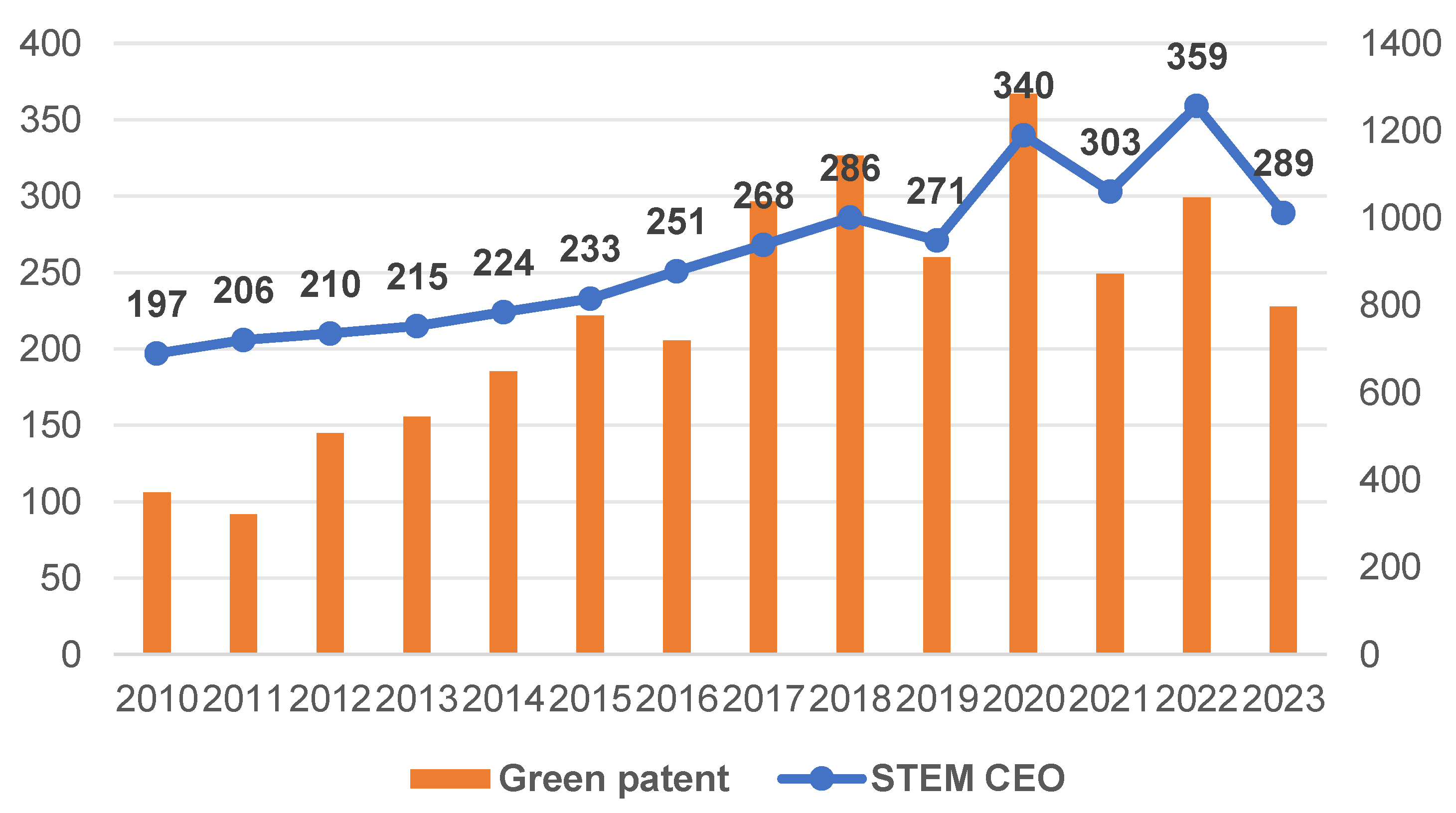

4.1. Sample and Data

4.2. Variable Measurement

4.2.1. Dependent Variable

4.2.2. Independent Variable

4.2.3. Channel Variables

4.2.4. Moderating Variable

4.2.5. Control Variables

4.3. Model Construction

5. Empirical Results and Analysis

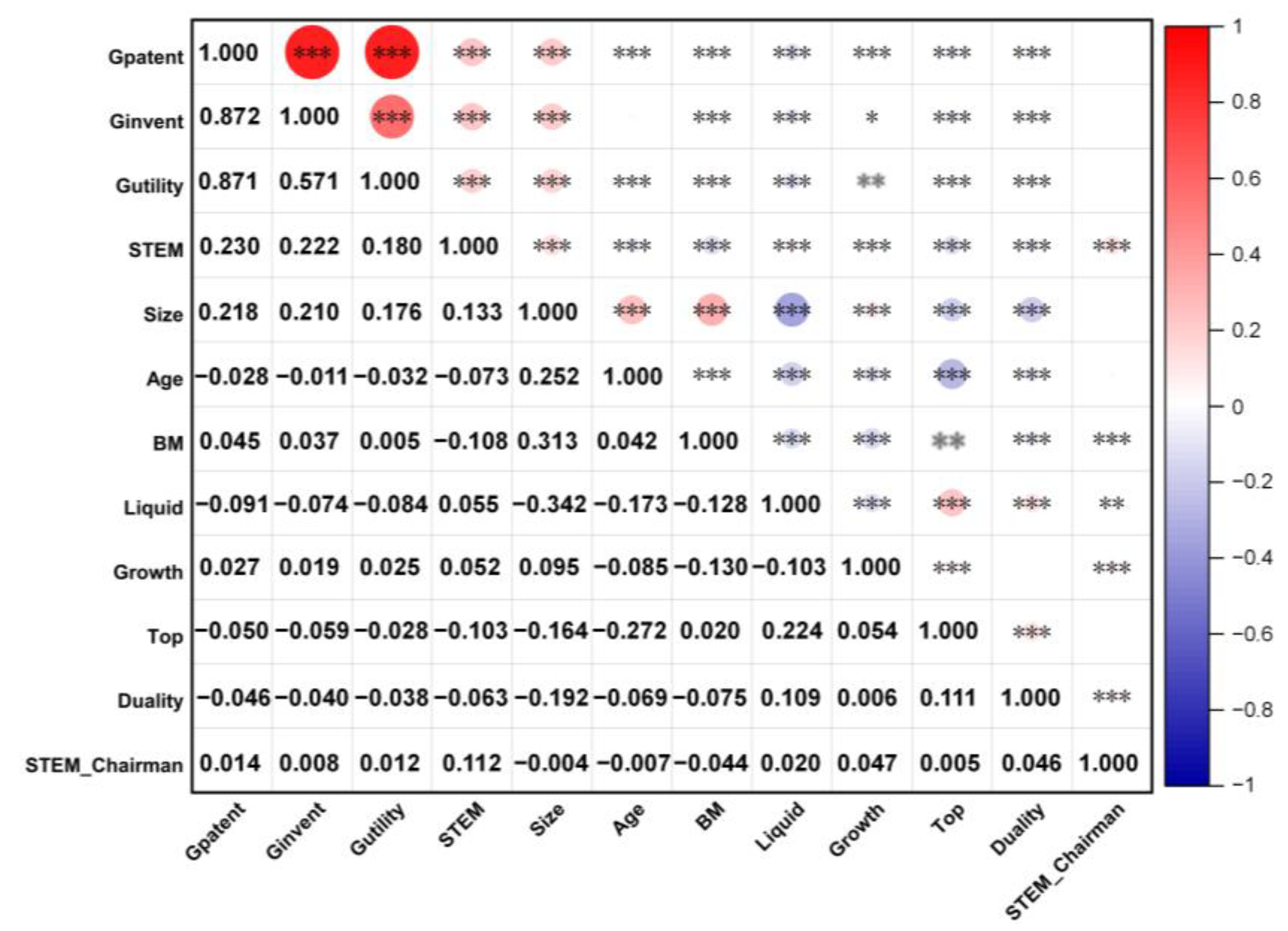

5.1. Descriptive Statistics

5.2. Baseline Results

5.3. Robustness Test

5.3.1. Tobit Model and Alternative Green Innovation Variables

5.3.2. Lagged Independent Variable

5.3.3. Propensity Score Matching (PSM) and Entropy Balancing Matching (EBM)

5.3.4. The 2SLS Approach

5.4. Potential Channels

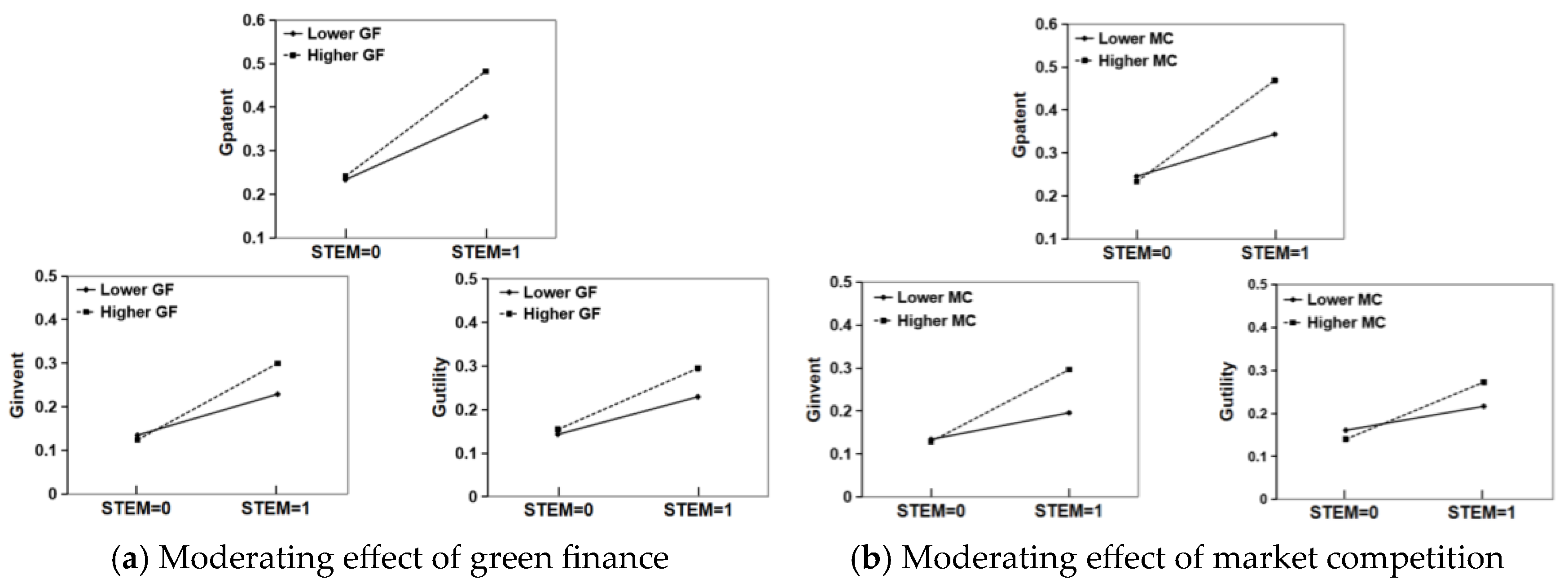

5.5. Moderating Effects

5.6. Heterogeneity Analyses

5.6.1. Heterogeneity Analysis by Public Environmental Concern

5.6.2. Heterogeneity Analysis by Industry

5.6.3. Heterogeneity Analysis by ESG Performance

5.6.4. Heterogeneity Analysis by Industry Competition

6. Discuss

7. Summary and Conclusions

7.1. Research Conclusion

7.2. Limitations and Future Research Opportunities

7.3. Recommendations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Wang, Z.; Zhang, X.; Song, X.; Huang, J. Unlocking AI’s Radical Innovation Potential: The Contingent Roles of Digital Foundation and Government Subsidy. Systems-Basel 2025, 13, 702. [Google Scholar] [CrossRef]

- Cheng, Y.; Du, K.; Yao, X. Stringent environmental regulation and inconsistent green innovation behavior: Evidence from air pollution prevention and control action plan in China. Energy Econ. 2023, 120, 106571. [Google Scholar] [CrossRef]

- Su, Y.; Liu, Z.; Liang, S. Does CEO information technology background promote substantive green innovation or strategic green innovation? Technol. Anal. Strateg. Manag. 2023, 37, 253–266. [Google Scholar] [CrossRef]

- Zhao, S.; Zhang, B.; Shao, D.; Wang, S. Can Top Management Teams’ Academic Experience Promote Green Innovation Output: Evidence from Chinese Enterprises. Sustainability 2021, 13, 11453. [Google Scholar] [CrossRef]

- Quan, X.; Ke, Y.; Qian, Y.; Zhang, Y. CEO Foreign Experience and Green Innovation: Evidence from China. J. Bus. Ethics 2023, 182, 535–557. [Google Scholar] [CrossRef]

- Hu, W.; Shi, S. CEO green background and enterprise green innovation. Int. Rev. Econ. Financ. 2025, 97, 103765. [Google Scholar] [CrossRef]

- Zollman, A. Learning for STEM Literacy: STEM Literacy for Learning. Sch. Sci. Math. 2012, 112, 12–19. [Google Scholar] [CrossRef]

- Kelley, T.R.; Knowles, J.G. A conceptual framework for integrated STEM education. Int. J. STEM Educ. 2016, 3, 11. [Google Scholar] [CrossRef]

- Hsieh, T.-S.; Kim, J.-B.; Wang, R.R.; Wang, Z. Educate to innovate: STEM directors and corporate innovation. J. Bus. Res. 2022, 138, 229–238. [Google Scholar] [CrossRef]

- Cho, C.H.; Jung, J.H.; Kwak, B.; Lee, J.; Yoo, C.-Y. Professors on the Board: Do They Contribute to Society Outside the Classroom? J. Bus. Ethics 2017, 141, 393–409. [Google Scholar] [CrossRef]

- Kong, D.; Liu, B.; Zhu, L. Stem CEOs and firm digitalization. Financ. Res. Lett. 2023, 58, 104573. [Google Scholar] [CrossRef]

- Garcia-Blandon, J.; Argilés-Bosch, J.M.; Ravenda, D. Exploring the relationship between ceo characteristics and performance. J. Bus. Econ. Manag. 2019, 20, 1064–1082. [Google Scholar] [CrossRef]

- Simon, H.A. A Behavioral Model of Rational Choice. Q. J. Econ. 1955, 69, 99–118. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Mason, P.A. Upper echelons: The organization as a reflection of its top managers. Acad. Manag. Rev. 1984, 9, 193–206. [Google Scholar] [CrossRef]

- Ren, S.; Wang, Y.; Hu, Y.; Yan, J. CEO hometown identity and firm green innovation. Bus. Strateg. Environ. 2021, 30, 756–774. [Google Scholar] [CrossRef]

- Ross, S.A. The Determination of Financial Structure: The Incentive-Signalling Approach. Bell J. Econ. 1977, 8, 23–40. [Google Scholar] [CrossRef]

- Connelly, B.L.; Certo, S.T.; Ireland, R.D.; Reutzel, C.R. Signaling Theory: A Review and Assessment. J. Manag. 2011, 37, 39–67. [Google Scholar] [CrossRef]

- Reagans, R.; Zuckerman, E.W. Networks, Diversity, and Productivity: The Social Capital of Corporate R&D Teams. Organ. Sci. 2001, 12, 502–517. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Grant, R.M. Toward a Knowledge-Based Theory of the Firm. Strateg. Manag. J. 1996, 17, 109–122. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating Dynamic Capabilities: The Nature and Microfoundations of (Sustainable) Enterprise Performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Wang, M.; Yu, X.; Hong, X.; Yang, X. Can digital finance promote green innovation collaboration in enterprises? Glob. Financ. J. 2025, 65, 101109. [Google Scholar] [CrossRef]

- Hu, Y.; Jin, S.; Ni, J.; Peng, K.; Zhang, L. Strategic or substantive green innovation: How do non-green firms respond to green credit policy? Econ. Model. 2023, 126, 106451. [Google Scholar] [CrossRef]

- Zhou, P.; Song, F.M.; Huang, X. Environmental regulations and firms’ green innovations: Transforming pressure into incentives. Int. Rev. Financ. Anal. 2023, 86, 102504. [Google Scholar] [CrossRef]

- Liu, J.; Zhao, M.; Wang, Y. Impacts of government subsidies and environmental regulations on green process innovation: A nonlinear approach. Technol. Soc. 2020, 63, 101417. [Google Scholar] [CrossRef]

- Qiao, N.; Xu, B. Green credit policy, media pressure, and corporate green innovation. Int. Rev. Econ. Financ. 2025, 98, 103921. [Google Scholar] [CrossRef]

- Yu, C.-H.; Wu, X.; Zhang, D.; Chen, S.; Zhao, J. Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 2021, 153, 112255. [Google Scholar] [CrossRef]

- Liu, X.; Liu, D. How green finance drives new-quality productivity from the perspective of Chinese modernization. Financ. Res. Lett. 2025, 82, 107496. [Google Scholar] [CrossRef]

- Ji, H.; Yu, Z.; Tian, G.; Wang, D.; Wen, Y. Market competition, environmental, social and corporate governance investment, and enterprise green innovation performance. Financ. Res. Lett. 2025, 77, 107057. [Google Scholar] [CrossRef]

- Zhu, Z.; Huang, Y.; Hu, C.; Yan, Y. The green effects of competition: Administrative monopoly regulation and green innovation. Financ. Res. Lett. 2024, 64, 105488. [Google Scholar] [CrossRef]

- Zhang, Z.; Wu, Y.; Wang, H. Corporate financial fragility, R&D investment, and corporate green innovation: Evidence from China. Financ. Res. Lett. 2024, 62, 105190. [Google Scholar] [CrossRef]

- Wu, R. Innovation or imitation? The impacts of financial factors on green and general research and development. Int. Rev. Econ. Financ. 2023, 88, 1068–1086. [Google Scholar] [CrossRef]

- Abbas, J.; Khan, S.M. Green knowledge management and organizational green culture: An interaction for organizational green innovation and green performance. J. Knowl. Manag. 2023, 27, 1852–1870. [Google Scholar] [CrossRef]

- Amore, M.D.; Bennedsen, M. Corporate governance and green innovation. J. Environ. Econ. Manag. 2016, 75, 54–72. [Google Scholar] [CrossRef]

- Shahab, Y.; Ntim, C.G.; Chen, Y.; Ullah, F.; Li, H.; Ye, Z. Chief executive officer attributes, sustainable performance, environmental performance, and environmental reporting: New insights from upper echelons perspective. Bus. Strateg. Environ. 2020, 29, 1–16. [Google Scholar] [CrossRef]

- Kassinis, G.; Panayiotou, A.; Dimou, A.; Katsifaraki, G. Gender and Environmental Sustainability: A Longitudinal Analysis. Corp. Soc. Responsib. Environ. Manag. 2016, 23, 399–412. [Google Scholar] [CrossRef]

- Khanchel, I.; Lassoued, N.; Khiari, C. Watch me invest: Does CEO narcissism affect green innovation? CEO personality traits and eco-innovation. Bus. Ethics Environ. Responsib. 2024, 33, 486–504. [Google Scholar] [CrossRef]

- Wang, Y.; Liu, Y. Can the Top Management Team’s Environmental Attention Promote Corporate Green Innovation? Sustainability 2024, 16, 3495. [Google Scholar] [CrossRef]

- Huang, H.; Chang, Y.; Zhang, L. CEO’s marketing experience and firm green innovation. Bus. Strateg. Environ. 2023, 32, 5211–5233. [Google Scholar] [CrossRef]

- Peri, G.; Shih, K.; Sparber, C. STEM workers, H-1B visas, and productivity in US cities. J. Labor Econ. 2015, 33, S225–S255. [Google Scholar] [CrossRef]

- Jung, T.; Ejermo, O. Demographic patterns and trends in patenting: Gender, age, and education of inventors. Technol. Forecast. Soc. Chang. 2014, 86, 110–124. [Google Scholar] [CrossRef]

- Rizki, A.; Ningsih, S.; Ekasari, W.F.; Putri, F.V.; Aini, S.N.; Nowland, J. The impact of STEM CEO on investment efficiency: Evidence from Indonesia. Cogent Bus. Manag. 2024, 11, 2429800. [Google Scholar] [CrossRef]

- Alderman, J.; Forsyth, J.; Griffy-Brown, C.; Walton, R.C. The benefits of hiring a STEM CEO: Decision making under innovation and real options. Technol. Soc. 2022, 71, 102064. [Google Scholar] [CrossRef]

- White, J.T.; Woidtke, T.; Black, H.A.; Schweitzer, R.L. Appointments of academic directors. J. Corp. Financ. 2014, 28, 135–151. [Google Scholar] [CrossRef]

- Khushk, A.; Zhiying, L.; Yi, X.; Zengtian, Z. Technology Innovation in STEM Education: A Review and Analysis. Int. J. Educ. Res. Innov. 2023, 19, 29–51. [Google Scholar] [CrossRef]

- Cahyono, S.; Ardianto, A.; Nasih, M. Breaking barriers: CEOs STEM educational background and corporate climate change disclosure. Int. J. Account. Inf. Manag. 2024, 32, 651–684. [Google Scholar] [CrossRef]

- Huang, S.K. The Impact of CEO Characteristics on Corporate Sustainable Development. Corp. Soc. Responsib. Environ. Manag. 2013, 20, 234–244. [Google Scholar] [CrossRef]

- Zhou, M.; Chen, F.; Chen, Z. Can CEO education promote environmental innovation: Evidence from Chinese enterprises. J. Clean. Prod. 2021, 297, 126725. [Google Scholar] [CrossRef]

- Wu, W.; Wang, X. Navigating Strategic Balance: CEO Big Data Orientation, Environmental Investment, and Technological Innovation in Chinese Manufacturing. Systems-Basel 2024, 12, 255. [Google Scholar] [CrossRef]

- Jaggia, S.; Thosar, S. CEO management style: Does educational background play a role? Manag. Financ. 2021, 47, 1465–1485. [Google Scholar] [CrossRef]

- Zhang, J.; Xue, C.; Zhang, J. The Impact of CEO Educational Background on Corporate Risk-Taking in China. J. Risk Financ. Manag. 2022, 16, 9. [Google Scholar] [CrossRef]

- Yang, B.; Du, X. How CEO power intensity drives the improvement of corporate green innovation performance: An in-depth analysis based on the mediating role of financing costs. Financ. Res. Lett. 2025, 83, 107734. [Google Scholar] [CrossRef]

- Xie, J.; Abbass, K.; Li, D. Advancing eco-excellence: Integrating stakeholders’ pressures, environmental awareness, and ethics for green innovation and performance. J. Environ. Manag. 2024, 352, 120027. [Google Scholar] [CrossRef]

- Zhang, W.; Zhao, Y.; Meng, F. ESG performance and green innovation of Chinese enterprises: Based on the perspective of financing constraints. J. Environ. Manag. 2024, 370, 122955. [Google Scholar] [CrossRef]

- Granovetter, M.S. The strength of weak ties. Am. J. Sociol. 1973, 78, 1360–1380. [Google Scholar] [CrossRef]

- Yang, J.; Grove, S.; Li, M. Bonding versus bridging: Disentangling effects of CEO social capital on firm exploratory innovation. R D Manag. 2025, 55, 855–872. [Google Scholar] [CrossRef]

- Haojun, W.; Jiazhu, L. Professional experience of CEOs in industry associations and corporate green innovation-empirical evidence from China. Pac.-Basin Financ. J. 2024, 85, 102383. [Google Scholar] [CrossRef]

- Ali, A.; Jiang, X.; Ali, A. Social ties, absorptive capacity, and the adoption of green innovation: A social capital perspective. Int. J. Manpow. 2023, 44, 214–230. [Google Scholar] [CrossRef]

- Wong, C.Y.; Boon-itt, S.; Wong, C.W.Y. The contingency effects of internal and external collaboration on the performance effects of green practices. Resour. Conserv. Recycl. 2021, 167, 105383. [Google Scholar] [CrossRef]

- Abdurrahman, A. Examining the impact of digital transformation on digital product innovation performance in banking industry through the integration of resource-based view and dynamic capabilities. J. Strategy Manag. 2025, 36, 200540. [Google Scholar] [CrossRef]

- Khanra, S.; Kaur, P.; Joseph, R.P.; Malik, A.; Dhir, A. A resource-based view of green innovation as a strategic firm resource: Present status and future directions. Bus. Strateg. Environ. 2022, 31, 1395–1413. [Google Scholar] [CrossRef]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manage. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef]

- Zor, S. A neural network-based measurement of corporate environmental attention and its impact on green open innovation: Evidence from heavily polluting listed companies in China. J. Clean. Prod. 2023, 432, 139815. [Google Scholar] [CrossRef]

- Aragón-Correa, J.A.; Sharma, S. A contingent resource-based view of proactive corporate environmental strategy. Acad. Manag. Rev. 2003, 28, 71–88. [Google Scholar] [CrossRef]

- Zhao, S.; Guan, Y.; Zhou, H.; Hu, F. Making digital technology innovation happen: The role of the CEO’s information technology backgrounds. Econ. Model. 2024, 140, 106866. [Google Scholar] [CrossRef]

- Barker, V.L., III; Mueller, G.C. CEO characteristics and firm R&D spending. Manag. Sci. 2002, 48, 782–801. [Google Scholar] [CrossRef]

- Wan, X.; Chun, S.; Xue, S.; Shehzad, M.U. The causal and interactive approach to drive sustainability: Role of green dynamic capabilities, ambidextrous green innovation strategy and resource orchestration capability. Bus. Process. Manag. J. 2025, ahead-of-print. [Google Scholar] [CrossRef]

- Xiong, X.; He, W.; Chen, S.; Wu, Y. Green finance, green technology innovation, and carbon emission reduction. Environ. Res. Commun. 2025, 7, 045018. [Google Scholar] [CrossRef]

- Chen, F.; Zeng, X.; Guo, X. Green finance, climate change, and green innovation: Evidence from China. Financ. Res. Lett. 2024, 63, 105283. [Google Scholar] [CrossRef]

- Bai, R.; Wu, H.; Tan, Z.; Hong, T. Green finance and green innovation: The Moderating role of ESG and synergies with inclusive finance. Res. Int. Bus. Financ. 2025, 79, 103056. [Google Scholar] [CrossRef]

- Hunjra, A.I. The green intentions of capital: How green finance is changing the boundaries of corporate sustainability strategies. J. Environ. Manag. 2025, 390, 126362. [Google Scholar] [CrossRef]

- Qiu, W.; Yang, W.; Qiu, L. Population aging, market competition and enterprise green innovation. Financ. Res. Lett. 2025, 74, 106596. [Google Scholar] [CrossRef]

- Labianca, G.; Fairbank, J.F.; Andrevski, G.; Parzen, M. Striving toward the future: Aspiration—Performance discrepancies and planned organizational change. Strateg. Organ. 2009, 7, 433–466. [Google Scholar] [CrossRef]

- Baum, J.A.C.; Dahlin, K.B. Aspiration Performance and Railroads’ Patterns of Learning from Train Wrecks and Crashes. Organ. Sci. 2007, 18, 368–385. [Google Scholar] [CrossRef]

- Karuna, C. Industry product market competition and managerial incentives. J. Account. Econ. 2007, 43, 275–297. [Google Scholar] [CrossRef]

- Zhang, Y.; Wiersema, M.F. Stock Market Reaction to CEO Certification: The Signaling Role of CEO Background. Strateg. Manag. J. 2009, 30, 693–710. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Cong, R.; Gao, H.; Wang, L.; Liu, B.; Wang, Y. Achieving Optimal Distinctiveness in Green Innovation: The Role of Pressure Congruence. Systems-Basel 2025, 13, 657. [Google Scholar] [CrossRef]

- Yu, X.; Hu, Y.; Feng, S. The bright side of executive financial background: A perspective based on corporate ESG performance. Environ. Res. Commun. 2025, 7, 075006. [Google Scholar] [CrossRef]

- Liu, M.; Shan, Y.; Li, Y. Heterogeneous Partners, R&D cooperation and corporate innovation capability: Evidence from Chinese manufacturing firms. Technol. Soc. 2023, 72, 102183. [Google Scholar] [CrossRef]

- Feng, L.; Hu, J.; Huang, M.; Irfan, M.; Hu, M. From algorithms to invention: AI’s impact on corporate innovation output and efficiency. Q. Rev. Econ. Financ. 2025, 104, 102042. [Google Scholar] [CrossRef]

- Yu, X. Potential contributions of digital finance to alleviating the ‘low-end lock-in’ dilemma for green innovation in enterprises. Environ. Res. Commun. 2024, 6, 055007. [Google Scholar] [CrossRef]

- Hainmueller, J. Entropy Balancing for Causal Effects: A Multivariate Reweighting Method to Produce Balanced Samples in Observational Studies. Pol. Anal. 2012, 20, 25–46. [Google Scholar] [CrossRef]

- Chen, N.; Hu, Y.; Wang, L. Enhancing enterprises’ green and low-carbon innovation through digital technology embeddedness: From passive response to active innovation. J. Innov. Knowl. 2025, 10, 100801. [Google Scholar] [CrossRef]

- Ding, Z.; Zhong, C.; Liu, D.; Liu, W. Public environmental concern, economic policy uncertainty, and green transformation of industrial firms. J. Environ. Manag. 2025, 394, 127505. [Google Scholar] [CrossRef] [PubMed]

- Chen, Z.; Jin, J.; Li, M. Does media coverage influence firm green innovation? The moderating role of regional environment. Technol. Soc. 2022, 70, 102006. [Google Scholar] [CrossRef]

- Zhu, P.H.; Cao, B.; Wei, W.; Zhang, K. How does public environmental concern affect ESG performance: Evidence from Chinese A-shares listed firms. Sustain. Futures 2025, 10, 101277. [Google Scholar] [CrossRef]

- Lu, Y.; Gao, Y.; Zhang, Y.; Wang, J. Can the green finance policy force the green transformation of high-polluting enterprises? A quasi-natural experiment based on “Green Credit Guidelines”. Energy Econ. 2022, 114, 106265. [Google Scholar] [CrossRef]

- Hao, X.; Wen, S.; Zhu, J.; Wu, H.; Hao, Y. Can business managerial capacity improve green innovation in different industries? Evidence from Chinese listed companies. Bus. Strateg. Environ. 2024, 33, 2600–2620. [Google Scholar] [CrossRef]

- Chen, Y.; Cao, C. Influence of distracted institutional investors on corporate green innovation: A data-driven analysis from China. J. Data Inf. Manag. 2025, 7, 185–214. [Google Scholar] [CrossRef]

- Wang, Q.; Xu, Y. Can industry competition stimulate enterprises ESG performance? Int. Rev. Financ. Anal. 2025, 104, 104274. [Google Scholar] [CrossRef]

- Meng, Q.; Wang, S. Green credit, industry competition and corporate green innovation. Financ. Res. Lett. 2025, 86, 108428. [Google Scholar] [CrossRef]

- Liu, D.; Fisher, G.; Chen, G.L. CEO attributes and firm performance: A sequential mediation process model. Acad. Manag. Ann. 2018, 12, 789–816. [Google Scholar] [CrossRef]

- Wan, J.; Yin, L.; Wu, Y. Return and volatility connectedness across global ESG stock indexes: Evidence from the time-frequency domain analysis. Int. Rev. Econ. Financ. 2024, 89, 397–428. [Google Scholar] [CrossRef]

- Zhang, M.C.; Wang, G. Female CEOs, digital transformation and green innovation of small and medium-sized enterprises. Financ. Res. Lett. 2025, 86, 108606. [Google Scholar] [CrossRef]

- Jeong, S.H.; Harrison, D.A. Glass breaking, strategy making, and value creating: Metaanalytic outcomes of women as CEOs and TMT members. Acad. Manag. J. 2017, 60, 1219–1252. [Google Scholar] [CrossRef]

| Level 1 Indicators | Level 2 Indicators | Measurement Indicators | Property |

|---|---|---|---|

| Green Credit | Credit ratio for environmental protection projects | Total amount of credit for environmental protection projects/Total credit amount | Positive |

| Green Bonds | Development level of green bonds | Total amount of green bonds issued/Total amount of bonds issued | Positive |

| Green Investment | Proportion of investment in pollution control | Investment in environmental pollution control/GDP | Positive |

| Green Insurance | The level of environmental pollution liability insurance | Revenue from environmental pollution liability insurance/Total insurance premium income | Positive |

| Green Funds | Proportion of green funds | Total market capitalization of green funds/Total market capitalization of funds | Positive |

| Green Equity | Depth of green equity development | (Carbon trading + energy use rights trading + emission rights trading)/Total equity market transactions | Positive |

| Carbon Finance | Financial carbon intensity | Carbon emissions/GDP | Negative |

| Variable Type | Variable Name | Definitions |

|---|---|---|

| Dependent variables | Gpatent | Natural logarithm of the number of green patent (including green invention patent and green utility model patent) applications after adding 1 |

| Ginvent | Natural logarithm of the number of green invention patent applications after adding 1 | |

| Gutility | Natural logarithm of the number of green utility model patent applications after adding 1 | |

| Independent variable | STEM | Take 1 if the CEO has obtained one of the professional degrees (including bachelor’s, master’s, or doctoral) in the disciplines of science, engineering, agriculture, and medicine; otherwise take 0 |

| Channel variables | FC | FC index |

| EC | Natural logarithm of the number of joint patent applications between firms and various heterogeneous partners after adding 1 | |

| RD | The proportion of R&D expenditure to operating income | |

| IE | The ratio of ln (1 + patent applications) to ln (1 + R&D expenditures) | |

| Moderating variables | GF | A green finance index, composed of five dimensions: green credit, green securities, green insurance, green investment, and carbon finance |

| MC | 1-HHI | |

| Control variables | Size | Natural logarithm of total assets at the end of the period |

| Age | The number of years the business has established plus 1 as the natural logarithm | |

| BM | Carrying value divided by total market value | |

| Liquid | Current assets divided by current liabilities | |

| Growth | The annual growth rate of enterprise sales revenue | |

| Top | Number of shares held by top 10 shareholders divided by total number of shares | |

| Duality | The chairman and general manager are the same person as 1; otherwise it is 0 | |

| STEM_Chairman | Take 1 if the chairman has obtained one of the professional degrees (including bachelor’s, master’s, or doctoral) in the disciplines of science, engineering, agriculture, and medicine; otherwise take 0 |

| Variables | N | Mean | SD | Min | p25 | p50 | p75 | Max |

|---|---|---|---|---|---|---|---|---|

| Gpatent | 10,317 | 0.320 | 0.634 | 0.000 | 0.000 | 0.000 | 0.000 | 2.708 |

| Ginvent | 10,317 | 0.190 | 0.460 | 0.000 | 0.000 | 0.000 | 0.000 | 2.197 |

| Gutility | 10,317 | 0.195 | 0.469 | 0.000 | 0.000 | 0.000 | 0.000 | 2.197 |

| STEM | 10,317 | 0.354 | 0.478 | 0.000 | 0.000 | 0.000 | 1.000 | 1.000 |

| Size | 10,317 | 21.86 | 1.017 | 20.00 | 21.12 | 21.74 | 22.46 | 24.85 |

| Age | 10,317 | 2.886 | 0.327 | 1.946 | 2.708 | 2.944 | 3.135 | 3.555 |

| BM | 10,317 | 3.068 | 2.991 | 0.533 | 1.340 | 2.033 | 3.541 | 18.24 |

| Liquid | 10,317 | 0.588 | 0.221 | 0.126 | 0.423 | 0.593 | 0.747 | 1.123 |

| Growth | 10,317 | 0.144 | 0.296 | −0.422 | −0.001 | 0.092 | 0.246 | 1.583 |

| Top | 10,317 | 0.587 | 0.146 | 0.230 | 0.481 | 0.597 | 0.707 | 0.882 |

| Duality | 10,317 | 0.408 | 0.492 | 0.000 | 0.000 | 0.000 | 1.000 | 1.000 |

| STEM_Chairman | 10,317 | 0.317 | 0.465 | 0.000 | 0.000 | 0.000 | 1.000 | 1.000 |

| Panel A: The CEO’s Professional Background | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Dimension | STEM | Business, Management, and Law | Social and Behavioral Sciences | Humanities and Arts | Education | |||||

| YES | NO | YES | NO | YES | NO | YES | NO | YES | NO | |

| Observations | 3648 | 6669 | 3903 | 6414 | 24 | 10,293 | 57 | 10,260 | 17 | 10,300 |

| Proportion | 35.4% | 64.6% | 37.8% | 62.2% | 0.2% | 99.8% | 0.6% | 99.4% | 0.2% | 99.8% |

| Panel B: Descriptive statistics for separate subsamples divided by STEM background | ||||||||||

| Variables | STEM = 0 | STEM = 1 | Difference | |||||||

| N | Mean | N | Mean | Mean | ||||||

| Gpatent | 6669 | 0.212 | 3648 | 0.517 | −0.305 *** | |||||

| Ginvent | 6669 | 0.114 | 3648 | 0.328 | −0.214 *** | |||||

| Gutility | 6669 | 0.132 | 3648 | 0.309 | −0.177 *** | |||||

| Size | 6669 | 21.76 | 3648 | 22.05 | −0.282 *** | |||||

| Age | 6669 | 2.904 | 3648 | 2.854 | 0.050 *** | |||||

| BM | 6669 | 0.606 | 3648 | 0.556 | 0.050 *** | |||||

| Liquid | 6669 | 2.946 | 3648 | 3.292 | −0.347 *** | |||||

| Growth | 6669 | 0.133 | 3648 | 0.165 | −0.032 *** | |||||

| Top | 6669 | 0.598 | 3648 | 0.566 | 0.032 *** | |||||

| Duality | 6669 | 0.431 | 3648 | 0.367 | 0.064 *** | |||||

| STEM_Chairman | 6669 | 0.278 | 3648 | 0.387 | −0.109 *** | |||||

| Variables | ADF-Fisher Test | Stationarity | |

|---|---|---|---|

| Gpatent | Statistic | 50.675 *** | Stable |

| p-value | 0.000 | ||

| Ginvent | Statistic | 51.431 *** | Stable |

| p-value | 0.000 | ||

| Gutility | Statistic | 43.229 *** | Stable |

| p-value | 0.000 | ||

| STEM | Statistic | 27.913 *** | Stable |

| p-value | 0.000 | ||

| Size | Statistic | 18.862 *** | Stable |

| p-value | 0.000 | ||

| Age | Statistic | 7.571 *** | Stable |

| p-value | 0.000 | ||

| BM | Statistic | 44.375 *** | Stable |

| p-value | 0.000 | ||

| Liquid | Statistic | 55.226 *** | Stable |

| p-value | 0.000 | ||

| Growth | Statistic | 72.791 *** | Stable |

| p-value | 0.000 | ||

| Top | Statistic | 27.163 *** | Stable |

| p-value | 0.000 | ||

| Duality | Statistic | 19.694 *** | Stable |

| p-value | 0.000 | ||

| STEM_Chairman | Statistic | 16.318 *** | Stable |

| p-value | 0.000 |

| Variables | VIF | 1/VIF |

|---|---|---|

| Size | 1.41 | 0.71 |

| Liquid | 1.21 | 0.83 |

| BM | 1.18 | 0.85 |

| Age | 1.17 | 0.85 |

| Top | 1.16 | 0.86 |

| STEM | 1.1 | 0.91 |

| Growth | 1.07 | 0.93 |

| Duality | 1.05 | 0.95 |

| STEM_Chairman | 1.02 | 0.98 |

| Mean VIF | 1.15 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| Gpatent | Ginvent | Gutility | |

| STEM | 0.210 *** | 0.151 *** | 0.121 *** |

| (8.451) | (8.414) | (6.622) | |

| Size | 0.139 *** | 0.099 *** | 0.081 *** |

| (9.626) | (9.589) | (7.376) | |

| Age | −0.135 *** | −0.063 ** | −0.098 *** |

| (−3.452) | (−2.383) | (−3.374) | |

| BM | −0.059 | −0.054 | −0.005 |

| (−1.199) | (−1.497) | (−0.147) | |

| Liquid | −0.006 ** | −0.001 | −0.006 *** |

| (−2.097) | (−0.662) | (−2.946) | |

| Growth | −0.057 ** | −0.046 *** | −0.028 * |

| (−2.490) | (−2.802) | (−1.666) | |

| Top | −0.050 | −0.054 | −0.012 |

| (−0.712) | (−1.061) | (−0.246) | |

| Duality | −0.007 | 0.002 | −0.006 |

| (−0.337) | (0.161) | (−0.416) | |

| STEM_Chairman | −0.005 | −0.008 | −0.006 |

| (−0.257) | (−0.519) | (−0.376) | |

| Constant | −2.304 *** | −1.767 *** | −1.299 *** |

| (−7.073) | (−7.811) | (−5.193) | |

| Industry FE | YES | YES | YES |

| Year FE | YES | YES | YES |

| Observations | 10,317 | 10,317 | 10,317 |

| Adj. R2 | 0.174 | 0.143 | 0.136 |

| Panel C: Tobit Model | Panel D: Alternative Measure of Green Innovation | |||||

|---|---|---|---|---|---|---|

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

| Gpatent | Ginvent | Gutility | eGpatent | eGinvent | eGutility | |

| STEM | 0.636 *** | 0.637 *** | 0.550 *** | 0.311 *** | 0.235 *** | 0.204 *** |

| (8.548) | (8.844) | (7.093) | (10.973) | (14.491) | (7.972) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −10.241 *** | −10.704 *** | −9.199 *** | −5.889 *** | −2.768 *** | −4.943 *** |

| (−10.058) | (−11.180) | (−8.292) | (−16.043) | (−12.802) | (−14.339) | |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 10,317 | 10,317 | 10,317 | 10,317 | 10,317 | 10,317 |

| Pseudo. R2 | 0.107 | 0.112 | 0.116 | - | - | - |

| Adj. R2 | - | - | - | 0.327 | 0.241 | 0.275 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Gpatent | Ginvent | Gutility | Gpatent | Ginvent | Gutility | |

| L1.STEM | 0.231 *** | 0.155 *** | 0.143 *** | |||

| (8.101) | (7.421) | (6.939) | ||||

| L2.STEM | 0.246 *** | 0.166 *** | 0.149 *** | |||

| (7.975) | (7.243) | (6.771) | ||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −2.051 *** | −1.531 *** | −1.212 *** | −2.321 *** | −1.816 *** | −1.308 *** |

| (−5.632) | (−6.254) | (−4.213) | (−5.682) | (−6.375) | (−4.107) | |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 7345 | 7345 | 7345 | 5859 | 5859 | 5859 |

| Adj. R2 | 0.182 | 0.147 | 0.146 | 0.184 | 0.154 | 0.145 |

| Panel E: PSM Results | Panel F: EBM Results | |||||

|---|---|---|---|---|---|---|

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

| Gpatent | Ginvent | Gutility | Gpatent | Ginvent | Gutility | |

| STEM | 0.197 *** | 0.155 *** | 0.096 *** | 0.202 *** | 0.156 *** | 0.108 *** |

| (7.244) | (7.582) | (4.944) | (7.593) | (7.904) | (5.485) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −2.822 *** | −2.101 *** | −1.608 *** | −2.760 *** | −1.944 *** | −1.666 *** |

| (−7.351) | (−7.380) | (−5.651) | (−7.129) | (−6.744) | (−5.604) | |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 4679 | 4679 | 4679 | 10,317 | 10,317 | 10,317 |

| Adj. R2 | 0.180 | 0.151 | 0.139 | 0.190 | 0.154 | 0.151 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| First Stage | Second Stage | |||

| STEM | Gpatent | Ginvent | Gutility | |

| Tool | 0.081 *** | |||

| (10.607) | ||||

| STEM | 0.342 *** | 0.211 *** | 0.168 ** | |

| (3.438) | (2.869) | (2.576) | ||

| Controls | Yes | Yes | Yes | Yes |

| Constant | −2.371 *** | −1.208 *** | −1.053 *** | −0.396 *** |

| (−14.452) | (−5.433) | (−6.424) | (−2.621) | |

| Industry FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 9304 | 9304 | 9304 | 9304 |

| Kleibergen–Paap rk LM statistic | 112.51 *** | |||

| Kleibergen–Paap rk Wald F statistic | 112.51 [16.38] | |||

| Panel G: Financing Constraints Channel Test | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

| Gpatent | FC | Gpatent | Ginvent | FC | Ginvent | Gutility | FC | Gutility | |

| STEM | 0.210 *** | −0.009 ** | 0.207 *** | 0.151 *** | −0.009 ** | 0.149 *** | 0.121 *** | −0.009 ** | 0.120 *** |

| (8.451) | (−2.258) | (8.385) | (8.414) | (−2.258) | (8.359) | (6.622) | (−2.258) | (6.557) | |

| FC | −0.248 *** | −0.209 *** | −0.122 *** | ||||||

| (−4.523) | (−5.153) | (−3.055) | |||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −2.304 *** | 5.332 *** | −0.980 ** | −1.767 *** | 5.332 *** | −0.652 ** | −1.299 *** | 5.332 *** | −0.647 * |

| (−7.073) | (103.738) | (−2.178) | (−7.811) | (103.738) | (−2.088) | (−5.193) | (103.738) | (−1.880) | |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 10,317 | 10,317 | 10,317 | 10,317 | 10,317 | 10,317 | 10,317 | 10,317 | 10,317 |

| Adj. R2 | 0.174 | 0.773 | 0.176 | 0.143 | 0.773 | 0.146 | 0.136 | 0.773 | 0.137 |

| Panel H: External Cooperation channel test | |||||||||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

| Gpatent | EC | Gpatent | Ginvent | EC | Ginvent | Gutility | EC | Gutility | |

| STEM | 0.210 *** | 0.245 *** | 0.186 *** | 0.151 *** | 0.245 *** | 0.129 *** | 0.121 *** | 0.245 *** | 0.111 *** |

| (8.451) | (6.497) | (7.622) | (8.414) | (6.497) | (7.436) | (6.622) | (6.497) | (6.125) | |

| EC | 0.098 *** | 0.089 *** | 0.040 *** | ||||||

| (7.357) | (8.453) | (4.071) | |||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −2.304 *** | −8.092 *** | −1.508 *** | −1.767 *** | −8.092 *** | −1.046 *** | −1.299 *** | −8.092 *** | −0.976 *** |

| (−7.073) | (−15.297) | (−4.552) | (−7.811) | (−15.297) | (−4.651) | (−5.193) | (−15.297) | (−3.787) | |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 10,317 | 10,317 | 10,317 | 10,317 | 10,317 | 10,317 | 10,317 | 10,317 | 10,317 |

| Adj. R2 | 0.174 | 0.219 | 0.191 | 0.143 | 0.219 | 0.170 | 0.136 | 0.219 | 0.141 |

| Panel I: R&D investment channel test | |||||||||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

| Gpatent | RD | Gpatent | Ginvent | RD | Ginvent | Gutility | RD | Gutility | |

| STEM | 0.210 *** | 0.012 *** | 0.199 *** | 0.151 *** | 0.012 *** | 0.140 *** | 0.121 *** | 0.012 *** | 0.119 *** |

| (8.451) | (8.716) | (7.913) | (8.414) | (8.716) | (7.742) | (6.622) | (8.716) | (6.474) | |

| RD | 1.331 *** | 1.107 *** | 0.548 ** | ||||||

| (4.020) | (4.440) | (2.356) | |||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −2.304 *** | 0.118 *** | −2.609 *** | −1.767 *** | 0.118 *** | −1.973 *** | −1.299 *** | 0.118 *** | −1.475 *** |

| (−7.073) | (7.530) | (−7.691) | (−7.811) | (7.530) | (−8.354) | (−5.193) | (7.530) | (−5.640) | |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 10,317 | 9989 | 9989 | 10,317 | 9989 | 9989 | 10,317 | 9989 | 9989 |

| Adj. R2 | 0.174 | 0.374 | 0.181 | 0.143 | 0.374 | 0.150 | 0.136 | 0.374 | 0.141 |

| Panel J: Efficiency of innovative resource allocation channel test | |||||||||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

| Gpatent | IE | Gpatent | Ginvent | IE | Ginvent | Gutility | IE | Gutility | |

| STEM | 0.210 *** | 0.012 *** | 0.191 *** | 0.151 *** | 0.012 *** | 0.140 *** | 0.121 *** | 0.012 *** | 0.109 *** |

| (8.451) | (4.566) | (7.832) | (8.414) | (4.566) | (7.934) | (6.622) | (4.566) | (6.033) | |

| IE | 1.674 *** | 1.004 *** | 1.112 *** | ||||||

| (12.281) | (10.061) | (11.419) | |||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −2.304 *** | −0.369 *** | −1.704 *** | −1.767 *** | −0.369 *** | −1.410 *** | −1.299 *** | −0.369 *** | −0.900 *** |

| (−7.073) | (−10.468) | (−5.323) | (−7.811) | (−10.468) | (−6.274) | (−5.193) | (−10.468) | (−3.708) | |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 10,317 | 10,247 | 10,247 | 10,317 | 10,247 | 10,247 | 10,317 | 10,247 | 10,247 |

| Adj. R2 | 0.174 | 0.296 | 0.203 | 0.143 | 0.296 | 0.163 | 0.136 | 0.296 | 0.159 |

| Variables | Panel K: Green Finace | Panel L: Market Competition | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Gpatent | Ginvent | Gutility | Gpatent | Ginvent | Gutility | |

| STEM | 0.193 *** | 0.135 *** | 0.113 *** | 0.167 *** | 0.114 *** | 0.094 *** |

| (8.280) | (8.289) | (6.495) | (7.118) | (7.076) | (5.339) | |

| GF | 0.066 | −0.087 | 0.093 | |||

| (0.201) | (−0.383) | (0.388) | ||||

| STEM×GF | 0.797 *** | 0.675 *** | 0.450 ** | |||

| (3.079) | (3.810) | (2.227) | ||||

| MC | −0.115 | −0.046 | −0.194 | |||

| (−0.423) | (−0.271) | (−0.904) | ||||

| STEM×MC | 1.291 *** | 0.987 *** | 0.721 ** | |||

| (2.947) | (4.028) | (1.968) | ||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 0.238 *** | 0.130 *** | 0.149 *** | 0.240 *** | 0.132 *** | 0.150 *** |

| (21.333) | (18.995) | (17.180) | (21.554) | (19.037) | (17.553) | |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 10,221 | 10,221 | 10,221 | 10,205 | 10,205 | 10,205 |

| Adj. R2 | 0.172 | 0.142 | 0.133 | 0.167 | 0.134 | 0.130 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Low | High | Low | High | Low | High | |

| Gpatent | Gpatent | Ginvent | Ginvent | Gutility | Gutility | |

| STEM | 0.025 | 0.250 *** | 0.012 | 0.186 *** | 0.001 | 0.145 *** |

| (1.204) | (7.694) | (0.867) | (7.714) | (0.078) | (6.128) | |

| Control | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −1.380 *** | −2.647 *** | −1.054 *** | −2.082 *** | −0.643 *** | −1.467 *** |

| (−5.433) | (−5.931) | (−5.804) | (−6.476) | (−3.505) | (−4.288) | |

| Observations | 4783 | 4926 | 4783 | 4926 | 4783 | 4926 |

| Adj. R2 | 0.108 | 0.188 | 0.079 | 0.165 | 0.083 | 0.143 |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Fisher’s Permutation test | −0.225 *** | −0.173 *** | −0.144 *** | |||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Non-Heavy | Heavy | Non-Heavy | Heavy | Non-Heavy | Heavy | |

| Gpatent | Gpatent | Ginvent | Ginvent | Gutility | Gutility | |

| STEM | 0.248 *** | 0.138 *** | 0.182 *** | 0.091 *** | 0.148 *** | 0.069 *** |

| (7.276) | (4.243) | (7.845) | (3.388) | (5.621) | (3.645) | |

| Control | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −2.610 *** | −1.899 *** | −2.186 *** | −1.187 *** | −1.508 *** | −1.031 *** |

| (−5.307) | (−5.341) | (−6.564) | (−4.515) | (−3.904) | (−4.240) | |

| Observations | 6323 | 3993 | 6323 | 3993 | 6323 | 3993 |

| Adj. R2 | 0.154 | 0.166 | 0.145 | 0.119 | 0.111 | 0.130 |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Fisher’s Permutation test | 0.110 *** | 0.091 *** | 0.079 *** | |||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Low | High | Low | High | Low | High | |

| Gpatent | Gpatent | Ginvent | Ginvent | Gutility | Gutility | |

| STEM | 0.151 *** | 0.264 *** | 0.116 *** | 0.185 *** | 0.076 *** | 0.160 *** |

| (5.080) | (8.545) | (5.359) | (8.257) | (3.604) | (6.841) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −1.806 *** | −2.547 *** | −1.481 *** | −1.892 *** | −0.999 *** | −1.461 *** |

| (−4.601) | (−6.262) | (−5.547) | (−6.541) | (−3.225) | (−4.709) | |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 5014 | 5303 | 5014 | 5303 | 5014 | 5303 |

| Adj. R2 | 0.157 | 0.189 | 0.126 | 0.156 | 0.125 | 0.147 |

| Fisher’s Permutation test | −0.112 *** | −0.069 *** | −0.084 *** | |||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Low | High | Low | High | Low | High | |

| Gpatent | Gpatent | Ginvent | Ginvent | Gutility | Gutility | |

| STEM | −0.149 | 0.387 *** | −0.313 | 0.222 *** | −0.034 | 0.242 *** |

| (−0.754) | (11.119) | (−1.310) | (8.665) | (−0.218) | (9.857) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −2.000 *** | −3.045 *** | −1.447 *** | −2.288 *** | −1.032 *** | −1.837 *** |

| (−5.143) | (−6.906) | (−5.449) | (−7.053) | (−3.475) | (−5.515) | |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 5240 | 5077 | 5240 | 5077 | 5240 | 5077 |

| Adj. R2 | 0.144 | 0.254 | 0.084 | 0.206 | 0.133 | 0.199 |

| Fisher’s Permutation test | −0.536 *** | −0.535 *** | −0.275 *** | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, Y.; Jiang, Y.; Ma, R. Bridging CEO Educational Background and Green Innovation: The Moderating Roles of Green Finance and Market Competition. Systems 2025, 13, 932. https://doi.org/10.3390/systems13110932

Xu Y, Jiang Y, Ma R. Bridging CEO Educational Background and Green Innovation: The Moderating Roles of Green Finance and Market Competition. Systems. 2025; 13(11):932. https://doi.org/10.3390/systems13110932

Chicago/Turabian StyleXu, Yi, Yaning Jiang, and Rundong Ma. 2025. "Bridging CEO Educational Background and Green Innovation: The Moderating Roles of Green Finance and Market Competition" Systems 13, no. 11: 932. https://doi.org/10.3390/systems13110932

APA StyleXu, Y., Jiang, Y., & Ma, R. (2025). Bridging CEO Educational Background and Green Innovation: The Moderating Roles of Green Finance and Market Competition. Systems, 13(11), 932. https://doi.org/10.3390/systems13110932