1. Introduction

Food security is a critical strategic issue for national livelihoods, and its importance has become increasingly pronounced in the context of global supply chain restructuring and energy transitions. Since joining the World Trade Organization (WTO), China’s agricultural trade has experienced an average annual growth rate of 10.8% (

https://stats.wto.org/). From a systems theory perspective, food security is not solely dependent on the supply–demand balance within a single market; rather, it is embedded within the global commodity system. In this system, nonlinear feedback and risk contagion significantly influence price fluctuations, necessitating analysis through a comprehensive, holistic framework. While deeper integration into the global market has brought various benefits, it has also made domestic grain prices more vulnerable to international supply and demand dynamics, as well as fluctuations in energy prices. In this context, understanding the mechanisms underlying grain price formation and improving price regulation capabilities are essential for safeguarding national food security and maintaining socio-economic stability [

1,

2,

3,

4,

5,

6].

As core components of the global commodity system, crude oil and grains have attracted significant academic attention due to their interconnected price dynamics [

7,

8,

9]. Since the 2007–2008 global food crisis, frequent co-movements between these commodities have underscored the profound interlinkages between them. Crude oil prices directly influence grain markets through production costs and maritime freight rates [

10,

11]. Additionally, the use of corn and soybeans in biofuel production, such as ethanol and biodiesel, further strengthens the nexus between energy and agricultural markets, forming an integrated “energy–grain” system [

12,

13]. Within this system, shocks from the energy market can spill over into the grain market and be amplified through production, transportation, and financial expectations. Therefore, systematically identifying dynamic spillover pathways from crude oil prices to grain markets, particularly through the intermediary roles of shipping costs and biofuel demand, is of both theoretical significance and practical relevance for enhancing countries’ capacities to manage global market risks [

14,

15,

16].

Despite growing scholarly attention, current research on the interplay between grain and crude oil markets has several key limitations. First, most studies examining the relationship between grain and oil prices rely heavily on Granger causality tests and time-varying impulse response analysis to assess cross-market price transmission [

8,

17,

18]. However, Granger causality does not establish true causal relationships; it only detects statistical predictive power. Similarly, while time-varying impulse response functions capture dynamic responses, they are limited in scope. These functions show whether the impact of a shock intensifies or weakens at a given moment, but they fail to provide comprehensive insights over extended horizons or to identify the directionality of international grain price influences. Second, although some studies recognize the mediating roles of renewable fuel demand and transportation costs [

19,

20,

21,

22,

23], few offer a systematic empirical examination of maritime freight costs and biofuel consumption as distinct transmission channels. More importantly, there is a notable lack of differentiated analysis across key grain types, particularly between corn and soybeans. Despite their differing exposure to biofuel markets and global trade structures, few studies address this disparity. Existing research tends to focus on single variables or partial perspectives, often overlooking cross-market coupling and risk contagion at the systems level. This limits a comprehensive understanding of energy–food market interactions. The gap in the literature not only constrains our understanding of the complex, multi-pathway interactions between energy and agricultural markets but also undermines the effectiveness of policy design aimed at enhancing food security under volatile energy conditions.

To address the limitations of existing research, this study introduces several methodological and conceptual innovations in analyzing the spillover effects of international crude oil prices on grain markets. Firstly, previous studies on the transmission effect of international grain prices to domestic prices often relied on static analysis methods, which fail to capture the time-varying characteristics of price transmission. Additionally, the impact of the international energy market on this transmission has not been thoroughly discussed, as previous research did not characterize this transmission index. In contrast, this study innovatively employs the DY spillover index to illustrate the time-varying transmission effect between domestic and international grain prices. This index effectively reflects the nonlinear and dynamic interdependencies between domestic and international grain markets and can be used as a target variable for subsequent studies on the impact of oil prices.

Secondly, building on the transmission effect index of domestic and international grain prices established in the first point, this study explores both the direct and indirect mechanisms through which international oil prices influence these markets. The study introduces international shipping costs as a mediating factor in the transmission of oil price effects on domestic and international grain prices. Furthermore, for crops like corn and soybeans, which are increasingly used for energy, the study incorporates the demand for international ethanol and biodiesel as mediators to analyze the transmission path from changes in traditional energy prices to the demand for new energy sources and their effect on cross-border grain price transmission.

Finally, the empirical results offer novel insights. On one hand, rising international oil prices lead to higher global shipping costs, which in turn increase the landed price of imported grain, strengthening the transmission effect of international grain prices to domestic prices. On the other hand, higher oil prices stimulate global demand for biofuels, including ethanol and biodiesel, which in turn increases the demand for corn and soybeans, enhancing the spillover effect on domestic and international grain prices. From a policy perspective, this study suggests the importance of monitoring international oil prices, shipping indices, and biofuel policies domestically, and establishing cross-sectoral risk assessment and early warning mechanisms.

This study is particularly important for China, as its food security is highly influenced by the volatility of international commodity markets, especially oil and grain. Chinese rapid economic growth and increasing integration into global markets have heightened its vulnerability to external economic shocks, including energy price fluctuations. The interconnectedness of the Chinese agricultural sector with global supply chains means that disruptions abroad can affect food prices and availability domestically. Understanding grain price dynamics and improving price regulation are vital for safeguarding Chinese food security and socio-economic stability. The findings also have broader implications for other emerging economies facing similar risks from global market fluctuations.

The structure of this study is as follows:

Section 2 reviews the existing literature, outlines the theoretical framework, and proposes the research hypotheses.

Section 3 details the methods employed.

Section 4 presents the empirical results, followed by the discussion in

Section 5.

Section 6 concludes the paper.

2. Literature Review and Theoretical Foundation

2.1. Literature Review

Since the global food crises of 2007–2008 and 2010–2011, an increasing number of scholars have begun to focus on the complex relationship between food prices and crude oil prices, as well as their interaction [

24,

25,

26,

27]. Cabrera and Schulz (2016) [

28] pointed out that crude oil is widely used in agricultural production and transportation. Therefore, the increase in crude oil prices will inevitably lead to higher production costs, resulting in a rise in grain prices. Cheng and Cao (2019) [

29] argue that the crude oil market’s influence on the agricultural market is nonlinear and asymmetric. The findings of Kirikkaleli and Darbaz (2021) [

30] and Shen and Qiu (2024) [

31] reveal that the pass-through effect of price fluctuations in oil and biofuels on both domestic and global food prices is particularly pronounced. Similarly, Hanif et al. (2021) [

32] provide a specific example of this, showing that the impact of rising crude oil prices on food prices exceeds that of price declines. Raza et al. (2022) [

33] argue that the correlation between food prices and oil prices is bidirectional, with oil prices and supply shocks being the primary factors that lead to the transmission of price fluctuations. According to Umar et al. (2021) [

34] and Shen et al. (2022) [

35], different grain varieties exhibit varying sensitivity to crude oil price changes, depending on their extent of use in biofuel production.

With the rise of the bioenergy industry, several scholars have begun to examine the potential upward pressure that biofuel demand may exert on grain prices [

36,

37,

38,

39]. De Gorter et al. (2013) [

40] propose that government policies regulating and restricting biofuels are a primary cause of sharp increases in food prices. Tanaka et al. (2024) [

41] demonstrate that U.S. biofuel production had a considerable influence on food prices in four African countries, with the effect being particularly pronounced during the 2011-2012 period. Wei et al. (2024) [

42] note that adverse exogenous oil supply shocks impact global food prices through the biofuel production channel. Karkowska and Urjasz (2024) [

7] note that, against the backdrop of climate change, the demand for energy stability is growing increasingly urgent; as a viable alternative energy source, biofuel production significantly impacts key commodities such as grains and vegetable oils, thereby driving up food prices and exacerbating market volatility. Zhao et al. (2025) [

43] employ a TVP-VAR model to examine the dynamic linkages between global biofuels and China’s grain market, and the results indicate that biofuels act as a net transmitter of spillovers, while corn and soybeans serve as net receivers of spillovers. From the existing literature, although studies have thoroughly examined various factors influencing grain prices, certain limitations remain. First, while existing literature has analyzed the impacts of international oil prices and international grain prices on domestic grain prices in China, these studies often overlook the mechanism through which international crude oil prices affect domestic prices by influencing international grain prices. In other words, they neglect the importance of the transmission effect of international crude oil prices on the pass-through between international and domestic grain prices. Second, current research pays little attention to the role of maritime shipping costs as a key transmission channel when analyzing the impact of international oil prices on both international and domestic grain prices. Moreover, for the two major grain types, corn and soybeans, there is insufficient in-depth exploration of the mediating effects of renewable energy demand, such as international ethanol fuel demand and international biodiesel demand, in the transmission relationship between international oil prices and domestic grain prices. These research gaps constrain a comprehensive understanding of the complex interactions between energy markets and agricultural markets, thus undermining the effectiveness of related policy formulation. Therefore, further investigation of these transmission pathways and mediating effects would help more accurately identify the multidimensional impacts of international crude oil price fluctuations on grain markets, providing a scientific basis for safeguarding national food security.

2.2. Theoretical Basis

2.2.1. International Crude Oil Price Impact on Food Prices at Home and Abroad: The Transfer Effect Mechanism

International crude oil prices, as a core variable in the global energy market, exert upward pressure on international grain prices through multiple channels, which are subsequently transmitted to the domestic market. On the one hand, rising crude oil prices directly increase the costs of agricultural production, including fertilizers, pesticides, and fuel for agricultural machinery. Given the relatively low short-term supply elasticity of grain, this cost push contributes to higher international grain prices. Since China has a high import dependency on commodities such as corn and soybeans, fluctuations in international prices are readily transmitted to the domestic market through trade channels. On the other hand, as crude oil is priced in U.S. dollars, oil price increases raise China’s energy import expenditure, intensify pressure on the depreciation of the RMB, and thereby elevate the domestic-currency cost of grain imports. Furthermore, higher oil prices trigger imported inflation and cost-push inflation, resulting in increases in refined fuel prices, transportation costs, and agricultural labor costs. This creates broad-based upward pressure on prices, ultimately exacerbating price volatility in China’s domestic grain markets. From a systems theory perspective, this process is not a linear transmission of a single variable but a complex feedback network operating through production, exchange rates, inflation, and trade, causing oil price shocks to reach domestic grain markets with nonlinear and amplified effects. Based on the above theoretical analysis, we propose Hypothesis 1 of this study:

Hypothesis 1.

The impact of international crude oil prices on the “international–domestic” grain price transmission effect is negative. That is, when the international crude oil price rises, it will prompt the international grain price to rise, which in turn leads to an increase in the landed price of China’s grain imports. This is reflected in the “international–domestic” dynamic net spillover index of grain prices, which shows a negative impact.

2.2.2. International Crude Oil Prices, Maritime Shipping Costs, and the Transmission of Grain Prices Between International and Domestic Markets

Rising international crude oil prices directly increase vessel fuel costs, leading to higher maritime freight rates. In the global grain trade, where CIF (Cost, Insurance, and Freight) pricing is widely adopted, higher freight costs contribute to an overall increase in the landed price of grain. Chinese importers thus face higher logistics expenses, which are subsequently passed through to the domestic market. Moreover, volatile oil prices may introduce uncertainty into shipping schedules, prompting traders to include freight adjustment clauses in contracts or to engage in hedging activities. The associated risks and transaction costs may indirectly push up international grain prices, thereby strengthening their transmission to the domestic market. From a systems perspective, shipping costs are not just a single intermediary variable but a key systemic link between energy and grain markets, amplifying and transmitting oil price shocks to grain markets through the transport system. Based on this analysis, we propose Research Hypothesis 2:

Hypothesis 2.

International crude oil prices indirectly influence the transmission of grain prices from international to domestic markets through their impact on maritime shipping costs.

2.2.3. International Crude Oil Prices, Biofuel Demand, and the Transmission of Grain Prices Between International and Domestic Markets

Rising international crude oil prices improve the economic viability of ethanol fuel, stimulating an increase in its demand. Driven by energy security concerns and emissions reduction policies, many countries have increased the blending ratios of biofuels, resulting in more substantial industrial demand for grain crops, such as corn. This increased demand reduces the availability of corn in international food markets, pushing up international corn prices. The resulting price increases are transmitted to the domestic market through import channels, exacerbating price volatility in China’s corn market. Systems theory suggests that this transmission is not merely a change in supply and demand, but a complex network effect shaped by the interplay of energy, food, and policy, where shocks accumulate within the system and exhibit nonlinear characteristics. Based on this theoretical analysis, we propose Research Hypothesis 3:

Hypothesis 3.

International crude oil prices indirectly influence the transmission of corn prices from international to domestic markets through their impact on international ethanol fuel demand.

In addition, rising crude oil prices enhance the relative economic attractiveness of biodiesel, leading to increased demand and, consequently, higher biodiesel prices. As soybeans are a primary feedstock for biodiesel production, industrial demand for soybeans rises, competing with food-grade demand. This shift alters the supply–demand structure in the international soybean market, driving up prices. These price increases are subsequently transmitted to China through imports, intensifying price fluctuations in the domestic soybean market. From a systems perspective, the structural tension in the soybean market between food and energy demand means that oil price shocks transmitted through the biodiesel channel manifest not only as price linkage but also as systemic co-movement risks between food and energy markets. Based on this analysis, we propose Research Hypothesis 4:

Hypothesis 4.

International crude oil prices indirectly influence the transmission of soybean prices from international to domestic markets through their impact on international biodiesel demand.

3. Methodology

3.1. DY Spillover Index Method

The studies by Wang et al. (2024) [

44] and Xu et al. (2025) [

45] define “grain pricing power” as the influence and authority in the process of forming grain prices. Referring to the Connectedness Spillover Index model proposed by Diebold and Yilmaz (2009) [

46], the DY spillover index method was used to construct the “international–domestic” grain price transmission effect index.

Firstly, use Formula (1) to convert the original futures price data of rice, wheat, corn and soybeans into a series of yield rates. In Formula (1), represents the transformed yield series, represents the current grain futures price, and represents the previous grain futures price.

Secondly, a VAR vector autoregressive model between the international grain futures yield rate and the domestic grain futures yield rate is constructed. The formula of the VAR model is shown in (2):

In Equation (2), represents the parameter matrix, represents the covariance matrix. The moving average form of Equation (2) is: , is an infinitely lagging polynomial matrix that can be recursively computed.

Referring to the KPSS method, the Generalized Forecast Error Variance Decomposition (GFEVD) is performed under the general VAR framework to obtain the proportion of the forecast error variance of China’s grain futures market caused by shocks from the international grain futures market:

In Equation (3),

is the variance matrix of the forecast error vector,

represents the standard deviation of the error term of the j-th equation,

is a column vector where all elements are 0 except the i-th element, which is 1,

. To make

comparable, it is also necessary to standardize it:

Finally, the total spillover, directional spillover and net spillover indices under the international grain market and the Chinese grain market system are constructed. They are used to quantitatively measure the total spillovers effect (TS), directional spillovers effect (DS), net spillovers effect (NS) between the international grain market and the Chinese grain market, and the net pairwise directional spillovers effect (NPDS).

In Formula (5),

represents the total spillover effect index, which measures the intensity of the overall price transmission effect between the international grain market and China’s grain market.

In Formula (6),

represents the directional spillover index, which indicates the directional spillover effect from the international grain market to China’s grain market, where the value is located in the “FROM” column of the spillover index table.

In Formula (7),

represents the reverse directional spillover index, which refers to the directional spillover effect transmitted from China’s grain market to the international grain market.

In Equation (8), measures the net spillover effect of China’s grain market on the international grain market, i.e., the difference between the price spillover effect transmitted from China’s grain market to the international market and the price spillover effect received by China from the international market.

In the subsequent empirical analysis of this paper, the above models will be established in sequence between international rice and domestic rice, international wheat and domestic wheat, international corn and domestic corn, and international soybeans and domestic soybeans, and the total spillover index, directional spillover index and net spillover index will be analyzed.

3.2. Vector Error Correction Model Construction

According to the theoretical analysis in

Section 2.2.1, fluctuations in international crude oil prices are transmitted to international grain prices in the short term and subsequently affect domestic grain prices in China. Therefore, this paper adopts the Vector Error Correction Model (VECM) to examine the cointegration relationship and error correction mechanism between international crude oil prices and the transmission effect of international-to-domestic grain prices. The core advantage of the VECM model lies in its ability to distinguish between the long-term equilibrium and short-term fluctuation effects between variables. The mathematical expression of the VECM model is as follows:

In Formula (9), represents the “international–domestic” grain price net spillover index, where x equals w, g, c, and s respectively representing wheat, rice, corn, and soybeans. t represents time; represents the first-order lagged error correction term; represents the first-order difference. Oil represents the WTI crude oil price variable; l and k represent the lag order.

When the estimated coefficient is significant, it indicates that there is a long-term causal relationship in the Granger sense between international crude oil prices and the transmission effect of domestic and international grain prices. If at least one is significant, it suggests that international crude oil prices influence the grain price transmission effect in the short term.

3.3. Construction of Regression Analysis

According to the theoretical analysis in

Section 2.2.1, in the long term, international crude oil prices will affect domestic grain prices in China through cost transmission, exchange rate transmission, and inflation transmission. Taking the transmission effect indices of domestic and international grain prices for wheat, rice, corn, and soybeans as the dependent variables, and the international crude oil price as the independent variable, the measurement equation constructed is shown in Formula (10):

In Formula (10),

represents the “international–domestic” grain price net spillover index, characterized by the dynamic net spillover index from

Section 3.1.

represent wheat, rice, corn, and soybeans, respectively.

represents the WTI crude oil price variable. For the control variables, this study draws on the works of Liu et al. (2025) [

47] and Viacheslav (2024) [

48] and introduces two control variables: the exchange rate and the interest rate. The exchange rate is represented by the RMB/USD middle rate (CNY), and the interest rate is represented by the Shanghai Interbank Offered Rate (Shibor) for overnight deposits. In the robustness test for replacing control variables, CNY will be replaced by the spot exchange rate (CNY_1), and Shibor will be replaced by the one-week interest rate (Shibor_1).

3.4. Model Construction for the Mediating Effect of Maritime Shipping Costs

According to the theoretical analysis in

Section 2.2.2, an increase in international crude oil prices raises the cost of shipping fuel, and higher freight rates lead to an overall rise in the landed price of grain. Therefore, the mediation analysis model in this study treats international crude oil prices as the independent variable, international maritime shipping costs as the mediator, and the international-to-domestic grain price transmission index as the dependent variable. The objective is to examine the pathway and mechanism through which rising international crude oil prices lead to higher maritime shipping costs, which in turn cause changes in the international-to-domestic grain price transmission index.

For the mediating effect research, this study does not adopt the traditional stepwise regression approach. Instead, we separately assess two causal relationships: (1) the direct effect of international crude oil prices on the grain price transmission index, and (2) the direct effect of international crude oil prices on maritime shipping costs. To model the influence of international crude oil prices on maritime shipping costs, we construct the following econometric specification, as shown in Equation (11):

In Equation (11), represents the WTI crude oil price variable, and denotes the Baltic Dry Index variable, which reflects fluctuations in international shipping costs. refers to the control variables. The expression is the control variable in Formula (11). Similar to Formula (10), the exchange rate (CNY) and the interest rate (Shibor) are selected.

3.5. Construction of a Mediating Effect Model for International Fuel Ethanol Consumption

According to the theoretical analysis in

Section 2.2.3, an increase in international crude oil prices enhances the economic feasibility of ethanol fuel, leading to greater industrial demand for grain crops such as corn. This shift in demand drives up international corn prices, which in turn causes a rise in domestic corn prices in China. Therefore, this paper also incorporates international fuel ethanol consumption as a mediating variable to examine whether the pathway and mechanism of “rising international crude oil prices → increasing international fuel ethanol demand → rising transmission effect of international corn prices on domestic corn prices” holds. The econometric model constructed for this purpose is shown in Equation (12) as follows:

In Formula (12), represents the WTI crude oil price variable, represents the consumption of fuel ethanol in the United States, reflecting the changes in the international demand for fuel ethanol. The expression is the control variable in Formula (12). Similar to Formula (10), the exchange rate (CNY) and the interest rate (Shibor) are selected.

3.6. Construction of a Mediating Effect Model for International Biodiesel Consumption

According to the theoretical analysis in

Section 2.2.3, an increase in crude oil prices enhances the relative economic attractiveness of biodiesel, leading to increased biodiesel demand. This, in turn, raises the demand for soybeans as a raw material, driving up international soybean prices, which then causes an increase in domestic soybean prices in China through transmission effects in international markets. Therefore, this paper also considers international biodiesel consumption as a mediating variable to examine whether the pathway and mechanism of “rising international crude oil prices → increasing international biodiesel demand → rising transmission effect of international soybean prices on China’s soybean prices” are valid. The constructed measurement model is shown in Equation (13) as follows:

In Formula (13), represents the WTI crude oil price variable, represents the consumption of biodiesel in the United States, reflecting the changes in international demand for biodiesel. The expression is the control variable in Formula (12). Similar to Formula (10), the exchange rate (CNY) and the interest rate (Shibor) are selected.

4. Descriptive Statistical Analysis and Spillover Index Analysis

4.1. Descriptive Statistical Analysis

Monthly spot prices for wheat, corn, and soybeans in China are sourced from Huiyi.com (

www.chinajci.com/default.aspx (accessed on 25 August 2025)), while monthly spot prices for rice are obtained from the Ministry of Commerce of China (

www.mofcom.gov.cn/index.html (accessed on 25 August 2025)), both expressed in yuan per kilogram. The data span the period from January 2004 to March 2025. Futures price data for wheat, rice, corn, and soybeans are collected from the Zhengzhou Commodity Exchange (

http://www.czce.com.cn/). WTI crude oil prices and maritime shipping cost data are sourced from the Wind database. The international fuel ethanol consumption is represented by monthly fuel ethanol consumption data downloaded from the Renewable Fuels Association (RFA) website (

ethanolrfa.org). International biodiesel consumption is measured by the monthly consumption of biodiesel and renewable diesel obtained from the U.S. Energy Information Administration (EIA) (

www.eia.gov). The international-to-domestic grain price transmission indices for wheat, rice, corn, and soybeans are derived from the estimation results of the DY spillover index.

It is worth noting that this study initially uses daily data of international and domestic food futures prices to measure the spillover index. This is because the measurement of the spillover index requires a fitting window, and monthly data is insufficient in length. Subsequently, this study converts the spillover index into monthly data because, in the following analysis of the impact of oil prices on the spillover index, the constructed transmission path includes intermediary variables such as shipping costs and biofuel demand, which are based on monthly data. While current studies on direct impacts can utilize methods like reverse mixed-frequency data analysis, there are almost no existing methods that can be referenced when it comes to the transmission mechanisms involving intermediary variables. Therefore, this study performs frequency conversion.

Table 1 presents the descriptive statistics of all variables used in the analysis.

4.2. Analysis of the Dynamic Total Spillover Index Between “International and Domestic” Grain Prices

The DY spillover index method is employed to measure the dynamic spillover effects between international and domestic futures prices of wheat, rice, corn, and soybeans. The results show that the price linkages in the four major grain markets all exhibit significant time-varying characteristics.

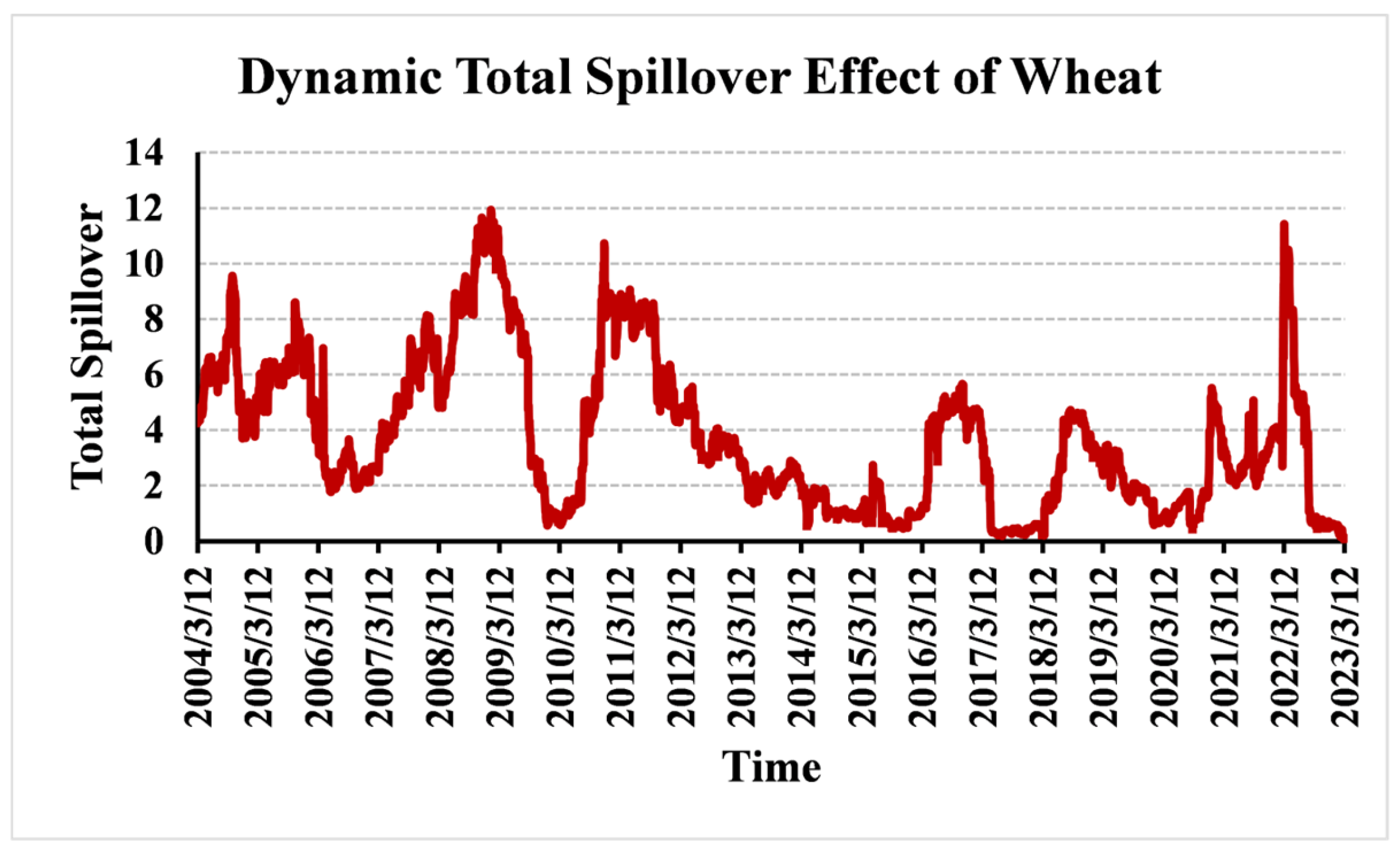

Figure 1,

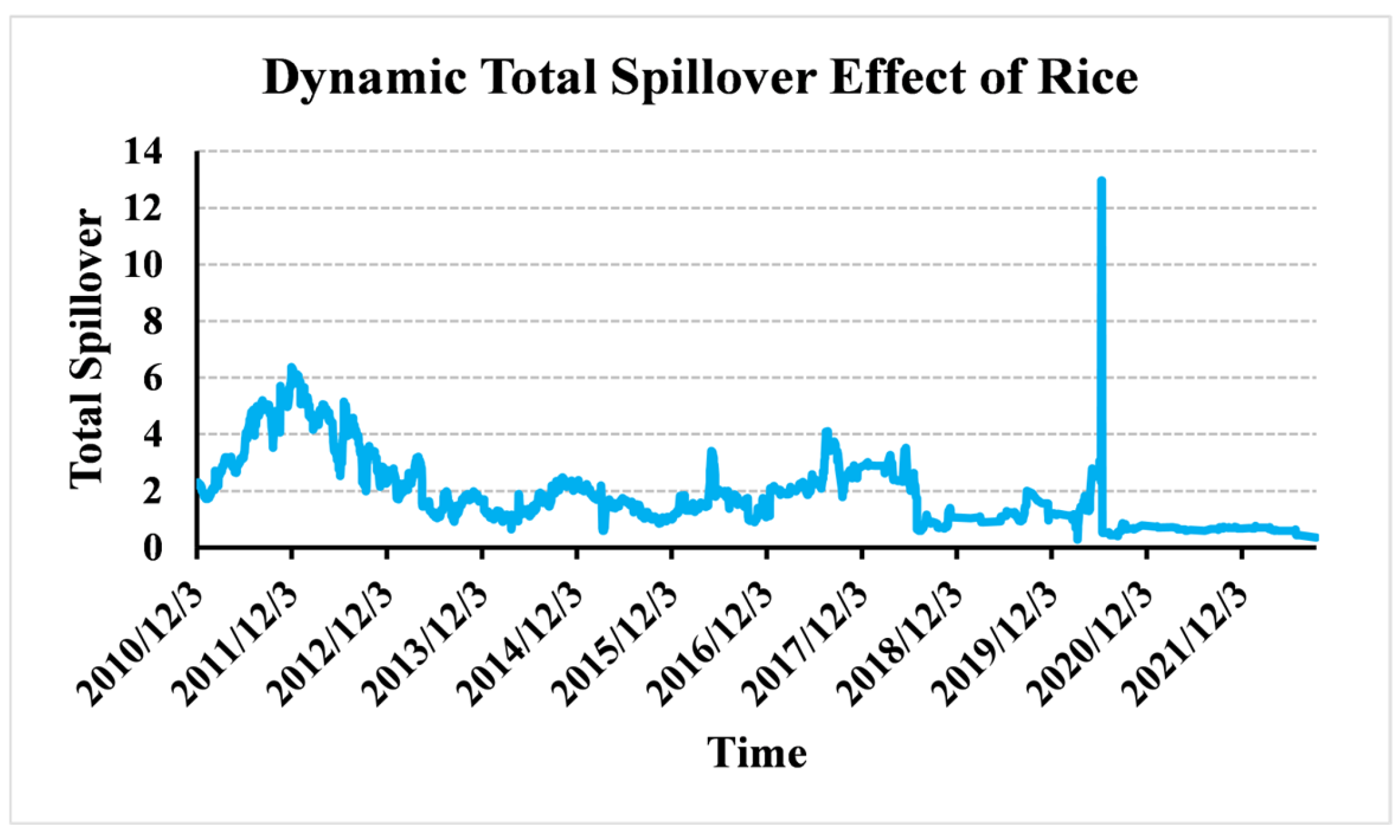

Figure 2,

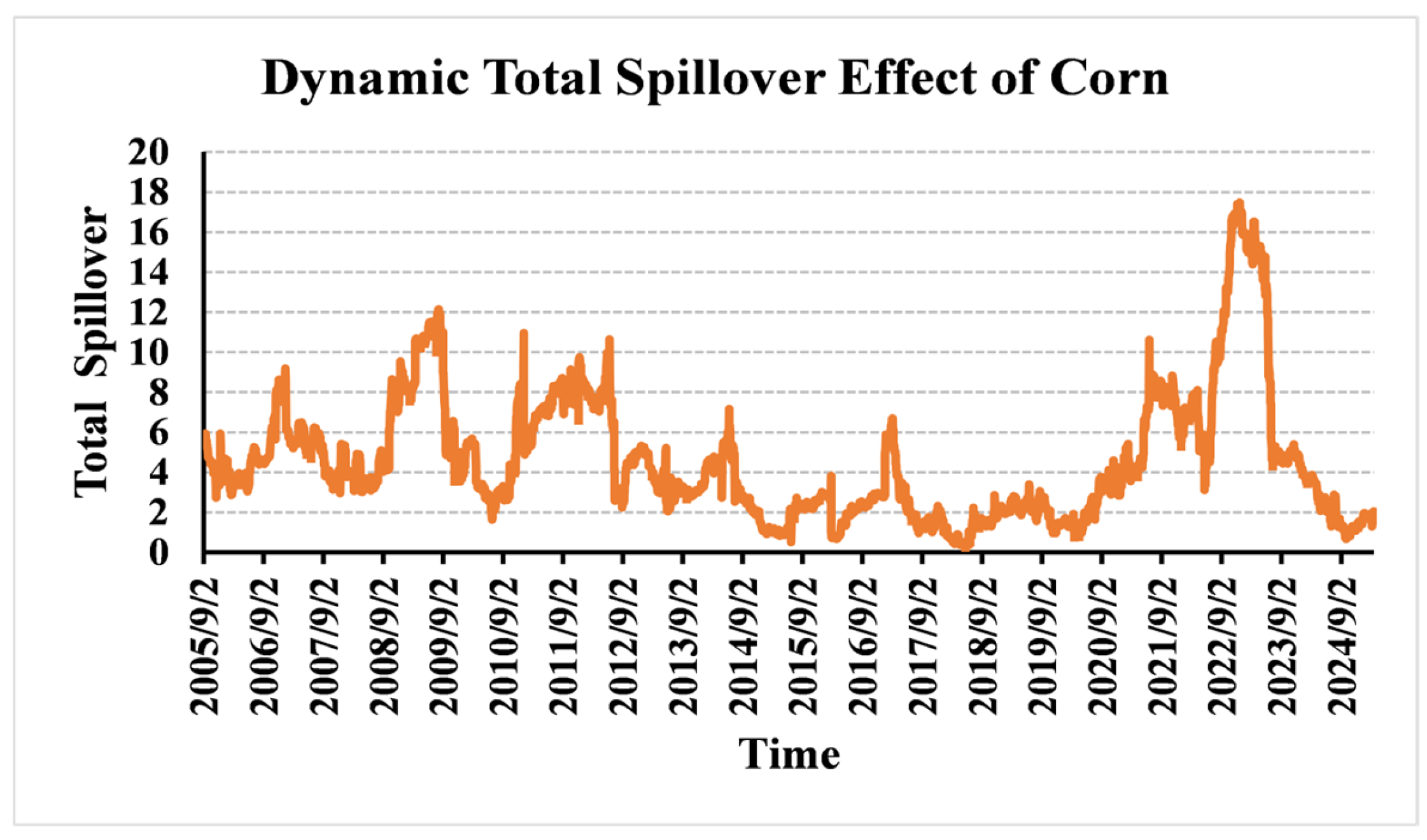

Figure 3 and

Figure 4 display the dynamic total spillover indices for international and domestic futures prices of wheat, rice, corn, and soybeans, respectively.

As shown in

Figure 1, international linkages in the wheat market strengthened notably during periods of global food crises, Middle East unrest (2010–2011), and the Russia-Ukraine conflict (2020–2022), with the spillover index rising above 10 on multiple occasions, reflecting strong transmission of external supply shocks to the domestic market. After 2023, the degree of integration declined significantly as international supply conditions recovered and domestic policy interventions intensified.

Figure 2 reveals that the rice market experienced spillover peaks during 2011–2012 and the early phase of the COVID-19 pandemic (2020). In particular, the index surged from around 1 to 12 during the pandemic, indicating a sharp intensification of price co-movement under crises. Following the recovery of supply chains, the linkage gradually weakened.

Figure 3 shows that the corn market experienced rising spillovers in the early period, driven by biofuel policies (2006–2009) and drought-related production shortfalls (2010–2012). The spillover effect weakened from 2013 to 2019 due to destocking and an improved supply–demand balance. However, from 2020 to 2022, the index surged to nearly 18, reflecting the combined impact of the pandemic and geopolitical conflicts, which amplified international shocks in a context of rising import dependency. After 2023, the linkage declined again as domestic supply capacity improved.

Figure 4 indicates that the soybean market exhibited weak integration in the early period (1999–2004). After 2004, integration strengthened.

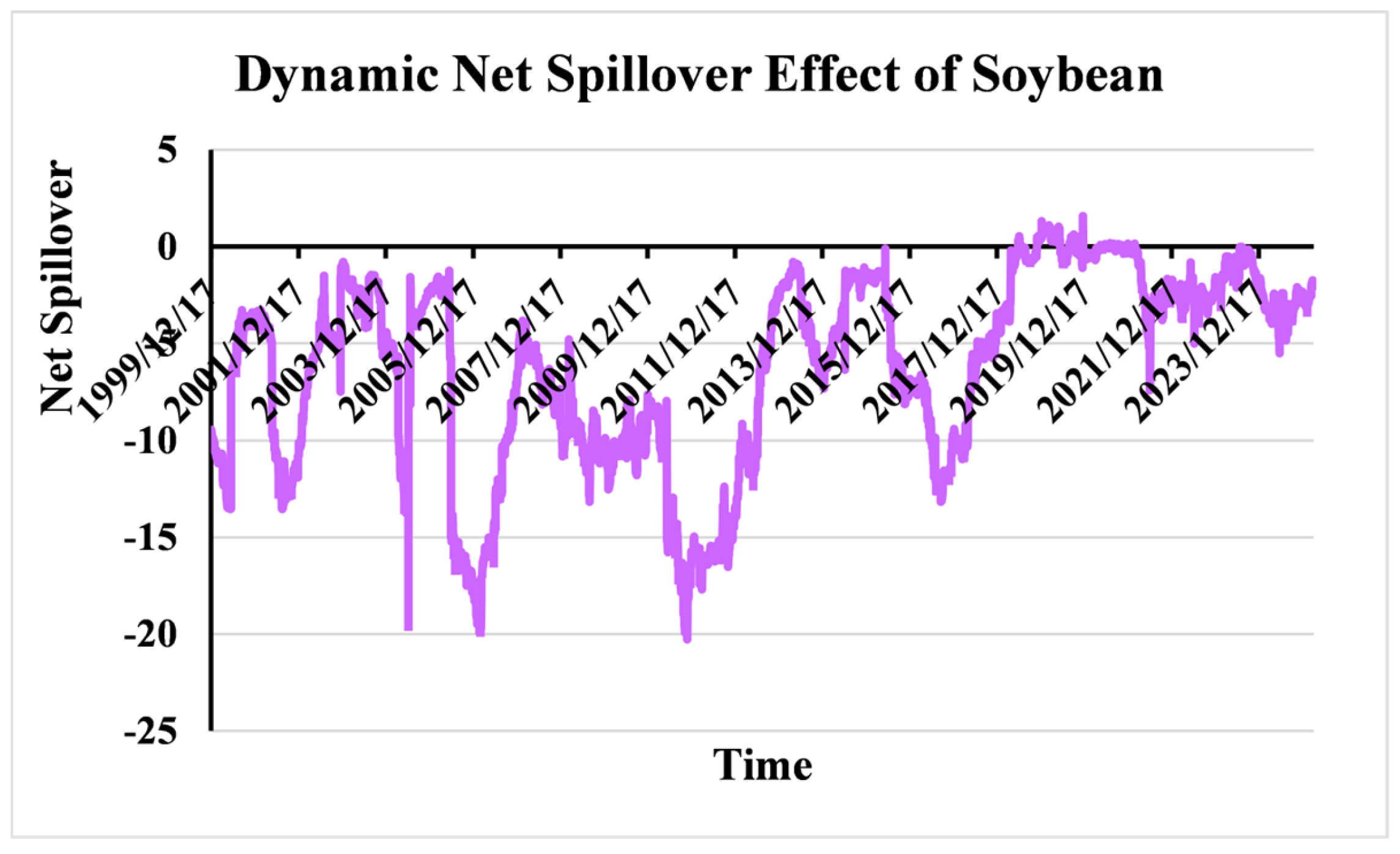

4.3. Analysis of the Dynamic Net Spillover Index Between “International and Domestic” Grain Prices

The DY spillover method based on the Vector Auto-Regression (VAR) model analyzes the dynamic net spillover effect between international and domestic staple grain futures prices, revealing the changes in the strength of price influences between domestic and international markets at different stages.

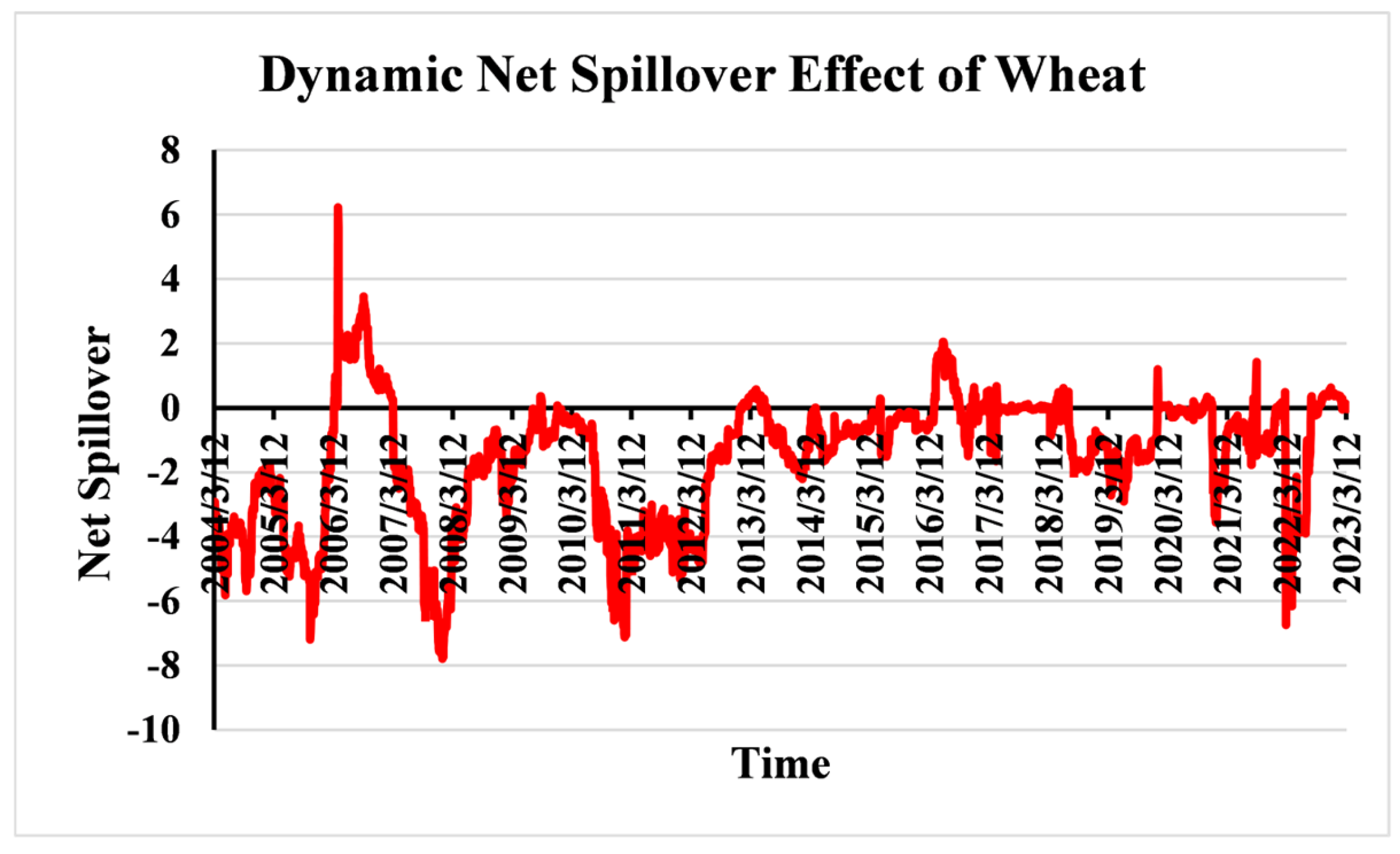

Figure 5,

Figure 6,

Figure 7 and

Figure 8, show the dynamic total spillover indices for domestic and international futures prices of wheat, rice, corn, and soybeans.

From

Figure 5, it can be observed that the dynamic net spillover index for wheat between 2004 and 2013 shows a significant negative net spillover from the U.S. market to China, especially during the global food shortage and the financial crisis. From 2013 to 2020, the volatility was mild, with negative values prevailing. Between 2020 and 2023, the COVID-19 pandemic and the Russia-Ukraine conflict led to increased volatility, with the international market’s influence on China decreasing initially and then increasing. From

Figure 6, it can be observed that, from 2010 to 2013, the U.S. rice market had a significant negative impact on China, particularly in 2011. Between 2013 and 2020, China exerted significant influence on the international market. From 2020, due to the impact of the pandemic, China was again strongly influenced by the international market, but gradually returned to normal after that. From

Figure 7, it can be observed that the net spillover index for corn was predominantly negative from 2005 to 2012, indicating a strong influence from the international market on China. From 2013 to 2019, the bidirectional influence was balanced. After 2020, due to the global pandemic and supply chain issues, the international market’s influence on China increased. From

Figure 8, it can be observed that international prices in the soybean market had a strong influence on China for most of the sample period, particularly during periods of supply–demand imbalances and policy adjustments. In mid-2020, a brief positive value emerged, indicating China’s enhanced capacity for self-regulation. From 2021 to 2025, although still influenced by the international market, this influence weakened, thanks to China’s efforts in improving domestic soybean production and diversifying market strategies.

5. Empirical Results

5.1. Estimation Results of the Vector Error Correction Model

This study first conducts an ADF test on the international and domestic prices of four major grains. The results show that the price series of both domestic and international futures for all four grains are non-stationary, but become stationary after first differencing. Furthermore, we use the Johansen trace test to analyze the cointegration relationships between pairs of grain prices, with the results presented in

Table 2. The first sub-table of

Table 2 tests the null hypotheses of “no cointegration” and “at most one cointegration relationship” for the four grains.

There may be a long-term stable equilibrium relationship (i.e., cointegration) between the international crude oil market and grain price transmission effects. However, in the short term, due to factors such as market frictions and information asymmetry, the system may deviate from this equilibrium.

Table 2 presents the estimation results of the VECM for the cointegration relationships and price transmission effects between international crude oil prices and the “international–domestic” grain price transmission effect of wheat, rice, corn, and soybeans. As shown in

Table 2, a statistically significant long-run cointegration relationship exists between international crude oil prices and each of the grain markets. However, the results also reveal heterogeneity in the responsiveness of different grain markets to fluctuations in crude oil prices.

Specifically, when the cointegration rank is 0, the trace statistics for the wheat, rice, corn, and soybean markets are all significantly greater than the critical value of 15.49. When the cointegration rank is 1, the trace statistics are also significantly higher than the critical value of 3.84. This suggests that a long-term stable equilibrium relationship exists between international crude oil prices and the transmission effects of domestic and international grain prices in each of the grain markets.

Further analysis of the VECM estimation results reveals that fluctuations in international crude oil prices play a dominant role in maintaining the long-term equilibrium relationship for both the wheat and soybean markets. The error correction term for the wheat market shows that when there is a deviation between crude oil prices and wheat prices, oil prices adjust towards the long-term equilibrium at a speed of −1.25 (t-value = −40.08), while the adjustment speed for wheat prices is only 0.02 (t-value = 4.38). Similarly, for the soybean market, the adjustment speed for oil prices is −0.73 (t-value = −30.19), and the adjustment speed for soybean prices is 0.09 (t-value = 25.15), indicating that fluctuations in crude oil prices have a more significant impact on these two markets.

In contrast, the long-term equilibrium relationships for the rice and corn markets are more dependent on the fluctuations in their own prices. In the rice market, although the adjustment speed for oil prices is (t-value = −0.16), it is not significant. However, the adjustment speed for rice prices is as high as (t-value = 42.67), showing that fluctuations in rice prices themselves are the main factor in maintaining the long-term equilibrium. Similarly, in the corn market, the adjustment speed for oil prices is −0.0529 (t-value = −7.42), while the adjustment speed for corn prices is −0.0314 (t-value = −41.96), indicating that the fluctuations in corn prices themselves play a more significant role in restoring the long-term equilibrium.

5.2. The Direct Impact of International Crude Oil Prices on the Transmission Effect of Domestic and Foreign Grain Market Prices

The empirical results presented in

Table 3 indicate that an increase in international crude oil prices has a significant negative impact on the international-to-domestic price transmission indices for the four major grain commodities—wheat, rice, corn, and soybeans. Specifically, a one-unit increase in international crude oil prices leads to a decrease of 0.0392, 0.0195, 0.0600, and 0.0457 units in the price transmission indices for wheat, rice, corn, and soybeans, respectively. All coefficients are statistically significant at the 1% level of significance. This finding suggests that rising oil prices significantly increase China’s dependence on international grain markets, thereby weakening the autonomy of domestic price regulation. Among the four commodities, the corn market is most strongly affected by oil price shocks, followed by wheat and soybeans, while the impact on rice is relatively more minor. All regression models exhibit a good fit after controlling for the real effective exchange rate of the RMB and domestic interest rates, with adjusted R

2 values ranging from 0.06 to 0.23, and all F-statistics being statistically significant. In

Table 3, the residuals of each regression result were also tested using the ADF test. The results are significant, indicating that the residuals are stationary and there is no suspicion of spurious regression in the model. This supports the robustness of the results and confirms the general validity of Hypothesis 1 across the four staple grains. Furthermore, the estimated coefficients of the control variables are consistent with theoretical expectations: RMB depreciation and rising domestic interest rates both strengthen the transmission of international grain prices to the domestic market, aligning with established economic logic.

The empirical findings can be attributed to the dual transmission channels through which international crude oil prices affect grain markets: production costs and exchange rate mechanisms. On one hand, crude oil serves as a key upstream energy source for agricultural inputs. When oil prices rise, they directly increase grain production costs through higher prices for fertilizers, pesticides, and diesel fuel used in agricultural machinery. For example, natural gas prices, which are closely linked to crude oil, constitute a significant component in the production of nitrogen fertilizers. Many pesticides are derived from petroleum, and agricultural mechanization depends heavily on diesel. As oil prices increase, global agricultural production costs rise broadly. This shifts the international grain supply curve to the left, leading to higher global grain prices. Domestic prices then follow suit, which strengthens the transmission of international price movements to the domestic market. On the other hand, as a net importer of crude oil, China faces higher energy import expenditures when international oil prices rise. This can lead to widening trade deficits and increased depreciation pressure on the RMB. A weaker RMB, in turn, raises the domestic-currency cost of importing grain priced in U.S. dollars, generating imported inflation and amplifying the price shocks transmitted from international to domestic grain markets. Consequently, the room for autonomous price stabilization in China’s domestic grain markets is significantly reduced.

To ensure the reliability of these conclusions, two robustness checks are conducted for each of the four grain markets. First, alternative control variables are employed: the U.S. dollar to RMB central parity rate (CNY_1) and the one-week Shibor rate (Shibor_1) replace the original exchange rate and interest rate measures. Second, the estimation window for the dynamic spillover index is extended from 200 to 240 periods and re-estimated. The results show that across different variable specifications and estimation approaches, the signs and statistical significance of the estimated coefficients for international crude oil prices remain stable. Model fit, as measured by adjusted R2, either improves slightly or remains unchanged. These findings confirm that the negative impact of rising oil prices on China’s grain price autonomy is robust across wheat, rice, corn, and soybean markets, further validating the reliability of the transmission mechanism from energy market volatility to agricultural markets.

5.3. Results of the Mediating Effect of Maritime Shipping Costs

Table 4 shows that within the sample periods for wheat, rice, corn, and soybeans, the impact coefficients of international crude oil prices on maritime shipping costs are 48.01, 15.58, 48.11, and 48.12, respectively, all of which are significant at the 1% level. This indicates a significant positive correlation between international oil prices and maritime shipping costs. These results remain robust after controlling for the exchange rate factor (CNY) and the interest rate factor (Shibor). The adjusted R

2 values and the F-statistics are significant, indicating good model fit. In addition,

Table 5 replaces the proxy variables for the control variables, and the results show that crude oil prices still have a significant positive impact on shipping costs, confirming the robustness of the regression results in

Table 4.

An increase in international crude oil prices directly raises the cost of marine fuel, driving up global shipping costs, which significantly increases the landed price of grain imports into China. Even if international grain futures prices remain stable, the rise in transportation costs will lead to a simultaneous increase in the domestic market price of imported grain. This, in turn, strengthens the influence of international grain prices on the Chinese grain market and weakens the relative independence of domestic grain prices.

Second, in terms of impact magnitude, the international-to-domestic price transmission effects for corn and soybeans are more sensitive to oil price shocks (with coefficients of −0.0572 and −0.0457, respectively), significantly higher than those for wheat (−0.0392) and rice (−0.0195). China’s import share of corn and soybeans is significant, with a high level of dependency on foreign markets, making the country highly sensitive to changes in international shipping costs. When international oil prices rise, the increase in international procurement costs makes the domestic corn and soybean markets more responsive to fluctuations in international grain prices. As a result, the rise in international crude oil prices drives up the landed prices of international corn and soybeans, causing China’s corn and soybean markets to react more quickly and strongly to changes in the international market.

Finally, international oil prices are often seen as indicators of global commodity demand and inflation expectations. A rise in oil prices can trigger widespread expectations of future increases in food prices, prompting traders to adjust their procurement strategies, stockpile goods, or preemptively raise prices. This creates psychological and behavioral connections, further accelerating the domestic market’s response to fluctuations in international prices and amplifying the price spillover effect. Overall, shipping costs play a crucial intermediary role in linking the international energy and food markets, particularly for goods that are heavily dependent on imports.

5.4. Results of the Mediating Effect of International Fuel Ethanol Consumption

The regression results in

Table 6 show that the coefficient of the impact of international crude oil prices on fuel ethanol consumption is −581.19, which is significantly negative at the 10% level, with an adjusted R

2 of 0.02 and an F-statistic of 2. This result contradicts the expected positive substitution effect in Hypothesis 3, indicating that the rise in international oil prices did not significantly stimulate fuel ethanol consumption, but instead showed a suppressive effect. In addition, the second column of

Table 6 replaces the control variables CNY and Shibor. The new regression results show that the coefficient for crude oil prices is −505.24, and the coefficient remains significant, confirming that the above conclusion is unchanged.

This negative relationship may stem from two reasons. First, while theoretically, an increase in oil prices enhances the attractiveness of ethanol as an alternative, the volatility of corn prices limits its impact. When international crude oil prices rise, international corn prices may initially increase due to cost or expectation factors, which in turn raises the cost of ethanol production, diminishing its economic feasibility and thus curbing ethanol supply and consumption. Second, the blending ratio of international fuel ethanol in gasoline is often constrained by technical or policy limits. Assuming the blending ratio during the sampling period is already near saturation, even with rising oil prices, significant growth in ethanol demand is unlikely. As a result, this may have a slight or even negative impact on ethanol consumption.

Therefore, the empirical results do not support the mechanism through which international crude oil prices influence international corn prices via fuel ethanol demand, thereby enhancing their transmission effect to domestic prices. This suggests that, apart from the transmission through transportation costs, other channels are more likely to explain the spillover effects of oil prices on the corn market. For instance, the international financial capital refinancing channel: As a barometer of the global economy and inflation expectations, rising oil prices often trigger a synchronized rally in commodity markets, strengthening the financial attributes of corn futures, pushing up international corn prices, and quickly transmitting them to the domestic market. Additionally, the import inflation channel should not be overlooked: A rise in oil prices significantly increases transportation, fertilizer, and agricultural machinery costs, compounded by pressure from the depreciation of the Chinese yuan, which drives up China’s corn import costs. Given the delayed adjustments in the domestic price control mechanisms, buffering external shocks in the short term becomes challenging, thereby intensifying the transmission of international prices to the domestic market.

5.5. Results of the Mediating Effect of International Biodiesel Consumption

The regression results in

Table 7 show that the coefficient of the impact of international crude oil prices on international biodiesel consumption is

, which is significantly positive at the 1% level. The model’s adjusted R

2 is 0.04, and the F-statistic is 3.34, indicating a good fit. This suggests that a 1-unit increase in international crude oil prices will lead to a

-unit increase in biodiesel consumption, confirming Hypothesis 4 of the study. This result aligns with the principle of energy substitution: When oil prices rise and push up the price of traditional diesel, the relative economic attractiveness of biodiesel as a renewable alternative increases. Energy companies and the transportation sector are increasing their procurement and use of biodiesel, thereby driving global demand for this renewable fuel. The second column of

Table 7 replaces the proxy variables for CNY and Shibor. The results show that the coefficient for

is

, and the coefficient remains significant, indicating that the regression results in the first column are robust.

These results further reveal the transmission path of “rising international crude oil prices leading to increased biodiesel demand, thereby enhancing the transmission of international soybean prices.” On the one hand, from the perspective of substitution demand, rising oil prices stimulate the consumption of biodiesel. Since the main raw material for biodiesel is soybean oil, this leads to an increased global demand for soybean crushing, directly pushing up international soybean prices. As the world’s largest importer of soybeans, China finds it difficult to keep its domestic prices independent of the international market. International price fluctuations are quickly transmitted through import channels, significantly strengthening the influence of the international soybean market on domestic prices.

On the other hand, from the perspective of industrial chain linkages and import dependency, rising international oil prices not only drive up soybean demand through the biodiesel channel but also increase the costs of agricultural production inputs such as fertilizers, pesticides, and fuel for agricultural machinery, thereby intensifying global soybean production cost pressures. Against this backdrop, the expansion of demand for soybean raw materials in the biodiesel industry further exacerbates competition for raw materials. Given that China’s dependence on soybean imports has long exceeded 80%, changes in international prices can easily be transmitted to the domestic market through crushing costs and downstream products (such as soybean oil and soybean meal), strengthening the link between domestic and international prices. Therefore, international crude oil prices affect the domestic market not only through direct cost channels but also significantly enhance the transmission effect of international soybean prices on the Chinese market via the biodiesel intermediary chain.

6. Discussion

In the context of deepening global economic integration, the connection between the energy market and the food market has been growing stronger. Crude oil prices not only directly affect food production by driving up the costs of agricultural production materials and transportation, but also indirectly reshape the supply and demand structure of the food market by altering the demand for biofuels. The existing literature has extensively discussed the linkage mechanism between international crude oil prices and food prices, resulting in a rich body of research. As listed in

Table 8, Gardebroek and Hernandez (2013) [

36] used a multivariate GARCH model to examine the volatility spillover effects between corn, soybean, and energy prices, while Raza et al. (2022) [

33] used spectral coherence analysis to reveal the dynamic correlation between agricultural products and energy markets. Karkowska and Urjasz (2024) [

7] focused on the role of biofuel policies in price transmission, and Zhao et al. (2025) [

43] further analyzed the dynamic relationship between global biofuel development and China’s grain market. Additionally, Padhan and Kocoglu (2025) [

9] approached the issue from the perspective of macroeconomic indicators, exploring their synergistic impact on the energy and grain markets. Zhang et al. (2025) [

27] and Andrikopoulos et al. (2025) [

23], respectively, studied the impact of oil prices on Chinese agricultural product prices and the relationship between shipping costs and oil prices. These studies have revealed the complex connections between the energy and food markets from different dimensions, laying an essential foundation for future research.

However, from a methodological perspective, existing studies primarily rely on traditional econometric models, such as VAR, GARCH, or TVP-VAR. While these models are capable of capturing the dynamic correlation and volatility transmission characteristics between variables, they still face limitations in handling nonlinear relationships, high-dimensional heterogeneous data, and time-varying structures. For example, the multivariate GARCH model typically characterizes volatility spillovers based on linear assumptions, making it challenging to reflect asymmetric responses under extreme events. While spectral coherence analysis can identify frequency-domain relationships, it lacks explanatory power regarding long-term equilibrium mechanisms. In contrast, this study systematically expands on the methodology. Not only does it use the VECM model to identify the long-term cointegration relationship and short-term dynamic adjustment mechanism between crude oil and various grain prices, but it also combines OLS regression and robustness tests to systematically assess the direct impact of oil prices on the domestic and international price transmission effects for wheat, rice, corn, and soybeans. At the same time, by introducing intermediary variables such as shipping costs and biodiesel consumption, a multi-path transmission model is constructed, linking “oil price to transportation costs/alternative energy demand to international grain prices to domestic prices,” thereby enhancing the completeness of the mechanism analysis and the logical coherence of the analysis chain.

In terms of research conclusions, existing studies have primarily focused on verifying the positive linkage or volatility spillovers between prices; however, there is an insufficient exploration of the heterogeneity of transmission paths, the asymmetry of mechanisms, and the differential responses of various grain types. For instance, while some studies have highlighted that biofuels serve as an essential transmission channel, they have not fully elucidated the boundaries of their effectiveness under different market conditions. Other studies have identified the role of shipping costs, but lack an in-depth analysis of the interaction effects between cost pass-through and import dependence. This study, however, achieves a deepening and expansion of conclusions: On one hand, it finds that the transmission effects of international crude oil prices on corn and soybeans are significantly more potent than those on wheat and rice, which are closely related to the import dependence of different grain varieties in China, highlighting the key role of structural factors. On the other hand, it not only validates the mediation effects of shipping costs and biodiesel demand but also further reveals the complementary paths of financial capital resonance and import inflation in price transmission. These findings not only address the shortcomings of existing studies but also provide more targeted regulatory guidance for policymakers, reflecting the comprehensive advantages of this study in both theoretical depth and practical explanatory power.

7. Conclusions

This study systematically examines the mechanism by which international crude oil prices influence the transmission effects of domestic and international grain prices, with a focus on how oil prices affect the prices of the four main grain varieties—wheat, rice, corn, and soybeans—through channels such as shipping costs and biofuel demand. The study finds that the rise in international crude oil prices significantly strengthens the transmission of international grain prices to the domestic market, thereby weakening China’s ability to regulate grain prices independently. This effect occurs primarily through two pathways: first, the rise in oil prices drives up global shipping costs, which in turn increases the landed price of imported grain, enhancing the transmission of international prices to the domestic market; second, the increase in oil prices stimulates international demand for biofuels (fuel ethanol and biodiesel), which drives up international market demand and prices for raw material crops such as corn and soybeans, indirectly intensifying the impact of international grain price fluctuations on the domestic market. The empirical results show that corn and soybeans, as crops with stronger energy correlations, are more significantly affected by the oil market, while the impact on wheat and rice is relatively more minor.

The findings of this study have significant theoretical and policy implications. Theoretically, the study constructs a complete transmission framework showing how oil prices influence shipping costs and biofuel demand, which then influence international grain prices, which subsequently influence domestic grain prices, confirming the complex, nonlinear and dynamic interlinkages between energy and agricultural product markets, thus enriching the theoretical understanding of the relationship between energy and food markets. By introducing the DY Spillover Index and mediation effect models, the study provides more refined quantitative tools and methodological support for analyzing cross-market risk transmission.

From a policy perspective, the study’s results serve as a warning that, in the context of globalization and the energy transition, ensuring national food security must extend beyond the traditional supply and demand perspective and prioritize the risk spillovers from external energy markets. Relevant authorities should strengthen the monitoring and early warning systems for international crude oil prices, shipping indices, and biofuel policies, and establish a cross-departmental risk linkage assessment mechanism. In terms of import strategies, efforts should be made to optimize the diversification of grain import sources further and reduce reliance on single markets and transportation channels to enhance the resilience of supply chains. Simultaneously, domestic bioenergy policies should be carefully assessed for their potential impacts to avoid unnecessary conflicts between energy security and food security. Additionally, the study highlights the importance of enhancing domestic food market regulation capacity. By enhancing reserve adjustments, market interventions, and price guidance mechanisms, the domestic market’s ability to withstand external shocks can be strengthened, thereby safeguarding national food security in a complex international environment.

One limitation of this study is that, in order to consider the data frequency of intermediary variables when analyzing the impact of oil prices on the transmission effects of domestic and international food prices, the transmission effect index was converted to a monthly frequency, resulting in the loss of some information. In future research, reverse mixed-frequency data analysis (RU-MIDAS) could be used to examine the impact of high-frequency oil prices on low-frequency intermediary variables. Furthermore, combining RU-MIDAS with machine learning methods may further improve the predictive accuracy of the transmission effects of domestic and international food prices.