1. Introduction

Global climate governance has entered a critical stage marked not by uniform convergence, but by cross-jurisdictional heterogeneity and asynchrony in policy timing, coverage, enforcement, and metrics—conditions that complicate coordination and measured effectiveness. A growing body of evidence documents fragmented policy portfolios, uneven enforcement capacities, and contested metrics across governance levels, which jointly generate coordination frictions and evaluation ambiguity [

1,

2,

3]. Internationally, COP28 incorporated the “phased-out use of fossil fuels” into its resolution [

4,

5]. The EU’s Carbon Border Adjustment Mechanism (CBAM) has entered its pilot phase, and the U.S. Inflation Reduction Act (IRA) is reshaping the global green industrial chain through substantial subsidies [

6,

7,

8]. Under this tightening external pressure for decarbonization and the urgent timeline for China’s “dual carbon” goals, firms face the challenge of pursuing low-carbon transitions in a cost-effective manner [

9,

10]. Conventional end-of-pipe governance approaches are insufficient to achieve this transformation. Digital technologies, particularly AI, introduce a new paradigm for emission reduction characterized by “substituting cement and steel with algorithms” [

11,

12,

13]. In China, the last decade has witnessed rapid advances in AI industrialization and green applications, spurred by the 2017 national plan, 2018 local policies, and post-2019 pilot zones. As the only middle-income economy in the GII top 30, China’s innovation clusters provide a distinctive setting to study AI-enabled decarbonization [

14].

Recently, AI and machine learning evolved from tools for improving productivity to potential enablers of cleaner production and intelligent carbon management. At the micro level, early deployments can be accompanied by higher energy use or emissions in specific contexts (e.g., in building applications or during enterprise-wide rollouts) [

15,

16,

17], yet continued adoption enables intelligence-driven energy monitoring, process optimization, and supply-chain coordination that are associated with lower carbon intensity [

18,

19]. At the same time, the energy and carbon footprints of model training and inference raise potential rebound concerns, making AI’s net environmental impact an empirical question that requires careful measurement and identification [

20]. Moreover, excessive reliance on AI in knowledge production may erode the foundations of breakthrough innovation, suggesting that AI is not a panacea and that its benefits are context-dependent [

21]. Beyond productivity tools, AI has demonstrated transformative potential in multiple domains [

22,

23,

24]. Against this broad backdrop, our focus in this paper is deliberately narrow and policy-relevant: we examine AI as a firm-level capability for cleaner production and carbon governance, rather than as a general engine of scientific invention.

At the macro level, research shows AI can raise total factor productivity (TFP) and support structural upgrading [

25,

26,

27] while also reshaping the distribution of labor income [

28]. However, at the firm level, direct evidence on how AI affects CEP through micro-decisions remains limited. Most studies examine AI’s economic outcomes—productivity, innovation, competitiveness [

29,

30,

31]—or report preliminary green applications in energy saving, emission reduction, and environmental disclosure [

15,

17,

18,

19]. These strands, while valuable, leave three gaps unaddressed: (i) a micro-level theoretical framework that embeds AI adoption into firms’ low-carbon decision-making under explicit emission constraints; (ii) identified mechanisms through which AI enhances firms’ environmental governance and stimulates green innovation capability; and (iii) empirical tests of selected mechanisms (ESG performance and green innovation) and contextual moderators (regional marketization and executives’ overseas experience), with explicit, testable links to theory.

To fill these gaps, this study developed a dynamic learning game model of “AI empowerment–carbon performance” to capture how firms adopt AI under carbon constraints and learning spillovers. Using 26,475 observations of Chinese listed firms from 2013 to 2023, we constructed a firm-level AI empowerment index via patent text mining. We estimated two-way fixed-effect models and examined a 2018 structural breakpoint to account for time heterogeneity in AI’s effects. We then empirically tested the direct effect of AI on CEP, explored its mediating pathways through ESG performance and green innovation capability, and examined the moderating roles of regional marketization and executives’ overseas backgrounds. Additionally, we conducted heterogeneity analyses to uncover how AI’s decarbonization effects vary across ownership types, industry pollution intensity, and regional contexts, offering evidence for targeted clean production policies in emerging economies.

Our preliminary analysis indicates that firm-level AI empowerment is associated with higher CEP, and this association strengthens after 2018. Mechanism evidence points to two channels: (i) improved ESG performance, and (ii) augmented green innovation capabilities. The effect is larger in regions with higher marketization, among private firms, and in less pollution-intensive industries, but weaker when top executives have overseas backgrounds. We also consider potential rebound effects from AI energy use and conduct extensive robustness checks.

This study makes several contributions. (1) Theoretical contribution: We develop a dynamic learning game model that incorporates AI investment thresholds, carbon constraints, and firm learning dynamics, enriching the theoretical framework of digital technology and low-carbon transition. (2) Mechanism identification: We identify two governance-related pathways through which AI is associated with better CEP—ESG performance and green innovation capability. (3) Institutional and managerial context: By integrating regional marketization and executives’ overseas backgrounds as moderators, we reveal the context-dependent nature of AI’s emission-reduction effects, highlighting the role of institutional and managerial heterogeneity. (4) Methodological approach: We adopt rigorous panel methods with multiple robustness checks to validate the robustness of our findings. (5) Practical relevance: By linking AI empowerment with carbon performance in an emerging-economy context, this study provides evidence-based insights for designing digital-driven decarbonization policies and strategies, aligning with the UN’s Sustainable Development Goals (SDGs) [

32].

The remainder of the paper develops the theoretical model and hypotheses, presents data and methods, and reports the results of baseline, mechanism, and moderation analyses, followed by conclusions and implications.

2. Theoretical Analysis

Constrained by traditional production systems and limited governance capacities, many firms face an inherent tension between emission-reduction targets and growth objectives [

33,

34]. As a general-purpose technology, AI offers unique advantages in data sensing, process optimization, and energy efficiency enhancement [

27,

29,

35], positioning it as a powerful driver of green transformation at the firm level [

36,

37]. Nevertheless, the adoption of AI entails substantial financial costs and technological uncertainties, imposing greater demands on firms’ capital deployment and managerial planning [

38,

39].

To address these challenges, this study developed a dynamic learning game model that examines how AI adoption can endogenously enhance CEP by improving production efficiency while reducing carbon intensity. This theoretical framework provided the foundation for the subsequent empirical analysis.

2.1. Research Trends and Structure

Recent work on AI-enabled corporate green transition can be grouped into four main strands that align with our theoretical framework. (i) Productivity and abatement: Studies show that AI improves production efficiency and factor substitution through automation and scheduling [

40,

41] while also reducing carbon intensity, particularly in growth firms or innovation-oriented applications [

42]. This corresponds to our CES production setting and marginal abatement efficiency channel. (ii) Governance and innovation: AI strengthens environmental monitoring, disclosure, and compliance, thereby improving ESG outcomes [

43,

44], and accelerates green technological opportunities through data mining and experimentation, boosting green innovation [

37]. These mechanisms map onto the shadow-price constraint and the TFP-enhancement channel in our model. (iii) Institutional context and managerial traits: Evidence suggests that marketization amplifies AI’s carbon-reduction effect [

45], whereas executives’ overseas experience may reduce local adaptation effectiveness [

46]. These insights motivate our moderation hypotheses on institutional fit and managerial heterogeneity. (iv) Energy footprint and rebound: AI training and inference entail nontrivial energy and carbon costs [

20,

47], raising the possibility of rebound effects and highlighting that the effective abatement parameter is time- and context-dependent.

Methodologically, most empirical studies rely on fixed effects, quasi-experimental designs, or spatial models, but few explicitly connect to parameterized theoretical structures. Our approach bridges this gap by embedding AI into a CES–emission framework with constraints and learning and testing the resulting hypotheses econometrically.

2.2. CES Production Function with AI Integration: Modeling Output Gains Through Technological Multipliers

With the rapid advancement of digitalization and smart manufacturing, the classical Cobb–Douglas production function is increasingly limited in capturing both the elasticity of factor substitution and the multidimensional role of AI in enhancing productivity. Following Wu and Zhu (2025) [

31], we adopt a CES production function that embeds AI input as a technological multiplier, thereby modeling its marginal contribution to TFP. We model the production function of firm

as follows:

In Equation (1), is the total output of firm , and are traditional labor and capital inputs, denotes the intensity of AI deployment, and reflects the elasticity of AI’s marginal impact on firm-level TFP. The weights and represent the input shares of labor and capital, respectively, satisfying . The parameter reflects the degree of substitutability between labor and capital, with reducing the function to the Cobb–Douglas form.

The CES framework allows for flexible substitution patterns between inputs and captures heterogeneous firm responses to AI adoption. AI technologies enhance capital efficiency (e.g., through smart machinery) and substitute human labor (e.g., via algorithmic automation), leading to dynamic and optimal factor reallocation. Although AI may not directly generate physical output, its multiplier effect enhances operational efficiency and productivity, thereby raising marginal output. Incorporating an AI-augmented CES production function thus provides a theoretical anchor for our broader decision-making model.

That said, two modeling choices warrant emphasis. First, within the CES framework we assume a constant substitution elasticity , interpreted as a local mechanism rather than a claim that elasticities are invariant across all industries or input ranges. Second, we treat AI as a Hicks-neutral multiplier without modeling factor-biased technical change: the mapping between and “AI empowerment” is therefore reduced-form rather than fully identified structurally. To mitigate potential bias, the empirical strategy employs two-way fixed effects, time-heterogeneity (2018 breakpoint) diagnostics, and multiple robustness cross-checks, prioritizing directional validity and mechanism testability over precise point identification of structural parameters.

2.3. Carbon Emission Function: Modeling AI’s Role in Curbing Carbon Intensity

In conventional production systems, carbon emissions tend to increase proportionally with output [

48,

49,

50]. However, AI technologies offer the potential to disrupt this trajectory by decoupling production growth from emissions.

To model this AI-enabled decarbonization mechanism, we build on the marginal abatement frameworks of Aghion et al. (2016) [

51] and Kruse-Andersen (2023) [

52], incorporating the CES production function

defined earlier to construct the following carbon emission function:

Here, stands for the overall carbon emissions of firm ; is firm output derived from the CES function in Equation (1); is the baseline emission coefficient per unit of output, reflecting sectoral technology levels and energy mixes; captures the marginal abatement effect of AI; and is the AI input intensity, as previously defined.

The multiplicative structure models scale effects—i.e., emissions increase with output—while the exponential decay term captures the nonlinear mitigation. The parameter measures the elasticity of AI-enabled abatement. A higher implies that even small AI investments lead to significant emission reductions, while a lower may indicate poor integration, inefficiencies, or inadequate managerial capability. Together, the CES production function and this exponential carbon emission function form the theoretical foundation for the firm’s objective function and subsequent constrained optimization analysis.

2.4. Dual-Constraint Optimization Model: Profit Function and First-Order Conditions

This section further develops an optimization model that incorporates both budgetary and carbon emission constraints. Assuming that firms aim to maximize profits, the profit function

is composed of output revenues and associated cost components:

In Equation (3), denotes the unit price of output; and represent the unit prices of labor and capital, respectively; and is the cost function of AI investment, assumed to satisfy and , indicating increasing marginal costs. is the carbon tax or penalty rate, which may be fixed or dynamically adjusted. corresponds to firm output as defined by the CES production function in Equation (1), and represents carbon emissions, specified by the exponential emission function in Equation (2).

The firm operates under two constraints—a budget constraint (

) and a carbon emission constraint—the latter of which may take the form of either a cap

or a tax-based ceiling

. This study adopted the cap-based emission constraint due to its broader applicability and its suitability for structured Lagrangian modeling:

Under these constraints, the firm’s Lagrangian function is constructed as:

In Equation (5), and are Lagrange multipliers associated with the budget and emission constraints, respectively. These multipliers can be interpreted as the shadow prices or marginal benefits of relaxing the corresponding constraints.

To derive the optimal input choices, we take the first-order derivatives of

with respect to

,

, and

. Starting with

:

We derive the following by plugging Equations (7) and (8) into Equation (6):

Equations (9)–(11) together describe the firm’s optimal allocation decisions under dual policy constraints. The marginal benefit of AI investment must equal its adjusted marginal cost, incorporating the shadow prices of institutional constraints. This balance reflects how firms optimize between output expansion and carbon mitigation. The Lagrange multipliers and quantify the institutional stringency of budget and emission constraints. Specifically, indicates the marginal gain from relaxing the budget constraint by one unit, while reflects the marginal value of an additional emission allowance. In a policy simulation context, these multipliers serve as key indicators of a firm’s responsiveness to regulatory environments. A looser budget constraint (lower ) or a tighter emission cap (higher ) increases the firm’s incentive to invest in AI to achieve output–emission synergies.

2.5. Strategic Behavior and Non-Cooperative Game Among Firms Under AI Empowerment

Firms’ carbon emission decisions do not occur in isolation, but rather within a competitive environment constrained by limited resources and regulatory oversight [

53,

54,

55]. Particularly in contexts such as carbon trading schemes, total emission control systems, or quota-based allocation mechanisms, the emission strategies and quota allocations of firms are interdependent and mutually influential [

10,

56]. Building on the previous single-firm profit maximization model, we now extend the framework to a non-cooperative game setting involving N competing firms. Suppose the regulator imposes an industry-wide emission cap

, such that:

To strengthen emission-reduction incentives, regulators introduce a dynamic penalty mechanism that adjusts the firm-level carbon penalty based on each firm’s share of total emissions. The penalty rate for firm

is given by:

In this formulation,

is the base carbon tax and

captures the sensitivity to relative emission intensity. This setup implies that the more a firm “occupies” the industry’s total allowable emissions the higher its marginal carbon cost becomes. This reinforces an “outperform by under-emitting” incentive structure and fosters competition for lower emissions. Under this regulatory mechanism, the profit function of firm

becomes:

Equation (14) illustrates how AI empowerment, by reducing , alters the firm’s share of total industry emissions, thus directly influencing the magnitude of the penalty term. In such a setting, firms are no longer passive “price takers” of carbon costs, but become strategic players who internalize the competitive implications of their emissions.

In this non-cooperative game framework, each firm optimizes its decision variables (

,

,

) given the strategies of all other firms (

,

,

), seeking to maximize its own profit. The firm’s optimal strategy thus satisfies the following Nash equilibrium condition:

This non-cooperative structure highlights the “green strategic logic” of AI adoption under a carbon quota regime. Within a system that rewards relative emission reductions, AI serves not only as a productivity-enhancing technology but also as a strategic lever to reduce marginal carbon costs and improve competitive positioning. The marginal value of AI is thus endogenously shaped by the institutional design of the carbon pricing scheme. As firms engage in emission-based competition, the presence of a high-penalty-sensitivity parameter () may trigger an industry-wide investment race in AI technologies. In such cases, the aggregate adoption of AI may exhibit a phase transition behavior—shifting the entire industry toward a higher carbon-efficiency equilibrium. Regulators can influence this equilibrium outcome by carefully calibrating parameters such as , , and . By doing so, they can steer firms toward a Nash equilibrium characterized by high AI investment and superior carbon performance, thereby advancing systemic green transformation.

In summary, under the dual influence of institutional carbon constraints and competitive penalty structures, AI adoption is no longer a purely technological choice—it becomes a strategic action within a game-theoretic context.

2.6. Cognitive Evolution Mechanism of AI-Enabled Abatement

Although AI technologies possess substantial potential for emission reduction, firms’ understanding of AI’s carbon abatement efficacy is often shaped by incomplete information. Perception of the AI-enabled emission-reduction efficiency parameter is not static, but dynamically evolves as firms accumulate experience. Therefore, this section incorporates a Bayesian learning mechanism into the firm’s decision-making framework to model a dynamic optimization process with evolving beliefs, which helps explain the gradual adoption path of AI: ranging from early-stage “trial use,” to mid-stage “marginal adjustment,” and eventually to large-scale “intensive deployment.”

We assume that at the initial time

, the firm does not know the true value of AI’s emission-reduction efficiency

. Instead, it holds a prior belief based on industry reports, consultant evaluations, or vendor claims, which follows a normal distribution:

Here, represents the firm’s subjective estimate of AI’s average abatement capability, and captures the uncertainty associated with this belief. A higher indicates weaker confidence in AI performance, which typically leads to more conservative investment decisions. This uncertainty may stem from limited cognitive capacity or the opacity of external information environments.

Once the firm adopts AI, it observes an actual CEP outcome

in each period

, reflecting changes in per-unit carbon emissions. The observed process is modeled as:

Applying Bayesian updating, the firm refines its belief about

over time. The posterior distribution at period

becomes:

The updated rules follow:

In this learning process, if the observed outcome

is better than expected, then

, enhancing the firm’s confidence in AI. A smaller observation variance

implies faster learning, reflecting higher information quality. As

moves toward

,

moves toward 0, indicating that the firm’s belief about

converges to the true value—achieving full information. Based on the updated belief

, the firm determines its optimal AI investment in the next period as:

Here, the optimal AI investment is a function of the firm’s updated expectation , current utility level , budget constraint , and emission quota .

Although this paper develops a nonlinear dynamic model with CES production and Bayesian learning to uncover how AI improves CEP, the empirical section uses fixed-effect models as a tractable linear approximation, with the empirical design directly operationalizing the key mechanisms identified in the theoretical framework.

3. Literature Review and Research Hypotheses

AI is increasingly recognized as a key driver of corporate green transition and sustainable production [

57]. Drawing on the natural resource–based view (NRBV), we conceptualize AI as a digital environmental capability that enables pollution prevention, process stewardship, and path-breaking resource reconfiguration for cleaner production [

58,

59]. Dynamic capabilities research further highlights AI’s role in upgrading firms’ sense–seize–reconfigure routines, which enhance production efficiency and reduce carbon intensity. Green technology adoption studies also suggest that AI reduces information and coordination frictions, thereby lowering adoption costs and strengthening the effectiveness of environmental constraints in shaping corporate decisions. These mechanisms jointly support our first hypothesis that AI may improve firms’ CEP.

Existing research on systematic evidence on firm-level CEP remains scarce. In particular, the pathways through which AI contributes to cleaner production—such as by improving ESG or stimulating green innovation—are underexplored. Moreover, contextual factors, including institutional environments and managerial traits, may condition AI’s effectiveness, but existing studies have not yet tested these systematically. Building on these insights and gaps, we propose a set of hypotheses to clarify how AI empowerment affects CEP directly, indirectly (via ESG and green innovation), and conditionally (via institutional and managerial contexts).

3.1. AI Empowerment and Firms’ CEP

AI technology has the potential to fundamentally transform production and environmental management by improving precision in carbon tracking and reducing energy and resource inefficiencies [

60,

61]. From a microeconomic perspective, AI enhances the technical efficiency component of the carbon production function, lowering marginal emission intensity and optimizing resource allocation [

30]. In accordance with our theoretical framework analysis, within the carbon budget constraint

, AI can facilitate enterprises in reducing emissions while sustaining output (enhancing the marginal emission-reduction efficiency of AI) or increasing the productivity multiplier effect on output under a fixed emission cap.

In practical terms, AI’s capabilities in intelligent scheduling, energy efficiency optimization, and automated process control contribute directly to reducing carbon intensity per unit of output [

62,

63]. Furthermore, AI-enabled real-time feedback and anomaly detection mechanisms support dynamic production adjustments, promoting compliance with environmental standards and advancing cleaner production [

64,

65]. Empirical research indicates that AI adoption promotes energy utilization efficiency and improves enterprises’ ability to comply with environmental standards [

10,

66,

67].

Nonetheless, the ultimate potential of AI is not without cost. The creation, training, and functioning of intricate AI models are interconnected, and carbon emissions from data centers may result in a “rebound effect” [

20,

47]. Within the NRBV framework, AI thus emerges as a critical capability for achieving sustainable competitive advantage through environmental efficiency [

68,

69].

Hypothesis 1: AI empowerment improves firms’ CEP, though its effectiveness may be constrained by energy consumption rebound effects.

3.2. Mechanism of ESG Performance and Green Innovation Capability

ESG performance signifies a company’s comprehensive plan and implementation regarding sustainable development. In our model, ESG performance tightens the effective emission constraint by increasing regulatory salience and raising the implicit cost of exceeding the emission cap. From a dynamic capabilities perspective [

70], ESG capabilities operationalize organizational routines of sensing (real-time monitoring), seizing (disclosure and stakeholder engagement), and reconfiguring (compliance and internal controls) [

71].

AI enables new pathways to improve ESG performance. AI enhances ESG performance by improving real-time environmental monitoring and carbon accounting [

16,

72], facilitating social engagement through data-driven communication tools [

73,

74], and strengthening governance mechanisms with automated compliance and risk controls [

75]. Stronger ESG in turn facilitates green innovation and reinforces carbon efficiency [

76].

Hypothesis 2: AI empowerment enhances CEP by improving ESG performance.

In this paper, ESG denotes process- and governance-level capabilities (environmental monitoring, disclosure, compliance, board oversight), whereas green innovation denotes technology-output capabilities (e.g., green patenting intensity and low-carbon R&D). The former strengthens the effective emission constraint and governance efficiency (linking to , λ2), while the latter shifts the technological frontier and raises abatement productivity (linking to , ). We therefore treat ESG and green innovation as parallel mediators rather than one subsuming the other.

Green technology innovation is central to advancing low-carbon technologies and achieving cleaner production outcomes [

37,

77]. Green innovation capability constitutes a critical environmental resource for firms [

78,

79]. Building on RBV and NRBV, AI is expected to foster technology-output capabilities [

80,

81]—measured by green innovation—by accelerating knowledge acquisition, digital experimentation, and IP analytics, thereby improving the TFP multiplier

and the marginal abatement efficiency

and ultimately CEP. Moreover, Xu et al. (2021) [

82] confirm that green innovation improves CEP by altering energy and industrial structures. H. Li et al. (2024) [

9] also highlight a “green innovation paradox,” wherein green innovation becomes effective only under appropriate governance and resource conditions—a challenge that AI can help overcome.

Hypothesis 3: AI empowerment enhances CEP indirectly by fostering green innovation capability.

3.3. The Moderating Effect of Marketization Level and Executives’ Overseas Background

The institutional environment is a critical external factor that shapes firms’ strategic behavior and determines the effectiveness of technological applications [

83,

84]. According to institutional theory and market structure theory, the more mature the market mechanism and the more intense the competition, the more likely firms are to adopt advanced technologies to gain efficiency advantages and external recognition [

85,

86,

87,

88]. Regional marketization reflects key institutional dimensions such as the degree to which resource allocation is market-driven, the extent of government intervention, the strength of property rights protection, and the quality of the legal system.

Within the institutional constraints embedded in the game-theoretic model, marketization serves as a proxy for external pressures and incentive mechanisms that affect firms’ low-carbon decision-making. In regions with higher levels of marketization, competition, disclosure requirements, and digital infrastructure are more developed [

89], enabling firms to better leverage AI technologies to gain green reputational advantages and resource access. Therefore, market-based institutions are more likely to amplify the marginal benefits of AI applications in carbon performance improvement. When AI systems can accurately identify carbon-intensive operations and drive process optimization, their environmental value can be more effectively translated into economic returns. In our theoretical framework, higher marketization increases the sensitivity of carbon penalties and the implicit cost of exceeding emission caps while reducing the frictions of adopting new technologies. Together, these factors strengthen the marginal benefits of AI adoption for emission reduction.

Hypothesis 4: The positive effect of AI empowerment on CEP is stronger in regions with higher marketization.

Executives’ characteristics are also key internal factors that influence firms’ strategic decisions, especially regarding the adoption of emerging technologies [

90,

91,

92]. Drawing on upper-echelon theory [

93] and institutional embeddedness theory [

94], executives with overseas backgrounds are often shaped by the institutional environments and managerial paradigms of the countries where they have studied or worked. Such “cognitive lock-in effects” may not fully align with local institutional conditions, digital infrastructure, or technological compatibility upon returning to domestic firms.

From a behavioral economics perspective, while overseas experience provides global vision and advanced managerial insights [

95], it may also weaken executives’ ability to recognize and promote locally viable low-carbon strategies. The non-cooperative game structure developed earlier also implies that managerial preferences influence technology adoption. Specifically, executives with overseas backgrounds may be more familiar with mature AI platforms, green certification systems, and carbon credit markets in developed economies, but less sensitive to institutional frictions, data asymmetries, or localization barriers in developing contexts [

46]. This could weaken the effectiveness of AI-driven abatement strategies. In our Bayesian learning block, overseas experience may increase uncertainty in evaluating AI’s abatement potential, thereby reducing optimal AI investment and weakening the marginal impact of AI on CEP.

Hypothesis 5: The positive effect of AI empowerment on CEP is weaker in firms led by executives with overseas backgrounds.

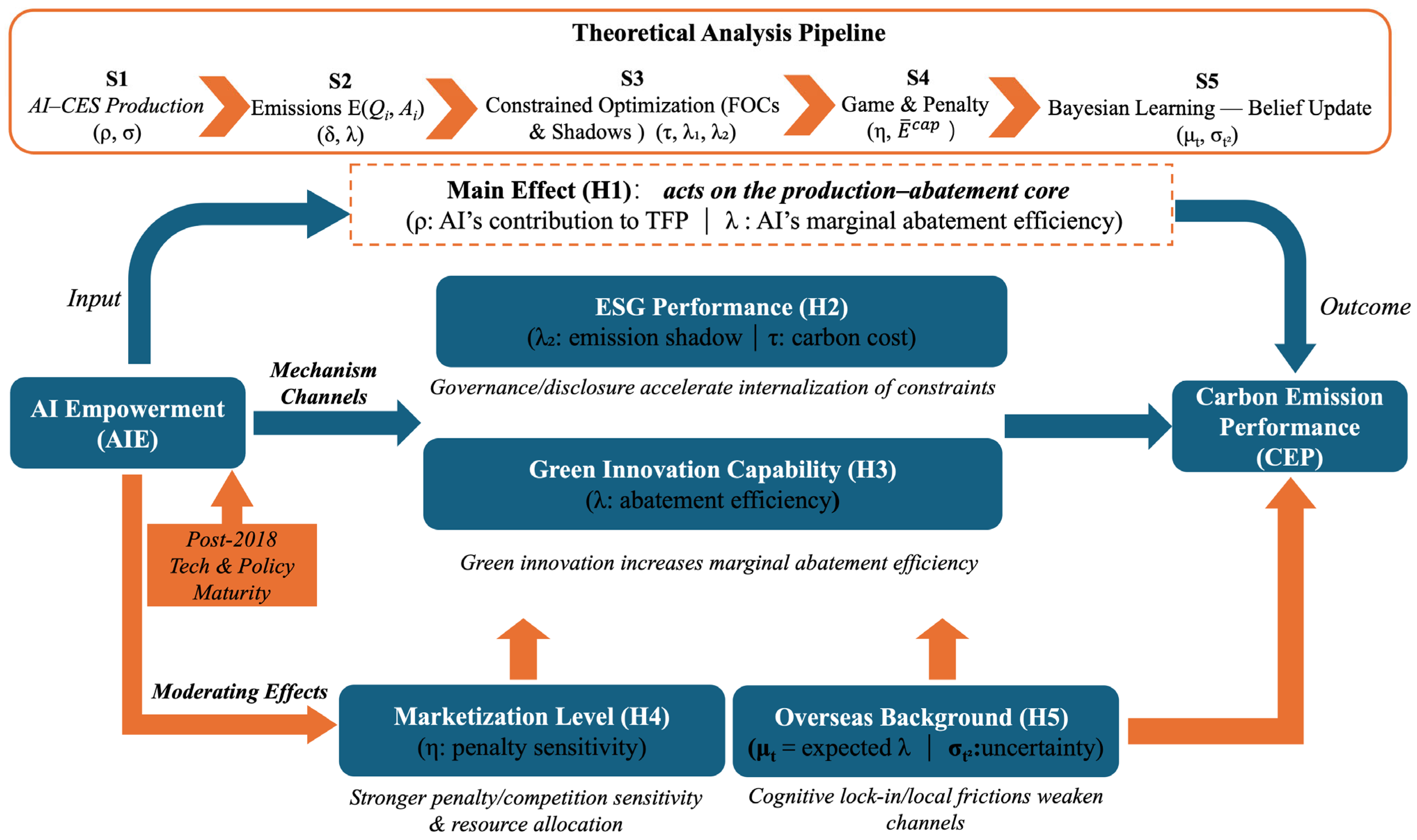

Figure 1 illustrates the systematic theoretical framework of this study, derived from the aforementioned theoretical analysis and research assumptions.

This study paradigm derives from the AI–CES production function and the nonlinear abatement function, incorporating dual optimization under budgetary and emission constraints, alongside a competitive game characterized by relative emission penalties, and further integrating Bayesian learning. It demonstrates how AI empowerment improves business CEP via ESG performance and green innovation capabilities, with moderation from the extent of marketization and executives’ overseas experience. The comprehensive definitions of the parameters are presented in

Section 2.

4. Research Design

4.1. Data Sources and Research Sample

This study examined China’s A-share listed companies from 2013 to 2023. The year 2013 was chosen as the starting point because it marks the onset of systematic carbon governance, more complete ESG data, and the acceleration of corporate digital transformation and AI adoption. In contrast, pre-2012 data were distorted by the global financial crisis and stimulus policies, while post-2013 data are relatively stable and better suited for long-term trend analysis.

In this study, data on CEP, executives’ overseas background, and other control variables were sourced from the CSMAR database (

https://data.csmar.com/, accessed on 10 April 2025); data on green innovation capability were compiled from the patent disclosure database of the CNIPA (

https://www.cnipa.gov.cn/, accessed on 12 April 2025); ESG performance data were drawn from the iFinD database (

https://www.10jqka.com.cn/, accessed on 12 May 2025); marketization-level data were obtained from the

China City Statistical Yearbook (

http://www.stats.gov.cn/. accessed on 14 May 2025); and AI-empowerment textual data were extracted from the IncoPat database (

https://www.incopat.com/, accessed on 14 April 2025).

The sample was refined by excluding financial, insurance, and certain tech-related firms to avoid bias from regulatory and technological factors (their regulatory environment, disclosure scope, and AI role differ fundamentally from manufacturing and service firms, which could bias CEP estimates) [

61,

96]. ST/*ST firms and records with missing data were removed, and winsorization was applied to continuous variables at the 1% and 99% levels. After processing, 26,475 observations remained. It should be noted that the dataset constitutes an unbalanced panel, as not all firms disclose relevant variables in every year. This unbalanced structure is typical in firm-level studies, and our econometric specification with firm-level clustering and multidimensional fixed effects appropriately addresses the resulting heterogeneity and ensures robust inference.

In sum, the research procedure followed a clear sequence of sample construction, variable measurement, and econometric specification, ensuring both data quality and methodological consistency.

4.2. Variable Definitions and Measurements

4.2.1. Dependent Variable: CEP (CEP)

Following the “output-oriented” measurement logic of Schaltegger and Csutora (2012) [

97] and Du and Wang (2022) [

98], we construct a firm-level indicator based on “annual abatement output per unit of operating scale”:

where

is firm

’s total greenhouse-gas emissions in year

;

denotes the annual net abatement (if emissions rise, then

, i.e., a “negative abatement”); and

is the two-year symmetric average of operating revenue, used to mitigate the change/level mismatch and to smooth one-year revenue volatility. Accordingly,

can be interpreted as tons of net annual abatement per unit of revenue at a comparable operating scale.

From an economic interpretation perspective, this design treats revenue as a proxy for firm output scale, making a measure of abatement efficiency relative to economic activity. Larger values indicate stronger governance performance in achieving emission reductions efficiently, while negative values reflect an annual deterioration. Relative to absolute emissions, enhances cross-firm comparability and aligns with policy evaluation logic, as regulators and investors often assess whether firms achieve reductions commensurate with their operating scale.

This construction also connects to the CES–emission framework in

Section 2: conditional on given constraints, an increase in AI’s marginal abatement efficiency yields greater annual net abatement for a fixed operating scale.

In addition, to ensure that our findings are not driven by a particular operationalization, we also adopt the inverse of carbon intensity as an alternative dependent variable:

where

is revenue per unit of emissions (a conventional carbon performance metric);

denotes carbon intensity;

is firm

’s operating revenue in year

; and

is defined as in Equation (21).

While Equation (21) emphasizes dynamic abatement relative to firm scale, Equation (22) provides a static productivity-style measure widely used in the literature. Our robustness tests confirm that the main conclusions hold across both measures, suggesting that the results are not artifacts of the chosen specification.

4.2.2. Independent Variable: AI Empowerment (AIE)

Following the measurement methods of Jardak and Ben Hamad (2022) [

99], Liu and Liu (2023) [

100], and Yao et al. (2024) [

30], this study constructed an AIE index based on corporate patent texts to measure the application and innovation level of AI technologies within firms. The patent texts were sourced from the IncoPat patent database, which contains the complete patent data of listed companies from 2013 to 2023. Since the patent database does not explicitly classify AI technologies, this study employed text-mining techniques to identify AI-related patents. The specific steps were as follows.

- (1)

Keyword Dictionary Construction: Referring to the approaches of Liu and Liu (2023) [

100], Xue et al. (2022) [

101], and Yao et al. (2024) [

30], and drawing on the China AI Industry Development Report and relevant industry standards, we constructed a precise dictionary containing 75 high-frequency and representative AI keywords. An extended keyword dictionary was also introduced in the robustness tests.

- (2)

Text Mining and Matching: Using Python 3.10, we segmented the patent abstracts of the sample firms and matched them with the keyword dictionary to identify AI-related patent entries.

- (3)

Annual Aggregation and Index Construction: We calculated the number of AI-related patent applications for each firm in each year (

), added one, and took the natural logarithm to obtain:

To verify the robustness, we constructed an alternative

measure based on the frequency of extended AI-related terms obtained from the MD&A portion of annual reports via text mining [

31]. This text-based proxy enriches the AI empowerment measure and corroborates the stability of our findings.

Although the patent-based

index reflects inventive effort rather than immediate deployment, this approach aligns with the dominant practice in measuring firm-level digital and AI capabilities (e.g., [

30,

99]). Importantly, our keyword set included categories with direct environmental relevance (e.g., smart environmental protection, intelligent sensors, intelligent supervision), while our sample excluded financial, insurance, and certain tech-only firms, where AI is less connected to abatement practices. Thus, the constructed AIE indicator primarily captures AI innovations with potential for emission optimization. Combined with the MD&A-based adoption proxy, the consistency of results suggests that our findings are not driven by a single proxy, but reflect a robust and environmentally relevant measure of AI empowerment.

4.2.3. Moderating Variables: Marketization Level (Market) and Executives’ Overseas Experience (Overseas)

Institutional environments shape corporate strategic behavior and the effectiveness of technological applications. Following the existing literature, we used the Regional Marketization Index from the

China Marketization Index Report to measure the extent of market development in each province [

102], where a higher score indicates a more competitive and market-driven institutional environment. The

Overseas variable is a dummy equal to 1 if at least one of the firm’s core executives (e.g., chairman, CEO, CFO) has overseas education or work experience, and 0 otherwise. This variable captures potential heterogeneity in the firm’s strategic decision-making and adoption of green technologies due to global exposure.

4.2.4. Mediating Variables: ESG Performance (ESG) and Green Innovation Capability (Innov)

First, ESG performance was measured using the Huazheng ESG rating, which evaluates firms across environmental, social, and governance dimensions. This rating has been widely used in China’s green finance research [

103,

104]. Second, green innovation capability was proxied by the natural logarithm of the number of green patent applications, reflecting the firm’s investment and output in green technology R&D [

58].

4.2.5. Control Variables

To control for firm-level heterogeneity that may influence CEP, we included a set of financial and corporate governance variables, as suggested by prior studies [

37,

99]. These included firm size (

Size), leverage (

Lev), firm age (

Age), return on assets (

ROA), cash flow ratio (

Cashflow), and revenue growth rate (

Growth). Governance variables included board size (

Board), proportion of independent directors (

Indep), CEO duality (

Dual), ownership balance (

Balance), managerial ownership (

Mshare), and the shareholding ratio of the top 10 shareholders (

Top10). Detailed definitions and computation methods of all variables are presented in

Table 1.

4.3. Econometric Model Specification

We employed econometric techniques to build a fixed-effect model that works well with unbalanced panels because it preserves the most information possible without necessitating a balanced structure.

To evaluate the impact of AI empowerment on firms’ CEP, the following baseline regression framework was established:

In Equation (24), denotes the CEP of firm in year , and represents the level of AI empowerment. is a vector of control variables, including firm-level financial characteristics (e.g., leverage, size, cash flow) and corporate governance indicators (e.g., board independence, managerial ownership). Year fixed effects (), province fixed effects (), city fixed effects (), and industry fixed effects () are included to absorb unobservable macro-institutional and regional policy heterogeneity. To overcome the possible bias from within-sample correlation and increase the inference efficiency, this research clustered the standard errors at the firm level.

To further explore the underlying mechanisms and heterogeneous effects, we extended the baseline model as follows:

We examined the mediating roles of ESG performance (

ESG) and green innovation capability (

Innov) using the following model:

In Equation (25),

refers to one of the three mediating variables:

or

. Following the identification strategy of Jiang (2022) [

105], if

is significant in Equation (25) and the path from AI empowerment to CEP is theoretically justified, we interpreted this as evidence that AI empowerment improves carbon performance via enhancing ESG or strengthening green innovation capability. All other model specifications remain consistent with the baseline.

- (2)

Moderation Models:

To investigate how external institutional context and managerial characteristics moderate the relationship between AI empowerment and CEP, we estimated the following interaction models:

In Equations (26) and (27), measures the level of marketization in the region where the firm is located and is a dummy indicating whether the firm’s top executives (e.g., chairman, CEO, CFO) have overseas experience. A significant interaction term suggests that regional market conditions significantly moderate the effect of AI empowerment on CEP. Similarly, a significant term implies that executive international experience affects how AI empowerment translates into emission outcomes. All other variables were defined as before.

5. Empirical Analysis

5.1. Descriptive Statistics

An overview of the descriptive statistics for the major variables is presented in

Table 2. The mean value of CEP is 0.790, with a relatively large standard deviation, which may suggest notable variation in carbon-reduction outcomes across sample firms. The average value of AI empowerment is 0.828, suggesting that the overall level of AI application is relatively low, but with considerable heterogeneity.

When it comes to the control variables, the average size of the company is 22.31, and the leverage ratio falls somewhere around 41.3%. Both return on assets and cash flow ratio appear relatively stable, which may reflect that many firms in the sample maintain a solid operational and financial foundation. In corporate governance, 38% of directors are independent, while 30% have CEO duality. The managerial ownership ratio exhibits high dispersion, implying heterogeneity in governance structures. For the mediating variables, the average ESG score is 4.155. The mean value of green innovation capability is 1.792, indicating that there remains considerable room for improvement in firms’ green strategic practices. Regarding the moderating variables, the average regional marketization level is 10.17, and overseas experience among top executives is present in 51.8% of the sample firms.

Overall, the distribution of the key variables appears reasonable, which provides a preliminary basis for further empirical analysis.

5.2. Baseline Regression Results

Before conducting the baseline regression, we performed diagnostic tests to determine the appropriate panel model specification [

106,

107]. The Hausman test yielded a significant result (χ

2 = 3070.44,

p = 0.000), indicating that the fixed-effect model is more consistent and appropriate for this study. Similarly, the Breusch–Pagan LM test was also significant (χ

2 = 126.85,

p = 0.000), suggesting the presence of individual heterogeneity and rendering ordinary least squares (OLS) estimation unsuitable. Therefore, we used a fixed-effect model for subsequent analyses.

The baseline regression results for AI empowerment on corporate CEP, which measures a firm’s ability to produce cleaner and more efficiently, are shown in

Table 3. Columns (1)–(3) employ our main indicator of carbon emission performance, defined as carbon reduction relative to revenue, whereas Columns (4)–(6) adopt an alternative measure—the inverse of carbon intensity (revenue/emissions)—to test robustness. Column (1) displays a simplistic specification devoid of fixed effects or controls. To account for unobserved macro- and region-level heterogeneity, Column (2) adds industry, year, province, and city fixed effects. A complete set of firm-level control variables is also included in Column (3) to lessen the bias caused by omitted variables. Columns (4)–(6) mirror these specifications with the alternative dependent variable (

CEP1).

Across specifications, AI empowerment is positively associated with CEP. In Column (1), without any fixed effects or controls, the coefficient for AIE is 0.138 (t = 13.85, p < 0.01). After introducing fixed effects (Column 2), the coefficient decreases to 0.029, but remains statistically significant. In the fully specified model with additional controls (Column 3), the coefficient is 0.030 (p < 0.01), with a t-value of 2.89, which suggests that AI empowerment facilitates cleaner production by reducing carbon intensity and improving resource allocation efficiency. When switching to the alternative measure CEP1, the coefficient for AIE also remains positive and statistically significant in the full model (β = 0.024, t = 2.03, p < 0.05). This consistency across two different measures of CEP indicates that our main findings are not driven by a particular operationalization of carbon performance.

Interpreted through our theoretical lens, these results align with the Porter hypothesis—that appropriately designed environmental pressures and constraints can induce efficiency-enhancing innovation [

108,

109]—and with the RBV, under which AI operates as a strategic, capability-like asset that raises energy efficiency and reduces emission intensity [

110,

111]. Framed this way, AI improves governance and operational discipline under emission constraints, yielding better CEP, which corresponds to our Hypothesis 1.

At the same time, AI carries a nontrivial energy footprint. Our baseline coefficients should therefore be read as net average effects. To probe time heterogeneity related to technology maturity and policy support, we additionally interact

AIE with a post-2018 indicator (

Section 5.5.4). The AI–CEP association strengthens after 2018, a period marked by rapid diffusion of AI applications and supportive policies, which is consistent with declining computed energy intensity and improved institutional complements. While we cannot separately identify AI’s own energy use within firms, we acknowledge this rebound risk and treat the post-2018 evidence as suggestive that net gains are larger when technology and policy environments improve.

Control-variable coefficients are broadly intuitive. We found that firm age shows a negative association with CEP, which may imply that more established firms face inertia in adopting digital and clean technologies. Cash flow is also negatively associated with carbon performance, possibly indicating that financial constraints limit firms’ capacity to invest in clean production. In contrast, growth rate is positively related to CEP, suggesting that growth-oriented firms are more likely to pursue clean technology adoption. Board size and independence appear more salient under the alternative measure (Columns 4–6), further reinforcing that AI’s positive effect is robust across different operationalizations of carbon performance. The inclusion of fixed effects and control factors significantly improves the explanatory power of the models, which ensures the robustness of the baseline specification.

At the same time, we verified robustness by adopting an alternative outcome measure—CEP1, the inverse of carbon intensity (Equation (22)). Consistent with the robustness analysis present later, the results remain consistent, confirming that our findings are not sensitive to a specific operationalization of CEP. Nevertheless, given that CEP (Equation (21)) emphasizes dynamic abatement relative to firm scale and aligns more closely with our theoretical framework, all subsequent mechanism and moderation analyses were conducted using CEP as the core indicator.

5.3. Mechanism Analysis

To explore the potential mechanisms through which AI empowerment may be linked to corporate CEP, this paper examines two key mediating pathways: ESG performance and green innovation capability. A theoretical transmission chain is constructed, and empirical testing is conducted following the approach of Jiang (2022) [

105]. It is crucial to highlight that there is little theoretical support for substantial reverse causality between the mediating variables and the result variable.

ESG and green innovation represent strategic pre-decision factors, whereas CEP reflects an operational outcome [

112]. The temporal structure and institutional context jointly establish a causal direction from “cause to effect.” Specifically, ESG improves compliance and disclosure [

104] and green innovation enhances low-carbon technology outputs [

48]. Taken together, these mediators provide a plausible mechanism through which AI empowerment translates strategic and governance choices into improved carbon outcomes (as shown in

Table 4).

5.3.1. ESG Performance

Table 4 shows that AI empowerment is positively associated with CEP. In Column (1), the coefficient for AI empowerment is 0.027 (

t = 2.67,

p < 0.01), indicating a statistically meaningful association with CEP. By contrast, Column (2) shows that artificial-intelligence empowerment is positively and significantly associated with firms’ ESG performance (0.051,

t = 5.21,

p < 0.01). We interpret this result as consistent with a possible governance-enhancement channel: in the environmental dimension, AI-enabled metering, carbon accounting, and anomaly detection strengthen real-time monitoring and tighten operational discipline; in the social dimension, data-driven disclosure, and sentiment-tracking tools improve responsiveness to employees, customers, and communities; and in the governance dimension, automated controls and compliance analytics raise transparency and reduce enforcement risk. In our theoretical framework, these improvements effectively raise the salience of emission constraints and their shadow value, thereby supporting cleaner production.

This mechanism is in line with both theory and evidence. Consistent with this view, recent firm-level studies document that AI applications improve ESG by enhancing environmental monitoring and disclosure quality, strengthening data-driven compliance, and reducing governance frictions [

43,

44]. Persakis (2023) [

113] argues that ESG, a systems-level governance device, stabilizes firm behavior under climate-policy uncertainty and facilitates emission reduction. Baratta et al. (2023) [

50] synthesize evidence that ESG practices directly suppress industrial carbon intensity and that coordination across E, S, and G is critical for low-carbon transitions. Using cross-country data, Oyewo (2023) [

114] shows that ESG committees and ESG-linked incentives materially improve carbon outcomes in carbon-intensive sectors. Kong et al. (2024) [

115] further find that green credit amplifies the emission-reduction impact of ESG, underscoring the role of financial infrastructure. Finally, Gabr and ElBannan (2025) [

116] identify a nonlinear threshold between ESG practice and carbon outcomes, implying that disclosure is most effective when paired with substantive abatement and sustainable investment.

Taken together, the results suggest that AI is associated with stronger ESG capabilities, which in turn may facilitate better carbon performance, following the logic chain “data intelligence → multidimensional accountability → improved emission outcomes.” This provides indicative support for Hypothesis 2, while our empirical design (with rich fixed effects and controls) focuses on association rather than strict causality. These associations are consistent with theory, though they should not be interpreted as definitive causal pathways.

5.3.2. Green Innovation Capability

Column (3) in

Table 4 shows that AI empowerment is positively and significantly associated with firms’ green innovation capability (β = 0.203;

t = 10.72;

p < 0.01). We interpret this as evidence that AI is associated with greater green patenting, cleaner process technologies, and low-carbon products, forming a plausible mediating pathway from digitalization to better CEP.

Mechanistically, AI strengthens green innovation through several complementary channels that align with the RBV and NRBV, as well as dynamic capabilities [

58]. First, machine learning, natural-language processing, and image recognition expand the firm’s ability to sense green technological opportunities by mining scientific literature, patent corpora, and operational data for emerging low-carbon solutions. Second, digital-twin simulation and data-driven experimentation help seize high-yield opportunities by shortening design–test cycles, improving experiment design, and reducing the cost of iteration, thereby improving the effectiveness of research and development allocation. Third, predictive analytics and knowledge-graph tools enable firms to reconfigure their innovation portfolios—prioritizing projects with higher expected abatement per unit of investment and strengthening intellectual-property discovery, integration, and protection. Together, these mechanisms may help extend the technological frontier relevant for decarbonization and enhance the productivity of abatement-oriented innovation.

The results are consistent with prior evidence. Recent studies provide direct support for the AI–green innovation link: Zhong and Song (2025) [

117] find that AI adoption significantly boosts green innovation capability among Chinese listed firms, while Lu and Li (2025) [

118] show that AI fosters green collaborative innovation through joint green patents. In addition, using Japanese manufacturing data, Lee and Min (2015) [

48] show that green research and development spending reduces carbon emissions while improving financial outcomes (a “double dividend”). Xu et al. (2021) [

82] find that green technology innovation improves CEP at the urban level via changes in energy structure, industrial composition, and foreign-investment inflows. From a natural resource–based perspective, Akhtar et al. (2023) [

119] document that green knowledge capital strengthens green absorptive capacity and the innovation climate, thereby enhancing environmental performance. In line with the dynamic capability view, prior research highlights that firms enhance resilience and sustainability when they effectively reconfigure internal resources in interaction with external ecosystems [

120].

In sum, AI empowerment appears to indirectly improve CEP by reinforcing firms’ green innovation capability. The evidence fits a coherent mechanism chain of “intelligent opportunity identification → targeted research and development → cleaner process and product transformation,” providing support for Hypothesis 3.

5.4. Moderation Effect Analysis

We further investigated whether the impact of AI empowerment on firms’ CEP varies with external institutional environment or internal governance structure. The results are reported in

Table 5.

5.4.1. Marketization Level

Table 5, Column (1) incorporates the regional marketization index (

Market) and its interaction term with AI empowerment (

AIE) to examine the moderating effect of market institutions on the carbon-reduction impact of AI. The interaction term

Market ×

AIE has a coefficient of 0.013 (

t-statistic of 1.74,

p < 0.1), suggesting that in regions where market mechanisms are more mature and competition more intense, the positive effect of AI empowerment on firms’ CEP may be stronger. Although the main effect of AI empowerment becomes insignificant in this specification, the significant interaction term implies potential heterogeneity in AI’s green empowerment effect across institutional contexts. To further verify this moderating mechanism, we report in

Appendix A Table A1 the marginal effects of

AIE at different percentiles of the marketization index. The results show that the effect of AI empowerment is insignificant in low-marketization regions (10th–25th percentile), but becomes positive and statistically significant from the median level onward and increases monotonically with marketization. This additional evidence provides stronger support for Hypothesis 4.

This finding can be interpreted through multiple theoretical lenses. Institutional theory suggests that corporate behavior is influenced by both institutional constraints and incentives [

87,

88,

121,

122]. In highly marketized regions, firms may face stronger disclosure pressures, investor supervision, and green reputation constraints [

123,

124], which may increase firms’ likelihood of leveraging AI for production optimization and emission reduction, consistent with institutional incentives and competitive pressures. From the resource-based view, high-marketization areas often possess more advanced digital infrastructure and open data platforms [

125,

126], which could provide a stronger resource base for AI deployment and carbon governance, thereby improving marginal abatement benefits. Moreover, institutional complementarity theory highlights possible synergies among institutional elements [

127,

128,

129]. Mature market mechanisms may complement green finance, environmental regulation, and data environment factors, facilitating the activation of AI empowerment mechanisms and promoting “technology–institution” synergy [

130,

131,

132].

From the perspective of our theoretical model, higher marketization effectively raises the penalty sensitivity to relative emissions and increases the shadow value of emission caps while lowering the frictions in AI adoption costs. This combination may amplify the marginal effect of AI on emission reduction, providing a structural explanation for why the marginal effect of AI on CEP strengthens with marketization.

In summary, a higher level of marketization appears to enhance firms’ responsiveness to incentives and their capability to implement AI technologies in carbon governance, encouraging more proactive use of intelligent tools to potentially improve CEP.

5.4.2. Executives’ Overseas Background

Table 5, Column (2) includes the executives’ overseas background dummy variable (

Overseas) and its interaction with AI empowerment (

AIE) to explore the moderating role of managerial characteristics on AI’s carbon-reduction effect. The coefficient of

AIE remains positive, but the interaction term

Overseas ×

AIE is negative and significant (β = −0.037,

t = −3.52,

p < 0.01). This indicates that although AI empowerment generally enhances CEP, its positive effect is significantly weakened in firms led by executives with overseas experience.

This seemingly counterintuitive result highlights the role of “technology adaptability–contextual fit.” While overseas experience is often regarded as a source of global vision and advanced managerial insights [

95,

133], it may not directly translate into advantages in domestic low-carbon governance. Recent empirical studies provide evidence consistent with this pattern. For instance, W. Su et al. (2023) [

134] find that directors with foreign experience improve environmental information disclosure only under strong regulatory conditions, while such effects vanish in weaker institutional environments. Similarly, Zhang and Dong (2023) [

135] show that CEO foreign experience enhances corporate social responsibility (CSR) performance mainly in regions with sound legal and institutional frameworks. These findings indicate that overseas experience is not uniformly beneficial, but its value is contingent on institutional fit.

From a theoretical perspective, institutional embeddedness and path dependence theories suggest that managers’ cognitive frameworks and decision-making logic are shaped by prior experiences. Overseas-trained executives often adopt schemas developed in foreign markets, which may not always align with domestic policy incentives, regulatory priorities, or infrastructural conditions, potentially weakening the effectiveness of AI adoption in local carbon governance. Bourmault and Siegel (2022) [

136] similarly emphasizes that multinational enterprise practices may fail in local subsidiaries due to adaptation failures. In addition, Simms and Frishammar (2024) [

137] highlight how institutional and technological “distance” in technology transfer can reduce gains from external knowledge, underscoring the importance of contextual fit.

This pattern can be explained through our theoretical framework. In the Bayesian learning block, executives’ prior beliefs about the marginal abatement efficiency of AI and their level of uncertainty jointly influence the firm’s optimal level of AI input. Executives with overseas backgrounds may underestimate the local abatement efficiency of AI or perceive greater uncertainty, which reduces their willingness to invest in AI and weakens its impact on CEP. Furthermore, because their institutional schemas are shaped abroad, they may misjudge the strength of domestic emission constraints and the value of compliance under local carbon caps, which could result in less efficient resource allocation. They may also perceive the costs of AI adoption as higher in local contexts due to possible misalignment with infrastructure and governance systems.

To test contextual dependence, we estimated the marginal effect of AIE across marketization percentiles and stratified by executives’ overseas background. The results show that: (i) in firms without overseas-background executives, the marginal effect becomes significantly positive from the median marketization level onward and strengthens thereafter; and (ii) in firms with overseas-background executives, the effect is insignificant or negative at low marketization, but turns significantly positive at high marketization (see

Appendix A Table A2). These patterns further support the “institutional fit–adaptation” mechanism.

In summary, the negative moderating effect observed here is consistent with a broader technology–institution–manager misfit mechanism, rather than being attributable to a single cognitive factor. Overseas experience, while a potential source of advanced knowledge, may attenuate AI’s effectiveness in carbon reduction when local adaptation is insufficient. This finding supports Hypothesis 5 and highlights the nuanced role of managerial characteristics in shaping the effectiveness of technological empowerment for green transformation.

For completeness, heterogeneity analyses (ownership, industry, region) are reported in

Appendix A Table A3. The results are consistent with and provide additional support for the main conclusions.

5.5. Robustness and Endogeneity Tests

This study conducted robustness checks across multiple dimensions, including variable substitution, sample adjustment, and model specification, to provide supportive evidence for the conclusion that AI empowerment may improve corporate CEP (see

Table 6).

5.5.1. Alternative Measurement

- (1)

Alternative measurement: Independent variable

Considering that the measurement of AI empowerment might be influenced by the keyword screening strategy, we constructed an alternative indicator—AI extended keyword frequency (

AI)—to redefine the firm’s AI empowerment intensity [

30]. Specifically, in addition to patent text data, we also used the MD&A section of annual reports to extract AI-related terms, thereby broadening the vocabulary used to capture AI activities.

Table 6, Column (1) shows that the coefficient of this alternative AI empowerment measure is 0.027 (

p < 0.01), confirming the robustness of our baseline specification and suggesting that our findings are not sensitive to a particular text-mining strategy.

- (2)

Alternative measurement: Independent and dependent variables

To further test robustness, we simultaneously replaced both the explanatory and dependent variables. The explanatory variable was substituted with the annual report–based AI index (AI), while the dependent variable was replaced with the inverse of carbon intensity (CEP1), defined as revenue divided by carbon emissions.

Column (2) reports the results under this joint specification. The coefficient for AI remains positive and statistically significant (β = 0.019, t = 1.99, p < 0.05), indicating that our main conclusion—that AI empowerment improves firms’ CEP—continues to hold when both variables are operationalized differently.

These results reinforce that the observed effect of AI empowerment is not an artifact of any particular measurement of AI or CEP, but reflects a robust and stable relationship across alternative proxies.

5.5.2. Controlling for COVID-19 Pandemic Shock: Excluding 2020–2023 Samples

Acknowledging the structural disruption caused by the COVID-19 pandemic on corporate AI adoption and carbon-reduction behavior during 2020–2023, the samples from this period were excluded, and the model was re-estimated.

In

Table 6, Column (3), the core explanatory variable

AIE coefficient remains significant at 0.051 (

p < 0.01), indicating that the conclusion holds after controlling for pandemic effects.

5.5.3. One-Period Lag of Independent Variable: Mitigating Reverse Causality

To alleviate potential endogeneity concerns, the AI empowerment variable was introduced with a one-period lag, i.e., using the previous year’s AI input to predict the current year’s CEP, thereby reducing the risk of reverse causality that firms with better CEP are more inclined to invest in AI.

Table 6, Column (4) reports a coefficient of 0.028 for the lagged variable, significant at

p < 0.05, confirming a lagged effect and causal robustness of AI empowerment on CEP.

5.5.4. Time-Heterogeneity Test

To further verify the robustness of the baseline results, we examined the time heterogeneity of AI empowerment’s effect on CEP. The period 2013–2023 marked a decade of rapid AI development in China: following the issuance of the New Generation AI Development Plan in 2017, a wave of AI-specific local policies arrived in 2018, and from 2019 onward the Ministry of Science and Technology launched and expanded the “National New-Generation AI Innovation and Development Pilot Zones,” accelerating implementation. Against this timeline, we set 2018 as a structural breakpoint, defined a dummy

Post2018 (equal to 1 for 2018 and thereafter, and 0 otherwise), and estimated a two-way fixed-effect specification with the interaction term (

AIE × Post2018) to conduct a phase-specific analysis (

Table 6, column (5)).

Although the measurement setup includes a fixed effect for the year, the main effect of Post2018 is absorbed by the year dummy variable, but this does not affect the identification or estimation of the interaction term, whose coefficient is informed by within-firm intertemporal changes.

The results show that during 2013–2017, the effect of AI empowerment on CEP is insignificant, whereas for 2018–2023 the interaction term is about 0.035 and significant at the 1% level (with controls and multidimensional fixed effects). This indicates that the positive effect of AI empowerment on CEP is mainly unlocked after 2018. The finding aligns with our theoretical mechanism on marginal abatement efficiency: before 2018, limited technological maturity and weaker complementary institutions kept the effective marginal efficiency low; after 2018, advances in algorithms, data, and computing power—combined with a stronger policy environment—substantially raised that effective marginal efficiency, thereby strengthening the impact of AI empowerment on CEP.

5.5.5. Endogeneity Test

Given the risk of sample selection bias from firms’ non-random green investment choices, the Heckman two-stage method was utilized to address potential endogeneity concerns. First, a probit model predicts whether a firm’s green investment exceeds the industry-year average (EPI_dum) and calculates the inverse Mills ratio (). The second stage incorporates IMR into the main regression to correct for selection bias and assess its impact on estimation results.

Table 6, Column (7) provides the estimates derived from the second-stage regression. The

AIE is still statistically significant (β = 0.024,

t = 1.88, at the 10% level). The

IMR coefficient is positive and highly significant (β = 10.337,

t = 59.29), indicating the presence of selection bias in firms’ green investment behavior, which is effectively corrected by the Heckman approach.

The above robustness and endogeneity tests consistently support the main conclusions. Additionally, considering that single-level clustering might underestimate standard errors, this study also conducted multilevel clustered robust standard error tests, which continued to uphold the main results (see

Appendix A Table A4).

6. Conclusions and Policy Implications

6.1. Conclusions

This study examined how AI empowerment reshapes firms’ CEP in the context of cleaner production. Using a dynamic learning game model and panel data of 3404 Chinese A-share listed firms from 2013 to 2023, we show that AI adoption is associated with an “intelligence-driven” paradigm, where emission optimization can be realized through process automation, predictive monitoring, and resource reconfiguration. In this sense, AI acts as a systemic production tool that enhances both the structure and productivity of firms’ low-carbon practices.

Our mechanism analysis indicates that AI empowerment significantly enhances firms’ ESG performance and green innovation capability, which in turn contribute to improved CEP. The empirical results also reveal that the emission-reduction effect of AI is contingent upon institutional and managerial contexts. Marketization strengthens the positive impact of AI by aligning incentives, improving disclosure pressure, and expanding access to digital infrastructure. By contrast, executives with overseas backgrounds weaken this relationship due to adaptation frictions, path dependence, and misalignment between foreign experience and local policy frameworks. This finding, further corroborated by stratified marginal-effect analysis across marketization levels (

Appendix A Table A2), highlights that the negative moderating role of overseas background is mainly confined to weak institutional environments. Additional heterogeneity tests—across ownership types and industry classifications—confirm that private and non-pollution-intensive firms benefit more directly from AI empowerment, while state-owned and heavy-polluting firms exhibit flatter AI and CEP responses, and the positive effect is mainly concentrated in eastern regions with stronger institutional and digital infrastructures.

Taken together, these findings yield three main theoretical contributions. First, by integrating dynamic learning mechanisms with cleaner production theory, the paper advances the microeconomic foundations of sustainable production. It demonstrates how AI modifies the marginal abatement efficiency of firms under budgetary and emission constraints, providing a dynamic and constraint-based perspective that extends beyond static production functions. Second, the study identifies two key mediation pathways—ESG enhancement and green innovation capability—that link AI empowerment to CEP. This provides a theoretical bridge between digital technology studies and environmental management research, explaining how digitalization drives environmental outcomes through governance improvement and technology upgrading. Third, by embedding institutional and managerial moderators, the analysis highlights how system-level factors shape the effectiveness of AI-enabled cleaner production. This enriches the literature at the intersection of technology, governance, and sustainability, showing that technological empowerment alone is insufficient without compatible institutions and managerial adaptation.

Finally, while AI empowerment promotes cleaner production, its own energy-intensive training and deployment may generate rebound effects that partially offset emission-reduction gains. This duality suggests that AI is not a panacea, but a context-dependent tool whose environmental benefits hinge on complementary energy structures, governance arrangements, and regulatory designs. Future policy and research should therefore place greater emphasis on balancing AI’s digital efficiency with its energy footprint to ensure that technological empowerment delivers net-positive contributions to sustainable development.

6.2. Policy Implications

The findings yield several targeted and actionable policy implications. Our evidence highlights three main mechanisms—AI’s role in enhancing ESG and green innovation, the amplifying effect of marketization, and the weakening role of executives with overseas backgrounds—which translate into the following policy priorities.

To begin with, mitigate the overseas executive paradox. Overseas managerial experience may dampen AI’s abatement effect in weaker institutional settings, but can become an asset in stronger ones. To address this, governments should provide certification and training on domestic carbon-governance rules, industry associations should facilitate cross-regional knowledge translation and case sharing, and firms should complement international exposure with ESG- and carbon-governance performance evaluations. These measures can reduce misalignment and turn global experience into a local advantage. In addition, institutional complements should be strengthened. Higher marketization magnifies AI’s benefits. Governments should enhance disclosure systems, property rights protection, and digital infrastructure in lagging areas. Pilot programs for green data markets could standardize carbon datasets, reduce AI adoption costs, and foster cross-firm learning. Equally important is addressing rebound effects explicitly. Policymakers should encourage renewable energy transitions, mandate carbon accounting for data centers, and incentivize energy-efficient AI architectures to ensure AI’s abatement benefits are not offset by its own energy footprint. Finally, tailor policies to ownership and industry heterogeneity. For SOEs, subsidies and financing should be conditional on performance-based adoption metrics (e.g., AI-enabled emission auditing), rather than unconditional capital access. For private firms, especially in non-pollution-intensive sectors, tax deductions for data circulation and cloud expenditures can accelerate adoption. In pollution-intensive industries, AI must be combined with energy-structure upgrades (e.g., electrification, clean fuels) to achieve measurable reductions.